Crypto World

Moonwell’s AI-coded oracle glitch misprices cbETH at $1, drains $1.78M

Moonwell’s lending pools racked up about $1.78M in bad debt after a cbETH oracle mispriced the token at nearly $1 instead of around $2.2k, enabling bots and liquidators to drain collateral within hours of a misconfigured Chainlink-based update reportedly using AI-generated logic.

Summary

- Misconfigured cbETH oracle set price near $1 vs roughly $2.2k, triggering a ~99% valuation gap that broke Moonwell’s collateral math.

- Liquidators repaid around $1 per position to seize over 1,096 cbETH, leaving Moonwell with roughly $1.78M in protocol-level bad debt.

- Faulty formula and scaling logic were reportedly co-authored by AI model Claude Opus 4.6, spotlighting new DeFi risk around AI-written oracle and pricing code.

Decentralized finance lending protocol Moonwell suffered a $1.78 million exploit due to a pricing oracle bug that misvalued Coinbase-wrapped ETH (cbETH), according to reports from the platform.

The vulnerability originated in oracle calculation logic reportedly generated by the AI model Claude Opus 4.6, which introduced an incorrect scaling factor in the asset price feed, according to the protocol’s disclosure. Attackers borrowed against severely underpriced collateral, extracting funds before the error was detected and corrected.

The cbETH mispricing effectively collapsed the collateral requirement for borrowing within affected pools. Because lending systems rely on accurate collateral ratios, the incorrect price allowed attackers to extract assets with minimal backing value, according to the protocol’s technical analysis.

Price oracles represent critical security components in DeFi lending systems. Incorrect asset valuation can enable under-collateralized borrowing or liquidation failures. Many major DeFi exploits have historically involved oracle manipulation or pricing errors rather than core protocol flaws, according to industry security reports.

The Moonwell incident differs from traditional oracle exploits in that the faulty logic appears linked to automated AI code generation rather than malicious oracle data feeds, according to the protocol’s preliminary investigation.

The exploit highlights risks associated with AI-assisted smart-contract development in financial applications. Language models can accelerate coding workflows, but financial protocols require precise numerical correctness, unit handling and edge-case validation, according to blockchain security experts.

In DeFi systems, small arithmetic or scaling mistakes can translate into systemic vulnerabilities affecting collateral valuation and solvency. The incident raises questions about whether AI-generated contract components may require stricter auditing standards than manually written code, according to security researchers.

AI-assisted development is increasingly used across Web3 engineering workflows, from contract templates to integration logic. Security models and audit frameworks have not yet fully adapted to AI-generated contract code, according to industry observers.

The broader implications center on how automated code generation errors in financial logic represent a new category of DeFi risk. Oracle math, scaling factors and unit conversions remain high-precision domains where automation failures can propagate into protocol-level vulnerabilities, according to technical analysis of the incident.

As AI-assisted smart-contract development expands, audit methodologies will likely need to evolve toward verifying not only code correctness but generation provenance and numerical invariants, according to blockchain security firms.

Crypto World

Democrats to Oversee DOJ Probe Into Binance, Reports Say

Democratic lawmakers are intensifying oversight as the Department of Justice weighs a probe into Binance’s handling of Iran-related sanctions. In a joint statement, Senators Chris Van Hollen, Elizabeth Warren and Ruben Gallego said they would oversee any DOJ inquiry to ensure the agency conducts a serious review and holds the exchange accountable for potential sanctions violations. The move follows a Wall Street Journal report that cited people familiar with the matter, indicating investigators are examining whether Iran-based entities used Binance to evade sanctions. The disclosure arrives amid broader questions about how crypto platforms enforce U.S. sanctions and how regulators scrutinize exchanges’ risk controls and compliance programs.

The WSJ report, published on a Wednesday, highlighted alleged gaps in verification and monitoring that could have allowed the movement of funds tied to sanctioned actors. In their response, the senators framed Binance as a firm with a documented tendency to place profits ahead of the law and warned that ongoing scrutiny could reveal new sanction-law breaches or reckless assistance to sanctioned networks tied to Iran.

Binance did not respond to a request for comment in this coverage window. A company spokesperson previously told Cointelegraph that the firm was “not aware of any investigations,” adding that Binance is “collaborating with regulators and law enforcement to investigate the facts.”

Last month, the legislators pressed other U.S. authorities—Treasury Secretary Janet Yellen’s successor and the U.S. Attorney General—to probe Binance over concerns about moving Iran-linked funds. The push underscores a concrete shift from high-profile rhetoric toward formal oversight and potential enforcement actions.

Key takeaways

- The Department of Justice is reportedly examining Binance for possible Iran sanctions evasion, per a Wall Street Journal report citing sources familiar with the matter.

- A bipartisan group of U.S. senators vowed to conduct oversight to ensure a serious DOJ investigation and accountability for any wrongdoing by the exchange.

- Binance has publicly stated it is not aware of investigations, while indicating it remains open to regulator and law-enforcement cooperation.

- Binance’s legal history looms over the current scrutiny, including a November 2023 settlement in which the firm pleaded guilty to AML and sanctions violations and agreed to a substantial fine and U.S. oversight.

- Associated twists include a defamation suit Binance filed against the Wall Street Journal over related reporting and past leadership actions by Changpeng Zhao, including a high-profile money-laundering case and a later pardon event.

Market context: The episode sits within a broader climate of tightening regulatory scrutiny over crypto exchanges, with sanctions enforcement and U.S. enforcement actions shaping how platforms implement compliance controls, monitor cross-border flows, and cooperate with authorities. The events also intersect with ongoing debates about how aggressively financial regulators should police crypto-related activities versus fostering innovation.

Why it matters

The unfolding developments are significant for investors, users and builders across the crypto landscape. For users, the episode reinforces the importance of robust know-your-customer and sanctions-screening processes on exchanges, especially those operating with global liquidity pools and complex counterparties. For the market, the alleged Iran-related activity intersects with sanctions enforcement risk—a factor that can influence liquidity, exchange flows and the perceived regulatory exposure of major platforms.

From a policy perspective, the bipartisan call for oversight signals a willingness in Congress to elevate sanction-compliance risk as a central governance issue for crypto businesses. Regulators’ willingness to scrutinize and potentially sanction exchanges for lax controls could accelerate investment in compliance tooling, internal controls, and audit regimes. For Binance, the situation underscores the reputational and legal headwinds that can follow high-stakes enforcement actions, even as the firm continues to court regulatory clarity and operational resilience under scrutiny.

What to watch next

- DOJ conclusions or disclosures stemming from any formal investigation into Binance’s sanctions compliance (dates pending).

- Statements or hearings from the Senate oversight group outlining findings, scope, or requested remedies related to Binance’s conduct.

- Any regulatory actions or consent orders resulting from broader sanctions-enforcement activities involving major crypto exchanges.

- Binance’s public responses or new compliance commitments in response to renewed inquiries and potential legal actions.

- Developments in related legal proceedings, including Binance’s defamation suit against the Wall Street Journal and any outcomes related to prior AML/sanctions settlements.

Sources & verification

- Joint statement by Senators Van Hollen, Warren and Gallego on DOJ investigation into Binance compliance with U.S. sanctions law.

- Wall Street Journal report detailing the DOJ’s potential probe into Iran’s use of Binance to evade sanctions.

- Binance’s public remarks to Cointelegraph about not being aware of investigations and willingness to cooperate with regulators.

- Binance’s defamation suit against the Wall Street Journal over reporting regarding Iran-sanctions-related financing.

Regulatory scrutiny and Binance’s Iran sanctions probe

Regulatory attention on Malta-based, global crypto trading platforms has intensified, and Binance’s case sits squarely at the intersection of sanctions enforcement and exchange governance. The sequence of events paints a picture of a landscape where regulators are elevating sanctions-compliance into a central risk category for platform operators. The Wall Street Journal’s reporting framed the DOJ inquiry as a potential line of inquiry into whether Binance enabled or facilitated transactions linked to Iran-linked entities in breach of U.S. sanctions regimes, including the long-standing restrictions designed to curb financing for designated groups and programs.

The senators’ response underscores the political dimension of the issue. By pledging to oversee the DOJ’s handling of the matter, they are signaling that oversight will extend beyond a single agency or incident, potentially prompting a broader review of Binance’s internal controls, transaction-monitoring capabilities, and cooperation with law enforcement. The public tension between scrutiny and corporate defense is a familiar rhythm in the crypto regulatory era: as investigations surface, exchanges lean on assurances of compliance and collaboration while lawmakers seek concrete accountability measures.

Binance’s public position has consistently emphasized cooperation with regulators and law enforcement, even as it navigates the fallout from earlier enforcement actions. The firm has faced substantial consequences in the past, including a November 2023 settlement that required a record penalty and ongoing oversight to resolve U.S. AML and sanctions concerns. The current inquiry adds another layer of uncertainty around the company’s ability to weather intensified enforcement pressures while maintaining global liquidity and user access. The defamation suit against the Wall Street Journal adds a legal counterpoint to the narrative, illustrating how market participants increasingly engage in strategic communications as investigations unfold.

Beyond Binance, the broader regulatory environment continues to evolve. The developments reflect ongoing efforts to tighten sanctions enforcement, improve compliance in cross-border crypto flows, and align exchange practices with U.S. national security objectives. For market participants, the emphasis on robust due diligence, transparent reporting, and rigorous transaction monitoring could reshape industry norms and drive investment in compliance-focused technologies and procedures. The balance between enabling legitimate crypto activity and enforcing sanctions remains delicate, with outcomes likely to influence how exchanges structure risk controls, governance, and regulatory engagement in the months ahead.

Crypto World

Pi rallies more than 30% after Kraken announces listing

Pi Network’s PI token led the market higher on Friday, according to CoinGecko data, rising 30% during Asia’s morning hours, after crypto exchange Kraken said it would list the asset.

Pi Network is a mobile-first cryptocurrency project that replaces traditional proof-of-work mining with a phone-based trust graph, where users tap a mobile app daily to “mine” tokens and form identity-verified security circles that feed into a consensus system derived from the Stellar protocol.

The project launched its externally connected mainnet in February 2025 after operating for years in a closed ecosystem, saying it had about 19 million KYC-verified users and roughly 10 million accounts migrated to the chain.

Pi Network is currently listed on OKX, Gate, and Bitget, as well as some smaller exchanges.

In February 2025, Bybit CEO Ben Zhou publicly refused to list Pi Network’s token and called the project a scam, citing a 2023 warning from Chinese police alleging that Pi Network targeted elderly users, collected personal information, and caused some victims to lose pension savings.

Crypto World

Democrats Promise to Oversee Reported DOJ Probe Into Binance

A group of Democratic senators say they will oversee a reported Justice Department investigation into possible Iran-related sanctions violations on the crypto exchange Binance.

Senators Chris Van Hollen, Elizabeth Warren and Ruben Gallego said in a joint statement on Thursday that they “will conduct oversight to ensure the Department of Justice conducts a serious investigation into Binance and holds the company accountable for any wrongdoing.”

The Wall Street Journal reported on Wednesday, citing people familiar with the matter, that the Justice Department was investigating Iran’s possible use of Binance to evade sanctions.

“Binance has an established track record of putting profits ahead of the law,” the senators said, adding that the report raised “serious concerns that the firm is again violating US sanctions laws, recklessly helping bankroll the activities of terrorist groups connected to Iran.”

Binance did not immediately respond to a request for comment, but a company spokesperson previously told Cointelegraph it was “not aware of any investigations. But as always, we are collaborating with regulators and law enforcement to investigate the facts.”

The senators said that last month, they asked US Treasury Secretary Scott Bessent and US Attorney General Pam Bondi to investigate Binance over concerns about the movement of Iran-linked funds.

Binance filed defamation suit against WSJ

Binance sued the Wall Street Journal on Wednesday, claiming a report it published on Feb. 23 was defamatory.

The report said that Binance fired staff who flagged $1 billion worth of crypto tied to sanctioned Iranian entities, including Yemen’s Houthis and the Islamic Revolutionary Guard Corps.

Binance denied that it had stopped any investigation and said the Wall Street Journal’s report was false.

Related: Binance claims ‘full and complete legal victory‘ in Alabama court

Binance had pleaded guilty in November 2023 to violating US anti-money-laundering and sanctions laws, paying a record $4.3 billion fine and agreeing to operate under US oversight.

Former Binance CEO Changpeng Zhao pleaded guilty to a money laundering-related charge and was sentenced to four months in jail in 2024.

US President Donald Trump pardoned Zhao in October.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Bitcoin above $71,000, ETH, SOL, ADA zoom higher as cryptos shrugs off stock weakness

Bitcoin held firm near $71,000 on Friday, extending a quiet stretch of consolidation that has kept the crypto market largely unmoved by turbulence in global equities.

BTC traded around $71,300 in early trading, up roughly 2.6% over the past 24 hours and slightly higher on the week. Ether changed hands near $2,117, gaining about 4.6% on the day, while Solana’s SOL climbed more than 5%. XRP rose to $1.41 and BNB hovered around $661, both posting modest daily gains.

The broader crypto market capitalization sat near $2.4 trillion for a third straight session, reflecting a market that has been stuck in a tight band since the sharp sell-off in late January.

That stability stands out against a much shakier backdrop in traditional markets. Asian stocks slipped earlier Friday and the S&P 500 has struggled this week as oil prices surged toward $100 per barrel amid geopolitical tensions in the Middle East and supply disruptions.

Yet crypto markets appear to be largely ignoring those pressures for now.

“Bitcoin is feeling more confident at levels near $70K, settling at the upper limit of the consolidation range of the last four weeks,” said Alex Kuptsikevich, chief market analyst at FxPro. “It is difficult for Bitcoin to grow amid a strengthening dollar and falling stock indices.”

“But the very fact that it is holding steady against this backdrop supports hopes for a fundamental change in sentiment compared to previous months, when almost any news was a reason to sell BTC.”

Data from analytics firm Glassnode suggests the current phase is more stabilization than breakout. The firm noted that while some on-chain metrics are improving, a sustained bull run would likely require a fresh influx of capital rather than continued rotation among existing holders.

The relative calm may also reflect a broader shift in how institutions view the asset.

“Indeed, Bitcoin is in its transition phase as a financial tool,” said Dom Harz, co-founder of BOB. “Institutions want more than exposure to Bitcoin and are increasingly looking for the infrastructure designed to unlock Bitcoin’s financial utility.”

Harz pointed to the growing push toward Bitcoin-native financial infrastructure — often referred to as Bitcoin DeFi — that allows institutions to build lending, payments and yield products directly on top of Bitcoin’s security layer.

“This Bitcoin-native financial architecture is at the centre of Bitcoin DeFi,” Harz said. “As the macro backdrop continues to challenge legacy asset classes, the advantages of a financial system built on Bitcoin DeFi become clear.”

For now, price action suggests traders remain comfortable keeping bitcoin inside its recent $60,000–$72,000 corridor. Until a clear macro catalyst or wave of new capital arrives, the market appears content to consolidate near the upper end of that range rather than chase a breakout.

Crypto World

Bonk.fun users report drained wallets after hackers hijack platform domain

The team behind the Solana-based memecoin launch platform Bonk.fun warned users to avoid its website after hackers reportedly compromised the domain and deployed a malicious wallet drainer, with at least one trader claiming losses of $273,000 after connecting their wallet.

Summary

- The Bonk.fun domain was reportedly compromised and used to deploy a malicious wallet drainer.

- The team says only users who signed a fake approval message after the breach were affected.

- Some users reported significant losses, including one trader claiming a $273,000 wallet drain.

Bonk.fun domain hack triggers wallet drainer

In a statement posted on social media, the Bonk.fun account said a “malicious actor” had taken control of the platform’s domain and urged users not to interact with the website until the issue is resolved.

“A malicious actor has compromised the BONKfun domain, do not interact with the website until we have secured everything,” the platform said.

Tom, an operator associated with Bonk.fun, also warned that hackers had hijacked a team account and placed a crypto drainer directly on the site’s domain. The attacker allegedly used the compromised domain to prompt users to sign a fraudulent approval message disguised as a terms-of-service request.

According to Tom, only users who signed the fake message after the compromise were affected.

“If you connected to Bonk.fun in the past you’re not affected,” Tom wrote, adding that users trading Bonk.fun tokens through external trading terminals were also safe.

He said the team quickly detected the incident and spread warnings across social media, which helped limit losses.

Despite the response, some users reported significant losses. One user claimed on X that they lost their entire wallet after connecting to the site.

“I just got drained for $273,000 on Bonk.fun,” the user wrote, adding that their wallet was left “bone dry” after connecting.

The team said it is working to secure the domain and investigate the incident, stressing that protecting users remains its top priority.

The attack highlights a recurring security risk in the crypto sector, where compromised websites are often used to trick users into signing malicious transactions that grant attackers access to their funds.

Crypto World

MediaTek chip flaw exposed crypto wallets and passwords without booting Android

Security researchers at Ledger have discovered a major flaw in some Android smartphone chips that lets an attacker siphon encrypted user data like passwords and private keys in a matter of seconds using just a USB connection.

Summary

- Ledger’s Donjon security team discovered a vulnerability in MediaTek and Trustonic TEE chips that could allow attackers to extract encrypted data from Android phones in under 45 seconds.

- The exploit bypasses the secure boot chain before Android loads, allowing attackers to recover the device PIN, decrypt storage and extract seed phrases from popular wallets.

The vulnerability was first spotted in January by Ledger’s internal security research team, Donjon, Ledger Chief Technology Officer Charles Guillemet wrote in a recent X post.

According to Guillemet, the vulnerability affected smartphones powered by MediaTek and Trustonic’s TEE processors.

MediaTek has since issued a security patch to fix the issue; users who have not installed the latest security updates on their devices may still remain at risk.

White hat hackers were able to penetrate a smartphone from manufacturer Nothing, notably the company’s CMF 1 phone, in under 45 seconds using a laptop.

“Without ever even booting into Android, the exploit automatically recovered the phone’s PIN, decrypted its storage, and extracted the seed phrases from the most popular software wallets,” Guillemet said.

This puts software wallets like Trust Wallet, Base, Kraken Wallet, Rabby, Tangem’s mobile wallet, and Phantom at risk, as the seed phrases and other sensitive credentials are stored locally on the device.

In their report, researchers noted that the vulnerability allowed attackers with physical access to bypass the phone’s security protections through the secure boot chain, which is a core startup process that runs at the highest privilege level before the operating system loads. Subsequently, the attacker can recover the device’s PIN, decrypt its storage, and extract the information.

“This has the potential to affect millions of Android smartphones,” Guillemet added.

Estimates suggest nearly 36 million people manage digital assets on their smartphones, which means that if attackers manage to exploit a vulnerability, it could put a large number of wallets at risk.

Guillemet advised using devices with dedicated secure elements that are built for key protection and can safeguard sensitive data even under physical attack.

The Ledger team also detailed a separate attack it tested on MediaTek Dimensity 7300 processors (MT6878) in December, where the team used electromagnetic fault injection to disrupt the chip’s boot process. It allowed them to bypass security checks and ultimately gain full control over the smartphone at the highest privilege level.

As covered by crypto.news on several occasions, crypto users have been targeted across multiple platforms, including iOS, macOS, and Windows.

While Android devices are often easier to compromise due to Google’s more open ecosystem and flexible app distribution model, Apple’s iOS devices have also developed unique attack vectors that target users through malicious frameworks embedded inside otherwise legitimate apps.

For instance, last year, security researchers discovered a malicious app that infiltrated both iOS and Android devices by requesting file access and subsequently scanning device storage to extract wallet data. Although not as technically severe in nature as hardware-level exploits, the scheme still managed to steal more than $1.8 million in cryptocurrency.

Around the same time, Kaspersky flagged a malware campaign that spread through malicious software development kits embedded in seemingly harmless apps.

Crypto World

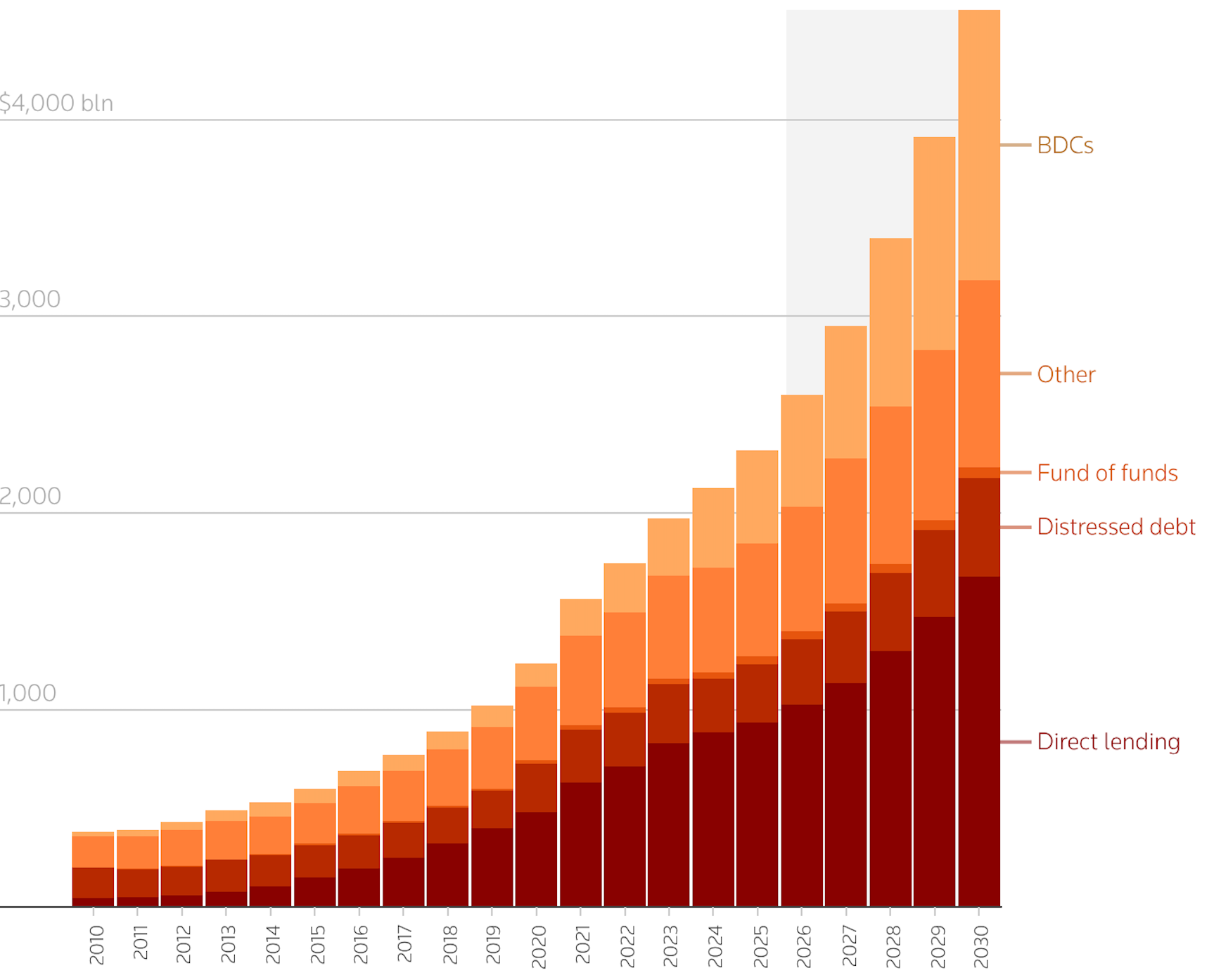

Will private credit break the Bitcoin price?

There is a growing risk that a looming crisis in the private credit market, fueled by rising redemptions and defaults, could spill over into Bitcoin (BTC) and crypto markets, according to analysts.

Key takeaways:

-

The $2 trillion private credit sector faces a crisis from defaults, redemptions, and limited oversight.

-

A liquidity crunch may force investors to sell readily accessible assets, like Bitcoin, first.

-

Historical crises show Fed interventions often lead to strong Bitcoin price rallies as a hedge against money supply expansion.

The private credit ticking time bomb?

The private credit sector, the non-bank lending sector that has grown to over $2 trillion from $500 billion in the past five years, is flashing warning signs of an impending crisis.

Fueled by low rates and investor hunger for high yields, it now rivals traditional banks but lacks the same oversight.

Related: Will Bitcoin crash if oil prices hit $100 per barrel?

In 2024, the International Monetary Fund (IMF) warned that the private credit sector “warranted closer watch,” adding:

“Rapid growth of this opaque and highly interconnected segment of the financial system could heighten financial vulnerabilities given its limited oversight.”

Now, the private credit market shows cracks that threaten triggering a financial crisis.

BlackRock, the world’s largest asset manager, with over $10 trillion under management, limited withdrawals from its $26 billion flagship credit funds, reported Bloomberg.

Blue Owl Capital halted redemptions amid software sector woes from AI disruptions, while UBS warns of default rates hitting 15% in worst-case scenarios.

On Wednesday, Reuters reported that JPMorgan restricted lending to its private credit funds while Morgan Stanley and Cliffwater Private Credit Fund joined the growing list of asset managers under distress.

”Bond King” Jeffrey Gundlach, founder at Double Line said that the private credit fund of funds in 2026 closely mirrors CDO-squared in early 2007, before the 2008 global financial crisis.

“Financial repression is incoming,” market analyst MartyParty said in an X post on Thursday, attributing the problems to the sector’s rapid growth in the face of ‘increasing scrutiny’ over liquidity during periods of investor outflows.

“Either the Fed injects liquidity, or we go into crisis.”

Global conflict and macroeconomic uncertainties exacerbate this, potentially delaying Fed easing while putting pressure on equities and the Bitcoin price.

As Cointelegraph reported, futures markets are pricing less than a 1% chance of Fed rate cuts at the March 18 FOMC meeting.

Liquidity crunch could crash Bitcoin price, at first

While the withdrawal limitations directly affect the private credit market, the implications extend far beyond traditional finance.

Withdrawal limits are a “big deal for crypto,” crypto investor Paul Barron said in a recent post on X, adding:

“When giants like Blackrock lock the gates on private funds, it signals a ‘liquidity crunch.’ Investors stuck in private credit might sell their ‘liquid’ assets (Bitcoin/ETH) to raise cash elsewhere.”

This means that if investors cannot access funds from illiquid private credit portfolios, they may turn to assets that can be sold instantly in public markets.

Bitcoin, which trades 24/7, often serves as the first pressure valve. Its price dropped sharply by 50% in March 2020 as the market priced in the COVID-19 crisis.

But this usually forces government interventions: emergency liquidity injections and rate cuts, aimed at averting systemic collapse.

In 2020, Fed actions post-crash fueled Bitcoin’s surge to its previous all-time high of $69,000 by year-end from $4,400, a 1,400% rally.

Similarly, during the March 2023 banking turmoil, Bitcoin initially sold off on contagion fears, then rallied more than 200% as markets priced in a Fed pause on rate hikes.

This suggests that a private credit breakdown might ultimately result in the further expansion of the money supply, sending BTC price to new highs.

As Cointelegraph reported, BitMEX co-founder Arthur Hayes will wait untill until the Fed loosens its monetary policy before buying any more Bitcoin. BTC price will then rise to $250,000, he predicted.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Top altcoins to buy as Iran

Looking for the best altcoins to buy amid the ongoing Iran-US war volatility? This article highlights some of the top coins to buy for big gains as the war goes on and as many tokens become bargains.

Summary

- Hyperliquid is a top altcoin to buy because of its strong fundamentals.

- Pi Network will be listed on Kraken this Friday.

- Chainlink is the biggest oracle network in the crypto industry.

Hyperliquid

Hyperliquid (HYPE) has become one of the top beneficiaries of the ongoing war in Iran because of its perpetual oil futures product. This product has made it possible for people to trade crude oil during the weekend when most of the developments are happening.

Data shows that the volume in Hyperliquid has jumped this month. According to DeFi Llama, the network has processed perpetual futures contracts worth over $178 billion in the last 30 days. That amount is higher than that of Aster, Lighter, and TradeXYZ, combined.

The benefit of all this is that Hyperliquid’s fees have continued rising, which, in turn, has led to more token burns and buybacks.

Technicals suggest that the HYPE price has more upside to go. It has already moved above the upper side of the falling wedge pattern. It also jumped above the 50-day and 100-day moving averages, pointing to more gains.

Pi Network

Pi Network (PI) is another top crypto to buy today. It has already jumped by over 80% from its lowest point this year and has numerous catalysts that may drive it higher in the coming weeks.

Kraken has already confirmed that it will list it on Friday. This listing is important as it will make it available in the United States for the first time. More exchanges may also decide to list it as it has become a top 50 coin.

The coin may continue rising because of the upcoming Pi Day event on Saturday and the ongoing network upgrades. Also, the developers are working on launching a KYC-as-a-Service solution. It is also becoming a top player in the artificial intelligence industry through its partnership with OpenMind.

Chainlink

Chainlink (LINK) is a top altcoin to buy for long-term gains because of it substantial market share in the oracle industry. It has a total value secured of over $50 billion, much higher than other oracles like RedStone and Pyth.

Chainlink is also a major player in the fast-growing real-world asset tokenization industry. It has large partnerships with companies like JPMorgan, Swift, ANZ Bank, and DTCC.

The Grayscale and Bitwise Chainlink ETFs have also accumulated $93 milion in inflows despite the ongoing crypto bear market.

There are other quality altcoins worth buying that will do well once a bull market starts. Some of the other notable ones are Ethereum, Solana, XRP, and Internet Computer.

Crypto World

PUMP price hints at breakout amid multi-chain expansion sign

PUMP price edged higher on Thursday as traders speculated about the project’s potential expansion beyond its current ecosystem.

Summary

- PUMP price rose as speculation around Pump.fun’s potential multi-chain expansion grew.

- Trading activity increased while the token held support near $0.002.

- Technical indicators show a volatility squeeze, suggesting a breakout could be approaching.

At press time, Pump.fun (PUMP) was trading at $0.00206, up about 4% in the past 24 hours. Over the past week, the token has traded between $0.001848 and $0.002108, keeping it near the top of its recent range.

The token has gained around 9% over the past month as buyers attempt a recovery. Even so, PUMP remains roughly 78% below its September 2025 all-time high.

Market activity has picked up alongside the price move. 24-hour trading volume reached about $111.1 million, a 32.4% increase from the previous day.

According to CoinGlass data, derivatives activity has also climbed, with futures volume rising 29% to $242 million while open interest increased 3.52% to $177 million. When both metrics rise together, it usually shows that traders are opening new positions rather than closing existing ones.

Multi-chain expansion rumors drive interest

Signs that Pump.fun may be getting ready to expand outside of Solana are largely responsible for the project’s recent surge in interest.

The platform recently registered a number of new subdomains linked to other networks, such as Ethereum, BNB Chain, Base, and Monad, according to observers. The move is often seen as early infrastructure work before launching services on additional chains.

At the same time, the project’s official social media profile removed its “Solana” location tag, adding to speculation that a broader rollout could be coming.

🚨JUST IN: https://t.co/VS31GZ3dMY has registered subdomains for Base, BSC, Monad and Ethereum, suggesting a possible move beyond Solana, while also removing Solana as its location from its X profile, adding to speculation of a crosschain expansion. pic.twitter.com/kpScjK7xDz

— SolanaFloor (@SolanaFloor) March 11, 2026

A new development has also emerged through a recent partnership with MoonPay, which allows users to fund Pump.fun accounts with assets held on different blockchains. Deposits from networks like Bitcoin, Polygon, and Arbitrum are possible with this integration.

The process is handled in the background by MoonPay, which automatically converts the assets and routes them to the platform.

Pump.fun itself continues to operate on the Solana network, and the team has not officially announced a full multi-chain expansion. Even so, the integration has sparked speculation that meme coin creation and trading on the platform could eventually extend beyond the Solana ecosystem.

If that direction is taken, the platform could gain access to larger liquidity pools from other networks. A rise in user activity and trading volume would likely increase the platform’s revenue.

In the past, those funds have been used for PUMP buybacks, token burns, and investments aimed at developing the ecosystem. However, some critics warn that multi-chain expansion could fragment liquidity. Memecoins listed on the platform may experience more volatility as a result.

PUMP price technical analysis

PUMP appears to be entering a volatility squeeze, which often precedes a large price movement. Following the recent period of consolidation, the Bollinger Bands have begun to contract, indicating a decrease in volatility.

When the bands narrow in this way, markets often react with a sharp move once price breaks out of the range. Several recent candles have formed near the $0.002 support area, where the token is currently trading. Buyers have stepped in around that level during the latest pullbacks.

Momentum also shows some improvement. The relative strength index has climbed back toward the 50 midpoint, indicating that selling pressure has started to ease after the earlier decline.

On shorter timeframes, the price structure is beginning to form higher lows. This pattern sometimes appears when a market starts to stabilize after a period of weakness.

For now, the next level traders are watching sits around $0.0022–$0.0023, which aligns with the upper Bollinger Band. A move above that area could confirm a volatility breakout.

If the breakout holds, the market may enter a new expansion phase. However, if resistance holds, the token could continue to move sideways around the $0.002 level while traders wait for clearer direction.

Crypto World

DeFi User Loses $50M in Crypto Swap Gone Wrong

A crypto user has lost millions during a crypto swap on the decentralized finance protocol Aave, with a Maximal Extractable Value, or MEV, bot also front-running the transaction to make almost $10 million.

A recently funded wallet from Binance containing $50.4 million USDt (USDT) executed a swap via decentralized exchange aggregator CoW Protocol and the SushiSwap DEX on Thursday, aiming to convert the full amount into the Aave (AAVE) token.

However, the wallet only received 327 AAVE tokens valued at approximately $36,000, according to Etherscan.

The result was an almost total loss as the user paid around $154,000 per AAVE, compared to its market price of around $114.

Adding to the loss was a MEV bot that did a “sandwich attack” on the user. MEV bots scan pending blockchain transactions, and in this case, targeted the large incoming AAVE order to inflate the price of the token ahead of the order to profit.

The bot front-ran the transaction by flash-borrowing $29 million wrapped Ether (ETH) tokens from Morpho to drive up the price of AAVE ahead of the user’s transaction with a purchase on Bancor. It then sold the inflated tokens on SushiSwap for a $9.9 million profit.

User ignored slippage warnings: Aave

Automated market makers, such as SushiSwap, use an automated pricing formula that adjusts slippage, the intended and actual price of a trade, depending on the size of the trading pool and impending trades.

Aave founder Stani Kulechov posted to X that the protocol interface warned the user about the “extraordinary slippage” due to the “unusually large size of the single order.”

“The user confirmed the warning on their mobile device and proceeded with the swap, accepting the high slippage, which ultimately resulted in receiving only 324 AAVE in return,” he said.

Related: Vitalik Buterin proposes solutions for Ethereum’s MEV problem

CoW DAO said on X that “despite clear warnings that showed the user they would lose nearly all of the value of their transaction, and despite needing to explicitly opt into the trade after seeing the warning, the user chose to proceed with their swap.”

“No DEX, DEX aggregator, public liquidity pool, or private liquidity pool (or combination thereof) would have been able to fill this trade at anywhere near a reasonable price.”

CoW DAO said that trades like this “show that DeFi UX still isn’t where it needs to be to protect all users,” adding that it would refund any protocol fees associated with the transaction.

Aave’s Kulechov said it sympathized with the user and would attempt to contact them to return $600,000 in fees it collected from the transaction.

“The key takeaway is that while DeFi should remain open and permissionless, allowing users to perform transactions freely, there are additional guardrails the industry can build to better protect users.”

Magazine: All 21 million Bitcoin is at risk from quantum computers

-

Business7 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos4 days ago

News Videos4 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Ann Taylor

-

Crypto World4 days ago

Crypto World4 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech2 days ago

Tech2 days agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Tech2 days ago

Tech2 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Politics7 days ago

Politics7 days agoTop Mamdani aide takes progressive project to the UK

-

Business3 days ago

Business3 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports5 days ago

Sports5 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports5 days ago

Sports5 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat1 day ago

NewsBeat1 day agoResidents reaction as Shildon murder probe enters second day

-

Entertainment6 days ago

Entertainment6 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business4 days ago

Business4 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business2 days ago

Business2 days agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech4 days ago

Tech4 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business3 days ago

Business3 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat2 days ago

NewsBeat2 days agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.

-

Business6 days ago

Business6 days agoIran war enters second week as Trump demands ’unconditional surrender’

-

Sports4 days ago

Sports4 days agoSkateboarding World Championships: Britain’s Sky Brown wins park gold