Crypto World

Is $1.8K the Bottom? ETH Hits Critical Demand Zone (Ethereum Price Analysis)

Ethereum remains under heavy bearish pressure, with recent price action confirming a continuation of the broader downtrend. The market is currently reacting to a major sell-side expansion, and both technical structure and on-chain liquidity dynamics suggest that the asset is still navigating a critical phase where downside targets remain relevant, even if short-term relief bounces occur.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH is clearly trading within a well-defined descending channel, with the price recently accelerating toward the lower boundary of this structure. The most important observation on the chart is the clean breakdown below multiple prior support levels, followed by a sharp impulsive leg to the downside. This move confirms strong bearish acceptance rather than a simple liquidity sweep.

The asset has now reached a major higher-timeframe demand zone, located around the $1.8K region, which previously acted as a base during earlier accumulation phases. The reaction off this zone has produced a modest bounce, but so far this move lacks structural strength and remains corrective in nature.

Nevertheless, the market is likely to enter a consolidation-correction phase above this crucial support until a decisive breakout occurs. The main supply zone during this consolidation range is the channel’s middle line, located at the $2.3K threshold. A break above this resistance will open the door for an extended bullish retracement toward the $2.5K significant resistance.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the bearish structure becomes even clearer. The most recent price action shows a sharp sell-off into demand, followed by a shallow bounce that lacks impulsive follow-through.

Crucially, the rebound appears corrective and technically opens the door for a pullback toward the most recent supply zones and Fibonacci levels, located around the $2.3K to $2.6K region. These areas align with prior breakdown levels and correspond to zones where sellers previously intervened aggressively. If the price retraces into these levels without strong volume or momentum, they are likely to act as rejection zones rather than breakout points.

Until Ethereum can reclaim and hold above these supply areas, the 4-hour structure continues to favour continuation to the downside or extended consolidation within the lower range, rather than a trend reversal.

Sentiment Analysis

The ETH liquidation heatmap over the last 6 months provides critical confirmation of the bearish technical structure. A significant concentration of liquidity has been built around and just below the $2K level, which has recently acted as a strong magnet for price. The sharp sell-off into this area confirms that downside liquidity was actively targeted, resulting in a large flush of leveraged long positions.

Despite this liquidation event, the heatmap still reveals residual liquidity pockets extending slightly below current price levels, indicating that the market may not have fully exhausted its downside objectives yet. These remaining clusters continue to exert gravitational pull on price, especially if spot demand remains weak and derivatives positioning rebuilds on the long side too quickly.

That said, the intensity of liquidations around the $2K zone suggests that a meaningful portion of forced selling has already occurred. This reduces immediate liquidation pressure and explains the short-term stabilization seen after the drop. However, from an on-chain perspective, this behavior supports consolidation or corrective rebounds, not a confirmed trend reversal, unless liquidity interest decisively shifts back above current levels.

In summary, on-chain data aligns closely with the technical picture: Ethereum is still operating in a bearish liquidity-driven environment, with downside risks remaining active as long as price fails to reclaim key supply zones and attract sustained spot demand.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Zero-dollar Bitcoin? A growing narrative is bubbling up

Skeptics say ‘Zero-Dollar Bitcoin’ as a new selloff revives brutal questions about utility, cash flows, and whether confidence alone can sustain its price/

Summary

- Commentators Buck Sexton and Richard Farr argue Bitcoin has no long-term value, no “fundamental floor,” and has failed as either money or a hedge.

- Critics frame Bitcoin as a reflexive high-beta tech proxy whose value depends on flows and belief, not cash flows or enforceable claims on real assets.

- The debate intensifies as BTC trades near the low-70k region alongside choppy ETH and SOL markets, underscoring crypto’s sensitivity to macro risk-off shocks.

Bitcoin’s (BTC) latest drawdown has revived an old, brutal question: could the world’s largest cryptocurrency ultimately be worth nothing? As prices slide and faith wobbles, a “Bitcoin to $0” thesis is again echoing through markets and media.

Zero‑dollar thesis resurfaces

The spark this week came from conservative commentator Buck Sexton, who wrote that “every time I ask a Bitcoin true believer to explain why they think it has any long-term value… I come away more certain that Bitcoin has no long-term value, and a floor price of zero.” His post went viral after Bitcoin tumbled more than 20% over the past week, amplifying a bearish narrative that critics have pushed for years. The core claim is simple: in a full confidence crisis, an asset with no cash flows and no legal claim on anything tangible has “no ‘fundamental floor.’”

Richard Farr, chief market strategist at Pivotus Partners, put it more bluntly, saying his firm’s Bitcoin target is “$0.0,” arguing it has “failed as a hedge against the dollar,” tracks high‑beta tech, and has not gained real traction as money. “The miners (who are the network) are bleeding cash,” Farr wrote. “We think it’s a zero.”

Belief versus utility

Long‑time antagonist Peter Schiff again contrasted Bitcoin with gold, insisting that “Bitcoin’s value is purely subjective, as it has no utility beyond belief.” “Bitcoin can’t do anything. That’s the problem,” he added. “Yes you can store and transfer your Bitcoin, but beyond that you can’t do anything with it.” That critique dovetails with academic warnings that non‑yielding assets are ultimately hostage to reflexive flows, a point underscored during previous deleveraging waves in 2018 and 2022.

Yet the ferocity of the latest backlash also reflects how over‑financialized the asset has become, tethered to macro risk cycles and ETF flows rather than cypherpunk ideals. Sexton himself argued that the “anger” from online advocates is part of the problem, eroding mainstream credibility just as regulators and traditional finance are demanding more discipline.

Market snapshot

The debate comes as digital assets grind through another risk‑off stretch. Bitcoin (BTC) trades near $70,961, up roughly 2.4% over the last 24 hours on about $42.3b in volume. Ethereum (ETH) changes hands around $2,094, up about 0.65% over the same period, with spot and futures turnover exceeding $50b. Solana (SOL) sits close to $86.6, down roughly 1.4% on the day, with more than $6.1b traded.

These skittish flows mirror broader macro anxiety, from tightening financial conditions to renewed equity volatility, that has historically pressured high‑beta crypto assets. For now, the “zero” narrative is less a precise price target than a stress test of Bitcoin’s maturing, yet still fragile, social contract.

Related coverage: Bitcoin’s correlation with tech stocks has repeatedly spiked during risk‑off shocks, challenging the “digital gold” hedge story. Ethereum’s evolving fee and burn dynamics highlight how protocol cash‑flow narratives can bolster perceived intrinsic value. Solana’s outsized rally and sharp pullbacks underline how execution risk and network outages still shape the market’s tolerance for speculative layer‑1 bets.

Crypto World

: Crypto Week Ahead

The brief, partial U.S. government shutdown put paid to the Employment Situation report that was due Friday; it’s coming this week instead. Look for the bellwether nonfarm payrolls report on Wednesday. The world’s largest economy is forecast to have created 70,000 jobs last month, more than in December, while the unemployment rate is expected to hold steady at 4.4%.

The week also includes earnings from some of the biggest, highest-profile crypto companies, including crypto exchange Coinbase (COIN). Robinhood (HOOD), a trading platform that covers equities as well as crypto, is also on the roster.

Outside the U.S., there will be plenty of focus on Asia, where CoinDesk’s second annual Consensus Hong Kong conference takes place. There’s a high chance participating companies will use the event as a venue for corporate announcements.

What to Watch

(All times ET)

- Crypto

- Macro

- Feb. 9, 11 a.m.: U.S. consumer inflation expectations for January (Prev. 3.4%)

- Feb. 10, 7 a.m.: Brazil inflation rate YoY (Prev. 4.26%), MoM (Prev. 0.33%)

- Feb. 10, 8:30 a.m.: U.S. retail sales MoM for December Est. 0.5% (Prev. 0.6%)

- Feb. 10 8:30 a.m.: U.S. employment cost index QoQ (Prev. 0.8%)

- Feb. 10, 2 p.m.: Argentina inflation rate YoY (PRev. 31.5%), MoM (Prev. 2.8%)

- Feb. 10, 8:30 p.m.: China inflation rate YoY for January (Prev. 0.8%); MoM (Prev. 0.2%)

- Feb. 11, 8:30 a.m.: U.S. nonfarm payrolls for January Est. 70K (Prev. 50K)

- Feb. 11, 8:30 a.m.: U.S. unemployment rate for January Est. 4.4% (Prev. 4.4%)

- Feb. 11, 8:30 a.m.: U.S. average hourly earnings for January YoY Est. 3.8% (Prev. 3.6%)

- Feb. 12, 2:00 a.m.: U.K. GDP MoM for December. (Prev. 0.3%)

- Feb. 12, 5:30 a.m.: India inflation rate YoY for January (Prev. 1.33%); MoM (Prev. 0.05%)

- Feb. 12, 8:30 a.m.: U.S. initial jobless claims week ending Feb. 7 (Prev. 231K)

- Feb 12, 10 a.m.: U.S. existing home sales for January Est. 4.25M (Prev. 4.35M)

- Feb. 13, 8:30 a.m.: U.S. core inflation rate YoY for January (Prev. 2.6%); MoM Est. 0.3% (Prev. 0.2%)

- Feb. 13, 8:30 a.m.: U.S. inflation rate YoY for January (Prev. 2.7%); MoM Est. 0.3% (Prev. 0.3%)

- Feb. 14: Japan GDP growth rate QoQ for Q4 (Prel) est. 0.4% (Prev. -0.6%); Annualized est. 1.6% (Prev. -2.3%)

- Earnings (Estimates based on FactSet data)

- Feb. 10: Canaan (CAN), pre-market, -$0.03

- Feb. 10: Robinhood Markets (HOOD), post-market, $0.63

- Feb. 10: Upexi (UPXI), post-market, -$0.07

- Feb. 10: Lite Strategy (LITS), post-market

- Feb. 12: Coinbase (COIN), post-market, $1.04

- Feb. 12: Coincheck Group (CNCK), post-market, $0.01

- Feb. 12: Bitdeer Technologies Group (BTDR), pre-market, -$0.06

- Feb. 13: Trump Media & Tech Group (DJT), post-market

- Feb. 13: HIVE Digital Technologies (HIVE), post-market, -$0.07

Token Events

- Governance votes & calls

- Feb. 11: Ripple to host XRP Community Day on X Spaces discussing XRP adotion, regulated finance and innovation.

- Unlocks

- Token Launches

Conferences

Crypto World

Bitcoin value investors move in as BTC price drops, ‘capitulation’ searches rise: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin has retreated by nearly 2.5% in the past 24 hours after failing to hold onto gains made during an end-of-week bounce that pushed it back up to $71,000.

The pullback followed a turbulent few days in which the cryptocurrency plunged to as low as $60,000 before rebounding. BTC is still down more than 11% in the past seven days.

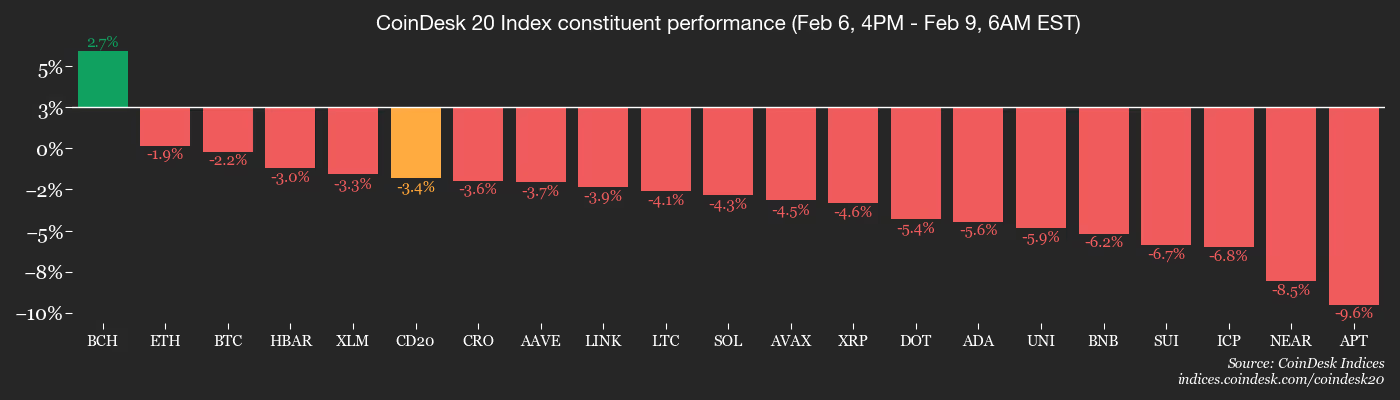

Even so, it’s outperforming the wider market, which saw the CoinDesk 20 (CD20) index drop 13.5% over 24 hours and 13.7% in a week.

The drop saw institutions move. Speaking to CNBC, Bitwise CEO Hunter Horsley said late last week that the firm saw significant inflows as prices dropped.

“I think long-time holders are feeling unsure, and I think the new investor set — institutions — are feeling they’re getting a new crack at the apple and seeing prices they thought they’d forever missed,” Horsley said.

Spot bitcoin ETFs on Friday reversed a three-day streak of outflows, bringing in a net $371 million, SoSoValue data shows. Still, retail sentiment remained fragile. Julio Moreno, CryptoQuant’s head of research, noted on social media that U.S. investors are buying back in, based on the Coinbase Premium Index turning positive for the first time since mid-January.

Online search interest for terms such as “crypto capitulation” spiked during the selloff and stayed elevated, according to crypto analytics firm Santiment, offering an opportunity for value investors to step in.

Meanwhile, capital flowed into traditional safe havens. Gold and silver extended their recovery after a selloff late last month, with gold once again topping $5,000 as investors consider a weaker U.S. dollar and major purchasers continued accumulating. These include Tether, whose gold stash has topped $23 billion, and China’s central bank.

Stock market futures are down ahead of the open, after a Japan equities rallied over the ruling party’s landslide win in a snap election. Prime Minister Sanae Takaichi had campaigned on low interest rates and significant fiscal spending.

The yield on Japanese government bonds kept rising, further unwinding the yen carry trade and affecting risk assets including cryptocurrencies. The unwind could bring nearly $5 trillion of overseas investments back into the country. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 9, 11 a.m.: U.S. consumer inflation expectations for January (Prev. 3.4%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- No major governance votes.

- Unlocks

- Token Launches

- Feb. 9: Pendle to launch sPENDLE buybacks with first yield distributions starting Feb. 13, and rewards time-weighted from Jan. 29.

- Feb. 9: ZKsync to launch Season 1 of the ZKnomics Staking Pilot Program via Tally

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is down 2.90% from 4 p.m. ET Sunday at $69,045.23 (24hrs: -2.44%)

- ETH is down 4.07% at $2,034.28 (24hrs: -4.40%)

- CoinDesk 20 is down 3.09% at 1,973.38 (24hrs: -3.46%)

- Ether CESR Composite Staking Rate is down 25 bps at 2.74%

- BTC funding rate is at -0.037% (-4.0362% annualized) on Binance

- DXY is down 0.33% at 97.31

- Gold futures are up 1.67% at $5,033.80

- Silver futures are up 5.62% at $81.05

- Nikkei 225 closed up 3.89% at 56,363.94

- Hang Seng closed up 1.76% at 27,027.16

- FTSE 100 is up 0.31% at 10,402.44

- Euro Stoxx 50 is up 0.39% at 6,021.78

- DJIA closed on Friday up 2.47% at 50,115.67

- S&P 500 closed up 1.97% at 6,932.30

- Nasdaq Composite closed up 2.18% at 23,031.21

- S&P/TSX Composite closed up 1.49% at 32,471.00

- S&P 40 Latin America closed down 2.89% at 3,653.05

- U.S. 10-Year Treasury rate is up 2 bps at 4.23%

- E-mini S&P 500 futures are unchanged at 6,949.25

- E-mini Nasdaq-100 futures are down 0.20% at 25,113.25

- E-mini Dow Jones Industrial Average futures are unchanged at 50,246.00

Bitcoin Stats

- BTC Dominance: 59.33% (-0.05%)

- Ether-bitcoin ratio: 0.02944 (-0.92%)

- Hashrate (seven-day moving average): 977 EH/s

- Hashprice (spot): $34.55

- Total fees: 2.23 BTC / $157,182

- CME Futures Open Interest: 116,125 BTC

- BTC priced in gold: 13.8 oz.

- BTC vs gold market cap: 4.62%

Technical Analysis

- Bitcoin is testing the 200-week exponential moving average (~$68,339), a critical support level to prevent an extended structural drawdown.

- The weekly RSI is firmly oversold at 28.18, a level that has historically preceded short-term rebounds.

- While this positioning suggests there’s a high probability of a bounce, a clear reversal of the downtrend requires a sustained breakout above $74,000.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $165.12 (+13.00%), –1.24% at $163.07 in pre-market

- Galaxy Digital (GLXY): closed at $19.76 (+17.34%), –0.30% at $19.70

- MARA Holdings, Inc. (MARA): closed at $8.24 (+22.44%), –2.67% at $8.02

- Riot Platforms, Inc. (RIOT): closed at $14.45 (+19.82%), –1.18% at $14.28

- Core Scientific, Inc. (CORZ): closed at $16.81 (+13.47%), –0.30% at $16.76

- CleanSpark (CLSK): closed at $10.08 (+21.96%), –0.89% at $9.99

- Exodus Movement (EXOD): closed at $10.56 (+12.10%)

- CoinShares Bitcoin Mining ETF (WGMI): closed at $40.43 (+14.76%)

- Circle Internet Group (CRCL): closed at $57.04 (+13.56%), –1.05% at $56.44

- Bullish (BLSH): closed at $27.45 (+10.24%), unchanged at $27.45

Crypto Treasury Companies

- Strategy (MSTR): closed at $134.93 (+26.11%), –3.47% at $130.25

- Strive Asset Management (ASST): closed at $11.91 (+20.84%), –3.40% at $11.51

- Sharplink Gaming (SBET): closed at $7.03 (+15.82%), –0.71% at $6.98

- Upexi, Inc. (UPXI): closed at $1.14 (+4.59%), +0.88% at $1.15

- Lite Strategy, Inc. (LITS): closed at $1.06 (+11.58%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $330.7 million

- Cumulative net flows: $54.63 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$21.3 million

- Cumulative net flows: $11.83 billion

- Total ETH holdings ~5.83 million

Source: Farside Investors

While You Were Sleeping

- Takaichi victory sends Nikkei to record, bitcoin to $72,000 and gold past $5,000 (CoinDesk): Japan’s Nikkei 225 index surged to a record on Monday, breaching 57,000 following Prime Minister Sanae Takaichi’s decisive “supermajority” electoral victory.

- China Urges Banks to Curb Exposure to U.S. Treasuries (Bloomberg): Chinese regulators advised financial institutions to rein in their holdings of U.S. Treasuries, citing concerns over concentration risks and market volatility.

- Tether’s gold stash tops $23 billion as buying outpaces nation states, Jefferies says (CoinDesk): The Wall Street investment bank estimates the crypto firm holds at least 148 metric tons of physical gold, joining the top 30 global holders of bullion.

- U.S. IPO proceeds to quadruple to record $160 billion in 2026 as dealmaking rebounds, says Goldman (Reuters): U.S. equity markets are set for a sharp rebound in IPOs in 2026, Goldman Sachs analysts said, forecasting proceeds quadrupling to a record $160 billion as marquee names such as SpaceX, OpenAI and Anthropic edge closer to public listings.

Crypto World

SoFi Stock Surges 7% as Executives Buy Shares After Earnings

TLDR

- SoFi stock surged 7% Friday after two executives bought shares totaling over $200,000 following the company’s Q4 earnings beat

- Citizens upgraded the stock to Market Outperform with a $30 target, while JPMorgan moved to Buy with a $31 target

- The fintech company posted Q4 EPS of $0.13 versus $0.11 expected and revenue of $1.03 billion versus $973.43 million forecast

- Insiders have purchased $204,800 in stock over the past three months, showing management confidence

- The stock has dropped 20% year-to-date despite strong revenue growth of 35.6% over the last twelve months

SoFi Technologies shares jumped over 7% Friday following insider purchases by two company executives. The buying activity occurred just days after the fintech platform reported quarterly results that exceeded analyst estimates.

General Counsel Robert S. Lavet acquired 5,000 shares for approximately $105,200 on February 6. EVP Eric Schuppenhauer purchased 5,000 shares the previous day for roughly $99,650. Both executives bought shares after the stock pulled back from recent highs.

The purchases followed SoFi’s fourth-quarter earnings announcement. The company reported earnings per share of $0.13, beating the consensus estimate of $0.11. Revenue hit $1.03 billion for the quarter, surpassing expectations of $973.43 million.

Analyst Upgrades Drive Momentum

Citizens upgraded SoFi from Market Perform to Market Outperform with a $30 price target. The upgrade represents about 44% upside from current levels around $20.86. The firm attributed the recent selloff to broader market rotation rather than company-specific issues.

JPMorgan also upgraded the stock to Buy from Hold. The bank set a $31 price target and highlighted improved execution and steady member growth. Analysts noted that SoFi continues adding customers while some competitors experience slower growth.

Mizuho maintained its Outperform rating with a $38 price target. The firm recommended investors buy on weakness after the post-earnings dip. Needham kept its Buy rating but adjusted its target to $33 from $36.

The stock has fallen roughly 20% year-to-date after trading above $30 in late 2025. Citizens views this decline as creating an opportunity for investors. The company has grown revenue 35.6% over the past twelve months.

Insider Activity Signals Confidence

The recent executive purchases add to a broader pattern. Corporate insiders have bought $204,800 worth of stock over the last three months according to regulatory filings.

While insider buying doesn’t guarantee future gains, it often attracts investor attention. Executives are investing their own capital at current price levels.

Citizens highlighted SoFi’s shift toward fee-based and capital-light revenue streams. The firm also pointed to opportunities in blockchain, artificial intelligence, business banking, and new loan platforms.

The stock has traded between $8.60 and $32.73 over the past 52 weeks. Current prices sit near the middle of that range following the pullback.

SoFi continues expanding its member base and product portfolio. The company is monetizing its platform while entering new business verticals. The combination of earnings results, analyst upgrades, and insider purchases pushed shares higher this week.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

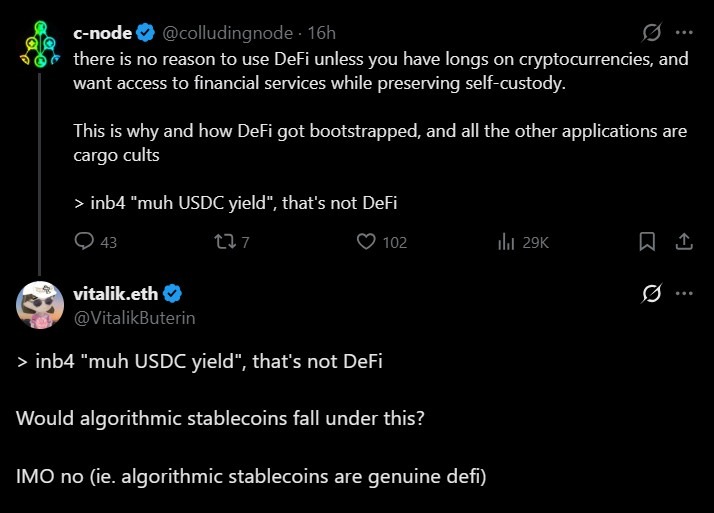

Ethereum co-founder Vitalik Buterin drew a clear boundary around what he considers “real” decentralized finance (DeFi), pushing back against yield-driven stablecoin strategies that he says fail to meaningfully transform risk.

In a discussion on X, Buterin said that DeFi derives its value from changing how risk is allocated and managed, not simply from generating yield on centralized assets.

Buterin’s comments come amid renewed scrutiny over DeFi’s dominant use cases, particularly in lending markets built around fiat-backed stablecoins like USDC (USDC).

While he did not name specific protocols, Buterin took aim at what he described as “USDC yield” products, saying they depend heavily on centralized issuers while offering little reduction in issuer or counterparty risk.

Two stablecoin paths outlined

Buterin outlined two paths that he considers to be more aligned with DeFi’s original ethos: an Ether (ETH)-backed algorithmic stablecoin and a real-world asset (RWA) backed algorithmic stablecoin that is overcollateralized.

In an ETH-backed algorithmic stablecoin, he said that even if most of a stablecoin’s liquidity comes from users who mint the token by borrowing against crypto collateral, the key innovation is that risk can be shifted to markets rather than a single issuer.

“The fact that you have the ability to punt the counterparty risk on the dollars to a market maker is still a big feature,” he said.

Buterin said that stablecoins backed by RWAs could still improve risk outcomes if they are conservatively structured.

He said that if such a stablecoin is sufficiently overcollateralized and diversified so that the failure of a single backing asset would not break the peg, the risk faced by holders would still be meaningfully reduced.

USDC dominates DeFi lending

Buterin’s comments land as lending markets across Ethereum remain heavily centered on USDC.

On Aave’s main Ethereum deployment, more than $4.1 billion worth of USDC is currently supplied out of a total market size of about $36.4 billion, with roughly $2.77 billion borrowed, according to protocol dashboard data.

A similar pattern appears on Morpho, which optimizes lending across Aave and Compound-based markets.

On Morpho’s borrow markets, three of the five largest markets by size are denominated in USDC, typically backed by collateral like wrapped Bitcoin or Ether. The top borrowing market lends USDC and has a market size of $510 million.

On Compound, USDC remains one of the protocol’s most used assets, with about $382 million in assets earning yield and $281 million borrowed. This is supported by roughly $536 million in collateral.

Cointelegraph reached out to Aave, Morpho and Compound for comment. Aave and Morpho acknowledged the inquiry, while Compound had not responded by publication.

Related: CFTC expands payment stablecoin criteria to include national trust banks

Buterin’s call for decentralized stablecoins

Buterin’s critique does not reject stablecoins outright but questions whether today’s dominant lending models deliver the decentralization of risk that DeFi promises.

The comments also build on earlier critiques he made about the structure of today’s stablecoin market.

On Jan. 12, he argued that Ethereum needs more resilient decentralized stablecoins, warning against designs that rely too heavily on centralized issuers and a single fiat currency.

At the time, he said stablecoins should be able to survive long-term macro risks, including currency instability and state-level failures, while remaining resistant to oracle manipulation and protocol errors.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

America’s oldest bank spends billions on tech

The BNY headquarters in New York, US, on Wednesday, July 10, 2024.

Jeenah Moon | Bloomberg | Getty Images

At America’s oldest bank, 134 new workers don’t sleep or take sick days. They don’t even have names.

They’re what BNY calls “digital employees.” They work side by side with humans. They have unique roles and are evaluated by how well they do them. Some of their jobs were done by people last year.

“The digital employee works 24/7, which is obviously very different to our human counterparts,” said Rachel Lewis, who oversees nine digital employees in addition to thousands of humans as head of payment operations for BNY. “It’s really focused on very specific repetitive tasks that allow our human employees to do much more human, intense, interesting-type roles.”

BNY employs 48,100 humans, down from about 53,400 in 2023, according to a recent earnings presentation. CFO Dermot McDonogh was asked on the firm’s fourth-quarter analyst call last month what the 134 digital employees mean for cost savings at the firm.

“Our head count has trended down a little bit, but that’s not really anything to do with AI yet,” McDonogh said. “We talk about, internally, AI is unlocking capacity. We don’t think about it in the narrow definition of efficiency. It’s all about growing with clients, increasing revenues and optimizing the potential for our employees.”

Across Wall Street, analysts and investors are starting to ask more questions about how the industry’s expenses on AI will translate into higher efficiencies and greater returns. BNY spent $3.8 billion on technology in 2025, or about 19% of its revenue. That’s the highest proportion among its large-bank peers, according to data collated by CNBC.

JPMorgan, Goldman Sachs, Bank of America, Wells Fargo, Citigroup, BNY

“There’s an AI arms race. The banks are part of that, said Wells Fargo analyst Mike Mayo. “But you don’t define success by who spends the most. You define success by who has the best results.”

“It’s a lot of ‘spraying and praying’ when it comes to spending on tech, generally,” he said.

However, BNY has been identified as one of the companies that could see the biggest benefits from AI. Goldman Sachs’ research team screened the Russell 1000 for potential productivity improvements, based on labor costs and wage exposure to AI automation. The firm ranked BNY toward the top of that list, saying the bank could see a potential 19% boost to earnings per share.

But in several conversations CNBC had with executives at BNY, they’ve been steadfast that the multitude of technology investments won’t come at the expense of human employees.

“I wouldn’t think about it that way,” said Michelle O’Reilly, BNY global head of talent. “I would think about it more as unlocking that productivity – enabling all employees to be productive.”

While the company is building more digital employees, it’s also upskilling the human ones. Shortly after ChatGPT was released in late 2022, BNY set up its AI Hub.

“That’s when we really doubled down and realized that this would be transformational for the bank,” said Leigh-Ann Russell, BNY’s chief information officer and global head of engineering. “Our biggest focus initially was enablement – getting some training rolled out to every one of our employees at the bank.”

BNY built a platform it calls Eliza, which pulls in a variety of open-source, commercially available models that are integrated with the firm’s internal data and compliance. Almost all of BNY’s workforce has completed a 10-hour training for Eliza, and thousands more have taken it a step further through a multi-day AI bootcamp that can help non-engineers find creative ways to automate parts of their jobs.

The name “Eliza” is a tribute to Elizabeth Schuyler Hamilton, the wife of the bank’s founder and America’s first Treasury Secretary, Alexander Hamilton.

“Democratization of this technology is one of our sweet spots on how we feel like we’ve been successful so far,” Russell said. “I have this juxtaposition of this original history of this amazing 241-year institution and being at the forefront of AI, and I think that’s just a lovely reminder of technology over the centuries.”

Crypto World

MicroStrategy (MSTR) Shares Rebound After a Dramatic Sell-Off

Shares of Strategy Incorporated (MSTR) suffered a severe collapse, falling by more than 75% from their July 2025 highs to last Thursday’s low. The main trigger was concern over the cryptocurrency market, as the company holds more than 700,000 coins on its balance sheet, with an average purchase price of around $76,000 per coin.

However, trading opened on Friday with a bullish gap, and MSTR surged by more than 20% during the session. Market sentiment shifted sharply due to two key factors:

→ Quarterly earnings release. Although earnings per share missed expectations, investors were reassured by statements from founder Michael Saylor and CEO Phong Le, who stressed that the decline in the price of the leading cryptocurrency does not threaten the company’s financial stability. Management confirmed that, despite unrealised losses, the core business generates sufficient cash flow to service debt, and the accumulation strategy remains unchanged.

→ Recovery in cryptocurrency prices. After forming a low on Thursday, the BTC/USD rate rebounded, finding support near the psychological $60,000 level.

Back in early December, we noted that:

→ signs of demand were emerging on the chart, giving bulls hope for a recovery;

→ much would depend on the direction of BTC/USD.

Since then, MSTR shares initially stabilised, finding support around $157, but the downtrend later resumed, driven by:

→ renewed weakness in the cryptocurrency market;

→ resistance at the median of the descending channel, as shown by the arrows. A breakout attempt in mid-January failed, allowing bears to regain control.

The last two candles on the chart form a bullish engulfing pattern, reinforced by exceptionally high trading volumes — a sign of “smart money” activity, which may view current prices as attractive.

Positive sentiment could persist this week, but the key question is whether it will be strong enough to break above the line dividing the lower half of the channel into two quarters. If successful, a crucial test for the bulls would be the area around the psychological $150 level, which stands out as a major resistance zone.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

BTC Price Wobbles Below $70K, WLFI Defies Monday Correction: Market Watch

ETH is close to breaking below $2,000 again, XRP’s price is down by 3% daily.

Bitcoin’s price ascent to $72,000 on Sunday failed in its tracks, and the asset has retraced by over two grand since that unsuccessful attempt.

Most larger-cap altcoins are in the red today after charting some gains over the weekend. WLFI and XMR are among the few exceptions.

BTC Below $70K Again

The primary cryptocurrency nosedived on several occasions in the past few weeks. On January 31, for example, it dumped from $84,000 to just under $76,000 after it had already dropped from a local peak of $90,000.

The bulls tried to intervene at this point, but their best effort took BTC to $79,000 a few days later. However, that was short-lived as the bears remained the predominant force in the market. As the selling pressure intensified over the business week, it culminated on Thursday and Friday morning when bitcoin plunged to $60,000.

This became its lowest price tag since before the US presidential elections in November 2024. After losing $30,000 in just over a week, the cryptocurrency finally rebounded and surged to $72,000 on Friday and Saturday morning. It failed there and dropped to $68,000, but tried once again on Sunday. However, it was stopped at $72,000 once again.

It has declined by $2,500 since then and now sits below $70,000. Its market capitalization is down to $1.390 trillion on CG, while its dominance over the alts is just over 57%.

WLFI Defies Market Trend

As mentioned above, the altcoins are back in the red today. Ethereum is down by 3% to $2,030, XRP is down to $1.40 after a similar decline, while BNB has slipped to $623. SOL and DOGE have dropped by 4%, while CC has shed 5% of value.

WLFI is among the few exceptions, with an 8% surge that has pushed it to almost $0.11. SKY, LEO, and XMR are also slightly in the green, while JUP, ONDO, and ARB have lost the most value daily, of up to 8%.

The total crypto market cap has declined by around $70 billion in a day and is below $2.430 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Gold Price Climbs Above $5,000 At the Start of the Week

As shown by today’s XAU/USD chart, gold began the week on a bullish note: trading opened with a bullish gap above Friday’s high, lifting the price above the psychological $5,000 level.

The strengthening of gold has been driven by the following factors (according to media reports):

→ The US dollar, which is weakening ahead of key US economic data. The January employment report is due on Wednesday (it is expected to show signs of stabilisation in the labour market), followed by inflation data on Friday.

→ Political developments in Japan. The decisive victory of Prime Minister Sanae Takaichi has reinforced expectations of large-scale fiscal stimulus (“Sanaenomics”), which traditionally puts pressure on the yen and supports gold.

→ Demand from central banks. It has been reported that China’s central bank extended its gold purchases for the fifteenth consecutive month in January.

On 3 February, when analysing gold price fluctuations, we:

→ noted that the market was extremely oversold within the context of a long-term ascending channel;

→ suggested that a rebound from the zone of extreme oversold conditions could encounter a resistance area formed by the median of that channel and the classic Fibonacci levels (50% and 61.8%).

Indeed, on 4 February, after recovering into this area (with the formation of peak C), the market reversed lower and found support near the lower boundary of the aforementioned channel on Friday, 6 February.

Technical Analysis of the XAU/USD Chart

Price action (expanding amplitude) during the formation of low D points to aggressive demand, which may reflect the intentions of large capital.

At the same time, analysis of the market structure based on the A–B–C–D swing points suggests that, following the burst of extreme volatility at the turn of the month (highlighted by the peak in the ATR indicator), the market is searching for a new equilibrium.

It is therefore reasonable to assume that in the near term we may see a contraction in the amplitude of price fluctuations on the XAU/USD chart. It cannot be ruled out that supply and demand will find a temporary balance around the psychological $5k level.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

China’s property slump will be worse than expected

A real estate project under construction along the ancient Huai River in Huai’an City, Jiangsu Province, China on January 29, 2026.

Cfoto | Future Publishing | Getty Images

BEIJING — S&P Global Ratings has lowered its forecast for China property sales this year, barely two months into 2026.

The firm said Sunday that primary real estate sales will likely drop by 10% to 14% this year, worse than the 5% to 8% decline for 2026 sales predicted back in October.

“This is a downturn so entrenched that only the government has capacity to absorb the excess inventory,” the analysts said in a note. They added that the state could buy more unsold property to create affordable housing, but that so far these efforts have been piecemeal.

China’s property market, once accounting for more than a quarter of the economy, has seen its annual sales volume halve in just four years. Beijing’s crackdown on developers’ high reliance on debt for growth sparked the initial slump, while consumer demand for homes has yet to pick up.

Economists have long warned of overbuilding in China’s property market. But developers have only kept up construction despite the sales slump, leading to a sixth-straight year of completed, unsold new housing, according to the ratings agency.

“China’s glut of primary housing is keeping a property market recovery out of reach,” the S&P analysts said, noting the oversupply pressures prices to fall by another 2% to 4% this year, following a similar decline last year.

“Falling prices erode homebuyers’ confidence,” S&P’s report said. “It’s a vicious cycle with no easy escape.”

What’s particularly concerning, S&P said, is that the price decline in China’s biggest cities worsened in the fourth quarter of last year. “We previously viewed these markets as healthy, and as the likely starting place of any national property recovery,” the report said.

The cities of Beijing, Guangzhou and Shenzhen reported home price declines last year of at least 3%, the report said, noting Shanghai was the only major city to report an increase, up 5.7% in 2025 from 2024.

Getting worse

China’s property slump progressively worsened throughout 2025.

In May, S&P predicted a 3% decline in sales of new homes, only to revise that in October to an 8% drop. Sales ended up falling by 12.6% to 8.4 trillion yuan ($1.21 trillion) — less than half the annual sales of 18.2 trillion yuan seen in 2021.

That’s ramping up the pressure on China’s struggling real-estate developers.

If sales end up falling 10 percentage points below S&P’s base case for this year and next, four of the 10 Chinese developers that the company rates could see downward rating pressure, the analysts said.

That excludes China Vanke, once one of the country’s largest developers, which, late last year, asked to delay repayment on some of its debt.

Chinese authorities have yet to release significant new support for real estate, preferring to double down on efforts to develop advanced technologies.

Last month, U.S.-based research firm Rhodium Group said that China’s push into high-tech industries isn’t large enough to offset the country’s property slump, leaving the economy more reliant on exports for growth and more exposed to trade tensions.

Top policymakers are set to release economic goals for the year at a parliamentary meeting next month.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics19 hours ago

Politics19 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat14 hours ago

NewsBeat14 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business19 hours ago

Business19 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports9 hours ago

Sports9 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics21 hours ago

Politics21 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat4 hours ago

NewsBeat4 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report