Crypto World

Nexus to Launch Revenue-Sharing USDx Stablecoin

The stablecoin is built in collaboration with M0 and returns T-bill yields to ecosystem applications.

Upcoming Layer 1 blockchain Nexus has unveiled its native rewards stablecoin, USDx.

USDx will serve as the Nexus ecosystem’s native dollar and will implement a Global Yield Distribution System (GYDS), under which applications that hold USDx earn a share of protocol revenue based on their users’ USDx holdings.

The design is intended to provide yield as a revenue stream for the ecosystem’s application layer, incentivizing each underlying protocol to integrate USDx.

Through USDx, Nexus aims to unify its ecosystem around a shared currency layer that aligns its applications and incentivizes them to drive conversions of USDT and USDC to USDx.

Nexus focuses on “verifiable finance,” where every layer and transaction in the ecosystem can be independently verified via cryptographic proofs without sacrificing privacy. The design is built on Nexus’ zero-knowledge virtual machine (zkVM), enabling verifiability without disclosing individual users’ sensitive information.

Nexus raised $27.2 million over two investment rounds between December 2022 and June 2024, with a seed round led by Dragonfly, and a Series A led by Pantera and Lightspeed.

CEO Daniel Marin told The Defiant that USDx is fully backed by U.S. Treasuries, but did not disclose an exact formula for how the yield will be distributed. “Applications and users that receive USDX-generated yield will do so according to their contributions to the protocol, such as TVL and volume, and as determined from time-to-time by the protocol’s monetary policy,” Marin said.

Marin did not directly explain why the yield is distributed to the application layer rather than to users who exchange their legacy stablecoins for USDx.

“USDx gives us the opportunity to create a new kind of economic design that allows Nexus to support decentralized governance, onchain activities, as well as yield streaming, all with the goal of building a system that aligns incentives for the protocol, developers, and users,” he said.

Crypto World

How Europe’s Blockchain Sandbox Ties Innovation to Regulation

The European Union, often criticized for prioritizing rulemaking over innovation, is pointing to the European Blockchain Sandbox as an example of how regulation can boost innovation.

After three cohorts of confidential dialogues, the initiative has produced a 230-page best practices report and drawn in nearly 125 regulators and authorities.

The European Commission tapped law firm Bird & Bird and its consortium partners to lead the initiative, which matches blockchain use cases with regulators for confidential dialogues aimed at clearing legal challenges.

Marjolein Geus, a partner at Bird & Bird, told Cointelegraph that the process has shown compliance need not be a deterrent.

“For use case owners, it helps them better understand the relevant regulations and how those rules apply to their projects,” she said. “It allows regulators and authorities to deepen their understanding of how those technologies interact with the regulatory frameworks within their areas of competence.”

In the latest cohort, “mature” use cases were increasingly operational and embedded in sectors such as energy, healthcare and artificial intelligence, bringing along more complex compliance discussions.

How MiCA became a test of regulatory timing for blockchain

When the Markets in Crypto-Assets Regulation (MiCA) was adopted, observers warned that strict obligations would raise barriers for startups. Stablecoin rules drew particular scrutiny as Tether — issuer of the world’s largest stablecoin — ultimately decided against seeking MiCA authorization for USDt (USDT).

The brain drain narrative predates crypto. European founders have often incorporated in jurisdictions perceived as having a lighter touch.

Similar fears surfaced when the General Data Protection Regulation (GDPR) took effect in 2018. Businesses complained of interpretive confusion and administrative burden. Some foreign firms scaled back EU exposure. However, the GDPR has since become a global reference point, with many multinationals aligning operations to its standards.

The criticism that Europe “regulates first and innovates later” rests on the idea that legal certainty follows market development. MiCA was adopted before the crypto sector reached institutional maturity. In theory, that sequencing risks locking rapidly developing tech into rigid categories too early.

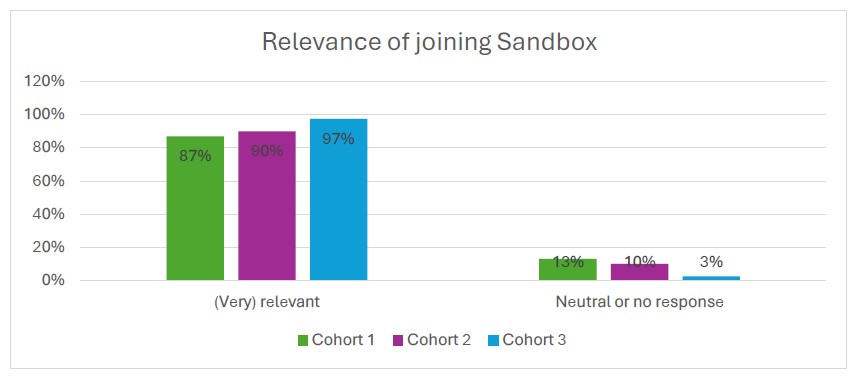

But the sandbox advanced a counterpoint, suggesting that early legislation combined with regulatory dialogue can enhance clarity and accelerate compliance. In the third cohort, 77% of respondents described the sandbox as having a crucial or valuable impact on innovation and regulation, and none reported no impact.

While the EU opted for early codification and dialogue, the world’s largest economy, the US, lacks a comprehensive federal framework for digital assets despite presidential pledges to become a global hub. Its proposed Digital Asset Market Clarity Act has stalled after key industry figures withdrew support over provisions, including restrictions on stablecoin yield.

Related: When will crypto’s CLARITY Act framework pass in the US Senate?

Smart contracts and the limits of decentralization

While the best practices report spans over 20 chapters across multiple regulatory domains, its sections on smart contracts and decentralization focus on how blockchain systems are structured at the code and governance level.

“Virtually all blockchain DLT use cases use smart contracts. They are subject to regulation, with security requirements often relevant, as well as obligations under the GDPR,” Geus said.

The dialogues examined how those contracts interact with existing EU frameworks, not just MiCA. Depending on their function and the degree of control retained by identifiable actors, smart contracts may trigger obligations ranging from cybersecurity source code reviews to operational resilience testing and conformity declarations.

“The question then becomes how to ensure those smart contracts are secure and GDPR compliant and how to test whether they meet the applicable regulatory frameworks. That is an area where further clarification, harmonization and standardization are needed,” Geus said.

Another focal point of the third cohort report is the qualification of services provided “in a fully decentralized manner without any intermediary” under MiCA.

MiCA references the term “fully decentralized” but doesn’t define it.

Like smart contracts, determining full decentralization in Europe requires further clarification. The report did attempt to lay out a checklist within the limits of how MiCA and the Markets in Financial Instruments Directive are structured.

Among those are identifiable fee recipients or entities capable of modifying the protocol, which may suggest the existence of an intermediary. Where such influence exists, MiCA is likely to apply, and authorization as a crypto service provider may be required.

Related: Crypto’s decentralization promise breaks at interoperability

Crypto in Europe’s legal architecture

The European Blockchain Regulatory Sandbox’s participation neither implies legal endorsement or regulatory approval nor does it grant derogations from applicable law.

By the third cohort, dialogues increasingly engaged horizontal legislation such as the GDPR and the Data Act. Projects were assessed not as isolated crypto experiments, but as embedded digital systems interacting with financial, cybersecurity and data governance frameworks.

Johannes Wirtz, partner at Bird & Bird’s finance regulation group, observed that regulators involved in the dialogues demonstrated deeper familiarity with crypto than expected.

“This was actually something which surprised me in certain regards because you always had this assumption that they are more or less bound to the old world, but they have their innovation departments, which are really good at identifying the issues,” Wirtz said.

If the early criticism of European policy assumed that law would constrain experimentation, Bird & Bird representatives claimed that structured dialogue clarifies how that perimeter applies in practice.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

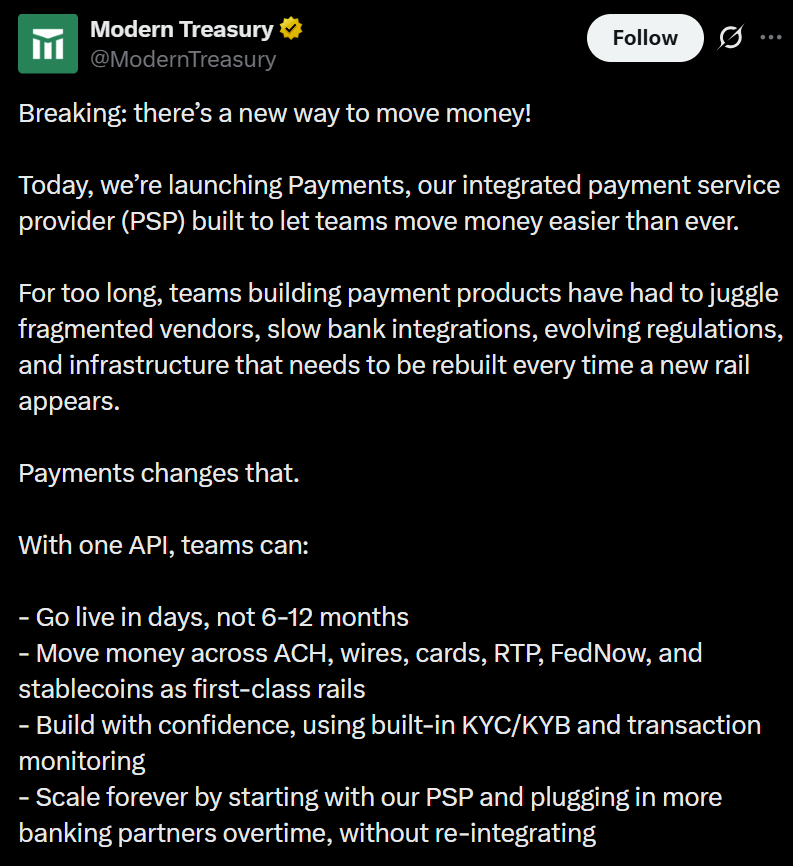

Modern Treasury Adds Stablecoin Settlement to PSP

Modern Treasury, a payments operations software provider that helps companies manage and reconcile money movement, has introduced an integrated payment service provider (PSP) that supports both traditional fiat rails and stablecoins.

On Wednesday, the company announced that it has added stablecoin settlement to the same infrastructure that businesses already use for ACH transfers, wire payments and real-time payment networks. At launch, the platform supports Global Dollar (USDG), Pax Dollar (USDP) and USDC (USDC), with USDt (USDT) expected to be added in the future.

Modern Treasure acquired stablecoin and fiat payment platform Beam in October.

The company has partnered with Paxos to integrate regulated stablecoins and settlement capabilities into its platform and has joined the Global Dollar Network. San Francisco-based Modern Treasury also participates in Circle’s Alliance Program, a partner network that supports the broader use of the USDC stablecoin in payments and financial services.

With the move, stablecoins are incorporated into a single compliance framework alongside traditional banking rails. Companies using Modern Treasury no longer need separate vendors or technical integrations to process crypto-based and fiat payments.

The update effectively makes stablecoins another settlement option within a conventional payment flow, potentially lowering the operational barrier for businesses seeking to integrate blockchain-based payment rails.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Stablecoins move deeper into mainstream financial infrastructure

Modern Treasury’s latest integration comes as stablecoins see broader uptake across the payments industry, particularly following the passage of the US GENIUS Act last July, which established a federal framework for dollar-backed stablecoins.

The total value of stablecoins in circulation grew by nearly 50% last year, surpassing $300 billion for the first time. Growth has slowed in recent months, with supply hovering around that level amid tighter liquidity conditions and a cooling crypto market.

Still, issuance remains near record highs, reflecting sustained demand for dollar-pegged digital assets in trading, cross-border transfers and settlement.

America’s largest banks have also signaled interest in stablecoins and related technology. JPMorgan Chase, Bank of America, Citigroup and Wells Fargo have been reported to be in early discussions about a jointly operated stablecoin initiative, though the plans are still at a conceptual stage.

Last month, Fidelity Investments announced plans to issue a new stablecoin called the Fidelity Digital Dollar. Fidelity Digital Assets president Mike O’Reilly described stablecoins as “foundational payment and settlement services.”

Related: How TradFi banks are advancing new stablecoin models

Crypto World

Peter Thiel Exits ETHZilla, Company Sells $74.5M in ETH Amid Market Pressure

Once holding over 100,000 ETH, ETHZilla liquidated some to cover debt and repurchase stock.

Peter Thiel and his Founders Fund have sold $74.5 million worth of ether (ETH) through ETHZilla Corp., fully exiting the company’s crypto treasury. The SEC filing confirmed Thiel’s entities no longer hold any shares in ETHZilla.

The sale follows a series of ether liquidations by ETHZilla to cover debt and buy back stock. The company previously held over 100,000 ETH at its peak, according to DefiLlama.

ETHZilla Faces Market Pressure

ETHZilla started as a biotech firm, 180 Life Sciences Corp., before making a full pivot to cryptocurrency management in August. The Palm Beach-based company rebranded and shifted its operations entirely to focus on holding ETH, signaling a major change from its original biotech focus.

The timing of this shift coincided with a broader crypto market downturn, which immediately affected the company’s treasury. Ether has fallen nearly 60% from last year’s peak, trading around $2,000 at press time. The decline put pressure on ETHZilla’s newly acquired crypto holdings, making careful financial management a priority.

To stabilize its finances, ETHZilla sold ether in October and December. In late October, it liquidated roughly $40 million to repurchase shares. Two months later, it sold $74.5 million to repay senior secured convertible notes, according to filings.

A Shift to Real-World Assets

ETHZilla has launched a subsidiary, ETHZilla Aerospace, to offer tokenized equity in leased jet engines. The move signals a shift toward real-world, asset-backed offerings beyond its cryptocurrency holdings.

Meanwhile, the company has not publicly commented on Thiel’s exit or its recent ETH sales. However, observers say these actions reflect the financial pressures facing crypto-focused public firms.

You may also like:

Notably, the development underscores the caution high-profile investors are showing amid volatile markets. It also highlights the challenges of maintaining a public ether treasury during rapid price swings.

Looking ahead, market watchers will follow ETHZilla’s aerospace venture and broader strategy for clues about its next steps. The pivot may indicate a new approach for digital asset companies seeking revenue outside of pure crypto holdings. It also shows how quickly corporate strategies can evolve in the crypto space.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

CryptoQuant Founder Proposes Freezing Old Bitcoin Addresses to Prevent Quantum Attacks

Bitcoin may need drastic fix against quantum threats as CryptoQuant founder urges freezing inactive wallets holding billions in BTC.

Ki Young Ju, founder of CryptoQuant, has proposed that a future Bitcoin (BTC) quantum upgrade may require freezing old addresses to protect against potential theft by quantum computers.

He also believes that addressing the risk would be challenging because the crypto community has historically struggled to agree on protocol changes.

Solution to Quantum Risk

In a social media post, Ju explained that anyone holding BTC in old address types faces the same risk. This is because the digital assets could either be frozen by design or stolen if quantum machines evolve enough to break BTC’s cryptography. He added that even securely stored private keys could become useless if owners fail to adopt protocol upgrades in time.

“In simple terms, coins that appear perfectly safe today could become spendable by an attacker tomorrow,” warned Ju.

In response to the threat, the CryptoQuant founder has suggested freezing old addresses, including the one containing Satoshi’s 1 million BTC, to prevent them from being stolen or compromised.

“Would you support freezing dormant coins, including Satoshi’s, to save BTC from quantum attacks?” he asked.

Bitcoin’s security relies on cryptography that is effectively unbreakable by classical computers. However, quantum computers change this assumption. Under certain conditions, a sufficiently powerful machine of this kind could get a private key from an exposed public key.

Once a public key is revealed on-chain, the risk is permanent. Ju estimates that roughly 6.89 million BTC are currently exposed to such attacks. Data shows that about 3.4 million BTC have been dormant for over a decade, including Satoshi’s stash, representing hundreds of billions of dollars in potential value. He explained that with so much value at risk, hackers could be very motivated if the technology becomes cheaper and easier to use.

Social Consensus Challenges

Even if freezing dormant BTC is technically possible, achieving community agreement is still a major challenge. This is because such solutions move quickly, while social consensus happens slowly.

You may also like:

The Bitcoin ecosystem has historically struggled with agreeing on protocol changes. This can be seen in the block size debate, which lasted more than three years and led to hard forks. Another example is the failed SegWit2x upgrade, demonstrating how difficult coming to an agreement can be.

Freezing coins, even to prevent quantum attacks, would likely face similar resistance because it conflicts with the OG cryptocurrency’s core philosophy of decentralization and user control.

Ju cautioned that the lack of full agreement could potentially lead to rival BTC forks as quantum technology progresses. According to him, the real question is not whether the threat will arrive in five or ten years, but whether the crypto community will be united on how to handle it before then.

Elsewhere, Bankless co-founder David Hoffman believes that in the event of a quantum attack, ETH would continue functioning normally even if BTC were to fail because it has been long prepared for these challenges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

16.6 Million PIPPIN Bought Since ATH Price Now Sits At 40% Loss

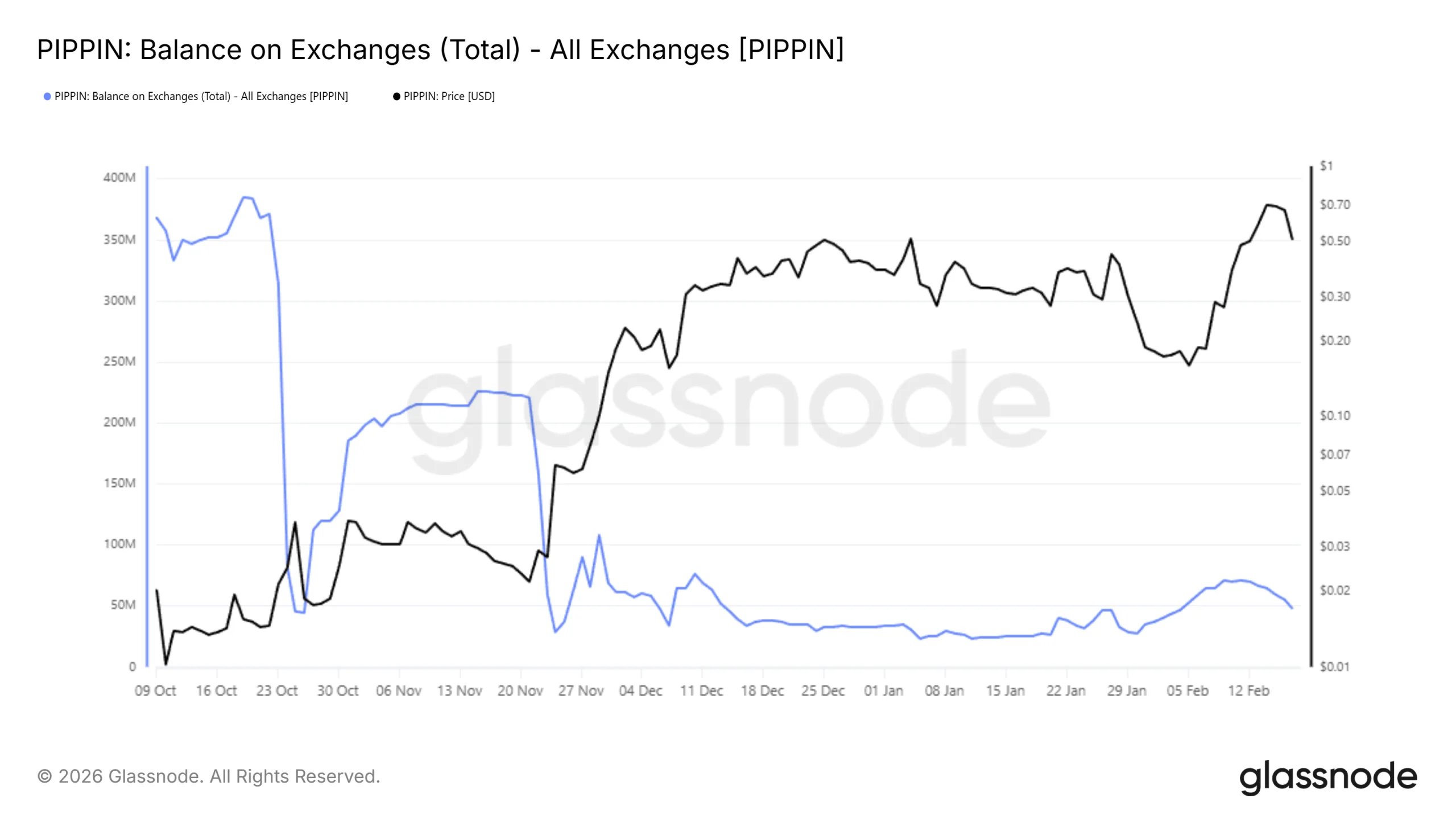

PIPPIN has entered a volatile phase after failing to sustain its recent breakout. The altcoin rallied sharply but has since retraced, placing many recent buyers at a loss.

Price action now threatens to invalidate a projected 221% breakout from a broadening descending wedge pattern.

Sponsored

Sponsored

PIPPIN Holders Run To Buy

Exchange balance data reveals notable accumulation following the recent all-time high. Since the peak three days ago, investors have purchased approximately 16.6 million PIPPIN. At current valuations, this represents roughly $7.7 million in buying activity.

This accumulation pattern is not new. Historical data shows that PIPPIN holders often buy aggressively near peaks. As prices decline, panic selling frequently follows. Similar behavior appeared during the late January surge and again during the October 2025 spike.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

These cycles tend to delay sustained recovery. Early buyers accumulate at elevated levels, then exit during pullbacks. If the price weakens further, selling pressure may intensify again. This pattern raises the probability of renewed volatility in the near term.

Momentum indicators signal caution. The Money Flow Index currently sits above 80.0, placing PIPPIN in overbought territory. Elevated readings often precede cooling phases as capital inflows slow.

Broader market indecision compounds the risk. Without strong directional cues from major cryptocurrencies, speculative altcoins often struggle to sustain rallies. Unless holders begin aggressive distribution, however, a full reversal may remain delayed rather than immediate.

Sponsored

Sponsored

Will LTHs Prove To Be Pippin’s Saviour?

The HODLer Net Position Change metric provides a mixed outlook. Long-term holders continue to accumulate, as indicated by persistent green bars. Although the slope has weakened, net buying remains intact.

This ongoing support is critical. If long-term PIPPIN holders shift to distribution, downside risk would escalate quickly. A transition from accumulation to selling could accelerate losses and confirm bearish control over the trend.

PIPPIN Price Faces a Crash

PIPPIN previously broke out of a broadening descending wedge pattern. That formation projected a potential 221% upside move. However, current price action suggests the breakout is at risk of invalidation if support levels fail.

If long-term holder support stabilizes the token, PIPPIN could rebound from the $0.449 support zone. A sustained bounce may drive the price toward $0.600. Strong follow-through could retest the $0.772 all-time high, recovering recent losses.

Conversely, downside risk remains substantial. Many investors who bought at the all-time high are currently facing losses of about 40%. If panic selling resumes, PIPPIN could break below $0.449. A drop toward $0.372 would invalidate the bullish pattern and confirm the breakdown scenario.

Crypto World

Bitwise wants to list prediction markets ETFs for U.S. elections in 2026 and 2028

Bitwise Asset Management wants to offer a prediction markets for the next U.S. presidential election through exchange-traded funds (ETFs).

Under “Prediction Shares” branding, the San Francisco-based crypto asset manager filed to list two ETFs tracking prediction markets betting on the outcome of the 2028 election — one for a Democratic winner, one for Republican — with the Securities and Exchange Commission (SEC) on Tuesday.

Bitwise also listed four equivalent products for 2026 mid-terms, predicting Democratic and Republican wins in the House of Representatives and the Senate.

Each ETFs will invest their assets in prediction markets bets supporting the applicable outcome denoted by that fund.

The same way that a bitcoin ETF allows investors to invest in BTC without purchasing the underlying cryptocurrency, these ETFs will allow users to bet on the outcome of U.S. elections without using a prediction platform like Polymarket.

Prediction markets came to prominence during the last U.S. election and now process trading volumes of around $10 billion monthly.

With ETFs also having opened the door to crypto investment for a wider array of prospective investors including institutions, Bitwise appears to trying to replicate this model for prediction markets, with the 2026 mid-terms as its testbed.

Crypto World

Crypto Long & Short: Crypto’s liquidity mirage

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Leo Mindyuk on how executable liquidity at scale is more fragmented and fragile than most institutions assume

- Top headlines institutions should pay attention to by Francisco Rodrigues

- Helium’s deflationary flip in Chart of the Week

Expert Insights

Crypto’s liquidity mirage: why headline volume doesn’t equal tradable depth

– By Leo Mindyuk, co-founder and CEO, ML Tech

Crypto looks liquid, until you try to trade large volumes. Especially during periods of market stress and even more so if you want to execute on coins outside of the top 10-20.

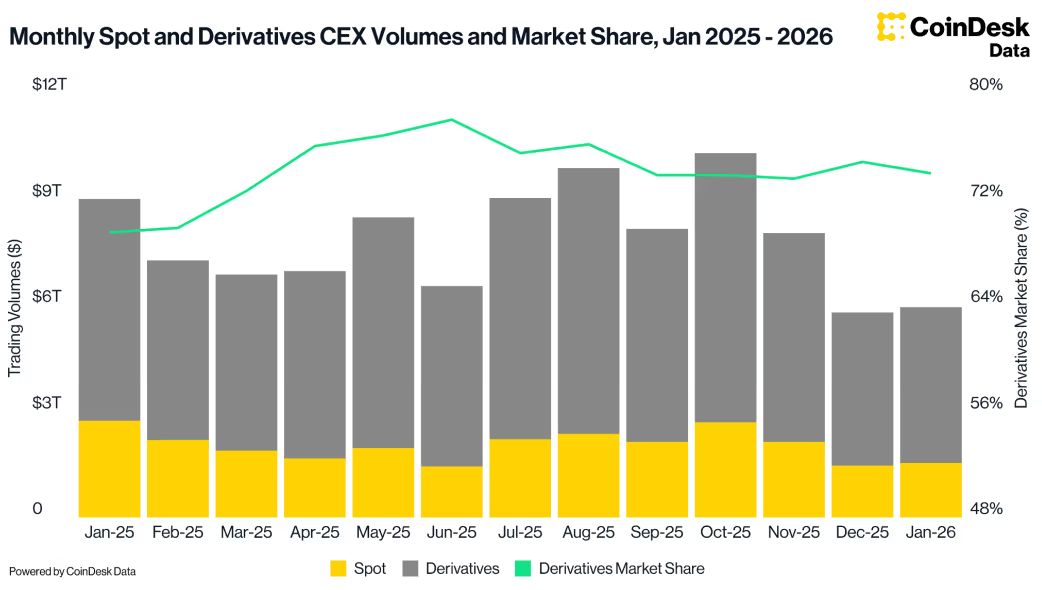

On paper, the numbers are impressive. Billions traded in daily volume and trillions traded in monthly volume. Tight spreads on bitcoin and ether (ETH). Dozens of exchanges competing for flow. It resembles a mature, highly efficient market. The beginning of the year saw around $9 trillion of monthly spot and derivatives volumes, then October 2025 saw around $10 trillion in monthly volume (including a lot of activity around the October 10th market bloodbath). Then in November, derivatives trading volumes decreased 26% to $5.61 trillion, recording the lowest monthly activity since June, followed by even larger declines in December and January, according to CoinDesk Data. Those are still some very impressive numbers, but let’s zoom in further.

At first glance there are a lot of crypto exchanges competing for flow, but in reality just a small group of exchanges dominate (see the graph below). If those have liquidity thinning out or connectivity issues preventing the execution of volume, the whole crypto market is impacted.

It’s not just that the volumes are concentrated on a few exchanges, they are also highly concentrated in BTC, ETH and a couple of other top coins.

The liquidity seems quite solid with a number of institutional market makers active in the space. However, the visible liquidity is not the same as executable liquidity. According to Amberdata (see the graph below), markets that showed $103.64 million in visible liquidity suddenly had just $0.17 million available, a 98%+ collapse. The bid-ask imbalance flipped from +0.0566 (bid-heavy, buyers waiting) to -0.2196 (ask-heavy, sellers overwhelming the market at a 78:22 ratio).

For institutions deploying meaningful capital, the distinction becomes obvious very quickly. The top of the book might show tight spreads and reasonable depth. Go a few levels down, and liquidity thins out fast. Market impact doesn’t increase gradually, it accelerates. What looks like a manageable order can move price far more than expected once it interacts with real depth.

The structural reason is simple. Crypto liquidity is fragmented. There is no single consolidated market. Depth is distributed across venues, each with different participants, latency profiles, API systems (that can break or have disruptions) and risk models (that can come under stress). Reported volume aggregates activity, but it does not aggregate liquidity in a way that makes it easily accessible for large execution. This is specifically apparent for smaller coins.

That fragmentation creates a false sense of comfort. In calm markets, spreads compress and books look stable. During volatility, liquidity providers reprice or pull entirely. They get unfavorable inventory and are unable to de-risk and pull out their quotes. Depth disappears faster than most models assume. The difference between quoted liquidity and durable liquidity becomes clear when conditions change.

What matters is not how the book looks at 10:00 a.m. on a quiet day. What matters is how it behaves during stress. Experienced quants know that but most of the market participants do not, as they struggle to close open positions gradually and then get liquidated during the stress events. We saw this in October, and a couple of times since.

In execution analysis, slippage does not scale linearly with order size; it compounds. Once an order crosses a certain depth threshold, impact increases disproportionately. In volatile conditions, that threshold shrinks. Suddenly, even modest trades can move prices more than historical norms would suggest.

For institutional allocators, this is not a technical nuance. It is a risk management issue. Liquidity risk is not only about entering a position, it is about exiting when liquidity is scarce and correlations rise. Want to execute a couple of millions of some smaller coins? Good luck! Want to exit losing positions in less liquid coins when the market is busy like during the October crash? It can become catastrophic!

As digital asset markets continue to mature, the conversation needs to move beyond headline volume metrics and top level liquidity snapshots during the calm markets. The real measure of market quality is resilience and how consistently liquidity holds up under pressure.

In crypto, liquidity isn’t defined by what’s visible during normal stable conditions. It’s defined by what’s left when the market gets tested. That’s when capacity assumptions break and risk management takes center stage.

Headlines of the Week

Wall Street giants have kept moving deeper into the cryptocurrency space over the past week, while new data has shed light on just how large the space is in Russia and how big it could become in Asia. Major market participants Binance and Strategy have meanwhile doubled down on their massive BTC reserves.

- Wall Street giants enter DeFi market with token investments: BlackRock has made its tokenized U.S. Treasury fund BUIDL tradable on decentralized exchange Uniswap, as part of a deal that saw it invest an undisclosed amount in UNI. Similarly, Apollo Global Management (APO) struck a cooperation agreement with Morpho.

- Russia’s daily crypto turnover exceeds $650 million, the Ministry of Finance says: The country’s government and central bank are pushing for legislation to regulate cryptocurrency activities, while the Moscow Exchange is looking to deepen its presence in the market.

- Binance converts its $1 billion safety net into 15,000 BTC: Leading cryptocurrency exchange Binance has finished converting the Secure Asset Fund for Users (SAFU) into bitcoin, turning about $1 billion into 15,000 BTC.

- BlackRock exec says 1% crypto allocation in Asia could unlock $2 trillion in new flows: BlackRock’s head of APAC iShares, Nicholas Peach, has said that even a modest portfolio allocation to crypto in Asia could unlock $2 trillion in new flows.

- Strategy says it can survive even if bitcoin drops to $8,000 and will ‘equitize’ debt: Strategy, the largest bitcoin treasury firm with 714,644 bitcoin on its balance sheet, said it can withstand a bitcoin price drop to $8,000 and still cover its roughly $6 billion in debt.

Chart of the Week

Helium’s deflationary flip

Helium has surged 37.5% month-to-date, decoupling from the broader market as its fundamentals shift toward a deflationary model. Since the start of 2026, the protocol’s net emissions have turned negative, effectively neutralizing long-standing sell pressure. This transition is fueled by a jump in network demand, with daily Data Credit burns climbing from $30,000 to over $50,000 since the beginning of the year, signaling that utility-driven token destruction is now outpacing new issuance.

Listen. Read. Watch. Engage.

Looking for more? Receive the latest crypto news from coindesk.com and explore our robust Data & Indices offerings by visiting coindesk.com/institutions.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.

Crypto World

Bitcoin price at risk of hitting $50k, Coinbase premium sinks

Bitcoin price remained in a tight range this week, and the waning Coinbase Premium Index points to more downside as institutional demand wanes.

Summary

- Bitcoin price has formed a bearish pennant pattern on the daily chart.

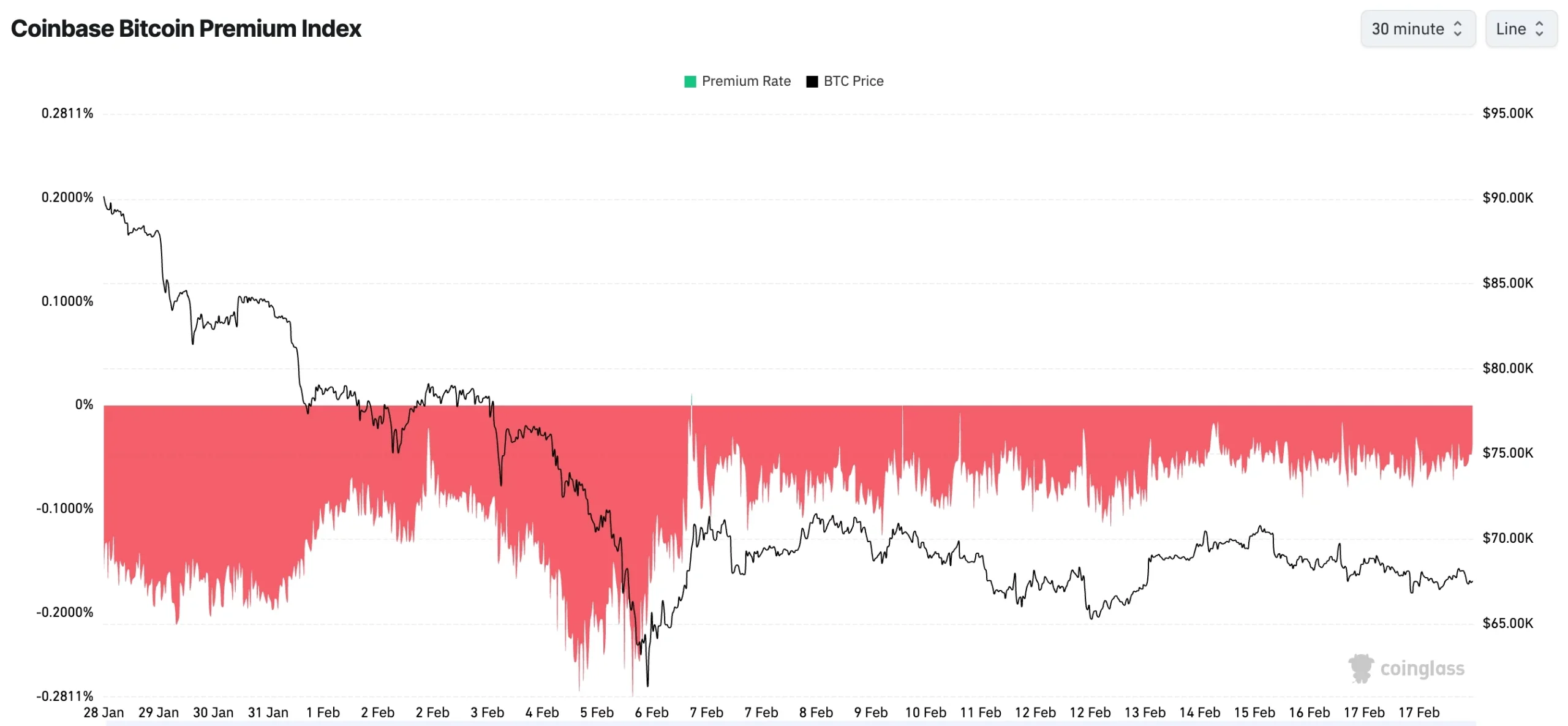

- The Coinbase Premium Index has remained in the red, a sign of weak demand from the US.

- Futures open interest has continued falling this month.

Bitcoin (BTC) was trading at $67,420 on Wednesday, down modestly from last weekend’s high of over $70,000. It has slumped by double digits from its all-time high of $126,300.

One major risk facing Bitcoin is that institutional demand has largely waned in the United States, which explains why the Coinbase Premium Index has remained in the red throughout this year. Coinbase is the most preferred platform for Bitcoin investing by American investors.

Additionally, only a handful of Bitcoin treasury companies are accumulating Bitcoin as they did last year. Strategy continued buying Bitcoin last week, bringing its total holdings to over 717,000. American Bitcoin and Strive have also bought Bitcoin this year.

Meanwhile, SoSoValue’s data shows that spot Bitcoin ETF outflows have jumped in the past few months. All these funds have shed over $8 billion in assets since October last year, and the trend is continuing.

According to Bloomberg, institutions have largely given up on Bitcoin because it has not fulfilled its role as a hedge against inflation and equity market stress. It has also not served its perceived role as a hedge against currency debasement.

Bitcoin’s futures open interest has continued falling in the past few months and now sits at $44 billion, down sharply from last year’s high of over $95 billion. Also, demand for borrowed exposure on CME has remained muted into the past few months.

Bitcoin price technical analysis suggests a crash

The daily timeframe chart shows that Bitcoin price is flashing red alerts. For example, the coin is slowly forming a large bearish pennant pattern. It has already completed forming the vertical line and is now in the process of forming the triangle section.

The Supertrend indicator has remained red since January 19 this year. It has also remained below the 50-day and 100-day Exponential Moving Averages.

Therefore, the coin will likely continue falling, with the initial target being the year-to-date low of $60,000. A drop below that level will signal further downside, potentially to the psychological $50,000 level, as Standard Chartered analysts predicted last week.

Crypto World

Hyper Foundation Backs New DC Lobby with 1M HYPE for Clearer DeFi Rules

With Jake Chervinsky at the helm, the Hyperliquid Policy Center gives the perp DEX a formal policy foothold in Washington.

Hyperliquid, the largest on-chain perpetual futures exchange by trading volumes, said it is backing a new Washington-based policy organization with 1 million HYPE tokens (around $29 million at current prices), as crypto firms try to influence U.S. rules for decentralized finance.

According to a press release published today, Feb. 18, the so-called “Hyperliquid Policy Center” — or just HPC — received the tokens from the Hyper Foundation and plans to use them to produce research and lobby for practical regulations on decentralized markets. The foundation is an independent organization that supports the development of the Hyperliquid ecosystem, per the release.

“We will publish technical research, comment on proposed rules and legislation, and serve as a resource for policymakers who want to understand how DeFi really works,” the new organization said in an X post today.

Jake Chervinsky, a long-standing crypto policy lawyer and former chief policy officer at the Blockchain Association, will lead the organization as founder and CEO.

“HPC exists to ensure that American entrepreneurs, consumers, and institutions have the regulatory clarity they need to build and benefit from the future of finance,” Chervinsky said in the release.

The Hyperliquid Policy Center also said it will “introduce lawmakers and regulators to Hyperliquid” and push for clear rules on DeFi.

Despite the news, HYPE is trading down 1% on the day at around $29.10, per CoinGecko data.

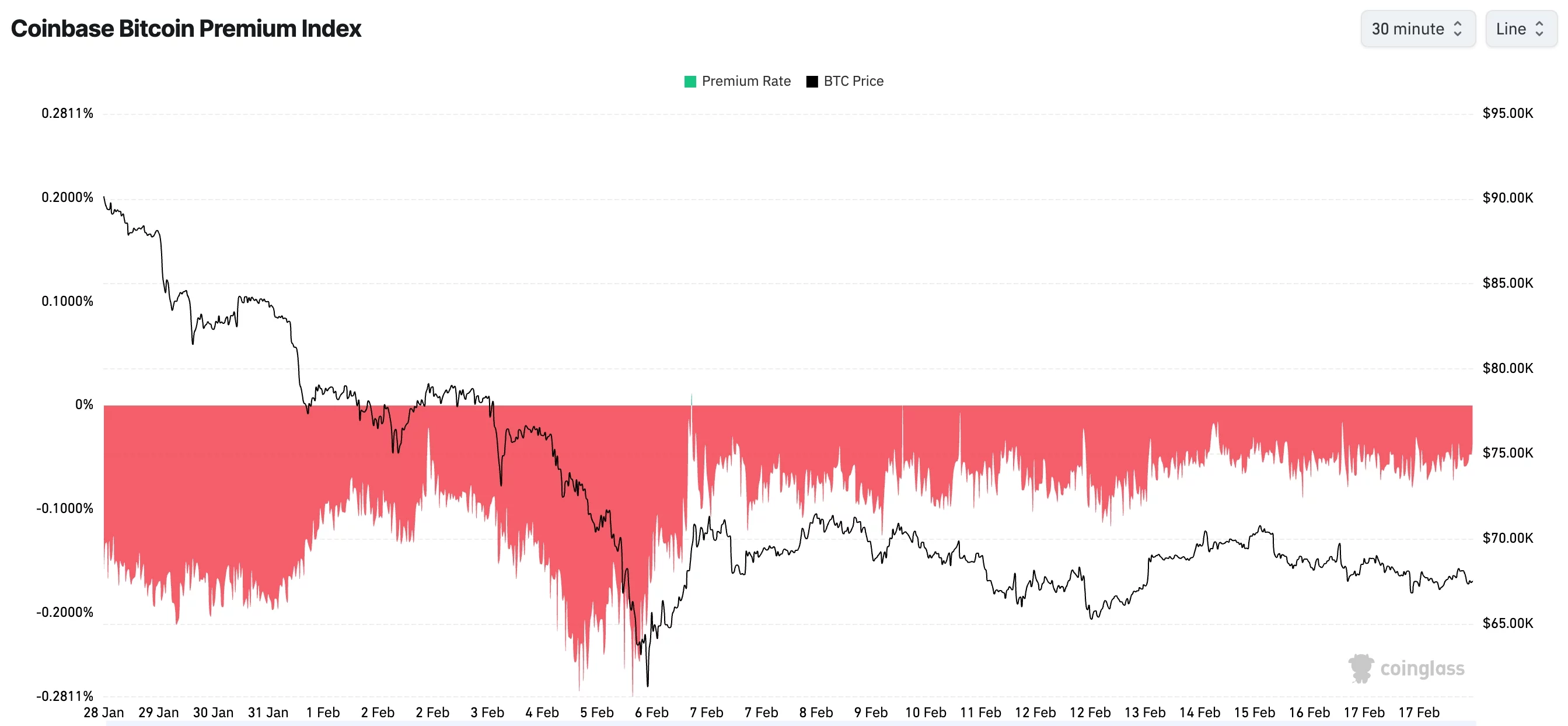

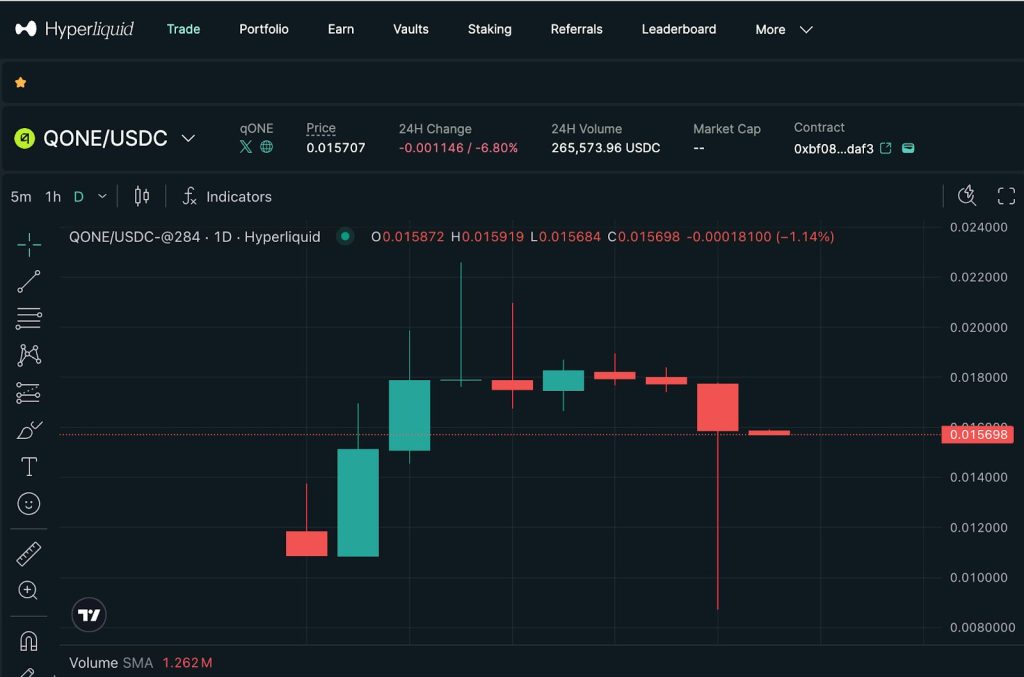

In the past 24 hours, Hyperliquid processed nearly $5.4 billion in trades, and open interest on the platform currently stands at over $5 billion, per data from DefiLlama. Perps trading on Hyperliquid surged in 2025, with monthly volumes reaching an all-time high of nearly $400 billion in July.

While the perp DEX mania that took off last year was mostly dominated by Hyperliquid, competitors like Aster and Lighter also saw rapid growth.

Crypto World

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Buys 18,333,334 qONE Tokens

HYLQ Strategy Corp has completed a strategic digital asset investment in qLABS, acquiring qONE tokens in an over-the-counter transaction with the Quantum Labs Foundation.

The qONE token trades on the booming Hyperliquid platform and is the native token of the qLABS ecosystem. HYLQ Strategy is the second public company to invest in quantum-safe tokens. qLABS partner 01 Quantum, as a founding member, is also a holder of qONE tokens.

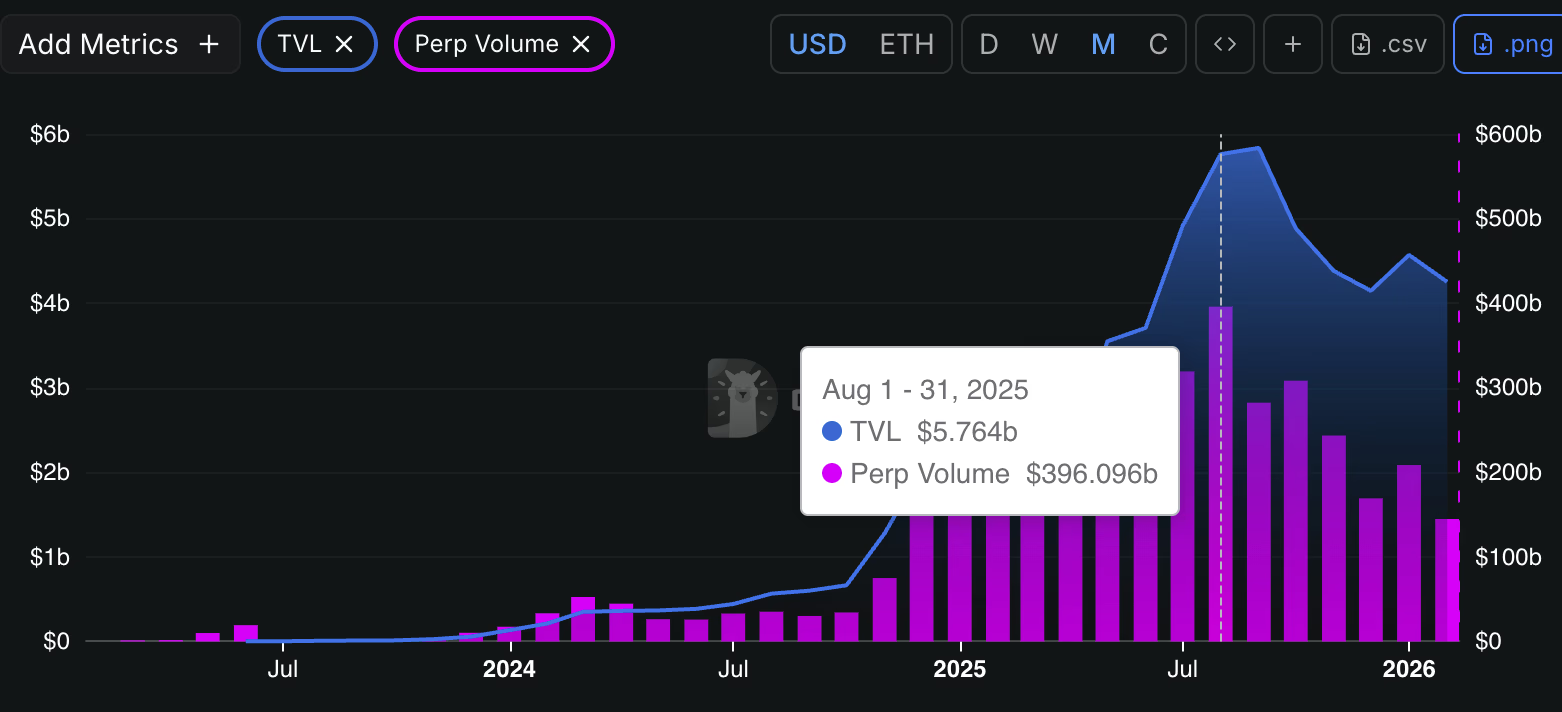

According to the terms of the agreement shared in a company press release, HYLQ purchased 18,333,334 qONE tokens for an aggregate purchase price of $0.006 in an investment totalling $100,000, inclusive of bonus tokens.

The transaction was executed directly with the Quantum Labs Foundation and settled in USDC. This strategic investment represents HYLQ’s commitment to supporting quantum-resistant infrastructure within the Hyperliquid ecosystem, making this the first institutional investment in quantum-safe cryptographic solutions built natively on Hyperliquid.

qLABS is the world’s first quantum-native crypto foundation, developing blockchain solutions resistant to quantum computing threats.

qLABS Launching Quantum-Safe Protection for Digital Assets

The foundation will launch the Quantum-Sig smart contract wallet to provide quantum-safe protection for digital assets at the user and asset level.

A separate L1 Migration Toolkit is in the works. Its design will help Layer-1 blockchains transition their core infrastructure to quantum-resistant cryptography ahead of Q-Day. Q-Day is the anticipated moment when quantum computers become powerful enough to break current cryptographic systems.

The qONE token, launched on Hyperliquid on 6 February 2026, serves as the ecosystem utility token, granting access to quantum-resilient wallet functions, protocol governance, and the broader quantum-safe infrastructure developed by qLABS.

qLABS leverages IronCAP by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

by 01 Quantum Inc. (TSXV: ONE), a NIST-approved post-quantum cryptography system.

HYLQ Strategy CEO Matt Zahab, commenting on the company’s investment in qLABS’ Quantum Labs Foundation, said:

“As quantum computing advances toward Q-Day, protecting crypto assets from quantum threats is becoming increasingly critical.”

He added: “qLABS is building essential quantum-resistant infrastructure natively on Hyperliquid, addressing a systemic risk that threatens the entire blockchain industry. This investment aligns perfectly with HYLQ’s mandate to support innovative companies within the Hyperliquid ecosystem that are building foundational infrastructure for the future of decentralized finance.”

HYLQ Stock Price is up 28.5% YTD

Year-to-date, HYLQ Strategy (HYLQ:CNSX CA) stock is up 28.5% at CAD0.90. In addition to its primary Canadian listing, the stock also trades over-the-counter in the US (HYLQF: OTCMKTS US). HYLQ is not to be confused with the competing digital asset treasury company, Hyperliquid Strategies (PURR), which trades on the Nasdaq.

How qONE’s staking plans could provide an income stream for HYLQ shareholders

According to Ada Jonuse, Executive Director at qLABS, qONE owners will be able to stake their tokens to earn yield and acquire protocol governance rights.

This means that HYLQ – at some point in the future – may be able to generate yield for its shareholders as a direct result of its $100,000 investment in qONE. An exact date for staking going live is yet to be revealed.

“Staking and governance participation are features to be enabled further down the roadmap when our core products are live and implemented in a full operational environment,” Jonuse explains.

“Because our 100% focus lies on security, in the early stage of the ecosystem, key decisions will be taken by the core team with gradual decentralization envisioned over the years.”

The centralization risk is acknowledged and mitigated through staking-based governance participation, time-weighted and activity-weighted voting, and progressive decentralization as emissions and unlocks occur.

Governance is expected to decentralize meaningfully as protocol usage grows.

Staking rewards will be set dynamically, which means yield is determined by the size of the staking pool, protocol usage, and fee generation, as well as the staker’s proportional contribution.

Jonuse says this approach “aligns incentives with real economic activity rather than fixed inflation.”

The price of the qONE token has been on a bullish run since launch, but the discounted token price offered to HYLQ triggered a sharp pullback, followed by an equally sharp bounceback. qONE was trading at $$0.01569 in the European morning session.

Why launching qONE on Hyperliquid was probably a smart move

Since last year’s 10 October record liquidation event, which wiped out $19 billion in value and marked the start of the current bear market, Hyperliquid and its native HYPE token have decoupled from other crypto assets.

While Bitcoin and Ethereum struggle with institutional outflows, retail investor apathy, and stagnant price action, HYPE surged to new highs, recently trading around $30.05.

YTD Performance Comparison (1 Jan – 17 Feb 2026)

Launching on Hyperliquid is looking increasingly like a very smart move by the qLABS team. As Jonuse points out, “Hyperliquid is a top player in DeFi and soon a venue for trading pretty much all assets on-chain.

“While Quantum-Sig wallet technology will protect any EVM or Solana assets, and our core innovation can be used to upgrade any smart contract-based chain, we are launching on Hyperliquid to highlight the importance of this chain.

“Launching $qONE on Hyperliquid positions us at the intersection of cutting-edge security infrastructure and an actively expanding ecosystem, allowing $qONE to benefit not only from technical alignment but also from narrative-driven adoption and visibility.”

The post HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Buys 18,333,334 qONE Tokens appeared first on Cryptonews.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business16 hours ago

Business16 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment3 hours ago

Entertainment3 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech7 hours ago

Tech7 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business9 hours ago

Business9 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal