Crypto World

Peter Thiel’s Founders Fund Exits ETHZilla as Ether Treasuries Strain

Billionaire tech investor Peter Thiel’s Founders Fund has fully exited Ether treasury company ETHZilla, according to a Tuesday filing with the United States Securities and Exchange Commission (SEC).

Entities linked to Thiel now report owning zero shares in the company in a 13G amendment filed on Tuesday, after disclosing a 7.5% stake on Aug. 4, 2025.

At that time, the group beneficially owned 11,592,241 shares of what was then known as 180 Life Sciences Corp., representing 7.5% of the 154,032,084 shares outstanding and worth about $40 million based on trading at around $3.50 per share in early August.

180 Life Sciences rebrands to ETHZilla

180 Life Sciences raised $425 million in July 2025 to launch an Ether treasury strategy and rebrand as ETHZilla.

The company later moved to raise another $350 million via convertible bonds in September to expand its Ether (ETH) holdings and deploy them across decentralized finance (DeFi) and tokenized assets, at one point holding more than 100,000 Ether.

Related: Bitmine’s staked Ether holdings point to $164M in annual staking revenue

ETHZilla began unloading tokens as markets turned, liquidating 24,291 Ether for $74.5 million in December 2025 at an average price of $3,068.69 per token, to repay debt, leaving about 69,800 ETH on its balance sheet.

Strain on Ether treasury company models

Thiel’s exit is the latest stress signal for public companies with crypto treasuries built around Ether rather than Bitcoin (BTC).

Other large Ether accumulators are taking different approaches. BitMine Immersion Technologies, the largest listed Ethereum holder, acquired a further 40,613 ETH on Feb. 9, lifting its total holdings to more than 4.325 million ETH, worth about $8.8 billion at current prices.

Trend Research, on the other hand, began unwinding its entire Ethereum position this month, selling 651,757 ETH for about $1.34 billion on Feb. 8, locking in an estimated $747 million realized loss.

ETHZilla has since tried to diversify by launching ETHZilla Aerospace, a subsidiary offering tokenized exposure to leased jet engines. However, Thiel’s exit magnifies how volatile Ether‑heavy treasury strategies have become in a market still digesting last year’s peak.

Magazine: Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Bitcoin Entering Phase 2 Bear Market, Analyst Warns

Analyst warns Bitcoin nearing Phase 2 bear market as volatility and liquidity trends point to further downside risk across crypto markets.

Veteran on-chain analyst Willy Woo has warned that the Bitcoin (BTC) market is strengthening its bear trend and approaching the second phase of a multi-stage downturn.

The forecast challenges persistent bullish narratives, suggesting the worst may be ahead for the world’s largest cryptocurrency.

Phase 1 Nears Its End as Volatility Spells Trouble

In a series of posts on X on February 18, Woo outlined a three-phase bear market framework, positioning Bitcoin at a crucial juncture. According to him, the first stage of the current bear market started in the third quarter of 2025 when liquidity first broke down, and the price started to follow.

He explained that the key signal comes from volatility metrics used by quantitative analysts, with Bitcoin entering a prolonged decline when volatility spiked upward. That volatility is still climbing, indicating the bear trend is gaining ground.

“In this phase, perma bulls will blindly say it’s a correction inside a broader bull market but will not give you any hard evidence of capital flowing in,” Woo wrote.

The analyst added that his internal liquidity models, released weekly to investors, currently match the volatility signals. In his opinion, the second part of the bear market will kick in when global equities begin to weaken.

He argued that the largest cryptocurrency often reacts faster than equities when capital exits markets because of its smaller size and higher sensitivity to liquidity shifts.

“Under this bear market framework, BTC is presently in Phase 1 and close to Phase 2,” stated Woo.

He characterized the final episode as “the light at the end of the tunnel,” predicting a turnaround in liquidity, with capital outflows hitting a high point before stabilizing. However, he warned that there could be one more price capitulation just before or immediately after the peak outflows.

You may also like:

Cycle Indicators Show Mixed Signals for Long-Term Outlook

Not all analysts are interpreting the data as outright bearish. In a recent post, Axel Adler Jr. wrote that Bitcoin’s Entity-Adjusted Liveliness metric peaked in December 2025 and has started declining, a pattern seen in past accumulation periods lasting between 1.1 and 2.5 years. The indicator tracks BTC movement relative to holding time and tends to fall after distribution periods end.

Another perspective from GugaOnChain focused on valuation. Using the MVRV Z-Score developed by Murad Mahmudov and David Puell, the analyst said the current reading near 0.48 places Bitcoin close to historical accumulation zones rather than overheated territory. That suggests some investors may see current prices as discounted compared with average acquisition costs.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

botim money launches digital silver with fractional access from AED 10

Editor’s note: This editorial perspective highlights a notable step in fintech inclusion. botim money’s expansion into digital silver underscores a growing trend toward accessible, regulated investing within popular UAE apps. By enabling fractional ownership from AED 10 and extending its Invest suite in partnership with OGold, botim aims to broaden asset diversification for millions of users. The move follows botim’s gold investment capability and reflects UAE’s push toward a digital-first, regulated financial ecosystem where everyday people can participate in precious metals markets with ease and security.

Key points

- Digital silver investing is added to botim money’s Invest feature, enabling fractional access from AED 10.

- The launch expands botim’s strategic partnership with OGold to broaden precious metals access in the UAE.

- Gold investment performance (128,000 trades, over AED 100 million) signals strong user demand for expanded metals offerings.

Why this matters

With silver drawing renewed attention as a store of value and industrial metal, botim money’s in-app silver offering lowers entry barriers and provides a regulated, user-friendly path to diversification. The UAE-focused rollout aligns with market demand for digital-first financial tools and broadens access to precious metals for millions of users within a popular fintech ecosystem.

What to watch next

- Uptake of digital silver within botim money’s Invest feature and its impact on user engagement.

- Potential expansion of the precious metals suite to include additional metals or products with partners like OGold.

- Continued alignment with UAE’s digital-first financial ecosystem and regulatory developments.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Press release: botim money launches digital silver with fractional access from AED 10

Dubai, UAE – 18 February 2026 – botim money, the financial services arm of botim, today announced the launch of digital silver investing within its ‘Invest’ feature, enabling eligible users to buy, sell, and manage fractional silver holdings from AED 10. The launch follows the in-app gold investing capability introduced in partnership with OGold, expanding botim’s precious metals suite across the UAE.

The new capability is designed to lower traditional entry barriers tied to bulk purchases and offline handling, giving users a simpler way to access silver through a regulated, in-app experience. It forms part of botim’s broader build-out of practical financial tools across the platform, alongside existing payments and remittance use cases.

Since its launch in August 2025, botim money’s gold investment feature recorded 128,000 in-app gold trades with a total amount exceeding AED 100 million. This rapid adoption signals strong and sustained user demand to expand botim money’s ‘Invest’ offerings beyond gold into silver within the same suite.

Sacha Haider, Chief Operating Officer of Astra Tech | botim, said:

We were the first fintech platform to announce plans for a digital gold investment portfolio within botim’s fintech ecosystem in 2023, in partnership with OGold. Since launch, fractional investing has removed traditional minimum investment thresholds that historically limited participation and driven notable growth in usage. Extended to silver and combined with botim’s ease of use and scale, this creates a seamless and inclusive pathway for users to begin investing with confidence.

Bandar Alothman, Chairman & Founder at OGold,

As an Emirati company, our goal at OGold is to make precious metal ownership simple, accessible, and secure for everyone. Partnering with a platform as widely used as botim allows us to extend these innovative silver-earning solutions to millions of users. This is a game-changer for democratizing access to timeless assets through Silver Wakalah, which ensures your silver is not a stagnant investment. Instead of just sitting in a vault, your silver is put to work to grow your wealth with just a few taps.

The launch comes as silver draws renewed attention globally both as a store-of-value asset and as an industrial metal with structural demand drivers. With the global silver market expected to record a sixth consecutive annual deficit in 2026, and a projected shortfall of around 67 million ounces, while retail investment demand is forecast to rise despite softer demand in some industrial and consumer categories.

By extending botim’s investment offering beyond gold into silver, botim is broadening access to asset diversification for everyday users while continuing to build toward the UAE’s ambition of a mature, digital-first financial ecosystem.

The digital silver feature is now available to eligible users through the botim app.

About botim

botim, part of Astra Tech’s ecosystem, is the MENA region’s leading fintech company headquartered in Abu Dhabi. Botim is a fintech-first, AI-native platform offering inclusive, user-centric solutions for financial services. Built on the foundation of being the UAE’s first free VoIP provider, Botim has evolved into a multi-layered ecosystem serving over 150 million users across 155 countries.

Designed to meet the needs of MENA consumers, businesses, and communities, botim delivers integrated services with innovation, accessibility, and regulatory credibility at its core. botim is building the next generation of everyday finance and connectivity easier, smarter, and more inclusive for everyone.

Crypto World

FTSE 100 Index Climbs to a Record High

The UK Consumer Price Index (CPI) report released today showed a slowdown in inflation. According to Forex Factory, the annual figure came in at 3.0%, compared with 3.4% the previous month.

Media reports note that:

→ this marks the lowest level since March 2025;

→ the easing in inflation was driven by lower prices for petrol, air fares, food and education.

As a result, optimism prevails in the equity market, with expectations of monetary policy easing gaining traction. According to Trading Economics, the bullish trend is particularly evident in defence and mining stocks.

The chart of the UK’s FTSE 100 index (UK 100 on FXOpen) shows the market in a clear uptrend, with a sequence of higher highs and higher lows allowing an ascending channel to be drawn.

Technical Analysis of the FTSE 100 Chart

Bullish strength is highlighted by:

→ the price’s decisive break above the 10,600 level and its ability to hold above it this week;

→ the behaviour of the line dividing the upper half of the channel into two quarters. This line acted as resistance throughout February but was broken to the upside today — and may now serve as support.

The RSI indicator has moved into overbought territory. However, given the strength of the fundamental driver, any pullbacks are unlikely to be deep.

It is reasonable to assume that bullish sentiment will continue to dominate the FTSE 100, with 10,750 — near the upper boundary of the long-term channel — potentially serving as a target for profit-taking.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Kaspersky finds Keenadu Android malware preinstalled on devices

Editor’s note: In an era of increasingly covert software supply chain threats, Kaspersky’s Keenadu discovery highlights how malware can slip into devices at multiple points—from preinstalled firmware to apps from official stores. This briefing breaks down what Keenadu is, how it operates, and what consumers and vendors should watch for as mobile devices become more integrated with smart ecosystems. While the study is technical, the takeaway is clear: routine device updates and robust security layers remain essential for staying ahead of evolving threats.

Key points

- Keenadu is Android malware that can be preinstalled in firmware, embedded in system apps, or downloaded from official stores.

- Used for ad fraud and can give attackers full control over the device in some variants.

- As of February 2026, over 13,000 infected devices reported; Russia, Japan, Germany, Brazil and others affected.

- Variants include firmware-integrated backdoors, system-app implants, and malicious apps on Google Play.

- Some infected apps on Google Play have been removed; risk persists with other app stores and APKs.

Why this matters

Preinstalled malware threatens users at the earliest moment of device setup, bypassing typical defenses and elevating the risk profile for mobile ecosystems. The Keenadu case underscores the need for rigorous supply-chain verification and proactive security solutions that monitor firmware and app-level integrity.

What to watch next

- Ongoing updates from Kaspersky on Keenadu variants and distribution vectors.

- Monitoring for new devices affected via firmware supply chains or app stores.

- User guidance to apply firmware updates and use reputable security software to detect such threats.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Kaspersky finds Keenadu Android malware preinstalled on devices

Kaspersky has detected a new malware for Android devices that it dubbed Keenadu. This malware is distributed in multiple forms – it can be preinstalled directly into devices’ firmware, embedded within system apps, or even downloaded from official app stores such as Google Play. Currently Keenadu is used for ad fraud, with attackers using infected devices as bots to deliver link clicks on ads, but it can also be used for malicious purposes, with some variants even allowing full control of the victim’s device.

As of February 2026, Kaspersky mobile security solutions detected over 13,000 devices infected with Keenadu. The highest numbers of the attacked users have been observed in Russia, Japan, Germany, Brazil, the Netherlands, Turkiye, and other countries have been affected.

Integrated into device firmware

Similar to the Triada backdoor that Kaspersky detected in 2025, some versions of Keenadu are integrated into the firmware of several models of Android tablets at one of the supply chain stages. In this variant, Keenadu is a fully functional backdoor that provides the attackers with unlimited control over the victim’s device. It can infect every app installed on the device, install any apps from APK files and give them any available permissions. As a result, all information on the device, including media, messages, banking credentials, location, etc., can be compromised. The malware even monitors search queries that the user inputs into the Chrome browser in incognito mode.

When integrated into the firmware, the malware behaves differently depending on several factors. It will not activate if the language set on the device is one of Chinese dialects, and the time is set to one of Chinese time zones. It will also not launch if the device doesn’t have Google Play Store and Google Play Services installed.

Embedded within system apps

In this variant, the functionality of Keenadu is limited – it cannot infect every app on the device, but since it exists within a system app (which has elevated privileges compared to usual apps), it can still install any side apps that the attackers choose without the user knowing. What’s more, Kaspersky discovered Keenadu embedded within a system application responsible for unlocking the device with the user’s face. The attackers could potentially acquire victim’s face data. In some cases, Keenadu was embedded within the home screen app which is responsible for the home screen interface.

Embedded within apps distributed through Android app stores

Kaspersky experts also discovered that several apps distributed on Google Play are infected with Keenadu. These are apps for smart home cameras, and they’ve been downloaded over 300,000 times. As of the time of publication, these apps have been removed from Google Play. When the apps are launched, attackers may launch invisible web browser tabs within the apps, that can be used to browse through different websites without the user knowing. Previous research from other cybersecurity researchers also showed similar infected apps being distributed via standalone APK files or through other app stores.

Infected apps on Google Play

As our recent research showed, preinstalled malware is a pressing issue on multiple Android devices. Without any actions on the user side, a device can be infected right out of the box. It is important for users to understand this risk and use security solutions that can detect this type of malware. Vendors likely didn’t know about the supply chain compromise that resulted in Keenadu infiltrating devices, as the malware was imitating legitimate system components. It is important to check every stage of the production process to ensure that device firmware is not infected,” comments Dmitry Kalinin, security researcher at Kaspersky.

See the post on Securelist for more information.

Recommendations:

- Use a reliable security solution to be promptly notified of similar threats on your device.

- If you are using a device with infected firmware, check for firmware updates. After the update, run a scan of the device with a security solution.

- If a system app is infected, we recommend that users stop using it and then disable it. If a launcher app is infected, we recommend disabling the default launcher and using third-party launchers.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.

Crypto World

‘YOLO’ Trade Could Drive $150B into Bitcoin, Risk Assets

US tax filers may see bigger refunds in 2026 compared with previous years, a development one Wall Street strategist said could lift risk appetite for tech stocks and digital assets favored by retail investors. In a note cited by CNBC, Wells Fargo analyst Ohsung Kwon estimated that a wave of larger refunds could revive the so‑called “YOLO” trade, with as much as $150 billion potentially flowing into equities and Bitcoin by the end of March. The extra cash could be most visible among higher-income consumers, according to the note.

Key takeaways

- The Wells Fargo projection suggests up to $150 billion in fresh liquidity could reach equities and Bitcoin by the end of March, signaling a potential near‑term risk-on push if refunds materialize as expected.

- Higher‑income households are identified as the primary beneficiaries of the refund wave, which could amplify appetite for volatile, high‑beta assets alongside traditional tech bets.

- Liquidity may flow into Bitcoin and stocks popular with retail traders, including platforms like Robinhood and large cap names such as Boeing, depending on how sentiment evolves.

- Crypto demand remains sentiment‑driven: positive momentum could attract new funds, while lack of enthusiasm may prompt investors to shift to assets with stronger near‑term momentum.

- The macro backdrop includes policy changes tied to the One Big Beautiful Bill Act, signed in mid‑2025, which policymakers argued would trim federal spending and reshape tax refunds in 2025 and beyond.

Sentiment: Neutral

Price impact: Neutral

Market context: In liquidity cycles, tax refunds frequently influence risk appetite, and 2026 could test how retail cash infusions translate into crypto and tech equity demand amid shifting policy signals and macro dynamics.

Why it matters

The intersection of tax policy, consumer liquidity, and retail trading trends has long shaped short‑term risk sentiment in crypto markets. If the refund wave materializes as projected, Bitcoin and other digital assets could see fresh attention from buyers who previously favored high‑growth tech stocks. The timing is notable because refunds are expected to be most visible among higher‑income segments, a cohort historically more active in discretionary investing. This could amplify trading activity in early spring, with price action potentially moving in tandem with broader equity flows as investors rebalance portfolios around tax season liquidity.

On the policy side, the so‑called One Big Beautiful Bill Act, signed on July 4, 2025, is cited as a driver of larger refunds in 2025 and beyond. Proponents argued the measure would curb federal spending and reshape the fiscal landscape, creating a more favorable environment for household cash returns during tax filing periods. The exact allocation of this liquidity remains uncertain, but the implication is that macro signals could feed through to risk assets, including digital currencies, if investor confidence strengthens alongside improving sentiment in crypto markets.

From a market‑structure perspective, the narrative dovetails with ongoing activity from both retail traders and large holders. While some liquidity could tilt toward Bitcoin and equities, others may seek alternative assets with strong momentum or social traction. Observers note that the retail‑oriented ecosystem—platforms and apps that higher‑income consumers already use—could be pivotal in determining where the money lands. The dynamic is further complicated by divergent views on crypto’s near‑term trajectory, with “smart money” positioning painting a mixed picture of risk tolerance in the current cycle.

What to watch next

- Monitor the February–March refund cycle for material evidence of inflows into Bitcoin and consumer tech equities, as highlighted in the Wells Fargo note reported by CNBC.

- Track sentiment indicators across crypto markets; if retail sentiment turns positive, expect increased on‑ramps into digital assets and a potential uptick in on‑chain activity.

- Watch whale and smart‑money behavior for Bitcoin and Ether to gauge whether larger players are dialing up or dialing back exposure as liquidity shifts emerge.

- Observe policy developments and fiscal signals tied to the One Big Beautiful Bill Act to assess any shifts in tax refunds that could influence liquidity cycles.

- Observe the performance of retail‑favorable names like Robinhood and Boeing, which were cited as potential beneficiaries of broader liquidity recovery in a risk‑on environment.

Sources & verification

- CNBC coverage of Wells Fargo analyst Ohsung Kwon’s note on a potential $150 billion refund‑driven inflow into equities and Bitcoin by the end of March 2026.

- Nansen data on “smart money” positioning, including Bitcoin net short exposure and Ether accumulation across multiple wallets.

- The One Big Beautiful Bill Act, signed into law on July 4, 2025, which proponents say shaped tax refund dynamics in 2025 and onward.

Tax refunds, sentiment and the crypto liquidity swing in 2026

As 2026 unfolds, a wave of larger tax refunds could reshape the risk appetite that has underpinned a portion of the crypto market in recent years. Wells Fargo’s Ohsung Kwon, in a note highlighted by CNBC, argues that an acceleration in refunds could reignite a “YOLO” trading mindset among investors who are flush with tax cash. He estimates that as much as $150 billion could move into equities and Bitcoin by the end of March, with the strongest buoyancy likely concentrated among higher‑income households. The framing is important: this is not a guaranteed market impulse, but a liquidity signal that could steer behavior if consumer confidence remains intact and risk appetite returns after a period of uncertainty.

Bitcoin (BTC) demand, the analyst notes, could be highly sentiment dependent. If retail investors rally around crypto assets, new funds might flow into the space, potentially lifting demand for tokens across the sector. Conversely, if sentiment falters, investors may pivot toward assets with more immediate momentum and social traction. The study highlights a dynamic tension: crypto markets often ride the same liquidity waves as the broader stock market, but the timing and magnitude of inflows can diverge based on macro cues and the perceived staying power of the rally.

Adding nuance, Nicolai Sondergaard, a research analyst at Nansen, emphasizes that sentiment acts as a gating factor. “If sentiment starts to come around and retail sees positive upwards momentum in crypto assets, I see that as increasing the likelihood of funds flowing in this direction,” he told Cointelegraph. The caveat is clear: a lack of enthusiasm could encourage retail traders to seek assets with stronger near‑term momentum, potentially dampening crypto inflows even if refunds are robust. The outcome hinges not just on the size of the refunds but on how widely the wind shifts from caution to confidence across the retail trading ecosystem.

The macro backdrop remains complex. The policy shift tied to the One Big Beautiful Bill Act, signed into law in 2025, is frequently cited as a contributor to the broader liquidity environment. While the bill’s supporters framed it as a measure to trim federal spending and reallocate resources, critics warned of unintended consequences for the pace and distribution of tax refunds. In practice, liquidity—in the form of refunds and discretionary cash—can influence trading dynamics across both traditional equities and digital assets. In this context, crypto developers and market participants are watching not only on‑chain data but also the evolving policy landscape that could redefine the cushion of available capital for speculative bets.

On the supply side, market participants have shown a bifurcated stance. While some whales continue to accumulate spot Ether across multiple wallets, the smart‑money cohort has been net short on Bitcoin for a sizable cumulative amount, according to Nansen’s metrics. The divergence underscores a market where large holders are positioning for different outcomes than the broader retail narrative. It also implies that any rebound in risk appetite could be tested by how quickly the composition of buyers shifts from traders favoring short‑term profits to investors willing to hold through volatility. In the near term, the liquidity landscape remains unsettled, and the pace of inflows will likely hinge on a confluence of sentiment, policy signals, and on‑chain activity.

What to watch next (summary)

- Early‑spring refund data and corresponding flows into Bitcoin and select equities to confirm the magnitude of the YOLO bid.

- Shifts in retail sentiment toward crypto assets, as evidenced by on‑chain activity and exchange flows.

- Whale activity and smart‑money positioning for Bitcoin and Ether to gauge whether accumulation or unwind is prevailing.

- Policy updates related to tax refunds and federal spending to assess how fiscal changes influence liquidity dynamics.

- Market reactions in retail‑oriented platforms and names tied to high retail engagement, reflecting the broader risk‑on environment.

Crypto World

ICO Development Guide 2026 | Tokenomics, Compliance, and Launch Strategy

Raising capital is no longer the hardest part of building a blockchain project. Sustaining value after launch is. Today, many Web3 founders enter fundraising with strong technology, passionate teams, and promising roadmaps. Yet, within months of launching, their tokens lose momentum, investor confidence declines, and communities disengage. The problem is rarely the idea. It is usually the economic structure behind it.

Without clear token utility, disciplined emissions, and governance alignment, even well-funded projects struggle to survive volatile market cycles. This is why working with a proven ICO development company has become a strategic necessity rather than an optional choice. This guide is designed for serious founders, protocol teams, and enterprises who want to build scalable, investor-ready ecosystems. You will learn how sustainable tokenomics, structured governance, and professional execution can transform your ICO into a long-term growth engine.

Why Well-Funded ICOs Still Collapse After Launch

Many founders assume that once funding is secured, success will naturally follow. In reality, funding only creates opportunity. Execution determines survival. Capital can amplify progress, but it can also accelerate structural weaknesses if the foundation is not carefully designed. Even well-funded projects can unravel faster than undercapitalized ones, without a disciplined economic model and operational clarity.

Some of the most common reasons ICOs fail after raising capital include:

- Excessive token inflation that dilutes value

- Weak or unclear utility models

- Overgenerous early investor allocations

- Lack of post-launch engagement strategy

- Poor liquidity planning

- Absence of governance frameworks

When these issues combine, selling pressure increases while demand stagnates. The result is a rapid decline in market confidence. Investor sentiment shifts quickly, liquidity dries up, and community morale weakens. Founders then spend most of their time firefighting instead of building. A strong launch must be engineered with sustainability in mind from day one.

Get expert feedback on your tokenomics, compliance readiness, and launch plan.

How Weak Token Economics Destroys Long-Term Project Value

When token supply grows faster than real usage, price erosion becomes inevitable. When rewards are misaligned, participants exploit incentives instead of contributing value. When governance lacks structure, disputes paralyze development. Sustainable ICO development requires deep modeling of how tokens will circulate, accumulate value, and support growth over time. It is about aligning user behavior with network success.

Projects that ignore this reality often experience:

- Rapid investor exits

- Exchange delistings

- Reduced partnership interest

- Difficulty raising follow-on capital

- Long-term brand damage

Once trust is lost, rebuilding it is extremely costly.

What VCs & Strategic Investors Look for Before Backing an ICO

Institutional investors no longer invest based on whitepapers alone. They evaluate token launches using rigorous frameworks. Before committing capital, most professional investors examine:

Is the token essential to the ecosystem, or is it optional?

Tokens without core utility struggle to maintain demand. Investors look for clear, recurring use cases that generate consistent transactional activity and long-term relevance.

Are supply releases predictable and disciplined?

Uncontrolled inflation signals high risk. Well-structured emission schedules demonstrate financial discipline and protect early participants from excessive dilution.

Do founders and early backers have long-term lockups?

Short vesting often leads to early dumping. Extended vesting periods signal commitment and align leadership incentives with ecosystem growth.

Is there a clear plan for managing raised funds?

Poor treasury strategy weakens sustainability. Institutional backers expect transparent budgeting, reserve planning, and responsible capital deployment.

Do token holders have meaningful participation?

Governance builds long-term engagement. Clear voting systems and proposal mechanisms help prevent internal conflicts and promote community ownership.

Are security audits, compliance planning, and contingency strategies in place?

Strong risk management reduces operational uncertainty and protects both users and investors from avoidable losses.

Projects that satisfy these criteria attract stronger capital and long-term partners.

Uncover hidden gaps in your token model and strategy.

The Six Pillars of Scalable ICO Development Architecture

- Supply and Emission Control: Supply schedules must balance incentives and scarcity. Gradual emissions encourage participation without creating excessive selling pressure. Effective ICO development involves testing multiple scenarios to maintain stability across growth phases.

- Utility Driven Demand: Tokens must provide real access, functionality, or economic benefits. Utility should be embedded into core product operations, as artificial demand rarely sustains long-term engagement.

- Governance and Voting Rights: Transparent governance systems strengthen community trust and reduce centralization risk. Clear voting processes support sustainable decision-making.

- Treasury and Reserve Design: Capital allocation must support development, security, and operations for multiple years. Reliable ICO development services help structure treasuries for long-term financial discipline.

- Vesting and Lockups: Well-designed vesting protects against short-term speculation and reinforces long-term commitment from founders and early investors.

- Liquidity Strategy: Liquidity planning is essential to stabilize early trading and manage volatility through exchange partnerships and market-making support.

When these pillars work together, ecosystems remain resilient under pressure and are positioned for sustainable growth.

Why Strategic Development Partners Matter in High-Stakes ICO Launches

Building a compliant, secure, and scalable token ecosystem requires expertise across economics, technology, regulation, and community development. Professional ICO development services extend far beyond basic smart contract deployment by integrating multiple strategic functions into a unified launch framework. Experienced partners support founders by helping them:

- Identify economic vulnerabilities before they impact token stability

- Optimize token distribution and incentive structures for long-term sustainability

- Prepare institutional-grade technical, legal, and compliance documentation

- Coordinate comprehensive security audits and regulatory reviews

- Design transparent and scalable post-launch governance systems

- Enable long-term platform performance and infrastructure growth

This integrated approach minimizes execution risk, strengthens investor confidence, and supports sustainable ecosystem expansion.

Critical ICO Mistakes Even Experienced Founders Make

Common pitfalls in ICO development include:

- Copying popular token models without customization

- Underestimating liquidity requirements

- Ignoring regulatory exposure

- Overpromising roadmap milestones

- Delaying governance implementation

- Prioritizing hype over infrastructure

Avoiding these errors requires disciplined planning, experienced oversight, and regular external review.

Are You Ready for a High-Impact ICO Launch

The difference between a short-lived token launch and a scalable digital economy lies in preparation, structure, and execution. Serious founders understand that sustainable growth does not happen by chance. It is engineered through disciplined planning, economic modeling, compliance clarity, and technical precision. If you are raising capital, preparing for exchange listings, or designing tokenomics for long-term value, now is the moment to make strategic decisions. The right partner can help you identify blind spots, strengthen investor confidence, and protect your ecosystem from avoidable risk.

Antier brings deep expertise in end-to-end ICO development, combining tokenomics strategy, regulatory alignment, smart contract security, and ecosystem architecture into a unified execution framework. Our team works alongside funded founders and Web3 innovators to design investor-ready systems that are built to scale. If you are serious about launching a resilient and institutionally credible token ecosystem, let us evaluate your readiness and design a strategy tailored to your vision.

Frequently Asked Questions

01. What is the main challenge for blockchain projects after their launch?

The main challenge is sustaining value after launch, as many projects experience a decline in token momentum, investor confidence, and community engagement.

02. Why do well-funded ICOs still fail after raising capital?

Well-funded ICOs can fail due to issues like excessive token inflation, unclear utility models, poor post-launch engagement strategies, and lack of governance frameworks.

03. What can founders do to ensure the long-term success of their ICO?

Founders can ensure long-term success by focusing on sustainable tokenomics, structured governance, and professional execution from the very beginning of their project.

Crypto World

Wells Fargo Says YOLO Trade Could Send $150B Into Bitcoin And Risk Assets

US tax filers may see bigger refunds in 2026 compared with previous years, a development one Wall Street strategist said may boost risk appetite for digital assets and tech stocks preferred among retail investors.

In a note cited by CNBC, Wells Fargo analyst Ohsung Kwon said the coming refund wave may help bring back the so-called “YOLO” trade, with as much as $150 billion potentially flowing into equities and Bitcoin (BTC) by the end of March. Kwon said the extra cash could be most visible among higher-income consumers.

“Speculation picks up with bigger savings…we expect YOLO to return,” wrote Wells Fargo analyst Ohsung Kwon in a Sunday note seen by news outlet CNBC. “Additional savings from tax returns, especially for the high-income consumer will flow back into equities, in our view,” he added.

Kwon said some of that liquidity could move into Bitcoin and into stocks popular with retail traders, including Robinhood and Boeing.

Cointelegraph contacted Wells Fargo for details on the assumptions behind the $150 billion estimate and how much of that total the bank expects could go to digital assets, but had not received a response by publication time.

Bitcoin demand depends on sentiment

While some of the taxpayer funds may flow into Bitcoin and digital assets, it’s important to consider the higher inflation and consumer spending compared to the period during the COVID-19 pandemic, Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph:

“If sentiment starts to come around and retail sees positive upwards momentum in crypto assets, I see that as increasing the likelihood of funds flowing in this direction.”

Conversely, retail investors may opt for other assets with “higher momentum and social stickiness,” if digital asset sentiment doesn’t improve in the near term, he said.

The larger tax returns are due to the passage of US President Donald Trump’s One Big Beautiful Bill, which included numerous favorable provisions for 2025 tax filings.

Trump signed the One Big Beautiful Bill Act into law on July 4, 2025, saying it would cut as much as $1.6 trillion in federal spending.

Related: BlackRock enters DeFi as institutional crypto push accelerates: Finance Redefined

Smart money bets on crypto market downside as whales quietly accumulate

Meanwhile, the whales, or large investors, continue their quiet spot accumulation of the leading cryptocurrencies, while the most profitable traders by returns, tracked as “smart money,” are betting on more crypto market downside.

Smart money traders were net short on Bitcoin for a cumulative $107 million, along with most of the leading cryptocurrencies excluding Avalanche (AVAX), according to crypto intelligence platform Nansen.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

Still, whales acquired over $41.9 million worth of spot Ether (ETH) tokens across 22 wallets during the past week, marking a 1.7-fold increase in the spot purchases of this cohort.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

Market Analysis: Gold Sees Profit-Taking While WTI Crude Tests Key Support

Gold price started a downside correction from $5,115. WTI Crude oil is now attempting to recover after sliding toward $61.80.

Important Takeaways for Gold and WTI Crude Oil Prices Analysis Today

· Gold price climbed higher toward the $5,120 zone before there was a sharp decline against the US Dollar.

· A key bearish trend line is forming with resistance at $4,945 on the hourly chart of gold at FXOpen.

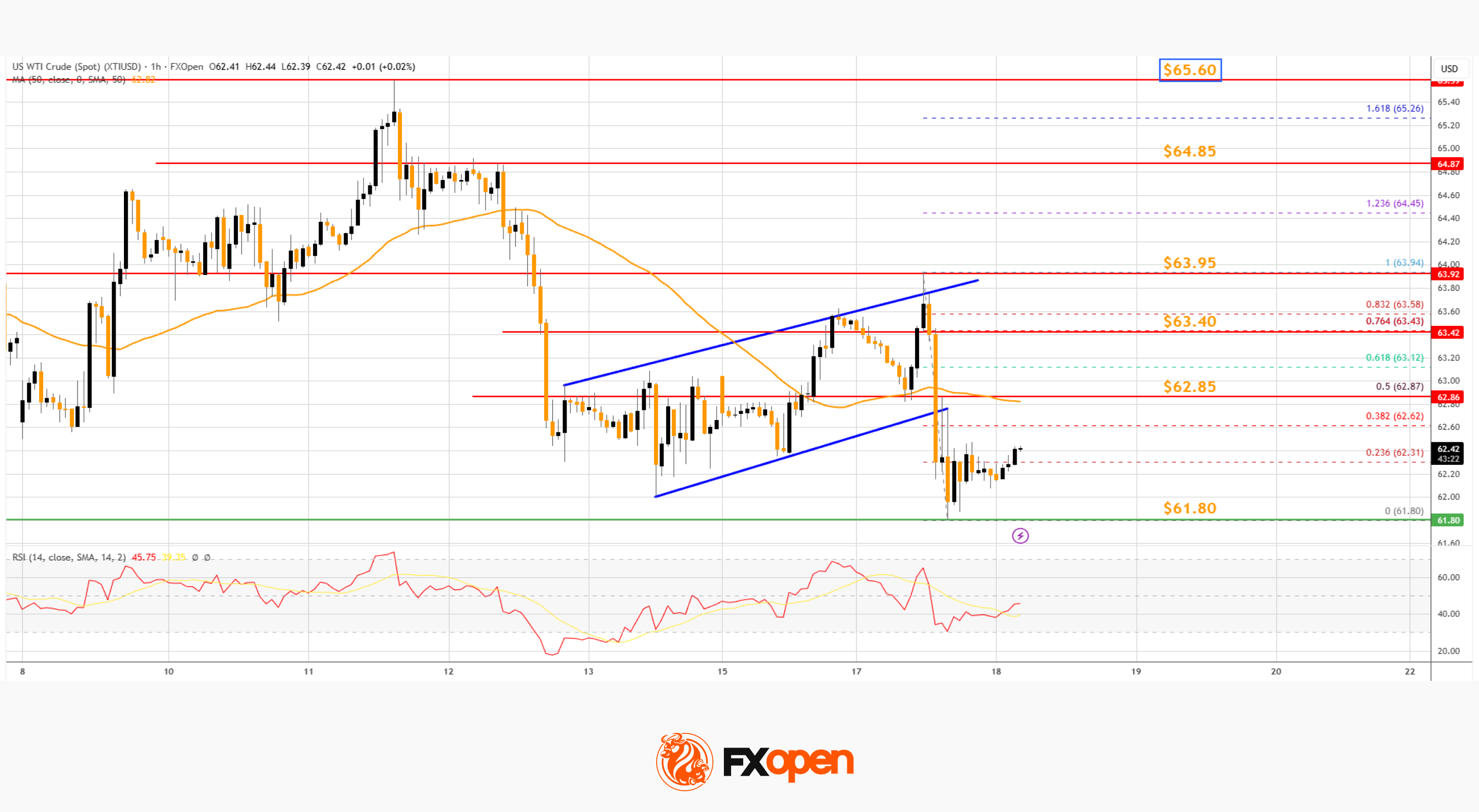

· WTI Crude oil prices extended losses below the $63.40 pivot zone.

· It dipped below a rising channel with support at $62.85 on the hourly chart of XTI/USD at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price climbed above $5,000. The price even spiked above $5,100 before the bears appeared.

A high was formed near $5,115 before there was a fresh decline. The last swing high was near $5,052 before the price settled below $5,000 and the 50-hour simple moving average. It tested the $4,850 zone.

A low is formed near $4,842, and the price is now correcting losses. There was a minor move above the 23.6% Fib retracement level of the downward move from the $5,052 swing high to the $4,842 low.

Immediate barrier on the upside is $4,945, the 50-hour simple moving average, and the 50% Fib retracement. There is also a bearish trend line with resistance at $4,945. The first major hurdle for the bulls could be $4,970.

A close above $4,970 could send the price above $5,000. The next sell zone sits at $5,050, above which the price could test the $5,115 region. Any more gains might call for a move toward $5,200.

An upside break above $5,200 could send Gold price toward $5,285. Initial support on the downside is $4,885. The next key level is $4,840. If there is a downside break below $4,840, the price might decline further. In the stated case, the price might drop toward $4,750.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price struggled to continue higher above $65.00 against the US Dollar. The price formed a short-term top and started a fresh decline below $64.20.

There was a steady drop below the $63.40 pivot level. The bears even pushed the price below $62.50, a rising channel, and the 50-hour simple moving average. Finally, the price tested $61.80. The recent swing low was formed near $61.80, and the price is now correcting losses.

There was a move above the 23.6% Fib retracement level of the downward move from the $63.94 swing high to the $61.80 low. On the upside, immediate resistance is near the 50% Fib retracement at $62.85.

The main hurdle is $63.40. A clear move above $63.40 could send the price toward $63.95. The next stop for the bulls might be $64.85.

If the price climbs further, it could face sellers near $65.60. Immediate support is $61.80. The next major breakdown level on the WTI crude oil chartis $60.50. If there is a downside break, the price might decline toward $58.80. Any more losses may perhaps open the doors for a move toward $56.50.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Farming HIP-3 Protocols on Hyperliquid

Trends to Watch (HIP-3 protocols, AI trenches)

Crypto World

Bitcoin ETFs Post $105M Outflows As Hong Kong Buyer Emerges

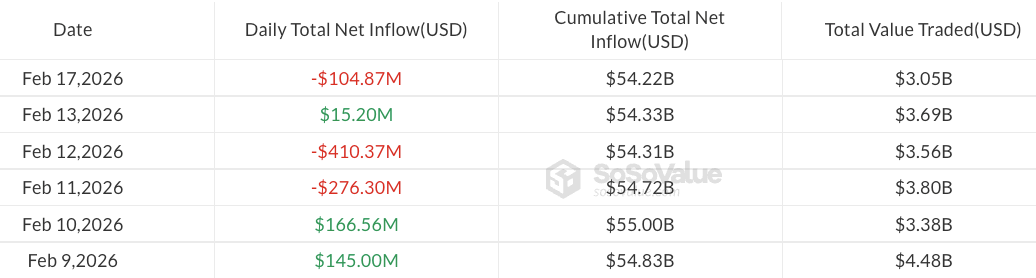

US spot Bitcoin exchange-traded funds (ETFs) posted $104.9 million in net outflows on Tuesday in the first trading session this week.

Total trading volume in spot Bitcoin (BTC) ETFs fell to just over $3 billion, down nearly 80% from a record $14.7 billion on Feb. 5, reflecting a continued slowdown in trading activity, according to SoSoValue data.

The outflows came as another round of institutions reported their Bitcoin ETF holdings for the fourth quarter of 2025, with Jane Street ranking as the second-largest buyer of BlackRock’s iShares Bitcoin ETF (IBIT) in Q4, buying $276 million.

Q4 also saw a new IBIT entrant, an obscure Hong Kong-based company called Laurore, which acquired $436.2 million of the ETF in a single purchase reported to the US Securities and Exchange Commission.

A potential sign of Chinese institutions moving into Bitcoin?

According to Bitwise Investments adviser Jeff Park, Laurore’s newly disclosed position in IBIT could be an early indication of institutional Chinese capital entering Bitcoin.

Park said Laurore has no public footprint — no website or press — and the only available information is that the filer’s name is Zhang Hui, the Chinese equivalent of “John Smith.”

While Park speculated that the investment may be linked to capital flight, some commentators questioned why the company would choose to buy Bitcoin through an ETF rather than directly.

Brevan Howard slashes IBIT holdings by 85%

Beyond Laurore and Jane Street, several institutions made significant moves with IBIT in Q4 2025. Weiss Asset Management reportedly added about 2.8 million shares ($107.5 million), while 59 North Capital increased its position by 2.6 million shares ($99.8 million).

Abu Dhabi’s state-owned investment firm Mubadala Investment also boosted its IBIT holdings by 45%, rising from 8.7 million shares in Q3 to 12.7 million in Q4, valued at $630.7 million.

In contrast, some companies cut their Bitcoin ETF exposure in Q4 2025. Brevan Howard reduced its IBIT holdings, dropping about 85% from 37 million shares ($2.4 billion) in Q3 2025 to about 5.5 million shares ($273.5 million) in Q4.

Goldman Sachs also trimmed its IBIT holdings by about 40%, leaving around $1 billion in assets.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business12 hours ago

Business12 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Tech3 hours ago

Tech3 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business4 hours ago

Business4 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show