Crypto World

Israeli soldier allegedly used military secrets to gamble on Polymarket

Israel is attempting to prosecute a reserve soldier who allegedly used military secrets to place bets on security operations via Polymarket.

Polymarket offers a multitude of markets on various military operations, from bets on the outcome of the Ukraine/Russia war, to more specific targeted missile strikes against various countries.

Israel’s Shin Bet security agency announced today that the soldier — who is facing court along with an alleged civilian accomplice — used “classified reports” accessed via their military role to help make bets that could threaten Israel’s national security.

The pair is charged with numerous security offences, as well as bribery and obstruction of justice. Several people were arrested, but only two have been charged so far.

A lawyer representing the soldier told Bloomberg that the indictment is “flawed,” adding that the charge of harm to national security has been dropped.

They added, however, that he’s still believed to have used confidential information without permission.

Pair might be connected to $150K Polymarket winnings on Israel-Iran strikes

It’s unknown which prediction markets the two bet on, or if they made any profits. There are suspicions, however, that they could be linked to the Polymarket account “ricosuave666.”

This account made over $150,000 betting on Israel’s strikes against Iran in 2025, and reportedly got each prediction correct across a war that lasted 12 days.

Israeli authorities then opened up an investigation into these bets.

Previous cases involving the leaking of military secrets led to an Israeli soldier reportedly being sentenced to 27 months in jail in 2023.

The individual passed on confidential information to users on social media so that they could gain credibility and popularity online.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Every month, there seems to be another debate surrounding Polymarket and the use of insider information to make bets, but it’s unclear how capable the platform is of preventing these sorts of trades.

There were concerns over one account that made $437,000 betting on the exit of Venezuela’s former president Nicolás Maduro hours before the US captured him.

There were also concerns that someone was able to use insider information to bet on the Nobel Peace Prize before it was announced.

After the home of Polymarket’s CEO, Shayne Coplan, was raided by the FBI, a company spokesperson said, “We charge no fees, take no trading positions, and allow observers from around the world to analyze all market data as a public good.”

Protos has reached out to Polymarket for comment and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

US SEC drops Justin Sun lawsuit with $10M settlement from Rainberry

Justin has secured a $10 million settlement in a multi-year lawsuit filed by the United States Securities and Exchange Commission that accused the crypto entrepreneur of alleged fraud and securities violations.

Summary

- Justin Sun settled the SEC’s long-running lawsuit with a $10 million payment from Rainberry, bringing an end to allegations tied to TRX and BTT token sales and trading practices.

- The case, originally filed in 2023 under former SEC Chair Gary Gensler, accused Sun and affiliated entities of unregistered securities sales.

A letter from the SEC made public on Feb. 5 confirmed that neither Sun nor any of his companies involved in the case had admitted or denied the allegations, but the claims would be dropped following the payment of the fine.

With this, the SEC has wrapped up a three-year-long case that was filed under the leadership of former SEC Chair Gary Gensler, who was widely known for his regulation-by-enforcement approach.

Sun, along with affiliated entities including the Tron Foundation, BitTorrent Foundation, and Rainberry, was accused of selling unregistered securities involving TRX and BTT tokens. Further, the SEC alleged that Sun engaged in “manipulative wash trading” of TRX and paid celebrities like Akon, Lindsay Lohan, and Jake Paul to promote BTT without disclosing their compensation.

Sun has reiterated that the SEC’s complaints “lacks merit.”

Rainberry has agreed to pay a $10 million fine as part of the latest settlement.

“Today’s resolution brings closure, but I never stopped building. I will continue to focus on accelerating innovation in the United States and around the world, and look forward to working with the SEC to develop guidance and regulations for crypto going forward,” Sun wrote in a recent X post.

The dismissal comes as no surprise because under President Donald Trump’s administration, the commission has taken a markedly pro-crypto stance and has dropped multiple enforcement actions that were previously brought against major industry players like Coinbase.

However, the decision to drop Sun’s case has also drawn scrutiny from some lawmakers, who believe the move may have been motivated by Sun’s financial ties to Trump-linked crypto ventures.

Soon after Trump’s election, Sun acquired $30 million worth of tokens linked to World Liberty Financial, which has direct links to the president’s family.

Democratic lawmakers, including Representatives Maxine Waters, Ritchie Torres, and Stephen Lynch, have argued that the circumstances surrounding the settlement warrant closer scrutiny and have requested the SEC to reopen the case.

Crypto World

Protocol Bankruptcy Courts – Smart Liquidity Research

How DeFi Could Handle Failure Without Chaos Decentralized finance has mastered many things: permissionless trading, algorithmic lending, automated market making. But one problem still sits awkwardly in the background — what happens when a protocol fails?

In traditional finance, companies that collapse enter structured legal processes like Chapter 11 bankruptcy, where courts coordinate creditors, restructure debt, and distribute remaining assets fairly. In DeFi, the equivalent often looks more like Twitter threads, governance drama, and panic withdrawals.

What if blockchains had their own Protocol Bankruptcy Courts?

The Missing Layer in DeFi: Orderly Failure

Protocols fail for many reasons:

-

Smart contract exploits

-

Insolvent lending pools

-

Governance attacks

-

Market collapses

-

Oracle manipulation

Events such as the collapse of Terra and the liquidation cascades across Celsius Network and FTX showed how chaotic unwinding can be when billions of dollars in digital assets are involved.

Unlike traditional companies, most DeFi protocols lack a formal mechanism to restructure obligations when something breaks.

Instead, we see:

-

Emergency governance votes

-

Ad-hoc treasury bailouts

-

Community-driven compensation plans

-

Legal interventions outside the chain

A Protocol Bankruptcy Court would aim to solve this by embedding structured crisis resolution directly into smart contracts and governance systems.

What Is a Protocol Bankruptcy Court?

A Protocol Bankruptcy Court (PBC) is a decentralized system that activates when a protocol becomes insolvent or unable to fulfill obligations.

Instead of shutting down chaotically, the protocol enters a structured recovery phase governed by predefined rules.

Think of it as a smart-contract-powered restructuring process.

Key functions could include:

1. Automatic Insolvency Detection

Smart contracts continuously monitor protocol health metrics:

-

Collateral ratios

-

Liquidity reserves

-

Treasury solvency

-

Withdrawal pressure

If thresholds are breached, the protocol automatically triggers Bankruptcy Mode.

2. Creditor Registry

All stakeholders are mapped on-chain:

-

Depositors

-

Liquidity providers

-

Token holders

-

Bond markets

-

DAO treasury claims

The court system creates a transparent creditor registry so everyone knows who is owed what.

No hidden liabilities. No off-chain spreadsheets.

3. Claim Prioritization

A core function of bankruptcy is deciding who gets paid first.

Protocols could encode priority layers such as:

-

User deposits

-

Secured collateral lenders

-

Liquidity providers

-

Governance token holders

This hierarchy could be voted on beforehand through DAO governance.

4. On-Chain Restructuring Proposals

Instead of chaotic community debates, restructuring proposals are submitted through a structured system.

Examples:

-

Treasury-backed compensation plans

-

Tokenized debt issuance

-

Recovery tokens (similar to post-crisis IOUs)

-

Liquidity lock extensions

Voting would determine which recovery plan becomes active.

5. Asset Liquidation Engines

Remaining assets could be distributed through:

Everything happens transparently on-chain.

The Concept of Recovery Tokens

A common tool in restructuring is the issuance of recovery tokens.

After a protocol collapse, affected users receive tokens representing their claim on future revenue.

These tokens could:

-

Earn a portion of protocol fees

-

Be tradable on secondary markets

-

Appreciate it if the protocol recovers

This approach transforms losses into long-term claims instead of instant write-offs.

Why DeFi Needs This

DeFi’s biggest weakness isn’t innovation — it’s crisis management.

Traditional finance has centuries of legal infrastructure for handling insolvency. Blockchains do not.

Protocol Bankruptcy Courts could:

-

Prevent panic bank runs

-

Provide fair creditor coordination

-

Reduce legal uncertainty

-

Preserve the surviving protocol value

-

Turn catastrophic collapses into structured recoveries

Instead of “rug → chaos → lawsuits,” the process becomes “failure → restructuring → recovery.”

The Governance Challenge

Who should run these courts?

Possible models include:

DAO Jury System

Randomly selected token holders review restructuring proposals.

Delegated Arbitration

Specialized governance delegates evaluate claims.

Automated Rules

Smart contracts execute pre-programmed recovery paths.

In reality, a hybrid system is likely.

Risks and Limitations

Protocol Bankruptcy Courts are not a perfect solution.

Challenges include:

-

Governance manipulation during crises

-

Disputes about creditor priority

-

Smart contract rigidity

-

Legal conflicts with real-world jurisdictions

Still, even an imperfect on-chain restructuring process could be far better than today’s improvisation.

A Future Where Protocols Can Fail Safely

Failure is inevitable in experimental financial systems.

The question isn’t whether protocols will collapse, but how they collapse.

If DeFi wants to mature into global financial infrastructure, it needs systems not just for growth, but for orderly failure.

Protocol Bankruptcy Courts could become one of the most important missing layers in decentralized finance — transforming collapse from a chaotic event into a managed, transparent restructuring process.

In a world where code governs capital, perhaps even bankruptcy should be programmable.

REQUEST AN ARTICLE

Crypto World

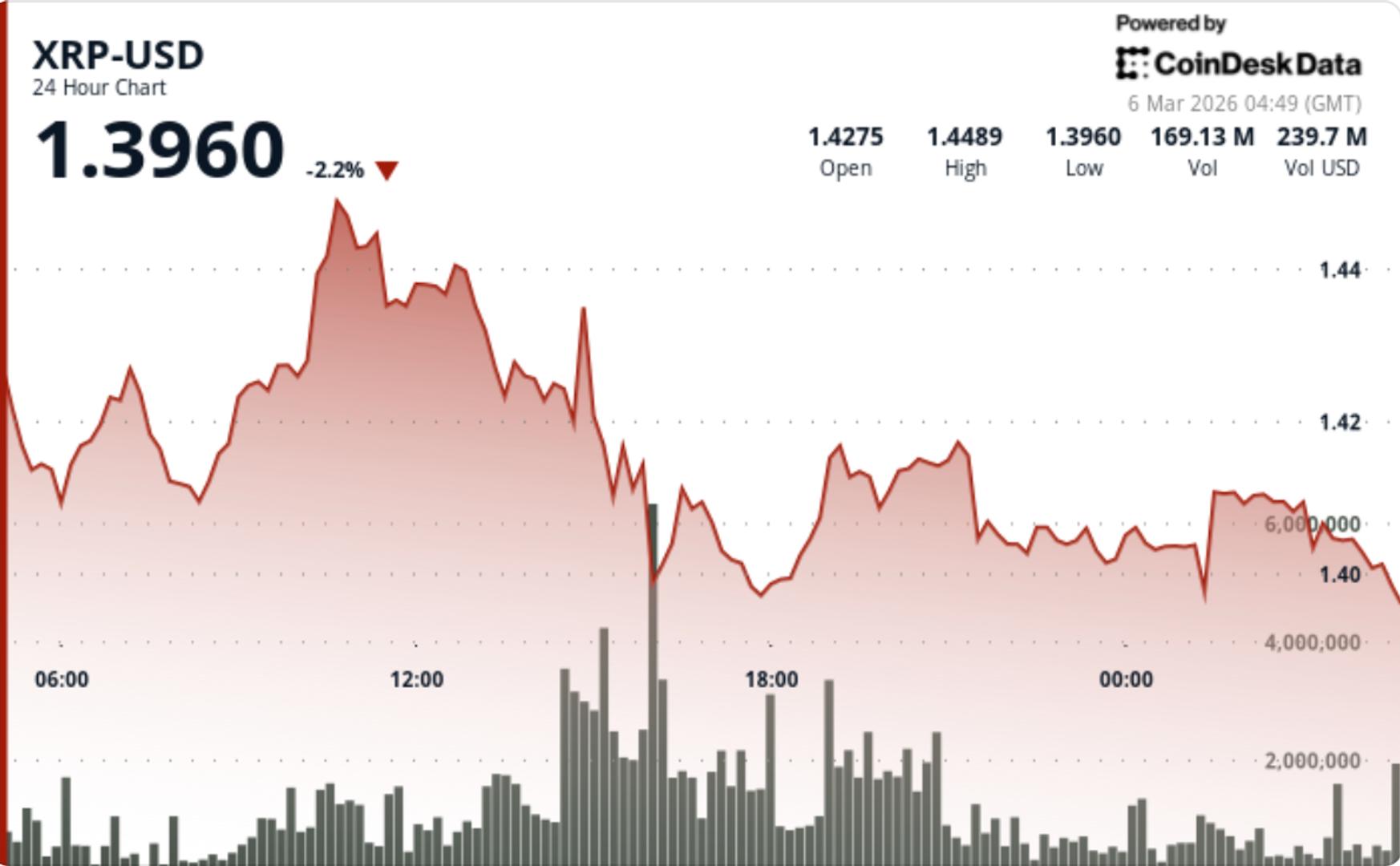

Solv Protocol Offers 10% Bounty After $2.7M Hack

Security researchers say a bug in Solv Protocol’s smart contracts allowed an attacker to mint an outsized amount of a Bitcoin-backed token and swap it for SolvBTC, the Bitcoin-pegged asset on the Solv network. In total, the incident is estimated at $2.7 million in losses, while the attacker minted 38.05 Solv Protocol BTC (SolvBTC) tokens before converting the bulk into a position on SolvBTC. Solv said fewer than ten users were affected and that it has deployed mitigations and engaged multiple security firms to investigate the exploit. The incident underscores ongoing security challenges in DeFi vaults that rely on cross-chain assets and minting logic.

Bitcoin-based DeFi platforms continue to attract attention for the financial leverage they offer across chains, but this episode shows how a single vulnerability can ripple through a broader ecosystem. The attacker’s maneuver involved 22 separate minting events, culminating in a swap that moved most of the minted tokens into just over 38 SolvBTC, a token pegged to Bitcoin. Pseudonymous researchers described the vulnerability as a re-entrancy-like flaw, a class of attack that has repeatedly exposed weaknesses in smart contracts where external inputs can provoke unintended minting or asset creation. While the precise chain of events remains under audit, the core insight is clear: minting controls on DeFi assets tied to real-world reserves demand robust, multi-layered safeguards.

Solv Protocol has been forthright about its response. In a public post on X, the team explained that they have put measures in place to prevent a recurrence and are collaborating with security firms Hypernative Labs, SlowMist, and CertiK to conduct a comprehensive review. A 10% bounty was offered to the attacker in exchange for returning the stolen funds, a strategy designed to recover value while maintaining a channel for dialogue. So far, there has been no confirmed on-chain communication from the attacker to the bounty address, according to Etherscan data, complicating any near-term recovery plan.

Solv Protocol’s model hinges on Bitcoin deposits backing Solv Protocol BTC, enabling users to lend, borrow, or stake across interconnected blockchains. The project has stressed that it possesses a substantial on-chain Bitcoin reserve—reported at roughly 24,226 BTC, valued at more than $1.7 billion at the time of reporting. This scale underscores the potential systemic impact of the breach, even if the immediate exposure to users appears limited. The event also places a spotlight on the resilience of liquidity providers across cross-chain ecosystems, where smart contract design, reserve accounting, and user protection mechanisms must align to prevent similar exploits in the future.

Initial assessments point to a flaw within a Solv smart contract that allowed excessive minting of a token used within the protocol. Security researchers describe this as a re-entrancy vulnerability, a persistent threat in DeFi that takes advantage of unexpected inputs to force asset creation beyond intended limits. The discourse around the incident has touched on broader lessons for DeFi—namely, the importance of formal verification, rigorous contract auditing, and robust guardrails for minting functions tied to real-world assets. The Solv incident joins a growing catalog of DeFi security episodes that encourage protocols to bake in stronger checks and consensus-driven escalation paths before minting or locking value.

Solv has provided a public wallet address in its update to encourage the attacker to participate in the bounty program. Yet, as of the latest blockchain checks, no on-chain message had arrived at that address. The lack of a reply is a reminder that, even with incentives, adversaries may delay or avoid engagement, leaving affected users and the ecosystem in a state of limbo as investigators map the full scope of the breach. The situation continues to evolve as security firms parse call traces, contract states, and token movements to determine whether additional exploits are possible or if the incident has crossed a boundary into a recoverable event.

The broader crypto community is watching how Solv and its security partners respond to this breach. The cross-chain nature of Solv’s products, coupled with the size of its Bitcoin-backed reserve, makes this incident more than an isolated hack; it tests the durability of risk controls, incident response, and incentive-driven remediation in DeFi’s Bitcoin-linked layer. While the immediate loss is tangible, the longer-term implications hinge on how effectively Solv can close the vulnerability, reassure participants, and demonstrate that cross-chain lending and staking platforms can withstand sophisticated, multi-stage exploits without eroding confidence in the underlying mechanics of wrap-and-bridge systems.

The event also highlights the tension between open, incentive-aligned security practices and the risk of misaligned incentives when large sums are at stake. As Solv and its partners conduct their audits and implement additional safeguards, observers will look for a clear roadmap outlining contract upgrades, formal verification steps, and a revised risk framework for minting and reserve management across Bitcoin-backed tokens. In an ecosystem where liquidity is a prized asset, the balance between rapid response and thorough, verifiable remediation remains the defining challenge for DeFi builders and auditors alike.

Why it matters

From a technical perspective, the Solv Protocol breach underscores how minting controls in DeFi products tied to real assets require exceptionally robust safeguards. A single bug in a contract that governs token creation can unlock outsized supply, enabling attackers to siphon value before guardrails activate. For users, the incident raises questions about the reliability of Bitcoin-backed DeFi vaults and the timeline for remediation—factors that influence whether liquidity remains available and secure across connected chains.

From a market perspective, the breach occurs against a backdrop of ongoing scrutiny of DeFi security practices, audit standards, and bug-bounty programs. The involvement of established security firms signals a serious investigative effort, but the absence of a public attacker-led recovery also underscores the fragility of trust when large on-chain reserves are at stake. For builders, the episode reinforces the need to implement multi-sig governance, formal verifications, and fail-safes that prevent minting beyond predefined caps, especially in systems that bridge Bitcoin to other networks.

For investors and users, the incident serves as a reminder to assess not only the yield or liquidity benefits of cross-chain DeFi products but also the depth and rigor of their security programs. The deployment of independent audits, transparent incident timelines, and concrete upgrade roadmaps will be critical in restoring confidence as the ecosystem weighs the trade-offs between innovation and safety in complex, asset-backed DeFi architectures.

What to watch next

- Updates from Hypernative Labs, SlowMist, and CertiK on the ongoing audit findings and patch implementations.

- Any further on-chain movements of the minted tokens or the SolvBTC asset, including potential recoveries or additional seizures.

- New governance or contract upgrades that address minting guards, emergency pause mechanisms, and reserve reporting.

- Public communications from Solv Protocol about timelines for remediation and user restitution, if applicable.

Sources & verification

- Solv Protocol’s official X posts detailing the incident and bounty offer.

- On-chain data and the transaction reference 0x44e637c7d85190d376a52d89ca75f2d208089bb02b7c4708ad2aaae3a97a958d.

- Public comments from security researchers (Hypernative Labs, SlowMist, CertiK) as cited in related updates.

- The reported figure of 24,226 BTC in Solv’s Bitcoin reserve and the broader context of SolvBTC as a Bitcoin-backed token.

Solv Protocol breach exposes risk in Bitcoin-backed DeFi vaults

Crypto World

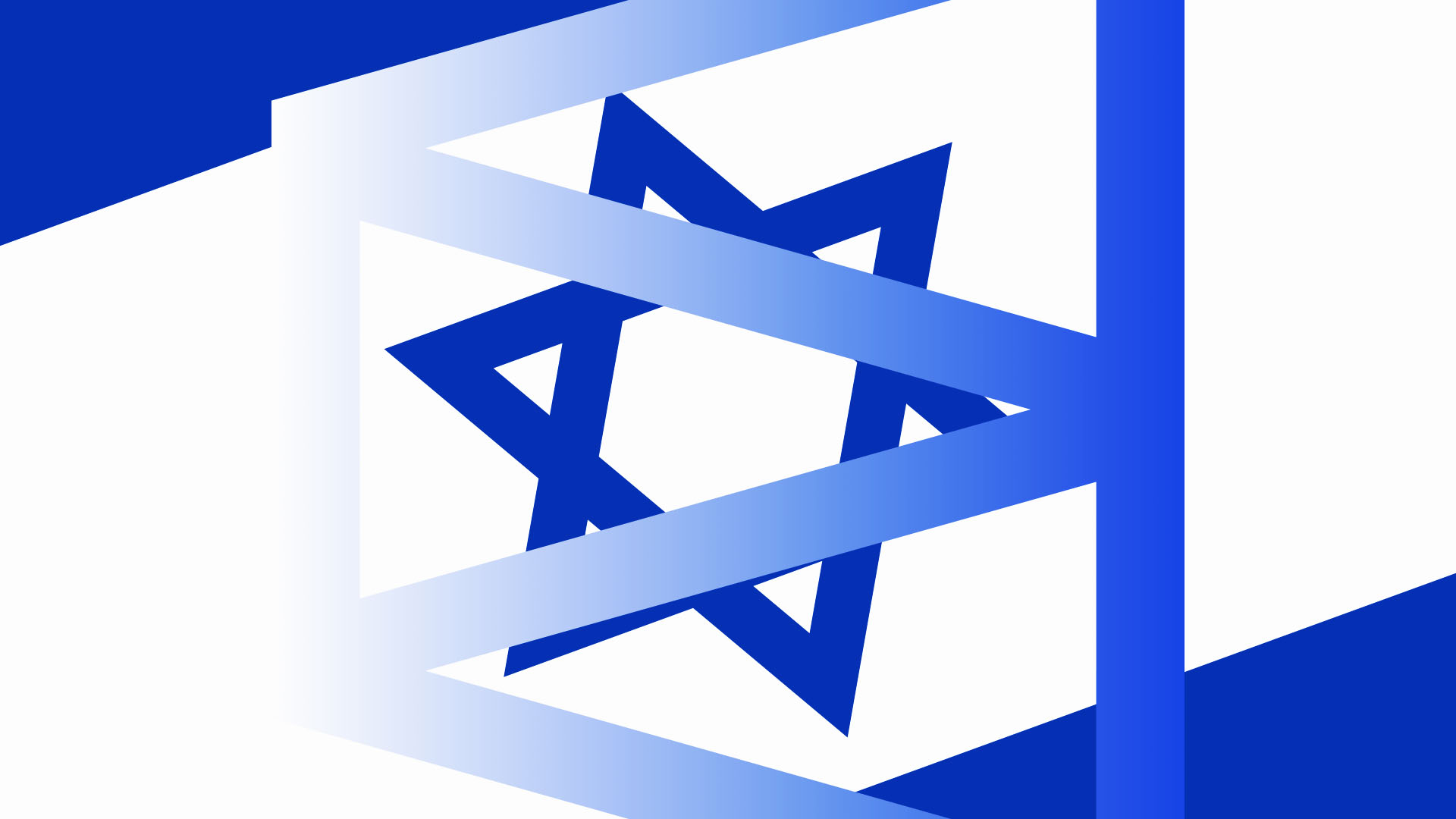

What next for Ripple-linked token as it fails to break above $1.45

XRP moved lower after another rejection near resistance, with rising volume confirming sellers remain in control of the short-term trend.

News Background

- XRP has struggled to regain momentum since its July 2025 peak, continuing to trade within a broader corrective structure. The token remains roughly 60% below that high as market participants debate whether the current consolidation represents accumulation or continuation of the downtrend.

- Institutional positioning has offered mixed signals. Spot XRP ETFs have accumulated roughly $1.24 billion in inflows over the past four months, while on-chain data shows large wallets adding to positions during recent dips.

- At the same time, derivatives activity has cooled significantly, with open interest declining sharply since late 2025 as leverage unwinds across crypto markets.

- Ripple’s supply dynamics also remain steady. The company re-locked 700 million XRP into escrow on March 1 as part of its routine supply management cycle.

Price Action Summary

- XRP declined 3.3%, falling from $1.4588 to $1.4108

- Price repeatedly failed to hold above the $1.43–$1.45 resistance zone

- Volume surged 74% above average during the main selloff

- A late-session break below $1.411 confirmed downside momentum

Technical Analysis

- The key technical event was the rejection from the $1.43–$1.45 resistance band, which triggered a sequence of lower highs and reinforced the prevailing descending channel structure.

- Once $1.411 support gave way on elevated volume, downside momentum accelerated, pushing XRP toward the $1.40 area. Short-term structure now favors sellers while price remains below the prior support zone.

- Despite the weakness, the broader chart shows compression forming between downward resistance and rising support, with a potential triangle structure approaching its apex. This suggests the market may be nearing a larger directional move once current consolidation resolves.

- Key levels now cluster around $1.40 support and $1.43–$1.45 resistance.

What traders say is next?

- Traders are closely watching whether XRP can stabilize above $1.40.

- Holding this level could allow the token to consolidate before attempting another move toward $1.45 and eventually $1.55, which analysts view as the first level that would weaken the broader bearish structure.

- A break below $1.40, however, would likely shift focus toward deeper support around $1.33, with some analysts pointing to the $1.00 zone as a potential longer-term reset area if selling pressure accelerates.

Crypto World

Hacker Steals $2.7M From Solv’s Bitcoin Yield Platform

Crypto security researchers say the hacker exploited a bug allowing them to mint tokens, before swapping the freely-gained tokens for another tied to Bitcoin.

Bitcoin-based decentralized finance platform Solv Protocol says one of its token vaults was exploited for $2.7 million and has offered the attacker a 10% bounty in exchange for returning the stolen funds.

Solv said in an X post on Thursday that less than 10 of its users were impacted, but it would cover the loss of 38.05 Solv Protocol BTC (SolvBTC), a token pegged to Bitcoin (BTC).

The project added that it had implemented measures to prevent the same attack from recurring and was investigating the exploit with crypto security firms Hypernative Labs, SlowMist and CertiK.

Solv allows users to deposit Bitcoin for Solv Protocol BTC, which they can then use to lend, borrow or stake on other blockchains. The project has 24,226 Bitcoin worth over $1.7 billion and claims it is the largest on-chain Bitcoin reserve.

Solv hasn’t confirmed how the exploit happened, but two crypto security researchers attributed it to a vulnerability in one of Solv’s smart contracts that allowed the hacker to excessively mint a token used on the protocol.

Related: Mt. Gox’s former CEO floats hard fork to recover 80K hacked Bitcoin

The hacker exploited this vulnerability 22 times before swapping hundreds of millions of the tokens for a little over 38 SolvBTC, CD Security co-founder Chris Dior said.

Pseudonymous crypto researcher “Pyro” described the exploit as a re-entrancy attack, where unexpected inputs expose gaps in smart contracts, a popular attack that has plagued multiple DeFi protocols for years.

Solv shared an Ethereum wallet address in its X post to encourage the hacker into accepting a 10% bounty.

However, the hacker has not yet sent an on-chain message to the address, according to Ethereum block explorer Etherscan.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

What next for BTC as it slides under $71,000

Bitcoin got to $74,000 and ran out of further buying pressure.

The largest cryptocurrency pulled back to $70,987 by Friday’s Asian session, down 2.2% over the past 24 hours after Thursday’s surge carried it to its highest level since early February. The rally from Saturday’s war-driven low near $64,000 to Thursday’s $74,000 peak amounted to roughly 15% in five days, but the retreat since has given back about a third of that move.

Chart watchers such as FxPro chief analyst Alex Kuptsikevich pointed to the rejection coincided with the 61.8% Fibonacci retracement and just below the 50-day moving average, two technical barriers that tend to attract sellers in bear market rallies.

Fibonacci retracement levels are derived from a mathematical sequence that traders use to identify where a bounce is likely to stall. The idea is that after a large move down, prices tend to retrace a predictable percentage of that drop before resuming the trend. The 61.8% level is the most closely watched because it represents the point where a recovery has retraced roughly two-thirds of its losses, far enough to feel convincing but historically where bear market rallies tend to die.

The 50-day moving average, meanwhile, is simply the average closing price over the past 50 days. It acts as a moving line of resistance during downtrends because it represents the price at which the average recent buyer breaks even, giving them an incentive to sell rather than hold. Bitcoin hitting both at the same time makes $74,000 a technically crowded level.

Kuptsikevich noted that “the bulls still have to convince the community that the bear market is over,” adding that the magnitude of the move was driven by a short squeeze from bears who “pulled their stops too close to the market price.”

Bitunix analysts flagged a similar read on the microstructure. The push to $74,000 triggered concentrated short liquidations, while long leverage liquidation clusters sit around $70,000. Secondary liquidity pools are near $64,000. That creates a defined range for the next move, with the floor and ceiling both visible on the liquidation heat map.

The weekly numbers still look strong for majors. Bitcoin is up 5.4% over seven days. Ether gained 2.7% to $2,080. BNB added 3.1% to $648. Solana rose 2.1% to $88.39. The laggards were dogecoin, down 3.7% on the week, and XRP, essentially flat with a 0.2% decline.

The macro picture heading into the weekend is messy, however.

Asia’s benchmark stock index has dropped 6.4% since the Iran war broke out, with MSCI’s regional gauge heading for its worst week since March 2020. The dollar is on pace for its best week since November 2024. Oil is posting its biggest weekly surge since 2022. Those are not the conditions that typically sustain a crypto rally.

Friday brought some tentative relief. Asian equities erased early losses as the dollar weakened and crude prices dipped on reports that the U.S. was weighing options to address the energy cost spike.

But the war isn’t over. The Senate failed to block Trump’s continued military actions against Iran, leaving conflict costs and energy disruption as open variables. Defense Secretary Hegseth has said operations could last three to eight weeks. The Strait of Hormuz remains effectively disrupted.

The $70,000 level that was resistance for a month is now the first test of support. Holding it would suggest the breakout is real. Losing it puts the $64,000 floor back in play.

Crypto World

Can Ethereum price reclaim $2,400 as it eyes a bullish reversal amid market recovery?

Ethereum bulls pushed its price to nearly $2,200 on Thursday amid a market-wide recovery.

Summary

- Ethereum price rebounded to a 4-week high on Friday amid increased demand from institutional traders and a surge in short liquidations.

- ETH has formed a double bottom pattern on the daily chart.

According to data from crypto.news, Ethereum (ETH) price rallied over 11% to a 4-week high of $2,192.

Ethereum price rallied amid a broader market recovery led by Bitcoin. The bellwether reclaimed the $73,000 mark for the first time since early February as reports emerged that the U.S. and Iran could be negotiating a deal to end their military confrontation.

As ETH price rose, it triggered a short squeeze of traders with highly leveraged bearish bets in the derivatives market. Data from CoinGlass show over $133 million in short positions were liquidated in the past 24 hours, compared to only $21.5 million in long positions.

A return of inflows into spot Ethereum ETFs also seems to suggest that institutional investors had played a significant part in the recovery. Per data compiled by Farside Investors, spot Ethereum ETFs drew in $169.4 million yesterday.

Simultaneously, Ethereum’s open interest shot up nearly 15%, which is a sign of increased derivatives market activity after multiple days of stagnation. While the weighted funding rate remains negative at press time, if it continues to climb, a shift toward positive funding rates could signal a return of bullish sentiment.

This surge in activity suggests that traders are once again aggressively positioning themselves, potentially setting the stage for more volatility if the price breaks key resistance levels.

On the daily chart, Ethereum price has formed a double bottom pattern, a major bullish reversal pattern formed of two consecutive troughs. The neckline of the pattern lies at the $2,200 psychological resistance level.

A breakout from the neckline could push Ethereum to $2,400, which aligns with the 38.2% Fibonacci retracement level that is often seen as a critical target for a trend reversal.

It should also be noted that a successful reclaiming of the $2,400 mark would invalidate a larger bearish flag pattern forming on the chart.

Key technical indicators seem to suggest that bulls are already on the move. Notably, the MACD lines have formed a bullish crossover and were pointing upwards, while the Aroon Up showed a reading of 92.86%, far above the bearish indicator at 35.71%.

For now, traders are eyeing $2,142, the 23.6% Fibonacci retracement level, as a key resistance. ETH was trading at $2,117 when writing, just 1.1% below that mark.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Can $155M ETF inflows extend the rally?

Bitcoin is regaining bullish momentum after a week of geopolitical-driven volatility, with fresh inflows into spot exchange-traded funds helping support the latest price rebound.

Summary

- Spot Bitcoin ETFs recorded roughly $155 million in net inflows, signaling renewed institutional demand.

- Bitcoin has recovered after last week’s volatility triggered by Middle East geopolitical tensions.

- Analysts say BTC could test $75,000 resistance if momentum and ETF inflows persist.

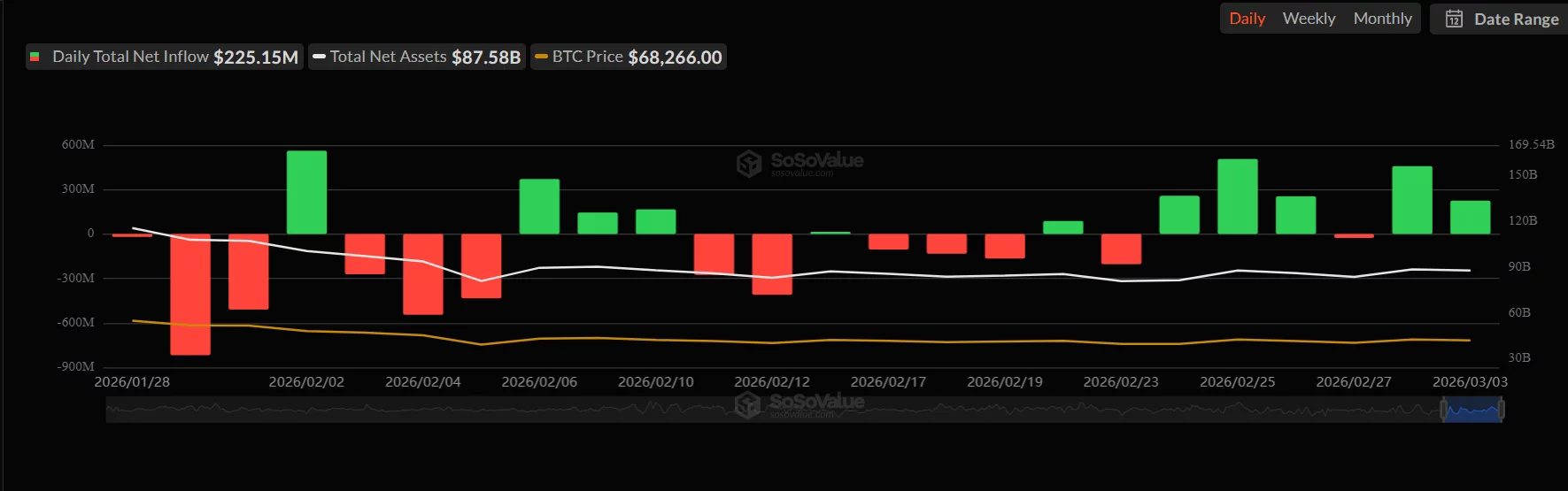

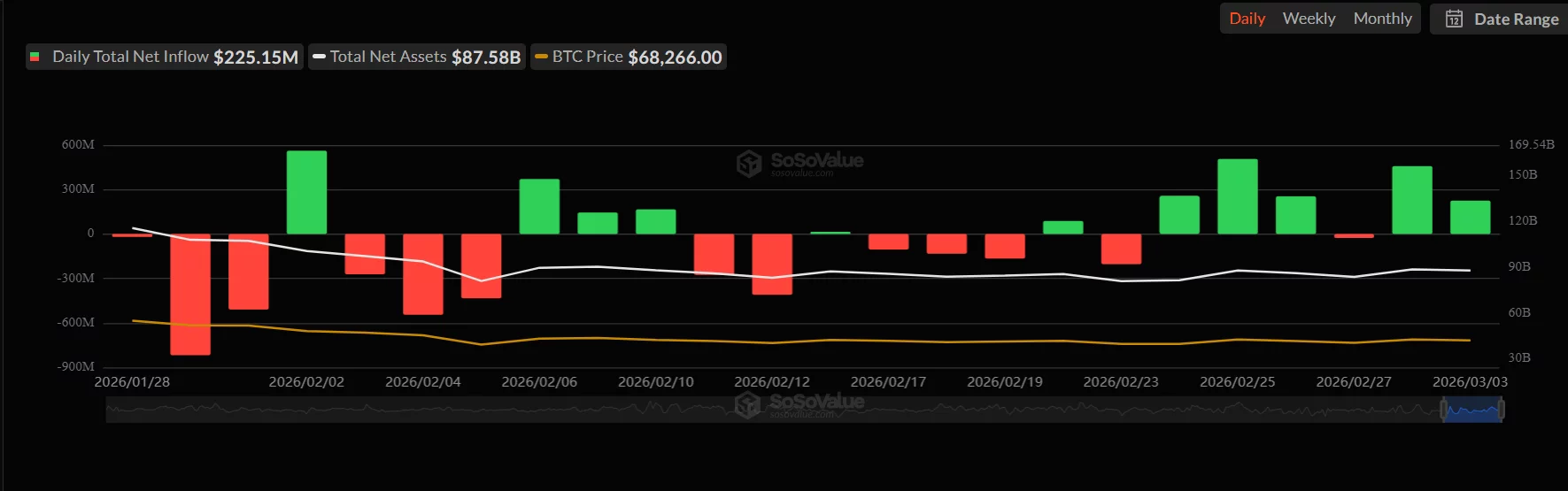

Data from SoSoValue shows that Bitcoin ETFs recorded about $155 million in daily net inflows, reversing a period of sustained outflows seen earlier in the week.

The renewed institutional demand comes as Bitcoin (BTC) stabilizes after sharp price swings triggered by rising tensions in the Middle East, which had briefly pressured risk assets across global markets.

The inflows appear to be translating into market strength. Bitcoin has climbed back above the $72,000 level, recovering from a dip near the $60,000–$65,000 zone during last week’s risk-off sentiment.

Previous market reports suggested that ETF demand and short covering were key drivers behind Bitcoin’s earlier rally toward $72,000, and the latest inflows indicate institutional buyers may be returning to the market.

Bitcoin price analysis

Beyond macro sentiment, the chart structure suggests Bitcoin is attempting to build a recovery trend.

On the daily chart, Bitcoin is currently trading around $72,500, pushing toward a key resistance band between $73,000 and $75,000. A decisive breakout above this zone could open the door for a retest of the $80,000 psychological level in the coming weeks.

Support levels remain near $69,000, followed by stronger structural support around $65,000, where buyers previously stepped in during the February correction.

Momentum indicators are also improving. The Accumulation/Distribution line is trending higher, suggesting renewed buying pressure, while the Bull Bear Power (BBP) indicator has flipped positive, signaling that bullish momentum may be returning after several weeks of selling pressure.

If ETF inflows continue and macro risks stabilize, Bitcoin could extend its recovery. However, analysts warn that failure to hold above the $70,000 region could trigger another consolidation phase before the next major move.

Crypto World

Coinbase, Microsoft and Europol dismantle Tycoon 2FA phishing network

Crypto exchange Coinbase teamed up with Microsoft and Europol to take down phishing-as-a-service platform Tycoon 2FA.

Summary

- Coinbase helped trace blockchain transactions linked to the Tycoon 2FA phishing network, allowing investigators to identify the platform’s alleged administrator and several users of the service.

- Tycoon 2FA offered a subscription toolkit that enabled criminals to intercept authentication sessions and bypass multi-factor protections.

- Phishing losses dropped nearly 83% in 2025.

In a Wednesday announcement, Coinbase said that it helped trace blockchain-based transactions linked to the platform, and as a result, law enforcement was able to identify the phishing operation’s alleged administrator and several of its customers.

According to Europol, Tycoon 2FA sold a subscription-based toolkit that helped bad actors intercept live authentication sessions and gain unauthorised access to online accounts, “including those protected by additional security layers.”

Using Tycoon’s phishing toolkit, cybercriminals were able to capture session cookies from authenticated users and therefore access accounts without triggering the multi-factor authentication prompts, Coinbase said.

“We’re actively working to identify Tycoon purchasers and will continue supporting law enforcement efforts focused on the people who bought and used this service to target victims,” it added.

The platform has been active since at least 2023, and by mid-2025, Tycoon 2FA accounted for nearly 62% of all phishing attacks blocked by Microsoft, Europol said.

“At scale, the platform generated tens of millions of phishing emails each month and facilitated unauthorised access to nearly 100,000 organisations globally, including schools, hospitals, and public institutions,” it added.

As previously reported by crypto.news, losses from phishing attacks dropped 83% in 2025 when compared to the previous year. Nevertheless, attackers have continued to use more advanced techniques, including exploits tied to EIP-7702, Permit and Permit2 signatures, and transfer-based attacks.

A separate report from blockchain security firm CertiK flagged that Phishing attacks remained the third most costly attack vector in 2025.

Crypto World

Eric Trump calls banks opposing stablecoin yields ‘anti-American’

Eric Trump has accused major U.S. banks of lobbying aggressively against crypto platforms offering higher yields to consumers, escalating tensions between the traditional financial sector and the digital asset industry.

Summary

- Eric Trump accused major U.S. banks of lobbying against crypto and stablecoin yield products.

- The comments come as debate intensifies around the CLARITY Act and GENIUS Act.

- Donald Trump also criticized banks, arguing legislation is needed to keep the U.S. competitive in the crypto sector.

Eric Trump accuses big banks of lobbying against crypto yields

In a post on X, Eric Trump claimed that institutions such as JPMorgan Chase, Bank of America, and Wells Fargo are attempting to block Americans from earning higher returns through crypto-based savings products.

“Big banks are lobbying overtime to block Americans from getting higher yields on their savings,” Trump wrote, arguing that traditional lenders offer extremely low annual percentage yields, often between 0.01% and 0.05%, despite benefiting from higher interest rates paid by the Federal Reserve.

According to Trump, the banking sector is particularly concerned about crypto and stablecoin platforms that are planning to offer yields or rewards in the 4% to 5% range. He alleged that banking lobby groups are spending heavily to restrict those products through legislation and regulatory pressure.

The comments come as lawmakers debate new digital asset legislation in Washington, including the CLARITY Act, which aims to define the regulatory framework for cryptocurrencies, and the GENIUS Act.

Trump argued that banks are invoking concerns about “fairness” and financial stability while attempting to protect profit margins built on the gap between the interest they receive and the rates paid to depositors.

The criticism echoes remarks made by Donald Trump, who recently said large banks are attempting to undermine crypto legislation that could strengthen the United States’ position in the global digital asset industry.

In a statement posted on Truth Social, the president said Congress must move quickly on market structure legislation to prevent the crypto industry from shifting to other countries.

The debate highlights growing friction between the banking industry and crypto firms as policymakers weigh how to regulate digital assets while maintaining the competitiveness of the U.S. financial system.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech23 hours ago

Tech23 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports11 hours ago

Sports11 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker