Crypto World

MicroStrategy Stock Price at 10% Risk as Bitcoin Link Tightens

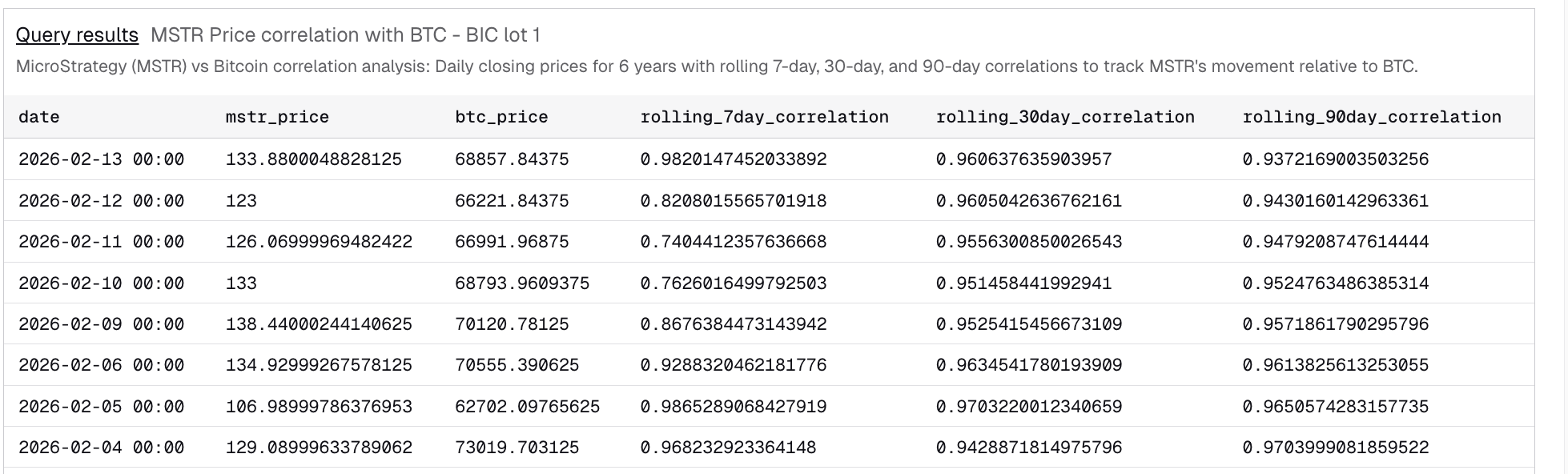

The MicroStrategy stock price closed around $133 on February 13, rising 8.85% in one day. The weekly gain reached nearly 5%, showing strength despite broader uncertainty. But this rally comes at a strange time. Bitcoin fell about 2.2% over the same period, creating a gap between the two assets that rarely lasts long.

New data shows that MicroStrategy and Bitcoin are moving almost identically again. The 7-day rolling correlation has surged to 0.98, near perfect alignment. This tight link means the MicroStrategy price prediction going forward in 2026 may depend heavily on Bitcoin’s next move. At the same time, momentum indicators and volume signals show early warning signs that the recent MSTR price bounce may face pressure.

Sponsored

Sponsored

MicroStrategy’s Bitcoin Correlation and RSI Signal Correction Risk

Rolling correlation measures how closely two assets move together over a set period. The current 7-day correlation of 0.98 means MicroStrategy and Bitcoin are moving in nearly the same direction. This is the highest level since early February. When correlation reaches this level, price moves in one asset often carry over to the other.

This creates a risk because Bitcoin has weakened recently while MicroStrategy stock moved higher. Such gaps often close when markets reopen, causing delayed corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Relative Strength Index (RSI) is showing a hidden bearish divergence. RSI measures buying and selling momentum by comparing recent gains and losses. Between December 9 and February 13, the MicroStrategy price seems to be forming a lower high.

However, during the same period, the Relative Strength Index (RSI), a momentum indicator, has already flashed a higher high. This pattern is called hidden bearish divergence. It shows that even though momentum appears stronger, the underlying price structure remains weak. Sellers may still be in control.

Sponsored

Sponsored

A similar divergence formed earlier between December and February. After that signal, MicroStrategy stock dropped nearly 14%. The same setup is now appearing again.

The key level to watch is $133 ($133.88 to be exact). If the next MicroStrategy (Strategy) stock price candle stays below this level, the correction risk remains active. A move above it would weaken this bearish signal (the hidden divergence) for now and could further the bounce. But that would also mean that Bitcoin’s influence would weaken temporarily.

Institutional Buying Supports Price, While Retail Selling Weakens Conviction

Despite the bearish momentum signal, institutional investors are showing a different behavior. The Chaikin Money Flow (CMF) indicator tracks large money flows into and out of an asset. Since November 21, the MSTR price has trended lower overall. But CMF has steadily moved higher and is now above zero.

This means that large investors have continued to buy even as the price has struggled. Institutional accumulation can reduce downside risk and stabilize prices during corrections.

Sponsored

Sponsored

However, retail investors are showing the opposite trend.

The On-Balance Volume (OBV) indicator tracks cumulative buying and selling volume. Unlike CMF, OBV has been trending lower since November, aligning with the price. This shows that smaller investors have been selling during recent months.

This creates a conflict. Institutional buyers are supporting the price, but retail investors are possibly reducing exposure. The key OBV level now sits near 972 million. If OBV fails to break above this level, it would confirm continued retail weakness. This would increase correction risk and support the forming bearish divergence signal.

This conflict between institutional and retail investors leaves MicroStrategy’s price prediction uncertain in the short term.

Sponsored

Sponsored

MicroStrategy Price Prediction Depends on $139 Breakout or $119 Breakdown

The MSTR price levels now provide the clearest guide to the next move. On the downside, the first key support level sits at $119. This level aligns with the 0.236 Fibonacci retracement and represents a potential 10% decline from current levels. This target also matches the size of previous divergence-driven corrections.

If MicroStrategy stock falls below $119, the next support sits near $106. This would represent a deeper correction and confirm seller control.

On the upside, the most important recovery level is $133, as mentioned earlier, followed by $139. This resistance has capped recent rallies. A confirmed breakout above $139 would signal renewed strength.

If this breakout happens, MicroStrategy stock could move toward $165. A stronger rally could extend toward $190 if Bitcoin also recovers. However, if Bitcoin weakness continues, MicroStrategy could follow lower due to the strong correlation.

For now, MicroStrategy stock remains at a critical point. The extremely high correlation with Bitcoin means its next move may depend on Bitcoin’s direction. If Bitcoin weakness continues, the MicroStrategy stock price could face a delayed correction. But if institutional buying continues and resistance breaks, the bullish trend could still resume for MSTR.

Crypto World

Anthropic Expands Its AI Business in India with Strong Enterprise Uptake

TLDR

- Anthropic has doubled its revenue run rate in India in just four months.

- Developer adoption of Anthropic’s Claude Code has been a key driver of growth in India.

- The company has opened an office in Bengaluru to support its expanding operations.

- Anthropic has formed strategic partnerships to expand its AI solutions in the public sector.

- Air India is using Claude Code to improve software development and reduce costs.

AI startup Anthropic has seen rapid revenue growth in India, with its AI tools gaining traction across various sectors. The company’s revenue run rate has doubled in just four months, driven by high demand from developers and early government deployments. Anthropic has also expanded its presence in the country by opening an office in Bengaluru.

Strong Developer Adoption in India Drives Revenue Growth

Anthropic’s revenue growth in India is largely due to high adoption rates among developers. The company’s Claude Code has seen increased use in India, a country known for its large pool of tech talent. Developers are leveraging the tool to enhance productivity and speed up software development processes. According to Dario Amodei, CEO of Anthropic, India’s developer-centric culture has accelerated the company’s growth. Amodei noted, “Since my last trip here, the company has doubled its run rate revenue in India.”

The speed at which developers are adopting AI tools in India is a key factor in Anthropic’s success. Unlike other countries where casual consumers also use AI, India’s AI adoption is concentrated in the professional sector. This intense use by developers reflects the country’s focus on productivity and rapid experimentation. In India, AI adoption is characterized by a culture of quickly testing new ideas and moving forward with adjustments if necessary.

Anthropic Expands Partnerships to Support Public Sector Growth

In addition to its success in the developer market, Anthropic has formed several strategic partnerships in India. These partnerships will help expand its AI solutions into the public sector, including education, healthcare, and judicial services. The company’s India team will also provide applied AI expertise to startups and enterprises, assisting them in building and scaling AI-driven solutions.

One of the key enterprise clients, Air India, has adopted Claude Code to improve its software development speed. By integrating AI into its operations, the airline aims to reduce costs and increase efficiency. This collaboration reflects the growing interest in AI-powered tools across industries, as businesses recognize their potential to drive productivity improvements.

Government agencies in India have also shown interest in using AI technology, further accelerating Anthropic’s growth in the country. The Ministry of Statistics, for example, is working on an AI-powered server for economic data and statistics. Anthropic’s CEO highlighted that such efforts are progressing much faster than similar projects in other countries. He credited India’s entrepreneurial spirit and technical expertise for the rapid pace of adoption.

Crypto World

Paradigm reframes Bitcoin mining as a grid asset, not energy drain

A surge in AI data-center activity has rekindled a long-running energy debate, pitting grid operators and policymakers against critics who warn that massive computing operations threaten power reliability and push up electricity costs in parts of the United States. In this backdrop, a February 2026 research note from Paradigm reframes Bitcoin mining within electricity markets, arguing that it behaves as a flexible demand source rather than a static drain on energy resources. The note, which surveys grid conditions and market signals, estimates Bitcoin’s current share of global energy use at about 0.23% and its global carbon emissions at roughly 0.08%. It emphasizes that the network’s issuance schedule and periodic reward reductions inherently cap long-run energy growth, shaping how miners respond to price signals and competing generators. The analysis by Paradigm’s Justin Slaughter and Veronica Irwin, anchored by a public discussion of energy modeling assumptions, invites a more nuanced view of mining’s role in modern electricity systems, beyond broad environmental comparisons.

Key takeaways

- Paradigm argues that Bitcoin mining is best viewed as flexible grid demand, adjusting consumption in response to real-time electricity prices and grid stress rather than remaining a fixed, unresponsive load.

- The note quantifies mining’s slice of the energy pie—about 0.23% of global energy use and roughly 0.08% of global carbon emissions—while noting the long-run growth is economically constrained by the fixed issuance schedule and periodic halving of rewards.

- Critiques of mining energy use that rely on per-transaction measurements are highlighted as misleading, since energy consumption is tied to network security and miner competition, not transaction volume alone.

- With increasing AI data-center deployments, several miners are partially pivoting to AI workloads to capture higher margins, reshaping the industry’s profile and demand patterns for power.

- The policy implication is a shift from alarmist energy comparisons to evaluating mining within the broader electricity market—raising questions about how regulators should model and price flexible demand in grid planning.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The conversation sits at the intersection of expanding AI infrastructure, grid reliability concerns, and a broader shift toward demand-side flexibility in electricity markets as crypto miners and traditional energy users alike react to price signals and regulatory frameworks.

Why it matters

The framing offered by Paradigm has the potential to recalibrate how policymakers and market participants think about crypto mining. If mining is treated as a responsive load that can scale up or down with grid conditions, it could be integrated more deliberately into demand-response programs and ancillary-services markets. This view challenges simplistic comparisons that measure energy use in isolation or rely on per-transaction efficiency metrics, which may obscure how miners contribute to grid resilience during periods of surplus or shortage.

The discussion also taps into a broader industry trend: the repurposing of crypto-era infrastructure to artificial intelligence workloads. As margins in traditional mining shift and data-center economics evolve, several players have begun to reallocate hardware and capacity toward AI processing. The shift has been noted across industry reporting and is reflected in the pathways taken by some miners to pursue higher-margin opportunities while continuing mining activities where economics permit. For example, coverage of the AI-data-center wave highlights how existing facilities and equipment can be adapted to meet surging demand for AI workloads, potentially altering regional power usage profiles and pricing dynamics.

At the core of Paradigm’s argument is the idea that energy modeling should reflect the realities of competitive electricity markets rather than rely on static benchmarks. By foregrounding grid conditions, price signals, and the possibility of demand response, the authors argue that Bitcoin mining’s energy footprint can be contextualized within the wider ecosystem of grid economics. This does not absolve miners of responsibility for energy use, but it suggests a framework in which policy decisions are informed by how mining interacts with supply and demand in real time, including its capacity to absorb excess generation or reduce demand during stress events.

The note also emphasizes that energy use and emissions are not the only metrics at play. Understanding where mining sits on the supply curve—where electricity is produced or curtailed—can illuminate why certain regions attract mining operations at particular times and how these operations might contribute to stabilizing grids during peak periods. In this sense, the narrative shifts from a binary “drain vs. benefit” debate to one about how energy users of all kinds can participate in a more dynamic, price-responsive market environment.

As AI infrastructure expands, the mining ecosystem’s response matters for both regional policy and investor sentiment. The industry’s evolving footprint—toward AI workloads in some cases—could influence where and how power is allocated, how utilities price peak versus off-peak energy, and how regulators design frameworks that accommodate flexible demand. While Paradigm’s conclusions are not universal prescriptions, they provide a structured lens for evaluating mining within electricity markets rather than through narrow environmental comparisons alone. The broader takeaway is a push for more sophisticated, market-responsive energy modeling that accounts for price signals, grid constraints, and the real-world behavior of miners under variable conditions.

What to watch next

- Publication and discussion of Paradigm’s February 2026 note and any ensuing responses from policymakers or industry groups.

- New analyses or grid studies examining the elasticity of mining demand in response to real-time pricing and transient grid conditions.

- Regulatory activity at state or federal levels addressing crypto-mining energy use, permitting, and integration with demand-response programs.

- Updates on the mining-to-AI workload transition, including pilot projects and capital reallocation by major miners such as those that have publicly discussed strategic shifts.

Sources & verification

- Paradigm, “Clarifying misconceptions about Bitcoin mining” (February 2026) – note the energy-use and emissions figures and the discussion of market signals. https://www.paradigm.xyz/2026/02/clarifying-misconceptions-about-bitcoin-mining

- Discussion of AI data centers and Bitcoin mining’s local resistance in the U.S. referencing grid- and energy-demand concerns. https://cointelegraph.com/news/ai-data-centers-local-resistance-bitcoin-mining

- Bitcoin mining outlook and profitability shifts in the context of AI-driven infrastructure changes. https://cointelegraph.com/news/bitcoin-mining-outlook-2026-ai-profitability-consolidation

- Bitcoin miner production data illustrating the scale of winter-storm disruption in the U.S. https://cointelegraph.com/news/bitcoin-miner-output-us-winter-storm-latest-data

Bitcoin mining as flexible grid demand in the AI era

Bitcoin (CRYPTO: BTC) mining is increasingly described as a dynamic, price-driven participant in electricity markets rather than a fixed-energy burden. The February 2026 Paradigm note insists that miners act as flexible loads, changing consumption in response to grid stress or surplus supply. This reframing rests on the premise that energy use is not merely a function of transaction volume; it is tied to network security, miner competition, and how power markets price electricity in real time. In practical terms, mining operations tend to gravitate toward the lowest-cost energy sources, often leveraging off-peak generation or surplus capacity, which enables them to scale demand up or down as conditions warrant. The ability to modulate consumption makes mining responsive to price signals, a characteristic that can be valuable to grid operators seeking to balance supply and demand without relying solely on traditional capacity additions.

AI data centers have accelerated this discussion, as industry coverage highlights shifts in crypto-era infrastructure toward AI workloads in some cases. While Bitcoin mining remains a core use case for many facilities, the broader trend underscores how high-density computing can be repurposed to align with profitability drivers and grid economics. Several traditional mining operators, including Hut 8, HIVE Digital, MARA Holdings, TeraWulf, and IREN, have begun exploring partial transitions toward AI processing, highlighting how portfolio strategy can adapt to evolving margins and demand profiles. The implications for energy policy are meaningful: rather than treating all high-energy activities as equivalent, regulators may consider how to integrate flexible-demand resources into reliability and pricing frameworks while maintaining environmental safeguards.

Paradigm’s argument also emphasizes that energy models should reflect the realities of constrained energy systems. If mining adapts to price signals and grid conditions, its contribution to energy demand may be more volatile but potentially more compatible with markets seeking to absorb intermittent generation or reduce peak demand. The authors point to a broader energy-economics logic: when miners respond to scarcity or surplus, they participate in price formation and help balance the system—an argument that invites policymakers to evaluate mining within the rightsized context of electricity markets and grid resilience rather than through simplistic energy-versus-environment comparisons. The discussion aligns with recent coverage of AI infrastructure’s supercycle, suggesting that the real opportunity lies not in static energy tallies but in understanding how demand shapes and responds to evolving grid dynamics.

Crypto World

Court Slams BitBoy With Punitive Damages Over Viral Accusations Against Kevin O’Leary

Armstrong had previously published O’Leary’s private phone number and urged followers to harass him as a supposed murderer.

A United States federal judge has ordered crypto influencer Ben Armstrong, previously known as “BitBoy,” to pay $2.8 million after he failed to defend himself in a defamation lawsuit brought by investor and television personality Kevin O’Leary.

According to court documents, US District Judge Beth Bloom of the Southern District of Florida entered the default judgment on Thursday, while citing Armstrong’s lack of any response during the proceedings. The damages award includes roughly $78,000 for reputational harm, $750,000 for emotional distress, and $2 million in punitive damages.

Background of the Case

The case stems from a series of posts Armstrong published on X in late March 2025, in which he accused O’Leary and his wife of murder and alleged they paid millions of dollars to cover up their involvement in a fatal 2019 boating collision in Ontario.

Two people were killed when one boat struck another on a lake, but O’Leary was only a passenger and was never charged. His wife, Linda O’Leary, on the other hand, was later acquitted of careless operation of a vessel following a 13-day trial. Armstrong publicly disclosed O’Leary’s private phone number and urged followers to contact him as a “real-life murderer.” These posts prompted a temporary suspension from the platform.

In January 2026, Armstrong moved to overturn the default judgment. He said incarceration and mental health problems prevented his involvement, while sealed filings referenced a bipolar disorder diagnosis. The court rejected the request and noted that Armstrong had been properly served and waited nearly a year before taking action.

Legal Woes

The ruling further expands the list of legal troubles facing Armstrong, who has faced repeated arrests since 2023. He was taken into custody in March 2025 on a fugitive warrant tied to alleged threats sent to a Georgia judge and was arrested again in June 2025 on multiple counts of harassing phone calls.

Armstrong was removed from the BitBoy Crypto brand in August 2023 after its parent company cited substance abuse concerns, which ended his run as one of the most visible figures in crypto media.

His career was repeatedly overshadowed by controversy, including admissions of paid promotions for failed or fraudulent projects and a high-profile legal dispute with YouTuber Atozy that he ultimately abandoned after a backlash from the crypto community.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tokenized Real-World Assets See 13.5% Growth Amid Crypto Market Slump

TLDR

- The total value of tokenized real-world assets increased by 13.5% over the past 30 days.

- Ethereum led the growth in tokenized assets, with a $1.7 billion rise in value.

- Tokenized US Treasuries and government debt remain the largest category in the market.

- Institutional participation is growing, with major players like BlackRock and JPMorgan entering the space.

- Tokenized money market funds are evolving, now serving as collateral in trading and lending markets.

Tokenized real-world assets (RWAs) have seen consistent growth, with the total value of onchain RWAs rising 13.5% over the past month. Despite the broader cryptocurrency market shedding $1 trillion in value, the tokenized asset sector continues to show resilience. The demand for tokenized RWAs, especially among institutional investors, reflects a growing interest in utilizing blockchain for traditional financial products.

Ethereum Leads Growth in Tokenized Assets

Ethereum recorded the highest growth in tokenized asset value, with an increase of $1.7 billion. Other blockchain networks, such as Arbitrum and Solana, followed closely, showing $880 million and $530 million in growth, respectively. The surge in value across these networks reflects the broader adoption of blockchain-based tokenized products.

The rise in Ethereum’s dominance highlights the growing role of the blockchain in asset tokenization. As the blockchain’s infrastructure strengthens, more institutions are entering the space, increasing demand for tokenized products. The growth in tokenized asset issuance has also contributed to the overall market rise.

Tokenized US Treasuries and government debt continue to dominate the tokenized asset space, accounting for over $10 billion in onchain products. These assets have seen continuous inflows, which further support their dominant position. As demand grows, more tokenized government securities are being issued on public blockchains.

The expansion of tokenized government debt demonstrates the increasing appeal of blockchain for settling traditional financial assets. Large institutions such as BlackRock, JPMorgan, and Goldman Sachs have shown active participation in this growing market. Their involvement indicates that tokenized government products are becoming a key focus of institutional investment.

Institutional Participation Drives Tokenized Asset Growth

The demand for tokenized assets points to deeper institutional participation in the space. Asset managers are increasingly issuing and settling tokenized versions of traditional financial products. Tokenized money market funds, which were once seen as yield vehicles, are now serving as collateral in trading and lending markets.

BlackRock’s move into decentralized finance with the launch of its tokenized US Treasury fund is one of the latest examples of institutional involvement. This shows a shift in how traditional financial institutions are engaging with blockchain technology.

Crypto World

Mike McGlone Forecasts Bitcoin Price Could Fall to $10,000 Amid Economic Concerns

TLDR

- Mike McGlone warns that Bitcoin could drop to $10,000 due to rising recession risks in the U.S.

- The long-standing “buy the dip” mentality may no longer support risk assets, including cryptocurrencies.

- McGlone highlights Bitcoin’s volatility and predicts a potential reversion to $56,000 before a possible $10,000 decline.

- Broader market instability, including low volatility in major stock indices, contributes to the ongoing crypto price decline.

- Jason Fernandes disagrees with McGlone’s forecast, suggesting a $40,000 to $50,000 price range instead of a collapse to $10,000.

Bloomberg Intelligence’s Mike McGlone has raised concerns about the future of Bitcoin. In a recent analysis, he suggested that the ongoing decline in cryptocurrency prices could signal broader financial stress. McGlone also warned that Bitcoin could revert to as low as $10,000, especially if a U.S. recession becomes more likely.

The analyst observed that the market’s traditional “buy the dip” mentality, which has supported risk assets since 2008, may be losing its strength. McGlone pointed out that the worsening situation in the cryptocurrency market is contributing to broader market volatility. He highlighted several macro indicators suggesting heightened risk conditions in global financial markets.

Bitcoin Price Faces Potential Decline to $10,000

McGlone’s analysis specifically mentions Bitcoin’s vulnerability in the current financial environment. He noted that Bitcoin, which recently fluctuated around $68,800, could continue to struggle. According to McGlone, the cryptocurrency’s decline reflects a broader market breakdown, suggesting that the “buy the dip” mindset may no longer be effective.

He further explained that Bitcoin could fall back toward $10,000 if stock markets continue to weaken. McGlone’s chart comparing Bitcoin to the S&P 500 highlighted how both assets were underperforming. He pointed out that Bitcoin’s volatile nature means it is unlikely to remain above current levels if equity markets experience further instability.

In his analysis, McGlone identified a potential reversion level of $56,000 for Bitcoin. This value corresponds to the 5,600 mark for the S&P 500, adjusted for Bitcoin’s volatility. Beyond this, McGlone predicts that the cryptocurrency could fall further, potentially reaching the $10,000 threshold.

Broader Market Volatility Contributes to Crypto Price Decline

McGlone attributes the ongoing volatility in the cryptocurrency market to broader financial instability. The U.S. stock market’s capitalization relative to GDP is at a century-high, signaling potential bubbles. He noted that the low volatility observed in major stock indices like the S&P 500 and Nasdaq 100 could be masking underlying risks.

Furthermore, McGlone emphasized the “imploding” crypto bubble and the role of factors like “Trump euphoria” in amplifying market stress. While gold and silver are seeing a resurgence, McGlone believes their rise could eventually spill over into equities. He noted that rising market volatility might further challenge asset prices across the board, including cryptocurrencies.

Contrasting Views on Bitcoin’s Future

While McGlone’s thesis on Bitcoin’s potential fall to $10,000 has drawn attention, it has also faced criticism. Jason Fernandes, co-founder of AdLunam, disagreed with McGlone’s view. Fernandes argued that market excesses can resolve through mechanisms like time, rotation, or inflation erosion, rather than necessarily collapsing.

According to Fernandes, Bitcoin’s price could instead stabilize between $40,000 and $50,000 in response to a macro slowdown. He pointed out that a crash to $10,000 would require more severe conditions, including liquidity contraction and financial stress. Fernandes believes that a true recession, marked by global liquidity drainage, would be needed for such a dramatic decline.

However, McGlone’s analysis continues to gain attention, as it reflects rising concerns over both the cryptocurrency and broader market conditions. His forecast suggests that Bitcoin, along with other risk assets, remains highly susceptible to a changing macroeconomic environment.

Crypto World

Binance Founder CZ Urges Faster Evolution of Privacy Features in Crypto

TLDR

- Changpeng Zhao, founder of Binance, emphasizes that privacy is the most significant unresolved issue in the cryptocurrency industry.

- Zhao argues that Bitcoin and most cryptocurrencies lack adequate privacy features, leaving users vulnerable to tracking.

- CZ highlights that blockchain transactions are traceable, especially with KYC practices on centralized exchanges.

- The Binance founder calls for the development of better privacy infrastructure to enable secure crypto payments while complying with regulations.

- Binance’s history with privacy coins, such as the delisting of Monero, raises concerns about the exchange’s stance on privacy.

Changpeng Zhao, the founder of Binance, has stressed the importance of privacy in the cryptocurrency sector. He pointed out that most digital assets lack sufficient privacy protections, making users vulnerable in ways traditional currency does not. Speaking on the All-In Podcast, CZ emphasized the need for faster advancements in crypto privacy.

Privacy Concerns for Cryptocurrency Payments

CZ argued that privacy plays a fundamental role in society but is currently inadequate in most cryptocurrencies, including Bitcoin. “Bitcoin was designed to be pseudo-anonymous,” he explained. “But in reality, every transaction on the blockchain can be traced, especially with KYC on centralized exchanges.” This, he noted, exposes users to risks like unwanted tracking, especially in scenarios such as hotel bookings where third parties might gain access to personal information.

He further elaborated on how payment privacy is a significant hurdle as the cryptocurrency industry moves toward mainstream adoption. With major players like AI agents and institutional investors getting involved, the open ledger design of blockchains like Bitcoin remains a challenge. CZ believes that to achieve widespread use, privacy features must evolve to meet the needs of both businesses and consumers.

Binance and Privacy Coins

Despite CZ’s calls for better privacy features, Binance’s own history with privacy coins has been controversial. In February 2024, Binance delisted Monero (XMR), which at the time was the largest privacy coin. This decision came shortly after CZ stepped down as CEO of Binance, and it led to a 17% drop in Monero’s price. Binance has often cited factors such as trading volume and liquidity in delisting assets, claiming it takes action when a coin no longer meets its standards.

CZ’s comments also raised questions about Binance’s stance on privacy coins like Zcash (ZEC). Last year, Binance included Zcash in a community vote on potential delistings. Zcash’s founder, Zooko Wilcox, raised concerns directly with Binance, highlighting the importance of privacy features in cryptocurrency transactions.

The Need for Widespread Privacy Infrastructure

While privacy coins like Monero and Zcash exist, CZ and industry experts suggest that they are not a complete solution. Nic Puckrin, a digital asset analyst, believes the focus should be on developing broader privacy-preserving infrastructure. Puckrin stressed that the issue isn’t to make payments untraceable but to ensure privacy while staying compliant with regulations. He argued that businesses must adopt these privacy features to enable secure crypto payments.

In the face of these challenges, CZ acknowledged that privacy features are a crucial aspect for crypto’s future. Although law enforcement may seek transparency for security reasons, CZ is confident that privacy can be enhanced without undermining efforts to track bad actors.

Crypto World

Paradigm Challenges Bitcoin Mining Narrative Amid AI Data Center Boom

The rapid buildout of AI data centers has revived a long-running debate over energy consumption, with critics arguing that large computing operations, including Bitcoin mining, strain power grids and drive up electricity prices.

As Cointelegraph previously reported, the surge in AI data center construction has fueled local resistance in several US regions, with residents and lawmakers raising concerns about power demand and rising electricity costs. Bitcoin (BTC) mining has increasingly been linked to the broader debate over high-density computing infrastructure.

In a recent research note, crypto investment firm Paradigm pushed back on that narrative, arguing that Bitcoin mining is frequently misunderstood and often mischaracterized in public energy debates. Rather than treating mining as a static energy drain, Paradigm frames it as a participant in electricity markets, one that responds to price signals and grid conditions.

Paradigm’s Justin Slaughter and co-author Veronica Irwin also challenge several common assumptions used in energy modeling. For example, they note that some analyses measure Bitcoin’s energy use on a per-transaction basis, even though mining energy consumption is tied to network security and competition among miners, not transaction volume.

Other models assume energy production is effectively limitless or that miners will continue operating regardless of profitability, assumptions Paradigm argues are unrealistic in competitive power markets.

According to Paradigm, Bitcoin mining currently accounts for about 0.23% of global energy consumption and about 0.08% of global carbon emissions. Because the network’s issuance schedule is fixed and mining rewards decline about every four years, Paradigm argues that long-term energy growth is constrained by economic incentives.

Related: Bitcoin miner production data reveals scale of US winter storm disruption

Bitcoin mining as flexible grid demand

A central pillar of Paradigm’s argument is demand flexibility.

Bitcoin miners typically seek out the lowest-cost electricity, often sourced from surplus or off-peak generation.

Mining operations can scale consumption based on grid conditions, reducing usage during periods of stress and increasing it when supply exceeds demand. In that sense, Paradigm describes mining as a flexible load, similar to energy-intensive industries that respond to real-time pricing signals.

The debate has taken on new urgency as AI data center expansion accelerates. As Cointelegraph recently reported, some crypto-era infrastructure is now being repurposed to support artificial intelligence workloads, with companies shifting from Bitcoin mining to AI data processing to pursue higher margins. Several traditional Bitcoin miners, including Hut 8, HIVE Digital, MARA Holdings, TeraWulf and IREN, have begun making partial transitions.

By framing mining as responsive demand rather than constant consumption, Paradigm’s report shifts the debate from environmental alarmism to grid economics. The implication for policymakers is that Bitcoin mining should be evaluated within the broader electricity market rather than through simplified energy comparisons.

Related: The real ‘supercycle’ isn’t crypto, it’s AI infrastructure: Analyst

Crypto World

South Korea Uses AI to Detect Crypto Market Manipulation

South Korea is accelerating its crypto market supervision by shifting from manual investigations to AI-powered surveillance. The Financial Supervisory Service (FSS) is upgrading its Virtual Assets Intelligence System for Trading Analysis (VISTA) to automate the initial detection of suspicious activity, a move aimed at coping with the speed and scale of modern digital-asset trading. The upgrade, supported by funding through 2026, enables sliding-window analysis across overlapping time frames to flag abnormal patterns such as sudden volume spikes or atypical price movements. In tandem, regulators are planning to extend AI capabilities to identify networks of coordinated trading accounts and trace the sources of funds used in manipulation. Officials also explore proactive interventions, including potential temporary suspensions of transactions or payments, to curb illicit gains before they can be withdrawn.

Key takeaways

- The Financial Supervisory Service’s upgraded VISTA now performs the initial detection of suspicious trading using automated algorithms rather than relying solely on human investigators.

- A sliding-window grid search method segments trading data into overlapping time frames to identify abnormal patterns, such as unusual volume surges or abrupt price moves.

- Through 2026, the FSS plans to add AI tools capable of detecting networks of coordinated trading accounts and tracing the funding sources behind manipulation schemes.

- Regulators are weighing proactive interventions, including temporary suspensions of transactions or payments, to block illicit gains before withdrawal or laundering.

- The move signals a broader shift toward continuous, AI-assisted oversight in digital-asset markets to align crypto supervision with evolving market dynamics.

Market context: Link the story to broader crypto conditions (liquidity, risk sentiment, regulation, ETF flows, macro, or sector trends) WITHOUT inventing facts.

Why it matters

The shift to automated surveillance reflects regulators’ need to keep pace with the sheer volume and velocity of crypto trading. In markets where a single exchange can process thousands of trades in minutes, manual review struggles to keep up, creating gaps that manipulators may exploit. By automating the detection of irregular activity, authorities can flag suspect intervals with far greater speed and consistency, reducing the window during which illicit actors can operate unchecked. Yet, automation also raises questions about the balance between vigilance and overreach. As algorithms flag patterns that resemble manipulation, there is a risk of false positives that could disrupt legitimate trading activity if not carefully managed.

For market participants, the move toward AI-driven oversight could raise the bar for compliance. Exchanges and custodians will need to ensure data quality and interoperability so that automated systems can access comprehensive, timely information. Regulators’ increased reliance on machine learning models may also spur new governance practices around model validation, transparency, and accountability. The net effect could be a more resilient market environment where manipulative tactics are detected earlier, but with continued diligence to avoid unintended penalties on innocent actors.

Beyond crypto-specific implications, the initiative signals regulators’ intent to harmonize digital-asset oversight with traditional financial markets. Korea’s exploration of proactive intervention intersects with broader debates on supervisory tools, due-process safeguards, and the threshold for action in fast-moving markets. If Korea proves effective, other jurisdictions may adopt similar AI-enabled approaches, extending the reach of automated risk detection across asset classes and trading venues.

What to watch next

- Milestones in the AI upgrade rollout through 2026, including when specific detection modules for coordinated accounts and funding tracing become operation-ready.

- Details of the proposed proactive intervention mechanism, such as criteria, governance, and safeguards for temporary transaction suspensions.

- Results from internal tests demonstrating the accuracy and coverage of automated detection, including any externally verified validation.

- Regulatory guidance on cross-venue data sharing and the integration of AI surveillance with existing market surveillance frameworks.

- Any expansion of AI-based monitoring to other asset classes or to cross-border coordinated trading investigations.

Sources & verification

- Official statements or documentation from the Financial Supervisory Service detailing the VISTA upgrade and its automated detection capabilities.

- Technical briefings or regulator notes describing the sliding-window grid search approach used to scan trading data.

- Public announcements about funding or timelines for AI enhancements through 2026.

- Regulatory notices or policy discussions about a potential payment-suspension mechanism to curb illicit gains.

- Industry coverage on pump-and-dump groups and spoofing in crypto markets for context on monitoring challenges.

South Korea deploys AI-powered surveillance to tighten crypto market oversight

The Financial Supervisory Service’s upgrade to VISTA represents a deliberate shift from reactionary, case-by-case probes to proactive, continuous monitoring of digital-asset markets. The upgraded system can autonomously identify likely manipulation windows across the entire data set, a capability regulators say was not feasible with earlier, manually driven methods. In internal testing, the AI detected all known manipulation periods from completed investigations and also highlighted additional intervals that human analysts had previously missed. This progress is framed as a necessary response to the extraordinary pace and complexity of today’s crypto markets, where millions of transactions occur across dozens of tokens every hour.

Central to the upgrade is a sliding-window grid search, a methodological choice that allows the model to examine overlapping time segments of varying durations. Rather than requiring investigators to guess where misconduct might lie, the algorithm evaluates every potential sub-period for telltale signs—such as sudden price spikes followed by rapid reversals or unusual bursts in trading volume. By prioritizing high-risk windows, the system helps analysts focus on the most suspicious intervals, enabling faster, more targeted inquiries. One striking insight from industry observers is that in crypto markets, some manipulation can unfold in under five minutes, a time frame that challenges human monitoring but is well within the reach of automated systems.

The upgrade is more than a technical upgrade; it signals regulators’ intent to extend AI capabilities beyond detection to prevention and enforcement. Through 2026, the FSS plans to implement tools that map networks of trading accounts that operate in coordination—an important step in dismantling capital flows that underpin manipulation schemes. The regulator also aims to perform large-scale analyses of trading-related text across thousands of crypto assets, seeking to correlate promotional narratives with price movements and to understand how attention shocks translate into market risk. And by tracing the origin of funds used in manipulation, authorities hope to build stronger enforcement cases and curb the ability of bad actors to launder proceeds.

As with any AI-driven regime, the initiative faces practical and philosophical challenges. Regulators acknowledge that automated surveillance must be complemented by human oversight to address issues such as cross-venue manipulation and off-platform coordination, which may elude any single venue’s view. Regular evaluation is required to mitigate bias or drift in models and to avoid flagging legitimate activity. The plan explicitly states that AI tools are intended to support, not replace, investigators, reinforcing the role of experienced analysts in interpreting and acting on automated signals.

Beyond the Korean context, the effort echoes a broader transition in financial markets toward real-time surveillance that blends traditional risk controls with modern data science. The Korea Financial Services Commission has even discussed a broader governance framework for algorithmic trading that would apply across asset classes, coupling market surveillance with behavioral signals and automated risk scoring. The overarching objective is a more resilient system capable of identifying irregularities promptly, while maintaining due-process protections and avoiding overreach that could disrupt legitimate market activity.

As policymakers weigh the regulatory levers, observers will look for concrete demonstrations of how these AI tools perform in live markets. The integration of automated detection with proactive interventions—such as potential temporary suspensions of transactions tied to suspected manipulation—could reshape how traders approach liquidity, risk, and compliance. The evolving framework may also influence how other jurisdictions craft AI-enhanced surveillance, potentially accelerating a global shift toward more transparent and accountable crypto markets.

For readers seeking deeper context, related analyses on pump-and-dump groups and the use of spoofing in crypto trading are available here: pump-and-dump groups: are they legal? and how scammers use fake transaction simulation sites to steal crypto.

Crypto World

$321 Million in Crypto Tokens Unlock This Week: What to Watch

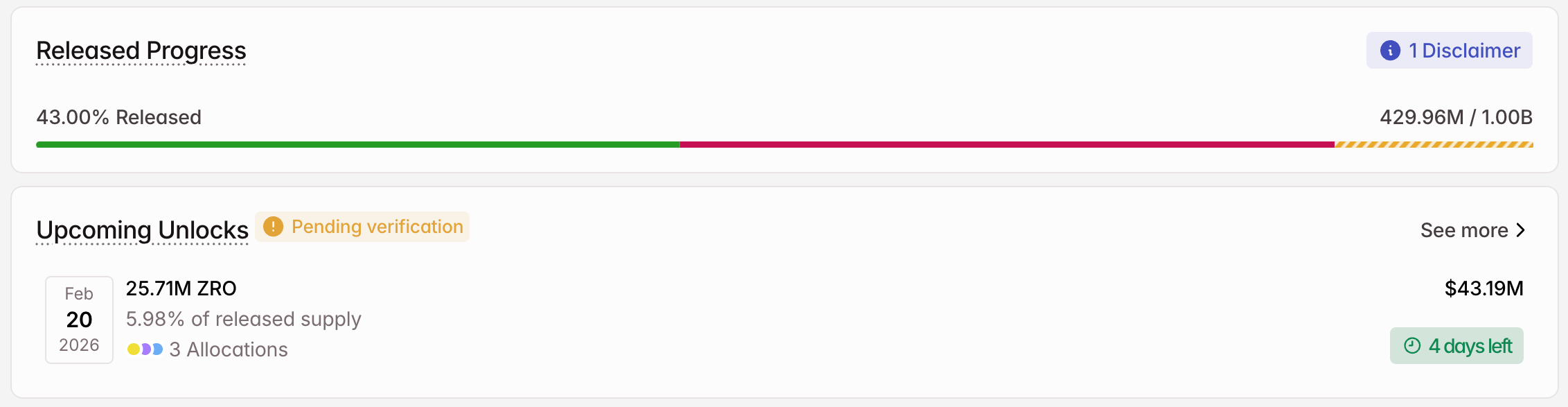

The crypto market will welcome tokens worth more than $321 million in the third week of February 2025. Major projects, including LayerZero (ZRO), YZY (YZY), and KAITO (KAITO), will release significant new token supplies.

These unlocks could introduce market volatility and influence short-term price movements. So, here’s a breakdown of what to watch.

Sponsored

1. LayerZero (ZRO)

- Unlock Date: February 20

- Number of Tokens to be Unlocked: 25.71 million ZRO

- Released Supply: 429.96 million ZRO

- Total Supply: 1 billion ZRO

LayerZero is an interoperability protocol that connects different blockchains. Its primary goal is to facilitate seamless cross-chain communication. Thus, it enables decentralized applications (dApps) to interact across multiple blockchains without relying on traditional bridging models.

The team will unlock 25.71 million tokens on February 20, representing 5.98% of the released supply. Moreover, the supply is worth approximately $43.19 million.

LayerZero will award 13.42 million altcoins to strategic partners. Core contributors will get 10.63 million ZRO. Lastly, 1.67 million ZRO are for tokens repurchased by the team.

Sponsored

2. YZY (YZY)

- Unlock Date: February 17

- Number of Tokens to be Unlocked: 62.5 million YZY

- Released Supply: 362.5 million YZY

- Total supply: 1 billion YZY

YZY is a cryptocurrency token associated with the rapper Ye (formerly known as Kanye West). It is positioned as part of the broader “YZY MONEY” ecosystem, which includes the YZY token, a payment platform called Ye Pay, and a physical YZY Card.

On February 17, YZY will unlock 62.5 million tokens worth around $20.34 million. The tokens represent 17.24% of the released supply.

Sponsored

The team will allocate 50 million altcoins to Yeezy Investments LLC, Vesting 2. Moreover, it will direct 12.5 million tokens to Yeezy Investments LLC, Vesting 1.

3. Kaito (KAITO)

- Unlock Date: February 20

- Number of Tokens to be Unlocked: 32.6 million KAITO

- Released Supply: 306.49 million KAITO

- Total Supply: 1 billion KAITO

Kaito is an artificial intelligence (AI)-powered Web3 information platform that aggregates and analyzes cryptocurrency market data from diverse sources like social media, governance forums, news, and more. The KAITO token serves as a medium of exchange, governance tool, and incentive mechanism within the platform.

Sponsored

On February 20, the team will unlock 32.6 million tokens, representing 10.64% of the current released supply. The supply is worth approximately $10.08 million.

The team will split the unlocked tokens five ways. The foundation will receive 1.19 million tokens. Core contributions will get 6.94 million tokens. Furthermore, early backers will receive 2.31 million KAITO.

Finally, the team will direct 7.16 million KAITO for ecosystem and network growth and 15 million tokens for long-term creator incentives.

In addition to these, other prominent unlocks that investors can look out for in the third week of February include ZKsync (ZK), Solv Protocol (SOLV), ApeCoin (APE), and more, contributing to the overall market-wide releases.

Crypto World

Bitcoin Holds Key Level, Altcoins Aim To Follow: Will Bears Relent?

Key points:

-

Bitcoin remains under pressure as bears are selling on rallies near the $74,508 resistance

-

The bears are mounting a solid defense in several major altcoins at higher levels, indicating a negative sentiment.

Bitcoin (BTC) has started the new week on a cautious note as bulls attempt to maintain the price above $67,500. Investors are not rushing in to buy the dip, as seen from the $133.3 million in outflows from BTC exchange-traded products last week. The total outflows from crypto investment products have risen to $3.8 billion over the past four weeks, according to a CoinShares update on Monday.

If BTC ends the month below $79,500, it will record its first-ever consecutive negative monthly closing in January and February. With more than 22% loss, BTC is staring at its worst first-quarter performance since the 49.7% loss in 2018, per CoinGlass data.

Despite BTC’s weak performance and uncertain near-term direction, Strategy co-founder Michael Saylor indicated in a post on X that the company is buying more BTC. That will be Strategy’s 99th BTC transaction, showing their long-term bullish view remains intact.

Could BTC and the major altcoins defend the support levels and start a strong relief rally? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) is witnessing a tough battle between the bulls and the bears at the support line of the ascending channel pattern.

The moving averages are on the verge of a bearish crossover, and the relative strength index (RSI) is in the negative territory, indicating that the bears are making a comeback. The index may start a deeper correction to 6,720 and then to solid support at 6,550 if the price breaks below the 6,780 level.

Buyers will have to propel the price above the 7,002 level to retain control. If they manage to do that, the index may resume its uptrend and surge toward the 7,290 level.

US Dollar Index price prediction

The US Dollar Index (DXY) has been trading below the moving averages, but the bears have failed to challenge the 96.21 to 95.55 support zone.

The bulls will try to strengthen their position by pushing the price above the moving averages. If they can pull it off, the index may rally to 99.49 and then to the overhead resistance at 100.54.

Contrarily, if the price turns down sharply from the moving averages, it suggests that the bears continue to sell on rallies. The index may the next leg of the downtrend on a close below the 95.55 support.

Bitcoin price prediction

Sellers are attempting to halt BTC’s recovery near $71,000, indicating that the bears remain sellers on rallies.

The sellers will have to pull the price below the $65,000 level to remain in command. The BTC/USDT pair may then retest the critical $60,000 level. If the $60,000 support cracks, the next stop is likely to be $52,500.

Buyers will have to drive the Bitcoin price above the breakdown level of $74,508 to signal that the bearish momentum is weakening. The pair may then surge toward the 50-day SMA ($83,910), where the bears are expected to mount a strong defense.

Ether price prediction

Ether (ETH) once again turned down from the $2,111 level on Sunday, indicating that the bears are fiercely defending the level.

Sellers will attempt to pull the price below the immediate support at $1,897. If they do that, the ETH/USDT pair may drop to the $1,750 level. Buyers are expected to defend the $1,750 level with all their might, as a close below it may sink the pair to $1,537.

Instead, if the Ether price turns up and breaks above the 20-day EMA ($2,221), it signals that the selling pressure is reducing. The pair may then rally to the 50-day SMA ($2,744).

BNB price prediction

BNB’s (BNB) relief rally fizzled out at $642 on Sunday, indicating that the bears are selling on every minor rise.

The bears will attempt to increase their hold by pulling the BNB price below the $570 level. If they manage to do that, the BNB/USDT pair may extend its decline to psychological support at $500.

The bulls will have to drive the price above the 20-day EMA ($686) to suggest that the bears are losing their grip. The pair may then climb to $730 and subsequently to the 50-day SMA ($817).

XRP price prediction

XRP (XRP) turned up from the support line of the descending channel pattern on Friday and pierced the 20-day EMA ($1.53) on Sunday.

However, the bears successfully defended the breakdown level of $1.61 and pulled the XRP price back below the 20-day EMA. The bulls are unlikely to give up easily and will make another attempt to clear the $1.61 level.

If they succeed, the XRP/USDT pair may rise to the 50-day SMA ($1.81). Such a move suggests that the pair may remain inside the channel for some more time.

Sellers will have to tug the price below the support line to gain the upper hand. The pair may then retest the Feb. 6 low of $1.11.

Solana price prediction

Buyers are attempting to push Solana (SOL) back above the breakdown level of $95, but the bears have held their ground.

The Solana price may trade inside the $76 to $95 range for some time. Such a move increases the likelihood of an upside breakout. The SOL/USDT pair may then rally toward $117.

This positive view will be negated in the near term if the price turns down and breaks below the $76 support. The pair may then retest the Feb. 6 low of $67, where the buyers are expected to step in.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

Dogecoin price prediction

Dogecoin (DOGE) turned down from the breakdown level of $0.12 on Sunday, indicating that the bears are defending the level.

The 20-day EMA ($0.10) is flattening out, and the RSI is just below the midpoint, signaling a possible range-bound action in the near term. The DOGE/USDT pair may swing between $0.08 and $0.12 for a few days.

Buyers will gain the upper hand on a close above the $0.12 resistance. That opens the doors for a rally to $0.16. Alternatively, the advantage will tilt in favor of the bears on a close below $0.08. The Dogecoin price may then slump to $0.06.

Cardano price prediction

Cardano’s (ADA) relief rally reached the 20-day EMA ($0.29) on Saturday, which is expected to act as a stiff hurdle.

If the bulls do not give up much ground to the bears, the possibility of a break above the 20-day EMA increases. That suggests the ADA/USDT pair may remain inside the descending channel for some more time. A break and close above the downtrend line signals a potential short-term trend change.

Sellers will have to pull the Cardano price below the support line to extend the downward move toward the next support at $0.20.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) surged above the 20-day EMA ($544) on Friday, indicating that the bears are losing their grip.

The recovery is facing resistance at the 50-day SMA ($578), but a positive sign is that the bulls have not allowed the Bitcoin Cash price to slip back below the 20-day EMA. That increases the likelihood of the continuation of the relief rally. If buyers pierce the 50-day SMA, the BCH/USDT pair may reach $600.

Sellers will have to swiftly yank the price below the 20-day EMA to apply pressure on the bulls. The pair may then skid to the $500 support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video5 hours ago

Video5 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash