Crypto World

Samson Mow Breaks Down Bitcoin Market Crash

In a video interview, Samson Mow shares his views on Bitcoin’s latest bloodbath, quantum fears and the catalysts that could drive Bitcoin’s next recovery.

In an exclusive Cointelegraph interview, Bitcoin OG Samson Mow shares his perspective on Bitcoin’s latest massive crash, what’s driving the sell-offs and why a rebound could be closer than most expect.

We discuss gold and silver’s rally, forced liquidations, the “quantum threat” to crypto, and examine the long-term Bitcoin thesis: Is Bitcoin truly designed to rise in price due to fiat devaluation, or is that a flawed narrative?

After months of relentless selling pressure, sharp liquidations and growing bearish sentiment, many investors are asking the same question: Why does Bitcoin keep falling despite strong fundamentals, and when could it finally recover?

According to Mow, Bitcoin’s unique role as the most liquid asset in global markets, combined with its 24/7 tradability, makes it particularly sensitive to downside shocks that more traditional assets often avoid, at least in the short term.

The discussion also explores one of the most important dynamics in today’s market: the relationship between gold, silver and Bitcoin. After a powerful rally in precious metals, Mow lays out the case for why capital rotation from other hard assets may be setting the stage for Bitcoin’s next move.

If you’re trying to understand the nature of Bitcoin’s recent decline and what may come next, watch the full interview on our YouTube channel.

This interview has been edited and condensed for clarity.

Crypto World

CLARITY Act Faces Critical April Deadline Amid Banking and Crypto Standoff

TLDR

- The CLARITY Act passed the House and awaits Senate action with an April 3 deadline approaching

- Central dispute centers on permitting stablecoins to provide yield to holders

- Traditional banks face greater pressure than crypto companies to secure passage, per ex-CFTC chair Chris Giancarlo

- Regulatory agencies may implement independent frameworks if legislation stalls

- Senate markup could occur before March ends to meet April target timeline

Following its passage through the US House of Representatives in July 2025, the CLARITY Act now awaits consideration by the Senate Committee on Banking, Housing, and Urban Affairs. Congressional leaders have established April 3 as their target date for advancing this comprehensive crypto market structure legislation.

🚨NEW: COMMUNITY BANKS AND CRYPTO CALLED “ALLIES” IN CLARITY ACT DEBATE

Community banks and the crypto sector share common ground in the debate over the CLARITY Act, Zero Knowledge Consulting founder Austin Campbell, says.

The proposed legislation aims to define crypto market… pic.twitter.com/go9jbvZA74

— BSCN (@BSCNews) March 7, 2026

This legislative proposal establishes jurisdictional boundaries between federal agencies governing digital assets. Token issuers and cryptocurrency platforms would face mandatory registration requirements alongside standardized disclosure obligations.

Progress has reached an impasse due to a fundamental disagreement. The question of whether stablecoin issuers should have permission to distribute yield payments to token holders remains unresolved among legislators, banking institutions, and cryptocurrency enterprises.

The cryptocurrency industry maintains that permitting regulated yield-bearing products would democratize financial services. Industry representatives contend that establishing transparent regulatory frameworks serves as a superior alternative to blanket prohibitions.

Traditional financial institutions hold an opposing perspective. They caution that inadequately supervised yield distribution mechanisms could siphon customer deposits from established banks while introducing systemic vulnerabilities.

Banking sector representatives advocate for stringent oversight of any yield generation or staking operations, insisting such services maintain direct linkage to authenticated investment activities. The opposing factions have yet to reach a compromise.

Why Banks Have More to Lose

Chris Giancarlo, who previously led the CFTC, argues that American banking institutions face the highest stakes in this legislative battle. During his appearance on The Wolf Of All Streets Podcast, he emphasized that cryptocurrency companies will continue their development trajectory independent of Congressional decisions.

“The banks, however, can’t afford regulatory uncertainty,” Giancarlo said. He explained that bank boards won’t invest billions without legal clarity.

Giancarlo cautioned that prolonged inaction by US financial institutions creates opportunities for Asian and European competitors to establish dominant positions in digital financial infrastructure. Such delays could ultimately exclude American banks from emerging global systems.

He emphasized the imperative for banking institutions to lead this transformation rather than scrambling to recover lost ground.

What Happens If the Bill Fails

Before becoming law, the legislation requires approval from the full Senate chamber followed by President Donald Trump’s signature. Trump has publicly pressed Congress to expedite the bill’s passage, characterizing it as essential for maintaining American dominance in digital asset markets.

JPMorgan analysts have forecasted potential passage occurring by mid-2025.

Regulatory Workarounds on the Table

Should the CLARITY Act fail to advance, Giancarlo indicated that SEC chair Paul Atkins and CFTC head Mike Selig would probably pursue independent rulemaking authority.

He acknowledged that agency-derived regulations lack the enduring legal foundation provided by Congressional legislation. Nevertheless, such administrative actions could establish functional interim guidelines.

A scheduled markup hearing was pushed back in January, creating procedural delays within the committee. Several legislators now contemplate arranging a markup session before March concludes.

Should the committee proceed, a comprehensive Senate floor vote might occur with sufficient time to meet the April target.

Crypto World

‘Bitcoin Is Going to Die’

Terrence Howard said he is not touching BTC as it’s going to die.

The Hollywood actor best known for movies like Hustle & Flow, which secured him an Academy Award nomination, the original Iron Man, and Get Rich or Die Trying, has joined the bitcoin skeptics’ side.

In a recent appearance on Patrick Bet-David’s PBD Podcast, he envisioned BTC’s upcoming demise. However, he is not the first, and many, many have been wrong in the past.

‘Bitcoin Is Going to Die’

Bitcoin death proclamations are nothing new, as they have been going left and right ever since the network (and underlying asset) saw the light of day over 17 years ago. Although such strong statements have declined in number lately, there are still some that make it out to the open, and when they are coming from a famous person, especially one not related to the cryptocurrency industry, we have to explore.

Howard falls under both categories. While speaking on different investments during the PBD Podcast, he was emphatic, stating:

“Bitcoin is going to die, I don’t mess with it.”

He explained that he recently received a call from a friend of his who offered him an investment opportunity that would earn him $75,000 if he put down $25 million. However, he failed to provide details on what the investment was or how it was related to bitcoin, as the cryptocurrency itself does not promise such returns.

“Bitcoin is still based on fiat, and because the dollar is decreasing in its value, because of the uncertainty of war around. Nobody wants their money in something that can be wiped out with the push of a button somewhere. I’ve stayed clear of it because it has been dropping a great deal,” ends the video on X.

Let’s Dissect

Aside from the lack of details on the aforementioned investment opportunity, there are some other controversial statements in Howard’s words. First, bitcoin is NOT based on fiat – it’s commonly priced in fiat currencies, but 1 BTC is always 1 BTC.

Second, we didn’t really understand the part of “because of the dollar is decreasing and the uncertainty of war around” – perhaps he related that to his last statement that BTC has been dropping a great deal lately.

You may also like:

That’s true, the asset trades 50% away from its all-time high seen in October last year. However, it trades around its previous ATH, and the more macro scale shows massive returns for investors. Additionally, BTC tends to move in cycles and now appears to be the bearish period.

The part of “nobody wants their money in something that can be wiped out with the push of a button” is also interesting. And wrong. Who is that someone? What’s that button? How can it wipe out BTC? And – ‘nobody wants their money’ in bitcoin? Really? What about the billions in ETF inflows? Or corporations buying bitcoin as their preferred reserve asset? Or, even governments buying BTC?

Anyways, bitcoin is no stranger to being declared dead. In fact, there have been nearly 500 such documented cases during its teenage existence. For now, though, nobody has been correct.

Been going to zero since 2009 Terrence, my boy pic.twitter.com/zyQrsi6h2y

— Ron Sovereignty Swanson⚡️🗝️ (@RonSwanonson) March 9, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Why China can withstand oil’s surge past $100 more easily than other countries

A drone view of an Evergreen container ship docked at the port of Umm Qasr during nighttime operations in Basra, Iraq, March 5, 2026.

Mohammed Aty | Reuters

BEIJING — Surging oil prices following the Iran war are expected to impact China less than in past years as the country has built large crude stockpiles and diversified its energy sources, including renewables.

As oil prices climbed past $100 a barrel for the first time in four years, OCBC analysts said China may be “less sensitive to a prolonged closure of the Strait of Hormuz than many of its Asian peers.”

“China has accumulated one of the world’s largest strategic and commercial crude reserves,” the analysts said, adding that its “rapid transition toward electric vehicles and renewable energy provides an additional structural hedge.”

China held an estimated 1.2 billion barrels of onshore crude stockpiles as of January.

That’s about 3 to 4 months of reserves, which will delay the economic impact, Rush Doshi, director of the China Strategy Initiative at the Council on Foreign Relations, said Monday on CNBC’s “Squawk Box Asia.”

“China has taken the last 20 years to reduce some of its dependence on maritime oil flows,” Doshi said, noting that new overland oil pipelines and some diversification to renewables mean the country now only relies on the Strait of Hormuz for about 40% to 50% of its seaborne oil imports.

By 2030, China aims to increase the share of non-fossil fuels in total energy consumption to 25%, up from 21.7% in 2025.

The strait connects the Persian Gulf to the Arabian Sea and global shipping routes. It’s a narrow passage with Iran to the north and Oman and the United Arab Emirates to the south. About 31% of the world’s seaborne oil flows passed through the Strait of Hormuz last year, or around 13 million barrels a day of crude, according to Kpler.

However, oil shipments through the strait account for only 6.6% of China’s overall energy consumption, according to Nomura’s chief China economist Ting Lu.

Natural gas imports through the route account for another 0.6%, he said.

The shift reflects two decades of strategic transition, giving China a unique position in global energy markets.

The U.S. is the world’s largest consumer of oil, followed by China and India, according to the Organization of the Petroleum Exporting Countries (OPEC), which was founded in 1960 to coordinate global oil supply.

But China is the largest crude importer, buying nearly twice as much as the U.S., while India ranks third, OPEC data showed.

Of the three, India is the most dependent on petroleum imports, accounting for one-fourth of its total consumption, according to CNBC’s analysis of U.S. Energy Information Administration data for 2023.

China was lower at 14%, while the U.S. produced most of its petroleum needs, according to the 2023 data, which includes “other liquids” in the petroleum category.

Diverging energy strategies

While the U.S. has ramped up domestic oil production over the past decade, China has rapidly diversified its energy sources.

Renewables, excluding nuclear power and hydropower, accounted for 1.2% of China’s total energy consumption in 2023, up from 0.2% two decades earlier, according to CNBC calculations based on International Energy Agency data.

India and the U.S. recorded a far lower share of renewables in 2023, at 0.2% each.

That’s a tiny figure for now. But the growing share of renewables in China’s energy mix has global implications.

China’s electric vehicle push, especially in trucks, has already displaced over 1 million barrels per day of implied oil demand, Rhodium Group said in July 2025.

The research firm expected that figure to rise by around 600,000 barrels per day over the following 12 months.

More than half of China’s new passenger vehicles sold are now new-energy vehicles, meaning they rely more on batteries than on gasoline.

“With road fuel demand already showing signs of peaking and renewable capacity expanding rapidly, China’s sensitivity to oil price fluctuations is declining on a [year-on-year] basis,” the OCBC analysts said.

“Over time, the electrification of transportation and the expansion of renewable power generation will further insulate the economy from oil-related shocks.”

Oil and natural gas only account for 4% of China’s power mix, far lower than the 40% to 50% share seen in many Asian economies, the analysts said.

Electricity, largely generated from coal and a growing amount of renewables, now accounts for a growing share of China’s total energy consumption, according to energy think tank Ember.

Fossil fuels still loom large

Renewables provided about 80% of China’s new electric power demand in 2024, Ember said.

But coal remains a significant, albeit stagnating, source of energy in the country. China was the world’s largest producer and consumer of coal in 2023, despite efforts to reduce carbon emissions.

U.S. sanctions on Iran have also made China one of the few buyers of Tehran’s oil.

Iran accounted for about 20% of China’s oil imports, though much of that volume could mostly be replaced by increased oil imports from Russia, said Ano Kuhanathan, Head of Corporate Research at Allianz Trade.

The larger risk lies in the roughly 5 million barrels per day of oil China imports from other Middle Eastern countries through the Strait of Hormuz, Kuhanathan said.

As the Iran war enters its second week, it remains unclear when the conflict will end.

“A shock like this would likely reinforce the direction China is already taking rather than change it,” said Muyi Yang, senior energy analyst, Asia, at Ember.

“It highlights the risks of relying heavily on imported oil and gas. And that’s why the transition is not only about building more wind and solar, but also about economy-wide decarbonisation,” she said.

However, change doesn’t happen easily. The country’s fossil fuel industry is dominated by China’s state-owned corporations, which tend to be less dynamic than their private-sector peers.

China may also continue building crude reserves.

The U.S. Energy Information Administration said in February it expects China to expand strategic stockpiles by around 1 million barrels a day in 2026.

China’s crude oil imports dropped by nearly 2% in 2024, according to Wind Information. But as Middle East tensions started to simmer last year, China’s crude imports climbed 4.6% to a record of around 580 million metric tons.

“China is materially exposed but more flexible,” Kpler’s principal insight analyst Go Katayama previously told CNBC.

— CNBC’s Sam Meredith, Ying Shan Lee and Penny Chen contributed to this report.

Crypto World

Here’s why Bitcoin price dropped under $66K today

Bitcoin price briefly touched an intraday low of $65,727 on Monday, March 9, as market sentiment remained risk-off amid concerns surrounding rising oil prices and escalating tensions between the U.S. and Iran.

Summary

- Bitcoin price briefly fell towards the $65,000 support level as investors reacted to a spike in oil prices.

- The ongoing conflict between the U.S. and Iran has disrupted trade at the Strait of Hormuz, a global checkpoint for oil distribution.

According to data from crypto.news, Bitcoin (BTC) price fell 3.5% to an intraday low of $65,727 on Monday, extending its downturn for the fifth straight day and dropping nearly 11% in that period. The world’s largest crypto asset is down roughly 5% over the past month.

Bitcoin price fell as investors continued to diverge from risk assets amid geopolitical tensions and macro volatility.

The bellwether appears to be mimicking traditional equity markets. Notably, futures tied to traditional market indices such as the Dow Jones Industrial Average dipped 1,026 points to 46,696, while the S&P 500 and Nasdaq-100 dropped by 136 points and 440 points each before U.S. markets resumed.

Investor sentiment deteriorated as the ongoing military conflict between the U.S. and Iran successively led to a blockade at the Strait of Hormuz, a global chokepoint for oil distribution. This led to a sharp jump in oil prices. In fact, oil prices across the globe shot up above the $100 mark, the first time crude oil has surpassed this level in nearly four years.

Market instability in the region began after Israeli fighter jets struck several fuel depots and refineries in the region on Saturday, March 7. Subsequently, Iran retaliated with missile and drone strikes of its own on vessels and military bases in the Gulf region.

As market risk sentiment soured, investors are concerned about whether Bitcoin price will continue to decline in correlation with traditional equity markets. The bellwether has historically moved in tandem with equities, especially during periods of macro uncertainty.

Against the backdrop, investors are concerned that rising oil prices could reignite U.S. inflation jitters and a potential delay in interest rate cuts. A hawkish stance from the Federal Reserve could dampen liquidity, which has often acted as a major tailwind for risk assets such as Bitcoin.

Bitcoin fell to an intraday low of $65,000 support during the late U.S. trading hours on Sunday. This level has acted as a strong demand zone over the past few months, and the asset managed to rebound as it retraced part of its weekend losses.

At presstime, Bitcoin had recovered above $68,000. The quick recovery suggests that investors may have already soaked up the latest market shock.

Crypto World

Why the terror financing case against Binance fell apart in court

A US federal court has dismissed a lawsuit accusing crypto exchange Binance of facilitating terrorism financing, ruling that the plaintiffs failed to establish the legal requirements needed to hold the platform liable under US anti-terror laws.

Summary

- A US federal judge dismissed a lawsuit accusing Binance of facilitating terrorism financing, citing insufficient evidence linking the exchange to specific attacks.

- The court said the plaintiffs failed to show that Binance knowingly provided substantial assistance to terrorist organizations.

- The judge allowed plaintiffs 60 days to amend their complaint, leaving the possibility that the case could return with new allegations.

Federal judge throws out the terrorism financing lawsuit against Binance

In an opinion issued on March 6, Judge Jeannette A. Vargas of the US District Court for the Southern District of New York granted the defendants’ motion to dismiss the complaint brought by hundreds of victims and relatives of victims of terrorist attacks.

The plaintiffs, linked to 64 attacks worldwide between 2016 and 2024, alleged that Binance allowed accounts tied to terrorist groups and their intermediaries to operate on its platform. They argued that the exchange’s services enabled those actors to move funds and therefore amounted to aiding and abetting terrorism under the US Anti-Terrorism Act and the Justice Against Sponsors of Terrorism Act.

However, the court ruled that the complaint did not plausibly show that Binance knowingly provided substantial assistance to terrorist organizations.

According to the opinion, the allegations largely relied on claims that certain wallets linked to sanctioned groups had used the exchange, but they failed to demonstrate that Binance was aware of those connections at the time.

Judge Vargas also found that the plaintiffs did not sufficiently link the alleged cryptocurrency transactions to the specific attacks cited in the lawsuit. The court said the complaint relied on generalized claims about terrorist use of digital assets rather than concrete allegations showing that funds moving through Binance directly supported the incidents referenced by the plaintiffs.

Because of these shortcomings, the court concluded that the complaint failed to meet the legal standard required for aiding-and-abetting liability under US anti-terror statutes.

While dismissing the case, the judge granted the plaintiffs 60 days to file an amended complaint addressing the deficiencies identified in the ruling. If they succeed in presenting stronger allegations, the case could proceed in federal court.

Crypto World

How Circle settled $68M in minutes using its own USDC rails

Circle Internet Group has begun using its own stablecoin infrastructure to handle internal treasury operations, settling $68 million in intercompany transfers across eight corporate entities in under 30 minutes.

Summary

- Circle Internet Group settled $68 million in intercompany transfers across eight entities in under 30 minutes using its USDC stablecoin and the Circle Mint treasury platform.

- The transactions replaced traditional bank wires that typically take one to three days to settle.

- Circle says the workflow helped complete about 90% of internal transfer pricing settlements in a single day, highlighting stablecoins’ potential for corporate treasury operations.

Jeremy Allaire says Circle settled $68M using USDC as firm “eats its own dog food”

The development was revealed by Circle CEO Jeremy Allaire in a recent post on X, where he said the company had started using USDC and the Circle Mint platform to replace traditional bank wires for internal settlements.

According to Allaire, the company’s treasury team processed the transfers across multiple internal entities in a single workflow that operated continuously, allowing funds to move at any time rather than during banking hours.

The process settled the $68 million in less than half an hour while maintaining full controls and auditability.

The stablecoin-based settlement replaces traditional fiat wire transfers that typically take one to three days to complete through conventional banking rails.

Circle said the move reflects how blockchain-based payments can streamline corporate treasury management. Through Circle Mint, the company’s platform that enables businesses to mint and redeem stablecoins and move funds, treasury staff can initiate transfers, apply role-based approvals, and confirm receipt of funds in near real time.

The company’s treasury case study describes the workflow as a way to reduce the “cash-in-transit” gap common in traditional banking systems, where funds may be debited from one entity but not immediately confirmed at another due to settlement delays.

With USDC settlement, confirmations occur within minutes rather than days.

Circle said the new system has also accelerated accounting operations. Approximately 90% of the company’s intercompany transfer-pricing settlements were completed in a single day, significantly compressing the month-end close process.

The firm plans to expand the workflow as additional updates to Circle Mint roll out, with Allaire suggesting the model could eventually enable other businesses to adopt stablecoin-based treasury settlement systems.

Crypto World

Flow Foundation seeks court order to stop FLOW token delisting in South Korea

Flow Foundation and Dapper Labs have filed a motion with the Seoul Central District Court to suspend the termination of trading support on major South Korean exchanges for the Flow blockchain’s native FLOW token.

Summary

- Flow Foundation and Dapper Labs have asked a Seoul court to suspend the planned termination of FLOW trading on Upbit, Bithumb, and Coinone.

- A December 2025 exploit allowed an attacker to duplicate about $3.9 million in tokens, but post-incident reports confirmed user balances were not affected.

According to a March 8 announcement, the firms are asking the court to temporarily halt the delisting decision by Upbit, Bithumb, and Coinone, which announced plans to end trading support for the token on Feb. 12 after a security incident on the layer-1 blockchain.

As previously reported by crypto.news, on Dec. 27, the Flow blockchain suffered a protocol-level exploit that allowed an attacker to mint about $3.9 million in duplicated tokens.

Although post-mortem reports published later confirmed that the incident did not impact user balances, it led to a temporary halt of the network and triggered emergency measures from validators, who were able to pause the chain and work with exchange partners to freeze and recover funds linked to the attack.

Flow initially proposed a full chain rollback recovery plan, which received opposition from ecosystem partners who were concerned it could create double balances for users who bridged assets out during the rollback window and losses for those who had bridged assets into the network during the same period.

Developers later opted for an isolated recovery plan by targeting and destroying the duplicate tokens in a bid to preserve legitimate user activity on the network.

Several exchanges suspended FLOW trading and services following the incident, including Upbit, Bithumb, and Coinone, which are at the center of the Flow Foundation’s court motion.

However, after conducting individual reviews of the incident and the remediation measures taken by the project, many of these platforms have since restored full services for the token.

The foundation contends that the FLOW token remains available on major global exchanges, including Binance, Coinbase, Kraken, while Korbit continues to support FLOW trading in South Korea.

“Given the weight of new evidence, Flow Foundation and Dapper Labs have filed a motion with the Seoul Central District Court requesting a suspension of the trading termination until a thorough review can be completed,” the foundation said.

“This step reflects the responsibility of the Foundation to advocate for the Korean community using every available pathway. The Foundation remains open to constructive conversation with all parties involved,” it added.

The court is set to review the application on March 9 and will determine the next steps in the case.

Further, the foundation said it would continue to pursue additional exchange listings in South Korea and would expand “self-custody access options” for impacted users.

As of last check, FLOW token was down 6.4% over the past 24 hours and was trading 99.9% below its all time high.

Crypto World

AI Infrastructure as a Service (AIaaS): Enterprise AI Deployment Guide

AI Summary

- Enterprises are pivoting towards large-scale AI deployment, with a focus on robust infrastructure to support advanced AI workloads.

- As global AI spending is set to reach $2.52 trillion by 2026, organizations are investing heavily in AI foundations.

- AI Infrastructure-as-a-Service (AIaaS) emerges as a pivotal model, offering on-demand access to essential resources for building AI systems without the burden of managing complex hardware.

- AI cloud infrastructure is becoming the cornerstone of enterprise AI, providing scalable environments optimized for high-performance computing and large-scale model training.

- Key architectural components of modern AI infrastructure include high-performance compute layers, data engineering, storage layers, machine learning development environments, and MLOps frameworks.

Artificial intelligence has entered a phase where infrastructure, not algorithms, is becoming the defining factor for enterprise success. Organizations are rapidly shifting their focus from experimentation to large-scale deployment of AI solutions. However, running modern AI workloads requires massive computing power, distributed storage systems, and specialized AI development infrastructure.

Industry research shows that enterprises are dramatically increasing their investments in AI foundations. According to research from Gartner, global AI spending is projected to reach $2.52 trillion by 2026, representing a 44% increase compared to previous years. A significant portion of this spending is directed toward AI infrastructure and enterprise AI platforms.

Infrastructure is now the backbone of enterprise AI adoption. Large organizations are investing heavily in high-performance computing clusters, AI cloud infrastructure, and scalable data pipelines to support generative AI and machine learning applications.

As John-David Lovelock, Distinguished VP Analyst at Gartner, explains:

“AI adoption is fundamentally shaped by the readiness of human capital and organizational processes.”

This shift toward infrastructure-led AI adoption has accelerated the rise of AI Infrastructure as a Service (AIaaS), enabling enterprises to build intelligent systems without managing complex underlying hardware.

What Is AI Infrastructure-as-a-Service (AIaaS)? A New Operating Model for Enterprise AI

AI Infrastructure-as-a-Service is a cloud-based delivery model that provides enterprises with on-demand access to computing resources, machine learning environments, and deployment platforms required to build and scale artificial intelligence systems.

Instead of investing in expensive hardware or building AI platforms internally, organizations can leverage managed AI infrastructure services delivered through cloud-based platforms.

An enterprise-grade AI infrastructure platform typically provides:

- GPU and AI accelerator clusters for large-scale computation

- Distributed storage for large datasets

- AI development infrastructure for model training

- MLOps pipelines for lifecycle management

- AI deployment and inference environments

This service-based model enables organizations to build advanced AI applications while focusing on innovation rather than infrastructure management.

Industry analysts highlight that AI-optimized infrastructure services are becoming one of the fastest-growing segments of enterprise technology.

According to Gartner research, spending on AI-optimized Infrastructure-as-a-Service is expected to reach $37.5 billion by 2026, driven by the increasing demand for specialized computing hardware such as GPUs and AI accelerators.

The Rise of AI Cloud Infrastructure: Powering the Next Generation of AI Applications

Modern AI systems rely heavily on scalable cloud environments capable of handling massive datasets and complex machine learning workloads. As a result, AI cloud infrastructure has become the foundation of enterprise AI deployment.

Unlike traditional cloud environments, AI cloud infrastructure is optimized for high-performance computing and large-scale model training. It integrates advanced hardware components such as GPUs, tensor processing units, and AI accelerators with distributed storage and networking systems.

Key capabilities of AI cloud infrastructure include:

- Scalable GPU clusters

- Distributed computing frameworks

- High-speed networking for parallel processing

- Automated model deployment environments

These capabilities allow enterprises to train complex machine learning models, process massive datasets, and deploy AI-driven applications across global markets.

According to reports from Deloitte and Gartner, enterprise spending on AI infrastructure is accelerating as organizations scale generative AI and machine learning deployments. Major technology companies are investing hundreds of billions of dollars into data centers designed specifically for AI workloads.

This growing infrastructure ecosystem is enabling enterprises to build AI systems that can process vast amounts of data in real time.

Building Enterprise AI Infrastructure: Key Architectural Components

A modern enterprise AI infrastructure consists of multiple interconnected layers designed to support the complete lifecycle of AI development.

These layers form the foundation of AI development infrastructure used by data scientists, machine learning engineers, and enterprise technology teams.

High-Performance Compute Layer

AI workloads require specialized hardware capable of handling parallel computations. GPU clusters and AI accelerators enable organizations to train deep learning models and generative AI systems efficiently.

These compute environments are particularly critical for large language models and advanced neural networks that require thousands of parallel operations.

Data Engineering and Storage Layer

AI systems rely on vast volumes of data. Enterprise AI platforms include advanced data pipelines that support data ingestion, storage, transformation, and governance.

These systems allow organizations to process structured and unstructured data at scale while maintaining security and compliance.

Machine Learning Development Environment

AI engineers require sophisticated development environments that allow them to experiment with models, test algorithms, and collaborate across teams.

These environments are an essential component of modern AI development infrastructure.

They typically include:

- model training frameworks

- experiment tracking tools

- collaborative development environments

These capabilities accelerate innovation while ensuring consistency across AI projects.

MLOps and Model Lifecycle Management

As AI systems move into production environments, organizations must manage the entire lifecycle of machine learning models.

MLOps frameworks provide automation for:

- model deployment

- monitoring and performance tracking

- continuous model retraining

These systems ensure that AI applications remain reliable and effective over time.

The Role of AI Development Companies in Accelerating Enterprise AI

For many organizations, building AI infrastructure internally can be both technically complex and financially demanding. As a result, enterprises increasingly collaborate with specialized AI development company partners that provide expertise in building scalable AI ecosystems.

An experienced AI development company can help enterprises:

- Design scalable AI infrastructure platforms

- Implement AI cloud infrastructure environments

- Build custom AI models and data pipelines

- Deploy AI applications across enterprise systems

By combining infrastructure expertise with advanced AI engineering capabilities, these companies enable organizations to accelerate AI adoption while minimizing operational risks.

Business Advantages of AI Infrastructure-as-a-Service

Adopting AI infrastructure as a service provides multiple strategic benefits for enterprises looking to scale AI initiatives

AIaaS eliminates infrastructure bottlenecks, allowing organizations to focus on building intelligent applications rather than managing hardware.

- Scalable Computing Resources

Enterprises can dynamically scale computing resources based on demand, enabling them to handle large AI workloads efficiently.

- Reduced Capital Investment

Organizations avoid large upfront investments in specialized hardware such as GPU clusters and AI accelerators.

- Improved Operational Efficiency

Managed AI infrastructure services reduce operational complexity and simplify the management of AI environments.

- Faster Deployment of AI Applications

AIaaS platforms accelerate the development and deployment of AI solutions across enterprise systems.

Transform your Enterprise with Scalable AI Infrastructure

Emerging AI Infrastructure Trends Shaping 2025-2026

The evolution of enterprise AI infrastructure is being shaped by several transformative trends.

- Generative AI Infrastructure

The rise of generative AI has significantly increased demand for computing power and data processing capabilities. Enterprises are building infrastructure specifically designed to support large language models and multimodal AI systems.

- AI Supercomputing Clusters

Large-scale AI clusters capable of connecting thousands of GPUs are becoming the backbone of enterprise AI platforms.

Organizations are increasingly deploying AI models closer to data sources to enable real-time processing for applications such as smart manufacturing and autonomous systems.

As AI adoption grows, enterprises are implementing governance frameworks and financial operations strategies to manage the cost and performance of AI workloads.

Experts highlight that infrastructure readiness is becoming a critical factor for successful AI implementation.

Challenges Enterprises Must Address When Building AI Infrastructure

- Data Security and Compliance

Enterprises must ensure that sensitive data remains protected when deploying AI workloads in cloud environments.

Training large AI models can require significant computing resources, increasing operational expenses.

Many organizations struggle to find professionals with expertise in AI infrastructure engineering.

Relying heavily on a single AI cloud provider can create long-term operational dependencies. Addressing these challenges requires careful planning and a well-defined enterprise AI strategy.

The Future of AI Infrastructure Platforms

AI infrastructure is rapidly evolving as enterprises push the boundaries of machine learning and generative AI technologies.

Future enterprise AI platforms are expected to incorporate:

- autonomous AI operations

- distributed AI networks

- edge computing infrastructure

- AI-native cloud environments

Researchers predict that the number of AI agents and intelligent systems could increase dramatically over the next decade, placing even greater demands on global computing infrastructure.

This means that scalable AI infrastructure platforms will become essential digital foundations for the next generation of intelligent systems.

Why AIaaS is Becoming the Backbone of Enterprise AI

Artificial intelligence is transforming how organizations operate, compete, and innovate. However, the ability to scale AI initiatives depends heavily on the availability of reliable and high-performance infrastructure. AI Infrastructure-as-a-Service provides enterprises with a powerful solution for building and deploying intelligent systems without the complexity of managing hardware environments. By leveraging scalable computing environments and modern AI platforms, organizations can accelerate innovation, reduce operational complexity, and unlock new opportunities in the AI-driven economy. As AI adoption continues to expand, AIaaS will play a critical role in enabling enterprises to build the intelligent digital ecosystems of the future.

As a trusted AI Development company, Antier helps enterprises design and implement scalable AI environments that support modern AI workloads and intelligent applications. With deep expertise in enterprise AI deployment, Antier empowers organizations to transform ideas into production-ready AI solutions.

Crypto World

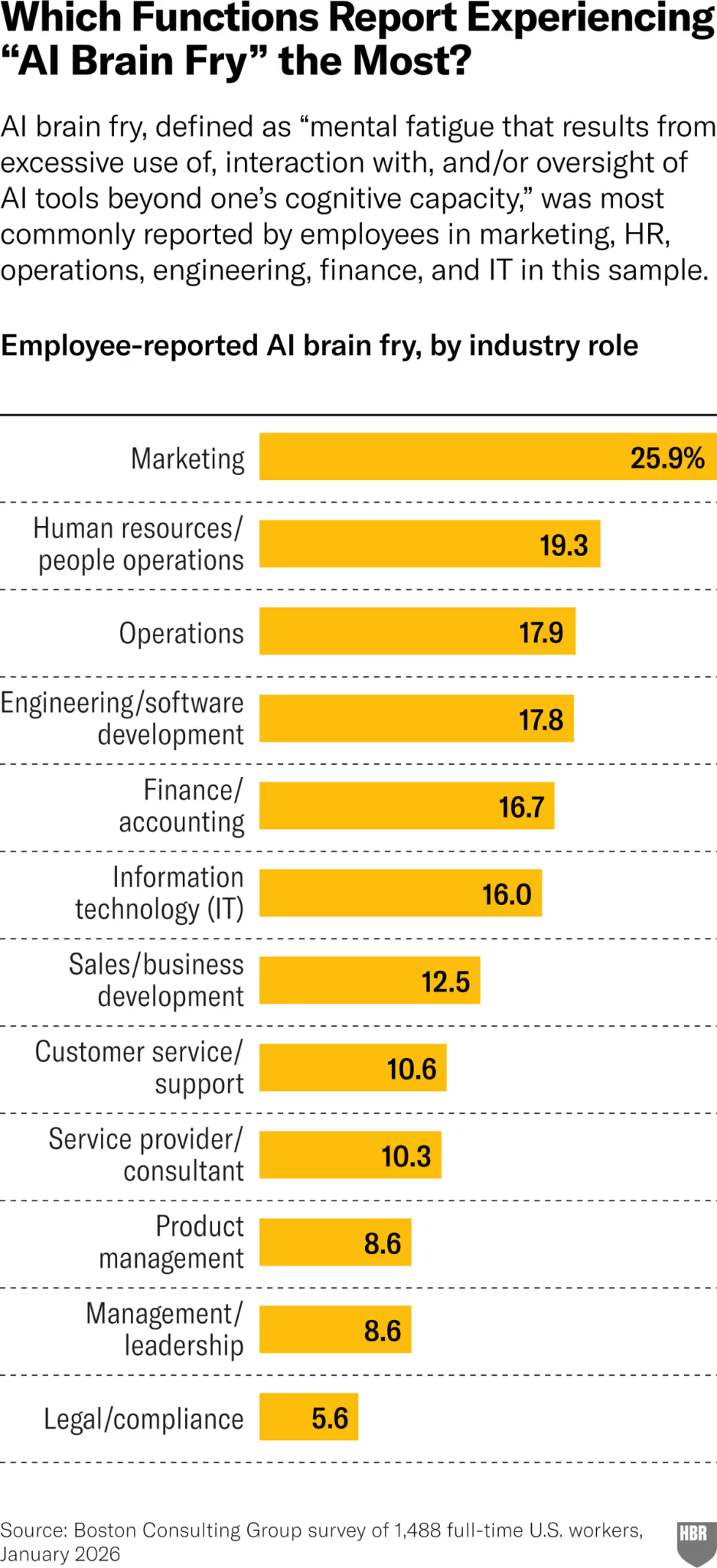

AI Use in Workplaces Causing ‘Brain Fry,’ Say Researchers

The excessive use and oversight of artificial intelligence in the workplace is giving workers “AI brain fry,” contrary to the technology’s assurance that it would ease job pressures.

Workers who are using AI tools report that the technology is “intensifying rather than simplifying work,” researchers from Boston Consulting Group and the University of California wrote in the Harvard Business Review on Friday.

A study of nearly 1,500 full-time US workers found 14% said they had experienced “mental fatigue that results from excessive use of, interaction with, and/or oversight of AI tools beyond one’s cognitive capacity,” or what the researchers called “AI brain fry.”

Respondents described having a “mental hangover” with a “fog” or “buzzing” and an inability to think clearly, along with headaches, slower decision-making, and difficulty focusing.

AI companies have pushed their products as a productivity booster, allowing workers to offload some or part of their workloads, a message that some companies have taken on and started to measure AI use as a performance metric.

Crypto exchange Coinbase CEO Brian Armstrong has said he fired engineers who didn’t want to use AI, and set a goal late last year to have AI generate half of the platform’s code.

“As enterprises use more multi-agent systems, employees find themselves toggling between more tools,” the researchers wrote. “Contrary to the promise of having more time to focus on meaningful work, juggling and multitasking can become the definitive features of working with AI.”

AI carries “significant costs,” but can improve burnout

The researchers said this AI-induced mental strain “carries significant costs in the form of increased employee errors, decision fatigue, and intention to quit.”

Study respondents who said they had brain fry experienced 33% more decision fatigue compared to those who didn’t, which researchers said could cost large companies millions of dollars a year. Those with AI brain fry were also around 40% more likely to have an active intent to quit.

Those reporting AI brain fry also self-reported making nearly 40% more major errors than those who did not, with a major error defined as one with “serious consequences, such as those that could affect safety, outcomes, or important decisions.”

The researchers found, however, that the use of AI to replace repetitive and routine tasks decreased burnout, a state of chronic workplace stress that leads to negative feelings about the job and decreased effectiveness.

Related: Anthropic reopens Pentagon talks as tech groups push Trump to drop risk tag

Respondents who used AI to reduce time spent on routine and repetitive tasks reported their levels of burnout were 15% lower than those who didn’t use AI in such a way.

The researchers said company leaders looking to reduce AI brain fry should “clearly define AI’s purpose in the organization” and explain how workloads will change with the tool.

Companies should also stick to “measurable outcomes” for AI, as “incentivizing quantity of use will lead to waste, low-quality work, and unnecessary mental strain.”

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

Finance Hiring Back to 2012 Levels as US Lost 92k Jobs Last Month

Finance and insurance job openings in the United States edged toward 13-year lows by the end of 2025, according to February data from the Federal Reserve Bank of St. Louis. A well-circulated analysis by The Kobeissi Letter on X warned that the industry may be bracing for more layoffs as the labor market recalibrates. The data show openings for the sector declining by 117,000 since December to 134,000 in February, with total finance and insurance listings approaching recession-era levels. The contraction is notable because it marks a swing from a peak reached in 2022 and raises questions about how the broader labor market will fare in 2026. (CRYPTO: BTC)

In a broader payroll snapshot, the February release from the US Bureau of Labor Statistics depicted a mixed picture. While the headline figure captured a net loss of 92,000 jobs for the month, the finance‑related segment posted a small gain of 10,000 positions. The healthcare sector, however, dragged on the numbers, shedding 28,000 roles in February — a consequence attributed in part to the Kaiser Permanente strike that spanned several weeks and ended late last month. The overall picture remains nuanced: a softening in certain segments coexists with pockets of resilience in others, underscoring a labor market that is anything but uniform. A CNN summary of the February report highlighted that weather conditions may have influenced the data, though the bureau noted that quantifying weather’s impact is challenging. (CNN: https://edition.cnn.com/2026/03/06/economy/us-jobs-report-february)

The discussions around these figures have fed a broader debate about the trajectory of monetary policy. A weaker payroll backdrop can tilt the balance toward rate cuts, which some market observers argue would be supportive for risk-on assets, including digital currencies. Yet the same fragility in the labor market can also push investors toward risk-off strategies as uncertainty persists, complicating the outlook for liquidity and appetite across high‑beta assets. While The Kobeissi Letter framed the sector as vulnerable to further layoffs, other data points suggest that some corners of the economy remained buoyant, creating a tug-of-war between softer hiring in finance and pockets of recovery elsewhere.

Bitcoin (CRYPTO: BTC) has traded with sensitivity to macro cues, absorbing both the caution from a softer jobs backdrop and the potential for policy shifts. The narrative around rate expectations—whether policymakers will cut sooner or hold a higher-for-longer stance—continues to shape how traders price risk, liquidity, and inflation expectations. In this context, the February numbers do not present a single storyline but rather a mosaic of forces that could influence crypto and broader markets in the weeks ahead.

The February report also touched on several sectors outside finance. The information sector, transportation and warehousing, and the federal government each lost around 11,000 jobs, contributing to the month’s mixed performance. The healthcare sector’s decline, tied to the electricity of ongoing labor actions in that space, underscored how sector-specific dynamics can travel across the broader payroll landscape. Weather, while cited as a possible contributing factor, was described by the bureau as difficult to quantify in terms of its net effect on the numbers.

Against this backdrop, market participants watched for how financial conditions might evolve as the year unfolds. The Labor Department data, coupled with independent assessments, continues to shape expectations around how aggressively the Federal Reserve might shift policy. If the data tilt toward weakness, the case for rate reductions could strengthen, potentially offering a more favorable environment for risk assets, including major crypto assets. Yet the overarching uncertainty surrounding the pace of growth and inflation means that investors remain vigilant for surprises in the coming releases.

As policymakers weigh the next steps, the market’s current mood reflects a balance between caution and opportunity. The possibility of rate relief remains a central theme for asset pricing, even as volatility persists in sectors affected by labor dynamics and sector-specific disruptions. The conversation surrounding how macro policy translates into crypto market performance is ongoing, and observers continue to parse the implications for liquidity, leverage, and investor sentiment.

Looking ahead, central bank commentary and upcoming data releases will be critical in shaping how the narrative evolves. While the February payrolls lay out a mixed landscape, the bigger question remains: will labor market softness materialize into a sustained shift in policy that catalyzes a broader risk-on rotation, or will persistent fragility push investors toward defensive positioning? The answer will likely influence the trajectory of crypto markets as traders seek clarity on the macro backdrop and the timing of potential policy pivots.

Why it matters

The February payroll data underscore a core tension in the current economic cycle: pockets of resilience exist alongside sectors that are contracting. For the crypto ecosystem, this matters because policy expectations and liquidity conditions are among the most influential drivers of price dynamics. If a softer labor market nudges the Federal Reserve toward rate cuts, it could lower the opportunity cost of holding non-yielding assets like Bitcoin and other digital currencies, potentially encouraging a broader risk-on stance among investors. Conversely, persistent hiring weakness and the possibility of renewed volatility can keep risk tolerance in check, reinforcing caution in both traditional markets and crypto trading desks.

From an investor perspective, the juxtaposition of gains in finance employment with losses in healthcare and government segments highlights the uneven nature of the recovery. The crypto market thrives on clarity—whether through clearer policy signals, stabilization in macro data, or the sustained entrance of institutional capital. The current data landscape suggests that traders should prepare for a range of outcomes, with the potential for both upside surprises and renewed downside pressure as new statistics arrive. The dynamic also reflects that macro conditions continue tooutweigh any one-harvest dataset, reinforcing the importance of a diversified approach to assessing risk and opportunity in the space.

For builders and strategists, the payroll trajectory matters in shaping how venture capital and corporate treasuries allocate liquidity in the short to mid term. The health of the labor market influences consumer demand, financial stability, and the speed at which digital asset ecosystems can scale. While the February numbers do not deliver a single roadmap, they contribute to a broader narrative in which policy direction, market liquidity, and sector-specific developments—especially in finance and healthcare—will interact with crypto-related funding, investments, and product launches as 2026 unfolds.

What to watch next

- Upcoming U.S. labor data releases (next month) to assess whether February’s softness or resilience persists across sectors.

- Federal Reserve communications and the timing of potential rate moves, including any shifts in language around inflation and growth.

- Macro liquidity trends and ETF flows that could influence risk appetite for crypto assets.

- Updates on major healthcare and labor actions that could alter sector hiring momentum in the near term.

- Monitor Bitcoin price action and volatility in response to macro news and policy signals as a gauge of risk sentiment.

Sources & verification

- Federal Reserve Bank of St. Louis data on finance and insurance job openings for February (13-year low, 134,000 openings; down 117,000 since December).

- The Kobeissi Letter posting on X summarizing the declines and comparing them to historical recession bottoms.

- US Bureau of Labor Statistics February jobs report (overall -92,000; finance activities +10,000; healthcare -28,000).

- CNN coverage of the February employment report, including discussion of weather impacts and sector contributions.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Entertainment7 days ago

Entertainment7 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

News Videos7 days ago

News Videos7 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports1 day ago

Sports1 day agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business14 hours ago

Business14 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3