Crypto World

SBI Ripple Asia Partners With AWAJ to Drive XRPL Adoption Across Asia

TLDR:

- SBI Ripple Asia and AWAJ signed an MOU to provide XRPL technical support to financial startups in Asia.

- AWAJ already holds separate partnership agreements with JETRO and Ripple, expanding its regional influence.

- Support under the deal covers system design, security checks, and connections to existing financial infrastructure.

- The initiative targets globally scalable XRPL use cases, with Japan positioned as the development launchpad.

SBI Ripple Asia has signed a formal memorandum of understanding with Asia Web3 Alliance Japan. The partnership targets startups building financial services on blockchain technology.

Both organizations will work together to provide structured technical support. This marks a key step in expanding XRP Ledger adoption within Asia’s growing web3 sector.

SBI Ripple Asia and AWAJ Formalize Technical Support Framework for Blockchain Startups

The agreement focuses on supporting businesses that want to deploy financial services using XRPL.

SBI Ripple Asia brings deep experience in international remittance and payments infrastructure. AWAJ, meanwhile, operates as a venture studio connecting startups with investors and institutional partners.

According to the announcement, support will cover system configuration, technical design, and security verification. Each engagement will be handled through individual contracts between the parties involved. The scope of support will vary case by case.

SBI Ripple Asia is headquartered in Minato-ku, Tokyo, and is led by Representative Director Masashi Okuyama.

AWAJ is based in Chuo-ku, Tokyo, and is represented by Hinza Asif. The two organizations say this collaboration is premised specifically on the XRP Ledger.

AWAJ recently signed separate agreements with the Japan External Trade Organization and Ripple. Those deals have positioned it as a central node in Japan’s web3 ecosystem. The new MOU with SBI Ripple Asia adds another layer to that growing network.

XRPL Positions as Infrastructure of Choice for Asia’s Financial Innovation Push

The announcement highlights growing interest in blockchain-based financial services across the region.

However, it also acknowledges real barriers: regulatory complexity, security requirements, and business viability concerns. SBI Ripple Asia plans to help startups navigate all of these.

Technical support under this initiative will primarily reach startups in AWAJ’s innovation programs. These programs are designed to take early-stage ideas through proof-of-concept and into commercialization.

AWAJ describes its model as “hands-on,” going beyond simple networking.

The organizations say the goal extends beyond Japan. They aim to develop financial use cases on XRPL that can scale globally. Japan, in their framing, becomes the origin point for these internationally applicable solutions.

Per the official announcement, the partnership also envisions connection with existing financial systems, not just new blockchain infrastructure.

This practical framing sets it apart from more theoretical web3 initiatives. The emphasis stays on whether technology can function as a real financial service.

Crypto World

MARA Takes Controlling Stake in French AI Data Center Operator Exaion

MARA Holdings has completed the purchase of a majority stake in French computing infrastructure operator Exaion, deepening its push into artificial intelligence (AI) and cloud services.

The deal, first agreed in August 2025 with EDF Pulse Ventures, gives MARA France a 64% stake in Exaion after required regulatory approvals were secured, the Bitcoin miner said in a Friday announcement. French energy giant EDF will remain a minority shareholder and continue as a customer of the business.

The investment also creates a broader alliance. NJJ Capital, the investment vehicle of telecom entrepreneur Xavier Niel, will acquire a 10% stake in MARA France as part of a partnership with MARA.

Governance of Exaion will reflect the new ownership structure. The company’s board will include three representatives from MARA, three from EDF Pulse Ventures and one from NJJ, alongside Exaion’s chief executive and co-founder. Niel and MARA CEO Fred Thiel will both hold seats on the board.

Related: Bitcoin miners chase 30 GW AI capacity to offset hashprice pressure

Bitcoin miners pivot to AI amid pressure

Bitcoin mining companies are increasingly turning to AI and data center computing as pressure on mining economics grows. After the 2024 halving cut block rewards and rising network difficulty squeezed margins, several publicly traded miners began adopting a hybrid model, keeping mining as a source of cash flow while building steadier revenue from AI cloud and high-performance computing services.

HIVE Digital Technologies is one example of the shift. The company reported strong results even during weaker Bitcoin prices, supported by expanding AI operations. CoreWeave has also moved from crypto mining to become a major AI infrastructure provider after GPU mining demand fell.

Other firms, including TeraWulf, Hut 8, IREN and MARA, are also repurposing mining facilities and energy capacity into AI data centers.

In November last year, CleanSpark announced plans to raise roughly $1.13 billion in net proceeds, up to $1.28 billion if additional notes are purchased, through a $1.15 billion senior convertible note offering to fund expansion of its Bitcoin mining and data center operations.

Related: Crypto miner Bitdeer tanks 17% after $300M debt offering

Bitcoin mining difficulty jumps 15%

Meanwhile, Bitcoin’s mining difficulty rose about 15% to 144.4 trillion on Friday, reversing an 11% drop earlier in the month, the steepest decline since China’s 2021 mining ban. The earlier fall followed severe winter storms across the United States that disrupted power grids and temporarily forced many miners offline, sharply reducing hash rate.

While the higher difficulty reinforces Bitcoin’s security, it also raises the computing effort needed to mine new blocks, adding further margin pressure on operators already dealing with rising costs.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Bitcoin ETFs add $88M, ending three-day outflow streak

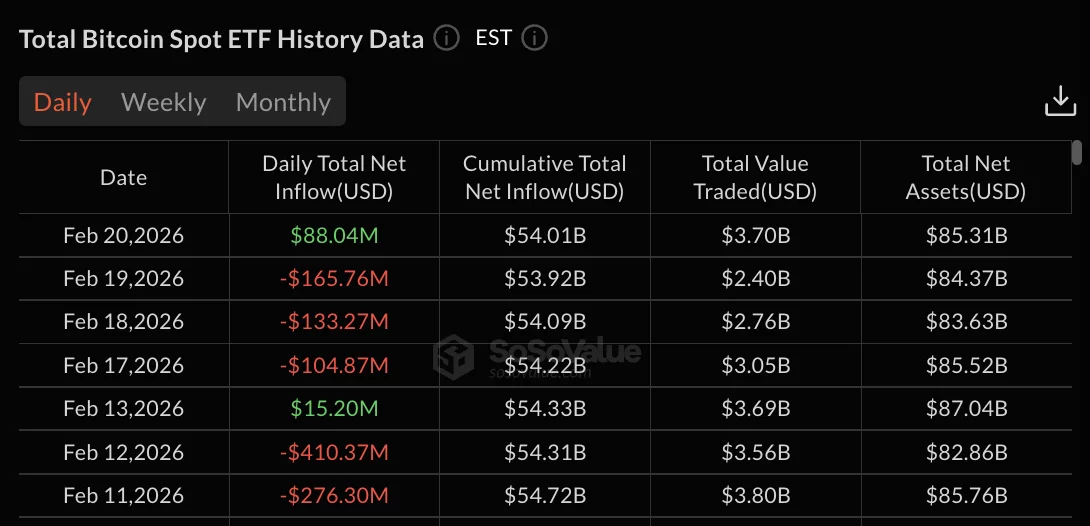

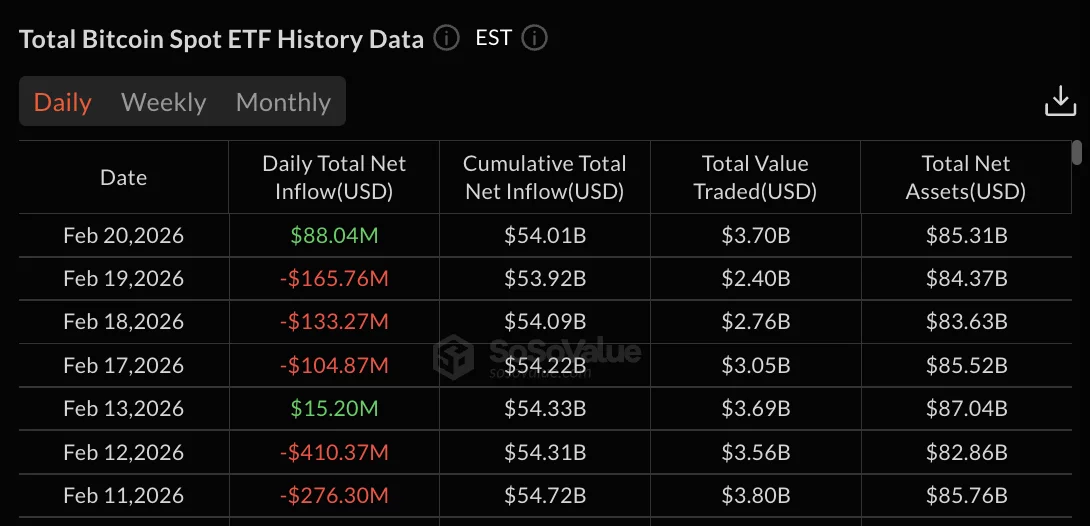

Bitcoin ETFs recorded $88.04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403.90 million.

Summary

- Bitcoin ETFs post $88M inflows after three days of $403M outflows.

- IBIT and FBTC drive all flows as most funds remain inactive.

- Weekly redemptions continue with $315M leaving BTC products.

BlackRock’s IBIT led with $64.46 million while Fidelity’s FBTC attracted $23.59 million, with remaining funds posting zero flows.

Bitcoin (BTC) traded at $67,800 with minimal 24-hour movement after touching a low of $66,452 during the session.

Total net assets reached $85.31 billion while cumulative total net inflow stood at $54.01 billion.

Three-day Bitcoin ETF outflow streak totaled $403 million

February 17-19 posted consecutive days of redemptions before February 20’s reversal. February 19 recorded the largest single-day withdrawal at $165.76 million.

This was followed by February 18’s $133.27 million and February 17’s $104.87 million in outflows.

The selling pressure dropped total net assets from $87.04 billion on February 13 to $85.31 billion on February 20.

February 13’s $15.20 million inflow briefly interrupted the pattern before three days of sustained withdrawals resumed.

Most Bitcoin ETF products recorded zero activity on February 20, with only IBIT and FBTC posting flows.

Grayscale’s GBTC and mini BTC trust, along with Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all showed no movement.

BlackRock’s IBIT maintains $61.30 billion in cumulative net inflows. Fidelity’s FBTC holds $10.96 billion in total inflows.

Weekly outflows persist at $315 million

The week ending February 20 posted $315.86 million in net outflows and was the fourth consecutive weekly redemption period.

The week ending February 13 recorded $359.91 million in withdrawals, while the week ending February 6 saw $318.07 million in outflows.

Late January posted the heaviest weekly redemptions. The week ending January 30 drained $1.49 billion from Bitcoin ETFs, while the week ending January 23 recorded $1.33 billion in withdrawals.

The four-week outflow period from January 23 through February 20 totals approximately $2.48 billion.

Weekly trading volume reached $11.91 billion for the period ending February 20, down from $18.91 billion the previous week.

Crypto World

Uniswap Founder Slams Scam Crypto Ads After Victim ‘Lost Everything’

Hayden Adams, founder of the decentralized exchange Uniswap, has warned users about fraudulent ads impersonating the platform, highlighting a case in which a victim reportedly lost everything.

It comes after January saw the highest amount of money stolen in crypto scams in 11 months.

“Scam ads keep returning despite years of reporting,” Adams said in an X post on Friday. “There were scam Uniswap apps while we waited months for App Store approval,” he said.

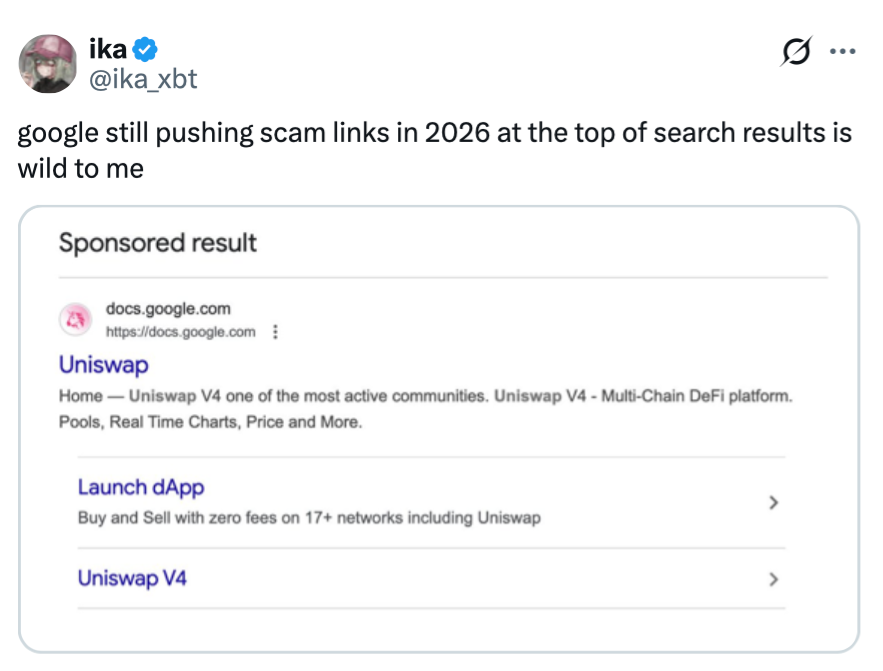

Scammers are increasingly buying ads on popular search engines targeting keywords like “Uniswap,” so when crypto users search for it, the top result looks official.

Unsuspecting users may then connect their wallets and approve a transaction, allowing scammers to drain their entire funds.

A consequence of a “long chain of bad decisions”

An X user named “Ika” said in an X article, titled “I lost everything, what’s next?” that his crypto wallet, valued in the mid-six-figure range, was drained despite his extreme care. “Disciplined for two years. Half-searching for a web3 job, half-hoping to make it fast enough not to need one,” he said.

“I believe that getting drained isn’t bad luck. It’s the final consequence of a long chain of bad decisions,” Ika said.

The lengthy post on X came shortly after he posted a screenshot of a top Google search result with an inauthentic Uniswap link.

It isn’t the first time that Uniswap has experienced this issue. In October 2024, Cointelegraph reported that scammers recognized the website’s lack of domain authority and created a version of the site that looks exactly like the real one, except that it featured a “connect” button where “get started” should have been and a “bridge” button where “read the docs” should have been.

Related: Dutch authorities call on Polymarket arm to cease activities

More recently, the value of cryptocurrency stolen through exploits and scams reached $370.3 million last month, the highest monthly figure in 11 months and a nearly fourfold rise from January 2025.

Crypto security company CertiK said that of the 40 exploit and scam incidents over January, the majority of the total value stolen came from one victim that lost around $284 million due to a social engineering scam.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Dutch Authorities Call on Polymarket’s Dutch Arm to Cease Activities

The Dutch gambling regulator has taken aim at a cryptocurrency-forward prediction platform, targeting its local arm for offering unlicensed gambling to residents. The Netherlands Gambling Authority accused Adventure One of Polymarket of marketing event-based bets without the required license, prompting a formal order to halt activities immediately and warning of steep penalties should the injunction be ignored. The action underscores the tension between innovative online prediction markets and national licensing regimes, a friction that regulators in multiple jurisdictions continue to scrutinize as crypto-based products gain traction. The enforcement also arrived amid broader domestic policy debates in the Netherlands over how to tax crypto investments, a topic that could reshape the financial landscape for digital assets if a proposed 36% capital gains tax clears the legislature and becomes law in 2028. Within days of the decision, lawmakers moved forward on the tax plan, framing the issue as part of a wider effort to bring crypto activity under clearer fiscal rules. The clash between a global platform and national regulators highlights how cross-border prediction markets navigate divergent legal environments while seeking to scale in regulated markets.

Key takeaways

- Netherlands Gambling Authority ordered Adventure One to cease “immediately,” with fines potentially reaching $990,000 for non-compliance.

- The regulator cited specific bets on local Dutch elections as part of the illegal offerings, noting no response from Polymarket to enforcement requests.

- Polymarket’s leadership signaled openness to dialogue with state authorities while federal courts in the United States weigh jurisdictional questions.

- Within a week of the Polymarket action, the Dutch House of Representatives advanced a 36% capital gains tax on investments that would likely include crypto assets, signaling growing tax scrutiny for digital assets.

- The case sits at the intersection of evolving regulation for prediction markets, global licensing regimes, and jurisdictions asserting control over the terrain where crypto-based bets live.

Tickers mentioned:

Sentiment: Neutral

Price impact: Negative. The immediate enforcement and potential fines constrain the operator’s Dutch activities and signal regulatory risk for similar platforms operating in the Netherlands.

Market context: The dispute unfolds as global authorities tighten oversight of prediction markets and crypto-related platforms, with U.S. regulators asserting jurisdiction even as state actions proliferate. The Netherlands’ move dovetails with ongoing debates over crypto taxation and licensing frameworks that influence international operators’ strategic choices.

Why it matters

The Netherlands’ abrupt intervention against Adventure One spotlights how prediction markets — platforms that allow users to place bets on future real-world events — are navigating a patchwork of national licenses and prohibitions. While such markets have expanded in several jurisdictions, unlicensed activity can trigger swift enforcement actions, creating a precedent for other operators that might be testing the boundaries of local gaming or securities law. The regulator’s decision emphasizes that even platforms with international footprints must respect domestic licensing rules when offering gambling products to residents, a principle that could shape the regulatory calculus for similar ventures across Europe and beyond.

For Polymarket, the event underscores a broader strategic risk: regulatory buy-in in some regions remains elusive, and the firm faces potential legal and financial penalties if it does not align its offerings with local requirements. The company has framed the tension as a jurisdictional question, signaling willingness to engage with authorities as courts in the United States weigh how such prediction markets should be regulated at the federal level. This stance reflects a broader industry pattern where operators seek clarity on how cross-border platforms can operate under varied regulatory regimes while safeguarding consumer protections and licensing standards. The tension between innovation and regulation is unlikely to dissipate soon, given the volume of political and regulatory attention on crypto-enabled financial products.

Beyond the enforcement action, the episode intersects with a domestic policy thread: the push to tax crypto investments more aggressively. The Dutch House of Representatives has moved forward with a proposal that would impose a 36% capital gains tax on investments, a category that would likely capture the gains from crypto trading and related digital-asset bets. If enacted and signed into law, the measure could take effect as early as 2028, reshaping the financial calculus for individuals participating in crypto markets, including those who engage in prediction-market activities. The regulatory and fiscal shifts together could influence where operators focus their growth efforts and how they structure user access to markets that hinge on real-world events, such as elections or policy announcements.

Analysts watching the Netherlands’ regulatory environment note that this action aligns with a broader global pattern: authorities are increasingly categorizing certain online prediction markets as gambling or financial products that require licensing, consumer protections, and robust compliance programs. The tension between federal regulatory ambitions in the United States and state-level experimentation adds another layer of complexity for platforms that operate in multiple jurisdictions. As policymakers weigh the appropriate boundaries for prediction markets, stakeholders anticipate continued legal disputes and evolving licensure requirements that will shape the architecture of future, crypto-enabled betting platforms.

For readers following the regulatory frontier, the Dutch case serves as a cautionary tale about the need to verify a platform’s licensing status before participating in event-based bets. It also highlights the importance of transparent engagement with regulators, as policymakers weigh how to balance innovation with consumer protection and tax compliance in a rapidly changing digital asset landscape.

What to watch next

- Polymarket’s formal response to the Dutch order and any subsequent steps the platform takes to address licensing concerns.

- Possible updates to the Dutch crypto tax framework and whether the 36% capital gains tax advances to become law in 2028.

- Potential regulatory alignments or conflicts between Dutch authorities and U.S. regulators as jurisdictional questions around prediction markets persist.

- Any future enforcement actions in the Netherlands or other EU states targeting unlicensed gambling or prediction-market activity.

Sources & verification

- Kansspelautoriteit (Dutch Gambling Authority) notice: “last onder dwangsom voor illegaal kansspelaanbod Polymarket” — https://kansspelautoriteit.nl/last-onder-dwangsom-voor-illegaal-kansspelaanbod-polymarket

- US CFTC leadership statements defending prediction markets — https://cointelegraph.com/news/cftc-michael-selig-defending-prediction-markets

- Polymarket commentary on jurisdiction and dialogue with states — https://x.com/HereComesKumar/status/2020845618789265743

- Polymarket-related lawsuit coverage and regulatory questions — https://cointelegraph.com/news/polymarket-s-lawsuit-could-decide-who-regulates-us-prediction-markets

- Dutch House advances 36% crypto tax — https://cointelegraph.com/news/dutch-house-advances-36-tax-law

What the story means for markets and regulation

The Netherlands’ move against Adventure One is a reminder that prediction markets, while innovative, remain squarely under regulatory scrutiny. As authorities in different jurisdictions refine licensing regimes and tax policies, platforms will need robust compliance programs to operate across borders. The broader regulatory backdrop — including ongoing debates about crypto taxation and jurisdictional authority over prediction markets — will likely influence how market participants structure bets, manage risk, and engage with policymakers in the months and years ahead. For investors and users, the episode reinforces the imperative to assess regulatory risk and to monitor statements from regulators and platform operators alike as the global landscape for crypto-enabled markets continues to evolve.

What to watch next

- Regulatory updates from the Netherlands on licensing for online betting and crypto-related platforms, including potential licensing reforms.

- Any official response from Polymarket regarding the Dutch order and its approach to compliance in Europe.

- Regulatory clarifications in the United States as courts weigh jurisdiction over prediction markets and enforcement actions expand at the state level.

Crypto World

Small investors, or shrimps, are buying BTC. But it’s the whales who keep rallies going.

For much of this month, bitcoin has been trading around the mid-$60,000s. That much is humdrum.

The interesting bit is a developing split in coin ownership that could shape what happens next.

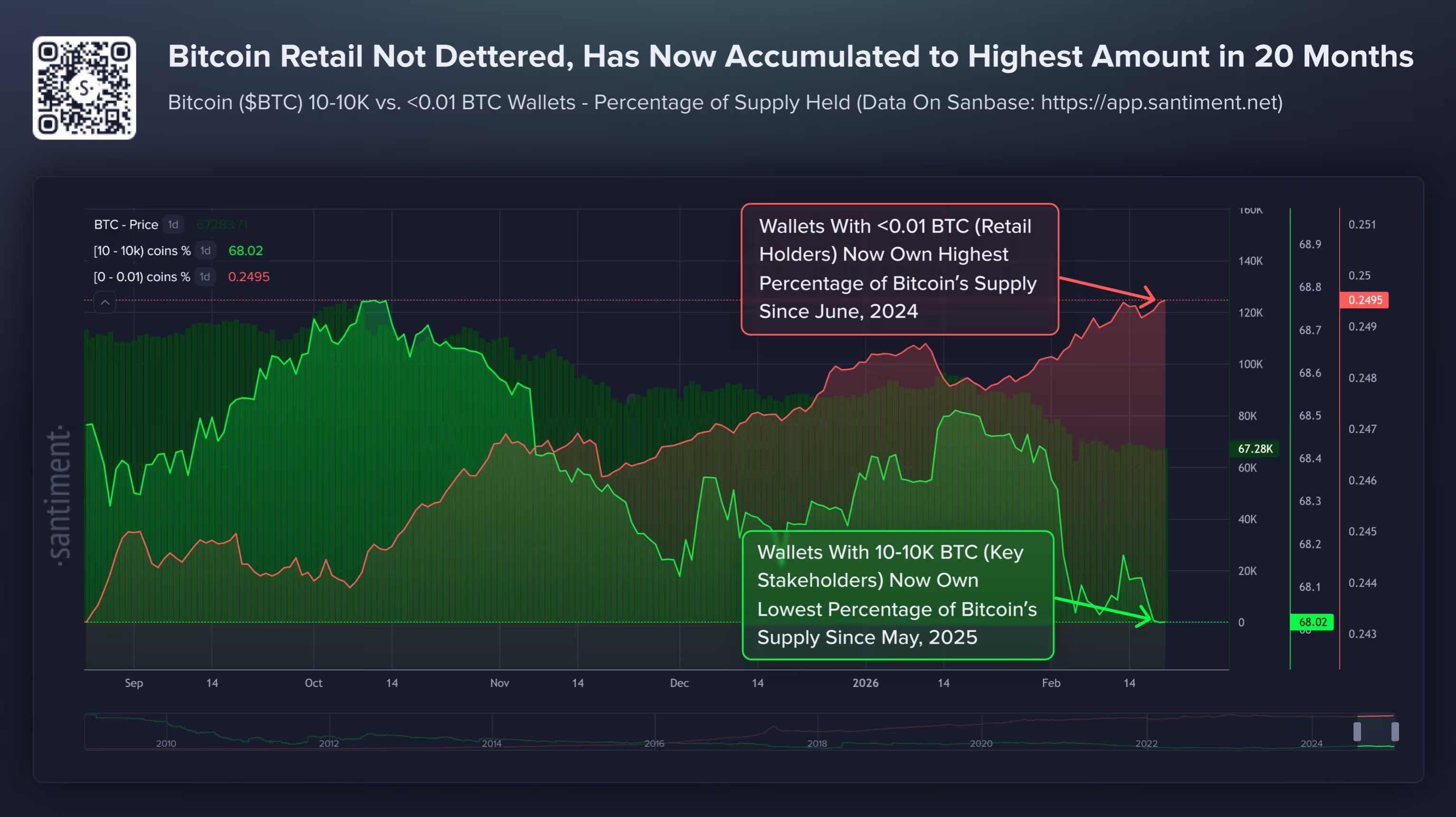

Data from Santiment shows the number of wallets holding less than 0.1 BTC, a level typically associated with retail investors, has increased by 2.5% since the largest cryptocurrency hit a record high in October. The growth has pushed the so-called shrimps’ share of supply to its highest since mid-2024.

In practice, though, it’s the larger holders known as whales and sharks who tend to set the tone for price direction. Those investors, with wallets holding between 10 and 10,000 BTC, went the other way, dropping about 0.8%.

It’s the kind of split that tends to produce choppy, frustrating price action rather than clean trends.

Retail provides a floor and can spark short-term momentum. Rallies that stick require bigger players who are prepared to buy whatever’s on offer.

The divergence is especially notable because the picture looked different just a few weeks ago.

After bitcoin cratered toward $60,000 on Feb. 5 — a drawdown of more than 50% from its October peak — Glassnode’s Accumulation Trend Score climbed to 0.68, the strongest broad-based reading since late November, as CoinDesk reported earlier in the month.

Glassnode’s metric measures the relative strength of accumulation across different wallet sizes by factoring in both entity size and the amount of BTC accumulated over the past 15 days. A score closer to 1 signals accumulation, while a score closer to 0 indicates distribution.

During the flash, the 10-to-100 BTC cohort was the most aggressive dip buyer, and the data suggested the market was shifting from capitulation into something more synchronized.

Santiment’s wider lens complicates that reading. Its 10-to-10,000 BTC band captures a much broader slice of large holders than Glassnode’s dip-buying cohort, and across that full range, net positioning since October is still negative.

One way to reconcile the two takes: mid-sized wallets may have genuinely bought the panic while the largest holders kept distributing into every recovery, dragging the aggregate number down.

It matters because bitcoin doesn’t need retail to show up. Retail is already here.

What it needs is for the distribution from large wallets to stop, or better yet, reverse. Without that, every rally risks being sold into by the very cohort that needs to provide structural demand if it is to succeed.

The shrimps are doing their part. They are waiting for the whales join in.

Crypto World

What Pioneers Need to Know

There’s only one step left until the v20 version.

Pi Network’s Core Team took it to X at the end of the business week to announce the latest blockchain update that was successfully migrated. The protocol v19.6 has been implemented, leaving version 19.9, which is next in line, the only one left before the highly-anticipated v20.

The announcement also urged nodes to ensure they had upgraded to comply with the new version.

Network Update: Protocol v19.6 migration successfully completed ✅ Next up is v19.9 — the final step before v20. Node operators should make sure they’re upgraded and stay tuned for further instructions: https://t.co/mnbwVzhaD9

— Pi Network (@PiCoreTeam) February 20, 2026

Nodes, The Update Is Here

Recall that the team first outlined the upcoming series of upgrades last week, stating that the Pi nodes have until February 15 to complete their migration to remain connected to the network once it’s implemented.

In the explanatory post dedicated to nodes, the team described them as the “fourth role within the Pi ecosystem,” which needs to operate on laptops and desktop computers rather than mobile devices. Similar to nodes in other blockchains, they have to validate transactions and maintain the distributed ledger by reaching consensus on the order of transactions.

However, there’s a difference between Pi Network’s nodes and those operating on proof-of-work systems, such as Bitcoin. Since Pi employs a consensus mechanism derived from the Stellar Consensus Protocol (SCP), nodes from trusted groups, known as quorum slices, validate transactions only when trusted peers agree.

It’s worth noting that security circles created by mobile miners form a global trust graph that helps determine which nodes can participate in validation.

You may also like:

Build for Accessibility

The Core Team also emphasized another difference between nodes on different blockchains and those operating within the Pi ecosystem. They explained that Pi Network’s entire concept is to work under a user-centric design where even less technically savvy Pioneers can install the Pi Node desktop application and enable or disable node participation with a simple interface.

The team noted that this method aligns with Pi’s strategy of “progressive decentralization,” which allows the network to evolve toward full decentralization while remaining accessible to everyday users.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

AI Stocks Becoming ‘Silly Big’ Says Lyn Alden

Bitcoin (CRYPTO: BTC) could see a renewed leg higher if AI equities overheat, according to macroeconomist Lyn Alden. In a discussion with Natalie Brunell on the Coin Stories podcast published to YouTube on Thursday, Alden noted that AI stocks may peak, prompting a rotation into assets with more upside potential. The core idea is simple but influential: when a price narrative becomes hard to justify, capital tends to migrate toward opportunities with stronger risk-reward profiles. The suggestion is not that crypto is guaranteed to rally, but that it could benefit from a shifting allocation mindset as investors reassess growth drivers.

Bitcoin’s price context matters here. From an October high near $126,100, the benchmark has retraced substantially, with data suggesting a drop of about 46% from that peak. The current trading environment—framed by recent softness in the AI rally and ongoing macro uncertainty—raises the prospect that capital may rotate away from frothy AI names and into assets considered more offense-ready over the medium term. Alden argued that BTC could be a beneficiary of this rotation even if the upshot requires patience, highlighting that long-term holders help set a price floor while shorter-term traders search for new catalysts.

Nvidia may be the “most important stock” in US, says exec

On the equity side, Nvidia (EXCHANGE: NVDA), the GPU giant central to AI workloads, remains a barometer for the market’s appetite for AI-driven growth. Albion Financial Group chief investment officer Jason Ware recently told Fox Business that while Nvidia could deliver “another great quarter,” the sustainability of those gains is not a foregone conclusion. “We all know they are the most concentrated, obvious winner in the AI build out. Can that growth continue in a way that supports the stock moving higher?” Ware asked, underscoring the delicate balance between AI optimism and actual earnings momentum. Over the past year, NVDA has climbed more than 35%, underscoring its status as a focal point for risk sentiment and equity leadership.

The linkage between AI enthusiasm and crypto markets is a recurring theme in contemporary market discourse. As investor interest in AI equities intensifies, Bitcoin is increasingly framed as a potential beneficiary of capital reallocation, particularly if the AI trade loses some steam or becomes viewed as overextended. The observation that Bitcoin is now competing for capital in a manner unseen before underscores the broader shift in how investors evaluate “growth” assets against “risk-off” assets in a precarious macro landscape. For some analysts, BTC’s appeal lies not in rapid gains but in its relative resilience as a hedge and store of value as traditional equities encounter volatility tied to interest-rate expectations and policy dynamics.

Bitcoin only needs a “marginal amount” of new demand

Yet Alden cautions that a rapid ascent is not a prerequisite for BTC to move higher. In her view, a marginal uptick in fresh demand could suffice to lift prices when long-term holders have already established a support floor and when speculative participants rotate elsewhere for a time. The rotation thesis rests on the idea that BTC’s supply-demand balance can tilt with a relatively small influx of new buyers entering the market as other narratives pause or cool off. The practical implication is a patient, risk-managed approach: BTC does not require a sudden flood of new capital to shift higher, but it does depend on a shift in who is holding the asset and why they are staying invested.

As part of the broader market mosaic, the industry continues to grapple with the reality that macro conditions—ranging from liquidity cycles to regulatory signals—shape how quickly a rotation into BTC can take hold. The discussion around whether AI leadership can sustain its current pace adds a layer of market psychology to the analysis: if AI stock names face a valuation reset, that reset could accelerate a reallocation toward perceived hedges or diversifiers, including cryptocurrency. In the same breath, observers acknowledge that BTC’s path is unlikely to mirror a textbook V-shaped rebound. The narrative often unfolds as a grind higher or sideways movement, punctuated by occasional pullbacks and interim pauses as market participants reassess risk premia.

At the time of writing, Bitcoin was trading near the mid-to-low $60,000s, a level that sits above the volatility troughs of past retracements but below the earlier peak reached during the height of the previous cycle. The price action aligns with Alden’s framework: slow, methodical accumulation by long-term holders, paired with selective participation by traders seeking a favorable entry point after a drawdown. Additional data points, including price action and on-chain signals, will be essential to gauge whether the rotation thesis translates into a sustained uptrend or whether BTC remains tethered to a choppy, range-bound regime.

It’s also worth noting the broader narrative around AI equities and crypto’s role within it. The AI narrative has intensified investor focus on the most influential players in the space, including Nvidia, whose momentum is often viewed as a proxy for AI-sector health. While Nvidia’s immediate near-term path remains subject to quarterly results and market expectations, the story underscores a wider appetite for AI exposure that could indirectly benefit crypto assets if risk appetites normalize and capital flows diversify. In parallel, market observers have drawn attention to the ongoing debates about crypto policy, macro liquidity, and the pace at which institutional participants allocate to digital assets. The dialogue continues to evolve as regulators, miners, and developers respond to shifting market dynamics and evolving use cases for blockchain technology.

Beyond price action, industry watchers recall that Bitcoin’s network metrics provide context for how price might respond to evolving demand. For example, mining-difficulty dynamics and network security considerations serve as a backdrop to price speculation, with several pieces of coverage illustrating how miners adapt to the macro environment and electricity markets. The broader informational ecosystem also includes a spectrum of research and data sources that track BTC’s performance relative to macro risk signals, as well as on-chain indicators that illuminate the behavior of long-term holders versus short-term traders. In this sense, the rotation narrative intersects with fundamentals, psychology, and policy considerations that collectively shape Bitcoin’s path forward.

For readers tracking the genesis of the current debate, it’s helpful to recall earlier commentary that highlighted Bitcoin’s evolving role as a capital allocator during periods of AI-driven market exuberance. The assertion that Bitcoin could garnert capital when AI valuations pause is not a guarantee but a lens on potential cross-asset dynamics where a shift in capital allocation could favor non-traditional growth assets. As Alden and others emphasized, the market’s focus on AI can create dislocations that crypto markets might exploit, particularly if the rotation proves sustainable and broad-based rather than episodic. The evolving narrative invites a closer look at how BTC’s price structure interacts with risk sentiment, liquidity, and the tempo of capital inflows or outflows across major asset classes. For those who monitor the crosswinds of technology, finance, and macroeconomics, the current moment offers a case study in how narrative-driven flows can realign as the market digests successive waves of innovation and regulation.

In the near term, observers will be watching for signals that indicate the depth and durability of any potential rotation. The intersection of AI momentum and crypto markets is likely to remain a focal point for traders seeking asymmetrical risk-reward opportunities. While no one can predict a definitive turn, the conversation about whether AI valuations will normalize and how BTC might respond remains central to the current market discourse. The ongoing dialogue also reflects a broader truth about crypto markets: they are increasingly entangled with the same macro drivers that shape traditional assets, even as they maintain their own distinct risk-and-reward profile. As the story unfolds, investors will be evaluating BTC’s price action alongside AI-ecosystem developments, regulatory signals, and the evolving architecture of the digital asset space.

What to watch next

- Watch Bitcoin price action for signs of a sustained breakout or renewed grinding below current levels, with attention to potential support zones around $60,000–$65,000.

- Monitor AI sector momentum, particularly Nvidia’s earnings cadence, to gauge whether current AI enthusiasm remains intact or begins to cool.

- Track capital flows into crypto from traditional risk assets as investor sentiment shifts, noting any shifts in cross-asset liquidity conditions.

- Observe long-term holders’ behavior as the market tests new price levels and potential floor formation, indicating conviction in BTC’s longer-term value proposition.

- Keep an eye on on-chain indicators and mining-related developments that could influence BTC’s supply dynamics and price resilience during periods of rotation.

Sources & verification

- Lyn Alden’s discussion on the Coin Stories podcast with Natalie Brunell; YouTube link: https://www.youtube.com/watch?v=x0kNGaxLg18

- Bitcoin price context and performance data (October high near $126,100; BTC price page in Cointelegraph) – https://cointelegraph.com/bitcoin-price

- Nvidia (EXCHANGE: NVDA) coverage and analysis from Fox Business interview with Jason Ware – https://www.foxbusiness.com/video/6389652121112

- Bitcoin is now competing for capital link to Ethereum price narrative – https://cointelegraph.com/news/bitcoin-price-quantum-computing-fears-ethereum-developer

- Bitcoin mining difficulty rebound coverage – https://cointelegraph.com/news/bitcoin-difficulty-rebounds-15-as-us-miners-recover-from-winter-outages

Rotation dynamics shaping Bitcoin’s next leg

Bitcoin (CRYPTO: BTC) sits at a crossroads as investors weigh whether the AI-driven surge can sustain its momentum and whether capital will reallocate toward crypto as a complementary growth narrative. In a recent dialogue with Natalie Brunell on the Coin Stories podcast, macroeconomist Lyn Alden outlined a rotation thesis: when AI stock valuations become difficult to justify, money tends to move toward assets that offer a more compelling risk-reward profile. The discussion, anchored in the idea that a fresh wave of demand is all that’s needed to alter price trajectories, emphasizes that BTC could benefit as market participants reassess where to allocate risk in a complex macro environment. The YouTube-embeds and podcast link in that discussion provide a direct thread to the source material for readers seeking further context.

The case for BTC as a beneficiary of rotation hinges on several interlocking dynamics. First, Bitcoin’s price action is framed by a sharp drawdown from its October all-time high of around $126,100. As Alden noted, the asset is down substantially from that peak, a development that invites a re-evaluation of BTC not as merely a risk-on asset but as a potential store of value and a non-sovereign alternative to traditional risk assets during periods of monetary tightening and liquidity shifts. The idea is not that Bitcoin will rally in a vacuum, but that its upside could be unlocked by a reallocation toward assets with different risk profiles when AI valuations come back to earth. The discussion also touches on how AI leadership may shape market expectations across asset classes, with the NFT and crypto ecosystems occasionally serving as counterweights to momentum-driven sectors.

Nvidia (EXCHANGE: NVDA), described by Ware as a cornerstone of AI infrastructure, remains a focal point for market participants assessing the sustainability of AI-driven growth. The tension between “the most concentrated, obvious winner in the AI build out” and a stock’s ability to justify further appreciation is a central question for investors watching both equities and crypto. The tension is not merely about the pace of AI-capital deployment; it is about how the broader risk appetite evolves. If AI stocks begin to trade at multiples that investors deem unsustainable, some capital could rotate into crypto assets that, for some participants, offer a different risk-reward proposition in a market that has grown more volatile and liquidity-driven. In this context, Bitcoin’s narrative as a potential beneficiary of a rotation in risk sentiment becomes increasingly plausible, even if a decisive up move remains elusive in the near term.

From a price-availability standpoint, Alden highlights that BTC does not require a flood of fresh capital to move higher; instead, a marginal amount of new demand could establish a floor, particularly if long-term holders maintain conviction while short-term players shift focus. The price landscape, characterized by a grinding pattern rather than a rapid V-shaped rebound, supports the view that BTC’s path is likely to be gradual and path-dependent. At the same time, the broader market’s liquidity regime and macro policy expectations will influence the speed and breadth of any rotation into crypto. The Bitcoin narrative is increasingly interwoven with the AI story, and as investors balance these competing drivers, the market will continue to search for price discovery in an environment shaped by policy, technology, and evolving risk sentiment.

As the market digests these ideas, observers will be attentive to on-chain signals and macro signals that could confirm or refute the rotation thesis. The discussion around AI momentum, regulatory developments, and the health of the broader crypto market will continue to shape BTC’s trajectory. In a landscape where AI leadership can still drive significant wealth creation, Bitcoin’s role as a potential beneficiary of shifting capital becomes a compelling line of analysis for traders, investors, and builders seeking to understand how sentiment translates into price movement across asset classes. The evolving narrative invites ongoing observation of how BTC responds to rotating flows, the pace of AI adoption, and the resilience of the crypto market in a world of rising macro uncertainty and policy evolution.

Crypto World

South Korea Delays Bithumb Probe Over $43B Bitcoin Mishap

South Korean lawmakers are stepping up pressure on financial regulators after crypto exchange Bithumb mistakenly credited customers with Bitcoin it did not hold, an error that briefly sparked a rush to sell and renewed questions about oversight of the country’s fast-growing digital-asset market.

Lawmakers said the Financial Services Commission (FSC) failed to detect critical flaws in Bithumb’s internal systems despite at least three inspections since 2022, The Korea Times reported Thursday.

Representative Kang Min-guk of the main opposition People Power Party said the incident was more than a technical mishap, claiming structural weaknesses in the crypto market, including gaps in regulation and oversight.

Bithumb mistakenly credited 2,000 Bitcoin (BTC) per user instead of 2,000 Korean won ($1.40) during a promotional event on Feb. 6, distributing a total of 620,000 BTC that the exchange did not actually hold.

FSC delays probe into Bithumb, intensifying accusations

Lawmakers’ criticism of the FSC intensified as the regulator delayed its inspection of Bithumb. The authority opened the investigation on Feb. 10, with FSC officials emphasizing they would take “stern legal actions against acts that harm the market order.”

The probe, initially expected to conclude Feb. 13, has been extended, with officials aiming to complete it by the end of February, citing a need for additional review, multiple local publications reported.

Bithumb CEO cites two prior payout incidents

The FSC’s inspection of Bithumb reportedly covers not only the recent 620,000 BTC error, but also two similar incidents in the past.

“There were two previous cases in which coins were mistakenly paid out and later recovered, but the amounts were minimal,” Bithumb CEO Lee Jae-won said during an emergency National Assembly session on Feb. 11.

In the latest incident, Bithumb said it managed to recover the majority of miscredited assets, with only 125 BTC ($8.6 million) out of the non-existent 620,000 BTC unrecovered.

Concerns over South Korea’s handling of crypto: The case of the disappearing Bitcoin

The Bithumb incident also lands as authorities face renewed embarrassment over custody and security of seized digital assets.

In 2021, 22 BTC worth about $1.5 million at current prices, disappeared from a cold wallet at Seoul’s Gangnam Police Station during a nationwide audit.

Related: Mirae Asset agrees to buy 92% stake in Korean exchange Korbit for $93M

A separate August 2025 case saw 320 BTC vanish from the Gwangju District Prosecutors’ Office, reportedly due to a leaked password. Authorities only reported yesterday that the full amount had been recovered after the hacker returned the funds, raising eyebrows as the disclosure comes amid the ongoing FSS investigation into Bithumb.

Lawmakers and industry observers say these incidents underscore persistent weaknesses in authorities’ oversight and custody of digital assets.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Crypto Treasury Execs Say Basel Risk Weights for Crypto Need Updating

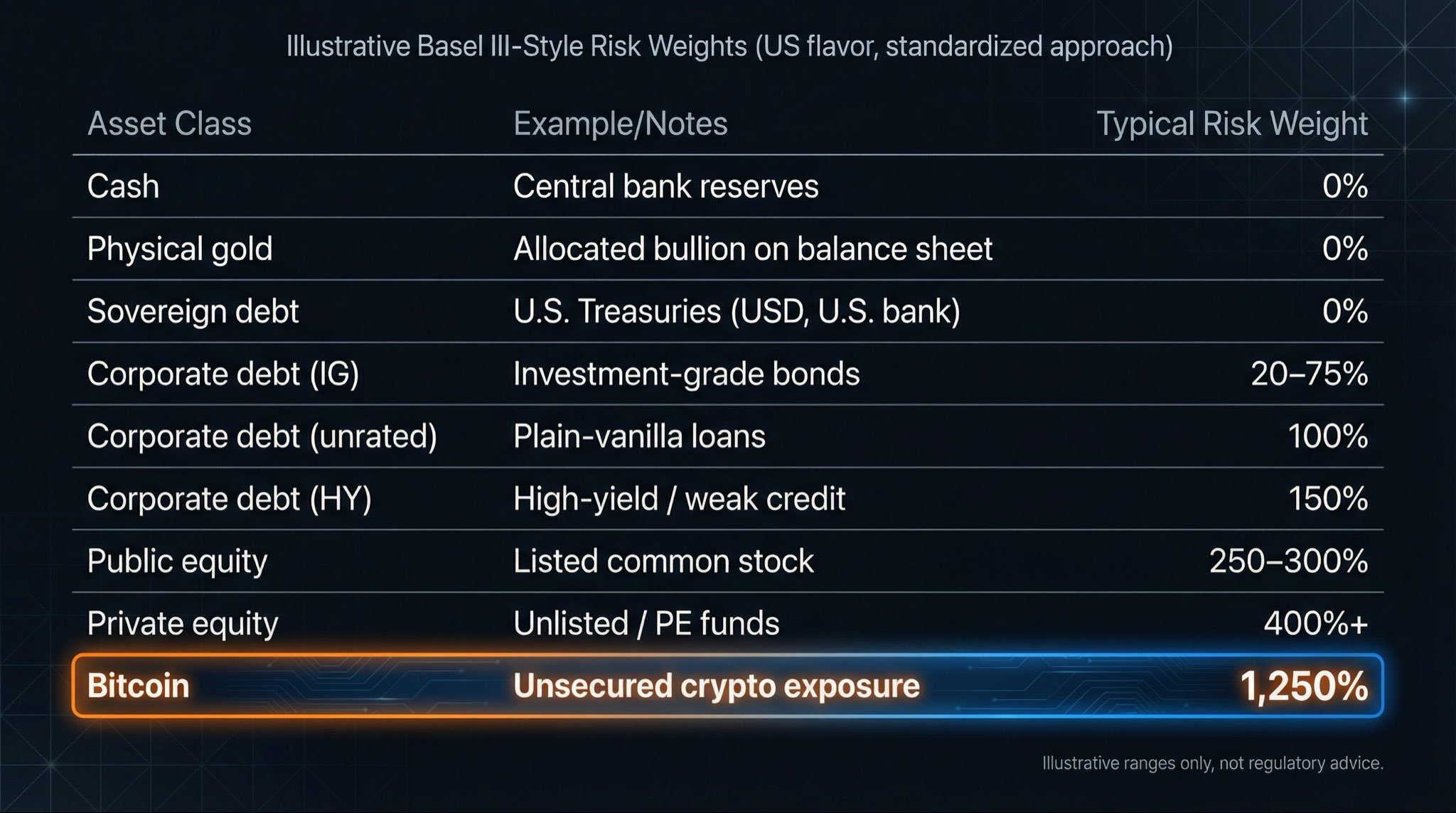

Crypto treasury executives are calling on the Basel Committee on Banking Supervision (BCBS), an international banking regulatory body, to revise the 1,250% risk weight for Bitcoin and other cryptocurrencies under the Basel III framework.

The 1,250% capital requirement means that banks must back any Bitcoin (BTC) on their balance sheets at a 1:1 ratio with approved collateral, making BTC holding more costly than other asset classes.

For comparison, cash, physical gold and government debt carry a 0% risk weight under the Basel III framework.

“If the US wants to be the ‘crypto capital’ of the world, the banking regulations need to change. Risk is mispriced,” Jeff Walton, chief risk officer at Bitcoin treasury company Strive, wrote on X.

The capital rules under Basel III discourage banks from holding BTC and crypto because of the relatively high cost of holding digital assets vis-a-vis reserve requirements, which lowers a bank’s return on equity, a critical metric for bank profitability, according to Chris Perkins, president of investment company CoinFund.

Related: Banks can’t seem to service crypto, even as it goes mainstream

Basel responds to growing backlash and pressure from the crypto industry

The Basel Committee proposed the current risk weightings in 2021, placing BTC and other cryptocurrencies in the highest risk category and imposing a 1,250% risk weight on digital assets.

In 2024, the committee finalized the capital requirements outlined in the 2021 proposal, which drew heavy backlash from the crypto industry.

The current rules represent a “different type of chokepoint” than the overt debanking of crypto companies in what some industry insiders dubbed Operation Chokepoint 2.0, Perkins told Cointelegraph in August 2025.

“It’s a very nuanced way of suppressing activity by making it so expensive for the bank to do those activities,” Perkins said.

In October 2025, reports emerged that the committee was considering easing the capital requirements for digital assets in response to the surge in the stablecoin market cap, which is nearing $300 billion, according to data from RWA.xyz.

The following month, Erik Thedéen, chair of the BCBS, said the international banking regulator may need a “different approach” to the 1,250% risk weight for cryptocurrencies, signaling a potential change in reserve requirements.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in the stablecoin fight

Crypto World

US Supreme Court Tariff Ruling Steals The Show As Bitcoin Sticks To $67,000

Bitcoin (BTC) saw choppy price action after Friday’s Wall Street open as markets reacted to the US Supreme Court decision on President Donald Trump’s trade tariffs.

Key points:

-

The US Supreme Court rules that certain US tariffs are illegal, sparking a modest risk-asset response.

-

US inflation data further cuts market hopes of a March interest-rate cut.

-

Bitcoin price action stays rooted in a firm range, with consensus seeing bears “in control.”

Supreme Court ruling attacks Trump tariffs

Data from TradingView showed $67,000 forming a focus for BTC price action, while US stocks gained.

The overall risk-asset response was muted however, as the Supreme Court ruled that some tariffs remained legal. In the firing line were those implemented under the International Emergency Economic Powers Act (IEEPA).

“IEEPA does not authorize the President to impose tariffs,” the Court wrote in its 170-page ruling.

Despite this, talk quickly surfaced over tariff refunds, with trading resource The Kobeissi Letter putting the potential total at $150 billion.

“Today’s Supreme Court ruling will be referenced for decades to come,” it added in a thread on X.

The event overshadowed earlier US macro data, which missed expectations. The Personal Consumption Expenditures (PCE) Index, known as the Federal Reserve’s “preferred” inflation gauge, hit its highest levels since late 2023 at 3%.

GDP data for Q4 2025, meanwhile, came in much lower than anticipated at 1.4% growth instead of 3%.

The numbers further reduced the odds of the Fed cutting interest rates at its March meeting, with data from CME Group’s FedWatch Tool now seeing a mere 4% chance of a 0.25% reduction.

On Thursday, trading resource Mosaic Asset Company expressed hope that stocks could still perform well despite the gloomy rates outlook.

“Even if the Fed goes an extended period on hold with interest rates, it’s worth remembering that financial conditions are still running much looser than average,” it summarized in an update.

“That should remain a tailwind for the bull market for now, even if the S&P 500 doesn’t reflect it. The combination of loose conditions and strong market breadth means a positive backdrop for position trading (for now).”

Bitcoin failing to escape “downwards trajectory”

Bitcoin traders continued to have few illusions about the precarious state of the market.

Related: Bitcoin ‘roadmap to bottom’ says $58.7K Binance cost basis now crucial

In his latest analysis, trader Jelle said that bears were still “in control.”

Bears remain in control – driving price lower and lower.

Don’t fight the trend, embrace it as the opportunity it presents: another chance to load up on cheaper coins.$BTC pic.twitter.com/wnhrKanAUb

— Jelle (@CryptoJelleNL) February 20, 2026

Trader and analyst Rekt Capital emphasized the importance of the 200-week exponential moving average (EMA), along with Bitcoin risking flipping it to resistance.

“History suggests Weekly Closes below the 200-week EMA followed by bearish retests of the EMA into new resistance can spur on the next phase of Bearish Acceleration to the downside,” he wrote on Thursday.

Earlier in the week, trader and commentator Skew suggested that the local BTC price range was indicative of “developing ‘value.’”

“Clear respected market supply around $70K & Clear tested market demand around $65K. This essentially points out the obvious which is a sustained move above $70K or below $65K will lead to trending price action,” he told X followers.

“Since the trend is in a downwards trajectory currently, this makes $72K quite significant as many shorts will place stops above & also it acts as a near term invalidation if cracked.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion12 hours ago

Fashion12 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show