Crypto World

Revolutionising Advanced Problem-Solving with AI

by Gonzalo Wangüemert Villalba

•

4 September 2025

Introduction The open-source AI ecosystem reached a turning point in August 2025 when Elon Musk’s company xAI released Grok 2.5 and, almost simultaneously, OpenAI launched two new models under the names GPT-OSS-20B and GPT-OSS-120B. While both announcements signalled a commitment to transparency and broader accessibility, the details of these releases highlight strikingly different approaches to what open AI should mean. This article explores the architecture, accessibility, performance benchmarks, regulatory compliance and wider industry impact of these three models. The aim is to clarify whether xAI’s Grok or OpenAI’s GPT-OSS family currently offers more value for developers, businesses and regulators in Europe and beyond. What Was Released Grok 2.5, described by xAI as a 270 billion parameter model, was made available through the release of its weights and tokenizer. These files amount to roughly half a terabyte and were published on Hugging Face. Yet the release lacks critical elements such as training code, detailed architectural notes or dataset documentation. Most importantly, Grok 2.5 comes with a bespoke licence drafted by xAI that has not yet been clearly scrutinised by legal or open-source communities. Analysts have noted that its terms could be revocable or carry restrictions that prevent the model from being considered genuinely open source. Elon Musk promised on social media that Grok 3 would be published in the same manner within six months, suggesting this is just the beginning of a broader strategy by xAI to join the open-source race. By contrast, OpenAI unveiled GPT-OSS-20B and GPT-OSS-120B on 5 August 2025 with a far more comprehensive package. The models were released under the widely recognised Apache 2.0 licence, which is permissive, business-friendly and in line with requirements of the European Union’s AI Act. OpenAI did not only share the weights but also architectural details, training methodology, evaluation benchmarks, code samples and usage guidelines. This represents one of the most transparent releases ever made by the company, which historically faced criticism for keeping its frontier models proprietary. Architectural Approach The architectural differences between these models reveal much about their intended use. Grok 2.5 is a dense transformer with all 270 billion parameters engaged in computation. Without detailed documentation, it is unclear how efficiently it handles scaling or what kinds of attention mechanisms are employed. Meanwhile, GPT-OSS-20B and GPT-OSS-120B make use of a Mixture-of-Experts design. In practice this means that although the models contain 21 and 117 billion parameters respectively, only a small subset of those parameters are activated for each token. GPT-OSS-20B activates 3.6 billion and GPT-OSS-120B activates just over 5 billion. This architecture leads to far greater efficiency, allowing the smaller of the two to run comfortably on devices with only 16 gigabytes of memory, including Snapdragon laptops and consumer-grade graphics cards. The larger model requires 80 gigabytes of GPU memory, placing it in the range of high-end professional hardware, yet still far more efficient than a dense model of similar size. This is a deliberate choice by OpenAI to ensure that open-weight models are not only theoretically available but practically usable. Documentation and Transparency The difference in documentation further separates the two releases. OpenAI’s GPT-OSS models include explanations of their sparse attention layers, grouped multi-query attention, and support for extended context lengths up to 128,000 tokens. These details allow independent researchers to understand, test and even modify the architecture. By contrast, Grok 2.5 offers little more than its weight files and tokenizer, making it effectively a black box. From a developer’s perspective this is crucial: having access to weights without knowing how the system was trained or structured limits reproducibility and hinders adaptation. Transparency also affects regulatory compliance and community trust, making OpenAI’s approach significantly more robust. Performance and Benchmarks Benchmark performance is another area where GPT-OSS models shine. According to OpenAI’s technical documentation and independent testing, GPT-OSS-120B rivals or exceeds the reasoning ability of the company’s o4-mini model, while GPT-OSS-20B achieves parity with the o3-mini. On benchmarks such as MMLU, Codeforces, HealthBench and the AIME mathematics tests from 2024 and 2025, the models perform strongly, especially considering their efficient architecture. GPT-OSS-20B in particular impressed researchers by outperforming much larger competitors such as Qwen3-32B on certain coding and reasoning tasks, despite using less energy and memory. Academic studies published on arXiv in August 2025 highlighted that the model achieved nearly 32 per cent higher throughput and more than 25 per cent lower energy consumption per 1,000 tokens than rival models. Interestingly, one paper noted that GPT-OSS-20B outperformed its larger sibling GPT-OSS-120B on some human evaluation benchmarks, suggesting that sparse scaling does not always correlate linearly with capability. In terms of safety and robustness, the GPT-OSS models again appear carefully designed. They perform comparably to o4-mini on jailbreak resistance and bias testing, though they display higher hallucination rates in simple factual question-answering tasks. This transparency allows researchers to target weaknesses directly, which is part of the value of an open-weight release. Grok 2.5, however, lacks publicly available benchmarks altogether. Without independent testing, its actual capabilities remain uncertain, leaving the community with only Musk’s promotional statements to go by. Regulatory Compliance Regulatory compliance is a particularly important issue for organisations in Europe under the EU AI Act. The legislation requires general-purpose AI models to be released under genuinely open licences, accompanied by detailed technical documentation, information on training and testing datasets, and usage reporting. For models that exceed systemic risk thresholds, such as those trained with more than 10²⁵ floating point operations, further obligations apply, including risk assessment and registration. Grok 2.5, by virtue of its vague licence and lack of documentation, appears non-compliant on several counts. Unless xAI publishes more details or adapts its licensing, European businesses may find it difficult or legally risky to adopt Grok in their workflows. GPT-OSS-20B and 120B, by contrast, seem carefully aligned with the requirements of the AI Act. Their Apache 2.0 licence is recognised under the Act, their documentation meets transparency demands, and OpenAI has signalled a commitment to provide usage reporting. From a regulatory standpoint, OpenAI’s releases are safer bets for integration within the UK and EU. Community Reception The reception from the AI community reflects these differences. Developers welcomed OpenAI’s move as a long-awaited recognition of the open-source movement, especially after years of criticism that the company had become overly protective of its models. Some users, however, expressed frustration with the mixture-of-experts design, reporting that it can lead to repetitive tool-calling behaviours and less engaging conversational output. Yet most acknowledged that for tasks requiring structured reasoning, coding or mathematical precision, the GPT-OSS family performs exceptionally well. Grok 2.5’s release was greeted with more scepticism. While some praised Musk for at least releasing weights, others argued that without a proper licence or documentation it was little more than a symbolic gesture designed to signal openness while avoiding true transparency. Strategic Implications The strategic motivations behind these releases are also worth considering. For xAI, releasing Grok 2.5 may be less about immediate usability and more about positioning in the competitive AI landscape, particularly against Chinese developers and American rivals. For OpenAI, the move appears to be a balancing act: maintaining leadership in proprietary frontier models like GPT-5 while offering credible open-weight alternatives that address regulatory scrutiny and community pressure. This dual strategy could prove effective, enabling the company to dominate both commercial and open-source markets. Conclusion Ultimately, the comparison between Grok 2.5 and GPT-OSS-20B and 120B is not merely technical but philosophical. xAI’s release demonstrates a willingness to participate in the open-source movement but stops short of true openness. OpenAI, on the other hand, has set a new standard for what open-weight releases should look like in 2025: efficient architectures, extensive documentation, clear licensing, strong benchmark performance and regulatory compliance. For European businesses and policymakers evaluating open-source AI options, GPT-OSS currently represents the more practical, compliant and capable choice. In conclusion, while both xAI and OpenAI contributed to the momentum of open-source AI in August 2025, the details reveal that not all openness is created equal. Grok 2.5 stands as an important symbolic release, but OpenAI’s GPT-OSS family sets the benchmark for practical usability, compliance with the EU AI Act, and genuine transparency.

Crypto World

Justin Sun says ‘keep going’ on Tron Inc’s TRX buys

Crypto billionaire Justin Sun endorsed Tron Inc.’s strategy of stacking the TRX token, which has recently outperformed bitcoin , as a core treasury asset, spotlighting their latest dip buy with a simple “keep going” on X.

The Nasdaq-listed Tron Inc. announced that it acquired 175,507 TRX tokens on Wednesday at an average price of $0.28, for a fresh investment of just over $49,000 in the Tron blockchain’s native token. The latest purchase boosted its TRX stash to 679.9 million tokens ($540 million).

The company plans to further grow its TRX holdings to enhance long-term shareholder value.

Tron Inc. — formed via a reverse merger between SRM Entertainment and a Tron-related entity — is a publicly listed firm focused on blockchain-integrated treasury strategies and holding a significant amount of TRX tokens. The company is modeled on Nasdaq-listed Strategy, which pioneered the digital asset treasury narrative by starting to accumulate Bitcoin as a reserve asset in August 2020.

The nod from Sun reinforces steady accumulation amid market dips. TRX’s price peaked near 45 cents in 2024 and has since pulled back to 28 cents. But lately, it has been relatively resilient, down just 1.3% this year versus the market leader, bitcoin, which is down nearly 19%, according to CoinDesk data.

TRX’s relative outperformance amid broader crypto weakness has led some analysts to view it as a defensive haven asset.

Crypto World

ZachXBT Highlights $282M Theft of Bitcoin and Litecoin in Hardware Wallet Scam

The investigator said the attacker swapped funds into Monero and moved BTC across chains using Thorchain.

Onchain investigator ZachXBT said a victim lost more than $282 million worth of Bitcoin (BTC) and Litecoin (LTC) in a scam involving a hardware wallet earlier this month.

In a post on X, ZachXBT said the theft happened on Jan. 10, 2026, around 11 p.m. UTC, and involved about 2.05 million LTC and 1,459 BTC. He said the victim was tricked in a social engineering scam.

The theft was reported as major crypto prices were slightly higher on the day. Litecoin (LTC) was trading around $74.57, up 3.6% in the past 24 hours, while Bitcoin (BTC) traded near $95,512, up 0.2%, according to CoinGecko.

The case highlights how even hardware wallets can be risky if someone is fooled into giving up access or approving a bad transaction. These scams don’t involve breaking code; instead, they rely on tricking the victim.

According to ZachXBT, the attacker began converting the stolen BTC and LTC into Monero (XMR) through multiple instant exchanges. Monero is a privacy-focused cryptocurrency and is currently trading at $642.77, down 3.7% on the day.

He said the conversions contributed to a sharp increase in XMR’s price as the market absorbed the flow. ZachXBT also said the attacker bridged BTC to other networks, including Ethereum, Ripple, and Litecoin, using Thorchain, a cross-chain liquidity protocol.

The theft comes as security firms continue to warn that many big crypto losses come from user error and scams. PeckShield reported that total exploit losses fell to about $76 million in December 2025 from $194.3 million in November, though it said incident activity remained elevated.

Crypto World

Current Bear Market Performance Worse Than 2022: Analysts

Bitcoin’s decline into a bear market has been faster than in the past cycle, according to analysts.

“Bitcoin’s bear market is off to a weaker start than 2022,” reported on-chain analytics platform CryptoQuant on Wednesday.

Since falling below the 365-day moving average in November, Bitcoin is down 23% in just 83 days, compared to a 6% decline over the same period in early 2022, they added before stating “momentum is deteriorating faster this cycle.”

“This performance is worse than at the start of the previous bear market in January 2022.”

Bitcoin Bear Market Deepens

Bitcoin peaked at $126,000 in early October with the “Bull Score Index” at 80, but following the Oct. 10 liquidation event, the index turned bearish and has now fallen to zero while the price dumped to $71,000, “signaling broad structural weakness,” CryptoQuant reported. The platform also stated that Bitcoin “has lost key support levels” and may be targeting $70,000 to $60,000.

Bitcoin was rejected three times at the “Traders’ On-chain Realized Price,” a key on-chain support and resistance level. It also recently crossed below the lower band of this same metric, which acted as a support during the bull market.

Bitcoin’s bear market is off to a weaker start than 2022.

Since falling below the 365-day MA on Nov 12, 2025, $BTC is down 23% in 83 days, vs. just 6% over the same period in early 2022.

Momentum is deteriorating faster this cycle. pic.twitter.com/t4xD2vljVI

— CryptoQuant.com (@cryptoquant_com) February 4, 2026

Meanwhile, Santiment reported that sentiment “has turned extremely bearish toward Bitcoin and Ethereum” following the major downswing this past week.

“As we know, markets move opposite to the fear and greed of retail traders. There remains a strong argument for a short-term relief rally as long as the small-trader crowd continues to show disbelief toward cryptocurrency as a whole.”

“The BTC bear market rages on as profitability resets, realised losses rise, spot demand stays weak, and leverage unwinds,” reported Glassnode.

Meanwhile, the crypto “Fear and Greed Index” has fallen back to all-time lows around 12 as sentiment collapses and panic selling continues.

You may also like:

Crypto Market Outlook

Total capitalization has declined again today, falling 4.4% to $2.53 trillion, its lowest level since April 2025. Further losses will see it back to bear market lows from 2024.

Bitcoin dumped again, tanking below $71,000 during early trading in Asia on Thursday morning. BTC is now back at November levels and heading towards support at around $65,000.

Ether is in meltdown, crashing below $2,100 and failing to recover, also on a path to previous cycle lows.

Altcoins are not even worth mentioning, tanking even harder than the top two, with most now at 80% down from their peaks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

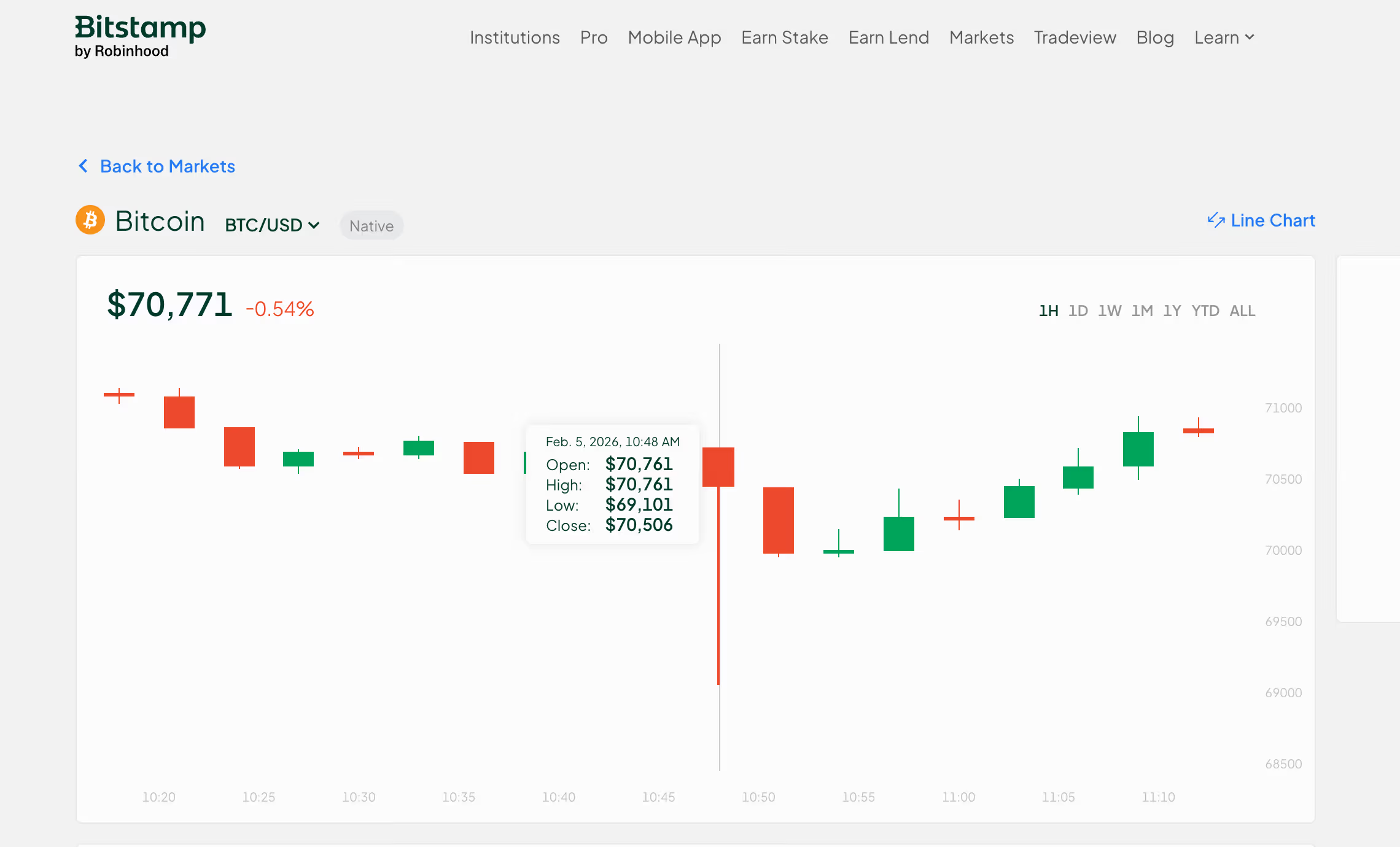

BTC tanks to $69,101 on Bitstamp

Bitcoin’s price sell-off continued Thursday, with prices breaking below the widely-tracked $70,000 level on the OG crypto exchange Bitstamp.

BTC’s dollar-denominated price slipped to $69,101 during the Asian trading hours, trading a discount to prices on other exchanges, including Coinbase, where BTC hit a low of $70,002.

The discount on Bitstamp likely stemmed from stronger selling pressure on the Robinhood-owned platform.

The global average price, tracked by CoinDesk, peaked above $126,000 in early October and has been in a downtrend since then. Some analysts expect further sell-off at least to $60,000, where prices may eventually bottom out.

Crypto World

Tether Tops 500 Million Users But USDT Peg Concerns Abound

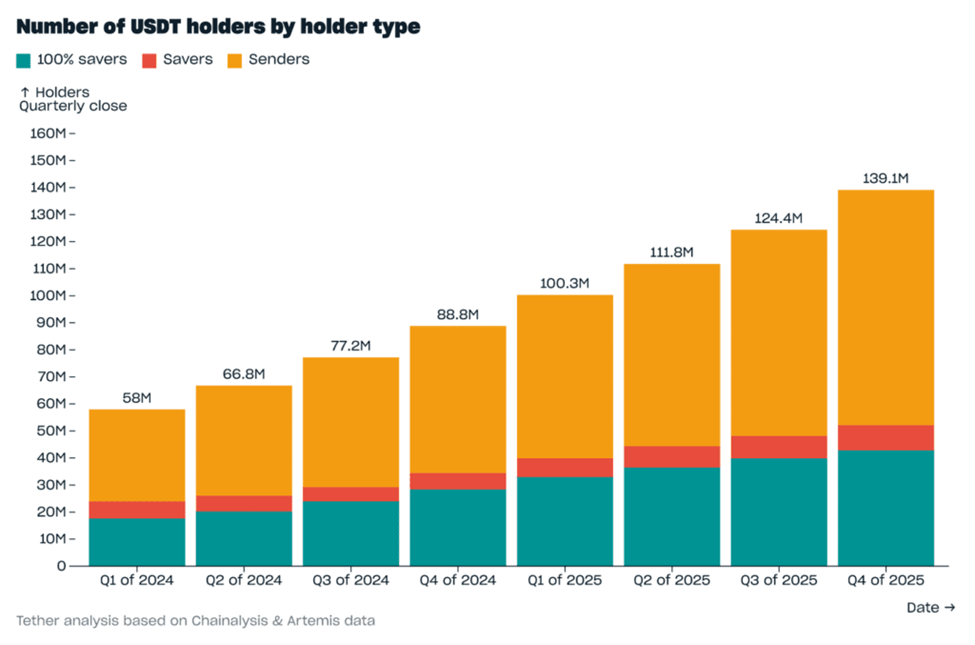

Tether’s USDT has crossed a major milestone, surpassing 534 million users, even as the broader crypto market remains under pressure following a sharp contraction that began in October 2025.

According to the company’s Q4 2025 USD₮ Market Report, the stablecoin added more than 35 million users in the quarter, marking the eighth consecutive quarter of adding over 30 million users.

Sponsored

Sponsored

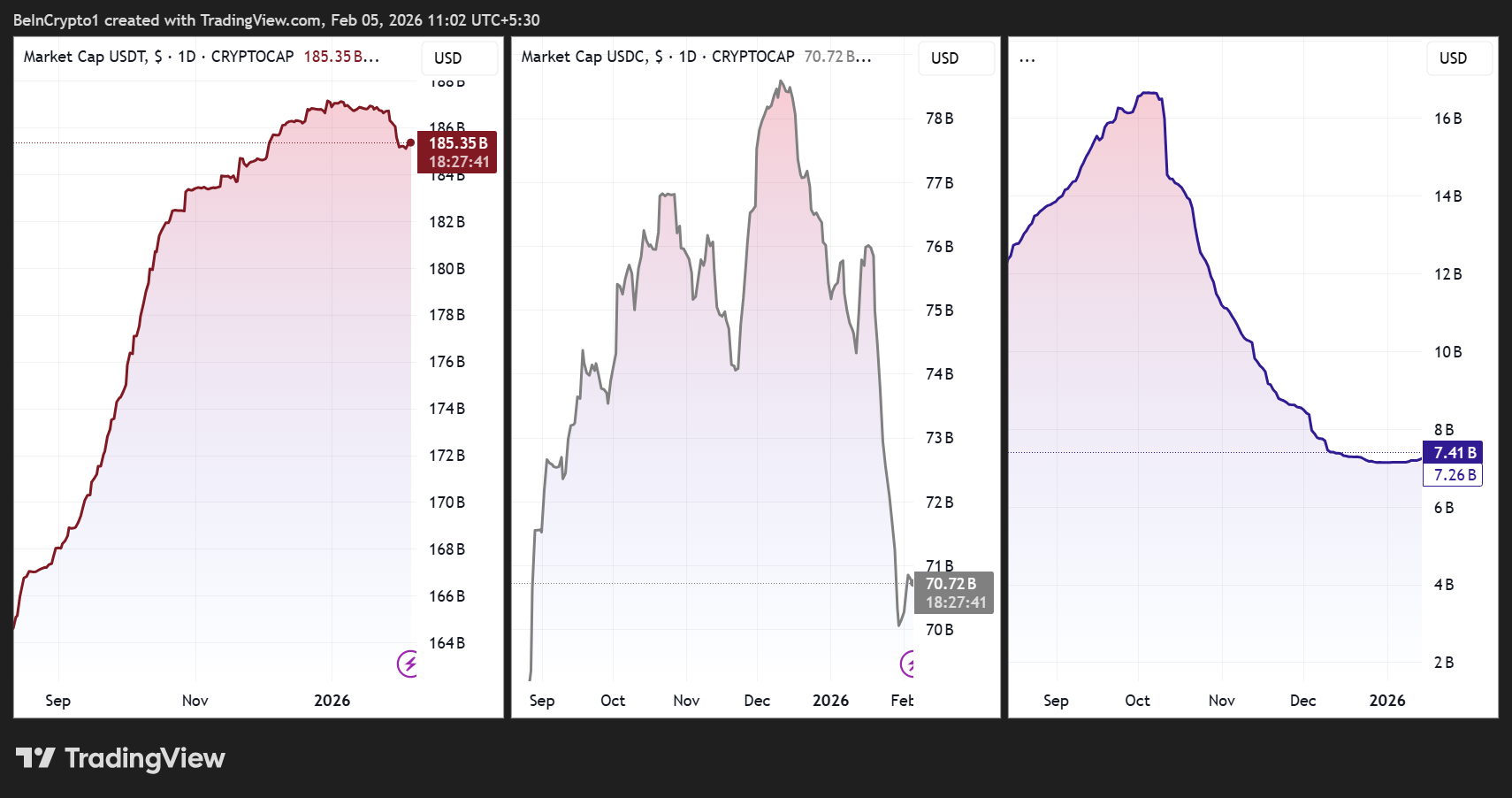

USDT Expands as a Global Store of Value Even as Crypto Market Cap Contracts

The growth comes during a period of declining risk appetite. Since the October 10 liquidation cascade, the total crypto market capitalization has fallen by more than one-third (30%). Meanwhile, USDT’s supply has continued to expand modestly.

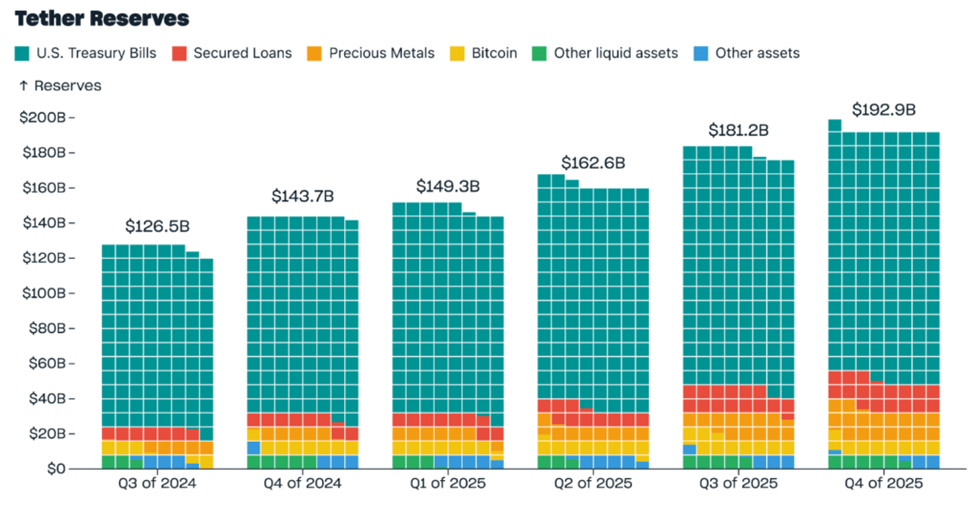

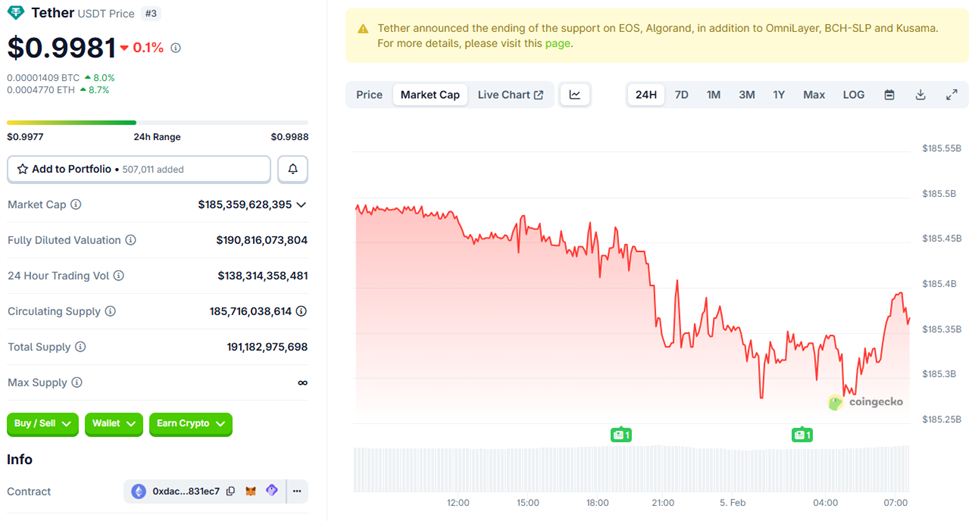

Tether reported that its market capitalization rose to $187.3 billion, up $12.4 billion in Q4, even as some competing stablecoins shrank.

Tether attributes the resilience to demand for savings, payments, and cross-border transfers rather than purely speculative trading.

On-chain metrics cited in the report show rising wallet balances among long-term holders and record transaction volumes.

However, the estimates of total users include both on-chain wallets and approximations of exchange users, making independent verification difficult.

Reserve disclosures also show continued expansion. Total reserves reached $192.9 billion, including $141.6 billion in US Treasuries, a level that would place Tether among the largest Treasury holders globally if it were a country.

Sponsored

Sponsored

The company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 metric tons, reflecting a strategy to diversify collateral beyond cash-equivalent assets.

On-chain activity continued to grow rapidly. The number of USDT holders rose to 139.1 million, while monthly active users reached 24.8 million, both record highs.

The value transferred on-chain reached $4.4 trillion in Q4, and USDT’s share of spot trading volumes on centralized exchanges climbed to 61.5%. This highlights its role as the dominant settlement asset in crypto markets.

Sponsored

Sponsored

Minting Surge, Peg Wobbles, and Flippening Talk Highlight USDT’s Growing Systemic Role

Recent issuance activity suggests demand has carried into early 2026. On February 4, blockchain analytics account Lookonchain reported that Tether minted $1 billion in USDT, part of roughly $3 billion in stablecoins issued by Tether and Circle over three days.

Large issuances are often interpreted by traders as a signal of incoming liquidity, although newly minted tokens are not always immediately circulated.

At the same time, Tether’s growing dominance has intensified scrutiny. Market attention briefly turned to USDT’s stability after the token slipped to around $0.9980, its weakest level in more than 5 years.

While the deviation was small and short-lived, any sustained loss of confidence in the peg could have outsized consequences, given the stablecoin’s central role in trading infrastructure.

Sponsored

Sponsored

Market estimates often suggest that most crypto trading volume flows through USDT pairs, making it a critical pillar of liquidity.

The scale of Tether’s expansion has also fueled debate over its place in the crypto hierarchy. Some market observers have speculated that, if current trends continue, USDT could eventually challenge Ethereum’s position as the second-largest cryptocurrency by market capitalization, particularly during prolonged periods of risk aversion when capital rotates into stable assets.

Meanwhile, the latest data shows that USDT is expanding in terms of users, reserves, and transaction volume, even as the broader market contracts.

Yet that same growth is concentrating liquidity and systemic importance in a single instrument. The stability of Tether’s peg is increasingly tied not just to one company, but to the resilience of the crypto market itself.

Crypto World

Why Vitalik Buterin Says L2s Aren’t Scaling Ethereum Anymore

Buterin argued that many Layer 2s no longer meaningfully inherit Ethereum security.

Ethereum co-founder Vitalik Buterin said recent developments mean the original conception of Layer 2 scaling within the ETH ecosystem is no longer viable.

He said that the progress among many L2 networks has fallen short of earlier expectations, while the mainnet continues to scale directly.

Slow Progress, Low Fees

In a recent post on X, Buterin pointed to two important realities reshaping the debate. First, there is the slow and difficult progress of L2s toward “stage 2” decentralization and interoperability, and the fact that Ethereum’s mainnet has already achieved very low fees, with gas limits expected to rise significantly through 2026.

Buterin reiterated that Ethereum scaling was originally defined as expanding block space that fully inherits Ethereum’s security. This means that all activity remains valid and censorship-resistant as long as the network operates. As such, systems that rely on multisig bridges or other forms of discretionary control cannot be considered extensions of Ethereum in this sense, even if they offer high throughput.

The co-founder explained that this framing no longer holds because the blockchain no longer needs L2s to function as “branded shards,” while many L2s are either unable or unwilling to meet the security and governance requirements that such a role would imply.

Buterin observed that some projects have explicitly stated they may never move beyond stage 1, not only due to technical concerns around zero-knowledge EVM safety, but also because regulatory or customer requirements necessitate ultimate control. While he said this may be appropriate for those projects’ use cases, it means they should not be described as scaling Ethereum under the original definition.

Instead, Buterin suggested abandoning the idea that all Layer 2s should occupy the same category and be judged by the same criteria. He proposed that they be viewed as a broad spectrum of systems with varying degrees of connection to Ethereum. In this framing, some L2s may be fully backed by Ethereum’s security while others operate with more limited guarantees. This would allow users and applications to choose based on their needs.

You may also like:

He added that L2s should focus on providing distinct value beyond generic scaling, such as specialized virtual machines, application-specific efficiency, extreme throughput, non-financial use cases, low-latency sequencing, or integrated services like oracles or dispute resolution. For networks handling ETH or Ethereum-issued assets, he said reaching at least stage 1 should be a minimum standard.

ZK-EVM Precompile

From Ethereum’s perspective, Buterin said he has become increasingly convinced of the importance of a native rollup precompile that would verify ZK-EVM proofs as part of Ethereum itself. Such a system in place enables trustless interoperability and composability while allowing L2s flexibility in extending functionality.

He said that while a permissionless ecosystem will inevitably include systems with weaker or trust-dependent guarantees, Ethereum’s responsibility is to make those guarantees clear and continue strengthening the base protocol.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

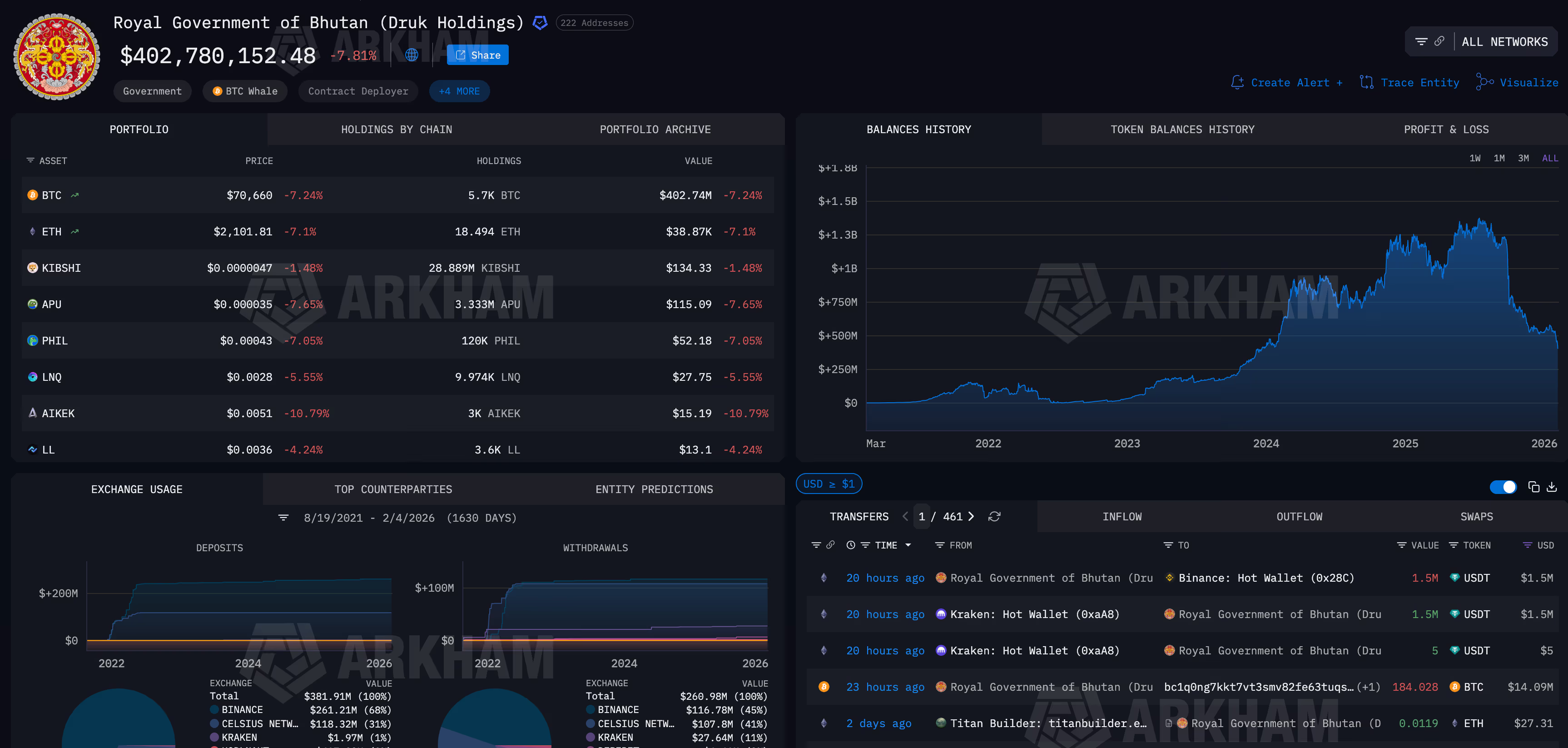

Bhutan shifts holdings after months of silence as BTC moves to $70,000

The Royal Government of Bhutan has begun moving bitcoin after months of wallet inactivity, shifting funds to trading firms, exchanges and fresh addresses as bitcoin slid below $71,000 and broader markets convulsed.

Onchain data tracked by Arkham shows Bhutan-linked wallets transferring more than 184 BTC, worth roughly $14 million, over the past 24 hours.

Some of the bitcoin was sent to new addresses, while other transfers flowed to known counterparties including QCP Capital and a Binance hot wallet, according to Arkham.

These destinations typically associated with trading, liquidity management or potential sales. CoinDesk reached out to QCP Capital via Telegram for comment.

The activity marks Bhutan’s first notable wallet movement in roughly three months and comes at a volatile moment for crypto markets. Bitcoin has fallen more than 7% in 24 hours, while silver plunged as much as 17% and global equities slid amid fears that artificial intelligence spending is undermining traditional software business models.

Bhutan has emerged over the past two years as one of the more unusual sovereign bitcoin holders, quietly building a stash through state-backed mining tied to hydropower.

Unlike corporate treasuries that trumpet accumulation strategies, Bhutan’s holdings have largely been managed out of the spotlight, making changes in wallet behavior closely watched by traders.

The latest transfers do not confirm outright selling. Coins were split across multiple destinations, including new wallets that could indicate internal reshuffling or collateral management rather than immediate liquidation.

Still, sending bitcoin to exchanges and trading firms during a sharp drawdown contrasts with the country’s otherwise long periods of inactivity.

The moves also echo a broader theme emerging in this selloff: large holders treating bitcoin less as a static reserve asset and more as a balance-sheet tool during stress.

Corporate treasuries, miners and now sovereign-linked entities are adjusting positions as liquidity tightens and price swings accelerate.

Crypto World

Bitcoin ETFs Hold On Amid Price Plunge, Analyst Says

US-based spot Bitcoin ETF holders are showing resilience despite a four-month downtrend in Bitcoin (CRYPTO: BTC), according to ETF analyst James Seyffart. In a recent post on X, he noted that the ETFs are “hanging in there pretty good,” even as the underlying asset has endured a prolonged slide. While acknowledging the pain of the current stretch—Bitcoin trading below $73,000 has left ETF holders with what he described as their largest paper losses since the January 2024 launch—the way flows have behaved contrasts with the height of the market cycle. The narrative is nuanced: inflows have cooled from peak levels, but the existing positions remain broadly intact as investors weather the drift in price.

Key takeaways

- Spot Bitcoin ETF holders are currently underwater but continuing to hold positions, signaling a degree of conviction despite the drawdown.

- Net ETF inflows had reached roughly $62.11 billion before the October downturn, and have since cooled to around $55 billion, according to preliminary data from Farside Investors.

- Bitcoin’s price trajectory has contributed to paper losses for ETF holders, with the broader market down about 24% over a 30-day window and the spot price near $70,537 at the time of reporting.

- Industry observers highlight a pattern of extended outflows, noting that three consecutive months of withdrawals marked a first in the history of higher-frequency ETF data monitoring.

- Industry voices emphasize a longer-term perspective, arguing that Bitcoin’s performance since 2022 has outpaced traditional assets in several periods, challenging the sentiment of a uniformly bearish cycle among analysts.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. ETF holders remain underwater as Bitcoin’s price decline drags on, though the net inflow dynamics offer a counterpoint to pure price Action.

Trading idea (Not Financial Advice): Hold. The combination of persistent holdings by ETF investors and improving inflows relative to peak levels suggests patience may be warranted amid ongoing price volatility.

Market context: The ETF landscape sits at the intersection of liquidity, risk appetite, and macro flows. Inflows into BTC-linked vehicles have cooled after a major cycle, while on-chain and market indicators show divergent signals about near-term momentum. The mix of price pressure and ongoing institutional participation shapes a cautious but not collapsing narrative for Bitcoin-focused ETFs.

Why it matters

The behavior of spot BTC ETFs helps illuminate a broader dynamic in crypto markets: institutional vehicles can provide a stabilizing, if not yet growth-driven, channel for price discovery. Even as price declines stretch across several weeks, the fact that ETF inflows remain sizable—albeit down from the peak—suggests that investors are maintaining exposure rather than exiting en masse. This matters for market liquidity, as ETF flows can dampen sharp price moves when buying or selling pressure intensifies, particularly in a sector as sensitive to macro headlines as crypto.

The discourse around investor sentiment is nuanced. On one hand, there is acknowledgment of substantial paper losses among ETF holders during the recent downturn, with Bitcoin navigating lower levels and volatility elevated. On the other hand, observers highlight that Bitcoin’s recovery potential remains tethered to macro risk appetite and the pace of flows into crypto vehicles. The conversation is further complicated by longer-term performance comparisons: Bitcoin has, in multiple cycles, outperformed traditional assets over extended horizons, which some argue justifies a longer view despite the near-term pain.

Analysts and researchers stress that focusing solely on near-term drawdowns can obscure the more complex picture of investor behavior and market structure. For instance, a well-known market observer suggested that Bitcoin’s strength in previous years—particularly its outsized gains through 2023 and 2024—remains a reference point for evaluating current demand. While the market may appear to be in a risk-off phase, the longer arc of Bitcoin’s price action has historically included substantial rallies following consolidation periods, underscoring the difficulty in drawing conclusions from a single quarter’s results.

Another thread in the discussion centers on the prudence of staying invested when ETF holders are effectively “underwater and collectively holding,” as some observers phrase it. This stance mirrors a broader crypto investing paradigm where conviction and time horizons matter as much as timing. In a space where episodic headlines can swing prices, the behavior of ETF holders offers a degree of reflexivity: ongoing participation from established vehicles can support price resilience, even when volatility remains elevated.

The discourse also touches on narrative risk—whether market participants are overly pessimistic about BTC’s near-term prospects. Some voices argue that evaluating Bitcoin’s performance in a post-2022 context should consider its outsized gains relative to gold and traditional assets, suggesting that the market’s recovery potential remains intact even after a difficult stretch. While sentiment among analysts fluctuates, the fact that a broad spectrum of commentators continues to discuss Bitcoin’s long-term trajectory hints at a market that is more nuanced than a straightforward bullish or bearish verdict.

The price action is clear: Bitcoin has shed nearly a quarter of its value in the last 30 days, with BTC trading around $70,537, according to CoinMarketCap. The linkage between ETF flows and price remains an evolving interplay, and investors are watching for how upcoming data and regulatory signals might shape the next leg of the cycle.

In the broader ecosystem, crypto analytics firms and market researchers have highlighted a pattern that may be drawing attention beyond immediate price moves. A widely cited analyst pointed out that the current period marks a historic phase in which consecutive outflows have occurred, raising questions about the implications for liquidity, volatility, and the resilience of BTC-linked products. Yet, this is not the first time the market has faced a testing environment, and some observers emphasize that Bitcoin’s fundamental narratives—scalability, network activity, and institutional adoption—remain central to the longer-term thesis.

Meanwhile, voices from the analytics community caution against a purely short-term lens. The market’s reaction to liquidity shifts, regulatory signals, and ETF flows can diverge from what is visible in day-to-day price movements. By examining the total inflows and outflows relative to the size of the market, investors can form a more balanced view of risk and opportunity in the BTC ETF space, rather than focusing solely on immediate losses or gains.

Eric Balchunas, a veteran ETF analyst, has emphasized that Bitcoin’s performance since 2022 has delivered outsized gains compared with gold and silver, arguing that those who judge BTC on a single year’s performance may be missing the broader arc. His comment underscores the importance of framing BTC’s story within a multiyear horizon, especially for investors considering exposure through spot BTC ETFs rather than direct spot markets. The ongoing debate about risk and return continues to shape how market participants approach BTC-focused ETFs and related products.

Ki Young Ju, CEO of CryptoQuant, summed up a meta-view that reflects a cautious mood among market participants: “every Bitcoin analyst is now bearish,” a remark that underscores the prevailing mood while leaving room for a counterpoint in a market that has historically proven contrarian at pivotal moments. The tension between bearish sentiment and the potential for a longer-term rebound remains a defining feature of BTC discourse as traders weigh the odds of a renewed upshift in price against continued macro uncertainty.

What to watch next

- Next wave of ETF flow data from Farside Investors and other researchers, which could show whether the contraction in inflows accelerates or stabilizes.

- Bitcoin price behavior over the next several weeks, particularly in response to macro cues and any regulatory developments impacting crypto markets.

- Further commentary from major ETF analysts and researchers on whether the current drawdown is a pause or the onset of a deeper correction.

- Updates on institutional participation in BTC-linked products, including any changes in flows into other crypto ETFs or related vehicles.

Sources & verification

- Preliminary net inflows data for spot BTC ETFs from Farside Investors (as cited in the article).

- Public X posts by James Seyffart discussing ETF holders’ performance and sentiment.

- Public X posts by Jim Bianco and Rand analyzing ETF holder underwater percentages and historical comparisons.

- Price data for Bitcoin from CoinMarketCap at the time of publication (BTC price around $70,537).

- Comments from Eric Balchunas regarding BTC’s performance since 2022 relative to other assets.

- Ki Young Ju’s remarks from CryptoQuant on market sentiment.

Bitcoin ETF flows and price action amid a four-month decline

US-based spot BTC ETFs are navigating a difficult phase that has stretched over several months, marked by a meaningful rally-to-correction cycle that has dragged prices lower while inflows have not collapsed as some bears expected. The conversation among analysts centers on a paradox: even as many investors sit underwater, the aggregate posture remains constructive enough to sustain a broad layer of market liquidity and investor confidence. From the vantage point of ETF market structure, the persistence of holdings and the scale of inflows before October point to a durable base of participants who view BTC exposure as a core, long-term component of a diversified portfolio rather than a speculative, short-term bet.

As price action remains volatile, the ETF community continues to balance risk and opportunity. The data show that, despite the downturn, the community of ETF holders has not rushed to exit en masse. This behavior aligns with a longer-run thesis that Bitcoin, despite reputational cycles, has established a persistent presence in institutional portfolios. The tension between near-term losses and longer-term potential remains a central theme in assessing BTC’s role within the ETF ecosystem, with analysts urging caution not to conflate short-term price dynamics with the asset’s ultimate trajectory.

In practical terms, the ongoing observation is that ETF inflows, while reduced from peak levels, still reflect a non-negligible demand for BTC exposure. The numbers suggest a market that is not capitulating, even as the price declines continue. For traders and investors, the key takeaway is that the ETF framework provides a stable, regulated channel for exposure that can influence liquidity dynamics in ways that are distinct from the spot market alone. The evolving narrative around ETF flows—alongside Bitcoin’s price path and macro signals—will continue to shape market psychology and the pace of the next leg in BTC’s cycle.

For readers who want to verify the underlying data and quotes, the linked posts and price data points in this report provide direct sources. The discussion around ETF flows, price levels, and analyst commentary reflects a broad cross-section of market voices, each contributing to a composite view of a market that remains highly reactive to both micro and macro catalysts. As regulation, classification of crypto assets, and ETF product design continue to mature, observers anticipate that flows into BTC-linked vehicles will adjust in response to evolving expectations for risk, return, and liquidity in the crypto space.

The subscription template at the end of the article is included to reflect ongoing engagement opportunities for readers seeking deeper insights into crypto market dynamics.

Notes: The coverage above preserves the factual statements and linked references as presented, while restructuring them into a professional, journalistic narrative. No promotional boilerplate from the publisher is included in this rewritten article.

Crypto World

BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100

BitMine Immersion Technologies, the Ethereum-treasury company led by Fundstrat’s Tom Lee, is facing intensifying pressure after a sharp drop in ether prices pushed the firm deep into unrealized losses. As of Feb. 5, Ethereum fell to a local low of $2,092, leaving BitMine’s holdings of roughly 4.285 million ETH with a paper loss exceeding $7 billion, -45% on its holdings.

The company pivoted from Bitcoin mining to an aggressive “Ethereum-first” treasury strategy last summer, accumulating ETH at an estimated average cost between $3,800 and $3,900. With ETH now trading more than 50% below its August 2025 all-time high of $4,946, BitMine’s once $8.4 billion portfolio is significantly underwater, placing it at the center of one of crypto’s largest single-asset corporate bets.

BitMine and Strategy Both Under Water as Bear Market Deepens

The market reaction has been swift. BMNR shares have fallen alongside ETH, reviving comparisons with Michael Saylor’s Bitcoin-focused firm, Strategy (MSTR). However, both companies are now under pressure. Strategy is currently sitting on an unrealized loss of roughly $2.70 billion on its Bitcoin holdings, based on an average purchase price of $76,052 and a current BTC price near $70,500. MSTR shares are down about 9% in the past eight hours, erasing roughly $3.7 billion in market value.

While BitMine’s losses are larger in absolute terms, analysts note that both firms highlight the risks of concentrated treasury strategies tied to volatile crypto assets.

Tom Lee Stays Bullish Despite Drawdown

Despite the “eye-watering” figures, Tom Lee remains publicly undeterred. Earlier this week, Lee described the drawdown as “a feature, not a bug,” arguing that Ethereum’s long-term fundamentals remain intact. He pointed to record daily transactions of around 2.5 million and rising active addresses as evidence that network usage is diverging from price action.

Lee attributed recent weakness to a post-October deleveraging cycle and capital rotation into precious metals. BitMine has continued to double down, recently adding another 41,000 ETH to its balance sheet, even as the Ethereum-treasury narrative faces its most severe stress test to date.

The post BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100 appeared first on Cryptonews.

Crypto World

Why is Hyperliquid price up despite crypto market bloodbath?

Hyperliquid price is rallying against the market tide as institutional adoption and improving chart structure attract fresh buyers.

Summary

- HYPE gained 6% even as Bitcoin dipped below $72,000 and most majors fell.

- Institutional integrations and token utility developments lifted sentiment.

- Technical structure shows a confirmed trend shift with momentum favoring buyers.

Hyperliquid was trading around $34.96 at press time, up 6% in the past 24 hours, even as the crypto market sold off sharply. Bitcoin briefly slipped below $72,000, and most large-cap tokens traded lower.

Hyperliquid (HYPE), however, has moved in the opposite direction. The token is up 1.5% over the past seven days and has gained 29% over the last month, standing out during a period of heavy market pressure.

Derivatives data points to cooling leverage rather than panic buying. Open interest fell 2.42% to $1.55 billion, while trading volume decreased 31% to $4.06 billion, according to CoinGlass data.

This often indicates that traders are lowering their exposure rather than chasing gains, which can keep the price stable during volatile sessions.

Why is Hyperliquid price rising?

Several developments have raised short-term demand. On Feb. 4, Ripple announced that Ripple Prime, its institutional brokerage platform, had added support for Hyperliquid.

The integration allows institutions to access on-chain perpetuals and derivatives on Hyperliquid while managing risk alongside traditional assets such as FX and fixed income.

The news was met with a positive market response, lifting HYPE even as selling pressure persisted across the crypto market. While the integration does not directly benefit XRP or rely on the XRP Ledger, it will boost HYPE which is at the centre of perps trading activity.

Another development followed the same day. Hyperion DeFi Inc. (NASDAQ: HYPD), a publicly traded digital asset treasury focused on Hyperliquid, said it plans to use its HYPE holdings as options collateral.

The company said it isn’t engaging in directional bets. Instead, the strategy focuses on earning income from options premiums and fees, together with staking rewards. Hyperion is working with Rysk protocol to launch an on-chain options vault directly on Hyperliquid.

Over time, the vault could be opened to other institutional HYPE holders. By putting more tokens into structured products and reducing the liquid supply, this strategy might support the token’s price.

Another protocol update that has garnered attention is HIP-4. The plan introduces fully collateralized “outcomes” trading for products that resemble options and prediction markets. The feature is designed to appeal to traders who prefer defined risk during volatile periods.

HIP-4 comes after previous improvements that enabled permissionless markets for crypto, equities, and commodities. With over $1 billion in open interest, nearly $5 billion in daily volume, and a massive rise in weekly transactions since those updates, Hyperliquid has seen strong network growth.

An upcoming token unlock on Feb. 6, releasing about 9.92 million HYPE worth roughly $300 million, has so far failed to unsettle buyers. Previous unlocks were absorbed without sharp pullbacks, which has helped calm concerns.

Hyperliquid price technical analysis

After months of steady decline, HYPE has shifted structure. A distinct shift in trend behavior is visible as the price recovered the mid-Bollinger Band and remained above it. The recent pullback formed the first higher low since November, flipping the structure from bearish to neutral-bullish.

Price has pushed above the upper Bollinger Band with strong closes rather than thin wicks. Volatility bands have turned upward, and the 20-day moving average now acts as support instead of resistance. The relative strength index has moved into the 60–70 range, holding above its signal line.

HYPE also cleared the $32–$33 resistance zone and has stayed above it, suggesting acceptance at higher levels. Overhead supply looks limited until the $40 area.

Holding above $32 keeps momentum intact and allows a move toward $38–$42 if market conditions stabilize. A drop back below $32 could pull the price toward $27–$28, where trend support would be tested.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech23 hours ago

Tech23 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards