Crypto World

Russia Blocks WhatsApp to Push Surveillance App, Company Claims

WhatsApp, the messaging app owned by Meta, is at the center of a high-stakes regulatory clash as Moscow pushes a domestic alternative and tightens control over digital communication. In recent days, the company publicly accused the Russian government of attempting to block access for millions of users to steer them toward a state-owned substitute. The dispute unfolds as Russia advances a homegrown platform, Max, developed by VK, and seeks to entrench it as the official backbone for private messaging inside the country. The government’s aim is amplified by directives to pre-install Max on all smartphones sold in Russia, a move scheduled to take effect on Sept. 1, and by a broader push to curb reliance on Western platforms amid ongoing regulatory scrutiny.

Key takeaways

- WhatsApp alleges Russia is attempting to isolate over 100 million users from private and secure communication, describing the move as a setback to digital safety.

- Max, announced by VK and described as a state-backed alternative to WhatsApp and Telegram, began rolling out in March 2025 and is being mandated for pre-installation on new devices starting Sept. 1.

- Backlinko estimates Russia hosts about 72 million active monthly WhatsApp users, placing the country among the top markets for the app outside the usual leaders.

- Russian authorities have signaled that unblocking WhatsApp would require compliance with local laws and a willingness to negotiate, signaling a potential but uncertain path to access restoration.

- Beyond Russia, authorities in other countries have intermittently restricted messaging services during periods of conflict or political upheaval, highlighting a broader trend in digital sovereignty and governance.

Sentiment: Neutral

Market context: The episode sits at the intersection of tech policy and geopolitical risk, illustrating how regulatory actions aimed at domestic control of communications can ripple through the broader digital ecosystem, including networks that crypto services rely on for open, cross-border activity. It underscores a growing attention to data localization, interoperability, and platform sovereignty that could influence global tech and financial ecosystems.

Why it matters

The confrontation between WhatsApp and Russia’s state-backed messaging initiative underscores a fundamental tension between user safety, privacy, and state interests. By introducing Max as a domestically controlled alternative, Moscow is signaling that access to private communication platforms is not simply a consumer choice but a matter of national policy. The move could reshape how Russians communicate, store sensitive information, and interact with businesses, while also raising questions about data localization, resilience, and security in a landscape where private messaging has become a critical utility for personal and professional life.

For international platforms, the Russian example highlights the costs and friction of compliance in a regulated environment that prizes sovereign control over digital infrastructure. The push to pre-install Max on all devices introduces a form of interoperability risk and raises concerns about interoperability with foreign networks, encryption standards, and user consent. Companies that operate across borders must navigate a patchwork of rules, sometimes in real time, which can affect everything from customer support to data flows and incident response protocols. The situation also hints at potential regulatory spillovers to adjacent technologies, including decentralized and cross-border services that crypto projects rely on to maintain open access and censorship resistance.

From a safety and governance perspective, the Russian case illustrates why policymakers abroad are investing in formal mechanisms to manage online communications. The tension between allowing free, secure messaging and enforcing content or data requests from law enforcement creates a persistent policy dilemma. In markets where crypto and blockchain technologies are gaining traction, observers will be watching to see how such regulatory dynamics influence the development of compliant, privacy-preserving communication tools and infrastructure that can withstand political pressure while preserving user trust.

The broader pattern is not limited to Russia. Reports from other countries describe a spectrum of actions—from partial restrictions to complete takedown attempts—that governments have employed during moments of political contention. The dialogue around messaging sovereignty compounds existing concerns about censorship, access to information, and digital rights. For users, this can mean unpredictability in service availability, the need for alternative channels, or the adoption of independent or decentralized messaging solutions as a hedge against outages or coercive controls.

On the technical front, the unfolding dynamic may accelerate innovation in how platforms approach data localization, compliance tooling, and cross-border interoperability. It also raises practical questions for developers, such as how to design communication apps that can operate seamlessly across multiple legal regimes without compromising user safety or security. While the immediate focus is regional, the implications reverberate through any ecosystem that depends on reliable, private messaging as a backbone for collaboration, financial transactions, or sensitive communications—an area where crypto communities have long stressed the importance of resilient, permissionless networks even as regulators seek to impose order and accountability.

What to watch next

- Sept. 1, 2025 — Russia’s mandatory pre-installation of Max on all smartphones takes effect, elevating the platform’s installed base and potentially altering user behavior during the ongoing policy debate.

- End of 2026 — Official signals from Moscow suggest a possible complete blocking of WhatsApp if compliance with national laws does not align with the state’s terms.

- February 2026 — Public commentary and further reporting on whether WhatsApp remains accessible or experiences domain-level restrictions within Russia, including official statements from the presidential administration or regulatory bodies.

- Regulatory actions and negotiations — Any new statements from Russia’s negotiation channels or law-enforcement agencies that clarify the conditions under which foreign messaging services could regain access or be forced to alter operational practices.

- Comparative developments — Monitoring similar moves in other jurisdictions to assess how messaging sovereignty affects global platforms, user experience, and cross-border data flows.

Sources & verification

- Gazeta.ru: Russia reports that WhatsApp’s domain had been blocked and would require VPN or similar workaround to access. https://www.gazeta.ru/tech/news/2026/02/11/27830761.shtml

- TASS: Presidential press secretary Dmitry Peskov commented that unblocking WhatsApp would require the app to follow Russian laws and engage in negotiations. https://www.gazeta.ru/tech/news/2026/02/12/27832279.shtml?utm_source=chatgpt.com&utm_auth=false

- Backlinko: Estimates of Russia’s active WhatsApp user base, highlighting a sizable market. https://backlinko.com/whatsapp-users

- WhatsApp on X: Official status update from the messaging platform regarding Russia’s access measures. https://x.com/WhatsApp/status/2021749165835829485?s=20

- Related coverage and context: Afghanistan internet outage and blockchain decentralization discussion. https://cointelegraph.com/news/afghanistan-internet-outage-blockchain-centralized-web

Digital friction in Russia’s messaging ecosystem: implications for users and global platforms

The dispute over WhatsApp and the push for a state-backed alternative in Russia crystallizes how policy choices can redefine the digital landscape that users rely on every day. The government’s insistence on pre-installation and on maintaining control over messaging channels is rooted in a broader imperative to keep communications within national boundaries, a stance that has long resonated with policymakers across different regions and sectors, including finance and crypto. While the immediate stakes involve access to a popular app and the safety of private conversations, the longer arc concerns how digital infrastructure is governed, who bears responsibility for safeguarding data, and how open networks can survive attempts at centralization.

For users in Russia, the outcome may hinge on a balance between safety assurances and the practicality of maintaining private, secure conversations in a domestic environment. The presence of a government-backed platform could improve certain regulatory alignments but might also introduce new layers of surveillance or compliance expectations. In contrast, WhatsApp’s contention that the move would “isolate over 100 million users” emphasizes concerns about user autonomy and the resilience of cross-border communication in the face of coercive policy changes. The debate has implications that extend beyond messaging to how crypto ecosystems—built on permissionless networks that assume open access—are perceived when governments seek to exert tighter control over digital channels and data flows.

From a business and innovation standpoint, the Max initiative raises questions about interoperability and the economics of protocol choices in a regulatory environment. Domestic platforms can attract usage through convenience and policy compliance, but they may also risk fragmentation, reduced interoperability with global services, and increased costs for developers who must adapt to multiple rule sets. For the broader tech community, the gambit signals a need to design systems and user experiences that maintain robust privacy protections while meeting diverse regulatory requirements. The lessons learned from Russia’s approach could influence the development of new messaging tools, privacy-preserving features, and strategies to ensure user safety without sacrificing openness—an objective that remains central to many crypto advocates who champion secure, censorship-resistant networks.

Ultimately, the case highlights how control over digital communications remains a strategic frontier for governments and tech firms alike. It also serves as a reminder for users and investors to monitor regulatory trajectories and policy signals, as these can have spillover effects on adjacent sectors that depend on stable, accessible online infrastructure. Whether by design or accident, policy choices in one major market can catalyze shifts in how people communicate, how services are delivered, and how new technologies—such as decentralized tools or crypto-enabled platforms—are perceived and adopted in the years ahead.

What to watch next

- Sept. 1, 2025 — Max becomes the default pre-installed option on new smartphones in Russia, solidifying its installed base.

- End-2026 — Official statements or regulatory actions that could signal a complete blocking of WhatsApp if compliance terms are not met.

- February 2026 — Ongoing reporting on access to WhatsApp in Russia, including potential official clarifications or statements from Moscow.

- Regulatory updates — Any new measures that define how foreign messaging platforms must operate within Russia’s legal framework.

Crypto World

Bitcoin Trading With Tech Stocks Narrative is Overstated: NYDIG

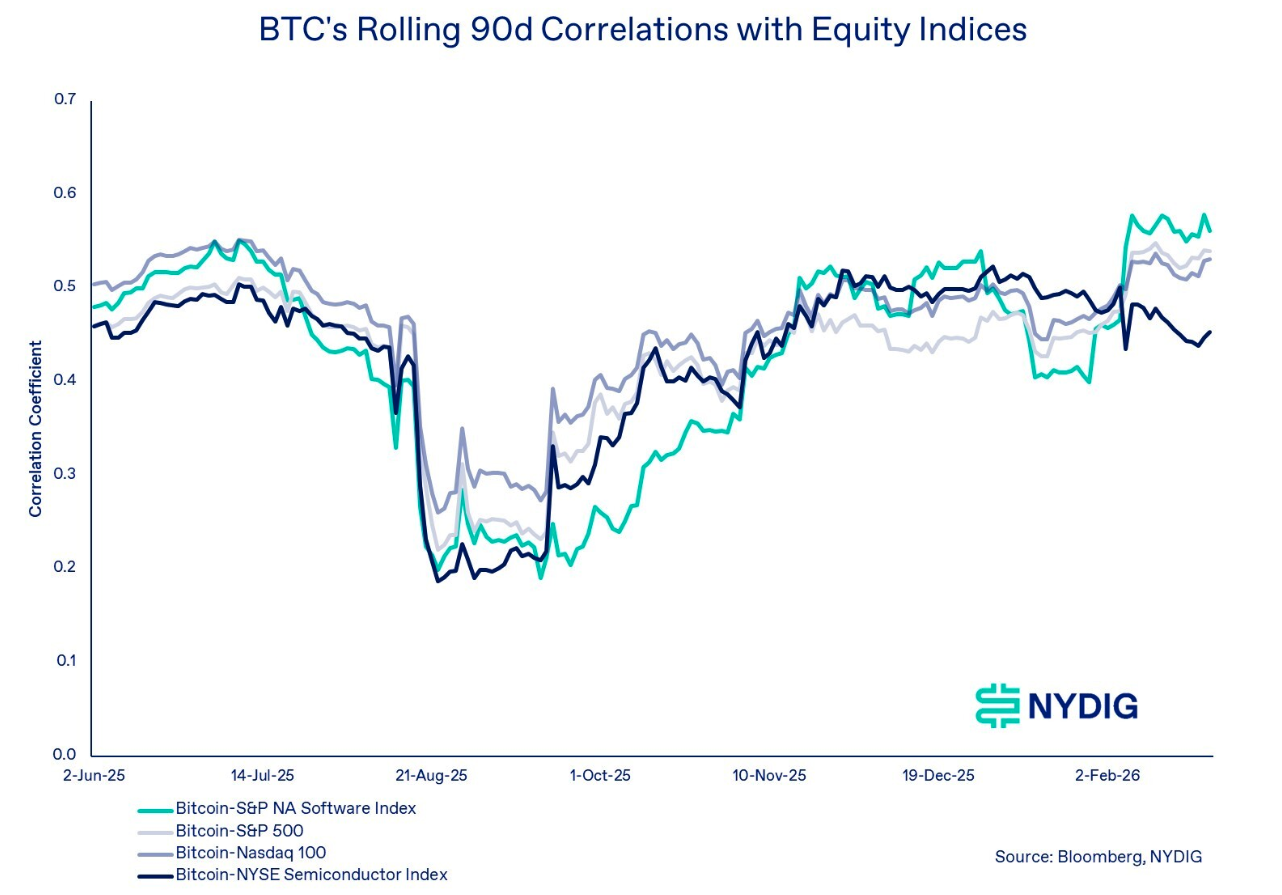

Bitcoin’s recent parallel movement with US software stocks is more of a case of shared exposure to macro events, rather than any structural convergence, according to financial services company NYDIG.

In the past week, Bitcoin (BTC) rallied alongside US software stocks, leading many to claim the cryptocurrency was a proxy for the sector, Greg Cipolaro, the head of research at NYDIG, said in a note on Friday.

“While the visual fit of their indexed price is compelling, the conclusion that Bitcoin and software equities have structurally converged, or that they share common exposure to themes such as AI or quantum risk, is overstated,” he said.

Cipolaro added the tandem rally “more plausibly reflects shared exposure to the current macro regime, specifically long-duration, liquidity-sensitive risk assets, rather than evidence of a structural convergence between Bitcoin and software equities.”

Bitcoin’s price is “unexplained by equities”

Bitcoin’s correlation with software stocks has increased on a 90-day rolling basis since its all-time high above $126,000 in early October, but Cipolaro said its correlations with the S&P 500 and Nasdaq have also recently risen, indicating that “the change is not isolated to software stocks.”

However, even with Bitcoin’s correlations to software stocks and the two indices, “the majority of Bitcoin’s price movement remains unexplained by equities,” Cipolaro added.

He said that, statistically measured, only a quarter of Bitcoin’s price movements are explained by a correlation to the stock market, while at least 75% of its movements are affected by drivers outside traditional stock indices.

Cipolaro said it appears Bitcoin is not being priced as a hedge against macroeconomic conditions, which explains “the ongoing frustration around Bitcoin’s failure to ‘act like gold’ despite the digital gold label.”

Related: Bitcoin drops 2% as oil prices surge on energy shortage fears

He added that traders appear to be allocating to assets along a risk curve, rather than buying Bitcoin for a “distinct monetary thesis.”

Cipolaro argued, however, that Bitcoin has a distinct market structure and economic drivers, pointing to its network activity and adoption trends, along with regulatory and policy developments that make it different from other assets.

“That differentiation supports bitcoin’s role as a portfolio diversifier,” he said. “While cross-asset correlations with equities are currently elevated, they remain far from determinative of bitcoin’s returns.”

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

US Banks Need Clear Crypto Rules to Stay Ahead, ex-CFTC chair says

US banks are the ones most in need of crypto regulatory clarity, according to Chris Giancarlo, former chairman of the US Commodity Futures Trading Commission, who argues that they risk falling behind the rest of the world in payment innovation.

During an episode of Scott Melker’s The Wolf Of All Streets Podcast on Sunday, Giancarlo said the crypto industry will continue to build, even if the Senate’s crypto market structure bill doesn’t pass. However, banks will be hesitant to invest in the technology without clear rules.

“The banks, however, can’t afford regulatory uncertainty. Their general counsels are telling their boards, you can’t invest billions of dollars in this… unless you’ve got regulatory certainty. The banks need this more than crypto,” he said.

“I think there’s a recognition that this is the new architecture of finance and America, our financial institutions are the world’s dominant financial institutions. We need to modernize that. We need to adopt this technology.”

US banks will fall behind if they wait too long on crypto

The crypto market structure bill, known as the CLARITY Act, has stalled in the Senate as banks, crypto firms, and lawmakers have yet to agree on crucial provisions such as whether to allow stablecoin yields.

Giancarlo warned that if US banks delay crypto adoption much longer, other countries in Asia and Europe will move ahead, leaving the American banking system behind.

“Digital rails will be built. And then the American banks will say, whoa what happened here? Our analogue identity-based, message-based system is no longer working anywhere outside the US, we need to modernize. They’ll be on the back foot,” he said.

“The banks need this clarity because they need to build this, they need to be in the forefront, not in the rear guard of this innovation,” Giancarlo added.

CLARITY Act failure could prompt workarounds

The crypto market structure bill passed the House of Representatives in July 2025 and has been referred to the Senate Committee on Banking, Housing, and Urban Affairs before a potential full Senate vote, according to Congress.

Related: Crypto industry split over CLARITY Act after Coinbase breaks ranks

If the bill passes the Senate, it will go to US President Donald Trump for signature. If it fails or is not signed, Giancarlo said SEC and CFTC leaders would likely step in to establish rules independently.

“If it doesn’t get done, I do believe that under leaders like Paul Atkins at the SEC and Mike Selig at the CFTC, they will write the kind of rules that will make this work for now. They won’t have the support of legislation that makes it work forever or at least into the next presidential cycle, but it’ll make it work for now,” he said.

“Now, does that give the industry the certainty they want? No. And who needs that certainty more than the banks? Crypto doesn’t need it. They were building even under the whip hand of Gary Gensler.”

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Oil futures surge 20% past $110 as war fears hammer Asian stocks, bitcoin steady near $67K

Oil futures surged above $110 a barrel Monday as escalating tensions in the Middle East rattled global markets, sending Asian stocks sharply lower, with all of the region’s markets opening deep in the red, even as bitcoin held steady near $67,000.

West Texas Intermediate crude jumped roughly 17% in 24 hours. Japan’s Nikkei 225 fell more than 6% and South Korea’s Kospi dropped about 8% as traders repriced energy costs across import-dependent economies.

The rally centers on the risk that fighting could restrict oil flows near the Strait of Hormuz, the chokepoint through which roughly 20% of global crude supply passes daily. Prediction markets on Polymarket assign a 76% probability that crude reaches $120 by the end of March.

Bitcoin traded around $67,000 with little sign of panic selling. Ether and solana posted modest gains, suggesting crypto markets have so far treated the spike as an energy-specific shock rather than a broad risk-off event.

Not all traders are convinced the move has legs. Funding rates on oil perpetual futures turned negative on Hyperliquid, indicating significant positioning for a pullback even as spot prices climb.

Markets still see little chance of an imminent rate cut.

Contracts on Polymarket show a roughly 98% probability that the Federal Reserve leaves rates unchanged at its March 18 meeting, with only about a 12% chance of a 25-basis-point cut by the end of April.

A sustained rally in crude would reinforce inflation pressures, something that the Fed would have to consider when setting rates.

Crypto World

Bitcoin Bull Trap Forms as Bear Market Enters Mid-Phase, Willy Woo

Bitcoin outlook remains mixed as on-chain analyst Willy Woo warns of a potential bull trap ahead of a broader downtrend return. In a Saturday post on X, Woo cautioned that a short-lived breakout could lure investors into believing a sustainable rally is underway, potentially persisting into the end of April. His assessment centers on liquidity dynamics rather than price levels, suggesting that if fresh capital returns with patient, long-term investors, the view could shift. The door for a test of resistance remains open, but the broader context continues to tilt toward a bear market narrative, with price action and flow data painting a sobering picture for near-term bulls.

From a long-range liquidity perspective, Bitcoin (CRYPTO: BTC) is described as being “solidly in the middle of its bear market.” Woo noted that after swift downward moves, BTC often enters a sideways phase during which resistance is tested but not decisively breached. The comments come as Bitcoin trades around $67,012, a level cited by market trackers after it slid from October’s all-time highs near $126,000. The retreat marks a loss of roughly 46.82% from the pinnacle, underscoring the depth of the bear cycle. While a brisk rally could form a temporary countertrend, the broader trajectory remains bearish until liquidity conditions brighten and longer-horizon buyers re-emerge with conviction.

Despite the fresh pullback and the struggling price action, some investors have pointed to a return of flows in a more constructive light. Woo has stressed that inflows from longer-term holders could alter the outlook, but the current signal is still dominated by liquidity constraints rather than outright bullish catalysts. Other analyses echo a cautious stance: Santiment highlighted a pattern where whales have been selling while retail buyers accumulate near the $70,000 zone, a dynamic that historically signals that the correction could extend further before a durable bottom is formed. The firm’s assessment, noted in commentary on the broader market, aligns with a tendency for significant holder activity to precede any sustained upturn rather than a rapid, self-sustained rally in the near term.

Bitcoin is “solidly” in the middle of a bear market

Willy Woo’s liquidity-centric view sits alongside a broader cadre of voices that view Bitcoin as mired in a structural bear phase. He argued that the most decisive moves tend to unfold after liquidity cycles shift—not solely after price tests or chart patterns. “Typically, after fast downward flushes like we have had, BTC likes to go sideways and mount a rally where resistance is tested,” Woo said, articulating a mechanism by which a surface-level bounce can obscure the continuing risk of a deeper retracement. For investors watching the tape, the implication is that any up-leg must be judged within the context of liquidity healing and the willingness of patient capital to participate meaningfully.

Data points reinforce the bearish backdrop. Bitcoin has retraced from its October peak, and the market has witnessed a broad risk-off mood that has persisted through much of the current cycle. As of the time of publication, CoinMarketCap prices pegged BTC in the mid-$60,000s, reflecting the struggle to sustain a meaningful break above key resistance zones. The combination of a deeply entrenched downtrend and limited willingness among market participants to chase momentum complicates the odds of a durable recovery in the near term. The ongoing debate about whether this cycle marks the start of a new bull phase or a protracted bear market continues to polarize analysts, with some arguing for a secular low kind of consolidation before new highs can be revisited.

In a separate line of analysis, CryptoQuant underscored that “Bitcoin is still in a bear market despite the recent rally,” a reminder that price gains do not, by themselves, confirm a reversal of the longer-term trend. The nuance matters for traders who historically watch on-chain indicators for liquidity shifts and capitulation signals rather than purely price action. The fear-and-greed gauge recently registered a retreat into extreme fear after a brief uptick, echoing the sentiment that the market remains skittish and hesitant to commit capital at elevated levels. This confluence of factors — on-chain dynamics, whale/retail flow patterns, and volatility in sentiment measures — helps explain why a meaningful up-leg may still be contingent on a more favorable liquidity backdrop and a broader shift in risk appetite among investors.

As the debate rages over Bitcoin’s four-year cycle and whether a new all-time high is on the horizon, the current data paint a cautious picture. The bear-market narrative is not purely a price story; it’s a liquidity story, a pattern of holder behavior, and an evolving sentiment environment that must align before bulls regain the upper hand. The interplay between on-chain signals, macro backdrop, and investor psychology will likely dictate whether the next several weeks bring a durable shift or another retest of the bear-market lows.

For readers seeking points of reference, Bitcoin’s price references persist in the public data feeds and price trackers, with CoinMarketCap offering a widely cited snapshot of levels around $67,000 to $68,000 in the current window. The ongoing discourse among analysts, from Woo to Santiment and CryptoQuant, illustrates the spectrum of views on whether a relief rally can morph into a lasting reversal or will fade under the weight of liquidity constraints and risk-off sentiment. The market remains at a crossroads where the outcome hinges on the balance between sellers’ conviction and new real long-term capital entering the space, a dynamic that will be critical to watch in the weeks ahead. For context on how the broader ecosystem is reacting to these signals, the fear-and-greed gauge, as well as coverage of spot ETF activity and related liquidity shifts, offer additional layers of insight into potential catalysts or headwinds for BTC in the near term.

Willy Woo’s perspective also sits within a wider chain of research into Bitcoin’s price dynamics and cycle theory. In particular, researchers have noted that the four-year cycle debate continues to generate discussion about whether macro timing, halving cycles, and investor behavior will align in a way that produces a new set of all-time highs. While the consensus remains unsettled, the prevailing view across a subset of on-chain analysts is that the market may see a period of consolidation and liquidity-driven volatility before any sustained upside materializes. The critical takeaway for traders is that the absence of a robust influx of patient capital reduces the probability of a clean breakout, even if a short-term rally captures attention and drives a temporary surge in volume.

Related:Bitcoin relief rally hits wall as spot ETFs log $228M in outflows

Crypto World

Bitcoin Falls 2% as Oil Prices Rally on Energy Shortage Fears

Bitcoin fell nearly 2% within a 15-minute window on Sunday as oil surged on escalating Middle East tensions, underscoring how energy-market shocks can ripple into the crypto space. Data from the decentralized derivatives platform Hyperliquid showed crude prices jumping from about $95 to $113.7 per barrel shortly after U.S. futures markets opened, driven by Iraq’s warning that roughly 3 million barrels per day of production could be disrupted amid Iranian threats against tankers in the Strait of Hormuz. The move marked the steepest one-day spike in oil in years, and it came as traders weighed the broader risk environment. In the immediate crypto reaction, Bitcoin briefly fell from $66,960 to $65,725 before rebounding toward $66,272 as funding and futures trading kicked in after the open.

Hyperliquid’s oil data also captured a later cooling, with prices easing back to around $105 per barrel, offering some relief to risk-assets that had roiled in the wake of the invasion-era proxy tensions. The narrative around energy and risk sentiment was already dynamic, as last week’s surge followed a broader fuel-price rally triggered by U.S.-Israel actions against Iran and the ensuing regional countermeasures. The same period saw Bitcoin rally off a dip, climbing from sub-$64,000 levels to roughly $73,770 mid-week after earlier volatility tied to geopolitical headlines, only to retreat again as the latest flare-ups unfolded. The price action illustrates a pattern where macro shocks can impose quick, non-linear moves on a market that remains highly sensitive to risk-off dynamics.

In a separate layer of context, former U.S. President Donald Trump commented that the run-up in oil prices would be temporary, arguing that any advance would come down quickly. “We figured oil prices would go up, which they will. They’ll also come down. They’ll come down very fast,” he told reporters, signaling to investors that energy-market pressures might ease, though the practical transmission to crypto markets remains nuanced. The broader environment—characterized by geopolitical risk, commodity volatility, and macro uncertainty—continues to shape crypto price formation in ways that can amplify short-term moves even as long-term narratives remain undecided.

Last week’s activity had already highlighted Bitcoin’s sensitivity to geopolitical risk. By midweek, the benchmark crypto had moved from a sub-$64,000 base to a recent peak near $73,770, a swing driven in part by headlines on Iran and allied regional actions. The latest cycle, however, shows a retreat from those highs, with the weekend data painting a more mixed picture as oil markets swung on supply expectations and geopolitical headlines. The net effect for the sector is a reminder that Bitcoin—often framed as a hedge by proponents—continues to trade in step with broader risk-on and risk-off cycles, even as its decoupling thesis remains a point of contention for researchers and market observers.

As traders digest the evolving scenario, several threads are converging: the reliability of energy supplies in a geopolitically tense region, the willingness of futures and options markets to provide liquidity during a flare-up, and the extent to which crypto markets price in these cross-asset risk factors. The oil-price path, with a peak well above $110 per barrel and subsequent consolidation around $105, acts as a barometer for how quickly risk appetite can toggle in digital-asset markets. For now, the price action around Bitcoin shows resilience after the initial decline, but the longer arc will depend on how the Strait of Hormuz risk evolves and how quickly production disruptions can be mitigated through alternative supply and policy responses.

Key takeaways

- Oil spiked to $113.7 per barrel after the open, driven by Iraq’s warning of potential disruptions in roughly 3 million barrels per day of output due to Iranian threats against tanker traffic in the Strait of Hormuz.

- Bitcoin traded a volatile path, dropping from about $66,960 to $65,725 during the early session before bouncing to roughly $66,272 as futures trading commenced.

- Oil prices later cooled to around $105 per barrel, offering a partial reprieve for risk assets amid ongoing geopolitical risk considerations.

- Bitcoin climbed through the prior week amid regional tensions, rising from below $64,000 to around $73,770, before retreating in the recent volatility cycle.

- Trump signaled that the move in oil would be temporary, a stance that markets weighed as they assessed the persistence of energy-market pressure and its impact on crypto liquidity and investor risk sentiment.

- The events underscore how energy-market dynamics and geopolitical risk can translate into rapid, cross-asset moves, including in digital assets and decentralized finance platforms.

Tickers mentioned: $BTC

Market context: The episode highlights how macro shocks—especially energy-market volatility tied to geopolitical frictions—can influence crypto liquidity and price action, even as investors weigh longer-term narratives around adoption, regulation, and institutional participation.

Why it matters

The weekend moves emphasize the ongoing sensitivity of digital-asset markets to macro developments. While Bitcoin has at times been framed as a hedge against traditional market risk, recent episodes suggest it remains intricately linked to broader risk sentiment, liquidity conditions, and policy signals. For traders and investors, the immediate takeaway is to monitor cross-asset channels—oil, credit, and equities—alongside crypto-specific indicators and on-chain signals to gauge potential follow-through in Bitcoin and related assets. Corporations, funds, and retail participants alike are watching how geopolitical risk translates into volatility across the crypto ecosystem, and how liquidity providers respond when traditional markets exhibit stress.

From a risk-management perspective, the situation underscores the value of diversification and hedging strategies that can operate across asset classes. It also raises questions about the resilience of crypto markets during sustained energy-price shocks and the potential for spillovers from geopolitical risk into DeFi protocols and spot markets. As observers track the evolving narrative—from tanker-route tensions to potential diplomatic or policy steps—the overall message is that crypto markets remain a dynamic and reactive frontier, where macro headlines can rapidly redefine sentiment and price trajectories.

What to watch next

- Oil price trajectory: Will prices stabilize near the $105–$110 range, or head higher if tensions persist or escalate further?

- Bitcoin price path: Will BTC hold above crucial levels around the mid-60,000s, or test new support as macro risk continues to shape liquidity?

- Geopolitical developments: Fresh statements or actions from Iraqi, Iranian, or regional actors that could affect oil flow and risk appetite.

- Market messaging: Any new commentary from policymakers or major financial institutions that might recalibrate energy and crypto risk premia.

Sources & verification

- Hyperliquid data on crude oil (OIL) price movements and intraday spikes in response to Middle East tensions.

- Iraq’s public warnings regarding potential disruptions to production in the context of Iranian threats against tanker routes.

- Bitcoin price moves described in the session, including the drop to $65,725 and rebound to $66,272 as U.S. futures opened.

- Historical context of Bitcoin’s rally in the prior week during geopolitical developments, with prices rising toward $73,770.

- Trump’s comments on oil-price dynamics and the implied expectation of a rapid reversion, as reported in the coverage.

- Related coverage: Iranian crypto outflows spike after geopolitical events (linked in the source material) for cross-verification of crypto-market responses to cross-border tensions.

Market reaction and key details

Bitcoin (CRYPTO: BTC) movements during the latest flare-up illustrate how crypto markets respond to energy-market volatility and geopolitical risk. After a sharp intraday dip, BTC retraced higher as futures and spot liquidity interacted with macro headlines. The oil market’s swing from the mid-$90s to well above $110 a barrel and back toward the $105 level served as a backdrop for a crypto market that continues to navigate evolving liquidity conditions, central-bank expectations, and the broader risk-on/off environment. The interplay between oil shocks and digital-asset pricing remains a focal point for traders looking to understand the sensitivity of decentralized markets to traditional macro indicators.

Why it matters

The episode reinforces that crypto markets are not insulated from real-world risk factors. Energy-price volatility can alter risk appetite, liquidity provision, and cross-asset correlations, influencing how quickly traders move in and out of Bitcoin and other digital assets. For long-term holders, the event highlights the importance of monitoring macro headlines and cross-market signals, as short-term volatility can be driven by geopolitical developments even when fundamental narratives for the technology remain intact. For builders and investors, it underscores the need for robust risk management, liquidity planning, and diversification strategies that can weather multi-asset shocks as geopolitical dynamics evolve.

What to watch next

- Watch oil-market action over the coming days for signs of sustained escalations or de-escalations, with attention to any new disruptions to supply or tanker traffic.

- Monitor Bitcoin price levels around critical thresholds (in the 60k–70k area) and the depth of liquidity during U.S. market hours.

- Track official statements and policy responses from Middle East stakeholders, which could alter energy-price expectations and risk sentiment.

Sources & verification

- Hyperliquid’s oil-price feed and its reported intraday spike to $113.7/bbl and later retreat to around $105/bbl.

- The Iraqi production-disruption warning related to Iranian threats against Strait of Hormuz traffic.

- Bitcoin price trail: decline to $65,725 and rebound toward $66,272 as U.S. futures markets opened.

- Mid-week Bitcoin rally to roughly $73,770 during the period of heightened geopolitical activity.

- Public commentary from Donald Trump regarding the oil-price trajectory and expected quick normalization.

- Related coverage on Iran-related crypto flows and broader regional developments for cross-verification of market responses.

Market reaction to oil shock and bitcoin price moves

In summary, the latest price action around Bitcoin and oil demonstrates the evolving dynamic between energy markets and digital assets. While Bitcoin has shown resilience at times, its short-term movements appear closely tied to macro risk signals, especially in moments of heightened geopolitical risk. As the situation continues to unfold, market participants should prepare for continued volatility and pay close attention to cross-market indicators that can illuminate the path forward for both energy prices and cryptocurrency prices.

Crypto World

Bitcoin Falls as Oil Prices Rise on Energy Shortage Fears

Bitcoin fell nearly 2% in just 15 minutes on Sunday while oil prices rose almost 20% as the escalating Middle East conflict prompted fears of a major supply shortage in the global energy market.

Data from decentralized derivatives platform Hyperliquid shows oil prices rose from $95 to $113.7 per barrel shortly after US futures markets opened, as Iraq warned that roughly 3 million barrels per day of production could be disrupted due to Iranian threats against tankers in the Strait of Hormuz.

It’s the highest price oil has reached since April 2022, a few weeks after Russia commenced its invasion of Ukraine, TradingView data shows.

The price of oil rose more than 30% last week after the US and Israel struck Iran, leading the war-torn nation to counterstrike against several of its Middle Eastern neighbors.

Bitcoin (BTC) fell from $66,960 to $65,725 by 10:30 pm UTC on Sunday as US futures markets opened before bouncing back up to $66,272 at the time of publication.

Hyperliquid data also shows that oil prices have cooled off to $105 per barrel.

Bitcoin climbed during the Middle Eastern conflict last week, which saw the death of Iranian Supreme Leader Ayatollah Khamenei, rising from below $64,000 to $73,770 by Wednesday.

But since then, Bitcoin’s price has fallen over the last four consecutive days.

Trump not worried about oil prices

Despite the boom in oil prices, Trump expects the rapid rise in oil prices to be short-lived:

“We figured oil prices would go up, which they will. They’ll also come down. They’ll come down very fast,” Trump told reporters on Saturday.

Related: Iranian crypto outflows spike 700% after US-Israeli airstrikes

Trump also shrugged off the idea that the US may need to tap its Strategic Petroleum Reserve, stating:

“We’ve got a lot of oil. Our country has a tremendous amount,” Trump said. “There’s a lot of oil out there. That’ll get healed very quickly.”

Magazine: South Korea gets rich from crypto… North Korea gets weapons

Crypto World

Vitalik Buterin Urges Crypto Community to Rethink Democratic Tools Amid Global Authoritarian Shift

TLDR:

- Vitalik Buterin warns that enthusiasm for DAOs, quadratic funding, and ZK voting tools is rapidly declining globally.

- Buterin contrasts the stable 2000s era of bold democratic vision with today’s chaotic, power-driven political landscape.

- He argues that democratic tools must now focus on consensus-finding rather than building hard binding governance mechanisms.

- Buterin calls for sanctuary tools that give politically vulnerable groups like Iranians a real, collective voice right now.

Vitalik Buterin, co-founder of Ethereum, has called for a fresh look at democratic tools across the blockchain space.

In a widely circulated post, he questioned the direction of DAOs, quadratic funding, and decentralized voting systems.

He noted growing disillusionment with democratic structures across political, corporate, and social media settings alike.

He also pointed to zero-knowledge proofs and artificial intelligence as powerful new resources for building more effective democratic mechanisms going forward.

Enthusiasm for Democratic Crypto Tools Is Fading

Vitalik Buterin recently raised concerns about declining interest in democratic tools across the crypto industry. He observed that enthusiasm for mechanisms like DAOs, quadratic voting, and ZK-based governance has dropped noticeably in recent years.

This shift, he argued, is not isolated to blockchain — it mirrors broader societal changes playing out globally.

Buterin pointed to what he described as an “authoritarian wave” affecting multiple areas of modern life. The trend is not confined to nation-state politics, he noted in his detailed post.

Corporations have increasingly become more founder-centric, and social media platforms have faced mounting public disillusionment as well.

He warned that defending democratic structures without offering a positive vision will ultimately prove insufficient. Buterin stated that such defense today carries the feel of conservatism rather than genuine progress.

He argued that if advocates only work to preserve the existing order, they will gradually lose ground to more aggressive and better-organized forces over time.

Stable vs. Chaotic Eras Shape What Democratic Tools Can Realistically Achieve

Buterin drew a clear contrast between the stable 2000s and 2010s and the chaotic conditions defining the 2020s. During the earlier decades, large-scale democratic visions seemed genuinely achievable and attracted widespread interest from builders.

Ambitious goals like global UBI, DAO-funded public goods, and wholesale electoral reform all felt within reach at that time.

Today, those same goals appear far more distant to most observers in the crypto and governance space. In a chaotic era, the average intervention in any political order tends to reflect raw power-grabbing rather than principled mechanism design.

Buterin noted that pushing for ranked-choice voting in the United States feels unrealistic when basic gerrymandering bans still cannot pass.

This context changes what democratic tools should realistically aim to accomplish right now. Rather than building hard binding governance systems, the focus should shift toward consensus-finding mechanisms instead.

These tools would surface broadly supported positions and present them to decision-making actors, giving distributed groups a credible and meaningful voice in outcomes.

New Technologies Offer a Credible Path Toward Collective Voice

Despite the difficult political climate, Buterin sees genuine opportunity in a new generation of technological tools. Zero-knowledge proofs, AI, and stronger cybersecurity all provide new ways to build effective democratic systems at scale.

He argued that today’s toolkit is considerably more powerful than anything available to builders just a decade ago.

He pointed to platforms like Pol.is and assurance contract-style voting as practical models worth developing further.

Anonymous votes that become public only after reaching a set threshold could give distributed groups a credible collective voice.

Such tools would also allow centralized actors to identify which policy shifts carry widespread support and hold genuine legitimacy.

Buterin also used the ongoing situation in Iran as a real-world case for what he called “sanctuary tools for collective voice.”

He argued that ordinary Iranians need mechanisms to express their collective positions in ways that carry actual weight right now.

He called for building tools that serve people seeking democratic expression while living under unstable and politically volatile conditions.

Crypto World

Private Credit Crisis Deepens: Can DeFi Offer a Safer Alternative?

TLDR:

- Private Credit giant BCRED received $3.7B in Q1 2026 redemptions, nearly triggering a formal gate

- Average BDCs now trade at a 20% NAV discount with yields of 10–11%, signaling rising credit stress.

- DeFi risks becoming exit liquidity for distressed private credit products offloaded by Wall Street.

- Smart contracts can enforce redemption rules transparently, giving onchain private credit an edge.

Private credit markets are under mounting pressure as elevated interest rates and AI-driven uncertainty shake investor confidence. Redemption requests have surged across major funds, raising liquidity concerns.

At the same time, the crypto and DeFi space is watching closely. Real-world asset strategies built on private credit are now drawing scrutiny.

The question is whether DeFi can offer a safer, more transparent alternative — or whether it risks becoming an exit route for distressed Wall Street products.

Rising Rates Have Strained Private Credit Borrowers

Private credit funds operate much like private banks. They lend capital to businesses and collect interest in return. Investors range from pension funds and insurance companies to retail participants via publicly traded Business Development Companies (BDCs) and semi-liquid vehicles.

The Federal Reserve began its aggressive rate-hiking cycle in March 2022, lifting rates from near zero to over 5% by mid-2023. Rates have stayed elevated through early 2026, with only modest cuts along the way.

This has made borrowing considerably more expensive for businesses that locked in debt during the low-rate era.

As Stani Kulechov noted on X: “The problem arises when the cost of capital stays elevated for too long, creating unmanageable expenses for borrowers.”

For many middle-market companies, this squeeze has lasted long enough to push credit quality lower across the private lending space.

Redemption Pressure Is Building Across Major Funds

The strain is showing up clearly in fund-level data. Blackstone’s flagship private credit vehicle, BCRED, manages roughly $82 billion. During Q1 2026, it received $3.7 billion in redemption requests — about 8% of NAV.

Blackstone injected $400 million of its own capital to manage the pressure. The fund narrowly avoided formal gating.

BlackRock’s HPS Corporate Lending Fund, a $26 billion vehicle, was not as fortunate. Redemption requests hit a point where gating became necessary, with approximately $580 million in requests going unfulfilled.

Blue Owl’s retail private credit fund saw $2.9 billion in redemptions during Q4 2025, partly due to heavy exposure to software lending.

The broader market has repriced accordingly. The average BDC now trades at roughly a 20% discount to net asset value, offering yields of 10 to 11%. Historically, these funds traded at a premium.

Some fund-level default metrics have climbed as high as 9%, a level that signals rising credit stress across the sector.

DeFi Must Avoid Becoming Wall Street’s Exit Liquidity

The private credit dislocation carries direct relevance for the DeFi ecosystem. Many real-world asset strategies in DeFi are built on private credit instruments.

Retail-oriented DeFi users often commit capital into high-yielding RWA products without fully understanding the duration or liquidity risks embedded in them.

Kulechov put the concern plainly: “My greatest fear is that institutional opportunists could view DeFi as a channel to offload illiquid and distressed products that Wall Street has already soured on.”

RWA opportunities are harder to assess than native DeFi strategies, as they lack the same onchain verifiability and transparency.

There is, however, a constructive path forward. Smart contracts can encode redemption windows, withdrawal limits, and collateral ratios in ways that traditional funds cannot match.

Unlike BCRED or HLEND, where terms were tightened at the manager’s discretion, onchain rules are transparent from the start and enforced by code.

For private credit done properly in DeFi, that structural advantage could ultimately benefit retail participants — provided the industry builds the right safeguards, risk disclosures, and governance frameworks first.

Crypto World

BTC falls sharply along with stocks as oil soars nearly 20%,

In what’s become a familiar scenario in crypto over the past few months, prices are starting the week on the wrong foot.

After little sign over the weekend of any de-escalation in the U.S. war against Iran, the price of oil has exploded higher in Sunday evening U.S. trade. April WTI crude oil futures are currently up 19.1% to $108.35 per barrel. That’s roughly double the price at the start of 2026 and the highest level in about four years.

That surge, in turn, has sent U.S. stock index futures down by nearly 2% across the board. Futures for Japan’s Nikkei 225 are lower by 3.1% shortly before that stock market opens for Monday trade.

Bitcoin is lower by 2% and trading just below $66,000. Ether (ETH) and solana (SOL) are down closer to 1.4%.

A check of other commodity prices finds the precious metals and copper all trading modestly lower.

Crypto World

How Strategy’s 3-Layer Architecture Is Building a New Financial System on Bitcoin

TLDR:

- Bitcoin anchors the 3-Layer Architecture as Digital Capital with a fixed supply and no central issuer or counterparty.

- Stretch functions as Digital Credit, using Bitcoin as collateral to create a superior alternative to traditional fiat-backed credit.

- Strategy operates as Digital Equity, deploying a reflexive flywheel that compounds Bitcoin Per Share for common equity holders.

- The 3-Layer Architecture is the first unified capital stack where treasury, credit, and equity are all backed by Bitcoin.

The 3-Layer Architecture enabling Strategy to revolutionise finance is drawing attention across global capital markets.

Strategy has built a vertically integrated capital stack that connects Bitcoin, credit, and equity into one coherent system. Each layer feeds the one above it, creating a structure that compounds over time.

This architecture did not exist before Bitcoin made it technically possible. It represents a new category of financial institution that operates entirely outside the traditional monetary framework.

How the Architecture Is Structured Across Three Distinct Layers

The 3-Layer Architecture is composed of Digital Capital, Digital Credit, and Digital Equity. Each layer serves a separate function and targets investors with different financial goals.

Bitcoin sits at the bottom as Digital Capital, providing the foundation for everything built above it. Stretch occupies the middle as Digital Credit, while Strategy sits at the top as Digital Equity.

Bitcoin is the only asset with a fixed supply, no issuer, and no central point of failure. No government or central bank can dilute, debase, or seize it.

These properties make it the most reliable foundation for a new financial system. Analyst Chris Millas described it as “the soundest money humanity has ever discovered.”

The architecture is intentionally built from the bottom up. Each layer derives its strength from the layer beneath it. Without sound capital at the base, neither the credit nor the equity layer could function with the same level of integrity.

Digital Credit Bridges Bitcoin and Equity in the Stack

Stretch, the Digital Credit layer, acts as the bridge between Bitcoin and Strategy’s equity. Unlike traditional credit, Stretch is collateralised by Bitcoin rather than fiat currency.

This changes the fundamental risk profile of the credit instrument entirely. As Millas noted, “the quality of a credit instrument is only as good as the quality of the collateral backing it.”

Traditional credit rests on fiat — a centralised asset that governments can inflate or seize at any time. Bitcoin-backed credit cannot be manipulated by any central authority.

That structural difference gives Digital Credit a clear advantage over conventional credit products. It also opens a new income category for investors who want Bitcoin exposure without direct price volatility.

Strategy raises capital by issuing these Digital Credit products to investors with varying risk tolerances. That capital flows directly into Bitcoin acquisitions. The credit layer is therefore not passive — it actively powers the equity layer above it.

Strategy’s Digital Equity Completes the Self-Reinforcing System

At the top of the 3-Layer Architecture sits Strategy as Digital Equity. It offers a leveraged, reflexive claim on Bitcoin’s appreciation, amplified through the financial engineering of the credit layer below.

As Bitcoin holdings grow, the balance sheet strengthens, attracting more investor capital. That capital then purchases more Bitcoin, and the cycle continues.

Millas described this loop clearly: “More Bitcoin → Stronger Balance Sheet → Stronger Credit Rating → Attract More Capital → More Bitcoin.”

Each rotation through this cycle compounds Strategy’s Bitcoin Per Share for common equity holders. The flywheel accelerates with each pass, not slows down.

Strategy is the first institution to unify treasury, credit, and equity under one Bitcoin-backed capital structure. Millas called this “a new financial primitive” with no direct predecessor in conventional finance.

The 3-Layer Architecture is not a theory — it is already operating and scaling across global capital markets.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

Entertainment7 days ago

Entertainment7 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

News Videos7 days ago

News Videos7 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports1 day ago

Sports1 day agoThree share 2-shot lead entering final round in Hong Kong

-

Sports23 hours ago

Sports23 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat7 days ago

NewsBeat7 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business10 hours ago

Business10 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK