Crypto World

Mint Incorporation Limited Partners with Rice Robotics to Launch Physical AI Joint Venture

TLDR:

- Mint signs MOU with Rice Robotics to establish a joint venture for physical AI solutions.

- Initial investment of HK$10M aims to accelerate robotics R&D in Hong Kong and Asia.

- MIMI shares surged nearly 97% in after-hours trading following the strategic announcement.

- Joint venture plans to expand from B2B services into consumer-focused robotics markets.

Mint Incorporation Limited (NASDAQ: MIMI) has signed a non-binding Memorandum of Understanding with Rice Robotics Holdings Limited on February 9, 2026.

The agreement sets the stage for a joint venture focused on physical AI solutions across Asia. Mint will provide an initial investment of approximately HK$10 million.

Following the announcement, MIMI shares surged nearly 97% in after-hours trading, reflecting investor interest in the company’s expansion into robotics and AI.

Joint Venture to Drive Physical AI Innovation

Mint Incorporation Limited’s subsidiary, Aspiration X Limited, will lead the collaboration with Rice Robotics Holdings Limited.

The joint venture aims to develop localized robotic technologies and expand research and development capabilities in Hong Kong.

Chairman and CEO Damian Chan said, “This partnership provides a compelling response to the question, ‘Why not Hong Kong?’ Many local firms act mainly as sales channels, but together with Rice Robotics, we are building core proprietary technology here.”

The comment reflects the company’s intention to establish Hong Kong as a hub for intelligent robotics development.

Mint brings experience in Southeast Asia, including smart office solutions in Singapore and security robot deployments in Thailand and Malaysia.

Rice Robotics adds expertise in delivery robotics and a robust client base in Japan, providing a strong operational foundation for the venture.

“The partnership significantly diversifies and strengthens our robotics portfolio, allowing us to move beyond B2B into the promising B2C space—developing robots for companionship, education, and daily life, powered by our robust AI,” added Chan.

This demonstrates the companies’ aim to combine AI and robotics across both enterprise and consumer markets.

Market Reaction and Strategic Vision

MIMI shares climbed nearly 97% in after-hours trading, more than doubling from the previous close. Investors reacted positively to the announcement, signaling confidence in Mint’s expansion into physical AI.

Victor Lee, Founder of Rice Robotics, commented, “Mint’s rapid expansion in AI and robotics across Southeast Asia makes it an ideal partner. Its dedicated commercial teams and AI platform will dramatically accelerate our joint R&D and market expansion.” His statement emphasizes the operational synergy between the two companies.

Lee also noted, “We share a bold vision to build the most anticipated robotics company in Hong Kong and drive meaningful diversification in the region’s tech ecosystem.” This highlights the joint venture’s ambition to strengthen Hong Kong’s robotics presence regionally.

The collaboration targets “Physical AI”—autonomous systems capable of reasoning, planning, and acting in real-world environments.

By integrating Mint’s AI platform with Rice Robotics’ proven hardware, the joint venture plans to deliver intuitive and practical robotic solutions. The MOU remains non-binding pending the execution of formal agreements.

Crypto World

Coinbase (COIN) says new U.S. tax-reporting rules for crypto are cluttered, confusing

Cryptocurrency trading giant Coinbase (COIN) said new U.S. tax reporting requirements are overly onerous for many crypto holders and add unnecessary clutter to the country’s taxation system.

While the idea is that taxable activity on crypto should be reported in the same way as with equities, for example, the rules require reporting transactions in stablecoins — whose value, by definition, doesn’t change — and the tiny amounts spent on the network fees known as gas.

The Nasdaq-listed exchange is currently sending millions of American crypto holders the new 1099-DA forms designed to bring crypto in line with the rest of finance. While all Coinbase’s customers will be affected to some extent, it’s the very large group of retail customers who are being hit with an unnecessary administrative burden on what amounts to small transaction flows, said Lawrence Zlatkin, the company’s VP of tax.

“Frankly, [small retail] transactional flow is so small, I just don’t know why we’re spending efforts as a country focused on them,” Zlatkin said in an interview. “I just think it just does a disservice to people when you’re trading 50 bucks, let’s say, that you get a form like this and you have to report gains or losses. That’s just not what the tax system is supposed to be about.”

For trading platforms, the new system means sharing details of customers’ digital asset transactions with the IRS. Customers are copied in using the form, so they can voluntarily reconcile their gains and losses with the tax authority.

As is often the case when trying to align crypto with traditional finance, however, there are challenges.

This year, Coinbase will provide the IRS only with the gross proceeds of digital asset sales, and not the net value or cost basis. As a result, the onus is on the trader to add what’s missing regarding their crypto acquisition costs and actual tax basis. (Coinbase will begin calculating cost basis on behalf of its customers starting next tax year.)

This will cause some degree of confusion, particularly among people who have never owned assets like stocks. And crypto brings its own level of complexity, given how holdings can be shunted between platforms and swapped in and out of various coins and tokens.

There are other obvious over-reporting wrinkles in the system that need to be ironed out, Zlatkin said, such as the need to report stablecoin holdings, whose value, by design, is fixed.

“People should pay taxes where they have income,” Zlatkin said. “Do you have income on USDC? No, you don’t. So why are we reporting USDC transactions? And we’re reporting those on our exchange as there’s no blanket exemption for USDC. That, to me, clutters the system.”

Gas fees, the small crypto transactions used to pay blockchain costs, just add to the reporting clutter, Zlatkin said.

“Gas fees might be 50 cents, a buck — do we have to disclose that? Is that a valuable use of resources to collect revenue? And I would posit that the answer is no,” he said. “We should focus on where there’s real income to get people to voluntarily comply. But not where there’s no income, such as in stablecoins or in tiny, tiny transactions that are mostly network fees.”

Coinbase’s goal is to educate and, moving forward, to create tools that help make the sometimes onerous task of calculating cost basis on crypto easier, said Ian Unger, the exchange’s director of tax reporting information.

When an equities investor sells stocks or moves their shares between brokers, those transactions come with transfer statements, so the cost basis transfers with it, he pointed out.

“That’s not the world we live in today for crypto assets,’ Unger said in an interview. “There could be a world where some of this does get easier for those who buy and sell on one exchange and want to move to another exchange. But we’re not there yet, and so until we get there, there’ll be a lot of confusion.”

Crypto World

Kuwait Oil Production Cut Begins as Strait of Hormuz Closure Fills Storage Tanks to Capacity

TLDR:

- Kuwait declared force majeure on day 18 as onshore tanks hit full capacity with no export route available.

- Seven insurance letters from London closed the Strait, not Iranian strikes on Kuwait’s oil production facilities.

- JPMorgan warns total Gulf shut-ins could reach nearly 5 million barrels per day if Hormuz stays closed.

- Forced well shut-ins risk 10 to 30 percent permanent recovery loss, turning disruption into long-term supply destruction.

Kuwait oil production has been curtailed after onshore storage tanks reached full capacity. This occurred on day 18 of the Strait of Hormuz closure to commercial shipping.

The Gulf nation was producing 2.8 million barrels per day before February 28. Since that date, no tankers have loaded at Kuwaiti export terminals.

Oil continued flowing from wells into storage with no route to market. Kuwait declared force majeure and began reducing output in response.

Insurance Withdrawal, Not Missiles, Closed the Strait

Analyst Shanaka Anslem Perera raised the root cause of the shutdown in a post on X. He noted that seven letters from London-based insurance companies effectively closed the Strait of Hormuz.

Without shipping insurance, commercial vessels could not legally transit the waterway. Those letters, rather than missiles, triggered Kuwait’s oil production cuts.

Iran fired missiles at military bases and the US embassy in Kuwait. However, zero confirmed strikes landed on any oil production or export facility.

Kuwait’s refineries and export terminals remained physically intact throughout the conflict. The shutdown was driven entirely by the logistics breakdown downstream of the wells.

JPMorgan had estimated Kuwait held an 18-day storage runway following the closure. That estimate proved accurate as tanks reached capacity on schedule.

Iraq had already cut 1.5 million barrels per day the prior week for identical reasons. The same storage arithmetic is now counting down in Saudi Arabia, the UAE, and Qatar.

JPMorgan further warned that continued closure could push total Gulf shut-ins to nearly 5 million barrels per day. That figure represents roughly 5 percent of global oil supply.

The cuts would stem from storage limits, not from any attack on production infrastructure.

Reservoir Damage Could Make Kuwait Oil Production Cuts Partially Permanent

Kuwait oil production shut-ins carry a second concern beyond immediate volume loss. Forced well closures under reservoir pressure can cause lasting formation damage.

Asphaltene precipitation, fines migration, clay swelling, and pressure depletion are the primary risks. These factors can reduce long-term recovery rates by 10 to 30 percent even after wells restart.

The Society of Petroleum Engineers has documented this pattern across decades of forced shut-ins. During the 1991 Gulf War, some Kuwaiti fields lost 15 to 25 percent of long-term recovery capacity.

Mitigation options exist, including chemical inhibitors and controlled shut-in procedures. However, these measures require planning time that an insurance-driven closure did not provide.

Kuwait had roughly 18 days of warning before the storage crisis peaked. Whether that window was sufficient to protect thousands of producing wells remains an open question.

Post-restart treatments may limit damage if applied promptly. The outcome will determine whether the production cut proves temporary or partially permanent.

Markets are currently pricing a supply disruption. Reservoir physics, however, may be signaling supply destruction.

The gap between those two outcomes could equal 10 to 30 percent of Kuwait’s long-term output. That distinction is the central question the energy market has yet to fully price in.

Crypto World

Prediction Market Kalshi Sued Over Khamenei Trade Carveout

A federal class-action suit targets prediction platform Kalshi, accusing the company of failing to clearly disclose a death carveout tied to a market that forecast the fate of Iran’s former supreme leader. The case centers on the “Ali Khamenei out as Supreme Leader” market, which was halted after the death of Ayatollah Ali Khamenei was confirmed, leaving won bets unsettled in a way the plaintiffs say was not anticipated by users. The plaintiffs contend that the death carveout policy was never incorporated into the user-facing rules summary and was not presented in a way that would alert a reasonable consumer. Kalshi’s co-founder has acknowledged that earlier disclosures were grammatically ambiguous, though the company maintains it did not profit from such markets. The lawsuit also highlights disputes over payouts and reimbursements to traders who were affected.

Key takeaways

- The class-action alleges Kalshi concealed a death carveout in a major political market and failed to disclose how payouts would be handled when a death outcome was involved.

- Trading was halted and positions were voided after the death was confirmed, meaning the market did not resolve to a definitive “yes.”

- Kalshi maintains it does not list death-related markets and asserts the policy is stated in market rules; co-founder Tarek Mansour says no money was made from the market and losses were reimbursed out of pocket.

- Plaintiffs criticize the reimbursement method, arguing the last-traded-price approach and the exact timestamps used to compute it were not disclosed or transparent.

- The suit arrives as prediction-market volumes on Kalshi and peers rose to record levels in 2026, underscoring growing interest in off-exchange forecasting tools.

- The dispute spotlights ongoing scrutiny of how market-design rules are conveyed and enforced in politically sensitive event markets.

Sentiment: Neutral

Market context: The dispute sits at a time when prediction-market platforms have drawn heightened attention as volumes surge in 2026. Regulators and market participants are increasingly weighing how disclosures, rule wording, and risk-management practices shape user trust in event-based forecasts.

Why it matters

For users, the case underscores the importance of transparent disclosures when markets hinge on sensitive outcomes such as political leadership and life-and-death scenarios. The reimbursement mechanism—meant to mitigate losses when outcomes are blocked or unsettled—will come under greater scrutiny if procedural details remain opaque. For Kalshi and the broader prediction-market sector, the suit tests how clearly rules must be communicated within user interfaces and whether policies prohibiting certain outcomes can withstand legal challenges if not explicitly explained. The outcome could influence how platforms design carveouts, disclosures, and payout methodologies when markets intersect with real-world, high-stakes events.

Beyond Kalshi, the dispute feeds into a broader conversation about governance and consumer protection in the burgeoning forecasting economy. As platforms compete for liquidity and user engagement, the balance between creative market design and clear, auditable rules becomes a growing focal point for investors, policymakers, and users alike. The case also arrives amid visible pushback over how reimbursements are determined, raising questions about standardization across operators and the expectations set for participants in this niche trading space.

What to watch next

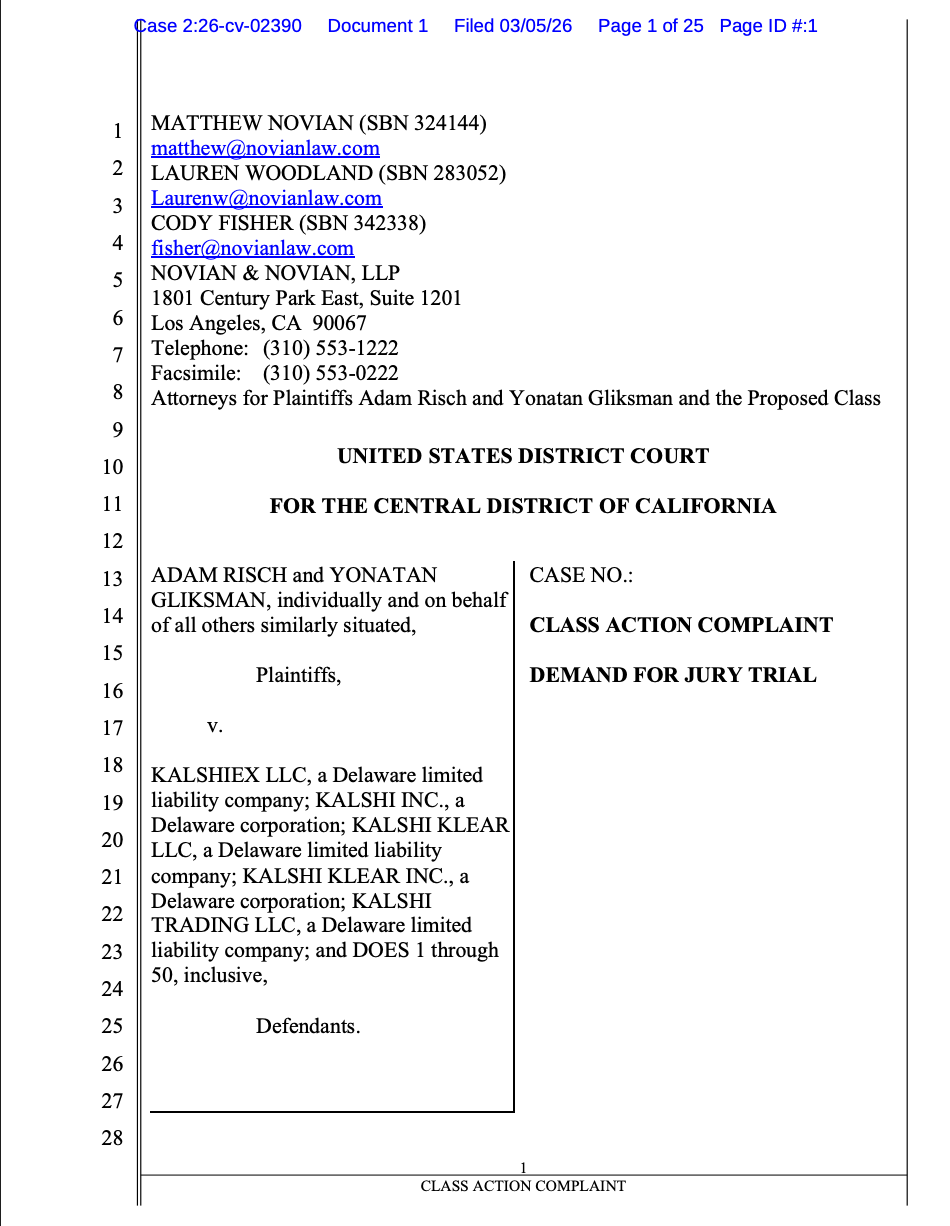

- Legal filings and court rulings in Risch v. Kalshi LLC, including any motions to dismiss or for class certification.

- Kalshi’s public updates to its market rules or disclaimers regarding death-related markets and any changes to the carveout policy.

- Public disclosure of the precise methodology and timestamps used to calculate last-traded prices for reimbursed trades.

- Any settlements or additional disclosures arising from related enforcement actions or disclosures in 2026 trading-volume activity.

- Follow-up reporting on how prediction-market operators adjust governance and risk controls in response to high-profile outcomes.

Sources & verification

- Court Listener docket for Risch v. Kalshi LLC, detailing the class-action complaint and filings.

- Public statements from Kalshi co-founder Tarek Mansour on X addressing the death-market carveout and reimbursements.

- Cointelegraph coverage on Kalshi’s response to the carveout and the reimbursement policy.

- Cointelegraph reporting on related Kalshi developments, including policy enforcement and market dynamics in 2026.

Market reaction and regulatory considerations surrounding Kalshi’s death-market carveout

A class-action alleging disclosure gaps around Kalshi’s death carveout has put the platform’s governance under a sharp lens. The complaint centers on the “Ali Khamenei out as Supreme Leader” market, which was voided after the death of the Iranian leader was confirmed, leaving a scenario where winners did not receive a payout and losers did not simply absorb gains. Plaintiffs emphasize that the carveout policy was not clearly present in the user-facing rules summary, and they point to statements from Kalshi acknowledging earlier disclosures were ambiguous rather than intentionally misleading.

“With an American naval armada amassed on Iran’s doorstep and military conflict not merely foreseeable but widely anticipated, consumers understood that the most likely, and in many cases the only realistic, mechanism by which an 85-year-old autocratic leader would ‘leave office’ was through his death. Defendants understood this as well.”

Kalshi’s co-founder, in defending the firm’s approach, reiterated that the company does not list markets directly tied to death and that the policy to avoid profit from such outcomes is embedded in the rules. He asserted that Kalshi did not profit from the market and that all losses were reimbursed out of pocket, a claim designed to counter arguments that the platform benefited from a misleading disclosure regime. The company’s stance aligns with a broader commitment it has publicly stated—that death-related markets are not listed and that the policy is clearly articulated within the market’s governance framework.

The debate over the reimbursed trades centers on the method used to determine compensation. Kalshi’s team has explained that reimbursements were calculated using the last traded price once the death confirmation occurred, a methodology designed to cap potential losses for participants while avoiding windfall profits. Critics, however, argue that the process and its exact timestamps should be transparent and auditable to ensure confidence in the remedy. The plaintiffs contend precisely that transparency is lacking, arguing that traders deserve a clear, reproducible account of how reimbursements were computed.

Trading activity in prediction markets continued to climb in 2026, with volumes reaching new highs even as legal questions surrounding rule disclosures and payout mechanics persist. The ongoing scrutiny reflects a maturing market where participants increasingly demand clarity on risk controls, governance, and the boundary between ambition in market design and consumer protection. In parallel, Kalshi has faced other regulatory and governance questions, including episodes related to insider trading and broader policy enforcement within its platform ecosystem.

As the case advances, observers will watch not only the court’s handling of disclosure questions but also whether Kalshi, and the wider ecosystem, respond with more explicit UI disclosures or refinements to how sensitive outcomes are treated in live markets. The outcome could influence how other platforms articulate carveouts and payout rules, shaping a more predictable framework for participants who use event-driven markets to hedge risk or speculate on real-world events.

Crypto World

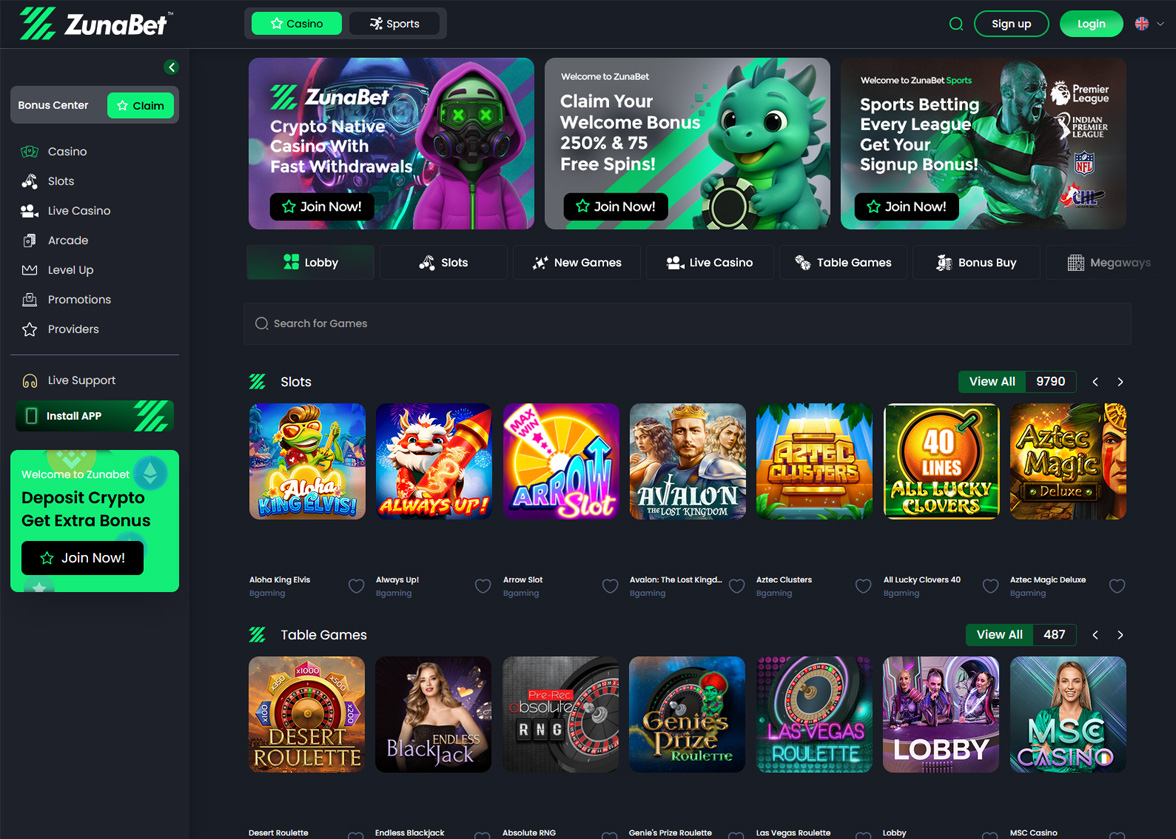

How BetRivers and ZunaBet Stack Up in 2026

Online gambling is going through a clear split. One side sticks with the traditional model — state licenses, bank transfers, and familiar interfaces. The other side is pushing forward with cryptocurrency, massive game catalogs, and reward systems built for a new kind of player. BetRivers and ZunaBet sit on opposite sides of that divide, and looking at them together paints a useful picture of where the market stands right now.

What BetRivers Brings to the Table

BetRivers operates under Rush Street Interactive and holds active licenses across multiple US states, including New Jersey, Pennsylvania, Illinois, and Michigan. It runs both an online casino and sportsbook with a straightforward interface that prioritizes ease of use.

Game availability at BetRivers depends on your state. Most players can access somewhere between a few hundred and a couple thousand titles covering slots, table games, and live dealer rooms. The sportsbook handles NFL, NBA, MLB, soccer, and other popular leagues with competitive lines and a simple bet slip process.

Banking at BetRivers follows the traditional playbook. Credit cards, debit cards, bank wires, and approved e-wallets handle both deposits and withdrawals. Cash-outs typically land within one to five business days, which is standard across most regulated US platforms. Nothing surprising, but nothing fast either.

The loyalty offering is iRush Rewards, a points-based system where real-money play earns credits that can be redeemed for bonuses. It does the job but follows the same template the industry has relied on for over a decade.

What Makes ZunaBet Different

ZunaBet entered the market in 2026 with a completely different blueprint. Strathvale Group Ltd owns the platform, which operates under an Anjouan gaming license. The team behind it brings over 20 years of combined experience in the gambling industry, but they chose to build something forward-looking rather than copying existing models.

The first thing that stands out is scale. ZunaBet hosts 11,294 games from 63 different providers. That puts it among the biggest game libraries in the crypto casino category. Names like Pragmatic Play, Evolution, Hacksaw Gaming, BGaming, and Yggdrasil anchor the catalog, with slots making up the largest portion alongside a strong selection of live dealer and RNG table games.

The sportsbook runs as a fully integrated part of the platform, not an add-on. Coverage spans football, basketball, tennis, NHL, and other major global leagues. Esports betting is baked in with markets on CS2, Dota 2, League of Legends, and Valorant. Virtual sports and combat sports round out a sportsbook that holds its own against dedicated betting sites.

Payments run entirely on crypto. ZunaBet supports over 20 coins — BTC, ETH, USDT across multiple chains, SOL, DOGE, ADA, XRP, and more. The platform charges no processing fees and processes withdrawals quickly. For crypto holders, there is no need to convert to fiat or wait days for a bank to release funds.

New players can access a welcome package worth up to $5,000 plus 75 free spins, split across three deposits. The first deposit earns a 100% match up to $2,000 with 25 spins. The second gives 50% up to $1,500 with 25 spins. The third adds another 100% up to $1,500 with 25 spins. Spreading the bonus across three deposits rewards players who stay active past their first session.

The platform runs on modern HTML5 technology with a dark-themed interface that loads fast and works smoothly across devices. Dedicated apps are available for iOS, Android, Windows, and MacOS, and 24/7 live chat support is on hand whenever something comes up.

How Their Reward Systems Compare

Loyalty is where these two platforms tell very different stories about what they think players deserve.

BetRivers hands out points through iRush Rewards. Play enough, earn enough points, and convert them into bonus money. The conversion rates are modest, and the overall experience feels like something designed a long time ago and never meaningfully updated.

ZunaBet built a gamified loyalty system around a dragon mascot called Zuno that evolves as players progress through six tiers. It starts at Squire with 1% rakeback and goes all the way up to Ultimate at 20% rakeback. Along the way, players unlock benefits like up to 1,000 free spins, VIP club access, and double wheel spins.

Rakeback changes the math for regular players. Instead of collecting abstract points and hoping the conversion rate is decent, players receive a direct percentage of their wagering activity back. At 10% or 20%, that represents serious value over time — far more than what most point-based systems deliver. The dragon evolution theme gives the whole thing a sense of progression that keeps players engaged beyond just the financial return.

The Crypto Question

The payment infrastructure is one of the biggest practical differences between these platforms.

BetRivers works through banks. That means processing times, potential holds, and availability limited to states where the platform is licensed. It is a system that functions but has not evolved much in years.

ZunaBet was designed around crypto from the start. Twenty-plus supported coins, zero platform fees, and quick withdrawals make it a fundamentally smoother payment experience. Players who already use crypto in their daily lives do not have to jump through conversion hoops or wait for institutional banking timelines. The crypto-first approach also opens up access to a broader international audience that state-locked platforms simply cannot reach.

This is not a small distinction. As crypto adoption continues to grow, platforms built natively around digital assets have a structural advantage over those trying to bolt crypto onto traditional systems after the fact.

Which Direction Is the Market Moving

BetRivers occupies a stable position. It has regulatory backing in its licensed states, a known brand, and the resources of Rush Street Interactive behind it. Players who want a traditional, regulated experience in the US still have a good option here.

But the momentum in 2026 sits with platforms like ZunaBet. The combination of 11,000-plus games, 63 providers, a full sportsbook with esports, up to 20% rakeback, and crypto-native payments puts it ahead of most competitors on the metrics that matter to today’s players. It is not just offering more — it is offering a different kind of experience that aligns with how a growing segment of the market actually wants to play and pay.

BetRivers is a safe, known quantity. ZunaBet is the platform that feels built for what comes next. For players deciding where to put their time and money in 2026, that difference matters more than it used to.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Trump’s cyber strategy vows to ‘support the security’ of cryptocurrencies and blockchain

The Trump administration’s new national cyber strategy places the security of cryptocurrencies and blockchain technologies within the United States’ broader push to maintain leadership in emerging technology.

In a section focused on maintaining “superiority in critical and emerging technologies,” the document states that the government will support the security of “cryptocurrencies and blockchain technologies.”

The statement appears in President Trump’s Cyber Strategy for America, which outlines six policy pillars meant to guide federal cyber policy, including securing infrastructure, modernizing federal networks and strengthening U.S. advantages in areas such as artificial intelligence and quantum computing.

“We will build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies. We will promote the adoption of post-quantum cryptography and secure quantum computing,” according to the document.

“And we will secure the AI technology stack—including our data centers—and promote innovation in AI security,” the document added.

By placing blockchain security alongside AI and post-quantum cryptography, the strategy frames decentralized financial infrastructure as part of the nation’s technology competition with foreign rivals.

The strategy does not introduce specific crypto regulations. Still, the language signals that federal policymakers see securing blockchain systems as part of protecting economic and technological leadership.

Still, it further underscores the Trump administration’s commitment to the cryptocurrency space (which came under scrutiny recently), a commitment he has supported since his 2024 campaign.

In July of that year, Trump addressed the Bitcoin 2024 conference in Nashville, promising to make the United States the “crypto capital of the planet” and a “Bitcoin superpower.” He pledged to end what he described as an anti-crypto regulatory push and proposed creating a national Bitcoin stockpile.

In early 2025, he directed the creation of a Strategic Bitcoin Reserve using seized bitcoin and launched a presidential working group on digital assets, while prohibiting a U.S. central bank digital currency (although a year has passed, and there’s still no reserve). Later that year, he promoted stablecoin legislation known as the GENIUS Act and continued to push for broader market-structure rules for the industry.

He has also eliminated various Biden-era anti-crypto policies and has seen U.S. lawmakers drop cases against major cryptocurrency firms, including Uniswap, Tron, Coinbase, and Binance.

Crypto World

The Multibillion-dollar shift turning prediction markets into a professional hedging tool

The dominant narrative around prediction markets still centers on elections and sports. Sports account for the majority of volume at major venues, and election contracts are what put the category on the front page. But based on what active traders are actually doing with real money, prediction markets are expanding for an even more impactful purpose: they’re a place to hedge risks that no existing financial instrument can price cleanly because the assets are new in nature. Their applicability spans geopolitical events, policy shifts, combined with commodity-linked outcomes, and this market has the potential to dwarf anything sports will ever produce.

Case in point: when Kevin Warsh was nominated as the next Federal Reserve chair in January, trading activity on Kalshi and Polymarket surged, and among frequent, multi-market traders, the volume spike dwarfed that of the Super Bowl. More recently, the 24-hour window around the Iran conflict produced more trading activity than any single sports day this year. Sports still account for the majority of the overall volume on both venues. But the traders driving the growth edge are building strategies across categories and venues. These traders are increasingly clustering around geopolitical, macro and policy-linked contracts. They are not looking for entertainment. They are looking for tools to price uncertainty that affects their other positions, their businesses, and (in some economies) their household budgets.

Serious institutional voices are now articulating that shift. In a February 2026 paper, Federal Reserve economists evaluated Kalshi’s macroeconomic prediction markets and argued that these markets can provide high-frequency, continuously updated, “distributionally rich” expectations data that could be valuable to researchers and policymakers.

From entertainment to infrastructure

To see where prediction markets are headed, we only need to monitor trader behavior, and the trend shows a growing number of participants integrating prediction market contracts into broader financial strategies.

This means a commodity trader monitoring oil exposure now tracks Russia-Ukraine ceasefire contracts as a live signal for geopolitical risk that directly affects energy prices. An equity trader managing a concentrated tech position watches tariff-related prediction markets to calibrate event risk that no single stock indicator captures cleanly. In both examples, contract prices are doing something no traditional instrument offers. They’re updating in real time as the narrative around a specific event shifts, and this gives traders a probability signal they can act on across their wider book.

The commodities market is a $60 trillion annual market in the United States. The entire category began with farmers hedging crop yields. This simple premise scaled because the underlying need was real. Prediction markets are approaching a similar threshold. The format is simplistic: what we currently have are binary yes/no contracts on time-elapsed events, but the need they address is both universal and largely unserved by existing instruments: they allow you to price and act on uncertainty.

Before prediction markets, there was no clean way to express a view on whether a central bank would hold rates, whether a military strike would occur or whether a trade policy would shift. Traders could try to infer these probabilities from currency pairs or futures, but they were always trading them as a proxy. Even elections, arguably the most closely watched political events, were priced indirectly, so that a clean-energy Democrat leading in the polls would suppress coal stocks. Prediction markets are a superior instrument as they price the event itself. That makes them useful as hedging tools, which is an order of magnitude more applicable.

The international dimension

The fastest-growing segment of prediction market participation is international, spread across Europe, Asia and, increasingly, emerging markets. In economies marked by currency volatility, inflation and policy unpredictability, the ability to price uncertainty is becoming a necessity for investors.

Stablecoins have already demonstrated this principle. Across Latin America and parts of Africa and Southeast Asia, digital dollars have become a mainstream store of value and remittance tool, not because users were drawn to crypto ideology, but because traditional banking infrastructure struggled with costs and volatility. Stablecoin adoption spread because it solved an everyday problem.

Prediction markets extend that applicability by providing a contract on whether a currency will depreciate next quarter, whether fuel subsidies will be cut, or whether a central bank will intervene. When such contracts are accessible through the same EVM infrastructure, a small position on a fuel price outcome starts to look less like a bet and more like insurance that provides a defined cost for a risk that is otherwise unmanageable.

Consumer-grade simplicity is not yet there, but the trajectory is visible, particularly for traders from high-volatility economies who are not treating prediction markets as entertainment. For them, they serve as an information layer that is also actionable.

What comes next

Prediction markets are now posting hundreds of millions in daily trading volume. Polymarket processed $8 billion in January; Kalshi processed $9 billion. Those figures have moved in only one direction.

But the more important evolution will be in format. The current generation of prediction markets operates on simple binary outcomes. As the category matures, expect conviction-weighted instruments, conditional contracts and markets that reference real economic indices, making these tools more useful for hedging and less dependent on novelty for adoption.

Prediction markets are gaining traction because they measure outcomes with direct economic consequences for traders. Weather and commodity-linked markets, inflation and monetary policy contracts, and geopolitical risk pricing all sit at this intersection. Prediction markets are beginning to overlap meaningfully with traditional finance.

Elections have consistently been the category that drives the deepest engagement and the largest volume spikes, and that will continue as the US midterms approach. Sports generate steady liquidity. But the long-term value of prediction markets will grow to serve a larger population of people and institutions that need to manage uncertainty as part of their daily economic lives.

Crypto World

Kalshi Faces Lawsuit Over Khamenei Prediction Market

A class action lawsuit has been filed against prediction market Kalshi, alleging that the death carveout in the “Ali Khamenei out as Supreme Leader” market was not properly disclosed to users and that the platform failed to pay out winning trades.

The plaintiffs said that the death carveout policy was “not incorporated into the user-facing rules summary,” and was not displayed in a way that would notify a “reasonable consumer” of the policy or its effects.

“Defendants, themselves, later acknowledged that their prior disclosures were ‘grammatically ambiguous,’” the lawsuit filing said.

Kalshi voided trading positions for the market after the death of Khamenei, the former Iranian Supreme Leader, was confirmed, meaning the market did not resolve to a “yes.”

“We don’t list markets directly tied to death. When there are markets where potential outcomes involve death, we design the rules to prevent people from profiting from death,” Kalshi co-founder Tarek Mansour said.

The plaintiffs characterized the carveout policy as “predatory” and an “unfair” business practice for this specific market. The lawsuit said:

“With an American naval armada amassed on Iran’s doorstep and military conflict not merely foreseeable but widely anticipated, consumers understood that the most likely, and in many cases the only realistic, mechanism by which an 85-year-old autocratic leader would ‘leave office’ was through his death. Defendants understood this as well.”

Mansour also announced reimbursements for users affected by the carveout policy, calculated using the “last traded price” for the market before the death of Khamenei was confirmed. The reimbursement policy also drew significant pushback from users.

The plaintiffs in the lawsuit say that the methodology and precise timestamps used to calculate the “last traded price” for the prediction market were not disclosed or transparent.

Related: Kalshi bans US politician over alleged insider trading violation

Kalshi co-founder fires back against lawsuit claims

Mansour maintained that Kalshi was simply adhering to its policy of not allowing “death markets” and said the policy was clearly stated in the market rules.

“Kalshi made no money here and even reimbursed all losses out of pocket. Not a single user walked away losing money from this market,” he said.

The incident came amid trading volumes on prediction markets surging to record highs in 2026, as the platforms gain popularity.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

How Much Bitcoin Can Saylor Buy?

Michael Saylor’s Strategy, linked to MSTR (EXCHANGE: MSTR), continues to funnel capital into Bitcoin (CRYPTO: BTC) via its STRC (EXCHANGE: STRC) stock program, with the potential for further purchases in the coming weeks. The publicly traded vehicle has built a BTC position that some estimates place near $50 billion across its corporate footprint—an all-time high among listed entities. STRC, launched in July 2025 as an income-focused preferred stock, powers an ATM-like mechanism designed to fund incremental BTC buys as demand for yield supports its price and par value. Investors will be watching the next SEC filing, due March 9, for signs of whether another wave of BTC acquisitions is materializing as Bitcoin trades against macro headwinds.

Key takeaways

- STRC (EXCHANGE: STRC) launched in July 2025 as an income-focused preferred stock to raise capital for Strategy’s Bitcoin accumulation plan and later expanded with an at-the-market program.

- In January 2026, STRC sold about 1.19 million shares for $119.1 million in net proceeds, complementing $1.12 billion raised through MSTR sales to fund BTC purchases totaling 13,627 BTC at roughly $1.25 billion.

- In February 2026, STRC proceeds of about $78.4 million were used to acquire 2,486 BTC net, underscoring the ongoing role of STRC in financing additional BTC accumulation.

- BitcoinQuant’s model suggests STRC could raise over $300 million in net proceeds this week, potentially funding about 4,334 BTC at prevailing prices; a Friday trading volume of $188 million implies substantial near-term capacity to finance BTC buys.

- Market observers note that the SEC filings—due March 9—will be a key data point to confirm whether the surge in STRC activity translates into a materially larger BTC purchase by Strategy.

Tickers mentioned: $BTC, $STRC, $MSTR

Sentiment: Neutral

Market context: The episode sits within a broader environment where institutional BTC programs coexist with ongoing regulatory scrutiny and fluctuating liquidity. STRC’s ATM-driven funding mechanism ties yield-seeking demand to active BTC accumulation, while public disclosures and SEC filings shape how much and how quickly Strategy can scale its purchases.

Why it matters

Strategy’s use of STRC to finance Bitcoin accumulation exemplifies a corporate approach to expanding a bitcoin treasury outside traditional balance-sheet buys. The IPO in mid-2025 laid the groundwork for a scalable, market-driven funding model: STRC’s initial proceeds enabled a sizable BTC accumulation, demonstrating how investor yield appetite can be monetized to propel crypto exposure at a scale uncommon for corporate treasuries. The strategy aligns with long-standing commitments by Saylor to increase the company’s BTC holdings, a stance that has helped position Bitcoin as a core reserve asset in some of the most visible corporate crypto bets.

From a market perspective, the unfolding STRC dynamic contributes to a broader dialogue about how public entities can leverage structured equity instruments to participate in crypto markets. The ATM program provides a controllable mechanism for deploying capital, which can help smooth BTC purchases over time and mitigate price impact when demand surges. If the next SEC filing confirms a larger tranche of BTC buys funded by STRC, it could reinforce a perception that corporate entities are leveraging public markets to sustain crypto accumulation even as online sentiment and macro conditions shift.

For investors, the STORY underscores the importance of following official disclosures and model-based analyses that attempt to quantify the potential BTC purchase power embedded in such programs. While the exact figure depends on STRC’s trading dynamics and market conditions, BitcoinQuant’s projection of hundreds of millions in possible proceeds highlights the scale at which STRC could influence short-term BTC demand if the firm chooses to monetize a sizable portion of its listed equity issuance in the near term. This balance between capital markets mechanics and crypto exposure is a focal point for traders watching the BTC market’s next phase of volatility and institutional participation.

What to watch next

- March 9, 2026: The next SEC filing from Strategy will shed light on STRC proceeds and BTC purchases that may have occurred since the last report.

- Any new STRC ATM activity or share sales that would indicate a ramp-up or moderation of BTC accumulation.

- Bitcoin price action and volatility surrounding the STRC-driven flow, as liquidity and macro sentiment evolve.

- Updates from BitcoinQuant on STRC’s ATM contributions and potential BTC purchase capacity under current market conditions.

Sources & verification

- SEC filing: https://www.sec.gov/Archives/edgar/data/1050446/000119312526009811/mstr-20260105.htm

- SEC filing: https://www.sec.gov/Archives/edgar/data/1050446/000119312526053105/mstr-20260105.htm

- SEC filing: https://www.sec.gov/Archives/edgar/data/1050446/000119312526084264

- BitcoinQuant STRC analysis: https://bitcoinquant.co/strc

- STRC IPO overview: STRC IPO

- Strategy expands STRC ATM program: ATM expansion

- Previous BTC buy references: Michael Saylor’s BTC purchases

Market reaction and key details

The ongoing STRC-driven BTC accumulation framework illustrates how publicly listed entities can leverage structured equity to expand crypto exposure. While the exact BTC total remains fluid, the combination of STRC sales, MSTR stock activity, and at-the-market issuance has created a measurable funding stream for BTC purchases. As the March 9 filing approaches, market participants will look for clarity on whether the most recent surge in STRC activity translates into a materially larger BTC allocation, and how this aligns with broader bitcoin-market liquidity and regulatory developments.

Key figures and next steps

Summary figures from the latest reporting cycles indicate a pattern: STRC proceeds are being deployed toward BTC purchases, with January and February activities showing multi-hundred-million-dollar movements and multi-thousand BTC acquisitions. If the trend continues, Strategy could edge closer to deploying hundreds of millions more into BTC over the next reporting window, potentially impacting micro- and macro-price dynamics depending on the pace and scale of new buys.

What this means for the crypto market

Beyond Strategy, the STRC mechanism may set a precedent for how other corporate holders approach crypto treasury expansion using equity-linked instruments. The transparency of SEC filings and the availability of market data will continue to influence investor expectations regarding the sustainability and pace of such programs. As Bitcoin (CRYPTO: BTC) remains a central reference point for institutional crypto exposure, the outcomes of STRC’s ongoing program could inform both treasury-management strategies and the wider discourse on corporate-level crypto adoption.

Crypto World

BTC Must Break This Key Level to Confirm a Real Rally

Bitcoin remains trapped in a broader corrective structure, but the price action is starting to stabilize after defending the $60,000 demand region. The daily chart still leans cautiously as BTC trades below the major moving averages and beneath the descending resistance trendline.

That leaves the cryptocurrency at an important crossroads, where a push higher could extend the recovery toward overhead supply, while failure would keep the broader downtrend intact.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, Bitcoin is still trading inside a well-defined bearish structure, with the price capped below both the 100-day and 200-day moving averages. The 100-day MA is now trending lower near the mid $80,000 region, while the 200-day MA sits even higher around the mid $90,000s, showing that the broader trend remains under pressure.

In addition, BTC is still moving beneath the descending trendline that has guided the correction for months, which means the buyers have not yet delivered a convincing structural reversal.

That said, the reaction from the blue support zone around $60,000 was technically important. Buyers stepped in aggressively after the sharp flush below $60,000, and BTC has since rebounded toward the $68,000 area. The first major resistance remains around $76,000 to $80,000, where previous horizontal support turned into supply. As long as Bitcoin stays below that region, rebounds are likely to be viewed as corrective.

BTC/USDT 4-Hour Chart

On the 4-hour chart, Bitcoin is consolidating inside a rising channel, suggesting that the recent move off the lows is more of a recovery phase than a full bullish reversal. The asset is currently hovering around $68,000 after rejecting from the upper boundary of the channel near the $72,000 to $75,000 resistance area. This rejection confirms that sellers are still active on rallies, especially when BTC approaches confluence resistance, where the channel top overlaps with horizontal supply.

Momentum has also cooled noticeably. The RSI pushed into overbought territory during the recent rally, but has since rolled over and dropped back toward neutral, showing fading upside strength in the short term.

For buyers, holding above the mid-channel area and continuing to defend the $64,000 to $65,000 region would keep the structure constructive for another attempt higher. On the downside, a breakdown below the lower boundary of the channel could send Bitcoin back toward the $60,000 support zone and potentially even lower.

On-Chain Analysis

From an on-chain perspective, Bitcoin’s Net Unrealized Profit and Loss, or NUPL, has fallen sharply and is now sitting around 0.20. That is a major reset compared to the euphoric readings seen during the rally toward the cycle highs.

In simple terms, the market has flushed out a large portion of paper profits, which usually reflects a substantial reduction in speculative excess. While this does not guarantee an immediate trend reversal, it often creates a healthier backdrop than the overheated conditions seen near major tops.

Historically, a NUPL reading around this zone points to a market that is no longer in euphoria and is instead moving closer to the kind of sentiment reset that can support medium term base building. That fits well with the current price structure, where Bitcoin is trying to stabilize after a heavy correction rather than accelerate into a fresh expansion leg.

So, on-chain data suggests downside risk may be more limited than it was near the highs, but for a stronger bullish case, that improving on-chain backdrop still needs confirmation from price through a reclaim of higher resistance levels on both the daily and 4-hour charts.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Latin America’s crypto user growth outpaced U.S. by 3x in 2025, report shows

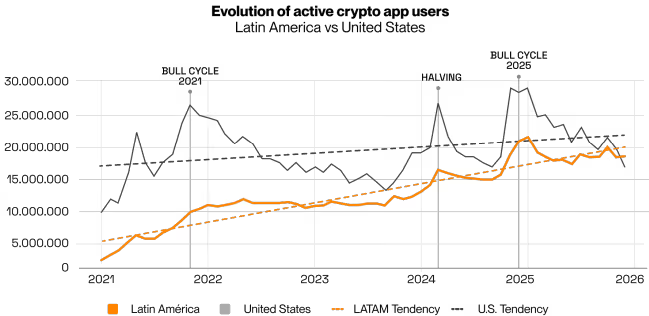

Latin America’s crypto market is expanding far faster than that of the United States as users increasingly rely on cryptocurrencies for payments and cross-border transfers rather than speculation. a new report claims.

The region, according to a report from Argentinian crypto firm Lemon, received more than $730 billion in cryptocurrency transaction volume in 2025, a 60% increase from the previous year, representing roughly 10% of global crypto activity.

Growth was not only measured in transaction volume. Monthly active crypto app users in Latin America rose about 18% year over year, roughly three times faster than growth in the United States, the report said.

Brazil dominates the region by transaction size.

The country received $318.8 billion in crypto value with growth approaching 250% year over year, driven largely by institutional trading and expanding regulatory clarity for financial institutions.

Argentina shows a different pattern. Despite inflation falling to about 32% in 2025, crypto adoption continued to rise. Average monthly users were four times higher than during the 2021 bull market, according to the report.

One driver is cross-border payments. Argentine fintech companies linked crypto rails to Brazil’s PIX instant payment system, allowing users to pay Brazilian merchants using pesos while stablecoins such as USDT settle the transaction behind the scenes.

The integration led to 5.4 million crypto app downloads in Argentina during 2025, with January downloads hitting a record level.

Peru, which back in January saw Bybit Pay integrate with digital wallets Yape and Plin, emerged as one of the fastest-growing markets. Crypto app users doubled as interoperability rules allowed banks and digital wallets to connect. Transfers between banks and wallets surpassed 540 million transactions, up 120% year over year.

Stablecoins are playing a central role in the shift toward practical use cases. Across the region, users rely on digital dollars to send money abroad, receive funds from platforms like PayPal and bypass traditional banking networks, the report points out.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Ann Taylor

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech7 days ago

Tech7 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Sports58 minutes ago

Sports58 minutes agoThree share 2-shot lead entering final round in Hong Kong

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World7 days ago

Crypto World7 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown