Crypto World

Logan Paul fakes $1 million Polymarket bet

An apparent $1 million Polymarket bet placed by Logan Paul during the Super Bowl was actually a stunt that failed to pull the wool over the eyes of crypto sleuths.

Paul was filmed supposedly placing a bet on the New England Patriots racking up a record-breaking seventh Super Bowl victory. Polymarket captioned the clip “Logan Paul checking Polymarket at the Big Game 👀.”

However, crypto sleuth ZachXBT, and numerous other onlookers noted that Paul’s Polymarket account balance had no money in it, and so the $1 million bet he proceeded to tap through was never going to be made.

Additionally, ZachXBT pulled up the top holders within that market and showed that none of them matched Paul’s apparent bet.

He called the stunt “yet another Logan Paul scam,” a comment possibly referencing Paul’s failed CryptoZoo project that lost victims tens of thousands of dollars and led to numerous lawsuits, some of which are still ongoing.

Read more: Coinbase’s Super Bowl ad was fun until it wasn’t

ZachXBT also speculated that there’s “at least some sort of relationship not being disclosed” between Paul and Polymarket.

The sleuth shared one of Paul’s livestreams, filmed days earlier, that showed the influencer trying to candidly promote Polymarket in a fashion ZachXBT described as “inorganic.”

In the end, it was a good job for Paul that he didn’t make the bet as Seattle won the game 29 to 13.

Prediction markets are battling state courts

Polymarket and rival market Kalshi are battling various legal challenges in courts across the US. Today, Polymarket launched a lawsuit against the state of Massachusetts to attempt to prevent it from shutting down its sports prediction markets.

Polymarket is arguing that the federal law and the Commodity Futures Trading Commission are the only legal tools that can prevent it from offering sports contracts.

Meanwhile, Kalshi’s advertisements are attracting a different kind of criticism from users online who take offence to the platform framing prediction market gambling as a viable means of making money on the side.

Crypto podcast host “DeFi_Dad” described Kalshi’s advertisements as “rat poison squared,” noting that its trying to pass off betting on the duration of the national anthem, and other markets, as “easy money” and bets that “normal Joes” are making every day.

Read more: Maduro Polymarket bet raises insider trading concerns

“Every ad is uniquely shameless and cringe. Great way to wreck the middle class and young people who SHOULD be taking risks by investing or learning about investing vs gambling,” DeFi_Dad added.

“I would never advocate for censoring or preventing anyone from using these platforms but the marketing is so dishonest and mark my words, it will eventually blow back hard on our industry for them being associated with crypto.”

CEO of crypto casino BetHog, Nigel Eccles, also noted how Kalshi ads are advertising to young adults the message that, if they can’t afford their rent, they should gamble on the platform instead to make back even more money.

Eccles claimed that operators view these ads as “highly unethical,” and highlighted that the ads promote both underage and problem gambling.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Bitcoin at Critical $69K-$72K Support: Death Cross Signals Deeper Correction Risk

TLDR:

- Bitcoin death cross forms on daily charts with moving averages positioned far above current price

- Weekly close below $69K-$72K support could trigger next leg down into deeper correction territory

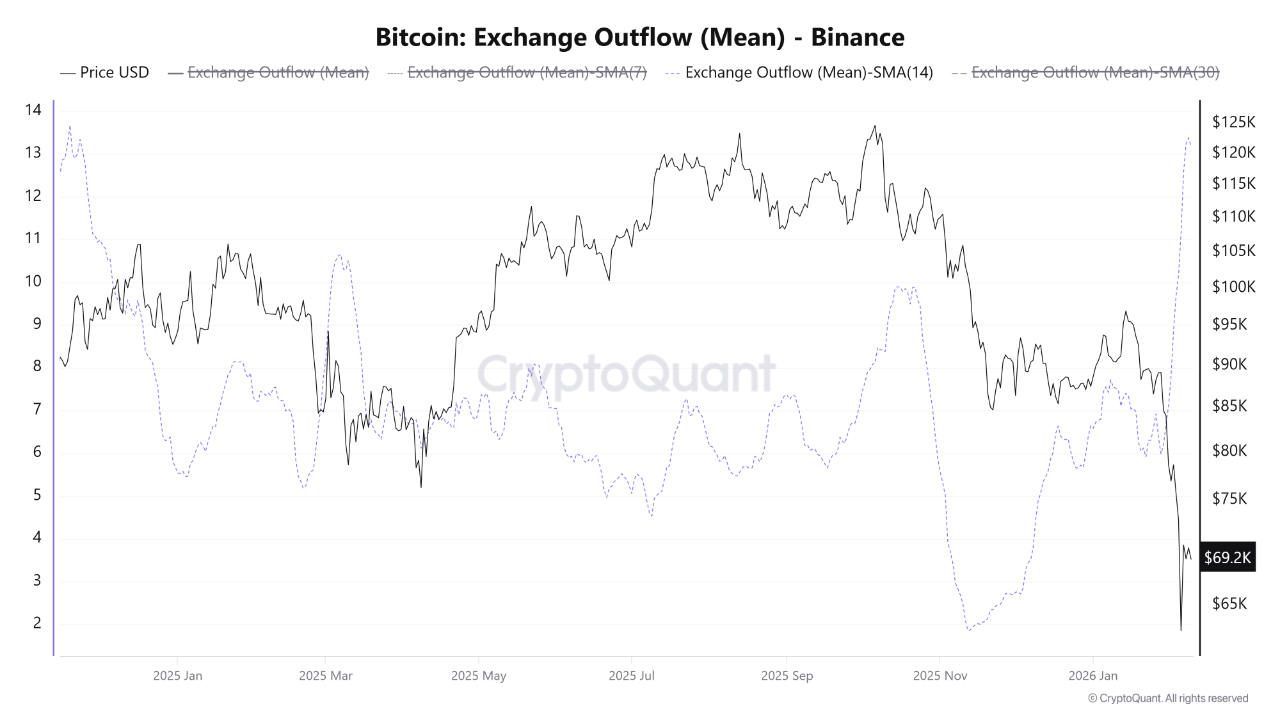

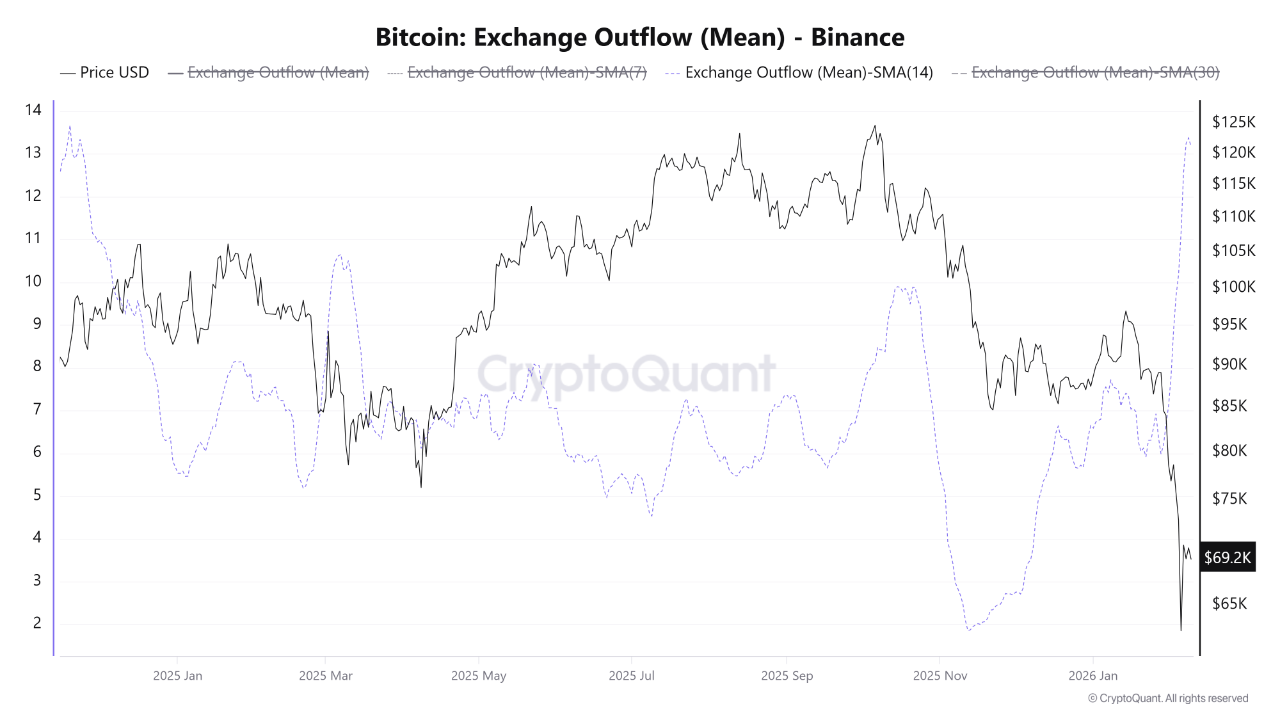

- Binance withdrawal data shows whale accumulation doubled to 13.3 BTC average since late January

- Price must reclaim $82K then mid-$90Ks to establish bottoming pattern and reverse bearish trend

Bitcoin faces a critical test as price slides into the $69,000 to $72,000 support zone amid mounting bearish technical signals.

A death cross has formed on daily charts while weekly moving averages remain far overhead. Traders warn that a clean weekly close below this range could trigger a deeper correction phase.

The current price action shows weak bounce attempts with consistent rejections at key resistance levels.

Death Cross Formation Signals Bearish Trend Structure

The technical setup has deteriorated significantly as BTC continues its descent from higher levels. Daily charts now display an active death cross with the 50-day and 200-day moving averages positioned miles above current price. This configuration represents a classic bearish trend structure where rallies meet aggressive selling pressure.

Weekly timeframes confirm the concerning technical picture. Price remains trapped below the exponential moving average ribbon with repeated rejection attempts at that level.

Any upward moves are functioning as retests rather than genuine reversals. Trader @DamiDefi emphasized that pumps are getting sold while supports face continuous stress tests.

The $69,000 to $72,000 band now represents the final line of defense. This zone determines whether the market experiences a temporary shakeout or enters a prolonged correction phase. Price behavior at this level will dictate the trajectory for coming weeks and potentially months.

A breakdown below $69,000 on a weekly closing basis would open the next leg down. The accumulation phase would become considerably more painful before any bullish momentum could rebuild.

Historical patterns suggest that losing major support zones often leads to cascading liquidations and accelerated downside movement.

Support Test Occurs Despite Whale Buying Activity

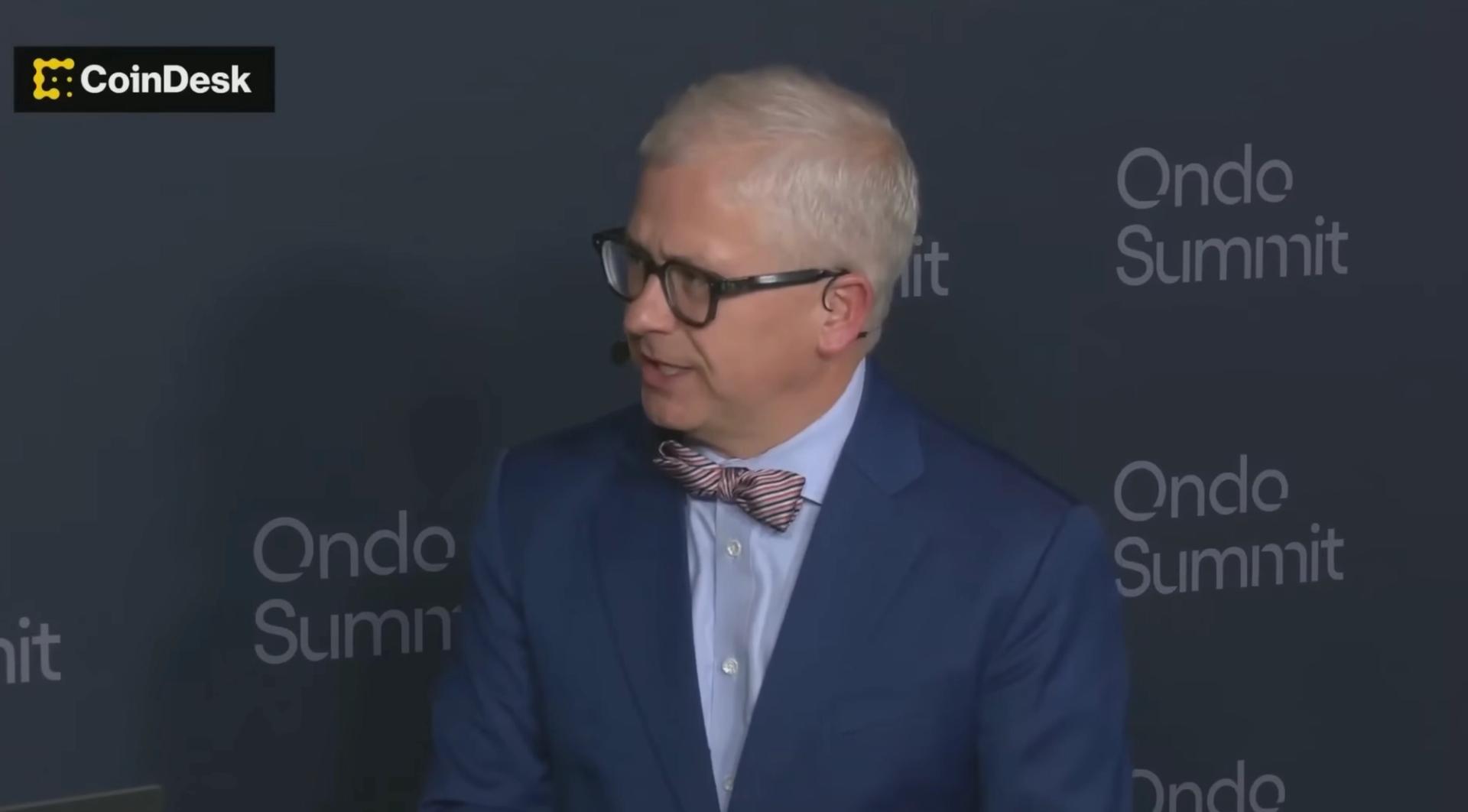

The bearish price action persists even as on-chain data reveals unusual buying patterns. Binance exchange metrics show a significant increase in average withdrawal sizes during the decline.

The 14-day simple moving average of mean outflows has doubled from approximately 6 BTC on January 28 to 13.3 BTC by February 8.

This withdrawal pattern indicates whale and institutional activity at current price levels. Large entities appear to be accumulating Bitcoin around $69,000 despite the technical deterioration.

The average outflow size represents the highest level recorded since November 2024, according to CryptoOnchain data.

However, this accumulation has not yet translated into price stability or reversal. The gap between falling prices and rising withdrawal sizes creates a divergence worth monitoring. Smart money appears to be positioning for longer-term gains while accepting near-term downside risk.

Moving coins off exchanges to cold storage traditionally reduces immediate selling pressure. Yet the current market structure suggests this effect remains insufficient to halt the decline.

Bulls need price to reclaim $82,000 first, then push back into the low-to-mid $90,000s to establish a credible bottoming range. Without holding the $69,000 to $72,000 support zone, those recovery targets become increasingly distant possibilities.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Beast Industries, the entertainment company founded by YouTuber Jimmy “MrBeast” Donaldson, is acquiring Step, a mobile banking app focused on teenagers and young adults, marking its most significant push into finance to date.

In a post to X on Monday, Donaldson said the motivation behind the acquisition was to equip young people with the tools and guidance needed to navigate personal finance from an early age.

Beast Industries CEO Jeff Housenbold said, “Financial health is fundamental to overall wellbeing, yet too many people lack access to the tools and knowledge they need to build financial security.”

The acquisition cost was not disclosed.

The YouTube channel’s expansion into finance comes after it received a $200 million investment from Ethereum treasury firm BitMine Immersion Technologies in January and a separate trademark filing for “MrBeast Financial” in October.

That trademark filing mentioned “cryptocurrency exchange services,” “cryptocurrency payment processing,” and “cryptocurrency via decentralized exchanges.”

However, it isn’t clear whether that trademark filing is related to the Step acquisition.

Cointelegraph reached out to Beast Industries for comment, but didn’t receive an immediate response.

Step scales to 6.5 million users in 8 years

The Step app aims to help Gen Z users manage money, build credit, earn rewards, and deepen their financial literacy. Spending accounts are Federal Deposit Insurance Corporation-insured through Evolve Bank & Trust.

The banking app has scaled to 6.5 million users since launching in 2018, having raised around $500 million from the likes of Steph Curry, Justin Timberlake, Will Smith, and Charli D’Amelio.

Related: Crypto PACs secure massive war chests ahead of US midterms

The MrBeast YouTube channel has 466 million subscribers, the largest channel on the video-streaming platform.

Housenbold said the Step acquisition “positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better.”

At the time of the strategic $200 million BitMine investment, its chair, Tom Lee, said the company viewed the deal as a long-term bet on the creator economy, stating:

“MrBeast and Beast Industries, in our view, is the leading content creator of our generation, with a reach and engagement unmatched with GenZ, GenAlpha and Millennials.”

Lee said that BitMine’s corporate values were “strongly aligned” with Beast Industries, but didn’t mention anything about integrating crypto at the time.

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

CryptoGames Advances Transparency and Mathematical Fairness in iGaming

[PRESS RELEASE – Willemstad, Curaçao, February 9th, 2026]

CryptoGames announced that players on its platform have placed over 9.5 billion Dice bets, marking a notable usage milestone and reflecting consistent engagement with its provably fair gaming system. The volume of verified wagers underscores the platform’s ongoing focus on transparency, statistical fairness, and game integrity.

Founded in 2020, CryptoGames was built around a clear guiding principle: to offer a gambling environment where fairness can be independently verified, odds are fully understood, and competition takes place on equal terms. Rather than relying on large libraries of third-party games with opaque mechanics, CryptoGames delivers a focused portfolio of internally developed titles, each engineered with some of the lowest house edges available online.

House Edge as a Foundation of Long-Term Value

In gambling mathematics, house edge defines the casino’s statistical advantage over time. While short-term outcomes can vary, long-term results are shaped almost entirely by this single metric. Even small differences in house edge can have a measurable impact when applied across a high volume of bets.

CryptoGames emphasizes transparency in house edge as a core aspect of its platform design. The platform offers low-margin games, which may result in higher value retention for players over extended periods of play, compared to traditional online casinos where house edges typically range from 4% to 10%.

In-House Development Enables Competitive Margins

All games on CryptoGames are developed internally. This approach removes the need for third-party licensing fees and external profit margins, allowing the platform to operate efficiently while offering leaner house edges.

Standard House Edge Across Games

CryptoGames maintains consistent and competitive margins across its game selection:

- Dice – 1.0%

- DiceV2 – 1.0%

- Keno – 1.0%

- Minesweeper – 1.0%

- Blackjack – 1.25%

- Roulette – 2.7%

- Plinko – 1.72%

- Slot – 1.97%

The Lottery game stands out with a 0.0% house edge, an uncommon structure that reinforces CryptoGames’ commitment to fairness and transparency.

By comparison, these margins offer players a measurable advantage over conventional casino offerings over time.

Provably Fair Technology Built Into Every Bet

Transparency is reinforced through full implementation of provably fair gaming across the CryptoGames platform.

Before each wager, the server seed is hashed and presented to the player. Once the bet concludes, the original seed is revealed, allowing independent verification of the outcome using the published algorithm.

By design, this eliminates one of the most common trust concerns in online gambling.

Broad Cryptocurrency Support and Flexible Access

CryptoGames supports betting with 14 cryptocurrencies, accommodating a wide range of blockchain users.

Through ChangeNow integration, users can also deposit more than 50 additional altcoins, which are automatically converted into supported assets. For those new to crypto, CryptoGames integrates the Swapped fiat-to-crypto gateway, enabling purchases via credit cards, Apple Pay, and Google Pay.

Ongoing Rewards Designed for Consistent Engagement

CryptoGames emphasizes long-term engagement through recurring rewards rather than one-time promotional offers.

Monthly Wagering Contest With Major Prize Pools

The platform hosts a monthly wagering contest offering rewards of up to $500,000 USD, depending on market conditions.

Leaderboards are separated by cryptocurrency, ensuring fair competition among players using the same assets. Participants also receive lottery tickets throughout the month, adding additional reward opportunities tied to consistent participation.

VIP Program Focused on Statistical Advantage

CryptoGames’ VIP program is tailored for high-volume and competitive players.

VIP Benefits

- Reduced dice house edge of 0.8%

- Removal of server-side betting delays

- Increased daily exchange limits up to 1 BTC

- Access to a private VIP chat room

- VIP chat identification

- $100 Bitcoin birthday bonus (Tier 3 KYC required)

- Additional faucet level

- Monthly voucher distributions

Players who maintain VIP status for three consecutive months retain most benefits even if they do not immediately requalify, reinforcing long-term loyalty.

Optimized User Experience and Community Engagement

CryptoGames delivers a clean, high-performance interface designed for speed and efficiency. Betting remains smooth even at high volumes. An active chatbox, blog, and forum further support transparency and community interaction.

A Platform Built for Fairness, Strategy, and Confidence

With more than 9.5 billion Dice bets placed, CryptoGames continues to demonstrate the scalability and reliability of its provably fair systems. Through in-house development, transparent odds, extensive crypto support, and competitive reward structures, CryptoGames sets a disciplined standard in the crypto gambling space.

For users focused on long-term value, verifiable fairness, and confident decision-making, CryptoGames represents a clear and data-driven approach to crypto gaming.

About CryptoGames

CryptoGames is a cryptocurrency-focused iGaming platform founded in 2020, built around the principles of transparency, mathematical fairness, and player-verifiable outcomes. The platform offers a curated selection of internally developed games with consistently low house edges, supported by provably fair technology that allows every wager to be independently verified. By combining in-house development, broad cryptocurrency support, and data-driven game design, CryptoGames provides a gambling environment designed for informed decision-making and long-term value.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Cardano Price Near Breakout as Selling Hits 6-Month Low

The Cardano price is down nearly 4% over the past 24 hours and remains about 33% lower over the past month. Despite this weakness, several technical and on-chain signals suggest that selling pressure is fading.

The share of ADA supply in profit has dropped by roughly 75% since January, sharply reducing profit-taking incentives. At the same time, a potential reversal pattern is forming on lower time frames. Together, these signals raise a key question: is this Charles Hoskinson-led token preparing for a rebound toward $0.34, or is this just another failed recovery attempt?

Sponsored

Sponsored

Inverse Pattern And Divergence Hint At Buyers Regaining Control

On the 4-hour chart, Cardano is forming an inverse head-and-shoulders pattern. This structure often appears near local bottoms and signals that sellers may be losing control. It consists of a left shoulder, a deeper central low, and a higher right shoulder.

In this case, the neckline is sloping downward. A downward-sloping neckline makes breakouts harder because buyers must push through falling resistance. For this pattern to activate, ADA needs a clear four-hour close above the $0.275–$0.280 zone.

A momentum indicator, the Relative Strength Index (RSI), also supports this early recovery attempt. Between January 31 and February 9, Cardano seems to be printing lower lows on price, while the Relative Strength Index or RSI is printing higher lows. This developing bullish divergence shows that selling pressure is weakening even as price tests new short-term lows.

The divergence signal would confirm if the next ADA price candle forms above $0.259.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, sellers are becoming less aggressive. Buyers are slowly stepping in. But this setup only works if demand continues to build. Without follow-through, these patterns usually fail. That brings attention to whether sellers still have strong reasons to exit.

Sponsored

Sponsored

Profit-Taking and Coin Activity Have Collapsed, Reducing Sell Pressure

On-chain data shows that selling incentives have dropped sharply over the past month.

The percentage of total ADA supply in profit has fallen from above 33% in mid-January to about 8% in early February. That represents a decline of roughly 75%. It places profitable supply close to its lowest level in six months.

When so few holders are in profit, fewer investors are motivated to sell into small rallies. Most are either at break-even or sitting on losses. This reduces natural selling pressure.

Another supportive signal comes from spent coins age data, which tracks how many coins, across old and young cohorts, are being moved. During the February 6 sell-off, coin activity surged to around 168 million ADA. Since then, it has dropped to roughly 92 million. That is a decline of about 45%.

Sponsored

Sponsored

This shows that long-term holders are no longer rushing to move or sell their coins. Panic-driven exits have slowed. Many investors are choosing to wait. When falling profit supply aligns with declining coin movement, it usually means distribution is easing. This does not guarantee a rally, but it creates space for one to develop.

With fewer motivated sellers, the next move depends mainly on buyer strength.

Volume and Cardano Price Levels Will Decide If $0.34 Comes Into Play

Despite improving structure and weaker selling pressure, buying strength remains limited.

On-Balance Volume, which tracks whether volume supports rising or falling prices, is still trending lower. It remains below a descending trendline. This shows that recent rebounds have not been supported by sustained demand.

Sponsored

Sponsored

The last major surge in buying happened on February 6, when ADA rallied from near $0.220 to around $0.285 in one day, almost 30%. Volume expanded sharply during that move. Since then, participation has cooled.

For a true breakout to develop, volume must expand again and push OBV above its downtrend. Without that, rallies are likely to fade. Key ADA price levels reflect this balance.

The first major resistance sits near $0.275. A confirmed break above this zone would validate the inverse pattern. Above that, $0.285 becomes the next hurdle. Clearing both would open the path toward $0.346, almost 30% from the pattern’s neckline.

On the downside, $0.259 is critical support. A break below this level would weaken the right shoulder and damage the bullish setup. Full invalidation occurs below $0.220, which would place the price back under the pattern’s base.

In simple terms, Cardano is approaching a decision point. Selling incentives have dropped about 75%. Coin activity has cooled. Momentum is improving. But volume has not yet confirmed buyer control.

If strong participation returns and $0.275 breaks, a move toward $0.34 ($0.346 to be exact) becomes realistic. If not, the ADA price risks drifting lower again.

Crypto World

Axie Infinity price jumps 15% after bounce, dead cat bounce risk remains

- AXS jumps over 15% after bouncing off $1.20 support amid rising trading activity.

- bAXS rollout and higher volume fuel rally, but broader market sentiment stays weak.

- Failure above $1.60 may signal a dead cat bounce, with downside risk toward $0.80.

Gaming token Axie Infinity is up by more than 15% in the past 24 hours as bulls show a notable bounce off the $1.20 support level.

The AXS price ticked up amid heightened trader activity, with the intraday surge pushing the cryptocurrency towards the top 100 by market capitalization.

However, with sentiment across the market still fragile, the big question is whether the upward move signals renewed bullish momentum or merely a fleeting “dead cat bounce”.

Why is Axie Infinity price up today?

AXS is among the top altcoin gainers with double-digit advances on February 9, 2026, posting gains that outpace all top 10 coins by market cap.

This outperformance coincides with Bitcoin’s steady hold above $70,000, bolstered by fresh institutional buying such as Binance’s acquisition of 4,225 BTC as it looks to convert its $1 billion SAFU Fund into BTC.

While the buying, much like Strategy’s (formerly known as MicoStrategy) BTC purchase over the past weeks, has not triggered bulls, stability has benefited small altcoins.

Notably, trader interest in AXS has also spiked following recent announcements from Sky Mavis, the developer behind Axie Infinity, regarding the rollout of bAXS.

The token offers in-ecosystem utility as well as staking and gameplay rewards, and bulls have shown excitement since the news.

What is bAXS and what can you do with it?

bAXS will do the same things as AXS: Use it to ascend, evolve, and breed axies.

Spend it in-game, forge new items on App.axie, and more.

Over time, we’ll also distribute most rewards in bAXS.

The difference between both tokens is… pic.twitter.com/X8kcpNTlGf

— Axie Infinity (@AxieInfinity) February 5, 2026

Axie Infinity price outlook: Momentum or dead cat bounce?

AXS recently surged to highs near $3 earlier in the year, before plummeting sharply amid last week’s market bloodbath.

The intraday gains of over 15% has therefore emboldened bulls, who targeted strength above $1.50.

Accompanied by a 250% spike in trading volume, AXS rose to above $1.56 as of writing.

The 4-hour chart shows a potential falling wedge breakout, with the RSI and MACD signaling room for more gains.

However, the broader crypto market remains mired in bearish sentiment.

Weakness, despite the impending bAXS airdrop, also saw bears retest the downtrend line from above $4.54.

Losses may mean fleeting gains or what analysts call a “dead cat bounce” scenario.

The outlook of the RSI on the 4-hour chart suggests fresh selling may strengthen this prospect.

In this case, a breakdown below the pivotal $1.20 support could accelerate downside momentum, potentially driving AXS toward lows of $0.80.

Prior accumulation zones sit here and might offer relief.

On the downside, a decisive close above $1.60 could invalidate the short-term bearish setup and allow buyers to test horizontal resistance near $3.00.

Crypto World

How 2 Wallet Errors and Phishing Attacks Cost Crypto Users $62M

Two crypto users lost $12.25 million and $50 million after copying incorrect wallet addresses.

In January, a crypto user lost $12.25 million by copying the wrong wallet address. In December as well, another one ended up losing $50 million in a similar way.

Together, the two incidents cost $62 million, according to the popular Web3 security solution, Scam Sniffer.

Crypto Blunders

Signature phishing attacks also surged in January. In fact, Scam Sniffer found that $6.27 million was stolen from 4,741 victims, which is a 207% increase from December. The largest cases involved $3.02 million from SLVon and XAUt via permit/increaseAllowance, and $1.08 million from aEthLBTC via permit.

Two wallets alone accounted for 65% of all phishing losses.

Address poisoning is a scam where attackers send small transactions from wallet addresses that closely resemble real ones, hoping users copy the wrong address from their transaction history. This can lead to funds being sent directly to scammers by mistake. Signature phishing further increases the risk by tricking users into signing malicious approvals that give attackers permission to move funds later. As such, these tactics rely on social engineering and human error, and may make even experienced users vulnerable.

In November last year, a crypto holder lost over $3 million worth of PYTH tokens after mistakenly sending funds to a scammer’s wallet. The error occurred when the victim copied a fake deposit address from their transaction history.

Blockchain analysts at Lookonchain said the attacker created a lookalike address matching the first four characters of the real wallet and sent a tiny SOL transaction to appear legitimate. The victim later transferred 7 million PYTH tokens without fully verifying the address and fell victim to an address poisoning attack. The transferred stash was worth about $3.08 million at that time.

You may also like:

Coordinated Multisig Scam Attempt

Amidst the growing frequency of such attacks, the non-custodial wallet, Safe, formerly known as Gnosis Safe, also issued a warning for its users about a large-scale address poisoning and social engineering campaign targeting multisig wallets. According to the platform, attackers created thousands of lookalike Safe addresses to trick users into sending funds to the wrong destination. It disclosed that the incident was not a protocol exploit, infrastructure breach, or smart contract vulnerability.

Safe identified around 5,000 malicious addresses, which have now been flagged and removed from the Safe Wallet interface to reduce the risk of accidental fund transfers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

McHenry predicts fast crypto deal as Witt brokers talks

Speaking on CoinDesk Live at the Ondo Summit in New York City, former House Financial Services Chair Patrick McHenry and White House advisor Patrick Witt said a sweeping crypto market structure bill could pass within months.

Latest developments: Optimism is rising across Washington and industry.

- McHenry and Witt discussed the growing momentum for landmark crypto legislation, even as debates intensify over yield, DeFi, and ethics.

- McHenry predicted a finalized market structure bill could reach the president’s desk by Memorial Day.

- Witt said President Trump has personally prioritized the legislation following passage of the Genius Act.

Inside the White House push: Negotiations are narrowing.

- Witt said a recent White House–brokered meeting on stablecoin yield surfaced “new areas of agreement” while clearly defining remaining red lines.

- He said the administration’s goal is to move from high-level principles to drafting actual legislative language.

- Witt emphasized his role is to broker a deal that can survive both Senate and House scrutiny.

The sticking point: Stablecoin yield is the biggest unresolved issue.

- Witt said there is broad agreement on banning deceptive practices, including marketing stablecoins as FDIC-insured deposits.

- The dispute centers on whether centralized exchanges should be allowed to pay passive yield on idle stablecoin balances.

- Banks, especially community lenders, see yield as a threat to deposit funding, while crypto firms argue yield drives platform engagement.

Why DeFi matters: McHenry says it’s foundational.

- McHenry said market structure legislation “doesn’t work without DeFi.”

- He argued decentralization is the source of crypto’s efficiency, transparency and lower costs compared with traditional finance.

- McHenry said tokenized lending products are already cheaper than traditional securities lending, signaling strong market demand.

The politics: Ethics concerns loom but may not block passage.

- McHenry said ethics rules should apply permanently to all officials, not target any single administration or family.

- Witt said some Democratic proposals would have imposed sweeping restrictions on officials’ spouses and were “grossly over-scoped.”

- Both said a narrower ethics compromise could still unlock bipartisan support, though Republicans could move the bill forward on partisan votes if needed.

What comes next: A compressed legislative timeline.

- Witt said drafting teams are now “trading paper” and working through specific statutory language.

- He said the White House is pushing banks and crypto firms to negotiate in good faith.

- McHenry said Senate action could come before Easter, setting up a rapid sprint toward final passage.

Watch CoinDesk Live from Ondo Summit here.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

Bitcoin (BTC) is trading above $70,000 as traders attempt to stabilize price action following the sharp sell-off last Friday, which briefly pushed BTC below $60,000 and erased nearly $10,000 in a single session.

Onchain data shows long-term holders (LTHs) reduced exposure at the fastest pace since December 2024, but the total supply held by long-term investors continued to rise in 2026, a divergence that may indicate traders repositioning and what may prove to be discounted Bitcoin.

Key takeaways:

-

Bitcoin long-term holders recorded a –245,000 BTC net position change last week, the largest daily outflow since December 2024.

-

Despite selling, LTH supply rose to 13.81 million from 13.63 million BTC in 2026, showing investors believe the sell-off generated discounted buying opportunities.

Bitcoin distribution rises, but supply continues to age

Glassnode data shows that the BTC LTH net-position change over 30 days reduced exposure by 245,000 BTC last Thursday, marking a cycle-relative extreme in daily distribution. Similar spikes in LTH net position change appeared during the corrective phases in 2019 and mid-2021, when prices consolidated rather than transitioning into downtrends.

Meanwhile, CryptoQuant data shows total LTH supply increased to 13.81 million from 13.63 million BTC in 2026, despite the ongoing distribution. This divergence reflects the time-based nature of LTH classification.

As the short-term holders reduce trading activity during periods of uncertainty, supply continues to age into long-term status. As a result, the LTH supply can rise even while older cohorts sell.

The long-term holder spent-output profit ratio (SOPR) regained a position above 1 on Monday, signaling recovery after a period of realized losses. With Bitcoin above the overall realized price of $55,000, this condition may be aligned with a base or bottom building phase.

Related: Bitcoin whales took advantage of $60K price dip, scooping up 40K BTC

Macro conditions continue to dominate near-term risk

Macroeconomic factors may remain the main driver of near-term volatility, with January U.S. Consumer Price Index (CPI) data due Wednesday amid elevated policy uncertainty.

Markets currently assign 82.2% odds of no rate cut at the March Federal Open Market Committee (FOMC) meeting, according to CME FedWatch, reflecting persistent inflation pressure and a restrictive policy outlook.

Uncertainty around Kevin Warsh’s anticipated appointment as the US Federal Reserve chair has added pressure to risk assets. Elevated treasury yields and tight financial conditions continue to pressure risk assets, with the US 10-year yield holding near multi-month highs of 4.22% and credit spreads remaining compressed. Periods of high real yields have coincided with lower crypto liquidity and muted BTC spot demand.

Meanwhile, the US dollar index (DXY) has dropped below 97 on Monday, after rebounding from January lows, remaining a key source of volatility for Bitcoin.

Related: BTC traders wait for $50K bottom: Five things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

ETH price moved above $2,150 as Bitcoin and US stock markets rallied, but does data show whether derivatives traders have turned bullish yet?

Key takeaways:

-

Ethereum maintains dominance in its total value locked metric, yet faces scrutiny over layer-2 scaling.

-

ETH inflation rose to 0.8% as onchain activity slowed, while US macroeconomic fears kept the derivatives markets in bearish territory.

Ether (ETH) price managed to reclaim the $2,100 level following a 43% crash over nine days that culminated in the altcoin making a $1,750 low on Friday. Despite a 22% relief bounce after hitting its lowest price since April 2025, ETH derivatives markets continue to reflect investors’ fear of further downside. Regardless of whether the macroeconomic environment is driving investor concerns, the odds of sustainable bullish momentum for ETH in the short term remain dim.

ETH monthly futures traded at a 3% premium relative to regular spot markets on Monday, which is below the 5% neutral threshold. This lack of optimism among Ether traders has been constant over the past month, showing no signs of improvement even as the price dropped toward $1,800. Unless bulls step in to demonstrate a strong appetite for risk at these levels, bears will likely remain in control.

ETH has underperformed the broader cryptocurrency market capitalization by 9% in 2026, leading investors to question what is driving capital away. From a broader perspective, the declining interest in decentralized applications (DApps) is not exclusive to Ethereum. The network remains the dominant leader in Total Value Locked (TVL) and fee generation when aggregating its layer-2 solutions.

Deposits on the Ethereum base layer account for 58% of the entire blockchain industry; that figure surpasses 65% when including Base, Arbitrum, and Optimism. For instance, the largest application on Solana hardly exceeds $2 billion in deposits. By comparison, the largest DApp on the Ethereum base layer holds over $23 billion in TVL. Solana’s Jupiter would not even crack the top 14 on Ethereum.

ETH supply growth and layer-2 subsidies remain problematic

The Ethereum base layer ranked third in network fees, generating $19 million over 30 days, while the layer-2 ecosystem contributed another $14.6 million. Ethereum has faced criticism for heavily subsidizing scalability via optimistic rollups—a strategy Vitalik Buterin himself admitted needs adjustment. The Ethereum co-founder argued on Tuesday that the network should prioritize base layer scalability.

According to Buterin, the layer-2 path to decentralization turned out more difficult than anticipated. The present solutions reportedly rely on multisig-controlled bridges, which does not meet security standards required by Ethereum’s original vision. Buterin notes that this is not the end game for layer-2 as demand for networks offering privacy features and application-specific design will continue to exist, especially for non-financial use cases.

Related: Vitalik draws line between ‘real DeFi’ and centralized yield stablecoins

Part of investor disappointment can be explained by the failure of Ether’s strategy to become deflationary, which is a secondary effect of reduced Ethereum network activity. The built-in burn mechanism depends on demand for base layer data processing; without it, there is a net increase in the ETH supply. The annualized growth of the total ETH issued reached 0.8% over the last 30 days, a significant jump from one year prior when equivalent inflation was near 0%.

Ether traders remain skeptical that a sustainable rally can occur in the near term due to increased uncertainty in the US job market and the long-term sustainability of investments in artificial intelligence infrastructure. Consequently, the weak ETH derivatives markets are a reflection of generalized risk aversion and a slowdown in onchain activity—factors that will likely take more time to stabilize.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

AI Deepfake Videos of Binance’s CZ and Yi He Flood Crypto Twitter

AI-generated deepfake videos portraying former Binance CEO Changpeng Zhao and Yi He have flooded Crypto Twitter. This has sparked debate over how far artificial intelligence has advanced in replicating real crypto figures.

The short videos, styled as dramatic “internal affairs” mini-series, use highly realistic AI avatars modeled on Zhao and Yi He, complete with lifelike voices, facial expressions, and emotional delivery.

Sponsored

Sponsored

While many users have clearly labeled the videos as AI-generated satire, the quality of the videos has shocked parts of the crypto community. Several clips circulated widely across X throughout the day, with users noting that the visuals and dialogue now rival professional studio productions.

Deepfakes and Crypto’s Growing Problem

Zhao and Yi He, who co-founded Binance in 2017, have long been known to share both a close professional partnership and a personal relationship.

The videos lightly reference that dynamic but focus primarily on imagined corporate tensions rather than real-world events.

Neither Zhao nor Yi He has publicly commented on the videos.

Sponsored

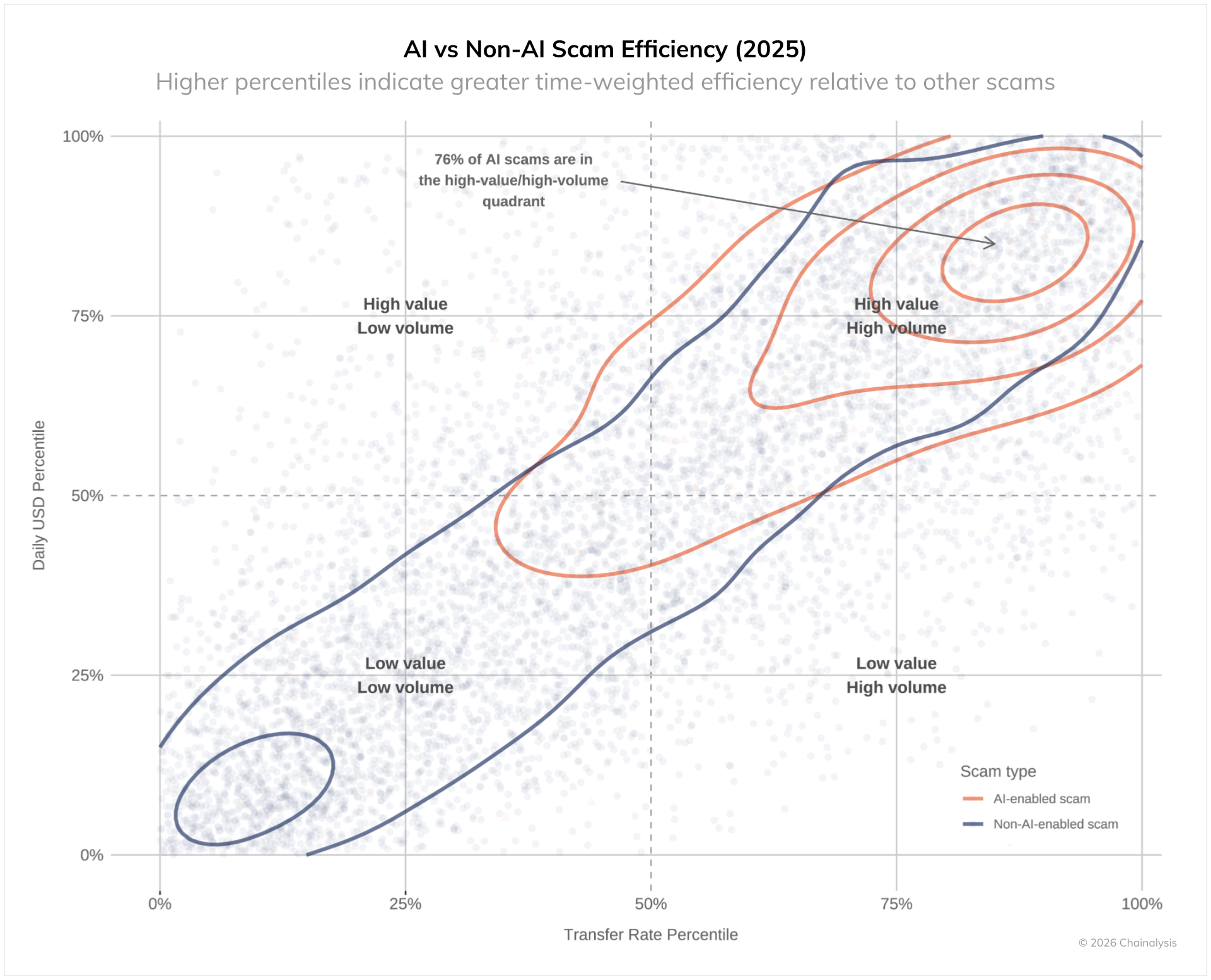

The viral clips arrive amid a broader surge in AI-driven deepfake content across the crypto sector.

In recent months, researchers have warned that crypto remains the most targeted industry for deepfake impersonation.

AI-generated videos, voice cloning, and synthetic avatars are increasingly used in scams impersonating founders, executives, and influencers.

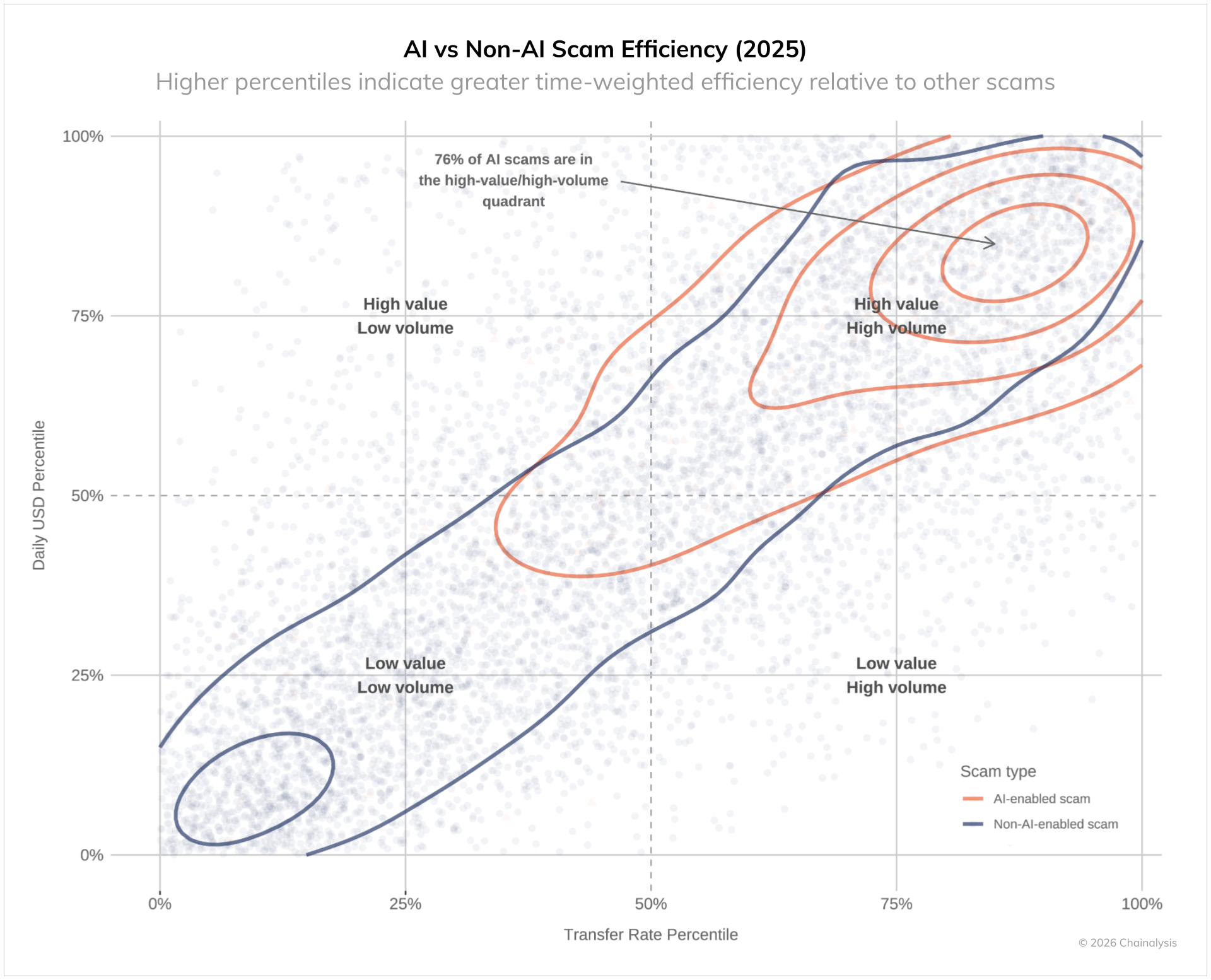

According to Chainalysis, AI-generated impersonation scams surged by more than 1,400% in 2025. Law enforcement agencies have also warned that the line between satire, misinformation, and outright fraud is becoming harder to detect as generative AI improves.

A New Cultural Flashpoint

In this case, the Binance videos appear designed for entertainment rather than deception. However, their realism underscores how easily similar tools could be weaponized for market manipulation or investment fraud.

As deepfake technology becomes cheaper and more accessible, the crypto industry faces growing pressure to educate users on verification and digital literacy.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat4 hours ago

NewsBeat4 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports20 hours ago

Sports20 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat15 hours ago

NewsBeat15 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports3 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know