Crypto World

Pi Network price analysis as it seeks to compete with Worldcoin, Humanity Protocol

Pi Network price remained under pressure this weekend, even as the developers announced major announcements, including a strategy to compete with Worldcoin and Humanity Protocol.

Summary

- Pi Network price retreated to $0.167 as the recent momentum faded.

- The developers celebrated the first anniversary by announcing future priorities.

- The priorities include KYC-as-a-Service, which will see it compete with Worldcoin.

Pi Coin (PI) token was trading at $0.1677 on Sunday, down slightly from the highest point this month. It remains 35% above its lowest level this year.

In a statement marking the first anniversary of its mainnet launch, Nicolas Kokkalis and Chengdiao Fan explained the key priorities to watch going forward.

The top priorities include features like native token generation, decentralized exchange, and launching developer tools. Their goal is to create an active network where creators can launch apps and their accompanying tokens.

Most notably, the developers are aiming to accelerate the Know Your Customer (KYC) process. They recently launched an AI-powered upgrade that has boosted the number of verified individuals.

With this experience, the developers are now working on rolling out KYC-as-a-Service. Their goal is to have Pi Network provide these services to companies from around the world.

The service will compete with WorldCoin (WORLD) and Humanity Protocol. World, which was launched by Sam Altman, aims to provide these services through the World ID and World App. It has already enrolled millions of people globally.

Humanity Protocol also aims to solve this challenge by leveraging the proof of humanity mechanism using palm recognition technology. The data is then converted into cryptographic hashes using zero-knowledge proofs.

Still, Pi Network price remains under pressure as the developers did not address key factors that have contributed to its underperformance. For example, they did not address the tokenomics, including the ongoing unlocks and potential token burns. Also, they did not address strategies to ensure more exchange listings.

Pi Network price technical analysis

The daily chart shows that the PI price has remained under pressure in the past few days. It retreated from this month’s high of $0.2050 to the current $0.1677.

The coin has remained below all moving averages, while the Relative Strength Index has turned around and moved below the neutral level at 50.

The most likely scenario is where the Pi Network price continues falling, potentially to the psychological level at $0.1500. A move below that level will point to more downside, potentially to $0.1300.

Crypto World

Ripple ETF Demand Is Gone as XRP Price Tumbles 11% Weekly

It has been over three months since the first XRP ETF launched, but the demand seems to have evaporated.

It has been another week of underwhelming XRP ETF performance, with the funds attracting little to no actual net inflows.

At the same time, the underlying asset has struggled to maintain the price resurgance from last week, and now trades over 10% lower.

Where Did the Ripple ETF Demand Go?

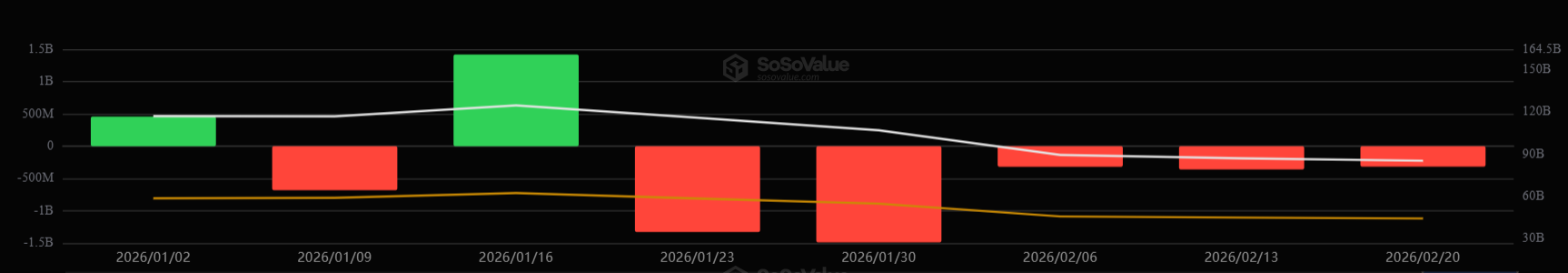

Canary Capital’s XRPC was met by investors with open arms, breaking the 2025 debut-day trading volume record on November 13. Four more products tracking the altcoin followed suit, and the total inflows quickly skyrocketed to over $1 billion. However, it has been mostly plateauing since then, and even some weeks deep in the red.

For example, investors pulled out $40.64 million during the week that ended on January 23, and another $52.26 million the following week. The next one was more positive, with $39.04 million in net inflows. The trend changed then: the interest and demand are nowhere to be found.

Two weeks ago – on February 11 – the ETFs had no reportable daily flows, with SoSoValue showing a clear “$0.00” for the first time since the products’ inception. This behavior worsened last week when there were two such days – February 17 and February 20. Even the other two showed little interest: $2.21 million in net outflows on February 18 and $4.05 million in net inflows on February 19.

Since Monday was a national holiday in the US and the markets were closed, this meant that half of the business days had no actual trading volume to report. As such, it’s no surprise that the cumulative net inflows have remained flat at $1.23 billion.

XRP Price Falls

Somewhat unexpectedly, Ripple’s native cross-border token jumped hard by double digits last weekend, going to a multi-week peak of over $1.65 despite the lack of ETF action. However, this sporadic price pump was short-lived, and the asset quickly lost traction. It returned to $1.40 mid-week and even dipped below that level on a couple of occasions.

You may also like:

It has managed to defend that support as of press time, but it’s still more than 10% down weekly. Aside from ETF investors who had displayed a serious lack of interest in the asset, data shared by popular analyst CW shows that short traders continue to dominate the XRP landscape.

Nevertheless, a recent report by Santiment suggested that XRP could be slightly undervalued at the moment, according to the 30-day MVRV ratio. Moreover, the skyrocketing amount of realized losses could lead to a significant price rebound for Ripple’s token, as it has happened in the past. In fact, it led to a 114% surge back in 2022 when such losses were last observed.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Polymarket Bitcoin Price Prediction Says $75K, But Charts Don’t

Bitcoin price has traded mostly flat over the past 24 hours near $68,000, reflecting continued indecision. The broader seven-day trend still shows a mild decline, highlighting the lack of strong bullish momentum. Yet one prediction market’s positioning is telling a far more optimistic story.

On Polymarket, the single largest February outcome, at 17%, expects Bitcoin to cross $75,000. This makes it the most popular directional bet as the month approaches its final week. However, market structure, on-chain activity, and whale positioning suggest reality may not align with this bullish expectation.

Prediction Markets Favor $75,000 — But Hidden Bearish Divergence Signals Trouble

Prediction market data shows ‘above $75,000’ remains the most favored February target despite weakening sentiment. Polymarket volumes, for this bet, exceed $88 million, with millions in active liquidity.

However, the probability of the $75,000 outcome has already declined by more than 50%, reflecting fading confidence.

At the same time, the next most likely outcome sits at ‘under $60,000’ with a 12% probability. This positioning reveals a growing split in expectations. While many traders still hope for upside, a large portion of the market is increasingly preparing for a deeper correction instead.

This growing caution aligns closely with Bitcoin’s technical structure.

On the daily chart, Bitcoin formed a lower high between November 15 and February 16. This means price failed to fully recover during its latest rally attempt.

Meanwhile, the Relative Strength Index (RSI), which measures momentum strength, formed a higher high during the same period.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Because Bitcoin was already in a downtrend, this creates a hidden bearish divergence. This pattern usually signals continuation of the existing downtrend rather than a bullish reversal. It shows that even though momentum improved briefly, the broader selling pressure remains intact.

Since this divergence appeared, Bitcoin has already corrected nearly 6%. As long as this signal remains active, the probability of reaching the prediction market’s $75,000 target remains limited.

Long-Term Holders Have Slowed Selling, But Have Not Started Buying

Long-term holder activity helps explain why prediction markets still retain some optimism, even as risks increase. These investors may have held Bitcoin for more than 1 year. Their buying and selling patterns often determine whether Bitcoin enters a sustained rally or correction.

On February 5, long-term holders reduced their holdings by 244,919 BTC (30-day rolling change), a sign of extremely heavy selling. By February 21, this number improved to 81,019 BTC. This marks a roughly 67% reduction in selling pressure.

This sharp slowdown in selling helps stabilize Bitcoin’s price and explains why some traders still expect upside.

However, long-term holders are still net sellers overall. They have not yet transitioned into accumulation. Their activity has improved, but they are not yet providing the strong buying support needed to push Bitcoin toward new highs.

This creates a neutral balance. Bitcoin may avoid immediate collapse, but it also lacks the strength needed for a major breakout to push it close to $75,000.

Whale Behavior Is Split

Whale positioning further reflects uncertainty.

The largest Bitcoin whales, holding between 100,000 and 1 million BTC, increased their holdings from 676,540 BTC to 690,000 BTC. This represents an accumulation of about 13,460 BTC, signaling cautious buying.

However, smaller whales holding between 10,000 and 100,000 BTC reduced their holdings from 2.27 million BTC to 2.26 million BTC. This means roughly 10,000 BTC were sold during the same period.

This opposing behavior shows a lack of unified conviction, even though the net balance slightly tilts towards accumulation. Some whales are preparing for a rebound, while others remain defensive.

At the same time, cost basis distribution data reveals a major resistance cluster between $72,600 and $73,200. Around 149,000 BTC were accumulated in this range. These levels also appear clearly on the price chart as a major resistance zone just below $75,000.

When Bitcoin approaches this area, many holders may sell to exit at breakeven. And the whale accumulation strength, as seen, isn’t strong enough to absorb the supply yet. This selling pressure creates a strong barrier that prediction markets may be underestimating.

Bitcoin Price Structure Shows BTC May Remain Trapped Between Key Levels

Bitcoin’s price structure closely aligns with these on-chain cost basis clusters.

To reach the $75,000 prediction target, Bitcoin must first break above $72,200. This level represents both technical resistance and is close to one of the largest cost basis clusters on the chart. Breaking this zone would require a rally of more than 6% from current levels.

However, failure to break this resistance increases the likelihood of continued range-bound movement. On the downside, strong support exists between $64,300 and $63,800, where approximately 150,000 BTC were accumulated.

On the Bitcoin price chart, the key support level resembling the zone is $63,300, breaking which would also mean the supply cluster break. Breaking under $63,300 can make the $60,000 zone, the 12% probability bet on Polymarket, come to fruition.

As a result, Bitcoin is currently trapped between two major cost basis zones. Resistance near $72,200 limits upside, while support near $63,300 prevents immediate collapse.

This range-bound structure suggests that prediction markets may be overestimating the probability of a breakout toward $75,000 while underestimating the growing risk of continued consolidation or a correction.

Crypto World

OpenClaw confirms Discord ban on Bitcoin and crypto discussions

Open-source AI agent framework OpenClaw has drawn attention not only for its code but for governance choices. The project, created by Peter Steinberger, recently enforced a hard rule: no discussions of cryptocurrency on its primary community channels. The ban surfaced after a user on X reported being blocked from OpenClaw’s Discord for referencing a block height as a timing mechanism in a benchmark for autonomous agents. Steinberger publicly backed the moderation, saying the community operates under strict server rules, including a crypto-free policy. In a later clarification, he offered to restore the user after receiving a username via email, signaling a cautious but reversible approach to enforcement.

Key takeaways

- OpenClaw enforces a strict no-crypto policy on its Discord server, publicly backing the ban after a user referenced a blockchain timing mechanism in a multi-agent benchmark.

- The founder confirmed the action and later offered to reinstate the user upon receiving the account details, illustrating a degree of administrative flexibility within the rules.

- A separate rebrand episode involved a fake token tied to the project, which briefly soared to a multi-million dollar market cap before collapsing sharply amid questions of authenticity and attribution.

- OpenClaw’s rapid growth, including surpassing 200,000 GitHub stars, has drawn significant attention from developers and crypto practitioners alike.

- Industry players are increasingly discussing crypto rails for AI workflows, with major moves from Circle and Coinbase signaling a broader push toward stablecoins and on-chain automation for AI agents.

- Security researchers have flagged widespread exposure of OpenClaw instances and a wave of malicious plug-ins targeting crypto traders, underscoring ongoing risk in open-source AI ecosystems.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The case sits at the crossroads of AI agent development and crypto infrastructure, illustrating how research tooling and digital assets increasingly intersect while questions about safety and governance remain unresolved.

Why it matters

The OpenClaw episode highlights a broader tension within the crypto-AI frontier: as autonomous agents gain traction, the communities building and using these tools must decide how crypto interacts with software governance. A no-crypto rule, such as the one OpenClaw instituted, can reflect an intent to keep research environments clean of financial incentives or external manipulation, but it may also constrain collaborations that rely on token-based incentives or payments within AI experiments.

From a user perspective, the incident underscores two practical concerns. First, moderation policies on open-source AI projects can directly affect access and collaboration, potentially slowing innovation if critical contributors are blocked for what could be perceived as benign references. Second, the CLAWD episode—where a token tied to the project briefly surged to a multi-million-dollar market cap and then cratered—serves as a cautionary tale about token fraud risk around high-profile projects. Even when a founder denies affiliation, the rapid market realization of a token can draw unintended attention and speculation, attracting bad actors before the project can respond effectively.

For the broader crypto ecosystem, the narrative sits alongside a wave of enterprise-grade AI developments that are increasingly being paired with native crypto rails. Circle’s commentary about billions of AI agents relying on stablecoins in the near future and Coinbase’s Agentic Wallets initiative point to a future where on-chain payments, wallet management, and autonomous trading become routine for software agents. This trend could drive demand for reliable on-chain infrastructure, but it will also elevate the importance of governance, security, and clear delineation between project development and speculative token activity.

What to watch next

- OpenClaw’s official stance on moderation and any updates to its crypto-free policy, including whether moderation rules will be clarified or revised.

- Any new information about the CLAWD token incident, including whether other developers or communities confirm or debunk ties to OpenClaw.

- Ongoing security research into OpenClaw deployments and the emergence of malicious plug-ins tied to crypto-trading activities.

- Progress on crypto-enabled AI workflows, such as new implementations of AgentKit-like tooling or on-chain automation features from major platforms.

Sources & verification

- OpenClaw Discord moderation actions and related X posts documenting the ban and subsequent reinstatement offer.

- The GitHub repository for OpenClaw, illustrating the project’s rapid growth and community engagement.

- Security research on the CLAWD token incident, including SlowMist’s threat intelligence analysis and linked investigations.

- Coinbase’s coverage of AI agents and on-chain wallet capabilities through Agentic Wallets, and related developer tooling.

OpenClaw’s crypto ban underscores tensions at the AI-crypto frontier

OpenClaw’s moderation decision, explicitly banning crypto mentions on its Discord, marks a notable stance within an ecosystem that increasingly blurs the line between research code and financial instruments. The initial online clash began when a user referenced a Bitcoin block height as a timing mechanism for a multi-agent benchmark, triggering a response from Steinberger that the server’s rules do not permit crypto references. The conversation quickly escalated to a formal acknowledgment: the policy existed, discussions about it were ongoing, and access could be suspended for non-compliance. The question now is how this policy will affect collaboration with external researchers who leverage on-chain data or token-based incentives to drive experiments in autonomous agents.

The claim that the ban would be lifted for a user once a username was provided by email signals a measured approach to governance. It suggests that OpenClaw is balancing its enforcement with a path to reinstatement, rather than pursuing permanent exclusion. This approach could reflect a broader trend: as AI research communities grow, moderators may increasingly grapple with how to handle financial instruments that—while tangential to the project’s technical objectives—are integral to the broader crypto economy. The tension lies in preserving a focused, safe development environment while not stifling legitimate cross-pollination between AI experimentation and crypto-enabled incentives or payments.

The bitcoin reference also triggers a deeper look at how crypto assets influence perception of open-source AI projects. When a project emphasizes transparency and collaboration but draws a line at crypto mentions, it raises questions about the boundaries between research collaboration and financial speculation. The event did not occur in isolation. In a separate, high-profile moment in the same period, a rebranding effort associated with OpenClaw preceded the appearance of a fake token, branded to resemble the project. The token, branded as $CLAWD, quickly attracted attention and reached a reported market capitalization of around $16 million within hours before a dramatic decline—more than 90%—after Steinberger publicly distanced the project from the token’s creation. Early buyers alleged that the token was a marketing ploy or a misattribution, highlighting the persistent risk of fraud in fast-moving crypto ecosystems tied to AI tooling.

Steinberger’s public statements at the time contained a clear warning: he would never launch a cryptocurrency, and any token claiming association with him or the project was fraudulent. Security researchers later documented widespread exposure of OpenClaw instances and a variety of malicious plug-ins aimed at crypto traders, underscoring the vulnerability of rapidly scaled, open-source AI platforms to exploitation. The experience is a reminder that, as AI agents become more capable and more deeply integrated with blockchain-enabled economics, the infrastructure around those agents must be rigorously secured, and governance policies must be transparent and enforceable.

Despite these controversies, OpenClaw has continued to grow, attracting a broad developer audience. By late January, the project had already surpassed significant milestones in community engagement, including more than 200,000 GitHub stars—a metric that signals intense interest in autonomous-agent architectures and their potential applications across finance, data processing, and decentralized marketplaces. The momentum around the project coincides with a broader industry push to integrate crypto rails with AI workflows. Circle’s public forecasts and Coinbase’s Agentic Wallets initiative illustrate that major players believe crypto-enabled automation will become a staple of the AI ecosystem, from simple payments to complex, automated trading strategies and compute settlements.

In this context, the OpenClaw episode raises important questions for builders, investors, and users. Governance rules that restrict crypto discussions may help maintain focus and reduce immediate risk, but they also necessitate careful communication to avoid misinterpretation or unintended exclusivity. As AI agents begin to touch more sectors of the real economy, the industry will likely see new forms of collaboration that respect safety standards while enabling legitimate experimentation with on-chain incentives and settlements. For developers, the key takeaway is to design governance that is as robust as the code itself—clear, auditable, and adaptable—as communities navigate the evolving terrain where autonomous agents and crypto intersect.

Bitcoin (CRYPTO: BTC) remains a touchpoint in discussions about crypto-enabled automation, and the broader trajectory of stablecoins and crypto wallets in AI workflows suggests that these technologies will coexist with varying degrees of integration and caution. The OpenClaw episode, with its bans, token episodes, and security concerns, provides a concrete case study in how quickly the AI-crypto nexus can surface governance questions, reputational risk, and the need for strong verification and safety measures as new software agents begin to operate in decentralized ecosystems.

https://cdn.example.com/analytics.js

Crypto World

How Whales and Retail Investors Are Reacting

Here’s who has been buying and who has been selling throughout BTC’s most recent retracement.

Bitcoin’s price movements since early October can safely be categorized as bearish, given the fact that the asset shed over 50% of its value from its all-time high to its multi-year low of $60,000 marked on February 6.

Although it has recovered some ground since then, the cryptocurrency is deep in the red even on a year-to-date scale. Santiment investigated which investor group sold off during the months-long correction, and which increased their positions.

Who’s Selling and Buying?

The post from the analytics company reveals an interesting pattern. It reads that wallets holding between 10 and 10,000 bitcoins have reduced their positions by 0.8% since the October peak. In contrast, micro investors, those with 0.1 BTC or less, have increased their holdings by 2.5% within the same timeframe.

The analysis reads that this behavior from both groups does not suggest an upcoming price reversal.

“Optimally, we begin to see these two Bitcoin groups begin to reverse course. Without key stakeholder support, any spark of a rally will tend to be slightly limited due to the lack of large capital,” Santiment said, before indicating that retail investors have remained undeterred, currently holding the highest amount in nearly two years.

ETF Investors Flock

Unlike the small discrepancy between the two investor groups examined by Santiment, those who gain exposure to the largest cryptocurrency through ETFs have shown a clear and painful trend. In the two weeks leading to the asset’s all-time high of over $126,000, they poured in over $6 billion into the funds.

Since then, red has dominated almost every week, with multiple $1 billion or more net outflow examples. In three consecutive weeks in early November, they withdrew more than $3.5 billion. This behavior continued into the new year, and the spot Bitcoin ETFs are currently on a massive red streak of five weeks in a row in the red.

Data from SoSoValue shows that these investors pulled out $1.33 billion during the week that ended on January 23. Another $1.49 billion followed, but the silver lining is that the net inflows have decreased to under $360 million in the past three weeks. Nevertheless, the total net inflows into the spot BTC ETFs have declined from $62.77 billion in early October to $54 billion last Friday.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Elliptic Flags Network of Russian Crypto Platforms Bypassing Sanctions

A group of cryptocurrency exchanges linked to Russia is helping users move funds outside the reach of Western financial restrictions, according to a report released Saturday by blockchain analytics firm Elliptic.

Key Takeaways:

- Elliptic identified five Russia-linked crypto exchanges providing pathways to bypass Western sanctions.

- Only one platform is formally sanctioned, yet several processed large transactions with restricted entities.

- Activity has shifted across multiple services, suggesting enforcement actions redirect rather than halt flows.

The study identifies five trading platforms, most of them not formally sanctioned, that continue to provide channels for high-volume crypto transactions beyond the oversight of the traditional banking system.

The findings arrive as European officials consider tighter measures, including a potential blanket ban on crypto transactions involving Russia, amid concerns that new platforms are emerging to replace previously targeted operators.

Elliptic: Nearly 10% of Bitpapa Transactions Tied to Sanctioned Targets

Among the exchanges examined, only the peer-to-peer marketplace Bitpapa is under US sanctions.

The US Treasury’s Office of Foreign Assets Control (OFAC) designated the platform in March 2024 for alleged sanctions evasion.

Elliptic found that about 9.7% of Bitpapa’s outgoing transactions were linked to sanctioned entities and that the exchange frequently rotated wallet addresses to make monitoring more difficult.

The report also highlights ABCeX, an unsanctioned exchange operating from Moscow’s Federation Tower, the same building previously used by Garantex before US authorities seized its domains in March 2025.

Elliptic estimates ABCeX has processed at least $11 billion in crypto, with significant transfers flowing to Garantex and another exchange, Aifory Pro.

Another case involves Exmo, which said it exited the Russian market after the 2022 invasion of Ukraine by selling its regional operations to a separate entity, Exmo.me.

Elliptic’s analysis suggests operational ties remain: both services appear to share custodial infrastructure and pooled hot wallets.

The firm recorded more than $19.5 million in transactions between Exmo and sanctioned exchanges, including Garantex, Grinex and Chatex.

Rapira, registered in Georgia but maintaining a Moscow office, was also flagged after sending over $72 million directly to sanctioned exchange Grinex.

Authorities in Russia reportedly raided Rapira’s offices in late 2025 over suspected capital transfers to Dubai.

The fifth platform, Aifory Pro, operates cash-to-crypto services in Moscow, Dubai and Turkey.

The company reportedly offers virtual payment cards funded with USDT that allow Russian users to access services restricted by Western providers. Elliptic also traced nearly $2 million from Aifory Pro to the Iranian exchange Abantether.

Sanctions Shift Activity, Illicit Crypto Volume Hits Record High

Researchers say the network illustrates how enforcement actions can shift activity rather than eliminate it.

After the shutdown of Garantex, transaction volumes rose on other exchanges, according to data from multiple analytics firms.

Chainalysis reported that illicit crypto addresses received a record $154 billion in 2025, while TRM Labs produced a similar estimate of $158 billion.

As reported, Russia’s industrial crypto mining sector continued to expand in 2024, with the country’s two largest operators, BitRiver and Intelion, generating a combined $200 million in revenue and accounting for more than half of the legal market.

The post Elliptic Flags Network of Russian Crypto Platforms Bypassing Sanctions appeared first on Cryptonews.

Crypto World

OpenClaw Bans Bitcoin and Crypto Mentions on Discord After Fake Token Scare

The developer behind the fast-growing open-source AI agent framework OpenClaw has confirmed that any mention of Bitcoin or other cryptocurrencies on its Discord server can lead to removal.

In a Saturday post on X, a user revealed that they were blocked from OpenClaw’s Discord simply for referencing Bitcoin block height as a timing mechanism in a multi-agent benchmark.

In response, OpenClaw creator Peter Steinberger confirmed the action, writing that members had accepted “strict server rules” upon joining and that the community maintains a “no crypto mention whatsoever” policy.

Steinberger later agreed to re-add the user, asking them to email their username so he could restore their access to the server.

Related: Ethereum’s Trustless Agents standard is the missing link for AI payments

OpenClaw’s crypto problem began with a fake token

Trouble began during a rebrand after Steinberger received a trademark notice related to the project’s original name. In the short window between releasing old social accounts and claiming new ones, scammers seized the abandoned handles and promoted a Solana-based token called $CLAWD.

The token surged to roughly $16 million in market capitalization within hours before collapsing more than 90% after Steinberger publicly denied involvement. Early buyers accused the developer.

Steinberger responded at the time by warning users he would never launch a cryptocurrency and that any token claiming association with him was fraudulent. Security researchers later identified hundreds of exposed OpenClaw instances online and dozens of malicious plug-ins, many designed to target crypto traders.

OpenClaw has expanded rapidly since launching in late January, surpassing 200,000 GitHub stars within weeks and attracting a wide developer audience interested in autonomous agents.

Related: Deel taps MoonPay to roll out stablecoin salary payouts in UK, EU

Crypto firms bullish on AI agents

Industry leaders increasingly see crypto as the default payment rail for AI. Circle CEO Jeremy Allaire predicted that billions of agents will use stablecoins for routine payments within a few years

Earlier this month, Coinbase launched “Agentic Wallets” infrastructure that lets AI agents hold wallets and autonomously spend, earn and trade crypto onchain. Built on its AgentKit developer framework and powered by the x402 payments protocol, the system enables software agents to actively manage DeFi positions, rebalance portfolios, pay for compute and data services, and participate in digital marketplaces.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Bitcoin ETFs Lose Billions Amid Wall Street’s Rotation to Gold

US spot Bitcoin exchange-traded funds (ETFs) are facing their most sustained period of institutional friction this year.

This year, the funds have logged six weeks of outflows amid macroeconomic uncertainty that is driving capital toward traditional safe havens.

BlackRock, Fidelity Lead Bitcoin ETF Exodus Amid Macro Jitters

Since the start of 2026, the funds have bled nearly $4.5 billion, offset by just $1.8 billion of inflows during the first and third weeks of the year, according to data from SosoValue.

The bulk of the damage occurred during the past five-week stretch beginning in late January. That run alone erased roughly $4 billion from the ETF complex, triggered by Bitcoin’s recent price struggles.

The bleeding has been most pronounced among the category’s heavyweights. BlackRock’s iShares Bitcoin Trust (IBIT) has shed over $2.1 billion in the past five weeks, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw more than $954 million walk out the door.

CryptoQuant analyst J.A. Maartun said Bitcoin ETF outflows are at $8.3 billion, down from their October all-time high, marking the weakest year since the funds launched.

Meanwhile, the current steady stream of withdrawals highlights a clear shift in institutional appetite from the aggressive momentum that defined the asset class in its first two years.

Over the past year, the US’s macro policies have prompted a broader de-risking among Wall Street allocators.

This has sparked a rotation out of digital assets and into precious metals like gold and silver. For context, gold and gold-themed ETFs have seen $16 billion in inflows during the past three months.

Still, market observers have pointed out that Bitcoin ETFs’ structural footprint remains largely intact.

Bloomberg senior ETF analyst Eric Balchunas noted that the larger picture remains historically bullish for the nascent asset class.

He noted that, despite recent outflows, the funds have significantly outperformed early market expectations, which had projected first-year inflows of just $5 billion to $15 billion.

Crypto World

Digital asset law changes in the USA, China, and the UAE

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In 2026, global digital asset laws are shifting from implementation to operational, with a major focus on stablecoin oversight, tokenized real-world assets, and tax compliance. Here are the key changes during February from the United States, China, and the United Arab Emirates.

Summary

- From experimentation to enforcement: In 2026, digital asset policy is shifting from pilots to operational law with stablecoins, tokenized RWAs, and tax compliance at the center.

- U.S. pushes market structure clarity: The Clarity Act advances toward finalization, aiming to formalize CFTC oversight and solidify US’ leadership in crypto infrastructure.

- Diverging global models: China tightens state control around e-CNY and bans most RWAs, while Hong Kong and the UAE expand licensing regimes and regulated stablecoin frameworks.

The United States

In 2026, U.S. cryptocurrency legislation is entering a transformative phase focused on finalizing market structure and implementing the first major federal digital asset laws. The U.S. Clarity Act, aimed at implementation in 2026, is proposed U.S. legislation designed to establish a regulatory framework for digital assets, primarily granting the Commodity Futures Trading Commission jurisdiction over most digital assets. As William Quigley, a cryptocurrency and blockchain investor and co-founder of WAX and Tether (USDT), explained:

“The Clarity Act, which is expected to become law this year, aims to distinguish between commodities and securities, requiring exchanges and dealers to register with the CFTC and adhere to consumer protections.”

Treasury Secretary Scott Bessent called for a “spring signing” of the bill, noting that the 2026 midterm elections create significant urgency to pass the legislation before the political window closes.

Current legislative status of the Clarity Act

| Body | Version | Status (as of Feb 16, 2026) |

| House | H.R. 3633 | Passed (294-134) in July 2025 |

| Senate Agriculture | DCIA (S. 3755) | Advanced 12-11 on Jan 29, 2026 |

| Senate Banking | CLARITY Act (Senate Draft) | Stalled; Markup postponed since Jan 14, 2026 |

China

During February, Chinese authorities strengthened their rules on digital payments through the sovereign digital yuan (e-CNY) and controlled tokenization projects. New regulations prohibit the unauthorized issuance of yuan-pegged stablecoins (both domestically and offshore) and mandate strict vetting for tokenized real-world assets, reinforcing the dominance of the state-backed e-CNY. Key details regarding China’s 2026 stablecoin regulations are as follows:

Ban on unauthorized stablecoins: A February 6, 2026, notice issued by eight government agencies reiterated that all virtual currency activities are illegal, specifically targeting stablecoins that replicate sovereign money. Yifan He, the founder and CEO of Red Data Tech, explained:

“I think the most significant aspect is that the authorities removed stablecoin from the definition of cryptocurrencies. If you compare these two to the one from last November, stablecoin is no longer mentioned alongside cryptocurrencies and RWAs. The only mention is to state that ‘stablecoin pegged with fiat functions partially as money’. This is a huge policy shift regarding stablecoin. This might mean greenlighting Chinese banks in Hong Kong to apply for the HK stablecoin license.”

No yuan-pegged stablecoins: The new regulations ban any entity (including foreign ones) from issuing stablecoins pegged to the renminbi (RMB) offshore without explicit approval.

Offshore restrictions: Domestic Chinese entities and their subsidiaries are strictly prohibited from issuing virtual currencies or conducting RWA tokenization outside China without consent. As Yifan added:

“Helping illegal crypto business from inside China (even for projects outside China), including promotion, IT development, and advisory, will face severe criminal punishment. This goes next level.”

RWA tokenization rules: While some market participants see potential for a regulatory framework for tokenized, real-world assets (RWA), the 2026 rules impose strict oversight on this sector, requiring approval for any RWA tokenization, especially if it involves onshore assets. As Yifan He explained:

“In the circulars, RWAs are totally banned. In the past two days, many people from the RWA industry have tried to confuse people with RWA and ‘tokenized security’ and claim that the Chinese government officially gives a clear path to legalize RWAs. It is not. The path is now a total ban.”

Nevertheless, “it gives a clear path for ‘tokenized securities.’ This is the bright side of the circulars. But because it is about ‘securities,’ the issuance and trading must go through licensed entities. I don’t think this brings any opportunities to the market, tech companies, or crypto companies. This will be a new business for existing underwriters and stock exchanges. The IPOs and fundraising won’t be any easier. Especially, one major required step is that the owners of the assets to be ‘tokenized’ must receive approval from CSRC, literally exactly the same procedures as for Chinese companies to be listed in foreign stock markets,” pointed out Yifan.

Separation from Hong Kong: While mainland China maintains a strict ban, Hong Kong continues to pursue a separate, cautious pilot program for regulated, licensed stablecoin issuance, though this is expected to be under tight supervision.

Hong Kong is currently implementing a comprehensive multi-layered regulatory framework for digital assets, with several significant legislative milestones scheduled for 2026. The government aims to solidify the city’s position as a global digital asset hub by expanding licensing requirements to nearly all types of crypto service providers and aligning tax transparency with international standards.

For 2026, Hong Kong has prioritized the regulation of previously “over-the-counter” (OTC) and advisory services:

- New licensing bill: Regulators plan to submit a bill to the Legislative Council in 2026 to establish licensing regimes for four new categories: Virtual Asset (VA) Dealing (including OTC desks), VA Custodians, VA Advisory Services, and VA Asset Management.

- Stablecoin licenses: Following the passage of the Stablecoins Ordinance in 2025, the Hong Kong Monetary Authority (HKMA) is expected to issue the first batch of official stablecoin licenses in the first quarter of 2026.

- Banking standards: Effective January 1, 2026, Hong Kong will fully implement the Basel Committee standards for crypto assets, governing how banks manage capital requirements and credit risks when dealing with digital assets.

- Tax exemptions: Hong Kong is shifting toward high transparency for tax compliance while maintaining its competitive “no capital gains” environment. The government plans to submit a bill in 2026 to formally expand tax exemptions for funds and family offices to include “digital assets,” essentially promising a 0% tax rate on crypto profits for these qualifying institutional investors.

- CARF implementation: Legislation to implement the OECD’s Crypto-Asset Reporting Framework (CARF) is slated for completion in 2026.

The United Arab Emirates

As of February 2026, the UAE has strengthened its crypto regulatory framework, with the Dubai Financial Services Authority (DFSA) updating its rules on 12 January 2026 to shift token suitability assessments from the regulator to authorized firms. The Central Bank of the UAE (CBUAE) also approved a dirham-backed stablecoin for institutional use on February 13, 2026. The new rules aim to increase market flexibility while ensuring high standards of integrity for digital asset service providers.

DIFC Updates (DFSA): Effective January 12, 2026, the DFSA eliminated the “Recognized Crypto Tokens” list, requiring firms to conduct their own due diligence, assessment, and monitoring of tokens before listing.

Stablecoin regulation: The CBUAE approved the launch of a Dirham-backed stablecoin (DDSC) on the ADI Chain for institutional, payment, and settlement use cases as of 13 February 2026. Erhan Kahraman, Former Chief Editor of Cointelegraph Turkey, said:

“I don’t see any major impact on the use of stablecoins in the MENA region, simply because here, it’s used more as a ‘survival tool’ rather than a trading asset. I know that for the Western Hemisphere, stablecoins are the main tool for on- and off-ramping cryptocurrencies (i.e., you first buy USDT and then use it for trading). In contrast, people in MENA use stablecoins as a gateway to a) cross-border payments/remittances and b) to join the global job market as individuals.”

He continued: “Imagine this: a freelancer needs to provide multiple legal documents, such as a ‘Bank Confirmation Letter,’ only to start working for a foreign company (to receive USD or Euro). This is incredibly difficult to provide for underbanked or unbanked populations found in the MENA region. Stablecoins eliminate that barrier. When you find a job that pays in USDT, all they ever ask you about your financial situation is your crypto wallet address. I believe that is making a huge difference for the underbanked population.”

Investor protection: Retail client protections remain strict, with mandatory appropriateness assessments and a ban on certain marketing practices.

Taxation 2026: Crypto activity generating income is subject to corporate tax, while transfers of crypto are generally exempt from VAT, and mining rewards are treated as taxable income.

Compliance and licensing: UAE regulators are heavily focused on institutional-grade compliance and preventing financial crime, emphasizing robust governance for licensing, according to reports from 16 February 2026.

Crypto World

Bitdeer Liquidates All BTC Reserves, Holdings Drop to Zero

Bitdeer Technologies, a prominent Bitcoin mining operator backed by industry figure Jihan Wu, has sharply recalibrated its Bitcoin treasury, reporting a zero balance in its corporate holdings. In the latest weekly operations update, the company disclosed that its “pure holdings,” which exclude client deposits, have fallen to 0 BTC. The period saw the production of 189.8 BTC, all of which were sold, alongside an additional 943.1 BTC liquidated from existing treasury reserves. This marks a notable shift from earlier disclosures, when the treasury still held a substantial balance.

Key takeaways

- Bitdeer reports zero corporate Bitcoin in its treasury, after selling 189.8 BTC produced in the latest period plus 943.1 BTC drawn from reserves.

- A February update showed the treasury at 943.1 BTC, with 179.9 BTC sold from 183.4 BTC mined that week, leaving treasury holdings unchanged at that time.

- The company is pursuing a significant financing move, announcing plans to raise $300 million through a convertible senior note offering, with a possible expansion to $345 million.

- The notes, due in 2032, can be converted into stock, cash, or a mix, and are intended to fund data center expansion, AI cloud growth, mining hardware development, and general corporate needs.

- Meanwhile, Bitdeer is expanding its self-mining capabilities as demand for external mining hardware wanes, reflecting a broader industry shift toward hybrid AI/HPC revenue streams.

Tickers mentioned: $BTC, $MARA

Price impact: Negative. Bitdeer’s plan to raise convertible debt coincided with a sharp share decline, underscoring investor concern over liquidity and funding strategy.

Market context: The sector has been navigating tighter margins post-halving and a growing interest in hybrid models that blend Bitcoin production with AI and high-performance computing revenue streams. The move toward self-mining and AI services mirrors a broader trend as miners reassess balance sheets and diversify revenue sources.

Why it matters

The decision to liquidate the corporate Bitcoin treasury signals a potential pivot in Bitdeer’s capital strategy. By converting a portion of mined proceeds into cash, the company may be prioritizing liquidity to support ongoing operations and debt servicing, even as it seeks to scale data center infrastructure and AI-focused offerings. This shift underscores the tension between treasury exposure to Bitcoin’s price volatility and the need for predictable funding for growth initiatives in a capital-intensive industry.

Concurrently, the $300 million convertible debt offering marks a high-profile move to raise capital that could be immediately deployed to expand Bitdeer’s data center footprint and advance AI cloud capabilities. The convertible feature adds a layer of complexity for investors, as future equity dilution is possible if the notes are converted. The company has framed the financing as a tool to accelerate its expansion plans and hardware development while maintaining flexibility to adapt to market conditions.

Beyond Bitdeer, the mining landscape is undergoing a broader reorientation toward AI and computing services. MARA Holdings recently acquired a majority stake in Exaion, a French computing infrastructure firm, signaling a deeper foray into AI and cloud services. The deal positions the miner as a broader technology infrastructure provider, expanding its footprint beyond traditional hash power. This follows a wider industry pattern where several miners, faced with tighter margins, are pursuing hybrid models that leverage their energy and data-center assets to offer AI-enabled computing capacity.

Observers note that the industry is reconfiguring around demand for AI capacity and energy-efficient compute, rather than venerating hash price alone. Several peers are repurposing facilities for data-center use or pivoting toward AI infrastructure as a way to diversify revenue streams and hedge against mining cycles. The trend is underscored by moves within the ecosystem that include CoreWeave’s established shift toward AI infrastructure and other players repositioning assets to capture AI compute demand. For readers tracking this space, the evolving balance between traditional hashing revenue and AI-enabled services will likely define miners’ strategizing in 2024 and beyond.

The current environment remains nuanced: while Bitcoin mining remains a niche but essential component of the larger crypto economy, the capital-intensive demands of data centers and the strategic importance of AI capabilities push miners to blend their hardware with software services. This dual approach can help stabilize cash flows amid volatility in digital asset prices, energy costs, and regulatory considerations, while offering new avenues for growth in an increasingly digital and compute-driven landscape.

What to watch next

- Bitdeer’s next weekly update to confirm whether the treasury remains at zero and to track any changes in production or sales pace.

- Progress and timing of the $300 million convertible debt offering, including potential expansion and terms of conversion.

- Updates on Bitdeer’s data center expansion plans and the development of AI cloud initiatives tied to mining operations.

- Industry moves by peers, particularly MARA Holdings’ integration of Exaion and how AI/hpc ventures influence miner profitability across the sector.

- Regulatory or energy-cost developments that could impact mining economics and the viability of hybrid business models combining Bitcoin production with AI infrastructure.

Sources & verification

- Bitdeer weekly operational update showing 0 BTC in pure holdings and the 189.8 BTC produced and sold, plus 943.1 BTC liquidated from treasury — https://x.com/BitdeerOfficial/status/2025136775266550191

- Bitdeer Feb. 13 update indicating 943.1 BTC treasury the week prior and 179.9 BTC sold out of 183.4 BTC mined — https://x.com/BitdeerOfficial/status/2022530485876896182

- Cointelegraph report on Bitdeer’s convertible debt offering of $300 million with potential expansion to $345 million — https://cointelegraph.com/news/bitdeer-stock-drops-17-after-convertible-senior-note-offering

- MARA Holdings’ majority stake in Exaion article detailing the AI/data-center expansion angle — https://cointelegraph.com/news/mara-majority-stake-exaion-ai-data-centers-bitcoin-miner

- Related industry shifts toward AI infrastructure in crypto mining, including CoreWeave’s pivot — https://cointelegraph.com/news/crypto-mining-ai-data-centers-coreweave-infrastructure-shift

Bitdeer pivots from treasury to expansion amid AI pivot

Bitcoin (CRYPTO: BTC) has become the focal point of Bitdeer’s latest strategic recalibration, as the company logs a full liquidation of its corporate Bitcoin treasury even as it grows commitments to data centers and AI-enabled compute. In its most recent weekly update, Bitdeer disclosed that its pure holdings, excluding client deposits, dropped to zero BTC. The report shows 189.8 BTC mined during the period, all of which were sold, in addition to 943.1 BTC drained from the treasury reserves. This marks a clear departure from prior reporting where the treasury still contained BTC, albeit with ongoing sales tied to operating costs.

The prior update, issued on Feb. 13, had the treasury at 943.1 BTC, with 179.9 BTC sold from 183.4 BTC mined that week, leaving treasury holdings unchanged after the sale. The shift from treasury exposure to a cash-focused approach is a notable pivot for a company that, like many in the sector, has balanced the need for liquidity with the opportunistic exposure to Bitcoin’s price action. In context, mining firms frequently sell a portion of production to cover electricity and equipment costs, yet fully liquidating a treasury position is less typical and can indicate a more aggressive capital deployment strategy.

Meanwhile, Bitdeer disclosed plans to raise $300 million through a convertible senior note offering, with an option to expand the sale by an additional $45 million. The notes, due in 2032, can be converted into stock, cash or a combination of both. The financing is earmarked to accelerate data center expansion, fuel AI cloud growth, support mining-hardware development, and fulfill general corporate needs. The market reacted to the financing news with a notable drop in Bitdeer’s shares, underscoring investor concerns about debt dilution and the company’s ability to deploy proceeds effectively in a competitive landscape.

Beyond Bitdeer, the broader mining industry is undergoing a reorientation toward AI and high-performance computing. MARA Holdings—another prominent name in the space—announced a majority stake in Exaion, a French computing infrastructure firm, signaling a deeper plunge into AI and cloud services. The deal highlights a strategic shift from pure hash-rate generation to hybrid business lines that leverage existing energy and data-center assets for AI compute capacity. It reflects a broader trend in which miners, faced with the realities of halved block rewards and tighter margins, pursue diversified revenue streams to sustain growth.

Industry coverage also notes that other miners are repurposing facilities and energy infrastructure for data-center use, while some players have fully pivoted to AI infrastructure providers. The exchange between crypto mining and AI data services is increasingly viewed as a way to reconcile revenue volatility with an expanding demand for AI compute capacity. The long‑term outlook for miners may hinge on whether these hybrid models can deliver consistent cash flows, especially as regulatory pressures and energy costs continue to shape the economics of the sector.

Crypto World

Spot Bitcoin ETFs Log Fifth Straight Week of Outflows as Institutional Demand Cools

US spot Bitcoin exchange-traded funds recorded a fifth consecutive week of net withdrawals, extending the longest negative streak since early 2025 as institutional demand softened alongside a broader pullback in digital assets.

Key Takeaways:

- Spot Bitcoin ETFs posted a fifth straight week of withdrawals, losing about $316 million and roughly $3.8 billion over the streak.

- Midweek selling outweighed Friday inflows, showing cooling institutional demand despite stable prices.

- Capital appears to be rotating within crypto funds, with Ether also seeing outflows while Solana and XRP products drew inflows.

Data from SoSoValue shows the 12 funds collectively lost about $316 million during the week ending Feb. 20.

Trading activity was compressed into four sessions due to the Presidents’ Day holiday, and the first three days all closed negative.

Bitcoin ETFs Post Heavy Midweek Outflows Despite Friday Rebound

Roughly $105 million exited on Tuesday, followed by $133 million on Wednesday and $166 million on Thursday.

A modest recovery on Friday, when $88 million flowed back into the products, was not enough to reverse the weekly trend. BlackRock’s IBIT led the rebound with about $64.5 million in inflows, while Fidelity’s FBTC added roughly $23.6 million.

The current run of outflows began the week of Jan. 20 and has removed around $3.8 billion from the Bitcoin ETF complex.

The last comparable stretch occurred nearly a year ago during a tariff-driven market sell-off that also weighed on risk assets.

While the duration of the streak matches that period, the magnitude has been smaller, with the heaviest withdrawals concentrated in late January when funds lost $1.33 billion and $1.49 billion in consecutive weeks.

More recent weekly losses have ranged between roughly $316 million and $360 million.

Despite the withdrawals, the ETF market remains substantial. Cumulative net inflows since launch in January 2024 still total about $54 billion, and aggregate net assets stand near $85.3 billion.

Bitcoin has traded around $68,600, down more than 20% year to date and below a key onchain level identified by analysts as separating expansion from consolidation phases.

Ether funds showed a similar pattern, losing about $123 million during the week and extending their own five-week streak of withdrawals.

By contrast, newer products tied to Solana attracted approximately $14.3 million in inflows, while XRP-based funds recorded a modest $1.8 million gain.

The divergence suggests capital is rotating within crypto investment products rather than leaving the sector altogether, with investors repositioning across assets as sentiment remains cautious rather than panicked.

Trump Media Files for Bitcoin, Ether and Cronos ETFs With Staking Rewards

Last week, Trump Media and Technology Group filed applications for two cryptocurrency ETFs that would track Bitcoin, Ether and the Cronos (CRO) token, expanding the company’s involvement in digital assets.

The proposed “Truth Social Bitcoin and Ether ETF” would primarily follow the performance of the two largest cryptocurrencies, while the “Truth Social Cronos Yield Maximizer ETF” would provide exposure to CRO.

The Cronos-focused fund would also offer staking rewards, with Crypto.com serving as custodian and providing liquidity and staking services.

Trump Media has also signaled interest in integrating blockchain beyond ETFs.

The company recently said it intends to distribute a new digital token to shareholders on the Cronos network and previously disclosed plans for a corporate crypto treasury involving CRO.

The post Spot Bitcoin ETFs Log Fifth Straight Week of Outflows as Institutional Demand Cools appeared first on Cryptonews.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics5 hours ago

Politics5 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat7 days ago

NewsBeat7 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat7 days ago

NewsBeat7 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat2 days ago

NewsBeat2 days agoAndrew Mountbatten-Windsor latest: Police search of Royal Lodge enters second day after Andrew released from custody

European Union proposes banning all crypto transactions with Russia to prevent sanctions evasion.

European Union proposes banning all crypto transactions with Russia to prevent sanctions evasion.  Individuals: 13.15M BTC

Individuals: 13.15M BTC  ETFs & Funds: 1.6M BTC

ETFs & Funds: 1.6M BTC  Companies: 1.17M BTC

Companies: 1.17M BTC  Governments: 647K BTC

Governments: 647K BTC