Crypto World

Polymarket sues Massachusetts over prediction market rules

Polymarket has taken legal action against Massachusetts officials, seeking to block the state from restricting its prediction markets.

Summary

- Polymarket sued Massachusetts officials after a court ruling against rival Kalshi.

- The platform says federal CFTC rules override state gambling laws.

- The case could shape how prediction markets operate across the U.S.

The move comes as U.S. regulators and courts step up scrutiny of platforms that allow users to trade on real-world events, especially in sports.

On Feb. 10, Polymarket filed a lawsuit in federal court against Massachusetts Attorney General Andrea Campbell and state gaming regulators. The company said the threat of enforcement is “immediate and concrete,” following a recent ruling against rival platform Kalshi.

According to Polymarket, state intervention would disrupt its national operations, fragment its user base, and force it to choose between federal compliance and state restrictions. The company argues that its markets fall under federal oversight and should not be treated as local gambling products.

Federal authority vs. state gambling laws

At the center of the case is a dispute over who has the right to regulate prediction markets.

Polymarket says its event contracts are governed by the Commodity Futures Trading Commission. Under federal law, the CFTC oversees derivatives and futures markets, including certain types of prediction products. The company claims this authority overrides state-level gambling rules.

In its complaint, Polymarket pointed to comments made on Jan. 29 by CFTC Chairman Michael Selig, who said the agency would re-assess how it handles cases testing its jurisdiction. Shortly after, the CFTC filed an amicus brief in a related lawsuit involving Crypto.com.

Massachusetts courts have taken a different view. Last week, a state judge refused to pause a ban on Kalshi’s sports contracts, ruling that the platform must follow state gaming laws. The judge said Congress did not intend federal regulation to replace traditional state powers over gambling.

Kalshi has appealed the decision but was denied a stay. The ruling requires the company to block Massachusetts users from sports markets within 30 days.A federal judge in Nevada also recently denied Coinbase’s request for protection from a similar enforcement action, adding to the legal pressure on prediction platforms.

Robinhood, which partners with Kalshi, is now seeking its own injunction in Massachusetts to avoid state licensing requirements.

Growing pressure on prediction platforms

Polymarket’s lawsuit reflects wider tensions between fast-growing prediction markets and state regulators.

In a statement posted on social media, Polymarket chief legal officer Neal Kumar said the company is fighting “for the users.” He argued that state officials are racing to shut down innovation and ignoring federal law.

He added that Massachusetts and Nevada risk missing an opportunity to support new market models that blend finance, data, and public forecasting. State officials have so far declined to comment on the lawsuit.

The case arrives as prediction markets gain mainstream attention. Jump Trading recently made investments in Polymarket and Kalshi, two platforms that have garnered institutional support. According to recent funding rounds, Polymarket is valued at approximately $9 billion.

Supporters claim that by enabling users to trade on economic, sports, and election data, these markets enhance price discovery and public insight. Many contracts, according to critics, resemble unlicensed gambling and may put users at risk.

If Polymarket succeeds, it could limit the ability of states to regulate prediction markets and strengthen the CFTC’s role nationwide. A loss, however, may encourage more states to impose licensing rules or bans.

Crypto World

How Will BTC’s Price React?

Iran also rejected Trump’s demand for unconditional surrender but apologized to its neighbors.

The war that started last Saturday between Iran on one side and the US and Israel on the other doesn’t seem to be stopping anytime soon, despite Trump’s demands for unconditional surrender.

The POTUS has made a new set of threats after Iran’s president called Trump’s request for the country’s unconditional surrender a “dream.” Nevertheless, Iran’s authorities issued a rare apology to its neighbors for its strikes against numerous sites.

The US President continued the intense topic by warning that Iran will be hit very hard today. He also threatened that areas and groups of people that were not targeted before might be “under serious consideration for complete destruction and certain death.”

TRUMP SAYS UNDER SERIOUS CONSIDERATION FOR COMPLETE DESTRUCTION AND CERTAIN DEATH, BECAUSE OF IRAN’S BAD BEHAVIOR, ARE AREAS AND GROUPS OF PEOPLE THAT WERE NOT CONSIDERED FOR TARGETING UP UNTIL THIS MOMENT IN TIME

— *Walter Bloomberg (@DeItaone) March 7, 2026

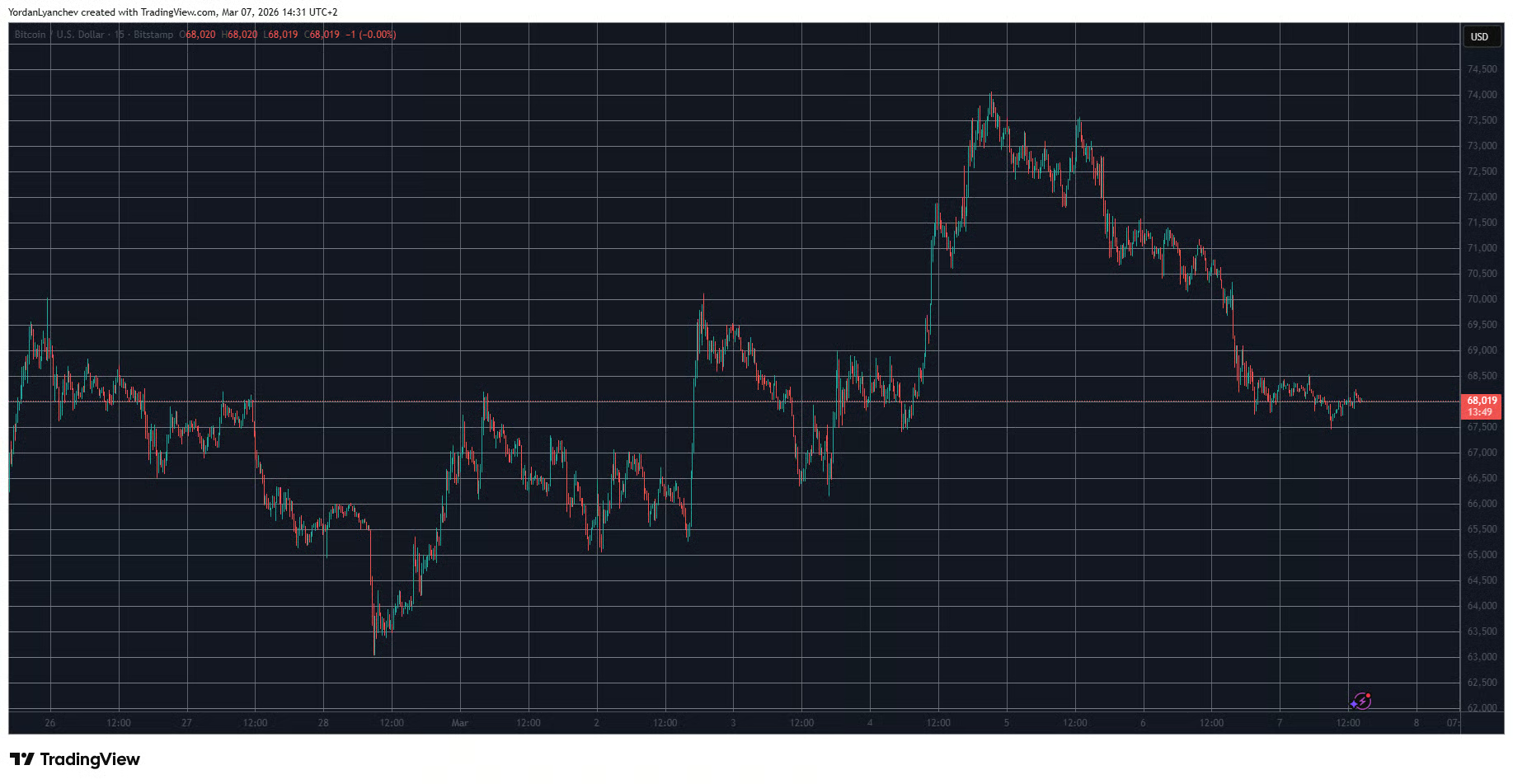

Recall that once the first strikes hit their targets last week, BTC’s price tumbled immediately from $67,000 to $63,000. However, it rebounded to $68,000 during the same day, especially after reports emerged that Iran’s Supreme Leader had been killed during the attacks.

It kept climbing mid-week as the tension grew and hit a monthly high at $74,000 on Wednesday. Nevertheless, it was rejected there, and the weak US jobs report from Friday, as well as Trump’s latest remarks on Iran and Cuba, sent it south to $68,000.

Today’s developments have left BTC unfazed as it continues to trade at around $68,000. However, more volatility might ensue if Trump’s threats become reality, especially since the crypto market is the only financial industry available for trading during the weekends.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

OmniPact Raises $50 Million to Power the Future of Decentralized Trust Infrastructure

TLDR:

- OmniPact raised $50M from anonymous institutional investors and family offices to advance its trust protocol.

- The funding will cover mainnet development, security audits, and a Q1 2026 testnet launch on schedule.

- Smart contracts serve as on-chain guarantors, removing all intermediaries from peer-to-peer transactions.

- OmniPact’s roadmap includes RWA integration and AI agent transaction capabilities across multiple chains.

OmniPact has secured $50 million in a private funding round to advance its decentralized trust infrastructure. The New York-based protocol is building a trust layer for peer-to-peer transactions involving both physical and digital assets.

A consortium of institutional investors and family offices backed the round, requesting anonymity. The capital will speed up mainnet development, cross-chain integration, and the launch of a decentralized arbitration module, bringing the project closer to full global deployment.

Funds to Drive Mainnet Development and Technical Expansion

A large share of the proceeds will fund the final development of OmniPact’s core contracts. Security audits of the multi-chain infrastructure are also scheduled as part of this phase.

Both steps must be completed before the protocol can advance into public deployment. This work is set to run alongside active engineering efforts on the mainnet.

OmniPact also confirmed that its testnet launch remains on schedule for Q1 2026. This milestone gives the protocol a clear timeline as it moves toward full market entry. Reaching this target would place OmniPact ahead of many competitors in the decentralized commerce sector.

Part of the capital will also go toward expanding OmniPact’s engineering team. More developers are expected to speed up real-world asset (RWA) integration across the platform. AI agent transaction capabilities are also being developed as part of this funding cycle.

Co-founder and CEO Alex Johnson commented on the raise, stating: “The funding validates our thesis that the future of commerce requires a neutral, transparent, and trustless foundation.”

Johnson added that the infrastructure “eliminates intermediaries entirely, returning power to users.” He further noted that investor confidence would allow the team to bring secure, decentralized custody to a global audience.

Smart Contracts and Decentralized Arbitration as the Trust Layer

OmniPact’s protocol is built to solve the trust problem that persists in peer-to-peer transactions. The platform deploys smart contracts as on-chain guarantors, removing reliance on any centralized platform. Two parties can therefore transact directly, with no third-party intermediary required.

Furthermore, the protocol pairs algorithmic custody with a built-in decentralized arbitration module. A reputation system operates alongside both tools, reinforcing accountability across all user activity.

Together, these mechanisms support secure and verifiable peer-to-peer asset exchange. The model also removes single points of failure common in traditional escrow services.

Cross-chain integration forms another technical pillar of OmniPact’s core architecture. The protocol is engineered to function across multiple blockchain networks at the same time. This gives the platform access to users operating across different digital asset ecosystems.

Institutional backers expressed confidence in OmniPact’s roadmap at the time of the announcement. They cited the protocol’s capacity to set new standards across both Web4 and traditional commerce.

Johnson concluded that the round gives the team the resources to “execute our roadmap” and deliver a live, fully operational protocol to a global audience.

Crypto World

European Energy Crisis: How Russia and Qatar Shocks Are Threatening EU Industrial Power

TLDR:

- Europe still imported 2 billion cubic feet per day of Russian LNG last year, half of Russia’s total exports.

- Qatar supplies 20% of global LNG and declared force majeure, with production halted for at least one month.

- The U.S. now controls over 50% of Europe’s LNG supply, giving Washington direct leverage over EU energy costs.

- Gas prices have already surged over 50% as simultaneous supply shocks strain Europe’s limited energy alternatives.

European energy crisis pressures are mounting as Russia redirects LNG exports while Qatar declares force majeure on gas. Europe replaced cheap Russian pipeline gas with costly LNG after the Ukraine war began.

Now two simultaneous supply shocks are hitting the continent at once. Gas prices have already surged over 50% in recent days.

The EU faces limited alternatives and growing concerns about a 2022-style energy crunch that could once again disrupt factories across the region.

Russia Redirects Exports as Qatar Shuts Down Production

Before the Ukraine war, Europe relied on 15 billion cubic feet per day of Russian gas. That supply kept European manufacturing costs competitive for years.

After the conflict began, Europe sourced costlier LNG from the U.S., Qatar, and other producers. The transition raised energy costs for European industry considerably.

The EU still imported 2 billion cubic feet per day of Russian LNG last year. That volume is roughly half of Russia’s total LNG exports globally. Russia has now announced it will redirect those flows to China and India.

Bull Theory stated on X: “Russia announced it will redirect part of its LNG exports away from Europe to friendly countries like China and India immediately.”

Russia’s move comes before the EU’s 2027 legal ban on Russian gas takes effect. Moscow has clear incentive to act on supply leverage before that deadline.

European policymakers now face a difficult position with limited response time. New supply chains cannot be established quickly enough to fill the gap.

Qatar’s Ras Laffan facility shutdown has added another blow to Europe’s energy position. Qatar supplies 20% of all global LNG and declared force majeure after the closure.

Normal production is not expected to resume for at least one month. Europe had relied on Qatari LNG as a central part of its post-Russia supply plan.

U.S. Leverage Grows While European Industry Faces Closures

The United States now supplies over 50% of Europe’s LNG. This gives Washington leverage over European energy costs and industrial policy.

European manufacturers must either absorb higher costs or relocate operations to North America. Bull Theory noted: “This effectively allows the U.S. to weaponize energy costs, forcing European factories to either pay a massive premium or relocate.”

Unlike China and India, Europe has not built diverse energy supply chains. Both nations secured alternatives that shielded them from current disruptions.

Europe, by contrast, faces simultaneous shocks with very few substitutes. Brussels is caught between U.S. bargaining pressure and a supply gap that diplomacy cannot quickly fill.

If the Hormuz blockade continues for weeks, a second wave of factory closures becomes likely. A similar pattern to 2022 could emerge, with permanent industrial losses for the European energy crisis.

The EU’s manufacturing standing faces direct structural pressure as a result. The outcome depends on events largely outside Europe’s control.

Russia still earns billions from the EU despite current tensions. The coming 2027 ban removes Moscow’s incentive to keep flows stable.

Europe has few tools to address a supply failure of this scale. The energy challenge now extends well beyond what Brussels can manage alone.

Crypto World

Kalshi, Polymarket Eye $20B Valuations in Potential Fundraising: WSJ

Prediction market platforms Kalshi and Polymarket are reportedly exploring new fundraising rounds that could value the companies at around $20 billion each, roughly double their most recent valuations.

Both platforms have held preliminary discussions with potential investors about raising fresh capital at the elevated valuation, the Wall Street Journal reported on Friday, citing people familiar with the matter. The report noted that the negotiations remain at an early stage and may not result in deals or secure the targeted valuation.

Kalshi currently operates in the United States and offers markets allowing users to wager on outcomes tied to sports, politics, the economy and cultural events. The company was last valued at about $11 billion in December when it raised $1 billion from investors including Paradigm and Sequoia Capital.

Founded in 2018 by Tarek Mansour and Luana Lopes Lara, Kalshi received approval from the US Commodity Futures Trading Commission in 2020 to operate as a regulated exchange for event-based markets. The platform has since expanded rapidly and recently surpassed a $1 billion revenue run rate, with some estimates placing the figure closer to $1.5 billion.

Related: Kalshi, Polymarket face trading halt in Nevada after court rulings

Polymarket plans US launch later this year

Polymarket, launched in 2020 by Shayne Coplan, remains inaccessible to US users without a virtual private network but plans to introduce a regulated domestic version of its platform later this year. The company was valued at roughly $9 billion in October after Intercontinental Exchange, the owner of the New York Stock Exchange, agreed to invest up to $2 billion.

Both platforms have drawn attention from lawmakers and regulators. As Cointelegraph reported, US Democratic lawmakers are drafting legislation to regulate prediction markets after suspiciously timed bets on the timing of US and Israeli strikes on Iran raised insider-trading concerns.

Senator Chris Murphy alleged that individuals close to the White House may have used advance knowledge of the attack to place bets, noting that several Polymarket accounts reportedly made about $1 million by wagering just hours before explosions were reported in Tehran.

Related: Kalshi founder provides update on Iran’s Khamenei market carveout

Polymarket faces insider trading suspicions

Polymarket has faced multiple insider trading allegations after several traders placed unusually well-timed bets on major events. A small group of crypto wallets recently made more than $1.2 million betting on a market tied to an onchain investigation into DeFi platform Axiom shortly before blockchain investigator ZachXBT published claims about insider trading linked to the project.

In a separate incident last month, another Polymarket account reportedly earned about $400,000 after placing a large wager on the capture of Venezuelan President Nicolás Maduro shortly before the news became public, further raising questions about whether some traders had advance information.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

USDC tops Tether as stablecoin transfers hit all-time high $1.8T

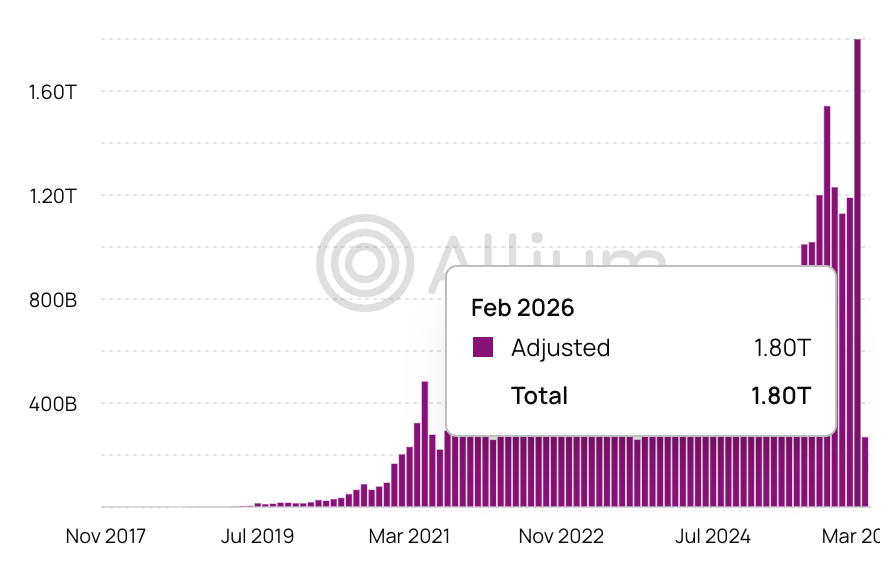

Stablecoins are delivering a liquidity surge unseen in recent cycles, with February marking a record on-chain transfer activity and signaling a shift in how capital moves through crypto markets. Allium’s data shows total stablecoin transfers climbed to $1.8 trillion in February, underscoring a robust appetite for dollar-pegged liquidity across chains. Within that, USDC accounted for roughly 70% of stablecoin activity, while USDt handled about $514 billion in transfers. The divergence—USDC’s dominance in flow despite a smaller market cap—illustrates how on-chain dynamics can outpace headline market-size metrics. The backdrop includes Circle reporting strong Q4 2025 earnings tied to rapid USDC business growth and expanded payments operations, alongside broader regulatory chatter shaping stablecoin frameworks.

Key takeaways

- February set a monthly record for stablecoin transfer volume at $1.8 trillion, according to Allium data.

- USDC comprised roughly 70% of all stablecoin transfer volume, with $1.26 trillion moved in February.

- USDt accounted for about $514 billion in stablecoin transfers in the same month, highlighting a substantial, yet smaller, slice of activity.

- USDC’s transfer volume has consistently surpassed USDt in recent months, even as USDt retains a larger market cap; Moonrock Capital’s Simon Dedic highlighted the trend on social media.

- New supply dynamics saw USDC minting accelerate in March, with Arkham data showing more than $3 billion minted in the first week of the month, while USDt’s supply remained comparatively flat.

- Broader liquidity signals—such as rising stablecoin supply on exchanges and the Stablecoin Supply Ratio’s recovery—converge with Bitcoin’s renewed price momentum, suggesting improving buying power in the market.

Tickers mentioned: $BTC, $USDC, $USDT

Sentiment: Bullish

Price impact: Positive. A higher on-chain stablecoin presence translates into greater liquidity for buyers, which can support price recoveries during risk-on periods.

Market context: The current liquidity uptick comes as crypto markets digest improved risk sentiment and a more active stablecoin ecosystem. Regulatory developments, including state-level discussions around stablecoins in places like Florida, add a layer of policy uncertainty that market participants are watching closely. These dynamics shape how liquidity profiles evolve across exchanges and DeFi protocols, influencing funding costs, slippage, and the pace of any potential rebound in broader crypto markets.

Why it matters

The February data illuminate a shift in how liquidity is sourced and deployed within the crypto ecosystem. Stablecoins are not only serving as a unit of account and settlement layer; they are becoming a primary engine for on-chain liquidity, enabling faster settlement and cross-chain movement. This has practical implications for traders, liquidity providers, and developers building on-ramp/off-ramp solutions, as larger flows can reduce slippage and improve the efficiency of executing large trades without destabilizing prices.

From an investor perspective, the observed dynamic—where USDC shows outsized transfer activity despite a smaller market cap relative to USDT—suggests that on-chain demand and real-use cases (such as payments, settlements, and cross-chain liquidity provisioning) can outpace traditional metrics. For builders and wallets, the data point to a thriving settlement layer, underscoring why stablecoins remain central to DeFi liquidity provisioning and cross-chain ecosystems. The broader regulatory context, including bills or policy proposals under consideration in jurisdictions like Florida, could influence user adoption and the pace at which institutions participate in stablecoin ecosystems, even as on-chain demand remains robust.

The market’s attention remains anchored on indicators that go beyond wallet counts or market caps and instead focus on real, on-chain activity. The Stablecoin Supply Ratio (SSR), which tracks Bitcoin’s market cap relative to stablecoin supply, has been recovering after a February dip, a signal CryptoQuant analyst Sunny Mom described as indicating “buying power returning to the market.” This sentiment aligns with a rebound in stablecoin supply on exchanges, where data indicate inflows contributing to a three-week high of roughly $66.5 billion, and with March inflows of about $5.14 billion on a single day tightening the liquidity pipeline. When sidelined capital returns to centralized and decentralized venues, it often precedes price moves in the flagship crypto assets, including Bitcoin and ether, as traders position for shifts in risk appetite.

What to watch next

- How March USDC minting evolves relative to USDT, and whether the pace sustains the early-month momentum observed by Arkham data.

- The trajectory of the SSR metric and whether rising stablecoin inflows on exchanges persist into the next quarter.

- Regulatory developments around stablecoins, including any state-level bills or federal policy steps that could affect settlement rails and cross-border payments.

- Circle’s ongoing earnings and operational updates, especially around USDC’s settlement capabilities and any further expansion of payments networks (as noted in prior earnings coverage).

- Monitoring the price action of Bitcoin and other major assets as liquidity flows and risk sentiment evolve, including shifts in funding rates and on-chain transaction activity.

Sources & verification

- Allium data on stablecoin transfer volumes, February metrics for USDC and USDt transfers.

- Arkham data on USDC minting pace in March, including the first-week minting total.

- Moonrock Capital — Simon Dedic’s observation on USDC vs USDT transfer volumes (social post).

- Cointelegraph coverage on Circle’s Q4/2025 earnings and USDC-related growth and settlement expansion.

- CryptoQuant analysis of SSR recovery and related exchange stablecoin inflows (including the March 5 figure of $5.14 billion).

- Florida Senate coverage of state-level stablecoin legislation and related regulatory considerations.

Stablecoins drive liquidity and the road ahead

The on-chain era is increasingly defined by how dollars move between wallets, scripts, and cross-chain bridges rather than by standalone token flips alone. February’s record stablecoin transfer volume, led by USDC (CRYPTO: USDC) and supported by a broad base of on-chain activity, suggests a fresh wave of liquidity is re-entering markets. While USDt (CRYPTO: USDT) remains the larger market-cap holder, its role in daily transaction flow appears to be waning relative to USDC’s immediate-use utility and cross-chain flexibility. This divergence — a rising proportion of actual transfers in USDC alongside ongoing growth of USDT’s nominal cap — highlights the complexity of today’s liquidity stack: more dollars are moving in ways that can support trades, settlements, and potentially price resilience as macro and regulatory signals evolve.

Watching the next few weeks will be instructive: will USDC sustain its elevated transfer-volume share and continue minting beyond the early March pace observed by Arkham? Will the SSR continue its ascent as more stablecoins circulate on exchanges? And how will policymakers respond to a stablecoin ecosystem that both powers practical payments and invites heightened scrutiny? The answers will shape not only the immediate liquidity environment but also the longer-term viability of stablecoins as liquidity rails for the crypto market.

//platform.twitter.com/widgets.js

Crypto World

South Korea Bars Stablecoins from Corporate Crypto Investment Guidelines Over Legal Conflict

TLDR:

- South Korea FSC excludes USDT and USDC from corporate crypto investment guidelines over legal conflicts.

- The Foreign Exchange Transactions Act does not recognize stablecoins as a valid external payment method.

- Listed companies may invest in the top 20 non-stablecoin assets, capped at 5% of their own capital.

- A pending amendment to the Foreign Exchange Act could eventually open the door for stablecoin inclusion.

Stablecoins, including USDT and USDC, are set to be excluded from South Korea’s corporate cryptocurrency investment guidelines.

South Korea’s Financial Services Commission (FSC) is preparing rules to allow listed companies to trade digital assets.

According to Herald Economy, regulators have opted to keep dollar-pegged stablecoins out of the approved investment list.

The decision stems from a conflict with the Foreign Exchange Transactions Act. This law does not currently recognize stablecoins as a legal external payment method.

Legal Conflict Shapes the Stablecoin Decision

South Korea’s Foreign Exchange Transactions Act requires external payments to go through designated foreign exchange banks. Stablecoins are not classified as external payment instruments under this law.

Allowing corporate investment in stablecoins would create a direct legal contradiction. The FSC chose to exclude stablecoins from the new corporate investment guidelines.

A partial amendment to the Foreign Exchange Transactions Act was introduced to the National Assembly in October. The amendment aims to formally recognize stablecoins as a means of payment.

The bill, however, remains under review and has not yet been passed. Until the law changes, stablecoins cannot be included in corporate investment guidelines.

Instead, the FSC plans to permit the top 20 non-stablecoin digital assets by market capitalization. Bitcoin and Ethereum are among the assets expected to be approved under these rules.

Investment amounts may also be capped at 5% of a company’s own capital. This limit is designed to reduce exposure during the early market stages.

Some listed companies with cross-border trade had requested stablecoin inclusion in the guidelines. They argued stablecoins support exchange rate hedging and fast international settlements.

The FSC, however, maintained its position and excluded stablecoins from the permitted investment list.

Corporate Stablecoin Access Remains Outside Regulated Guidelines

Even without official guidelines covering stablecoins, companies can still trade them through other channels. Personal wallets like MetaMask and overseas exchanges such as Coinbase’s OTC platform remain accessible to corporations.

These transactions, however, operate outside any officially regulated framework. The guidelines do not block companies from using stablecoins entirely.

Authorities noted that some companies already use stablecoins through personal accounts or overseas exchange platforms for trade.

These transactions occur outside formal banking channels. The FSC acknowledged this but still chose not to formalize stablecoin use in the guidelines. Regulators placed legal consistency above industry convenience in this case.

An industry insider confirmed the corporate guidelines task force has wrapped up its work. “I know that the working task force on corporate guidelines has been completed,” the insider said.

They added, “It is in line with the legislative status of the Phase 2 Digital Asset Framework Act, so we have to wait and see, but it is a knotted situation.” Progress, therefore, depends heavily on how the broader legal framework develops.

The FSC’s approach signals a cautious entry into corporate digital asset participation. By limiting access to top non-stablecoin assets, regulators aim to manage financial risk.

Companies seeking stablecoin access will likely need to wait for the Foreign Exchange Transactions Act to be amended.

Crypto World

Stablecoin Transaction Volume Hits a New Record High as USDC Surpasses USDT

Stablecoins have hit an all-time high in monthly transaction volume, as Circle’s USDC (USDC) flipped Tether’s USDt (USDT), new data shows.

Key takeaways:

-

Stablecoin monthly transaction volume reached a record $1.8 trillion in February.

-

USDC comprised 70% of all stablecoin volume.

-

Rising stablecoin supply on exchanges puts crypto markets in a good position to recover.

USDC “consistently” flips USDt transfer volume

The stablecoin transfer volume reached $1.8 trillion in February, setting a monthly record, according to data from Allium.

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to fiat currencies like the US dollar, and can be hosted on multiple blockchains.

Similarly, the volume of USDC transactions reached a high of $1.26 trillion, representing a new milestone in the adoption of the second-largest stablecoin by market cap since its launch in September 2018.

Related: Florida Senate passes state-level stablecoin bill, awaits DeSantis’ signature

This was more than double that of USDt, whose transfer volume was $514 billion in February.

In fact, USDC has “consistently flipped” Tether in transfer volume over the last few months, founder at Moonrock Capital, Simon Dedic, said in a Friday post on X.

USDC’s usage comes as a “surprise” given that its market cap is less than half that of USDt, Dedic added. USDC is the second-largest stablecoin by market cap at $77.4 billion, compared to USDt’s $184 billion.

Moreover, USDC’s supply has grown faster than USDt’s in recent weeks. Over $3 billion in USDC has been printed already in March, according to market intelligence firm Arkham, as USDt’s supply has remained relatively unchanged.

CIRCLE JUST MINTED $250M $USDC

Circle just minted another $250M USDC on Solana. They’ve minted over $3 BILLION in just this first week of March.

If Circle continue at this pace, they’re on track to mint over $12 Billion USDC by the end of the month. pic.twitter.com/aoQKi6zbFE

— Arkham (@arkham) March 7, 2026

As Cointelegraph reported, USDC issuer Circle Internet Group reported strong Q4/2025 earnings, attributed to rapid growth in the USDC’s business and expanding payments operations.

More stablecoin liquidity suggests “buying power”

The Stablecoin Supply Ratio (SSR), or the ratio of the Bitcoin (BTC) market cap relative to stablecoin market cap, is “steadily recovering after crashing” in February, said CryptoQuant analyst Sunny Mom in a Friday Quicktake post, adding:

“This shows buying power is returning to the market.”

Meanwhile, Bitcoin’s latest push to $74,000 was fueled by a recovery in stablecoin supply on crypto exchanges, which rose to a three-week high of $66.5 billion on Friday.

Stablecoin inflows to exchanges have boosted the SSR alongside Bitcoin’s (BTC) price. On March 5, the total amount of stablecoins transferred to the exchange amounted to nearly $5.14 billion, up from $1.14 billion on March 1.

More stablecoins on exchanges means more buying power for cryptocurrencies. In the past, the return of sidelined capital to exchanges was a major catalyst for the start of Bitcoin bull markets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Washington Man Sentenced to 2 Years for Diverting $35M to Failed DeFi Platform

A Washington state man has been sentenced to two years in federal prison after diverting $35 million from his employer to fund a personal decentralized finance venture that ultimately collapsed during the 2022 crypto market downturn.

Key Takeaways:

- A former Washington CFO was sentenced to two years in prison for diverting $35 million in company funds into a failed DeFi investment scheme.

- The crypto strategy collapsed during the 2022 market downturn following the Terra ecosystem crash.

- The losses severely impacted the company, triggering layoffs and nearly forcing the business to shut down.

Nevin Shetty, 42, was convicted of wire fraud in November after prosecutors showed he secretly transferred company funds into a crypto investment scheme tied to his side project, HighTower Treasury.

The funds belonged to a private software company where Shetty served as chief financial officer.

Prosecutors Say CFO Diverted Funds After Learning of Job Termination

According to the US Department of Justice, Shetty drafted a conservative investment policy for the firm that limited how corporate funds could be used.

Despite those internal guidelines, he moved tens of millions of dollars from the company’s accounts after learning in April 2022 that his position would be terminated due to performance concerns.

The money was routed to HighTower Treasury, where Shetty and a business partner invested heavily in decentralized finance lending protocols promising annual returns of 20% or more.

Prosecutors said Shetty intended to return a fixed payment to the company while keeping the remainder of any profits generated by the crypto strategy.

Initially, the scheme produced modest gains. Court filings show the operation generated roughly $133,000 in its first month.

However, the broader crypto market soon entered a steep downturn following the collapse of the Terra ecosystem in May 2022.

As the market fell, the value of HighTower’s positions rapidly deteriorated. The investments tied to Shetty’s strategy plunged from approximately $35 million to nearly nothing during the subsequent crypto winter.

After the losses became clear, Shetty admitted his actions to colleagues at the company. He was later dismissed from his role.

During sentencing, US District Judge Tana Lin said the incident inflicted serious damage on the business. According to the court, the company faced “significant and severe effects” from the losses and was nearly forced to shut down.

The financial damage also triggered layoffs, with about 60 employees losing their jobs as the company attempted to stabilize operations following the missing funds.

Federal prosecutors had requested a nine-year prison sentence, arguing that Shetty’s actions involved deception and caused lasting harm to the company and its staff. The court ultimately imposed a shorter sentence of two years.

Washington Man Ordered to Pay $35M Restitution After DeFi Fraud

In addition to prison time, Shetty was ordered to pay $35,000,100 in restitution. After completing his sentence, he will remain under supervised release for three years.

Judge Lin also imposed restrictions on Shetty’s future employment, prohibiting him from serving as an officer or director of a company without approval from the probation office.

Last month, two teenagers from California faced serious felony charges after authorities say they traveled hundreds of miles to carry out a violent home invasion in Scottsdale, Arizona, in a bid to obtain cryptocurrency believed to be worth $66 million.

The case came amid a broader rise in so-called wrench attacks, physical assaults aimed at forcing crypto holders to hand over private keys.

Security researcher Jameson Lopp’s public database lists roughly 70 such incidents in 2025, a sharp increase from the previous year.

Security analysts say criminals are increasingly using leaked personal data to identify targets and recruiting young perpetrators online to reduce traceability.

The post Washington Man Sentenced to 2 Years for Diverting $35M to Failed DeFi Platform appeared first on Cryptonews.

Crypto World

China’s HR Minister Says Jobs Will Stay Stable for 5 Years Despite AI and Labour Headwinds

TLDR:

- China’s HR minister pledges stable employment over five years despite rapid AI and labour disruptions.

- Young people, college graduates, and migrant workers are prioritized under China’s new employment plan.

- Vocational training and entrepreneurship support will help workers adapt to AI-driven industry changes.

- China aims to align AI development with workforce growth rather than allowing automation to replace jobs.

China says it can keep jobs stable over the next five years, even as artificial intelligence and labour market pressures grow.

Human Resources Minister Wang Xiaoping made this confident assertion on Saturday at the annual parliamentary session in Beijing.

She acknowledged mounting challenges but maintained that positive employment momentum remains achievable.

The government’s plan targets young people, college graduates, and migrant workers to sustain workforce stability nationwide.

China Stands Firm on Job Stability Despite Growing AI Disruption

China says it can keep jobs stable even as automation continues reshaping traditional industries across the country. The government recognizes that AI adoption may disrupt workforce demand in several key sectors.

Despite these concerns, officials remain confident that proactive policies will protect employment conditions. The rapid pace of technological change has not shifted China’s firm stance on labour stability.

Wang Xiaoping stated during the parliamentary session that China will expand employment opportunities for vulnerable workforce groups.

Young people, college graduates, and migrant workers remain at the center of this commitment. Reuters reported that Wang said China will “keep employment stable and sustain positive momentum over the next five years,” affirming the government’s resolve. These groups face the greatest exposure to shifts driven by economic and technological changes.

Vocational training programs will be strengthened to prepare workers for an evolving job market. Entrepreneurship support and new-sector job growth policies will also be introduced.

College graduates entering the workforce each year will receive expanded employment assistance. Migrant workers, critical to manufacturing and urban development, will benefit from additional targeted measures.

Officials argue that combining economic growth with forward-looking employment policy creates a strong buffer against disruption.

China says it can keep jobs stable by ensuring technological progress works alongside workforce development. The government believes this dual approach will carry employment conditions through the next five-year period. Policymakers remain cautious but consistently optimistic about the road ahead.

Labour Market Uncertainties Challenge China’s Five-Year Employment Pledge

China says it can keep jobs stable, but labour market uncertainties continue to test that confidence in real time. Structural economic shifts and the growing adoption of AI technologies are altering workforce demand.

Traditional industries face pressure as automation replaces roles previously held by human workers. The government acknowledges these realities while pushing back against projections of widespread job loss.

Reports from the NPC sidelines noted that Wang emphasized “rising labour market uncertainties and the rapid development of artificial intelligence pose challenges,” making the government’s stable-employment pledge all the more significant.

Officials are now prioritizing policies that stimulate job creation within emerging digital and technology sectors. These industries are expected to absorb workers transitioning out of disrupted traditional roles. A measured and structured transition strategy remains central to China’s employment protection plan.

China plans to ensure AI development complements rather than replaces workforce opportunities across industries. Retraining programs will help workers adapt to new technological demands over time.

Digital transformation strategies will be rolled out alongside accessible worker support systems. This balanced approach aims to reduce the human cost of rapid automation.

China says it can keep jobs stable over the next five years through consistent policy action and economic management. Workforce training, innovation-driven job creation, and targeted group support form the backbone of this plan.

The government remains committed to protecting employment while advancing its broader digital economy goals. With clear policy direction in place, China moves forward with both ambition and measured confidence.

Crypto World

What if climate insurance were paid to farmers in seconds?

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Extreme weather events have become routine with climate change globally. In 2024, U.S. farmers lost over $20 billion to wildfires, floods, hurricanes, hail, frost, and tornadoes. Canadian producers face similar difficulties: 51% of operations suffered from drought in 2022 and 2023, while 26% experienced flooding. British Columbia alone saw almost $460 million in losses last year. Producers in developing nations like Kenya or Brazil, who don’t have access to the same technologies as their peers in North America, are even more vulnerable.

Summary

- Climate disasters move fast — insurance doesn’t: Farmers lose critical planting windows while waiting months for payouts, compounding economic damage after floods or droughts.

- Stablecoins change the speed of recovery: 24/7, borderless payments can deliver funds in seconds, even to unbanked rural producers with only a smartphone.

- Smart contracts remove friction and corruption: Parametric insurance triggered by verified weather data enables automatic, transparent payouts without adjusters or delays.

When a farm is hit by a flood or a drought, the physical damage is compounded by the fact that the operation’s economic activity ceases. Each week without compensation means lost seeds, missed planting, and mounting debt. Yet most insurance systems remain stuck in the past. After Pakistan’s devastating 2022 floods, many smallholders waited months for disaster aid to clear local banks. By the time funds arrived, the planting season had already passed, and worse, vulnerable farmers may have been unable to pay expenses to keep their farms viable for the following season.

As climate volatility increases, farmers need faster and more reliable support. One unexpected technology might finally close that gap: stablecoins. These digital tokens are designed to always keep the value of government-issued currencies like the U.S. dollar. Far from being just another crypto fad, stablecoins could underpin instant, programmable insurance that leverages real-time weather data.

Shock disasters, slow money

Traditional insurance depends on human verification. Adjusters must visit farms, file reports, and route payments through banks that rarely reach rural communities. Even in advanced economies, it can take months, and in developing nations, it can be a year-long process.

If disasters strike in seconds, payouts must move just as fast. Stablecoins are able to move value across borders in milliseconds, 24/7, with full transparency. Unlike bank wires, they don’t close for weekends or holidays. And unlike checks, they don’t depend on local banking infrastructure.

For a Canadian farmer in a remote, rural region, the technology can prove transformative. Using only a smartphone, they can receive climate insurance payouts directly to their digital wallet, without passing through the clunky banking sector.

Besides, not all producers have access to banking services in the first place. El Salvador counts almost 400,000 farmers, but 70% of the total population is unbanked, so only 32 000 Salvadoran farmers have access to agricultural credit. Stablecoins can help bridge that gap, turning smartphones into financial access points.

NGOs already use this model. The UN Refugee Agency has sent stablecoin-based emergency funds to displaced families in Ukraine, bypassing weeks of banking delays. If stablecoins can reach war zones, they can certainly reach farms.

Smart contracts can make insurance payouts automatic

Stablecoins become even more powerful when combined with smart contracts, which are software programs that can autonomously trigger an action (for example, send out payments) when specific events occur. In climate insurance, this enables parametric coverage, where payouts are linked to weather thresholds.

We can easily imagine a system where, if rainfall drops below a set level and thereby signals a drought, a blockchain contract would automatically send out stablecoin payouts to those affected. The data would come from verified, neutral weather data providers, not human claims adjusters. The system would drastically cut paperwork, delays, and especially subjective decisions on the part of insurance companies.

Platforms like Arbol already use a system like this to send automatic stablecoin payments to farmers affected by extreme weather events. What once took weeks of processing now happens in minutes, with no room for corruption or error.

Transparency builds trust

Beyond speed, stablecoins offer something equally valuable: trust. Billions in climate aid and insurance funds vanish each year into administrative black holes. Blockchain-based payments are transparent by design; it’s easy to have visibility into each transaction.

That transparency is already restoring credibility to climate finance. The Lemonade Foundation’s Crypto Climate Coalition, for instance, uses stablecoins to deliver verifiable payouts to African farmers. Every transfer can be traced from donor to recipient, ensuring funds go where they’re meant to.

When speed and transparency combine, confidence follows. Farmers can plan their next planting season with certainty. Donors can see their money at work. And policymakers can measure results instantly, not months later.

Stablecoins are often viewed through the lens of crypto speculation, but their promise lies in their utility. Their features make them ideal for solving one of humanity’s oldest problems: managing risk in an unpredictable world. Stablecoins won’t stop the next drought or flood, but they can make recovery faster, fairer, and more predictable.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business22 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion19 hours ago

Fashion19 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

JUST IN: NEVIN SHETTY SENTENCED TO 2 YEARS IN PRISON FOR $35M DEFI THEFT

JUST IN: NEVIN SHETTY SENTENCED TO 2 YEARS IN PRISON FOR $35M DEFI THEFT