Crypto World

Ripple CEO Joins CFTC Panel

XRP price has struggled to recover in recent days, raising concerns about a potential repeat of the 2021-2022 bear market.

While weakness persists, a recent development involving Ripple CEO Brad Garlinghouse could shift sentiment.

Sponsored

XRP May Not Imitate The Past

Brad Garlinghouse has joined the Commodity Futures Trading Commission’s Innovation Advisory Committee. This appointment marks a significant milestone for Ripple and the broader XRP ecosystem. The same regulatory environment that challenged Ripple for nearly five years is now seeking industry input.

For XRP supporters, this signals growing regulatory normalization. Engagement with the CFTC may enhance Ripple’s credibility in US policy discussions. Constructive dialogue could ease uncertainty and reduce the long-term legal overhang that previously weighed on the XRP price.

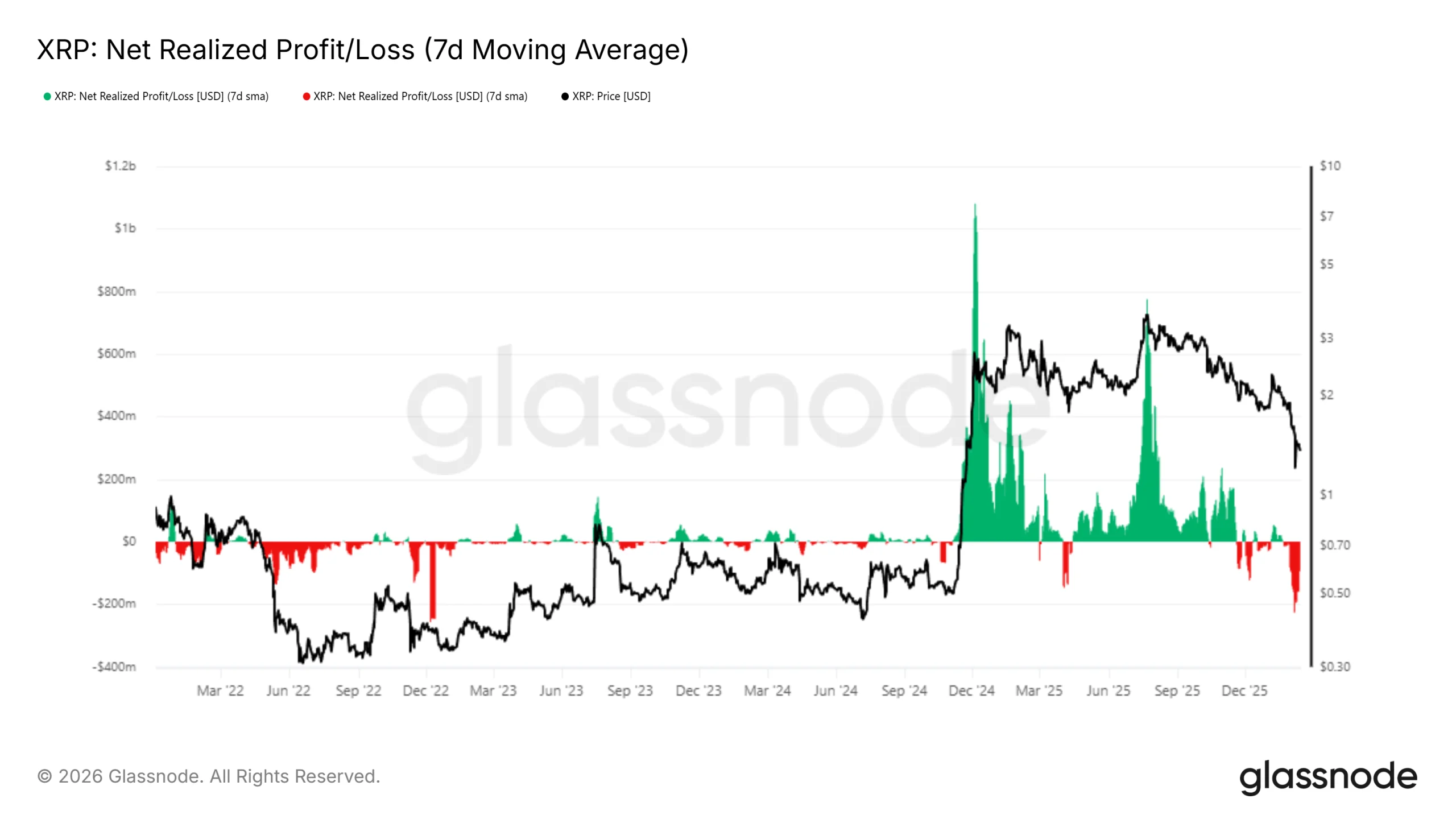

Recently realized profit-and-loss data show a spike in sales. Some observers compare this activity to early signals seen before the 2022 bear market. However, in 2022, sustained distribution lasted nearly four months. Current selling lacks that duration and intensity, reducing the probability of a prolonged downturn for XRP.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Selling Exists, But It’s Not a Concern

Exchange balance data suggests selling pressure remains measured. Roughly 100 million XRP moved to exchanges over the past 10 days, valued at $130 million. While notable, the scale does not indicate widespread panic.

In November 2025, 130 million XRP was sold within 72 hours. That episode reflected sharper urgency among holders. Compared to that event, current flows appear controlled and less aggressive.

Sponsored

Moderate selling combined with positive regulatory developments could stabilize sentiment. If distribution does not accelerate, XRP may absorb supply without severe downside extension. Market participants are watching closely for confirmation through on-chain metrics.

XRP Has Room To Recover

The liquidation heatmap shows limited immediate obstacles to recovery. XRP faces its next major resistance between $1.78 and $1.80. This zone represents a potential profit-taking area rather than an immediate structural ceiling.

Absence of dense liquidation clusters below current levels reduces short-term risk of cascading sell-offs. If momentum improves, XRP has room to advance before encountering significant overhead supply. That technical flexibility supports a cautiously constructive outlook.

Sponsored

XRP Price Needs To Bounce Back

XRP trades at $1.35 and is slipping below the $1.36 support level. The next key support lies near $1.27, aligning with the 23.6% Fibonacci retracement. Despite recent weakness, broader factors suggest a balanced risk profile.

Garlinghouse’s CFTC appointment may improve investor confidence. If XRP reclaims $1.51, a recovery rally could unfold. Sustained strength above that threshold may drive price toward the supply zone above $1.76.

However, a breakdown below $1.27 would shift momentum decisively. Panic selling could intensify if support fails. A drop toward $1.11 would invalidate the bullish thesis and extend the current corrective phase.

Crypto World

Tokenization’s move to Wall Street needs more than issuance

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Tokenization reaching Wall Street is a headline. Building compliant, liquid, enforceable on-chain markets is the real test. Without infrastructure, issuance is just digitization.

Summary

- Issuance isn’t innovation: Tokenizing equities is a milestone, but without compliant trading, liquidity, lending, and enforceable rights, digital securities remain cosmetic upgrades.

- Wall Street’s cadence is breaking: 24/7 markets and instant settlement are reshaping investor expectations, making fixed hours and delayed clearing structurally outdated.

- Infrastructure decides the outcome: Purpose-built rails embedding compliance, custody, and secondary liquidity will determine whether tokenization integrates into core finance or stalls at experimentation.

For much of its history, the New York Stock Exchange (NYSE) has run on human energy. The reality of Wall Street: Traders filled the floor, hand signals flew across a sea of people, and paper tickets were passed from one desk to another. The market opened with a bell and closed with another, compressing the world’s capital into a daily ritual.

Even as technology replaced paper with screens and servers, the structure remained recognizable. Trading hours were fixed, settlement followed a prescribed cycle, and ownership records were maintained in centralized systems. The infrastructure was continuously refined to keep pace with innovation, but its foundations rarely shifted.

While each century welcomed a technological leap that widened participation and improved efficiency, the underlying cadence of the markets — open, close, settle — remained intact. But now that cadence is being challenged.

Retail investors today operate in a financial environment that feels fundamentally different from the one equity markets were designed for. Capital moves instantly, markets are global and always on. Crypto trading has normalized 24/7 access, near-instant settlement, and the ability to trade in dollar amounts rather than discrete units. Against that backdrop, waiting for an opening bell or a multi-day settlement cycle increasingly feels out of step with modern financial behavior.

In January 2026, the NYSE and its parent company, Intercontinental Exchange (ICE), made that shift explicit by announcing plans to develop a tokenized securities platform, signaling that tokenization is moving from the margins of finance to the core.

The timing is not coincidental. Tokenization has quickly become one of the most defining themes in global markets. What started as a crypto-native experiment has matured into a multi-asset shift, with equities, commodities, and other real-world assets increasingly being structured as blockchain-based representations. These allow assets to be fractionalized, traded continuously, and settled with greater efficiency than traditional systems allow.

Governments have also taken notice and have started exploring tokenization concepts at the sovereign level. At the World Economic Forum in Davos, Binance co-founder Changpeng Zhao shared he is in discussions with multiple governments interested in tokenizing national assets. He framed it as a way for governments to unlock value upfront, then reinvest the earnings to develop industries, attractions, and trading markets.

However, the real question shifts from issuance to infrastructure, since issuing a token is a milestone, but it’s only the starting point. Markets aren’t defined solely by issuance; they depend on liquidity, compliance, and enforceability. The difficult part is building systems that can support compliant trading, sustain secondary liquidity, integrate lending and borrowing, and operate within enforceable regulatory frameworks.

This distinction is why purpose-built platforms for real-world asset tokenization have become increasingly important. Mavryk Network, for example, is a purpose-built Layer 1 blockchain focused specifically on the tokenization of real-world assets. Rather than operating as an application on an existing chain, which can leave systemic risks such as governance decisions and validator incentives outside the platform’s control, Mavryk was designed specifically to support regulated financial instruments. Its architecture embeds compliance logic directly into its token standards and integrates trading and lending infrastructure, moving beyond simple digitization to functional onchain markets. The platform was built on the premise that RWAs are not just tokens but regulated financial instruments tied to real legal rights, and that they require infrastructure that reflects that reality.

That distinction matters. Many projects have the tools to tokenize an asset, but few are built for what comes after issuance. As tokenization shifts from experimentation to institutional deployment, the strength of its underlying infrastructure will determine how far this transformation can go, and whether digital markets stall, stay parallel to traditional finance, or become the next evolution of capital markets.

Crypto World

Seattle CFO Sentenced to Prison After Losing $35M in Secret Crypto Gamble

TLDR

- Nevin Shetty, former chief financial officer, covertly transferred $35 million in corporate assets to cryptocurrency platforms without authorization

- Funds were deposited into decentralized finance protocols offering annual yields exceeding 20%

- The May 2022 Terra crash eliminated virtually all invested capital

- Following conviction on four wire fraud charges, Shetty received a 24-month prison sentence

- The unauthorized investments resulted in approximately 60 job losses and nearly bankrupted the organization

A federal court has sentenced Nevin Shetty, who previously served as CFO for a Seattle-based software company, to 24 months behind bars after he illegally diverted $35 million in corporate assets into cryptocurrency ventures under his personal control.

The sentence was delivered by a Seattle federal judge after a nine-day trial that wrapped up on November 7, 2025. The jury delivered guilty verdicts on all four wire fraud charges.

Shetty assumed the chief financial officer position at the startup in March 2021. Company policy explicitly mandated that all corporate funds remain in low-risk, conservative investment vehicles such as money market accounts.

Ironically, despite participating in drafting these investment guidelines, Shetty established a cryptocurrency consulting entity named HighTower Treasury in early 2022. The venture had zero additional customers.

After learning in April 2022 that he would be stripped of his CFO responsibilities due to inadequate job performance, Shetty took action. Over a twelve-day period from April 1 to April 12, 2022, he executed wire transfers totaling $35,000,100 from a Chase banking location near his residence into HighTower Treasury accounts.

Not a single board member or executive colleague had knowledge of these transactions.

Shetty subsequently allocated the capital into DeFi lending protocols. These platforms advertised interest rates of 20% annually or higher.

During the initial thirty days, the positions generated approximately $133,000 in gains.

When the Crypto Market Collapsed

The initial profits proved short-lived. When the Terra blockchain ecosystem imploded in May 2022, it catalyzed a broader cryptocurrency market downturn. By May 13, 2022, Shetty’s portfolio had depreciated to essentially worthless.

Facing the reality that $35 million had evaporated, Shetty disclosed his actions to two executive colleagues. His employment was terminated on the spot.

U.S. District Judge Tana Lin emphasized the devastating impact of the fraud. The capital loss compelled the company to terminate roughly 60 employees and brought the business to the brink of insolvency.

Shetty faced indictment on wire fraud counts in May 2023. His conviction came in November 2025 following the jury trial, with sentencing occurring in March 2026.

Crypto Fraud Cases Continue in U.S. Courts

This prosecution represents just one among numerous prominent cryptocurrency fraud proceedings that have advanced through federal courts recently.

FTX CEO Sam Bankman-Fried, for instance, received a 25-year sentence in 2024. His attorneys have filed appellate briefs, and as of Friday, the U.S. Court of Appeals for the Second Circuit has yet to render a decision following oral arguments heard in November.

Beyond the two-year incarceration period, Shetty faces an order to make full restitution of the $35 million. Following his release, he must complete three years under supervised probation.

Crypto World

ZEC’s Historic Rally and Collapse: What Drove the $7 Billion Wipeout

TLDR:

- ZEC surged over 700% from sub-$50 levels, briefly hitting $750 and nearing a $10 billion market cap in 2025.

- Winklevoss Capital and Cypherpunk Technologies poured over $76 million into ZEC during the peak privacy narrative rally.

- Zcash DeFi TVL collapsed from $30 million to under $2 million weeks before the governance crisis became public news.

- ECC’s full leadership resigned in January 2026, triggering an instant 14–25% price drop and a $7 billion valuation loss.

ZEC, the native token of Zcash’s privacy protocol, experienced one of crypto’s sharpest reversals in recent memory.

Over just a few months, the asset gained over 700%, drew billions in institutional capital, then shed most of its value.

ZEC Rally Built on Privacy Narrative and Institutional Demand

From sub-$50 levels in late summer 2025, ZEC surged more than 700% within a matter of weeks. The token climbed to $400 in October before briefly touching a peak near $750 in November.

That pace placed it among the top performers across the entire crypto market. It also briefly overtook Monero in market capitalization, pushing total valuation close to $10 billion.

The surge was not purely speculative. Privacy had returned as one of the most discussed themes in the industry. A report from a16z’s State of Crypto documented a notable rise in online searches around privacy-focused tools.

Prominent figures like Arthur Hayes and Naval Ravikant backed the concept of privacy-first transactions, framing it as a natural evolution beyond standard crypto infrastructure.

Institutional capital moved in quickly after that narrative gained ground. Cypherpunk Technologies purchased $18 million in ZEC.

Winklevoss Capital added more than $58 million, while Grayscale reopened its Zcash Trust to buyers. These purchases collectively created a strong base and helped sustain upward momentum.

The November 2025 halving further shaped market conditions. Block rewards dropped from 3.125 to 1.5625 ZEC per block.

Separately, the ZIP-1015 lockbox mechanism redirected 12% of rewards going forward. Together, these supply-side changes reinforced the bullish case during that period.

TVL Collapse and Governance Crisis Erased $7 Billion in Value

Even before any governance news emerged, early warning signs appeared within the ecosystem. At the rally’s peak, Zcash DeFi recorded over $30 million in total value locked.

That figure fell to under $2 million within weeks. Prices, however, remained elevated, creating a visible gap between on-chain activity and market valuation.

That kind of disconnect tends to precede broader corrections in crypto markets. When capital exits an ecosystem quietly, it often reflects weakened conviction among active participants. The token price held on sentiment alone, while actual on-chain usage told a different story.

The breaking point arrived in January 2026. The entire leadership team of the Electric Coin Company resigned following a governance conflict with the Zcash Bootstrap nonprofit board.

As @ourcryptotalk reported, prices fell between 14% and 25% almost immediately after the announcement surfaced.

Despite the resignations, Zcash’s core protocol continued operating without interruption. The departing developers formed a new independent company and resumed work on privacy tools, including continued development of the Zashi wallet.

However, market confidence had already shifted. ZEC’s valuation fell from nearly $10 billion to around $3 billion, erasing over $7 billion in total market value across the period.

Crypto World

XRP Price Analysis: Potential Decline to $1 Looms as ETFs Experience Weekly Outflows

Key Takeaways

- Technical analyst ChartNerd forecasts XRP may decline to $1 through a liquidity sweep before reversing higher.

- Exchange-traded funds tracking XRP saw their first weekly capital exodus since January 30, with outflows exceeding $4 million.

- The digital asset currently hovers around $1.35 following a brief decline to $1.347 amid increased selling pressure.

- Ripple’s CEO Brad Garlinghouse expressed optimism about long-term holders being rewarded within a five-year timeframe.

- Large holder activity, tracked via the Flow 30-DMA indicator, has shifted positive for the first time since late 2024.

XRP maintains its position near $1.35 following a challenging week characterized by institutional fund withdrawals, technical resistance, and cautionary price forecasts. Despite near-term headwinds, Ripple’s leadership maintains an optimistic long-range outlook.

The cryptocurrency declined from $1.3666 to $1.3554 throughout the previous 24-hour period, momentarily reaching $1.347 as trading activity intensified. Support emerged around the $1.35 threshold, with the asset subsequently consolidating within a narrow corridor between $1.35 and $1.37.

Technical analyst ChartNerd shared analysis on X suggesting XRP might retreat to $1, highlighting significant liquidity concentration between $1 and $1.20. Additional liquidity pools exist around the $1.80 level.

According to ChartNerd, the probable March trajectory involves an initial push toward $1.80, subsequently followed by a pullback into the $1 zone. This pattern represents a classic “liquidity grab” — a strategic price movement intended to activate stop-loss orders before a possible trend reversal.

Exchange-Traded Funds Experience First Weekly Capital Flight Since January

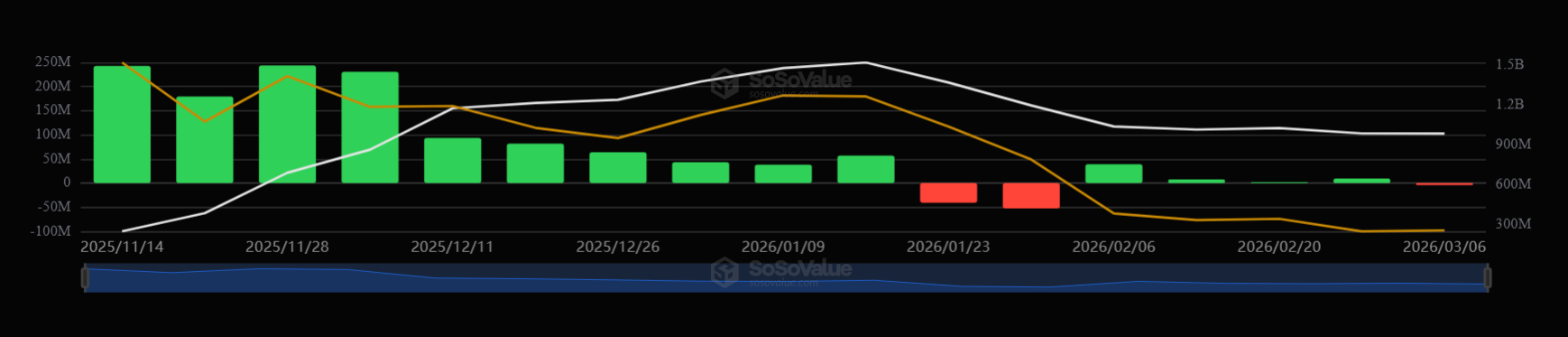

Data from SoSoValue reveals XRP exchange-traded funds recorded net weekly withdrawals slightly exceeding $4 million. This represents the initial weekly capital exodus observed since January 30.

These investment vehicles attracted capital during the week’s opening three trading sessions before momentum shifted on March 5 and 6. March 6 witnessed particularly heavy redemptions totaling $16.62 million — representing the largest single-session withdrawal since January 29.

Meanwhile, Bitcoin, Ethereum, and Solana ETFs experienced parallel outflows measuring $349 million, $83 million, and $8 million respectively throughout the identical timeframe.

Ripple Executive Emphasizes Strategic Patience

Speaking at the XRP Australia 2026 gathering, Ripple’s CEO Brad Garlinghouse conveyed to participants that today’s investors might discover themselves in a “very happy place” over a five-year horizon.

Garlinghouse highlighted the growing momentum behind institutional blockchain integration, encompassing asset tokenization, stablecoin deployment, and distributed ledger settlement infrastructure.

He characterized advancement as incremental progression rather than a singular transformative event. “There’s not one switch; there are hundreds and thousands of switches,” he explained.

Evernorth’s CEO Asheesh Birla emphasized that genuine financial industry transformation requires approximately a decade. He noted that immediate price fluctuations frequently fail to capture the underlying technological evolution.

One encouraging blockchain metric: the XRP Whale Flow 30-DMA indicator has registered positive territory for the first instance in over ninety days, indicating renewed accumulation by substantial holders.

XRP presently defends the $1.35 support threshold, with market participants monitoring closely for a decisive directional breakout.

Crypto World

Federal Judge Tosses Terror Financing Case Against Binance and CZ Following Court Victory

TLDR

- Manhattan federal court threw out terrorism financing claims filed by 535 victims against Binance, CZ, and Binance.US

- Judge ruled plaintiffs didn’t establish direct connection between exchange operations and individual terror attacks

- Court found Binance likely had “general awareness” of illicit financing activity on its platform

- Plaintiffs given 60-day window to submit revised complaint with stronger evidence

- Binance labeled the decision “a complete vindication,” though two separate lawsuits continue

A Manhattan-based federal judge threw out all allegations in a significant Anti-Terrorism Act case against Binance this past Friday. The legal action involved 535 individuals who were either victims or family members of those affected by 64 separate terrorist incidents.

The defendants in the case included Binance, its co-founder Changpeng “CZ” Zhao, and BAM Trading Services, which operates Binance.US. Those filing suit claimed the cryptocurrency platform enabled terrorist organizations to transfer money using digital assets.

The terrorist incidents cited occurred from 2016 through 2024. Organizations mentioned in the legal filing included Hamas, Hezbollah, ISIS, al-Qaeda, and Palestinian Islamic Jihad.

Judge Jeannette A. Vargas from the US District Court for the Southern District of New York delivered the decision. Her written judgment spanned 62 pages.

The ruling acknowledged that Binance appeared “generally aware” that its platform facilitated terrorist financing. Evidence included Binance’s track record of anti-money laundering compliance failures, its provision of services to Iranian users under sanctions, and internal company messages demonstrating executives understood terrorists were using the platform.

Yet general awareness proved insufficient. The court determined that those bringing the lawsuit needed to demonstrate “knowing and substantial assistance” with clear connections to the particular attacks that resulted in their harm. The complaint fell short of this requirement.

What the Court Found on Hamas and Iran Transactions

The legal documents outlined approximately $56 million in transfers associated with Hamas and $59 million connected to Palestinian Islamic Jihad flowing through Binance. The court characterized this segment of the lawsuit as “a closer call.”

Binance had also acknowledged internally that it was aware of Hamas conducting transactions on its platform since at least 2019. Nonetheless, the court determined the plaintiffs’ argument depended excessively on fungibility — the concept that because Binance enabled widespread illicit transactions, some money must have reached those responsible for the attacks.

The judgment referenced a 2025 Second Circuit ruling in Ashley v. Deutsche Bank. That decision elevated legal standards for terrorism financing lawsuits against financial entities.

Judge Vargas observed that another case, Raanan v. Binance, had withstood dismissal motions in February 2025 despite similar accusations. However, that proceeding concluded before the Ashley decision, which she indicated now demands a different legal outcome.

Binance’s Response and Ongoing Scrutiny

Binance General Counsel Eleanor Hughes characterized the dismissal as “a complete vindication.” CZ shared on X that centralized cryptocurrency platforms have “zero motive” to enable terrorists, arguing such individuals produce minimal trading fees.

Zhao entered a guilty plea to federal charges involving anti-money laundering violations and sanctions breaches in November 2023 and subsequently received a presidential pardon from President Trump.

The judge authorized plaintiffs to submit a revised complaint within 60 days. She indicated shortcomings might be addressed through more precise information regarding wallet ownership, transaction dates, and connections between account users and the attacks.

Two related legal proceedings remain ongoing: the Raanan case brought by October 7 survivors, and another lawsuit filed in North Dakota during November 2025.

Additionally, Binance continues to contest accusations from 11 US senators alleging the exchange handled more than $1 billion in transactions connected to Iranian entities.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

Crypto World

Prediction Market Giant Kalshi Faces Federal Lawsuit Over Khamenei Bet Payout Refusal

TLDR:

- Kalshi is facing a $54 million class-action lawsuit over its refusal to pay out on the Khamenei market.

- Plaintiffs argue Kalshi’s death carveout was applied after Khamenei’s death, not before trading began.

- Kalshi claims its rules were always clear and that it reimbursed all fees and net losses to affected users.

- The lawsuit could set a major legal precedent for how prediction markets handle politically sensitive events.

Kalshi, a prominent prediction market platform, is now at the center of a federal class-action lawsuit. Plaintiffs allege the company refused to pay approximately $54 million to users.

These users had bet that Iranian Supreme Leader Ali Khamenei would leave office before March 1. Khamenei was killed in U.S.-Israeli strikes on Saturday.

The lawsuit was filed Thursday in the U.S. District Court for the Central District of California.

Plaintiffs Allege Kalshi Invoked Death Clause After the Fact

The lawsuit claims Kalshi did not apply its “death carveout” rule until after Khamenei was killed. According to plaintiffs, the company used this provision to avoid honoring payouts. They argue this move was both “deceptive” and “predatory” toward its own users.

Users say the market’s language was “clear, unambiguous and binary” from the start. The terms stated Khamenei could leave office for any reason, including death. Many bettors considered his death the most realistic outcome, given the military situation.

The lawsuit also notes that Kalshi continued accepting trades as reports of Khamenei’s death began to surface. Plaintiffs argue this further damaged users who were unaware the rules would later shift. This timing has become a central point of the legal dispute.

The complaint further states that “consumers understood that the most likely — and in many cases the only realistic — mechanism” for Khamenei leaving office was death.

It also asserts that “defendants understood this as well.” With a U.S. naval presence near Iran and conflict widely anticipated, the lawsuit argues users placed bets with that reality fully in mind.

Kalshi Disputes Claims, Says Rules Were Always Clear

Kalshi responded to the lawsuit with a firm denial of any wrongdoing. A company spokesperson stated the platform had “included every precaution to make sure people could not trade on the outcome of death.” According to Kalshi, the rules were consistent and transparent from the beginning.

The spokesperson added that Kalshi reimbursed all fees and net losses directly out of pocket. “We even reimbursed all fees and net losses out of pocket — to the tune of millions of dollars — to make sure not a single person lost money on this market,” the spokesperson said. The company maintains no customer suffered a financial loss.

Kalshi further insisted that it followed its own established guidelines throughout the process. The platform argues the death carveout was always part of its market structure. It was not, the company says, introduced after the fact.

Prediction markets have grown sharply in popularity since the 2024 U.S. presidential election. Platforms like Kalshi allow users to trade yes-or-no contracts on real-world events.

These markets accurately predicted Donald Trump’s election victory ahead of traditional polling methods. The outcome of this lawsuit may shape how such platforms handle sensitive, high-stakes markets going forward.

Crypto World

1win Arranges Private Charter Flights for VIP Clients Leaving the UAE Amid Aviation Disruptions

[PRESS RELEASE – Duabu, United Arab Emirates, March 8th, 2026]

As aviation disruptions continue in the Gulf region following reports of a drone strike near Dubai International Airport, global crypto platform 1win has organized a private evacuation operation for its VIP clients currently in the United Arab Emirates.

“Safety first,” the Owner of 1win commented on X. “When airports in Dubai closed, and many were stranded, not knowing how to get out, in less than a day, we organized the evacuation of our VIP clients on all private jets, so they could return home safely without waiting for the situation to stabilize. We are here to support you in any situation.”

Commercial aviation in the region has been heavily disrupted. The airline Emirates temporarily suspended flights to and from Dubai International Airport, urging passengers not to travel to the airport until the security situation stabilizes. Several international routes have also been cancelled in the coming weeks as airlines reassess operational risks.

To provide additional flexibility for VIP clients who were unable or unwilling to rely on disrupted commercial flights, 1win coordinated private aviation options with several international charter operators. The initiative focused on offering direct departures from airports in Dubai and Abu Dhabi to destinations across Latin America, Asia, and the CIS region.

Industry reports indicate that demand for business aviation in the UAE has surged sharply as travelers seek alternatives to disrupted commercial flights. Several aviation outlets and international media reported a significant spike in private jet charters and sharply rising prices for departures from Dubai, reflecting the growing demand for alternative travel options during the crisis.

1win’s charter program remains ongoing, with additional aircraft arranged depending on client travel needs.

About 1win

Founded in 2016, 1win is a crypto platform in the global gaming industry. Operating across Asia, Latin America, and Africa, 1win offers a wide range of services adapted to regional audiences. In 2024, 1win partnered with actor Johnny Sins as its brand ambassador. In 2025, MMA legend Jon Jones joined 1win as its global ambassador. American professional wrestler and mixed martial artist, Gable Steveson, stepped into the 1win global ambassador team earlier this year.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin Struggles to Maintain $67K, Pi Network’s PI Plunges After Recent Rally: Weekend Watch

PI has erased much of the recent gains, but still trades around $0.20.

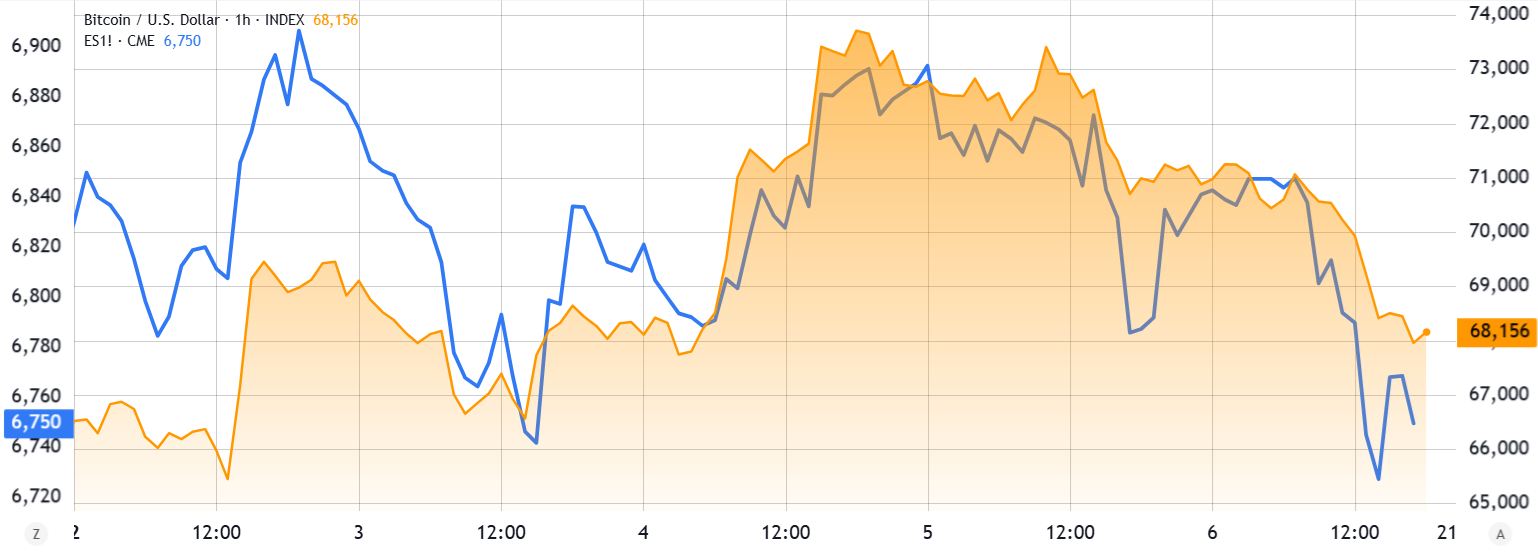

Bitcoin’s underwhelming price moves over the weekend continued as the asset dipped below $67,000 earlier today for the first time since Tuesday.

Most altcoins are also in the red today, with ETH slipping further away from the coveted $2,000 level, while ADA and XMR are down by over 2%. ZEC and PI have dumped the most daily.

BTC Fights for $67K

Last weekend brought intense volatility for the crypto markets after the US and Israel attacked Iran. BTC dropped immediately from $67,000 to $63,000 but rebounded within the day to $68,000 after reports that the Iranian Supreme Leader was killed during the attacks.

The gains continued by the middle of the business week when bitcoin peaked at $74,000, a level not seen in a month. However, the bears stepped up at this moment and didn’t allow for any further increases.

Just the opposite; BTC started to lose value but dumped the most on Friday after a weak US jobs report and Trump’s latest threats and remarks on Iran and Cuba. It slipped further on Sunday, dipping to $66,600, which became its lowest level since Tuesday. However, it reacted well and now trades almost a grand higher.

As of now, BTC’s market cap has settled at $1.350 trillion, while its dominance over the alts sits quietly at 56.6% on CG.

PI Nosedives

Pi Network’s native token defied the overall market correction in the past few days, skyrocketing to a three-month peak of over $0.23 yesterday. However, it failed there, and the subsequent rejection has pushed it south hard to $0.20 as of press time. ZEC follows suit in terms of daily losses and now struggles below $200.

Most larger-cap alts are also in the red, but in a less painful manner. ETH has decisively broken below the $2,000 level after another minor decline, while BNB is down to $620. SOL, XRP, ADA, XMR, and LINK are also down today.

The total crypto market cap has shed around $30 billion daily and is below $2.4 trillion as of now on CG.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin Sell-off To $65K Likely As Traders Run From Global Risks

Key takeaways:

-

Bitcoin faced pressure as rising oil prices and weak US data sparked risk-off sentiment and drove investors to gold.

-

A redemption spike in private credit funds from BlackRock and Blackstone signaled growing anxiety among retail investors.

Bitcoin (BTC) saw a 7% correction between Thursday and Friday following a failed attempt to reclaim the $74,000 level. The pullback tracked weak US macroeconomic data and a spike in oil prices as the US and Israel-Iran war entered its seventh day. Traders now question whether Bitcoin can maintain support above $65,000.

Typically, deteriorating economic conditions pave the way for monetary stimulus, often boosting the stock market in anticipation of increased liquidity. However, this cycle saw the S&P 500 retreat as a generalized risk-off sentiment erased all of Bitcoin’s gains from Wednesday.

US retail sales fell 0.2% in January compared to the previous month, while the US economy shed 92,000 jobs in February. Despite the cooling labor market, investors lack confidence that the Federal Reserve will cut interest rates further, as rising energy costs typically generate inflationary pressure.

US Treasury markets currently price a 78% probability that interest rates will remain steady between 3.5% and 3.75% through late April. A flight to safety pattern emerged as gold surged while the Russell 2000 Small Capitalization index hit a two-month low. Bitcoin’s drop below $85,000 in late January hindered its reputation as an uncorrelated asset, especially as silver rose to become the second most valuable asset.

Traders also fear a wave of corporate layoffs driven by artificial intelligence automation. Kansas City Fed President Jeff Schmid noted that AI is increasingly filling roles that once required manual labor. Schmid added that “older Americans are retiring,” causing a real-time structural change in the labor market, according to Yahoo Finance.

War and credit strain weigh on Bitcoin’s outlook

A prolonged war suggests increased US government spending, reducing the fiscal capacity for monetary stimulus aimed at economic expansion. Investors increasingly fear rising logistics costs beyond the commodities sector. Shipping giant Maersk announced on Friday the temporary suspension of two routes connecting the Middle East to Asia and Europe.

Bitcoin’s retest of the $68,000 level on Friday indicates that technical resistance levels identified by analysts may be secondary to geopolitical events impacting the oil and energy industries and, by extension, global growth prospects. The current weakness in risk assets appears to be a reflection of poor macroeconomic visibility rather than a structural collapse.

Related: Lyn Alden tips Bitcoin outperforming gold over next ‘two to three years’

A potential deterioration in trader expectations could originate within the US private credit market. BlackRock reportedly limited withdrawals from one of its largest credit funds following a spike in redemption requests, according to a Bloomberg report on Friday. Earlier this week, Blackstone’s flagship private credit fund fulfilled requests to tender a record 7.9% of shares, signaling rising retail anxiety.

Currently, the 3% option-adjusted spread for riskier firms is hovering within the normal range seen over the last six months. Periods of significant economic turmoil typically push this indicator above 5.0%, a level last seen in March 2023. As a result, there is no clear sign that Bitcoin will break below $65,000, even with the ongoing uncertainty surrounding global economic growth.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Trump’s National Cyber Strategy Backs Crypto Security in Post-Quantum Era

US President Donald Trump’s newly released National Cyber Strategy outlines federal support for strengthening the security of cryptocurrencies and blockchain systems, including protections against future threats posed by quantum computing.

Key Takeaways:

- Trump’s National Cyber Strategy includes federal support for securing cryptocurrencies and blockchain networks.

- The plan promotes post-quantum cryptography to protect digital infrastructure from future quantum computing threats.

- The strategy comes as the crypto industry debates how Bitcoin and other blockchains should prepare for quantum-era security risks.

The strategy, published Friday by the White House, states that the administration intends to ensure the United States remains “unrivaled in cyberspace.”

The document highlights the role of secure digital infrastructure and emphasizes that Americans should take steps to safeguard their online activities while the government works to reinforce broader cybersecurity protections.

Trump Cyber Strategy Highlights Crypto and Blockchain Security

Within that framework, the strategy includes a specific focus on emerging technologies tied to the digital asset sector.

According to the document, the administration plans to “build secure technologies and supply chains that protect user privacy from design to deployment,” while also supporting the security of cryptocurrencies and blockchain networks.

The strategy also calls for promoting post-quantum cryptography, encryption systems designed to withstand attacks from future quantum computers, alongside the development of secure quantum computing technologies.

The mention of crypto security comes as debate intensifies within the digital asset industry over whether major blockchain networks are prepared for a future where quantum machines could break current encryption methods.

Quantum computers remain largely experimental, but researchers have warned that sufficiently powerful versions could one day crack cryptographic systems used by Bitcoin and other blockchains.

Such a development would require networks to migrate to new encryption standards capable of resisting quantum attacks.

Some figures in the crypto sector argue the risk remains distant. Michael Saylor, co-founder of Bitcoin-focused firm Strategy, has said concerns about quantum threats are exaggerated, though he acknowledges that developers should remain prepared for technological shifts.

Other projects have begun exploring upgrades more actively. Ethereum co-founder Vitalik Buterin proposed a “quantum roadmap” earlier this year aimed at preparing the blockchain for a future where quantum computing could undermine existing cryptographic protections.

Trump’s cybersecurity plan arrives alongside other policy actions that touch the digital asset sector.

On the same day the strategy was released, the president signed an executive order targeting cybercrime, part of a broader effort to strengthen the country’s digital defenses.

Trump Expands Pro-Crypto Agenda With Bitcoin Reserve and CBDC Ban

Since returning to office, Trump has taken several steps aimed at reshaping US crypto policy. Last year, he approved the creation of a strategic Bitcoin reserve held by the federal government.

The reserve currently contains Bitcoin seized in criminal cases, and the administration has not indicated plans to acquire additional assets.

Earlier executive actions also included a sweeping review of digital asset policy and a prohibition on the development of US central bank digital currencies, reflecting the administration’s stance against government-issued digital money.

Meanwhile, Trump has intensified pressure on Jerome Powell, including threats of a criminal investigation, but the Federal Reserve has again held interest rates steady, citing solid growth and still-elevated inflation.

Powell declined to comment on the investigation and defended the Fed’s independence, warning that politicizing monetary policy would undermine the institution’s credibility.

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The post Trump’s National Cyber Strategy Backs Crypto Security in Post-Quantum Era appeared first on Cryptonews.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports14 hours ago

Sports14 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports4 hours ago

Sports4 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026

-

NewsBeat6 days ago

NewsBeat6 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports5 days ago

Sports5 days agoJack Grealish posts new injury update as Man City star enters crucial period