Crypto World

MARA Holdings Secures 64% Stake in Exaion to Drive European AI Data Center Growth

TLDR:

- MARA France completed a 64% majority acquisition of Exaion after securing all required regulatory approvals.

- NJJ Capital acquired a 10% stake in MARA France, strengthening the deal’s local French investment structure.

- Fred Thiel and Xavier Niel will both serve on Exaion’s board, representing key stakeholders across the partnership.

- The three-way deal aims to position Exaion as a leading European player in secure cloud and HPC services.

MARA Holdings has completed its acquisition of a 64% majority stake in Exaion, a French high-performance computing firm.

EDF Pulse Ventures, the investment arm of EDF Group, partnered with MARA and NJJ Capital to support this deal.

The transaction, initially agreed upon on August 11, 2025, received all required regulatory approvals before closing. EDF Group continues as both a minority shareholder and a customer of the company.

MARA and EDF Pulse Ventures Formalize a Strategic Alliance

Through this agreement, MARA France completed the acquisition after fulfilling all conditions precedent. The deal marks a notable step for MARA beyond its core Bitcoin mining operations.

Exaion develops and operates high-performance computing data centers based in France. The company also provides secure cloud services and artificial intelligence infrastructure to its clients.

Fred Thiel, Chairman and CEO of MARA, addressed the partnership’s broader purpose at the time of the initial announcement. “Our partnership with Exaion would bring together two global leaders in data center development and digital energy,” Thiel said.

“As data protection and energy efficiency become top priorities for both governments and enterprises, MARA and Exaion’s combined expertise would enable us to deliver secure and scalable cloud solutions built for the future of AI.” His statement laid out the strategic vision that drove the months-long approval process.

As part of the transaction, NJJ Capital acquired a 10% stake in MARA France. NJJ Capital is a holding company closely associated with French billionaire Xavier Niel.

This stake positions NJJ as a key strategic partner alongside MARA in the French market. The arrangement also brought additional regulatory confidence, as France required a local investor to participate before granting its approval.

Exaion’s Board of Directors will reflect the new ownership structure going forward. MARA Inc will appoint three representatives, EDF Pulse Ventures will appoint three, and NJJ will appoint one, with Exaion’s CEO and co-founder also holding a seat.

Xavier Niel and Fred Thiel will both serve on the board. This governance model ensures every major stakeholder has a direct voice in Exaion’s direction.

Exaion Eyes European Leadership in Digital Infrastructure

The core aim of this three-way partnership is to accelerate Exaion’s expansion across Europe. MARA, EDF, and NJJ together plan to strengthen Exaion’s capabilities in HPC and secure cloud services.

The partnership is specifically designed to position Exaion as a European leader in digital infrastructure. This goal has been central to all three partners since the deal was first structured.

Julien Villeret, Head of Innovation at EDF Group, commented on EDF’s role in enabling this transition. “Since its creation in 2020, EDF Pulse Ventures has supported Exaion’s growth and the development of its cutting-edge digital technologies,” Villeret said.

“This transaction would mark a new chapter, as Exaion would join forces with a seasoned global tech partner, while maintaining a collaborative relationship with the EDF Group.” He further described it as a major opportunity for Exaion to accelerate its international development.

The deal also carried strong backing from the French government. France’s Finance Minister Roland Lescure described the deal as a confirmation of the country’s ability to attract international capital without relinquishing control over its strategic assets, noting that the agreement guarantees the protection of national interests and technological sovereignty.

His remarks reflected France’s careful approach to approving the foreign acquisition.

MARA’s move into AI data centers reflects a broader trend among crypto mining companies. Bitcoin miners have been redirecting computational resources toward AI and HPC workloads.

This transition allows companies to diversify revenue beyond cryptocurrency market cycles. The MARA-Exaion deal fits directly within that wider industry pattern, combining energy expertise, digital infrastructure, and computing capacity under one strategic alliance.

Crypto World

Bitcoin Price Analysis: How Important Is It for BTC to Reclaim the $70K Resistance?

Bitcoin’s recent breakdown toward the $60K region triggered aggressive volatility, and the asset is now attempting to stabilize near a key demand base. Both higher- and lower-timeframe indicators suggest the market is approaching a decision point, with leverage dynamics adding another layer of sensitivity.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin continues to trade within a well-defined descending channel, consistently forming lower highs and lower lows. The recent sell-off drove price directly into the $60K–$63K demand zone, where buyers reacted and prevented an immediate continuation lower.

However, the broader structure remains bearish. The price is still below the 100-day and 200-day moving averages, both of which are sloping downward and acting as dynamic resistance. The $75K–$80K region now stands as a significant supply zone, aligning with prior breakdown structure and acting as the first major obstacle in case of a recovery.

As long as BTC remains capped below the mid-channel resistance and the moving averages, any rebound should be considered corrective. A sustained hold above the $60K base is critical; otherwise, renewed selling pressure could push the price toward deeper levels within the channel.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, Bitcoin is consolidating inside a tightening symmetrical triangle following the sharp rebound from the $60K low. The structure reflects short-term equilibrium after extreme volatility, with the upper boundary acting as dynamic resistance and the ascending lower trendline providing near-term support.

The asset is currently compressing near the apex, signaling that a breakout is likely imminent. A bullish breakout above the triangle could trigger a move toward the $74K–$76K resistance zone, which aligns with the previous breakdown area and local supply. On the other hand, a downside break would expose the $60K demand region once again and potentially open the door for a deeper liquidity sweep.

Sentiment Analysis

The Estimated Leverage Ratio on Binance has recently declined sharply alongside price, indicating that a significant portion of leveraged positions has been flushed from the market. This deleveraging phase reduces immediate systemic risk and suggests that some excess speculative exposure has already been cleared.

Currently, leverage levels are stabilizing at relatively lower readings compared to prior peaks. While this reduces the probability of an aggressive long squeeze in the immediate term, it also means that any new expansion in leverage could amplify the next breakout from the current consolidation.

Overall, Bitcoin is at a technically sensitive level. The price is consolidating above a major daily demand zone, the short-term structure is compressing, and leverage has reset. The next directional move will likely be driven by a decisive breakout from the 4-hour triangle, with $60K as the key downside pivot and the $75K region as the first major upside barrier.

The post Bitcoin Price Analysis: How Important Is It for BTC to Reclaim the $70K Resistance? appeared first on CryptoPotato.

Crypto World

Cardano (ADA) Trading Activity Hits 6-Month Low as Mutuum Finance (MUTM) Gains Attention After Testnet Launch

Trading activity for Cardano (ADA) has fallen to a six-month low. Analysts note that ADA’s liquidity and on-chain engagement have cooled, highlighting a period of stagnation for one of the crypto market’s early blue-chip assets. In contrast, Mutuum Finance (MUTM) has garnered attention following the launch of its testnet. The new crypto offers a protocol that allows users to lend and borrow in a non-custodial manner.

Cardano Sees Sharply Reduced Trading Activity

Cardano (ADA) has experienced a slowdown in market activity over the past six months. Weekly decentralized exchange trading volume has dropped over 94% from 19.1 million ADA in August 2025 to just 1.17 million ADA by mid-February 2026. This decline mirrors the token’s price, which has retraced 68% over the same period.

Despite this weakness, early signs of a potential recovery are emerging. Cardano’s daily chart now shows an inverse head-and-shoulders formation. However, the increase in profitable supply from 6% to around 10% introduces profit-taking risks, as some investors may sell when returns are regained. While Cardano battles fading investor interest, DeFi crypto Mutuum Finance experiences the exact opposite. Its presale continues to see growing investor attention.

Mutuum Finance Presale Maintains Strong Momentum

Mutuum Finance draws strong investor interest following its public debut on the Sepolia testnet in 2026. Now in Phase 7, the token is priced at $0.04, a 4x increase from $0.01 in phase one. The current phase presents a narrowing entry window, with a limited allocation remaining for presale participants and a confirmed listing price of $0.06. The presale features gradual price increases, including a 20% jump in the upcoming phase. This approach rewards early participation, while delayed entry means paying more for the same number of tokens.

Mutuum Finance has officially launched its V1 Protocol on the Sepolia testnet, allowing users to interact with the platform in a safe testing environment using test tokens instead of real funds. This testnet enables participants to explore the protocol’s lending, borrowing, and staking features while helping the team refine performance and security before the mainnet goes live.

Core features available on the testnet include:

- Liquidity pools and mtTokens, which are receipt tokens that track deposits, interest, and lending activity within the protocol.

- Debt tokens that represent borrowers’ loan positions.

- A liquidator bot that automatically protects the protocol by liquidating unsafe loans if collateral levels drop too low.

- A Portfolio dashboard where investors can monitor deposits, loans, and collateral levels

- Support for ETH, USDT, LINK & WBTC assets

Why the testnet launch is important

- It validates the protocol before mainnet launch

- It allows users to test features without financial risk

- It helps identify bugs and improve security

- Builds trust and transparency

- Demonstrates that the platform is functional

Looking ahead, Mutuum Finance plans multichain deployment and Layer-2 integration to enhance transaction speed and accessibility when the protocol goes live. The presale has drawn participation from over 19,020 investors, with the testnet debut recently sending the funds raised past $20.60 million.

Collateral-Backed Lending Supports Stability

Mutuum Finance features a native stablecoin designed to provide stability for DeFi participants. Users can deposit other assets as collateral to mint the stablecoin and receive corresponding debt tokens that represent their obligations. This ensures all issued stablecoins are fully backed.

A user may, for instance, deposit 4,500 USDC as collateral to mint 4,000 units of the Mutuum Finance stablecoin. Over time, this loan may gain a $500 borrow interest. Once the borrower settles the loan, the 5,000 units of the Mutuum Finance stablecoin (4,500 loan plus 500 interest) are removed from circulation, and the corresponding debt tokens are destroyed, releasing the 4,500 USDC collateral back to the user. This mechanism maintains solvency and transparency while supporting flexible borrowing.

Peer-to-Peer Lending Expands Investment Options

Mutuum Finance offers Peer-to-Contract (P2C) and Peer-to-Peer (P2P) lending. P2C follows a pool-based lending model in which lenders deposit funds into shared liquidity pools, and borrowers access loans from these pools while paying interest. P2P allows users to create customized lending agreements outside liquidity pools, providing flexibility for volatile assets.

For example, an investor could offer $12,000 worth of a volatile token, such as PEPE, as collateral for an $8,000 USDT loan at 13% borrow APY. A lender will then review and accept these agreements, enabling tailored opportunities.

As Cardano’s trading activity hits a six-month low with DEX volume down 94%, investor attention is shifting toward Mutuum Finance (MUTM), a new crypto in presale. The DeFi crypto is gaining attention following its testnet launch, with presale funds now exceeding $20.62 million. Its $0.04 token price represents a discounted entry with strong growth potential ahead. This positions it as a strong alternative while legacy assets like ADA experience slow growth.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

ProShares Stablecoin ETF Breaks Records, But There’s a Twist

The ProShares GENIUS Money Market ETF (IQMM) shattered all records by logging $17 billion in first-day trading volume. The ETF invests in very short-term US government debt, making it extremely low risk and similar to holding cash.

This ETF is designed so institutions, including stablecoin issuers, can use it as a safe place to store money while earning a small yield. However, market structure experts warn the staggering sum reflects a massive, behind-the-scenes corporate treasury migration rather than a sudden wave of retail investor mania.

IQMM’s Historic Launch Redraws How Stablecoin Issuers Hold Dollar Reserves

Bloomberg Senior ETF Analyst Eric Balchunas noted that BlackRock’s highly successful Bitcoin fund, IBIT, only pulled then the unprecedented $1 billion in day-one volume. IBIT is the largest Bitcoin fund with over $50 billion in assets.

However, Balchunas stated that IQMM’s launch is “multitudes beyond the all-time record for an ETF.”

“I was wrong about this ETF, I just figured it would be niche at best as people would use $BIL or $SHV as money market substitutes,” he wrote on the social media platform X.

According to him, the fund appears to be a textbook example of a “bring your own assets” strategy, in which an institutional client pre-arranges the transfer of existing off-balance-sheet capital into a newly regulated wrapper.

Initially, industry experts assumed ProShares had secured a lucrative deal with a major stablecoin issuer, such as Boston-based Circle.

“Would assume ProShares cut a deal with one of the major US-based stablecoin issuers. Looking at assets, believe that would only leave Circle,” Nate Geraci, president of NovaDius Wealth Management, claimed.

This is because IQMM is not a standard cash-equivalent fund as it is a purpose-built regulatory compliance vehicle. It was designed specifically to meet the strict legal reserve requirements established by the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act.

Signed into law last year, the legislation mandates that domestic stablecoin issuers maintain one-to-one backing with highly liquid assets. It also strictly caps eligible US Treasury maturities at 93 days to prevent forced selling during periods of market stress.

However, Balchunas later clarified the true, decidedly less glamorous source of the record-breaking inflow.

“The call is coming from inside the house, literally, ProShares own funds are all now using IQMM now for their cash positions. Big time BYOA and not as exciting but arguably smart vs paying another fund co,” he added.

Still, crypto research firm 10X Research said the IQMM’s record launch proves that stablecoin reserves could rapidly migrate into transparent structures.

According to the firm, ProShares’ IQMM represents an unprecedented bridge between traditional financial markets and the digital asset economy.

The fund allows stablecoin issuers to park their dollar reserves in a highly liquid, transparent, and heavily regulated ETF wrapper, rather than shouldering the operational burden of managing complex, private portfolios.

“This is massive because it institutionalizes stablecoin backing, reduces opacity risk, and could channel hundreds of billions of dollars in digital dollar reserves directly into Treasury markets under the GENIUS framework,” the firm added.

By institutionalizing stablecoin backing, the traditional US financial system has effectively pulled crypto’s monetary base onshore.

Crypto World

Kiyosaki Explains Why He Bought More BTC and When Bitcoin Will Become Better Than Gold

The flipping point between the two investment assets is close, Kiyosaki said. But, it could be a century away in reality.

The famed New York best-selling author made the headlines on Friday again as he outlined his latest bitcoin purchase, and doubled down on his belief that BTC is (or will eventually) be a better investment option than gold.

It’s worth noting that some of Kiyosaki’s recent statements have caused significant backlash due to a lack of consistency, and some interpreted them as simply false.

Bought 1 More BTC

The author of the Rich Dad, Poor Dad series took it to X to highlight his latest purchase of a whole bitcoin for $67,000. He outlined two major reasons for his decision now:

# 1: Because the Big Print will begin when the US debt crashes the dollar and “The Marxist Fed” begins printing trillions in fake dollars.

#2: The magical 21 millionth Bitcoin is getting close to being mined.

Moreover, he noted that once the last BTC is mined, the cryptocurrency “becomes better than gold.” Now, there are a couple of things we need to address for this statement. First, yes, it might sound as if this moment is close, given the fact that nearly 20 million bitcoins have already been mined.

However, due to the unique way the Bitcoin network works, the last million will be the hardest to mine and will take a long, long time. Probably so long that most of us won’t be here for that pivotal moment.

The incorporation of a halving event that cuts the mining speed in half every roughly four years ensures that the mining of new BTC will gradually decline over time. Consequently, current estimates indicate that the last bitcoin will be mined around 2140. In other words, Kiyosaki will be almost 200 years old at the time (he was born in 1947).

Second, he now says that BTC will become better than gold once the last bitcoin is mined. However, in a post from just a couple of weeks ago, he said he would opt for BTC every time if he had to choose between the two, as by design, there can only be 21 million (no mention of the last bitcoin to be mined).

You may also like:

At What Price Did You Buy?

Again in February, another of his statements led multiple people on X to scratch their heads. He said at the time that he stopped buying BTC at $6,000. However, in many, many other posts, he was bragging about purchasing more bitcoins at prices of well over $100,000.

Naturally, the ever-vigilant crypto community picked up the inconsistency in his words, and the backlash was severe. Nevertheless, there was no response from the famed investor.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

IoTeX Investigates Token Safe Incident as Analysts Estimate $4.3M Loss

Decentralized identity protocol IoTeX has confirmed that it is investigating unusual activity tied to one of its token safes after onchain analysts flagged a possible security incident.

In a Saturday post on X, the project said its team was “fully engaged, working around the clock to assess and contain the situation.” IoTeX added that early estimates indicate the potential loss is lower than circulating rumors and that it has coordinated with major exchanges and security partners to trace and freeze funds linked to the attacker.

“The situation is under control. We will continue to monitor closely and provide timely updates to the community,” the project said.

IoTeX’s native token (IOTX) dropped following the incident, with the price sliding more than 8% over 24 hours to around $0.0049, according to data from CoinMarketCap.

Related: CertiK links $63M in Tornado Cash deposits to $282M wallet compromise

Analyst says compromised key drained $4.3 million

The response came after onchain investigator Specter claimed a private key connected to the safe may have been compromised.

The onchain sleuth revealed that the wallet was drained of several tokens, including USDC (USDC), USDt (USDT), IoTeX (IOTX) and wrapped Bitcoin (WBTC), with losses estimated at roughly $4.3 million. The stolen funds were reportedly swapped into Ether (ETH), and about 45 ETH was bridged to Bitcoin.

The analyst also published addresses associated with the suspected attacker, alongside transaction records showing rapid movements through decentralized exchanges and token swaps. The activity suggested an attempt to convert assets quickly and move them across chains to complicate recovery efforts.

Related: SwapNet exploit drains up to $13.3M from Matcha Meta users

Most crypto projects don’t recover from hacks

As Cointelegraph reported, nearly 80% of crypto projects hit by major hacks struggle to recover, largely due to mismanaged responses rather than the immediate financial damage, according to Web3 security leaders. Immunefi CEO Mitchell Amador said many teams are unprepared for breaches, leading to delayed decisions and poor communication during the crucial early hours, which worsens losses and shakes user confidence.

Even after technical fixes are implemented, the reputational impact can linger. Kerberus CEO Alex Katz noted that serious exploits often result in users withdrawing funds, declining liquidity and long-term credibility damage that projects rarely overcome.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Tech-Led Stock Rally Fails to Lift Crypto as Ether, XRP, and Solana Slide

19 Febuary 2026

Key Takeaways

- Major cryptocurrencies declined even though there was an increase in Asian and U.S. stock markets based on technology.

- Weakness was attributed to the appreciation of the dollar and insecurities regarding interest rate policy of the Federal Reserve.

- Crypto rallies are not sustained since market demand is very poor and unreliable.

- Gold is still doing well as a safe haven, which undermines the bitcoin story of digital gold.

Large cryptocurrencies lost ground on Thursday, Ether, XRP, and Solana performed the worst, despite the rise of Asian and U.S. equities after a fresh surge in technology stocks optimism. Market data indicated that bitcoin was trading close to $66,700, about 1.7 per cent below in 24 hours whereas ether fell to approximately $1,965. XRP dropped almost 5 percent, Solana fell nearly 4 percent and BNB and Dogecoin were also trading in the red which is an indication of widespread weakness and not a token issue.

The pullback was achieved against the improvement of regional equities. Asian markets saw gains in thin holiday trading, which Asian markets were boosted by strength in technology stocks, and U.S. stocks regained their footing following the signing of a multi-year deal by Nvidia to provide AI chips to Meta Platforms. Regional indices followed by MSCI had recorded slight improvements, indicating the improvement in sentiment in the traditional markets.

Crypto, nevertheless, was not a part of the rally. Rebounds of prices in the recent past have been there in a few seconds and there have been consistent selling pressures anytime the momentum is lost. Although the market has ceased to break sharply as it was the case at the beginning of the year, it is also not performing at the current spot level that can sustain a more permanent recovery.

One of the factors that have contributed to the weakness is the stronger U.S. dollar, which strengthened following minutes presented by the Federal Reserve, which stated that policymakers were not in a rush to reduce the interest rates. Certain authorities even indicated that there would be potential increases in case inflation would be intractable. The stronger dollar generally squeezes the liquidity of the world, which puts a heavy burden on risk assets like crypto-currencies.

Conversely, gold has remained relatively strong as investors look to its conventional safe havens amid confusion on geopolitics, monetary policy and inflation. This schism has deepened the controversy around the long-standing bitcoin story of digital gold because the cryptocurrency continues to be even more volatile than the precious metal during macro stress.

Alex Tsepaev, the chief strategy officer of B2PRIME Group, says the resilience of gold can be explained by the fact that investors want to be simple in unstable markets.

“I believe that gold will continue to be a default haven and will probably attempt to break through the tough $5,000–$5,100 ceiling. That said, once risk appetite returns, ETF flows stabilize, and U.S. regulations stop dragging, Bitcoin may recover considerably more quickly,” he said

“After all, Bitcoin attracts liquidity faster than gold, partly because it’s still sometimes referred to as a speculative asset.”

In the meantime, geopolitical risks are also in the spotlight due to the continued U.S.-Iran tensions accompanied by the high oil prices. It is against this background that cryptocurrencies are stuck between a series of relief rallies and a yet not fully conducive macroeconomic environment to maintain a long-term upside.

In the meantime, traders seem conservative. Interest rate uncertainty, a strong dollar, and traditional havens among investors are still head winds on crypto markets, as global equities sentiment improves, even though increasingly.

Crypto World

What’s Next for Crypto in EU After Lagarde Leaves?

European Central Bank (ECB) president Christine Lagarde is stepping down sometime before the French presidential election next year.

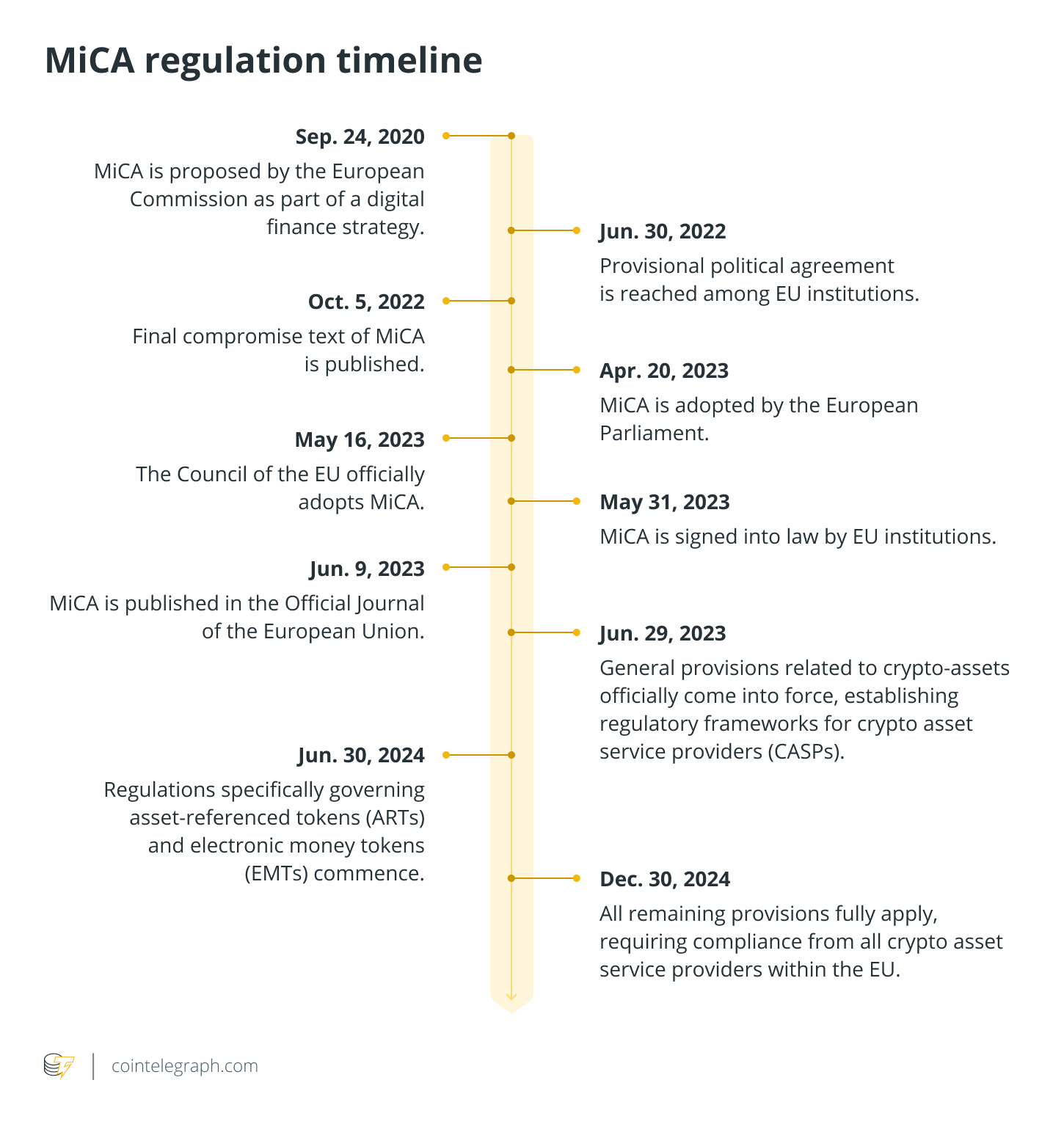

Under her leadership, the ECB has consulted on the Markets in Crypto Assets (MiCA) legislation that defined the crypto landscape in the European Union. The preeminent European bank also began work on the digital euro — the next iteration of the Eurozone’s currency.

But there is still work to be done on crypto policy in Europe. MiCA does not, in its current form, regulate decentralized finance (DeFi), and policymakers at the ECB are still deliberating over the digital euro’s final details.

While the exact timing of Lagarde’s departure has not yet been determined, observers are already speculating about who will take her place and how it will affect crypto policy in Europe.

Lagarde was a crypto-skeptic, critical of stablecoins

Like many central bankers, Lagarde has been cautious at best when it comes to cryptocurrencies. In 2022, she said regarding crypto, “My very humble assessment is that it is worth nothing.”

“It is based on nothing … There is no underlying asset to act as an anchor of safety.”

She said that crypto should be regulated, citing concern that investors did not understand the risks associated with crypto investing and would “lose it all.”

This set the tone for the ECB consultations on MiCA that would follow. The ECB itself does not create laws, but throughout the legislative process, the ECB advised, observed and offered comments, particularly over areas related to monetary policy and payments regulations.

Even after MiCA was passed, Lagarde advocated for tight regulations on stablecoins and aligning international standards. In September 2025, she called on lawmakers in Europe to provide safeguards for stablecoins and equivalence for foreign stablecoin issuers to prevent the risk of stablecoin runs.

“European legislation should ensure that such schemes cannot operate in the EU unless supported by robust equivalence regimes in other jurisdictions and safeguards relating to the transfer of assets between the EU and non-EU entities,” she said.

“This also highlights why international cooperation is indispensable. Without a level global playing field, risks will always seek the path of least resistance.”

She further stated that stablecoins are a threat to national sovereignty and turn money from a public good into a privately controlled enterprise.

“When stablecoins are left unchecked, we risk creating a system in which money is controlled by the private sector. That is not the mandate we were appointed to serve as public servants.”

Demand for digital cash and the euro

While a noted crypto skeptic, Lagarde acknowledged the demand for digital currencies back in 2021. In an interview that year at the World Economic Forum, Lagarde said, “If customers prefer to use digital currencies rather than have banknotes and cash available, it should be available.”

“We should respond to that demand and have a solution that is European based, that is secure, that is available, and friendly terms that can be used as a means of payment.” At the ECB level, this response took the form of the digital euro.

But the wheels of Brussels do not turn quickly. The investigation phase for a digital euro began all the way back in October 2021. In October 2025, the ECB completed the preparation phase when its governing council decided to start preparing for issuance.

The digital euro has faced harsh criticism, namely that it will give central banks yet another tool to monitor consumer behavior, control spending and eradicate anonymous transactions. There have also been concerns over offline operability and overreliance on digital systems.

The ECB claims that the digital euro will have strict privacy standards and that it will bring all the same benefits of cash to the digital monetary space. In October 2025, Lagarde said that the ECB wants to make the euro “fit for the future, redesigning and modernising our banknotes and preparing for the issuance of digital cash.”

Her colleague, ECB executive board member Piero Cipollone, iterated that the digital euro “will ensure that people enjoy the benefits of cash also in the digital era. In doing so, it will enhance the resilience of Europe’s payment landscape, lower costs for merchants, and create a platform for private companies to innovate, scale up and compete.”

New ECB frontrunners unlikely to depart from cautious stance

Lagarde’s decision to step down comes at a politically fraught time. Leaving before the next French presidential election will allow President Emmanuel Macron to participate in picking her replacement.

France is the second-largest economy in the EU, and according to Reuters, no ECB president has been picked without a nod from Paris.

The right-wing National Rally has been ascendant in the polls recently, while Macron has failed to offer stable governance, with seven different prime ministers serving under his tenure. National Rally president Jordan Bardella claims that, in choosing a new ECB president, Macron would be able to exercise influence beyond the end of his official term.

According to the Financial Times, the current frontrunners to replace Lagarde are former Spanish central bank governor Pablo Hernández de Cos and former Dutch central bank governor Klaas Knot.

In 2022, Hernández de Cos said at a Bank of International Settlements (BIS) conference that crypto can “pose highly significant risks that are hard to understand and measure, even for the most experienced agents.”

He called for a robust regulatory framework to transition crypto from “that hyperbolic ‘Wild West’ myth to a more desirable orderly ‘railroad of civilisation.’”

Knot has been similarly cautious. Speaking before the BIS in 2024, he acknowledged the possible benefits of certain aspects of blockchain technology.

Related: How euro stablecoins could address EU’s dollar concerns

“Creating a digital representation of an asset and placing it on a distributed ledger could bring benefits to the financial system. This includes efficiency gains and potentially increased liquidity of certain assets. Of course, there may also be risks for financial stability.”

Still, he stressed the regulators were assessing the implications these technologies would have on broader financial stability, stating that, “We cannot presume that this innovation, and potentially more decentralization, will bring significant benefits to the global financial system.”

In June 2025, he addressed stablecoins specifically. Knot said that whether the next form of money comes via stablecoins or already established payment networks “should be something we are agnostic on.”

While neutral on the manner of technology supporting financial innovation, he said that “fostering innovation must not come at the expense of stability.”

While often criticized for the glacial pace of progress, the EU managed to pass a comprehensive crypto framework earlier than the far more crypto-friendly United States. This framework included guidance and input from a crypto-cautious central bank, with a skeptic at the helm.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

SEC Just Made a Huge Change to American Stablecoins

The US Securities and Exchange Commission (SEC) has paved the way for Wall Street to integrate stablecoins into traditional finance.

On February 19, the financial regulator issued guidance allowing broker-dealers to apply a 2% “haircut” to positions in payment stablecoins. A haircut is the percentage of an asset’s value that a financial institution cannot count toward its deployable capital, acting as a customer-protection buffer against market risk.

SEC Stablecoin Pivot Pressures Brokers to Build Crypto Rails

Previously, broker-dealers faced a punitive 100% haircut on stablecoins. If a financial firm held $1 million in digital dollars to facilitate rapid on-chain settlement, it had to lock up that capital.

That requirement effectively made institutional crypto trading economically radioactive for traditional financial institutions.

By dropping the capital penalty to 2%, the SEC has granted compliant stablecoins the same economic treatment as traditional money market funds.

“This is another terrific step in the right direction from our team in the Division of Trading and Markets to remove barriers and unlock access to on-chain markets,” SEC Chair Paul Atkins said.

Interestingly, this pivot is heavily anchored in the newly passed GENIUS Act. This is a federal regulatory framework for payment stablecoins in the US. It mandates 1:1 reserve backing and strengthens anti-money laundering (AML) compliance.

SEC Commissioner Hester Peirce noted that the new legislation forces stringent reserve requirements for stablecoin issuers.

According to her, these requirements are even stricter than those applied to government money market funds, which justify the reduced capital penalty.

“Stablecoins are essential to transacting on blockchain rails. Using stablecoins will make it feasible for broker-dealers to engage in a broader range of business activities relating to tokenized securities and other crypto assets,” Peirce added.

In light of this, US-regulated entities such as Circle’s USDC could see substantial adoption from firms in the $6 trillion sector.

As a result, industry executives were quick to celebrate the digital asset industry’s shifting fortunes.

Exodus CEO JP Richardson called it the most important crypto win of the year. He argued it makes tokenized treasuries, equities, and on-chain settlement “economically viable overnight.”

“This puts pressure on every major broker-dealer to build stablecoin infrastructure or fall behind the ones who do. Because their competitors now can and there’s no longer a capital penalty that makes it uneconomical,” he explained.

Meanwhile, this approval continues the current SEC’s slew of pro-crypto regulations.

Over the past year, the SEC has launched a digital asset task force and initiated “Project Crypto” to modernize its rules. These efforts are designed to make the US the crypto capital of the world.

Crypto World

RWA Goes Mainstream: BlackRock and Apollo Plug Billions Into Uniswap and Morpho Protocols

TLDR:

- RWA integration reaches a new level as BlackRock’s $2.4B BUIDL fund goes live on UniswapX for 24/7 trading

- Apollo Global Management is authorized to acquire up to 90M MORPHO tokens over 48 months.

- MORPHO token surged 17.8% after Apollo’s formal cooperation agreement was publicly announced.

- Wall Street’s governance token purchases signal a major shift in institutional DeFi confidence.

RWA momentum reached a new milestone this week as BlackRock and Apollo Global Management moved beyond pilot programs into deep infrastructure integration.

BlackRock connected its tokenized fund to Uniswap’s trading rails, while Apollo signed a formal agreement with Morpho’s lending protocol.

Together, these moves mark a structural shift in how traditional asset managers are engaging with decentralized finance. Wall Street is no longer testing the waters; it is now actively building within them.

BlackRock Plugs BUIDL Into Uniswap’s Trading Infrastructure

BlackRock partnered with Securitize and Uniswap Labs to integrate its BUIDL fund into the UniswapX system. The fund currently holds approximately $2.4 billion in assets under management. Eligible institutional investors can now trade BUIDL against USDC around the clock, seven days a week.

Notably, the integration bypasses traditional AMM liquidity pools entirely. Instead, it uses UniswapX’s off-chain order routing system, which settles transactions on-chain.

Orders flow through a Request-for-Quote framework to whitelisted market makers, including Wintermute and Flowdesk, acting as solvers.

Sentora’s newsletter captured the weight of the moment, noting that “the era of testing is over,” and that Wall Street is now “actively utilizing decentralized protocols to trade and lend” tokenized assets.

Securitize handles compliance by pre-qualifying all participating wallets. This structure keeps institutional capital separate from non-KYC retail pools.

Beyond the technical setup, BlackRock also purchased an undisclosed amount of UNI governance tokens, marking its first direct financial engagement with a DeFi protocol’s governance structure.

Apollo Enters Decentralized Credit Through Morpho Agreement

Apollo Global Management, which oversees $940 billion in traditional assets, signed a formal cooperation agreement with Morpho.

The deal centers on building and scaling on-chain lending markets using Morpho’s infrastructure. Apollo and its affiliates are authorized to acquire up to 90 million MORPHO tokens over the next 48 months.

Sentora framed the broader trend clearly, stating that these institutions are “natively plugging tokenized assets into Uniswap’s liquidity rails and Morpho’s lending markets.”

The MORPHO token rallied 17.8% in the week following the announcement, according to CoinGecko data. Apollo’s acquisition strategy combines open-market purchases with over-the-counter transactions, with strict ownership caps and transfer restrictions built into the agreement.

Morpho’s architecture suits institutional needs because it allows permissionless market creation. Apollo can launch isolated lending pairs and custom vaults without waiting for a DAO governance vote.

This flexibility lets large managers set their own collateral ratios and interest rate parameters within a controlled environment.

Wall Street’s Growing Appetite for DeFi Governance Tokens

The RWA narrative is evolving beyond asset tokenization into active protocol ownership. Both BlackRock and Apollo are now acquiring governance tokens, a practice that traditional institutions previously avoided due to regulatory concerns.

As Sentora analyst Gabriel Halm put it, these firms view governance tokens as “essential infrastructure stakes, analogous to holding equity in a clearinghouse or a traditional exchange network.”

This shift also reflects a broader efficiency argument. Traditional markets carry T+1 or T+2 settlement delays and fragmented liquidity.

Halm noted that by “plugging tokenized Treasuries into decentralized routing and building structured credit on permissionless rails, institutions are actively upgrading their operational efficiency.”

These advantages are increasingly difficult for institutional managers to overlook as competition for yield tightens.

Meanwhile, the broader DeFi market shows mixed conditions. TVL and token supply remain flat, and leveraged ETH restaking strategies have moved into negative carry territory.

The debt-weighted average cost of borrowing ETH now sits at 3.40%, exceeding yields across all major liquid staking and restaking protocols tracked as of February 20, 2026.

Crypto World

Bitcoin $150K Calls Drying Up, Santiment Says That’s Healthy

Bitcoin market sentiment has cooled as speculative euphoria ebbs, according to a weekly assessment by Santiment. The analytics firm notes that calls for BTC to sprint into uncharted territory — with bold targets ranging from $150,000 to $200,000, or even a drop to $50,000–$100,000 — have faded from the discourse. The shift away from meme-driven optimism is framed as a healthier sign for the market, suggesting retail buyers are retreating from extreme projections. While price action has not produced a definitive trend, the combination of cooling FOMO and mixed on-chain signals points to a more cautious environment. Bitcoin previously surged to around $126,100 in October before sliding into a downtrend that persisted through year-end.

Key takeaways

- Calls for extraordinary BTC targets are fading, signaling a rebalanced risk appetite.

- Bitcoin traded near $60,000 on Feb. 6 and later rose toward the mid-$60s, reaching about $67,800 at the time of publication.

- Social sentiment around BTC has shifted from extreme bearishness to neutral, complicating short-term trading decisions.

- The Crypto Fear & Greed Index remained in Extreme Fear, underscoring persistent caution among investors.

- On-chain activity shows warning signs, with declining transaction volume, fewer active addresses, and slower network growth suggesting dormancy rather than expansion.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Positive. Bitcoin’s bounce back toward the mid-$60k range provides a modest near-term price lift after February’s dip.

Trading idea (Not Financial Advice): Hold. The combination of softened sentiment signals and dwindling on-chain activity argues for a cautious stance rather than aggressive positioning.

Market context: The mood around BTC sits at a crossroads between a cooler speculative outlook and a still-fragile risk-off backdrop. With daily trading volumes and on-chain participation cooling, the market appears to be testing whether the recent price appreciation can translate into sustainable user activity or whether it remains a symptom of speculative liquidity rather than fundamental growth.

Why it matters

The Santiment analysis captures a moment when the crypto narrative shifts from high-conviction price fantasies to a more grounded view of Bitcoin’s fundamentals and macro-driven price action. On one hand, prominent proponents previously predicting multi-hundred-thousand-dollar BTC prices have softened their stance, acknowledging the need for a longer, steadier runway. On the other hand, even as price nudges higher, traders face a paradox: sentiment has improved enough to reduce panic-driven moves, yet on-chain metrics tell a story of reduced network activity, which historically can precede meaningful price moves or retests of support levels.

Bitcoin’s price trajectory has been a central point of focus for market participants. After a push to the early 2025 high, BTC then retraced into late-year weakness, a pattern that left many investors cautious about the durability of any rebound. The February dip to around $60,000 was followed by a tentative recovery into the mid-$60k area, with the latest readings showing the asset hovering near $67,847 according to CoinMarketCap. This price action, set against fading meme-driven enthusiasm, underscores a market that may require clearer catalysts before committing to a fresh up-leg or a renewed consolidation phase.

From a sentiment perspective, the shift from “extreme bearishness” toward a neutral stance can both help and hinder decision-making. While neutral sentiment reflects a cooling of speculative frenzy, it can also reduce the clarity of trading signals, making it harder for participants to determine whether a breakout is genuine or simply a pause in the current range. Santiment cautions that relying solely on sentiment metrics in such environments can be misleading, urging traders to balance social indicators with real-time on-chain data and price action.

On-chain indicators add another layer of nuance. Transaction volume, active addresses, and network growth have all shown a tendency to trend downward, a sign that the network is being used less frequently. In practical terms, this dormancy can imply that a large portion of market participants are waiting on the sidelines, rather than actively expanding utilization or driving new demand for block space. While this is not inherently bearish, it does suggest that price momentum might rely more on liquidity and macro factors than on fundamental network-driven demand in the near term.

Meanwhile, the Crypto Fear & Greed Index has persisted in the Extreme Fear zone, a reminder that risk appetite remains fragile even as prices recover from mid-wFebruary lows. Such readings often reflect a market where traders are wary of mispricing or sudden reversals, preferring to observe and react rather than to chase momentum. The juxtaposition of a modest price uptick with cautionary social sentiment and waning on-chain activity paints a complex picture for investors weighing the odds of a sustained rally versus a prolonged consolidation or a deeper pullback.

Beyond BTC-specific dynamics, the broader market context remains relevant. A cooler sentiment regime can coincide with tighter liquidity and a more selective investment climate, impacting capitalization on new products, exchange-traded products, and institutional allocations. In this environment, investors may favor risk-managed strategies and deeper due diligence over rapid entry, even as favourable macro cues or favorable regulatory developments could tilt the balance toward a renewed upswing.

What to watch next

- Monitor on-chain metrics for signs of renewed active participation (transaction volume, number of active addresses, network growth) over the next few weeks.

- Track BTC price action around key levels near $68,000–$70,000 to identify potential breakouts or resistance tests.

- Watch sentiment indicators for any renewed swing toward bullishness or a return to fear-driven selling pressures.

- Observe any shifts in macro liquidity and risk sentiment that could provide a catalyst for a sustained move higher or a pullback.

Sources & verification

- Santiment: Weekly sentiment overview noting the decline in extreme price targets and the shift in retail optimism.

- CoinMarketCap: Bitcoin price data showing a dip near $60,000 in early February and a later level around $67,800 at publication time.

- Alternative.me: Crypto Fear & Greed Index reading at 8 (Extreme Fear).

- On-chain indicators referenced by Santiment: transaction volume, active addresses, and network growth trends.

- The broader discussion of BTC price dynamics and sentiment shifts summarized in Santiment’s weekly report.

Market reaction and key details

Bitcoin (CRYPTO: BTC) has navigated a climate where speculative frenzy has cooled, and investors are increasingly data-driven in their approach. Santiment’s latest weekly note highlights a notable retreat in calls for explosive BTC appreciation or drastic downside, signaling a more tempered market outlook. The shift away from outsized targets underscores a broader recalibration of risk as participants weigh the likelihood of a sustained rally against the possibility of choppy, range-bound trading.

The historical price arc serves as a reference point for the current mood. After peaking around $126,100 in October, BTC entered a downtrend that tempered expectations for a rapid, uninterrupted ascent. The subsequent months reinforced a picture of a market sensitive to macro headlines and liquidity cycles, rather than a purely driven by hyperbolic optimism. In early February, the asset found its footing around the $60,000 mark, only to recover modestly in the mid-$60,000s and hover near $67,800 at the time of writing. This sequence illustrates how price and sentiment can diverge in the short term, with cautious optimism coexisting with measured risk-taking.

On the sentiment front, the recovery from prior “extreme bearishness” suggests participants are beginning to consider price action in a more balanced light. Yet the absence of a clear, confirmatory trend means traders face a dilemma: whether to read the current neutral stance as a precursor to a durable rally or as a temporary pause before renewed volatility. Santiment emphasizes that sentiment metrics should not be the sole basis for decisions in such conditions; instead, they should be interpreted in the context of on-chain activity and price momentum to form a holistic view.

Despite the more constructive narrative around BTC, on-chain metrics offer a cautionary note. The indicators highlighted—transaction volume, active addresses, and network growth—are showing signs of deceleration. This pattern points to a market where a large share of participants is currently waiting on the sidelines, rather than actively expanding network usage or driving new adoption. While not inherently bearish, the data signals that any upside momentum may depend on a fresh round of sustained utility and user participation beyond mere price speculation.

Additionally, the Crypto Fear & Greed Index’s Extreme Fear reading reinforces the sense that risk tolerance remains constrained. In such an environment, even favorable price moves might be treated with scepticism by some investors who seek stronger proof of durable demand or clearer catalysts before committing additional capital. Taken together, the data landscape from Santiment — coupled with the price action and the on-chain signals — depicts a market undergoing a cautious recalibration rather than a wholesale paradigm shift toward new all-time highs.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion19 hours ago

Fashion19 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business4 days ago

Business4 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment3 days ago

Entertainment3 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show