Crypto World

Relative-Value Strategies Beat Directional Bets as Crypto Volatility Bites

Crypto funds shifted to market-neutral trades as volatility punished directional bets and triggered a fourth straight month of losses.

Crypto funds opened 2026 with losses and defensive positioning, according to a February 18 survey by Presto Research and Otos Data.

The report shows investors shifting toward relative-value and market-neutral trades as macro uncertainty and price swings weigh on directional bets.

Market-Neutral Funds Outperform as Directional Strategies Sink

According to Presto’s survey, all liquid crypto hedge funds dipped by an average of 1.49% last month. The losses extended a difficult stretch for active managers, marking the fourth consecutive month of negative equally weighted performance across both fundamental and quantitative categories, a sequence not seen since late 2018 and early 2019.

The dispersion within the numbers tells a clearer story, with fundamental funds dropping 3.01% in January, while quantitative funds fell 3.51%. On the other hand, Presto revealed that market-neutral funds, which aim to profit from price differences rather than market direction, gained about 1.6%. Over six months, those same neutral strategies are up nearly 5% while fundamental funds are down more than 24%.

During that same period, Bitcoin (BTC) has fallen approximately 31%, Ethereum (ETH) 23%, and Solana (SOL) 47%.

Analysis by other market watchers supports the fragile tone, with data from Alphractal showing that Bitcoin was trading in a stress zone where weaker holders tend to sell while long-term investors accumulate. The firm’s founder, Joao Wedson, said long-term holder profit levels are still positive, a sign the market may not yet be at a final turning point.

Positioning Data Points to Defensive Posture, Not Panic

The Presto survey’s flow analysis shows a clear behavioral arc through January. The month opened with constructive positioning and call buying, but as rallies failed, traders rotated into tactical fade structures. By the third week, downside hedging became dominant, as ETF flows fluctuated, with periods of inflow offset by miner distribution and whale selling. Meanwhile, corporate accumulation remained present but insufficient to offset broader risk reduction.

You may also like:

Importantly, the report noted that positioning into the month-end was not outright capitulative. The analysts stated that while protection was in place, the leverage looked more orderly compared to the chaotic reset event in October 2025.

The absence of broad panic suggests that stress is building in pockets rather than being expressed as systemic liquidation. This distinction matters as the market assesses whether January represents continuation or exhaustion.

The researchers advised that until policy clarity improves or a structural crypto-specific catalyst emerges, rallies are likely to fade, volatility will stay reactive to headline risk, and adaptability rather than conviction will determine survival in the first quarter of 2026.

Whether January marked a continuation of the bear trend or the exhaustion phase of selling pressure remains an open question. However, at present, the data indicate that strategies that prioritize relative value over directional conviction are successfully navigating the current challenges.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Grayscale’s GSUI Sui Staking ETF Begins Trading on NYSE Arca

Key insights:

- GSUI ETF approved via SEC 8-A filing, begins NYSE Arca trading on February 18 with staking-based yield exposure.

- Fund charges 0.35% fee but waives it for 3 months or until $1B AUM threshold is reached.

- SUI rose by 7% after the announcement; derivatives data shows mixed sentiment despite growing institutional interest.

Grayscale Investments’ Sui Staking ETF will start trading on NYSE Arca on February 18 under the ticker GSUI after the 8-A filing became automatically effective with the U.S. Securities and Exchange Commission (SEC).

Grayscale’s 8-A Filing for Sui Staking ETF. Source: U.S. SEC

The listing gives investors regulated exposure to the SUI token and staking rewards without directly holding crypto assets, marking a significant expansion of exchange-traded products tied to alternative Layer-1 blockchains.

GSUI ETF Framework, Fees, and Key Institutional Participants

The management fee on the fund is 0.35%. Grayscale Investments Sponsors LLC has foregone the entire fee for up to 3 months or until assets under management reach $1 billion. The ETF aims to generate yield by staking SUI tokens deposited in the trust.

The key market participants include Jane Street Capital and Virtu Americas, which act as authorized participants, while JSCT, Virtu Financial Singapore, Galaxy Digital Trading Cayman, and Flowdesk will provide liquidity. Additionally, the Bank of New York Mellon serves as transfer agent and administrator, while Coinbase functions as the prime broker, and Coinbase Custody Trust Company holds the assets.

The product was previously available on OTCQX in 2025. Moving to NYSE Arca broadens access for traditional investors who want blockchain exposure without managing wallets or private keys.

SUI Market Reaction and Price Movement

SUI rose about 7% after news of the ETF surfaced, but later traded at $0.968, down 0.88% on the day. The 24-hour range stood between $0.954 and $0.987, while trading volume fell roughly 22% amid wider crypto-market uncertainty ahead of macroeconomic data, including the Federal Reserve’s FOMC minutes.

Derivatives data showed mixed sentiment. Total SUI futures open interest rose about 1% to $509 million, though short-term positions fluctuated across exchanges. In a post on X, analyst Ali suggested a potential 15% rally toward $1.16 based on a technical breakout pattern.

$SUI is breaking out of an Adam & Eve pattern, opening the door to a 15% rally toward $1.16. pic.twitter.com/2qtjppCzxw

— Ali Charts (@alicharts) February 14, 2026

GSUI Launch Signals Expansion of Staking-Based Crypto ETFs

GSUI ETF enables investors to receive staking rewards in a regulated environment, blending conventional finance with blockchain yield systems. The launch also increases institutional visibility for the Sui network, a Layer-1 blockchain designed to support high-throughput Web3 apps.

Grayscale entering into staking-based exchange-traded products is an indication of a wider trend in diversified crypto ETFs that are no longer limited to Bitcoin and Ethereum. With more adoption, analysts believe that there will be better liquidity and involvement in smaller ecosystems of digital assets.

What happens next?

GSUI will begin trading on NYSE Arca, with market participants watching early inflows and their impact on SUI liquidity and price dynamics. This indicates an expanding competition in the wider crypto ETF market.

Crypto World

Polygon Acquires Sequence to Power Enterprise-Grade Smart Wallet Infrastructure for Stablecoin Payments

TLDR:

- Polygon Labs acquired Sequence to eliminate wallet fragmentation blocking institutional stablecoin payment adoption at scale.

- Sequence Smart Sessions sandbox app-level permissions, reducing signature prompts while preserving non-custodial wallet security controls.

- Timed recovery keys in Sequence prevent silent account takeovers, meeting enterprise security standards for production payment systems.

- Polygon’s low fees and fast finality make Sequence’s cross-chain smart wallet features viable for real-world payment infrastructure.

Polygon Labs has acquired Sequence, a non-custodial smart wallet provider built for ecosystems and apps. The move brings together enterprise-grade wallet infrastructure and high-efficiency blockchain rails.

Together, the two aim to remove long-standing blockers preventing institutions from launching production-ready stablecoin payment products.

The combination addresses key pain points around authentication, recovery, permissions, and compliance controls that have slowed adoption in real-world payment environments.

Wallet Fragmentation Has Long Blocked Production Payment Systems

Account fragmentation remains one of the most persistent problems for payments teams building on blockchain. Users often end up with multiple wallet addresses depending on which app they used to sign in, leading to stranded balances and inconsistent account states. This creates operational complexity that few enterprise teams can manage at scale.

Traditional wallets were designed for asset custody, not operational money movement. A single private key controlling all permissions creates an all-or-nothing authority model.

Any move to delegate access or automate transactions increases risk without clear boundaries, making compliance reviews difficult.

Recovery presents an equally serious problem. Simple recovery paths open the door to silent takeovers. Stronger recovery processes introduce friction that leads to failed transactions and increased support costs. Neither option suits a production payment environment.

Polygon recently shared how this acquisition changes the equation for institutions: “With the recent acquisition of Sequence by Polygon Labs, there’s now a robust, enterprise-grade wallet offering, in conjunction with widely-adopted, highly-efficient blockchain rails.”

Operations teams also struggle to reason about fund controls. Without a clear model for who can move money, under what conditions, and for how long, compliance teams cannot complete proper security reviews or respond effectively to incidents.

Sequence Brings Smart Sessions and Sandboxed Permissions to Polygon

Sequence addresses these problems through a set of features designed specifically for payment-grade environments.

Smart Sessions allow each app to operate within sandboxed, clearly defined permissions rather than broad approvals. Users set session limits upfront, reducing signature prompts without sacrificing control.

Timed recovery keys add another layer of security. They provide time-based recovery mechanisms that prevent silent account takeovers, a critical requirement for any financial application handling real funds.

Hardware-isolated signing and verifiable attestations meet the expectations of enterprise security teams.

For developers, Sequence provides SDKs across Web, Mobile, Unity, and Unreal, with built-in flows for authentication, session management, and transaction handling.

Ecosystems can launch branded wallets on their own domains with admin controls for chains, branding, and session policies.

Polygon’s role in this setup is to provide fast finality and low, predictable transaction costs. That reliability makes features like Smart Sessions and cross-chain behavior viable at scale.

Together, Sequence and Polygon aim to turn wallet infrastructure from a blocker into a production-ready foundation for stablecoin payment products.

Crypto World

Bitcoin Whales Show Confidence in Accumulating Despite Market Instability

TLDR

- Bitcoin whale holdings have increased by 3.4% over the past two months, reaching 3.1 million BTC.

- The surge in whale accumulation follows a sharp 7% drop in Bitcoin’s price before December 2025.

- Darkfrost notes that whale buying behavior typically occurs during market corrections, signaling future recovery.

- Despite a 46% decline from Bitcoin’s all-time high, whales view the current price as a favorable accumulation zone.

- Bitcoin faces continued selling pressure, with price fluctuations remaining between $66,615 and $68,434.

Bitcoin whales are increasing their holdings of the cryptocurrency, as price fluctuations continue. Data from CryptoQuant Analyst Darkfrost shows that whale Bitcoin accumulations have risen by 3.4% over the past two months. This uptick, following a significant drop in November 2025, suggests that large investors are taking advantage of current price levels. At present, Bitcoin’s price remains volatile, but whale activity indicates a strong belief in future growth.

Bitcoin Whale Accumulations Show Growth

Whale holdings of Bitcoin have seen a steady increase since mid-December 2025. According to CryptoQuant Analyst Darkfrost, these accumulations have gone up by 3.4%. The total amount of Bitcoin in whale wallets has reached 3.1 million BTC, a rise from 2.9 million BTC. Despite the volatile market conditions, Bitcoin whales are clearly acting on these price fluctuations.

The trend marks a significant rebound after a sharp decline in Bitcoin’s price. Prior to December, Bitcoin saw a 7% drop, leading to a temporary halt in whale accumulation. The increase in whale Bitcoin holdings now reflects a more confident outlook. Darkfrost notes that this behavior is usually seen during market corrections and that whales tend to accumulate when prices are lower.

The last recorded whale accumulation occurred in April 2025. At that time, the market had experienced a large correction, with Bitcoin’s price falling below $80,000. However, this accumulation helped fuel a recovery, pushing Bitcoin’s price from $76,000 to an all-time high above $126,000. The return of buying activity now, even with Bitcoin still down by 46% from its ATH, signals that whales see this as a favorable accumulation zone.

Darkfrost argues that Bitcoin price is currently undervalued, which has led to increased buying pressure from whales. He believes that these investors are positioning themselves for future gains once market conditions improve. However, he also pointed out that, despite the growing demand, market forces are still influencing prices in the short term.

Bitcoin Faces Continued Sell-Off Pressure

Despite the increased whale activity, Bitcoin continues to face selling pressure. Darkfrost highlighted that while demand for Bitcoin remains strong, sell-offs are still affecting the market. Bitcoin’s price has been fluctuating between $66,615 and $68,434 over the past 24 hours, indicating ongoing uncertainty. As the market consolidates, traders are keeping a close eye on the broader trend.

In the midst of this, firms like Michael Saylor’s Strategy Inc are continuing to show support for Bitcoin. While some experts point to a crypto winter, Saylor remains confident in Bitcoin’s long-term potential. The firm’s continued interest in Bitcoin reinforces the belief that the cryptocurrency will eventually overcome current price challenges.

At the time of writing, Bitcoin’s price was $67,469.58, reflecting a 0.44% drop in the last 24 hours. As the market remains volatile, it remains to be seen whether whale accumulation will continue to drive Bitcoin’s price upward.

Crypto World

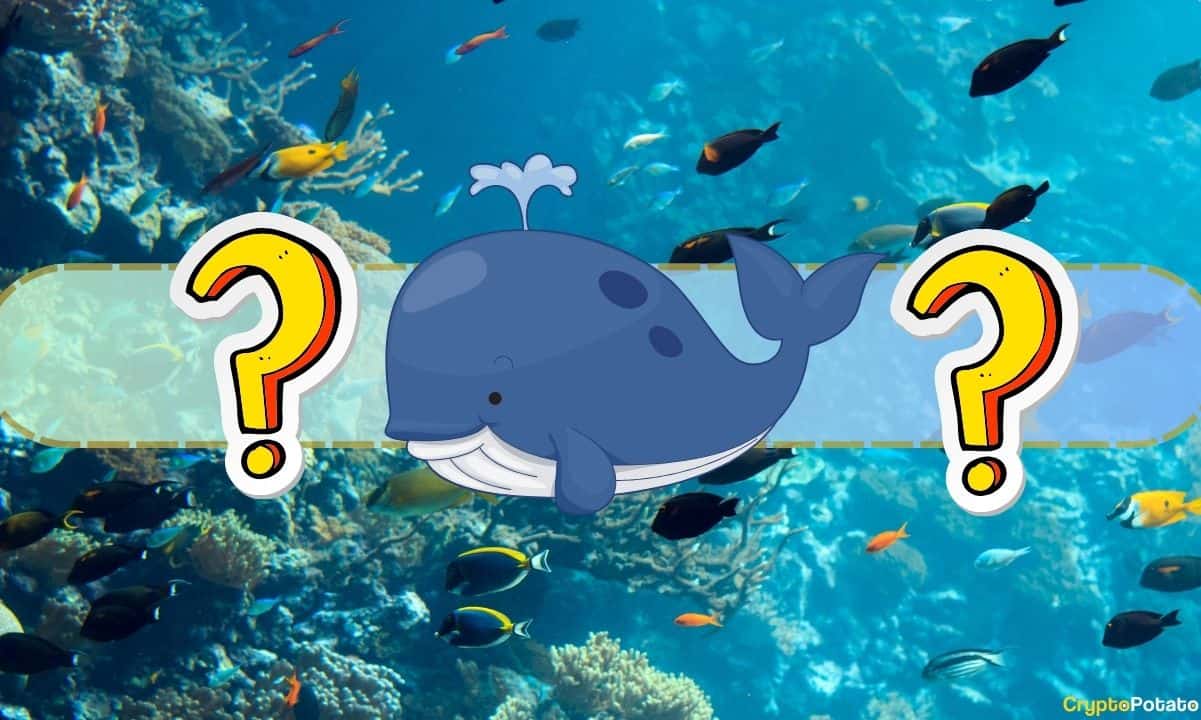

Base Parts Ways With Optimism’s OP Stack

Base, the Ethereum Layer 2 network launched by Coinbase, is transitioning from Optimism’s OP Stack to a self-managed codebase.

Base, the Ethereum Layer 2 blockchain solution developed by Coinbase, is making a significant strategic shift by moving away from reliance on Optimism’s OP Stack.

Optimism’s OP token plunged 7% following the news.

Initially built on Optimism’s OP Stack, Base has decided to transition to its own codebase to gain greater control over its infrastructure and streamline upgrades. This move is expected to double the pace of its major upgrades to approximately six per year.

According to a blog post, the protocol will consolidate upgrades and changes internally, while continuing to collaborate with Optimism as an OP Enterprise client for support during the transition.

Optimism’s OP Stack is widely used by Layer 2 solutions, and Base’s transition might prompt similar moves by other industry players. Base is the largest Layer 2 by total value locked, with nearly $3.9 billion, according to DeFiLlama.

This article was generated with the assistance of AI workflows.

Crypto World

volume up 156% as Wall St stays skeptical

COIN gained in post‑Q4 earnings as 2025 volume jumped 156% despite Wall St skepticism.

Summary

- Coinbase total trading volume grew 156% YoY in 2025, with crypto trading market share roughly doubling versus the prior year.

- Assets on COIN have tripled over 3 years, while 12 products, including USDC and Coinbase One, each now generate over $100m in annualized revenue.

- Armstrong says ~5 GSIBs and about half of major institutions already work with COIN, arguing GAAP noise hides profitability and that Wall St still underestimates the stock.

Coinbase Global Inc. Chief Executive Officer Brian Armstrong has attributed Wall Street’s skepticism of the cryptocurrency exchange to a broader pattern of industries resisting disruptive technologies, according to statements the executive shared on social media following an analyst session.

Coinbase total volume continues to tip upward

Armstrong responded to questions about why traditional financial institutions continue to misunderstand Coinbase’s business model, comparing crypto skeptics to historical examples of incumbent industries dismissing new competitors. The CEO referenced the comparison between legacy taxi services and ride-sharing platforms as an analogy for the current dynamic between traditional finance and cryptocurrency firms.

According to Armstrong’s statements, five of the globally systemically important banks (GSIBs) have initiated partnerships with Coinbase, and approximately 50% of major financial institutions are actively engaging with cryptocurrency services. The remaining institutions have been slower to adopt the technology, Armstrong said.

The company reported total trading volume growth of 156% year over year in its fourth quarter and full-year earnings report. Coinbase’s crypto trading market share doubled in 2025, and assets on the platform have tripled over the past three years, according to the company’s financial disclosures.

Armstrong highlighted that Coinbase’s GAAP net income includes unrealized gains and losses on cryptocurrency holdings, suggesting investors examine adjusted net income metrics instead. By that measure, the company remained profitable in the most recent quarter despite market headwinds, the CEO stated.

The cryptocurrency exchange now operates 12 products each generating over $100 million in annualized revenue, according to Armstrong. Both USDC, a stablecoin product, and Coinbase One, a subscription service, reached all-time highs. Armstrong characterized this diversification as evidence the company has reduced its dependence on trading fee revenue.

The CEO told investors to evaluate companies based on stated objectives and execution results, noting Coinbase has delivered consistent financial performance for three consecutive years. Armstrong cited improving regulatory clarity as a favorable factor for the industry’s growth, along with increasing participation from governments, institutions, and retail investors.

Armstrong concluded that Coinbase remains well-positioned to benefit from ongoing transformation in the financial system, describing the company as underestimated by market consensus. The executive suggested this gap between market perception and company performance represents an opportunity for investors.

Crypto World

Kresus secures $13M investment from Hanwha to scale wallet and RWA tokenization tech

Wallet infrastructure firm Kresus Labs has raised approximately 18 billion won ($13 million) in investment from Hanwha Investment & Securities, one of South Korea’s largest financial institutions.

The investment follows a memorandum of understanding signed in December at Abu Dhabi Finance Week and is aimed at expanding Kresus’ enterprise digital wallet infrastructure, real-world asset (RWA) tokenization platforms and onchain financial workflows.

The wallet and blockchain infrastructure firm develops digital asset tools for both consumers and institutions, including “seedless” wallet recovery technology and multi-party computation (MPC)-based security systems.

Seedless recovery refers to the means of restoring access to a digital asset stored in a wallet without having to use the traditional stream of 12-24 random words, which could prove a barrier to entry for some.

Kresus also operates wallet infrastructure and tokenization platforms designed to meet institutional compliance and operational requirements.

Hanwha plans to use Kresus’ technology to enhance its client-facing digital asset services and to develop tokenized versions of traditional financial products. For established financial firms, wallet security and compliant tokenization frameworks remain key barriers to deeper engagement with blockchain-based markets.

The raise underscores how capital continues to flow into infrastructure providers even when broader crypto markets are volatile. Rather than backing speculative tokens, institutions are increasingly targeting custody, security and tokenization layers that can plug into existing financial systems.

Crypto World

Unknown Trader Up $7M While Others Lose Millions

A relatively unknown crypto trader gained $7 million from shorting ETH while major investors suffered huge losses.

An anonymous trader known only as 0x58bro has accumulated $7 million in unrealized profits by shorting Ethereum (ETH) and a handful of other cryptocurrencies, according to data from on-chain intelligence platform Arkham.

What’s noteworthy about their success is that it has come at a time when several high-profile crypto personalities have suffered eight-figure losses betting on price increases.

The Quiet Whale Swimming Against the Current

Despite holding a portfolio valued at just under $13 million, 0x58bro maintains a minimal social media presence with just 1,300 followers on X. Arkham’s analysis shows the trader has generated the bulk of his profits from two positions: a $3.7 million gain shorting ETH and $1.45 million from shorting ENA, the governance token of Ethena Labs.

The trader’s wallet composition also revealed a strategic approach to the current market volatility. They hold over $7.5 million in Aave’s interest-bearing ETH token (aETHWETH) and $5 million in Aave’s USDC deposit token (aETHUSDC), suggesting they have positioned capital to earn yield while maintaining the flexibility to deploy it against further downside.

A smaller position of 10 million HANA tokens, currently worth close to $353,000, represents their only significant long exposure.

The timing of these short positions has proven critical, with Ethereum struggling to maintain momentum in recent weeks and prices hovering around the $2,000 psychological support level.

Market Backdrop Shows Leverage Risks and Speculation Cycles

While 0x58bro is profiting from market declines, other traders have faced catastrophic losses attempting to catch a falling knife. On-chain data shows that Machi Big Brother, a well-known crypto personality once worth nearly nine figures, has seen his Hyperliquid account value fall below $1 million. To meet margin calls on his long positions, he was forced to tap into PleasrDAO treasury funds deposited five years ago, with his total losses now standing at $28 million.

You may also like:

The contrast extends to institutional players as well. For instance, Trend Research, the trading firm led by Liquid Capital founder Jack Yi, fully exited its Ethereum positions last week after accumulating about $1.34 billion in ETH at an average entry of $3,180. The exit locked in losses of approximately $869 million, according to Arkham data, coming just days after Yi publicly predicted ETH would reach $10,000.

While Trend Research was forced to unwind what was once Asia’s largest ETH long position, on-chain data from CryptoQuant shows that wallets with no history of outflows holding at least 100 ETH, known as “accumulation addresses,” are still buying through the downturn. These addresses now hold around 23% of Ethereum’s circulating supply and have maintained their accumulation even when prices were trading below their average cost basis.

Whether 0x58bro will maintain his short positions or join the accumulating addresses betting on a rebound remains unknown. But for now, the trader with 1,300 followers has outperformed an industry of influencers with millions watching their every move.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Shielded Labs Introduces Advisory Services to Support Teams Building on Zcash Network

TLDR:

- Shielded Labs launched Partner Support Services to diversify funding beyond its existing donation-based revenue model.

- The NEAR Foundation became the first partner, covering past work and ongoing technical and strategic Zcash support.

- NEAR Intents has made it easier for users to acquire ZEC directly without depending on centralized crypto exchanges.

- Shielded Labs is already in talks with additional teams exploring similar advisory and ecosystem coordination agreements.

Shielded Labs has introduced a new Partner Support and Advisory Services initiative to diversify its funding. The organization, which backs long-term Zcash development, previously relied solely on donations.

Under the new program, external teams building on or integrating with Zcash can engage Shielded Labs directly. Services include technical support, advisory work, and ecosystem coordination. The NEAR Foundation is the first confirmed partner under this arrangement.

Shielded Labs Expands Revenue Model Through Ecosystem Partnerships

Shielded Labs has structured the new initiative to serve teams working through integrations, network upgrades, and related development efforts.

The program also offers advisory input based on direct experience with the Zcash protocol, community, and governance process. This creates a clearer path for external teams to engage with Zcash more efficiently.

The initiative also aims to reduce friction for builders entering the Zcash ecosystem. Teams that previously had no formal channel to engage Shielded Labs now have a direct route.

This approach helps ensure that new integrations align naturally with the broader ecosystem’s direction and standards.

Partner Services does not replace Shielded Labs’ core technical mission. Rather, it runs alongside it as a supplementary revenue stream.

The organization stated that its primary focus remains building and supporting technology that strengthens Zcash over the long term.

Shielded Labs confirmed it is already in discussions with additional teams considering similar engagements. Organizations interested in exploring collaboration are encouraged to contact the team directly, according to the announcement.

NEAR Foundation Becomes First Partner Under the New Program

Shielded Labs and the NEAR Foundation have formalized an agreement that covers both past contributions and future work.

Early collaboration involved communications and awareness strategy around Zcash’s initial integration into NEAR Intents.

Shielded Labs also helped organize the NEAR Intents hackathon and provided similar coordination support for integrations with Rhea Finance and Templar Protocol.

NEAR Intents has been noted as a meaningful development for Zcash, making it easier for users to acquire ZEC without relying on centralized exchanges.

Wallet teams, including Zashi, have since brought NEAR Intents integrations into mobile applications independently. These developments expanded access to ZEC for a broader user base.

As part of the ongoing agreement, Shielded Labs will continue providing technical, strategic, and ecosystem support to the NEAR Foundation.

This also covers teams building use cases around NEAR Intents. Stakeholder engagement, education, and coordination remain central components of the continued work.

On the technical side, Shielded Labs is exploring ways to simplify implementation for partners through targeted guidance and coordination.

Advisory input on security and privacy improvements is also part of the scope as new use cases around NEAR Intents continue to develop.

Crypto World

Is This the End of the Machi Big Brother Dump? Giant Whale Clings to Last $1M After Disaster

Arkham Intelligence estimates cumulative trading losses at $28 million.

Machi Big Brother is known for taking massive, highly leveraged long positions in several tokens on the decentralized exchange Hyperliquid, which has led to significant, high-profile liquidations.

Recent volatile months have massively drained his remaining capital.

Fortune Shrinks

Blockchain data shared by Arkham Intelligence revealed that Machi Big Brother’s Hyperliquid HL account value has fallen below $1 million. The data indicates the Taiwanese-American entrepreneur and former musician, whose real name is Jeffrey Huang, added margin to recent Hyperliquid long positions by drawing from the PleasrDAO treasury, funds that were deposited roughly five years ago.

Arkham Intelligence reports that around five months ago, Machi Big Brother’s net worth was close to nine figures. Since then, his holdings have witnessed a steep fall.

The on-chain tracking firm estimates his cumulative trading performance at a loss of $28 million. The movements were identified through wallet activity linked to Machi Big Brother and the PleasrDAO treasury.

Controversies

Machi Big Brother has been one of the controversial figures in crypto who is known for massive gains, heavy losses, and constant reinvention. He entered the space around 2017, launching Mithril (MITH), a “social mining” project that rewarded users with tokens. The project raised about $13 million, but the token collapsed roughly 80% within months.

He later joined Formosa Financial, which helped raise around 44,000 ETH, then worth about $37 million. About 22,000 ETH later disappeared from the treasury and were never recovered. In 2020, he moved aggressively into DeFi, forking Compound to create Cream Finance. The protocol suffered multiple exploits, and total losses surpassed $192 million.

You may also like:

He continued launching fast-moving forks such as Mith Cash, Wifey Finance, and Typhoon Cash, many of which failed within weeks. From 2021 to 2023, he became a dominant NFT player and amassed more than 200 Bored Ape Yacht Club NFTs worth over $9 million at the peak.

He later sold more than 1,000 NFTs in a short period, which crashed floor prices in what became known as the “Machi Dump.” In 2022, on-chain investigator ZachXBT accused him of embezzling 22,000 ETH and leaving multiple failed projects behind. Machi responded with a defamation lawsuit in Texas, which ended quietly without a ruling.

In 2024, he launched the Boba Oppa meme coin on Solana. He raised over $40 million before the token dropped sharply.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Optimism’s OP token falls after Base moves away from the network’s ‘OP stack’ in major tech shift

Coinbase’s Ethereum layer-2 network, Base, is changing the technology that powers it, stepping back from relying on Optimism’s OP Stack, the toolkit it originally launched on.

In a blog post titled “The Next Chapter for Base,” the team said it plans to take more control over its own code and infrastructure. Instead of depending on multiple outside teams for key upgrades and changes, Base will consolidate everything into a Base-managed codebase.

In simple terms, Base was built using Optimism’s technology, but now it wants to steer more of its own ship. Optimism is a layer-2 blockchain on top of Ethereum that aims to reduce settlement times and transaction costs.

Base launched in 2023 and quickly became one of the most widely used Ethereum layer-2 networks, with $3.85 billion locked in the protocol today. When the network went live, the Optimism and Base teams shared that Base could earn up to approximately 118 million OP tokens over six years. It is unclear as to what that means for that agreement.

The OP token is down 4% over the past 24 hours following the announcement.

The team said that the change doesn’t mean Base is cutting ties with Optimism entirely. The company said it will still work with Optimism for support and will remain compatible with OP Stack standards during the transition. For everyday users and developers, nothing should immediately change.

The team said the shift is happening because, if it controls its own stack, Base can ship upgrades faster and simplify how the network operates behind the scenes, aiming to double its pace of major upgrades to about six per year.

For now, the transition is mostly technical.

“This unification does not mean Base will be built in isolation. The protocol remains public and specified in the open, and alternative implementations are welcome and encouraged,” the team wrote in their blog post.

“We’re grateful for our three-year partnership with Base, and proud to have helped it become one of the most successful Layer 2 deployments in history,” an OP Labs spokesperson told CoinDesk.

“Our focus remains on delivering enterprise-grade blockchain infrastructure to our ecosystem, and we will continue to serve Base as an OP Enterprise customer while they build out their independent infrastructure.”

UPDATE (Feb. 18, 2026, 18:06 UTC): Adds OP Labs statement + background info on 118M OP token agreement.

Read more: Coinbase Officially Launches Base Blockchain in Milestone for a Public Company

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment12 hours ago

Entertainment12 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech16 hours ago

Tech16 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Entertainment3 hours ago

Entertainment3 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business18 hours ago

Business18 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 hours ago

Crypto World6 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

![Cleyton M - Money Official Dance Video By Calvinperbi & His Team Dance Makes You Better[DMYB]](https://wordupnews.com/wp-content/uploads/2026/02/1771464058_maxresdefault-80x80.jpg)