Crypto World

Ripple’s prime brokerage platform adds support for decentralized exchange Hyperliquid

Ripple has announced that its institutional prime brokerage platform, Ripple Prime, now supports the decentralized derivatives trading protocol Hyperliquid.

The integration gives Ripple Prime clients access to Hyperliquid’s onchain perpetuals liquidity while keeping margin and risk managed inside Ripple Prime. The company said clients will be able to cross-margin decentralized finance derivatives exposures, alongside positions in other markets the platform supports.

Ripple Prime currently supports traditional assets that include FX, fixed income, over-the-counter swaps, and more. The platform acts as a single point of access for institutions managing multi-asset portfolios, offering centralized risk management and capital efficiency, Ripple said.

The integration builds on growing interoperability in the space. Earlier this year Flare, a blockchain focused on interoperability, launched the first XRP spot market on Hyperliquid with the listing of FXRP. Ripple’s announcement focuses on derivatives access through Ripple Prime rather than retail spot trading.

Hyperliquid has drawn attention over its rapid growth to become the largest perpetual contracts decentralized exchange. As of mid-January, it had surpassed $5 billion in open interest and $200 billion in monthly trading volume, outpacing several rival exchanges.

Its recent surge in tokenized commodity trades, including silver futures, has attracted interest in the space and helped its HYPE token outperform during the ongoing selloff. The platform is also eyeing prediction markets.

Ripple launched its Prime platform in late 2025 following its $1.25 billion acquisition of prime brokerage firm Hidden Road.

Crypto World

Tether Tops 500 Million Users But USDT Peg Concerns Abound

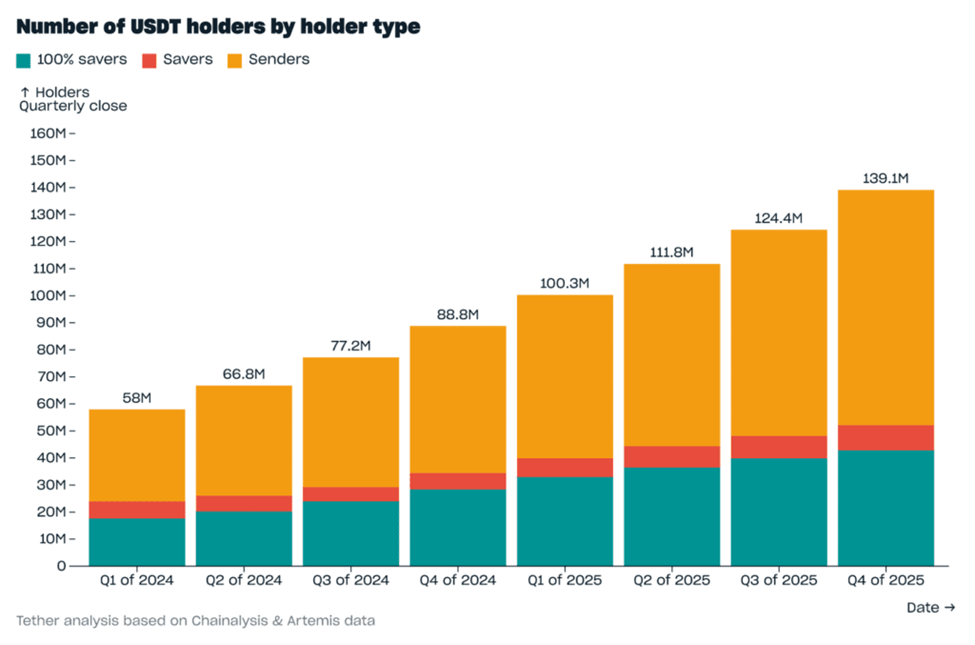

Tether’s USDT has crossed a major milestone, surpassing 534 million users, even as the broader crypto market remains under pressure following a sharp contraction that began in October 2025.

According to the company’s Q4 2025 USD₮ Market Report, the stablecoin added more than 35 million users in the quarter, marking the eighth consecutive quarter of adding over 30 million users.

Sponsored

Sponsored

USDT Expands as a Global Store of Value Even as Crypto Market Cap Contracts

The growth comes during a period of declining risk appetite. Since the October 10 liquidation cascade, the total crypto market capitalization has fallen by more than one-third (30%). Meanwhile, USDT’s supply has continued to expand modestly.

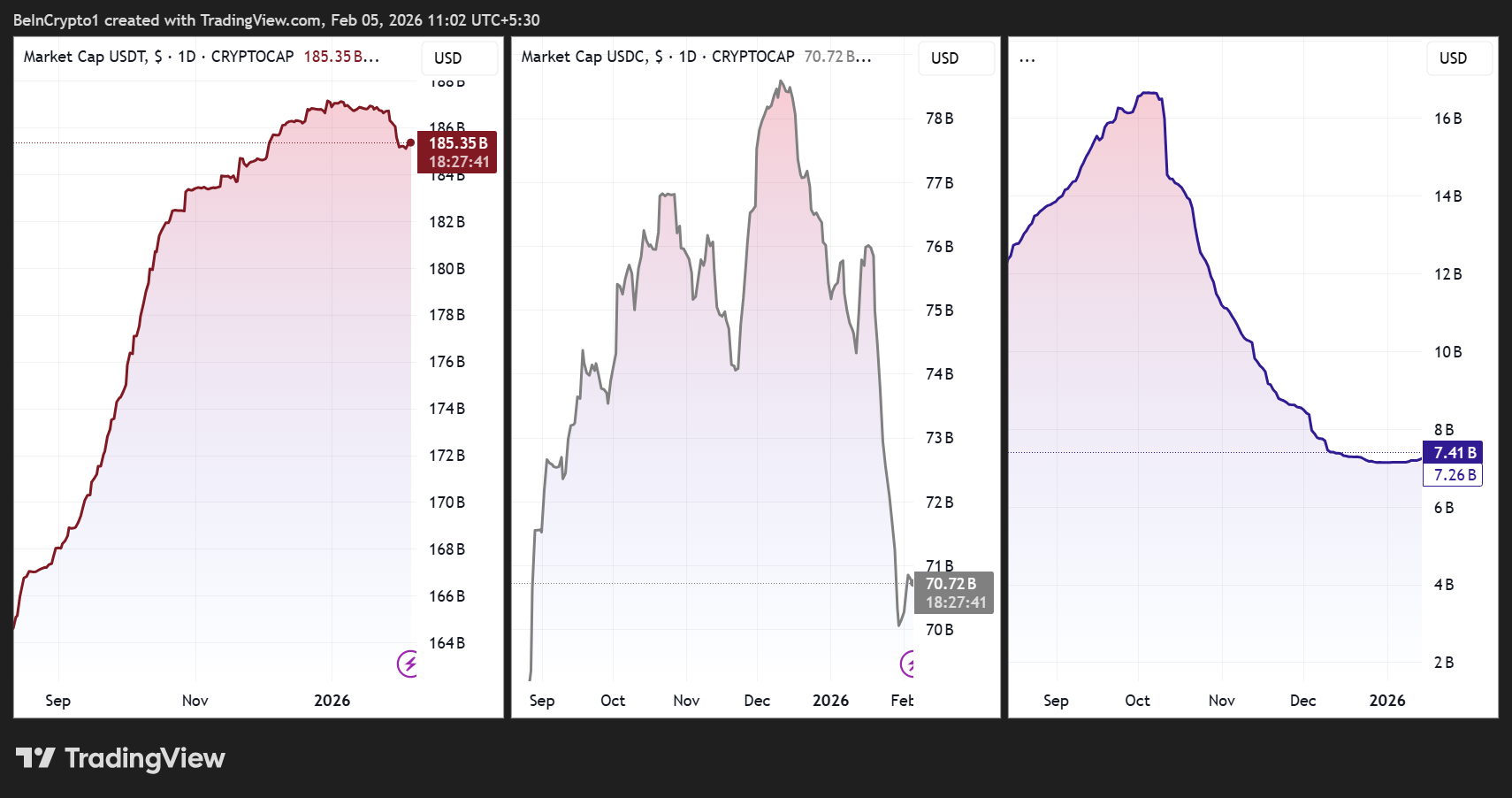

Tether reported that its market capitalization rose to $187.3 billion, up $12.4 billion in Q4, even as some competing stablecoins shrank.

Tether attributes the resilience to demand for savings, payments, and cross-border transfers rather than purely speculative trading.

On-chain metrics cited in the report show rising wallet balances among long-term holders and record transaction volumes.

However, the estimates of total users include both on-chain wallets and approximations of exchange users, making independent verification difficult.

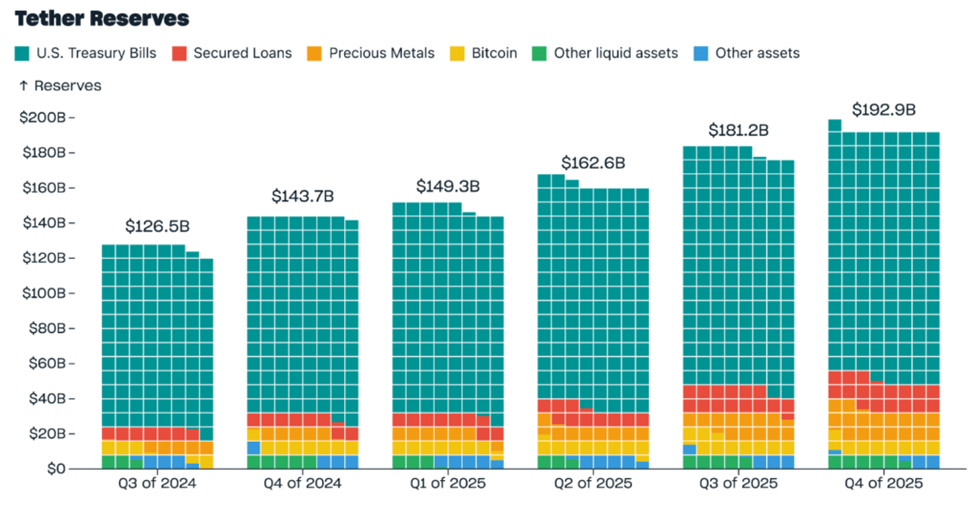

Reserve disclosures also show continued expansion. Total reserves reached $192.9 billion, including $141.6 billion in US Treasuries, a level that would place Tether among the largest Treasury holders globally if it were a country.

Sponsored

Sponsored

The company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 metric tons, reflecting a strategy to diversify collateral beyond cash-equivalent assets.

On-chain activity continued to grow rapidly. The number of USDT holders rose to 139.1 million, while monthly active users reached 24.8 million, both record highs.

The value transferred on-chain reached $4.4 trillion in Q4, and USDT’s share of spot trading volumes on centralized exchanges climbed to 61.5%. This highlights its role as the dominant settlement asset in crypto markets.

Sponsored

Sponsored

Minting Surge, Peg Wobbles, and Flippening Talk Highlight USDT’s Growing Systemic Role

Recent issuance activity suggests demand has carried into early 2026. On February 4, blockchain analytics account Lookonchain reported that Tether minted $1 billion in USDT, part of roughly $3 billion in stablecoins issued by Tether and Circle over three days.

Large issuances are often interpreted by traders as a signal of incoming liquidity, although newly minted tokens are not always immediately circulated.

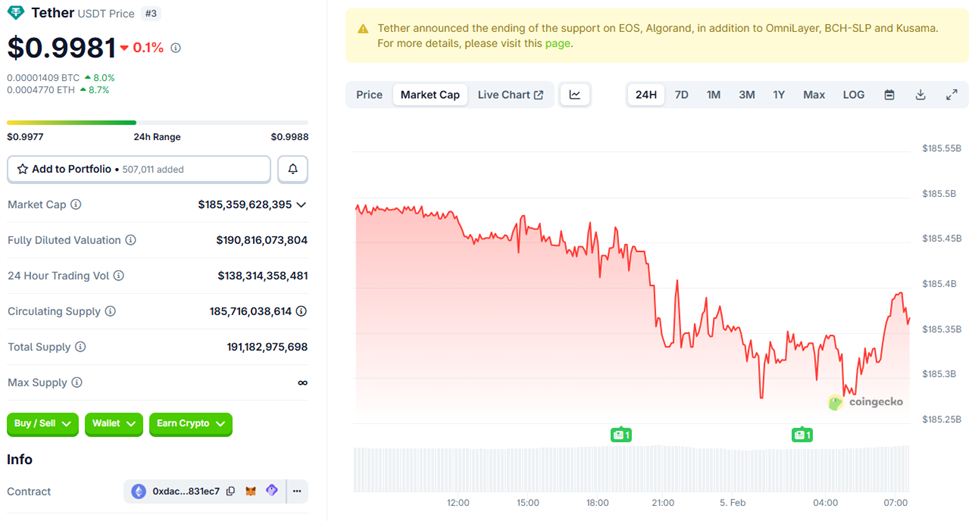

At the same time, Tether’s growing dominance has intensified scrutiny. Market attention briefly turned to USDT’s stability after the token slipped to around $0.9980, its weakest level in more than 5 years.

While the deviation was small and short-lived, any sustained loss of confidence in the peg could have outsized consequences, given the stablecoin’s central role in trading infrastructure.

Sponsored

Sponsored

Market estimates often suggest that most crypto trading volume flows through USDT pairs, making it a critical pillar of liquidity.

The scale of Tether’s expansion has also fueled debate over its place in the crypto hierarchy. Some market observers have speculated that, if current trends continue, USDT could eventually challenge Ethereum’s position as the second-largest cryptocurrency by market capitalization, particularly during prolonged periods of risk aversion when capital rotates into stable assets.

Meanwhile, the latest data shows that USDT is expanding in terms of users, reserves, and transaction volume, even as the broader market contracts.

Yet that same growth is concentrating liquidity and systemic importance in a single instrument. The stability of Tether’s peg is increasingly tied not just to one company, but to the resilience of the crypto market itself.

Crypto World

Why Vitalik Buterin Says L2s Aren’t Scaling Ethereum Anymore

Buterin argued that many Layer 2s no longer meaningfully inherit Ethereum security.

Ethereum co-founder Vitalik Buterin said recent developments mean the original conception of Layer 2 scaling within the ETH ecosystem is no longer viable.

He said that the progress among many L2 networks has fallen short of earlier expectations, while the mainnet continues to scale directly.

Slow Progress, Low Fees

In a recent post on X, Buterin pointed to two important realities reshaping the debate. First, there is the slow and difficult progress of L2s toward “stage 2” decentralization and interoperability, and the fact that Ethereum’s mainnet has already achieved very low fees, with gas limits expected to rise significantly through 2026.

Buterin reiterated that Ethereum scaling was originally defined as expanding block space that fully inherits Ethereum’s security. This means that all activity remains valid and censorship-resistant as long as the network operates. As such, systems that rely on multisig bridges or other forms of discretionary control cannot be considered extensions of Ethereum in this sense, even if they offer high throughput.

The co-founder explained that this framing no longer holds because the blockchain no longer needs L2s to function as “branded shards,” while many L2s are either unable or unwilling to meet the security and governance requirements that such a role would imply.

Buterin observed that some projects have explicitly stated they may never move beyond stage 1, not only due to technical concerns around zero-knowledge EVM safety, but also because regulatory or customer requirements necessitate ultimate control. While he said this may be appropriate for those projects’ use cases, it means they should not be described as scaling Ethereum under the original definition.

Instead, Buterin suggested abandoning the idea that all Layer 2s should occupy the same category and be judged by the same criteria. He proposed that they be viewed as a broad spectrum of systems with varying degrees of connection to Ethereum. In this framing, some L2s may be fully backed by Ethereum’s security while others operate with more limited guarantees. This would allow users and applications to choose based on their needs.

You may also like:

He added that L2s should focus on providing distinct value beyond generic scaling, such as specialized virtual machines, application-specific efficiency, extreme throughput, non-financial use cases, low-latency sequencing, or integrated services like oracles or dispute resolution. For networks handling ETH or Ethereum-issued assets, he said reaching at least stage 1 should be a minimum standard.

ZK-EVM Precompile

From Ethereum’s perspective, Buterin said he has become increasingly convinced of the importance of a native rollup precompile that would verify ZK-EVM proofs as part of Ethereum itself. Such a system in place enables trustless interoperability and composability while allowing L2s flexibility in extending functionality.

He said that while a permissionless ecosystem will inevitably include systems with weaker or trust-dependent guarantees, Ethereum’s responsibility is to make those guarantees clear and continue strengthening the base protocol.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

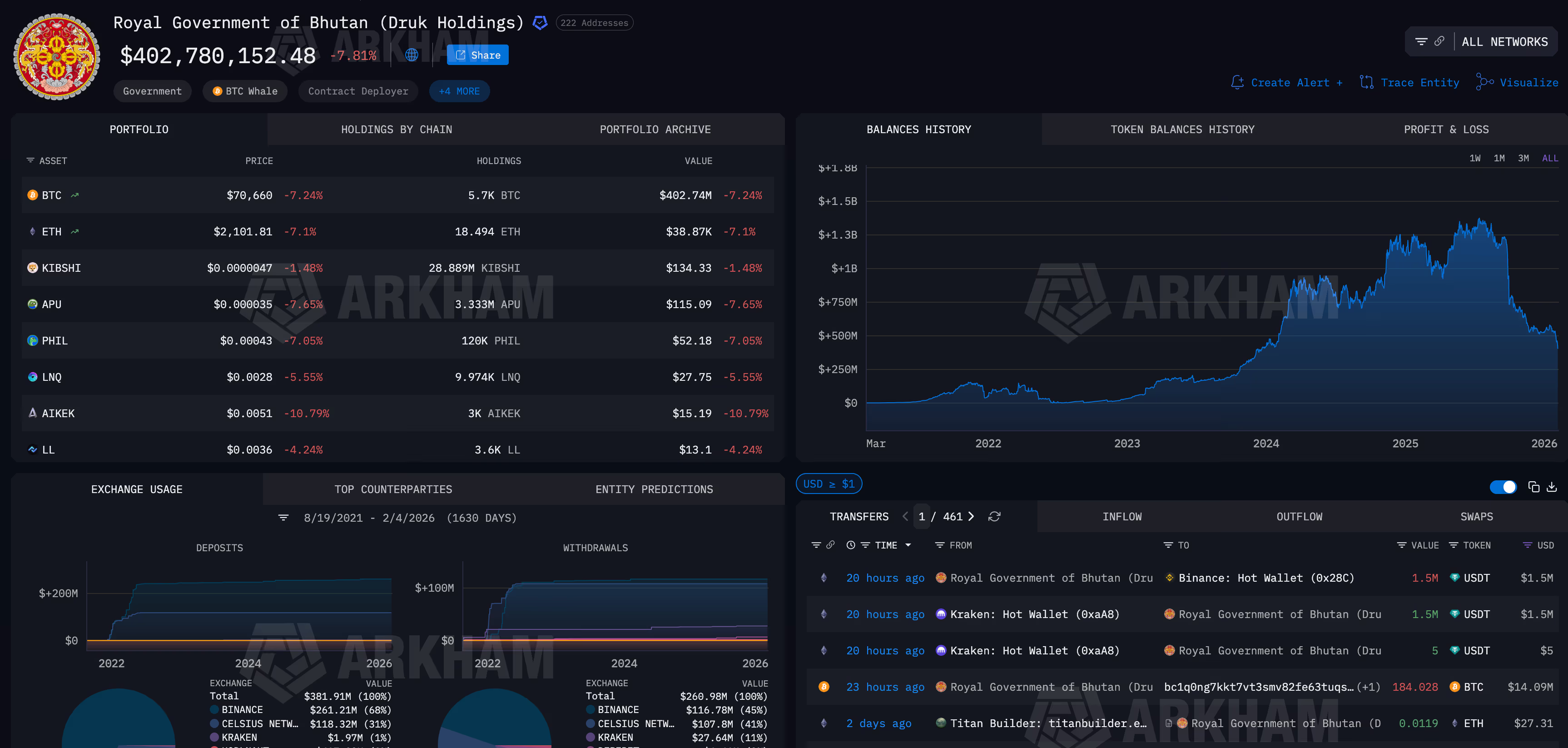

Bhutan shifts holdings after months of silence as BTC moves to $70,000

The Royal Government of Bhutan has begun moving bitcoin after months of wallet inactivity, shifting funds to trading firms, exchanges and fresh addresses as bitcoin slid below $71,000 and broader markets convulsed.

Onchain data tracked by Arkham shows Bhutan-linked wallets transferring more than 184 BTC, worth roughly $14 million, over the past 24 hours.

Some of the bitcoin was sent to new addresses, while other transfers flowed to known counterparties including QCP Capital and a Binance hot wallet, according to Arkham.

These destinations typically associated with trading, liquidity management or potential sales. CoinDesk reached out to QCP Capital via Telegram for comment.

The activity marks Bhutan’s first notable wallet movement in roughly three months and comes at a volatile moment for crypto markets. Bitcoin has fallen more than 7% in 24 hours, while silver plunged as much as 17% and global equities slid amid fears that artificial intelligence spending is undermining traditional software business models.

Bhutan has emerged over the past two years as one of the more unusual sovereign bitcoin holders, quietly building a stash through state-backed mining tied to hydropower.

Unlike corporate treasuries that trumpet accumulation strategies, Bhutan’s holdings have largely been managed out of the spotlight, making changes in wallet behavior closely watched by traders.

The latest transfers do not confirm outright selling. Coins were split across multiple destinations, including new wallets that could indicate internal reshuffling or collateral management rather than immediate liquidation.

Still, sending bitcoin to exchanges and trading firms during a sharp drawdown contrasts with the country’s otherwise long periods of inactivity.

The moves also echo a broader theme emerging in this selloff: large holders treating bitcoin less as a static reserve asset and more as a balance-sheet tool during stress.

Corporate treasuries, miners and now sovereign-linked entities are adjusting positions as liquidity tightens and price swings accelerate.

Crypto World

Bitcoin ETFs Hold On Amid Price Plunge, Analyst Says

US-based spot Bitcoin ETF holders are showing resilience despite a four-month downtrend in Bitcoin (CRYPTO: BTC), according to ETF analyst James Seyffart. In a recent post on X, he noted that the ETFs are “hanging in there pretty good,” even as the underlying asset has endured a prolonged slide. While acknowledging the pain of the current stretch—Bitcoin trading below $73,000 has left ETF holders with what he described as their largest paper losses since the January 2024 launch—the way flows have behaved contrasts with the height of the market cycle. The narrative is nuanced: inflows have cooled from peak levels, but the existing positions remain broadly intact as investors weather the drift in price.

Key takeaways

- Spot Bitcoin ETF holders are currently underwater but continuing to hold positions, signaling a degree of conviction despite the drawdown.

- Net ETF inflows had reached roughly $62.11 billion before the October downturn, and have since cooled to around $55 billion, according to preliminary data from Farside Investors.

- Bitcoin’s price trajectory has contributed to paper losses for ETF holders, with the broader market down about 24% over a 30-day window and the spot price near $70,537 at the time of reporting.

- Industry observers highlight a pattern of extended outflows, noting that three consecutive months of withdrawals marked a first in the history of higher-frequency ETF data monitoring.

- Industry voices emphasize a longer-term perspective, arguing that Bitcoin’s performance since 2022 has outpaced traditional assets in several periods, challenging the sentiment of a uniformly bearish cycle among analysts.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. ETF holders remain underwater as Bitcoin’s price decline drags on, though the net inflow dynamics offer a counterpoint to pure price Action.

Trading idea (Not Financial Advice): Hold. The combination of persistent holdings by ETF investors and improving inflows relative to peak levels suggests patience may be warranted amid ongoing price volatility.

Market context: The ETF landscape sits at the intersection of liquidity, risk appetite, and macro flows. Inflows into BTC-linked vehicles have cooled after a major cycle, while on-chain and market indicators show divergent signals about near-term momentum. The mix of price pressure and ongoing institutional participation shapes a cautious but not collapsing narrative for Bitcoin-focused ETFs.

Why it matters

The behavior of spot BTC ETFs helps illuminate a broader dynamic in crypto markets: institutional vehicles can provide a stabilizing, if not yet growth-driven, channel for price discovery. Even as price declines stretch across several weeks, the fact that ETF inflows remain sizable—albeit down from the peak—suggests that investors are maintaining exposure rather than exiting en masse. This matters for market liquidity, as ETF flows can dampen sharp price moves when buying or selling pressure intensifies, particularly in a sector as sensitive to macro headlines as crypto.

The discourse around investor sentiment is nuanced. On one hand, there is acknowledgment of substantial paper losses among ETF holders during the recent downturn, with Bitcoin navigating lower levels and volatility elevated. On the other hand, observers highlight that Bitcoin’s recovery potential remains tethered to macro risk appetite and the pace of flows into crypto vehicles. The conversation is further complicated by longer-term performance comparisons: Bitcoin has, in multiple cycles, outperformed traditional assets over extended horizons, which some argue justifies a longer view despite the near-term pain.

Analysts and researchers stress that focusing solely on near-term drawdowns can obscure the more complex picture of investor behavior and market structure. For instance, a well-known market observer suggested that Bitcoin’s strength in previous years—particularly its outsized gains through 2023 and 2024—remains a reference point for evaluating current demand. While the market may appear to be in a risk-off phase, the longer arc of Bitcoin’s price action has historically included substantial rallies following consolidation periods, underscoring the difficulty in drawing conclusions from a single quarter’s results.

Another thread in the discussion centers on the prudence of staying invested when ETF holders are effectively “underwater and collectively holding,” as some observers phrase it. This stance mirrors a broader crypto investing paradigm where conviction and time horizons matter as much as timing. In a space where episodic headlines can swing prices, the behavior of ETF holders offers a degree of reflexivity: ongoing participation from established vehicles can support price resilience, even when volatility remains elevated.

The discourse also touches on narrative risk—whether market participants are overly pessimistic about BTC’s near-term prospects. Some voices argue that evaluating Bitcoin’s performance in a post-2022 context should consider its outsized gains relative to gold and traditional assets, suggesting that the market’s recovery potential remains intact even after a difficult stretch. While sentiment among analysts fluctuates, the fact that a broad spectrum of commentators continues to discuss Bitcoin’s long-term trajectory hints at a market that is more nuanced than a straightforward bullish or bearish verdict.

The price action is clear: Bitcoin has shed nearly a quarter of its value in the last 30 days, with BTC trading around $70,537, according to CoinMarketCap. The linkage between ETF flows and price remains an evolving interplay, and investors are watching for how upcoming data and regulatory signals might shape the next leg of the cycle.

In the broader ecosystem, crypto analytics firms and market researchers have highlighted a pattern that may be drawing attention beyond immediate price moves. A widely cited analyst pointed out that the current period marks a historic phase in which consecutive outflows have occurred, raising questions about the implications for liquidity, volatility, and the resilience of BTC-linked products. Yet, this is not the first time the market has faced a testing environment, and some observers emphasize that Bitcoin’s fundamental narratives—scalability, network activity, and institutional adoption—remain central to the longer-term thesis.

Meanwhile, voices from the analytics community caution against a purely short-term lens. The market’s reaction to liquidity shifts, regulatory signals, and ETF flows can diverge from what is visible in day-to-day price movements. By examining the total inflows and outflows relative to the size of the market, investors can form a more balanced view of risk and opportunity in the BTC ETF space, rather than focusing solely on immediate losses or gains.

Eric Balchunas, a veteran ETF analyst, has emphasized that Bitcoin’s performance since 2022 has delivered outsized gains compared with gold and silver, arguing that those who judge BTC on a single year’s performance may be missing the broader arc. His comment underscores the importance of framing BTC’s story within a multiyear horizon, especially for investors considering exposure through spot BTC ETFs rather than direct spot markets. The ongoing debate about risk and return continues to shape how market participants approach BTC-focused ETFs and related products.

Ki Young Ju, CEO of CryptoQuant, summed up a meta-view that reflects a cautious mood among market participants: “every Bitcoin analyst is now bearish,” a remark that underscores the prevailing mood while leaving room for a counterpoint in a market that has historically proven contrarian at pivotal moments. The tension between bearish sentiment and the potential for a longer-term rebound remains a defining feature of BTC discourse as traders weigh the odds of a renewed upshift in price against continued macro uncertainty.

What to watch next

- Next wave of ETF flow data from Farside Investors and other researchers, which could show whether the contraction in inflows accelerates or stabilizes.

- Bitcoin price behavior over the next several weeks, particularly in response to macro cues and any regulatory developments impacting crypto markets.

- Further commentary from major ETF analysts and researchers on whether the current drawdown is a pause or the onset of a deeper correction.

- Updates on institutional participation in BTC-linked products, including any changes in flows into other crypto ETFs or related vehicles.

Sources & verification

- Preliminary net inflows data for spot BTC ETFs from Farside Investors (as cited in the article).

- Public X posts by James Seyffart discussing ETF holders’ performance and sentiment.

- Public X posts by Jim Bianco and Rand analyzing ETF holder underwater percentages and historical comparisons.

- Price data for Bitcoin from CoinMarketCap at the time of publication (BTC price around $70,537).

- Comments from Eric Balchunas regarding BTC’s performance since 2022 relative to other assets.

- Ki Young Ju’s remarks from CryptoQuant on market sentiment.

Bitcoin ETF flows and price action amid a four-month decline

US-based spot BTC ETFs are navigating a difficult phase that has stretched over several months, marked by a meaningful rally-to-correction cycle that has dragged prices lower while inflows have not collapsed as some bears expected. The conversation among analysts centers on a paradox: even as many investors sit underwater, the aggregate posture remains constructive enough to sustain a broad layer of market liquidity and investor confidence. From the vantage point of ETF market structure, the persistence of holdings and the scale of inflows before October point to a durable base of participants who view BTC exposure as a core, long-term component of a diversified portfolio rather than a speculative, short-term bet.

As price action remains volatile, the ETF community continues to balance risk and opportunity. The data show that, despite the downturn, the community of ETF holders has not rushed to exit en masse. This behavior aligns with a longer-run thesis that Bitcoin, despite reputational cycles, has established a persistent presence in institutional portfolios. The tension between near-term losses and longer-term potential remains a central theme in assessing BTC’s role within the ETF ecosystem, with analysts urging caution not to conflate short-term price dynamics with the asset’s ultimate trajectory.

In practical terms, the ongoing observation is that ETF inflows, while reduced from peak levels, still reflect a non-negligible demand for BTC exposure. The numbers suggest a market that is not capitulating, even as the price declines continue. For traders and investors, the key takeaway is that the ETF framework provides a stable, regulated channel for exposure that can influence liquidity dynamics in ways that are distinct from the spot market alone. The evolving narrative around ETF flows—alongside Bitcoin’s price path and macro signals—will continue to shape market psychology and the pace of the next leg in BTC’s cycle.

For readers who want to verify the underlying data and quotes, the linked posts and price data points in this report provide direct sources. The discussion around ETF flows, price levels, and analyst commentary reflects a broad cross-section of market voices, each contributing to a composite view of a market that remains highly reactive to both micro and macro catalysts. As regulation, classification of crypto assets, and ETF product design continue to mature, observers anticipate that flows into BTC-linked vehicles will adjust in response to evolving expectations for risk, return, and liquidity in the crypto space.

The subscription template at the end of the article is included to reflect ongoing engagement opportunities for readers seeking deeper insights into crypto market dynamics.

Notes: The coverage above preserves the factual statements and linked references as presented, while restructuring them into a professional, journalistic narrative. No promotional boilerplate from the publisher is included in this rewritten article.

Crypto World

BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100

BitMine Immersion Technologies, the Ethereum-treasury company led by Fundstrat’s Tom Lee, is facing intensifying pressure after a sharp drop in ether prices pushed the firm deep into unrealized losses. As of Feb. 5, Ethereum fell to a local low of $2,092, leaving BitMine’s holdings of roughly 4.285 million ETH with a paper loss exceeding $7 billion, -45% on its holdings.

The company pivoted from Bitcoin mining to an aggressive “Ethereum-first” treasury strategy last summer, accumulating ETH at an estimated average cost between $3,800 and $3,900. With ETH now trading more than 50% below its August 2025 all-time high of $4,946, BitMine’s once $8.4 billion portfolio is significantly underwater, placing it at the center of one of crypto’s largest single-asset corporate bets.

BitMine and Strategy Both Under Water as Bear Market Deepens

The market reaction has been swift. BMNR shares have fallen alongside ETH, reviving comparisons with Michael Saylor’s Bitcoin-focused firm, Strategy (MSTR). However, both companies are now under pressure. Strategy is currently sitting on an unrealized loss of roughly $2.70 billion on its Bitcoin holdings, based on an average purchase price of $76,052 and a current BTC price near $70,500. MSTR shares are down about 9% in the past eight hours, erasing roughly $3.7 billion in market value.

While BitMine’s losses are larger in absolute terms, analysts note that both firms highlight the risks of concentrated treasury strategies tied to volatile crypto assets.

Tom Lee Stays Bullish Despite Drawdown

Despite the “eye-watering” figures, Tom Lee remains publicly undeterred. Earlier this week, Lee described the drawdown as “a feature, not a bug,” arguing that Ethereum’s long-term fundamentals remain intact. He pointed to record daily transactions of around 2.5 million and rising active addresses as evidence that network usage is diverging from price action.

Lee attributed recent weakness to a post-October deleveraging cycle and capital rotation into precious metals. BitMine has continued to double down, recently adding another 41,000 ETH to its balance sheet, even as the Ethereum-treasury narrative faces its most severe stress test to date.

The post BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100 appeared first on Cryptonews.

Crypto World

Why is Hyperliquid price up despite crypto market bloodbath?

Hyperliquid price is rallying against the market tide as institutional adoption and improving chart structure attract fresh buyers.

Summary

- HYPE gained 6% even as Bitcoin dipped below $72,000 and most majors fell.

- Institutional integrations and token utility developments lifted sentiment.

- Technical structure shows a confirmed trend shift with momentum favoring buyers.

Hyperliquid was trading around $34.96 at press time, up 6% in the past 24 hours, even as the crypto market sold off sharply. Bitcoin briefly slipped below $72,000, and most large-cap tokens traded lower.

Hyperliquid (HYPE), however, has moved in the opposite direction. The token is up 1.5% over the past seven days and has gained 29% over the last month, standing out during a period of heavy market pressure.

Derivatives data points to cooling leverage rather than panic buying. Open interest fell 2.42% to $1.55 billion, while trading volume decreased 31% to $4.06 billion, according to CoinGlass data.

This often indicates that traders are lowering their exposure rather than chasing gains, which can keep the price stable during volatile sessions.

Why is Hyperliquid price rising?

Several developments have raised short-term demand. On Feb. 4, Ripple announced that Ripple Prime, its institutional brokerage platform, had added support for Hyperliquid.

The integration allows institutions to access on-chain perpetuals and derivatives on Hyperliquid while managing risk alongside traditional assets such as FX and fixed income.

The news was met with a positive market response, lifting HYPE even as selling pressure persisted across the crypto market. While the integration does not directly benefit XRP or rely on the XRP Ledger, it will boost HYPE which is at the centre of perps trading activity.

Another development followed the same day. Hyperion DeFi Inc. (NASDAQ: HYPD), a publicly traded digital asset treasury focused on Hyperliquid, said it plans to use its HYPE holdings as options collateral.

The company said it isn’t engaging in directional bets. Instead, the strategy focuses on earning income from options premiums and fees, together with staking rewards. Hyperion is working with Rysk protocol to launch an on-chain options vault directly on Hyperliquid.

Over time, the vault could be opened to other institutional HYPE holders. By putting more tokens into structured products and reducing the liquid supply, this strategy might support the token’s price.

Another protocol update that has garnered attention is HIP-4. The plan introduces fully collateralized “outcomes” trading for products that resemble options and prediction markets. The feature is designed to appeal to traders who prefer defined risk during volatile periods.

HIP-4 comes after previous improvements that enabled permissionless markets for crypto, equities, and commodities. With over $1 billion in open interest, nearly $5 billion in daily volume, and a massive rise in weekly transactions since those updates, Hyperliquid has seen strong network growth.

An upcoming token unlock on Feb. 6, releasing about 9.92 million HYPE worth roughly $300 million, has so far failed to unsettle buyers. Previous unlocks were absorbed without sharp pullbacks, which has helped calm concerns.

Hyperliquid price technical analysis

After months of steady decline, HYPE has shifted structure. A distinct shift in trend behavior is visible as the price recovered the mid-Bollinger Band and remained above it. The recent pullback formed the first higher low since November, flipping the structure from bearish to neutral-bullish.

Price has pushed above the upper Bollinger Band with strong closes rather than thin wicks. Volatility bands have turned upward, and the 20-day moving average now acts as support instead of resistance. The relative strength index has moved into the 60–70 range, holding above its signal line.

HYPE also cleared the $32–$33 resistance zone and has stayed above it, suggesting acceptance at higher levels. Overhead supply looks limited until the $40 area.

Holding above $32 keeps momentum intact and allows a move toward $38–$42 if market conditions stabilize. A drop back below $32 could pull the price toward $27–$28, where trend support would be tested.

Crypto World

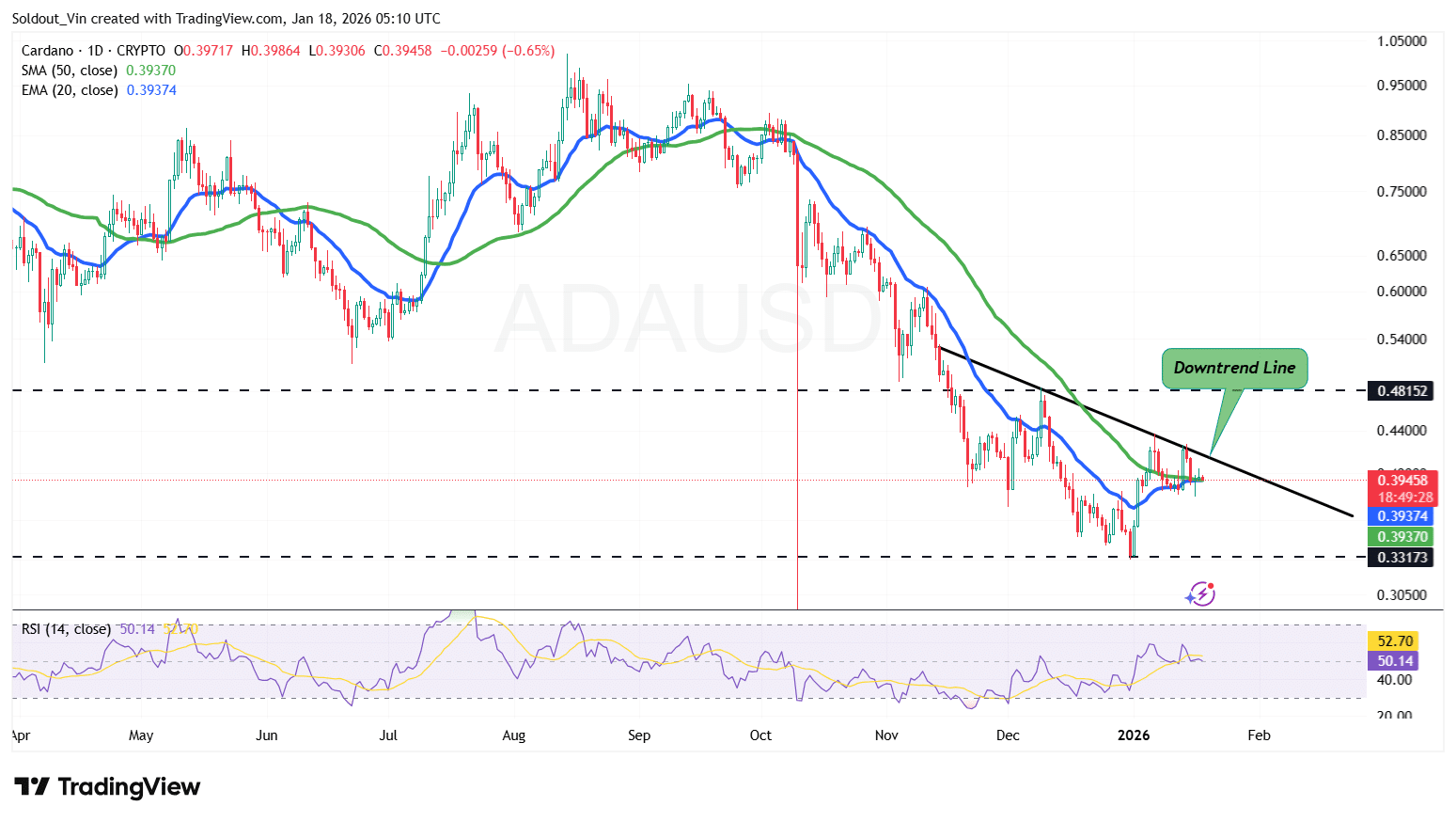

Cardano Whales Stack 210M ADA, Igniting $1 Recovery Hopes

Join Our Telegram channel to stay up to date on breaking news coverage

Cardano continues to trade in a massive drawdown even after rebounding from the $0.30 lows. However, fresh on-chain data shows whales are back to aggressively buying ADA alongside other altcoins.

Large holders have stacked another significant volume in recent weeks, signaling renewed conviction despite broader market pressure.

This accumulation, combined with tightening supply and improving technical setups, is once again fueling speculation of a stronger recovery push toward higher levels.

With interest creeping in, can it sustain a bullish sentiment for Cardano’s price?

According to data from Ali Martinez, a popular analyst on X, whales have bought 210 million Cardano tokens over the past three weeks. This level of accumulation signals strong interest from large holders.

210 million Cardano $ADA bought by whales in the past three weeks! pic.twitter.com/Mqq4xdQGSK

— Ali Charts (@alicharts) January 17, 2026

In one of the latest buys, a whale deposited $7.9 million USDC into the Hyperliquid exchange, buying 6.46 million ADA for a position worth about $2.50 million.

Whale activity is an indicator of informed money, suggesting the Cardano token price could be gearing up for a rally.

ADA Volumes Increase In The Derivatives Market

Cardano is seeing increased volume in the derivatives market, with traders now watching what comes next for its price.

Data from Coinglass shows that Cardano has increased 10,654% in futures volume on the Bitmex exchange, reaching $40.04 million.

Cardano’s derivatives have benefited from a surprisingly high boost.

The BitMEX futures have expanded by an extraordinary 10,654% to a whopping $40 million, in conjunction with a looming listing of $ADA futures by @CMEGroup. The institutional appetite is evidently waking up. A… pic.twitter.com/QmNDacBvpQ

— Mentor (@CardanoMentor) January 17, 2026

This indicates a surge in activity in the derivatives market, given that Bitmex is a major derivatives exchange.

Can ADA Rally To $1?

Cardano’s price is currently consolidating near the $0.39–$0.40 region, holding above the short-term support zone at $0.33–$0.35, which buyers have defended following the recent sell-off.

This stabilization followed a sharp decline from the October highs, with demand stepping in near $0.33, a historically significant support level. The bounce from this area suggests selling pressure is easing, although bullish conviction remains cautious.

ADA is trading around the 20-day EMA (~$0.39) but remains below the 50-day Simple Moving Average (SMA) near $0.48, which continues to act as a key overhead resistance. The downward slope of the 50-day SMA suggests the broader trend remains bearish unless ADA can reclaim and hold above this level.

Cardano’s Relative Strength Index (RSI) is hovering around 52, sitting near the neutral zone. This reflects modest momentum recovery without signs of overbought conditions, meaning price has room to move higher if buying strength increases.

From the 1-day ADA/USD chart perspective, Cardano could attempt a move toward the $0.45–$0.48 resistance zone, where the downtrend line and the 50-day SMA converge. A clean breakout above this area would be the first meaningful signal of a trend shift and could open the door for a move toward $0.60 in the medium term.

For ADA to realistically target $1, the price would need a sustained trend reversal, including a break above its resistance around $0.54.

Conversely, failure to break above the downtrend resistance could trigger another pullback, with $0.35 as initial support, followed by the $0.33 demand zone if selling pressure returns.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

BTC, SOL, UNI, PUMP slide

Crypto prices today are in the red as forced liquidations and weak demand pushed major tokens lower.

Summary

- Extreme fear dominated sentiment, with the Fear & Greed Index at 12.

- Analysts see $70,000 as the next key level for Bitcoin.

- Short-term recovery possible if BTC holds $72,000–$74,000 and spot inflows resume.

At press time, total crypto market capitalization was down 4.4% to $2.35 trillion. Bitcoin fell 5.5% in the past 24 hours to $73,103. Almost all top 100 altcoins were in the red.

Solana briefly slipped below $90, a level last seen in 2024, and was trading at $91, down 7.6%. Uniswap declined 3% to $3.78, while Pump.fun dropped 6% to $0.002271.

Alternative’s Fear and Greed Index fell two points to 12, remaining in the extreme fear range. The average relative strength index across the market was at 40, showing weak short-term momentum.

In addition, total open interest fell 4% to $106 billion, indicating continued deleveraging.

Liquidations put pressure on crypto prices

Much of the selling pressure came from forced liquidations in leveraged futures and perpetual contracts. Traders holding highly leveraged long positions faced margin calls, leading exchanges to automatically close those positions. This added to the selling and contributed to cascading losses.

According to CoinGlass data, long positions accounted for $520 million of the $650 million in total liquidations, which rose by 22% over the previous day. Since late January 2026, cumulative liquidations have now reached about $7 billion, contributing to a market capitalization drop of roughly $500 billion in the same period.

Open interest is now at multi-month lows in several markets, indicating that over-leveraged positions are being cleared.

Other pressures are coming from risk-averse behavior across financial markets. Crypto has moved alongside declines in technology stocks, mostly AI-related shares. Hawkish signals from the Federal Reserve, including expectations for higher interest rates for longer, have reduced liquidity and made speculative assets less attractive.

Institutional flows have weakened as well. Spot Bitcoin exchange-traded funds have seen outflows in recent weeks, while a negative Coinbase premiums and selling by large holders has added steady pressure.

Short-term outlook and analyst views

The short-term outlook for crypto is cautious. Bitcoin has broken support in the $75,000–$78,000 range, and many analysts are watching $70,000 as the next test level. If the price falls below that, it could move toward $65,000–$68,000 if selling intensifies.

On the upside, a hold above $72,000–$74,000 could allow a relief rally toward $82,000–$88,000 by late February. Liquidity is thin, and market swings could be sharp if macroeconomic news or Fed updates influence sentiment.

Polymarket odds now show an 82% probability of Bitcoin falling below $70,000. Analysts at Citi noted that slowing spot ETF inflows and regulatory uncertainty could push Bitcoin toward that level. In a February 4 report, Citi highlighted that the average entry price for spot ETF investors is $81,600.

Compared with gold, which has gained amid geopolitical concerns, Bitcoin is more sensitive to liquidity and risk appetite. According to Citi, delays in the U.S. CLARITY crypto bill and shrinking liquidity from the Federal Reserve are also adding pressure.

As of now, traders are watching closely to see whether oversold conditions and historical February trends will create opportunities for short-term relief.

Crypto World

Zama Token Debuts at $400 Milion Valuation

ZAMA is currently trading 30% below its ICO price.

Zama’s highly anticipated $ZAMA token has made headlines as the first production-scale use of Fully Homomorphic Encryption (FHE) on the Ethereum mainnet.

However, the token is currently trading at $0.035, marking a 30% decrease from its initial coin offering (ICO) price).

Zama’s auction format was notable for its confidentiality features. The token sale raised $118.5 million through a sealed-bid Dutch auction, using Zama’s technology to protect the privacy of participants’ bids.

Zama’s focus on FHE is part of a broader strategy to enable confidential smart contracts on Ethereum. This technology enables computation on encrypted data without first decrypting it, enhancing privacy for blockchain applications.

This article was generated with the assistance of AI workflows.

Crypto World

Trump-Linked World Liberty Financial Draws House Scrutiny After $500M UAE Stake Revealed

A US House investigation has turned its focus to World Liberty Financial, a Trump-linked crypto venture.

The move follows a recent Wall Street Journal report of a $500M UAE-linked stake agreed shortly before President Donald Trump’s inauguration.

Rep. Ro Khanna, a Democrat from California and the ranking member of the House Select Committee on the Chinese Communist Party, on Wednesday sent a letter to World Liberty co-founder Zach Witkoff seeking ownership records, payment details and internal communications tied to the reported deal and related transactions.

Khanna wrote that the Journal reported “lieutenants to an Abu Dhabi royal secretly signed a deal with the Trump Family to purchase a 49% stake in their fledgling cryptocurrency venture [World Liberty Financial] for half a billion dollars” shortly before Trump took office.

He argued the reported investment raises questions about conflicts of interest, national security and whether US technology policy shifted in ways that benefited foreign capital tied to strategic priorities.

Meanwhile, Trump has said he had no knowledge of the deal. Speaking to reporters on Monday, he said he was not aware of the transaction and noted that his sons and other family members manage the business and receive investments from various parties.

Crypto Venture Deal Draws Scurinty Over AI And National Security Policy Intersection

The letter also linked the reported stake to US export controls on advanced AI chips and concerns about diversion to China through third countries.

Khanna said the Journal report suggested the UAE-linked investment “may have resulted in significant changes to U.S. Government policies designed to prevent the diversion of advanced artificial intelligence chips and related computing capabilities to the People’s Republic of China.”

According to the Journal account cited in the letter, the agreement was signed by Eric Trump days before the inauguration.

The investor group was described as linked to Sheikh Tahnoon bin Zayed Al Nahyan, the UAE national security adviser. Two senior figures connected to his network later joined World Liberty’s board.

USD1 Stablecoin Use Raises Questions Over Influence And Profits

Khanna’s letter pointed to another UAE-linked deal involving World Liberty’s USD1 stablecoin, which he said was used to facilitate a $2B investment into Binance by MGX, an entity tied to Sheikh Tahnoon. He wrote that this use “helped catapult USD1 into one of the world’s largest stablecoins”, which could have increased fees and revenues for the project and its shareholders.

The lawmaker also connected the Binance investment to later policy developments, including chip export decisions and a presidential pardon for Binance founder Changpeng Zhao.

He cited a former pardon attorney who said, “The influence that money played in securing this pardon is unprecedented. The self-dealing aspect of the pardon in terms of the benefit that it conferred on President Trump, and his family, and people in his inner circle is also unprecedented.”

Khanna framed the overall picture as more than political optics. “Taken together, these arrangements are not just a scandal, but may even represent a violation of multiple laws and the United States Constitution,” he wrote, citing conflict-of-interest rules and the Constitution’s Foreign Emoluments Clause.

Khanna Warns Of National Security Stakes In WLFI Case

He asked World Liberty to answer detailed questions and produce documents by March 1, 2026, including agreements tied to the reported 49% stake, payment flows, communications with UAE-linked representatives, board appointments, due diligence and records tied to the USD1 stablecoin’s role in the Binance transaction.

Khanna also pressed for details on any discussions around export controls, US policy toward the UAE and strategic competition with China, as well as communications related to President Trump’s decision to pardon Zhao.

The probe lands at a moment when stablecoins sit closer to the center of market structure debates, and when politically connected crypto ventures face sharper questions about ownership, governance and access.

Khanna closed his letter with a warning about the stakes, writing, “Congress will not be supine amid this scandal and its unmistakable implications on our national security.”

The post Trump-Linked World Liberty Financial Draws House Scrutiny After $500M UAE Stake Revealed appeared first on Cryptonews.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech23 hours ago

Tech23 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards