Crypto World

JPMorgan Issues Bold Bitcoin Prediction Amid Crash

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in — the market’s been on a rollercoaster lately. Bitcoin is moving, stocks are shifting, and headlines are coming fast. While some investors are hitting pause, others are watching closely, trying to read the signals beneath the noise.

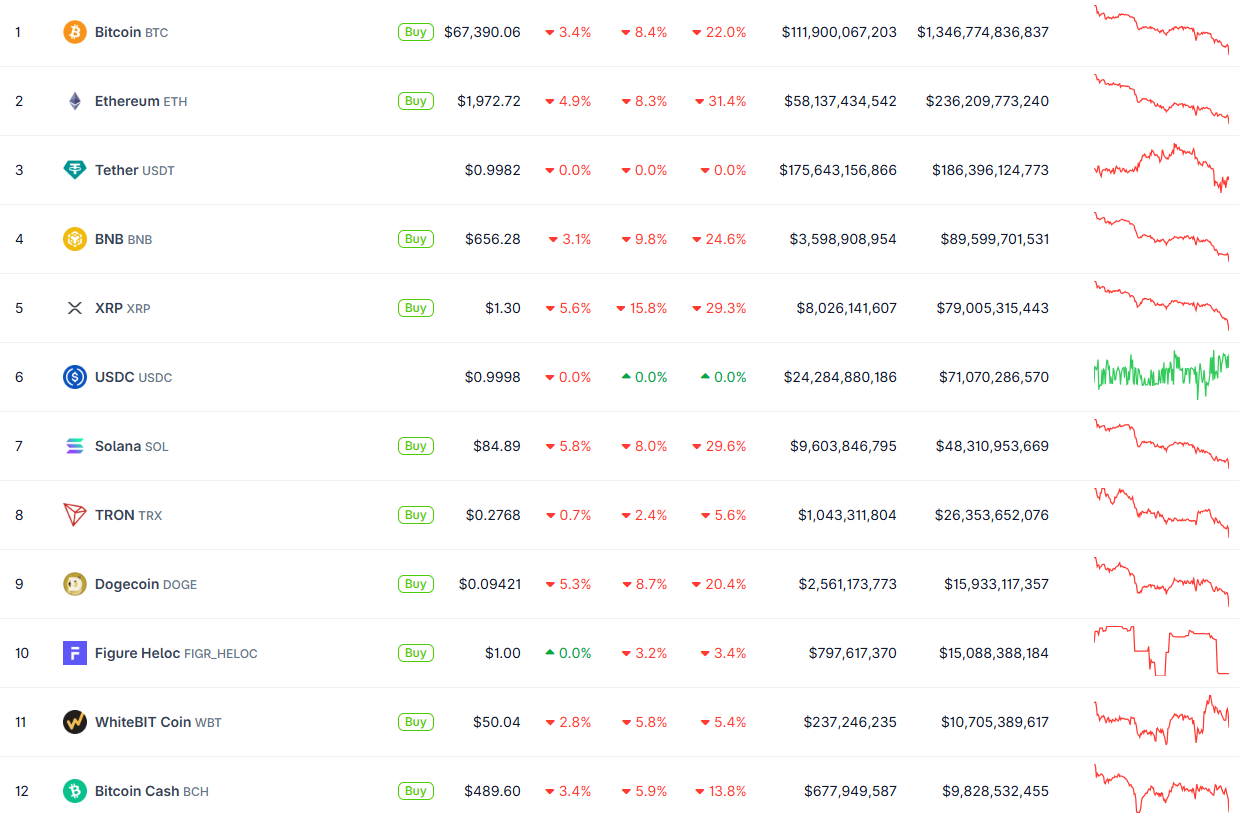

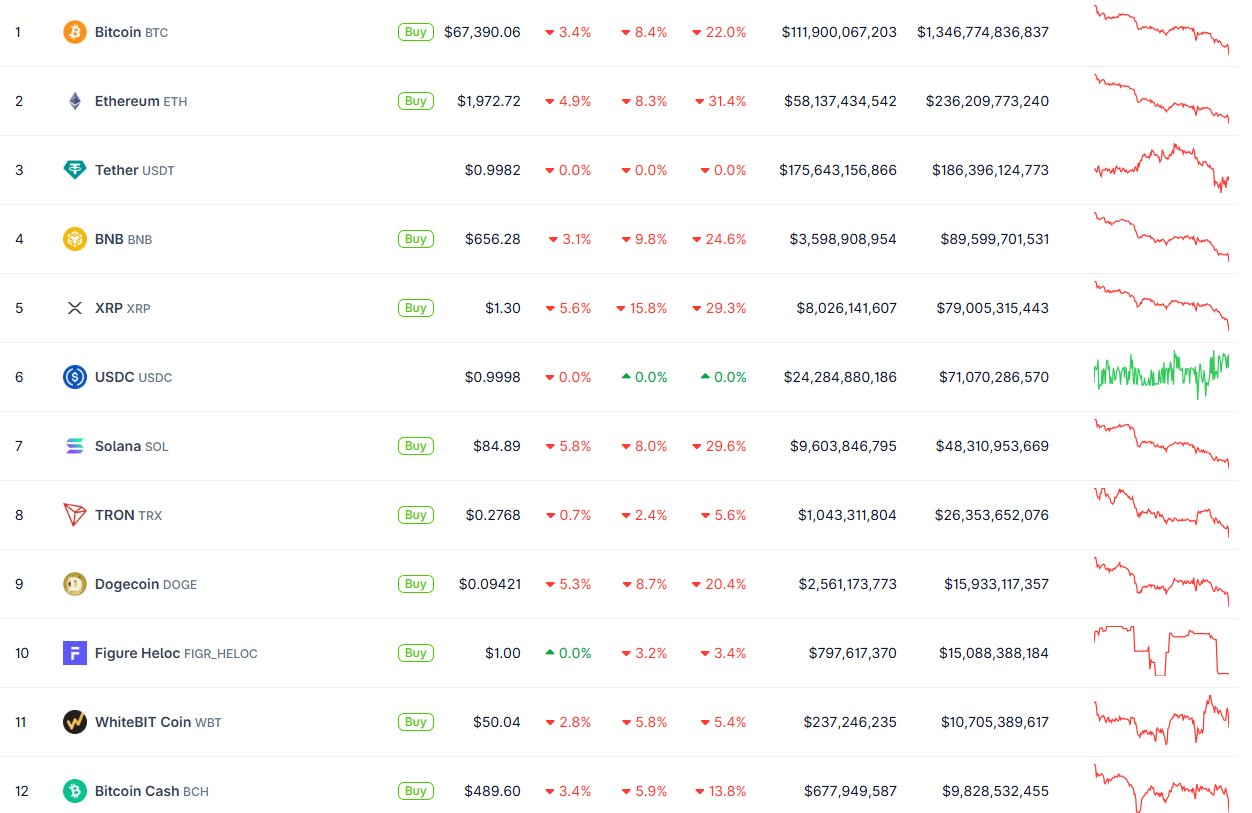

Crypto News of the Day: Bitcoin Slides Below $68,000 Amid Forced Deleveraging

Bitcoin fell below $70,000 on Thursday, before extending a leg down to levels below $68,000, an area last tested on October 28, 2024. The move came as intensified selling swept across crypto markets.

Sponsored

Sponsored

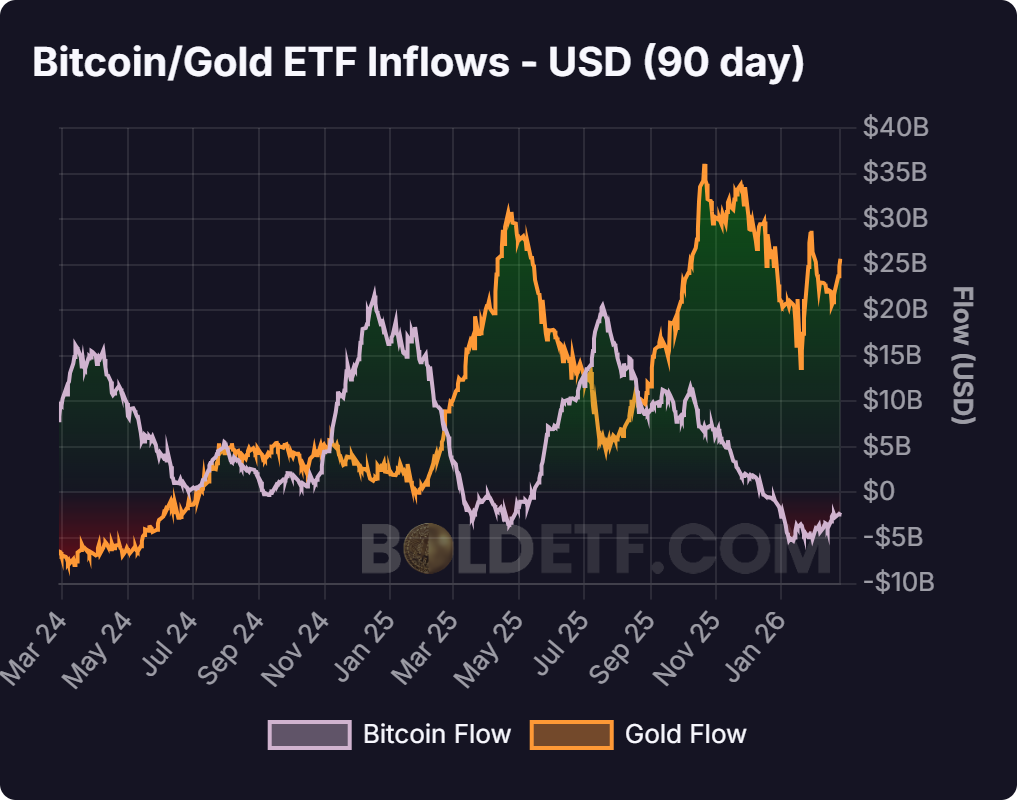

The decline marks roughly a 45% drop from October highs, fueled by ETF outflows, fading demand, and a “forced deleveraging” phase in futures markets.

“…with demand fading, ETF inflows drying up, and futures markets entering a “forced deleveraging” phase. Analysts say weak volumes and sustained selling are prompting investors to exit at a loss, despite technical indicators signaling oversold conditions,” wrote Walter Deaton.

Weak volumes and sustained selling pressure have prompted many investors to exit positions at a loss, even as technical indicators signal oversold conditions.

Despite the short-term turbulence, JPMorgan is increasingly bullish on Bitcoin’s long-term potential relative to gold.

The bank highlighted that BTC is now trading well below its estimated production cost of $87,000, a level historically considered a soft floor, and that its volatility relative to gold has dropped to record lows.

“…large outperformance of gold vs. Bitcoin since last October, coupled with the sharp rise in gold volatility, has left Bitcoin looking even more attractive compared to gold over the long term,” MarketWatch reported, citing JPMorgan’s quantitative strategist Nikolaos Panigirtzoglou.

According to the bank, this improved risk-adjusted profile suggests significant upside for investors willing to hold over a multi-year horizon.

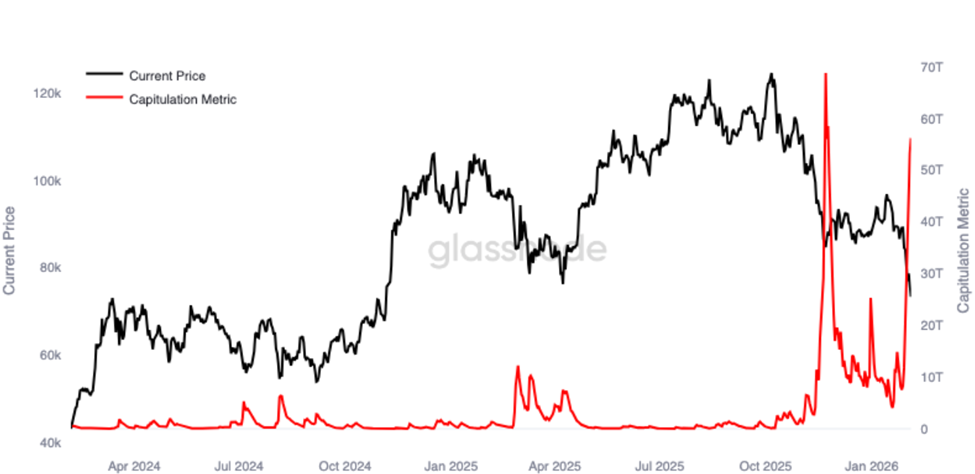

Market stress metrics highlight the fragility of the current environment. Glassnode data shows that Bitcoin’s capitulation metric has recorded its second-largest spike in two years. This reflects sharp forced selling and accelerated de-risking by market participants.

Sponsored

Sponsored

Meanwhile, it is worth noting that Bitcoin has erased all gains since Donald Trump won the election, wiping out a 78% post-election rally and highlighting ongoing volatility.

Crypto Stocks Tumble Amid Bitcoin Sell-Off and Rising Economic Uncertainty

Crypto equities mirror the broader weakness in Bitcoin. Shares of Coinbase, Riot, Marathon, and Strategy fell between 5% and 7% premarket after the drop below $70,000, with ETF holdings also down more than 5%.

The crypto downturn comes amid broader macroeconomic headwinds. US January layoffs surged 205% year-over-year to 108,435, the highest January total since 2009, according to Challenger, Gray & Christmas.

Job cuts were concentrated in transportation — led by UPS — and tech, with Amazon announcing 16,000 layoffs. Healthcare also saw notable reductions.

Sponsored

Sponsored

Meanwhile, federal job protections were overhauled, with the Trump administration finalizing reforms affecting 50,000 civil service workers. Continuing claims remain elevated at 1.84 million, highlighting ongoing economic uncertainty.

Equity markets are also witnessing a similarly complex backdrop, with the BMO Capital Markets projecting the S&P 500 could reach 7,380 by the end of 2026, implying an 8% expected return.

The firm favors cyclical sectors such as industrials, materials, energy, and financials, while underweighting defensive sectors. Inflation remains a principal risk, though global monetary and fiscal stimulus provide support.

With all these in mind, Bitcoin and broader financial market investors face a delicate balancing act:

- Technical oversold conditions and low relative volatility suggest a long-term opportunity

- Yet, immediate pressures from leveraged positions, ETF outflows, and macro uncertainty continue to weigh on sentiment.

JPMorgan’s analysis points to potential gains for patient holders, but the short-term outlook remains volatile, reflecting a market in the midst of recalibration.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 4 | Pre-Market Overview |

| Strategy (MSTR) | $129.09 | $120.78 (-6.58%) |

| Coinbase (COIN) | $168.62 | $159.42 (-5.46%) |

| Galaxy Digital Holdings (GLXY) | $20.16 | $19.10 (-5.26%) |

| MARA Holdings (MARA) | $8.28 | $7.81 (-5.68%) |

| Riot Platforms (RIOT) | $14.14 | $13.36 (-5.51%) |

| Core Scientific (CORZ) | $16.15 | $15.50 (-4.02%) |

Crypto World

PIPPIN Jumps 23% as AI and Meme Tokens Gain Momentum

The Solana-based AI memecoin is up 170% over the past month.

PIPPIN, an AI-driven memecoin on the Solana blockchain, surged 23% over the past 24 hours, outperforming large-cap cryptocurrencies as traders rotated into narrative-focused tokens.

The coin is currently hovering around $0.87, up 70% over the past week and 169% over the past month. It boasts a market capitalization of around $870 million, with daily trading volume above $70 million, according to CoinGecko.

The rally comes as AI-linked tokens have regained attention across crypto markets in recent days. The AI token sector’s market cap today is $13.8 billion, up 5.6% over 24 hours. The meme-coin market is also higher at $34.6 billion, up 4.7%, with PIPPIN leading the surge. Meanwhile, the global cryptocurrency market cap stands at $2.38 trillion, down 2.2% on the day.

PIPPIN’s move also reflects a broader trend of markets reacting to AI narratives, where even hypothetical scenarios have recently moved stocks and crypto. However, some experts say the rally has no clear driver.

“The PIPPIN AI-meme token has been going up since early December 2025. There isn’t too much known about why,” Nicolai Sondergaard, research analyst at Nansen, told The Defiant. “In addition, much of the supply is on exchanges (GATE), which further reduces the likelihood of understanding what is going on.”

Sondergaard explained that there also aren’t many smart money or public figures in it anymore, and that a majority of the top holders are labeled on-chain as “investment recipients.”

“This could insinuate somewhat centralized control,” Sondergaard added. “Alas, this cannot be proven or disproven at this point, even if accusations such as these have been flying around on CT.”

CoinGecko also cautioned traders to do their research before trading PIPPIN, as Bubblemap data found that 80% of its supply is controlled by interconnected insider wallets.

Crypto World

Google’s Gemini AI Predicts the Price of XRP, Dogecoin and Shiba Inu by the end of 2026

Google’s Gemini AI leverages its parent company’s vast data sets whenever forming conclusions.

It’s somewhat surprising, given months of red candles, that Gemini is pretty bullish XRP, Dogecoin, and Shiba Inu, and thinks all of them will hit towering new all-time highs (ATHs) over the next ten months.

But how realistic are Gemini’s projections?

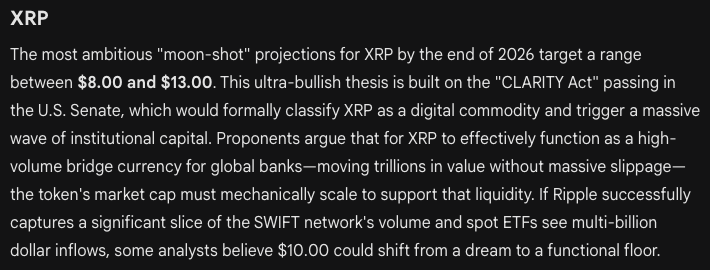

XRP ($XRP): Gemini AI Prophesies 9x Surge To $13 by Christmas

In a recent update, Ripple reiterated that XRP ($XRP) remains a core pillar of its long-term vision to establish the XRP Ledger as a global, enterprise-ready payments network.

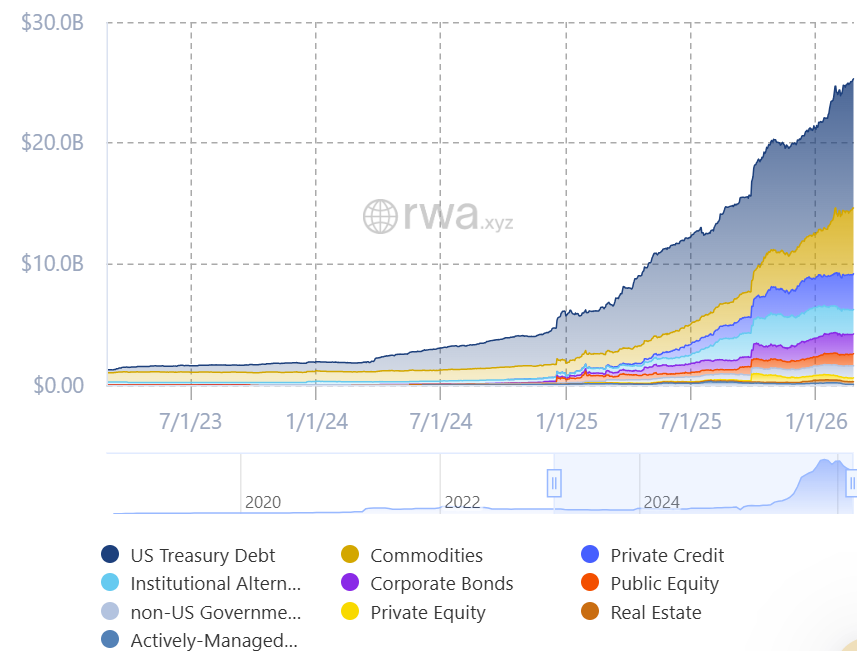

With fast settlement times and minimal transaction costs, the XRP Ledger is in a great position to capitalize on two rapidly expanding areas: stablecoins and tokenized real-world assets.

Currently trading around $1.44, Gemini’s long-term forecasting points to a 2026 high of $13, implying gains of 9x for current HODLers.

Technical indicators asupport this scenario. XRP’s Relative Strength Index (RSI) is a neutral 43 and the price has converged with the 30-day moving average, hinting that the prolonged and painful consolidation phase might be over.

Additional price drivers could include institutional demand following the rollout of U.S. listed XRP ETFs, Ripple’s growing network of global partnerships, and improved regulatory clarity if the U.S. passes the CLARITY bill this year.

Dogecoin (DOGE): Is the $1 Milestone Finally on the Horizon?

Launched in 2013 as a parody, Dogecoin ($DOGE) is now one of the most recognized digital assets, with a market capitalization of almost $15 billion, nearly half of the $35 billion meme coin sector.

DOGE last peaked at $0.7316 during the retail-fueled crypto rally of 2021.

For much of its history, the Dogecoin community has rallied around the goal of reaching $1. According to Gemini AI, under strong bullish conditions DOGE could comfortably overshoot that target this year, after clearing sticky resistance at $0.20 and $0.40.

With the token currently trading just below $0.10, a move toward $1.50 would net an explosive 15x for current holders.

Real-world adoption continues apace. Tesla accepts DOGE for select merchandise, while PayPal and Revolut now support Dogecoin transactions.

Shiba Inu (SHIB): Gemini AI Thinks a 1,500% SHIB Rally is Incoming

Shiba Inu ($SHIB), introduced in 2020 as a tongue-in-cheek rival to Dogecoin, has since grown into an ecosystem with a market capitalization of over $3.5 billion.

At its current price near $0.000006, Gemini’s analysis suggests that a decisive breakout above the $0.000025–$0.00003 resistance range could trigger strong upside momentum, potentially pushing SHIB toward $0.0001 before year-end.

That move would equate to gains of roughly 17x, placing it just above SHIB’s October 2021 ATH of $0.00008616.

The project offers much more than just meme coin speculation. Shiba Inu’s Ethereum Layer-2 network, Shibarium, delivers faster transaction speeds, reduced fees, enhanced privacy features, and a more robust environment for developers.

Maxi Doge: Early-Stage Meme Coin Targets Outsized Growth

While Gemini’s outlook suggests Dogecoin and Shiba Inu could still post significant gains, their already sizable market caps limits extreme upside in a bull run compared with smaller, newer, canine coins.

Maxi Doge ($MAXI) is coming for them. The project has raised $4.6 million in its ongoing presale as traders pile in to snap up the next biggest Doge-themed coin before the CLARITY Act passes.

Maxi Doge is a loud, degenerate, gym bro and alpha doge. He claims to be both a rival and an envious distant cousin to Dogecoin in a viral marketing campaign that embraces the fun and irreverent tone that defined the 2021 meme coin boom.

MAXI is issued as an ERC-20 token on the Ethereum proof-of-stake network, resulting in a smaller environmental footprint compared with Dogecoin’s proof-of-work model.

Early presale buyers can currently stake MAXI for returns of up to 67% APY, with yields gradually decreasing as the staking pool expands.

The token is $0.0002806 in the current presale stage, with automatic price increases scheduled at each funding milestone. Purchases are supported via wallets such as MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post Google’s Gemini AI Predicts the Price of XRP, Dogecoin and Shiba Inu by the end of 2026 appeared first on Cryptonews.

Crypto World

Bitcoin (BTC) price tumbles below $48,000 on Lighter as $67 million sell order triggers flash crash

While the broader crypto market was ripping higher on Wednesday, bitcoin briefly plunged 30% to below $48,000 on decentralized perpetuals exchange Lighter in a violent move that lasted seconds.

The flash crash stood in sharp contrast to price action elsewhere. During the same session, bitcoin surged from below $64,000 to above $69,000, marking one of its strongest intraday rallies in weeks.

The extreme move appeared to have been isolated to Lighter, where thin liquidity amplified what would otherwise have been a routine trade. In shallow order books, even modest sell pressure can trigger exaggerated price swings, producing so-called flash crashes that don’t reflect the broader market.

That’s likely what happened on Lighter. A single sell order of roughly 1,000 bitcoin — worth about $67 million at the time — wiped out available bids and briefly sent prices spiraling, according to a Discord post by pseudonymous Web3 developer 0xTimberJ.

“Because Lighter is a newer DEX with less liquidity than centralized exchanges, the sell order wiped out all available bids and pushed the price down to ~$47k before recovering instantly,” 0xTimberJ wrote.

Lighter is an up-and-coming decentralized perpetuals exchange seeking to challenge category leader Hyperliquid. Perpetual futures, or “perps,” have become crypto’s dominant derivatives product, allowing traders to use leverage and take long or short positions around the clock without contract expirations.

The platform briefly captured significant market share last November, processing over $292 billion in monthly volume — roughly a quarter of the $1.15 trillion traded across exchanges, according to data by The Block.

But activity has cooled sharply since its token airdrop late last year. Traders who ramped up activity to farm rewards have since rotated out, and monthly volume fell to $70 billion in February out of a $500 billion total market, trailing rivals such as Hyperliquid, Aster and EdgeX.

Crypto World

UK investors only have until April to add crypto ETNs to their ISAs: FT

U.K. investors will no longer be able to add crypto exchange-traded notes (ETNs) to their tax-free individual savings accounts (ISAs) after the start of the new tax year on April 6, the Financial Times (FT) reported on Wednesday.

The tax authority, His Majesty’s Revenue and Customs (HMRC), will reclassify cryptocurrency ETNs as qualifying instruments only for Innovative Finance ISAs (IFISAs), rather than the more mainstream stocks and shares ISAs.

ISAs allow users to put away up to 20,000 pounds ($27,000) a year without paying income tax or capital gains tax on the returns. The two main types are cash ISAs, bank account-like investments that pay interest, and stocks and shares ISAs, which invest in equities and exchange-traded instruments.

The Financial Conduct Authority’s decision to lift the ban on retail investors accessing crypto ETNs last October was seen as a major development in the adoption of cryptocurrency investments in the U.K., as it raised the possibility of the vehicles being added to everyday products like ISAs.

Limiting them to IFISAs means this opportunity will be snuffed out because no mainstream investment platforms offer them. IFISAs are a somewhat obscure investment wrapper, offered largely for purposes of peer-to-peer lending and crowdfunding. None of the 57 platforms currently authorized to offer IFISAs have plans to support crypto ETNs, according to the FT’s report, depriving investors of the tax shield that ISAs provide.

Investors who already have crypto ETN holdings in their ISAs will not be forced to sell them, however, as doing so “could risk some level of market disruption,” HMRC said.

The authority said the ruling was due to crypto ETNs’ “innovative nature and the fact that is an emerging market,” and it would keep the decision under review with a view to including them in stocks and shares ISAs at a later date.

The decision risks positioning the U.K. as an outlier among major financial markets, where exchange-traded products (ETPs) have opened the door to crypto investment for a much wider base of users because they remove some of the technical aspects such as needing to deal with crypto exchanges and wallets.

George Bauer, Fidelity’s head of investment and product for global platform solutions, said the government’s approach “challenges the intention of allowing regulated access to crypto assets,” the FT reported.

“We would encourage the government and HMRC to reconsider this and allow access through stocks-and-shares ISAs which are much more widely used.”

HMRC did not respond to CoinDesk’s request for comment.

Crypto World

Crypto social isn’t dead, it’s just changing hands

In a 48-hour period at the end of January, the two largest decentralized social protocols underwent major leadership changes. Farcaster shifted stewardship of its protocol, flagship client, and leading Base launchpad, Clanker, to its primary infrastructure provider, Neynar. Concurrently, Lens Protocol announced its transition from Avara (the team behind Aave) to Mask Network.

The suddenness of these transitions was enough to rekindle a familiar debate: Do these restructurings by the sector’s most established projects signal a failure for crypto social? For many critics, the answer was an immediate yes. They argued that crypto social never moved beyond the crypto bubble, failed to compete meaningfully with Web2 giants, and ultimately imploded under its own momentum. For them, the ownership changes confirmed that decentralized social media is a dead end—at best, a niche experiment. However, this view misinterprets a necessary market correction as a complete collapse.

Why the first save struggled

What these transitions actually reveal is a long-overdue acknowledgement of reality: building social networks is not primarily a question of ideology or infrastructure, but of product quality, distribution and incentives. The first wave of crypto social struggled not because decentralization is inherently flawed, but because it attempted to recreate legacy social platforms while layering crypto’s complexity on top of them. Farcaster and Lens were ambitious efforts to reimagine social media around user-owned identity, open graphs and composable data. Both attracted top-tier capital and world-class engineers. And yet neither managed to break meaningfully beyond a crypto-native audience.

A key misstep was assuming social graphs would scale like blockchains, that you could build a shared, open layer first, and value would naturally accrue. In practice, social graphs do not compound simply by existing. And this is not uniquely a crypto lesson. Decentralized social graphs have existed for years, with Mastodon and Nostr as the obvious examples, yet neither has achieved sustained mainstream adoption. The pattern is consistent: users do not migrate for ideological reasons, and portability does not overcome the cold start. Without a flagship experience that feels materially better today, with better content, better loops, better status and better tools, decentralization remains an implementation detail that appeals to a committed minority, not a mass-market hook.

In addition, both ecosystems leaned too early into platform-building and developer ecosystems, overestimating their ability to solve the cold-start problem for builders. With user counts in the low tens of thousands, the economic pie was simply too small for third-party applications to thrive. Builders were asked to take on distribution risk before meaningful distribution existed, while competing, implicitly or explicitly, with flagship clients that controlled the primary surface area.

Social networks live and die by network effects, and crypto introduces additional friction at every layer: wallets, security assumptions, moderation trade-offs and identity management. Convincing users to abandon platforms where their social graphs already exist is difficult under any circumstances. Asking them to do so while navigating unfamiliar tooling raises the bar even higher.

From Social Media to Social Financial Networks

Rather than chasing a decentralized Twitter analogue, the narrative is shifting toward what might be better described as social financial networks. In these systems, the primary function is not broadcasting opinions or accumulating followers, but coordinating information, capital and collective belief. Success is measured less by engagement metrics and more by the quality of signal and the flow of value.

Seen through this lens, crypto may already have found its most compelling native social platform, just not in the form many expected. Prediction markets such as Polymarket function as social coordination engines. They aggregate opinion, surface collective intelligence and transform discourse into probabilistic outcomes. Crucially, this model is not a copy of Web2 social media. It does not rely on advertising, algorithmic outrage or attention extraction. And it has demonstrated relevance beyond a purely crypto-native audience.

But social financial networks are only the first wave of what crypto can unlock. Blockchains make certain end-user experiences possible in a way Web2 rails simply do not, and speculation is just the most legible early expression of that. Polymarket turns conversation into accountable belief. Products like FOMO show how trading itself can become social, with transparency, shared context, and real-time feedback loops baked into the graph.

The bigger opportunity goes well beyond a social + markets equation. It is social systems where ownership, identity and monetization are native rather than bolted on. Digital ownership can turn content and status into durable assets. Programmable incentives can align creators, curators, and communities around long-term behavior rather than short-term extraction. Onchain coordination can unlock new group behaviors, from collective funding to shared membership, shared governance and shared upside. The point is not that crypto makes social cheaper or more open, but rather it expands the design space for what social networks can be.

A reset, not an obituary

Declaring crypto social “dead” misses the point. What has ended is a particular vision of Web3 social, one that assumed legacy social media could be recreated on crypto rails with better incentives and better values.

What remains is a harder, more grounded challenge: identifying where crypto enables forms of social coordination that were previously impossible. Capital formation, information markets, community-owned infrastructure and new mechanisms for aligning incentives all remain open design spaces. Crypto social is not disappearing. It is shedding its earliest assumptions.

One reason the “dead” narrative feels premature is that we may have been looking for the next crypto social breakout in the wrong place. Moltbook is a deliberately weird experiment: a social network designed primarily for AI agents, with humans as observers. In a matter of days, tens of thousands of agents reportedly spun up emergent behaviors that look uncannily social, creating religions, organizing governance, publishing manifestos and even experimenting with privacy and encryption.

The surprising part is that watching it has been engaging for humans, precisely because it feels like observing a new social class forming in real time, negotiating norms, status and even revenue strategies, sometimes explicitly trying to evade human legibility. It is too early to know whether this is a durable phenomenon or a passing narrative, but it is a bold reminder that new forms of social can emerge when the participants, incentives and constraints change. If AI agents increasingly need to transact and coordinate across the digital world, blockchains are a natural substrate for them to do so.

For now, it turns out, the crypto social obituary was written for the wrong thing.

Long live crypto social!

Legal Disclaimer: This article is for general information purposes only and should not be construed as or relied upon in any manner as investment, financial, legal, regulatory, tax, accounting, or similar advice. Under no circumstances should any material at the site be used or be construed as an offer soliciting the purchase or sale of any security, future, or other financial product or instrument. Views expressed in the article are those of the individual 1kx personnel quoted therein and are not the views of 1kx and are subject to change. The article is not directed to any investors or potential investors, and does not constitute an offer to sell or a solicitation of an offer to buy any securities, and may not be used or relied upon in evaluating the merits of any investment. All information contained herein should be independently verified and confirmed. 1kx does not accept any liability for any loss or damage whatsoever caused in reliance upon such information. Certain information has been obtained from third-party sources. While taken from sources believed to be reliable, 1kx has not independently verified such information and makes no representations about the enduring accuracy or completeness of any information provided or its appropriateness for a given situation. 1kx may hold positions in certain projects or assets discussed in this article.

The views and opinions expressed in this article are solely the authors’ own and do not reflect the views of their employer, 21Shares, or any affiliated organizations.

Crypto World

Ethereum Data Backs the ETH Price Recovery

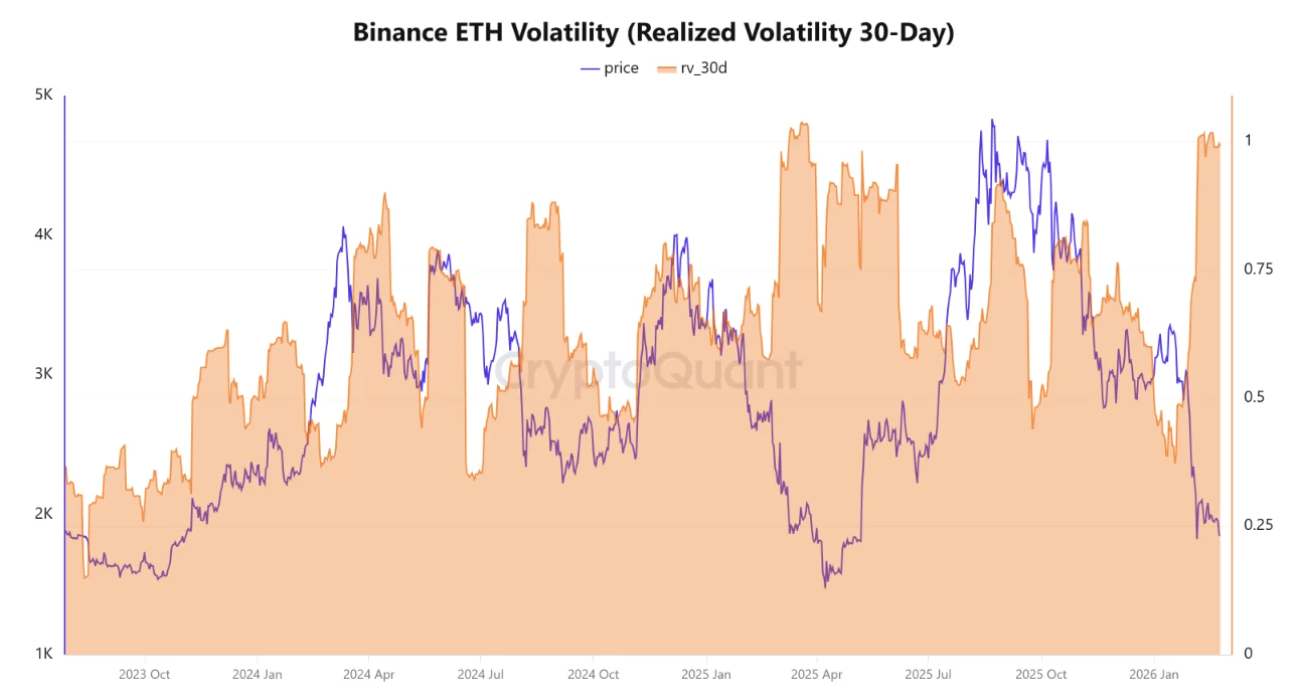

Ether (ETH) price is up 18% since plunging below the $1,800 mark on Feb. 6, reclaiming the $2,000 support level. Surging price volatility and a low MVRV Z-score value are also signaling a local bottom forming.

Key takeaways:

-

Ether realized volatility on Binance has risen to its highest level since March 2025, hinting at a potential recovery.

-

Ether’s MVRV Z-Score has dropped into the accumulation zone, suggesting that ETH has bottomed.

-

Ether’s multiyear trend line around $1,800-$1,900 holds as support.

Ether’s volatility hits 12-month highs

Ether’s volatility has seen a sudden spike, suggesting that the market is entering a period of intense activity and strong repricing, according to data from CryptoQuant.

Volatility is a metric used to determine how much and how quickly Ether’s price fluctuates over a given period.

Related: ETH options turn bearish as traders prepare for extended Ether price downside

The chart below shows that the realized volatility (30-day) indicator on Binance rose sharply to 0.97 on Thursday from 0.37 in mid-January.

A spike in realized volatility to such high levels indicates that the “market has emerged from a period of relative calm and entered a highly volatile environment,” CryptoQuant analyst Arab Chain said in a Quicktake analysis, adding:

“Past experience has shown that such readings have often preceded a significant upward move in Ethereum’s price.”

The last time the volatility was this high was late March to early April 2025 as ETH price formed a bottom range of $1,500 to $1,700.

After that, the ETH/USD pair rallied 77% to $2,700 in less than 30 days. A similar spike in Q4/2024 preceded a 74% rally in Ether’s price.

If history repeats itself, this spike in volatility could mark the end of the downtrend, setting up ETH for a multimonth rally once volatility normalizes and conviction builds.

MVRV Z-Score suggests Ether bottomed below $1,800

Ether’s MVRV Z-Score, one of the most popular onchain metrics used to identify market tops and bottoms, has dropped into the historical accumulation zone (the green line in the chart below), strengthening the argument that ETH may have found its bottom.

The last time Ether’s MVRV Z-Score dipped to the current level around -0.31 was in April 2025, after a 66% price drawdown. This coincided with a price bottom at $1,400 and preceded a multi-month rally, with ETH price rising 258% to its $4,950 all-time high.

This indicates that, from an onchain perspective, Ether is oversold and may continue the ongoing recovery, potentially rising toward liquidity clusters between $2,200 and $2,500 in the short term.

Ether’s 2020 fractal projects an “explosive climb” for ETH price

Ether’s current technical structure closely mirrors the setup that sparked its 2020-2021 price rally.

The monthly chart below suggests that the price is currently holding a multi-year trend line, much like the one that supported the price from December 2018 to April 2020.

“Every time price holds above this ascending support trend line, it launches into a parabolic rally,” as seen in 2020, analyst Trader Tardigrade said in an X post on Thursday, adding:

”Now $ETH is testing the trendline again. If it holds here, history says we’re gearing up for another explosive climb.”

This trend line lies within the $1,900 to $1,800 support zone, where investors recently acquired 2.9 million ETH, Glassnode’s cost basis distribution heatmap shows.

As Cointelegraph reported, ETH could continue its recovery to retest the 50-day simple moving average (SMA) at $2,540 if bulls manage to push the price above $2,100.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

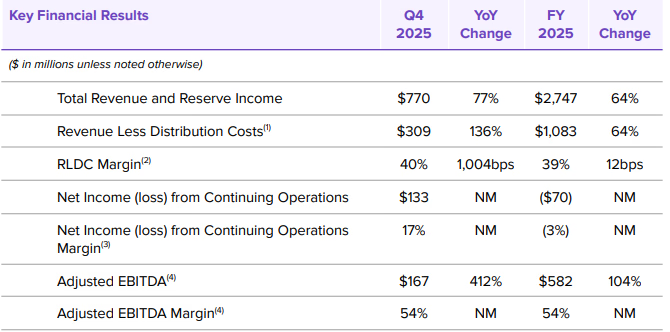

Circle Stock Jumps 40% on Q4 Earnings

The stablecoin company had a strong 2025 and is exploring a token launch for Arc, its new Layer 1 blockchain.

Circle’s stock, CRCL, is up 40% over the last two trading days after the company unveiled its Q4 2025 report, showcasing a 64% increase in revenue and 104% growth in earnings year over year (YoY).

The report sent CRCL rallying from $61 per share to $86.25, as the company also shared an 82% increase in total USDC minted and a 59% increase in what it calls “meaningful wallets,” defined as any onchain wallet holding more than 10 USDC.

The stock appears to be pricing in future growth, as the company still posted a net loss of $70 million in 2025, “significantly impacted by $424 million for stock-based compensation.”

The company also touched on its upcoming Layer 1 stablechain, Arc, which launched its testnet in October.

In addition to Arc’s impending mainnet launch, Circle CEO Jeremy Allaire also revealed that Circle is exploring a native token for the Arc blockchain, but did not reveal any further details.

While the earnings report and subsequent rebound offer some relief for shareholders, CRCL is still down 71% from its all-time high of $300, reached shortly after its initial public offering (IPO).

Crypto World

Bitcoin Adoption Booms While Bear Market Deepens: Watch These Signals

Since dropping by 35% from Jan. 14 to Feb. 5, Bitcoin (BTC) has consolidated in a range from $60,000 to $70,000 over the past 22 days. At the same time, several BTC adoption-linked metrics are moving in different directions across exchange-traded funds (ETFs), whales, miners and corporate Bitcoin treasuries.

These divergences highlight steady capital commitment beneath muted price action and how each signal fits into the bigger picture.

Bitcoin ETF flows remain negative

The 90-day rolling average of US spot Bitcoin ETF net flows has dropped to -$2.18 billion. Over the past two years, the metric has turned negative only twice: from March to May 2025, and in the current stretch that began on December 11, 2025. In both instances, Bitcoin followed with a corrective phase.

When the rolling average turns negative, it means more money is leaving ETFs than coming in over a longer period. That reduces buying pressure, weakens overall demand, and can make it harder for prices to move higher.

A move back above zero, followed by steady inflows, may mark the return of institutional participation. Sustained positive readings tend to align with stronger price action from BTC, alongside improving liquidity conditions.

BTC whale accumulation versus dominant trend

CryptoQuant data tracks the one-year change in total whale holdings and its 365-day moving average. Addresses holding 1,000 to 10,000 BTC added more than 200,000 BTC from June to November 2023, while the price ranged from $25,000 to $30,000.

When the raw one-year change crosses above its 365-day average, whales are accumulating faster than their longer-term trend. That crossover in 2023 coincided with supply absorption during sideways trade, which eventually led to BTC’s bullish rally.

Thus, a bullish trend may unfold for BTC once the one-year change sustainably moves above its moving average (365-SMA), signaling renewed large-scale absorption.

Hash rate and infrastructure signal

Bitcoin’s 30-day mean hash rate stands near 0.99 ZH/s after peaking at 1.10 ZH/s in November 2025. Both hash rate and price have moved lower in recent weeks.

Hash rate measures the computational power securing the network and reflects miner investment in hardware and energy capacity. Rising hash rate during price consolidation points to infrastructure expansion independent of short-term price gains.

If the hash rate trends higher while the price trades sideways, it points to a stronger long-term commitment from miners. A sustained divergence, where hash rate rises ahead of price, can signal growing confidence within the mining sector.

Likewise, miner economics must also improve. Stabilizing the hash price and lower miner sell pressure confirms that rising computational power is backed by healthier revenue conditions rather than tightening margins.

Related: Analysts reject Jane Street ‘10 a.m. dump’ claims, say Bitcoin isn’t easily manipulated

Corporate BTC treasury concentration cools

A recent report from bitcointreasuries.net noted that treasuries added about 43,200 BTC in January, with Strategy accounting for about 40,150 BTC.

Zooming out, the chart shows that corporate accumulation by Strategy has slowed significantly since late 2024. Monthly additions peaked near 148,000 BTC in November 2024 and 87,000 BTC in July 2025.

Recent monthly figures are materially lower, and the last 30-day increase represents only a marginal change relative to the 1.13 million BTC now held by public companies.

The latest monthly net increase equates to roughly 0.1% growth relative to total public company holdings. That pace signals stability rather than acceleration in treasury expansion.

For BTC price, broader and accelerating treasury inflows help absorb available supply more effectively. Slower increases, by contrast, signal companies are largely maintaining positions rather than driving new demand.

Related: Bitcoin bear market not ‘over already’ as price rejects at $68K trend line

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Circle Stock Jumps 50% as Short Squeeze Fuels Rally

TLDR

- Circle shares surged nearly 50% within two sessions after the company reported fourth quarter earnings.

- Analysts said a short squeeze drove the rally rather than a change in the company’s fundamentals.

- Hedge funds had built large bearish positions before the earnings release, which led to rapid short covering.

- USDC circulation rose 72% year over year to $75.3 billion during the quarter.

- Circle reported a net loss of $70 million for 2024 compared with a net profit in the prior year.

Circle shares surged nearly 50% within two sessions after the company released fourth quarter earnings on Wednesday. The rally followed an 80% decline from record highs reached last year and reversed recent losses. Analysts said short covering, rather than improved fundamentals, powered most of the advance.

Circle Earnings Trigger Short Squeeze

Circle reported strong growth in USDC circulation during the fourth quarter. The company said USDC supply reached $75.3 billion, up 72% year over year. However, analysts linked the sharp share price jump to hedge fund positioning.

Markus Thielen, founder of 10x Research, said positioning drove the move. He stated, “The magnitude of the move was not driven purely by the headline numbers.” He added, “The real catalyst was positioning,” and described the rally as a “high-probability short squeeze rather than a fundamental re-rating.” He estimated hedge funds lost about $500 million in one day on short positions.

Hedge funds had built large bearish bets before the earnings release. As the stock climbed, short sellers rushed to cover positions. Consequently, buying pressure accelerated and pushed shares sharply higher.

The surge broke a prolonged downtrend that had erased most of last year’s gains. Shares had fallen about 80% from prior record levels before the earnings report. The rapid rebound followed heavy trading volumes across sessions.

USDC Growth Contrasts with Profitability Decline

Circle’s flagship stablecoin, USDC, expanded in circulation during the quarter. The company reported $75.3 billion in USDC supply, which outpaced Tether’s USDT growth rate. Harvey Li, founder of Tokenization Insight, highlighted the supply increase in a research note.

Revenue from reserve income rose 58% to $2.64 billion. Circle earns reserve income mainly from U.S. government debt backing USDC. However, distribution costs climbed 66% to $1.66 billion during the same period.

Despite higher circulation, Circle posted a net loss of $70 million for 2024. The company had reported a $156 million net profit in 2023. Li said, “Stablecoin may be scaling; stablecoin issuance is a tough business.”

Japanese investment bank Mizuho raised its price target on Circle to $90 from $77. The bank cited stronger fourth-quarter results and growth linked to prediction markets. However, it kept a neutral rating and warned that lower rates could pressure reserve income.

Analysts Dan Dolev and Alexander Jenkins said revenue and profit exceeded expectations. Management pointed to prediction and betting platforms, including Polymarket, as drivers of USDC growth. Executives also described USDC as a potential default currency for AI agents in digital marketplaces.

Mizuho projected an average USDC circulation of about 123 million in 2027. The bank modeled reserve income near $3.7 billion and EBITDA of $916 million for that year. It applied a 24x EBITDA multiple and set a $90 price target.

Crypto World

Bloomberg, Kaiko Bring Licensed Data to Tokenized Markets

Bloomberg is collaborating with Kaiko, a Paris-based digital asset market data provider, to make Bloomberg’s licensed financial data accessible directly within blockchain environments rather than through traditional offchain databases.

The companies said Thursday that the initiative is designed to address the challenge of inconsistent data across tokenized markets.

In many tokenized asset ecosystems, companies may rely on different versions of pricing data, security identifiers or reference information, increasing the risk of discrepancies and operational inefficiencies.

By enabling a common, licensed data source to be embedded onchain, the collaboration aims to ensure that market participants reference the same dataset, potentially reducing reconciliation disputes and improving data integrity.

The first use case focuses on tokenized US Treasurys and repo markets operating on the Canton Network, a permissioned blockchain network designed for institutional financial applications. Kaiko launched that data on-ramp service in August.

The integration targets banks, asset managers and other regulated financial institutions experimenting with blockchain-based versions of traditional financial instruments, rather than retail crypto traders.

Questions around data reliability and market size in tokenized real-world assets (RWAs) have surfaced before.

In May, Cointelegraph interviewed Chris Yin, co-founder of RWA platform Plume, who said that the tokenized asset market may be significantly smaller than figures cited by some industry aggregators. At the time, Yin said the sector’s actual size was likely closer to half of what major data sources were reporting.

Related: Hong Kong to link new digital bond platform with regional tokenization hubs

Why data integrity matters for tokenized markets

Kaiko CEO Ambre Soubiran said institutional-grade data is essential for well-functioning financial markets, stating that the collaboration with Bloomberg “will extend the availability of market data used in traditional markets to now support the next generation of tokenized securities infrastructure.”

Kaiko expanded its footprint in the digital asset data sector with its 2024 acquisition of European crypto index provider Vinter, strengthening its presence in regulated benchmark and index services across Europe.

Reliable data has long been a priority in the digital asset industry, where market participants have relied not only on price feeds but also on onchain analytics and sentiment indicators to improve transparency.

In tokenized markets, particularly those linked to real-world assets like Treasurys, consistent pricing data and reference information help ensure that onchain assets accurately mirror the underlying financial instruments.

Related: Aster’s quiet relisting on DefiLlama leaves ‘big gaps’ in data: Exec

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports3 days ago

Sports3 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics3 days ago

Politics3 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business2 days ago

Business2 days agoTrue Citrus debuts functional drink mix collection

-

Politics2 hours ago

Politics2 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business4 days ago

Business4 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech2 days ago

Tech2 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat1 day ago

NewsBeat1 day agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat1 day ago

NewsBeat1 day agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech4 days ago

Tech4 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat4 days ago

NewsBeat4 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics4 days ago

Politics4 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat2 days ago

NewsBeat2 days agoPolice latest as search for missing woman enters day nine

-

Business22 hours ago

Business22 hours agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business6 hours ago

Business6 hours agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Crypto World2 days ago

Crypto World2 days agoEntering new markets without increasing payment costs