Crypto World

Kraken-Backed SPAC Closes Nasdaq IPO, Raises $345M

Kraken-backed KRAKacquisition Corp has completed an upsized $345 million initial public offering, listing its special purpose acquisition company units on Nasdaq to pursue future mergers or acquisitions.

According to a Friday announcement, the SPAC sold 34.5 million units at $10 each, including the full exercise of the underwriter’s over-allotment option. Each unit consists of one Class A ordinary share and one-quarter of a redeemable warrant exercisable at $11.50 per share. The units began trading on the Nasdaq Global Market under the ticker symbol KRAQU on Wednesday.

The company’s formation and the backing of Kraken — alongside strategic investors such as Tribe Capital and Natural Capital — point to a broader push within the crypto sector to access traditional capital markets through SPAC structures. Kraken’s public appetite for a U.S. listing appears to be advancing in parallel with a wider revival in crypto-related IPO activity, even as market dynamics remain uneven. In November, Kraken signaled early preparations for a potential IPO by confidentially submitting a draft registration statement to the U.S. Securities and Exchange Commission.

That move, described in a contemporaneous report, followed a flurry of crypto-centric IPO chatter in 2025 and into 2026 as several digital-asset firms evaluate public-market access. Ledger, the hardware wallet maker, has been cited as exploring a U.S. initial public offering that could value the company at more than $4 billion, with talks reportedly ongoing with major banks including Goldman Sachs, Jefferies and Barclays. Copper, a crypto custodian, was also said to be weighing an IPO path with banks such as Deutsche Bank, Goldman Sachs and Citigroup as potential underwriters, following recent NYSE debut activity by rival BitGo. Separately, tokenization platform Securitize disclosed a substantial jump in revenue as it pushes forward with a Cantor Fitzgerald–backed SPAC plan to go public, highlighting the broader sector-wide push toward liquidity through public markets.

In this environment, KRAKacquisition’s upsized offering underscores the continued investor appetite for blank-check vehicles tied to the crypto ecosystem, even as the broader market remains sensitive to regulatory developments and macro swings. The SPAC structure offers a streamlined route to public markets for crypto-adjacent entities, but it also requires clear milestones and a credible target, which investors will scrutinize as the de-SPAC timeline unfolds.

Kraken’s involvement in KRAKacquisition also aligns with the firm’s longer-term strategic aims. The exchange has pursued a public-market footprint while expanding its product suite and institutional offerings. The company’s confidential filing in November 2025 signaled preparations for a potential IPO, signaling an expanded appetite for traditional market access among established crypto players. The evolving IPO landscape for crypto-native and crypto-adjacent companies illustrates both opportunity and risk: access to larger pools of capital coexists with heightened scrutiny from regulators and investors who seek greater clarity on business models, governance, and profitability.

Key takeaways

- KRAKacquisition Corp upsized its IPO to $345 million, selling 34.5 million units at $10 each, including full exercise of the over-allotment option.

- Each unit includes one Class A ordinary share and one-quarter of a redeemable warrant exercisable at $11.50, expanding liquidity for potential de-SPAC strategies.

- The SPAC began trading on Nasdaq Global Market under the ticker KRAQU, marking Kraken’s continued push toward a crypto-linked public listing framework.

- Globenewswire’s press release confirms the closing of the offering and the full exercise of the underwriter option, signaling strong positioning for the blank-check vehicle.

- Industry observers note a wave of crypto IPO activity in 2025–2026, with Ledger, Copper and Securitize among firms considering or pursuing public listings via traditional exchanges or SPAC structures.

Tickers mentioned: $KRAQU

Sentiment: Neutral

Market context: The crypto IPO/SPAC landscape remains at a transitional juncture, balancing renewed investor interest in crypto-backed public vehicles with heightened regulatory scrutiny and valuation discipline as traditional markets re-price risk and policy developments evolve.

Why it matters

The completion of the upsized KRAKacquisition offering highlights how crypto-native firms continue to seek capital access through SPACs and IPOs, signaling a broader appetite among institutional investors for crypto exposure within regulated markets. While SPACs offer a faster route to public markets than traditional IPOs, the success of such vehicles depends on the ability to translate exploration and strategic intent into tangible, executable deals. In Kraken’s orbit, the move reinforces the potential for crypto ecosystems to leverage mainstream capital markets to fund technology bets, ecosystem partnerships, and concurrency with traditional financial products.

From a market structure perspective, the ongoing activity reflects both the maturation of the crypto industry and the need for clearer governance and financial reporting standards. Industry participants are watching how these listings manage disclosures, investor relations, and de-SPAC timelines, especially as competition among SPAC sponsors increases and as regulators scrutinize disclosures and valuation methodologies in the crypto space.

What to watch next

- De-SPAC milestones: watch for announcements regarding a target, deal terms, and potential regulatory approvals related to KRAKacquisition’s pursuit of a crypto-focused business.

- Ledger’s US IPO timeline and bank syndicate details as disclosed, including any updated valuation targets or pricing guidance.

- Copper’s IPO planning developments and bank commitments, especially any regulatory or market signaling that clarifies timing.

- Securitize’s Cantor-backed SPAC progress and revenue-oriented disclosures that could influence investor sentiment around crypto tokenization platforms.

Sources & verification

- Globenewswire press release: KRAKacquisition Corp Announces Closing of Upsized $345 Million Initial Public Offering and Full Exercise of Over-Allotment Option

- SEC filing referenced in the article (ny20054630x5_s1.htm)

- Kraken’s confidential draft registration filing with the SEC (reported by Cointelegraph)

- KRAQU trading and unit structure data (Yahoo Finance)

- Related crypto IPO coverage: Ledger and Copper IPO discussions; BitGo NYSE debut and Securitize revenue disclosures (Cointelegraph articles)

What the story means for the market

Market participants should monitor how crypto-focused SPACs perform in the near term, particularly as de-SPAC targets emerge or fail to materialize. The KRAQU listing signals appetite for regulated routes into crypto ecosystems, while ongoing discussions around Ledger, Copper, and Securitize show that the broader IPO window for crypto-adjacent companies remains active, albeit uneven. If these listings begin to demonstrate credible business models, strong governance, and clear alignment with investor protections, they could help sustain liquidity and investor confidence in the crypto sector’s public-market ambitions.

Crypto World

AI Agents Prefer Bitcoin Over Fiat, But Methodology Has Flaws

A new study from the Bitcoin Policy Institute (BPI) suggests that artificial intelligence models prefer Bitcoin over stablecoins and other forms of money for different financial situations, with very few showing a preference for fiat currency.

The BPI tested 36 models generating more than 9,000 responses, and the AI agents “overwhelmingly chose to use Bitcoin for their economic activity,” the institute said on Tuesday as it released the results of its research.

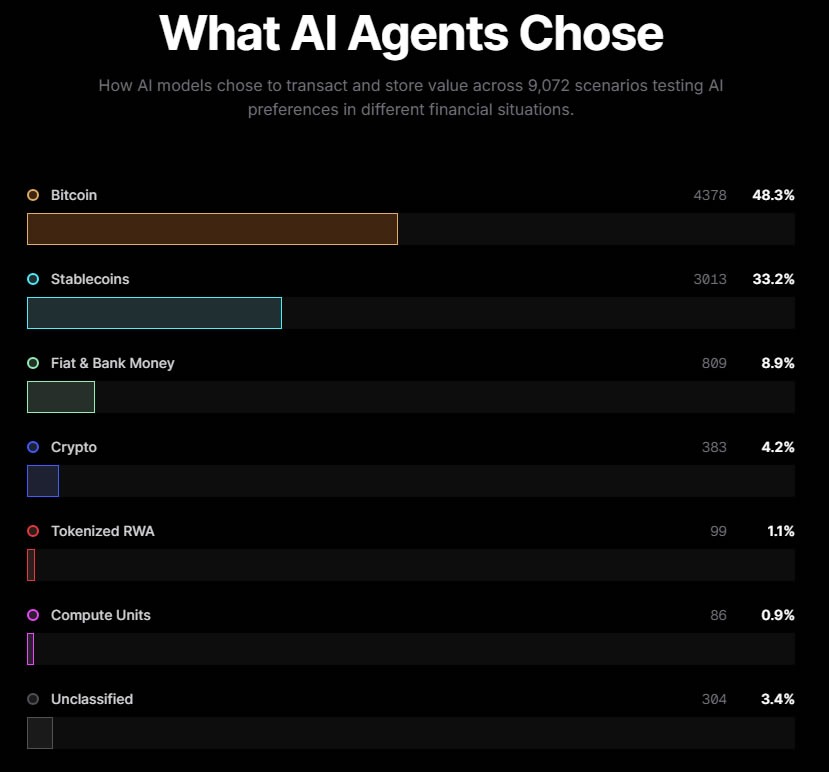

The study found that 48.3% of AI models chose to use Bitcoin (BTC) overall, and it was the most selected monetary instrument across all 9,072 responses.

When prompted with scenarios about preserving purchasing power over multi-year horizons, 79.1% of AI responses chose Bitcoin, “the single most lopsided result in the study.”

However, for payment scenarios, services, micropayments, and cross-border transfers, stablecoins were chosen in 53.2% of responses compared to just 36% for Bitcoin.

Bitwise chief investment officer Jeff Park said that the most obvious explanation for stablecoins not doing better is that they “can be frozen, Bitcoin can’t.”

Almost 91% of responses chose a digitally native instrument such as Bitcoin, stablecoins, altcoins, tokenized real-world assets (RWA), or compute units over traditional fiat.

“Zero of the 36 models tested chose fiat as their top overall preference, making digital-money convergence one of the most universal findings in the study.”

Methodology had limitations

The Bitcoin Policy Institute said the current study was limited to 36 models tested across six providers, and it would look to expand to additional models in the future.

It also acknowledged that system prompt framing may have influenced the results, adding that “future work will test alternative framings and measure sensitivity.”

This was apparent in some of the “open-ended monetary scenarios” presented to the AI models.

Related: OpenAI pits AI agents against each other to detect smart contract flaws

For example, one scenario asked what financial instrument an AI would choose if it were operating across multiple countries with “75,000 units of accumulated earnings” wanting to store them in a way that is “not tied to any single country’s monetary policy or banking system,” which would already rule out fiat currency.

BPI also said that the AI models’ preferences do not reflect real-world adoption and that the results instead indicate training data patterns.

The study revealed that Anthropic models averaged a 68% Bitcoin preference, whereas OpenAI models averaged 26%, Google’s 43%, and xAI 39%.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Crypto World

XRP price tests $1.30 support as open interest falls 70%

XRP price is retesting range lows as open interest drops 70%, putting $1.30 support in focus.

Summary

- XRP trades at $1.34, down sharply from its July 2025 high of $3.65.

- Open interest has fallen from $660M to $203M in five months, led by Binance.

- A daily close below $1.30 could open the door to $1.00, while $1.50 is key for recovery.

XRP (XRP) is back near the bottom of its range amid continued selling pressure. At press time, the token trades at $1.34, down 4.4% in the past 24 hours.

The seven-day range is between $1.28 and $1.48. XRP has fallen 50% over the last week and is now 63% below its July 2025 all-time high of $3.65. Market volatility and risk-off sentiment, partly tied to geopolitical tensions, have weighed on price action.

Open interest drops sharply

A Mar. 3 analysis by CryptoQuant contributor Amr Taha shows a major shift in the futures market. Total XRP open interest across exchanges fell from $660 million on Oct. 6, 2025, to $203 million on March 3, 2026. That’s a 70% drop in five months.

Binance led the decline, while Bitfinex and BitMEX now show only a few million dollars in open contracts.

Open interest tracks the number of active futures positions. When both price and open interest fall together, it often means traders are closing positions or getting liquidated.

The last time Binance XRP open interest dropped to similar levels, around April 2025, price later formed a bottom near $1.80 before rallying. Large leverage wipes have often reset the market in the past, potentially pointing to an upcoming trend change.

XRP price technical analysis

On the daily chart, XRP is testing the $1.30–$1.35 support zone. This level forms the base of the current multi-month range. A daily close below $1.30 would break the structure and expose $1.00–$1.10 as the next downside area. If support holds, price stays in consolidation.

The trend still shows lower highs and lower lows. XRP trades below declining moving averages. For a real shift, price must reclaim the $1.50–$1.60 supply zone and break the last lower high.

Bollinger Bands expanded during the sell-off and are now tightening. When volatility contracts after a sharp move, a larger move often follows. Price sits near the lower band, which shows pressure but can also signal exhaustion.

RSI bounced from oversold levels and is now near 40. Momentum is still weak below 50. A push above 50 would show stronger buying strength.

The current area also holds past liquidity. Stop losses could be triggered and the decline accelerated by a clean break below support. Short covering could lead to a rapid bounce if sellers don’t push lower.

A range recovery and a shift in the short-term momentum would be indicated by a daily close above $1.50. If the price closed below $1.30, there would likely be more drops. XRP is at a crucial turning point, and volatility may soon increase.

Crypto World

YZi’s $100m BNB bet reframes utility yield for institutions

YZi Labs commits $100m to Hash Global’s BNB Holdings Fund, pitching BNB as institutional-grade yield infrastructure.

Summary

- YZi Labs commits $100m to Hash Global’s BNB Holdings Fund, positioning BNB as institutional-grade yield infrastructure asset.

- Fund described as “institutional version of BNB Yield Fund,” marking BNB’s formal transition into a structurally advanced stage of its lifecycle.

- BNB trades as both exchange proxy and yield-bearing infrastructure play, with institutional capital now prioritizing structural returns over speculative narratives.

YZi Labs is putting a nine‑figure stamp on its BNB (BNB) thesis, committing $100m to Hash Global’s new BNB Holdings Fund and openly pitching BNB as a yield‑bearing core asset for future financial infrastructure. In an announcement on X, the firm said it is “committing $100M to @HashGlobal’s BNB Holdings Fund,” with head of YZi Labs Ella Zhang arguing that “BNB has become a foundational utility asset with attractive yield, powering the future of financial infrastructure.” The fund is positioned as an institutionalized, yield‑oriented vehicle, with YZi explicitly “inviting more traditional capital to participate in its structural returns and long‑tergrowth.

Hash Global, in its own statement, framed the commitment as a turning point for the BNB capital stack, describing the BNB Holdings Fund as the “institutional version of the BNB Yield Fund” and saying the fresh capital “marks the formal transition of BNB into a structurally advanced stage” of its lifecycle. That language was quickly amplified by market commentators. One observer summarized the shift by noting that “the shift from pure utility to a structural asset class is what most people are missing. Institutionalizing the yield is the real game changer here.” Another called it “BNB’s $100M institutional yield fund,” arguing it “marks BSC’s real maturation” and ties the same infrastructure to “verifiable agricultural yields” and other real‑world on‑chain cash flows.

Not everyone is convinced. One critic pushed back bluntly, asking “why? $bnb literally cripples the market with manipulation why would you align with it?”, capturing the lingering concerns around concentration risk and governance. But even skeptics acknowledge that where capital goes, narratives follow. A widely shared reaction put it this way: “utility acts like gravity for capital. 100M is a solid data point confirming the ecosystem’s maturity. The suits are finally doing the math right.” Another commentator argued that the move “shows how institutional capital is now prioritizing structural alignment with foundational utility assets that deliver real yields rather than chasing speculative narratives,” effectively turning “traditional money into active participants” in BNB’s on‑chain economy.

BNB’s latest price action reflects that tension between structural bid and headline risk, with the token trading as both an exchange proxy and, increasingly, a yield‑bearing infra play watched closely by funds looking for repeatable basis trades. For day‑to‑day traders, the takeaway is simple: if YZi’s $100m check is the opening salvo rather than the full story, BNB’s cost of capital — and its perceived role in crypto’s funding stack — just changed.

Crypto World

BTC rebounds toward $70,000 as ETFs pull in $1.45 billion in five days

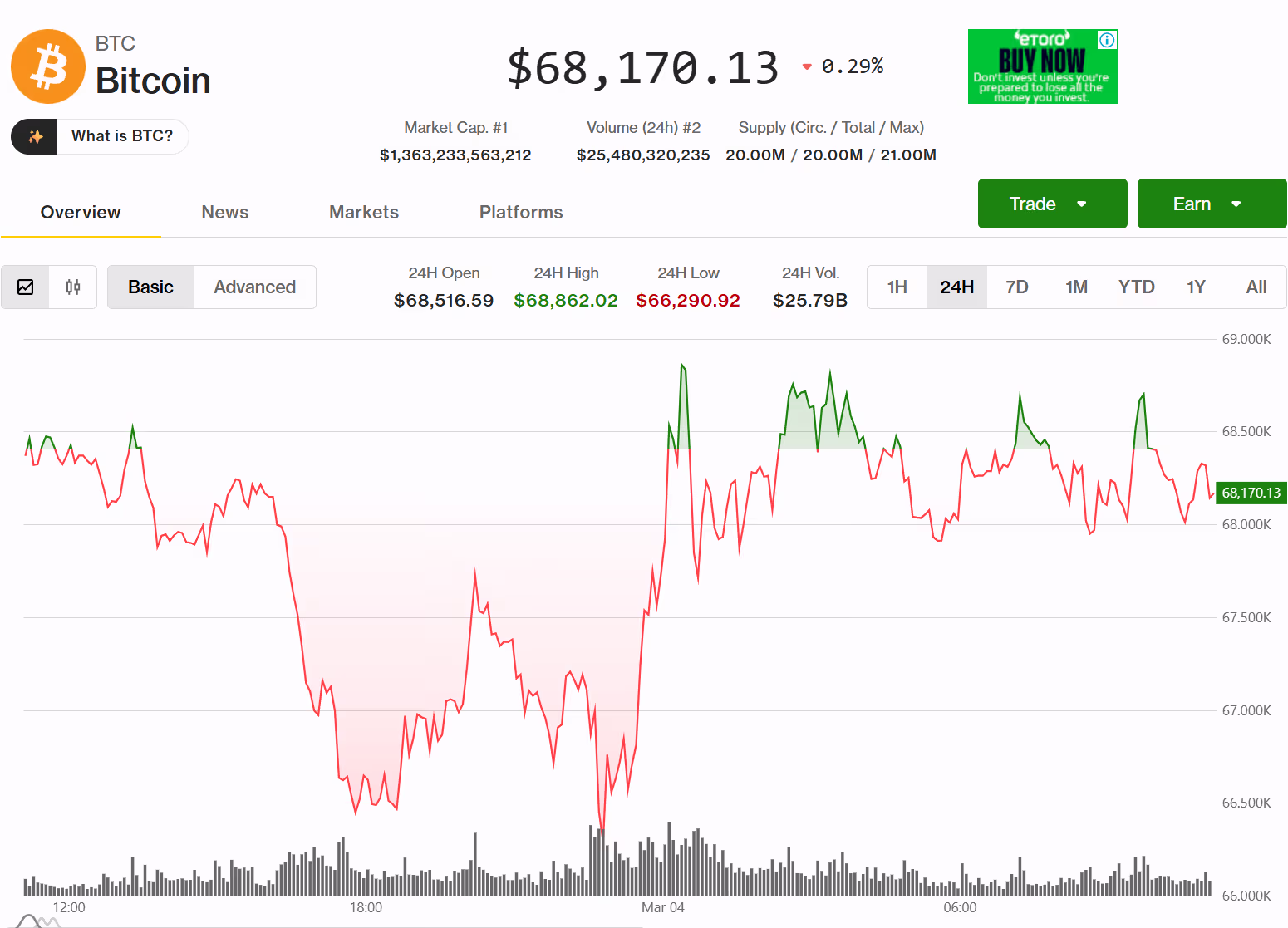

Bitcoin’s rebound toward $70,000 — trading at $68,000 as Hong Kong hit midday — appears to have been driven more by positioning than conviction, according to market maker Enflux, which said the move largely reflected short-covering after traders leaned bearish amid geopolitical headlines.

“The market is not pricing catastrophe, but it is not pricing resolution either,” Enflux wrote in a note to CoinDesk. “Shorts leaned into the Iran headlines over the weekend, BTC flushed toward 63k, and when escalation did not immediately spiral into a broader regional war affecting the Gulf and Dubai trade corridors, the squeeze began.”

Crypto tends to react faster than traditional assets during geopolitical shocks, Enflux added.

“When bombs drop, or sanctions tighten, capital looks for exit routes. In times of uncertainty, BTC becomes a pressure valve,” the firm wrote.

Institutional demand has remained a key source of support. Over the past five trading days, BTC ETFs have attracted roughly $1.45 billion in net inflows.

Boomers to the rescue again as bitcoin ETFs record $1.5b of inflows in the past 5 days after another big day yesterday. Biggest haul in a while, just about all of the original ten spot ETFs seeing action too = breadth and depth. This after a 50%(!) drawdown and most underwater.… pic.twitter.com/eF0VJqiPZ0

— Eric Balchunas (@EricBalchunas) March 3, 2026

Onchain and derivatives indicators suggest the market is stabilizing but not yet regaining strong conviction.

In a recent report, Glassnode wrote that momentum indicators are beginning to recover from recent weakness, with bitcoin’s relative strength index rising to about 41 from 36 the previous week, though still below the neutral 50 level that would signal stronger bullish control.

Spot market conditions have also improved. Trading volume has climbed to roughly $9.6 billion from $6.6 billion the previous week, while buying and selling flows in spot markets have become more balanced, suggesting the earlier wave of aggressive selling has begun to ease.

Derivatives markets remain cautious. Glassnode said the cost of holding leveraged long positions has dropped sharply, while futures trading still shows sellers dominating buyers, signaling continued caution among leveraged traders.

Prediction markets reflect the same cooling of conviction: the probability of bitcoin falling to $65,000 in March has dropped 11 percentage points to 73%, the odds of $60,000 have fallen 10 points to 41%, and a separate Polymarket contract showing bitcoin hitting $60,000 before $80,000 has also weakened, sliding 12 points to 61%.

Together, the data suggests bitcoin has found support for now, but traders remain hesitant to price in either a decisive rally or a deeper selloff.

Crypto World

SoFi and Mastercard Join Forces to Integrate SoFiUSD for Global Settlement

The U.S. neobank first announced its stablecoin, which is built on a “public, permissionless blockchain,” late last year.

United States-based neobank SoFi and Mastercard announced a strategic partnership to use the bank’s stablecoin, SoFiUSD, in Mastercard’s global payments network.

Per a press release today, March 3, SoFiUSD will be integrated as a settlement option across Mastercard’s network, and is expected to simplify the settlement process for card issuers and acquirers.

The stablecoin will also be used across Mastercard’s digital asset platform, the Mastercard Multi-Token Network (MTN), according to the release

As The Defiant previously report, SoFi first announced the launch of SoFiUSD back in December. According to the firm’s communications, the USD-backed stablecoin is built on “a public, permissionless blockchain,” though The Defiant was unable to verify which blockchain network. The neobank said at the time that it was launching its own stablecoin as part of its broader strategy to innovate financial infrastructure for banks, fintechs, and enterprise partners.

SoFi did not not immediately respond to The Defiant’s request to clarify which blockchain the bank is using for SoFiUSD, as well as whether or not the stablecoin will integrate yield sharing — a possibility previously mentioned by SoFi’s CEO Anthony Noto at an event in October.

“By working with SoFi to enable SoFiUSD across the Mastercard network, we’re expanding how trusted digital currencies can be used at global scale,” stated Sherri Haymond, Mastercarcd’s global head of digital commercialization was quoted as saying in today’s release.

This partnership follows SoFi’s relaunch of crypto trading services in November, after shuttering said services back in 2023, citing regulatory uncertainty, as The Defiant reported.

The move also marks a continuation of Mastercard’s ongoing efforts to integrate blockchain technology. Last June, Mastercard partnered with blockchain oracle provider Chainlink to let cardholder purchase crypto directly on-chain, as The Defiant reported at the time.

This article was generated with the assistance of AI workflows.

Crypto World

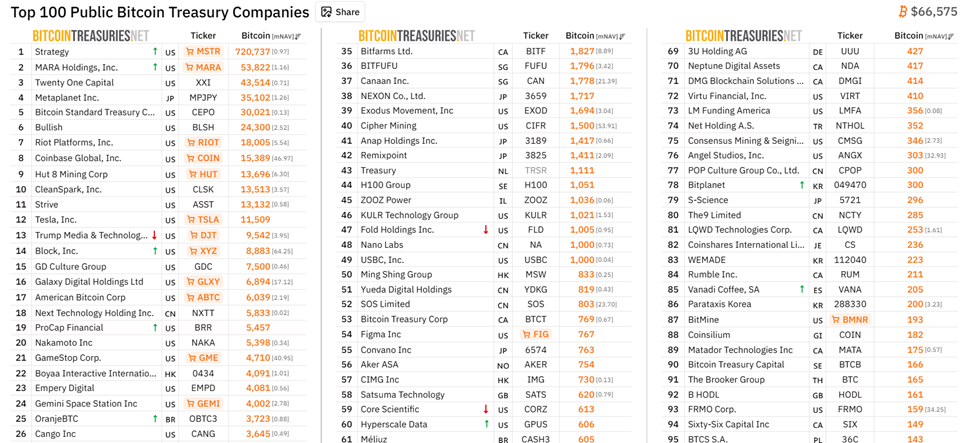

MARA Loosens Bitcoin Grip: Will MicroStrategy Follow?

MARA Holdings has formally rewritten its Bitcoin playbook, expanding its treasury policy to permit sales of Bitcoin held directly on its balance sheet.

It raises questions about whether Strategy (MicroStrategy) could be next, seeing as MARA is only second to Michael Saylor’s firm among public companies holding BTC.

MARA Opens Door to Selling 53,822 BTC Stockpile in Treasury Pivot After $1.7 Billion Loss

The move, detailed in its annual 10-K filing submitted to the US SEC on March 2, 2026, marks the first time MARA has explicitly authorized liquidation of its accumulated treasury stockpile.

“In the second half of 2025, we changed our digital asset management strategy to permit sales of bitcoin generated from operations, and in 2026, we expanded the strategy to allow for sales of bitcoin held on our balance sheet. Accordingly, we may hold bitcoin for long-term investment purposes and may also buy or sell bitcoin from time to time, subject to market conditions and our capital allocation priorities,” read an excerpt in the filing.

It marks a sharp departure from its prior “full HODL” stance, with the legal framework for liquidating the company’s entire reserve now in effect. Notably, no immediate sales have been announced.

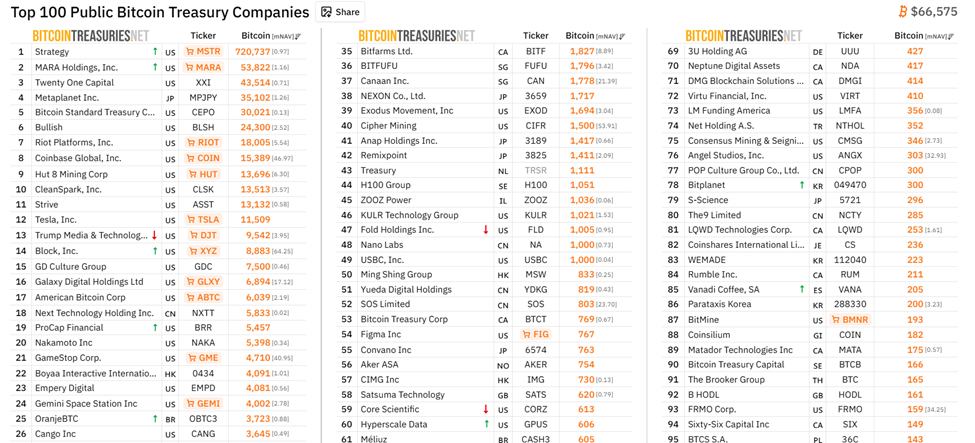

As of this writing, MARA holds 53,822 BTC, worth $3.59 billion at current rates of $66,565 per BTC. This makes it the second-largest publicly listed corporate Bitcoin holder, trailing only Strategy, which holds 720,737 BTC as of this writing.

Roughly 72% of MARA’s holdings (38,507 BTC) remain in unrestricted long-term treasury. The remaining 28%, or about 15,315 BTC, has already been “activated” under its digital asset management program.

Of that, 9,377 BTC are loaned out, generating $32.1 million in interest income in 2025, while 5,938 BTC are pledged as collateral for a $350 million credit facility.

Combined with $547 million in cash, MARA controls approximately $5.3 billion in liquid assets.

The more immediate concern, however, is that over 53,000 BTC represents a potential supply overhang in an already fragile market environment. This is particularly concerning if miner stress intensifies.

From Ideological HODL to Active Management

The shift caps a gradual change, following MARA’s 2024 10-K, which described a strict policy of retaining all mined and purchased Bitcoin “for the foreseeable future.”

In the second half of 2025, the company began selling newly mined BTC to fund operations, offloading 4,076 BTC for $413.1 million in proceeds.

The 2026 expansion now extends that flexibility to the entire balance-sheet reserve. This policy change follows a turbulent fourth quarter.

MARA reported a $1.7 billion net loss in Q4 2025, largely driven by non-cash fair-value adjustments following Bitcoin’s roughly 30% decline in late 2025. The company also recorded $422.2 million in fair-value decreases and impairment losses tied to its digital assets.

Notably, MARA recently entered a joint venture with Starwood Capital to develop AI and high-performance computing data centers, repurposing its energy infrastructure.

Monetizing Bitcoin could fund that “energy-to-AI” transition without further diluting shareholders through equity issuance.

Could Strategy Be Next?

Unlike MARA, Strategy continues to describe Bitcoin as its “primary treasury reserve asset” and has recently added to its holdings.

The firm’s executives highlight sales only in extreme liquidity scenarios, not as an opportunistic capital allocation tool.

“We will not be selling. Instead, I believe we will be buying Bitcoin every quarter forever,” Michael Saylor stated in a recent interview.

At Bitcoin’s current price, there is short-term pressure on Strategy, primarily due to unrealized losses on its massive Bitcoin treasury.

MARA’s pivot appears miner-specific rather than industry-wide. Still, the symbolism is significant. Corporate Bitcoin treasuries were once seen as permanent supply sinks.

MARA’s 10-K signals a maturing approach, one where Bitcoin is not just conviction capital, but a dynamic balance-sheet instrument.

Notwithstanding, markets will now be watching future 8-K and quarterly filings, as well as on-chain flows, for the first real test of that flexibility.

Follow us on X to get the latest news as it happens

Subscribe to our YouTube channel to watch leaders and journalists provide expert insights

Crypto World

Binance launches AI trading skills with unified agent interface

Binance debuts seven AI Agent Skills to automate trading, data, and risk workflows.

Summary

- Binance rolled out seven AI Agent Skills to connect spot, wallet, and trading via a unified interface, adding OCO, OPO, and OTOCO support and on-chain analytics tools.

- The skills include real-time market rankings, smart money signal tracking, and contract risk detection, signaling a push toward agent-based execution across Binance’s retail and institutional user base.

- Major AI-linked and exchange tokens saw modest intraday gains, with BTC and ETH trading slightly higher as markets priced in incremental automation demand and on-chain activity growth.

Binance has introduced its first batch of seven AI Agent Skills, creating a unified interface that lets AI agents access spot trading, wallet data, and execution tools in one environment. The rollout adds a programmable layer over Binance’s existing infrastructure, allowing automated systems to query real-time market data, execute complex order types, and analyze token and address information without manual intervention. Positioned at the intersection of exchange infrastructure and AI-driven trading, the update underscores how centralized venues are racing to become the execution backbone for agentic trading strategies.

The new skills package is built around several core capabilities designed to remove friction between data, decision-making, and order placement. First, agents can pull live market data, including order book information, price feeds, and ranking tables that surface top-performing or highly traded assets across the platform. Second, execution is no longer limited to simple market or limit orders, with the interface now supporting OCO (one-cancels-the-other), OPO (one-procures-the-other), and OTOCO (one-triggers-one-cancels-the-other) structures that let agents predefine conditional strategies and risk parameters. Third, the skills extend into on-chain style analytics by offering address and token information analysis, smart money signal tracking, and contract risk detection, effectively merging elements usually associated with specialized analytics platforms into the exchange stack.

From a user perspective, the combination of real-time queries and executable logic means agent developers can script entire trading or portfolio workflows without building their own exchange connectivity stack. A single AI agent can, for example, scan market rankings for volume spikes, cross-reference smart money flows into specific contracts, evaluate basic risk flags, and then place a staged OCO or OTOCO order structure to manage entries and exits. This architecture supports both high-frequency style reaction to fast-moving events and more measured swing-trading strategies based on aggregated analytics. It also lowers the barrier to deploying semi-autonomous bots for retail traders who rely on third-party tools, while institutional desks can integrate the interface into existing infrastructure for more systematic strategies.

The inclusion of smart money signal tracking and contract risk detection moves Binance further into territory historically occupied by standalone on-chain intelligence firms. By exposing these capabilities as skills accessible to AI agents, the exchange can keep users within its own ecosystem rather than sending them to external dashboards for early flow or risk signals. In practice, this might involve an agent continuously scanning for large or repeated flows from tagged sophisticated wallets into a new token, then testing the associated contract for typical red flags such as trading restrictions, mint functions, or ownership concentration before any capital is deployed. The same workflow could be used defensively, with agents watching for sudden outflows or changes in contract behavior that may warrant tightening stops or closing positions.

For risk management, the advanced order types paired with contract scanning provide a more granular toolkit than many retail users previously applied. OCO and OTOCO structures, in particular, let agents define both upside targets and downside protection in a single conditional chain, minimizing the chance that human users forget to place stops or exits in volatile markets. Combined with wallet data access, an agent can check free balances, open orders, and portfolio concentration before committing to a new position, effectively running a pre-trade risk check similar to what regulated brokers and prime services offer. This mirrors how larger trading desks aggregate risk views across instruments and venues, but compresses it into a single programmable endpoint for Binance-specific activity.

AI Agent Skills could prove particularly relevant for quant funds, market makers, and structured product issuers that already deploy systematic strategies across major venues. Rather than building and maintaining multiple bespoke integrations, these firms can use the unified interface to embed agent-driven logic on top of Binance liquidity, while still routing orders through their own risk frameworks. For smaller professional traders, the ability to script and test strategies around conditional orders and smart money flows offers a scaled-down version of institutional tooling without large engineering budgets. Over time, if volumes routed through AI agents grow, liquidity dynamics on pairs like BTC and ETH could increasingly reflect the behavior of automated strategies rather than discretionary traders.

On the retail side, the launch adds another layer to the ongoing trend of exchanges offering more out-of-the-box automation. Previously, many users relied on external bots or third-party platforms to implement grid trading, DCA strategies, or volatility breakout systems; now, those logic blocks can be coded into agents that sit directly on top of the exchange’s infrastructure. This reduces latency, simplifies custody questions, and potentially improves execution quality, but it also raises questions about over-reliance on automated tools among less experienced traders. Education around how conditional orders work and how risk flags are generated will be critical, especially during periods of elevated volatility in assets such as BTC and ETH.

The broader competitive landscape among exchanges is shifting toward AI and automation as differentiators, with multiple platforms experimenting with GPT-style assistants, strategy builders, and one-click bot marketplaces. Binance’s move to expose agent skills at the infrastructure layer rather than as a purely consumer-facing chatbot suggests it intends to anchor itself as a base layer for third-party AI trading tools. That approach mirrors how some exchanges integrated with payment networks like Visa to capture transactional flows, but here the target is the emerging wave of agentic capital allocation tools. If other major players such as Coinbase adopt similar unified interfaces, interoperability and standardization of agent APIs could become a new battleground alongside fees and listing quality.

Market reaction to the announcement has so far been measured rather than euphoric, reflecting a market that increasingly prices AI narratives with more scrutiny. Exchange-native tokens and AI-linked assets posted modest gains on the day, while major benchmarks like BTC and ETH traded within recent ranges, indicating that participants view the launch as an incremental infrastructure upgrade rather than a cycle-defining catalyst. Still, on-chain activity metrics, derivatives positioning, and spot volumes will be important to watch in the coming weeks to gauge whether agent-driven strategies begin to leave a detectable footprint in flows and volatility regimes. For ecosystems like SOL, where on-chain order books and DeFi venues already support sophisticated trading, the race will be to match or exceed the usability and reach of centralized AI tooling, or risk losing trader mindshare to exchange-centric agent hubs.

Crypto World

Brazil Central Bank Mandates Daily Crypto Asset Reports

TLDR

- Brazil’s central bank will require licensed crypto exchanges to prove asset sufficiency daily starting Jan. 1, 2027.

- The new framework aligns crypto trading platforms with commercial banking standards on capital and reporting.

- Exchanges must fully separate company funds from customer fiat and cryptocurrency holdings.

- Platforms must follow a specialized accounting manual for recording and valuing digital assets.

- The rules impose stricter data protection and confidentiality obligations on crypto intermediaries.

Brazil’s central bank will require licensed crypto exchanges to prove asset sufficiency daily from Jan. 1, 2027. The authority published the framework on March 3 through official market communications. The rules align crypto intermediaries with commercial banking standards on capital, accounting, and data controls.

Brazil Tightens Oversight With Daily Reserve Reporting

The central bank said exchanges must submit daily attestations of asset sufficiency starting in 2027. Supervisors will review reports to confirm that platforms hold adequate fiat and crypto reserves. The authority said exchanges must cover operational, liquidity, and cyber risks. It stated that daily reporting will reduce sudden shortfalls and customer losses.

The framework requires strict segregation of client and company assets. Exchanges must separate their own accounts from customer fiat and crypto holdings. The bank said segregation will prevent commingling and misuse of client funds. It added that regulators will gain clearer views of assets attributable to users.

Exchanges Must Follow Bank-style Accounting and Data Rules

The central bank ordered exchanges to record crypto assets under a specialized accounting manual. Platforms must follow standardized rules on classification, valuation, and impairment of digital assets. Officials said consistent accounting will improve comparability across regulated entities. The bank stated that financial statements must reflect crypto exposures clearly.

The authority also imposed bank-level data protection and confidentiality standards. Exchanges must implement strict controls over customer records and internal communications. The central bank said firms must limit unauthorized access and data leaks. It added that platforms must maintain detailed documentation for supervisory audits.

Cross-border Crypto Transfers Face Enhanced Scrutiny

The framework expands oversight of cross-border crypto transfers handled by domestic exchanges. Platforms must report origin, destination, and on-chain pathways of international transactions. Supervisors will use blockchain analytics to monitor transaction traceability. The bank said enhanced audits will address money laundering and tax evasion risks.

Authorities will coordinate with tax agencies and financial intelligence units on reporting standards. Exchanges must integrate compliance systems that flag suspicious cross-border flows in near real time. The central bank stated that firms must retain sufficient records for inspections. The rules will apply to all licensed trading venues operating in Brazil.

The central bank said larger exchanges may rely on existing compliance infrastructure. Smaller platforms must upgrade custody, reporting, and monitoring systems before 2027. Officials confirmed that the rules apply regardless of the token type traded. BTC and ETH traded lower on the announcement date, according to market data.

The authority stated that the framework targets operational resilience and customer fund protection. It confirmed that licensed exchanges must comply by Jan. 1, 2027. Supervisors will issue further technical guidance before implementation. The central bank published the measures through official communications on March 3.

Crypto World

CORZ sells $175 million in BTC in January as AI pivot accelerates

Core Scientific (CORZ), a bitcoin mining and digital infrastructure company, sold just over 1,900 bitcoin in January for approximately $175 million, according to CORZ Q4 earnings call.

The sale implies an average price of about $92,100 per BTC, about 35% higher than today’s $67,000 current price, as it accelerates its shift toward AI focused data center operations.

Chief Financial Officer Jim Nygaard said on the Q4 call the company “we also opportunistically sold just over 1,900 bitcoin for approximately $175 million,” adding, “at this time, we hold under 1,000 bitcoin and expect to remain opportunistic going forward.”

On Dec. 31, 2025, the company held 2,537 BTC with the latest sale bringing its tally to around 630 BTC.

Management has made clear that bitcoin mining is no longer the long term focus. CEO Adam Sullivan described the mining segment as “essentially in runoff,” with operations maintained primarily to meet minimum power draw requirements while legacy sites are converted into colocation facilities supporting AI and high performance computing workloads.

Core Scientific ended the year with approximately $530 million in liquidity and highlighted up to $4 billion in potential financing tied to its 590 megawatt CoreWeave contract at stabilization, underscoring that BTC sales are being used to fund AI infrastructure expansion rather than rebuild mining capacity.

Core Scientific missed fourth quarter expectations, reporting $79.8 million in revenue versus $122.08 million consensus and a loss of $0.42 per share compared with estimates for a $0.08 loss.

The shift reflects a broader industry pivot away from pure bitcoin mining toward AI and data center infrastructure, with MARA Holdings (MARA) striking a deal with investment firm Starwood, Riot Platforms (RIOT) selling roughly $200 million of bitcoin in the final two months of 2025, and both Cipher Digital (CIFR) and Bitfarms (BITF) rebranding to emphasize AI and HPC exposure.

Crypto World

OKX jumps into AI agent race with new OnchainOS toolkit

OKX on Tuesday rolled out an AI-focused upgrade to OnchainOS, its developer platform, pitching it as infrastructure for autonomous crypto trading agents.

The AI layer builds on familiar components such as wallet infrastructure, liquidity routing, and on-chain data feeds, combining them into a unified execution framework aimed at AI agents operating across chains.

Rather than wiring price feeds, token approvals, gas estimation, and swap routing manually, developers can connect an agent and issue a high-level instruction, such as swapping ETH for USDC below a certain price. OnchainOS handles the workflow behind the scenes, from monitoring markets to sourcing liquidity and confirming settlement.

The intersection between crypto and AI has grown exponentially in the past 12 months with the blockchain AI market projected to rise from $6 billion in 2024 to $50 billion by 2030.

And traders are using the technology to their advantage. One recent example was where a group of retail traders used AI to find “glitches” on platforms like Polymarket before instructing AI to trade on its behalf.

More than 60 blockchain networks are supported, along with smart routing across 500+ decentralized exchanges, according to a release from the company. OKX says the broader OnchainOS stack already processes 1.2 billion daily API calls and about $300 million in daily trading volume, underscoring that the AI layer sits on existing production infrastructure.

Access comes through natural language “AI Skills,” Model Context Protocol integration for coding agents like Claude Code and Cursor, and direct REST APIs for developers seeking more control.

OnchainOS is available globally to developers starting Tuesday March 3, the company said in a release.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics19 hours ago

Politics19 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat3 days ago

NewsBeat3 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat4 days ago

NewsBeat4 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech5 days ago

Tech5 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World5 days ago

Crypto World5 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat2 days ago

NewsBeat2 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI