Crypto World

Revolutionising AI Application Development with Language Models

by Gonzalo Wangüemert Villalba

•

4 September 2025

Introduction The open-source AI ecosystem reached a turning point in August 2025 when Elon Musk’s company xAI released Grok 2.5 and, almost simultaneously, OpenAI launched two new models under the names GPT-OSS-20B and GPT-OSS-120B. While both announcements signalled a commitment to transparency and broader accessibility, the details of these releases highlight strikingly different approaches to what open AI should mean. This article explores the architecture, accessibility, performance benchmarks, regulatory compliance and wider industry impact of these three models. The aim is to clarify whether xAI’s Grok or OpenAI’s GPT-OSS family currently offers more value for developers, businesses and regulators in Europe and beyond. What Was Released Grok 2.5, described by xAI as a 270 billion parameter model, was made available through the release of its weights and tokenizer. These files amount to roughly half a terabyte and were published on Hugging Face. Yet the release lacks critical elements such as training code, detailed architectural notes or dataset documentation. Most importantly, Grok 2.5 comes with a bespoke licence drafted by xAI that has not yet been clearly scrutinised by legal or open-source communities. Analysts have noted that its terms could be revocable or carry restrictions that prevent the model from being considered genuinely open source. Elon Musk promised on social media that Grok 3 would be published in the same manner within six months, suggesting this is just the beginning of a broader strategy by xAI to join the open-source race. By contrast, OpenAI unveiled GPT-OSS-20B and GPT-OSS-120B on 5 August 2025 with a far more comprehensive package. The models were released under the widely recognised Apache 2.0 licence, which is permissive, business-friendly and in line with requirements of the European Union’s AI Act. OpenAI did not only share the weights but also architectural details, training methodology, evaluation benchmarks, code samples and usage guidelines. This represents one of the most transparent releases ever made by the company, which historically faced criticism for keeping its frontier models proprietary. Architectural Approach The architectural differences between these models reveal much about their intended use. Grok 2.5 is a dense transformer with all 270 billion parameters engaged in computation. Without detailed documentation, it is unclear how efficiently it handles scaling or what kinds of attention mechanisms are employed. Meanwhile, GPT-OSS-20B and GPT-OSS-120B make use of a Mixture-of-Experts design. In practice this means that although the models contain 21 and 117 billion parameters respectively, only a small subset of those parameters are activated for each token. GPT-OSS-20B activates 3.6 billion and GPT-OSS-120B activates just over 5 billion. This architecture leads to far greater efficiency, allowing the smaller of the two to run comfortably on devices with only 16 gigabytes of memory, including Snapdragon laptops and consumer-grade graphics cards. The larger model requires 80 gigabytes of GPU memory, placing it in the range of high-end professional hardware, yet still far more efficient than a dense model of similar size. This is a deliberate choice by OpenAI to ensure that open-weight models are not only theoretically available but practically usable. Documentation and Transparency The difference in documentation further separates the two releases. OpenAI’s GPT-OSS models include explanations of their sparse attention layers, grouped multi-query attention, and support for extended context lengths up to 128,000 tokens. These details allow independent researchers to understand, test and even modify the architecture. By contrast, Grok 2.5 offers little more than its weight files and tokenizer, making it effectively a black box. From a developer’s perspective this is crucial: having access to weights without knowing how the system was trained or structured limits reproducibility and hinders adaptation. Transparency also affects regulatory compliance and community trust, making OpenAI’s approach significantly more robust. Performance and Benchmarks Benchmark performance is another area where GPT-OSS models shine. According to OpenAI’s technical documentation and independent testing, GPT-OSS-120B rivals or exceeds the reasoning ability of the company’s o4-mini model, while GPT-OSS-20B achieves parity with the o3-mini. On benchmarks such as MMLU, Codeforces, HealthBench and the AIME mathematics tests from 2024 and 2025, the models perform strongly, especially considering their efficient architecture. GPT-OSS-20B in particular impressed researchers by outperforming much larger competitors such as Qwen3-32B on certain coding and reasoning tasks, despite using less energy and memory. Academic studies published on arXiv in August 2025 highlighted that the model achieved nearly 32 per cent higher throughput and more than 25 per cent lower energy consumption per 1,000 tokens than rival models. Interestingly, one paper noted that GPT-OSS-20B outperformed its larger sibling GPT-OSS-120B on some human evaluation benchmarks, suggesting that sparse scaling does not always correlate linearly with capability. In terms of safety and robustness, the GPT-OSS models again appear carefully designed. They perform comparably to o4-mini on jailbreak resistance and bias testing, though they display higher hallucination rates in simple factual question-answering tasks. This transparency allows researchers to target weaknesses directly, which is part of the value of an open-weight release. Grok 2.5, however, lacks publicly available benchmarks altogether. Without independent testing, its actual capabilities remain uncertain, leaving the community with only Musk’s promotional statements to go by. Regulatory Compliance Regulatory compliance is a particularly important issue for organisations in Europe under the EU AI Act. The legislation requires general-purpose AI models to be released under genuinely open licences, accompanied by detailed technical documentation, information on training and testing datasets, and usage reporting. For models that exceed systemic risk thresholds, such as those trained with more than 10²⁵ floating point operations, further obligations apply, including risk assessment and registration. Grok 2.5, by virtue of its vague licence and lack of documentation, appears non-compliant on several counts. Unless xAI publishes more details or adapts its licensing, European businesses may find it difficult or legally risky to adopt Grok in their workflows. GPT-OSS-20B and 120B, by contrast, seem carefully aligned with the requirements of the AI Act. Their Apache 2.0 licence is recognised under the Act, their documentation meets transparency demands, and OpenAI has signalled a commitment to provide usage reporting. From a regulatory standpoint, OpenAI’s releases are safer bets for integration within the UK and EU. Community Reception The reception from the AI community reflects these differences. Developers welcomed OpenAI’s move as a long-awaited recognition of the open-source movement, especially after years of criticism that the company had become overly protective of its models. Some users, however, expressed frustration with the mixture-of-experts design, reporting that it can lead to repetitive tool-calling behaviours and less engaging conversational output. Yet most acknowledged that for tasks requiring structured reasoning, coding or mathematical precision, the GPT-OSS family performs exceptionally well. Grok 2.5’s release was greeted with more scepticism. While some praised Musk for at least releasing weights, others argued that without a proper licence or documentation it was little more than a symbolic gesture designed to signal openness while avoiding true transparency. Strategic Implications The strategic motivations behind these releases are also worth considering. For xAI, releasing Grok 2.5 may be less about immediate usability and more about positioning in the competitive AI landscape, particularly against Chinese developers and American rivals. For OpenAI, the move appears to be a balancing act: maintaining leadership in proprietary frontier models like GPT-5 while offering credible open-weight alternatives that address regulatory scrutiny and community pressure. This dual strategy could prove effective, enabling the company to dominate both commercial and open-source markets. Conclusion Ultimately, the comparison between Grok 2.5 and GPT-OSS-20B and 120B is not merely technical but philosophical. xAI’s release demonstrates a willingness to participate in the open-source movement but stops short of true openness. OpenAI, on the other hand, has set a new standard for what open-weight releases should look like in 2025: efficient architectures, extensive documentation, clear licensing, strong benchmark performance and regulatory compliance. For European businesses and policymakers evaluating open-source AI options, GPT-OSS currently represents the more practical, compliant and capable choice. In conclusion, while both xAI and OpenAI contributed to the momentum of open-source AI in August 2025, the details reveal that not all openness is created equal. Grok 2.5 stands as an important symbolic release, but OpenAI’s GPT-OSS family sets the benchmark for practical usability, compliance with the EU AI Act, and genuine transparency.

Crypto World

Buterin Offloads ETH, Bitcoin Unable to Push Past $70K, XRP Spot Buying Increases: This Week’s Crypto Recap

Bitcoin played a trick on us this week, making us believe that a recovery is inbound but the positivity was for not.

It’s been a relatively dynamic week within the cryptocurrency industry. The total market capitalization currently stands at around $2.36 trillion, which is more or less where it was last Friday when we did the previous weekly recap, but this doesn’t paint the whole picture.

You see, BTC started the week as anyone would expect – chopping to the downside, which inevitably led to an abrupt crash on Monday, when it dropped from above $67K to around $64K. This was followed by an intraday dead cat bounce and an immediate continuation to below $63,000. Sentiment was down bad, as was most of Crypto Twitter, but what followed raised a few eyebrows.

Bitcoin actually started recovering… notably. It soared from $63K to $70K in less than two days. And then came yet another sign that we are amidst the depths of crypto winter – the recovery was put to a halt, and the bears once again took control, pushing the price down to where we currently sit at slightly above $66K. In case you are wondering, we are still in a state of “extreme fear,” according to the popular Crypto Fear and Greed index, meaning that the masses are definitely not convinced that the worst is behind us. In fact, the most recent bounce did very little to improve the overall sentiment.

Meanwhile, the co-founder of Ethereum, Vitalik Buterin, continues selling ETH. So far, his total disposals reached around 18,700 ETH, even though he previously stated that he plans to sell 16,384 ETH to fund open-source software and hardware development, privacy tools, and security-critical infrastructure projects.

Elsewhere, we have some light at the end of the tunnel for XRP holders, with spot buying seemingly on the rise. While it has done little for the price so far, this could be a sign of a structural shift in XRP’s market dynamics. Bitrue reported a 212% surge in spot buying on February 26th, most of which was linked to ETF inflows, suggesting steady demand from funds.

All in all, the week started off as depressing, turned bullish, and then went back exactly to where it was in the beginning. Strength is being dissolved quickly as negative sentiment prevails, which is incredibly indicative of bear markets. That also makes it quite exciting to see what the next seven days have in store for us.

Market Data

Market Cap: $2.35T | 24H Vol: $113B | BTC Dominance: 56.1%

You may also like:

BTC: $66,097 (-1.5%) | ETH: $1,947 (+0.2%) | XRP: $1.35 (-3.2%)

This Week’s Crypto Headlines You Can’t Miss

Bitwise CIO Matt Hougan Rejects Jane Street Blame for Bitcoin Dip. Matt Hougan, the chief investment officer at Bitwise, has dismissed claims that Jane Street is orchestrating Bitcoin’s ongoing downturn. Instead, he said that the current price action is typical of a “classic crypto winter.” Read more.

BSC Fees Hit Multi-Month Lows as History Signals Bitcoin Rebound Ahead. The Binance Smart Chain (BSC) saw its total fees paid drop to $593,000, which pretty much marks the network’s lowest usage cost since at least August 2025. Read more.

2026 US Midterms Emerge as Potential Turning Point for Crypto Markets. The 2026 US midterm elections are closing in. Many view them as a potential catalyst that’s tied to liquidity cycles in traditional financial markets, as well as a recovery in the broader cryptocurrency market. Read more.

Bitcoin’s Recovery Isn’t Here Yet – Here’s What Still Needs to Flip. Data shows that BTC remains trapped in a structurally defensive consolidation. This happens as the price oscillates between $60K and $90K. Therefore, for a recovery to start shaping, the price needs to push above the upper boundary. Read more.

Vitalik Buterin Exceeds 16,384 ETH Selling Target with $38M in Total Disposals. The co-founder of Ethereum (and likely the most prominent person behind it), Vitalik Buterin, is dumping ETH. In fact, he has exceeded his previously stated plan to sell 16,384 ETH by almost 20%. Read more.

Wall Street Is Going On-Chain, And Investors Still Don’t Get It, Says Bitwise CIO. According to the CIO of Bitwise, investors often misinterpret what is truly happening in the market due to behavioural biases and think that Wall Street is already going on-chain. Read more.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid – click here for the complete price analysis.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

US Bank With 14 Million Users Just Turned Bullish On Solana

Major US Bank SoFi now supports Solana network deposits. This means 13.7 million users of the bank can send SOL directly to their SoFi crypto accounts from external wallets.

The US-chartered bank announced the update on X, stating users can buy, sell and hold SOL inside the SoFi app.

Major Solana Access For US Banking Customers

In practice, SoFi is enabling direct on-chain deposits for a major public blockchain within a regulated national bank. Users can manage balances alongside checking, savings and other financial products in a single interface.

The move expands SoFi’s digital asset offering beyond simple brokerage-style exposure. It connects a traditional bank charter with a live blockchain network, which remains rare among nationally chartered US banks.

An Important US Access for Solana

SoFi began as a student loan refinancing platform in 2011 and later secured a national bank charter. It has grown into a mid-sized US bank with more than $50 billion in assets and tens of billions in deposits.

While far smaller than Wall Street giants, it ranks among the larger digital-first banks in the country.

The company’s brand extends beyond finance. SoFi holds naming rights to SoFi Stadium in Inglewood, California.

The venue hosted Super Bowl LVI in 2022 and WrestleMania 39 in 2023. It is also scheduled to host multiple matches during the 2026 FIFA World Cup and will play a central role in the 2028 Los Angeles Olympics.

Against that backdrop, adding Solana deposits signals deeper integration between US banking infrastructure and public blockchains.

It allows regulated bank customers to move assets directly on-chain while staying inside a traditional banking framework.

Crypto World

XRP Price Fell 40%, But Strong Holders Loaded 200% More

XRP price has fallen nearly 40% since January 5, dropping from $2.35 to around $1.40. Moves of this size usually trigger panic selling and long-term damage to market structure. But this time, something very different happened.

Instead of accelerating the decline, one holder group stayed calm, while another, less enterprising, group quietly left. At the same time, leverage remained balanced and institutional flows stayed positive. Together, these signals suggest XRP’s crash may have strengthened its foundation rather than broken it.

Speculative Holders Collapsed — Removing the Biggest Source of Selling Pressure

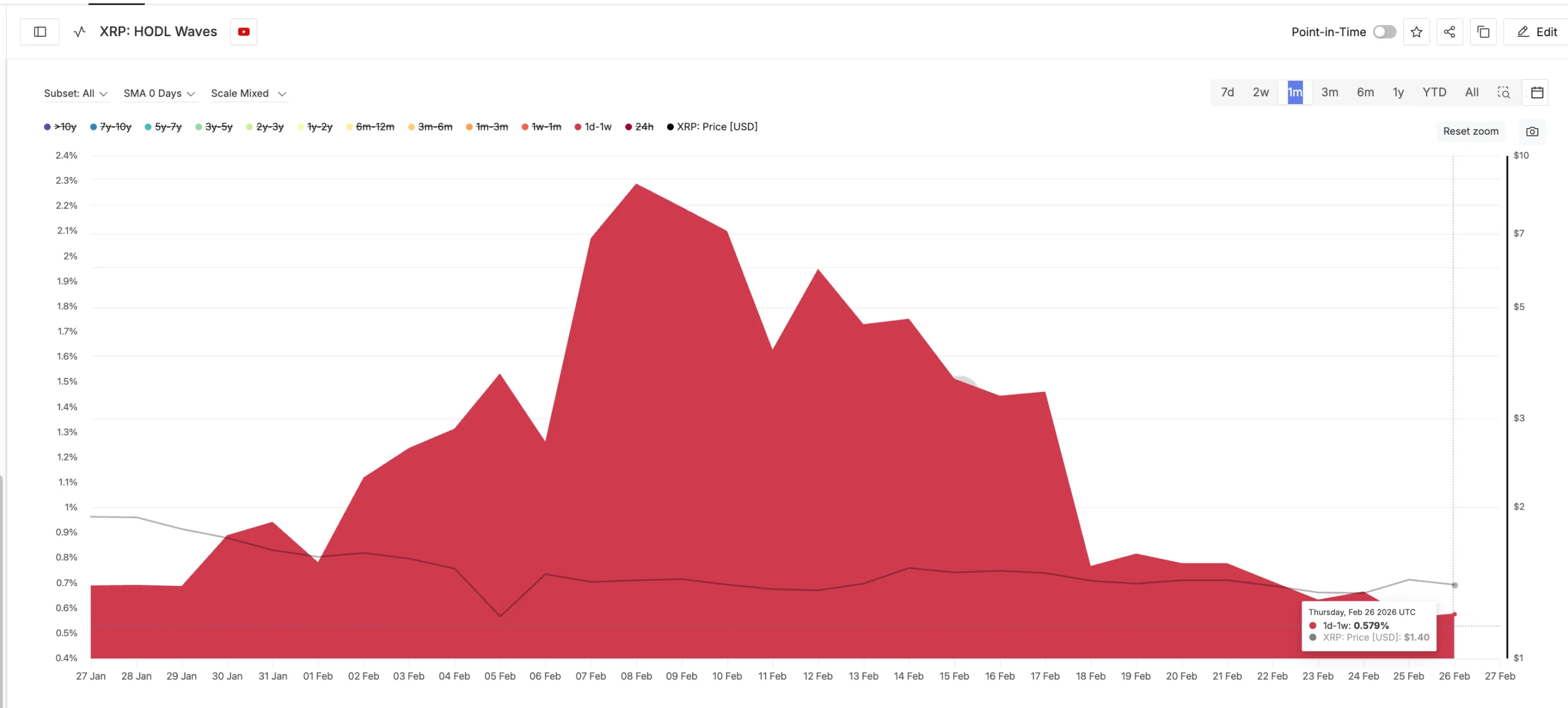

One of the most important changes during XRP’s decline was the exit of speculative holders, as measured by the HODL Waves metric, which segments cohorts by time. These are short-term traders who typically hold for one day to one week and tend to sell quickly during volatility.

On February 8, these short-term holders controlled 2.29% of XRP’s total supply. By February 26, that figure had fallen sharply to just 0.579%. This represents a 74.7% decline in speculative supply share in less than three weeks. All while the price declined.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This kind of flush is important because speculative holders often create continuous selling pressure during rebounds. Their exit removes an unstable supply, allowing the price to stabilize. In simple terms, weak hands have already left. This reduces the risk of panic-driven crashes during future pullbacks.

But removing weak holders alone does not create strength. The more important question is whether strong holders also stayed.

Long-Term Holders Held Firm, Even as XRP Price Lost 40%

While XRP price collapsed, long-term holders behaved very differently.

The Hodler Net Position Change metric tracks whether investors holding for at least 155 days are buying or selling over a 30-day period. These holders are often considered the most informed participants because they typically accumulate during weak markets.

On January 5, when XRP traded near $2.35, long-term holders had added around 47.3 million XRP on a rolling monthly basis. By February 26, after XRP had dropped to around $1.40 (a 40% dip), their net position change had risen dramatically to approximately 145.45 million XRP, a 200% rise.

This means the largest and most patient holders increased exposure while price collapsed — the exact opposite of panic behavior.

More importantly, since mid-February, their holdings have remained steady even as XRP fluctuated between $1.21 and $1.52. They did not reduce exposure during volatility. This stability sends a strong signal. It suggests that the investors with the highest conviction are not treating the crash as a reason to exit. Instead, they appear to be positioning for future recovery.

This creates a stronger holder base. But price stability also depends heavily on derivatives positioning.

XRP’s Balanced Leverage Weakens The Biggest Crash Risk

One of the main reasons crypto crashes accelerate is excessive leverage imbalance. When too many traders take the same position, forced liquidations amplify price moves.

Ethereum currently shows this risk clearly. On Binance’s ETH/USDT perpetual contracts, long leverage stands near $976 million compared to $576 million in shorts. This creates heavy downside liquidation risk if the price falls.

XRP’s positioning looks very different.

On Binance, XRP’s perpetual contracts show approximately $74.93 million in long leverage and $69.14 million in short leverage. This is almost perfectly balanced, in the same timeframe as ETH.

This balance is important. It means XRP does not have a large cluster of overleveraged buyers that could be wiped out during a drop. At the same time, it also avoids overcrowded short positioning that could destabilize the price.

Balanced leverage creates a healthier structure. It allows price to move based more on real demand instead of forced liquidations. This healthier positioning is also appearing in institutional flows and technical structure.

Institutional Flows and XRP Price Structure Now Open the Path Toward $1.70

While many major crypto assets experienced weak ETF demand in February, XRP-related investment products continued attracting steady inflows. This shows institutional participation did not collapse during XRP’s decline. There were no major net outflow weeks recorded in XRP-linked investment products

Institutional inflows are important because they represent longer-term capital. Unlike speculative traders, institutions do not usually react to short-term volatility. Their steady participation helps stabilize markets during uncertain periods.

Combined with strong holder behavior and balanced leverage, this strengthens XRP’s recovery foundation. These structural improvements are now aligning with a key technical setup.

On the 8-hour chart, XRP appears to be forming a cup-and-handle pattern. This is a bullish continuation structure that often appears before upward breakouts. The handle formed after XRP corrected about 7% from its recent February 25 high, creating a consolidation zone.

This structure now defines the key levels ahead. If XRP holds above $1.38, the bullish structure remains intact. A drop below this level would weaken momentum.

A move below $1.31 would invalidate the bullish pattern completely. On the upside, XRP must first break above $1.42 to confirm the handle breakout. The more important breakout level sits at $1.52, which sits near the neckline of the cup-and-handle pattern.

If XRP breaks above $1.52, the technical projection points toward approximately $1.71 (the $1.70 zone). In stronger breakout scenarios, the move could extend toward $1.86 depending on breakout strength and where the neckline gets breached.

For now, XRP’s crash may have done something unexpected. It may have made the asset structurally stronger rather than weaker.

Crypto World

XRP Price Structure Keeps 900% Upside Target Active

TLDR

- XRP surged 647% from $0.49 to $3.66 after its late 2024 breakout.

- The token now trades near $1.38 following a 70% pullback from its peak.

- Analyst Javon Marks said the $15 measured move target remains unchanged.

- A move to $15 would represent more than 900% upside from current levels.

- XForceGlobal said the current price action reflects compression rather than weakness.

XRP price has returned to focus after its late 2024 breakout triggered a 647% rally to $3.66 by mid 2025. The asset now trades near $1.38 following a 70% pullback from its peak. Analysts state that the original breakout structure still supports a larger upside move.

XRP Price Structure Keeps $15 Measured Move in Play

Javon Marks stated on X that the “$15 measured move target goes unchanged” despite recent volatility. He based his view on the multi-year triangle breakout that occurred in November 2024.

The XRP price surged from $0.49 to $3.66 after the breakout was confirmed. Marks calculated the target by extending the triangle height from the breakout point. He said the structure still supports a 10x move from current levels. From $1.38, a rise to $15 would mark a gain above 1,000%.

Meanwhile, the XRP price has declined by over 38% on a yearly basis. The token also slipped 4.3% in the past 24 hours. However, Marks maintained that price swings do not invalidate the broader breakout setup.

Measured move analysis uses the full height of consolidation patterns. Analysts apply this method after confirmed breakouts. In this case, the late 2024 move remains the reference point.

Analysts Cite Compression Phase After 70% Pullback

Korean Elliott Wave analyst XForceGlobal said, “it’s all coming together” for XRP from a structural view. He pointed to the rally that revisited the prior all-time high zone near $3.66.

He also referenced the retracement back toward the $1 region. According to him, this reset completed two major milestones within the broader wave count. He described the current sideways movement as “compression, not weakness.”

XForceGlobal earlier projected $6 as a conservative Fibonacci extension level. He later referenced $5 and $10 as possible targets within the same wave structure. He stated that short-term volatility does not disrupt the impulsive expansion outlook.

At the same time, XRP has printed five consecutive red monthly candles. This pattern last appeared during the 2016 to 2017 consolidation period.

That earlier stretch preceded a sharp rally in 2017. Current market data also showed over $900 million in realized losses within one week.

Community commentator Archie projected a long-term chart target near $83. He based this outlook on historical breakout extensions and long cycle projections.

An $83 price would imply a multi-trillion-dollar market capitalization. Meanwhile, XRP continues to trade around $1.38 at the time of reporting.

Crypto World

Will crypto market dip as US PPI shows sticky inflation?

The crypto market is facing new pressure after fresh U.S. inflation data showed that price growth is still stubbornly high, raising concerns about tighter financial conditions.

Summary

- January PPI beat forecasts, signaling persistent inflation pressures.

- Bitcoin fell toward $66,000 as rate-cut hopes weakened.

- Analysts warn of more downside if macro data stays hot.

The January 2026 Producer Price Index report from the Bureau of Labor Statistics was released today, Feb. 27. It showed that wholesale inflation was higher than expected, supporting predictions that the Federal Reserve might keep interest rates high for a longer period.

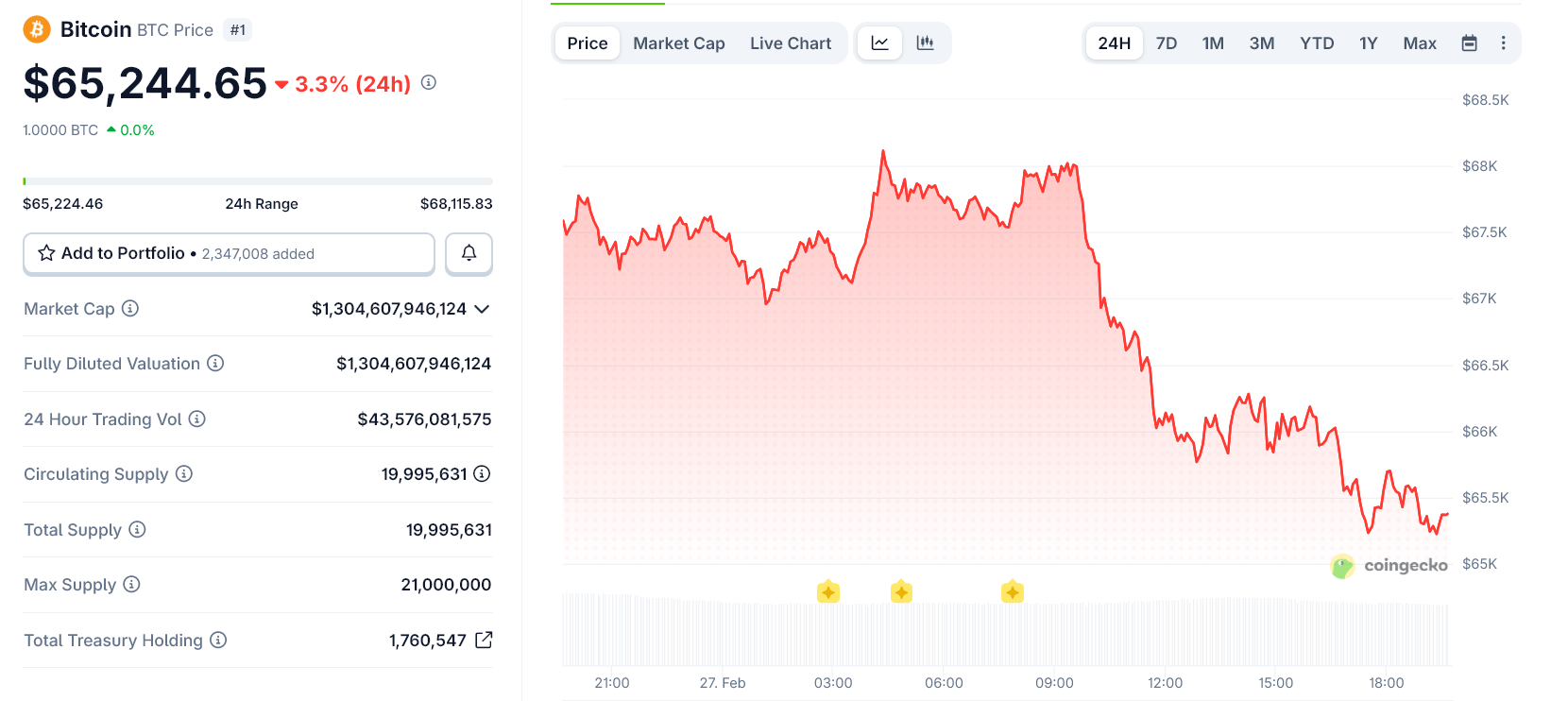

The data arrived at 8:30 a.m. ET and was followed by immediate weakness in equities and digital assets. Bitcoin (BTC) slipped toward the $66,000, while Ethereum (ETH) and major altcoins posted similar declines.

Hot PPI data raises rate fears

The January report showed headline producer prices rising 0.5% month over month, above the 0.3% forecast. On a yearly basis, PPI climbed 2.9%, also exceeding expectations.

Core PPI, which excludes food and energy, rose 0.8% on the month and 3.6% year over year, marking its highest reading in around 10 months. A narrower “super-core” measure increased 0.3% for the third straight month.

Services prices were the main driver. Final demand services jumped 0.8%, the largest gain since July. Trade services margins surged 2.5%, while professional and commercial equipment wholesaling rose 14.4%, a move widely linked to higher import costs tied to tariffs.

In contrast, goods prices fell 0.3%, led by declines in energy and food. Goods outside of those categories did, however, rise by 0.7%, indicating that underlying cost pressures are still very much present.

It was a clear message for investors. Policymakers are finding it more difficult to defend short-term rate cuts as a result of the services sector’s inflation.

Markets have already reduced expectations for easing in early 2026, pushing real yields and the U.S. dollar higher. These conditions typically weigh on risk assets, including cryptocurrencies.

Crypto market reaction and short-term outlook

Financial markets responded quickly to the data. Dow futures dropped more than 400 points at one stage, while Nasdaq futures fell over 1%. Crypto followed the same risk-off pattern.

Within hours of the release, Bitcoin declined about 2% to 3% from pre-report levels. Ethereum and major altcoins tracked the move. At the same time, gold moved higher, reflecting renewed demand for traditional safe havens.

Analysts say the report strengthens the case for “higher-for-longer” interest rates. If producer price pressures continue feeding into consumer inflation, liquidity conditions could tighten further, limiting upside for digital assets.

Some strategists warn that a sustained break below key support near $64,000–$66,000 could open the door to deeper losses. Others say that until the next significant data release, such as the February CPI in mid-March, volatility is probably going to stay high.

There is also a longer-term counterview. Interest in Bitcoin as a hedge may eventually resurface due to ongoing inflation, trade pressures, and fiscal constraints. For now, however, short-term macro signals remain dominant.

Crypto World

Did L2 Fragment Ethereum? – With Yuval Rooz, CEO of Digital Asset, Co-Founder of Canton

Crypto World

UK Gambling Regulator Weighs Crypto Payments for Casinos

TLDR

- The UK Gambling Commission is reviewing whether licensed casinos can accept cryptocurrency payments.

- Tim Miller said the regulator will examine a clear path for crypto use in online betting.

- Companies offering regulated crypto services must obtain FCA authorization under the Financial Services and Markets Act 2000.

- The commission asked its Industry Forum to study how crypto payments could work within current gambling rules.

- Research shows crypto searches often direct British gamblers to illegal gambling websites.

The United Kingdom’s Gambling Commission has started formal talks on allowing cryptocurrency payments at licensed online casinos. The regulator confirmed it will assess how digital assets could fit within existing gambling rules. Officials said the review aligns with the country’s incoming crypto regulatory framework led by the Financial Conduct Authority.

UK Gambling Commission Studies Crypto Payment Framework

Tim Miller addressed the Betting and Gaming Council’s annual meeting in London on Thursday. He said the commission wants to examine “the potential path forward” for cryptoasset payments. He explained that the regulator aims to allow crypto as a consumer payment option for licensed gambling in Great Britain. He linked this move to rising consumer interest and regulatory changes. He also confirmed that companies conducting regulated crypto activities must secure FCA authorization under the Financial Services and Markets Act 2000.

He stated that growing appetite from punters prompted the review. He said, “We do now want to start looking at what the potential path forward would be.” He added that crypto could become a consumer payment option for licensed operators. However, he clarified that accepting crypto would not change casino licensing standards. He noted that operators must still pass customer suitability checks under existing rules.

FCA Sets Timeline as UK Gambling Sector Reviews Digital Assets

Miller said he asked the Industry Forum to explore the best route for crypto payments. The advisory group represents workers across the gambling sector. He did not provide a deadline for the review. He said illegal markets research shows crypto searches often lead British gamblers to unlawful websites. He added, “Crypto is one of the two biggest searches that lead British gamblers to illegal sites.”

He explained that allowing regulated crypto payments could help protect consumers. He stated that the commission wants to reduce exposure to illegal platforms. Meanwhile, the Financial Conduct Authority released a final consultation outlining ten proposals for crypto markets. The FCA plans to complete the process in March. It targets full implementation of the new regime by October 2027.

The FCA confirmed that companies must obtain full authorization before October 25, 2027. It stated that the application window will open in September 2026. Crypto asset service providers that miss the deadline will enter transitional rules. Those rules will allow existing products but restrict new offerings. The regulator published the timeline in a document dated January 8.

Crypto World

S&P 500 index dips as private credit risks escalate

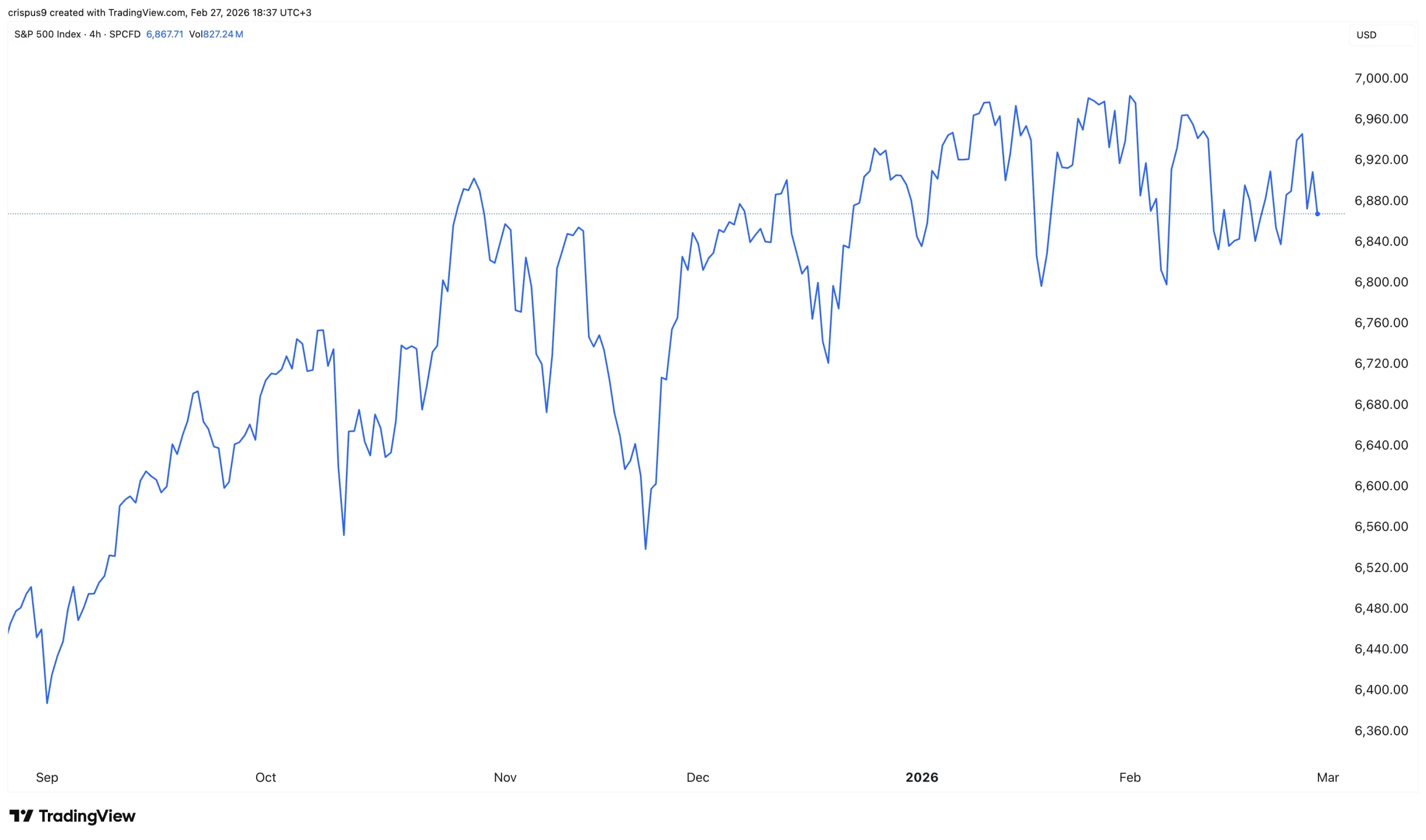

The S&P 500 Index retreated by over 0.6% on Friday, continuing a retreat that started on Thursday as market participants reacted to the latest NVIDIA earnings.

Summary

- The S&P 500 Index retreated by over 0.50% on Friday.

- Jitters in the booming private credit industry accelerated.

- The US published a strong producer price index report.

The blue-chip index, which tracks the biggest companies in the United States, dropped to $6,857, down substantially from the year-to-date high of $7,010.

Other stock indices like the Nasdaq 100, Dow Jones, and the Russell 2000 declined by over 1%.

The decline happened as concerns about the $1.8 trillion private credit industry escalated. These concerns started earlier this month after Blue Owl, a company with over $300 billion in assets under management, sent shockwaves in the broader market.

Blue Owl sold a private credit portfolio and announced measures to limit redemption by its investors. This move was an escalation to what happened last year when the company attempted to merge a private and public fund.

The crisis escalated this week after a fund managed by Apollo Asset Management slashed its dividend in a bid to preserve cash as defaults rose.

As a result, top private credit and equity companies like Blue Owl, Apollo, Ares, and Blackstone continued falling. Blue Owl stock dropped by over 4.3%, bringing its three-month decline to 25%.

Apollo Global Management’s stock dropped by over 7%, while Ares fell by over 6%. Blackstone and KKR stocks also continued falling.

The S&P 500 Index also dropped as odds of a US attack on Iran jumped after Israel’s embassy asked non-essential staff to leave. As a result, airline stocks like United Airlines, Delta Airlines, and American Airlines were among the top laggards in the S&P 500 Index.

Additionally, the index retreated after the US published strong producer price index (PPI) data.

The report showed that the headline PPI rose by 2.9% in January, while the core PPI moved to 3.6%. These numbers mean that the Federal Reserve may find it difficult to cut interest rates in the coming meetings.

Crypto World

Trump Plans Cuba Takeover, Iran War Heat Drives Bitcoin Crash

Bitcoin fell sharply on February 27 as geopolitical tensions intensified, pulling the price back to around $65,200 after several days of attempts to recover toward $70,000. The drop came as US President Donald Trump suggested the possibility of a “friendly takeover” of Cuba, while Washington simultaneously increased its military posture in Israel.

The combined headlines injected fresh uncertainty into global markets. Crypto, which had been stabilizing, reacted quickly.

Trump on Cuba: “Maybe We Will Do a Friendly Takeover”

Speaking earlier today, Trump said the Cuban government is “in big trouble” and “talking with us,” adding that the US could pursue a “friendly takeover.” He framed Cuba as financially desperate and open to negotiation.

The comment follows weeks of mounting pressure. Since returning to office in January 2025, Trump reinstated and expanded maximum pressure policies against Havana.

In late January 2026, he signed an executive order declaring a national emergency related to Cuba and threatening tariffs on any country supplying oil to the island.

That move effectively created an oil blockade. Cuba relies heavily on Venezuelan and Mexican fuel. When shipments were halted under US pressure, the island faced rolling blackouts, airport fuel shortages, and widespread economic strain.

How the Cuba Crisis Escalated

Tensions intensified further this week after a deadly maritime incident. Cuban forces intercepted a US-registered speedboat near their territorial waters. Four people were killed in the exchange.

Havana described the group as armed infiltrators. Washington denied involvement but launched investigations.

Meanwhile, Trump’s administration briefly allowed limited humanitarian oil flows through private channels.

However, the broader economic pressure remains in place.

Against this backdrop, the phrase “friendly takeover” carries weight. It likely implies a negotiated political transition under US leverage, not a military invasion.

Still, the language is sensitive. Cuba has built its identity around resisting US influence for over six decades.

US Military Build-Up in Israel

At the same time, the United States has increased its military presence in Israel amid rising tensions with Iran.

Advanced fighter jets and additional assets have been positioned in the region. The State Department also authorized the departure of non-essential diplomatic staff.

Although officials describe the posture as deterrence, markets see rising geopolitical risk. The Middle East and the Caribbean now sit under simultaneous US pressure campaigns.

Bitcoin Reacts to Global Risk

Bitcoin had been attempting to reclaim $70,000 in recent sessions. Instead, it reversed sharply, falling more than 3% in 24 hours. The move suggests traders are reducing risk exposure.

Crypto often reacts to macro uncertainty in two phases. Initially, liquidity tightens and prices drop. Later, if instability persists, some investors rotate into Bitcoin as a hedge.

For now, markets appear to be in the first phase.

With geopolitical tensions expanding on multiple fronts, volatility may remain elevated. Bitcoin’s next move will likely depend on whether diplomatic channels calm the situation — or whether escalation continues.

Crypto World

Barclays Evaluates Blockchain-based Settlement – “The Defiant”

Barclays is exploring a new platform integrating stablecoins and tokenized deposits.

Barclays is evaluating technology providers for a new platform to integrate stablecoins and tokenized deposits, according to a report from Bloomberg.

The British banking giant is exploring blockchain-based settlement systems in response to growing demand, and could pick a vendor as soon as April, according to people familiar with the matter.

Barclays’ recent activities signify a shift from its previously cautious stance to active investment in blockchain infrastructure. This change aligns with the evolving financial landscape, influenced by regulatory developments like the US GENIUS Act, which established a framework for dollar-backed tokens, and has encouraged institutions to explore blockchain and digital currencies more aggressively.

Moreover, Barclays has joined a bank-led consortium to explore a reserve-backed digital currency using public blockchain technology. This initiative focuses on G7-pegged assets to enhance cross-border settlements, as highlighted by the Financial Times.

Barclays’ potential embrace of blockchain is part of a broader trend among major financial institutions, including JPMorgan and HSBC, who are also investing in digital infrastructure. This strategic direction by Barclays underscores the growing importance of blockchain technology in traditional finance, with stablecoins playing a crucial role in future payment systems.

This article was generated with the assistance of AI workflows.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics21 hours ago

Politics21 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Sports4 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business1 day ago

Business1 day agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Crypto World3 days ago

Crypto World3 days agoEntering new markets without increasing payment costs