Crypto World

Is This the End of the Machi Big Brother Dump? Giant Whale Clings to Last $1M After Disaster

Arkham Intelligence estimates cumulative trading losses at $28 million.

Machi Big Brother is known for taking massive, highly leveraged long positions in several tokens on the decentralized exchange Hyperliquid, which has led to significant, high-profile liquidations.

Recent volatile months have massively drained his remaining capital.

Fortune Shrinks

Blockchain data shared by Arkham Intelligence revealed that Machi Big Brother’s Hyperliquid HL account value has fallen below $1 million. The data indicates the Taiwanese-American entrepreneur and former musician, whose real name is Jeffrey Huang, added margin to recent Hyperliquid long positions by drawing from the PleasrDAO treasury, funds that were deposited roughly five years ago.

Arkham Intelligence reports that around five months ago, Machi Big Brother’s net worth was close to nine figures. Since then, his holdings have witnessed a steep fall.

The on-chain tracking firm estimates his cumulative trading performance at a loss of $28 million. The movements were identified through wallet activity linked to Machi Big Brother and the PleasrDAO treasury.

Controversies

Machi Big Brother has been one of the controversial figures in crypto who is known for massive gains, heavy losses, and constant reinvention. He entered the space around 2017, launching Mithril (MITH), a “social mining” project that rewarded users with tokens. The project raised about $13 million, but the token collapsed roughly 80% within months.

He later joined Formosa Financial, which helped raise around 44,000 ETH, then worth about $37 million. About 22,000 ETH later disappeared from the treasury and were never recovered. In 2020, he moved aggressively into DeFi, forking Compound to create Cream Finance. The protocol suffered multiple exploits, and total losses surpassed $192 million.

You may also like:

He continued launching fast-moving forks such as Mith Cash, Wifey Finance, and Typhoon Cash, many of which failed within weeks. From 2021 to 2023, he became a dominant NFT player and amassed more than 200 Bored Ape Yacht Club NFTs worth over $9 million at the peak.

He later sold more than 1,000 NFTs in a short period, which crashed floor prices in what became known as the “Machi Dump.” In 2022, on-chain investigator ZachXBT accused him of embezzling 22,000 ETH and leaving multiple failed projects behind. Machi responded with a defamation lawsuit in Texas, which ended quietly without a ruling.

In 2024, he launched the Boba Oppa meme coin on Solana. He raised over $40 million before the token dropped sharply.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dogecoin and Ripple-linked token holders now eligible for U.S. loans

Coinbase is expanding its crypto-backed lending product in the U.S. to include XRP, , Cardano’s ADA and , widening access to a service it has pitched as a way for customers to unlock liquidity without selling their holdings.

The product allows users to post crypto as collateral and borrow up to $100,000 in Circle’s USDC stablecoin. The loans are routed through Morpho, a decentralized lending protocol, meaning the borrowing mechanics are handled on-chain rather than through Coinbase’s own balance sheet.

The service is available across the U.S., excluding New York.

The move brings some of crypto’s most retail-heavy tokens into a product that previously focused on bitcoin and ether. While Ethereum and Cardano holders can already earn yield through staking on their native networks, assets like XRP, DOGE and Litecoin do not offer built-in reward mechanisms.

For those investors, borrowing against their holdings has become one of the few ways to access liquidity without exiting the position.

Coinbase is also expanding the potential pool of collateral on its platform. The exchange reported it held $17.2 billion worth of XRP as of Dec. 31, according to an SEC filing, making the token one of the larger assets sitting in customer accounts.

Crypto-backed loans have long been marketed as a tax-efficient strategy, since borrowing against an asset does not trigger capital gains in the same way selling does.

But the structure comes with sharp risks when markets move quickly. If the value of the collateral falls too far relative to the loan, the position can be liquidated, meaning a third party can repay the debt and seize the collateral at a discount.

Coinbase applies an extra buffer when users take out a loan to reduce liquidation risk and sends notifications as the threshold is approached. Still, the exchange has also warned that collateral used through the product is wrapped, a process that allows tokens like XRP to exist on Ethereum-compatible networks.

Crypto World

BTC can bounce but market still lacks fuel for a real run

Bitcoin is finding space to bounce, but not yet the fuel to run.

The macro backdrop has improved just enough to give bulls something to work with. Cooling headline inflation has strengthened expectations for three rate cuts this year, reviving the familiar playbook in which easier monetary policy supports risk assets.

And it could signal the possibility of liquidity slowly returning after months of tight financial conditions for crypto markets.

But caution against reading too much into that shift. The Federal Reserve is unlikely to embark on an aggressive easing cycle. Instead, it appears set for a measured approach that rebuilds liquidity gradually. That creates an environment where bitcoin can stage tactical rallies yet struggle to hold them.

Bitfinex analysts describe the market as one prone to moves in waves rather than clean breakouts.

“In this environment, volatility remains likely,” the firm said in a note shared with CoinDesk. “Tactical upside moves can occur when positioning becomes overly defensive, but a durable structural advance will require clearer confirmation from both macro disinflation trends and sustained spot demand.”

Spot recoveries continue to meet steady selling. Each bounce is absorbed more smoothly than earlier in the quarter, suggesting some stabilization.

The overnight tape is a good example. Bitcoin traded as high as $68,500 before rolling over during the U.S. afternoon and sliding under $66,000, a move that lined up with a stronger dollar and hawkish Fed minutes. That kind of intraday reversal is the market’s way of saying rallies are still fragile, and that traders are quick to sell the moment macro conditions turn even slightly less friendly.

“It is alarming that Bitcoin’s dynamics mirror the recent strengthening of the dollar. When investors become convinced that the rise of the dollar is a trend, there may be a sharp increase in volatility,” Alex Kuptsikevich, the FxPro chief market analyst, said in an email.”

“Volatility seems to have been turned off in this market, while stock indices are much livelier. There, investors are actively buying up dips, relying on support in the form of important moving averages: 50-day for the Dow Jones and Russell 2000 and 200-day for the Nasdaq100. The crypto market is now below its 50- and 200-day curves by 17% and 31%, respectively,” he added.

Sentiment remains fragile, meanwhile, as a crypto fear gauge has printed single digits on nine of the past fourteen days, territory rarely seen outside prior cycle lows.

At the same time, stablecoin outflows from major exchanges point to tighter liquidity, and long-term holders have shown signs of stress comparable to late bear-market phases in 2022, according to Glassnode.

For now, bitcoin appears caught between improving macro optics and stubborn supply. Tactical upside remains possible, especially when positioning leans too defensive.

A durable advance, however, likely requires clearer evidence of disinflation, a softer dollar and consistent spot demand. Until then, the path higher may be uneven.

Crypto World

Fueling Saudi Arabia’s Vision 2030

Editor’s note: Global Games Show Riyadh 2026 signals a turning point for Saudi Arabia’s digital entertainment ecosystem as the kingdom accelerates growth across gaming, esports, and Web3. This press release outlines a multi-day program that combines live demonstrations, developer workshops, and high-profile panels, underscoring Riyadh’s emergence as a regional hub for interactive technology. The show also reinforces collaboration among startups, creators, and investors through dedicated networking spaces and matchmaking sessions. By bringing together leaders from across the industry, the event aims to catalyze partnerships and accelerate the creative economy envisioned in Vision 2030.

Key points

- Global Games Show Riyadh 2026 brings together gaming, esports, and Web3 within Saudi Vision 2030.

- The event features live demos, workshops, panels, and networking with industry leaders, indie developers to global publishers.

- It is organized by VAP Group and powered by Times of Games, with parallel events Global AI Show and Global Blockchain Show on a single ticket.

Why this matters

By concentrating expertise and investment in Riyadh, the Global Games Show aims to accelerate Saudi Arabia’s creative economy and position the Kingdom as a regional and global hub for interactive technology. The conference highlights trends in immersive gaming, cloud gaming, and monetization strategies, and emphasizes collaboration across startups, developers, and publishers, aligning with Vision 2030’s diversification goals.

What to watch next

- Updates on Day 1 and Day 2 sessions and key speakers.

- Public announcements of participating companies and partnerships.

- Ticketing details for the Global AI Show and Global Blockchain Show, accessible with one ticket.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Global Games Show Riyadh 2026 : Fueling Saudi Arabia’s Vision 2030

Global Games Show Riyadh 2026 Riyadh edition is poised to become the ultimate destination for gaming enthusiasts, developers, and investors alike. Organized by VAP Group and powered by the Times of Games, the event promises a vibrant lineup of discussions and engaging experiences that symbolize the rapidly changing gaming sphere.

Participants can explore the latest in game development, esports, and interactive entertainment, with live demonstrations, workshops, and panels led by industry leaders. From indie developers to global publishers, companies will present their most innovative games and technologies, providing attendees with insights into the future of gaming.

Educational and strategic sessions focus on trends such as immersive gaming, cloud gaming, and monetization strategies. These discussions equip participants with knowledge to navigate challenges, leverage opportunities, and scale their ventures effectively.

Day 1 is all about the future of gaming technology, with talk on Saudi Arabia becoming a world esports capital, the next phase of gaming engines with Unreal Engine 6, brain–computer interfaces, and AI-generated game design. Experts will also discuss what the future of esports will look like in the Kingdom and how it is increasingly driving Vision 2030’s creative economy.

Day 2, entitled “Gameconomics,” explores the gaming business—from crowdfunded games to mobile gaming opportunity, player-coined communities, and developer–investor partnerships that form industry expansion.

By bringing a diverse mix of professionals under one roof, the Global Games Show strengthens Riyadh’s position as a hub for interactive technology and digital entertainment. Attendees also get access to other parallel flagship events, the Global AI Show and the Global Blockchain Show with just one ticket. GGS is a convergence of ideas, creativity, and opportunity in the gaming world.

Media enquiries :

Press contact : media@globalblockchainshow.com

Crypto World

Moonwell’s AI-coded oracle glitch misprices cbETH at $1, drains $1.78M

Moonwell’s lending pools racked up about $1.78M in bad debt after a cbETH oracle mispriced the token at nearly $1 instead of around $2.2k, enabling bots and liquidators to drain collateral within hours of a misconfigured Chainlink-based update reportedly using AI-generated logic.

Summary

- Misconfigured cbETH oracle set price near $1 vs roughly $2.2k, triggering a ~99% valuation gap that broke Moonwell’s collateral math.

- Liquidators repaid around $1 per position to seize over 1,096 cbETH, leaving Moonwell with roughly $1.78M in protocol-level bad debt.

- Faulty formula and scaling logic were reportedly co-authored by AI model Claude Opus 4.6, spotlighting new DeFi risk around AI-written oracle and pricing code.

Decentralized finance lending protocol Moonwell suffered a $1.78 million exploit due to a pricing oracle bug that misvalued Coinbase-wrapped ETH (cbETH), according to reports from the platform.

The vulnerability originated in oracle calculation logic reportedly generated by the AI model Claude Opus 4.6, which introduced an incorrect scaling factor in the asset price feed, according to the protocol’s disclosure. Attackers borrowed against severely underpriced collateral, extracting funds before the error was detected and corrected.

The cbETH mispricing effectively collapsed the collateral requirement for borrowing within affected pools. Because lending systems rely on accurate collateral ratios, the incorrect price allowed attackers to extract assets with minimal backing value, according to the protocol’s technical analysis.

Price oracles represent critical security components in DeFi lending systems. Incorrect asset valuation can enable under-collateralized borrowing or liquidation failures. Many major DeFi exploits have historically involved oracle manipulation or pricing errors rather than core protocol flaws, according to industry security reports.

The Moonwell incident differs from traditional oracle exploits in that the faulty logic appears linked to automated AI code generation rather than malicious oracle data feeds, according to the protocol’s preliminary investigation.

The exploit highlights risks associated with AI-assisted smart-contract development in financial applications. Language models can accelerate coding workflows, but financial protocols require precise numerical correctness, unit handling and edge-case validation, according to blockchain security experts.

In DeFi systems, small arithmetic or scaling mistakes can translate into systemic vulnerabilities affecting collateral valuation and solvency. The incident raises questions about whether AI-generated contract components may require stricter auditing standards than manually written code, according to security researchers.

AI-assisted development is increasingly used across Web3 engineering workflows, from contract templates to integration logic. Security models and audit frameworks have not yet fully adapted to AI-generated contract code, according to industry observers.

The broader implications center on how automated code generation errors in financial logic represent a new category of DeFi risk. Oracle math, scaling factors and unit conversions remain high-precision domains where automation failures can propagate into protocol-level vulnerabilities, according to technical analysis of the incident.

As AI-assisted smart-contract development expands, audit methodologies will likely need to evolve toward verifying not only code correctness but generation provenance and numerical invariants, according to blockchain security firms.

Crypto World

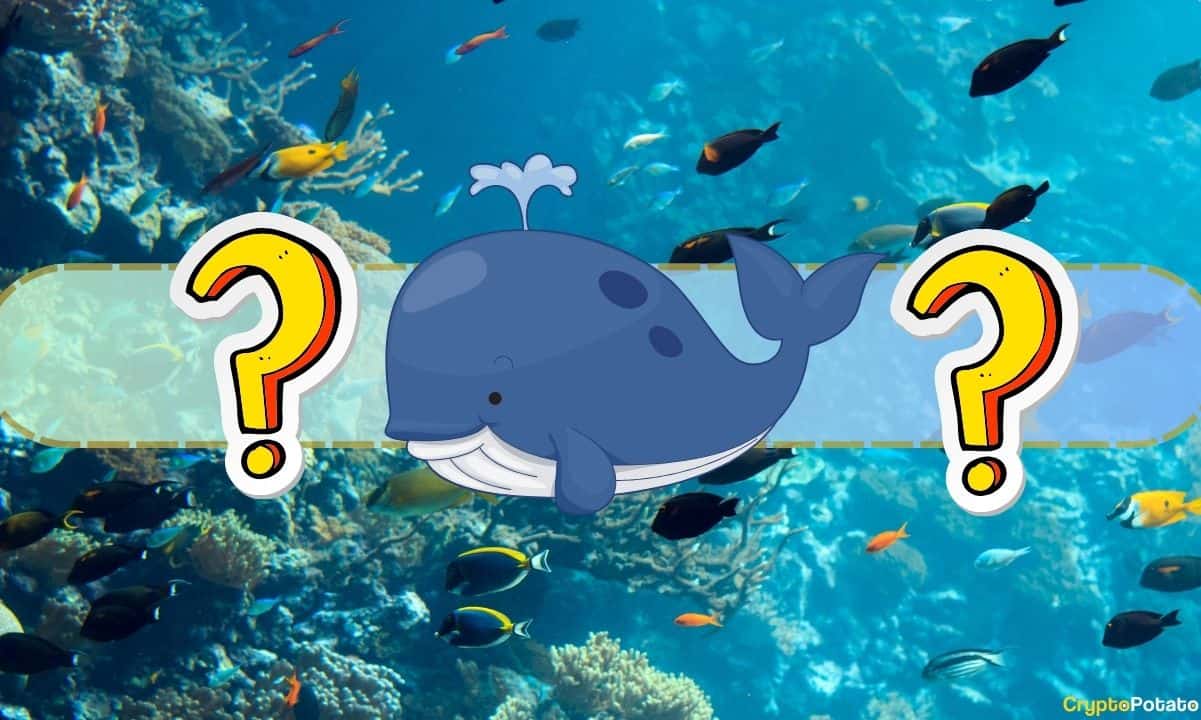

Kalshi Data Could Inform Fed Reserve Policy, Say Researchers

Three researchers at the US Federal Reserve argue that prediction market Kalshi can better measure macroeconomic expectations in real time than existing solutions and thus should be incorporated into the Fed’s decision-making process.

The “Kalshi and the Rise of Macro Markets” paper was released on Feb. 12 by Federal Reserve Board principal economist Anthony Diercks, Federal Reserve research assistant Jared Dean Katz and Johns Hopkins research associate Jonathan Wright.

Kalshi data was compared with traditional surveys and market-implied forecasts to examine how beliefs about future economic outcomes change in response to macroeconomic news and statements from policymakers.

“Managing expectations is central to modern macroeconomic policy. Yet the tools that are often relied upon—surveys and financial derivatives—have many drawbacks,” the researchers said, adding that Kalshi can capture the market’s “beliefs directly and in real time.”

“Kalshi markets provide a high-frequency, continuously updated, distributionally rich benchmark that is valuable to both researchers and policymakers.”

Kalshi traders can bet on a range of markets tied to the Federal Reserve’s decision-making, including consumer price index inflation and payroll, in addition to other macroeconomic outcomes such as gross domestic product growth and gas prices.

The Fed researchers said Kalshi data should be used to provide a risk-neutral probability density function, which shows all possible outcomes of Fed interest rate decisions and how likely each one is.

“Overall, we argue that Kalshi should be used to provide risk-neutral [probability density functions] concerning FOMC decisions at specific meetings” arguing that the current benchmark is “too far removed from the monetary policy interest rate decision.”

However, Fed research papers are only “preliminary materials circulated to stimulate discussion” and do not impact the central bank’s decision-making.

Prediction markets became one of the hottest use cases in crypto last year and have consistently surpassed $10 billion in monthly trading volume. Kalshi and competitor platform Polymarket have been aggressively marketing their products to retail users in recent months despite some state regulators seeking to restrict the industry.

Kalshi is more reactive than existing expectations tools

The Federal Reserve noted one advantage Kalshi has in examining macroeconomic expectations is its “rich intraday dynamics.”

Related: Treasury bills seen as primary driver of Bitcoin’s price: Report

“These probabilities respond sharply and sensibly to major developments,” the researchers said, pointing out an example where the implied probability of a rate cut in July rose to 25% following remarks from Federal Reserve Governors Christopher Waller and Michelle Bowman before falling after a stronger-than-expected June employment report.

“Kalshi provides the fastest-updating distributions currently available for many key macroeconomic indicators,” the researchers added.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Institutions Favor Crypto Rails Over Tokens, Experts Say

Institutional capital is flowing into digital markets. But it is not chasing speculative altcoins. Instead, it is targeting tokenization, custody, and on-chain infrastructure.

That was the clear message from a recent BeInCrypto Digital Summit panel, where executives from across exchanges, infrastructure, and tokenization platforms discussed how traditional finance is approaching crypto.

The discussion featured Federico Variola, CEO of Phemex; Maria Adamjee, Global Head of Investor Relations and Market Structure at Polygon; Jeremy Ng, Founder and CEO of OpenEden; and Gideon Greaves, Head of Investment at Lisk.

Sponsored

Operating Exposure, Not Speculation

Maria Adamjee, Global Head of Investor Relations and Market Structure at Polygon, said institutions are no longer debating whether crypto belongs in portfolios. The question now is how to size it.

“Institutions aren’t debating if crypto belongs anymore,” said Maria Adamjee from Polygon . “They’re figuring out how to size it as a new asset class.”

However, she stressed that most large asset managers are not taking outright balance sheet risk on volatile tokens. Instead, they are seeking “operating exposure” through tokenization, custody, and on-chain settlement.

In other words, they are buying access to the infrastructure rather than speculating on price swings.

Conviction Still Being Tested

Federico Variola, CEO of Phemex, struck a more cautious tone. He questioned whether institutions have truly committed for the long term.

“Not many companies have gone really full crypto,” the Phemex CEO said. Many institutions, he added, structure partnerships in ways that do not disrupt their core business lines.

He warned that current enthusiasm may not survive a prolonged downturn. “If we enter a longer bear period, maybe we wouldn’t see as much interest as we are seeing today,” he said.

Sponsored

Sponsored

That raises a critical question. Are institutions building strategic allocations, or are they hedging against disruption while limiting risk?

Tokenization as the Bridge

Jeremy Ng, founder and CEO of OpenEden, argued that the strongest institutional case lies in tokenized real-world assets.

He pointed to growing hedge fund participation in crypto and rising plans to increase exposure in 2026. At the same time, he emphasized that tokenization solves a practical problem: cost.

“When large asset managers put products on-chain, it reduces costs,” Ng said. Blockchain can replace transfer agents and fund administrators by acting as a proof-of-record layer.

For institutions, this is less about ideology and more about efficiency.

Sponsored

Sponsored

The Market Structure Gap

Still, structural barriers remain.

Polygon’s Adamjee noted that institutions struggle to price most crypto tokens. “Are they priced based off revenues, or network value?” she asked. “There’s no real P/E ratio associated with them.”

As a result, institutional allocations skew heavily toward Bitcoin, Ethereum, and infrastructure plays. The broader altcoin market lacks the valuation frameworks traditional finance relies on.

Ng echoed that concern. “90% of these tokens that have been launched don’t really have a real business,” he said. “They are not really generating fees.”

Without revenue models and clear value accrual, many tokens fail institutional due diligence.

Fewer Tokens, More Real Businesses?

Variola acknowledged that the industry itself bears responsibility. Exchanges, he said, have often pushed new listings aggressively.

Sponsored

Sponsored

“As an industry we should be policing a little bit better,” Ng said, adding that there should likely be fewer tokens overall.

Polygon’s Adamjee agreed that current incentives reward token proliferation. Exchanges earn fees from listings, creating tension between growth and quality control.

That dynamic complicates institutional adoption. Large asset managers require transparency, durable revenue, and predictable market structure.

Infrastructure First

Taken together, the panel’s message was clear. Institutions are not embracing crypto culture wholesale. They are integrating blockchain, which improves efficiency.

They favor low-volatility assets, regulated wrappers, and tokenized versions of traditional products. They are building exposure to the rails.

For now, infrastructure and tokenization lead. Speculative tokens follow at a distance.

The next phase of institutional adoption may depend less on price cycles and more on whether crypto can build businesses that look familiar to traditional capital — with revenue, structure, and accountability to match.

Crypto World

BTC, ETH eyed as Kiyosaki calls giant stock crash near

BTC holds near support as Kiyosaki flags imminent stock crash, boosting demand for scarce assets.

Summary

- Kiyosaki warns of the “biggest stock market crash” approaching, citing his 2013 book and framing it as a wealth transfer for prepared investors.

- He is accumulating BTC, ETH, gold, and silver on dips, highlighting BTC’s fixed 21m cap and viewing panic selloffs as long-term entry opportunities.

- BTC recently traded near $68.4k after a drop from the $90k–$95k zone, with key support around $64k and $60k–$62k as markets stay fragile.

Financial author Robert Kiyosaki has issued a renewed warning of a major market crash, stating that the “biggest stock market crash in history” is imminent, according to his recent public statements.

Kiyosaki referenced his 2013 book “Rich Dad’s Prophecy,” in which he predicted a massive financial downturn. The author stated that the moment he warned about is now approaching and characterized the potential event as an opportunity for prepared investors.

The “Rich Dad Poor Dad” author described the anticipated downturn as a wealth transfer event. Those who prepared could become “richer beyond your wildest dreams,” while those who did not may face severe losses, according to his statements.

“In Rich Dad’s Prophecy published 2013 I warned of the biggest stock market crash in history still coming. That giant crash is now imminent,” Kiyosaki stated, adding that those who followed his warning and prepared would benefit from the coming crash.

Kiyosaki stated he is holding gold, silver, Ethereum, and Bitcoin, which he described as “real” assets, while avoiding what he characterized as “fake” versions of those instruments. The author said he is actively purchasing additional Bitcoin (BTC) as prices decline.

The financial educator emphasized Bitcoin’s fixed supply, noting that only 21 million Bitcoin will ever exist and that nearly the full supply is already in circulation. Kiyosaki argued that panic-driven selloffs create accumulation opportunities for long-term investors, stating he plans to purchase more Bitcoin if markets decline further.

Kiyosaki’s message aligns with his long-standing investment philosophy that economic crises present buying opportunities for hard assets. The author views falling markets as a chance to accumulate Bitcoin and other scarce assets at lower prices, according to his statements.

Crypto World

BTC climbs to $67,000 as Trump says U.S. deficit cut by 78%

Bitcoin trading remained volatile on Thursday, rising to around $67,000 after briefly dipping near $65,900, as traders weighed a new message from U.S. President Donald Trump claiming the nation’s trade deficit has been cut by 78% thanks to tariffs and could turn positive later this year.

“The United States trade deficit has been reduced by 78% because of the tariffs being charged to other companies and countries,” Trump said in a Truth Social post late Wednesday. “Ot will go into positive territory during this year, for the first time in many decades.”

The claim matters for crypto less because of the math in any single post and more because it pulls the market back to a familiar pressure point.

Tariffs can act like a tax on imports, which can lift prices in the real economy and complicate the path for interest rates. When markets start pricing “rates higher for longer,” the dollar tends to firm and risk assets tend to lose oxygen.

Bitcoin has spent the past two weeks trading like a macro proxy again, reacting to shifts in liquidity and rate expectations rather than any crypto specific catalyst.

There is also a real data backdrop that makes trade a live topic. In early January, the U.S. trade deficit narrowed sharply to about $29.4 billion, the lowest since 2009, with analysts pointing to a drop in imports, a jump in exports and the knock on effects of tariff threats.

But economists also noted that a big part of the swing came from non monetary gold flows, which can make month to month numbers look cleaner than the underlying trend.

If the tariffs story hardens into a stronger dollar and tighter financial conditions, rallies can struggle to stick. If it fades into political noise, crypto goes back to watching flows, leverage and whether buyers can reclaim lost levels.

Crypto World

Arthur Hayes predicts AI credit crisis as Bitcoin sounds liquidity alarm

Arthur Hayes believes Bitcoin is signaling that markets are underestimating a coming credit shock.

Summary

- Arthur Hayes argues Bitcoin is signaling a looming credit shock, citing its sharp drop from $126,000 to $60,000 while the Nasdaq remained relatively stable.

- He estimates AI-driven job losses among knowledge workers could trigger over $500 billion in consumer and mortgage defaults, potentially hitting U.S. bank equity by 13%.

- Hayes expects a deflationary phase first, followed by aggressive Federal Reserve money printing, which he believes would ultimately push Bitcoin higher.

In his latest Substack essay, “This Is Fine,” the BitMEX co-founder argues that Bitcoin (BTC) acts as a “global fiat liquidity fire alarm.” Its sharp drop from $126,000 to around $60,000, while the Nasdaq 100 remained relatively stable, reflects tightening dollar liquidity and rising deflation risk.

AI job losses may trigger $500B bank losses, Arthur Hayes says

Hayes links that risk to artificial intelligence. He estimates there are 72.1 million knowledge workers in the U.S., many of whom carry significant consumer debt and mortgages. If AI tools rapidly replace even 20% of those workers, he projects major stress for the banking system.

Using Federal Reserve data, Hayes calculates roughly $3.76 trillion in bank-held consumer credit, excluding student loans. He also estimates knowledge workers carry an average mortgage balance of about $250,000.

If widespread layoffs occur, he projects $330 billion in consumer credit losses and $227 billion in mortgage losses. After accounting for reserves, that would translate to roughly a 13% hit to U.S. commercial bank equity.

Hayes argues that while the largest “too big to fail” banks may withstand the shock, smaller regional lenders could face severe stress. Lending would tighten, credit would contract, and economic demand would weaken. Markets would first price in deflation before policymakers intervene.

He points to several early warning signs. Software and SaaS stocks have underperformed broader tech indices. Consumer staples are outperforming discretionary stocks, suggesting households are cutting back. Credit card delinquencies are rising. Meanwhile, gold has strengthened relative to Bitcoin, another sign of defensive positioning.

Despite the near-term risk, Hayes remains structurally bullish on Bitcoin. He argues that deflationary shocks eventually force the Federal Reserve to restart aggressive liquidity programs. Political tensions may delay action, but once banking stress intensifies, he expects policymakers to “print” on a large scale.

Hayes outlines two scenarios. Either Bitcoin’s drop to $60,000 marked the bottom and equities will follow lower before liquidity returns, or Bitcoin could fall further if credit conditions worsen. In both cases, he believes renewed monetary expansion would ultimately push Bitcoin to new highs.

For now, Hayes advises caution and limited leverage. The alarm may be ringing, but he argues the real opportunity comes when the money printer starts again.

Crypto World

American Bitcoin Corp Joins Top 20 Bitcoin Holders With 6,039 BTC

TLDR

- American Bitcoin Corp has reached 6,039 BTC in its corporate treasury.

- The company is now the 17th largest corporate holder of Bitcoin globally.

- ABTC uses a “mining-to-treasury” strategy to retain the Bitcoin it mines.

- Since going public in September 2025, ABTC has achieved a 116% Bitcoin yield.

- Despite the Bitcoin reserve growth, ABTC’s stock has fallen by 86%.

American Bitcoin Corp (ABTC), a company backed by the Trump family, has reached a major milestone in the cryptocurrency market. After just six months of going public, the company now holds 6,039 Bitcoin (BTC), valued at approximately $409 million. This achievement positions ABTC as the 17th largest corporate holder of Bitcoin globally.

ABTC’s Bitcoin Reserves and Mining-to-Treasury Strategy

American Bitcoin Corp’s Bitcoin reserves have quickly grown due to its “mining-to-treasury” approach. Instead of selling the Bitcoin it mines, ABTC retains the coins, which has contributed to the company’s swift growth. In January alone, it added 217 BTC to its holdings, showing continued success in this strategy.

The company has combined both mining operations and market purchases to fuel its treasury growth. This hybrid strategy has led to a 116% yield in Bitcoin since ABTC’s debut on the Nasdaq in September 2025. By keeping its mined Bitcoin instead of selling, ABTC has steadily built its reserve, distinguishing itself from traditional miners.

Stock Performance and Market Volatility

Despite growing its Bitcoin treasury, ABTC’s stock has faced significant challenges in the market. Since going public, the company’s shares have dropped by 86%, affected by Bitcoin’s volatility and the expiration of the lock-up period for early investors. This sharp decline in stock price is a reflection of the broader market trends impacting both ABTC and the cryptocurrency space.

Despite the stock downturn, analysts remain confident about ABTC’s prospects. Both Roth Capital and H.C. Wainwright & Co. have maintained Buy ratings with a $4 price target. These ratings reflect optimism about the company’s long-term potential, even with short-term market volatility.

Bitcoin’s Influence on ABTC’s Growth

American Bitcoin Corp’s treasury growth highlights its effective use of Bitcoin mining and market participation. The company’s strategy has enabled it to quickly accumulate a significant amount of Bitcoin, surpassing other firms like GameStop and Gemini Space Station in corporate holdings. However, the broader market conditions continue to affect the company’s stock performance.

ABTC’s current position in the global ranking of Bitcoin corporate treasuries signals its ambition in the cryptocurrency space. Despite the challenges, the company’s approach of retaining its mined Bitcoin continues to prove effective in growing its reserve. As Bitcoin prices remain volatile, ABTC’s future strategy will be crucial in maintaining its position in the market.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment15 hours ago

Entertainment15 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech20 hours ago

Tech20 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Entertainment7 hours ago

Entertainment7 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business22 hours ago

Business22 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World10 hours ago

Crypto World10 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show