Crypto World

Saylor pushes “1.4% forever” Bitcoin play to Middle East wealth funds

Michael Saylor pitches a 1.4% credit‑funded balance‑sheet formula to Middle East capital, aiming to turn corporates into perpetual Bitcoin accumulators in a fragile market.

Summary

- Saylor claims selling credit equal to 1.4% of capital assets can both fund stock dividends and grow a company’s Bitcoin stack indefinitely.

- He frames Bitcoin as “digital capital” and “digital gold,” arguing Bitcoin‑backed credit can deliver two to four times traditional fixed‑income yields.

- The pitch hits as Bitcoin trades near $70,345 and major alts like ETH, SOL, and XRP reflect a macro‑sensitive, drawdown‑scarred risk environment.

Michael Saylor has found a way to turn balance‑sheet engineering into a perpetual Bitcoin (BTC) accumulator’s charter — and he is not whispering it, he is broadcasting it to the Middle East.

Saylor’s “1.4% forever” math

Speaking live on Middle Eastern television, Strategy’s executive chairman Michael Saylor distilled his pitch into a single, aggressive sentence: “If we sell credit instruments equal to 1.4% of our capital assets, we can pay the dividends funded in Bitcoin and we can increase the amount of BTC we have forever.”

The logic is brutally simple: monetize a thin slice of the asset base via credit, recycle that into yield‑bearing Bitcoin exposure, and feed shareholders both cash flow and upside without, in his view, diluting the core capital stack. KuCoin’s summary of the framework put it starkly: selling 1.4% of capital assets as credit “could allow the company to boost Bitcoin holdings permanently” while still supporting stock dividends.

This approach extends a strategy he outlined at the Bitcoin MENA conference, where he told regional sovereign funds in the Middle East that “Bitcoin is digital capital, or digital gold, and digital credit builds on it by stripping out volatility to generate yield.”

Macro risk, meet corporate leverage

Saylor’s formula lands in a market where Bitcoin itself has turned into the cleanest proxy for global risk appetite. At press time, Bitcoin (BTC) trades around $70,345, with a 24‑hour range between roughly $68,428 and $71,852 on about $59.3B in volume. Ethereum (ETH) changes hands near $2,012, with 24‑hour trading volume close to $28.7B and intraday prints between about $1,999 and $2,140. Solana (SOL) sits around $86, with roughly $3.9B traded over the last day as it grinds through a 2025–26 drawdown. XRP (XRP) hovers near $1.44, down about 1% over the last 24 hours as on‑chain data flags a “stop‑loss phase” after months of distribution.crypto+8

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $70,345, with a 24‑hour high near $71,852 and a low near $68,428, on roughly $59.3B in dollar volumes. Ethereum (ETH) changes hands close to $2,012, with about $28.7B in 24‑hour turnover and spot quotes clustered in the $2,000–$2,100 band on major exchanges earlier this week. Solana trades around $86, up modestly over the last 24 hours, with nearly $3.9B in volume.crypto+5

Middle Eastern capital in the crosshairs

Saylor has been explicit about his target audience. In Abu Dhabi, he claimed to have met “every Middle East sovereign wealth fund” to pitch Bitcoin‑backed credit as a superior fixed‑income replacement, promising “two to four times” traditional yields while using corporate structures like Strategy as leverage amplifiers.

The sales pitch collides with a more fragile tape. Bitcoin has slipped below $70,000 amid what one analyst called an “unpumpable” market, with selling pressure overwhelming inflows after a 45% drawdown from the 2025 peak. Whether Saylor’s 1.4% rule becomes a template or a cautionary tale will be decided not in televised sound bites, but in the next macro stress test.

Crypto World

FBI Arrests Custody Company CEO‘s Son over Alleged $46M Crypto Theft

The US Federal Bureau of Investigation (FBI) announced that it had made an arrest related to the theft of more than $46 million in cryptocurrency from the US Marshals Service.

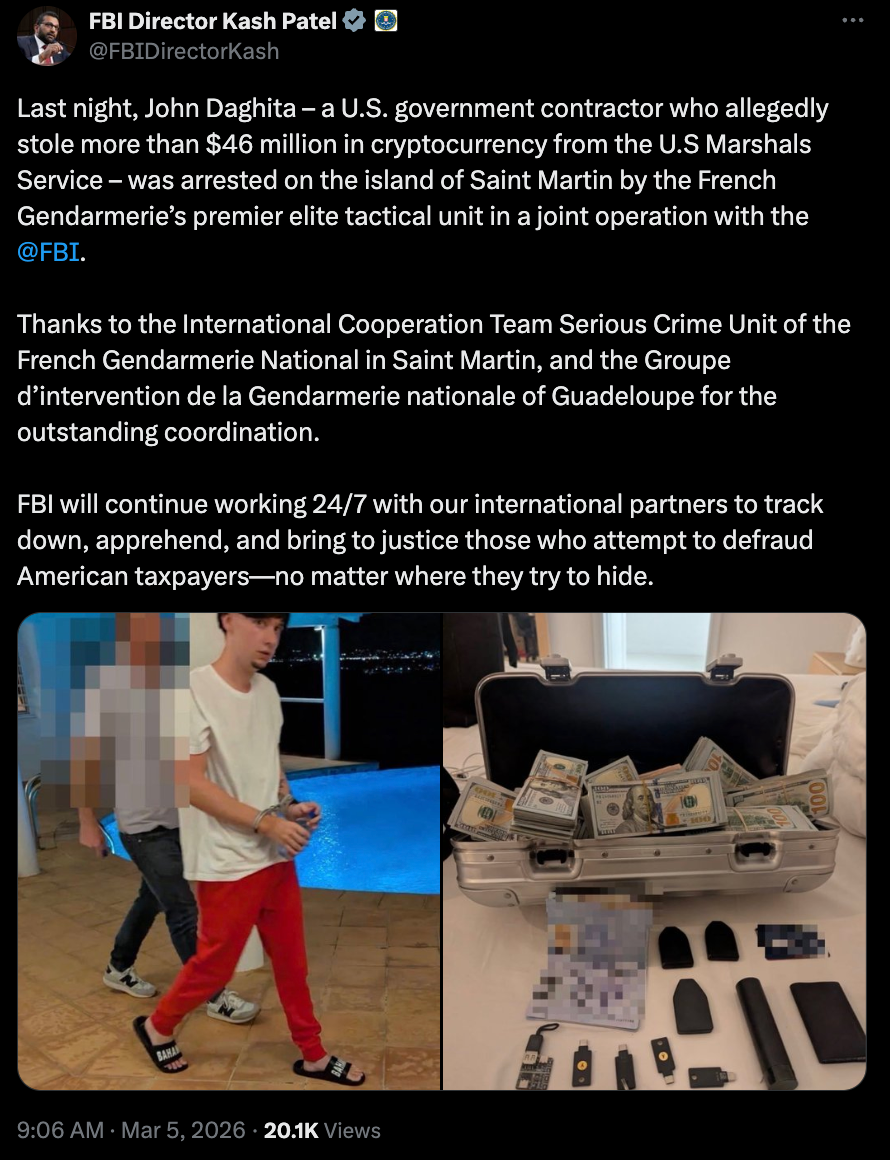

In a Thursday X post, FBI Director Kash Patel said that the bureau had arrested John Daghita, the son of Command Services & Support (CMDSS) president Dean Daghita, after he allegedly gained unauthorized access to wallets managed under the federal asset protection program. Patel said the arrest was carried out by the “French Gendarmerie’s premier elite tactical unit” with the FBI on the island of Saint Martin in the Caribbean.

Patel’s social media post with a photo of a handcuffed Daghita, also included a photo of a suitcase containing cash, several thumb drives, a phone and three devices resembling Trezor hardware wallets. The FBI director did not disclose whether any of the stolen funds had been recovered.

The alleged crypto theft was reported in January by online sleuth ZachXBT, who said that he had traced a wallet linked to Daghita holding about $23 million in digital assets connected to $90 million reportedly seized by the US government in 2024 and 2025. Daghita’s father heads CMDSS, which was awarded a contract by the US Marshals Service in 2024 related to the custody of the seized crypto.

Related: Wallet linked to alleged US seizure theft launches memecoin, crashes 97%

The US Marshals Service confirmed that it was investigating the matter at the time. Patrick Witt, the director of the White House Crypto Council, said in a Jan. 26 X post that he was “on it,” referencing ZachXBT’s claims. Witt had not publicly commented on the arrest as of Thursday.

According to data from BitcoinTreasuries.NET, US authorities, including the Marshals Service, may hold as much as 328,372 Bitcoin (BTC) through various seizures.

South Korean authorities make two arrests related to seized crypto

Daghita’s arrest is the latest example of global law enforcement efforts to recover previously seized assets.

In February, police in South Korea arrested two people allegedly connected to a case in which authorities lost access to 22 BTC, worth about $1.6 million at the time of publication.

The crypto was reportedly stolen after police seized the assets from a hack on a South Korean exchange in 2021, storing them on a cold wallet owned by a third party.

Earlier this week, Deputy Prime Minister and Minister of Strategy and Finance Koo Yun-cheol said the government and relevant agencies will “conduct an inspection of the current status and management practices of digital assets held and managed by the government and public institutions,” according to local media reports.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

Monero price flips daily structure bullish, $473 target

Monero price has confirmed a bullish market structure shift on the daily timeframe after reclaiming key support. If the $357 level continues to hold, the next major upside target sits at the $473 resistance.

Summary

- Bullish structure confirmed: Monero printed a higher low followed by a new higher high on the daily chart.

- $357 flipped to support: Former resistance now acting as key support for continuation.

- $473 target: Next major high-timeframe resistance if bullish momentum holds.

Monero (XMR) price is beginning to show renewed bullish momentum after a decisive structural shift on the daily chart. The recent price action suggests that buyers have regained control of the market following a confirmed break in market structure.

With price reclaiming and holding above the $357 level, traders are now watching for a potential continuation move that could send Monero toward the next major resistance zone at $473.

Monero price key technical points:

- Bullish market structure break: Daily chart confirms a new higher high after a higher low.

- Key support reclaimed: $357 resistance has flipped into strong support.

- Upside target: $473 stands as the next high-timeframe resistance level.

Monero’s latest price action has confirmed a bullish shift in market structure on the daily timeframe. The chart shows a clear sequence of a higher low followed by a new higher high, which is one of the most widely recognized signals of trend continuation in technical analysis. This break of structure confirms that buyers have regained momentum after a previous corrective phase.

The key development supporting this bullish outlook is the reclaim of the $357 level. Previously acting as a significant resistance zone, this area has now flipped into support, which is often a strong technical signal that the market is preparing for a continuation move. When resistance converts into support, it typically indicates that buyers are willing to defend the level, increasing the probability of sustained upward momentum.

The break of market structure (MSB) is clearly visible on the daily chart. After establishing a higher low during the previous pullback, Monero successfully pushed above the prior swing high, confirming a new higher high. This structure is critical because it signals a transition from a consolidation phase into a potential trending environment.

Such structural confirmations often precede strong directional moves as market participants reposition in line with the new trend. In the broader market narrative, several leading cryptocurrencies attracting trader attention include BCH, XMR, HYPE, and BlockDAG, as investors continue to seek assets offering strong utility, growth potential, and sustained momentum.

Another important aspect of this setup is the positioning of the current support relative to recent price action. As long as Monero continues to hold above the reclaimed $357 support on a daily candle-closing basis, the bullish structure remains intact. Maintaining this level would suggest that buyers are still in control and that the recent breakout is not a false move.

From a broader technical perspective, sustained trading above the newly established support opens the path for an accelerated move toward higher resistance levels. The next significant high-timeframe resistance sits near $473, which historically has acted as a major barrier for price. If bullish momentum continues to build, this level becomes the most logical upside objective for the current trend.

Market structure shifts often lead to rapid price expansion when combined with strong momentum and sustained support levels. The current configuration on Monero’s daily chart suggests that the market may be entering such a phase. With buyers defending key levels and the trend structure now pointing higher, traders are closely monitoring the potential for a continuation rally.

What to expect in the coming price action

From a technical and structural perspective, Monero now maintains a bullish outlook after confirming a daily market structure break. As long as price remains above the $357 support level on a closing basis, the probability favors continued upside toward the $473 resistance.

A sustained move above current levels would further reinforce the bullish trend, while a loss of support could delay the advance and lead to consolidation.

Crypto World

38% of Altcoins Near All-Time Lows, Worse Than FTX Crash

Risk-off market dynamics are pressing the broader crypto landscape, with new data underscoring a deepening drawdown in the altcoin sector. A CryptoQuant analyst highlighted that an estimated 38% of altcoins are currently trading near their all-time lows, a level that signals significant caution among traders and institutions alike. The overall market is viewed as unfavorable for risk-on assets, and altcoins appear to be among the first beneficiaries of a shift toward safer positions as investors reassess risk and liquidity allocation. This snapshot echoes past stress points: the same metric stood at 35% in April 2025 and hovered around 37.8% shortly after the FTX-related turmoil, illustrating that the current environment is among the most cautious in the ongoing cycle. In short, the altcoin market is grappling with a liquidity squeeze as capital reallocates toward traditional risk assets, a trend that could persist until macro and sector catalysts offer fresh direction.

Key takeaways

- About 38% of altcoins sit near or at all-time lows, a share that underscores a broad risk-off tilt not seen since peak stress moments following major market shocks.

- Liquidity is migrating away from altcoins toward equities and commodities, with daily crypto trading volume surging to over $417 billion on Oct. 10, reflecting a broad reallocation of risk appetite.

- The TOTAL3 metric, which tracks the market capitalization of the crypto sector excluding BTC and ETH, has retraced to levels last seen in November 2024, signaling a broad retrenchment in altcoin activity.

- Social and search interest in altcoins has cooled markedly, with social mentions shrinking and Google Trends showing the altcoin query at a yearly low, signaling waning public and retail enthusiasm.

- Analysts point to structural headwinds—token oversupply and the emergence of BTC ETFs—that have changed market dynamics and kept liquidity tethered to traditional financial vehicles.

Tickers mentioned: $BTC, $ADA, $DOT, $POL

Sentiment: Bearish

Price impact: Negative. The liquidity drain and risk-off sentiment have weighed on altcoin pricing and activity, with broad caution dominating near-term price action.

Trading idea (Not Financial Advice): Hold. The current trough in altcoin activity could precede a pause or reversal, but uncertainty remains high until macro and sector catalysts clarify the path forward.

Market context: The pullback occurs despite ongoing developments across the crypto ecosystem, including nuanced shifts in liquidity and evolving investor sentiment. These conditions are shaping price discovery as ETF dynamics and macro risk appetite influence both inflows and capital allocation to digital assets.

Why it matters

The widening drawdown in altcoins matters because it reflects a broader risk-off regime that can impact a wide spectrum of market participants—from retail traders to institutions exploring where to allocate capital in a volatile landscape. When nearly four in 10 altcoins trade near all-time lows, liquidity tends to contract, and price discovery becomes more selective. The consequence is a market where relatively fewer assets lead the narrative, and capital concentrates in a smaller subset of major coins and liquid assets. That concentration can amplify volatility for those outliers that do manage to attract attention and funding, while the bulk of smaller tokens remain under pressure.

On the investor side, the current dynamics heighten the risk of false bottoms and prolonged drawdowns. The decline in altcoin social activity and a dip in search interest—evidenced by a drop in Google Trends data for the term “altcoins”—signal waning consumer engagement. This creates a situation where catalysts beyond price action—such as new use cases, on-chain developments, or regulatory clarity—may be required to rekindle momentum. In this context, risk management becomes essential, as does nuanced monitoring of liquidity flows across markets that color altcoin performance relative to Bitcoin and major equity benchmarks.

The shift in liquidity also aligns with broader macro-trends in which institutional appetite for risk-on assets remains cautious, and capital is more readily deployed into traditional financial instruments via BTC ETFs and related vehicles. Analysts contend that the oversupply of tokens—more than 36.8 million different crypto tokens listed on CoinMarketCap—creates a crowded field where capital must be actively allocated and reallocated. While this environment can suppress broad-based altcoin rallies, it can also yield selective value opportunities as investors identify favorable risk-reward dynamics among a smaller set of assets and use-case-driven projects. The net effect is a market that trades closer to macro and liquidity signals than to pure tech narratives, a shift that has tangible implications for portfolio construction and risk budgeting in the crypto space.

In parallel, data points show that the market remains highly sensitive to shifts in sentiment and on-chain activity. The observation that daily trading volume peaked at over $417 billion on Oct. 10—on the day of a historic market event—illustrates how liquidity surges can occur in response to systemic shocks, even as the long-running trend points to a more cautious appetite for risk. The same period saw a retracement in the TOTAL3 metric toward late-2024 levels, highlighting how the aggregate asset base outside the dominant coins has to contend with a thinning of active interest. Taken together, these signals emphasize that the altcoin sector remains highly reactive to both macro developments and industry-specific catalysts, with broader market conditions setting the tone for near-term price action.

In this environment, a few altcoins have stood out as potential beneficiaries if a bottom forms or a catalyst emerges. While the market is not short on candidates, the current reality is that liquidity remains fragile, and downside risk remains a persistent feature of price discovery for most non-BTC assets. The overall message is one of heightened caution, where selective, well-supported projects with solid use cases and robust on-chain metrics may find more favorable reception than the broader, heavily diluted field.

As part of the broader discussion, observers note that social interest in altcoins has trended downward in tandem with a cooling in search interest. This combination of diminished engagement and thinner liquidity can complicate the task of forecasting immediate rebounds, even if some token-specific developments spark renewed attention. The market’s focus appears to be shifting away from broad altcoin momentum toward a more conditional, event-driven approach where only a handful of assets can sustain momentum in the face of competing macro headwinds and liquidity constraints. The conversation around altcoins remains central to the ongoing debates about how crypto markets should price risk, allocate capital, and measure value in a landscape characterized by rapid innovation and evolving regulatory considerations.

For readers who want to verify the underlying data, the discussion references several sources that track altcoin activity, liquidity, and interest metrics. The CryptoQuant analysis offers a direct read on near-ATL altcoin exposure, while CoinMarketCap’s charts provide a lens into overall trading volumes. TradingView’s TOTAL3 metric sheds light on asset mix dynamics outside the two dominant coins, and Google Trends provides a proxy for public interest in altcoins. A related data point highlights how a sizable portion of altcoins has seen outflows relative to Bitcoin, underscoring a broader rotation of capital within the crypto space.

In the broader arc of market evolution, the current altcoin drawdown is taking place alongside ongoing debates about the pace and direction of crypto regulation, institutional adoption, and the introduction of new investment vehicles. The evolving landscape suggests that the next phase will hinge on both macro risk sentiment and the emergence of catalysts within the altcoin segment that can spark renewed risk appetite or a more durable bottoming process.

The broader crypto ecosystem remains dynamic, and investors should stay attuned to shifts in liquidity, sentiment, and on-chain activity as the market navigates a potentially extended period of price discovery for altcoins.

Related: $209B exited altcoins over the last 13 months: Did traders rotate into Bitcoin?

Altcoin social activity drowned out by Bitcoin

The latest data indicate that altcoin mentions on social platforms have cooled, with sentiment analysis showing fewer discussions around altcoins as Bitcoin-led narratives dominate market chatter. This shift aligns with a broader pattern of reduced engagement in altcoin narratives, even as select developments continue within specific projects. The dynamic underscores the challenge for altcoins to regain visibility and traction in a crowded, highly competitive space where macro factors and institutional flows dominate the conversation.

What to watch next

- Monitor changes in the Total3 metric and related on-chain activity for altcoins, looking for signs of broad-based stabilization or further erosion.

- Track BTC ETF flows and any shifts in Bitcoin liquidity, as these can influence the broader altcoin rotation and market dynamics.

- Watch social sentiment and Google Trends data for altcoins for early indicators of renewed interest or renewed weakness.

- Notice any policy or regulatory developments that could affect liquidity and capital allocation within the crypto market.

Sources & verification

- CryptoQuant analysis by Darkfost on the share of altcoins near all-time lows: https://cryptoquant.com/insights/quicktake/69a608ad312550148f4ed342-38-of-Altcoins-Near-ATL-worse-than-the-post-FTX-period

- CoinMarketCap charts for overall trading volumes and market data: https://coinmarketcap.com/charts/

- TradingView TOTAL3 metric illustrating altcoin market cap movements (excl. BTC and ETH): https://www.tradingview.com/chart/g7xkPkTa/?symbol=CRYPTOCAP%3ATOTAL3

- Google Trends data for altcoins: https://trends.google.com/explore?q=altcoins&date=today%201-y&geo=Worldwide

- Discussion on altcoin exits and Bitcoin rotation: https://cointelegraph.com/news/dollar209b-exited-altcoins-over-the-last-13-months-did-traders-rotate-into-bitcoin

Market reaction and key details

Altcoin drawdown deepens as risk-off sentiment takes hold

In the latest market read, a broad risk-off pulse is pressuring the altcoin cohort, with a notable portion treading near all-time lows and liquidity shifting toward more traditional assets. The breadth of the weakness across altcoins is a defining feature of the current phase, even as select projects with real-world traction continue to pursue growth narratives. The emphasis now is on identifying what can catalyze a sustainable repricing in a landscape that has grown more selective as liquidity concentrates around fewer assets.

Why it matters

For investors, the current environment underscores the importance of robust risk controls and disciplined capital allocation. With a large share of altcoins trading at or near their worst prices, there’s a heightened risk of continued drawdown unless catalysts emerge that restore demand and liquidity. For builders and protocol teams, the context reinforces the need for clear value propositions, on-chain utility, and measurable traction to attract scarce capital in a crowded market. The broader market’s sensitivity to macro signals and ETF flows also suggests that token-specific developments must be complemented by broader market catalysts to sustain any meaningful upside.

What to watch next

- Watch for any shifts in the TOTAL3 metric that would indicate broader stabilization or renewed focus on altcoin liquidity.

- Monitor ETF-related capital movements into Bitcoin and how they ripple through altcoin liquidity and market breadth.

- Track social sentiment and search interest as potential leading indicators of renewed retail interest or renewed caution.

Crypto World

Ethereum (ETH) Could Rally by Double Digits if This Key Condition Is Met

Can ETH make a decisive comeback, or will the bears intercept the move?

The second-largest cryptocurrency has performed quite well lately, with its price soaring by nearly 10% over the past two weeks.

A number of popular analysts see potential for further gains, though they emphasize that holding critical support levels will be essential.

$2,500 and Beyond?

Ethereum (ETH) briefly climbed to a monthly peak of almost $2,200 before slightly retreating to the current $2,120 (per CoinGecko’s data). According to the renowned crypto commentator Ali Martinez, the asset “looks ready to break out” and is pressing at the upper boundary of a channel. He believes a sustained close above $2,147 could open the door to a more substantial rise to $2,335 or even $2,542.

Shortly after, Martinez made another ETH-related remark, claiming that the MVRV pricing bands show the asset has reached a level that has historically aligned with market bottoms.

X users Ted and Investor Jordan are also optimistic. The former suggested that a daily close beyond $2,150 could trigger a rally towards the $2,400 zone. At the same time, he warned that failure to do so would result in a retest of the $2,000 psychological level. For their part, Investor Jordan argued that ETH is starting “to warm up,” adding they are “disgustingly bullish” on the cryptocurrency right now.

Some on-chain indicators support the scenario of a further increase. The supply of ETH stored on exchanges, for instance, today (March 5), plummeted to around 15.93 million tokens, the lowest point since the summer of 2016. This development suggests that an increasing number of investors are abandoning centralized platforms and moving their holdings to self-custody, thereby reducing immediate selling pressure.

The Journey South Begins Again?

Other market observers, like X user Emirhan, presented rather pessimistic outcomes. They outlined 2,109 as a key level, assuming a break below could lead to a drop to under $1,900.

You may also like:

Moreover, ETH’s Relative Strength Index (RSI) temporarily crossed the bearish 70 threshold. The indicator helps traders spot potential reversal points by measuring the speed and magnitude of recent price changes. Readings around and above 70 signal that the asset has become overbought and could be headed for a pullback, whereas anything beneath 30 is seen as bullish territory.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Crypto sanctions evasion surged in 2025 as states moved $104 billion: Chainalysis

Sanctions evasion dominated crypto-related illicit finance last year, with state actors including Russia, Iran and North Korea driving a surge in activity, Chainalysis said in a Thursday report.

Sanctioned entities received at least $104 billion in cryptocurrency, an almost eightfold increase on 2024, pushing total illicit onchain volume to a record $154 billion. The findings show how heavily sanctioned states are integrating cryptocurrency into national financial strategies to bypass traditional banking systems.

Chainalysis’ report follows a similar study by TRM Labs, which in February said illicit entities received $141 billion in stablecoins, the highest level observed in five years. Sanctions-related activity accounted for 86% of the flows, mostly in stablecoins, TRM said. About 50% of the total, $72 billion, was linked to the Kyrgyzstan-registered A7A5 token, a ruble-pegged stablecoin.

Chainalysis’ 88-page report also named A7A5 as a major participant, saying it processed $93.3 billion in transactions in less than a year, functioning as a settlement rail for sanctioned Russian businesses to conduct cross-border trade. The token is linked to exchanges Grinex and Meer, which handled billions in transactions before being sanctioned by the U.S. and European Union.

Chainalysis identified an “A7A5 Instant Swapper” service that converts the token into mainstream dollar-pegged stablecoins with few or no know-your-customer (KYC) checks. The service has processed more than $2.2 billion so far, effectively allowing sanctioned entities to bridge into the broader crypto economy, it said.

“These Chainalysis statements are not new for us. They are politically motivated by Western countries,” Oleg Ogienko, A7A5’s director for regulatory and overseas affairs, told Coindesk via Telegram. “We mainly provide payment rails extensively for Russian export and import operations. It is absolutely legal and compliant with the legislation of Russia, Kyrgyzstan and the legislation of other countries who are trade partners of Russia.”

A7A5 has state-of-the-art KYC and anti-money laundering (AML) controls and processes in place, complying with regulatory requirements, he said. Moreover, the ruble-pegged stablecoin is not mentioned in any of the global Financial Action Task Force (FATF) reports.

Iran also expanded its crypto use. Addresses tied to the Islamic Revolutionary Guard Corps (IRGC), designated a terrorist organization by the U.S, EU and other jurisdictions, accounted for more than 50% of value received by Iranian services by late 2025, moving over $3 billion tied to regional proxy financing, oil trade and procurement networks.

North Korea remained the most prolific cyber-theft actor, according to Chainalysis, stealing more than $2 billion in cryptocurrency in 2025, including $1.5 billion from a hack of Bybit, the largest digital asset theft ever recorded.

The report also highlights a structural shift in crypto crime. Stablecoins now account for roughly 84% of illicit transaction volume, reflecting how sanctioned actors increasingly rely on liquid, dollar-pegged assets to move funds across borders.

Crypto World

U.S. judge freezes BlockFills assets in dispute over 70 bitcoin with creditor Dominion Capital

A U.S. federal judge has issued a temporary restraining order (TRO) against crypto lender BlockFills in a lawsuit brought by Dominion Capital, temporarily freezing assets tied to the dispute, according to a filing seen by CoinDesk.

In a complaint dated February 27, Dominion alleged that BlockFills misappropriated and unlawfully retained millions of dollars’ worth of customer crypto assets, commingled client assets and concealed heavy losses.

Dominion claimed BlockFills concealed the misuse of customer funds and refused to return the company’s assets after suspending withdrawals in February. As part of the complaint, the investment firm sought an asset freeze to protect its crypto trapped on Blockfills’ platform, which was granted by the court.

In an order filed March 3 in the U.S. District Court for the Southern District of New York, federal Judge Mary Kay Vyskocil barred the firm from transferring or disposing of 70.6 bitcoin allegedly belonging to Dominion, or moving assets outside the United States while the case proceeds.

The court also ordered Blockfills, which is backed by trading giant Susquehanna, to account for and segregate customer funds, including Dominion’s bitcoin, pending a hearing on a possible preliminary injunction.

CoinDesk reported last month that the crypto lender had incurred losses of around $75 million during the recent market downturn, and was looking for a buyer or emergency funding

BlockFills is a Chicago-based crypto trading and lending firm that provides liquidity, financing and risk-management services to institutional clients. Its platform facilitates crypto lending and borrowing, derivatives trading and over-the-counter (OTC) execution for hedge funds, asset managers, market makers and mining companies.

A Blockfills spokesperson said as a matter of policy the firm does not comment on pending litigation. Dominion Capital declined to comment.

A temporary restraining order in the U.S. is an emergency court order that temporarily stops someone from taking a specific action until the court can hold a full hearing. It’s commonly used in legal disputes involving money, assets or financial activity to prevent immediate harm.

The TRO was issued without notice to BlockFills, with the court citing a risk of “immediate and irreparable injury,” noting the firm had suspended client withdrawals and that insolvency could be imminent.

BlockFills must respond by March 17, when the temporary order is set to expire unless extended by the court.

Dominion Capital is a New York-based private investment firm and family office that invests across private equity, structured finance and digital assets, including backing bitcoin mining companies such as Bitfarms (BITF).

Tough times

Blockfills said it was halting customer withdrawals and deposits on Feb. 11 due to recent market and financial conditions.

The firm said at the time that it was working with investors and clients to reach a swift resolution and restore liquidity to the platform. CoinDesk subsequently learned that the crypto lender had incurred losses of around $75 million in the recent market downturn and was seeking a buyer or emergency funding.

CoinDesk also reported that Nicholas Hammer, co-founder and CEO of Blockfills, has stepped down from his leadership role. The firm’s website now lists Joseph Perry as the interim CEO.

Blockfills said it processed over $60 billion in trading volume in 2025, a 28% increase from the prior year, and is among the more active institutional crypto lending and borrowing desks. It serves about 2,000 institutional clients, including hedge funds, asset managers and mining firms.

“The company is now hurtling towards bankruptcy,” according to insolvency professional Thomas Braziel, founder of 117 Partners.

“After something like this, no serious institution is touching the platform,” Braziel said. “They are going to have to file for bankruptcy.”

The New York Law Journal first reported news of the Dominion complaint on Monday.

Read more: Blockfills co-founder and CEO Nicholas Hammer has stepped down

Crypto World

Revolut Files for U.S. National Bank Charter With OCC

TLDR

- Revolut filed an application for a U.S. national bank charter with the Office of the Comptroller of the Currency.

- The license would allow Revolut to access Federal Reserve payment systems like Fedwire and ACH.

- The charter would enable Revolut to offer federally insured deposits, credit cards, and personal loans directly.

- Revolut currently provides U.S. banking services through its partner Lead Bank in Kansas City.

- The company plans to invest $500 million in the U.S. market over the next three to five years.

Revolut has filed an application for a U.S. national bank charter with the Office of the Comptroller of the Currency. The move advances its plan to expand deeper into the American financial system. The company confirmed the filing on Thursday and outlined its strategy for growth in North America.

Revolut Seeks a U.S. National Bank Charter

Revolut submitted its application to the Office of the Comptroller of the Currency to secure a national bank charter. The company said the license would allow direct access to Federal Reserve payment systems. It expects access to networks such as Fedwire and the Automated Clearing House.

The charter would also allow Revolut to accept federally insured deposits up to $250,000 per account. It would also enable the company to issue credit cards and personal loans directly. Revolut currently provides U.S. banking services through Lead Bank in Kansas City.

That partnership allows accounts and payments without holding its own banking charter. However, the company dropped plans in January to acquire a U.S. bank. Instead, it chose to pursue a de novo banking license to build operations from scratch.

Revolut previously applied for a U.S. banking license in 2021 but withdrew in 2023. The company cited regulatory setbacks at that time. It has now renewed efforts under what it describes as updated regulatory conditions.

The company said the United States remains central to its global digital banking strategy. It reported more than one million customers in the U.S. market. Revolut also plans to invest $500 million over the next three to five years.

Regulatory Steps and Crypto Expansion

The filing follows a development in the crypto sector earlier this week. Kraken secured a Federal Reserve master account for its banking arm. That approval grants Kraken direct access to the Fed’s core payment system.

Revolut described its own application as a step toward direct participation in U.S. payment infrastructure. A national charter would reduce reliance on partner banks. It would also place the company under federal banking supervision.

Revolut holds a restricted banking license in the United Kingdom. The Prudential Regulation Authority granted that license in 2024 with operational limits. The company continues its mobilization phase toward full authorization.

It also holds banking licenses in other regions where it operates. However, it does not hold a banking license in every market. The U.S. charter would expand its regulated footprint.

Revolut said it appointed Cetin Duransoy to lead its U.S. operations. Duransoy previously worked as a senior executive at Visa. The company said his experience will guide its expansion in the American market.

The Financial Conduct Authority selected Revolut to test stablecoin services under proposed U.K. rules. The company continues to develop crypto trading services across markets. It values the firm at about $75 billion based on recent disclosures.

Crypto World

ICE Values OKX at $25B in Strategic Tokenized Markets Deal

TLDR

- Intercontinental Exchange valued OKX at 25 billion dollars through a new strategic partnership.

- ICE secured a board seat in OKX as part of the agreement.

- The companies will explore tokenized equities linked to New York Stock Exchange listings.

- ICE will license OKX spot crypto price data for regulated U.S. futures products.

- OKX will provide its 120 million users access to ICE U.S. futures markets.

Intercontinental Exchange has valued crypto exchange OKX at $25 billion in a new partnership. The New York Stock Exchange owner also secured a board seat in the deal. Both companies will collaborate on tokenized stocks and regulated crypto futures.

ICE announced the agreement through a formal press release on Thursday. It did not disclose the financial terms of its strategic investment.

However, ICE confirmed it valued OKX at $25 billion. The San Jose-based company operates a global cryptocurrency trading platform.

The agreement expands ICE’s digital asset strategy across multiple markets. It also strengthens ties between traditional exchanges and crypto firms.

ICE Expands Digital Asset Strategy

ICE will license OKX’s spot cryptocurrency price data for U.S. futures products. In return, OKX will provide access to ICE’s regulated futures markets.

The companies said they will explore tokenized equities tied to NYSE listings. They will also study derivatives linked to listed securities.

Jeffrey C. Sprecher, ICE chair and CEO, addressed the partnership in a statement. He said, “Our strategic relationship with OKX will expand global retail access to ICE’s pre-eminent regulated markets.”

He added that the partnership will accelerate plans for on-chain infrastructure. ICE aims to offer tokenized assets to U.S. investors.

ICE will also gain representation on OKX’s board of directors. The companies plan cooperation on clearing and risk management services.

They will work on multichain custody systems and wallet architecture. Both firms operate high-performance matching engines and transparent order books.

OKX and Market Reaction

Star Xu, founder and CEO of OKX, welcomed the collaboration. He said the partnership will help build a reliable market structure.

Xu stated that the firms will bridge digital assets and equities. He added that the venture will strengthen cross-market price formation.

OKX’s native token, OKB, surged after the announcement. The token rose as much as 58% within one hour.

It later pulled back and traded near $96. Earlier, it reached a high of $120 following the news.

Bakkt, another ICE-backed digital asset firm, also saw market movement. Its NYSE-listed shares rose 0.74% in early New York trading.

ICE has invested in digital asset platforms in recent years. It previously backed Bakkt and invested $2 billion in Polymarket.

The companies confirmed they will continue regulatory discussions. They said any new products will depend on regulatory support.

OKX serves about 120 million users worldwide. ICE operates major regulated exchanges, including the New York Stock Exchange.

Crypto World

Crypto Markets Dip as Oil Spikes Amid Iran Conflict

Bitcoin is holding around $71,000, while ETH and SOL are down 3%.

Crypto markets dipped on Thursday, reversing some of the previous day’s gains as investors turned cautious again following a reported attack by Iran on an oil tanker.

Bitcoin (BTC) is trading at around $71,000, down 3.5% over the past 24 hours. Meanwhile, ETH and SOL fell 4% to about $2,060 and $88, respectively, and BNB is down 2% on the day.

The overall crypto market capitalization declined by 3% to $2.48 trillion, according to Coingecko.

U.S. crude oil (WTI) spiked above $79 after Iran claimed that it attacked an American oil tanker in the Persian Gulf. WTI is up more than 17% this week to its highest level since January 2025. Investor sentiment was also dampened by reports that the conflict could last longer than previously expected. The S&P 500 and the Nasdaq slipped by around 1%, while gold and silver posted modest losses as the dollar strengthened.

Almost all of the Top 100 digital assets posted losses over the last 24 hours.

Today’s top gainer is OKB, the native token of the OKX crypto exchange, which surged more than 20% after the company disclosed an investment from Intercontinental Exchange (ICE) at a $25 billion valuation.

Memecoins DOGE and PEPE are the biggest losers, plunging 9%.

Around 99,000 leveraged traders were liquidated for $322 million in the past 24 hours, according to CoinGlass. Bitcoin accounted for $120 million, while ETH positions made up $90 million.

Bitcoin exchange-traded funds (ETFs) pulled in another $461 million on Tuesday, marking a third day of gains. This brings inflows to nearly $2 billion since last week.

Crypto World

Interoperability Is ‘Essential’ for Digital Assets to Reach Their Full Potential: DTCC

A new report from DTCC, Clearstream, Euroclear, and the Boston Consulting Group advocates for interoperable infrastructure across blockchain and traditional ledgers.

A report published by The Depository Trust & Clearing Corporation (DTCC), Clearstream, Euroclear, and the Boston Consulting Group (BCG) presents a new framework for interoperability, with the aim of enabling “the safe and scalable adoption” of digital assets.

The joint report, published on Wednesday, March 4, argues that interoperability is key for cryptocurrencies to “achieve their full potential” in traditional capital markets. It emphasizes the need for open, neutral, and reliable infrastructure to support the integration of what it refers to as “digital asset securities,” or DAS, into mainstream finance.

In unpacking the current state of blockchain interoperability, the report highlights the problem of fragmentation across public and permissioned blockchains as Layer 1 and Layer 2 chains continue to proliferate.

“This diversity is widening because spinning up new chains keeps getting easier: modular stacks and ‘rollup-as-a-service’ providers allow institutions to launch bespoke L2s with configurable data availability, privacy, and permissions in weeks rather than years,” the report states.

The research also highlights regulatory fragmentation globally, arguing that this adds to the “structural inefficiencies” of implementing blockchain in traditional capital markets.

“The operating model is evolving into a network-of-networks, with standards, gateways, and regulated service providers linking on-chain objects to off-chain finance,” the report reads.

The proposed framework also argues that to integrate digital assets into TradFi systems, interoperability is needed not only between blockchain networks, but between L1s and L2s, traditional bank ledgers, and Central Securities Depository ledgers (CSDs ledgers). The report reads:

“interoperability can be defined as ‘the ability to exchange assets across ledgers – DLT and traditional – while preserving the asset’s integrity, ownership rights and lifecycle, with full legal and regulatory compliance”

In December, DTCC received clearance from the U.S. Securities and Exchange Commission (SEC) to pilot tokenized versions of securities it already holds, and later that month, it announced the tokenization pilot would use institution-focused Layer 1 Canton.

DTCC, Clearstream, and Euroclear are key players in post-trade services, offering settlement and custody solutions for securities across global markets.

This initiative aligns with other industry efforts, such as Intercontinental Echange’s strategic investment into OKX, as The Defiant reported earlier today.

This article was generated with the assistance of AI workflows.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech13 hours ago

Tech13 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Sports1 hour ago

Sports1 hour ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes