Crypto World

SEC chair warns some prediction markets may fall under securities laws

The head of the U.S. Securities and Exchange Commission says prediction markets are drawing serious legal and regulatory attention.

Summary

- U.S. Securities and Exchange Commission Chair Paul Atkins called prediction markets a “huge issue” as the sector faces growing legal and regulatory scrutiny.

- Atkins said some event-based contracts could fall under SEC jurisdiction if they meet the definition of a security.

- The SEC is coordinating with the Commodity Futures Trading Commission as questions mount over oversight, especially for platforms like Polymarket and Kalshi.

At a Senate Banking Committee hearing on February 12, SEC Chair Paul Atkins described rapidly-growing prediction markets as “a huge issue” for federal regulators.

Platforms such as Kalshi and Polymarket have expanded quickly since the 2024 election cycle. These markets let users speculate on outcomes from elections and sports to economic events.

Their growth, now measured in tens of billions of dollars, has pushed them into the spotlight of U.S. regulators.

Who regulates prediction markets?

Atkins said the legal status of prediction markets isn’t always clear. He noted that jurisdiction overlaps between the SEC and the Commodity Futures Trading Commission (CFTC).

“Prediction markets are exactly one thing where there’s overlapping jurisdiction potentially,” Atkins said.

Historically, the CFTC has been seen as the primary federal regulator for these markets. Atkins said the SEC may regulate some markets depending on how they’re structured, especially if contracts resemble securities.

“We have enough authority,” he told lawmakers, adding that a “security is a security regardless how it is and some of the nuance with prediction markets and the products depends on wording.”

SEC officials are reportedly meeting weekly with their counterparts at the CFTC.

CFTC Chair Michael Selig said regulators want a framework that protects market participants without pushing these platforms offshore.

Meanwhile, prediction markets also face state-level litigation, including claims that some offerings are illegal gambling under local laws.

Recent reports have noted insider trading concerns and legislative efforts to limit political event betting.

Crypto World

Bitcoin Struggles to Maintain $67K, Pi Network’s PI Plunges After Recent Rally: Weekend Watch

PI has erased much of the recent gains, but still trades around $0.20.

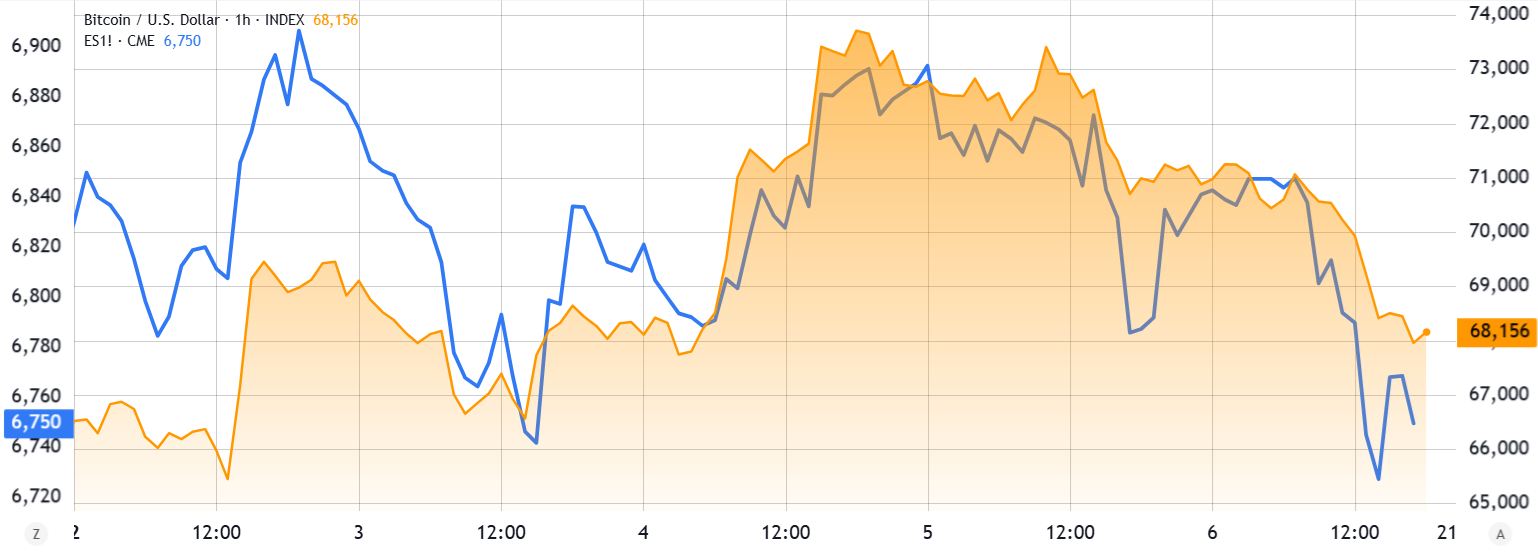

Bitcoin’s underwhelming price moves over the weekend continued as the asset dipped below $67,000 earlier today for the first time since Tuesday.

Most altcoins are also in the red today, with ETH slipping further away from the coveted $2,000 level, while ADA and XMR are down by over 2%. ZEC and PI have dumped the most daily.

BTC Fights for $67K

Last weekend brought intense volatility for the crypto markets after the US and Israel attacked Iran. BTC dropped immediately from $67,000 to $63,000 but rebounded within the day to $68,000 after reports that the Iranian Supreme Leader was killed during the attacks.

The gains continued by the middle of the business week when bitcoin peaked at $74,000, a level not seen in a month. However, the bears stepped up at this moment and didn’t allow for any further increases.

Just the opposite; BTC started to lose value but dumped the most on Friday after a weak US jobs report and Trump’s latest threats and remarks on Iran and Cuba. It slipped further on Sunday, dipping to $66,600, which became its lowest level since Tuesday. However, it reacted well and now trades almost a grand higher.

As of now, BTC’s market cap has settled at $1.350 trillion, while its dominance over the alts sits quietly at 56.6% on CG.

PI Nosedives

Pi Network’s native token defied the overall market correction in the past few days, skyrocketing to a three-month peak of over $0.23 yesterday. However, it failed there, and the subsequent rejection has pushed it south hard to $0.20 as of press time. ZEC follows suit in terms of daily losses and now struggles below $200.

Most larger-cap alts are also in the red, but in a less painful manner. ETH has decisively broken below the $2,000 level after another minor decline, while BNB is down to $620. SOL, XRP, ADA, XMR, and LINK are also down today.

The total crypto market cap has shed around $30 billion daily and is below $2.4 trillion as of now on CG.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin Sell-off To $65K Likely As Traders Run From Global Risks

Key takeaways:

-

Bitcoin faced pressure as rising oil prices and weak US data sparked risk-off sentiment and drove investors to gold.

-

A redemption spike in private credit funds from BlackRock and Blackstone signaled growing anxiety among retail investors.

Bitcoin (BTC) saw a 7% correction between Thursday and Friday following a failed attempt to reclaim the $74,000 level. The pullback tracked weak US macroeconomic data and a spike in oil prices as the US and Israel-Iran war entered its seventh day. Traders now question whether Bitcoin can maintain support above $65,000.

Typically, deteriorating economic conditions pave the way for monetary stimulus, often boosting the stock market in anticipation of increased liquidity. However, this cycle saw the S&P 500 retreat as a generalized risk-off sentiment erased all of Bitcoin’s gains from Wednesday.

US retail sales fell 0.2% in January compared to the previous month, while the US economy shed 92,000 jobs in February. Despite the cooling labor market, investors lack confidence that the Federal Reserve will cut interest rates further, as rising energy costs typically generate inflationary pressure.

US Treasury markets currently price a 78% probability that interest rates will remain steady between 3.5% and 3.75% through late April. A flight to safety pattern emerged as gold surged while the Russell 2000 Small Capitalization index hit a two-month low. Bitcoin’s drop below $85,000 in late January hindered its reputation as an uncorrelated asset, especially as silver rose to become the second most valuable asset.

Traders also fear a wave of corporate layoffs driven by artificial intelligence automation. Kansas City Fed President Jeff Schmid noted that AI is increasingly filling roles that once required manual labor. Schmid added that “older Americans are retiring,” causing a real-time structural change in the labor market, according to Yahoo Finance.

War and credit strain weigh on Bitcoin’s outlook

A prolonged war suggests increased US government spending, reducing the fiscal capacity for monetary stimulus aimed at economic expansion. Investors increasingly fear rising logistics costs beyond the commodities sector. Shipping giant Maersk announced on Friday the temporary suspension of two routes connecting the Middle East to Asia and Europe.

Bitcoin’s retest of the $68,000 level on Friday indicates that technical resistance levels identified by analysts may be secondary to geopolitical events impacting the oil and energy industries and, by extension, global growth prospects. The current weakness in risk assets appears to be a reflection of poor macroeconomic visibility rather than a structural collapse.

Related: Lyn Alden tips Bitcoin outperforming gold over next ‘two to three years’

A potential deterioration in trader expectations could originate within the US private credit market. BlackRock reportedly limited withdrawals from one of its largest credit funds following a spike in redemption requests, according to a Bloomberg report on Friday. Earlier this week, Blackstone’s flagship private credit fund fulfilled requests to tender a record 7.9% of shares, signaling rising retail anxiety.

Currently, the 3% option-adjusted spread for riskier firms is hovering within the normal range seen over the last six months. Periods of significant economic turmoil typically push this indicator above 5.0%, a level last seen in March 2023. As a result, there is no clear sign that Bitcoin will break below $65,000, even with the ongoing uncertainty surrounding global economic growth.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Trump’s National Cyber Strategy Backs Crypto Security in Post-Quantum Era

US President Donald Trump’s newly released National Cyber Strategy outlines federal support for strengthening the security of cryptocurrencies and blockchain systems, including protections against future threats posed by quantum computing.

Key Takeaways:

- Trump’s National Cyber Strategy includes federal support for securing cryptocurrencies and blockchain networks.

- The plan promotes post-quantum cryptography to protect digital infrastructure from future quantum computing threats.

- The strategy comes as the crypto industry debates how Bitcoin and other blockchains should prepare for quantum-era security risks.

The strategy, published Friday by the White House, states that the administration intends to ensure the United States remains “unrivaled in cyberspace.”

The document highlights the role of secure digital infrastructure and emphasizes that Americans should take steps to safeguard their online activities while the government works to reinforce broader cybersecurity protections.

Trump Cyber Strategy Highlights Crypto and Blockchain Security

Within that framework, the strategy includes a specific focus on emerging technologies tied to the digital asset sector.

According to the document, the administration plans to “build secure technologies and supply chains that protect user privacy from design to deployment,” while also supporting the security of cryptocurrencies and blockchain networks.

The strategy also calls for promoting post-quantum cryptography, encryption systems designed to withstand attacks from future quantum computers, alongside the development of secure quantum computing technologies.

The mention of crypto security comes as debate intensifies within the digital asset industry over whether major blockchain networks are prepared for a future where quantum machines could break current encryption methods.

Quantum computers remain largely experimental, but researchers have warned that sufficiently powerful versions could one day crack cryptographic systems used by Bitcoin and other blockchains.

Such a development would require networks to migrate to new encryption standards capable of resisting quantum attacks.

Some figures in the crypto sector argue the risk remains distant. Michael Saylor, co-founder of Bitcoin-focused firm Strategy, has said concerns about quantum threats are exaggerated, though he acknowledges that developers should remain prepared for technological shifts.

Other projects have begun exploring upgrades more actively. Ethereum co-founder Vitalik Buterin proposed a “quantum roadmap” earlier this year aimed at preparing the blockchain for a future where quantum computing could undermine existing cryptographic protections.

Trump’s cybersecurity plan arrives alongside other policy actions that touch the digital asset sector.

On the same day the strategy was released, the president signed an executive order targeting cybercrime, part of a broader effort to strengthen the country’s digital defenses.

Trump Expands Pro-Crypto Agenda With Bitcoin Reserve and CBDC Ban

Since returning to office, Trump has taken several steps aimed at reshaping US crypto policy. Last year, he approved the creation of a strategic Bitcoin reserve held by the federal government.

The reserve currently contains Bitcoin seized in criminal cases, and the administration has not indicated plans to acquire additional assets.

Earlier executive actions also included a sweeping review of digital asset policy and a prohibition on the development of US central bank digital currencies, reflecting the administration’s stance against government-issued digital money.

Meanwhile, Trump has intensified pressure on Jerome Powell, including threats of a criminal investigation, but the Federal Reserve has again held interest rates steady, citing solid growth and still-elevated inflation.

Powell declined to comment on the investigation and defended the Fed’s independence, warning that politicizing monetary policy would undermine the institution’s credibility.

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The post Trump’s National Cyber Strategy Backs Crypto Security in Post-Quantum Era appeared first on Cryptonews.

Crypto World

US Treasury Says ‘Lawful’ Crypto Users Have Valid Reasons To Use Mixers

The Treasury’s report to the US Congress was commissioned as part of directives under the GENIUS stablecoin regulatory framework.

The United States Treasury Department acknowledged the legitimate use of mixers, which obfuscate crypto transfers to preserve user privacy, in its report to Congress on “Innovative Technologies to Counter Illicit Finance Involving Digital Assets.”

“As consumers increase their use of digital assets for payments, individuals may want to use mixers to maintain more privacy in their consumer spending habits,” the report said. The Treasury report continued:

“Lawful users of digital assets may leverage mixers to enable financial privacy when transacting through public blockchains. For instance, individuals may use mixers to protect sensitive information on personal wealth, business payments or charitable donations from appearing on a public blockchain.”

However, the report also noted the dangers of “darknet” or non-custodial, decentralized mixers. The Treasury said that non-custodial mixers are used for money laundering or shifting illicit funds by cybercriminals, including North Korea-linked hackers.

The authors suggested that custodial mixers, centralized services that take possession of user funds during the process, could provide identifying information that could be used to track users and transaction flows.

Privacy in crypto became a hot-button issue in 2025, as financial surveillance increases and US lawmakers attempt to impose know-your-customer (KYC) requirements on digital asset service providers and even decentralized finance (DeFi) platforms.

Related: Dash Evolution chain integrates Zcash Orchard privacy pool

DeFi leaders and seasoned investors warn about the threat to privacy

DeFi leaders and advocates sounded the alarm on ambiguous language in the Digital Asset Market Clarity Act of 2025, also known as the CLARITY bill, that could force DeFi platforms to collect identifying information from users.

The bill also lacked sufficient protections for open-source software developers in the US, according to Alexander Grieve, vice president of government affairs at crypto investment company Paradigm.

Former hedge fund manager Ray Dalio also warned that central bank digital currencies (CBDCs), onchain fiat currencies managed by a central banking institution or the government, are coming and pose a major risk to digital privacy.

In an interview with independent journalist Tucker Carlson, Dalio said CBDCs are a “very effective controlling mechanism” for the government.

Magazine: Can privacy survive in US crypto policy after Roman Storm’s conviction?

Crypto World

Curve Stablecoin Pool Outperforms Uniswap With Higher Volume Efficiency

TLDR:

- Curve’s USDC/USDT pool processes 75% of Uniswap volume with only one eighth of the liquidity available.

- Liquidity providers earn about 2.5% base yield on Curve compared with under 1% across Uniswap pools.

- Curve’s stablecoin focused AMM concentrates liquidity near parity to increase capital efficiency.

- Maximum boosted rewards can lift liquidity provider returns on Curve pools to about 5.5% APR.

New data reveals a sharp efficiency gap between Curve and Uniswap in stablecoin trading pools. A USDC and USDT pool on Curve processed major trading activity despite holding far less liquidity than similar Uniswap pools.

The pool generated comparable trading volume while operating with only a fraction of the capital. The development has renewed focus on how automated market maker designs influence liquidity efficiency and returns.

Curve Stablecoin Pool Shows Higher Volume Efficiency Than Uniswap

Data shared on X indicates the USDC and USDT pool on Curve holds about $5 million in liquidity. Comparable pools on Uniswap V3 and V4 hold around $37 million combined.

Despite that difference, Curve recorded roughly $33 million in trading volume during the same period. Uniswap pools handled about $43 million in volume.

The comparison shows Curve processing nearly 75% of Uniswap’s combined volume while using about one eighth of the liquidity. That efficiency stems from Curve’s automated market maker design built for stablecoin trading.

Curve’s system concentrates liquidity around tight price ranges for assets with similar values. Stablecoins such as USDC and USDT typically trade near parity.

Michael Egorov, the founder of Curve, commented on the data through X. He noted that the Curve pool outperformed comparable Uniswap pools in both utilization and annual yield.

Egorov also pointed out that average trading fees inside the Curve pool exceeded those in the comparable Uniswap V4 pool. The data suggests higher utilization of available liquidity inside Curve’s market structure.

Higher APR on Curve Stablecoin Pool Boosts Liquidity Provider Returns

Liquidity providers in the Curve pool also receive stronger base yields. Data shared by market analyst CredibleCrypto shows base returns around 2.5%.

Comparable pools on Uniswap generate lower base yields. Uniswap V3 produces about 0.6% while Uniswap V4 returns around 0.95%.

The gap means Curve liquidity providers earn roughly 2.5 to five times more yield from base fees alone. That difference reflects higher trading activity relative to capital size.

Additional incentives further increase potential returns on Curve. Liquidity providers can earn up to about 5.5% annual percentage rate with a maximum boost.

These boosts come from Curve’s reward structure tied to veCRV governance participation. The mechanism increases rewards for users who lock tokens and participate in governance.

The structure encourages long term liquidity commitments while raising effective yield for active participants. As a result, Curve maintains strong capital efficiency even with smaller pools.

The comparison between Curve and Uniswap highlights a broader design difference between automated market makers. Curve specializes in stable asset trading while Uniswap supports a wider range of tokens and markets.

Crypto World

Pi Network, Polkadot, US inflation data

The crypto market will likely maintain its volatility this week as the war in Iran continues and the US releases its consumer inflation report on Wednesday. This article looks at some of the top crypto news to watch this week.

Pi Network in the spotlight ahead of Pi Day

One of the top crypto news this week will be on Pi Network. The network will conclude the current phase of the network upgrade on March 12. This upgrade is part of that transition from v19 to v23 of the Stellar consensus.

Pi Network price will also react to the upcoming Pi Day event on March 14. This is a major event meant to commemorate and celebrate the mathematical constant pi.

Pi Network uses the event to make major announcements that often moves prices. There is also speculation that Kraken will decide to list the coin on this day.

Polkadot tokenomics upgrade

The other key crypto market news this week will be the upcoming Polkadot tokenomics upgrade that happens on March 12.

This is a major overhaul that will reduce the number of DOT tokens in circulation to 2.1 billion and reduce emissions by 53.6%. The upgrade will also reduce the number of unbonding days from 28 days to between 24 and 48 hours.

The new upgrade aims to introduce the concept of scarcity and capital efficiency. It also comes a few days after 21Shares launched the first DOT ETF on Friday.

US-Iran war and US inflation data

The other key crypto news to watch this week will be the ongoing war in Iran. The three sides – Iran, the United States, and Israel – have all vowed to continue the fight, leading to higher crude oil prices.

Signs that the war will continue for longer will be highly bearish for the crypto market as Bitcoin’s role as a safe-haven asset has been decimated. Instead, investors have turned to gold and the Swiss franc.

In line with this, the US will publish its inflation report on Wednesday this week. Economists expect the upcoming numbers to show that inflation rose from 2.4% in January to 2.5% in February. This inflation comes a few days after the US published weak jobs numbers.

It is unclear whether the upcoming inflation report will have an impact on crypto prices because investors are now focusing on the impact of the ongoing Iran war and its impact on crude oil prices.

Crypto World

US Lawmakers Demand ‘Permanent’ CBDC Block

A group of US lawmakers is uniting to prevent the US central bank from ever issuing a Central Bank Digital Currency (CBDC), warning that proposed legislation only delays it until 2031.

“We write to you to express the dire need to prohibit a Central Bank Digital Currency from ever happening in the United States,” US Congressman Michael Cloud wrote in a letter on Friday addressed to House Speaker Mike Johnson and US Senate majority leader John Thune, joined by 28 other members of Congress in support.

It follows a proposed amendment to the Federal Reserve Act that would bar the US central bank from issuing a CBDC until 2031. The amendment is part of the 300-page “21st Century ROAD to Housing Act” (HR 6644), which was released on Monday by the Senate Committee on Banking, Housing, and Urban Affairs.

However, Cloud and the other lawmakers argued that the temporary block isn’t strong enough to protect Americans.

“A prohibition of a Central Bank Digital Currency must be permanent,” the letter said, adding that CBDCs “would expose Americans to unconstitutional financial surveillance and give the unelected Federal Reserve unprecedented power over Americans’ finances that would violate their civil liberties and financial freedom.”

US lawmakers argue it must end “before it is too late”

“A CBDC is inherently anti-American and a looming issue we must put an end to before it is too late,” the letter said.

The lawmakers argued that the amendment “includes a watered-down version” of the “Anti-CBDC Surveillance State Act” (HR 1919), which was introduced in June 2025 by Congressman Tom Emmer.

The bill passed the House on July 17 but has yet to receive full Senate approval.

Related: Trump’s National Cyber Strategy pledges to support crypto and blockchain

The letter pointed out that the amended bill does not prohibit the Federal Reserve from studying a CBDC. “The strong language of H.R.1919 must be restored,” the letter said.

A separate standalone bill, the No CBDC Act (S 464), was introduced by Senator Mike Lee in February 2025 to prohibit the Federal Reserve or Treasury from issuing a CBDC, but it stalled in Congress.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Bitcoin ‘Bull Trap’ Forming As Bear Market Middle Stage Approaches: Analyst

Bitcoin could experience a short-term rally that catches investors off guard before the broader downtrend resumes, according to on-chain analyst Willy Woo.

“Bull trap forming,” Woo said in an X post on Saturday, referring to a fake breakout suggesting that the market is entering a sustained uptrend. He added that it may last “out to [the] end of April.”

Woo said his outlook is based on liquidity conditions rather than price levels. “If capital comes back in force with the right type of long-term investors, then I’ll happily change my views,” Woo said.

Bitcoin is “solidly” in the middle of a bear market

From a long-range liquidity perspective, Woo said Bitcoin (BTC) is “solidly in the middle of its bear market.” “Typically, after fast downward flushes like we have had, BTC likes to go sideways and mount a rally where resistance is tested,” Woo said.

Bitcoin has fallen approximately 46.82% since reaching its October all-time highs of $126,000, trading at $67,012 at the time of publication, according to CoinMarketCap.

Woo said that this level isn’t the bottom for Bitcoin and the asset may see further downside. Crypto sentiment platform Santiment shared a similar view on Saturday, pointing to whales aggressively selling while retail investors buy below $70,000.

“When retail buys while whales sell, it typically signals that the correction is not yet over,” Santiment said.

Bitcoin investor flows have been in “consistent recovery”

Woo said that despite Bitcoin failing to hold the “mid-70s” range after it soared to $74,000 on Wednesday, investor flows have been in “consistent recovery” since the middle of February.

Related: Bitcoin relief rally hits wall as spot ETFs log $228M in outflows

Woo isn’t the only analyst who thinks Bitcoin is in a bear market. Crypto analyst Benjamin Cowen recently told Magazine that 2026 is a “bear market year” for Bitcoin and unlikely to bring new all-time highs.

On-chain analytics company CryptoQuant said on Thursday that “Bitcoin is still in a bear market despite the recent rally.”

It comes after the Crypto Fear and Greed Index, one of the most widely used gauges of crypto investor sentiment, fell back to “extreme fear” levels after briefly recovering on Wednesday.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

RWA Market Tops $24.9B as Tokenized Gold, Stocks, and Treasuries Reshape Crypto Finance

TLDR:

- Tokenized RWAs hit $24.9B in Feb 2026, up 289% YoY as six asset classes cross the $1B mark.

- BlackRock’s BUIDL leads tokenized Treasuries at $2.2B after surging 239% over the past year.

- Tokenized stocks reached $786M since mid-2025, growing independently of Bitcoin’s price swings.

- Only 11.8% of $8.49B in RWA stablecoins are active in DeFi due to KYC and whitelist barriers.

The tokenized real-world asset market crossed $24.9 billion in February 2026. That figure marks a 289% increase from $6.4 billion just one year prior.

Six asset classes now individually exceed $1 billion in tokenized value. The market is no longer driven by a single sector. It is diversifying fast.

Treasuries, Gold, and Equities Drive Explosive RWA Expansion

U.S. Treasuries remained the largest segment. They grew 183% year-over-year, reaching $10.8 billion, according to data compiled by Nexus Data Labs.

Active products expanded from 35 to 53, with entries from Fidelity, ChinaAMC, and VanEck. BlackRock’s BUIDL fund now leads the space at $2.2 billion, up 239% in 12 months.

Ondo Finance’s combined Treasury exposure reached $2 billion across OUSG and USDY.

Superstate’s USTB grew 499% to $0.8 billion. WisdomTree’s WTGXX surged 759%. The top-three concentration in this market dropped from 61% to 48%, per Nexus Data.

Tokenized stocks are the newest category and the fastest-growing. They scaled from near-zero to $786 million since mid-2025.

Platforms including Ondo Finance, Backed Finance, Dinari, and Robinhood now offer onchain access to NVDA, TSLA, GOOGL, SPY, and QQQ. Growth continued even while Bitcoin dipped below $70,000.

Tokenized gold also posted strong gains. Circulating supply on Ethereum nearly doubled, from 687,000 to over 1.3 million troy ounces in 12 months.

The spot price of gold rose 80% over the same period, from $2,963 to $5,327. Supply growth outpaced price gains. That signals active minting, not passive price appreciation.

88% of RWA-Backed Stablecoins Remain Locked Outside DeFi Protocols

The stablecoin side of the RWA story tells a different tale.

Total RWA-backed stablecoin supply stands at $8.49 billion, per DeFiLlama. Only $1 billion of that, roughly 11.8%, is actively deployed in DeFi protocols.

DAI dominates by market cap at 53%, or $4.48 billion. USDY from Ondo Finance holds 15% of supply. But when filtered for active DeFi usage, USDY drops to just 1.99% of utilization. YLDS, at $598 million in supply, disappears from DeFi entirely.

The gap comes down to access restrictions. KYC requirements and whitelisting walls block permissioned tokens from integrating with permissionless DeFi contracts.

Permissionless assets show a stark contrast. reUSD posts 96.7% DeFi utilization. USDtb reaches 29.5%. Legacy FRAX sits at 28%.

That leaves $7.49 billion, roughly 88% of all RWA-backed stablecoin supply, sitting outside DeFi. The infrastructure exists. The capital is onchain.

Composability remains the gap between presence and productivity.

Crypto World

CEXs Have Zero Motive to Aid Terrorists as Court Dismisses Case

In a setback for plaintiffs seeking to link Binance to terrorist financing, a U.S. federal court in New York dismissed a broad claim that the exchange helped move funds for terrorist groups. The ruling comes as Binance and its founder CEO, Changpeng Zhao, have repeatedly argued that centralized crypto exchanges operate on economic incentives that make it irrational for criminals to use legitimate platforms for funding violent acts. The decision, while narrow in scope, underscores the challenges in tying crypto trading venues to specific acts of violence, even amid heightened scrutiny over sanctions and compliance practices.

Key takeaways

- The Southern District of New York judge dismissed the case at the pleading stage, citing an insufficient link between Binance’s operations and the listed attacks.

- The plaintiffs represented 535 individuals connected to 64 attacks dating from 2016 to 2024, attributed to groups including Hezbollah, Hamas, ISIS, al-Qaeda and Palestinian Islamic Jihad.

- Changpeng Zhao (CZ) asserted on X that centralized exchanges have “zero motive” to assist terrorists, arguing that such activity would not generate trading revenue and would likely be short-livedDeposits.

- The court’s decision narrows the path for victims pursuing anti-terrorism claims under statutes such as the US Anti-Terrorism Act and the Justice Against Sponsors of Terrorism Act.

- Binance has faced separate scrutiny over sanctions-related transactions and Iran-linked activity, including pushback against Senate probes and media reports that alleged extensive ties to sanctioned entities.

Sentiment: Neutral

Market context: The ruling arrives amid a broader backdrop of intensified regulatory scrutiny of centralized exchanges, including debates over sanctions enforcement, AML/KYC standards and the role of crypto platforms in cross-border law enforcement efforts. While the decision limits one legal avenue for victims, it does not resolve ongoing questions about how large exchanges respond to illicit activity and geopolitical sanctions.

Why it matters

The SDNY’s dismissal signals that, at least in this case, plaintiffs faced a high bar in proving direct, actionable links between Binance’s services and the specific terrorist attacks cited in the complaint. The decision emphasizes the difficulty of proving causation for criminal actions that occur through a broad, permissionless ecosystem where many intermediaries and third parties could be involved. For traders and institutions watching regulatory risk, the ruling reinforces the boundary between platform responsibility and the broader ecosystem in which crypto assets circulate.

From a policy vantage point, the case highlights the tension between victims seeking redress under anti-terrorism statutes and the practical standards courts apply to show that a platform’s compliance practices materially facilitated or enabled wrongdoing. The judge’s ruling does not absolve Binance of potential wrongdoing in other contexts, but it does illustrate how courts assess linkages between a platform’s operations and the crimes alleged. In the process, it preserves the possibility that future amendments to complaints, if sufficiently grounded, could reframe liability questions under different facts or legal theories.

Beyond the courtroom, Binance’s public posture remains that it endeavors to operate within regulatory expectations while contesting allegations that rely on incomplete or mischaracterized information. The exchange has repeatedly argued that its internal controls, risk models and cooperation with authorities are designed to prevent illicit activity, and it has asserted that certain allegations—particularly those tied to sanctions evasion—are overstated or unfounded. The recent court decision, while narrow, interacts with a broader narrative about how exchanges balance rapid, global crypto trading with stringent compliance obligations.

What to watch next

- Whether plaintiffs pursue an amended complaint within the 60-day window noted by the judge, potentially re framing allegations or adding new evidence to strengthen causation links.

- Binance’s ongoing responses to regulatory inquiries, including statements addressing Senate probes and sanctions-related reporting, and how the company frames its compliance posture in light of evolving rules.

- Regulatory developments surrounding Iran-related and other sanctions-compliance matters, as policymakers weigh enforcement priorities and the role of major crypto platforms in monitoring cross-border flows.

- Subsequent court activity, including any appeals or related actions that might test different legal theories or damages frameworks under anti-terrorism statutes.

Sources & verification

- U.S. District Court for the Southern District of New York dismissal order (PDF) detailing the court’s rationale for ruling at the pleading stage.

- Original court filing referenced in coverage, including the inclusion of 535 plaintiffs connected to 64 attacks (2016–2024).

- Changpeng Zhao’s X post remarking on the economics of centralized exchanges and their lack of motive to engage with terrorists.

- Binance’s response to Senate inquiries and related reporting discussed in coverage of sanctions and Iran-linked activity.

Binance court ruling and regulatory scrutiny

The decision in the SDNY case marks a notable moment in crypto litigation, illustrating how courts evaluate the relationship between a large exchange’s operations and criminal acts pursued by external actors. While the ruling narrows the path for the plaintiffs, it does not preclude other lawsuits or investigations that might pursue different factual or legal avenues. In the immediate aftermath, Binance pressed a cautious but defiant stance on the sanctions-related allegations, reiterating that a February inquiry relied on information the firm described as false and lacking credible substantiation. The exchange emphasized its commitment to compliance and cooperation with authorities while warning against conflation of isolated incidents with systemic failures.

As the industry navigates a landscape of looming regulatory expectations, the case underscores the importance of robust AML/CFT controls, transparent transaction monitoring, and proactive risk management—elements that policymakers argue are essential to preserving the integrity of crypto markets. It also highlights how defendants in high-profile cases must balance public diplomacy with legal strategy, especially when countering narratives that tie crypto platforms to violent acts or sanctioned networks. In this environment, market participants—ranging from retail traders to institutional buyers—will be closely watching how courts interpret platform responsibilities and how regulators adapt their guidance to evolving technologies and use cases.

What to watch next

- The 60-day window for an amended complaint, which could shift pleadings and potentially introduce new factual claims.

- Binance’s continued engagement with U.S. lawmakers and regulators as scrutiny around Iranian-linked transactions and broader sanctions compliance persists.

- Any new court actions related to similar theories of liability, including potential appeals or separate lawsuits that challenge platform practices or risk controls.

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports13 hours ago

Sports13 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Sports4 hours ago

Sports4 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026

-

NewsBeat6 days ago

NewsBeat6 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

![Ripple CTO Made an ENCRYPTED Message... "DO NOT SELL XRP EARLY" GET READY XRP HOLDERS! [MUST SEE]](https://wordupnews.com/wp-content/uploads/2026/03/1772957034_maxresdefault-80x80.jpg)