Crypto World

Metaplanet Reports $605 Million Loss After Billions Spent on Bitcoin

TLDR

- Metaplanet posted a $605 million loss due to the decline in Bitcoin’s value.

- The company spent $3.8 billion on Bitcoin, purchasing the asset at an average price of $107,000 per coin.

- Metaplanet’s Bitcoin holdings are currently down by 37%, reflecting an unrealized loss of $1.4 billion.

- Despite the losses, the company saw an 81% increase in operating profit from its options business.

- Metaplanet continued purchasing Bitcoin even when the price exceeded $100,000, making its largest purchases in September and October.

Metaplanet, a Japanese firm that heavily invested in Bitcoin, has revealed a significant financial setback. The company announced a loss of ¥95 billion, or $605 million, for the past year. This decline follows the cryptocurrency’s steep drop in price from its all-time highs in October.

Metaplanet’s Losses Stem from Falling Bitcoin Value

The primary reason behind Metaplanet’s financial struggles lies in the falling value of its Bitcoin holdings. The firm’s 35,100 Bitcoin, which was worth $2.4 billion, has seen a dramatic decline in value. Since the company began accumulating Bitcoin 21 months ago, it has spent approximately $3.8 billion, acquiring the digital asset at an average price of $107,000 per Bitcoin.

At the current market value, Metaplanet’s Bitcoin holdings are down by about 37%, reflecting an unrealized loss of $1.4 billion. In the last quarter, ending December 31, the company’s Bitcoin stash lost ¥102 billion, or $664 million, in value. Despite these losses, Metaplanet’s stock price saw a minor increase to ¥326 on Monday.

Revenue from Premiums Amid the Losses

Metaplanet’s revenue model remains largely dependent on premiums from writing options. Over the course of the year, the company’s option premiums increased substantially, rising to ¥7.9 billion, or $51 million. This marks a sharp contrast to the previous ¥691 million, or $4.5 million, recorded in the prior year.

The firm has projected an 81% increase in operating profit, which it expects to come from its options business. While Metaplanet’s Bitcoin holdings have significantly decreased in value, this shift in focus toward its options business aims to provide some financial stability.

Bitcoin Purchases Amid the Decline

Metaplanet has continued to invest in Bitcoin even as its value fluctuated. The company made some of its largest purchases when Bitcoin was trading above $100,000. In September, Metaplanet acquired $630 million worth of Bitcoin when the price was around $106,000, followed by another purchase of $615 million in October.

In total, Metaplanet has been purchasing Bitcoin through a combination of common stock issuance and preferred shares. The company’s strategy mirrors that of Michael Saylor’s firm, Strategy, which has also invested heavily in Bitcoin. However, unlike Strategy, Metaplanet has introduced products like MERCURY and MARS to help mitigate market risks.

Crypto World

Fintech Company Secures Regulatory Approval in HK

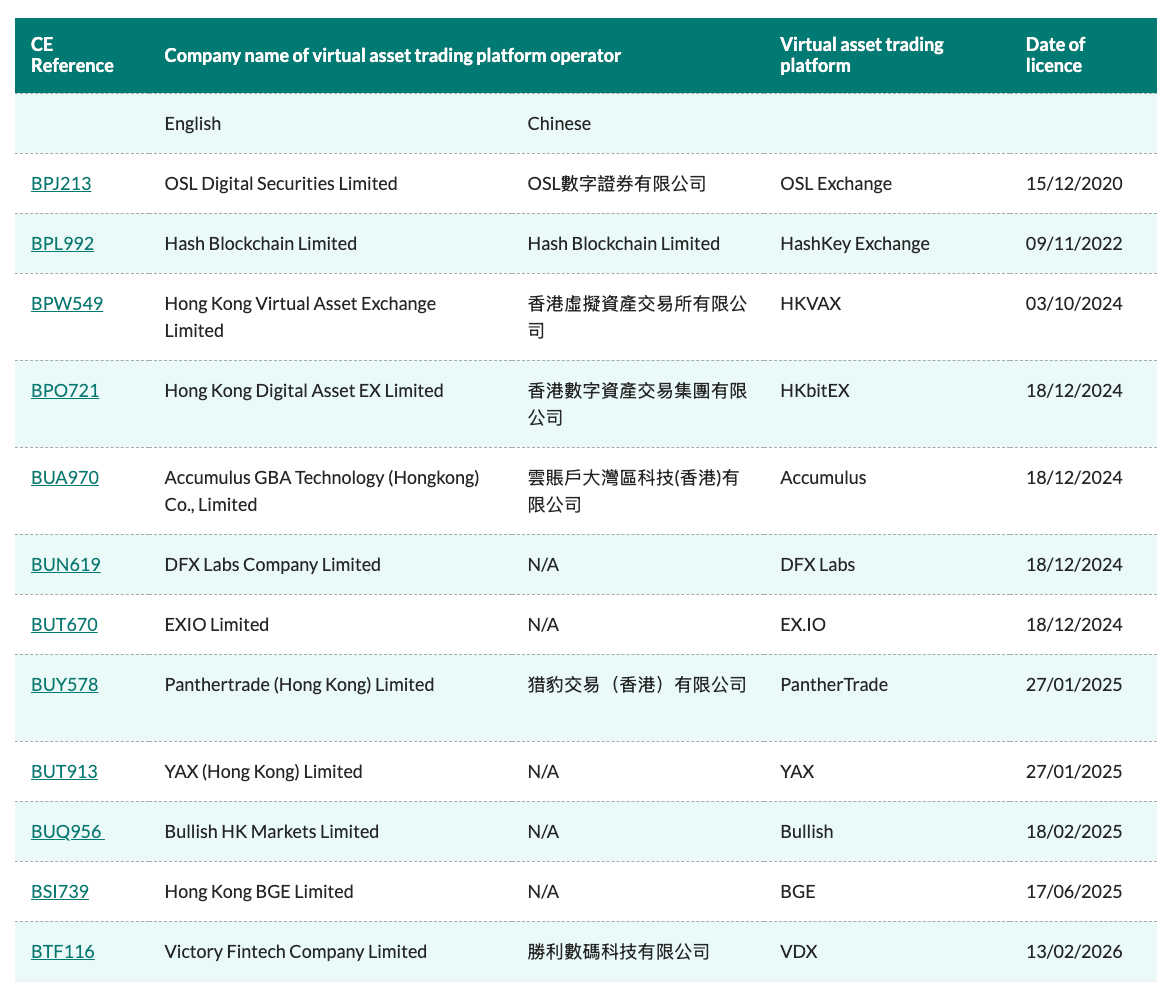

The addition is the first crypto company to be licensed by the Securities and Futures Commission since June 2025, when the regulator approved Hong Kong BGE.

Hong Kong’s Securities and Futures Commission (SFC) has added another company to its list of formally licensed cryptocurrency trading platforms, according to a Friday announcement.

The SFC’s list of licensed virtual asset trading platforms includes Victory Fintech Company Limited as the latest of now 12 cryptocurrency and blockchain entities on the Hong Kong regulator’s website. The addition of Victory marked the first time since June 2025 that the SFC had approved a crypto trading platform in Hong Kong.

Although Hong Kong has been known for some time as a particularly strict jurisdiction in for crypto companies to operate in, authorities have been pursuing unlicensed virtual asset trading platforms as a criminal offense since June 2024. Many exchanges that had previously been operating in Hong Kong shut down, while others like OKX and Bybit withdrew their licensing applications.

Related: Crypto funds log fourth week of outflows at $173M as BTC dips below $70K

In January, Hong Kong’s Secretary for Financial Services and the Treasury, Christopher Hui, said regulators, including those at the SFC, were planning to submit a draft ordinance for providers offering crypto advisory services sometime in 2026. While a dozen companies are now licensed under the SFC, Hong Kong’s Monetary Authority listed no licensed stablecoin issuers as of Monday.

HK allows licensed companies to engage in crypto margin financing, perpetual trading

The addition of Victory Fintech came just a few days after Hong Kong’s SFC said it will allow licensed brokers to provide virtual asset margin financing. The securities regulator’s guidance only allows Bitcoin (BTC) and Ether (ETH) to be eligible as collateral, initially.

The SFC also outlined a framework for trading platforms to offer perpetual contracts to professional investors.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Ether May Retest $2.5K Soon If This Pattern Plays Out

Ether (ETH) opened the week with a drop below the psychological $2,000 level, placing the altcoin into a 20% loss for February. Still, onchain data shows long-term investors accumulating ETH and rising network usage.

Now, analysts are examining how ETH’s technical outlook and the derivatives data align with its emerging demand to determine if a prolonged rally above $2,000 is possible.

Key takeaways:

-

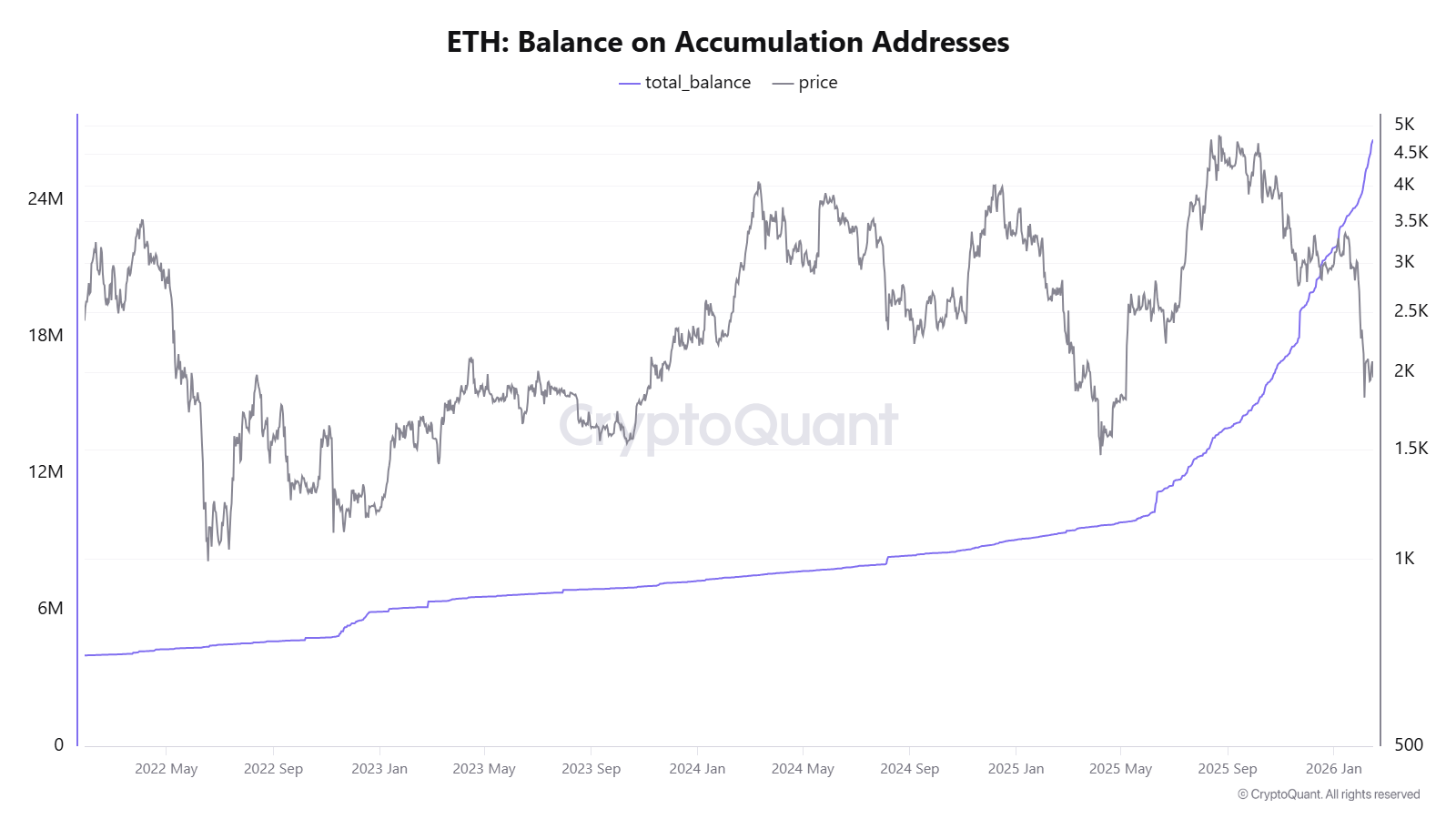

Over 2.5 million ETH flowed into accumulation addresses in February, lifting holdings to 26.7 million for 2026.

-

Ethereum weekly transactions hit 17.3 million as the median fees fell to $0.008, a 3,000x drop from 2021 peaks.

-

ETH open interest dropped to $11.2 billion, but leverage remains elevated, with liquidation clusters stacked near $1,909 and $2,200.

Ether accumulation grows despite price drop

Ether accumulation addresses added more than 2.5 million ETH in February, even as the price declined about 20%. Total holdings have risen to 26.7 million ETH, up from 22 million at the beginning of 2026.

MN Capital founder Michaël van de Poppe noted that ETH valued against silver is at its lowest level on record, arguing that such difficult market phases often present a long-term accumulation window.

The network demand is also improving alongside improving fundamentals. Over 30% of ETH’s circulating supply (37,228,911 ETH) is currently staked, reducing the liquid supply. At the same time, weekly transaction count reached an all-time high of 17.3 million, while median fees fell to $0.008.

In comparison, head of research at Lisk, Leon Waidmann, noted that the weekly transactions were near 21 million, but the median fees surged above $25 during the 2021 peak. The current structure reflects a higher usage at significantly lower cost.

Related: Harvard endowment reduces stake in Bitcoin ETF, adds Ether exposure

ETH compresses below $2,000 as leveraged traders brace for a breakout

On the four-hour chart, Ether appears to be forming an Adam and Eve bottom, a bullish reversal setup that begins with a sharp, V-shaped low (the “Adam”) followed by a slower, rounded base (the “Eve”).

The structure reflects an initial aggressive sell-off that quickly finds buyers, then a period of gradual accumulation as the volatility contracts.

A confirmed breakout above the $2,150 neckline validates the pattern and may open the door toward the $2,473–$2,634 region, based on the measured move projection from the base. The invalidation remains below recent higher lows, with $1,909 acting as a key short-term liquidity level.

Open interest has declined to $11.2 billion from a $30 billion cycle peak in August 2025. However, the estimated leverage ratio remains elevated at 0.7, only slightly down from 0.77 in January. This suggests leverage is still concentrated in the system, increasing the possibility of a sharp move.

Hyblock data shows that 73% of the global accounts are currently long on ETH. Liquidation heatmaps show more than $2 billion in short positions clustered above $2,200, compared with roughly $1 billion in long liquidations stacked near $1,800, highlighting a heavier squeeze risk to the upside.

Although the nearest dense cluster sits at $1,909, where $563 million in longs are vulnerable, which may act as a potential short-term liquidity magnet before the expected uptrend.

Related: Crypto funds log fourth week of outflows at $173M as BTC dips below $70K

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Germany’s central bank president touts stablecoins, CBDCs for EU

The head of Germany’s central bank signaled a deliberate shift in Europe’s approach to digital money, endorsing euro-denominated instruments as a path to greater autonomy in payments. Joachim Nagel, president of the Deutsche Bundesbank, used remarks at the New Year’s Reception of the American Chamber of Commerce in Frankfurt to outline support for both a euro-denominated central bank digital currency (CBDC) and euro-stablecoins for everyday transactions. He noted that EU officials are actively pursuing a retail CBDC and argued that stablecoins pegged to the euro could help Europe “become more independent in terms of payment systems and solutions.” The comments underscore a broader, ongoing debate about how Europe should compete with dollar-based rails in a rapidly evolving digital money landscape.

Key takeaways

- Europe is actively weighing a retail CBDC alongside euro-denominated stablecoins as tools to improve payment efficiency and sovereignty.

- European officials view euro-stablecoins as a potential means to reduce cross-border settlement costs for businesses and individuals.

- The discussion sits against the backdrop of a US framework for payment stablecoins, with the GENIUS Act cited as a benchmark for regulatory direction.

- Nagel warned that European monetary policy could be impaired if USD-denominated stablecoins grow too large a share of the market.

- In parallel, a wholesale CBDC could enable programmable payments in central bank money, signaling a possible shift in how banks settle transactions.

Market context: The dialogue arrives as Washington accelerates work on a broader regulatory framework for digital assets, including stablecoins, with White House discussions and Senate consideration surrounding the CLARITY Act. The GENIUS Act, referenced in policy discussions, would shape how payment-focused stablecoins are governed in the United States, potentially influencing cross-border competition and global liquidity channels.

Why it matters

At the core of Nagel’s remarks is a recognition that Europe cannot rely solely on US-dominated payment rails if it wants to preserve sovereignty over its monetary infrastructure. The Bundesbank chief’s emphasis on euro-denominated stablecoins points to a belief that European coins could complement, rather than replace, traditional fiat money by enabling near-instant cross-border transactions at a lower cost. In practical terms, euro-stablecoins could streamline settlement for trade, remittances, and business-to-business payments across the single market and beyond, potentially reducing frictions tied to currency conversion and correspondent banking networks.

Yet the path forward is not without risk. Nagel highlighted that a wholesale CBDC could unlock programmable payments in central bank money, a feature that could transform how financial institutions manage liquidity, settlement risk, and monetary policy transmission. Still, he warned that if USD-denominated stablecoins were to gain outsized market share, European monetary sovereignty could be compromised. Those tensions mirror broader global debates about who controls the rails for a digital, borderless payments landscape and how to balance innovation with financial stability.

The remarks come amid broader regulatory activity in the United States. Lawmakers and White House officials have been meeting with banking and crypto industry representatives ahead of potential votes on legislation such as the CLARITY Act, which seeks to establish a comprehensive framework for digital assets. The GENIUS Act, referenced in various policy discussions, would establish a structured approach to stablecoins and their use in everyday payments. The legislative process is ongoing, with timelines cited for implementation once enacted or once related regulations are finalized. These developments signal a convergence of policy considerations in the United States and Europe as both blocs weigh how best to foster innovation while protecting financial stability.

Against this regulatory backdrop, European institutions have continued to explore practical pilots and market offerings that could align with a euro-centric digital money strategy. The intersection of central bank digital currency planning and private sector stablecoins could yield a spectrum of options for users—from instant, low-cost cross-border transfers to programmable payments anchored in central bank money. The evolution of these ideas will likely depend on how policymakers assess risk, privacy, interoperability, and compatibility with existing monetary policy frameworks.

What to watch next

- Progress on the European Central Bank’s retail CBDC framework and any concrete milestones for a euro-denominated digital currency in 2024–2025.

- Regulatory developments in the United States around the GENIUS Act and the CLARITY Act, including any votes or regulatory proposals that could shape cross-border stablecoin flows.

- Policy debates within the Eurogroup and European Parliament on how euro-stablecoins should be treated for consumer protection, taxation, and financial stability.

- Implementation timelines for the US framework and how retail and wholesale digital assets might interact with euro-denominated instruments in a global settlement landscape.

- Industry actions, including testing and deployment of euro-stablecoins in cross-border corridors and any notable pilot programs among European banks and fintechs.

Sources & verification

- Bundesbank speech: “priorities and challenges for Europe in a changing world,” link to the official Bundesbank page detailing Nagel’s prepared remarks.

- GENIUS Act context: coverage of the bill’s status and its implications for stablecoins and payment systems in the United States.

- White House discussions on stablecoin yields and regulatory approaches as referenced in public reporting on CLARITY Act proceedings.

- ING Germany’s crypto ETP/ETN offerings in the market and related commentary on how financial institutions are adapting to crypto products.

Sources & verification

Euro-denominated stablecoins and a European CBDC: implications for payments

Europe is rapidly outlining a digital money strategy that blends central bank-issued digital currencies with privately issued, euro-pegged stablecoins. Nagel’s remarks reflect a strategic shift: rather than purely adapting existing fiat rails, Europe appears to be exploring digital instruments designed to operate alongside traditional money while offering new capabilities for payments and settlement. The emphasis on euro-denominated stablecoins as a vehicle for cross-border transactions aligns with a broader push to reduce frictions in regional commerce and to avoid overreliance on dollar-based settlement networks. By framing these instruments as potential levers for European sovereignty, Nagel signals that digital money policy is moving from abstract theory to concrete policy design and market testing.

The discussion also underscores the complexity of implementing these tools in a way that preserves financial stability and consumer protections. A wholesale CBDC, with its programmable-money feature set, could enable central banks to automate and tailor payments at scale. Yet such capabilities raise questions about privacy, data governance, and the potential impact on bank balance sheets as settlement rails evolve. While euro-stablecoins could offer efficiency gains for cross-border flows and domestic payments, policymakers will need to weigh currency sovereignty against integration with global markets, ensuring interoperability with existing payment ecosystems and compliance with anti-money-laundering standards.

On the policy front, the United States is actively shaping its own framework for digital assets, and lawmakers have signaled a willingness to adopt a comprehensive regime. The GENIUS Act and related measures aim to provide a clear regulatory pathway, while ongoing White House discussions with financial institutions and crypto firms illustrate the complexity of balancing innovation with risk controls. The timing of these regulatory moves is critical, given the speed at which digital payment technologies are evolving and the possibility that stablecoins could become a dominant cross-border supplier of liquidity if left unregulated or underregulated. In Europe, the path forward will be shaped by the European Central Bank’s decisions, national implementations, and the region’s ability to coordinate with international standards to ensure compatibility and resilience across the payment ecosystem.

Ultimately, Nagel’s comments framing euro-denominated tools as a means to strengthen European autonomy in payments reflect a broader trend: governments are increasingly looking to digital money not merely as a fintech curiosity but as a strategic pillar of monetary sovereignty, financial stability, and competitive positioning in a rapidly digitizing global economy.

Crypto World

Claude Computer Use The Agentic Revolution

From Chatbots to Autonomous Agents: The Next Phase of Artificial Intelligence

For years, artificial intelligence has been dominated by conversational assistants capable of answering questions, generating content, and supporting knowledge work. Today, however, the industry is undergoing a far more profound transformation: the shift from chatbots to autonomous AI agents capable of acting directly within digital environments and completing tasks end-to-end. This transition, widely referred to as

the Agentic Revolution, marks the emergence of a new class of systems that do not merely communicate, but observe, reason, and operate.

Early projects such as Manus AI demonstrated that agents could plan, decompose complex objectives, and coordinate multi-step reasoning. Building on this foundation, Anthropic’s Claude Computer Use now represents a major leap forward: one of the first commercially available AI agents capable of using a real computer autonomously, browsing the web, interacting with graphical interfaces, and executing full workflows in the same way a human operator would.

This development signals a fundamental change in how artificial intelligence interfaces with the digital world, transforming language models into fully operational digital workers.

How Claude Computer Use Works: The Computer-Using Agent Model

Claude Computer Use is based on the concept of a Computer-Using Agent (CUA). Rather than relying on predefined APIs or rigid automation scripts, the agent interacts directly with the operating system via the graphical user interface.

The system visually perceives the screen using computer vision, recognises interface elements such as buttons, text fields, menus, and windows, and interprets them within a semantic and task-oriented context. Given a user objective, the model applies its reasoning capabilities to construct a plan by decomposing the task into a sequence of atomic actions, such as moving the cursor, clicking, typing, scrolling, and navigating between applications and web pages.

Crucially, Claude does not follow a fixed script. It can adapt to unexpected interface changes, recover from errors, reassess its strategy, and continue execution dynamically. This level of flexibility distinguishes it from traditional robotic process automation and brings its behaviour much closer to that of a human digital operator.

From Manus AI to Claude: The Evolution Towards Fully Operational Agents

Manus AI introduced the idea of general-purpose agents capable of long-horizon reasoning, task decomposition, and tool orchestration. However, its interaction with software systems was still largely mediated through structured tools and APIs.

Claude Computer Use removes this intermediary layer by allowing the agent to operate the computer directly. Any application, including legacy systems without modern integrations, becomes accessible. This shift moves autonomous agents from a conceptual framework into practical deployment, enabling real-world task execution across virtually any digital environment.

Claude vs OpenAI Operator vs Google Mariner

Anthropic is not alone in developing agentic systems. OpenAI and Google are pursuing similar goals, each with a distinct strategic focus.

OpenAI Operator is designed for high-performance task execution across web and enterprise workflows, with deep integration into the GPT ecosystem and API-driven tooling. Its strengths lie in speed, scalability, and developer extensibility.

Google Mariner focuses on autonomous web navigation and large-scale information retrieval, leveraging tight integration with Chrome, Google Search, and Google Workspace. It is particularly well-suited to research, data collection, and productivity automation within Google’s ecosystem.

Claude Computer Use differentiates itself through its emphasis on general-purpose reasoning, interpretability, and safety. Anthropic has prioritised controlled autonomy, alignment, and robust governance, making Claude especially attractive for enterprise and regulated environments where reliability and risk management are critical.

Business Implications: True Cognitive Task Automation

Computer-using agents unlock a new level of cognitive automation that extends far beyond repetitive process scripting.

In operations, they can interact with legacy systems, enter and validate data, generate reports, and coordinate internal workflows without custom integrations.

In marketing and sales, they can conduct market research, perform competitive analysis, update CRMs, manage campaigns, and publish content.

In finance, they can access banking portals, prepare financial statements, perform reconciliations, and support audit processes.

In human resources, they can screen candidates, operate recruitment platforms, schedule interviews, and automate onboarding.

These capabilities effectively create a new category of worker: the autonomous digital employee, capable of performing knowledge-intensive tasks continuously, at scale, and with near-zero marginal cost.

Security and Privacy in the Age of Autonomous Agents

Granting AI direct control over computers introduces unprecedented security challenges. Such agents may handle credentials, access sensitive information, and execute actions with real operational consequences.

Potential risks include interface manipulation, visual prompt injection, execution errors, and insufficient auditability. In response, Anthropic has designed Claude Computer Use with layered safeguards: sandboxed environments, granular permission controls, human oversight for high-impact actions, comprehensive activity logging, and strict behavioural policies.

In the agentic era, cybersecurity is no longer only about protecting data. It is about governing autonomous behaviour within complex digital infrastructures.

The Shift from Chatbots to Agents

The transition from chatbots to autonomous agents represents a structural change in software architecture.

Chatbots respond; agents act.

Chatbots operate in isolated turns; agents maintain a persistent state and long-term plans.

Chatbots are reactive; agents can be proactive and goal-driven.

This evolution is giving rise to the agentic economy, in which organisations orchestrate fleets of specialised agents that research, plan, execute, and coordinate with one another across digital systems.

Conclusion: The Dawn of the Agentic Revolution

Anthropic’s Claude Computer Use marks a decisive step in the evolution of artificial intelligence from conversational tools to operational digital entities. While Manus AI laid the conceptual groundwork for autonomous agents, Claude demonstrates their practical viability by showing that a model can control a real computer and complete complex tasks independently.

The Agentic Revolution is not an incremental improvement. It is a paradigm shift: from passive tools to active digital collaborators, from assistants to operators, from software that advises to software that executes. In the coming years, competitive advantage will increasingly depend on how effectively organisations design, govern, and scale ecosystems of autonomous agents.

We are witnessing the emergence of a new form of workforce: the autonomous AI workforce. And Claude Computer Use is one of the clearest early signals that this future has already begun.

Crypto World

Trump Brings Nicki Minaj Into His Crypto Inner Circle With WLFI

Nicki Minaj will take the stage at the Trump-linked World Liberty Forum later this week, marking her latest public alignment with the Trump family’s expanding crypto ambitions.

World Liberty Financial (WLFI), the DeFi project backed by Donald Trump’s family, confirmed that the global music icon will attend its flagship summit at Mar-a-Lago on February 18.

Sponsored

From White House Stage to Crypto Power Circle

Her participation comes just weeks after she appeared alongside Donald Trump at a government-linked event in Washington, D.C., where she openly praised the president and described herself as one of his strongest supporters.

Minaj’s invitation to the World Liberty Forum signals a deeper connection between Trump’s political influence and his family’s growing crypto ecosystem.

The forum, hosted by WLFI, will take place on February 18 at Trump’s Mar-a-Lago resort in Palm Beach, Florida.

It is an invitation-only gathering expected to bring together approximately 300 to 400 executives, investors, policymakers, and technologists.

Sponsored

The event’s speaker roster includes some of the most powerful figures in global finance and crypto. Confirmed attendees include Goldman Sachs CEO David Solomon, Nasdaq CEO Adena Friedman, Coinbase CEO Brian Armstrong, Franklin Templeton CEO Jenny Johnson, and FIFA president Gianni Infantino.

Trump’s sons, Donald Trump Jr. and Eric Trump, who co-founded World Liberty Financial, will also speak.

Political Support Comes as Trump Expands Crypto Agenda

Minaj’s latest appearance follows her participation in Trump’s January event tied to a government savings initiative, where she publicly endorsed him and dismissed criticism from media and political opponents.

Her remarks marked one of the clearest endorsements Trump has received from a major global pop star. Trump has increasingly relied on high-profile cultural figures to amplify his message, particularly as his administration pushes policies aimed at supporting crypto markets and stablecoin infrastructure.

Recently, the broader pool of Hollywood celebrities has been vocal in opposition to the Trump administration and its policies. It’s evident that the US president is likely trying to bring his celebrity supporters closer to his inner circle across the entire spectrum, including crypto.

Sponsored

Nicki Minaj’s Limited but Notable Crypto History

While Minaj has not launched her own cryptocurrency or NFT collection, she has previously engaged with the crypto ecosystem.

In 2021, she promoted the Happy Hippos NFT project on social media during the peak of the NFT boom, joining a wave of artists experimenting with blockchain-based digital ownership.

However, unlike celebrities such as Snoop Dogg, Paris Hilton, or Logan Paul, Minaj has not launched a personal token, NFT platform, or crypto startup.

Her involvement has remained largely promotional and cultural rather than operational or technical.

Her appearance at the World Liberty Forum represents her most direct connection yet to institutional crypto infrastructure and policy discussions.

Crypto World

Altcoin Traders Are Turning to APEMARS Best Altcoins to Invest With 8,100% ROI After Missing Ethereum and XRP’s Initial Days

In the volatile crypto landscape of February 2026, where Bitcoin has dipped to $68,000 amid a sea of red, and altcoins are rotating amid macroeconomic pressures, scarcity mechanics are the key differentiator for savvy altcoin traders seeking the best altcoins to invest in. Remember Ethereum’s monumental rise from its $0.42 ATL to a $4,953 ATH, delivering life-changing returns for early holders? Or XRP’s explosive surge from $0.0028 to $3.84, turning modest investments into fortunes? Yet, many missed those ICO-like opportunities, watching from the sidelines as prices skyrocketed.

Don’t let history repeat with APEMARS ($APRZ), the live presale that’s igniting FOMO with its structured scarcity and 8,100%+ ROI potential from Stage 8 at $0.00006651 to $0.0055 listing. As Ethereum endures a 60% drawdown from highs but remains resilient with $14.6 billion in tokenized assets, and XRP boasts $1 billion in ETF inflows fueling a 38% post-crash surge, APEMARS leverages similar mechanics through post-stage token burns, like the 4 billion removed after Stage 6, creating limited availability and hype. With over 1,000 holders and $214K raised already, this Mars-themed gem rewards early access in a market where timing is everything.

APEMARS: The Scarcity-Powered Altcoin Set to Explode, Join Stage 8 Before Availability Vanishes

For every altcoin trader chasing the best altcoins to invest in during 2026’s rebound, APEMARS ($APRZ) screams urgency with its scarcity-driven model that’s already burning tokens and building massive hype. Imagine locking in at Stage 8’s ultra-low $0.00006651 price, poised for an 8,100%+ ROI to the $0.0055 listing, that’s not just potential; it’s a transparent pricing gap. What sets APEMARS apart? It’s Orbital Boost System, a killer utility offering 9.34% referral bonuses from a community pool, turning every holder into a growth engine and amplifying network effects faster than typical memes.

Add the deflationary burns, like the post-Stage 6 incineration of billions, ensuring supply shrinks as demand surges, creating that irresistible scarcity hype. With a clear 23-stage roadmap mapping out Mars conquests, staking rewards, and liquidity locks, APEMARS isn’t just another token; it’s a community-driven powerhouse with over 1,000 holders fueling momentum. In a market where Ethereum’s resilience shines through tokenized value and XRP rides ETF waves, APEMARS mirrors their success by structuring burns for value accretion. Don’t sleep on this; stages advance rapidly, availability is limited, and the hype is real.

As the best altcoins to invest in go, APEMARS is your now-or-never shot at explosive gains. Secure your bag today and ride the rocket.

$5,000 in APEMARS Now: Your Path to 8,100%+ Gains, Act Before Stage 8 Ends and Regret Sets In

Picture this, altcoin trader: You invest $5,000 in APEMARS ($APRZ) at Stage 8’s $0.00006651 price, snagging about 75.18 million tokens amid scorching scarcity from post-stage burns. Fast-forward to the $0.0055 listing, and that bag explodes to over $413,500, a jaw-dropping 8,100%+ ROI that eclipses even Ethereum’s historic runs. With limited availability and stages advancing weekly, this isn’t hype; it’s math fueled by deflationary mechanics and community momentum.

Imagine missing XRP’s 38% surge or ETH’s tokenized resilience, don’t repeat that FOMO nightmare. As the best altcoins to invest in 2026, APEMARS’ urgency is real: over $214K raised, 1,000+ holders, and burns like post-Stage 6’s billions tightening supply. Hesitate, and Stage 9 hikes prices, slashing your edge. Secure this now-or-never opportunity before hype catapults it.

How to Buy APEMARS: Quick Steps to Join the Presale Hype

As an altcoin trader hunting the best altcoins to invest in, buying APEMARS ($APRZ) is seamless. Head to apemars.com, connect your Web3 wallet. Select ETH, USDT, BNB, or fiat via card, input your amount, and confirm. Tokens hit your wallet instantly. With Stage 8 live at $0.00006651, act fast before progression limits availability, and burns amplify scarcity.

Ethereum: Resilience Amid Drawdowns, A Lesson in Scarcity for Altcoin Traders

Ethereum (ETH) exemplifies why scarcity and utility make it one of the best altcoins to invest in, even as altcoin traders navigate its current 60% drawdown from an all-time high of $4,953.73 reached on August 24, 2025. Priced around $1,973 in February 2026, ETH has shown remarkable resilience, hosting $14.6 billion in tokenized assets, a 16% increase in just 30 days, proving its dominance in real-world assets (RWAs) and DeFi. This tokenized value underscores Ethereum’s built-in scarcity through mechanisms like gas fees and upgrades that enhance efficiency, drawing institutional flows despite market reds.

From its all-time low of $0.4209 on October 21, 2015, ETH has surged over 467,000%, rewarding early participants who bet on its programmable scarcity via smart contracts. In today’s conditions, with Bitcoin at $68,000 and broader sell-offs, Ethereum’s $234 billion market cap and daily transactions nearing 3 million highlight its staying power. For altcoin traders, ETH’s story is a blueprint: scarcity mechanics, like its proof-of-stake burns, create long-term value. Yet, while ETH endures volatility, emerging projects like APEMARS adopt similar burns to amplify hype.

As one of the best altcoins to invest in, Ethereum teaches that drawdowns are opportunities, but don’t miss fresher scarcities like APEMARS’ presale before they moon.

XRP: ETF-Fueled Surges and Historical Highs, Why Scarcity Matters Now More Than Ever

XRP stands as a prime example for altcoin traders eyeing the best altcoins to invest in, with its $1 billion ETF inflows since late 2025, no outflows reported, propelling a 38% surge post the February 6, 2026, crash, lifting it to around $1.47. This momentum builds on XRP’s historical volatility, from an all-time high of $3.84 on January 4, 2018, to an all-time low of $0.002802 on July 7, 2014, a staggering 52,143% rise from ATL. These inflows, concentrated in low-fee products like Franklin and Bitwise, signal institutional confidence in XRP’s scarcity through its fixed 100 billion token supply and Ripple’s DeFi updates for scaling.

Amid 2026’s red market, where ETH slides over 5%, XRP’s resilience shines, with trading volumes spiking and ETF holdings surpassing $548 million overall. For altcoin traders, XRP’s story warns of missed opportunities: those who ignored its ATL regretted the ATH boom. Now, with no outflows and post-crash gains, it’s a scarcity play bridging traditional finance. But as XRP rides ETF waves, newer altcoins like APEMARS enhance scarcity via structured burns, urging traders to act on live presales. As one of the best altcoins to invest in, XRP proves scarcity drives hype. Don’t let APEMARS’ limited Stage 8 slip away.

Conclusion: Embrace Scarcity Now, APEMARS Is the Altcoin You Can’t Afford to Miss in 2026

In 2026’s rebounding yet red market, scarcity mechanics define winners for altcoin traders, as seen in Ethereum’s 60% drawdown resilience with $14.6B tokenized value and XRP’s $1B ETF inflows sparking 38% surges. Yet, APEMARS ($APRZ) elevates this with structured burns enhancing scarcity, making it one of the best altcoins to invest in amid limited Stage 8 availability at $0.00006651 and 8,100%+ ROI to $0.0055.

Don’t regret missing ETH’s ATL-to-ATH glory or XRP’s institutional hype, APEMARS’ community-driven roadmap, referral utilities, and momentum create unmatched urgency. As stages advance and hype builds, hesitation means watching others profit. Position yourself for the best crypto to buy now for this structured opportunity before broader listings ignite the moonshot.

For More Information:

Website: Visit the Official APEMARS Website

Telegram: Join the APEMARS Telegram Channel

Twitter: Follow APEMARS ON X (Formerly Twitter)

FAQs About Best Altcoins to Invest In 2026

What Makes APEMARS One of the Best Altcoins to Invest in for Altcoin Traders?

For altcoin traders, APEMARS stands out among the best altcoins to invest in with its scarcity burns and 8,100%+ ROI potential, rewarding early Stage 8 participants.

How Does APEMARS’ Presale Structure Benefit Altcoin Traders?

Altcoin traders benefit from APEMARS’ 23-stage presale, where prices rise progressively, making Stage 8 at $0.00006651 one of the best altcoins to invest in for maximized gains.

Why Is Scarcity Key for the Best Altcoins to Invest in, Like APEMARS?

Scarcity via token burns positions APEMARS as a top choice for altcoin traders seeking the best altcoins to invest in, mirroring ETH and XRP’s value drivers.

What ROI Can Altcoin Traders Expect from APEMARS?

Altcoin traders can eye 8,100%+ ROI from APEMARS’ Stage 8 to listing, solidifying it as one of the best altcoins to invest in during 2026’s market.

When Should Altcoin Traders Join APEMARS Presale?

Altcoin traders should join APEMARS now, as Stage 8’s limited availability makes it the best altcoin to invest in before hype and burns drive prices up.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

VALR Highlights Africa’s Leadership in Crypto Adoption at Africa Tech Summit Nairobi

[PRESS RELEASE – Johannesburg, South Africa, February 16th, 2026]

VALR, Africa’s largest crypto exchange by trade volume, concluded its role as a Gold Sponsor at the Africa Tech Summit in Nairobi on 11–12 February 2026. The event underscored Africa’s growing prominence as a centre for crypto innovation and adoption.

Africa’s financial landscape remains fragmented, with 54 countries and multiple national currencies in use. Cross-border payments continue to face high costs, often averaging around 7-8% for remittances according to sources such as the World Bank and industry reports from 2025, and delays of several days via traditional systems. Inflation averaged above 13% across the continent in 2025, according to the African Development Bank’s Macroeconomic Performance and Outlook Update from November 2025. These factors limit access to relatively stable foreign currencies such as the US dollar and encourage the use of alternatives for value preservation and efficient transactions.

Crypto adoption has accelerated in response. Sub-Saharan Africa recorded 52% year-over-year growth in crypto activity through mid-2025, according to Chainalysis’ 2025 Global Crypto Adoption Index and Geography of Cryptocurrency Report. Stablecoins such as USDT and USDC play a prominent role in transaction volumes in the region, supporting practical applications including hedging inflation, remittances, and payments.

Countries including Nigeria, South Africa, Kenya, Ethiopia, and Ghana rank among the highest globally for crypto adoption, according to Chainalysis data. Nigeria leads Sub-Saharan Africa with over $92 billion in transaction value in the 12 months to mid-2025, followed by South Africa. Africa accounts for only about 3% of global trade volumes, yet these markets demonstrate leadership in applying crypto to real-world challenges around accessibility, participation, and capital flows.

VALR has expanded rapidly over the past two years, establishing itself as Africa’s leading crypto exchange by trade volume. It offers the deepest ZAR-denominated crypto markets in the world and ranks among the largest minters of USDC globally. Licensed by South Africa’s Financial Sector Conduct Authority (FSCA) and with regulatory approval in Europe, VALR serves over 1.7 million registered users and 1,800 corporate and institutional clients.

Co-Founder and CEO Farzam Ehsani delivered a keynote speech on the VALR Stage. He addressed the need for the global financial system to reflect the fundamental oneness of humanity, with crypto well-positioned to play a key role in achieving this.

Reflecting on the summit, Ehsani said: “The Africa Tech Summit in Nairobi reinforced a clear message: “Africa is not merely adopting crypto but leading its practical application to solve pressing financial needs. We are optimistic about the continent’s future and the role of unified, inclusive finance globally. VALR remains committed to building infrastructure that bridges divides and advances this shared vision.”

Co-Founder and Chief Product Officer Badi Sudhakaran participated in a panel on crypto adoption in Africa. He emphasised that adoption stems from necessity, positioning the continent as a hub for innovation and real-world application.

About VALR

Founded in 2018, headquartered in Johannesburg, and backed by leading investors including Pantera Capital, Coinbase Ventures and Fidelity’s F-Prime Capital, VALR is a global crypto exchange offering a comprehensive suite of products—including Spot Trading, Spot Margin, Perpetual Futures, Staking, Lending, Borrowing, OTC services, VALR Invest, Crypto Bundles, and VALR Pay. Licensed by South Africa’s FSCA, with regulatory approval in Europe, VALR serves over 1.7 million registered users and 1,800 corporate and institutional clients worldwide. The exchange is dedicated to advancing a just financial future that upholds human dignity and the unity of mankind. For more information, visit valr.com.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Dogecoin price eyes a steeper dive as headwinds rise

Dogecoin price dropped for two consecutive days after hitting the 50-day Exponential Moving Average as demand dropped and key headwinds rose.

Summary

- Dogecoin price has slumped in the past few months.

- Spot DOGE ETFs inflows have stalled this year.

- The futures open interest has continued falling, while the funding rate has turned negative.

Dogecoin (DOGE) token dropped to the important support level at $0.100, much lower than this month’s high of $0.1176. It remains ~67% from its highest level in 2025.

The coin faces major headwinds, which may drag its price in the near term. For example, it faces a major challenge on the ongoing crypto market crash, which has affected Bitcoin and most altcoins.

Additionally, the futures open interest has continued falling in the past few months, moving from a high of $5.20 billion in September to the current $1.16 billion. Falling open interest is a sign that demand has continued falling in the past few months.

More data shows that the weighted funding rate has remained in the red in the past few days. It dropped to the lowest level since February 10. A falling funding rate is a sign that investors believe that the coin will continue falling in the near term.

The same is happening in the exchange-traded fund market this year. Data compiled by SoSoValue shows that spot three spot DOGE ETFs by companies like Grayscale, 21Shares, and Bitwise have not had any inflows or outflows since February 3 this year. These funds now have had over $6.67 million in cumulative inflows, bringing the net inflows to $8.69 million.

Dogecoin price technical analysis

The daily timeframe chart shows that the DOGE price has been in a strong downward trend in the past few months, moving from a high of $0.3073 in September last year.

Dogecoin price has dropped below the key support level at $0.1295, its lowest level on April 7 last year. It has fallen below all moving averages, while the Percentage Price Oscillator remains below the zero line.

Therefore, the most likely scenario is where the coin continues falling, potentially to the year-to-date low of $0.0790, its lowest level this month. A drop below that support level will signal more downside.

Crypto World

Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

Feeding Google’s Gemini AI careful prompts unlocks explosive 2026 price predictions for XRP, Solana, and Bitcoin.

Given the fact that Gemini leverages Google’s expansive data set, these compelling predictions are grounded in hard analysis of the projects’ fundamental strengths, overall roadmap and ongoing macro and industry developments.

Below we unpack why Gemini is bullish on these specific coins.

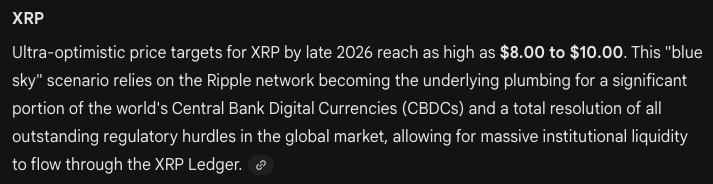

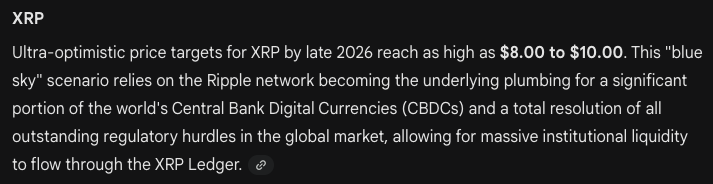

XRP ($XRP): Gemini Suggests Ripple’s Payments Solution Could Drive XRP to $10

In a recent update, Ripple reiterated that XRP ($XRP) remains central to its roadmap of establishing the XRP Ledger as a global, institution-ready payments layer.

With near-instant settlement speeds and minimal transaction costs, XRPL is in a position to benefit from growth in two rapidly expanding sectors: stablecoins, (via Ripple’s in-house RLUSD), and real-world asset tokenization.

The XRP token is currently trading around $1.49. Gemini’s outlook points to a potential move toward $10 by late 2026, implying a near-sevenfold gain, or roughly 600%, from current prices.

XRP’s Relative Strength Index (RSI) is at 42 and climbing quickly, a hint that investors are quietly stacking it at its current discounted price.

Possible momentum drivers include institutional capital flows following the approval of U.S.-listed spot XRP exchange-traded funds, Ripple’s expanding list of strategic partnerships, and the possibility of U.S. lawmakers finalizing the CLARITY bill later this year.

Solana (SOL): Gemini Projects a Climb Toward $600

The Solana ($SOL) network currently secures approximately $6.6 billion in total value locked (TVL) and carries a market capitalization near $50 billion. Increased on-chain activity, developer engagement, and daily user growth have supported its expansion.

The rollout of Solana-linked exchange-traded funds by firms such as Bitwise and Grayscale has further boosted institutional interest.

That said, following an extended correction in late 2025, SOL has spent much of February trading below the $100 level.

Under Gemini’s most optimistic scenario, Solana could rally toward $600 by 2027. Such a move would represent 7x upside from current levels around $84, comfortably exceeding SOL’s January 2025 ATH of $293.

Asset managers including Franklin Templeton and BlackRock are issuing tokenized real-world assets on the network, strengthening its real-world utility and long-term growth potential.

Bitcoin (BTC): Gemini Sees $250,000 Bitcoin on the Horizon

Bitcoin ($BTC), the original cryptocurrency and largest by market cap, reached a new all-time high of $126,080 on October 6 before entering a prolonged downturn.

Despite recent volatility, Gemini’s analysis indicates that Bitcoin can sustain its year-on-year growth and hit a new high watermark of $250,000.

Often referred to as digital gold, Bitcoin continues to attract institutional and retail investors seeking a hedge against inflation and macroeconomic uncertainty.

Bitcoin currently represents roughly $1.4 trillion of the $2.4 trillion total crypto market. Since setting its most recent ATH, BTC has fallen by around 46% and now trades below $70,000, following two sharp selloffs as potential U.S. military actions involving Iran and Greenland scared risk averse investors.

Gemini’s outlook highlights accelerating institutional adoption and post-halving supply constraints as key forces that could drive Bitcoin to multiple new highs this year.

Additionally, if U.S. lawmakers move forward with proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could extend even beyond Gemini’s already bullish forecasts.

Maxi Doge: A New Meme Coin Enters the Frame

Finally, while Gemini’s analysis centers on the steady advance of established market leaders, high-risk-high-reward seekers are diversifying their portfolios with Maxi Doge ($MAXI), a sensational new pre-launch token sale that has already pulled $4.6 million from investors.

The project revolves around Maxi Doge, a gym-obsessed, Dogecoin challenger who channels the fun and outrageous spirit of the 2021 bull run, aka the meme coin heyday.

Additionally, presale buyers can stake MAXI for yields of up to 68% APY, with returns gradually declining as the staking pool grows.

MAXI is priced at $0.0002804 in the current presale round, with planned price increases at each funding milestone. Interested participants can purchase using wallets such as MetaMask and Best Wallet, or via bank card.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Germany‘s Central Bank President Touts Stablecoin Benefits for EU

Joachim Nagel said euro-pegged stablecoins would offer the bloc more independence from US dollar-pegged coins soon to be allowed under the GENIUS Act.

Joachim Nagel, president of Germany’s central bank, the Deutsche Bundesbank, supported the introduction of a euro-pegged central bank digital currency (CBDC) and euro-denominated stablecoins for payments.

In remarks prepared for a speech at the New Year’s Reception of the American Chamber of Commerce in Frankfurt on Monday, Nagel said EU officials were “working hard” toward the introduction of a retail CBDC. Euro-denominated stablecoins, according to the central bank president, could also contribute to “making Europe more independent in terms of payment systems and solutions.”

“Notably, a wholesale CBDC would allow financial institutions to make programmable payments in central bank money,” said Nagel. “I also see merit in euro-denominated stablecoins, as they can be used for cross-border payments by individuals and firms at low cost.”

Nagel’s remarks come months after US President Donald Trump signed a bill into law establishing a framework for payment stablecoins in the country, potentially setting US dollar-pegged stablecoins on a path to challenge any possible rollout of a euro-pegged peer. The law is expected to be fully implemented 18 months after it was signed or 120 days after related regulations are finalized.

Related: ING Germany expands crypto ETP and ETN offerings with Bitwise, VanEck

The German central bank president’s comment on stablecoins did not include risks he mentioned last week at the Euro50 Group meeting. Nagel warned domestic monetary policy “could be severely impaired, not to mention that European sovereignty could be weakened” if US dollar-denominated stablecoins were to have significantly larger market share than a euro-pegged coin.

Stablecoin yield at issue in US bill under consideration

Washington lawmakers and White House officials have been meeting with representatives from the banking and crypto industries ahead of a potential vote on the CLARITY Act in the US Senate. The bill, expected to provide a comprehensive regulatory framework for digital assets, has been dividing many crypto industry and banking leaders due to its approach to stablecoin rewards, which has yet to be finalized in the legislation.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video8 hours ago

Video8 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash