Crypto World

Markets Signal Stress as El Salvador Sticks to Its Bitcoin Playbook

Bitcoin’s (BTC) bear market has weighed heavily on investors across the spectrum. Corporate treasuries, major whales, and even nation-state holders have all felt the pressure.

The cryptocurrency’s slide has slashed the value of El Salvador’s holdings as credit default swaps rise to a five-month high, raising concerns over the country’s IMF program and debt outlook.

Sponsored

El Salvador’s Bitcoin Bet Under Pressure as Portfolio Drops

According to the latest data from El Salvador’s Bitcoin Office, the country’s Bitcoin reserves stand at 7,560 BTC, worth approximately $503.8 million. Bloomberg reported that the portfolio’s value has fallen from around $800 million at Bitcoin’s October 2025 peak, marking a drop of nearly $300 million in just four months.

Bukele, an ardent Bitcoin advocate, has continued purchasing one Bitcoin per day. However, this strategy increases the country’s exposure to market volatility.

In contrast, Bhutan recently sold $22.4 million worth of Bitcoin. The divergent strategies of El Salvador and Bhutan reflect fundamentally different risk philosophies.

Bhutan’s Bitcoin mining operations generated more than $765 million in profit since 2019. However, the 2024 Bitcoin halving significantly increased mining costs, compressing margins and reducing returns. Bhutan now appears to be liquidating part of its holdings, while El Salvador continues to prioritize long-term accumulation.

Nonetheless, the country has also diversified its portfolio. Last month, it spent $50 million to acquire gold as demand for the safe-haven metal rose amid macroeconomic tensions.

IMF Loan Talks Face Strain Over El Salvador’s Bitcoin Policy

El Salvador’s deepening commitment to cryptocurrency has impacted relations with the International Monetary Fund. The government’s continued Bitcoin purchases, combined with delays in implementing pension reforms, have complicated the country’s IMF agreement.

Sponsored

The Fund has expressed concern about Bitcoin’s potential impact on fiscal stability. A disruption to the IMF program would weaken one of the key supports behind El Salvador’s sovereign debt recovery. Over the past three years, the country’s bonds have returned more than 130%, making them one of the standout turnaround stories in emerging markets.

“The IMF may take issue with disbursements potentially being used to add Bitcoin. Bitcoin being down also doesn’t help to ease investors’ concerns,” Christopher Mejia, an EM sovereign analyst at T Rowe Price, told Bloomberg.

The IMF approved a 40-month Extended Fund Facility on February 26, 2025, unlocking about $1.4 billion in total, according to official IMF documentation. The first review ended in June 2025, with $231 million disbursed.

However, the second review has remained on hold since September, following the government’s delay in publishing a pension system analysis. During that period, El Salvador continued to add to its Bitcoin reserves despite repeated warnings from the IMF.

Sponsored

A third review is scheduled for March, with each review tied to additional loan disbursements.

“The continued purchase of Bitcoin, in our view, does create some potential challenges for the IMF reviews. The market would react quite poorly if the anchor provided by the IMF were no longer present.” Jared Lou, who helps manage the William Blair Emerging Markets Debt Fund, said.

Meanwhile, bond markets are signaling rising concern over El Salvador’s fiscal outlook. Credit default swaps have climbed to a five-month high, reflecting increasing investor anxiety about the country’s repayment capacity.

According to data compiled by Bloomberg, El Salvador faces $450 million in bond payments this year, with obligations increasing to nearly $700 million next year.

El Salvador’s Bitcoin policy now sits alongside key fiscal and IMF negotiations. The outcome of upcoming IMF reviews and the country’s bond repayment schedule will play a significant role in shaping investor confidence and the sustainability of its debt trajectory.

Crypto World

Altcoin ETF Surge: SOL and XRP Pull $23M as Institutions Diversify

Institutional capital is widening its net and causing a surge in altcoin ETF inflows.

On March 4, Crypto ETFs tracking alternative assets recorded significant activity, with Solana Inflows hitting $19.06 million and XRP products securing $4.19 million in net entries, according to SoSoValue.

While Bitcoin continues to command the lion’s share of volume, this $23.25 million combined allocation signals that active managers are beginning to diversify aggressively beyond the market leader. No retail hype cycle. Just size moving in.

- Solana Leads Alts: Solana (SOL) ETFs recorded $19.06 million in net inflows on March 4, establishing dominance among non-ETH altcoin products.

- XRP Accumulation: XRP funds attracted $4.19 million, confirming steady XRP Institutional demand despite broader market volatility.

- Diversification Signal: The simultaneous inflows into SOL and XRP suggest institutional portfolios are increasingly rotating into high-utility Layer 1 assets.

Discover: The best meme coins on Solana

Solana ETFs: Does $19.06M Inflow Signal Future Stablecoin and Tokenization Demand?

Solana (SOL) is seeing a specific type of bid. The $19.06 million net inflow recorded on March 4 represents one of the strongest daily sessions for the asset since approvals normalized.

This isn’t just speculative rotation; it aligns with the growing narrative of Solana as the preferred infrastructure for institutional tokenization, backed by heavyweights like Franklin Templeton and BlackRock.

The flow data suggests that institutions are pricing in value beyond simple store-of-wealth mechanics.

Unlike the Bitcoin ETFs and MicroStrategy demand surge that focuses on scarcity, Solana Inflows are chasing yield and transaction velocity.

The network’s multibillion-dollar Total Value Locked (TVL) and record stablecoin volume continue to challenge Ethereum’s dominance, providing a fundamental floor for these investment products.

Technicals are responding to the flow. Solana is approaching another important level that could point to an explosive price prediction if these inflows sustain.

Watch the $158 level closely. If ETF buyers continue to soak up daily issuance and push the price above this resistance, a run toward $185 becomes the high-probability scenario. If flows dry up and price rejects, support at $138 must hold to preserve the bullish structure.

XRP Inflows: $4.19M Hints at Growing Support for Ripple’s Institutional-Grade Payments Infrastructure

XRP (XRP) is carving out its own lane. The $4.19 million inflow on March 4 might look small compared to Bitcoin’s billions, but for an altcoin asset class, it represents sustained conviction.

Following the approval of spot XRP exchange-traded funds in the U.S., the asset has transitioned from a retail-heavy volatility play to a component of diversified institutional portfolios.

The thesis here is utility. Investors are positioning for Ripple’s RLUSD stablecoin integration and the broader adoption of the XRP Ledger (XRPL) in cross-border settlements.

XRP Institutional interest is less about quick flips and more about long-term infrastructure bets. The capital entering these funds is sticky; it doesn’t tend to panic sell on minor dips.

Altcoin ETF Institutional Adoption: The Diversification Thesis

The March 4 data paints a clear picture: the “Bitcoin-only” era of institutional crypto is ending.

While Bitcoin remains the primary allocation, the simultaneous bid for SOL, XRP, and the massive $169.4 million into the Ethereum ETF sector indicates a maturing strategy. Institutions are effectively building a crypto-native index, weighting assets by sector dominance rather than just market cap.

This mimics movements seen in traditional finance. Just as Harvard picks ETH and trims Bitcoin ETF exposure, other large allocators are rebalancing to capture the upside of technological utility.

Institutional Adoption is moving down the risk curve. They aren’t gambling on memecoins; they are buying the protocols that run the new financial internet.

Watch the flow ratios next week. If the ratio of Altcoin ETF inflows to Bitcoin ETF inflows continues to rise, we are officially in a structural rotation. If Bitcoin dominance reasserts itself heavily, this was just a brief pause in the king’s rally.

Discover: The best crypto to buy today

The post Altcoin ETF Surge: SOL and XRP Pull $23M as Institutions Diversify appeared first on Cryptonews.

Crypto World

Bitcoin’s (BTC) drawdown hasn’t shaken institutional investors yet, says CoinShares

The first phase of bitcoin’s recent drawdown has not triggered panic among institutional investors, according to crypto asset management firm CoinShares.

Professional allocators reduced exposure modestly but largely maintained their positions compared with last year. Advisors trimmed holdings while hedge funds scaled back alongside the broader leverage unwind and shifting opportunities in other markets, the crypto investment manager said in a Tuesday report.

Longer-duration investors kept accumulating. “Endowments, pensions, and sovereigns continued to build quietly,” wrote analyst Matt Kimmell.

Bitcoin has struggled to regain momentum since hitting a record high near $125,000 in early October. The world’s largest cryptocurrency was trading around $72,370 at publication time.

Crypto markets have delivered muted performance in recent months as a mix of macro and market-specific pressures weighed on prices. Higher interest rates and a stronger dollar have dampened appetite for risk assets, while leveraged positions built earlier in the rally have been unwound. At the same time, profit-taking from long-term bitcoin holders and uneven flows into spot exchange-traded funds (ETFs) have limited momentum, leaving the sector struggling to regain a sustained upward trend.

Despite bitcoin falling about 23% during the period, global bitcoin ETF flows remained positive, suggesting the sell-off in the fourth quarter was driven more by long-time holders taking profits than by new institutional money exiting the market, Kimmell said.

Historically, crypto bear markets have redistributed supply from short-term traders to long-term holders. According to Kimmell, the emergence of ETFs now offers a new way to observe whether institutional capital follows the same pattern.

So far, the data points in that direction. A roughly 25% quarterly drawdown did not trigger broad institutional capitulation, the report said, with most declines in assets under management reflecting price moves rather than large investor outflows.

Still, CoinShares cautioned that the sample size remains small. The firm said the real test may appear in upcoming regulatory filings, which will capture institutional behavior during sharper moves, including bitcoin’s slide toward $60,000 and a single-day 17% drop.

Bitcoin and the broader crypto market moved higher this week, rebounding after weeks of choppy trading. The rally was driven in part by renewed risk appetite across markets and steady demand for bitcoin ETFs, helping the largest cryptocurrency regain momentum and lift major altcoins alongside it. Traders also pointed to short covering and positioning resets following the recent sell-off as factors behind the move.

Read more: CEO of crypto investment firm Keyrock says bitcoin is undervalued, entering ‘transition year’

Crypto World

Revolut Files for US Bank Charter and Names Former Visa Executive Cetin Duransoy as New US CEO

TLDR:

- Revolut has filed for a US bank charter with the OCC and FDIC to offer full banking services in America.

- Former Visa executive Cetin Duransoy has been named Revolut’s new CEO for United States operations.

- Revolut plans to invest $500 million in the US over three to five years covering capital, marketing, and hiring.

- Revolut’s global valuation reached $75 billion following a secondary share sale completed in November 2024.

Revolut has officially filed for a U.S. bank charter, marking a major move into the American financial market. The British fintech giant also named former Visa executive Cetin Duransoy as its new United States CEO.

With around 70 million clients across 40 markets, Revolut is targeting the U.S. as a core part of its global expansion.

The applications have been submitted to the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation for review.

Revolut Eyes US Banking Approval to Expand Financial Services

If regulators approve the applications, Revolut plans to gather deposits and issue loans in the U.S. The company also intends to offer credit cards and facilitate payments for American customers.

This would represent a full-scale banking operation, moving beyond its current limited U.S. presence. Revolut currently serves American users primarily through payment and foreign exchange services.

Revolut founder and CEO Nik Storonsky made the company’s intentions clear in a recent statement. “The United States is a key pillar of our global growth strategy,” Storonsky said.

He added that a stronger U.S. presence is necessary to reach 100 million global customers. The company is expected to invest $500 million in the U.S. over the next three to five years.

That $500 million figure covers bank capital, marketing, and new hiring across the country. Outgoing U.S. CEO Sid Jajodia confirmed the investment scope in a recent interview.

Jajodia will transition into a global chief banking officer role as Duransoy steps in. Duransoy’s background at Visa brings strong financial industry experience to Revolut’s U.S. operations.

Revolut’s strategy involves attracting users first as a secondary bank account. Services like payments and foreign exchange act as entry points for new customers.

Over time, the company woos users with perks and subscription-based offerings. This model has already proven effective across Europe and other international markets.

Revolut’s US Push Comes Amid Growing Neobank Competition

Revolut is not alone in pursuing a U.S. banking license among global neobanks. Brazil’s Nubank is currently awaiting full approval for its own U.S. banking license.

Spain’s Santander launched a digital bank in the U.S. in 2024 and recently announced an acquisition. These moves show that international digital banks are actively competing for U.S. customers.

To raise brand awareness in the U.S., Revolut plans to pursue sponsorship opportunities. The company already sponsors the Audi Formula 1 team, soccer clubs, and music festivals globally.

Similar partnerships in the U.S. could help boost its visibility among American consumers. Marketing investment is built into the $500 million U.S. spending plan.

On the topic of a potential IPO, Jajodia declined to comment on any timeline. He noted that private market capital remains available and accessible for the company.

Revolut completed a secondary share sale in November, valuing the company at $75 billion. That valuation places Revolut among the most valuable private fintech companies in the world.

Revolut’s U.K. bank continues to operate under some restrictions during a mobilization phase. The restrictions are tied to the bank’s size as it scales its operations.

However, the company appears focused on moving forward with its international growth plans. The U.S. charter application is the clearest sign yet of that ambition.

Crypto World

New Berkshire Hathaway CEO still talks with Warren Buffett nearly every day

Berkshire Hathaway CEO Greg Abel said he still speaks with Warren Buffett nearly every day, underscoring the continued presence of the legendary investor at the sprawling conglomerate, even after handing over the top job at the start of the year.

Buffett, who stepped down as CEO after more than six decades at the helm, remains chairman of the Omaha-based company and continues to come into the office regularly, Abel said.

“He’s in the office every day, so we’re talking every day if I’m in Omaha, we’re always connecting,” Abel said on CNBC’s “Squawk Box” Thursday. “If I’m traveling, like I was yesterday, I often check in just to catch up on what he’s seeing, what he’s hearing, what am I feeling. So if it’s not every day, it’s every couple days.”

Abel also acknowledged the challenge of stepping into Buffett’s role as Berkshire’s chief communicator to shareholders, particularly when writing his first annual letter to investors.

“The shoes to fill are tough on all fronts, but Warren is an exceptional communicator,” Abel said. “It was not easy. I’ve told Warren, ‘listen, the responsibilities transferred are great, but as far as the work and the task I had to do, that was the toughest.’”

Abel used the letter to shareholders to outline a clear framework of foundational values centered on financial strength and disciplined investing, vowing to preserve the blueprint Buffett carefully orchestrated since the 1960s.

Buffett offered little comfort, Abel added with a laugh. “When we were discussing it, he said, ‘the second letter doesn’t get any easier.’”

On investing, Abel said Berkshire is unlikely to move into cryptocurrencies, echoing Buffett’s longstanding skepticism of the asset class.

“I don’t think you’ll see crypto … I just don’t see it,” Abel said.

He left the door open to investments tied to technology, however.

“What I do see is that when it comes to technology, even from an operational perspective, where we’re seeing how we use it, the impact it’s having, it does allow us to develop strong views and a better knowledge base around certain companies that are technology companies, or how we’re using the technology. So technology will always be on the table,” Abel said.

Crypto World

ETH, XRP, ADA, BNB, and HYPE

This Thursday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

Ethereum (ETH)

With $2,000 support secured, Ethereum has a good shot at testing the $2,400 resistance in the near future. This also allowed the price to close the week with a 2% gain.

The current PA shows a clear reversal pattern, with a bullish engulfing candle indicating buyers are back in control. To secure their dominance, they will need to break above $2,400 as well.

Looking ahead, the most important resistance on the chart is found at $2,800. Thus, bulls may be able to keep Ethereum in a rally until then. Once there, sellers could return in force.

Ripple (XRP)

XRP turned bullish this week and reclaimed the $1.4 support level. While the price fell by a modest 2% compared to last week, the recent buying spree sends a strong bullish signal to market participants.

The most important resistance point is at $1.6, which will need to become support if buyers want to keep XRP in a sustained uptrend. Any weakness there will quickly be exploited by sellers.

Looking ahead, after a prolonged downtrend, this cryptocurrency is finally giving signs that the selloff may be behind us and a recovery is likely.

Cardano (ADA)

Cardano had a difficult start this week, falling by 7%. Buyers tried multiple times to reclaim the support at 28 cents, but each time they were rejected, including this week. This is a sign of weakness.

As long as ADA keeps failing to move above 28 cents, it is unlikely for any bullish momentum to form. Should selling intensify, the price may fall to 24 cents again, as it did earlier this year.

Looking ahead, this cryptocurrency is in a tough spot. While most altcoins are giving signs of a reversal, Cardano still lags behind its peers. Hopefully, this will change soon and push the price back into an uptrend.

Binance Coin (BNB)

Binance Coin moved higher by 4% this week after buyers defended the $580 support well. Their current target is the resistance at $690, which may be challenging to break through, given the previous price action.

Even if sellers attempt to defend the current resistance, bullish momentum is intensifying and may be enough to drive a quick relief rally towards $900.

Looking ahead, BNB has a clear shot at a rally in the weeks to come, considering that since late 2025, the price has been in a downtrend. A sustained rally appears likely and may be quite significant.

Hype (HYPE)

HYPE closed the week 12% higher and reclaimed a price above the key $30 support. As long as the price holds above this level, the bulls have the upper hand, and they may aim to break the resistance at $36 next.

While the momentum is bullish, there is a bit of lag since the price moved above $30. This should not last long since it would encourage sellers to return and put pressure on that support again.

Looking ahead, HYPE needs to break the $36 resistance to maintain a bullish bias in the coming weeks. Hopefully, buying volume will increase to sustain the current move into higher highs.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Cardano Gets Real-World Checkout Rails in 137 Swiss Spar Stores

Supermarket giant Spar has enabled ADA payment rails for customers in 137 Swiss stores, as the country moves closer to its global crypto hub ambitions.

Switzerland’s push as a crypto-friendly hub is getting a new retail test case, with Cardano’s ADA token now usable for grocery purchases at Spar stores across the country.

Cardano (ADA) users can start paying for their groceries in 137 Spar supermarkets across Switzerland after the latest Open Crypto Pay integration from Swiss fintech firm DFX.swiss, the Cardano Foundation said Thursday.

The system is designed to process transactions in real time and allow payments directly from ADA wallets without routing through a centralized exchange. For merchants, Open Crypto pay reduces transaction costs by about two-thirds compared to traditional cards, according to the announcement.

Frederik Gregaard, the CEO of the Swiss-based Cardano Foundation, called the development the “beginning of a fundamental shift in how value moves through society,” which marks the blockchain industry’s transition from an experimental phase to “genuine financial transformation.”

Spar first rolled out nationwide crypto and stablecoin payments in Switzerland in August 2025 for 100 stores via Binance Pay and DFX.swiss, with plans at the time to extend to 300 stores.

Related: Switzerland delays crypto tax info sharing until 2027

Tether, Lugano commit $6.4 million to global crypto hub ambitions

Separately, on Tuesday, Tether and the city of Lugano committed 5 million Swiss francs ($6.4 million) to a second phase of the city’s Plan B forum between 2026 and 2030, which aims to make Lugano a “global hub for digital asset infrastructure.”

Lugano has already allowed residents to pay certain municipal fees in Bitcoin (BTC) and USDt (USDT) as part of an effort to embed digital assets into the local economy.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Stellar (XLM) drops 3.5% as nearly all assets decline

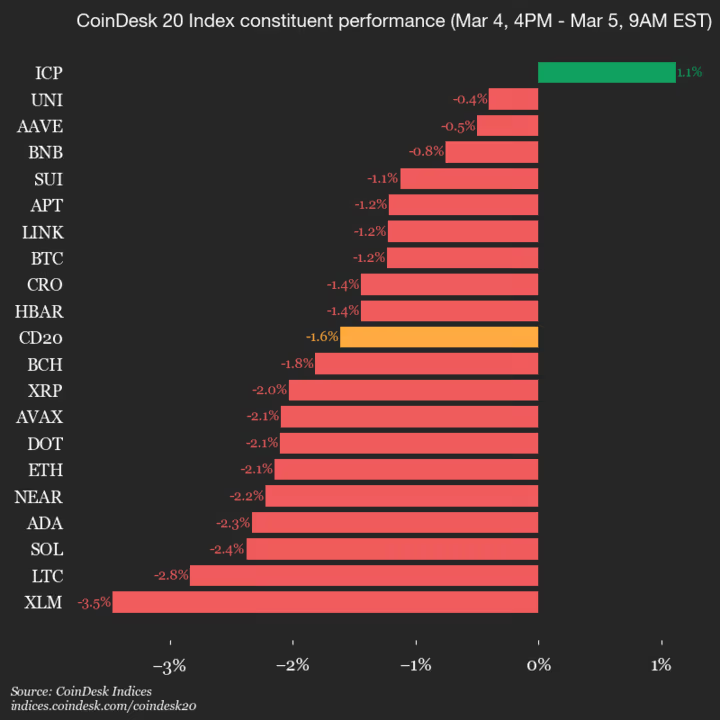

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2064.51, down 1.6% (-33.92) since 4 p.m. ET on Wednesday.

One of 20 assets is trading higher.

Leaders: ICP (+1.1%) and UNI (-0.4%).

Laggards: XLM (-3.5%) and LTC (-2.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

4 Bitcoin Charts Show BTC Price Forming a Bottom

Bitcoin has cooled from its all-time high and is tracing a defined range, yet several technical signals point to a potential bottom and a renewed ascent. The asset remains roughly 42% below its peak of around $126,000, with price action compressing in the $60,000 to $72,000 zone. After a dip to $60,000 on Feb. 6, Bitcoin rallied to a 30-day high near $74,000 and has since pulled back to about $72,500. Analysts describe the formation as an Adam-and-Eve bottom on shorter timeframes, while the BTC-to-gold ratio tests cycle-support levels, suggesting that risk-off pressures could be easing as buyers accumulate near critical supports. For context and data, traders often reference market pages like the Bitcoin price hub.

Key takeaways

- Bitcoin is potentially forming an Adam-and-Eve bottom on shorter timeframes, signaling a trend reversal.

- The BTC-to-gold ratio is revisiting cycle-low territory, a pattern historically associated with bottoming conditions.

- BTC has retested a multi-year trend line that has marked bear-market bottoms in prior cycles, bolstering the case for support validity.

- Price action has produced a breakout above the $70,000 neckline, but sustained strength above that level is required to confirm a new uptrend.

- Analysts emphasize that a meaningful recovery would depend on a slowdown in profit-taking and a clear break above nearby resistance zones.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: In a market shaped by liquidity cycles and shifting risk appetite, BTC’s path remains tethered to whether key support holds and whether demand resumes near pivotal levels. Observers watch macro cues, on-chain signals, and the pace of price action around the breakout threshold at $70,000 to gauge the durability of any potential reversal.

Why it matters

The emergence of a potential bottom could recalibrate sentiment among both retail and institutional participants. If the pattern holds, traders may eye renewed liquidity and interest as Bitcoin challenges the upper end of the current range, potentially paving the way for a sustained rally rather than another extended consolidation phase.

Patterns like Adam-and-Eve bottoms historically precede meaningful upside, especially when a neckline break is supported by a convincing close above resistance. The confluence of a rising pattern on shorter timeframes and a test of a longer-term trend line suggests that bulls could gain traction if buying pressure persists through the next few sessions.

However, the market remains wary. Even with a break above the neckline, a lack of momentum or renewed selling could reassert the bear narrative, keeping BTC tethered to a broad range. In such a scenario, on-chain activity, volatility regimes, and macro developments would play a decisive role in testing whether a bottom is truly in or merely forming a temporary floor.

What to watch next

- Monitor BTC price action around the $70,000 level and observe whether price closes above that benchmark on consecutive daily candles.

- Watch the BTC-to-gold ratio for signs of a sustained move away from cycle lows, which could corroborate a broader risk-on shift.

- Assess momentum indicators, including RSI and MACD, for confirmation of a trend reversal and a shift in buying pressure.

Sources & verification

- BTC price action: bottom near $60,000 on Feb. 6, followed by a rally to around $74,000 and a retracement to roughly $72,500, with a breakout above $70,000 on the neckline observed in the wake of the pattern.

- Adam-and-Eve bottom concept and related analysis, including commentary on the evolving pattern on shorter timeframes.

- Bitcoin-to-gold ratio studies showing a 13-month downtrend and cycle-low considerations, with historical context from bear-market bottoms in prior cycles.

- TradingView data illustrating BTC’s approach to a multi-year trend line that has marked previous bottoms in 2018 and 2022.

Market reaction and key details

Bitcoin (CRYPTO: BTC) has moved through a landscape defined by volatility, where a wraparound of support and resistance levels often decides whether a mid-range rebound matures into a sustained rally. The asset’s rebound from a $60,000 floor—achieved on Feb. 6—to a 30-day peak near $74,000 demonstrates a resilient bid that could underpin further gains if buyers maintain price discipline around the $70,000 mark. A break above that neckline, followed by a stable daily close, would be the clearest evidence that the bottom formation is taking hold. Analysts who track the 12-hour charts have highlighted the ongoing Adam-and-Eve bottom as a bullish reversal flag, albeit with the caveat that the pattern’s success hinges on demand persistence rather than mere technical breadth.

On-chain dynamics and cross-asset signals add further texture. The BTC-to-gold ratio has been trending lower for about 13 months, a drift that has historically coincided with macro risk-off shifts and liquidity constraints. Yet, when BTC eventually resumes price discovery, the pattern often aligns with renewed appetite for risk assets, as observed in prior bear-market troughs. The pattern’s proponents argue that BTC’s relative weakness against gold in recent months could be indicative of a mispricing correction that unfolds once the downtrend exhausts itself. In the same vein, the macro setup—characterized by bouts of volatility and cautious positioning—has kept traders vigilant for a decisive breakout above key thresholds. A noteworthy observation from market participants is the alignment between the neckline break at $70,000 and the subsequent penetration of the trend line that has historically signaled deeper bottoms in Bitcoin’s history.

Further confirmation comes from market observers monitoring the broader technical matrix. TradingView data show Bitcoin retesting a multi-year support trend line on a monthly basis, a move that has preceded recoveries in past cycles. Several traders have spoken to the idea that a retest, if followed by a confirmed bounce, could catalyze a renewed upside phase. In a recent post, a market analyst noted that if history repeats, the price could stage a meaningful upside after a successful test of the line, a thesis that has driven cautious optimism among some market participants. Others have highlighted that even with a robust breakout, sustained upside requires more than a single bullish candle; it demands sustained conviction across price action, volume, and on-chain metrics.

As with any market-sensitive analysis, caution remains warranted. A breakout above $70,000 is a necessary step, but not a promise of a new long-term bull run. The narrative hinges on many moving parts: the tempo of profit-taking, the depth of liquidity, the strength of macro cues, and unseen catalysts such as regulatory developments and institutional participation. The tension between optimism around a bottom and the risk of renewed volatility is likely to define the near-term trajectory. For now, traders will be watching whether the price can hold above the critical zone and whether the longer-term trend line can serve as a reliable anchor for continued upside in the weeks ahead.

Related analyses and ongoing coverage continue to emphasize that the interplay between chart patterns, cross-asset signals, and macro conditions will determine whether Bitcoin transitions from a corrective phase into a more durable upcycle. As always, readers are encouraged to verify the situation across multiple data sources and to monitor official statements and market-moving events that influence sentiment and liquidity in the space.

Crypto World

CORZ secures up to $1 billion loan facility from Morgan Stanley

Core Scientific (CORZ), the Texas-based digital infrastructure provider, has secured up to $1 billion in strategic financing from Morgan Stanley to support the development of its data center infrastructure.

The company announced the initial closing of a $500 million 364-day loan facility, with an accordion option that could expand total commitments by another $500 million, subject to standard conditions. Borrowings under the facility will carry interest at the Secured Overnight Financing Rate (SOFR), plus 2.50%.

According to CEO Adam Sullivan, the additional capital will allow the company to move faster on projects approaching service readiness, helping it better meet growing customer demand.

Core Scientific plans to use the funds for general corporate purposes tied to data center development. This includes equipment purchases, early-stage project costs, land acquisitions, and securing additional energy supply agreements needed to power future facilities.

This comes just days after Core Scientific’s Q4 earnings, during which the company disclosed that it sold $175 million worth of bitcoin as it pivots toward AI infrastructure.

Shares of Core Scientific were down around 1% in pre-market trading on Thursday.

Crypto World

Solana Price to Break Soon? $95 Is the Level to Watch

Solana (SOL) is approaching another important level that could point to an explosive price prediction. SOL is trading near $91.70 at the time of writing, up around 3% in the past 24 hours. The token is up roughly 6% over the last week.

The broader picture remains stressful. Solana is still about 11% lower over the past month and nearly 70% below its January 2025 all-time high of $293.31.

Meanwhile, derivatives activity is picking up. CoinGlass data shows trading volume dropping 3% to $16.4 billion, while open interest climbed 2% to $5.37 billion.

Additionally, on March 4, Solana ETF inflows hit $19.06 million, according to SoSoValue. This suggests institutions are accumulating right now, opening new positions as price approaches a key decision zone.

Discover: The best new cryptocurrencies

Solana Price Prediction: Why $95 Is the Level Everyone Is Watching

The $95 price is now the key level. Looking at the move from the $120 swing high to the $80 low, the 38.2% to 50% Fibonacci retracement sits exactly near $95. That area often acts as the first major resistance during recovery rallies, and the market appears to be respecting it.

It also has structural weight. The $100 range represented a key support level during the March 2025 crash. It now appears to have flipped to resistance, but successfully recapturing during a market-wide rally could flip it back to support.

RSI has long recovered from oversold and is now slightly above 50, reflecting growing momentum. If it stalls there, sellers could regain control. A 24-hour trading volume of just over $6 billion on the rebound has also been moderate, suggesting this move may still be a corrective bounce rather than a full reversal.

If SOL breaks and holds above $95, the next upside zone opens around $105 to $110. This would align with a more bullish Solana price projection targeting local range highs.

However, if price rejects again here, focus quickly shifts back toward $85. A loss of that support level would expose the recent lows near $80, invalidating the current recovery attempt.

In the mid-to-long-term, there’s sticky resistance ahead, located around the $200 and $275 levels. Clearing this would line Solana up to challenge its ATH, opening the possibility to a summer spent in price discovery mode.

Ultimately, in spite of all the negative market noise, things are looking bullish for Solana in many respects. The network has an early lead on the likely soon-to-be-massive sectors of stablecoins and real world asset (RWA) tokenization.

In the latter department, asset managers Franklin Templeton and BlackRock have started leveraging the network for its tokenization capabilities.

Discover: The next crypto to explode

The post Solana Price to Break Soon? $95 Is the Level to Watch appeared first on Cryptonews.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech8 hours ago

Tech8 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

Spot ETF Flows: BTC, ETH, SOL and XRP spot ETFs saw net inflows on Mar. 4.

Spot ETF Flows: BTC, ETH, SOL and XRP spot ETFs saw net inflows on Mar. 4.