Crypto World

MicroStrategy Explains What Happens First in a Bitcoin Collapse

MicroStrategy (Strategy) released its Q4 2025 earnings report and, along with it, disclosed an extreme downside scenario that would begin to strain its Bitcoin treasury model.

The CEO’s remarks provided rare insight into how far the market could fall before the company’s capital structure comes under serious pressure.

MicroStrategy Finally Reveals What Would Be Its Breaking Point as Bitcoin Price Drops

During its latest earnings discussion, MicroStrategy CEO Phong Le said that a 90% decline in Bitcoin’s price to roughly $8,000 would mark the point where the firm’s Bitcoin reserves roughly equal its net debt.

Sponsored

Sponsored

At that level, the company would likely be unable to repay convertible debt using its BTC holdings alone. As a result, it may need to consider restructuring, issuing new equity, or raising additional debt over time.

Leadership emphasized that such a scenario is viewed as highly improbable and would unfold over several years, giving the firm time to respond if markets deteriorated significantly.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price to $8,000, which is pretty hard to imagine, that is the point at which our BTC reserve equals our net debt and we’ll not be able to then pay off of our convertibles using our Bitcoin reserve and we’d either look at restructuring, issuing additional equity, issuing an additional debt. And let me remind you: this is over the next five years. Right, So I’m not really worried at this point in time, even with Bitcoin drops,” said Le.

Meanwhile, it is worth noting that Le’s remarks come only months after the Strategy executive admitted a situation that would compell the firm would sell Bitcoin. As BeInCrypto reported, Phong Le cited a Bitcoin sale trigger tied to mNAV and liquidity stress.

Speaking on What Bitcoin Did, CEO Phong Le outlined the precise trigger that would force a Bitcoin sale:

- First, the company’s stock must trade below 1x mNAV, meaning the market capitalization falls below the value of its Bitcoin holdings.

- Second, MicroStrategy must be unable to raise new capital through equity or debt issuance. This would mean capital markets are closed or too expensive to access.

Therefore, the latest statement does not contradict Phong Le’s earlier position but adds another layer of risk.

Previously, a Bitcoin sale depended on stock trading below mNAV and capital markets’ closing. Now, he clarifies that in an extreme 90% crash, the immediate issue would be debt servicing, likely addressed first through restructuring or new financing—not necessarily selling Bitcoin.

Sponsored

Sponsored

Massive Bitcoin Exposure Comes with Large Losses

Strategy remains the world’s largest corporate holder of Bitcoin, reporting 713,502 BTC as of early February 2026. The company acquired the holdings at a total cost of about $54.26 billion, according to its fourth-quarter financial results.

However, Bitcoin’s decline during the final months of 2025 significantly impacted the balance sheet. The firm reported $17.4 billion in unrealized digital-asset losses for the quarter and a net loss of $12.4 billion. This highlights the sensitivity of its financial performance to market swings.

At the same time, Strategy continued to raise substantial capital. The company said it raised $25.3 billion in 2025, making it one of the largest equity issuers in the US.

Meanwhile, they also reportedly built a $2.25 billion USD reserve designed to cover roughly two and a half years of dividend and interest obligations.

Executives argue that these measures strengthen liquidity and provide flexibility, even during periods of market stress.

Sponsored

Sponsored

Bitcoin Volatility Brings the Risk Into Focus

The disclosure comes amid heightened volatility in crypto markets. Bitcoin traded near $70,000 in early February before extending successive legs lower to an intraday low of $60,000 on February 6. This shows how quickly price movements can reshape the outlook for highly leveraged treasury strategies.

Strategy’s capital structure relies heavily on debt, preferred equity, and convertible instruments used to accumulate Bitcoin over multiple years.

While this approach has amplified gains during bull markets, it also magnifies losses during downturns, drawing increasing scrutiny from investors and analysts.

However, the company’s leadership maintains that the long-dated nature of much of its debt provides time to manage through cycles. This, they say, reduces the risk of forced liquidations in the near term.

Saylor Doubles Down on Long-Term Thesis

Elsewhere, executive chair Michael Saylor reiterated his conviction in Bitcoin despite recent losses, describing it as the “digital transformation of capital” and urging investors to “HODL.”

Sponsored

Sponsored

Saylor and other executives argue that Bitcoin remains the hardest form of money and that the company’s long-term strategy is built around holding the asset indefinitely, rather than attempting to time market cycles.

The firm has also expanded its financial engineering efforts, including scaling its Digital Credit instruments and preferred equity offerings. According to management, these are designed to reduce volatility and diversify funding sources while continuing to accumulate Bitcoin.

Investors Split on the Risks Ahead

Market reaction to the earnings disclosures and downside scenario has been mixed. Supporters argue that Strategy’s massive Bitcoin reserves, ability to issue equity, and multi-year debt maturities provide sufficient flexibility to navigate even severe downturns.

Critics, however, warn that a prolonged bear market could still force difficult choices. Potential risks cited by investors include shareholder dilution, pressure on the capital structure, or the possibility of selling Bitcoin if funding conditions tighten.

“The company is currently facing a whopping -$7.3 billion loss on their Bitcoin investments,” said Jacob King.

For now, Strategy appears committed to its high-conviction approach. However, by acknowledging that its Bitcoin reserves would merely match its debt, the company has made clear that even the most aggressive corporate Bitcoin strategy still has a theoretical breaking point, one defined not just by market prices but by the limits of leverage itself.

Crypto World

Bitcoin ‘Bull Trap’ Forming As Bear Market Middle Stage Approaches: Analyst

Bitcoin could experience a short-term rally that catches investors off guard before the broader downtrend resumes, according to on-chain analyst Willy Woo.

“Bull trap forming,” Woo said in an X post on Saturday, referring to a fake breakout suggesting that the market is entering a sustained uptrend. He added that it may last “out to [the] end of April.”

Woo said his outlook is based on liquidity conditions rather than price levels. “If capital comes back in force with the right type of long-term investors, then I’ll happily change my views,” Woo said.

Bitcoin is “solidly” in the middle of a bear market

From a long-range liquidity perspective, Woo said Bitcoin (BTC) is “solidly in the middle of its bear market.” “Typically, after fast downward flushes like we have had, BTC likes to go sideways and mount a rally where resistance is tested,” Woo said.

Bitcoin has fallen approximately 46.82% since reaching its October all-time highs of $126,000, trading at $67,012 at the time of publication, according to CoinMarketCap.

Woo said that this level isn’t the bottom for Bitcoin and the asset may see further downside. Crypto sentiment platform Santiment shared a similar view on Saturday, pointing to whales aggressively selling while retail investors buy below $70,000.

“When retail buys while whales sell, it typically signals that the correction is not yet over,” Santiment said.

Bitcoin investor flows have been in “consistent recovery”

Woo said that despite Bitcoin failing to hold the “mid-70s” range after it soared to $74,000 on Wednesday, investor flows have been in “consistent recovery” since the middle of February.

Related: Bitcoin relief rally hits wall as spot ETFs log $228M in outflows

Woo isn’t the only analyst who thinks Bitcoin is in a bear market. Crypto analyst Benjamin Cowen recently told Magazine that 2026 is a “bear market year” for Bitcoin and unlikely to bring new all-time highs.

On-chain analytics company CryptoQuant said on Thursday that “Bitcoin is still in a bear market despite the recent rally.”

It comes after the Crypto Fear and Greed Index, one of the most widely used gauges of crypto investor sentiment, fell back to “extreme fear” levels after briefly recovering on Wednesday.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

RWA Market Tops $24.9B as Tokenized Gold, Stocks, and Treasuries Reshape Crypto Finance

TLDR:

- Tokenized RWAs hit $24.9B in Feb 2026, up 289% YoY as six asset classes cross the $1B mark.

- BlackRock’s BUIDL leads tokenized Treasuries at $2.2B after surging 239% over the past year.

- Tokenized stocks reached $786M since mid-2025, growing independently of Bitcoin’s price swings.

- Only 11.8% of $8.49B in RWA stablecoins are active in DeFi due to KYC and whitelist barriers.

The tokenized real-world asset market crossed $24.9 billion in February 2026. That figure marks a 289% increase from $6.4 billion just one year prior.

Six asset classes now individually exceed $1 billion in tokenized value. The market is no longer driven by a single sector. It is diversifying fast.

Treasuries, Gold, and Equities Drive Explosive RWA Expansion

U.S. Treasuries remained the largest segment. They grew 183% year-over-year, reaching $10.8 billion, according to data compiled by Nexus Data Labs.

Active products expanded from 35 to 53, with entries from Fidelity, ChinaAMC, and VanEck. BlackRock’s BUIDL fund now leads the space at $2.2 billion, up 239% in 12 months.

Ondo Finance’s combined Treasury exposure reached $2 billion across OUSG and USDY.

Superstate’s USTB grew 499% to $0.8 billion. WisdomTree’s WTGXX surged 759%. The top-three concentration in this market dropped from 61% to 48%, per Nexus Data.

Tokenized stocks are the newest category and the fastest-growing. They scaled from near-zero to $786 million since mid-2025.

Platforms including Ondo Finance, Backed Finance, Dinari, and Robinhood now offer onchain access to NVDA, TSLA, GOOGL, SPY, and QQQ. Growth continued even while Bitcoin dipped below $70,000.

Tokenized gold also posted strong gains. Circulating supply on Ethereum nearly doubled, from 687,000 to over 1.3 million troy ounces in 12 months.

The spot price of gold rose 80% over the same period, from $2,963 to $5,327. Supply growth outpaced price gains. That signals active minting, not passive price appreciation.

88% of RWA-Backed Stablecoins Remain Locked Outside DeFi Protocols

The stablecoin side of the RWA story tells a different tale.

Total RWA-backed stablecoin supply stands at $8.49 billion, per DeFiLlama. Only $1 billion of that, roughly 11.8%, is actively deployed in DeFi protocols.

DAI dominates by market cap at 53%, or $4.48 billion. USDY from Ondo Finance holds 15% of supply. But when filtered for active DeFi usage, USDY drops to just 1.99% of utilization. YLDS, at $598 million in supply, disappears from DeFi entirely.

The gap comes down to access restrictions. KYC requirements and whitelisting walls block permissioned tokens from integrating with permissionless DeFi contracts.

Permissionless assets show a stark contrast. reUSD posts 96.7% DeFi utilization. USDtb reaches 29.5%. Legacy FRAX sits at 28%.

That leaves $7.49 billion, roughly 88% of all RWA-backed stablecoin supply, sitting outside DeFi. The infrastructure exists. The capital is onchain.

Composability remains the gap between presence and productivity.

Crypto World

CEXs Have Zero Motive to Aid Terrorists as Court Dismisses Case

In a setback for plaintiffs seeking to link Binance to terrorist financing, a U.S. federal court in New York dismissed a broad claim that the exchange helped move funds for terrorist groups. The ruling comes as Binance and its founder CEO, Changpeng Zhao, have repeatedly argued that centralized crypto exchanges operate on economic incentives that make it irrational for criminals to use legitimate platforms for funding violent acts. The decision, while narrow in scope, underscores the challenges in tying crypto trading venues to specific acts of violence, even amid heightened scrutiny over sanctions and compliance practices.

Key takeaways

- The Southern District of New York judge dismissed the case at the pleading stage, citing an insufficient link between Binance’s operations and the listed attacks.

- The plaintiffs represented 535 individuals connected to 64 attacks dating from 2016 to 2024, attributed to groups including Hezbollah, Hamas, ISIS, al-Qaeda and Palestinian Islamic Jihad.

- Changpeng Zhao (CZ) asserted on X that centralized exchanges have “zero motive” to assist terrorists, arguing that such activity would not generate trading revenue and would likely be short-livedDeposits.

- The court’s decision narrows the path for victims pursuing anti-terrorism claims under statutes such as the US Anti-Terrorism Act and the Justice Against Sponsors of Terrorism Act.

- Binance has faced separate scrutiny over sanctions-related transactions and Iran-linked activity, including pushback against Senate probes and media reports that alleged extensive ties to sanctioned entities.

Sentiment: Neutral

Market context: The ruling arrives amid a broader backdrop of intensified regulatory scrutiny of centralized exchanges, including debates over sanctions enforcement, AML/KYC standards and the role of crypto platforms in cross-border law enforcement efforts. While the decision limits one legal avenue for victims, it does not resolve ongoing questions about how large exchanges respond to illicit activity and geopolitical sanctions.

Why it matters

The SDNY’s dismissal signals that, at least in this case, plaintiffs faced a high bar in proving direct, actionable links between Binance’s services and the specific terrorist attacks cited in the complaint. The decision emphasizes the difficulty of proving causation for criminal actions that occur through a broad, permissionless ecosystem where many intermediaries and third parties could be involved. For traders and institutions watching regulatory risk, the ruling reinforces the boundary between platform responsibility and the broader ecosystem in which crypto assets circulate.

From a policy vantage point, the case highlights the tension between victims seeking redress under anti-terrorism statutes and the practical standards courts apply to show that a platform’s compliance practices materially facilitated or enabled wrongdoing. The judge’s ruling does not absolve Binance of potential wrongdoing in other contexts, but it does illustrate how courts assess linkages between a platform’s operations and the crimes alleged. In the process, it preserves the possibility that future amendments to complaints, if sufficiently grounded, could reframe liability questions under different facts or legal theories.

Beyond the courtroom, Binance’s public posture remains that it endeavors to operate within regulatory expectations while contesting allegations that rely on incomplete or mischaracterized information. The exchange has repeatedly argued that its internal controls, risk models and cooperation with authorities are designed to prevent illicit activity, and it has asserted that certain allegations—particularly those tied to sanctions evasion—are overstated or unfounded. The recent court decision, while narrow, interacts with a broader narrative about how exchanges balance rapid, global crypto trading with stringent compliance obligations.

What to watch next

- Whether plaintiffs pursue an amended complaint within the 60-day window noted by the judge, potentially re framing allegations or adding new evidence to strengthen causation links.

- Binance’s ongoing responses to regulatory inquiries, including statements addressing Senate probes and sanctions-related reporting, and how the company frames its compliance posture in light of evolving rules.

- Regulatory developments surrounding Iran-related and other sanctions-compliance matters, as policymakers weigh enforcement priorities and the role of major crypto platforms in monitoring cross-border flows.

- Subsequent court activity, including any appeals or related actions that might test different legal theories or damages frameworks under anti-terrorism statutes.

Sources & verification

- U.S. District Court for the Southern District of New York dismissal order (PDF) detailing the court’s rationale for ruling at the pleading stage.

- Original court filing referenced in coverage, including the inclusion of 535 plaintiffs connected to 64 attacks (2016–2024).

- Changpeng Zhao’s X post remarking on the economics of centralized exchanges and their lack of motive to engage with terrorists.

- Binance’s response to Senate inquiries and related reporting discussed in coverage of sanctions and Iran-linked activity.

Binance court ruling and regulatory scrutiny

The decision in the SDNY case marks a notable moment in crypto litigation, illustrating how courts evaluate the relationship between a large exchange’s operations and criminal acts pursued by external actors. While the ruling narrows the path for the plaintiffs, it does not preclude other lawsuits or investigations that might pursue different factual or legal avenues. In the immediate aftermath, Binance pressed a cautious but defiant stance on the sanctions-related allegations, reiterating that a February inquiry relied on information the firm described as false and lacking credible substantiation. The exchange emphasized its commitment to compliance and cooperation with authorities while warning against conflation of isolated incidents with systemic failures.

As the industry navigates a landscape of looming regulatory expectations, the case underscores the importance of robust AML/CFT controls, transparent transaction monitoring, and proactive risk management—elements that policymakers argue are essential to preserving the integrity of crypto markets. It also highlights how defendants in high-profile cases must balance public diplomacy with legal strategy, especially when countering narratives that tie crypto platforms to violent acts or sanctioned networks. In this environment, market participants—ranging from retail traders to institutional buyers—will be closely watching how courts interpret platform responsibilities and how regulators adapt their guidance to evolving technologies and use cases.

What to watch next

- The 60-day window for an amended complaint, which could shift pleadings and potentially introduce new factual claims.

- Binance’s continued engagement with U.S. lawmakers and regulators as scrutiny around Iranian-linked transactions and broader sanctions compliance persists.

- Any new court actions related to similar theories of liability, including potential appeals or separate lawsuits that challenge platform practices or risk controls.

Crypto World

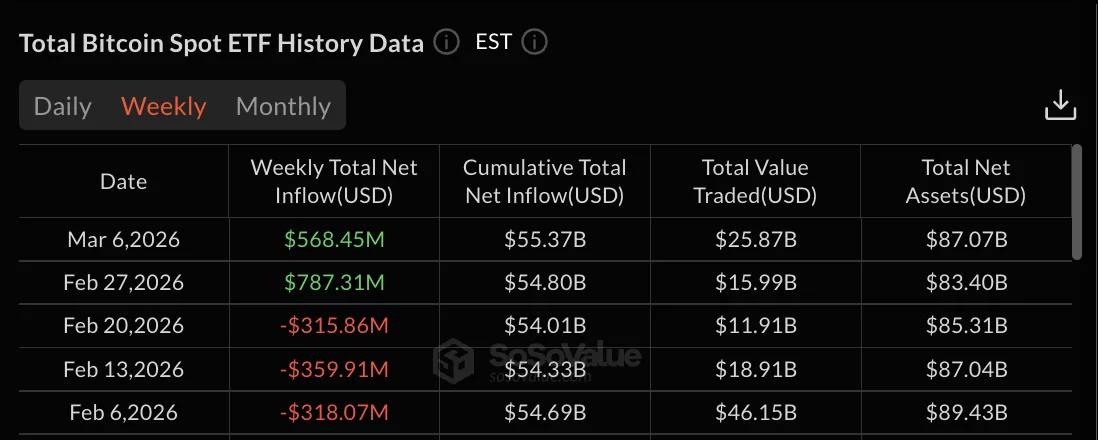

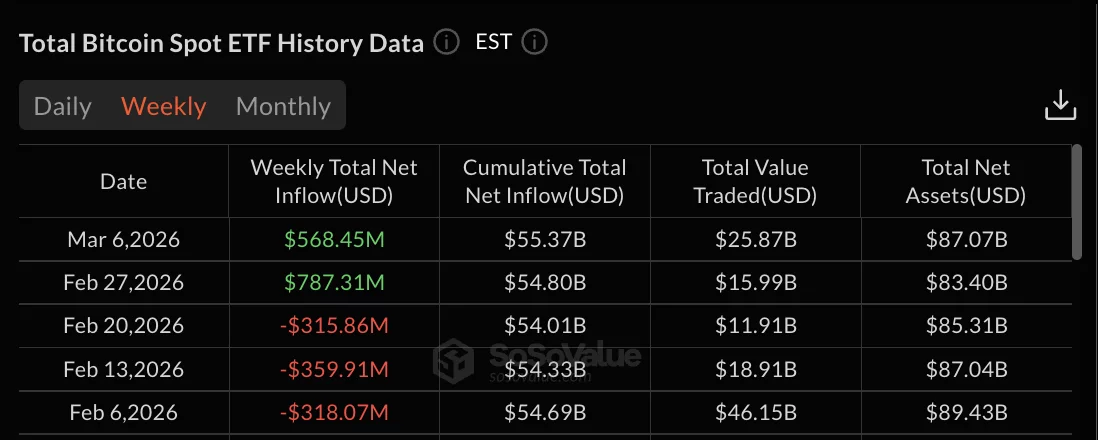

Bitcoin ETFs post $568M inflows after $1.15B buying wave

Bitcoin spot ETFs recorded $568.45 million in net inflows for the week ending March 6 and were the second consecutive week of positive flows.

Summary

- Bitcoin ETFs recorded $568.45M weekly inflows.

- A $1.15B buying wave from March 2–4 offset $576M in late-week outflows.

- Ethereum ETFs added $23.56M, but heavy redemptions erased most midweek gains.

Three days of strong buying from March 2-4 totaling $1.15 billion offset outflows on March 5-6 that drained $576.66 million, leaving the week with net positive flows.

Bitcoin (BTC) traded below $67,000 after dropping 2% over 24 hours, while total net assets for Bitcoin ETFs reached $87.07 billion.

March 2-4 buying wave brings $1.15 billion before reversal

March 2 and March 4 posted nearly identical inflows of $458.19 million and $461.77 million respectively, bracketing March 3’s $225.15 million in positive flows.

The three-day streak brought $1.15 billion into Bitcoin ETF products. March 5 recorded $227.83 million in outflows, followed by March 6’s larger $348.83 million in redemptions.

The two-day withdrawal period removed just under half of the prior three days’ gains but left the week with $568.45 million in net inflows.

Weekly trading volume reached $25.87 billion for the period ending March 6, up from $15.99 billion during the week ending February 27.

Total net assets climbed from $83.40 billion on February 27 to $87.07 billion on March 6.

Ethereum posts modest $23.56 million in weekly inflows

Ethereum spot ETFs recorded $23.56 million in net inflows for the week ending March 6, down sharply from the prior week’s $80.46 million.

March 4 posted the strongest single-day performance at $169.41 million before two consecutive days of heavy outflows.

March 5 saw $90.94 million in redemptions, followed by March 6’s $82.85 million in outflows.

The two-day withdrawal period nearly wiped out March 4’s gains. March 2 added $38.69 million in inflows while March 3 posted a modest $10.75 million in outflows.

Total net assets for Ethereum products reached $11.28 billion with cumulative total net inflow at $11.63 billion. Ethereum price also traded below $1,900 after the 2% daily decline.

Crypto World

Kalshi, Polymarket Discuss Fundraising at $20B Valuations: Report

US President Donald Trump’s newly released National Cyber Strategy outlines federal support for strengthening the security of cryptocurrencies and blockchain systems, including protections against future threats posed by quantum computing.

Key Takeaways:

- Kalshi and Polymarket are exploring fundraising rounds that could value each platform at around $20 billion.

- The potential valuations would mark a sharp increase from their latest funding rounds of $11 billion for Kalshi and $9 billion for Polymarket.

- Rapid growth in prediction markets is attracting investor interest even as regulatory scrutiny rises.

The strategy, published Friday by the White House, states that the administration intends to ensure the United States remains “unrivaled in cyberspace.”

The document highlights the role of secure digital infrastructure and emphasizes that Americans should take steps to safeguard their online activities while the government works to reinforce broader cybersecurity protections.

Trump Cyber Strategy Highlights Crypto and Blockchain Security

Within that framework, the strategy includes a specific focus on emerging technologies tied to the digital asset sector.

According to the document, the administration plans to “build secure technologies and supply chains that protect user privacy from design to deployment,” while also supporting the security of cryptocurrencies and blockchain networks.

The strategy also calls for promoting post-quantum cryptography, encryption systems designed to withstand attacks from future quantum computers, alongside the development of secure quantum computing technologies.

The mention of crypto security comes as debate intensifies within the digital asset industry over whether major blockchain networks are prepared for a future where quantum machines could break current encryption methods.

Quantum computers remain largely experimental, but researchers have warned that sufficiently powerful versions could one day crack cryptographic systems used by Bitcoin and other blockchains.

Such a development would require networks to migrate to new encryption standards capable of resisting quantum attacks.

Some figures in the crypto sector argue the risk remains distant. Michael Saylor, co-founder of Bitcoin-focused firm Strategy, has said concerns about quantum threats are exaggerated, though he acknowledges that developers should remain prepared for technological shifts.

Other projects have begun exploring upgrades more actively. Ethereum co-founder Vitalik Buterin proposed a “quantum roadmap” earlier this year aimed at preparing the blockchain for a future where quantum computing could undermine existing cryptographic protections.

Trump’s cybersecurity plan arrives alongside other policy actions that touch the digital asset sector.

On the same day the strategy was released, the president signed an executive order targeting cybercrime, part of a broader effort to strengthen the country’s digital defenses.

Trump Expands Pro-Crypto Agenda With Bitcoin Reserve and CBDC Ban

Since returning to office, Trump has taken several steps aimed at reshaping US crypto policy. Last year, he approved the creation of a strategic Bitcoin reserve held by the federal government.

The reserve currently contains Bitcoin seized in criminal cases, and the administration has not indicated plans to acquire additional assets.

Earlier executive actions also included a sweeping review of digital asset policy and a prohibition on the development of US central bank digital currencies, reflecting the administration’s stance against government-issued digital money.

Meanwhile, Trump has intensified pressure on Jerome Powell, including threats of a criminal investigation, but the Federal Reserve has again held interest rates steady, citing solid growth and still-elevated inflation.

Powell declined to comment on the investigation and defended the Fed’s independence, warning that politicizing monetary policy would undermine the institution’s credibility.

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The post Kalshi, Polymarket Discuss Fundraising at $20B Valuations: Report appeared first on Cryptonews.

Crypto World

Ripple Whales Take Control of XRP Trading as Key Metric Signals Potential Rally

The transactions on the XRP Ledger has been growing lately, while one analyst explained the importance of the XRP/BTC pair.

Although it was rejected at $2.40 at the beginning of the year, crashed hard in the following month, and even its rebound attempt was halted at $1.65, XRP is still primed for upcoming gains, noted a few analysts on X.

The factors that could propel an impressive rally are whales’ behavior and the growing network usage of the XRP Ledger. Additionally, the XRP/BTC trading pair has reached a pivotal moment that could determine the future price moves of Ripple’s token.

Whales Dominate

Analyst CW indicated that the transactions on the XRP Ledger have been growing lately, which they categorized as a “positive signal” in the current macro conditions. This is because investors generally abandon the market and transactions decrease during bear phases. However, a rise in this metric now is a pattern that precedes a price rally.

Transactions on the $XRP ledger are increasing.

In general, in a bear market, investors leave market and transactions decrease.

An increase in transactions is a pattern that before a rally.

The transaction count, which had been declining since December 2024, is now increasing… pic.twitter.com/g7jkYZQWA8

— CW (@CW8900) March 7, 2026

In another post, the analyst outlined the significance of big whales in the XRP ecosystem. They noted that these large market participants continue to dominate XRP trading, maintaining a buying trend. CW added that they continue to accumulate tokens at prices below $2.40.

This is also regarded as a bullish signal for the underlying asset, as whales typically make sizeable purchases that reduce the immediate selling pressure. Moreover, retail investors tend to follow whales.

The XRP/BTC Pair

In a post titled “The Hidden Liquidity Cycle,” analyst EGRAG CRYPTO explained that the XRP/BTC pair demonstrates when “capital rotates” from the market leader to the altcoins. Historically, “XRP explodes” when this happens.

You may also like:

After noting that the green zone (in the chart below) is where XRP had become “extremely overextended” and a likely crash against BTC is coming, and the red area is the opposite, the analyst added that Ripple’s token is currently in the accumulation phase of the current cycle.

#XRP / #BTC – The Hidden Liquidity Cycle 🔄:

This chart is extremely important. 🧵1/13

Because #XRP/#BTC tells us whether #XRP will outperform #BTC, not just whether #XRP rises in #USD.

And when you zoom out… A powerful liquidity cycle begins to appear.

Let’s break it down. pic.twitter.com/LygPphS5pX

— EGRAG CRYPTO (@egragcrypto) March 7, 2026

If it breaks above the silver line, currently positioned at around 0.00003600 SAT, its rally is expected to begin. XRP/BTC is trading around 0.00002000 SAT as of press time.

EGRAG explained, though, that the XRP/BTC liquidity pair tends to move in long 7-8-year cycles, so this anticipated rally could take a while before it reignites as it did in late 2024.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

China says ‘thorough preparations’ needed ahead of Trump-Xi meeting

Chinese Foreign Minister Wang Yi attends a press conference on China’s foreign policy and external relations on the sidelines of the fourth session of the 14th National People’s Congress (NPC) on March 8, 2026 in Beijing, China.

Vcg | Visual China Group | Getty Images

BEIJING — China’s top diplomat Wang Yi underscored Sunday the benefits of interacting with the U.S., and signaled preparations are underway for a planned meeting between the two countries’ leaders amid differences over the war in Iran and trade tariffs.

“The agenda of high-level exchanges is already on the table,” Wang told reporters in Mandarin Chinese, according to an official translation. “What the two sides need to do now is make thorough preparations accordingly, create a suitable environment, manage the risks that do exist and remove unnecessary disruptions.”

“Turning our backs on each other would only lead to mutual misperception and miscalculation,” he said. “Sliding into conflict or confrontation would only drag the whole world down.”

After an in-person meeting in South Korea in the fall, Chinese President Xi Jinping and U.S. President Donald Trump indicated plans to visit each other’s countries.

Trump is scheduled to visit China from March 31 to April 2, which would be the first trip to the country by a sitting U.S. president since 2017.

However, Beijing has yet to confirm the exact dates of a Trump visit. Wang did not elaborate either, but noted the U.S. and Chinese presidents’ high-level interactions have “provided [an] important strategic safeguard for the China-U.S. relationship to improve and move forward.”

Some analysts have raised doubts over whether the trip will happen on schedule, especially since it would likely come shortly after joint U.S.-Israeli attacks on Iran that killed its Supreme Leader Ayatollah Ali Khamenei and the U.S. capture of Venezuelan leader Nicolas Maduro.

Wang did not name either individual in his remarks to the press Sunday morning but reiterated Beijing’s calls for a ceasefire in the Iran conflict.

“This is a war that should not have happened,” he said. “It is a war that does no one any good.”

Wang has held phone calls with at least seven foreign ministers — including those of Russia, Iran and Israel — since the joint U.S.-Israel strikes on Iran began on Feb. 28, according to official readouts.

He was speaking Sunday to reporters on the sidelines of China’s eight-day annual parliamentary meeting that is set to wrap Thursday. China’s top leaders, including President Xi Jinping, Premier Li Qiang and Vice Premier He Lifeng, are meeting in Beijing with delegates from across the country.

Tariffs in question

The bilateral discussions come as the U.S. and China reached a fragile truce in October for lowering tariffs on each other’s goods to below 50% for one year. The two countries had previously ratcheted up duties to well over 100% during the height of tensions last spring.

In response to a question about Trump’s casting of U.S.-China relations as a new “G2” for leading the world, Wang pushed back against the idea that two countries alone would do so, instead emphasizing multipolarity.

Without naming the U.S., Wang warned against “erecting tariff barriers and pushing [for] economic and technological decoupling.”

“This is no different from using kindling to put out a fire,” he said. “You will only get burned.”

Crypto World

Reasons behind the crypto crash with Trump as President and Paul Atkins at the SEC

The crypto crash has unfolded under Donald Trump as the president and Paul Atkins as the head of the Securities and Exchange Commission.

Summary

- The crypto market crash has happened under Donald Trump as President.

- It also tumbled despite the friendly regulations under Paul Atkins.

- Trump’s second term has been characterized by uncertainty, especially on trade.

Crypto crash has happened under Donald Trump

Bitcoin (BTC) has already erased all the gains made during the Trump presidency and is now trading at its lowest level since October 2024. Altcoins have done worse, with some notable names like Shiba Inu and Cardano hovering near their lowest levels in 2022.

The ongoing crypto crash is ironic as the industry has some major tailwinds. President Trump is the most friendly president for the industry, while Paul Atkins has embraced a different approach than Gary Gensler.

For example, Gary Gensler ended the lawsuits against top companies like Coinbase, Uniswap, and Ripple. He also embraced a more friendly approach, including not launching any lawsuits.

Washington has also enacted some friendly regulations. It passed the GENIUS Act last year, and is now working on the CLARITY Act that will separate SEC and CFTC duties.

There are a few reasons behind the crypto market crash under Trump. Analysts cite the launch of the Official Trump meme coin as a major risk in the industry as it drained vast liquidity. The meme coin initially jumped to $50 and then plunged to below $5.

At the same time, geopolitical risks have remained elevated under Trump. It started with his global tariffs to the current war in Iran that has pushed crude oil prices to the highest level in years.

His tariffs disrupted the falling inflation and pushed the Federal Reserve to be more cautious in its monetary policy. This trend may continue in the foreseeable future as inflation is expected to rise now that the crude oil and natural gas prices have jumped by over 50% this year amid the war in Iran.

Deleveraging after the huge liquidation event in October

Crypto prices have also crashed amid his ongoing deleveraging among investors, especially after the major liquidation event that happened on October 10 last year when over 1.6 million traders were wiped out.

Over $20 billion was lost on that day. Since then, the futures open interest has tumbled to below $100 billion, while the weighted funding rate has largely moved sideways. The Crypto Fear and Greed Index has remained in the red in the past few months.

The crypto crash also happened because of the gridlock in Washington about the CLARITY Act, which has stalled in the past few months. This gridlock started when Coinbase withdrew its support, citing the view that the bill made it almost impossible for crypto companies to pay stablecoin rewards.

Banks and credit unions have argued that allowing these companies to offer rewards will drain funds from their institutions, which will affect the broader economy.

Crypto World

US Court Dismisses Binance, CZ Terrorism Financing Lawsuit

Former Binance CEO Changpeng “CZ” Zhao said centralized crypto exchanges have “zero motive” to assist terrorists after a US court dismissed a lawsuit accusing the exchange of facilitating terrorist financing.

In a post on X, Zhao argued that the economics of crypto trading make such activity illogical for exchanges. “There are absolutely zero (0) motive for any CEX to have anything to do with terrorists,” Zhao wrote, adding that such actors are unlikely to generate trading revenue and may only deposit funds briefly before withdrawing them.

The comments followed a ruling by the US District Court for the Southern District of New York that dismissed claims brought by hundreds of victims and relatives of victims of terrorist attacks. The lawsuit alleged that Binance, Zhao and Binance.US operator BAM Trading Services helped terrorist groups move funds through cryptocurrency transactions.

According to the court filing, the plaintiffs represented 535 individuals linked to victims of 64 attacks carried out between 2016 and 2024. The incidents were attributed to groups including Hezbollah, Hamas, ISIS, al-Qaeda and Palestinian Islamic Jihad.

Related: Binance slams US Senate probe over Iran as based on defamatory reports

Victims seek damages from Binance

The plaintiffs argued that the attackers or affiliated organizations benefited from transactions conducted on the Binance exchange. They sought damages under the US Anti-Terrorism Act and the Justice Against Sponsors of Terrorism Act, which allows victims to pursue claims against entities accused of assisting terrorist acts.

Judge Jeannette A. Vargas dismissed the case after finding that the complaint failed to establish a sufficient connection between Binance’s operations and the attacks themselves. While the filing described alleged compliance failures and illicit activity on the platform, the court said the plaintiffs did not plausibly link the exchange’s conduct to the specific attacks that caused their injuries.

The decision effectively ended the case at the pleading stage. The judge also said that “any amended complaint shall be due within 60 days.”

Related: Binance CEO accuses WSJ of defamation over Iran sanctions report

Binance denies Iran transaction claims

The recent win for Binance comes at a time when the exchange is under growing scrutiny over transactions tied to sanctioned entities. On Friday, the exchange pushed back against allegations raised by a group of 11 US senators, rejecting claims that it facilitated transactions tied to Iranian entities.

In a letter sent Friday to Senators Richard Blumenthal and Ron Johnson, Binance said the February inquiry relied on reports that were “demonstrably false” and lacked credible evidence. The scrutiny came after media reports alleged it processed more than $1 billion in crypto transactions linked to Iranian entities Hexa Whale and Blessed Trust and fired employees who raised concerns internally.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Could a 4x Rally Follow?

Another analyst noted in the meantime that the Ethereum network activity has picked up the pace after a solid decline earlier this year.

Ethereum’s price has fought for $2,000 for a month now, but the bears have taken advantage once again after another 4% decline on a weekly scale. The macro charts are even more painful for the largest altcoin, which barely broke its 2021 all-time high in 2025, but now trades over 60% away from it.

According to a few analysts, though, the landscape around it could change soon due to the rising network activity and previous cycle moves. History has shown that ETH has posted incredible returns after it successfully defended a zone that it’s currently testing.

Can ETH Rocket by 4x Next?

Merlijn The Trader said in a Saturday post on X that “Ethereum is entering the zone that decided the last cycle.” Four years ago, it bottomed after sweeping the liquidity inside the $1.2K-$1.6K range. Technical tools like the RSI show that it’s approaching an oversold territory again, and Merlijn predicted that if it holds the $1.6K level, “buyers regain control.”

However, if it falls below the lower boundary of that range, “deeper liquidity becomes the target.” The last time this zone was tested and defended successfully, the analyst said ETH skyrocketed by 4x. A similar surge now would take it well beyond its all-time high of nearly $5,000.

In a subsequent post, Merlijn doubled down that ETH is at a “make-or-break level,” as the price has respected this rising trendline for years. It has neared the $2,000 level, and the next major move could be determined whether it will defend it or not.

ETHEREUM IS AT A MAKE-OR-BREAK LEVEL.

For years price has respected this rising trendline.

Each touch led to a major move.$ETH is testing it again near $2K.

Hold it: the bull structure stays intact.

Lose it: the macro trend breaks.Every previous touch resolved violently.… pic.twitter.com/eRauroDcrX

— Merlijn The Trader (@MerlijnTrader) March 7, 2026

Rising Network Activity

Meanwhile, fellow analyst CW noted that there’s a notable uptick in the network activity on Ethereum. The transactions peaked at over 2.5 million at the beginning of the year but quickly plunged to under 2 million. However, they have gone above that level as of the latest data.

You may also like:

Similar developments mean that investors and users are more inclined to use the network, which is generally a bullish sign for the underlying asset.

After a brief decline, $ETH network activity is increasing again.

Daily transactions are already well above last year levels. Despite the price decline, the network is becoming more active.

This indicates a bullish, not a bearish. pic.twitter.com/ZSICoVnbsO

— CW (@CW8900) March 7, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports12 hours ago

Sports12 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Sports3 hours ago

Sports3 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026

-

NewsBeat6 days ago

NewsBeat6 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

![Ripple CTO Made an ENCRYPTED Message... "DO NOT SELL XRP EARLY" GET READY XRP HOLDERS! [MUST SEE]](https://wordupnews.com/wp-content/uploads/2026/03/1772957034_maxresdefault-80x80.jpg)