Crypto World

Russia May Block Foreign Crypto Exchanges Under New Domestic Regulations

Breaking RBC reports suggest that Russia is manoeuvring to block foreign crypto exchange websites like Binance and OKX starting September 1 unless they comply with strict domestic regulations.

The strategic move funnels crypto customers to locally licensed and state monitored exchanges, securing control over cross-border on-chain capital flows while tightening the grip on retail speculation.

Key Takeaways

- The Move: Foreign crypto exchanges face a potential blockade by September 1 under new “experimental” legal frameworks.

- The Goal: Authorities want to centralize cross-border crypto payments to evade sanctions while monitoring domestic capital flight.

- The Impact: Traders using offshore platforms may be forced onto planned state-backed exchanges in Moscow and St. Petersburg.

Why Is This Happening Now?

Why limit access now? It comes down to control. Following the laws signed by President Putin in August 2024, crypto is no longer viewed merely as a speculative asset but as a critical tool for bypassing SWIFT bans. However, the Kremlin demands oversight.

Data from Chainalysis indicates Russia has pivoted toward “legislated sanctions evasion.” By forcing activity onto domestic platforms, authorities can monitor flows that were previously opaque.

This broadly mirrors concerns across the continent in Brussels, where leaders like Christine Lagarde warn of regulatory gaps in digital finance. Moscow wants those gaps closed.

The government is essentially bifurcating the market. One lane is for state-sanctioned entities like exporters using crypto for international settlement.

The other lane (retail) is being subjected to extreme friction to prevent capital flight.

Discover: The best meme coins on Solana

How Will the Ban Work?

The proposed mechanism targets foreign platforms offering unlicensed access. While major players like Coinbase, which Cathie Wood recently doubled down on, rely on global accessibility, Russian user bases are substantial.

Under the new regime, only exchanges operating within specific “experimental legal regimes” (EPR) might survive.

Reports suggest plans for state-backed exchanges in St. Petersburg and Moscow are accelerating.

These venues would facilitate cross-border trade for approved exporters while retail traders get squeezed out of foreign venues. Compliance is the bottleneck.

As noted in Crystal Intelligence’s regulatory roadmap, strict KYC and capital requirements have been on the table for Russian regulators since 2022. Now, they are becoming entry barriers.

Finance Minister Anton Siluanov has previously admitted that Moscow finding a regulatory solution is complex but vital.

Yet, the urgency to mitigate sanctions is overriding technical hesitations. This aligns with global trends where developer liability and platform compliance are central to legislative debates.

If foreign entities do not register locally, a move many will refuse due to Western sanctions, they face a hard block.

What Happens Next for Traders?

If the crackdown goes live in September, expect a liquidity fracture. Russian retail volume, estimated over a hundred billion annually, will likely flood into underground P2P networks or the few sanctioned domestic entities like Garantex.

As industry lobbying groups work to define clearer frameworks globally, Russia’s isolating move offers a stark counter-narrative: nationalization over decentralization.

In that light, the ruble pairing spreads may reveal the first signs of this shift.

The post Russia May Block Foreign Crypto Exchanges Under New Domestic Regulations appeared first on Cryptonews.

Crypto World

Bitcoin $60K Retest Odds Rise As Bearish Options, ETF Outflows Show Fear

Key takeaways:

-

Professional traders are paying a 13% premium for downside protection as Bitcoin struggles to maintain support above $66,000.

-

While stocks and gold remain strong, $910 million in Bitcoin ETF outflows suggest that institutional investor caution is rising.

Bitcoin (BTC) price entered a downward spiral after rejecting near $71,000 on Sunday. Despite successfully defending the $66,000 level throughout the week, options markets reflect growing fear as professional traders avoid downside price exposure.

Even with relative strength in the stock market and gold prices, traders seem to be effectively betting on a $60,000 retest rather than overreacting to Bitcoin price dips.

Bitcoin put (sell) options traded at a 13% premium relative to call (buy) instruments on Thursday. Under neutral conditions, the delta skew metric typically ranges between -6% and +6%, indicating balanced demand for upside and downside strategies. The fact that these levels have been sustained over the past four weeks shows that professional sentiment is leaning heavily toward caution.

This bearish bias is clear in the neutral-to-bearish positioning seen in Bitcoin options. According to Laevitas data, the bear diagonal spread, short straddle and short risk reversal were the most traded strategies on the Deribit exchange over the past 48 hours.

The first lowers the cost of the bearish bet because the short-term option loses value faster, while the second maximizes profit if Bitcoin price barely moves. The short risk reversal, on the other hand, generates profit from a downward move with little to no upfront cost, but it carries unlimited risk if the price spikes.

Weak institutional demand for Bitcoin ETFs fuels discontent

To better gauge the risk appetite of traders, analysts often look at stablecoin demand in China. When investors rush to exit the cryptocurrency market, this indicator usually drops below parity.

Under neutral conditions, stablecoins should trade at a 0.5% to 1% premium relative to the US dollar/Yuan exchange rate. This premium compensates for the high costs of traditional FX conversion, remittance fees and the regulatory friction caused by China’s capital controls. The current 0.2% discount suggests moderate outflows, though this is an improvement from the 1.4% discount seen on Monday.

Part of the current discontent among traders can be explained by the lackluster flows in Bitcoin exchange-traded funds (ETFs), which serve as a proxy for institutional demand.

Related: Bitcoin ETFs still sit on $53B in net inflows despite recent outflows–Bloomberg

US-listed Bitcoin ETFs have seen $910 million in total outflows since Feb. 11, which likely caught bulls off balance, especially as Bitcoin traded 47% below its all-time high while gold prices hovered near $5,000, up 15% in just two months. Similarly, the S&P 500 index sat only 2% below its own all-time high, indicating that this risk-aversion is largely restricted to the cryptocurrency sector.

While Bitcoin options signal a fear of further downside, traders are likely staying extremely cautious until a clear rationale for the crash to $60,200 on Feb. 6 finally emerges.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Ethereum Foundation Flags Post-Quantum Security as Core Priority in 2026 Protocol Roadmap

Ethereum developers plan major protocol changes in 2026, combining scaling, security hardening, and UX improvements following last year’s network upgrades.

The Ethereum Foundation said it will prioritize post-quantum security and further increases to the gas limit as part of its protocol roadmap for 2026.

The organization is also restructuring its development efforts into three core tracks covering scaling, user experience, and Layer 1 security.

Three-Track Protocol Overhaul

On Wednesday, the Foundation said Ethereum’s next phase will focus on expanding network capacity while ensuring long-term security and resilience. Gas limit increases also remain a central objective, following a rise from 30 million to 60 million over the past year. Developers are now targeting a move toward and beyond 100 million gas per block.

Post-quantum readiness was identified as a crucial consideration across multiple areas of protocol development, amidst growing attention to cryptographic security as quantum computing capabilities advance. The Foundation said its protocol work in 2026 will be organized into three tracks – Scale, Improve UX, and Harden the L1.

The “Scale” track combines work previously split between Layer 1 execution scaling and blob data availability. This track will oversee continued gas limit increases supported by client benchmarking and block-level access lists, further blob parameter increases following recent upgrades, and delivery of scaling components planned for the Glamsterdam network upgrade. It will also advance state scaling efforts, including near-term repricing and history expiry, and longer-term plans for statelessness and new data structures.

The “Improve UX” track will focus on protocol-level changes that aim to simplify how users interact with Ethereum. Focus will also be on native account abstraction and interoperability. Building on EIP-7702, which allows externally owned accounts to temporarily execute smart contract code, developers are working toward making smart contract wallets the default without relying on additional infrastructure or incurring extra gas overhead.

The Foundation said this work also intersects with post-quantum readiness, as native account abstraction provides a pathway for transitioning away from ECDSA-based authentication. Efforts to improve interoperability will continue through the Open Intents Framework, in addition to progress on faster Layer 1 confirmations and shorter Layer 2 settlement times.

You may also like:

The “Harden the L1” track introduces a dedicated focus on preserving Ethereum’s core properties as the network scales. This includes security initiatives such as post-quantum readiness and execution-layer safeguards, research into censorship resistance for transactions and blob data, and expanded testing infrastructure to support a faster upgrade cadence. The Foundation said work on devnets, testnets, and client interoperability will remain critical as protocol changes are deployed more frequently.

Looking Ahead

Meanwhile, Glamsterdam is targeted for the first half of 2026, according to the update shared by the Ethereum Foundation. Additionally, the Hegotá upgrade is planned for later in the year.

These upgrades are expected to include higher gas limits, continued blob scaling, enshrined proposer-builder separation, and further progress on native account abstraction, censorship resistance, and post-quantum security.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Active Supply Plateaus as Price Volatility Fades

Quiet networks and idle supply point to social demotivation, which often appears before sentiment and price narratives flip.

Bitcoin has been trading around the mid-$60,000s after losing significant ground from its late-2025 highs. It has failed to reclaim the psychologically crucial $70,000 threshold despite several attempts.

On-chain activity of the world’s largest cryptocurrency and blockchain is showing signs of stagnation, according to data shared by Alphractal.

Bearish Divergence Builds

The firm reported that Bitcoin’s active supply has stopped growing, which indicates that fewer BTC are moving across the network, and overall activity has slowed. The latest decline goes beyond market structure and reflects ” global human behavior,” as weaker prices and rising uncertainty have made participants less willing to act.

Alphractal explained that holders are increasingly keeping coins idle, which has resulted in a quieter network. This phase is being described as “social demotivation” on-chain, amid emotional fatigue, reduced engagement, and a lack of conviction. Such changes in behaviour often surface before broader market narratives change.

Santiment’s data also reported a sharp deterioration in Bitcoin’s network activity compared with 2021 levels, with 42% fewer unique BTC addresses making transactions and 47% fewer new addresses being created. These trends do not mean crypto is “dead” or that a multi-year bear market is inevitable. However, the analytics platform did highlight a clear bearish divergence developed throughout 2025, as total market capitalizations continued to reach new highs even as BTC’s on-chain utility declined.

Whale Accumulation Accelerates

Even as on-chain participation has slowed, accumulation by large BTC holders has accelerated. Bitcoin whale accumulation has increased by more than 200,000 BTC in recent weeks. While whale inflows to exchanges have picked up, a trend often linked to short-term selling, overall whale holdings have continued to rise.

To assess behavior over a longer timeframe, CryptoQuant tracks whale-held supply using monthly averages rather than short-term flows. This metric dropped sharply to nearly minus 7% on December 15 but has since reversed, as whale holdings increased by 3.4% over the past month.

You may also like:

During this period, the amount of Bitcoin held by whales grew from around 2.9 million BTC to more than 3.1 million BTC. CryptoQuant observed that a similar scale of accumulation last occurred during the April 2025 market correction, when whale buying helped absorb selling pressure and boosted the BTC rally from $76,000 to $126,000. With Bitcoin being 46% below its peak, the current level could be encouraging some large holders to accumulate.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

SEC Chair Paul Atkins Says Regulators Should Not Panic Over Falling Crypto Prices

Rather than reacting to market drops, Paul Atkins signaled regulators are prioritizing crypto frameworks over price stabilization efforts.

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins has said that regulators should not panic over falling crypto prices, pushing back against calls for emergency intervention as Bitcoin (BTC) slipped toward $66,000.

The remarks signal the SEC’s intent to focus on structural rulemaking rather than market volatility, offering a roadmap for tokenized securities while dismissing short-term price action as irrelevant to the agency’s mission.

Regulators Address Market Downturn With Policy Agenda

Speaking at ETHDenver on February 18 with Commissioner Hester Peirce, Atkins acknowledged the market’s recent slide but rejected the idea that the SEC should respond to price swings.

“It is not the regulator’s job to worry about the daily swings of the markets,” Atkins said. “People whose only focus is on the number always going up are likely to be disappointed.”

The comments come as crypto markets face sustained pressure, with Bitcoin trading near $66,000 at the time of writing, and analysts watching the $60,000 support level as a potential next test. Meanwhile, Ripple’s XRP dropped nearly 5% to $1.40, and Ethereum (ETH) fell back below $2,000. Some market watchers have warned of further downside, with Bloomberg Intelligence strategist Mike McGlone reiterating a bearish $10,000 Bitcoin forecast just days before Atkins’s speech.

But rather than address price action, the SEC Chair used the appearance to outline a series of regulatory initiatives under “Project Crypto,” a joint effort with the Commodity Futures Trading Commission (CFTC).

The agenda includes developing frameworks for crypto asset classification, crafting rules for tokenized securities trading on automated market makers, and issuing guidance on custody for non-security assets like stablecoins.

Building a Framework Beyond Market Cycles

The SEC’s approach reflects a deliberate shift away from the enforcement-heavy tactics of previous years. Atkins noted that the agency has already dropped numerous crypto cases, ended what critics called “regulation by enforcement,” and issued staff guidance on mining, staking, and meme coins.

You may also like:

On her part, Commissioner Peirce framed the current downturn as an opportunity for builders. “Numbers go down is the mantra of the moment,” she said, noting that some critics are engaging in “Schadenfreude” over crypto’s struggles.

But she argued that regulatory clarity alone does not create value.

“You have to build stuff that people want and need,” Peirce said. “That is the best way to garner support on both sides of the aisle in Washington.”

Atkins emphasized that the SEC’s rulebook should not be a barrier to innovation, encouraging developers to “come in and talk to us” and announcing plans for an “innovation exemption” to allow limited trading of tokenized securities on decentralized platforms.

The exemption would be temporary and include volume limits, designed to let market participants experiment while the agency develops permanent rules.

“Put your nose to the grindstone and work to build things that matter,” Atkins told the audience. “That is how you transform Schadenfreude to Freudenfreude—the sense of happiness we feel when others succeed.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

SocGen taps XRP-linked firm for expanding euro stablecoin

Societe Generale’s digital assets arm SG-FORGE has deployed its euro stablecoin, EUR CoinVertible, on the XRP Ledger, expanding beyond its existing integrations on Ethereum and Solana as competition heats up in Europe’s regulated stablecoin race.

EUR CoinVertible is issued under French digital asset rules and is backed 1 to 1 by cash deposits or high-quality securities. It has a circulating supply of roughly 65.8 million euros, per CoinGecko, making it one of the larger euro stablecoins in the market behind Circle’s EURC.

SG-FORGE said it chose the XRP Ledger for its low transaction costs and fast settlement, while Ripple’s custody infrastructure will be used to support the rollout. The stablecoin could eventually be explored as collateral for trading or integrated into Ripple’s payment-related products.

For XRPL, the listing is another institutional credibility win as the network positions itself as a compliant venue for tokenized finance. The launch lands just as XRPL validators have been voting on new upgrades such as Permissioned DEX, a feature meant to allow controlled trading environments where only approved participants can interact, a requirement for many regulated firms.

The stablecoin push also comes as blockchains compete to host tokenized deposits, bonds and settlement assets. For XRP itself, the news is more structural than price-driving, but it adds to the narrative that XRPL is trying to be more than a payments chain.

Crypto World

Peter Schiff Gives Shocking Bitcoin Price Prediction, Is It Possible?

Economist and longtime Bitcoin critic Peter Schiff warned that Bitcoin could collapse to $20,000 if the asset loses key support near $50,000.

His comments come as geopolitical tensions escalate following reports that the US military is preparing strike options against Iran.

Peter Schiff’s Anti-Bitcoin Perception is Stronger than Ever Before

Schiff argued that a drop below $50,000 now appears likely and could trigger a much deeper decline. He suggested Bitcoin may repeat historic crash patterns seen in previous cycles, even despite increased institutional adoption and broader mainstream interest.

His warning arrives as Bitcoin trades near $66,000, down sharply from its recent cycle highs.

Schiff has remained one of Bitcoin’s most consistent skeptics for over a decade. He has repeatedly described Bitcoin as a speculative bubble and argued that it lacks intrinsic value.

Throughout previous bull markets, he predicted major crashes, while continuing to promote gold as a superior store of value.

However, Bitcoin has also repeatedly recovered from severe corrections and reached new highs over time.

His latest warning comes at a fragile moment for crypto markets. Global risk sentiment has weakened amid fears of potential US military action against Iran.

Historically, Bitcoin often falls in the early phase of geopolitical shocks as investors reduce exposure to volatile assets.

On-chain data supports the view that short-term weakness remains possible. The Short-Term Holder SOPR indicator currently sits below 1, showing that recent buyers are selling at a loss.

This reflects fear and ongoing capitulation among weaker investors.

At the same time, another key metric tells a different story. Bitcoin’s short-term Sharpe ratio has dropped to extremely negative levels.

This suggests Bitcoin has already experienced unusually poor returns relative to volatility.

In past cycles, such conditions often appeared near local bottoms rather than the beginning of prolonged collapses.

This creates a mixed outlook. While geopolitical stress and weak sentiment could push Bitcoin lower in the short term, much of the speculative excess appears already flushed out.

Schiff’s prediction reflects rising uncertainty—but on-chain data suggests the market may be closer to a reset phase than the start of a full-scale collapse.

Crypto World

ETH staking hits 50% on paper, but active stake only ~31%

ETH’s reported 50.18% staking share is disputed, with CoinShares putting active staking near 30.8% due to deposit‑only contract data.

Summary

- Santiment says 50.18% of ETH supply (about 80m ETH) sits in the staking deposit contract, crossing a symbolic 50% threshold for the first time.

- CoinShares’ Luke Nolan calls the figure “inaccurate or materially misleading,” noting the contract logs deposits only and ignores withdrawals.

- Active staking is closer to 37m ETH, or roughly 30.8% of circulating supply, using Ethplorer and CryptoQuant validator data.

A dispute has emerged between blockchain analytics firms over the accuracy of Ethereum staking data, with analysts disagreeing on whether staking volume has exceeded 50% of the cryptocurrency’s total supply.

On-chain analytics company Santiment announced that Ethereum (ETH) staking volume had surpassed 50% of the total supply for the first time, according to a recent analysis. The firm reported that 50.18% of the total Ethereum supply was recorded in the staking deposit contract.

CoinShares analysts challenged Santiment’s findings, calling the figure misleading, according to CoinDesk. The analysts stated that the reported percentage does not accurately reflect the amount of active staking on the network.

Luke Nolan, a senior research fellow at CoinShares, said the data is inaccurate or significantly misleading. He explained that the Ethereum staking deposit contract only accumulates deposit records and does not process withdrawal data.

The approximately 80 million Ether reported by Santiment represents accumulated deposit records rather than the actual balance, according to Nolan. The figure does not account for withdrawals from the staking contract, he said.

CoinShares estimates the active staking volume that contributes to network security stands at approximately 37 million Ether, or 30.8% of the supply, according to the firm’s analysis.

Other analysts have also claimed the staking rate is around 30%, not 50%, according to reports.

Crypto World

White House favors some stablecoin rewards, tells banks it’s time to move

Limited stablecoin rewards are favored by the White House, and if bankers sign off, they’ll be in the next draft of the crypto market structure bill, according to two people familiar with the negotiation.

At a Thursday working session meant to secure common ground on stablecoin rewards between banks and the crypto industry, the White House made it clear that certain rewards programs were going to stay in the next draft of the crypto market structure bill, the people said. Representatives of Wall Street banks that attended the meeting actively worked on that language, and the White House will put together an updated draft to circulate among them, they said.

This section of the U.S. Senate’s Digital Asset Market Clarity Act — the crypto industry’s top policy aim in Washington — is one of the major fault lines for the legislation that would govern the operations of U.S. crypto markets. As it happens, the stablecoin section (404 of the draft bill) has nothing directly to do with market structure, and the revisions being discussed would actually overhaul an earlier crypto effort that became law last year, the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act.

This was the third White House sitdown between bankers and crypto insiders, and after the bankers dug in their heels on allowing stablecoin rewards last time, White House negotiators arrived at the table with a position that some rewards must be allowed for certain activities and transactions, but not for holdings of stablecoins that more closely resemble deposit accounts. The White House team — led by President Donald Trump’s crypto adviser, Patrick Witt — urged a quick resolution on this point that allows the legislation to move forward, the people said.

That reflects the fear expressed by bankers: that stablecoin rewards would undermine their bread-and-butter business model that depends on customers making interest-bearing deposits.

Participants at the meeting privately expressed hopes that the compromise they’ve waited for is potentially very close. Spokespeople for the White House didn’t immediately respond to a request for comment.

“Today’s meeting at the White House was a constructive step forward in resolving outstanding issues related to rewards and keeping market structure legislation on track,” Blockchain Association CEO Summer Mersinger, who has been among those at the table, said in a statement after the gathering.

If the banks decline to shake hands on limited rewards, the status quo is the GENIUS Act, which gives crypto platforms a much freer hand with rewards programs than this proposal would. If they instead give this approach a nod, their agreement would be likely to sway reluctant senators back into support.

However, this is just one of several holes in the Clarity Act that need to be filled with negotiated language. The crypto industry also remains very involved in the requests from Democratic lawmakers that the bill ramp up the protections against bad actors in crypto, especially in the decentralized finance (DeFi) space.

Also, Democratic negotiators have insisted on a couple of other points that may put them at odds with the White House. They’ve demanded a ban on senior government officials getting directly involved in the crypto industry — a position targeted most directly at President Donald Trump. They’ve also called for the White House to name a full slate of commissions at the Commodity Futures Trading Commission and the Securities and Exchange Commission, including their Democratic vacancies.

None of the Democrats’ major issues have yet been resolved. If the Senate Banking Committee moves forward with a hearing to advance the bill, as the Senate Agriculture Committee did, the outcome may again be partisan if the parties don’t find answers to those points. That won’t prevent the legislation’s advancement through the next step, but it can’t win approval from the overall Senate without significant Democratic support.

Read More: Latest White House talks on stablecoin yield make ‘progress’ with banks, no deal yet

Crypto World

XRP shorts dominate as funding drops 80% and OI falls

XRP slips below support as funding drops ~80% today on bearish leverage.

Summary

- XRP funding rate dropped nearly 80% on Thursday, signaling aggressive short bias and sustained downside positioning in derivatives markets.

- Open interest declined alongside negative funding, showing leveraged traders are de-risking as spot price trades below its short-term moving average and key Fibonacci support.

- XRP trends lower with RSI nearing oversold while crypto Fear & Greed prints “Extreme Fear” and BTC dominance climbs, pointing to rotation away from altcoins.

Daily XRP (XRP) funding rates declined nearly 80% on Thursday, February 19, according to derivatives market data, indicating continued pressure on the cryptocurrency.

Negative funding rates indicate that traders holding short positions are paying those maintaining long positions, a sign that bearish bets currently outweigh bullish exposure, according to market mechanics. The decline was accompanied by a drop in open interest, according to real-time data.

Negative funding rates suggest the market is positioned for further downside, as the metric reflects the balance between long and short traders.

Deeply negative funding can signal overcrowded positioning, according to market analysts. Historical data shows extreme short bias has sometimes preceded sharp reversals, particularly when price action stabilizes and short sellers are forced to cover positions. A prolonged negative funding environment marked a cyclical bottom for XRP in 2022 during the FTX collapse, according to historical market data.

XRP’s spot price showed a decline on the daily chart, falling below its short-term moving average and a key Fibonacci retracement level, which represents a loss of near-term support. The Relative Strength Index has fallen and is approaching oversold territory, according to technical indicators.

Market sentiment remains weak, reflected in an “Extreme Fear” reading on the Crypto Fear & Greed Index. Bitcoin dominance data suggests capital is consolidating into larger-cap assets rather than flowing into altcoins such as XRP, according to market metrics.

Technical analysts note that a recovery above the recent short-term resistance zone would signal price stabilization. Current short-term momentum favors bearish positions, as evidenced by the state of funding rates, according to derivatives market data.

Crypto World

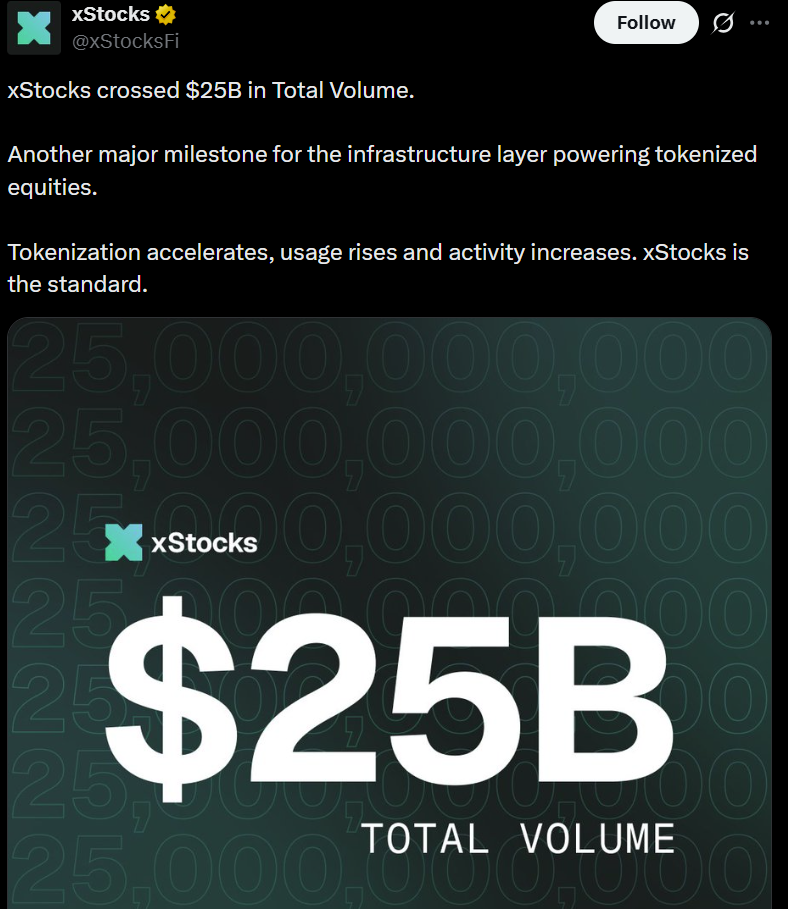

Kraken xStocks Surpasses $25B in Tokenized Stock Volume

Kraken’s tokenized equities platform, xStocks, has surpassed $25 billion in total transaction volume less than eight months after launch, underscoring accelerating adoption as tokenization gains traction among mainstream investors.

Kraken disclosed Thursday that the $25 billion figure includes trading across centralized exchanges and decentralized exchanges, as well as minting and redemption activity. The milestone represents a 150% increase since November, when xStocks first crossed $10 billion in cumulative transaction volume.

The xStocks tokens are issued by Backed Finance, a regulated asset provider that creates 1:1 backed tokenized representations of publicly traded equities and exchange-traded funds. Kraken serves as a primary distribution and trading venue, while Backed is responsible for structuring and issuing the tokenized instruments.

When xStocks debuted in 2025, it offered more than 60 tokenized equities, including shares tied to major US technology companies like Amazon, Meta Platforms, Nvidia and Tesla.

Kraken said onchain activity has been a key growth driver since launch, with xStocks generating $3.5 billion in onchain trading volume and surpassing 80,000 unique onchain holders.

Unlike trading that occurs solely within centralized exchanges’ internal order books, onchain activity takes place directly on public blockchains, where transactions are transparent and wallets can self-custody assets.

Growing onchain participation suggests users are not only trading tokenized equities but also integrating them into broader decentralized finance (DeFi) ecosystems.

Kraken said that eight of the 11 largest tokenized equities by unique holder count are now part of the xStocks ecosystem, signaling increased market share in the emerging tokenized equities sector.

Related: Kraken launches tokenized securities trading in Europe with xStocks

Tokenized stocks mirror stablecoins’ early growth

Tokenization of real-world assets (RWAs) remains one of the fastest-growing segments of the digital asset market, even as broader crypto prices have trended lower since the start of the year.

Tokenized RWAs have increased 13.5% in total value over the last 30 days, according to industry data. By comparison, the broader crypto market shed roughly $1 trillion in market value over the same period.

Market observers say tokenized stocks may be experiencing their own “stablecoin moment,” a reference to the rapid early adoption that propelled dollar-pegged digital assets into mainstream use.

Data from Token Terminal shows tokenized stocks reached a market capitalization of $1.2 billion in December, after being virtually nonexistent six months earlier.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports19 hours ago

Sports19 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World1 hour ago

Crypto World1 hour ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

Russia is setting up two Cryptocurrency exchanges—one for international trade, one for Russian — alongside its own stablecoin. Wave "bye" to another aspect of sanctions.

Russia is setting up two Cryptocurrency exchanges—one for international trade, one for Russian — alongside its own stablecoin. Wave "bye" to another aspect of sanctions.