Crypto World

Paxful Hit with $4 Million Penalty Over Illegal Transactions and Crimes

TLDR

- Paxful has been sentenced to pay a $4 million fine after pleading guilty to money laundering and prostitution charges.

- The company processed over $3 billion in crypto trades between 2017 and 2019, including transactions linked to Backpage.

- The U.S. Department of Justice initially sought a $112 million penalty but reduced it to $4 million based on Paxful’s financial situation.

- Paxful also agreed to pay a separate $3.5 million civil penalty to the Financial Crimes Enforcement Network.

- The case highlights the legal risks faced by cryptocurrency exchanges involved in facilitating illegal activities.

Paxful Holdings, a peer-to-peer Bitcoin marketplace, has been sentenced to pay a $4 million fine after pleading guilty to charges of fostering illegal prostitution, violating money-laundering laws, and knowingly handling criminal proceeds. The company, which ceased operations in 2023, processed over $3 billion in crypto trades between 2017 and 2019. U.S. authorities also revealed that Paxful had facilitated transactions linked to Backpage, a platform notorious for promoting illicit sex work.

Paxful Pleads Guilty to Criminal Charges

Paxful entered a plea agreement with U.S. authorities in December, admitting to its involvement in illegal activities. The peer-to-peer exchange knowingly transferred Bitcoin for customers linked to criminal schemes, including money laundering and fraud. During this period, Paxful made substantial profits, collecting approximately $30 million from its operations.

The Justice Department emphasized that Paxful’s actions allowed illegal transactions to take place undisturbed. “By putting profit over compliance, the company enabled money laundering and other crimes,” said Eric Grant, U.S. Attorney for the Eastern District of California. The company also processed Bitcoin for Backpage, a platform heavily involved in prostitution and trafficking, further complicating its legal standing.

Impact of the $4 Million Fine on Paxful

Originally, the Justice Department had sought a fine exceeding $112 million. However, the company’s inability to pay that amount led to a drastically reduced penalty. After considering Paxful’s financial situation, the final fine was set at $4 million, which a federal judge affirmed during a sentencing hearing.

In addition to the criminal fine, Paxful agreed to pay a separate $3.5 million civil penalty to the Financial Crimes Enforcement Network (FinCEN). The company’s founders were also implicated, with Artur Schaback, Paxful’s co-founder from Estonia, pleading guilty to violating anti-money laundering laws in 2024. Paxful’s operations and marketing strategies were scrutinized, with the company once boasting about the “Backpage Effect” in boosting its business.

The court’s ruling reflects a broader commitment to holding companies accountable for facilitating illegal activity. U.S. Attorney Eric Grant emphasized that the sentence serves as a clear warning. Companies that fail to prevent criminal activities on their platforms will face severe legal consequences under U.S. law. Paxful’s plea deal marks a pivotal moment in the ongoing effort to regulate cryptocurrency exchanges and curb illegal use.

The $4 million fine, while a fraction of the initial demand, underscores the seriousness of the charges and Paxful’s role in criminal networks. This case serves as a reminder of the legal and financial risks faced by cryptocurrency exchanges that fail to comply with U.S. laws.

Crypto World

Hacker Steals $2.7M From Solv’s Bitcoin Yield Platform

Crypto security researchers say the hacker exploited a bug allowing them to mint tokens, before swapping the freely-gained tokens for another tied to Bitcoin.

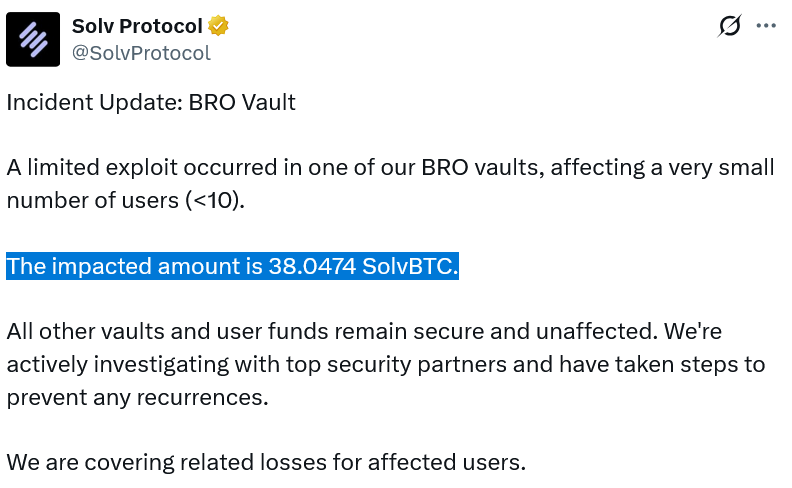

Bitcoin-based decentralized finance platform Solv Protocol says one of its token vaults was exploited for $2.7 million and has offered the attacker a 10% bounty in exchange for returning the stolen funds.

Solv said in an X post on Thursday that less than 10 of its users were impacted, but it would cover the loss of 38.05 Solv Protocol BTC (SolvBTC), a token pegged to Bitcoin (BTC).

The project added that it had implemented measures to prevent the same attack from recurring and was investigating the exploit with crypto security firms Hypernative Labs, SlowMist and CertiK.

Solv allows users to deposit Bitcoin for Solv Protocol BTC, which they can then use to lend, borrow or stake on other blockchains. The project has 24,226 Bitcoin worth over $1.7 billion and claims it is the largest on-chain Bitcoin reserve.

Solv hasn’t confirmed how the exploit happened, but two crypto security researchers attributed it to a vulnerability in one of Solv’s smart contracts that allowed the hacker to excessively mint a token used on the protocol.

Related: Mt. Gox’s former CEO floats hard fork to recover 80K hacked Bitcoin

The hacker exploited this vulnerability 22 times before swapping hundreds of millions of the tokens for a little over 38 SolvBTC, CD Security co-founder Chris Dior said.

Pseudonymous crypto researcher “Pyro” described the exploit as a re-entrancy attack, where unexpected inputs expose gaps in smart contracts, a popular attack that has plagued multiple DeFi protocols for years.

Solv shared an Ethereum wallet address in its X post to encourage the hacker into accepting a 10% bounty.

However, the hacker has not yet sent an on-chain message to the address, according to Ethereum block explorer Etherscan.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

What next for BTC as it slides under $71,000

Bitcoin got to $74,000 and ran out of further buying pressure.

The largest cryptocurrency pulled back to $70,987 by Friday’s Asian session, down 2.2% over the past 24 hours after Thursday’s surge carried it to its highest level since early February. The rally from Saturday’s war-driven low near $64,000 to Thursday’s $74,000 peak amounted to roughly 15% in five days, but the retreat since has given back about a third of that move.

Chart watchers such as FxPro chief analyst Alex Kuptsikevich pointed to the rejection coincided with the 61.8% Fibonacci retracement and just below the 50-day moving average, two technical barriers that tend to attract sellers in bear market rallies.

Fibonacci retracement levels are derived from a mathematical sequence that traders use to identify where a bounce is likely to stall. The idea is that after a large move down, prices tend to retrace a predictable percentage of that drop before resuming the trend. The 61.8% level is the most closely watched because it represents the point where a recovery has retraced roughly two-thirds of its losses, far enough to feel convincing but historically where bear market rallies tend to die.

The 50-day moving average, meanwhile, is simply the average closing price over the past 50 days. It acts as a moving line of resistance during downtrends because it represents the price at which the average recent buyer breaks even, giving them an incentive to sell rather than hold. Bitcoin hitting both at the same time makes $74,000 a technically crowded level.

Kuptsikevich noted that “the bulls still have to convince the community that the bear market is over,” adding that the magnitude of the move was driven by a short squeeze from bears who “pulled their stops too close to the market price.”

Bitunix analysts flagged a similar read on the microstructure. The push to $74,000 triggered concentrated short liquidations, while long leverage liquidation clusters sit around $70,000. Secondary liquidity pools are near $64,000. That creates a defined range for the next move, with the floor and ceiling both visible on the liquidation heat map.

The weekly numbers still look strong for majors. Bitcoin is up 5.4% over seven days. Ether gained 2.7% to $2,080. BNB added 3.1% to $648. Solana rose 2.1% to $88.39. The laggards were dogecoin, down 3.7% on the week, and XRP, essentially flat with a 0.2% decline.

The macro picture heading into the weekend is messy, however.

Asia’s benchmark stock index has dropped 6.4% since the Iran war broke out, with MSCI’s regional gauge heading for its worst week since March 2020. The dollar is on pace for its best week since November 2024. Oil is posting its biggest weekly surge since 2022. Those are not the conditions that typically sustain a crypto rally.

Friday brought some tentative relief. Asian equities erased early losses as the dollar weakened and crude prices dipped on reports that the U.S. was weighing options to address the energy cost spike.

But the war isn’t over. The Senate failed to block Trump’s continued military actions against Iran, leaving conflict costs and energy disruption as open variables. Defense Secretary Hegseth has said operations could last three to eight weeks. The Strait of Hormuz remains effectively disrupted.

The $70,000 level that was resistance for a month is now the first test of support. Holding it would suggest the breakout is real. Losing it puts the $64,000 floor back in play.

Crypto World

Can Ethereum price reclaim $2,400 as it eyes a bullish reversal amid market recovery?

Ethereum bulls pushed its price to nearly $2,200 on Thursday amid a market-wide recovery.

Summary

- Ethereum price rebounded to a 4-week high on Friday amid increased demand from institutional traders and a surge in short liquidations.

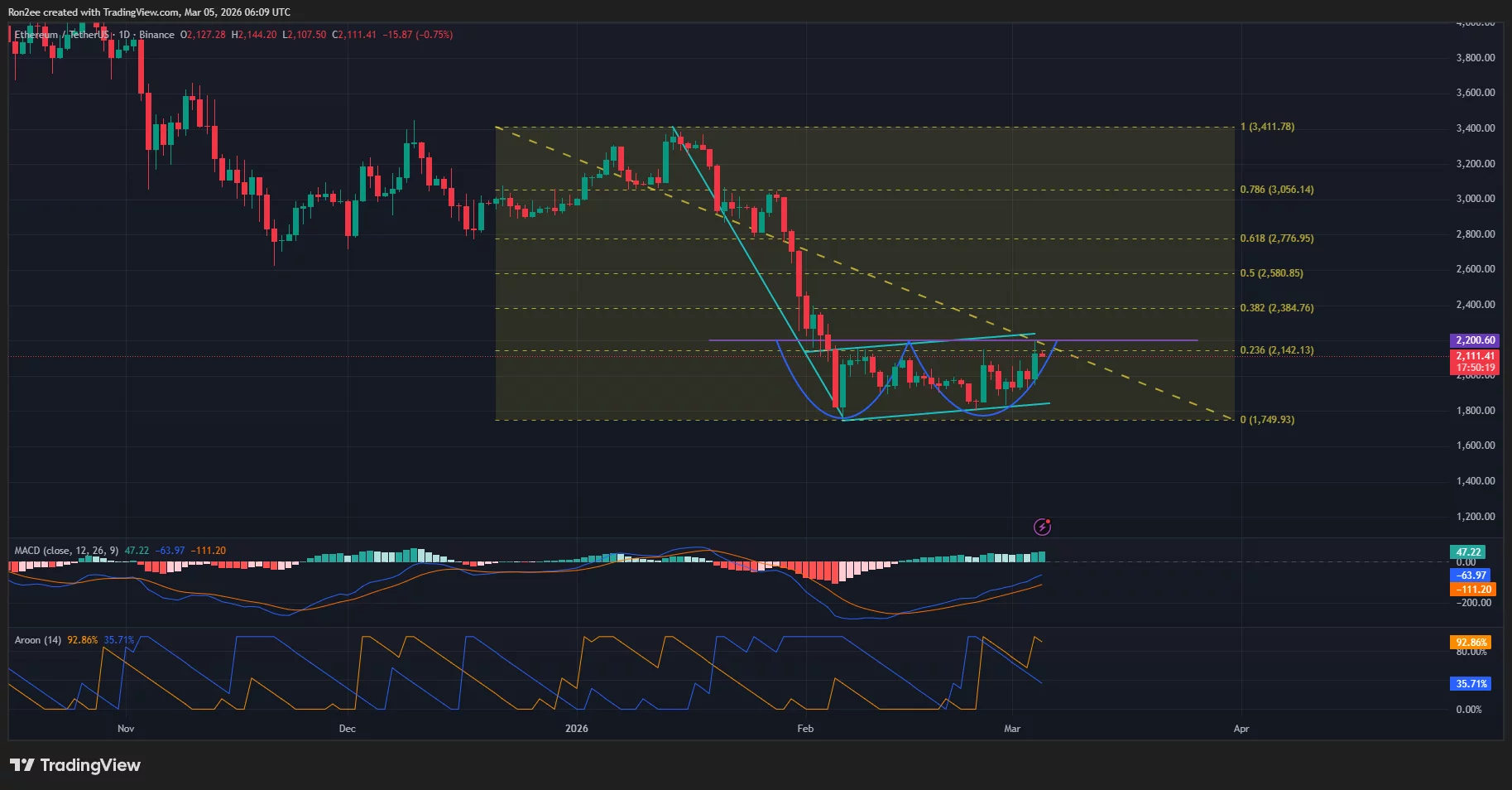

- ETH has formed a double bottom pattern on the daily chart.

According to data from crypto.news, Ethereum (ETH) price rallied over 11% to a 4-week high of $2,192.

Ethereum price rallied amid a broader market recovery led by Bitcoin. The bellwether reclaimed the $73,000 mark for the first time since early February as reports emerged that the U.S. and Iran could be negotiating a deal to end their military confrontation.

As ETH price rose, it triggered a short squeeze of traders with highly leveraged bearish bets in the derivatives market. Data from CoinGlass show over $133 million in short positions were liquidated in the past 24 hours, compared to only $21.5 million in long positions.

A return of inflows into spot Ethereum ETFs also seems to suggest that institutional investors had played a significant part in the recovery. Per data compiled by Farside Investors, spot Ethereum ETFs drew in $169.4 million yesterday.

Simultaneously, Ethereum’s open interest shot up nearly 15%, which is a sign of increased derivatives market activity after multiple days of stagnation. While the weighted funding rate remains negative at press time, if it continues to climb, a shift toward positive funding rates could signal a return of bullish sentiment.

This surge in activity suggests that traders are once again aggressively positioning themselves, potentially setting the stage for more volatility if the price breaks key resistance levels.

On the daily chart, Ethereum price has formed a double bottom pattern, a major bullish reversal pattern formed of two consecutive troughs. The neckline of the pattern lies at the $2,200 psychological resistance level.

A breakout from the neckline could push Ethereum to $2,400, which aligns with the 38.2% Fibonacci retracement level that is often seen as a critical target for a trend reversal.

It should also be noted that a successful reclaiming of the $2,400 mark would invalidate a larger bearish flag pattern forming on the chart.

Key technical indicators seem to suggest that bulls are already on the move. Notably, the MACD lines have formed a bullish crossover and were pointing upwards, while the Aroon Up showed a reading of 92.86%, far above the bearish indicator at 35.71%.

For now, traders are eyeing $2,142, the 23.6% Fibonacci retracement level, as a key resistance. ETH was trading at $2,117 when writing, just 1.1% below that mark.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Can $155M ETF inflows extend the rally?

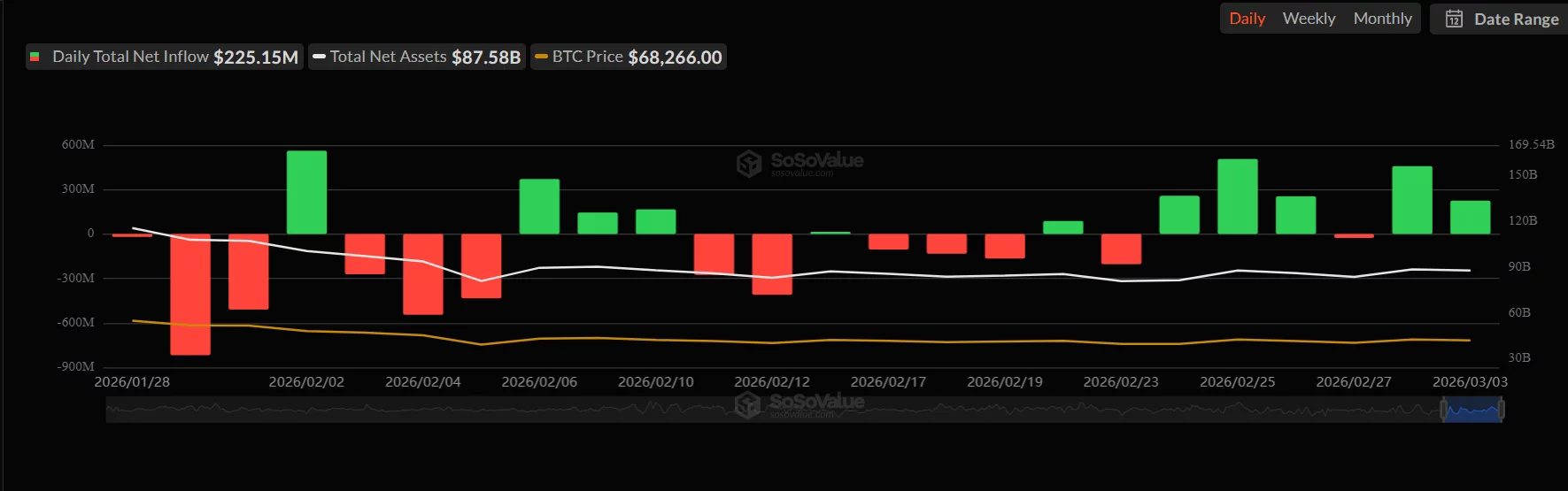

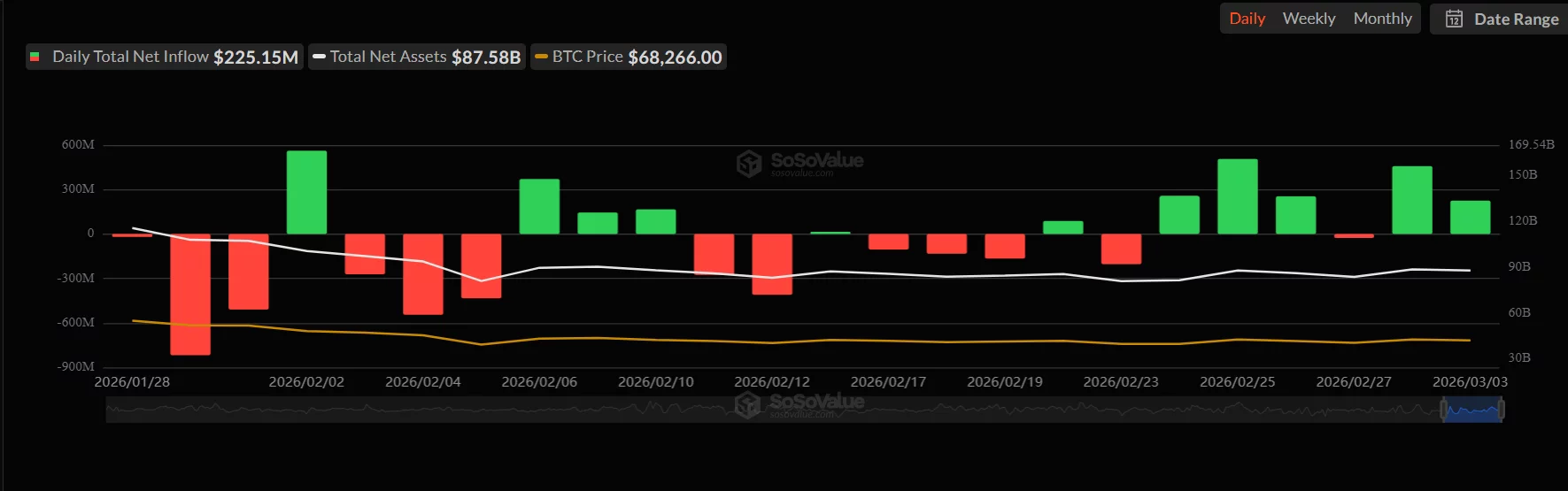

Bitcoin is regaining bullish momentum after a week of geopolitical-driven volatility, with fresh inflows into spot exchange-traded funds helping support the latest price rebound.

Summary

- Spot Bitcoin ETFs recorded roughly $155 million in net inflows, signaling renewed institutional demand.

- Bitcoin has recovered after last week’s volatility triggered by Middle East geopolitical tensions.

- Analysts say BTC could test $75,000 resistance if momentum and ETF inflows persist.

Data from SoSoValue shows that Bitcoin ETFs recorded about $155 million in daily net inflows, reversing a period of sustained outflows seen earlier in the week.

The renewed institutional demand comes as Bitcoin (BTC) stabilizes after sharp price swings triggered by rising tensions in the Middle East, which had briefly pressured risk assets across global markets.

The inflows appear to be translating into market strength. Bitcoin has climbed back above the $72,000 level, recovering from a dip near the $60,000–$65,000 zone during last week’s risk-off sentiment.

Previous market reports suggested that ETF demand and short covering were key drivers behind Bitcoin’s earlier rally toward $72,000, and the latest inflows indicate institutional buyers may be returning to the market.

Bitcoin price analysis

Beyond macro sentiment, the chart structure suggests Bitcoin is attempting to build a recovery trend.

On the daily chart, Bitcoin is currently trading around $72,500, pushing toward a key resistance band between $73,000 and $75,000. A decisive breakout above this zone could open the door for a retest of the $80,000 psychological level in the coming weeks.

Support levels remain near $69,000, followed by stronger structural support around $65,000, where buyers previously stepped in during the February correction.

Momentum indicators are also improving. The Accumulation/Distribution line is trending higher, suggesting renewed buying pressure, while the Bull Bear Power (BBP) indicator has flipped positive, signaling that bullish momentum may be returning after several weeks of selling pressure.

If ETF inflows continue and macro risks stabilize, Bitcoin could extend its recovery. However, analysts warn that failure to hold above the $70,000 region could trigger another consolidation phase before the next major move.

Crypto World

Coinbase, Microsoft and Europol dismantle Tycoon 2FA phishing network

Crypto exchange Coinbase teamed up with Microsoft and Europol to take down phishing-as-a-service platform Tycoon 2FA.

Summary

- Coinbase helped trace blockchain transactions linked to the Tycoon 2FA phishing network, allowing investigators to identify the platform’s alleged administrator and several users of the service.

- Tycoon 2FA offered a subscription toolkit that enabled criminals to intercept authentication sessions and bypass multi-factor protections.

- Phishing losses dropped nearly 83% in 2025.

In a Wednesday announcement, Coinbase said that it helped trace blockchain-based transactions linked to the platform, and as a result, law enforcement was able to identify the phishing operation’s alleged administrator and several of its customers.

According to Europol, Tycoon 2FA sold a subscription-based toolkit that helped bad actors intercept live authentication sessions and gain unauthorised access to online accounts, “including those protected by additional security layers.”

Using Tycoon’s phishing toolkit, cybercriminals were able to capture session cookies from authenticated users and therefore access accounts without triggering the multi-factor authentication prompts, Coinbase said.

“We’re actively working to identify Tycoon purchasers and will continue supporting law enforcement efforts focused on the people who bought and used this service to target victims,” it added.

The platform has been active since at least 2023, and by mid-2025, Tycoon 2FA accounted for nearly 62% of all phishing attacks blocked by Microsoft, Europol said.

“At scale, the platform generated tens of millions of phishing emails each month and facilitated unauthorised access to nearly 100,000 organisations globally, including schools, hospitals, and public institutions,” it added.

As previously reported by crypto.news, losses from phishing attacks dropped 83% in 2025 when compared to the previous year. Nevertheless, attackers have continued to use more advanced techniques, including exploits tied to EIP-7702, Permit and Permit2 signatures, and transfer-based attacks.

A separate report from blockchain security firm CertiK flagged that Phishing attacks remained the third most costly attack vector in 2025.

Crypto World

Eric Trump calls banks opposing stablecoin yields ‘anti-American’

Eric Trump has accused major U.S. banks of lobbying aggressively against crypto platforms offering higher yields to consumers, escalating tensions between the traditional financial sector and the digital asset industry.

Summary

- Eric Trump accused major U.S. banks of lobbying against crypto and stablecoin yield products.

- The comments come as debate intensifies around the CLARITY Act and GENIUS Act.

- Donald Trump also criticized banks, arguing legislation is needed to keep the U.S. competitive in the crypto sector.

Eric Trump accuses big banks of lobbying against crypto yields

In a post on X, Eric Trump claimed that institutions such as JPMorgan Chase, Bank of America, and Wells Fargo are attempting to block Americans from earning higher returns through crypto-based savings products.

“Big banks are lobbying overtime to block Americans from getting higher yields on their savings,” Trump wrote, arguing that traditional lenders offer extremely low annual percentage yields, often between 0.01% and 0.05%, despite benefiting from higher interest rates paid by the Federal Reserve.

According to Trump, the banking sector is particularly concerned about crypto and stablecoin platforms that are planning to offer yields or rewards in the 4% to 5% range. He alleged that banking lobby groups are spending heavily to restrict those products through legislation and regulatory pressure.

The comments come as lawmakers debate new digital asset legislation in Washington, including the CLARITY Act, which aims to define the regulatory framework for cryptocurrencies, and the GENIUS Act.

Trump argued that banks are invoking concerns about “fairness” and financial stability while attempting to protect profit margins built on the gap between the interest they receive and the rates paid to depositors.

The criticism echoes remarks made by Donald Trump, who recently said large banks are attempting to undermine crypto legislation that could strengthen the United States’ position in the global digital asset industry.

In a statement posted on Truth Social, the president said Congress must move quickly on market structure legislation to prevent the crypto industry from shifting to other countries.

The debate highlights growing friction between the banking industry and crypto firms as policymakers weigh how to regulate digital assets while maintaining the competitiveness of the U.S. financial system.

Crypto World

Bitwise allocates $233K to support Bitcoin core development

Bitwise Asset Management has announced a $233,000 donation to Bitcoin open-source developers, marking the firm’s second annual contribution tied to the success of its spot Bitcoin exchange-traded fund.

Summary

- Bitwise Asset Management donated $233,000 to Bitcoin development groups as part of its commitment to allocate 10% of gross profits from its Bitcoin ETF.

- The donation will be distributed through Brink, OpenSats, and the Human Rights Foundation Bitcoin Development Fund.

- The contribution follows continued growth of the Bitwise Bitcoin ETF since its launch.

The funds come from profits generated by the Bitwise Bitcoin ETF, which launched with a commitment from Bitwise to allocate 10% of the ETF’s gross profits each year toward supporting the development and security of the Bitcoin network.

According to the firm, the latest contribution reflects strong growth in the ETF during the past year, allowing the company to expand its support for the developers maintaining Bitcoin’s underlying infrastructure.

The donation will be distributed among three nonprofit organizations focused on sustaining the Bitcoin ecosystem: Brink, OpenSats, and the Human Rights Foundation Bitcoin Development Fund.

These groups provide funding, fellowships, and grants to developers working on critical Bitcoin software, security research, and infrastructure upgrades. Their mission centers on supporting the open-source contributors responsible for maintaining and improving the decentralized network.

Bitwise described the developers as “unsung heroes” who help secure and evolve Bitcoin’s technology stack, noting that the contribution represents a reinvestment into the ecosystem that supports the firm’s investment products.

The asset manager also credited investors in the ETF for enabling the donation, stating that the contribution would not be possible without the support of those who chose to invest in the fund.

Bitwise added that its donations are expected to grow alongside the ETF’s expansion, reinforcing its pledge to continue directing a portion of profits toward the broader Bitcoin development community.

The initiative reflects a broader trend among crypto firms and investment products that are increasingly channeling funds toward open-source development as institutional interest in Bitcoin continues to rise.

Crypto World

The signal investors are missing

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

While market headlines focus on short-term price swings, the real signal shaping America’s crypto future in 2026 lies beneath the surface. Institutional infrastructure, regulatory developments, and a shift toward long-term investor strategy are quietly redefining how digital assets integrate into the U.S. financial system.

The conversation about digital assets in the United States is becoming increasingly complex as the market enters a new stage of development. Many readers who follow blockchain trends begin their research by exploring the coinspot website, where ongoing discussions about cryptocurrency innovation and market dynamics continue to evolve.

What makes the current situation particularly interesting is that the most important signals shaping the future of crypto in America are not always the ones dominating headlines. While price movements attract attention, deeper structural changes within technology, finance, and regulation are gradually redefining the ecosystem, mentioned on https://coinspot.io/en/

Institutional Strategy Is Quietly Expanding

Financial institutions across the United States are playing a growing role in the evolution of digital assets. What once appeared to be cautious experimentation has gradually transformed into structured long-term strategies.

Investment firms, fintech companies, and payment platforms are building services designed to support cryptocurrency adoption at scale. These initiatives include digital asset custody, blockchain settlement systems, and tokenized financial instruments that connect traditional finance with decentralized technology.

Blockchain Innovation Is Driving Long-Term Growth

Technological development remains one of the strongest forces behind the transformation of the crypto market. Developers continue to improve blockchain networks by increasing scalability, enhancing security protocols, and optimizing transaction performance.

These improvements are enabling the creation of new decentralized applications. From digital ownership systems to decentralized finance platforms, blockchain technology is expanding its role within the global digital economy.

Investor Attention Is Slowly Shifting

Another notable trend involves the changing mindset of market participants. Earlier cycles of the cryptocurrency industry were often dominated by speculation and rapid trading activity.

Today many investors appear more interested in research, technological fundamentals, and long-term strategic positioning. This shift toward a more analytical approach may contribute to a more stable phase of development for digital assets.

Regulation May Shape The Next Phase

Government policy continues to influence how cryptocurrency evolves within the United States. For several years uncertainty surrounding legal frameworks created obstacles for some blockchain initiatives.

However, policymakers are increasingly exploring ways to establish clearer rules for digital assets. A more defined regulatory environment could encourage additional investment and provide greater confidence for companies operating in the crypto sector.

The Signal Many Investors May Overlook

The future of cryptocurrency in America may not depend on a single dramatic breakthrough. Instead, it is being shaped by the gradual convergence of multiple forces including institutional adoption, technological innovation, and evolving investor behavior.

These developments may appear subtle in the short term, yet their long-term implications could be profound. As the crypto ecosystem continues to mature, the signals investors overlook today may ultimately define the direction of the market tomorrow.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

XRP price eyes a rebound as ETF inflows rise, exchange outflows rise

XRP’s price remained flat today, March, continuing the consolidation phase that began in February. However, ongoing inflows into exchange-traded funds and declining exchange supply suggest that a rebound may be on the horizon.

Summary

- XRP price has formed a double-bottom pattern pointing to a strong rebound.

- The supply of XRP tokens on exchanges has dropped to the lowest level in years.

- Data shows that spot XRP ETF inflows have continued rising this month.

Ripple (XRP), one of the top cryptocurrencies, was trading at $1.4282 on Thursday, inside a range it has been in the past few weeks. This price is 28% above the year-to-date low of $1.1137.

American investors are still buying XRP ETFs, a sign that they expect it to rebound in the coming weeks. SoSoValue data shows that spot XRP ETFs added $4.2 million in inflows on Wednesday as the crypto market rally restarted. It was the seventh consecutive day of inflows, with the cumulative total rising to $1.26 billion.

Increased buying by American institutional investors in a time when the price is stuck in a tight range is a sign of accumulation, which often leads to a strong rebound.

Another sign of accumulation is that XRP outflows from exchanges are increasing. Data compiled by CryptoQuant shows that over 7 billion XRP tokens exited exchanges in February. The total amount of XRP tokens in exchanges has dropped to the lowest level in years.

A possible reason why investors are accumulating XRP tokens is its strong fundamentals, including the ongoing Ripple USD growth. The stablecoin has accumulated over $1.5 billion in assets, with its daily volume soaring to over $1.5 billion.

RLUSD is benefiting from the rising demand from both retail and institutional investors, a trend that may continue after its integration on Ripple Prime.

XRP price forecast: Technical analysis

The eight-hour chart shows that the XRP price has remained in a narrow range in the past few weeks.

A closer look shows that it formed a double-bottom pattern at $1.3350 and a neckline at $1.6745. This pattern normally means that short-sellers are largely uncomfortable placing short trades below that level.

The coin has moved slightly above the 50-day Exponential Moving Average. Also, the Percentage Price Oscillator has crossed the zero line, while the Relative Strength Index has jumped above 50.

Therefore, the most likely XRP price forecast is bullish, with the next key target being the neckline at $1.6638. The bullish view will become invalid if it drops below the key support level at $1.3350.

Crypto World

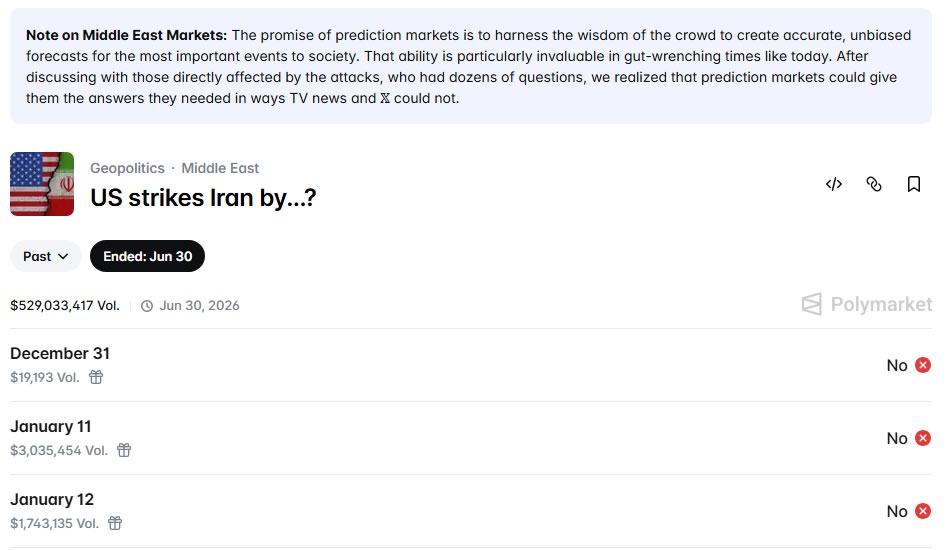

Iran Strike Bets Usher Moves to Curb Prediction Markets

Senator Chris Murphy says it’s likely people close to Donald Trump with “inside information” made bets on prediction markets on when the US would strike Iran.

US Democratic lawmakers are working on a bill to police prediction markets after raising insider trading concerns over bets made on the timing of Israeli and US strikes on Iran.

Democrat Senator Chris Murphy said in a video posted to X on Wednesday that what he claimed were White House insiders made a “very specific bet” on Friday that the US would go to war with Iran on Saturday.

“Obviously, there are people close to Donald Trump who, on Friday, knew what was happening on Saturday, and it is very likely — probable even — that the people that placed those bets were people with inside information,” he said.

Murphy added that allowing bets on war to continue could see those close to the president “pushing us into war because they can cash in.”

A number of bets on Polymarket were widely circulated on Saturday, where six newly-created accounts reportedly earned around $1 million betting on the timing of US strikes on Iran.

In several cases, bets were made just hours before explosions were first reported in Tehran.

Bets on US strikes in Iran have so far generated $529 million in volume on Polymarket. Last month, a Polymarket trader made about $400,000 from a well-timed wager on the capture of Venezuelan President Nicolás Maduro.

Bill to target prediction market insider trading

Reuters reported on Thursday that Murphy and Democratic House Representative Mike Levin are working on the bill, intensifying pressure on prediction markets such as Polymarket and Kalshi.

Related: Polymarket user gains $400K betting on ZachXBT investigation

“It’s unbelievably clear to me that if anyone is using prior knowledge of military action for financial gain, that should be absolutely illegal,” Levin said.

He added that commodity laws ban event contracts tied to war, terrorism, or other events “contrary to the public interest,” but the rules give prediction markets too much freedom.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech22 hours ago

Tech22 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports11 hours ago

Sports11 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker