Crypto World

Pony AI Begins Mass Production of Robotaxis with Toyota Partnership

TLDR

- Pony AI has started mass production of its autonomous robotaxis in partnership with Toyota, planning 1,000 units this year.

- By 2026, Pony AI aims to operate a fleet of 3,000 autonomous vehicles across mainland China, Europe, and the GCC.

- The robotaxis will feature level 4 (L4) autonomous capabilities, capable of operating without human intervention.

- Pony AI plans to offer affordable robotaxi services, with fares up to 10% lower than regular taxi rides.

- The company’s strategy includes expanding infrastructure, such as ultra-fast charging stations, to support robotaxi growth.

Pony AI has initiated mass production of its autonomous robotaxis in collaboration with Toyota. The company plans to roll out 1,000 driverless cabs this year, with deployment in key cities across mainland China. This move signals a major milestone in the commercialization of autonomous vehicles and the company’s ambitious expansion.

Mass Production of Robotaxis Begins

Pony AI, the Chinese self-driving technology firm, has started the production of its robotaxis in collaboration with Toyota. By the end of 2026, the company expects to operate a fleet of more than 3,000 autonomous vehicles globally. The Guangzhou-based company emphasized the milestone as a new phase in scaling production and commercial deployment.

The development also highlights the deep integration between the partners in autonomous driving technology and vehicle manufacturing. According to the company, the partnership leverages Toyota’s vehicle manufacturing capabilities combined with Pony AI’s advanced self-driving technology.

The vehicles will feature level 4 (L4) autonomous capabilities, meaning they can operate without human intervention under most conditions. As the first step in its global strategy, Pony AI aims to provide autonomous services in mainland Chinese cities and potentially expand to other international markets by 2026.

Pony AI’s Vision for the Future of Autonomous Vehicles

Pony AI has outlined its plans to expand its robotaxi fleet to more than 3,000 units by the end of 2026. The company intends to operate autonomous vehicles not just in China, but also in regions such as Europe and the Gulf Cooperation Council (GCC). The cars will provide affordable mobility options, with fares up to 10% lower than regular taxi services.

Pony AI’s rapid scaling strategy includes establishing the necessary infrastructure for autonomous driving, such as ultra-fast charging stations and battery storage solutions. Pony AI’s collaboration with Toyota aims to create a model for the global autonomous taxi market.

According to financial consultant Ding Haifeng, the combination of self-driving technology and robust vehicle assembly creates a powerful growth engine for the robotaxi industry. With 1,000 driverless cabs set to hit the streets this year, the company is making strides toward widespread adoption and furthering its mission to revolutionize urban transportation.

Crypto World

3 Altcoins to Watch In The Second Week Of February 2026

Altcoin momentum is picking up as renewed buying pressure returns to select high-beta tokens. After a period of consolidation and volatility, several charts are now flashing continuation signals and reversal signals.

BeInCrypto has analyzed three such altcoins that the investors should watch in the second week of February.

Sponsored

Sponsored

Axie Infinity (AXS)

AXS emerged as the best-performing altcoin today, surging 18% over the past 24 hours. The rally helped preserve the broader uptrend that began at the start of the year. Renewed buying interest suggests traders are regaining confidence after recent volatility weighed on momentum.

A recent pullback delayed a potential Golden Cross that AXS was approaching in early February. If bullish momentum resumes from current levels, the setup could re-emerge. Such a reversal may push AXS above $1.65, opening the path toward the $1.92 resistance zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk remains if bullish momentum fails to hold. A breakdown below $1.32 would signal a loss of uptrend support. Under that scenario, AXS could slide toward the $1.05 support, invalidating the bullish thesis and shifting sentiment back toward caution.

Sponsored

Sponsored

Kite (KITE)

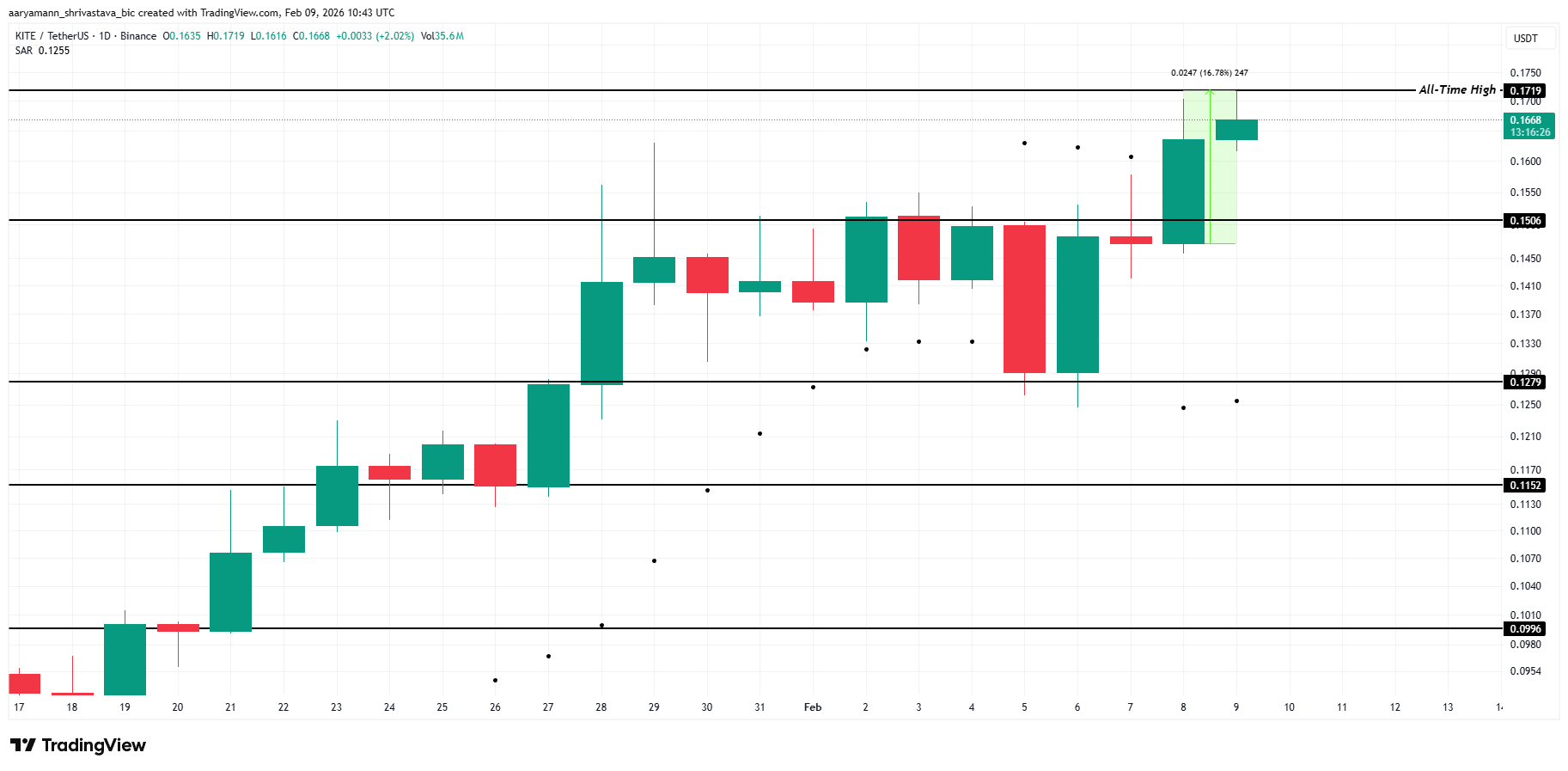

KITE is among the strongest-performing altcoins in the market, continuing to post fresh all-time highs since February began. The altcoin set a new ATH at $0.1719 today, extending its momentum-led rally. Persistent buying interest highlights strong demand as traders favor high-momentum assets during the current market phase.

KITE recently bounced from the $0.1506 support, reinforcing bullish structure. The Parabolic SAR remains positioned below the price, signaling an active uptrend. This technical setup supports further upside and suggests the ATH rally may continue as long as buyers defend key support levels.

Profit-taking risk remains elevated after repeated ATHs. Additionally, a decisive drop below the $0.150 support would weaken the bullish structure. Under that scenario, KITE could retreat toward $0.127, invalidating the bullish thesis and signaling a deeper corrective phase.

BankrCoin (BANKR)

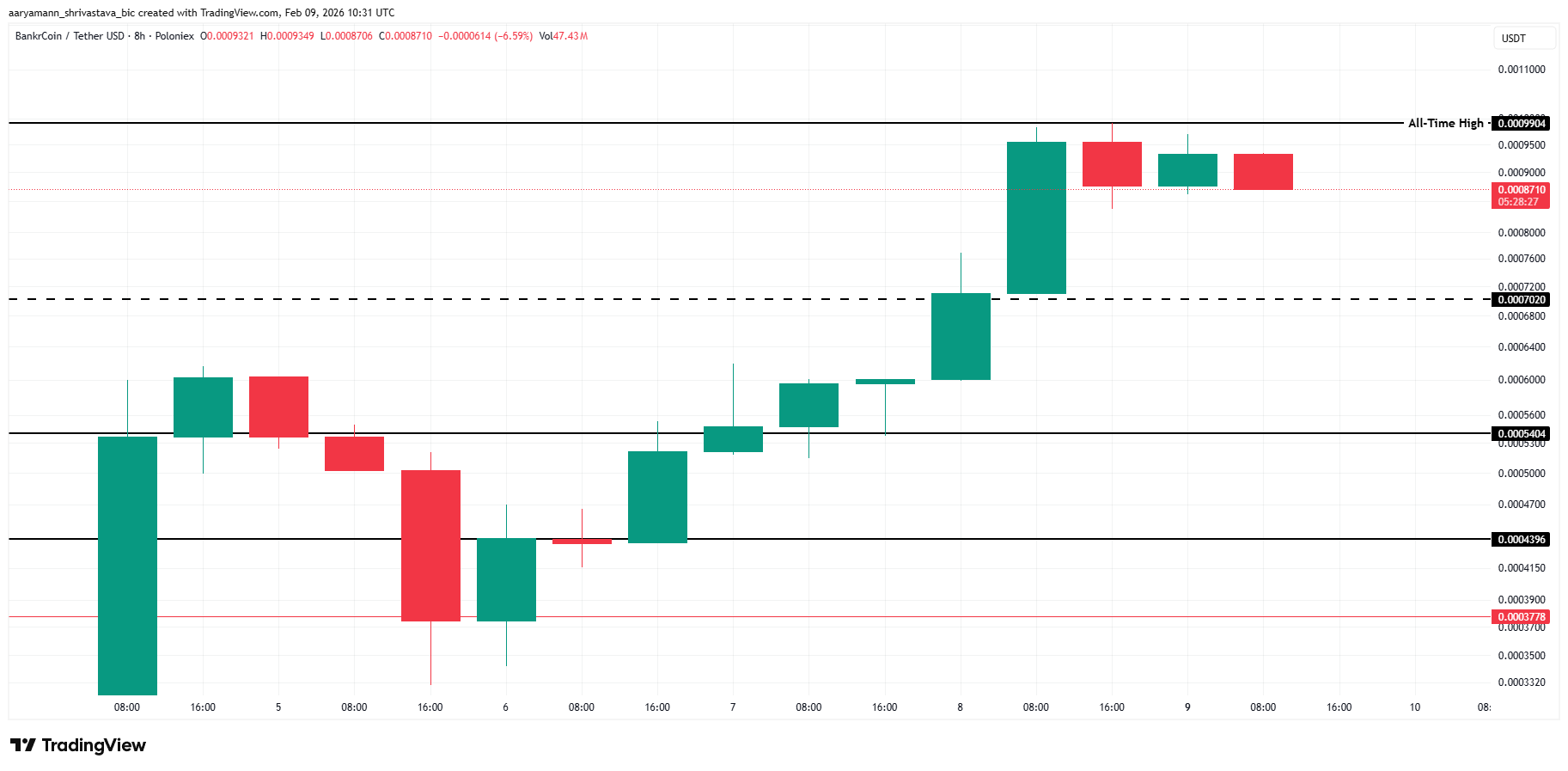

BankrCoin is showing strong bullish momentum after a sharp impulsive breakout from the $0.0007020 resistance, which has now flipped into support. Price accelerated toward the $0.00099 all-time high, followed by a tight consolidation near $0.00087. The structure suggests healthy continuation rather than distribution, positioning it as an altcoin to watch.

If buyers defend $0.00087, the price is likely to retest the $0.00099 all-time high. Furthermore, a clean breakout above $0.00099 would open price discovery toward $0.00110 next. Strong bullish candles, rising volume, and shallow pullbacks support continuation, indicating momentum remains firmly in favor of bulls.

Bullish invalidation occurs on an 8-hour close below $0.0007020, which would signal a failed breakout and shift momentum neutral. As a result, a deeper breakdown below $0.0005404 would fully invalidate the bullish structure.

Crypto World

Cango Offloads 4,451 BTC for $305M to Repay Loan and Fund AI

TLDR

- Cango sold 4,451 BTC, reducing Bitcoin reserves by 60% to repay a Bitcoin-collateralized loan.

- The company raised $305M, improving its financial leverage and balance sheet.

- Cango aims to pivot towards AI compute infrastructure, targeting small and medium enterprises.

- Jack Jin, former Zoom Communications leader, appointed CTO of Cango’s AI business line.

- Bitcoin’s price dropped 1.06%, while Cango saw a 3.26% after-hours rebound to $0.9500.

Cango, a Bitcoin mining company, has sold 4,451 BTC for approximately $305 million, reducing its Bitcoin reserves by 60%. The sale aims to repay a Bitcoin-collateralized loan amid recent market volatility.

Bitcoin Sale Reduces Cango’s Reserves and Strengthens Balance Sheet

The sale of 4,451 BTC represents a substantial reduction in Cango’s digital asset holdings. This move is part of a broader strategy to strengthen the company’s balance sheet and reduce financial leverage.

The $305 million raised from the sale was directly applied to partially repay a Bitcoin-backed loan, improving Cango’s financial position. The divestment comes at a time when Bitcoin prices have rebounded from a recent low.

By selling a portion of its reserves, Cango aims to maintain flexibility while funding strategic growth initiatives, including expansion into AI compute infrastructure.

Cango Shifts Focus to AI Compute Infrastructure

In addition to the sale, Cango is pivoting toward AI computing by leveraging its existing infrastructure. The company plans to offer distributed compute capacity for the AI industry, targeting small and medium-sized enterprises.

Cango’s modular approach promises faster deployment timelines compared to traditional data center models. Cango also appointed Jack Jin as CTO of its AI business line.

Jin, a former leader at Zoom Communications, brings expertise in AI/ML infrastructure and large-scale GPU systems. His experience aligns with Cango’s strategy to develop a global distributed inference platform using modular, containerized GPU compute nodes.

Bitcoin Dips 1.06% While Cango Inc. Sees After-Hours Rebound

At the time of press, CoinMarketCap data indicates that Bitcoin’s price is currently $69,983.52, down 1.06% in the last 24 hours. The price fluctuated between $69,730 and $71,000 during the day.

On the other side, Cango Inc. (CANG) closed at $0.9200, down 5.52% on the day. The stock fluctuated between $0.8840 and $0.9887. After hours, the price rose by 3.26%, reaching $0.9500.

The stock had a previous close of $0.9738. Trading volume reached 1,229,780 shares, with an average volume of 985,054. The 52-week range for Cango is between $0.8840 and $2.8750, with a market cap of $318.642 million.

Crypto World

3 Altcoins Facing Liquidation Risks in the 2nd Week of February

After three consecutive weeks of sharp declines, buying pressure has returned to the market. However, it remains insufficient to dispel investor skepticism fully. Several altcoins now show unique catalysts that could drive outsized recoveries this week, increasing liquidation risks.

Ethereum (ETH), Dogecoin (DOGE), and Zcash (ZEC) could collectively trigger more than $3.1 billion in liquidations if traders fail to assess the following risks properly.

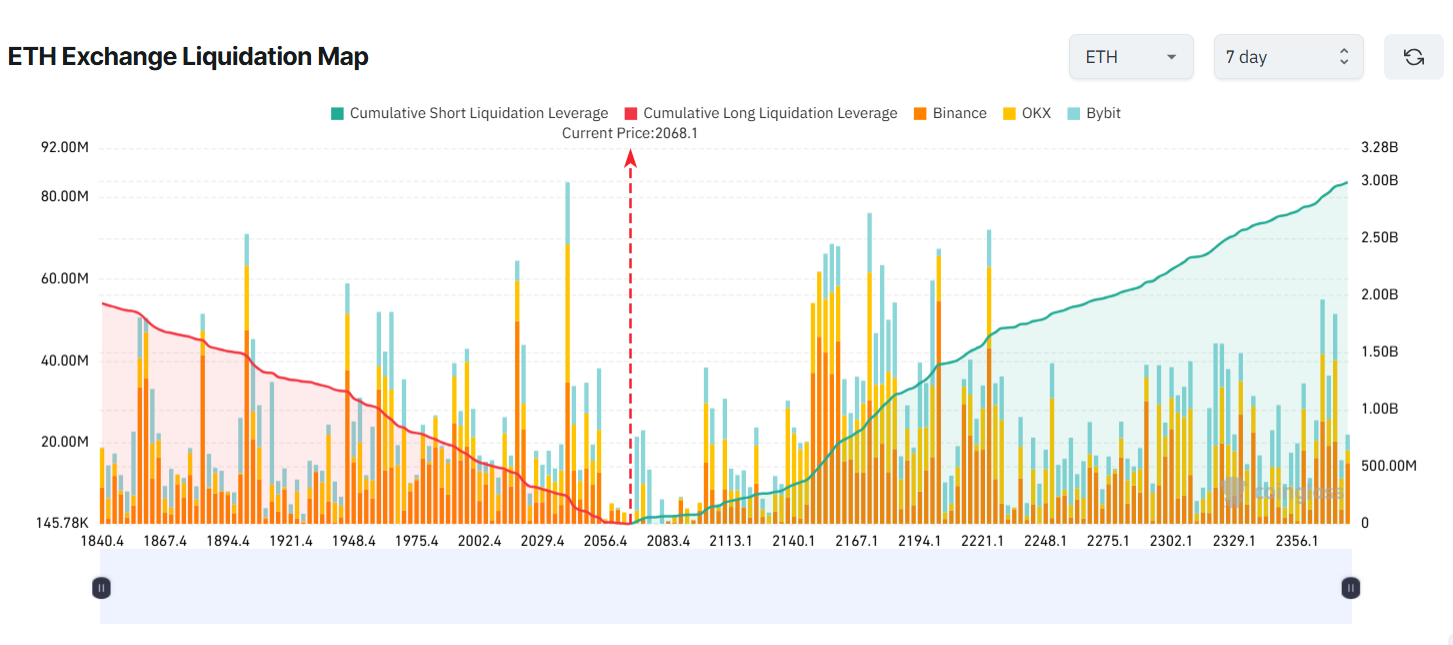

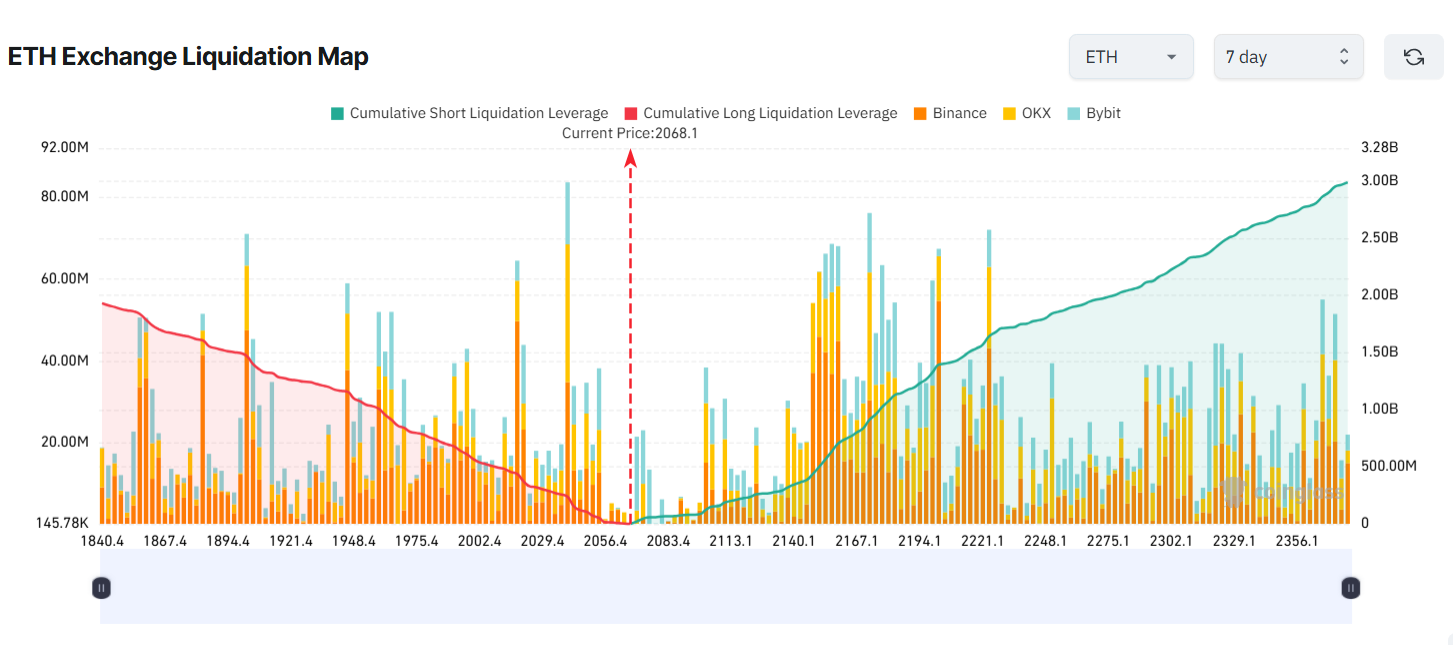

1. Ethereum (ETH)

ETH’s 7-day liquidation map shows that potential liquidations from short positions outweigh those from long positions.

Sponsored

Sponsored

Many traders appear to expect further downside. ETH has already fallen about 40% since mid-January.

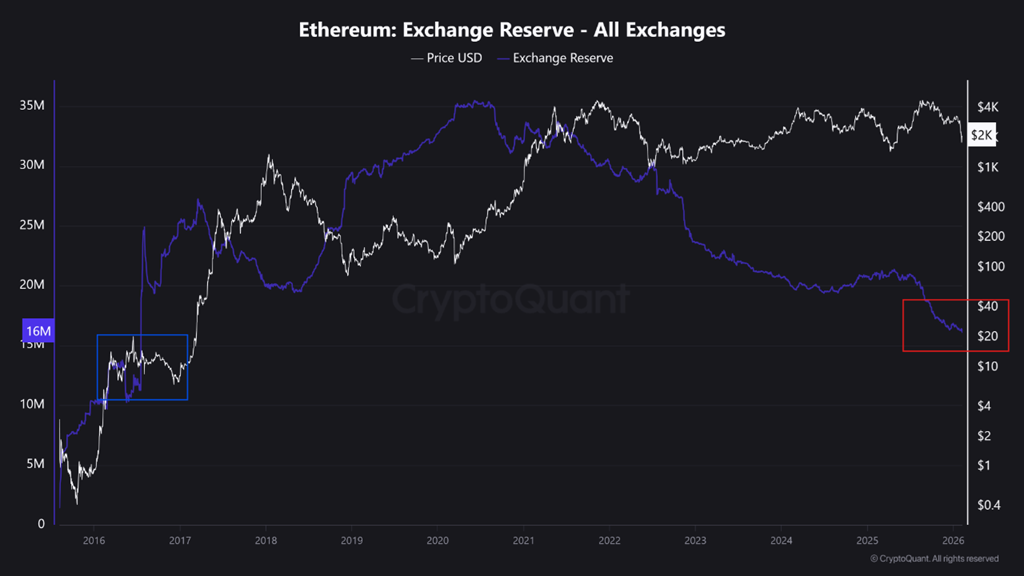

This bearish expectation faces growing risk. On-chain data shows that only around 16 million ETH remain on exchanges. This level marks the lowest since 2024.

Recent sell-offs have accelerated outflows from exchanges. Lower exchange balances reduce available supply. This dynamic can amplify price recoveries through supply–demand imbalances.

Additionally, more than 4 million ETH also sit in the staking queue. This further constrains the market’s liquid supply.

If ETH’s recovery strengthens due to these factors, short sellers could face significant risk. If ETH rises to $2,370 this week, potential liquidations from short positions could reach $3 billion.

Sponsored

Sponsored

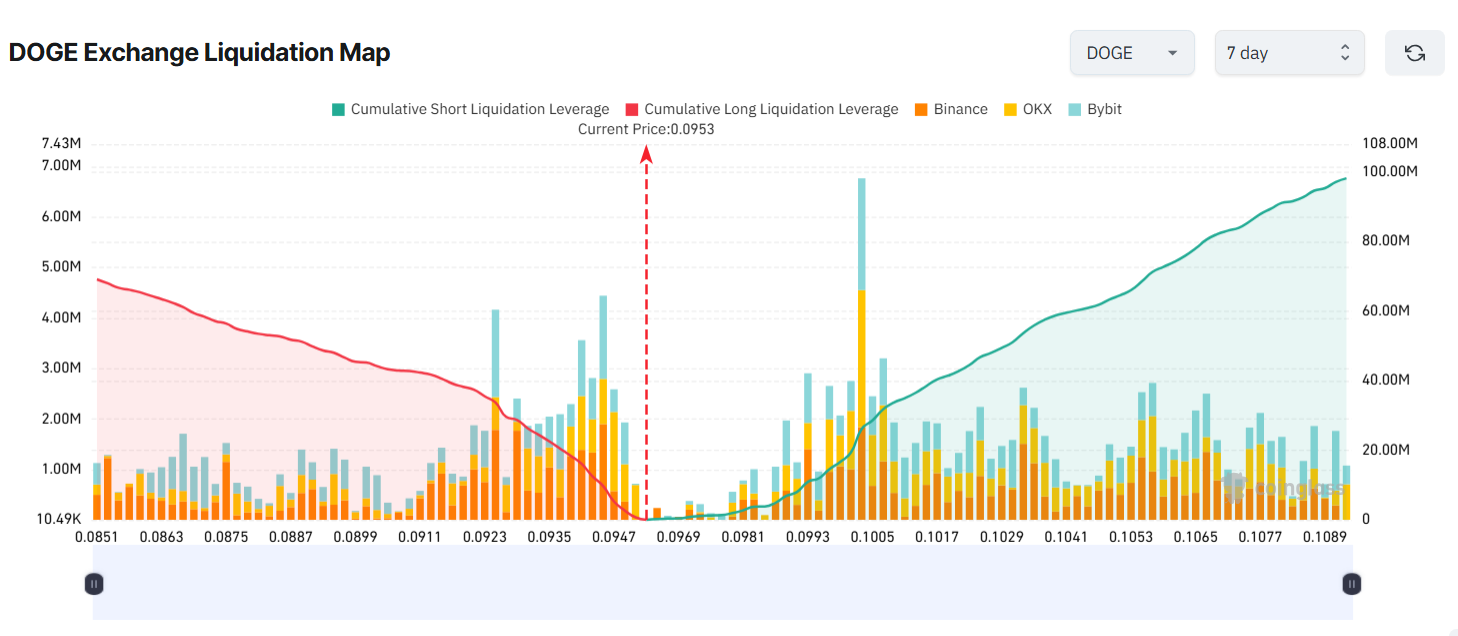

2. Dogecoin (DOGE)

Dogecoin (DOGE) has fallen below $0.10. This level matches its 2024 price low. The 7-day liquidation map shows potential short liquidations of up to $98 million if DOGE rebounds to $0.109 this week.

Analysts argue that such a scenario remains plausible given both short- and long-term structures.

In the short term, trader Trader Tardigrade points to a Bull Flag pattern. This setup suggests DOGE could move toward $0.12 this week.

From a longer-term perspective, analyst Javon Marks highlights the formation of Higher Lows (HL) following Higher Highs (HH). This structure signals strength.

Sponsored

Sponsored

“As Higher Lows hold, we could see Dogecoin climb over 640% to and above the current ATH levels at ~$0.73905,” Javon Marks projected.

Discussion around Dogecoin may also regain momentum. In early February, billionaire Elon Musk responded to a question from the Tesla Owners Silicon Valley account regarding Dogecoin.

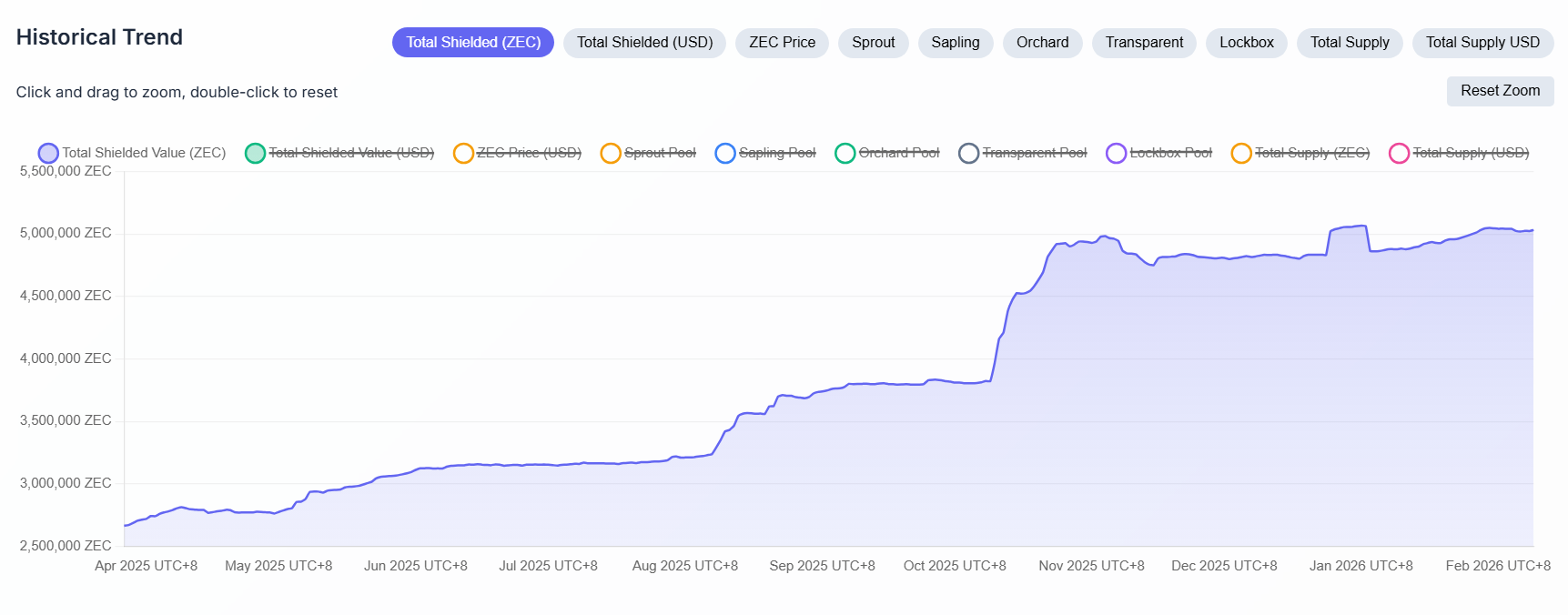

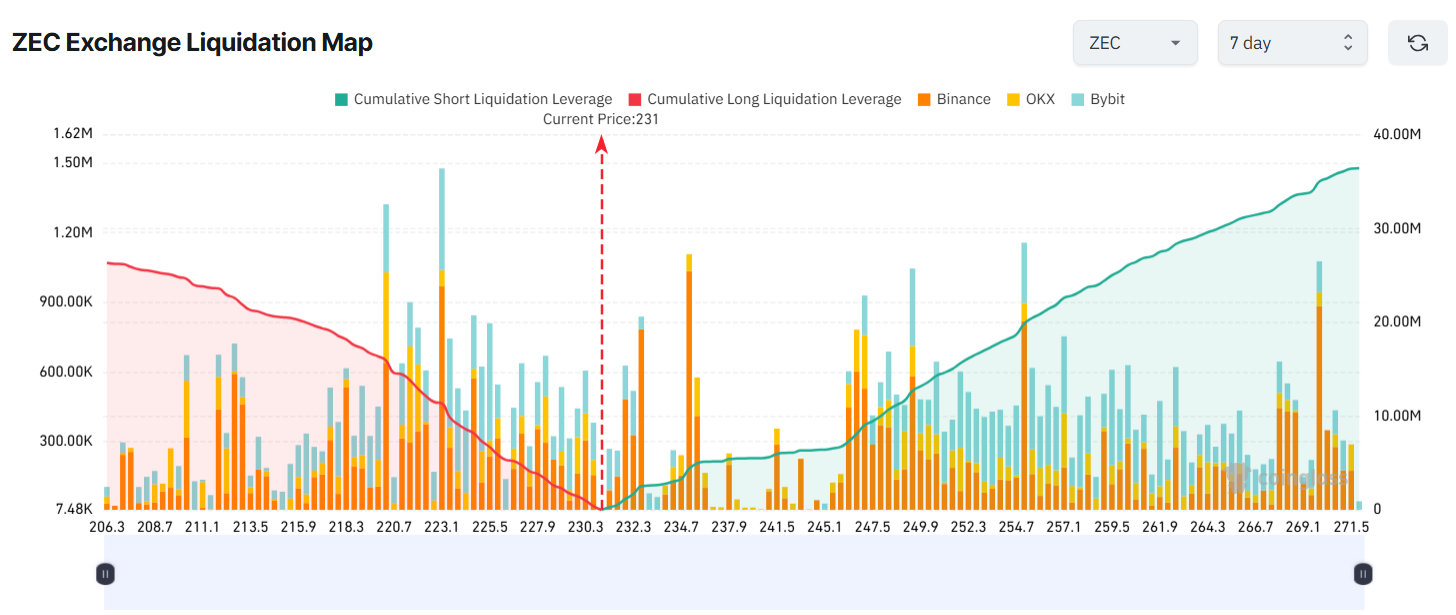

3. Zcash (ZEC)

Zcash (ZEC) has dropped about 50% since January 8. The decline followed the announcement that the entire Electric Coin Company (ECC) team, the core developer behind Zcash, would depart. Broader negative market sentiment has further prolonged the downturn.

ZEC’s liquidation map shows that potential liquidations from short positions dominate. This indicates that many traders still expect the downtrend to continue.

Sponsored

Sponsored

Several positive signals have emerged recently. Vitalik Buterin, the founder of Ethereum, publicly donated to Shielded Labs, a development group working on Zcash.

Buterin emphasized that privacy is not optional. He described it as core blockchain infrastructure. This action could help revive positive sentiment toward ZEC.

Data from zkp.baby shows that more than 5 million ZEC remain locked in the Shielded pool, despite the sharp price decline. Negative news and broader selling pressure appear not to have undermined investor confidence in Zcash’s technology.

Overall, the altcoin market has begun to rebound after a period of panic selling. Recent analyses suggest total market capitalization could recover above $2.8 trillion.

This broader recovery, combined with asset-specific catalysts, could push prices well beyond short sellers’ expectations, increasing the likelihood of liquidations.

Crypto World

WLFI price outlook as bulls target key resistance at $0.14

- World Liberty Financial’s price traded to highs of $0.1145 in the early hours on Monday.

- The WLFI token could break to $0.14 or higher if bulls hold.

- Broader market conditions may derail the momentum.

WLFI, the native token of the World Liberty Financial project, posted double-digit gains early on Monday, rebounding from losses that saw prices slide to lows near $0.09 on Friday.

Data from CoinMarketCap showed WLFI climbing more than 12% to intraday highs of $0.1145, placing it among the day’s top performers alongside Axie Infinity.

The rally was supported by a sharp rise in trading activity, with 24-hour volume surging 98% to more than $228 million.

The move also coincided with Bitcoin and Ethereum hovering near $70,000 and $2,000, respectively.

The rebound suggests the token is attempting to recover quickly from the lows recorded during last week’s broader market sell-off.

WLFI price jumps to near $0.12

WLFI’s upward momentum propelled the token close to $0.12, with likely bullish drivers being a confluence of whale accumulation and an upcoming high-profile event.

Blockchain analytics firm Lookonchain reported that a new wallet had deployed $10 million in USDC to acquire 47.6 million WLFI tokens.

The large purchase was at an average price of $0.109, and data showed the whale still held more than $4.8 million of dry powder ready for fresh buying.

Adding to the bullish sentiment is the anticipation surrounding the World Liberty Forum.

The event is slated for February 18 at Mar-a-Lago, and could feature investment heavyweights from Goldman Sachs, Franklin Templeton, and FIFA.

These developments come despite the latest spotlight on World Liberty Financial from Democrats, largely around the $500 million investment into the project by the UAE.

Investors defying the negative sentiment from this development look to have added to the buying pressure that pushed WLFI toward the $0.12 supply wall.

World Liberty Financial price prediction

Technical indicators on WLFI’s four-hour chart point to a strengthening near-term outlook, with prices trading above the midline of a descending channel.

Further upside could see the token test the upper boundary of the channel.

From a technical perspective, this setup suggests the potential for a breakout, with a key supply zone located around $0.14.

Momentum indicators are also supportive. The Moving Average Convergence Divergence (MACD) has registered a bullish crossover, while the Relative Strength Index (RSI) is hovering near 47, indicating neutral-to-bullish conditions as the market recovers from earlier overbought levels.

Traders are now focused on $0.14 as the main resistance level.

A sustained move above this zone could open the way toward $0.16, where the upper Bollinger Band and previous support levels converge.

On the downside, a failure to hold support near $0.13 could trigger a pullback toward the lower end of the channel, around $0.10, underscoring the importance of strong volume confirmation for any further upside move.

Crypto World

Will Bitcoin Pump or Crash From $70K? 3 Charts Can Answer

Bitcoin is holding firm around the $70,000 level after one of its sharpest sell-offs this cycle, leaving investors split on what comes next.

On-chain data, ETF flows, and market structure signals now point in two opposing directions, raising a key question: is Bitcoin preparing for another leg up, or setting up for renewed downside?

Sponsored

Sponsored

Selling Pressure Remains Elevated

One of the clearest warning signals comes from Bitcoin’s growth rate difference between market cap and realized cap. The indicator remains in negative territory, historically associated with heavier selling pressure.

When realized cap grows faster than market cap, it suggests coins are being redistributed at lower prices rather than pushed higher by fresh demand.

In past cycles, this environment made sustained price “pumps” difficult, as rallies were often met with distribution rather than follow-through.

Overall, current conditions suggest a structural selling pressure overwhelming demand.

Whales are Buying Bitcoin Aggressively

At the same time, on-chain accumulation data tells a very different story. Inflows to long-term accumulation addresses surged sharply during the recent dip, marking the largest single-day inflow of this cycle.

Sponsored

Sponsored

Historically, such spikes tend to appear near local bottoms rather than tops.

While accumulation does not guarantee an immediate rally, it signals that large holders are absorbing supply instead of distributing it.

This creates a floor effect, limiting downside even when broader sentiment remains fragile.

Sponsored

Sponsored

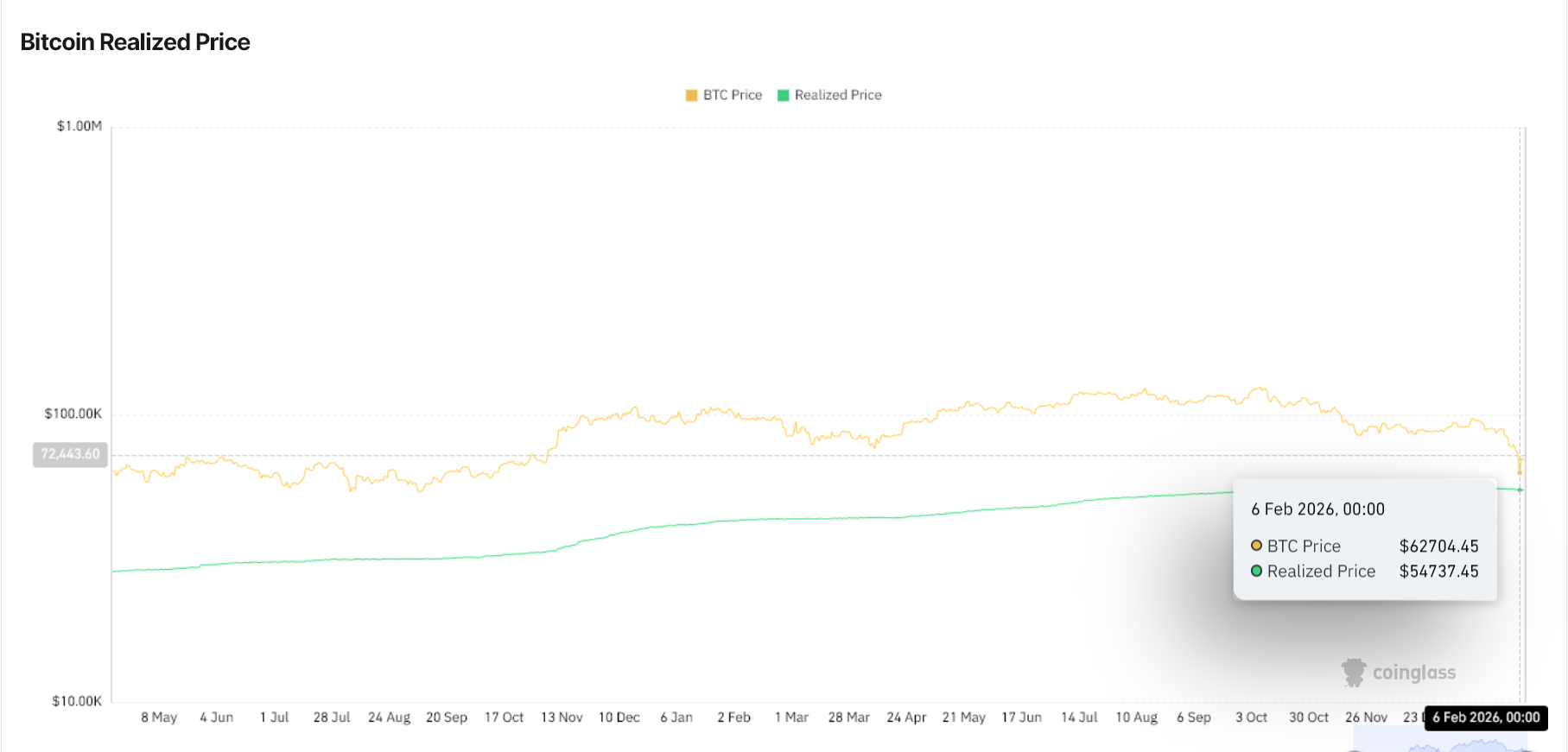

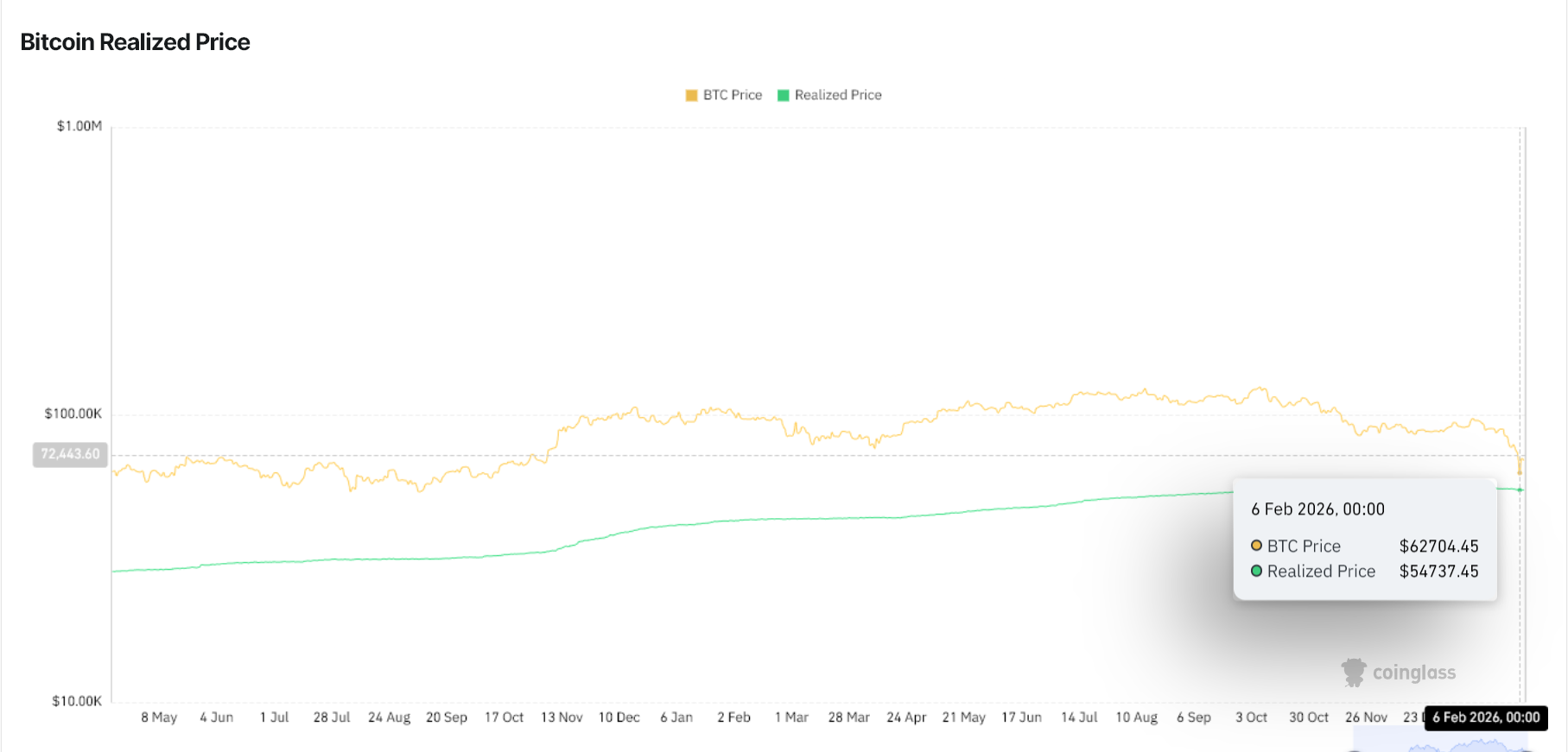

Price Holds Above Realized Value

Bitcoin is also trading well above its realized price, which currently sits near the mid-$50,000 range. That keeps the broader network in profit and reduces the risk of widespread capitulation.

Previous cycles show that deep, sustained bear markets typically occur only when price falls below realized levels for extended periods.

For now, Bitcoin remains in a neutral-to-positive regime.

Sponsored

Sponsored

ETF Flows Stabilize After Shock Outflows

US spot Bitcoin ETFs recorded heavy outflows during the crash, validating Arthur Hayes’ view that institutional hedging and dealer mechanics amplified the move. However, flows flipped back to strong inflows once prices stabilized near $60,000–$65,000.

That reversal suggests the worst forced selling has passed, though ETF demand has not yet returned to levels that would drive a breakout.

Range-Bound, Not Explosive

Taken together, the data points to a market caught between accumulation and distribution. Whale buying and ETF stabilization support the downside, while persistent sell pressure limits upside momentum.

In the near term, Bitcoin is more likely to remain range-bound around $70,000 than enter a decisive pump or dump.

Crypto World

HTX Launches USDe Minting and Redemption Service

TLDR

- HTX launches USDe minting and redemption service, offering an efficient platform for global users with enhanced features.

- The new minting and redemption service eliminates the need for OTC liquidity, simplifying the process for users.

- HTX introduces a daily rewards program for USDe holders, paid weekly, increasing capital efficiency and incentivizing participation.

- Users can now access USDe with unlimited minting and redemption capabilities and uniform transaction costs.

- HTX’s new campaigns, including APY boosts and trading competitions, encourage increased engagement with the USDe ecosystem.

HTX has launched its new USDe minting and redemption service, enhancing its platform with a daily rewards program for USDe holders. This service follows the recent listing of USDe and promises to provide a more efficient experience for HTX’s global user base.

USDe Minting and Redemption Now Available on HTX

According to the press release, the HTX minting and redemption process for USDe utilizes Ethena Labs’ smart contracts. The service eliminates the need for spot order books or OTC liquidity, simplifying the minting and redemption process.

This new feature provides benefits, including unlimited scale for minting and redemption and uniform transaction costs. With this integration, HTX users can smoothly enter or exit USDe positions, avoiding liquidity issues often seen in secondary markets.

The addition of USDe to HTX’s platform strengthens its position in both the DeFi and CeFi ecosystems. As HTX strives for innovation, these features enable users to manage their exposure to USDe with improved efficiency and transparency.

Daily Rewards and Additional Campaigns for USDe Holders

Alongside minting and redemption, HTX introduces a daily rewards program for users holding USDe in their spot accounts. Rewards will be paid weekly, allowing users to earn passive returns while maintaining dollar-denominated exposure.

The initiative enhances capital efficiency, offering an attractive incentive to hold USDe on the platform. HTX users can also participate in several campaigns, such as the upcoming APY boost for USDe in HTX Earn. This will provide subscribers with an annual percentage yield of up to 15%.

In addition, users can compete in a trading competition to share a 10,000 USDe prize pool. These initiatives aim to increase engagement with the USDe ecosystem and incentivize users to participate in HTX’s offerings.

Crypto World

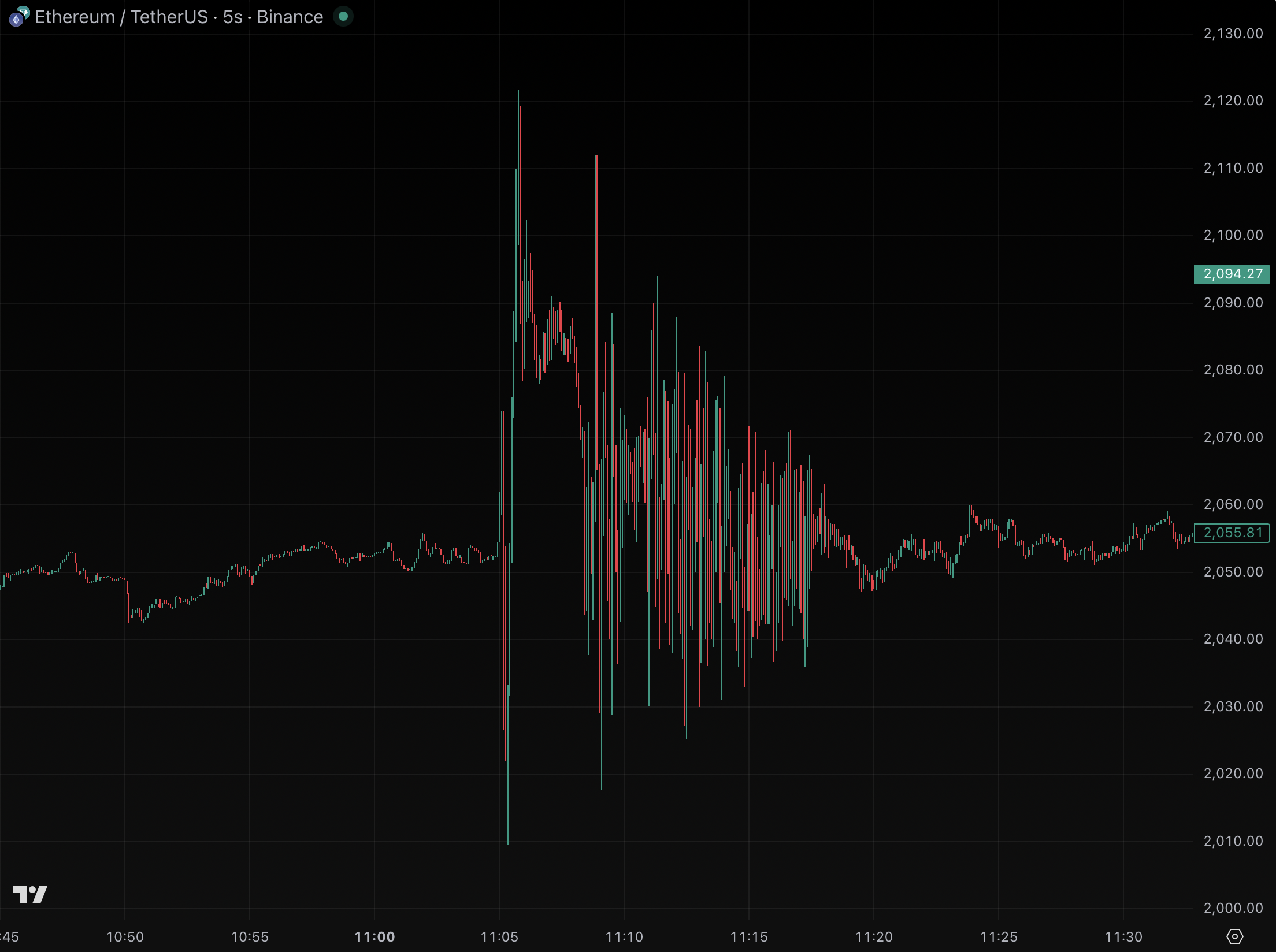

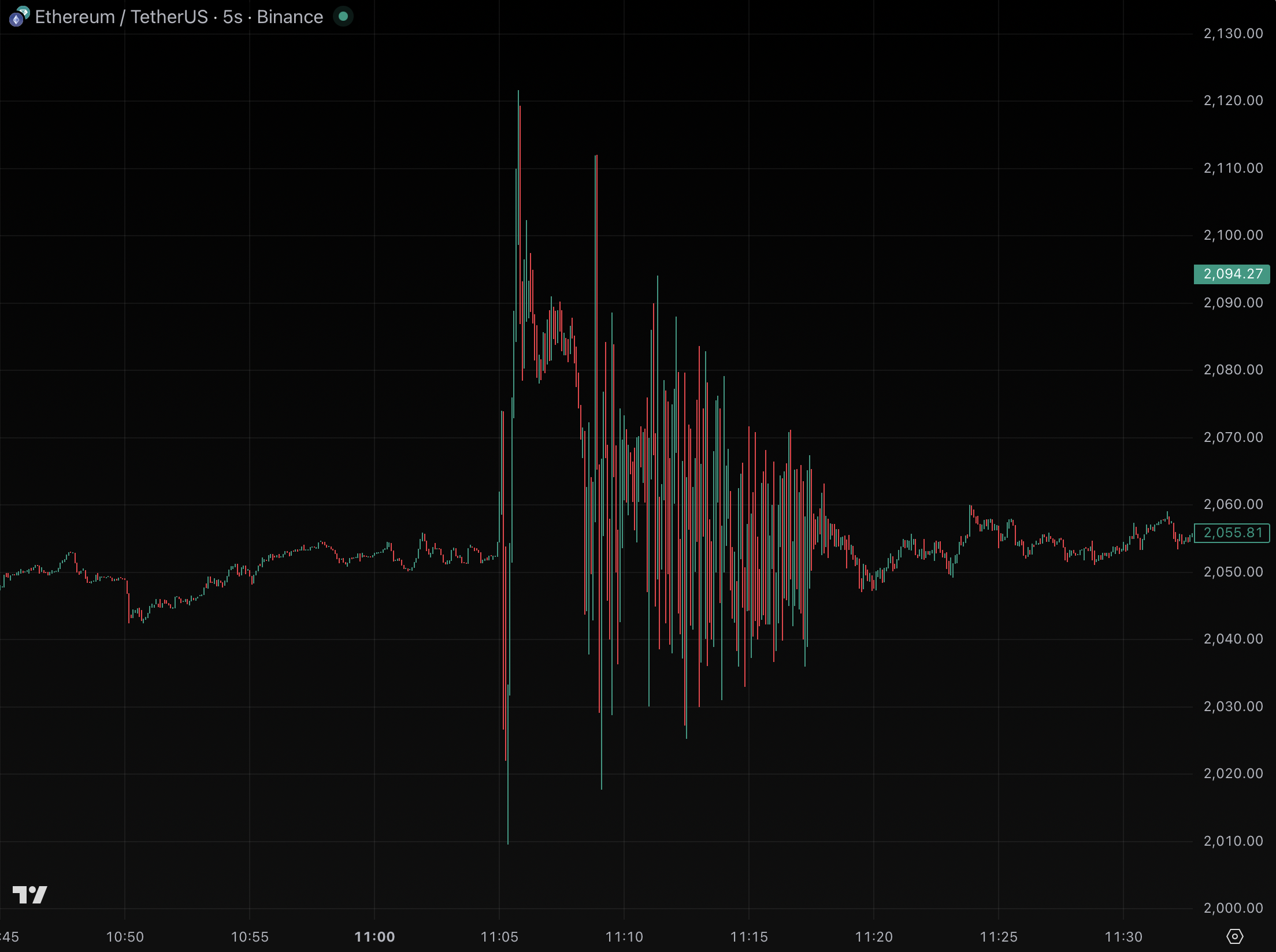

Binance critics revive trading allegations against CZ after ETH whipsaw

Amid ongoing backlash over its role in October 10’s liquidations and a bizarre chart of transactions from Saturday, critics of Binance are questioning founder Changpeng Zhao (CZ) over his repeated claims that he’s not an active crypto trader.

Sharing reminders about CZ’s ownership of market-makers Merit Peak Limited and Sigma Chain (which have both traded on Binance) critics decried a tether (USDT)-denominated ether (ETH) chart from Binance’s exchange on Saturday, alleging that CZ somehow was involved.

However, one of the most repeated assurances from CZ is that he is not an active crypto trader.

Indeed, in countless interviews, he tells a story of his brief attempt at active trading about a decade ago, concluding that he was entirely unskilled at that endeavor.

’I don’t trade at all’

For years, CZ has claimed, he’s not been an active crypto trader. Although he makes infrequent, long-term purchases, he reiterates that he’s “not a trader. I buy and hold.”

CZ worked at Bloomberg and built high-frequency trading platforms for stockbrokers, so he had plenty of experience with active traders before his career at crypto businesses Blockchain.info, OKCoin, and Binance.

According to CZ’s version of his biography, he wanted to become a trader during the early years of his crypto career, didn’t succeed, and instead decided to focus on building Binance.

Rather than trade along the way, he’s focused on long-term investments: bitcoin (BTC), the Binance Coin (BNB) he founded, and most of all, equity in Binance itself.

“I don’t trade at all, I just hold bitcoins,” CZ said in a representative interview. “I hold BNB, and I don’t do daytrading.”

Read more: Lawsuits are piling up against Binance over Oct. 10

CZ doesn’t need to trade to make billions from Binance

Bloomberg analysts agree that CZ’s long-held equity in Binance, for what it’s worth, accounts for the vast majority of his estimated $50 billion net worth.

Even without any digital asset holdings, CZ could easily be worth tens of billions of dollars simply as the founding shareholder of his profitable company.

However, critics on social media have recently become skeptical of CZ, alleging or insinuating that he’s concerned with manipulating Binance trading pairs.

A highly suspicious whipsaw in ETH renewed their anger.

Just because trades occur on Binance, however, doesn’t mean that CZ or Binance are participating in those markets beyond its customary commissions for matching third-party orders.

Wintermute CEO Evgeny Gaevoy called Saturday’s trading action “a market-maker bot blowing up to the tune of tens of millions,” defending his own market-making company from an accusation about scamming on Binance, for example.

For his part, CZ barely acknowledged the social media controversy. He summarized it as another example of FUD and posted recaps of his snowboarding trip, instead.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Remittix tops crypto altcoin charts worldwide as exchanges get set to list mega token Remittix

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix is climbing global altcoin charts as rising demand for payment-focused crypto and a wave of upcoming exchange listings put the token firmly in the spotlight.

Summary

- Remittix has sold over 703.7 million tokens, raised more than $28.9 million, and continues to gain traction through strong sales, user engagement, and a 300% bonus incentive.

- Confirmed listings on BitMart and LBANK, with more exchanges preparing to onboard the token, are expanding Remittix’s global reach and liquidity.

- A live wallet, upcoming PayFi platform launch on February 9, 2026, and CertiK verification are reinforcing Remittix’s position as one of the most closely watched altcoins of 2026.

The crypto market is paying attention as Remittix climbs altcoin rankings across trading platforms and chart trackers. The interest in payment tokens has been on the increase with the growing demand for real utility in the blockchain world. Although other tokens fluctuate and experience volatility, Remittix has been successful in terms of sales and user engagement.

The project’s momentum has intensified as multiple exchanges prepare to list Remittix, giving the token broader access globally. Remittix isn’t just moving in the charts; it is becoming one of the most talked-about tokens in the crypto market.

How Remittix is rising in market attention

Remittix’s recent performance shows an increase in investor interest and adoption of the token. Remittix has sold more than 703.7 million out of the 750 million tokens available for sale at $0.123 and has raised more than $28.9 million, with the aim of reaching the milestone of raising approximately $30 million.

The project’s 300% bonus, available via email activation, has also driven new buyers, increasing liquidity and attention.

Beyond sales figures, Remittix has seen real product engagement. Its crypto wallet is live on the Apple App Store, with the Google Play release in progress. This wallet allows users to securely store, send, and manage assets ahead of the official platform launch on 9 February 2026, when the full PayFi services will go live.

Some crypto analytics platforms have reported a climb in social mentions and ranking metrics tied to altcoin performance. This uptick in attention signals that Remittix is gaining traction among traders and investors looking at projects with both utility and growing demand.

Listing momentum is boosting Remittix exposure

Exchange listings are playing a key role in Remittix’s rising profile. BitMart and LBANK have already confirmed listings for Remittix, giving traders on those platforms direct access to trade and hold the token. These listings help expand liquidity and provide a broader market reach for users seeking exposure to Remittix as one of the fastest growing crypto in 2026.

Preparations are underway for additional top-tier exchange listings that will open Remittix to even larger trading communities once the next funding milestone is hit. Market watchers note that broad exchange access often correlates with higher volume visibility and ranking improvements on altcoin charts.

Security and credibility support this expansion. Remittix is fully audited and verified by CertiK, holding a #1 ranking on CertiK Skynet with an 80.09 Grade A score from over 24,000 community ratings, which strengthens confidence among traders and long-term holders.

Also, a 15% USDT referral program rewards engagement and helps broaden the user base. All of this activity, strong sales, listing momentum, live wallet adoption, and incentives, contribute to why Remittix attracts attention from both traders and long-term supporters.

Key drivers behind Remittix demand:

- Tackling the $19 trillion global payments market with real-world solutions

- Seamless crypto-to-bank transfers across 30+ countries

- Utility-focused token supported by genuine transaction activity

- Deflationary tokenomics designed for long-term growth

- Broad market appeal extending beyond traditional crypto users

Why Remittix continues to attract interest

Remittix’s growth in visibility is rooted in both its incentives and product rollout. Positioned at the intersection of crypto, payments, and global remittance, a $19 trillion market, Remittix aims to be the go-to crypto-to-fiat payment hub for merchants, users, and businesses worldwide.

With the 9 February 2026 platform launch approaching, Remittix is moving from early momentum to real utility deployment. As more exchanges prepare to list the token and user engagement grows, Remittix stands as a clear example of how practical adoption and visibility can combine to lift a token’s presence across global charts.

To learn more about Remittix, visit the website and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

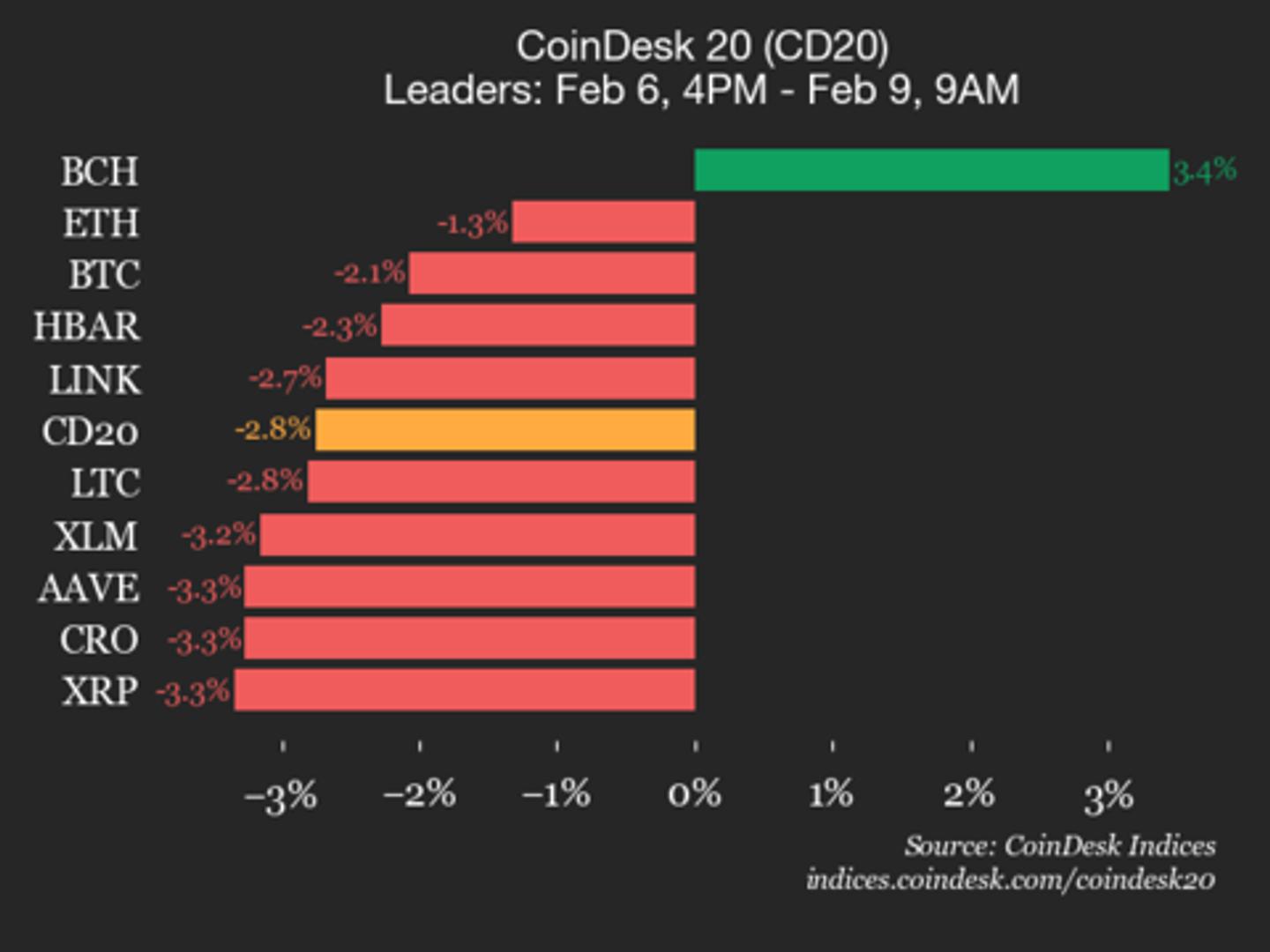

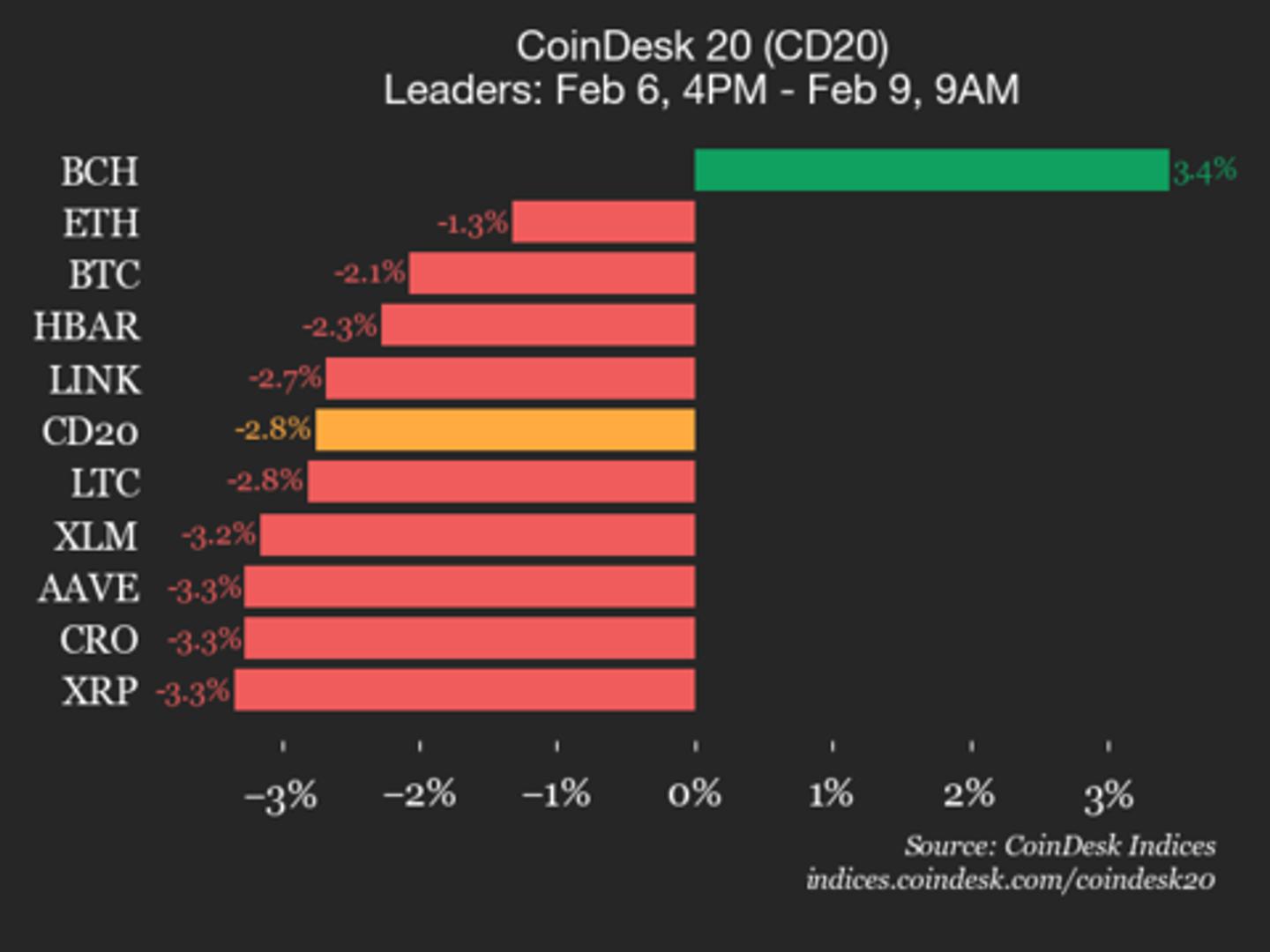

CoinDesk 20 performance update: Bitcoin Cash (BCH) is only gainer, up 3.4%

Aptos (APT) declined 9.4% and NEAR Protocol (NEAR) fell 8%, leading index lower.

Crypto World

Solana price near key $75 support as RSI oversold signals potential bounce

- Solana (SOL) currently trades near $83 after a nearly 39% monthly drop.

- Weekly and daily RSI signal the token is oversold, hinting at a possible short bounce.

- The key support around $75 is critical to prevent further decline.

Solana (SOL) has been under intense pressure in recent weeks.

The altcoin currently trades around $83, down nearly 39% over the past month.

This decline comes amid broader weakness in the crypto market and low retail engagement.

Technical analysis shows that SOL’s weekly Relative Strength Index (RSI) is deeply oversold.

Some are suggesting that the token may have reached a “final dip,” referencing a long-term structural support around the $75 level, and eyes are now on whether this support can hold.

Solana price technical analysis

From a technical standpoint, Solana’s trading volume remains high, with over $3.9 billion exchanging in the past 24 hours.

But despite this high activity, the token is trading well below key moving averages.

The 50-day and 200-day averages now act as the immediate resistance levels and remain out of reach for now.

Short-term momentum indicators, including the MACD histogram, have flattened, reflecting waning bearish momentum.

In addition, on the daily and weekly charts, RSI remains near historic lows, indicating extreme oversold conditions.

This combination suggests potential for a short-term relief bounce, though trend reversal is not guaranteed.

Market sentiment shows a muted retail engagement

Retail interest in Solana remains muted, with recent reports showing low futures open interest, signalling that traders are reducing exposure.

Derivatives funding rates are also negative, suggesting bias toward short positions.

Solana ETFs have also recorded outflows, reinforcing weak institutional participation.

Analysts note that these factors add to the bearish pressure on the token.

Still, technical indicators hint at a potential stabilisation near critical support zones, with the $75 level having been repeatedly cited as key support in recent forecasts.

Breaking below this threshold could open the door to further downside, possibly toward $67 or even $51 in extreme scenarios.

On the upside, recovery faces resistance around $111 and $138, which would need to be breached to shift the market sentiment positively.

Long-term Solana market analysis

Long-term forecasts for Solana remain mixed.

Some analysts foresee recovery toward the mid-$100s if support holds and broader market conditions improve.

Bullish projections even extend toward $250, though these are contingent on sustained buying pressure and macro-level stability.

For now, the focus remains on short-term price stability.

Investors and traders should keep a close eye on the $75 support, viewing it as a potential floor for consolidation.

SOL’s trajectory will likely depend on a combination of market sentiment, institutional flows, and technical momentum.

As it stands, Solana is navigating a critical juncture where its next move could define the tone for the coming months.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat23 hours ago

NewsBeat23 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports18 hours ago

Sports18 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

NewsBeat2 hours ago

NewsBeat2 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat13 hours ago

NewsBeat13 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 hour ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout