Crypto World

McHenry predicts fast crypto deal as Witt brokers talks

Speaking on CoinDesk Live at the Ondo Summit in New York City, former House Financial Services Chair Patrick McHenry and White House advisor Patrick Witt said a sweeping crypto market structure bill could pass within months.

Latest developments: Optimism is rising across Washington and industry.

- McHenry and Witt discussed the growing momentum for landmark crypto legislation, even as debates intensify over yield, DeFi, and ethics.

- McHenry predicted a finalized market structure bill could reach the president’s desk by Memorial Day.

- Witt said President Trump has personally prioritized the legislation following passage of the Genius Act.

Inside the White House push: Negotiations are narrowing.

- Witt said a recent White House–brokered meeting on stablecoin yield surfaced “new areas of agreement” while clearly defining remaining red lines.

- He said the administration’s goal is to move from high-level principles to drafting actual legislative language.

- Witt emphasized his role is to broker a deal that can survive both Senate and House scrutiny.

The sticking point: Stablecoin yield is the biggest unresolved issue.

- Witt said there is broad agreement on banning deceptive practices, including marketing stablecoins as FDIC-insured deposits.

- The dispute centers on whether centralized exchanges should be allowed to pay passive yield on idle stablecoin balances.

- Banks, especially community lenders, see yield as a threat to deposit funding, while crypto firms argue yield drives platform engagement.

Why DeFi matters: McHenry says it’s foundational.

- McHenry said market structure legislation “doesn’t work without DeFi.”

- He argued decentralization is the source of crypto’s efficiency, transparency and lower costs compared with traditional finance.

- McHenry said tokenized lending products are already cheaper than traditional securities lending, signaling strong market demand.

The politics: Ethics concerns loom but may not block passage.

- McHenry said ethics rules should apply permanently to all officials, not target any single administration or family.

- Witt said some Democratic proposals would have imposed sweeping restrictions on officials’ spouses and were “grossly over-scoped.”

- Both said a narrower ethics compromise could still unlock bipartisan support, though Republicans could move the bill forward on partisan votes if needed.

What comes next: A compressed legislative timeline.

- Witt said drafting teams are now “trading paper” and working through specific statutory language.

- He said the White House is pushing banks and crypto firms to negotiate in good faith.

- McHenry said Senate action could come before Easter, setting up a rapid sprint toward final passage.

Watch CoinDesk Live from Ondo Summit here.

Crypto World

Telegram Mini Apps Development on TON Network

Telegram is quietly transforming from a messaging app into a distribution platform for lightweight applications, games, and digital services. For enterprises watching user acquisition costs rise and app store competition intensify, Telegram mini apps represent a structural shift in how products reach audiences. The best part is that:

There are no installs

No app-store approvals

No onboarding friction

Therefore, users can conveniently access mini apps directly inside chats, often in one tap.

When combined with the TON blockchain, Telegram mini apps development can readily support payments, tokenized incentives, and ownership models, all inside a familiar interface. This is exactly the reason why these apps are no longer considered as experimental. They are becoming a serious growth channel.

To understand why, let’s examine some of the Telegram mini apps leading the TON ecosystem and what makes them successful from a business perspective.

Check Out TON Ecosystem’s Top 7 Telegram Mini Apps

1) Notcoin

Notcoin became one of the fastest-growing Telegram-native experiences by reducing gameplay to the simplest possible action that is just tapping. However, its success is not just about simplicity. Notcoin leveraged:

- Viral referral loops

- Social bragging rights

- Progress-based incentives

- Low cognitive load gameplay

It aligned perfectly with Telegram’s quick-interaction behavior. For businesses, the lesson is clear: Complex mechanics reduce adoption inside chat ecosystems.

2) Hamster Kombat

Hamster Kombat added humor, storytelling, and crypto rewards. It built a narrative-driven engagement model instead of just pure mechanics. It demonstrates that:

- Branding matters even in mini apps

- Identity-driven communities retain better

- Humor and culture drive sharing

For enterprises, this is a very clear indication that Telegram mini apps development can build brand affinity, not just usage. In this regard, if enterprises have a stricter time frame, they can launch a Hamster Combat clone script in just 7 days with the help of experts.

3) Catizen

Catizen combines community engagement with recurring reward cycles. It readily encourages habitual interaction. It proves that retention comes from:

- Community alignment

- Predictable reward schedules

- Social belonging

Hence, it is clear that Telegram mini apps can act as social ecosystems, not just tools. However, it is also possible to build a game like Catizen from scratch in 15 days when you seek the help of professional Telegram game developers.

4) Yescoin

Yescoin uses swipe-based interactions that feel natural in messaging contexts. Designing for Telegram means:

- One-handed interactions

- Short session times

- Instant feedback loops

This is worth noting here that it is UX strategy and not just design.

5) TapSwap

TapSwap introduced gamified token accumulation tied to user activity. Players respond strongly to visible progress and accumulation psychology. However, sustainability requires careful tokenomics, which happens to be a key lesson for enterprises planning to explore the field.

6) Tonkeeper Mini App Integrations

Wallet integrations like Tonkeeper show mini apps can deliver real financial utility. Utility apps build long-term value because they solve actual problems. It needs to be kept in mind that not every Telegram mini app needs to be a game. Financial tools and service apps are equally viable.

7) Fragment

Fragment enables buying and selling Telegram usernames and collectibles on TON. This shows Telegram mini apps can power real marketplaces with:

- Verified ownership

- Scarcity mechanics

- On-chain transactions

This is where mini apps cross into digital commerce infrastructure and opens up opportunities for businesses.

What Businesses Should Notice

The real takeaway for businesses is not the apps themselves. However, it is essential to note the patterns:

✔ Frictionless onboarding

✔ Native distribution

✔ Social virality

✔ Micro-session engagement

✔ Incentivized retention

✔ Integrated payments

Telegram mini apps succeed because they align with user behavior, not because they are Web3.

Want to Build Telegram Mini Apps in the TON Ecosystem?

Telegram Mini Apps & TON Ecosystem — By the Numbers

900M+ Monthly Active Users on Telegram

Telegram’s massive global user base gives mini-apps instant distribution without app-store dependency.

30%+ of Mobile Engagement Happens in Messaging Apps

Messaging platforms are now primary digital environments, making in-chat apps highly discoverable and frequently used.

120%+ Year-Over-Year Growth in TON Transactions

TON’s transaction growth reflects rising adoption and real economic activity across mini-apps and wallets.

Why TON Makes Telegram Mini Apps Viable

TON is not just a blockchain attached to Telegram; it is a purpose-built infrastructure designed to support high-frequency, low-friction digital interactions at scale.

For enterprises evaluating Telegram mini apps as business channels, the viability of the underlying blockchain is critical. Slow, expensive, or congested networks kill user experience quickly.

However, TON addresses this in several ways:

1. High Throughput for Micro-Transactions

Telegram mini apps often rely on small, frequent user actions, like reward claims, token distributions, in-app purchases, and micro-payments. TON’s architecture supports high transaction volumes with minimal latency, making it practical for real-time mini app interactions. For businesses, this ensures smoother user journeys and fewer drop-offs due to delays.

2. Low Transaction Costs

User-facing apps cannot survive on high gas fees. TON’s low-cost transaction model enables sustainable reward systems and micro-economies.

This is especially important for:

- Tap-to-earn models

- Reward distribution

- In-app asset transfers

- Marketplace transactions

Low fees allow businesses to experiment without burning capital on infrastructure costs.

3. Native Telegram Integration

TON is tightly aligned with Telegram’s ecosystem. Wallets, usernames, and mini app interactions can be linked seamlessly. This, in turn, reduces onboarding friction, which happens to be one of the biggest barriers in Web3 adoption. Here users do not feel like they are “entering crypto.” They simply feel like they are using a feature. For enterprises, this means faster adoption and lower user education costs.

4. Scalable Architecture

TON’s sharding design enables horizontal scalability. As user demand grows, the network can handle more load without congestion spikes. This matters because Telegram mini apps can scale rapidly overnight. A viral app can jump from thousands to millions of users quickly. Infrastructure that cannot scale becomes a liability.

5. Built-In Asset Logic

TON supports token creation, NFTs, and digital asset management natively. This allows businesses to design reward systems and ownership layers without building custom infrastructure from scratch. This shortens Telegram mini app development timelines and reduces technical risk.

Business Benefits for Early Movers

Timing plays a major role in emerging ecosystems. Telegram mini apps are still in a growth phase, which creates strategic advantages for early entrants.

1. Lower Competition for Attention

As the ecosystem matures, user attention becomes expensive. Early movers benefit from less crowded discovery environments and higher visibility.

This translates to:

- Faster user acquisition

- Lower marketing spend

- Higher organic reach

2. First Access to Community Loyalty

Users who adopt early platforms often develop stronger loyalty. They associate their early experiences with the brand or ecosystem that introduced them.

For businesses, this creates:

- Long-term retention

- Stronger community identity

- Higher lifetime value per user

3. Data & Learning Advantage

Early projects gain valuable behavioral data, such as what works, what retains users, what monetizes. Late entrants must rely on assumptions. Early movers rely on insights. This data advantage compounds over time.

4. Partnership & Ecosystem Opportunities

Early builders often secure stronger partnerships within the ecosystem, like wallets, marketplaces, other mini apps, and cross-promotions. Once the space matures, these partnerships become harder to secure.

5. Category Leadership Positioning

Brands that enter early often become synonymous with the category itself. This positioning is hard to replicate later. Being “one of the first” often leads to being “one of the biggest.”

Wish to Explore the Benefits of Launching Telegram Mini Apps in the TON Ecosystem?

The Hidden Complexity

From the outside, Telegram mini apps appear lightweight. However, building scalable, secure, and sustainable mini apps requires serious engineering. This is where a number of projects tend to fail.

1. Backend Infrastructure

Mini apps still require reliable servers, databases, and APIs. Handling spikes in user activity requires cloud architecture that can auto-scale. Without this, apps crash during viral growth.

2. TON Smart Contract Design

Smart contracts must be secure and efficient. Poorly designed contracts can lead to exploits, fund loss, or frozen assets. Auditing and optimization are critical.

3. Tokenomics & Reward Logic

Designing reward systems that retain users without inflating value is complex. Many mini apps fail because their token economies collapse. Economic modeling is not optional, it’s foundational.

4. Anti-Bot & Anti-Exploit Systems

Tap-to-earn and reward-based systems attract bots. Without anti-abuse mechanisms, economies break quickly. Enterprises must invest in fraud detection and behavioral monitoring.

5. UX Simplicity with Technical Depth

Mini apps must feel simple while hiding complex infrastructure. Balancing UX and blockchain logic during Telegram mini apps development is a design challenge. Users expect instant responses and zero friction.

6. Security & Compliance

Handling wallets and digital assets introduces security responsibilities. Enterprises must consider:

- Smart contract audits

- Secure wallet flows

- Regulatory awareness

Security lapses destroy trust very quickly.

Strategic Takeaway

Telegram mini apps might look easy to build. However, they are not easy to scale or sustain. The difference between a viral hit and a short-lived experiment often lies in architecture, economy design, and security readiness. This is exactly the reason why experienced Telegram mini app developers matter.

Why the Right Development Partner Matters

Successful Telegram mini apps blend:

- UX design

- Game psychology

- Blockchain logic

- Infrastructure scalability

- Economic modeling

This is multidisciplinary and a capable Telegram game development company rightly understands how these layers interact.

Antier works with startups and enterprises to build Telegram mini apps and TON-powered games that are designed for real adoption. This includes:

- Mini game design

- TON smart contract development

- Token and reward systems

- Scalable architecture

- Security-first development

It is to be kept in mind that in Telegram ecosystems, scale can happen overnight and only well-architected systems survive rapid growth.

Final Thoughts

Telegram mini apps are evolving into a major distribution channel where gaming, finance, and community intersect. They reduce friction, shorten adoption cycles, and enable creative monetization. The opportunity is real. However, success depends on execution. Businesses entering the field now are not chasing trends. Their focus is on positioning themselves in a new app ecosystem forming inside Telegram. Antier, with its sheer level of expertise as a Telegram game development company, helps businesses build scalable mini apps that not only sustain but also deliver the intended results.

Frequently Asked Questions

01. What are Telegram mini apps and how do they differ from traditional apps?

Telegram mini apps are lightweight applications that can be accessed directly within chats without the need for installations, app-store approvals, or onboarding friction, making them more convenient for users.

02. How do Telegram mini apps leverage the TON blockchain?

Telegram mini apps can utilize the TON blockchain to support payments, tokenized incentives, and ownership models, all within the familiar Telegram interface, enhancing user engagement and monetization.

03. What are some key factors that contribute to the success of Telegram mini apps?

Successful Telegram mini apps often incorporate elements like simplicity in gameplay, community engagement, branding, humor, and predictable reward systems, which align with user behavior and enhance retention.

Crypto World

The Role of AI Chatbots in Modern HR Process Automation

Human Resources has evolved from an administrative function into a strategic driver of organizational performance. Yet, despite this shift, many HR teams remain burdened by manual processes, fragmented systems, and reactive workflows that do not scale with modern workforce demands. As organizations grow across geographies, compliance frameworks, and talent models, the complexity of HR operations increases exponentially. Traditional HR automation tools, built on rigid workflows and static portals, fail to deliver the responsiveness and intelligence required today.

This is where AI chatbots in HR are redefining how organizations automate, scale, and modernize HR operations. By partnering with an experienced AI Chatbot Development Company, enterprises can implement conversational interfaces powered by artificial intelligence to unlock a new era of HR process automation – one that is proactive, context-aware, and deeply integrated into core business systems.

The Limitations of Traditional HR Automation Systems

Before understanding the impact of AI chatbots, it is critical to examine why legacy HR automation approaches fall short.

Key Challenges in Traditional HR Operations

- HR systems operate in silos (HRMS, ATS, payroll, compliance tools)

- Employees struggle to navigate complex portals for simple queries

- Most HR workflows rely on email-based approvals

- Policy interpretation remains manual and inconsistent

- HR teams spend the majority of their time on repetitive support tasks

Despite digitization, HR remains process-heavy but intelligence-light. Automation exists, but decision-making and interpretation still require human intervention. This operational gap has created the need for HR automation using AI, where systems can understand, decide, and act without constant manual oversight.

How AI Chatbots Enable HR Workflow Automation at Enterprise Scale

Unlike traditional rule-based systems that rely on fixed keywords, modern AI chatbots are built to understand how employees naturally communicate. Powered by advanced language intelligence and enterprise integrations, they play an active role in automating HR operations rather than simply responding to queries.

Key Differentiators of AI Chatbots in HR

- Intent-based understanding, not keyword matching

AI chatbots use Natural Language Processing to accurately interpret employee intent even when questions are informal, incomplete, or phrased differently. - Context-aware conversations

By retaining conversation history and employee context such as role, location, and policy eligibility, chatbots deliver consistent and personalized responses without repetition. - Direct integration with HR systems

AI chatbots connect seamlessly with HRMS, payroll, ATS, and compliance platforms to retrieve real-time data and perform actions securely. - Built-in workflow execution

Beyond answering questions, chatbots can initiate and complete HR workflows, including leave applications, approvals, and record updates. - Active participation in HR operations

These capabilities allow AI chatbots to move beyond static FAQs and function as intelligent, action-driven components of end-to-end HR process automation.

Together, these capabilities form the intelligence layer that differentiates AI-powered HR solutions from traditional, rule-based HR software.

AI Chatbots for Employee Self-Service: Redefining HR Accessibility

One of the most impactful and widely adopted use cases of AI chatbots in HR is employee self-service automation. As organizations scale, HR teams are increasingly overwhelmed by repetitive, high-volume queries that do not require human intervention but still consume significant time and resources.

The Employee Experience Challenge

Employees regularly reach out to HR for routine requests such as:

- Leave balances and approval status

- HR policy explanations and clarifications

- Payroll and salary-related questions

- Benefits eligibility and coverage details

- Tax documents and compliance information

While these queries are essential, they are largely repetitive and manual, leading to slower response times, employee frustration, and reduced HR productivity.

How AI Chatbots Enable Self-Service at Scale

When integrated with core HRMS and payroll systems, AI chatbots for employee self-service can:

- Securely authenticate employees

- Retrieve real-time, role-specific HR data

- Interpret policies contextually based on eligibility

- Deliver instant, conversational responses

This approach significantly reduces dependency on HR support tickets while ensuring employees receive accurate, consistent, and timely information—anytime they need it.

HR Workflow Automation Using AI Chatbots

The true power of AI chatbots lies in their ability to execute HR workflows, not just provide information.

Examples of Automated HR Workflows

- Leave requests and approvals

- Attendance regularization

- Shift and roster management

- Policy acknowledgment tracking

- Employee exit and clearance processes

How Workflow Automation Works

Instead of navigating forms or sending emails, employees interact naturally:

Employee: “Apply for three days of leave starting Monday.”

AI Chatbot:

- Validates leave balance

- Checks policy rules

- Routes approval to the manager

- Updates HRMS automatically

This is HR workflow automation driven by conversation, fast, accurate, and scalable.

AI Chatbots for Recruitment: Automating Talent Acquisition at Scale

Recruitment is one of the most resource-intensive HR functions, making it an ideal candidate for automation.

AI Chatbots for Recruitment and Candidate Engagement

AI chatbots assist recruitment teams by:

- Engaging candidates 24/7

- Answering role-specific queries

- Screening candidates based on predefined criteria

- Scheduling interviews automatically

- Sending follow-ups and reminders

This improves both recruiter efficiency and candidate experience.

Intelligent Candidate Screening

Chatbots can evaluate:

- Skill relevance

- Experience thresholds

- Availability and location preferences

- Role alignment

By automating early-stage screening, recruiters focus on high-quality candidates instead of manual filtering.

AI Chatbots for Onboarding: Accelerating Time-to-Productivity

Once a candidate is hired, onboarding becomes the next critical HR challenge.

How AI Chatbots Improve Onboarding

AI chatbots guide new employees through:

- Document submission and verification

- Policy walkthroughs

- IT and access requests

- Training module assignments

- First-week task coordination

This structured, guided onboarding experience improves retention, engagement, and early productivity.

Payroll and HR Compliance Automation with AI Chatbots

Payroll and compliance processes involve high risk, strict regulations, and minimal tolerance for errors.

1. Payroll Automation Use Cases

AI chatbots can:

- Explain salary structures

- Break down tax deductions

- Track reimbursements

- Answer bonus and incentive queries

2. HR Compliance Automation

Chatbots assist with:

- Labor law interpretation

- Location-specific compliance rules

- Policy enforcement consistency

- Audit-ready interaction logs

This enables payroll and HR compliance automation with reduced manual dependency and lower risk exposure.

AI Chatbots for Internal HR Support and Knowledge Management

HR knowledge often exists in scattered formats, such as PDFs, intranets, shared drives, and emails.

Centralized HR Knowledge Access

AI chatbots for internal HR support act as a unified interface that:

- Retrieves policy documents instantly

- Interprets complex policy queries

- Escalates sensitive issues appropriately

- Provides role-specific guidance to managers and employees

This transforms HR from a reactive support function into a structured, intelligent service layer.

Enterprise Architecture for AI-Powered HR Solutions

Enterprise-grade HR chatbots require a robust technical foundation.

Key Components:

- Conversational AI and LLMs

- Secure HR data retrieval (RAG pipelines)

- HRMS, ATS, and payroll integrations

- Workflow orchestration engines

- Role-based access control (RBAC)

- Compliance logging and audit trails

Because of this complexity, most enterprises partner with an experienced AI Chatbot Development Company to design, build, and maintain these systems.

Data Privacy, Security, and Compliance Considerations

HR data includes sensitive personal and financial information. Any AI-driven HR system must prioritize security.

Best Practices

- End-to-end data encryption

- On-premises or private cloud deployment

- Zero data retention for AI models

- Access control by role and hierarchy

- Compliance with GDPR and regional labor laws

Without these safeguards, HR automation introduces operational risk.

The New Standard for HR Operations

As workforce structures grow more complex and distributed, organizations must move beyond basic digitization and embrace intelligent, AI-driven automation. AI chatbots are no longer optional add-ons; they are becoming the backbone of modern HR operations and a core component of enterprise HR workflow automation solutions. By enabling employee self-service, automating recruitment and onboarding, streamlining payroll and compliance, and strengthening internal HR support, AI chatbots deliver faster execution, consistent governance, and significantly improved employee experiences. The future of HR belongs to organizations that invest early in scalable, secure, and AI-powered HR solutions, setting new benchmarks for efficiency, agility, and workforce engagement.

Antier empowers enterprises to build next-gen AI-driven HR ecosystems as a trusted AI Chatbot Development Company, delivering secure, enterprise-grade chatbot solutions tailored for complex HR environments. With deep expertise in AI, automation, and system integration, Antier helps organizations transform HR into a strategic, future-ready function.

Frequently Asked Questions

01. How have HR operations evolved in recent years?

HR operations have shifted from being purely administrative to becoming a strategic driver of organizational performance, although many teams still face challenges with manual processes and fragmented systems.

02. What are the limitations of traditional HR automation systems?

Traditional HR automation systems often operate in silos, require manual intervention for decision-making, and rely on outdated workflows, making them less responsive to modern workforce demands.

03. How do AI chatbots improve HR workflow automation?

AI chatbots enhance HR workflow automation by using Natural Language Processing to understand employee intent, enabling proactive and context-aware interactions that streamline HR operations.

Crypto World

Polymarket sues Massachusetts over prediction market rules

Polymarket has taken legal action against Massachusetts officials, seeking to block the state from restricting its prediction markets.

Summary

- Polymarket sued Massachusetts officials after a court ruling against rival Kalshi.

- The platform says federal CFTC rules override state gambling laws.

- The case could shape how prediction markets operate across the U.S.

The move comes as U.S. regulators and courts step up scrutiny of platforms that allow users to trade on real-world events, especially in sports.

On Feb. 10, Polymarket filed a lawsuit in federal court against Massachusetts Attorney General Andrea Campbell and state gaming regulators. The company said the threat of enforcement is “immediate and concrete,” following a recent ruling against rival platform Kalshi.

According to Polymarket, state intervention would disrupt its national operations, fragment its user base, and force it to choose between federal compliance and state restrictions. The company argues that its markets fall under federal oversight and should not be treated as local gambling products.

Federal authority vs. state gambling laws

At the center of the case is a dispute over who has the right to regulate prediction markets.

Polymarket says its event contracts are governed by the Commodity Futures Trading Commission. Under federal law, the CFTC oversees derivatives and futures markets, including certain types of prediction products. The company claims this authority overrides state-level gambling rules.

In its complaint, Polymarket pointed to comments made on Jan. 29 by CFTC Chairman Michael Selig, who said the agency would re-assess how it handles cases testing its jurisdiction. Shortly after, the CFTC filed an amicus brief in a related lawsuit involving Crypto.com.

Massachusetts courts have taken a different view. Last week, a state judge refused to pause a ban on Kalshi’s sports contracts, ruling that the platform must follow state gaming laws. The judge said Congress did not intend federal regulation to replace traditional state powers over gambling.

Kalshi has appealed the decision but was denied a stay. The ruling requires the company to block Massachusetts users from sports markets within 30 days.A federal judge in Nevada also recently denied Coinbase’s request for protection from a similar enforcement action, adding to the legal pressure on prediction platforms.

Robinhood, which partners with Kalshi, is now seeking its own injunction in Massachusetts to avoid state licensing requirements.

Growing pressure on prediction platforms

Polymarket’s lawsuit reflects wider tensions between fast-growing prediction markets and state regulators.

In a statement posted on social media, Polymarket chief legal officer Neal Kumar said the company is fighting “for the users.” He argued that state officials are racing to shut down innovation and ignoring federal law.

He added that Massachusetts and Nevada risk missing an opportunity to support new market models that blend finance, data, and public forecasting. State officials have so far declined to comment on the lawsuit.

The case arrives as prediction markets gain mainstream attention. Jump Trading recently made investments in Polymarket and Kalshi, two platforms that have garnered institutional support. According to recent funding rounds, Polymarket is valued at approximately $9 billion.

Supporters claim that by enabling users to trade on economic, sports, and election data, these markets enhance price discovery and public insight. Many contracts, according to critics, resemble unlicensed gambling and may put users at risk.

If Polymarket succeeds, it could limit the ability of states to regulate prediction markets and strengthen the CFTC’s role nationwide. A loss, however, may encourage more states to impose licensing rules or bans.

Crypto World

Chainlink CEO Says On-Chain RWAs Are Reshaping Crypto Market Structure

TLDR:

- On-chain RWAs continue expanding despite crypto price swings, showing independence from speculative market cycles.

- Institutional data providers now supply pricing and reserve data to support tokenized asset markets.

- Blockchain connectivity systems are becoming essential for linking financial infrastructure with on-chain trading.

- Orchestration tools now manage cross-chain workflows, data feeds, and privacy for complex RWA applications.

The current crypto market cycle is revealing signs of structural change rather than financial stress. Industry data shows fewer systemic failures compared with previous downturns.

At the same time, real-world assets are steadily moving onto blockchains. These developments suggest a shift in how value forms across digital markets.

On-chain RWAs reshape crypto market structure

Recent commentary from Chainlink co-founder Sergey Nazarov highlighted the absence of major institutional collapses during recent price drawdowns. He contrasted this with past cycles that saw large failures among centralized lenders and exchanges.

According to Nazarov, the industry now shows stronger risk controls and infrastructure resilience.

He also pointed to continued growth in on-chain RWAs despite volatile crypto prices. Tokenized commodities and financial instruments have expanded across decentralized platforms. This trend indicates that RWA adoption operates independently from short-term crypto market movements.

Data feeds and proof mechanisms now support on-chain trading for assets such as silver and tokenized funds.

Nazarov noted that on-chain perpetual markets for traditional commodities rival activity seen in permissioned financial venues. These markets rely on transparent pricing and continuous settlement.

The shift has attracted attention from established data providers.

Chainlink confirmed integrations with institutions, including S&P and ICE, to support pricing and reserve verification for RWAs. These integrations aim to standardize how off-chain financial data enters blockchain systems.

Infrastructure demand grows with institutional adoption of on-chain RWAs

Nazarov identified connectivity as a central requirement for scaling RWA markets.

Blockchain networks must link with accounting systems, payment rails, and risk management platforms. Chainlink’s interoperability tools have been selected by several Web3 security teams due to their operational track record.

He also emphasized orchestration as a technical layer coordinating multiple systems in one transaction flow. This includes cross-chain operations, off-chain data feeds, and automated settlement processes.

Chainlink’s Runtime Environment currently supports these workflows for enterprise applications.

Privacy features are also becoming critical for advanced RWA use cases. Nazarov stated that new orchestration tools aim to combine data transparency with confidential execution. These features target institutions that require regulatory compliance and internal controls.

According to Nazarov’s assessment, on-chain RWAs may eventually exceed cryptocurrencies in total on-chain value.

He described this shift as a transition from speculative markets to functional financial infrastructure. The growth of tokenized assets would still support crypto liquidity by bringing more capital onto blockchains.

Crypto World

XRP ETFs See $6.31 Million in Daily Inflows as XRPC, GXRP, and XRPZ Excel

TLDR

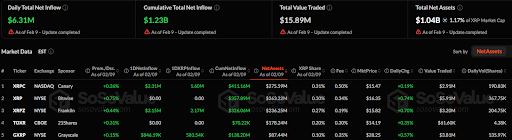

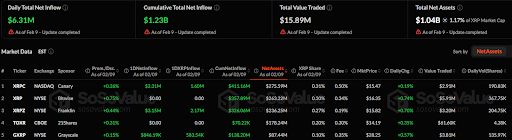

- XRP ETFs total daily net inflows of $6.31M with a cumulative net inflow of $1.23B as of February 9.

- The XRPC ETF on NASDAQ reports a $2.31M daily inflow, holding net assets of $275.59M.

- GXRP ETF on NYSE has daily inflows of $846.19K, with net assets of $87.44M.

- The Franklin XRPZ ETF sees a daily inflow of $3.15M and holds $236.25M in assets.

- TOXR and Bitwise XRP ETFs report no daily inflows or outflows, maintaining minimal changes.

According to a recent SoSoValue update as of February 9, the total daily net inflow for XRP ETFs stands at $6.31 million, with a cumulative net inflow of $1.23 billion. The total value traded on this day is recorded at $15.89 million.

XRP ETFs See Inflows Across XRPC, GXRP, and XRPZ

The XRP ETF products on various exchanges have reported varying levels of performance. A deep dive on the individual ETFs reveals that the XRPC ETF on NASDAQ, managed by Canary, shows a premium of +0.26%. The daily net inflow for this ETF amounts to $2.31 million, with a cumulative inflow of $411.16 million. It holds net assets of $275.59 million, equating to a 0.31% share of the total XRP market cap.

The GXRP ETF, also on the NYSE and managed by Grayscale, reports a daily inflow of $846.19K. GXRP holds the lowest net assets at $87.44 million, which represents 0.10% of XRP’s total market cap. The market price of this ETF is $28.25, with a daily change of +0.57%.

The Franklin XRPZ ETF, listed on the NYSE, has a daily inflow of $3.15 million. It currently holds $236.25 million in net assets, representing a 0.27% XRP share. Its market price stands at $15.82, with a daily increase of +0.70%.

TOXR and XRP ETFs Record No Inflow or Outflow

The TOXR ETF, trading on CBOE under the 21Shares sponsor, reports no change in daily flow with a cumulative net inflow of $70.22K. With net assets of $178.24 million, it has a minimal XRP share of 0.20%. The ETF shows a market price of $14.19, with a daily change of +0.35%.

On the NYSE, the Bitwise XRP ETF has gained a premium of +0.75%, with no changes in daily inflow and a cumulative net inflow of $357.89 million. This XRP ETF holds net assets of $263.22 million and a 0.30% XRP share. Its market price is $16.35, with a daily change of +0.74%.

Crypto World

Digital Assets & TradFi Convergence

From 2023 to 2026, from Hong Kong to a global stage, institutions from around the world convened once again. As the next decade of digital assets unfolds, LTP looks ahead alongside the industry.

What does it feel like to observe—at close range—the front-line pulse of digital assets and traditional finance (TradFi) amid market volatility?

On Feb. 9, 2026, Liquidity 2026, the annual flagship institutional digital asset summit hosted by LTP Hong Kong, concluded successfully in Hong Kong. Now in its fourth consecutive year, the event once again brought together senior representatives from hedge funds, market makers, high-frequency trading firms, family offices, asset managers, exchanges, custodians, banks, and technology service providers, marking another milestone in the accelerating convergence of digital assets and traditional financial markets.

Throughout the full-day agenda, the summit featured keynote addresses, fireside chats, and in-depth roundtable discussions. Speakers and participants engaged in rigorous exchanges around the evolution of the global financial system, the rise of tokenization, and the rapid integration of multi-asset ecosystems—exploring what new opportunities and new paradigms may emerge as institutional adoption deepens.

As the summit drew to a close, a clear consensus emerged across diverse perspectives: at a turning point in the reshaping of the global financial landscape, infrastructure development, regulatory dialogue, and cross-institutional collaboration will be the critical variables shaping the industry’s sustainable growth.This was not merely a forum for ideas, but a defining step in the digital asset industry’s progression toward standardization, institutionalization, and mainstream relevance.

Full Agenda Highlights and Key Takeaways

At Liquidity 2026, LTP convened global experts to examine the future of institutional digital asset markets through multiple lenses—including core infrastructure, liquidity connectivity, tokenization, and emerging market paradigms.

Multi-Asset Trading and Market Convergence: Compatibility and Resilience

Participants broadly agreed that crypto assets are increasingly being redefined as a core asset class that must be integrated into institutional portfolio management frameworks, rather than treated as a standalone alternative market. Stephan Lutz, CEO of BitMEX, noted that CIOs can no longer afford to ignore this asset class. As institutions formally incorporate digital assets into allocation frameworks, the design logic of trading systems is shifting—from pursuing peak performance to enabling seamless integration within existing governance structures, API architectures, and risk controls.

System resilience was repeatedly emphasized. Tom Higgins, Founder and CEO of Gold-i, remarked during a roundtable that system design must assume failure as inevitable, with redundancy and survivability achieved through multi-venue aggregation. At a macro level, regulatory fragmentation remains a key obstacle to global market interoperability; without cross-jurisdictional alignment, genuine multi-asset convergence will remain constrained.

The New Settlement Layer: Clearing, Custody, and Interoperability

Discussions around settlement and custody pointed to a clear direction: custodians are evolving from passive asset safekeeping toward becoming a core infrastructure layer supporting clearing, settlement, and risk management. As institutional participation grows, custody is no longer viewed solely as a compliance requirement, but as a critical nexus connecting regulatory certainty with operational scalability.

The definition of trust is also evolving. Ian Loh, CEO of Ceffu, emphasized that trust must be embedded in executable on-chain mechanisms, with assets generating tangible yield through collaboration between custodians and prime brokers. The importance of mature third-party technology has become increasingly evident. Amy Zhang, Head of APAC at Fireblocks, highlighted the industry’s growing reliance on established infrastructure providers, noting that Europe is emerging as a strategic hub for institutional digital assets due to its regulatory clarity and infrastructure maturity.

Technological redundancy was widely seen as essential to mitigating systemic disruptions. As Darren Jordan, Chief Commercial Officer at Komainu, observed, the future of custody lies in asset usability—shifting the core question from whether assets are safely stored to whether they can be securely and reliably mobilized.

Rebuilding Infrastructure and the Price of Data

Johann Kerbrat, SVP and GM of Robinhood Crypto, shared how Robinhood is evolving from a crypto trading platform into a general-purpose financial infrastructure provider, leveraging blockchain to re-architect payments, settlement, and traditional asset trading—while abstracting complexity away from the end user.

In his view, TradFi’s core bottleneck remains settlement efficiency, often operating at T+1 or longer, whereas crypto-native systems offer 24/7 availability, near-instant transfers, and composability that materially reduce capital costs and counterparty risk. Within regulatory frameworks, Robinhood is advancing equity tokenization on a fully collateralized, 1:1 basis, anticipating that tokenization will expand beyond stablecoins into equities, ETFs, and private markets. The central challenge, he argued, lies not in technology, but in regulatory implementation and collective adoption.

Cory Loo, Head of APAC at Pyth Network, described market data as a structurally underappreciated industry—generating over $50 billion in annual revenue, with data costs rising more than 15-fold over the past 25 years. The true cost, he noted, stems not from information asymmetry, but from data quality, which ultimately determines whether traders achieve best execution.

Pyth Network aims to reconstruct traditional data pipelines by bringing price inputs directly from trading firms and exchanges into a shared price layer, which is then redistributed to institutions at higher quality and lower cost with millisecond-level multi-asset updates. Loo disclosed that Pyth Pro attracted over 80 subscribers within two months of launch, achieving more than $1 million in ARR in its first month. The project also plans to implement a value-capture mechanism whereby subscription revenue flows into a DAO, which repurchases tokens and builds long-term reserves.

Institutional Capital Allocation: From Speculation to Systematic Exposure

A notable shift in capital allocation is underway. Institutional capital is rotating away from narrative-driven assets toward instruments with clear demand drivers and regulatory visibility. Fabian Dori, CIO of Sygnum, observed that as metaverse narratives faded, institutions have refocused on leveraging smart contracts for value-chain integration and process automation. Risk management has increasingly displaced return speculation as the primary screening criterion.

Tokenization is widely expected to drive structural, rather than incremental, change—but scale will depend on demonstrable client demand rather than technological capability alone. Interest in index-based and structured products is rising, and Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group, noted that the future market landscape will likely be defined by the coexistence of multiple technologies and market structures.

Trading Convergence: Bridging Liquidity, Pricing, and Risk

In discussions on liquidity and risk management, participants focused on system stability during extreme market conditions. Jeremi Long, CIO of Ludisia, highlighted how infrastructure upgrades have materially improved execution quality, while emphasizing that risk management must be designed for worst-case scenarios.

Improving cross-venue capital efficiency was identified as a key solution to fragmented capital deployment. Collaborative models between exchanges and custodians—enabling shared capital pools—are increasingly being explored. In this context, transparency has become paramount. Giuseppe Giuliani, Vice President of Kraken’s Institutional team, stressed that liquidity depends on risks being clearly priced, and that exchange transparency and operational stability directly influence market-maker participation.

Building Institutional Rails for the Digital Asset Economy

At the institutional and infrastructure level, multiple case studies suggest a shift from proof-of-concept to real-world deployment. Stablecoin pilots in insurance and payments demonstrate the tangible efficiency gains of on-chain settlement. Some institutions are now exploring migrating flagship products directly on-chain to access broader global liquidity.

System stability is increasingly viewed as a form of revenue protection. Zeng Xin, Senior Web3 Solutions Architect at AWS, noted that stability functions as “income insurance,” with cloud infrastructure providing the resilience and elasticity required for digital markets. Meanwhile, traditional regulatory frameworks continue to impose structural constraints on capital allocation.

Sherry Zhu, Global Head of Digital Assets at Futu Holdings Limited for Futu Group, emphasized that trust and convenience represent core opportunities for brokerage platforms, while acknowledging the capital constraints imposed by frameworks such as Basel. Balancing compliance, privacy, and custody remains a critical threshold for institutional participation in DeFi.

Everything as Collateral: RWA, Stablecoins, and Tokenized Credit

Debates around whether tokenized assets can serve as core collateral are moving from theory to practice. Compared with traditional structures, on-chain collateral—enabled by 24/7 settlement—is better suited to meet sudden margin requirements in derivatives markets. However, legal clarity remains the determining factor.

Chetan Karkhanis, SVP at Franklin Templeton, emphasized the importance of choosing natively on-chain asset structures rather than digital replicas, ensuring a single source of legal truth. Regulatory classification and its impact on capital requirements are equally critical. Institutions evaluating tokenized collateral tend to focus on four dimensions: legal ownership, operational risk, custody arrangements, and liquidity depth.

Beyond the Hype: Where the Industry Goes Next

As the summit concluded, participants converged on a shared view: tokenization alone does not constitute a competitive advantage. The true differentiator lies in whether it delivers measurable improvements across reserves, trading, or settlement.

Erkan Kaya, CEO of ABEX, suggested that tokenization has the potential to fully absorb traditional finance into crypto-native systems, with a tipping point likely to emerge over the next decade. As regulatory credentials, system stability, and user experience become decisive factors, the evolution of financial infrastructure appears irreversible. Digital assets are no longer a peripheral complement to TradFi, but a force increasingly capable of reshaping its operating logic and power structures.Moses Lee, Head of APAC at Anchorage Digital, summarized the sentiment succinctly: tokenization does not equal success—its value depends on delivering clear functional advantages in reserves, trading, or settlement.

Closing Thoughts

For LTP, the industry’s transition into a more mature phase—marked by the fading of hype—also represents the optimal moment for infrastructure, compliance, and sustainable innovation to take root. We remain firmly convinced that lasting value creation resides in the foundational systems that quietly support market operations.

From 2023 to 2026, from regional markets to a global perspective, LTP has remained committed to observing, documenting, and actively participating in the structural, institutional, and regulatory evolution of the digital asset industry. The successful conclusion of Liquidity 2026 marks another meaningful milestone in our long-term effort to advance the integration of digital assets and TradFi.

Looking ahead, LTP will continue to invest heavily in ecosystem development—championing more resilient infrastructure and more open collaboration—to help shape the next decade of digital assets.

With infrastructure build-out, regulatory engagement, and cross-institutional collaboration converging, a healthier, more professional, and increasingly mainstream digital asset era is taking shape.

While Liquidity 2026 has just concluded, the marathon toward deep digital asset–TradFi integration is only entering its second half. As a long-term participant and observer, LTP will continue to dedicate resources to ecosystem building and industry dialogue, helping to usher in the next decade of digital assets.

A full post-event report, including detailed roundtable highlights and key speaker insights, will be released shortly. Stay tuned.

About LTP

LTP is a global institutional prime broker, purpose-built to meet the evolving needs of digital asset market participants. By applying traditional financial standards to blockchain innovation, LTP provides end-to-end prime services spanning trade execution, clearing, settlement, custody, and financing. Its offerings further extend to institutional asset management, regulated OTC block trading, and compliant on/off-ramp solutions — delivering a secure and scalable foundation for institutions across the digital asset ecosystem.

LiquidityTech Limited is HK SFC licensed for Type 1, 2, 4, 5, and 9 regulated activities.

Liquidity Technology Limited is BVI FSC licensed to act as a Virtual Asset Service Provider and licensed under SIBA for Dealing in Investments activities.

Liquidity Technology S.L. is registered with Bank of Spain as a Virtual Asset Service Provider.

Liquidity Fintech Pty Ltd AUSTRAC registered for digital currency exchange, remittance, and foreign exchange service provider activities.

Liquidity Fintech Investment Limited is BVI FSC licensed to provide investment management services.

Neutrium Trust Limited is registered as a Trust Company under the Trustee Ordinance and licensed as a Trust or Company Service Provider under AMLO.

Liquidity Fintech FZE, granted In-Principle Approval (IPA) by the Dubai VARA for a VASP licence (note: IPA does not permit regulated activities).

Disclaimer: All regulated activities are performed exclusively by the relevant entities that are duly licensed or registered, and strictly within the boundaries of their respective regulatory approvals and jurisdictions.

More details: https://www.liquiditytech.com

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

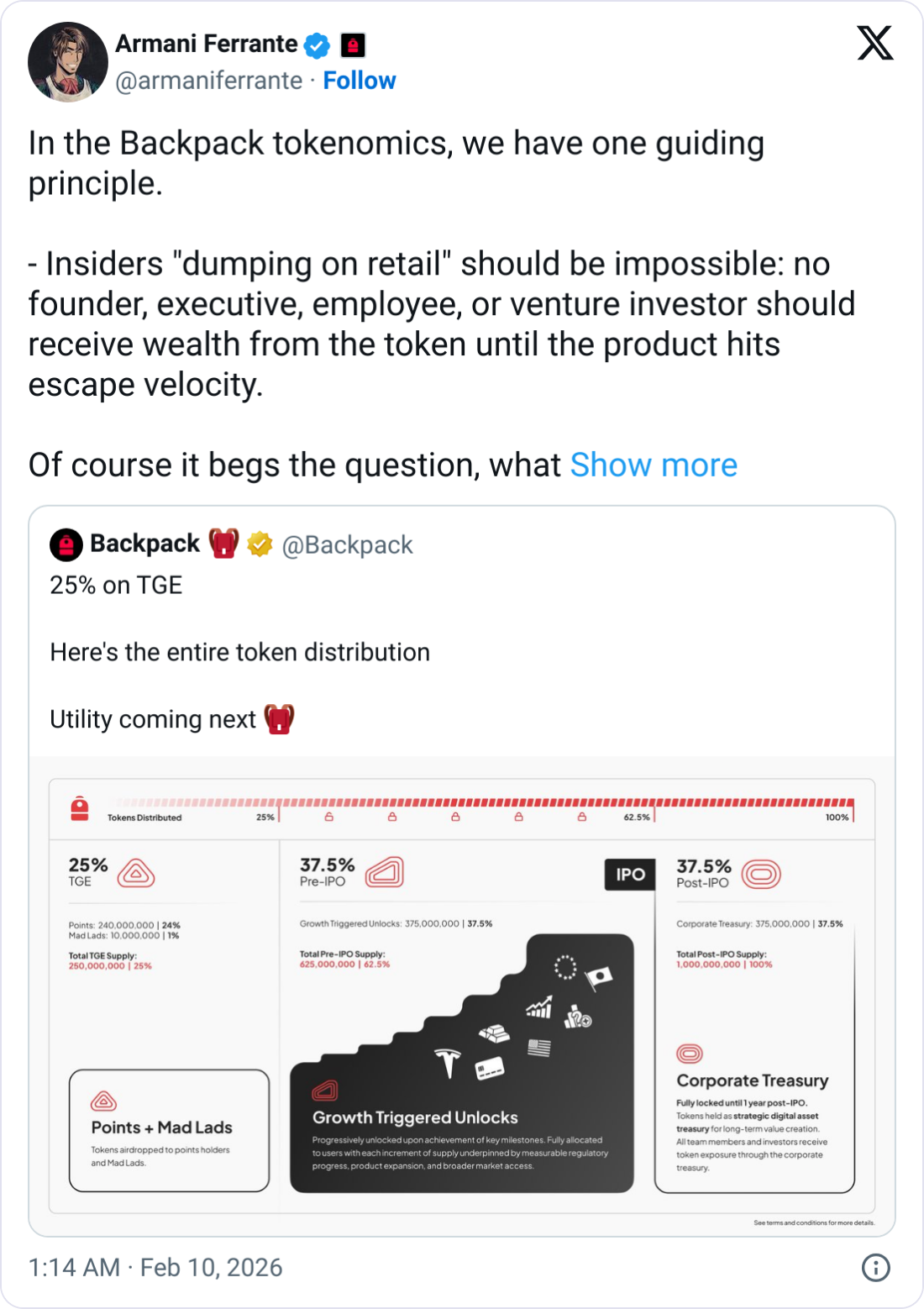

Backpack, a crypto exchange founded by former employees of FTX, says it will launch a 1-billion-supply token in the future, with its distribution schedule tied to its goal of going public in the US.

Backpack posted to X on Monday that its token launch will begin with 25% of the intended supply, or 250 million tokens, to become available on a yet-to-be-disclosed launch date.

Another 37.5% of the total supply, or 375 million pre-IPO tokens, will be made available “upon achievement of key milestones,” which Ferrante said would include opening in a new region or launching a new product.

The remaining 375 million post-IPO tokens would be locked until a year after the company goes public, with the tokens held strategically in a corporate treasury.

The IPO push comes as Axios reported on Monday that Backpack is in discussions to raise $50 million at a $1 billion pre-money valuation, potentially making it the crypto industry’s latest unicorn.

In a separate post, Backpack co-founder and CEO Armani Ferrante wrote on X on Monday that the “guiding principle” for its token unlocks was that “insiders ‘dumping on retail’ should be impossible.”

Ferrante, an early employee at the FTX-linked Alameda Research, added that none of the Backpack team or investors should gain wealth from the token “until the product hits escape velocity,” which he said would happen when the company launches an initial public offering.

“Going public might happen quickly, it might happen not so quickly, and in fact, it might not happen at all,” Ferrante said. “In any case, we’re going for it.”

Related: Backpack Exchange launches beta testing of prediction market platform

Ferrante said that “not a single founder, executive, team member, or venture investor has been given a direct token allocation,” and that the team instead owns equity in the company.

“It’s not until the company goes public (or has some other type of equity exit event), that the team can earn any wealth from the project,” he added.

“It’s not until the company has done all the hard work to earn access to those markets that the team can reap the rewards of the value created by the Backpack community from now until then.”

Backpack launched in 2022 and Ferrante co-founded the exchange alongside former FTX.US strategy lead Tristan Yver and former FTX general counsel Can Sun.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

YouTube star MrBeast buys youth-focused financial services app Step

Creator, Entrepreneur and Philanthropist Jimmy Donaldson, also known as MrBeast, speaks onstage during the 2025 New York Times Dealbook Summit at Jazz at Lincoln Center on December 03, 2025 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

The world’s largest YouTuber by subscriber count, Jimmy Donaldson, better known as MrBeast, has acquired the financial services app Step, marking his company’s entry into fintech with a focus on serving younger users.

Step is advertised as an all-in-one money app for teens and young adults to manage money, build credit and access financial tools. The app will operate under the umbrella of Donalson’s company, Beast Industries.

“Nobody taught me about investing, building credit, or managing money when I was growing up. That’s exactly why we’re joining forces with Step,” MrBeast told his millions of fans on Monday. “I want to give millions of young people the financial foundation I never had. Lots to share soon.”

Beast Industries did not disclose how much it paid for Step. CNBC contacted the company for comment but did not receive a response by publication.

Beast Industries has been fundraising over the past year, including a recent $200 million investment from Bitmine Immersion Technologies, the largest corporate holder of the cryptocurrency Ether and chaired by Fundstrat’s Tom Lee.

Step is backed by fintech giant Stripe, as well as venture capital firms such as Coatue, Collaborative Fund, Crosslink Capital and General Catalyst.

The newly acquired Step was founded in 2018 by fintech veterans CJ MacDonald and Alexey Kalinichenko, with a mission of providing the next generation with tools for financial literacy.

While it is not a bank, Step partnered with Evolve Bank & Trust, a consumer banking company, for banking services in 2022. The platform also includes a Step Visa Card, an account for saving, spending, sending money and investing, with no monthly fees.

Beast Industries said in a press release Step’s over 7 million users, technology platform and in-house fintech team would complement its large digital audience and philanthropic initiatives.

“This acquisition positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better,” Jeff Housenbold, CEO of Beast Industries, said in a statement.

Beast Industries’ other ventures include Feastables, a snack brand, Beast Philanthropy, its non-profit arm, and Beast Games, its reality competition series on Amazon Prime Video.

Those ventures leverage Donaldson’s YouTube brand, which had over 450 million subscribers and 5 billion monthly views across channels as of early 2026.

Crypto World

Bitcoin’s U.S. demand signal flickers back after crash

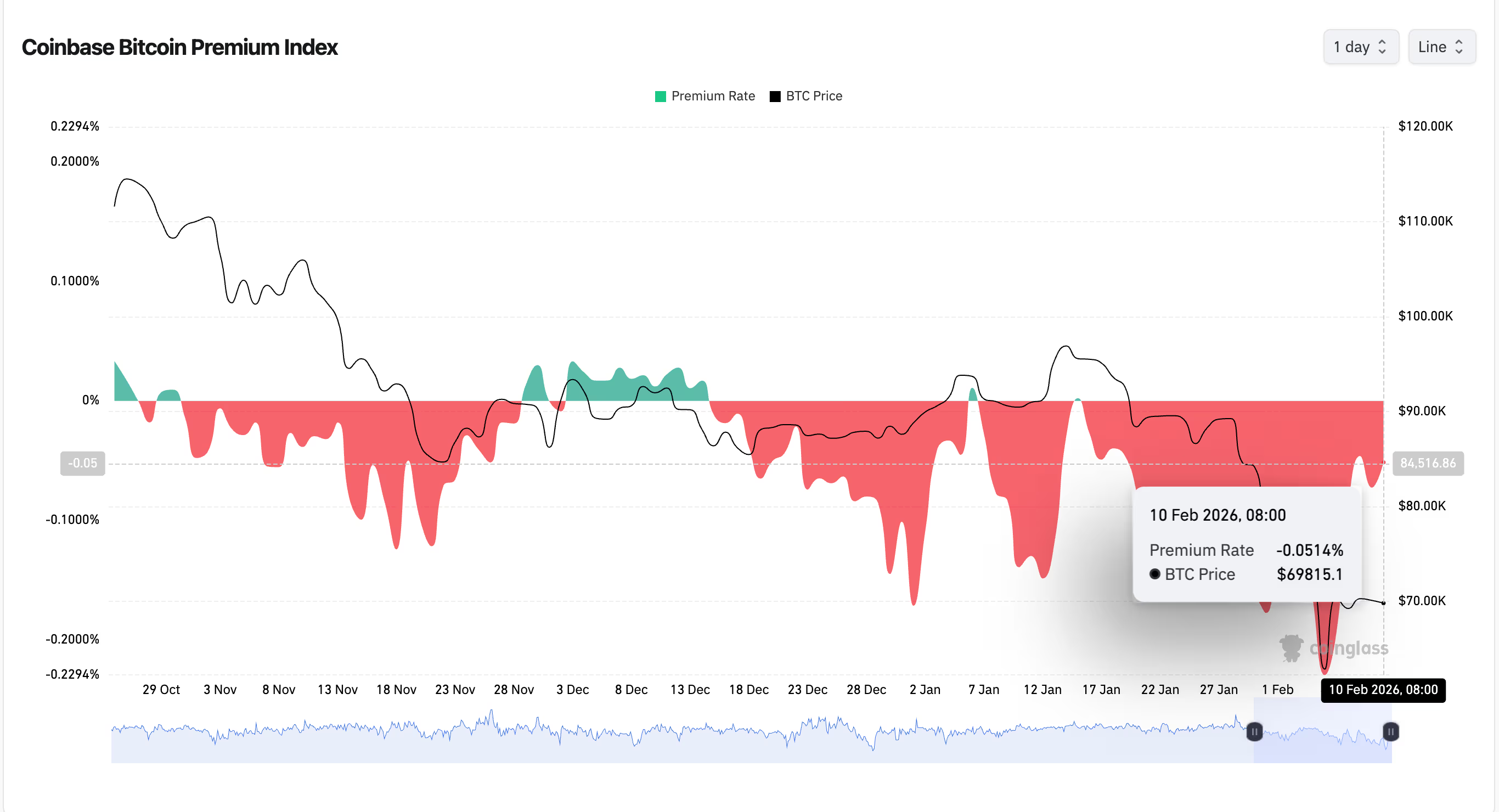

Bitcoin’s sharp rebound from last week’s plunge toward $60,000 has been accompanied by a subtle but important shift in one closely watched indicator of U.S. demand.

The Coinbase Bitcoin Premium Index — which tracks the price gap between bitcoin traded on Coinbase and the global market average — has climbed sharply from deeply negative territory, moving from around -0.22% at the height of the selloff to roughly -0.05% by Tuesday.

While the index remains below zero, the rebound suggests U.S.-based investors stepped in to buy the dip as forced selling pressure eased.

Coinbase is widely viewed as a proxy for institutional and dollar-based flows. A deeply negative premium typically signals U.S. investors are either selling aggressively or staying on the sidelines altogether. The move back toward neutral indicates that some buyers found value at lower levels, particularly as bitcoin stabilized after its fastest drawdown since the FTX collapse in 2022.

Still, the premium has not turned positive, a threshold that historically coincides with sustained accumulation and renewed risk appetite among U.S. funds. Instead, the current move points to selective buying rather than broader conviction.

Market structure data supports that cautious interpretation. Aggregate trading volumes across major exchanges remain well below late-2025 highs, according to Kaiko, with spot activity showing signs of gradual attrition rather than a decisive surge in demand.

Thin liquidity means prices can bounce sharply once selling exhausts itself, but also leaves the market vulnerable to renewed downside if buyers fail to follow through.

Bitcoin is currently trading just under $70,000 after recovering more than 15% from its intraday low, though it remains down over 10% on the week.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

The Israeli Crypto Blockchain & Web 3.0 Companies Forum last week launched a lobbying effort to push regulatory reforms that research from KPMG says may add 120 billion shekels ($38.36 billion) to the country’s economy by 2035 and create 70,000 new jobs.

At a Feb. 3 event in Tel Aviv, Forum leader Nir Hirshman-Rub said there is broad public support for legislation that would relax rules on stablecoins and tokenization, along with simplifying tax compliance requirements.

In the wake of the US-brokered ceasefire of the Gaza war, 2026 is seen as a “defining year” for the local digital assets industry, Hirshman-Rub said.

“The Israeli public is already there and the politicians need to act,” Hirshman-Rub told Cointelegraph on the sidelines of the Tel Aviv event. “More than 25% of the public already has had crypto dealings in the last five years and more than 20% currently hold digital assets,” he said, citing the KPMG research.

Steady growth as digital asset landscape evolves

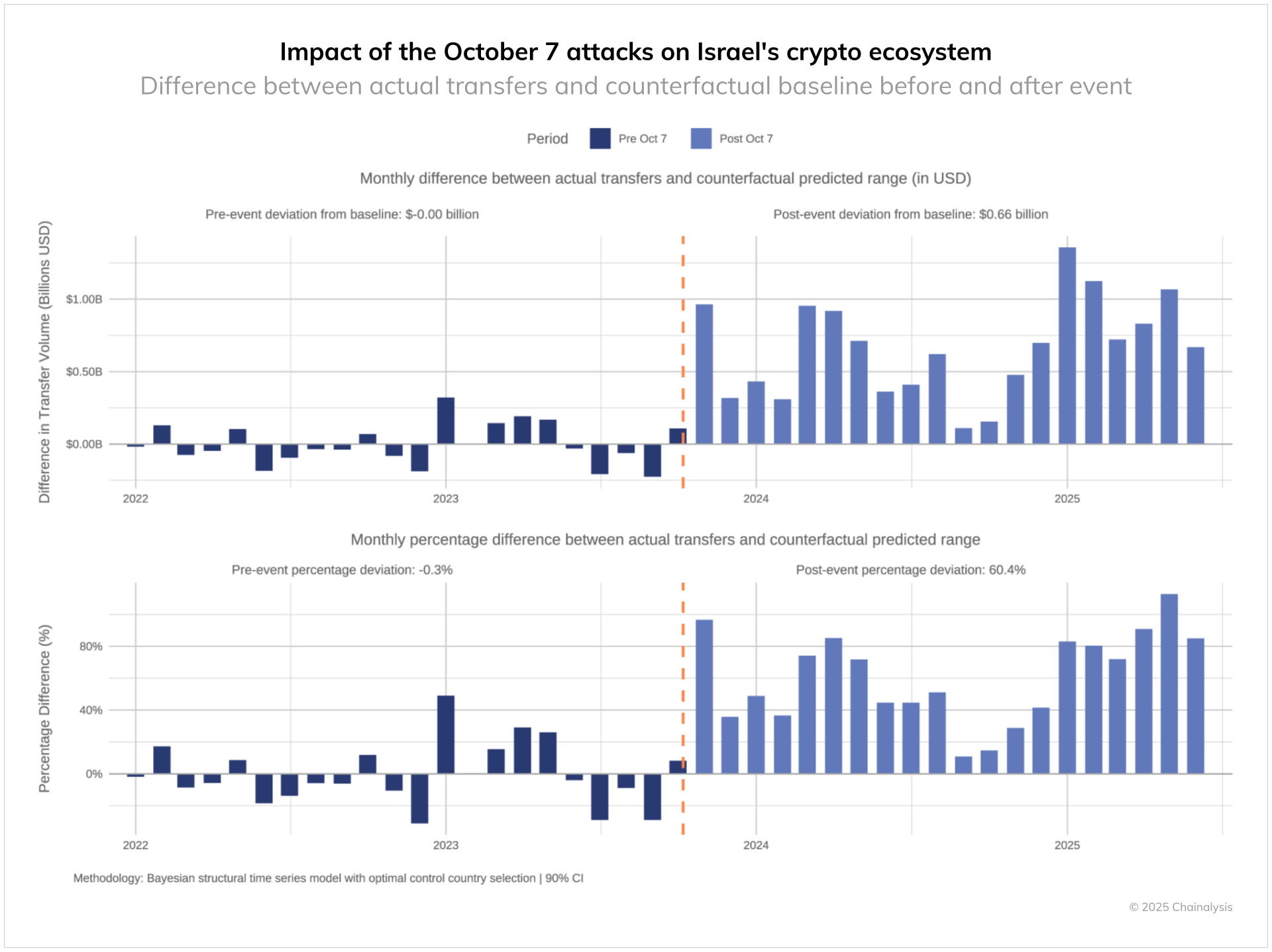

An October Chainalysis report showed that the G-20 country’s crypto economy has showed steady growth, with inflows topping $713 billion last year. Those levels reflect a sharp increase in crypto volumes in the aftermath of the October 2023 Hamas attacks, which were sustained by strong retail activity, the report said.

Israeli companies, such as Fireblocks and Starkware, have established leadership positions in the global digital assets landscape and are among the Forum’s sponsors. According to NGO Startup Nation Central, more than 160 locally founded companies have attracted more than 5% of the $30 billion invested worldwide in the sector, employing more than 2,500, primarily in the greater Tel Aviv area.

“The problem is that once a company here disclosed that it deals with digital assets, Israeli banks refuse to serve the company or require the company’s attorneys to make an impossible declaration that funds originating in a digital asset will not be deposited in an Israeli bank account,” said Hirshman-Rub. “It may not be outright refusal, but simply dragging their feet, adding demands in a never-ending due diligence process.”

Related: EU tokenization companies push for DLT pilot changes amid US momentum

Among other barriers that the group seeks to reform is an income tax ordinance that penalizes token distribution to employees as stock options. While traditional stock options provided to employees are taxed at a 25% rate, tokenized options will pay a 50% rate for similar value.

A national strategy

In July, the country’s National Crypto Strategy Committee presented an interim report to the Israeli Knesset for parliamentary review. The committee outlined a strategic framework underpinned by five pillars, including establishing a unified regulator, creating token issuance rules, and banking integration.

In August, the Israel Tax Authority published a new Voluntary Disclosure Procedure that would offer taxpayers a path to disclose previously unreported income and assets, including digital assets, and obtain immunity from criminal proceedings. It was the agency’s third attempt to implement a disclosure regime.

However, last month, the agency said taxpayer participation has so far fallen short of expectations, but committed to seeing the initiative through to the end of August 2026.

“The Israeli banking system is not willing to accept cryptocurrency, and it is also very difficult to bring in funds as a result of selling cryptocurrency,” Tax Authority director Shay Aharonovich said, according to local media reports. “There is no doubt that this also affects the willingness to make voluntary disclosure, because in the end people do not just want to pay the tax, but to use the money.”

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat8 hours ago

NewsBeat8 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat19 hours ago

NewsBeat19 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports8 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report