Crypto World

Parsec shuts down after 5 years as crypto volatility claims another platform

Decentralized finance analytics platform Parsec is shutting down after five years, marking the latest casualty in a volatile crypto market that continues to reshape the industry.

Summary

- Parsec shuts down after five years, with its CEO citing shifting market dynamics and declining DeFi leverage following the 2022 crypto collapse and FTX fallout.

- The platform rose to prominence during the 2020–2021 DeFi boom, helping traders navigate major unwind events including Terra, OHM, Wonderland and the 3AC/stETH crisis.

- Parsec’s closure reflects broader strain in the crypto sector, following recent shutdowns of smaller platforms such as Arkham’s exchange and ZeroLend amid persistent volatility and thinning liquidity.

Parsec calls it quits after 5 years

In a post on X, the company said: “After 5 years, Parsec is shutting down. Not how we wanted our story to end, but we are proud of what we built and the value we provided along the way.” The team thanked users who “traversed the ups and downs onchain” with them, calling the journey “quite the ride.”

Parsec’s CEO described the closure as “the end of the road,” adding that “the market zigged while we zagged a few too many times.” The platform began in early 2020 as a side project charting Uniswap v1 activity before evolving into a full DeFi terminal during the 2020 “DeFi summer” and the bull market frenzy of 2021.

The company gained traction during the 2022 market collapse, when major protocols and firms, including Wonderland, OlympusDAO, Terra, and the 3AC/stETH unwind, imploded under extreme leverage. According to the CEO, traders and firms relied on Parsec’s dashboards to navigate cascading liquidations.

However, after the collapse of FTX, on-chain activity shifted. “DeFi spot lending leverage never really came back in the same way,” the CEO wrote, noting that crypto activity “changed hugely” in ways the team struggled to fully anticipate.

While Parsec saw brief spikes of engagement, including during the Friend.tech boom and a high-traffic Polymarket election dashboard, sustained growth proved elusive.

The shutdown reflects a broader trend. Smaller crypto venues and projects have been winding down amid thinning liquidity, shifting user behavior and persistent volatility. Recent examples include Arkham’s exchange closure and ZeroLend’s decision to cease operations after three years, underscoring the harsh operating environment for niche platforms.

Despite Parsec’s closure, its CEO said he remains committed to DeFi’s long-term vision of reinventing finance. “I’m not going anywhere,” he wrote. “Onwards.”

Crypto World

What next for Ripple-linked token as volatility sinks to 2024 lows

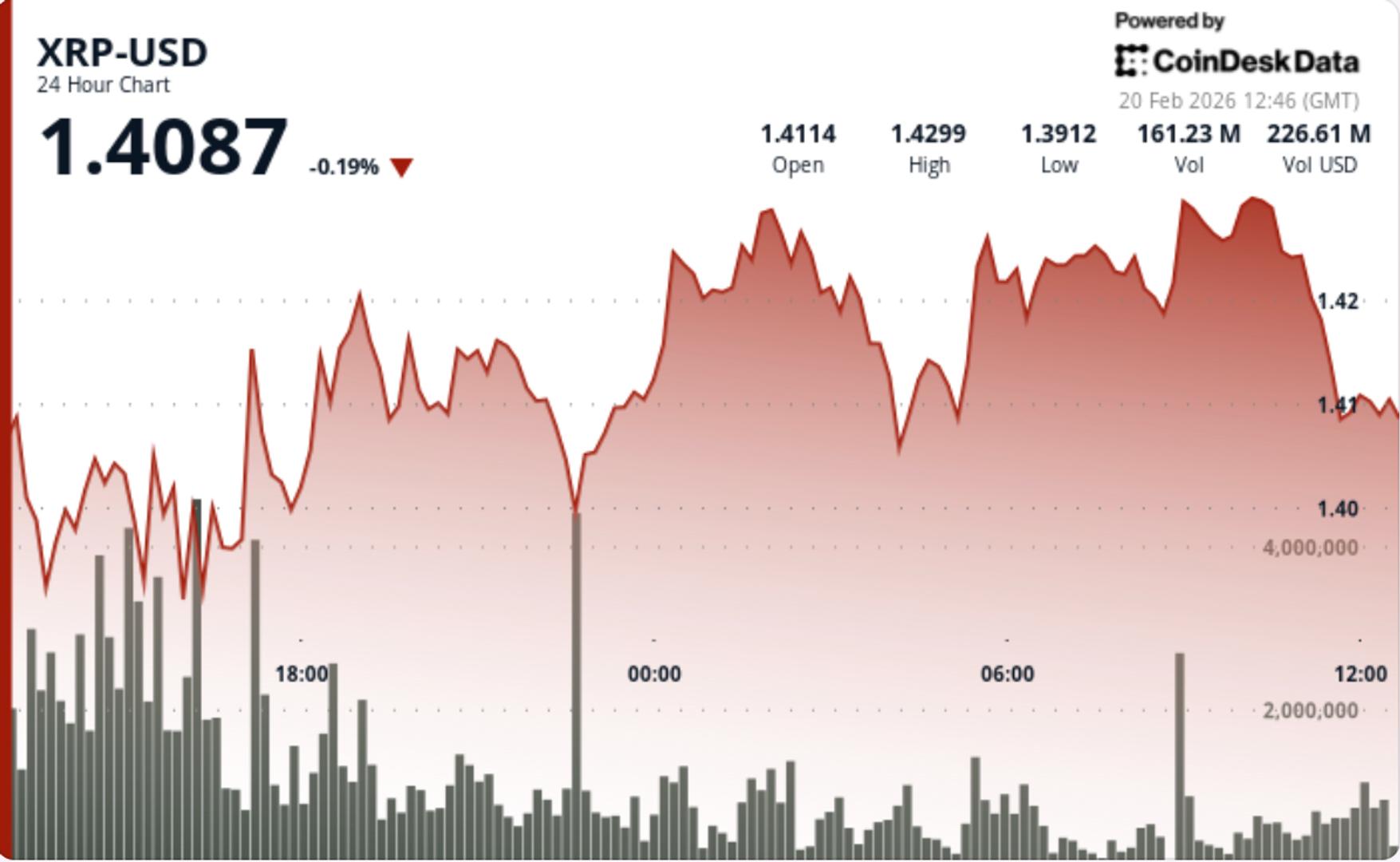

XRP held steady near $1.42 as volatility dropped to levels last seen before a major 2024 rally, raising questions about whether the downtrend is exhausting.

News Background

- XRP has declined roughly 61% from its all-time high during the current stretch of market turbulence, but recent price action suggests the selloff may be slowing. Losses have moderated into consolidation, with small gains across shorter timeframes replacing sharp directional moves.

- Notably, XRP’s historical volatility has fallen to 96, matching levels last seen in June 2024 — a period that marked the bottom of a prior downtrend before a rally into November.

- The compression has fueled speculation that XRP may be entering a similar base-building phase.

- Some analysts point to parallels with earlier cycle structures, including the extended consolidation that preceded the 2017 breakout.

Price Action Summary

- XRP slipped 0.14% to $1.42

- Price tested and held support near $1.39

- Volume surged nearly 94% above average during the breakdown

- Recovery stalled near $1.428–$1.431 resistance

Technical Analysis

- The session’s key moment came when XRP tested $1.3915 on heavy volume before stabilizing. While the bounce completed a 38.2% retracement, momentum faded as price approached $1.44, the daily pivot and near-term ceiling.

- Structure remains cautious below $1.44–$1.45, but the successful defense of $1.39 suggests sellers are losing urgency. Declining volume during consolidation points to compression rather than fresh distribution.

What traders say is next?

- Traders view this as a compression setup.

- If XRP reclaims $1.44, it opens room toward $1.50 and potentially $1.62.

If $1.39 breaks, downside risk shifts toward $1.35. - With volatility near prior cycle lows, the next decisive move may be less about direction now — and more about how long this compression can hold before expansion resumes.

Crypto World

BTC/USD Analysis: Are the Bulls Stirring?

According to media reports, Bitcoin’s fall from its all-time high in October 2025 to February’s low near $60k triggered the largest outflow from spot Bitcoin ETF funds since their launch in January 2024.

Glassnode data show that more than 100,000 BTC were withdrawn from these funds in January alone, though the total remains substantial, with roughly 1.25 million coins still held on balance sheets.

Analysing trading volumes on Coinbase, however, reveals a trend of declining activity (as indicated by the arrow). From a long-term perspective, this may suggest the ETF outflow trend is easing, potentially allowing the market to resume its multi-year uptrend. How plausible is this scenario?

Technical Analysis of BTC/USD

Bitcoin’s price fluctuations are currently compressing between the thick lines on the chart – a sign of market stabilisation, where supply and demand appear balanced.

Notable bullish patterns include:

- A double bottom (A1–B1) on 11–12 February, aligning with the lower boundary of the long-term descending channel.

- A second double bottom (A2–B2) on 18–19 February, featuring a slightly lower secondary low.

In the short term, traders might anticipate a rebound towards the upper boundary of the triangle. While the descending channel remains relevant, a decisive bullish break of this consolidation pattern would signal improving sentiment in the crypto market following February’s panic selling.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Driving Enterprise AI Transformation & ROI in 2026

Artificial Intelligence is no longer an experimental capability; it is redefining how businesses generate revenue, manage risk, optimize operations, and compete at scale. In 2026, the impact of AI on businesses is visible in faster decision cycles, predictive supply chains, autonomous customer engagement systems, and data-driven product innovation. Intelligence is no longer layered onto systems; it is becoming the system itself.

Enterprises that embed AI into their operational core are compressing costs, accelerating time-to-market, and increasing customer lifetime value. Those who hesitate remain trapped in fragmented data environments and reactive decision models. The competitive divide is widening not because of access to AI tools, but because of how strategically AI is integrated into enterprise architecture, often with the support of an experienced AI Development Company capable of aligning technology with measurable business outcomes.

This guide breaks down the real impact of AI on business performance, from data maturity and workflow orchestration to ROI measurement and autonomous operations. It provides a structured roadmap for leaders who want to move beyond pilots, scale intelligently through comprehensive AI Development Services, and convert AI investment into a measurable enterprise advantage.

1. AI in 2026: From Pilots to Production – The Adoption Reality Check

Despite massive hype and rapid investment growth, the journey from pilot projects to enterprise-wide AI adoption remains uneven.

- Gartner forecasts global AI spending will exceed $2.5 trillion in 2026, with AI services, infrastructure, and software driving massive enterprise budgets.

- Research shows that only a small percentage of companies have AI fully embedded in core workflows, with as few as 5% deriving significant value from their deployments, despite broad adoption efforts.

- IBM’s Global AI Adoption Index reports 42% of enterprises actively deploying AI, while another 40% remain in the exploration stage.

This gap between adoption and actual impact highlights a defining theme of 2026: AI is no longer optional, but far from fully realized.

2. Why Many AI Projects Fall Short: The “Execution Divide”

Data shows that enterprises frequently struggle to scale AI beyond proof-of-concept (POC) due to:

1. Lack of AI-Ready Data

AI systems are only as effective as the data that fuels them. Fragmented, noisy, or siloed data pipelines undermine model accuracy and enterprise insight generation.

2. Misalignment of Strategy with Business Outcomes

Executives often invest in technology first and strategy second, leading to solutions that don’t solve real business problems.

3. Organizational Resistance

AI transformations require process redesign, workforce shift, and governance maturity, not just technology. Without aligning people and workflows, most initiatives stall.

4. Overemphasis on Tools vs. Outcomes

Although 78% of organizations report using AI, only a fraction derive a measurable business impact because their workflows remain unchanged.

This execution gap is why many teams invest heavily but see little strategic value.

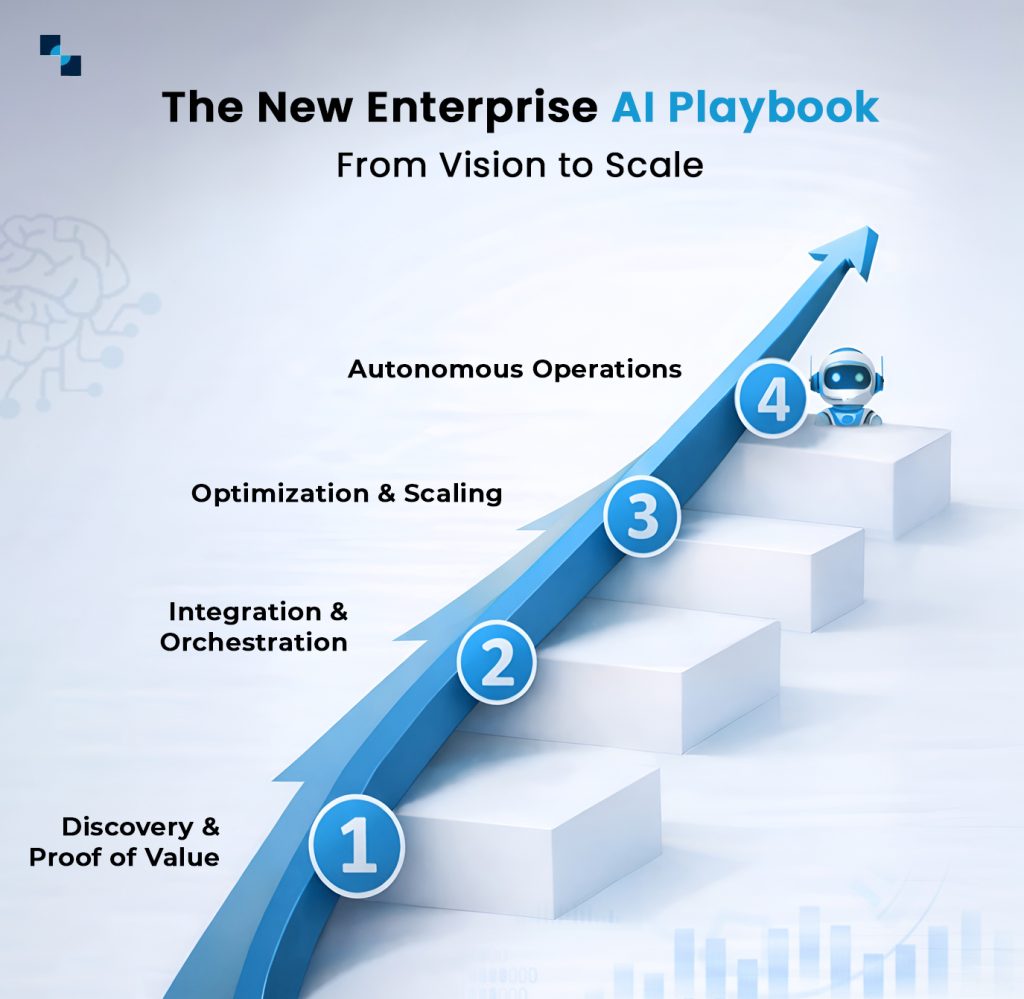

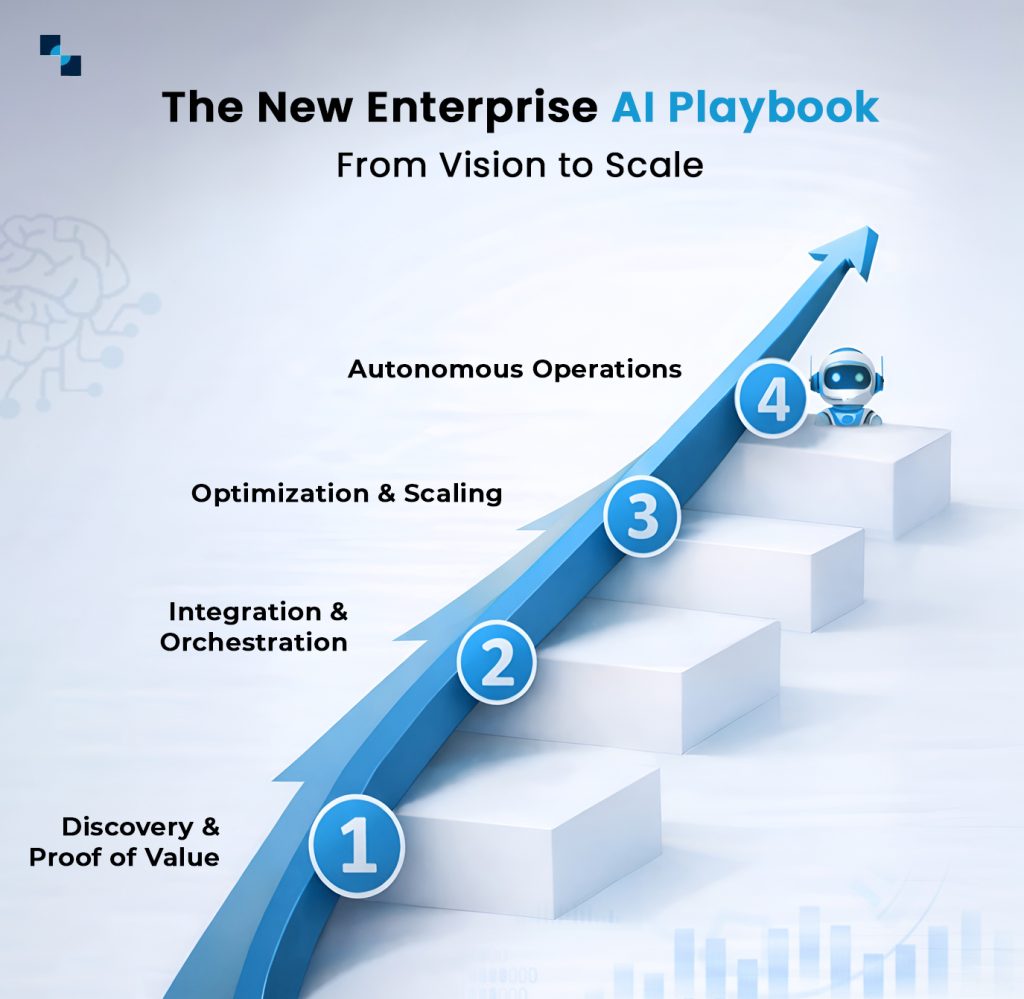

3. The New Enterprise AI Playbook: From Vision to Scale

To succeed in 2026, enterprises must follow a structured transformation path:

Stage 1: Discovery & Proof of Value

- Define specific business outcomes (e.g., cost reduction, revenue uplift, customer personalization).

- Identify high-impact use cases (e.g., automated claims processing, dynamic pricing models).

Stage 2: Integration & Orchestration

- Enterprises partnering with an AI Development Company for Business are embedding generative models directly into core operational workflows.

- Establish robust data governance frameworks.

Stage 3: Optimization & Scaling

- Transition from discrete models to a connected AI ecosystem that powers cross-functional intelligence.

- Track ROI consistently and build feedback loops for continuous improvement.

Stage 4: Autonomous Operations

- Mature organizations will reach a point where AI proactively manages resource allocation, pricing, and risk response.

According to Gartner’s 2026 Enterprise AI Outlook, the maturity of enterprise AI outcomes is increasingly determined by data readiness, seamless process integration, and clearly measurable ROI rather than by technology expenditure or model scale alone.

4. Demonstrable ROI: How AI Delivers Real Business Value

The most successful companies measure AI through three ROI dimensions:

Direct ROI

- Operational cost reduction

- Efficiency gains via automation and workflow augmentation

Indirect ROI

- Increased customer lifetime value through personalization

- Better customer satisfaction via AI-driven experiences

Strategic ROI

- Shorter product cycles

- Faster innovation via predictive insights and AI-augmented R&D

Organizations leveraging structured AI Development Services ensure that AI initiatives are aligned with measurable business objectives, linking model performance directly to revenue growth, operational efficiency, and strategic impact.

Recent enterprise research from Deloitte finds that AI delivers measurable outcomes such as enhanced customer relationships, operational efficiency, and increased revenue potential, though many companies are still in early phases of realization.

5. Generative AI: The New Enterprise Advantage

Generative AI has evolved from experimental technology into a critical enterprise capability. Unlike traditional AI that analyzes data, generative AI can create content, simulate scenarios, generate code, draft reports, design workflows, and support strategic planning. Enterprises partnering with an AI Development Company for Business embed these models directly into daily operational workflows across customer service, finance, marketing, procurement, and knowledge management.

Enterprises are deploying task-specific AI agents that handle repetitive, cognitive workloads, automate multi-step processes, support decision-making, and continuously optimize through real-time feedback. By engaging AI software developers, companies move beyond pilots toward integrated, enterprise-scale systems. These enterprise deployments are strengthened through structured AI software development services that ensure scalability, governance alignment, and long-term system resilience.

The result is a structural shift from standalone AI tools to digital workforce augmentation. Generative AI, implemented through AI-Powered Development Company expertise, becomes a strategic foundation that enhances productivity, accelerates execution, and transforms organizational performance into a scalable competitive advantage.

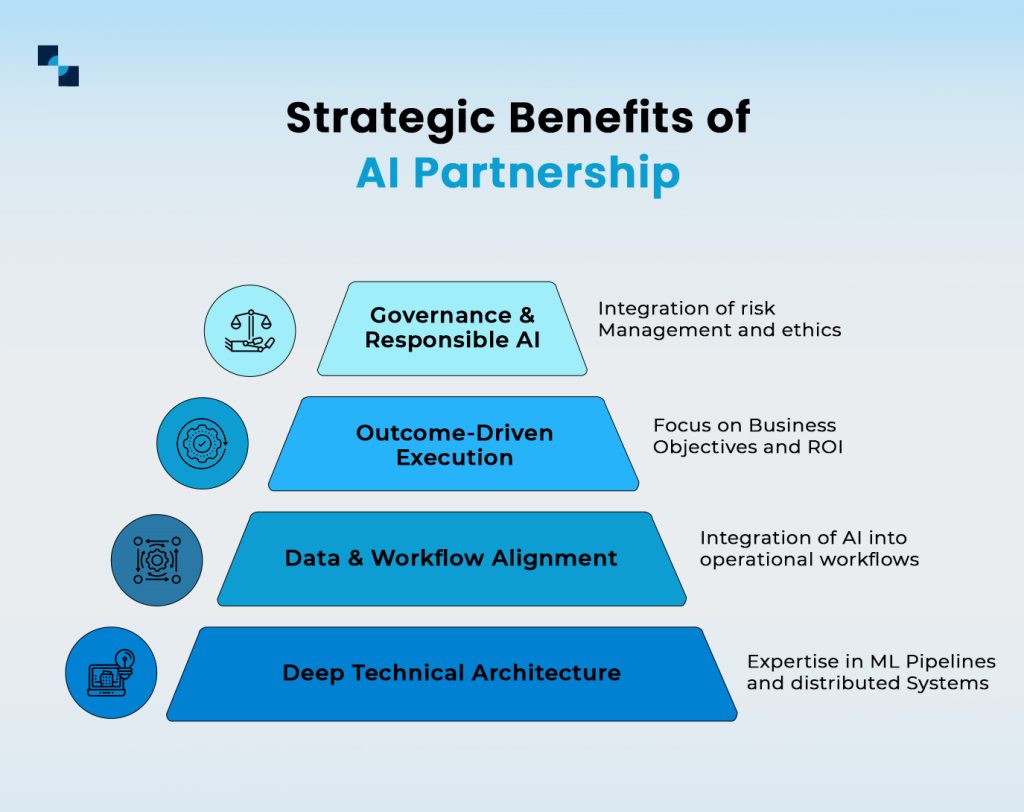

6. The Strategic Benefits of Partnering with an AI Development Company

Implementing AI at scale is not simply a technical exercise; it is an architectural transformation that touches data, workflows, governance, and long-term business strategy. Organizations that attempt to build advanced AI capabilities in isolation often encounter scalability bottlenecks, integration gaps, and unclear ROI.

Enterprises evaluating the best AI development companies prioritize scalability, governance maturity, architectural depth, and measurable ROI over experimental capability alone. Partnering with an experienced AI Development Company provides structured expertise that strengthens execution quality, accelerates deployment maturity, and ensures measurable business outcomes.

Deep Technical Architecture Capabilities

Enterprise-grade AI requires more than model deployment. It demands expertise in machine learning pipelines, large language models, agent-based orchestration, distributed systems, and secure infrastructure. Specialized AI teams understand how to design systems that are scalable, modular, and production-ready, not just experimental prototypes.

Data & Workflow Alignment

AI performance is fundamentally dependent on data quality and system integration. Strategic partners establish governed data pipelines, eliminate silos, and ensure models are embedded directly into operational workflows. This alignment transforms AI from a disconnected layer into a core operational engine.

Outcome-Driven Execution

Successful AI initiatives begin with business objectives, not algorithms. Experienced AI partners define clear performance metrics, build measurement frameworks, and align deployments with revenue growth, cost efficiency, and customer experience improvements. This approach ensures that AI investments translate into tangible enterprise value.

Governance, Risk, and Responsible AI

Enterprise deployment requires structured oversight. From model bias mitigation to compliance frameworks, data privacy safeguards, and auditability, governance must be engineered from the start. Strong AI partnerships integrate risk management and ethical design principles into system architecture, thus reducing exposure and ensuring long-term sustainability.

7. Workforce Transformation: The New Enterprise Skill Imperative

Artificial Intelligence is not merely optimizing workflows; it is redefining how work itself is structured, executed, and measured. As automation expands across cognitive and operational domains, roles are not simply being replaced; they are being redesigned. Organizations leveraging AI Development Services ensure that AI adoption is aligned with workforce transformation and skill development.

Across industries, millions of positions are evolving as AI systems absorb repetitive analysis, data processing, and routine decision-making tasks. Forward-looking enterprises engage ai software developers to equip employees with AI fluency, embedding it into performance metrics, leadership expectations, and career development pathways.

The emerging model is human enhanced by machine intelligence. Competitive advantage will depend not only on AI-Powered Development Company expertise but also on building intelligent teams capable of leveraging AI systems at scale.

Start Your Enterprise AI Transformation with Confidence

8. Building the AI-First Enterprise: The Future of AI Development Services

Over the next decade, AI will move beyond workflow support and become the structural backbone of enterprise design. Intelligence will be embedded across finance, operations, marketing, supply chains, product development, and risk management, not as a feature, but as core infrastructure built with AI Development Services.

In AI-first organizations:

Decision cycles compress dramatically

Real-time data modeling enables dynamic forecasting, adaptive pricing, automated risk scoring, and continuous operational recalibration.

Customer engagement becomes predictive rather than reactive

Behavioral modeling anticipates needs, optimizes touchpoints, and adjusts experiences across channels in milliseconds.

Innovation becomes systematic

AI-assisted research, simulation environments, and rapid prototyping reduce development timelines and increase experimentation velocity.

Competitive strength compounds over time

Self-improving systems continuously refine algorithms using proprietary data, creating intelligence loops that are difficult for competitors to replicate.

The Standard for Modern Enterprise Excellence

Artificial Intelligence has moved from optional experimentation to operational expectation. Its impact on business performance is seen in margin expansion, faster decision-making, improved capital allocation, and measurable revenue growth. Enterprises must leverage AI Development Services to strengthen data foundations, align AI initiatives with financial metrics, embed governance, and build workforce capability for AI collaboration.

Organizations that treat AI as core infrastructure and partner with a trusted AI Development Company will outperform peers in efficiency, innovation speed, and customer value creation. Supported by custom AI development, businesses can institutionalize AI today to shape tomorrow’s market dynamics. Antier empowers enterprises with scalable, secure AI and blockchain solutions, driving measurable ROI through expert AI-Powered Development Company services with the dedicated support of experienced professionals guiding every stage of innovation and implementation.

Frequently Asked Questions

01. What is the current impact of AI on businesses as of 2026?

By 2026, AI is redefining business operations through faster decision cycles, predictive supply chains, autonomous customer engagement, and data-driven product innovation, becoming integral to enterprise systems.

02. Why do many AI projects fail to deliver significant value?

Many AI projects fall short due to a lack of AI-ready data, as fragmented and siloed data pipelines hinder model accuracy and limit enterprise insights.

03. How can enterprises effectively integrate AI into their operations?

Enterprises can effectively integrate AI by embedding it into their operational core, leveraging comprehensive AI development services, and aligning technology with measurable business outcomes to enhance performance and competitiveness.

Crypto World

CME Launches 24/7 Crypto Futures Trading Starting May 29

CME Group will run cryptocurrency futures and options on CME Globex around the clock starting May 29, 2026, after recording $3 trillion in notional volume across its crypto derivatives in 2025.

Why it matters:

- Traders can react to breaking news on weekends, eliminating the price gap risk that builds when crypto markets move while CME is closed.

- Institutions managing crypto exposure via CME derivatives gain continuous hedging access, reducing overnight risk accumulation.

- The move signals CME’s direct response to demand from TradFi firms scaling into digital assets.

The details:

- CME Group announced the 24/7 schedule on February 19, 2026, pending regulatory approval, per an official press release.

- Crypto derivatives average daily volume (ADV) hit 407,200 contracts year-to-date in 2026, up 46% year-over-year.

- Futures ADV reached 403,900 contracts, up 47% year-over-year, per CME Group data.

- Average daily open interest stands at 335,400 contracts, up 7% year-over-year.

- CME confirmed the launch date of May 29, 2026, via its official X account.

The big picture:

- CME’s 2025 crypto notional volume of $3 trillion confirms institutional demand for regulated derivatives now rivals spot market activity.

- The 24/7 schedule aligns CME with native crypto exchanges, which have always traded continuously, narrowing a structural gap between TradFi and DeFi.

- Continuous trading on a regulated venue could pull institutional volume away from offshore perpetual futures markets.

The post CME Launches 24/7 Crypto Futures Trading Starting May 29 appeared first on BeInCrypto.

Crypto World

Tether USDT Set for Biggest Monthly Decline Since FTX Collapse

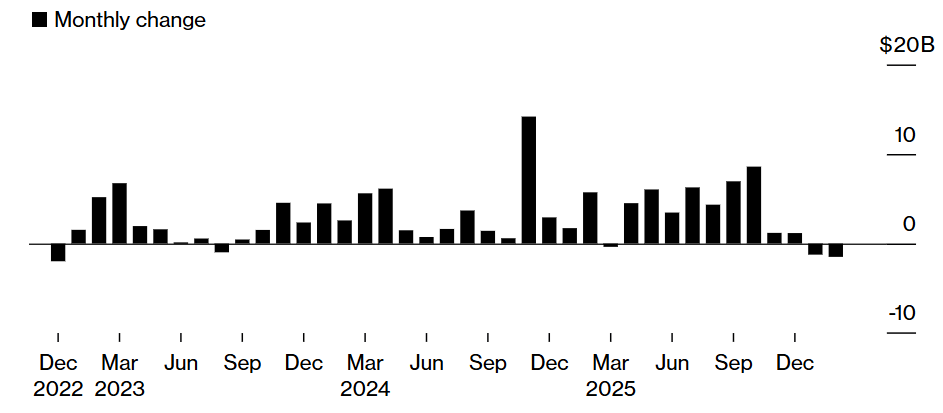

Tether’s USDT, the world’s largest US dollar-pegged stablecoin, is heading for its steepest monthly decline in years as large holders step up redemptions, according to blockchain data.

The circulating supply of USDt (USDT) fell by about $1.5 billion so far in February, following an $1.2 billion decrease in January, according to Artemis Analytics data reported by Bloomberg. This puts USDT on track for the biggest monthly drop in three years, weeks after the collapse of cryptocurrency exchange FTX in November 2022.

The USDT supply logged a $2 billion decrease in December 2022 after the collapse of FTX and its 150 subsidiaries sent shockwaves through the crypto industry.

The decline may signal a contraction in crypto market liquidity, as Tether’s USDT is the primary on-ramp for crypto investors. Its $183 billion market capitalization accounts for about 71% of the total stablecoin market, according to CoinMarketCap.

Cointelegraph reached out to Tether for comment on what is driving the February supply drop, but had not received a response by publication.

Related: BlackRock enters DeFi as institutional crypto push accelerates: Finance Redefined

Total stablecoin market cap flat in February

The pullback in USDT has not translated into a broader contraction across dollar-linked stablecoins.

The total market capitalization of stablecoins across all exchanges has risen 2.33% so far in February, from $300 billion to $307 billion, according to DeFiLlama data.

While the two leading stablecoins, USDT and Circle’s USDC (USDC), both decreased by 1.7% and 0.9%, respectively, the Trump-family-linked World Liberty Financial’s USD1 (USD1) stablecoin recorded a 50% increase in market capitalization over the past month and was valued at $5.1 billion as of Friday, according to DeFiLlama.

Related: Wells Fargo sees ‘YOLO’ trade driving $150B into Bitcoin and risk assets

Whales and smart money traders offload USDT, but fresh wallets stepping in

Whales, or large cryptocurrency investors, have been cutting their USDT holdings, but new participants are bringing fresh demand for the leading stablecoin.

Whale wallets sold $69.9 million USDT across 22 wallets over the past week, marking a 1.6-fold increase in the selling rate of this cohort, according to crypto intelligence platform Nansen.

The leading traders by returns, tracked as “smart money,” have also been net sellers of USDT. At the same time, new wallets created in the past 15 days bought roughly $591 million worth of USDT over the week, according to the platform.

The mixed flows highlight a market split between large holders redeeming or reallocating capital and new entrants stepping in to take the other side, even as overall stablecoin issuance remains broadly steady.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Crypto World

As Ethereum staking surges, SolStaking expands the opportunity for scalable crypto returns

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

With over half of all ETH now staked, platforms like SolStaking are positioning themselves to serve investors shifting from short-term trading toward structured yield strategies.

Summary

- More than 50% of Ethereum’s circulating supply is locked in staking, signaling a market shift toward long-term participation and reduced liquid supply.

- SolStaking offers fixed-term automated staking plans executed via smart contracts, targeting predictable returns and hands-off participation.

- Its infrastructure emphasizes institutional safeguards, including audits by PwC and custody insurance from Lloyd’s of London, alongside asset segregation and encryption.

Ethereum has quietly crossed a major threshold.

More than half of its total supply is now locked in staking. Even as ETH trades below recent highs, participation continues to increase. Over 50% of the network’s circulating supply is committed to validation rather than short-term trading.

That shift matters.

When supply tightens and long-term participation rises, market dynamics begin to change. The focus moves from daily volatility to sustained yield generation.

For many investors, the conversation is no longer just about price appreciation. It’s about capital efficiency.

That is where SolStaking positions itself.

About SolStaking

SolStaking is a multi-asset cryptocurrency staking platform operating under its U.S.-registered entity, Sol Investments, LLC.

The platform operates through automated smart contracts. Once a plan is activated, distributions are executed according to predefined contract terms without manual intervention.

Participation plans currently include:

Trial Plan — $100 — 2 Days — ~$108

TRX Income Plan — $3,000 — 15 Days — ~$3,585

XRP Flagship Plan — $30,000 — 30 Days — ~$44,400

BTC Flagship Plan — $300,000 — 50 Days — ~$630,000

Complete plan details are available on the official website.

Institutional-grade infrastructure

SolStaking operates with a framework designed for operational clarity and asset oversight:

- U.S.-registered entity: Sol Investments, LLC

- Separation of user assets and corporate operating funds

- Independent audits conducted by PwC

- Custody insurance provided by Lloyd’s of London

- Enterprise-grade encryption and continuous system monitoring

This infrastructure supports consistent smart contract execution and platform integrity.

Real-world asset integration

Beyond digital staking, SolStaking integrates real-world assets into its broader ecosystem, including:

- AI data centers

- Sovereign and investment-grade bonds

- Physical gold and commodities

- Industrial metals

- Logistics infrastructure

- Agriculture and clean energy projects

These components contribute to the platform’s operational ecosystem while smart contracts manage on-chain settlement processes.

Getting started

- Register on the official SolStaking platform.

- Deposit supported assets (XRP, BTC, ETH, SOL, USDT, USDC, LTC, DOGE).

- Select a smart contract plan.

- Activate participation.

Users can monitor balances and settlement progress in real time.

Conclusion

As digital asset markets mature, participation models are evolving.

For many investors, capital deployment is no longer limited to directional trading. Automated smart contract participation provides an alternative approach focused on predefined timelines and programmed execution.

SolStaking delivers fixed-term staking participation within a framework designed for transparency, automation, and operational structure.

To learn more about SolStaking, visit the official website. Email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

World Markets Launches on MegaETH: High-Speed DeFi Trading

For years, crypto markets have operated with a clear gap. DeFi introduced open and transparent trading, while centralized exchanges continued to handle most price discovery. The difference came down to infrastructure. Most blockchains focused on running applications, not high-speed trading. Order books, tight spreads, and real-time hedging demand fast execution and low costs, and that level of performance is now becoming non-negotiable.

At these volumes, the pressure on infrastructure becomes obvious. According to DeFiLlama, decentralized perpetual futures markets are now clearing roughly $20–30 billion in daily volume, with monthly volumes regularly approaching the $1 trillion range depending on market conditions.

As this trend accelerates, MegaETH, a high-performance Ethereum Layer 2 built around ultra-low latency and high throughput, has gone live. Among the first flagship applications to launch on this Layer 2 network on February 17 was World Markets – a decentralized trading platform that unifies spot trading, perpetual futures, and lending under a single account.

As one of the first full trading platforms on the network, it effectively serves as an early test of whether performance-focused chains can support institutional-style market structure on-chain.

When Markets Outgrow the Infrastructure

For most of DeFi’s first wave, the focus was composability. Protocols stacked on top of each other, liquidity moved across AMMs, and lending markets thrived.

However, serious trading is different from yield farming.

Order books require constant updates. Market makers need predictable fees. High-frequency traders need execution that doesn’t lag behind centralized venues by seconds. Even small inefficiencies compound when leverage is involved.

That’s where many general-purpose chains struggled.

Gas fees on networks like Base or Arbitrum can fluctuate dramatically during congestion. Latency, even if acceptable for swaps or NFT mints, becomes a real issue when managing leveraged derivatives.

Kevin Coons, founder of World Markets, speaks candidly:

“There has yet to be a successful DEX on a general purpose chain. Two simple reasons are gas and speed. Gas costs can be close to 100x higher. High gas costs prevent market makers from being able to quote tight spreads meaning on-chain exchanges can’t be competitive with Binance, until now.”

Whether or not one agrees with the 100x comparison, the broader point resonates: tight spreads and fast execution aren’t optional features in capital markets. They’re the foundation.

Coons adds:

“Speed matters to an extent. Being within range of Binance is important for getting price discovery on-chain. MegaETH is the first chain where price discovery is possible.”

That statement speaks to a larger trend. If decentralized markets want to compete, they can’t just be transparent but efficient as well.

MegaETH and the Rise of Performance Chains

MegaETH has positioned itself differently from earlier Ethereum scaling efforts.

Instead of focusing only on cheaper gas, it emphasizes performance metrics closer to centralized systems, targeting very high throughput and low confirmation times. The project has publicly referenced stress tests processing billions of transactions ahead of mainnet launch.

Official docs and ecosystem materials emphasize execution speed specifically for latency-sensitive use cases like order books and gaming.

This approach aligns with a pattern seen elsewhere. Hyperliquid, another trading-focused environment, has become one of the most active perpetual futures venues onchain, frequently clearing billions in daily volume.

The takeaway is that markets seem to gravitate toward infrastructure built specifically for trading workloads. General-purpose chains aren’t disappearing but capital markets are starting to migrate toward environments designed for financial throughput.

What World Markets Is Trying to Change

World Markets enters this environment with a structural design choice: unified margin.

Instead of forcing traders to separate capital across spot markets, perpetual futures, and lending platforms, the system keeps everything under a single portfolio.

On paper, that sounds straightforward. In practice, it opens the door to strategies that were previously difficult on-chain, including basis trades that exploit the structural gap between borrow rates and perpetual funding rates.

Traditional DeFi often leaves capital fragmented and heavily overcollateralized, forcing traders to split borrowing, hedging, and execution across separate platforms, with billions in capital sitting idle or locked inefficiently because the infrastructure never unified those functions.

World Markets attempts to consolidate all of that. The platform’s ATLAS risk engine enables portfolio-level margining and undercollateralized lending – mechanics more common in prime brokerage models than in early DeFi protocols.

In traditional finance, hedge funds operate under consolidated accounts where risk is assessed at the portfolio level. DeFi historically hasn’t worked that way.

World Markets is effectively attempting to replicate prime brokerage-style capital management on-chain, giving traders access to structures that have traditionally been reserved for institutional desks.

Rethinking Liquidations and Risk

Liquidation mechanics are one of the most controversial parts of leveraged trading.

Most exchanges, both centralized or decentralized, rely on automated systems that close positions once thresholds are breached. While necessary for solvency, those systems can override trader discretion.

World Markets frames its model differently. In Coons’ view:

“Sophisticated traders have highly leveraged portfolios. They reduce risk by hedging… Exchanges currently socialize these losses to their users by closing out their positions. On World Markets you have ultimate control over your risk. We don’t decide your risk for you.”

The idea is to give traders more direct control over counterparty exposure rather than relying entirely on exchange-imposed forced liquidations.

Whether that model scales will depend on adoption and liquidity depth. But structurally, it signals a move away from rigid, siloed liquidation logic toward portfolio-based risk management.

Where On-Chain Markets Are Heading

Zooming out, this moment is bigger than any single platform. Decentralized markets are beginning to outgrow the general-purpose infrastructure they were originally built on. DeFi’s first phase focused on access and composability. The next phase is about capital efficiency, execution quality, and market structure that can handle real trading volume.

According to Messari’s 2025 derivatives research, perpetual futures have become one of the largest segments of DeFi by volume, accounting for a significant share of total on-chain activity.

At that scale, performance stops being optional. Competing with centralized venues requires tighter spreads, faster execution, and deeper liquidity, all of which depend on infrastructure designed specifically for financial workloads.

MegaETH is aligning itself with that change, and World Markets’ launch represents one of the earliest attempts to run a fully integrated trading stack, including a central limit order book, on infrastructure designed specifically for high-speed financial execution. It signals a maturing phase for DeFi, where the chain itself becomes a strategic choice aligned with the demands of capital markets.

Crypto World

ETH, XRP, ADA, BNB, and HYPE

This Friday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

Ethereum (ETH)

Ethereum had a mostly flat week, closing up only 1%. This means buyers managed to defend the key support at $1,800. The sell momentum is also fading, which could hint at a possible reversal soon.

The current resistance levels are found at $2,000 and $2,400. Given the price closed in the red over the last four weeks, a relief rally appears likely and could test these key levels.

Looking ahead, Ethereum may be completing its second leg down in an ABC correction. If so, bulls may soon make their presence known on the order book. That starts once the $2,000 level is reclaimed.

Ripple (XRP)

XRP closes the week up 5%. However, this was not sufficient to turn the chart bullish. That’s because the attempt to break the resistance at $1.6 was rejected sharply by sellers.

Such a rejection is a bearish signal that the downtrend may still continue for some time. If so, a retest of support at $1.4 and even $1 is likely in the future.

Looking ahead, the sell momentum continues to dominate, which can lead to lower price levels. Watch closely how the price reacts at $1.4 for a good indication of where XRP will go next.

Cardano (ADA)

ADA is hanging close to the support at $0.28, but appears to struggle and may lose this level again. If so, expect lower prices in the future, with key support at $0.24. This comes after a 6% gain to close the week.

Cardano’s price action mirrors somewhat the one from XRP. The momentum remains bearish, but sellers and buyers are still fighting for dominance at the key support. Either way, a decisive move can be expected soon.

Looking ahead, ADA had a very disappointing year so far and this will not change until it reclaims a price above 50 cents. That’s the moment when bulls could hope for sustained gains.

Binance Coin (BNB)

Binance Coin has been hugging the $580 support level over the past week and closed with a 3% gain. Sellers also appear to be taking a break, but that does not mean the selloff is over.

The current resistance is at $690 and has not tested to date. This shows buyers are still hesitant to return here, but the signs are promising since the selling volume has decreased substantially lately.

Looking ahead, if BNB can hold here, then buyers may gather enough courage to push higher and challenge the resistance at $690. If, however, sellers return in force, the price could fall to $500 next.

Hype (HYPE)

HYPE closed the week in the red with a 5% loss. This comes after a sharp rejection at the $36 and $30 resistance levels. Buyers are on the defensive, which could see the price fall lower up to the key support at $26.

If $26 is lost later as well, that will be an extremely bearish signal, which could see HYPE make new lows this year. On the other hand, if that level holds, then it could be interpreted as a higher lo,w which will encourage buyers to return once more.

Looking ahead, this cryptocurrency is found in a pullback that may last a while. Best to be patient here and wait for bulls and bears to show their intention around $26 first.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Metaplanet CEO Refutes Claims of Hidden Bitcoin Trades

Metaplanet’s chief executive Simon Gerovich pushed back against criticisms from anonymous accounts alleging that the company misrepresented its Bitcoin treasury strategy and disclosures. Critics on X argued that Metaplanet delayed or withheld price-sensitive information about large BTC purchases and options trades funded with shareholder capital, and that losses from its derivatives program were not fully disclosed. In a detailed public post on X, Gerovich contends that the company has consistently reported all Bitcoin purchases, option strategies and borrowings, and that readers have misinterpreted the financial statements rather than uncovering any misconduct.

Key takeaways

- Metaplanet disclosed four Bitcoin purchases in September 2025 totaling 11,832 BTC (1,009 on Sept. 1; 136 on Sept. 8; 5,419 on Sept. 22; 5,268 on Sept. 30), with the company asserting prompt disclosure for each move.

- The firm’s public dashboard corroborates the September buys, and Bitcointreasuries.net also lists the transactions along with related announcements and filings.

- Gerovich said selling put options and put spreads were designed to acquire BTC below spot and monetize volatility for shareholders, rather than betting on short-term price swings.

- Metaplanet reported fiscal 2025 revenue of 8.9 billion yen (about $58 million), up roughly 738% year over year, but posted a net loss near $680 million due to a decline in the value of its Bitcoin holdings.

- As the debate around Bitcoin treasury strategies grows, Metaplanet’s disclosures and borrowing activities—including a credit facility set up in late 2025—remain under scrutiny by investors and regulators alike.

- Beyond Metaplanet, the sector faces broader questions about the sustainability of BTC-heavy treasuries, with peers such as Strategy posting large quarterly losses despite signaling a long-term outlook.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The controversy surrounding Metaplanet’s Bitcoin treasury approach unfolds as crypto markets experience liquidity shifts and ongoing scrutiny of corporate crypto holdings. The sector’s dynamics are further colored by notable market moves and annual results from other BTC holders, including Strategy, which reported a $12.4 billion net loss in Q4 2025 as Bitcoin declined, highlighting the tension between revenue opportunities from BTC-related activities and material impairment risks tied to price swings.

Why it matters

For investors tracking crypto-native treasuries, Metaplanet’s disclosures illuminate how such firms balance disclosure requirements with the volatility of digital assets. The company’s strategy—using option structures to monetize volatility while seeking BTC below spot via puts—shows a deliberate approach to acquiring exposure without entirely relying on directional bets. The earnings mix, where revenue from Bitcoin-related activities rose substantially while the balance sheet reflected non-cash losses tied to price movements, underscores a broader accounting challenge: treating asset impairments as business costs can mask underlying revenue growth and cash-generation potential.

From a governance standpoint, the incident underscores the importance of transparent, timely disclosures as markets increasingly scrutinize how corporate treasuries operate in real time. The availability of data on Metaplanet’s public analytics dashboard and third-party trackers adds a layer of accountability, but it also raises questions about the sufficiency of disclosures for complex derivatives programs and loan facilities tied to crypto assets. The sector’s trajectory will hinge on how well such disclosures align with investor expectations and how regulators interpret leverage and protections within crypto-backed borrowings.

For builders and users in the crypto space, this episode reinforces the need for robust risk management and clear accounting treatment for digital assets. As platforms experiment with diversified revenue streams tied to BTC, including options income and structured borrowings, maintaining clarity around valuation, impairment, and liquidity is essential to sustain investor confidence during periods of price volatility.

What to watch next

- Updates to Metaplanet’s disclosures page detailing borrowing terms, collateral, and facility conditions following the October 2025 credit line.

- New BTC purchase or sale disclosures that align with the September timeline and any subsequent months, including any changes to the company’s public dashboard.

- Additional commentary from Metaplanet’s leadership on X and any subsequent investor communications clarifying accounting treatment of asset impairments.

- Public trackers like Bitcointreasuries.net updating holdings in response to new disclosures or market moves.

- Regulatory or market developments affecting crypto-treasury strategies, including any updates to lending terms or disclosure requirements for listed BTC-holding vehicles.

Sources & verification

- Metaplanet analytics page: https://metaplanet.jp/en/analytics

- Bitcointreasuries.net listing: http://bitcointreasuries.net

- X post by Metaplanet on September purchases: https://x.com/Metaplanet/status/1962340921049309536

- Gerovich’s explanatory post: https://x.com/gerovich/status/2024646152877133907

- September BTC purchases previously disclosed: https://x.com/tenb1/status/2024099604044890455

- Metaplanet revenue and impairment discussion: https://cointelegraph.com/news/metaplanet-revenue-jumps-738-percent-bitcoin-generates-95-percent-revenue

- Impairment-related revenue context: https://cointelegraph.com/news/metaplanet-raises-revenue-forecast-bitcoin-impairment

- Bitcoin-backed borrowings and disclosures: https://metaplanet.jp/en/shareholders/disclosures

- Related coverage of BTC treasury strategies and performance: https://cointelegraph.com/news/strategy-reports-12b-loss-q4-2025

- Big questions on macro and gold references: https://cointelegraph.com/magazine/china-stockpiling-gold-yaun-global-reserve-us-dollar/

Metaplanet defends Bitcoin treasury strategy amid investor scrutiny

Bitcoin (CRYPTO: BTC) sits at the center of Metaplanet’s corporate strategy, a fact that has drawn sharp questions from observers about disclosure timeliness, asset valuation and the company’s approach to risk management. In a detailed post on X, Simon Gerovich laid out the sequence of events that led to September 2025’s Bitcoin purchases and the accompanying derivative strategies designed to generate income while controlling entry points for BTC exposure. He emphasized that the company’s real-time dashboard and public disclosures provide a transparent view of the purchases, option strategies and borrowing activity that underpin the treasury program.

According to Metaplanet, the September buys were executed in four distinct transactions: 1,009 BTC on Sept. 1; 136 BTC on Sept. 8; 5,419 BTC on Sept. 22; and 5,268 BTC on Sept. 30. The total of these maneuvers equates to 11,832 BTC acquired over the month, a figure the company asserts was promptly disclosed. The public dashboard, which is accessible to investors and researchers alike, corroborates these entry points and offers a transparent ledger of the company’s Bitcoin holdings and related activity. The Bitcointreasuries.net tracker, which aggregates corporate BTC holdings and their disclosures, also reflects these transactions and the accompanying public announcements.

Gerovich defended the use of put options and put spreads as a mechanism to acquire BTC at levels below the spot price while monetizing volatility in a way that benefits shareholders, rather than speculating on sprint-to-the-close price moves. The approach, he argued, is aligned with a risk-managed treasury strategy that seeks to build a long-term Bitcoin position through measured, disclosed steps rather than abrupt, undisclosed trades. He further highlighted that the company has historically disclosed all relevant purchases, borrowings and option strategies, urging readers to examine the financial statements with this context in mind.

Beyond operational disclosures, Metaplanet’s 2025 financial results painted a mixed picture. The company reported revenue of 8.9 billion yen (roughly $58 million), a surge of about 738% year over year, reflecting the strength of its Bitcoin-related activities. Yet the firm also recorded a net loss of approximately $680 million, attributed to the marked impairment in the value of its Bitcoin holdings as prices slumped. Gerovich contended that non-cash impairment charges are an accounting consequence of asset valuation rather than a reflection of trading missteps or misalignment with the treasury plan. In other words, the revenue line demonstrates activity and monetization potential, while the impairment line reflects the price-driven realities of holding a volatile asset.

Metaplanet has not shied away from highlighting the non-cash nature of certain losses, arguing that the accounting treatment of digital assets does not imply strategic failure. The company underlined that it established a credit facility in October 2025 and disclosed subsequent drawdowns in November and December, including information on borrowing amounts, collateral and general terms on its disclosures page. The lender’s identity and specific rates were kept confidential at the counterparty’s request, Gerovich noted, but he stressed that the borrowing terms were favorable and that the balance sheet remained strong despite Bitcoin’s movements.

The broader industry backdrop adds another layer of context to Metaplanet’s defenses. A cluster of Bitcoin treasury plays has come under scrutiny as investors weigh the sustainability of long-term BTC-based financing strategies. Strategy, historically the largest corporate holder of BTC, reported a substantial quarterly loss in late 2025 as Bitcoin’s price deteriorated, even as the company emphasized a longer horizon and a robust capital structure. This juxtaposition—strong revenue streams from BTC activities against sizable impairments in asset values—helps explain why market participants are closely scrutinizing disclosure practices, risk controls and governance around crypto treasuries.

As Metaplanet continues to publish data and respond to scrutiny, the industry will likely watch not only for new purchases or borrowings but also for the consistency and clarity of its accounting disclosures. The balance between revenue growth from Bitcoin-derived activities and the non-cash losses tied to asset valuations will remain a focal point for investors evaluating the viability of BTC-heavy treasury models in a volatile market environment.

Crypto World

Peter Schiff wants you to sell your Bitcoin as he predicts 84% crash

Longtime Bitcoin critic Peter Schiff has reignited debate over the cryptocurrency’s outlook, warning that a break below $50,000 could trigger a steep drop toward $20,000, an 84% decline from its all-time high.

Summary

- Peter Schiff warned that if Bitcoin breaks below $50,000, it could fall to $20,000 — an 84% drop from its all-time high — urging investors to “sell Bitcoin now.”

- Schiff argued that while Bitcoin has suffered similar drawdowns before, the current market carries greater risk due to increased leverage, institutional ownership, and overall market size.

- His comments sparked backlash on X, with users pointing to his long history of bearish calls and defending Bitcoin’s long-term value proposition as a censorship-resistant, globally liquid financial network.

Sell Bitcoin now, says Peter Schiff

In a post on X, Schiff argued that “if Bitcoin breaks $50K, which looks likely, it seems highly likely it will at least test $20K,” adding that such a move would mirror previous drawdowns but unfold under very different market conditions.

“I know Bitcoin has done that before,” he wrote, “but never with so much hype, leverage, institutional ownership, and market cap at stake. Sell Bitcoin now!”

Schiff, a prominent gold advocate and frequent crypto skeptic, has long maintained that Bitcoin’s price cycles resemble speculative bubbles fueled by liquidity and investor enthusiasm. His latest warning comes amid renewed volatility in digital asset markets, where traders are closely watching key technical levels.

An 84% retracement would echo past bear markets. Bitcoin has previously suffered drawdowns exceeding 70% following euphoric rallies, including after its 2017 peak and again following its 2021 high. However, the asset’s structure has evolved significantly, with spot exchange-traded funds, corporate treasuries, and institutional allocators now holding sizable positions.

Schiff’s latest warning quickly drew pushback on X, where critics accused the longtime gold advocate of repeating a decade-old bearish script.

One user claimed investors who followed his past calls on silver were left “stuck in it for 20 years,” referencing the metal’s prolonged stagnation after previous peaks. Others pointed to Schiff’s history of urging investors to sell Bitcoin at far lower levels, noting that he has been issuing similar warnings since the asset traded near $100.

A separate response argued that Bitcoin’s “intrinsic value” lies in its censorship-resistant settlement network, global liquidity, and lack of gatekeepers, framing its volatility not as a flaw but as the market’s process of pricing a new financial system in real time.

The exchange shows the entrenched divide between Schiff and Bitcoin advocates, with critics portraying his latest $20,000 forecast as a continuation of a long-running skepticism that has so far failed to derail the cryptocurrency’s broader upward trajectory.

Still, Schiff’s comments highlight a persistent divide in the investment community: whether Bitcoin’s growing institutional footprint makes it more resilient or more vulnerable in the event of a sharp downturn.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video11 hours ago

Video11 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World15 hours ago

Crypto World15 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery