Crypto World

Ripple (XRP) Price Predictions for this Week

The XRP price is plunging alongisde everything else in the cryptocurrency market. Let’s have a look at where it may be headed to next.

XRP lost its support at $1.6. How low will it go next?

Ripple (XRP) Price Predictions: Analysis

Key support levels: $1.4, $1

Key resistance levels: $1.6

XRP Loses Key Support

With sellers on the offensive, XRP has lost its key support at $1.6 and is well on its way to make lower lows. Key target areas are at $1.4 and $1, which could trigger a relief rally.

Sell Volume Dominates

Every monthly candle since October 2025 has closed in red. This is a very aggressive selloff with no relief. There was a brief bounce around $2, but that level did not hold off the pressure from bears. Keep a close eye on $1.4 for a possible bounce.

Monthly MACD Remains Bearish

Even if buyers appear in the coming days and weeks, the macroeconomic outlook remains extremely bearish, as indicated by the monthly MACD. This downtrend may take several more months before a bottom is found.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum price tests $2K as exchange withdrawals spike

Ethereum price faces $2,000 support as exchange withdrawals surge to the highest level since November, indicating potential shifts in market supply and momentum.

Summary

- Ethereum trades at $2,001, down 4.3% in the last 24 hours.

- Exchange withdrawals hit 31.6M ETH in February, highest since November.

- $2,000 support is critical; break below risks $1,850, upside targets $2,300–$2,400.

Ethereum (ETH) is trading at $2,001 at press time, down 4.3% in the past 24 hours. The seven-day range stands between $1,841 and $2,099. ETH is still up 7.7% over the past week but down 14% in the last 30 days.

From its August 2025 all-time high of $4,946, the price has retraced about 59%. Spot trading volume reached $25 billion in the past 24 hours, a 21% drop in the last day.

Data from CoinGlass shows a cooling in the derivatives market. Trading volume has slipped 7.8% to $59 billion, and open interest has declined 5.6% to $25 billion.

As ETH approaches a critical price zone, many traders appear to be trimming positions and lowering risk.

Exchange withdrawals surge

At the same time, on-chain activity tells a different story. According to a March 3 report by CryptoQuant contributor Arab Chain, February recorded nearly 31.6 million ETH in exchange withdrawals, the largest monthly outflow since November.

A significant portion of that came from Binance, where about 14.45 million ETH was moved off the platform. About 1.04 million ETH were withdrawn from Kraken and approximately 3.83 million ETH were removed from OKX.

Large withdrawals from exchanges usually mean the assets are being moved into cold storage or set aside for longer-term holding. Once tokens leave trading platforms, there’s less supply readily available, which can ease immediate selling pressure.

This kind of shift often suggests that investors are choosing to hold onto their positions or adjust their strategy during periods of market volatility.

Ethereum price technical analysis

The $2,000 level carries both psychological and structural importance. Because that price level coincides with an important technical area on the chart and has psychological weight for investors, both bulls and bears are pay close attention to it.

Buyers have stepped in on dips, but support is under pressure. A daily close below $1,950 would expose the $1,850–$1,900 area, where prior liquidity sits. Below that, $1,700 becomes a deeper downside target.

ETH recently moved down to the lower Bollinger Band, a level that often suggests the asset may be oversold in the short term. At the same time, the bands have begun to tighten, a pattern that usually precedes a more significant price movement in either direction.

A recovery toward the middle band in the $2,050 to $2,100 range may occur if buyers are able to hold the $2,000 level. The relative strength index has rebounded from near 30 and is attempting to recover. A push above 45–50 would show improving momentum.

Until then, the broader pattern of lower highs stays intact. ETH remains below its 50-day moving average, and a move above $2,150–$2,200 would be needed to shift short-term structure.

If ETH holds above $2,000 and breaks $2,150 with stronger momentum, upside targets sit near $2,300 and $2,400. If $2,000 fails on a daily close, the path toward $1,850 opens quickly. The next few sessions will likely decide whether ETH stabilizes or enters another leg lower.

Crypto World

Visa expands stablecoin cards to 100+ countries via Bridge

Global payments giant Visa is expanding its partnership with Stripe-owned Bridge to scale stablecoin-backed cards to more than 100 countries.

Summary

- Visa and Stripe’s Bridge will expand stablecoin cards to over 100 countries by end of 2026.

- The cards let users spend stablecoins at 175M+ Visa merchants worldwide.

- Settlement is supported through Visa’s on-chain stablecoin pilot with Lead Bank.

In a statement published on March 3, Visa confirmed that the expanded program will allow businesses and developers to issue cards linked to stablecoins, with transactions settled on-chain through Bridge’s partnership with Lead Bank.

The product was first released in 2025 with a targeted rollout in several Latin American countries, including Mexico, Argentina, and Colombia. Since then, it has progressively expanded its global reach to operate in 18 countries.

Stablecoin Cards Move Toward Global Reach

The partnership is now preparing for its next stage of growth, with plans to extend coverage throughout Europe, Asia Pacific, Africa, and the Middle East by the end of 2026. Through Bridge, businesses can issue Visa cards that let customers spend stablecoins directly at over 175 million merchant locations across the globe.

These cards convert digital assets into payments that function like traditional debit cards, without requiring users to first move funds into a bank account.

Several major crypto platforms already use the service. Bridge-powered cards have been integrated by wallet providers like Phantom and MetaMask, allowing millions of users to make daily purchases using their cryptocurrency balances.

The expansion builds on Visa’s stablecoin settlement pilot, which lets partners settle transactions on supported blockchains using stablecoins. The aim is faster settlements, greater transparency, and lower costs than traditional banking systems.

According to Visa, the system allows faster reconciliation and more flexible settlement options for fintech firms and program managers operating across borders.

What the Expansion Means for Payments and Crypto

The wider rollout reflects Visa’s long-term push to connect blockchain-based assets with its global payments network. Cuy Sheffield, Visa’s head of crypto, said the initiative brings “speed, transparency, and programmability” into settlement processes while preserving institutional-grade security.

For Bridge and Stripe, the move supports their strategy of helping businesses launch custom stablecoins that can be used directly within card programs. Bridge chief executive officer Zach Abrams said the partnership allows companies to control more of their financial infrastructure without rebuilding payment systems from scratch.

The expansion also shows growing confidence in stablecoins as a practical payment tool rather than a niche crypto product. With cards already live in 18 countries and a roadmap toward more than 100, stablecoins are moving closer to mainstream consumer use.

At the same time, Visa is reviewing whether Bridge-issued digital assets could play a larger role in future settlement flows. If approved, this could introduce new pathways for moving funds across borders using blockchain technology.

Crypto World

How Trump’s Middle East Escalation Impacts His Political Future

Israel and the United States have launched a joint attack on Iran, one that has an unclear expiry date and that has already caused reverberations across the rest of the Middle East. Though Israel’s intentions are clear, those of the United States are not.

In a conversation with Steve Hanke, former Reagan advisor and economics professor at Johns Hopkins University, the consequences for US President Donald Trump are risky, potentially costing him his Make America Great Again voter base.

Trump’s Unclear Motives in the Middle East

If America’s founding fathers were alive today, they would look at the situation that unfolded over the weekend and shake their heads.

During the 18th century, Benjamin Franklin laid out his belief regarding conflict and trade with the quote, “the system of America is universal commerce with all nations, and war with none.” Thomas Jefferson reinforced this vision of foreign policy through his own quote: “Peace, commerce, and honest friendship with all nations—entangling alliances with none.”

Today, quite the opposite vision is being carried out. Aware of Israel’s planned strike against Iran’s capital, the United States joined in preemptively.

“It was abundantly clear that if Iran came under attack by anyone – the United States or Israel, or anyone – they were going to respond, and respond against the United States,” Secretary of State Marco Rubio told reporters in a recent interview in Washington.

For Hanke, Israel’s intentions were also abundantly clear: to expand its influence across the Middle East. When it came to the United States, concrete reasons were harder to find. Hanke attributed this to Trump’s already unpredictable policymaking in other areas of his presidency.

“We don’t exactly know what the thinking of the president of the United States is because he changes his mind a lot,” Hanke told BeInCrypto in a recent interview held on X Spaces.

What’s more apparent, however, is Israel’s grip on Washington.

Israel’s Growing Influence Over US Policymaking

Israel-US relations can be best exemplified by the extensive lobbying efforts of certain political action committees (PACs), such as the American Israel Public Affairs Committee (AIPAC), during US election cycles.

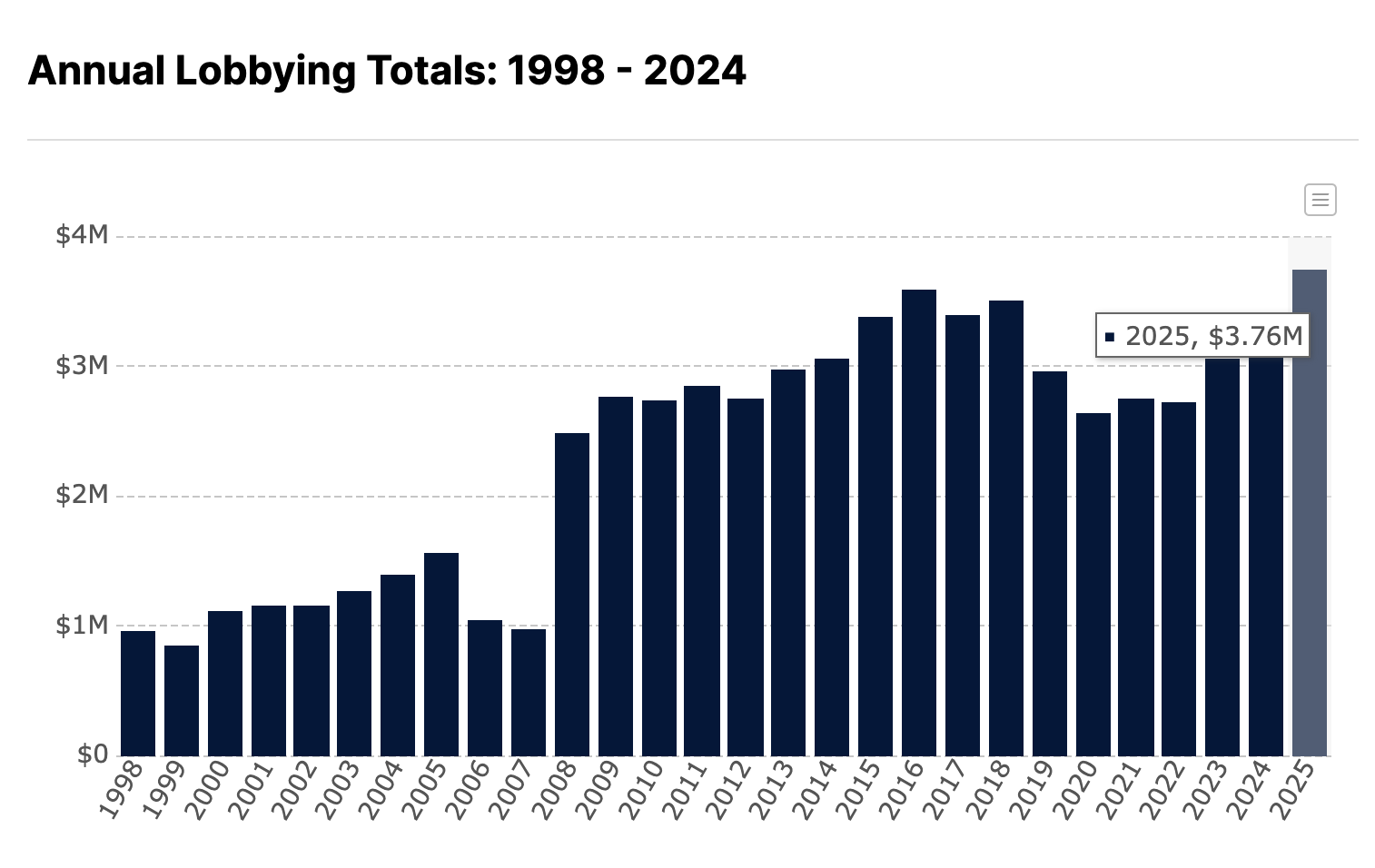

According to the nonpartisan research group OpenSecrets, AIPAC spent over $42 million on bipartisan contributions during the 2024 federal elections. In 2025, the committee spent $3.76 million on lobbying efforts. This figure marked the highest single-year spending to date.

“The lobby has an enormous influence on what goes on with regard to foreign policy that’s taken by the United States in the Middle East,” Hanke explained.

Beyond the increasingly entangled alliances between the United States and Israel, Trump may be using this latest attack on Iran as a distraction from certain unfolding events happening back home.

Trump’s Antiwar Image Begins to Fade

Trump jump-started 2026 with a series of controversial decisions. Three days into the new year, the United States captured and extradited Venezuelan leader Nicolás Maduro. Less than a month later, the president launched an aggressive campaign to acquire Greenland, sparking direct conflict with European allies.

These two decisions came amid a broader backdrop of constant tariff threats. At the same time, the Department of Justice released its latest batch of Epstein files.

This has placed the president at the center of a debate over his ties to billionaire socialite Epstein and his knowledge of the sex trafficking charges Epstein faced in 2019.

“The Jeffrey Epstein case is not going away— it’s still all over the press,” Hanke said, adding, “It’s an exit ramp from declining poll numbers. The best way to stay in power is to start a war… that’s a pretty big distraction.”

Meanwhile, Trump’s actions could pose a significant challenge to the future strength of his political power. One of Trump’s central promises on his campaign trail was to end ongoing wars, going so far as to declare himself the “president of peace.”

This narrative has begun to unravel.

“I think politically, he’s playing a very risky hand of cards with his base… his popularity is deteriorating rapidly in the United States because of his interventionist and threatening positions,” Hanke said. “Whether he’s going to be able to wind up [the Middle East conflict] in a short period of time… we don’t know.”

The next indicator of the president’s current popularity will be the November midterm elections, which will determine whether the Republican Party can maintain control of both chambers of Congress.

Though Trump’s foreign policy decisions may have significant domestic political repercussions, their impact on the global economy, especially oil prices, seems more limited than expected.

Iran Conflict Fails to Disrupt Oil, China Keeps Balance

Contrary to popular belief, Hanke does not believe that the war on Iran will catastrophically affect oil prices in the US.

In the 20th century, disruptions in oil production had a larger impact on global economies. However, today, the US has increased its oil production, while Iran and the Gulf have seen a decrease in theirs.

Hanke noted that, since events unfolded over the weekend, the price of American oil has risen by only about $10 per barrel, translating into a 25-cent-per-gallon increase.

“What’s happening today is a kind of modest reaction,” Hanke said, adding, “The oil intensity has gone way down. Even as the price goes up, it’s not going to be as large an impact on GDP as was the case in 1978.”

Trump’s efforts to disrupt oil supply to China through his interventions in both Venezuela and Iran may not achieve the intended result against the United States’ main rival. Hanke argued that even if the Strait of Hormuz remains closed, China’s strategic advantages must not be overlooked.

While the Organization of Petroleum Exporting Countries [OPEC] has oil, China has rare-earth minerals.

“If the US was wanting to play this game and cut off the Venezuelan oil and the exit of the Strait of Hormuz, believe me, the Chinese know how to play hardball,” he explained. “They would cut the rare earths off, and that would be the end. Within six months, Western economies would be in really bad shape.”

As the situation in the Middle East continues to unfold, the true impact of these geopolitical moves on global stability and US politics remains to be seen. The next few months will reveal whether Trump’s foreign policy gambles will strengthen or further erode his political standing.

Crypto World

Aave governance rift deepens as major governance group exits $26 billion DeFi protocol

The Aave Chan Initiative, one of the most active governance groups inside the Aave DAO, announced its shutdown after a dispute over transparency and voting power tied to a record budget request from Aave Labs.

Marc Zeller, founder of ACI, announced that the eight-person team will not seek renewal of its contract and will wind down operations over the next four months. The group plans to continue participating in governance during that period while handing off infrastructure and open-sourcing its tools.

The exit marks a turning point for Aave, the leading decentralized finance protocol with nearly $27 billion in total value locked across 20 blockchains.

It comes weeks after BGD Labs, the team that built and maintained Aave’s V3 codebase, said it would also step away over organizational and strategic disagreements with Aave Labs.

Aave’s governance token, AAVE, is down more than 11% in the last 24 hours over ACI’s exit to now trade at $110. It’s down more than 44% in the past year, compared to BTC’s 24% drop in the same period.

ACI’s impact

ACI said it drove 61% of governance actions over the past three years and helped deploy $101 million in incentives. During that time, Aave’s GHO stablecoin grew from $35 million to $527 million in supply, and the protocol’s DeFi market share rose above 65%, according to the group’s figures. ACI said it cost the DAO $4.6 million over three years.

The conflict centers on a proposal from Aave Labs titled “Aave Will Win.” The plan asked the DAO to approve up to roughly $51 million in stablecoins and 75,000 AAVE tokens to fund product development, marketing and expansion tied to Aave V4.

It also proposed directing all of the revenue from Aave-branded products to the DAO. That proposal has passed its first formal vote over the weekend with around 52% supporting it.

ACI said it requested four conditions before supporting the proposal, including stricter onchain milestone tracking and limits on self-voting by addresses linked to the budget recipient. Those conditions went unaddressed, Zeller wrote.

The organization argued that addresses linked to Aave Labs voted on the proposal, ultimately tipping the outcome in their favor. In a post-mortem published on the governance forum, the group said the episode showed there is “no role for an independent service provider” if the largest budget recipient can influence its own approval without full disclosure.

Aave Labs has not yet issued a response to ACI’s exit.

Winding down

To settle its remaining obligations, ACI will submit a direct proposal to cancel its GHO funding stream and transfer 120 days of funding to its treasury address, with the rest returning to the DAO.

The group said it chose a lump sum approach because it does not trust the governance process to maintain its stream during the transition. After the proposal executes, ACI will also cut its own AAVE vesting stream.

Over the next four months, ACI plans to hand off or open-source the systems it built. These include governance dashboards, incentive frameworks, delegate coordination programs and its roles on committees such as the Aave Liquidity Committee and GHO Stewards. The group will step down from those posts at the end of the wind-down period.

The departure raises broader questions about decentralization inside large DAOs. In theory, token holders control the system yet, in practice, voting power often clusters around founders, early investors and large delegates.

If a single entity holds enough influence, critics say, independent oversight becomes hard to sustain. The decentralization question in Aave began to grow after the DAO started debating who controls the protocol’s interface and who benefits financially from it.

For Aave users, lending and borrowing will continue as normal. Smart contracts remain live, and other service providers such as Chaos Labs, TokenLogic, and Certora continue their roles.

Still, the loss of two major contributors in quick succession may shift how the DAO manages risk, budgets and future upgrades.

Crypto World

The users of blockchain will be AI agents, NEAR co-founder says

SAN FRANCISCO, CA – For years, the crypto industry has searched for its next breakout moment — something on the scale of DeFi summer or the NFT boom. Meanwhile, artificial intelligence has quietly embedded itself into daily life. Developers use ChatGPT as a co-pilot. Consumers rely on AI assistants to draft emails, plan travel, and increasingly manage workflows. Crypto, by comparison, still feels infrastructural.

Illia Polosukhin, co-founder of NEAR, believes that divide is about to collapse — but not in the way many expect.

“The users of blockchain will be AI agents,” Polosukhin said in an interview. “AI is going to be on the front end, and blockchain is going to be the back end.”

His framing cuts against much of crypto’s recent experimentation with AI, which has largely centered on speculative tokens, memecoins and agent-themed trading bots. Instead, Polosukhin argues that AI will become the primary interface layer for everything online, including crypto, abstracting away wallets, explorers and transaction hashes.

“The goal is to make your AI hide all the blockchain,” he said. “The fact that we have [blockchain] explorers is effectively a failure, because we don’t abstract the technology.”

In this view, blockchain doesn’t disappear — it recedes. AI agents interact with protocols directly, executing payments, managing assets, coordinating services and even voting in governance systems. Humans, meanwhile, interact with the AI.

“AI is the front end, not just for blockchain, but for everything,” Polosukhin said. “In a few years, it’s going to be just AI, like the operating system.”

That shift, he argues, could explain why crypto hasn’t had an “AI moment” comparable to the consumer explosion of generative tools. “Blockchain is inherently financial,” he said. “It will be limited to finance, but everything we do in our life is finance.”

Rather than competing with AI platforms, crypto’s role may be to provide neutral financial rails beneath them: settlement, ownership, verifiability and programmable incentives.

Still, Polosukhin is critical of how the industry has approached both AI and governance so far — comments that come just days after Ethereum co-founder Vitalik Buterin proposed “AI stewards” to help reinvent DAO governance.

“In blockchain, we propose technical solutions before asking: what is the core problem?” he said.

He points to decentralized autonomous organizations, or DAOs, as an example. “DAOs have dramatically failed because they have been unbounded, not really designed to solve any problem,” he said, arguing that governance tools, including AI-assisted voting agents, only make sense if they’re tied to clearly defined economic or coordination needs.

Another friction point between the AI and crypto communities has been culture. “The memecoins are ruining [the industry’s] reputation,” Polosukhin said, arguing that rampant speculation and scams have alienated serious AI researchers. “AI people are banning crypto effectively because of memecoins.”

The longer-term convergence, however, may be less about token launches and more about infrastructure. As AI systems increasingly act on users’ behalf, like paying bills, hiring services, allocating capital, they will require trusted execution, privacy and programmable financial coordination.

“Blockchain is about neutral markets and neutral infrastructure,” Polosukhin said.

If AI becomes the operating system of the internet, crypto’s future may not lie in being the app users open, but in becoming the invisible settlement layer their AI agents quietly depend on.

Read more: NEAR Launches Near.com super app, touting AI capabilities and confidential transactions

Crypto World

Trump urges passage of U.S. Clarity Act, attacks banks for ‘undercutting’ GENIUS

U.S. President Donald Trump said bankers are trying to undermine the GENIUS Act — the signature stablecoin legislation he signed into law last year — in a Truth Social post Tuesday, and he urged passage of Congress’ crypto market structure legislation without interference.

“The U.S. needs to get Market Structure done, ASAP. Americans should earn more money on their money,” he said in the post. “The Banks are hitting record profits, and we are not going to allow them to undermine our powerful Crypto Agenda that will end up going to China, and other Countries if we don’t get The Clarity Act taken care of.”

He warned banks against holding the Clarity Act “hostage” in his post, saying the bill was necessary to keep the crypto industry in the U.S.

“They need to make a good deal with the Crypto Industry because that’s what’s in best interest of the American People,” he said.

The market structure bill has been in limbo since the Senate Banking Committee indefinitely postponed a markup hearing, in which lawmakers were set to debate and vote on amendments to the bill, in January. There are a number of issues still holding up passage of the bill, but the most public fight has been between the banking and crypto sectors over whether third parties can offer yield on stablecoin deposits to customers.

Banks are concerned that allowing Coinbase and other exchanges to offer stablecoin yield to customers might lead to deposit flight from the banking sector. Crypto companies contend that people should be allowed to earn yield on their holdings, a practice they say was allowed in the GENIUS Act.

The White House has facilitated meetings between banking and crypto industry representatives to negotiate the language of the bill. Individuals familiar with the negotiations say draft language is circulating among lawmakers.

While the White House had set a tentative deadline for the end of February to get a deal together, one has not yet emerged. The Senate still has time to work on the bill, but the calendar is beginning to shrink. Lawmakers have a recess during the summer, and the 2026 election cycle is beginning to kick into full gear, which will take away from time they could dedicate to the bill otherwise.

The Office of the Comptroller of the Currency, a federal banking regulator, said in a rule proposal last week that the terms of the contracts between stablecoin issuers and their third-party associates need to be clear about what exactly these third parties are offering, but the agency did not explicitly ban yield payouts.

World Liberty Financial, a company associated with Trump and his family, offers its own stablecoin, USD1, and it recently sought to secure a trust charter under the OCC for an affiliated firm.

The post about the Clarity Act was an abrupt dip into financial policy after Trump spent the last few days overseeing U.S. military strikes against Iran, in what the U.S. government has described as a “special combat operation.” The emerging hostilities have disrupted air travel throughout the Middle East, as well as shipping through the Strait of Hormuz.

Read more: Bitcoin is stuck in a rut but JPMorgan says new legislation could be the ultimate spark

UPDATE (March 3, 2026, 20:25 UTC): Adds additional detail.

Crypto World

CFTC Chair Teases Crypto Perpetual Futures Coming Next Month

Regulators in Washington signaled renewed urgency around how crypto markets are structured and regulated, as a Milken Institute panel brought together key U.S. overseers to discuss perpetual futures, prediction markets and the broader market framework. CFTC Chair Michael Selig outlined a path to US-accessible perpetual futures, while SEC Chair Paul Atkins pressed for greater congressional clarity to steer crypto policy. The conversations come amid ongoing questions about governance, enforcement actions against prediction-market platforms, and a stalled market-structure bill that remains the subject of intense debate in Congress. With the CFTC short of a full slate and lawmakers weighing ethics, stablecoins and tokenized equities, the regulatory tempo appears poised to intensify in the weeks ahead.

During the Washington event, Selig said the Commission is actively pursuing a pathway to “true perpetual futures” for digital assets in the United States, aiming to deliver a functional version “within the next month or so.” The comments underscored a coordinated push to bring crypto product design closer to traditional futures markets and to anchor these instruments within a domestic legal framework rather than offshore venues. Selig’s remarks reflect a broader objective: reduce regulatory arbs and promote market integrity by establishing a clear, US-based regime for innovative derivatives tied to cryptocurrencies.

Notably, Selig currently stands as the sole Senate-confirmed commissioner at the CFTC, a vacancy-heavy backdrop that has persisted for months. He noted the agency’s reliance on a sense of congressional direction to advance policy and market structure reforms, underscoring how essential new leadership could be for momentum. In a panel exchange with Atkins, Selig pointed to the reality that, historically, “the prior administration drove a lot of these firms and the liquidity offshore,” a reality many market participants have cited as a driver of fragmented liquidity and uneven regulatory oversight.

Beyond futures, Selig signaled that the CFTC intends to publish guidance on prediction markets “in the very near future.” The agency has long asserted jurisdiction over event-contract platforms such as Kalshi and Polymarket, a stance that has drawn scrutiny from states pursuing their own enforcement actions against these operators. The discussion at Milken highlighted a recurring theme in crypto policy: the tension between federal authority and state-level actions, and the need for clear, uniform standards to prevent a patchwork regulatory environment that complicates compliance for innovators and operators alike.

On the topic of market structure, Atkins stressed the importance of legislative clarity. He described the ongoing digital asset market-structure bill as moving through Congress but effectively paused as the White House and lawmakers navigate debates over ethics, stablecoin yield and tokenized equities. Atkins argued that the SEC needs statutory direction to direct the courts and support the commission’s crypto initiatives, while Selig countered that “there’s only so much you can do without legal certainty from Congress.” The exchange of views captured a broader cross-agency push for a map of responsibilities that could harmonize enforcement, supervision and market access for crypto products.

These remarks come as the Senate Banking Committee has not yet scheduled a markup for the market-structure bill, according to multiple briefings. The White House has been holding a stream of talks with industry leaders on stablecoin yield, a topic that continues to generate both optimism and risk for policy pathways. While administration officials have signaled interest in advancing a framework, observers note that substantive progress remains contingent on navigating concerns about consumer protections, financial stability and the implications for the broader asset class. The absence of a clear legislative timetable has left exchanges, liquidity providers and investors watching closely for any signs of accelerated action or renewed negotiation on key provisions.

Why it matters

The near-term focus on perpetual futures, prediction markets and market structure signals that the U.S. regulatory narrative around crypto is shifting from scattered enforcement and piecemeal guidance toward a more integrated framework. If the CFTC can operationalize a US-based perpetual futures regime in weeks, it could draw liquidity back from offshore venues and consolidate activity within regulated platforms, potentially improving transparency, disclosure and risk controls for retail and institutionally backed trades.

At the same time, the push to clarify the regulatory status of prediction markets—platforms that allow users to trade on event outcomes—has the potential to redefine how decentralized information markets operate in the United States. The CFTC’s insistence on exclusive jurisdiction over event contracts contrasts with ongoing state-level actions against Kalshi and Polymarket, highlighting a broader strategic debate about federal supremacy versus state experimentation. The outcome could influence where innovation remains permissible and where compliance costs rise, shaping the trajectory of experimentation in event-based speculation and its integration with broader DeFi ecosystems.

Meanwhile, the market-structure bill sits at a crossroads. Proponents argue that a statutory framework would reduce uncertainty for market participants and provide a clear mandate for both the CFTC and the SEC. Critics contend that the legislation, if rushed, may neglect nuanced issues such as governance, transparency, and consumer protection. The discussions around stablecoins—central to the policy package—illustrate how a single policy thread can ripple across multiple regulatory domains, affecting liquidity, yield strategies and the potential for tokenized financial instruments. The net effect for users and builders is a heightened need for precise, verifiable guidance and a predictable regulatory clock that can support sustainable product development.

These developments are unfolding against a backdrop of ongoing policy chatter and industry dialogue. The Milken Institute event, the subsequent reporting on Selig’s remarks, and the broader media coverage of market-structure debates collectively reinforce a sense that Washington is recalibrating how crypto markets should operate within a traditional financial framework. As policymakers weigh the balance between innovation and protection, the sector watches for concrete milestones—whether a formal rulemaking, a legislative markup, or a fresh round of guidance—that could anchor near-term decisions around product design, liquidity strategies and risk management.

For investors and developers, the implications are twofold. First, a cleared path for perpetual futures could attract more liquidity to compliant, U.S.-based venues, reducing reliance on offshore liquidity pools that have often been a feature of the crypto derivatives landscape. Second, clear guidance or legislation on prediction markets and stablecoins would help define permissible structures and capital requirements, potentially unlocking new product categories while imposing guardrails designed to reduce systemic risk. In short, the next few weeks could prove pivotal for how deeply regulated, institutionally aligned crypto markets become in the United States, and how much of the global liquidity shift back toward home shores will actually materialize.

As policymakers keep their focus on the balance between innovation and protection, market participants should monitor several concrete signals: when the CFTC releases its true perpetual-futures guidance; whether prediction markets receive formal regulatory clarity; whether the market-structure bill advances in markup; and how the White House’s ongoing discussions with industry translate into concrete policy proposals. The convergence or divergence of these threads will likely shape the trajectory of U.S. crypto market infrastructure for the remainder of the year.

Crypto World

Core Scientific’s Bitcoin Sell-Off Raises Questions About DATs

Core Scientific, a Bitcoin mining company, announced this week its plans to sell nearly all of its Bitcoin holdings to fund its shift towards AI and high-performance computing.

The move reflected a broader trend in the Bitcoin mining industry. However, it also raised questions over the purpose of sustaining Bitcoin treasuries, especially in light of a broader market downturn.

Bitcoin Miner Reduces Holdings for Growth

Core Scientific unveiled on Monday its plans to use the proceeds from its Bitcoin sales to finance its growing data center buildout. According to its most recent 10-K filing, the company sold 1,924 Bitcoin between December and February for aggregate proceeds of nearly $176 million.

According to Bitcoin Treasuries, Core Scientific currently holds 613 Bitcoin, worth nearly $42 million.

The company also announced that it will transition its Pecos, Texas, facility from Bitcoin mining to colocation services, a move that aligns with rising demand for artificial intelligence (AI) infrastructure.

The change reflects a broader trend among Bitcoin miners seeking more lucrative business models. It also coincides with weaker Bitcoin prices and rising energy costs, which have burdened miners’ operations.

Last December, BeInCrypto reported that Bitcoin mining profitability hit record lows by the end of 2025, with 70% of the top 10 Bitcoin mining companies already generating revenue from infrastructure services.

Core Scientific became the latest miner to do so, joining CleanSpark, Riot Platforms, and IREN, among others.

However, its latest move not only reflects general restructuring but also indicates a shift away from Bitcoin accumulation.

Bitcoin’s Stagnation Raises Questions for DATs

Core Scientific’s Bitcoin holdings, prior to its recent sell-off, were not among the largest in the industry. According to Bitcoin Treasuries, it ranks 59th out of the top 100 public Bitcoin treasury companies.

However, the scale of this sell-off has sparked questions about the future profitability of digital asset treasuries (DATs).

This shift also coincides with MARA Holdings revising its treasury policy, now allowing the sale of Bitcoin held directly on its balance sheet.

The announcement marked the second-largest Bitcoin holding company’s sharp departure from its prior “full HODL” stance. It also raised broader questions over whether other DATs will soon follow suit.

Bitcoin’s failure to reach new highs, instead stagnating, has raised broader concerns. As of writing, its price is $68,000, but it has fallen 11% over the past month and 27% over the past three months.

The possibility of Bitcoin returning to its previous all-time high of $126,000 now seems increasingly unlikely.

Meanwhile, Strategy (formerly MicroStrategy), the top Bitcoin treasury holder, remains committed to Bitcoin, with founder Michael Saylor tweeting on Tuesday, “I’m buying Bitcoin right now. Are you?”

However, the volatility of its stock, MSTR, has raised concerns about investor confidence.

Meanwhile, Phong Le, the company’s CEO, admitted last November that Strategy might be forced to sell Bitcoin under specific crisis conditions.

Crypto World

MARA Clarifies Bitcoin Strategy After 10-K Misinterpretation

MARA Holdings, one of the world’s largest Bitcoin mining companies, has rejected claims that it plans to unload the majority of its Bitcoin holdings following speculation about a shift in its treasury policy.

The clarification came in a post on X from MARA vice president for investor relations Robert Samuels, who said the company has not altered its core Bitcoin (BTC) treasury approach.

His remarks were a direct response to SwanDesk adviser Jacob King, who claimed Tuesday that MARA had shifted toward a sell-down strategy, citing filings with the US Securities and Exchange Commission. King’s post had received more than 325,000 views at the time of writing.

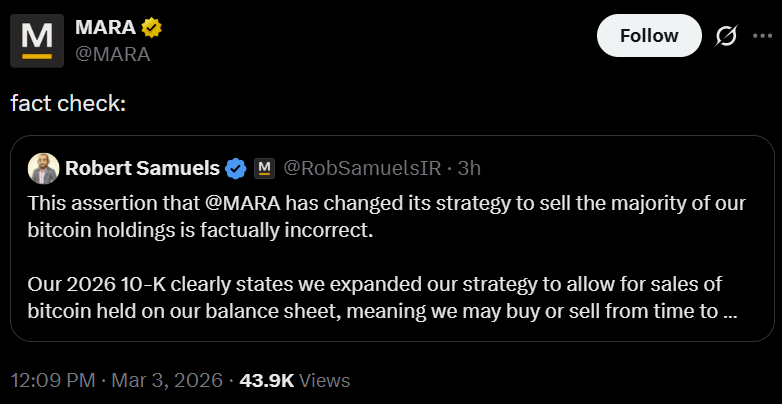

Samuels pointed to the company’s 2026 10-K filing, which states that MARA expanded its policy to allow for potential sales of Bitcoin held on its balance sheet.

“Our 2026 10-K clearly states we expanded our strategy to allow for sales of bitcoin held on our balance sheet,” Samuels wrote.

As Cointelegraph initially reported, the filing authorizes discretionary transactions based on market conditions and capital allocation priorities, rather than mandating a reduction in reserves.

The distinction, Samuels argued, is between preserving optionality and committing to a material drawdown of Bitcoin treasury holdings.

MARA has historically positioned itself as a long-term Bitcoin holder, making any perceived shift in its treasury strategy closely watched by investors and market participants.

Related: Bitcoin mining’s 2026 reckoning: AI pivots, margin pressure and a fight to survive

MARA doubles down on diversification while maintaining a large BTC treasury

While MARA has broadened its operational footprint in recent years, its balance sheet remains heavily tied to Bitcoin exposure.

That diversification accelerated last month when MARA acquired a 64% stake in Exaion, a France-based computing infrastructure company focused on high-performance computing and blockchain services.

Even so, Bitcoin remains central to MARA’s balance sheet. The company holds 53,822 BTC, valued at about $3.7 billion, making it the largest publicly traded Bitcoin miner by treasury size.

Among public companies overall, only Michael Saylor’s Strategy holds more, with over 720,000 BTC accumulated to date.

Related: American Bitcoin boosts hashrate with 11,298 new mining machines

Crypto World

Bybit Retrieves $300M for Thousands of Users Through AI-Enhanced Fraud Prevention: Report

Beyond recoveries, Bybit blocked 3 million credential-stuffing attempts tied to account takeover schemes in 2025.

Bybit has reported recovering $300 million for thousands of users at a time when crypto-related fraud remains high across the industry.

The exchange attributed these efforts to an AI-powered fraud detection system that intervenes before people lose their funds.

Security Initiative Results

Bybit shared the results of its 2025 Security Initiative, stating on social media,

“We raised the standard in 2025, intercepting $300M in impersonation scams and fraud through our new AI-driven risk framework.”

The announcement comes as crypto fraud continues to weigh on the sector, with Chainalysis data showing that $17 billion in digital assets was drained in scam and fraud cases in 2025.

The report reveals that in the fourth quarter alone, the exchange flagged $500 million in withdrawals for review. Of that amount, $300 million was successfully intercepted and recovered, protecting the savings of more than 4,000 users.

During the same period, Bybit’s proprietary AI models identified 350 high-risk investment fraud addresses using on-chain data, shielding 8,000 people from potential withdrawal losses. The company also reported blocking over 3 million credential-stuffing attempts linked to account-takeover efforts in 2025.

Additionally, its system automatically labeled 350 suspicious addresses, and it manually tagged 600 more via internal ticket operations, preventing a further $1 million in imminent fraud losses.

You may also like:

David Zong, Head of Group Risk Control at Bybit, said in a statement that the firm’s goal in 2025 was to transform risk control into an active and intelligent guardian by integrating AI and on-chain monitoring.

“By integrating AI-driven on-chain monitoring with real-time intelligence from industry partners like TRM, Elliptic and Chainalysis, we not only just protect Bybit users but also help map the DNA of fraudulent networks,” he wrote.

Three-Tier Risk Framework

Bybit’s protection model structures potential scam scenarios into three escalating tiers while preserving normal trading activity. At the lowest risk level, the platform uses big data analysis to detect unusual activity, such as mass withdrawals to newly created addresses, and deploys automated surveys to support its Risk Operations team in blacklisting suspicious destinations.

Real-time alerts trigger during the withdrawal process for medium-risk cases, such as accounts flagged through credential stuffing databases or linked to questionable withdrawal addresses. This, in turn, prompts individuals to review transactions that may be influenced by social engineering tactics.

At the highest level, wallet addresses associated with confirmed scams face immediate withdrawal blocking and a mandatory one-hour cooling-off period.

The report concluded by outlining standardized monitoring indicators for wider industry use, including an anti-credential stuffing engine, real-time on-chain AI pattern recognition for pig butchering flows, an integrated intelligence hub combining tools from TRM Labs, Elliptic, and Chainalysis, and an end-to-end cross-chain tracing model for illicit fund tracking.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Politics15 hours ago

Politics15 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World5 days ago

Crypto World5 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat1 day ago

NewsBeat1 day agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI