Crypto World

Silver Price Breaks February Resistance Line

As seen on the XAG/USD chart, silver has today breached the upper boundary of the descending channel formed by February’s lower highs and lows.

Bullish sentiment is supported by heightened geopolitical tensions and rising demand for safe-haven assets. According to media reports:

→ On Thursday, US President Donald Trump warned Iran that it must reach an agreement on its nuclear programme, or “really bad things” would happen, setting a 10–15 day deadline.

→ In response, Tehran threatened retaliatory strikes on US bases in the region if attacked.

On 11 February, analysing the XAG/USD chart, we noted that silver was consolidating between two key levels:

→ resistance around $87.5–95

→ support near $70

Today’s bullish breakout of the channel’s upper boundary – which acted as resistance in February – can be interpreted as a move towards the $87.5–95 zone.

Confidence for bulls is further reinforced by an inverted head and shoulders (SHS) pattern. If buyers are determined, this should be confirmed by XAG/USD holding above:

→ the channel breakout level near $79

→ the psychological $80 mark.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

AAVE falls 3.3%, leading index lower

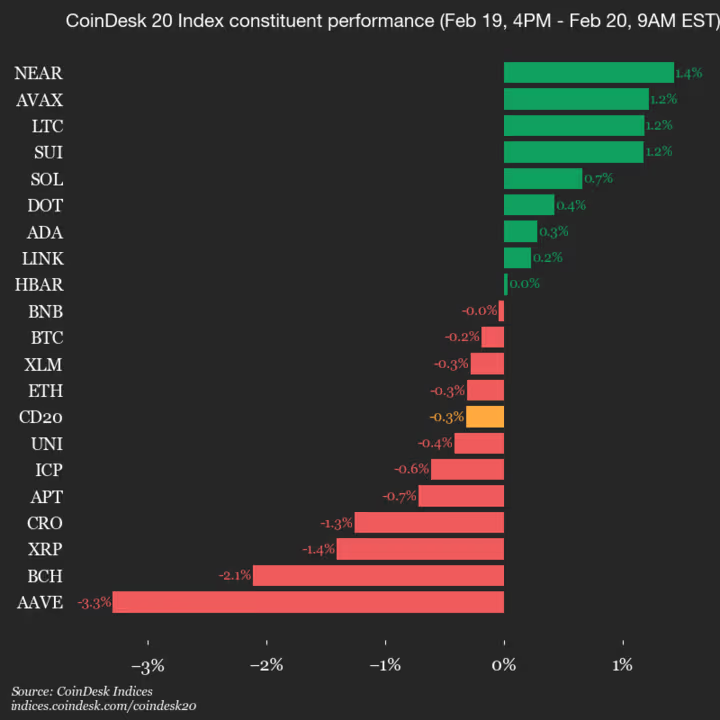

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1924.88, down 0.3% (-6.12) since yesterday’s close.

Nine of the 20 assets are trading higher.

Leaders: NEAR (+1.4%) and AVAX (+1.2%).

Laggards: AAVE (-3.3%) and BCH (-2.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Is $2.7 Billion Whale Selling the Last Shakeout for Ethereum?

Ethereum continues to trade sideways as uncertainty weighs on the broader crypto market. The altcoin king has struggled to regain decisive bullish momentum.

While the current structure suggests potential bottom formation, large holders appear to be making aggressive moves.

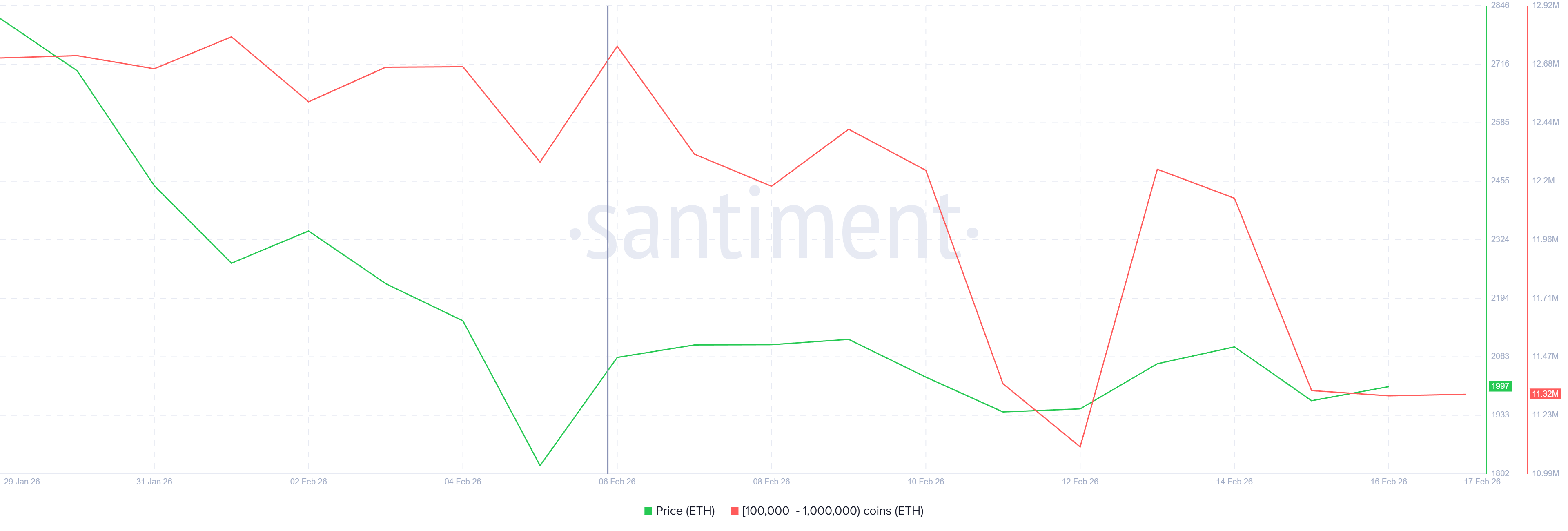

Ethereum Whales Selling Has Not Stopped

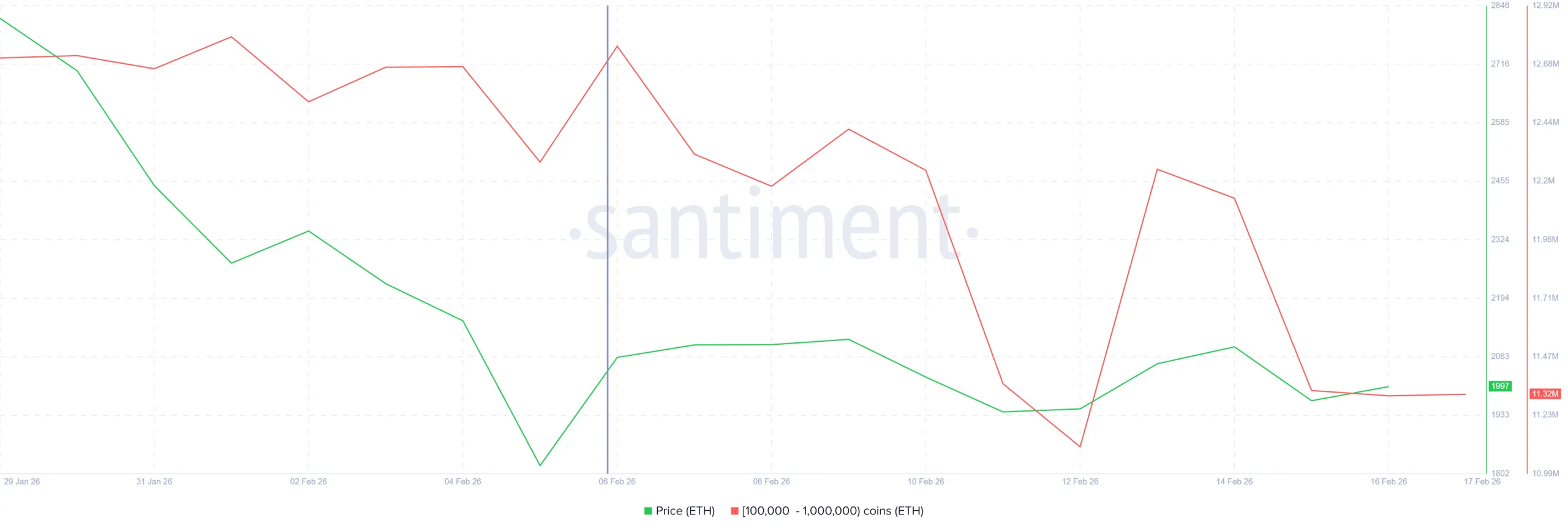

Ethereum whales have demonstrated erratic behavior in recent sessions. Sharp accumulation phases have been followed by equally aggressive distribution. This volatility signals uncertainty among high-capital participants.

Over the past two weeks, addresses holding between 100,000 and 1 million ETH have sold approximately 1.43 million ETH. At current valuations, that equals roughly $2.7 billion. Such large-scale distribution significantly impacts liquidity conditions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This level of selling often reflects late-cycle stress rather than early panic. Historically, heavy whale exits tend to occur near capitulation phases. Large holders sometimes reduce exposure before the broader acceptance of a market bottom. These episodes frequently precede structural reversals once selling pressure exhausts.

Ethereum Bottom Signals Strengthen

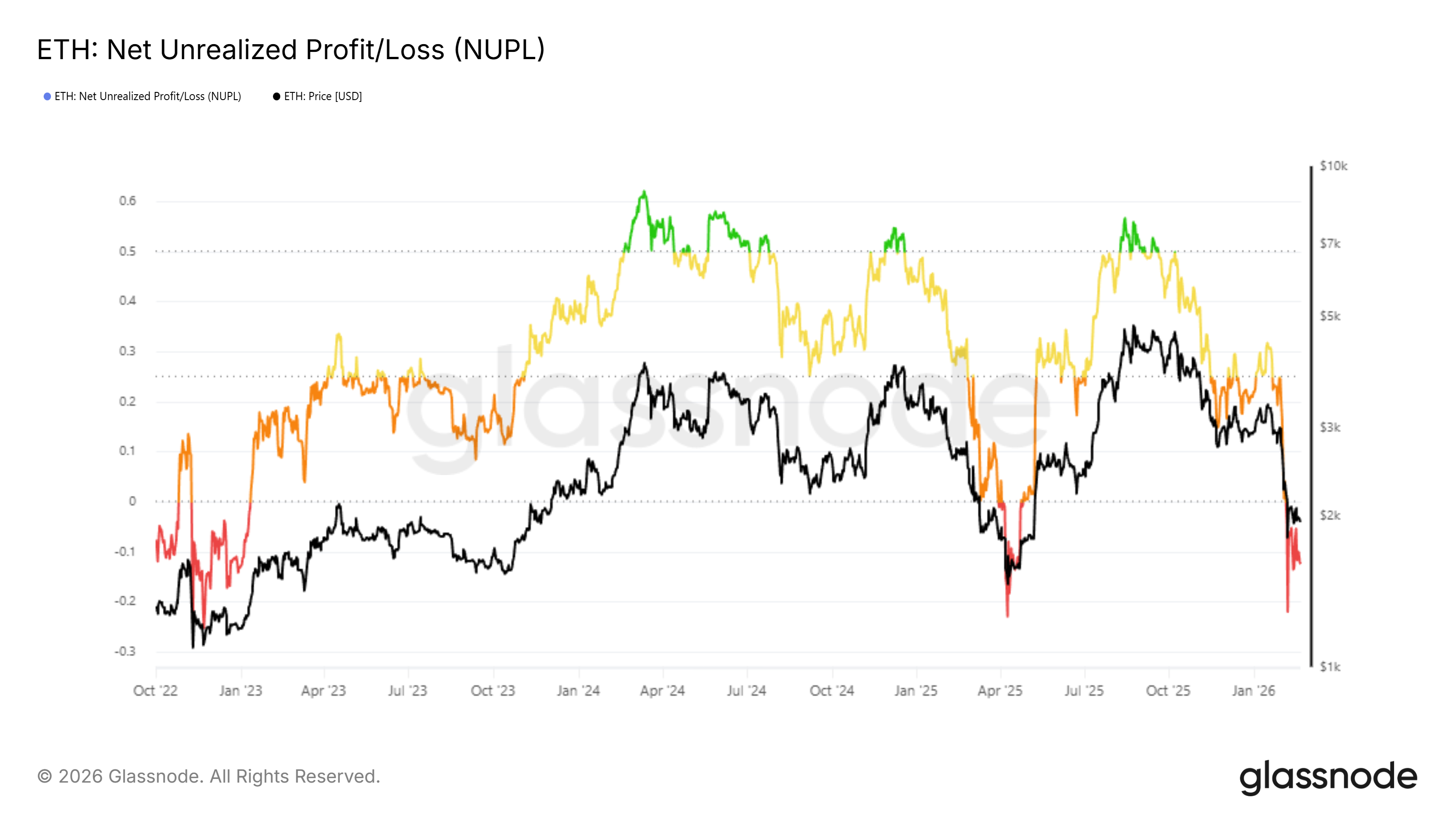

On-chain data provides additional context. The Net Unrealized Profit and Loss, or NUPL, indicator shows Ethereum in the capitulation zone. This reading indicates that average holders face substantial unrealized losses.

In prior cycles, similar NUPL conditions preceded meaningful reversals. However, Ethereum typically remains in this zone for extended periods. Capitulation does not imply immediate recovery.

Sustained time in the capitulation band often reduces speculative selling. As weaker hands exit positions, remaining holders tend to exhibit stronger conviction. Gradual stabilization in NUPL readings can signal diminishing downside momentum before recovery begins.

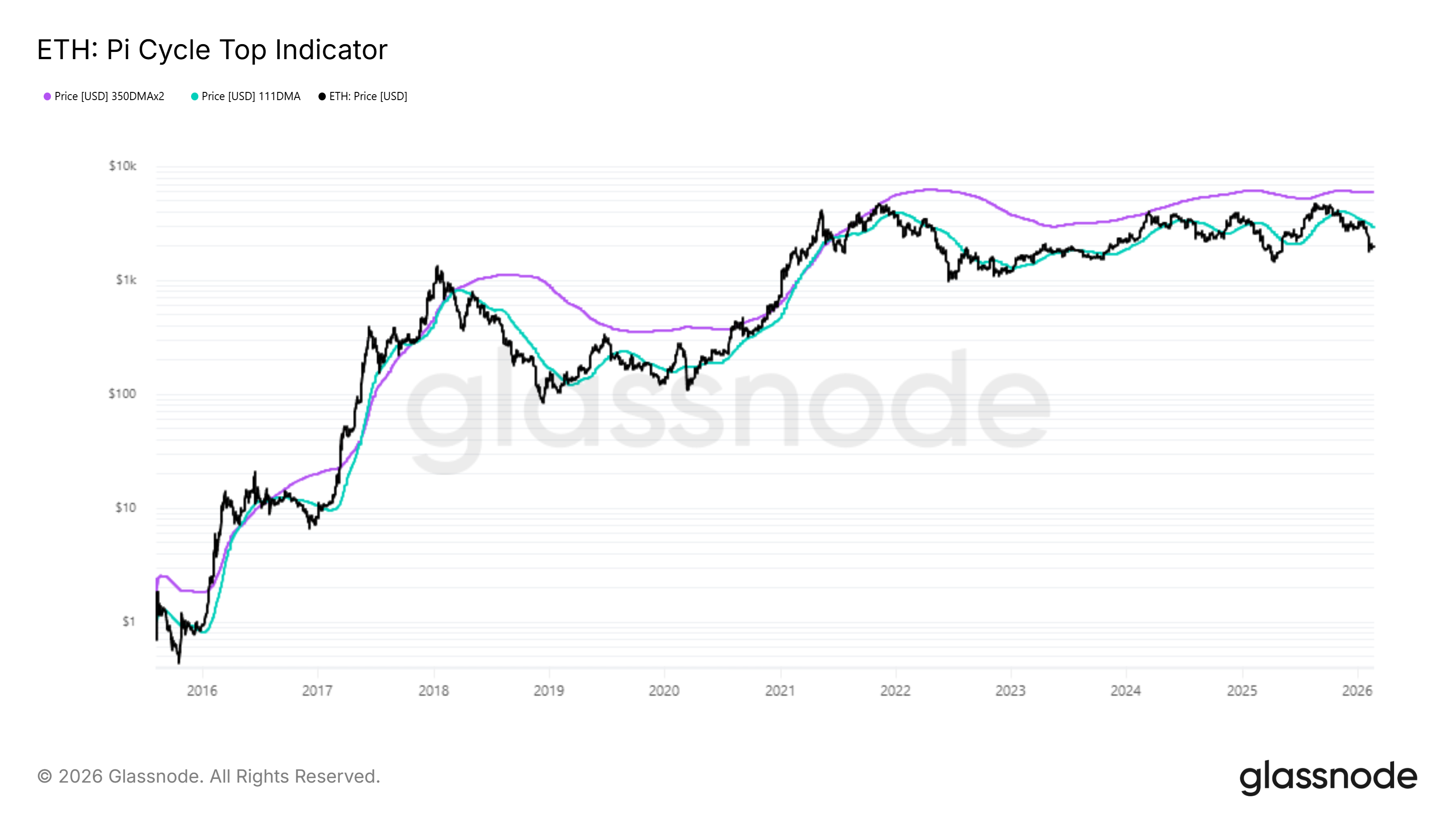

The Pi Cycle Top Indicator also supports a potential ETH bottoming narrative. This metric tracks the relationship between short-term and long-term moving averages. Historically, convergence signals overheating near cycle tops.

Conversely, extreme divergence between these averages often aligns with cyclical bottoms. Current readings show meaningful separation between the two curves. Similar divergence patterns previously marked recovery zones.

Historical instances demonstrate that widening gaps preceded upward reversals. Although timing remains uncertain, this structural setup aligns with late-stage correction behavior. Combined with capitulation metrics, the data suggests Ethereum may be approaching stabilization rather than early bear expansion.

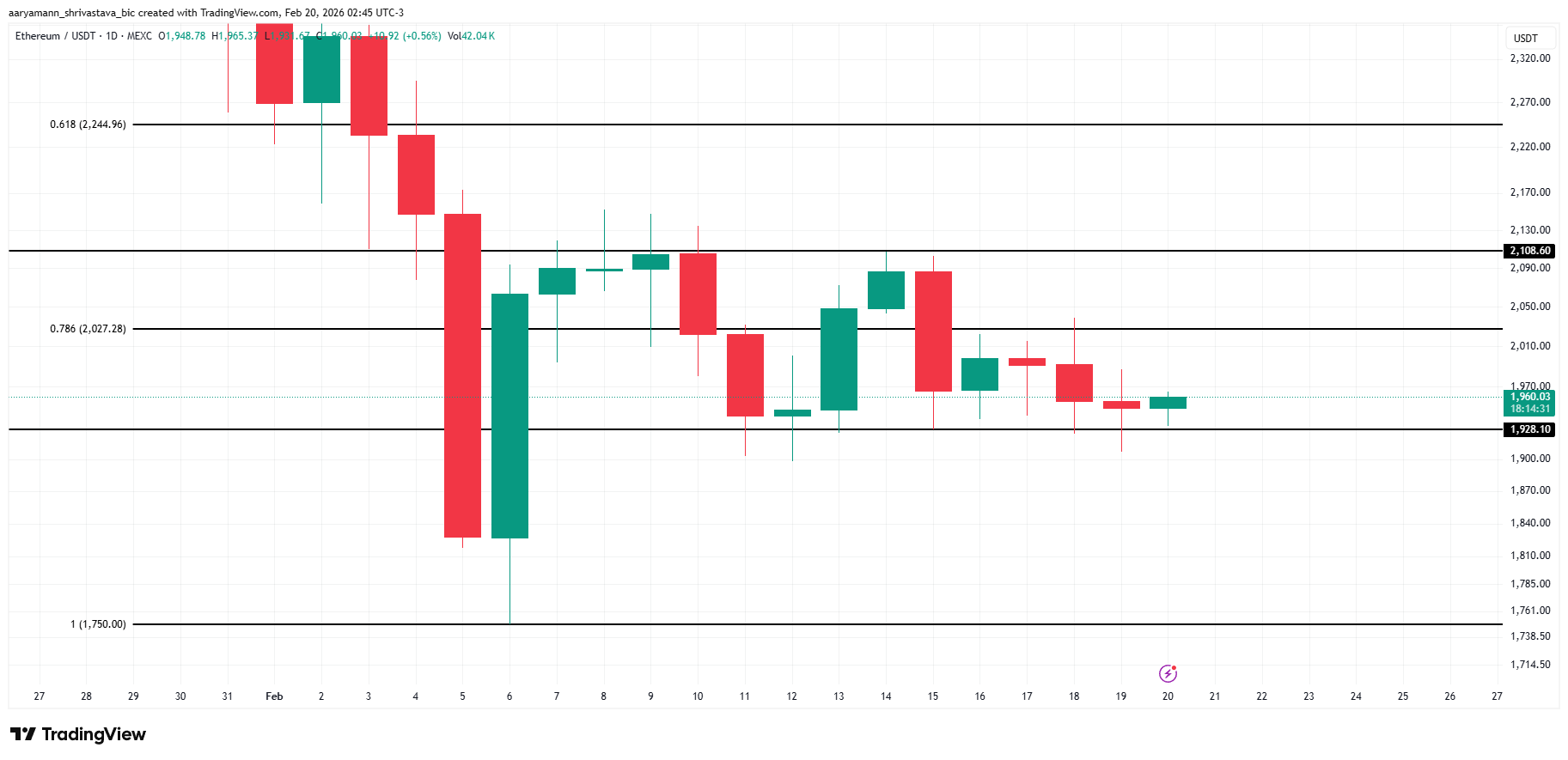

ETH Price Holds Above Support

Ethereum trades at $1,960 at the time of writing. The asset has consistently held above the $1,928 support level despite whale distribution. This zone remains technically significant in maintaining short-term structure.

Although overall sentiment remains cautious, underlying demand has prevented a sharper breakdown. Buyers appear willing to accumulate near perceived value levels. Sustained support may enable Ethereum to challenge the $2,027 resistance. Clearing $2,108 would confirm a breakout from consolidation.

However, downside risks cannot be ignored. If bearish momentum intensifies, Ethereum could lose $1,928 support. A breakdown may expose $1,820 as the next potential floor. Continued weakness could extend toward $1,750, invalidating the near-term bullish thesis.

Crypto World

BTC quickly gives back gain as Trump tariffs struck down

The U.S. Supreme Court on Friday struck down President Trump’s tariff regime in a 6-3 decision.

“No President has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope,” the court ruling said.

“That lack of historical precedent, coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.”

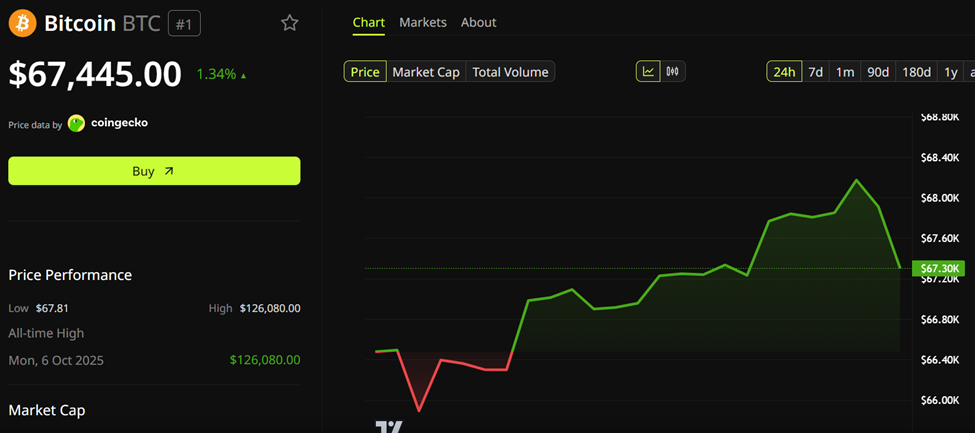

Bitcoin knee-jerked about 2% higher on the news, rising past the $68,000 level. As has been typical in crypto lately, though, the gain was reversed within minutes, returning to just below $67,000 at the current time.

Crypto’s fleeting gains stood in contrast to what’s appearing more sustainable in stocks, with the Nasdaq rising 0.6% to a session high.

Stagflationary data

Earlier Friday, a batch of U.S. economic data showed signs of stagflationary impulses. The U.S. economy grew only a modest 1.4% in the final three months of 2025, the Commerce Department reported. Alongside core personal consumer expenditure prices rose 3% year-over-year, faster than the hoped for 2.9% and up from 2.8% previously.

On a yearly basis, the economy grew 2.2%, which is the slowest growth since Covid year 2020.

“Today’s economic data delivered a messy message of both hotter than expected inflation, and slower than anticipated growth,” Art Hogan, chief market strategist at B. Riley Wealth, said. “The confusing message from today’s data confirms the current Fed bias to take their time with monetary policy.”

Crypto World

XRP Ledger Debuts Controlled Trading for Dubai Property Tokens, Ripple Says

TLDR

- Ripple executive Reece Merrick confirmed the launch of controlled trading for tokenized properties on the XRP Ledger.

- The Dubai Land Department joined the project to support real estate tokenization and on-chain title management.

- Phase two of the project introduced regulated resale of fractional property tokens for broader market access.

- The pilot phase previously tokenized ten properties with a value of over five million dollars.

- About 7.8 million tokens created during the pilot are now eligible for resale under the new framework.

The project advanced further on Friday as new details emerged and expanded its scope and purpose, and the update introduced controlled trading for tokenized properties. The development created a clear path for broader asset access and drew attention to expanding token markets. The disclosure from senior leadership also showed how partners support the ongoing rollout phase.

Phase Two Expands Property Trading on the XRP Ledger

Ripple executive Reece Merrick confirmed the launch of controlled trading for tokenized properties. He shared the update on X and said the system now supports structured resale activity.

He explained that phase two follows a pilot that tested token issuance and supported early property onboarding. He added that trading now operates under a regulated setup.

The pilot introduced 10 properties worth over $5 million and created 7.8 million eligible tokens. The new phase now enables investors to resell those units.

Merrick said the expansion provides a pathway for wider access to tokenized assets. He noted that the market framework supports investor protections.

The update also shows how partners built the trading model for long-term use. It now connects infrastructure with land registry processes.

Dubai Entities Deepen Real Estate Tokenization With Ripple Custody

The Dubai Land Department joined the project to support asset tokenization and registry integration. The agency now links property data with the blockchain system.

The department works with Ctrl Alt to manage a tokenization engine that issues and transfers title deeds on-chain. This setup allows the market to track property changes.

Partners said the system records all transactions using Ripple Custody for secure verification. They also confirmed that asset movements remain visible to regulators.

The controlled market aims to test operational readiness under real trading conditions. It also helps partners evaluate governance tools.

The update reflects how agencies coordinate to align registry processes with blockchain tools. It supports consistent tracking across each property event.

Controlled Market Framework Drives Regulated Activity for Tokenized Assets

Project leaders said the controlled market creates a clear environment for resale activity. They emphasized that all trades follow set rules.

Merrick stated that investors can enter or exit positions under defined oversight. He said this structure keeps transactions orderly.

The partnership with Ctrl Alt improves how title data moves through the chain of records. It links each update to on-chain documentation.

Teams designed the system to support future expansion. They continue monitoring how participants use the trading functions.

The latest update confirms that phase two is now active with regulated resale features. It also shows that about 7.8 million tokens are ready for trading under the new framework.

Crypto World

Inside Trump’s surreal Mar-a-Lago crypto summit

PALM BEACH, Fla. — Attending World Liberty Financial’s forum at Mar-a-Lago felt less like a high-powered summit and more like an intimate gathering — if the guest list included people who control trillions in assets and the future of finance.

Tucked beneath chandeliers and gold-painted trim, the guest list read like a who’s who of the industry’s old guard and rising disruptors. There were no name tags needed. Everyone seemed to know everyone, or at least know someone who did.

Conversations floated from the future of finance to how it might fix what’s been broken in the past — ambitious visions of tokenized assets, regulatory overhauls, and reimagined capital markets. But just as easily, the talk turned to the upcoming FIFA World Cup tournament and press-on nails, courtesy of a few unexpected names who probably had no business being there, and yet somehow made the whole thing feel even more surreal.

The event was not targeted toward an exclusively U.S. audience; attendees hailed from a number of countries. Several attendees flew from Consensus Hong Kong last week directly to Palm Beach to attend the World Liberty Forum. One attendee said they had flown in on Wednesday morning from ETHDenver, and several others said they would be flying to the Colorado conference following the forum.

‘Punitive finance’

In any other context, the event would seem to be a typical crypto conference; speakers from traditional financial backgrounds explaining how they’re using blockchain or why they’re discussing crypto to a dimly lit room.

However, the backdrop loomed: This was a conference put on by World Liberty Financial, the crypto company launched and owned in part by the family of U.S. President Donald Trump, held at his golf club Mar-a-Lago, with several attendees tied to his business interests. Binance founder Changpeng Zhao, in his first U.S. appearance since receiving a pardon from Trump, was spotted at the event. Goldman Sachs’ David Solomon joked on stage that he was there because his client had requested his presence.

Many of the panels themselves were high-level; World Liberty Financial co-founder Alex Witkoff asked U.S. Senator Ashley Moody to walk the audience through her background, or Eric Trump and Donald Trump, Jr. reiterating their past grievances with the banks.

“It was forced and maybe opportunistic but we lived a life that opened our eyes to maybe how corrupt the system was … banks [canceled our accounts] for no reason other than my father was wearing a hat that said ‘Make America Great Again,’” Eric Trump claimed. “We realized how antiquated finance was, how punitive finance was.”

Amid these sessions, some speakers walked through their arguments for the digital assets sector. Franklin Templeton CEO Jenny Johnson laid out the rationale for the U.S. dollar remaining the global reserve currency, saying the European Union was too uncoordinated for the euro to take the dollar’s place and other currencies just didn’t meet the moment.

“About 50% of trade today is done in dollars, another 30% is in the euros, [but] there’s no single European debt market. They can’t even coordinate around the euro … so that’s not going to be the next reserve,” she said.

China’s renminbi and India’s rupee are contenders, but neither is free-floating, and so that makes it unlikely either of those currencies can take on the role, she said.

“As long as people are still looking for their stablecoin to be backed by the most risk-free currency, it’s going to be the dollar,” she said.

Many of the panels nevertheless only had a passing focus on digital assets themselves. The audience reflected this, with crowds mingling outside the actual room to chat during several panels.

It wouldn’t have been a Trump gathering without the biggest real estate moguls in the room — and that’s when tokenization (putting assets on blockchain) became a topic. Hotel billionaire Barry Sternlicht, whose Starwood Capital manages over $125 million in assets under management, said the firm was ready to tokenize real-world assets such as real estate, but continues to be unable to do so given the regularity uncertainty.

Similarly, Kevin O’Leary told listeners that sovereign wealth funds, with whom he speaks regularly, won’t touch crypto because they’re afraid of the regulatory risk that comes with it in the U.S.

Glamour and celebrities

From O’Leary to Goldman Sachs CEO David Solomon to FIFA president Gianni Infantino, if the day’s lineup were ranked by celebrity status, the organizers surely saved the best for last — and probably the least relevant.

Nicki Minaj closed out the event as the final panelist, but the first that caused half the room to take out their phones to snap a picture. Her presence may not make sense in the context of finance or crypto specifically — when moderator Alex Bruesewitz informed her that people gathered to talk about a new innovation in finance, she said she “can like it” — but given her recently developed close relationship with President Donald Trump, it wasn’t entirely surprising to see her support the family’s event.

The World Liberty Forum wasn’t just a conference, it was the kind of room where fortunes are steered, not pitched, and where the side chatter was just as telling as the main agenda.

Crypto World

Supreme Court on Tariffs, Core PCE, and More

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee. Bitcoin’s multi-year lifeline is on the line—not because of anything it did, but because of decisions being made in a courtroom far from Wall Street.

Crypto News of the Day: Supreme Court Ruling on Trump’s Tariffs Poised to Shake Markets and Bitcoin

Bitcoin and risk assets in general face heightened volatility on February 20, 2026, as the U.S. Supreme Court prepares to issue its long-awaited ruling on the legality of President Trump’s 2025 tariffs.

The decision, expected at 10:00 AM ET, could have sweeping implications for trade, government revenue, and global markets.

The case, consolidated as Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., challenges whether Trump had the legal authority to impose broad tariffs under the International Emergency Economic Powers Act (IEEPA) of 1977.

While IEEPA allows the President to address “unusual and extraordinary threats” to national security or the economy, it does not explicitly authorize sweeping trade tariffs.

Lower courts have twice ruled against the administration, setting the stage for the Supreme Court’s opinion.

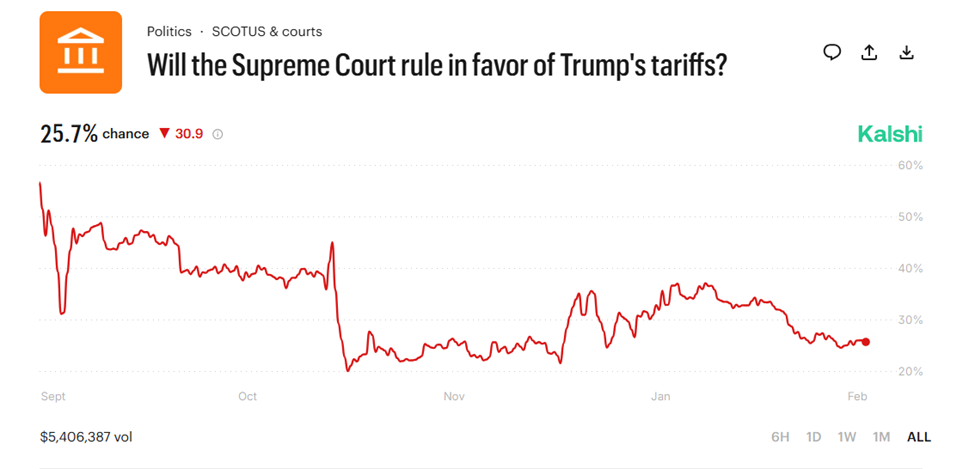

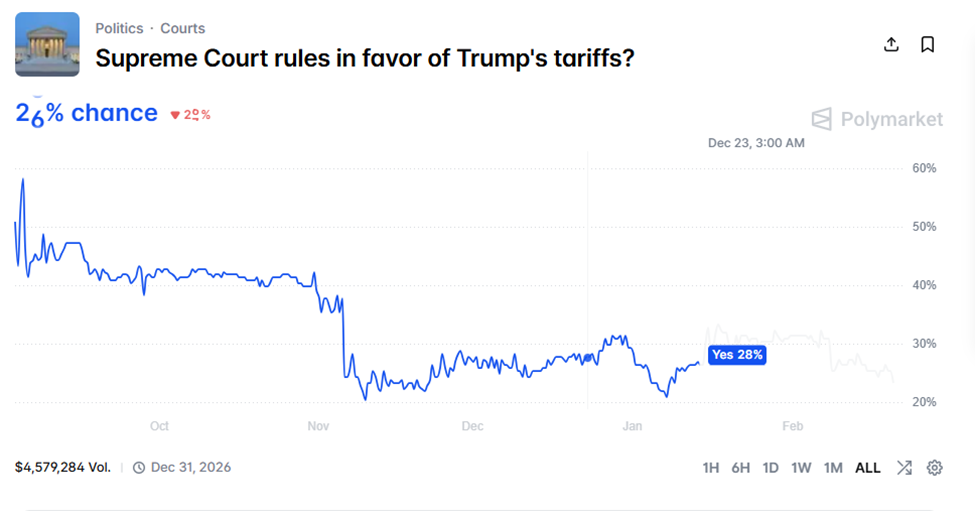

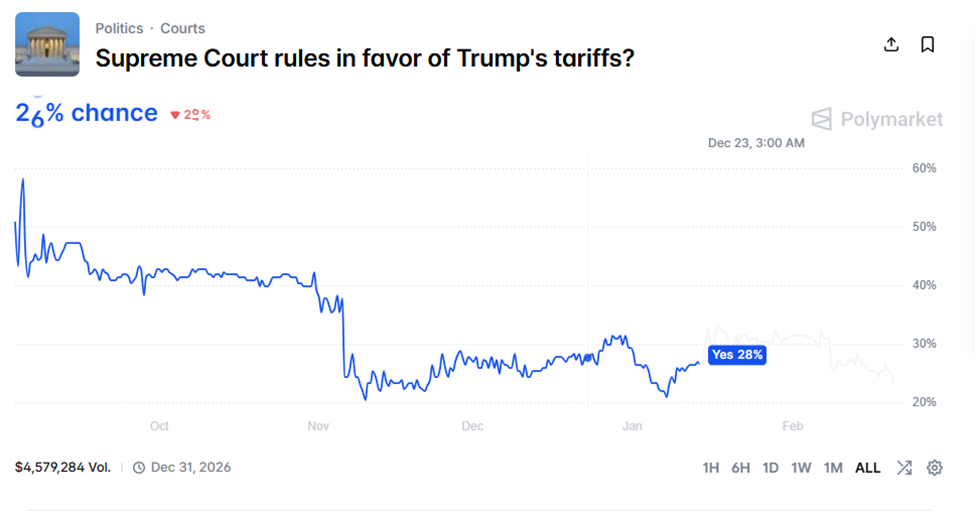

Prediction markets suggest a high likelihood of illegality, with Polymarket pricing roughly a 26% chance that the Supreme Court will uphold the tariffs.

The odds are almost identical on prediction market Kalshi, where bettors wager on a 25.7% chance that the court rules in favor of Trump’s tariffs. Notably, crowd bets on Kalshi are gaining more authority of late.

If upheld, tariffs would remain in place, potentially escalating trade tensions with Canada, the EU, China, and other partners. If struck down, importers could be entitled to refunds of duties collected since early 2025.

The $600 Billion Tariff Claim: Reality vs. Hype

Notably, some media and crypto commentators have cited Trump’s repeated claim that his tariffs generated $600 billion in revenue. However, neutral analyses, including the Penn-Wharton Budget Model, place the actual exposure at $133–$179 billion, a fraction of the widely referenced figure.

Notwithstanding, even at these lower levels, the financial impact could ripple through markets, with traders anticipating “pure chaos” as markets price in:

- Potential refunds

- Emergency replacement tariffs, and

- Retaliatory actions from trade partners.

Crypto, equities, and bond markets are all expected to experience turbulence, with liquidity swings and risk-off sentiment particularly affecting Bitcoin in the short term.

BTC’s market capitalization was $1.35 trillion, with prices trading for $67,445 as of this writing.

A Perfect Storm: Supreme Court Ruling Meets Key Economic Data

The timing of the Supreme Court ruling coincides with other key US economic data releases, including Q4 GDP, the PCE Price Index, and the Manufacturing PMI. These may amplify market volatility.

Meanwhile, the Supreme Court’s decision carries broader implications for executive authority and fiscal policy.

A ruling against Trump could require the Treasury to process hundreds of billions in refunds, widening deficits and potentially prompting emergency legislation or alternative trade measures.

For crypto traders, this translates into a period of elevated uncertainty, in which macro shocks and risk sentiment can drive market swings independent of fundamentals.

Whether Bitcoin holds its multi-year lifeline or succumbs to a volatility surge will depend in large part on the legal and economic fallout of this landmark decision.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 19 | Pre-Market Overview |

| Strategy (MSTR) | $129.45 | $130.53 (+0.83%) |

| Coinbase (COIN) | $165.94 | $167.03 (+0.66%) |

| Galaxy Digital Holdings (GLXY) | $21.63 | $21.54 (-0.42%) |

| MARA Holdings (MARA) | $7.96 | $8.00 (+0.50%) |

| Riot Platforms (RIOT) | $16.22 | $16.20 (-0.12%) |

| Core Scientific (CORZ) | $17.98 | $17.68 (-1.67%) |

Crypto World

Analysts’ Tesla (TSLA) Price Predictions for 2026-2030 and Beyond

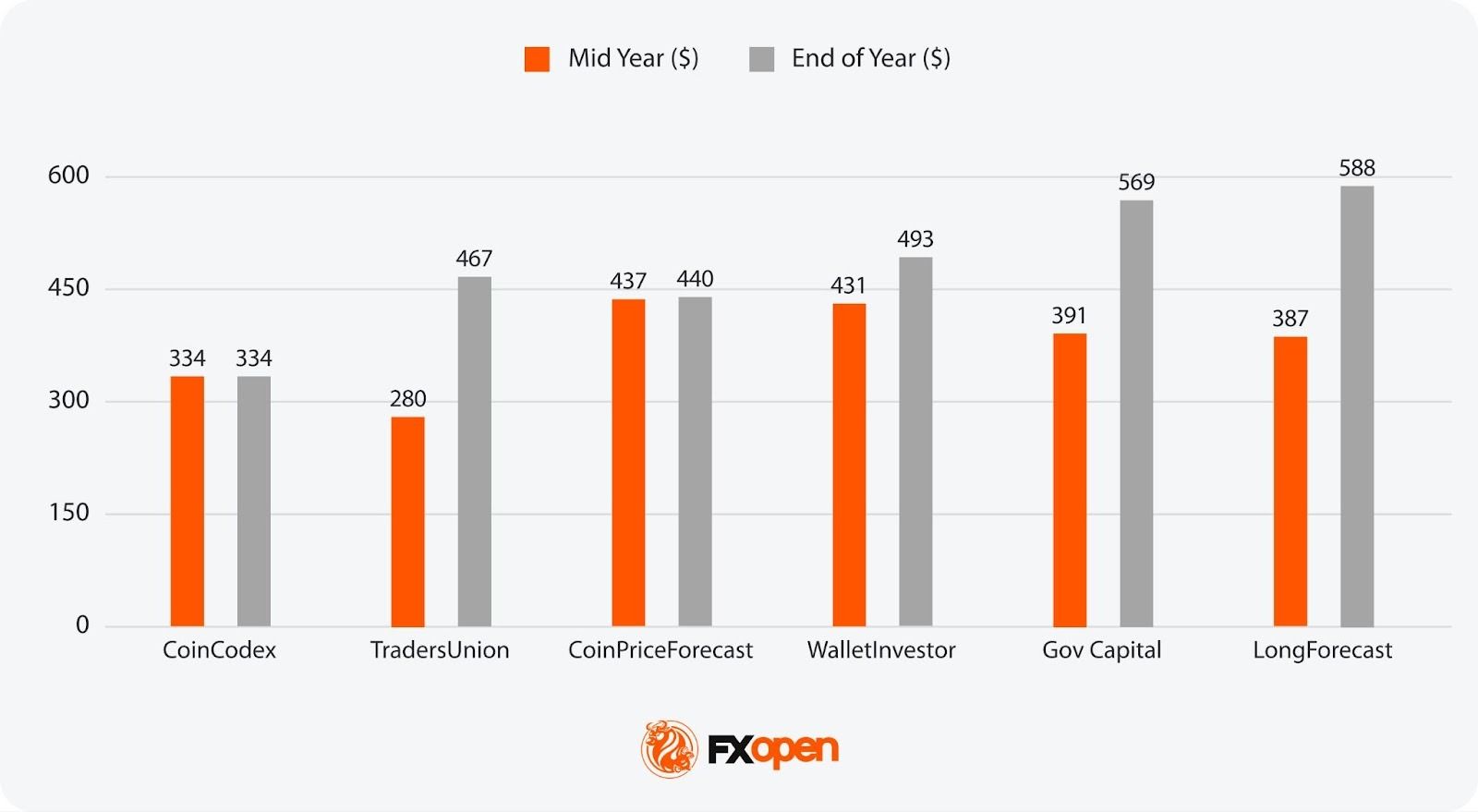

Tesla (TSLA) is one of the most closely watched growth stocks in the market. Analysts predict the stock could trade between $330 and $600 by the end of 2026, driven by its electric vehicle leadership and AI ambitions. Investors looking for a Tesla stock forecast for 2026–2030 are trying to assess whether the company’s AI ambitions and EV leadership can sustain long-term share price growth. While Tesla’s share price has experienced significant volatility, the company’s investments in artificial intelligence, autonomous driving, and energy storage continue to shape its long-term growth narrative.

In this article, we break down analysts’ Tesla price forecasts for 2026 to 2030, discuss key factors that are expected to influence the TSLA stock price direction, and go through the stock price history.

Forecast Summary

2026

Algorithmic forecasting sources project TSLA between $334 and $588 by year-end, a wide range reflecting deep disagreement over Tesla’s near-term trajectory. Wall Street analyst targets cluster between $400 and $600, with the Robotaxi rollout timeline, Cybercab production ramp, and FSD monetisation expected to be the dominant price drivers.

2027

Predictions range from $351 to $1,110. Sources at the bullish end assume Tesla successfully scales autonomous ride-hailing across multiple US cities, while bearish models reflect concerns over EV margin compression and intensifying competition from BYD and other Chinese manufacturers.

2028

Estimates span $347 to $814. The spread reflects uncertainty over whether Robotaxi and Optimus revenue can meaningfully offset a maturing core EV business, and whether Tesla can maintain pricing power as the global EV market becomes increasingly commoditised.

2029

Most projections fall between $494 and $1,200. Sources note that execution on Optimus commercialisation and international Robotaxi expansion could drive significant re-rating, while regulatory setbacks or autonomous safety incidents remain key downside risks.

2030

Long-range forecasts suggest $320 to $1,250, with the spread underscoring how speculative five-year projections for Tesla remain. Outcomes hinge largely on whether autonomy and robotics deliver the transformative revenue streams that currently underpin much of the stock’s premium valuation.

What Factors Could Impact Tesla’s Stock Price in 2026-2030 and Beyond?

Looking ahead to 2026 and beyond, Tesla’s future stock price is expected to be shaped by significant technological advancements, market expansions, and strategic initiatives. Analysts present a diverse range of forecasts, reflecting both optimistic and cautious perspectives on Tesla’s future.

Technological Advancements

Tesla’s ongoing development of Full Self-Driving (FSD) technology is a critical factor in its long-term outlook. By 2026, Tesla aims to fully integrate autonomous driving capabilities, potentially revolutionising the transportation industry. The success of FSD could open new revenue streams through autonomous ride-hailing services, with ARK Invest projecting a substantial market for these services.

Production and Market Expansion

Tesla plans to ramp up production capabilities significantly, aiming to produce millions of vehicles annually by the end of the decade. The company is expected to leverage its Gigafactories in Berlin, Shanghai, and Texas to meet global demand. Expansion into new markets, particularly in Asia and Europe, will be crucial for sustaining growth. Analysts believe Tesla’s ability to efficiently scale production while maintaining quality will be a major determinant of its success.

Energy Solutions

Beyond automotive, Tesla’s energy division, including solar and energy storage products, is poised for substantial growth. The demand for renewable energy solutions is expected to surge, and Tesla’s innovations in battery technology and energy storage systems could capture a significant share of this market.

Financial Performance

Analysts predict a wide range of outcomes for Tesla’s financial performance. Revenue growth is expected to be driven by increased vehicle deliveries, higher adoption of FSD, and expanding energy solutions.

Challenges and Risks

Tesla faces several potential challenges, including increased competition from other electric vehicle manufacturers and traditional automakers entering the EV market. Regulatory changes, supply chain constraints, and economic fluctuations could also impact Tesla’s growth trajectory. Despite these risks, many analysts remain optimistic about Tesla’s ability to navigate these challenges and continue its upward momentum.

Analytical Tesla Stock Price Forecasts for 2026 to 2030 and Beyond

Check the long-term analytical price projections for the TSLA stock price.

Wedbush Securities analyst Dan Ives maintains a Street-high $600 price target with an Outperform rating, projecting Tesla could reach a $2 trillion market cap in 2026 and up to $3 trillion in a bull case. Ives expects an accelerated Robotaxi rollout across more than 30 US cities this year. “We are raising our price target on Tesla to $600, reflecting our view that an accelerated AI autonomous path is now on the horizon in 2026 and investors are underestimating the major transformation underway,” Ives wrote. “We believe this will be the biggest growth chapter in Tesla’s history.”

Morgan Stanley expects Tesla to deploy around 1,000 Robotaxis by end-2026, with a path toward one million by 2035. Analyst Adam Jonas declared in October 2025 that “autonomous cars are solved,” comparing the moment to the invention of the steam engine and noting that Tesla’s camera-only system would “seriously challenge the conventional thinking of many in the robotaxi community.” The firm places Tesla’s broader product suite, including Tesla’s Full Self-Driving (FSD), charging, and licensing, at almost $160 per share. As of the TSLA stock price, Morgan Stanley believes that it may reach $415.

Goldman Sachs analyst Mark Delaney lowered its target to $405 from $420 following Q4 2025 earnings, maintaining a Neutral rating. Delaney flagged Tesla’s plan to increase capital expenditure to over $20 billion in 2026, partly to fund AI training infrastructure, writing: “We now expect negative overall free cash flow this year for Tesla.”

Stifel reiterated its Buy rating on Tesla with a $508 price target following Q4 2025 results, noting that revenue, gross profit, and operating income all exceeded estimations. The firm highlighted Tesla’s progress expanding its Robotaxi service in Austin and the Bay Area and plans to cover seven additional metro areas in H1 2026, alongside ongoing improvements in AI capabilities supporting FSD. Stifel also flagged Tesla’s shift to a monthly FSD subscription model and expects Optimus 3 supply chain development with production beginning by the end of 2026.

TD Cowen lifted their target to $519 from $509 after Q4 2025 results, retaining a Buy rating. The firm pointed to better-than-expected margins and encouraging Robotaxi developments, estimating that Tesla’s Cybercab could achieve operating costs of around $0.30 per mile – low enough to unlock growth in rideshare markets where penetration remains limited. The company flagged several near-term catalysts, including the start of Cybercab production, Robotaxi geographic expansion, continued FSD improvements, and progress on Optimus V3.

Tesla Stock Price Predictions for 2026

Mid-Year 2026:

- Most Bullish Projection: $437 (CoinPriceForecast)

- Most Bearish Projection: $280 (TradersUnion)

End-of-Year 2026:

- Most Bullish Projection: $588 (LongForecast)

- Most Bearish Projection: $334 (CoinCodex)

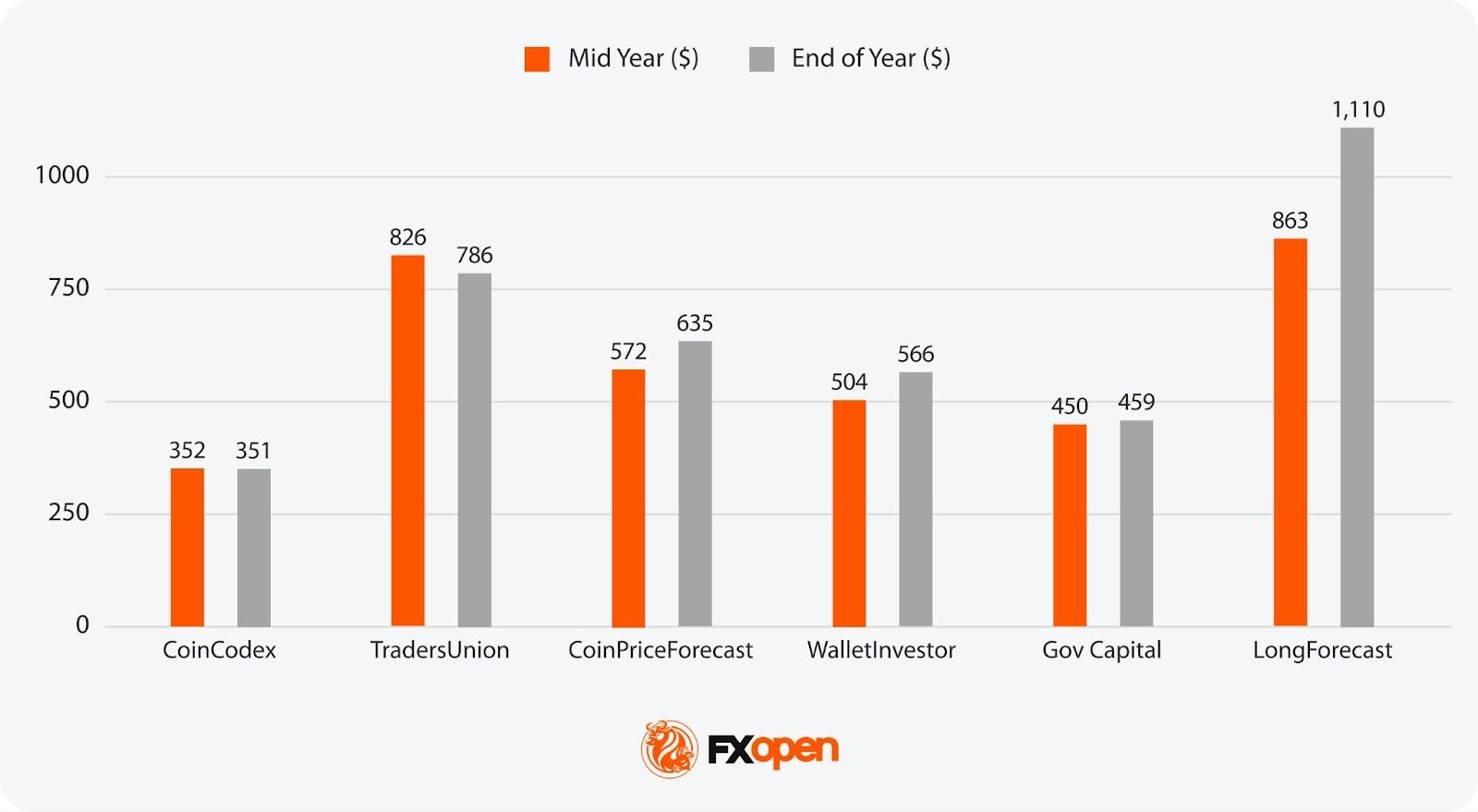

Tesla Stock Price Predictions for 2027

Mid-Year 2027:

- Most Bullish Projection: $863 (LongForecast)

- Most Bearish Projection: $352 (CoinCodex)

End-of-Year 2027:

- Most Bullish Projection: $1,110 (LongForecast)

- Most Bearish Projection: $351 (CoinCodex)

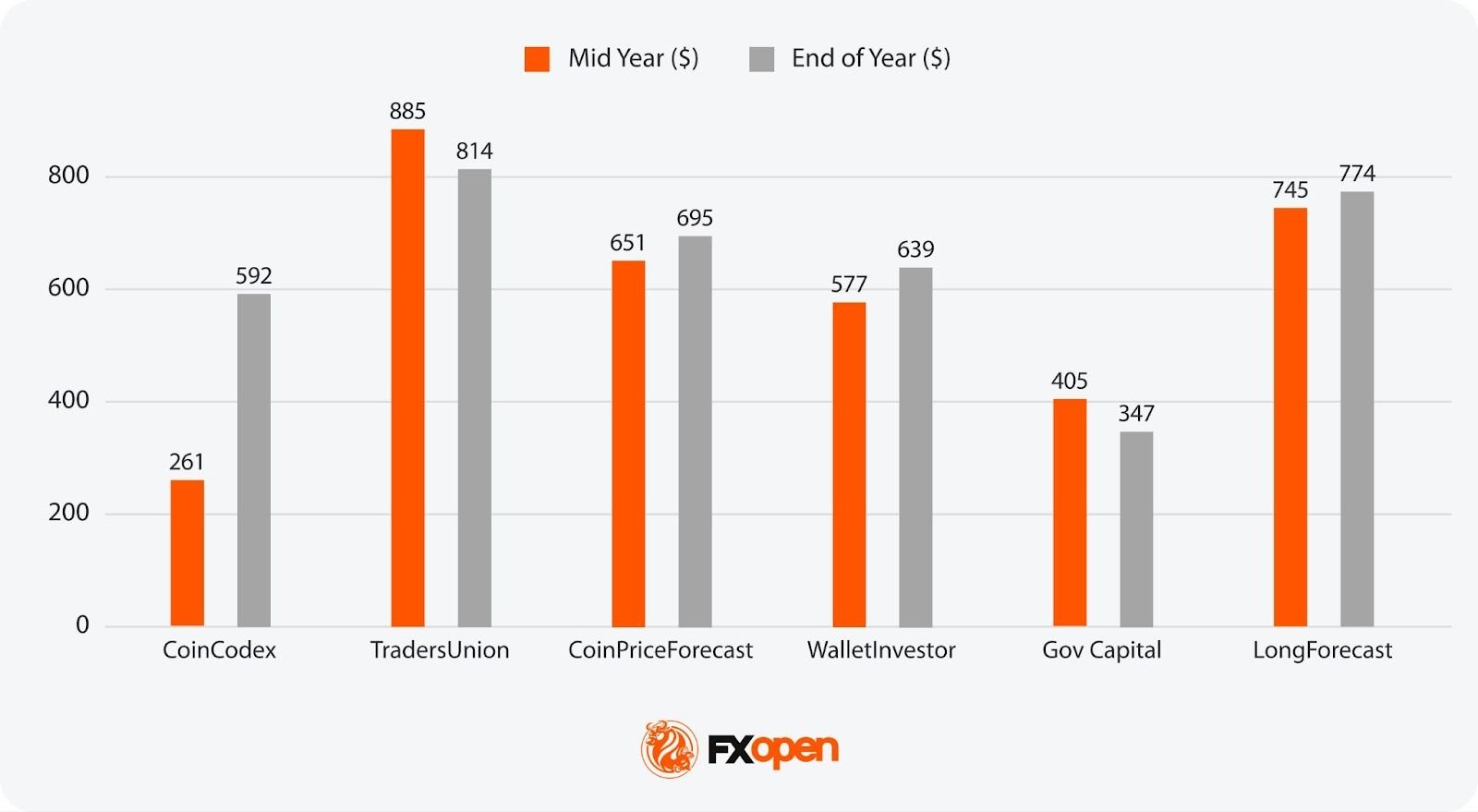

Tesla Stock Price Predictions for 2028

Mid-Year 2028:

- Most Bullish Projection: $885 (TradersUnion)

- Most Bearish Projection: $261 (CoinCodex)

End-of-Year 2028:

- Most Bullish Projection: $814 (TradersUnion)

- Most Bearish Projection: $347 (Gov Capital)

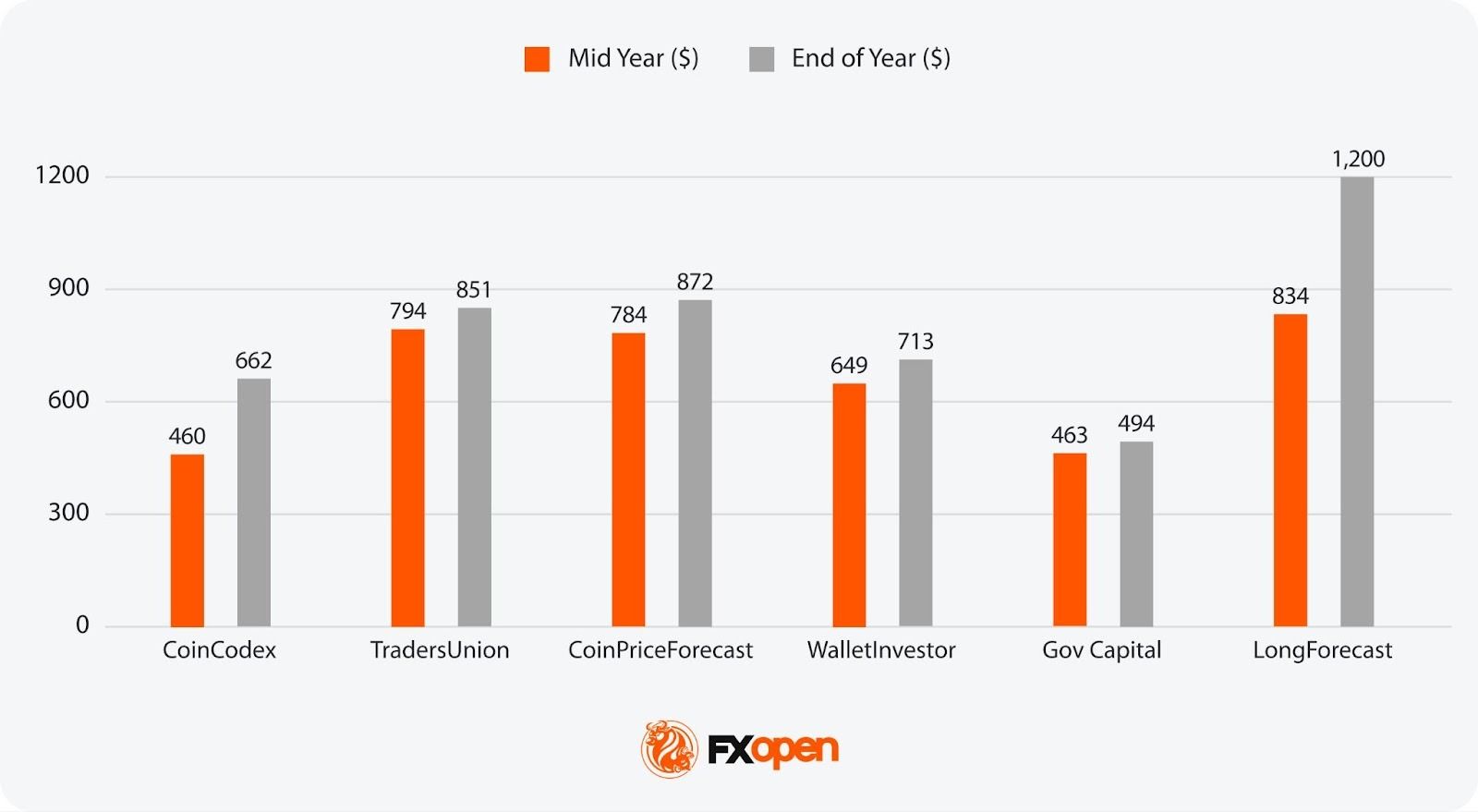

Tesla Stock Price Predictions for 2029

Mid-Year 2029:

- Most Bullish Projection: $834 (LongForecast)

- Most Bearish Projection: $460 (CoinCodex)

End-of-Year 2029:

- Most Bullish Projection: $1,200 (LongForecast)

- Most Bearish Projection: $494 (Gov Capital)

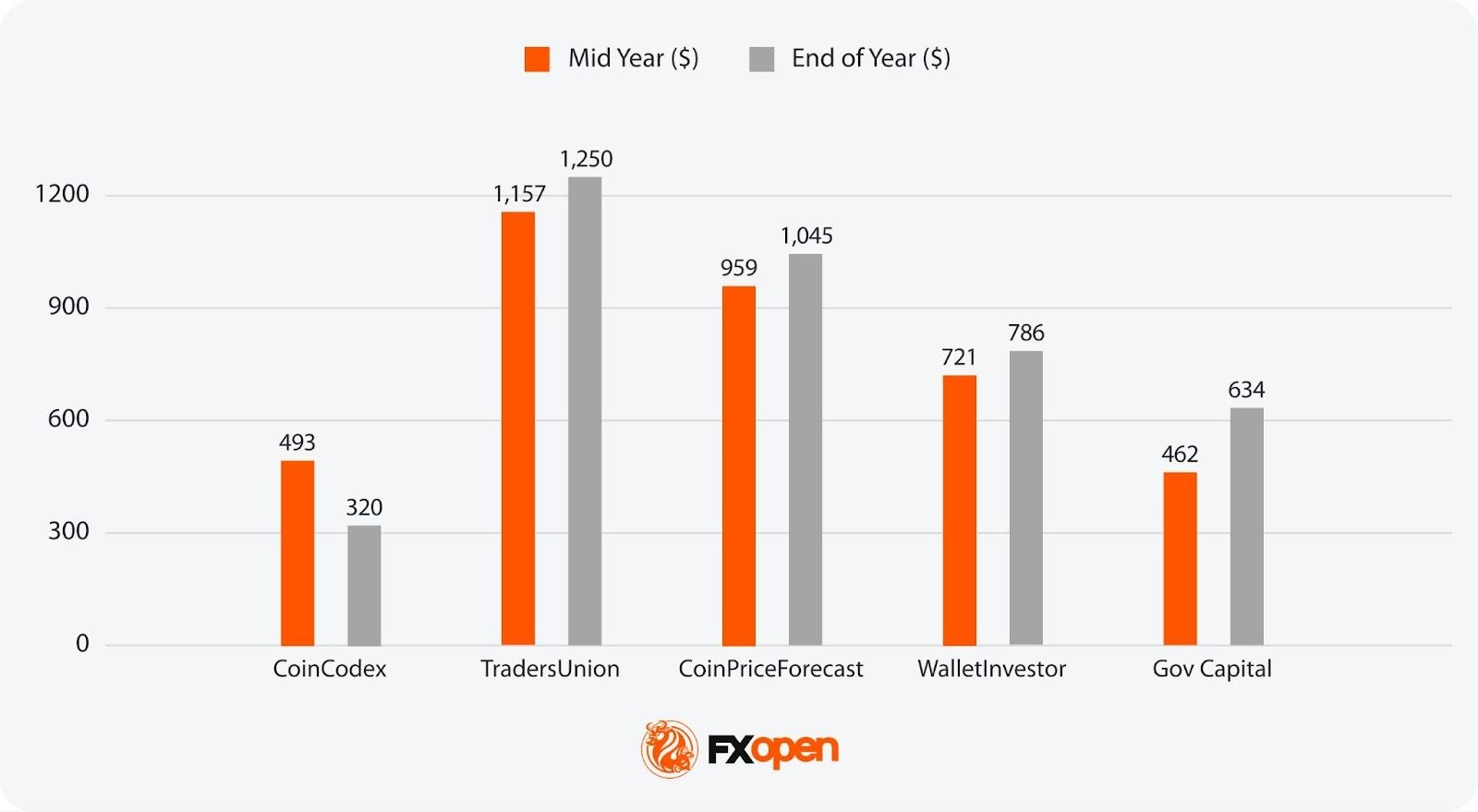

Tesla Stock Price Predictions for 2030

Mid-Year 2030:

- Most Bullish Projection: $1,157 (TradersUnion)

- Most Bearish Projection: $462 (Gov Capital)

End-of-Year 2030:

- Most Bullish Projection: $1,250 (TradersUnion)

- Most Bearish Projection: $320 (CoinCodex)

Tesla Stock Price Prediction Beyond 2030

While long-term forecasts for Tesla’s stock beyond 2030 are uncommon, several sources provide projections. By 2035, CoinPriceForecast estimates Tesla’s share price could reach $1,354, while TradersUnion projects $1,131. Looking further ahead to 2040, TradersUnion projects $3,935.

Tesla: How It Started

Tesla was established in 2003 by engineers Martin Eberhard and Marc Tarpenning, driven by a vision to develop electric vehicles that could compete with conventional internal combustion cars in both performance and design. Shortly thereafter, Elon Musk joined the company, assuming the role of CEO and spearheading critical investment rounds that played a pivotal role in defining Tesla’s long-term strategic direction.

Tesla’s first car, the Roadster, launched in 2008 and set the stage for what the brand would become—an innovator in high-performance electric vehicles. The Roadster could travel over 200 miles on a single charge, shattering public scepticism about EV capabilities and proving that electric cars could be fast, efficient, and practical.

This early success positioned Tesla as a serious player in the automotive industry. As the company continued to innovate, Tesla’s mission evolved: to accelerate the world’s transition to sustainable energy, a goal that would define its trajectory in the years to come.

Tesla’s Recent Price History

Tesla’s journey in the stock market has been marked by significant milestones and periods of volatility. Since its initial public offering (IPO) in June 2010, when it debuted at $17 per share, Tesla has seen dramatic price changes driven by key events and developments.

If you want to follow TSLA CFD price movements, consider heading over to the TickTrader trading platform.

2010-2012

Tesla’s early years as a public company were challenging. After its IPO, the stock price fluctuated but remained relatively low. A pivotal moment came in 2012 with the launch of the Model S, Tesla’s first mass-market electric vehicle (EV), which boosted investor confidence and put TSLA at a high of $2.66 in March 2012.

2013

This year marked a turning point as Tesla reported its first profitable quarter. The stock price soared from $2.33 at the start of 2013 to over $10 by the end of the year, reflecting increased market confidence and investor enthusiasm.

2014-2016

Tesla continued to innovate and expand. The announcement of the Gigafactory in Nevada in February 2014 aimed to scale up battery production, boosting TSLA’s price further. It closed 2014 at $14.83. In 2016, the introduction of the Model 3 and the acquisition of SolarCity were significant milestones. However, the stock faced volatility due to high capital expenditures and production challenges, reaching a low of $9.40 in February 2016 before closing the year at $14.25.

2017-2019

The release of the Model 3 in 2017 was a turning point, making EVs vastly more accessible to the general public. Despite production bottlenecks, the stock price reached new heights, peaking at $25.97 in mid-2017. The unveiling of the Cybertruck in 2019 and the ramp-up of production in the Shanghai Gigafactory kickstarted significant bullish momentum, with TSLA ending 2019 at $27.89.

2020-2024

Tesla’s stock experienced explosive growth in 2020. While the onset of the COVID-19 pandemic prompted a brief downturn, Tesla quickly became one of 2020/2021’s biggest success stories. It closed 2020 and 2021 at $232.22 and $352.26, respectively. This surge was fueled by four consecutive profitable quarters (the middle of 2020), the S&P 500 index inclusion (December 2020), and increasing global demand for EVs.

However, a generally restrictive economic environment led Tesla to experience its most notable slump to date. As US interest rates began to rise in March 2022, sales of EVs began to decline while competition in the market increased—particularly in China, one of its key markets. Elon Musk’s acquisition of Twitter also raised concerns about potential distractions and conflicts of interest. TSLA opened 2022 at $382.58 and closed the year at $123.18.

Stocks began to rebound in 2023, and Tesla was a prime beneficiary. After cutting prices, increasing production, and working to improve profitability, sentiment around TSLA began to rise again, with the stock rising to a high of $299.29 in July 2023.

Since then, TSLA has seen volatility. After beginning 2024 at $250.08 and trending downward for the first half of the year—factors including a slowing adoption rate of EVs, declining Tesla sales, competition from Chinese rivals like BYD, and general economic uncertainty—TSLA has since recovered to break its 2023 high.

Confidence has bounced back, with developments in full self-driving (FSD) capabilities and the unveiling of FSD-enabled Robotaxis in October 2024 helping drive the stock higher. Following the US presidential election, Tesla surged amid speculation that Elon Musk’s strong relationship with Donald Trump could benefit the company. As a result, by the end of the year, on 17th December 2024, Tesla reached its all-time high of $479.86.

2025-2026

After an all-time high the price needed to correct, and despite the S&P 500 index continuing to rise, TSLA moved down. By March 2025, the price had dropped below $250, and it wasn’t just the price correction that sent the stock down. One of the main reasons was weak global sales. Another major factor that initially drove TSLA’s price higher but then had a negative impact on it was concerns about Elon Musk’s close ties to Donald Trump. A leading position in the US Department of Government Efficiency (DOGE) raised doubts about whether this could shift Musk’s focus from Tesla. Another potential reason for TSLA stock depreciation was Musk’s controversial political activities, which could significantly reduce the number of Tesla customers.

Between late April and early September 2025, Tesla’s stock demonstrated notable resilience and volatility. Following a dip in April as global EV sales slowed and Chinese demand softened, TSLA rebounded in May amid optimism over its upcoming robotaxi initiative.

A significant factor driving the turbulence was the public feud between Elon Musk and President Donald Trump. Their conflict ignited following Musk’s criticism of Trump’s “Big Beautiful Bill,” which proposed eliminating EV tax credits, triggering a sharp ~14% one‑day drop in TSLA shares in early June—the stock losing over $150 billion in market capitalisation in mere hours.

In July, market sentiment remained fragile as Musk’s announcement of the “America Party” raised concerns about distraction from Tesla’s core business.

Tesla’s Q2 2025 earnings report on 23 July showed weaker margins and slowing profit growth, leading to another sell-off despite positive news about the first builds of a lower-cost vehicle. In early August, the board’s approval of a $29 billion stock-based compensation package for Musk added volatility, as investors debated dilution risks and governance issues.

Between September and mid-October 2025, Tesla’s stock rose sharply as investor sentiment turned positive. Elon Musk’s $1 billion share purchase in mid-September acted as a strong confidence signal, boosting demand for TSLA. The company also reported better-than-expected Q3 deliveries, though analysts warned that some sales were pulled forward ahead of expiring US tax credits.

Optimism increased further after Tesla gained new approvals to expand autonomous-vehicle testing in Arizona and Nevada, reinforcing its position in the “physical AI” space. But the third-quarter earnings report exposed weaknesses in the company, which, as it evolves into a hybrid automaker and artificial intelligence company, faces the growing pains of trying to juggle both.

TSLA surged to an all-time high of $498.83 on 22 December 2025, fuelled by Robotaxi testing milestones in Austin, including the first rides without a safety driver, and Elon Musk’s $1 billion personal share purchase in September. However, the stock has since pulled back, trading around $417 in mid-February 2026 amid weaker Q4 2025 deliveries (down ~16% year-on-year), escalating US-EU trade tensions, and growing investor scrutiny over whether Tesla’s ambitious AI and autonomy spending can deliver near-term returns.

The Bottom Line

Tesla’s long-term trajectory to 2030 will largely depend on its ability to sustain technological leadership, scale production efficiently, and navigate evolving macroeconomic conditions. While short-term volatility remains inherent in high-growth equities, Tesla’s strategic position in electric vehicles, AI-driven automation, and energy storage provides a solid foundation for continued development. Maintaining an objective outlook and regularly reassessing valuation metrics against operational performance is important in evaluating Tesla’s progress throughout its next growth cycle.

If you are interested in trading Tesla stock and other financial assets via CFDs, you may consider opening an FXOpen account and gain access to tight spreads and low commissions (additional fees may apply).

FAQ

Will Tesla Stock Go Up in 2026?

Analytical Tesla stock forecasts in 2026 are divided. Most Wall Street analysts hold targets above the current price of ~$417, with a consensus around $400–$500. However, declining deliveries, negative free cash flow from heavy AI spending, and rising EV competition mean gains are far from guaranteed.

What Is the 12-Month Forecast for Tesla Stock?

Forecasts for TSLA over the next 12 months range from around $334 to $588. This wide spread reflects deep disagreement over whether Tesla’s Robotaxi and FSD initiatives can offset slowing growth in its core automotive business.

How Much Will Tesla Stock Be in 5 Years?

Analytical Tesla price targets in 5 years range from $320 to $1,250 by 2030. The outcome depends heavily on whether Tesla can commercialise its autonomy and robotics programmes at scale, and maintain market share against intensifying global EV competition.

How Much Will Tesla Stock Be Worth in 10 Years?

CoinPriceForecast projects Tesla could exceed $1,350 by 2035, while TradersUnion predicts around $1,100 over the same period. These long-range outlooks factor in Robotaxi scaling, Optimus production, and energy division growth, though predictions this far out are inherently speculative.

Can Tesla Stock Reach $1,000?

Several algorithmic sources project TSLA crossing $1,000 between 2027 and 2030. However, reaching this level requires successful execution on autonomy, robotics, and sustained investor confidence in Tesla’s premium valuation.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

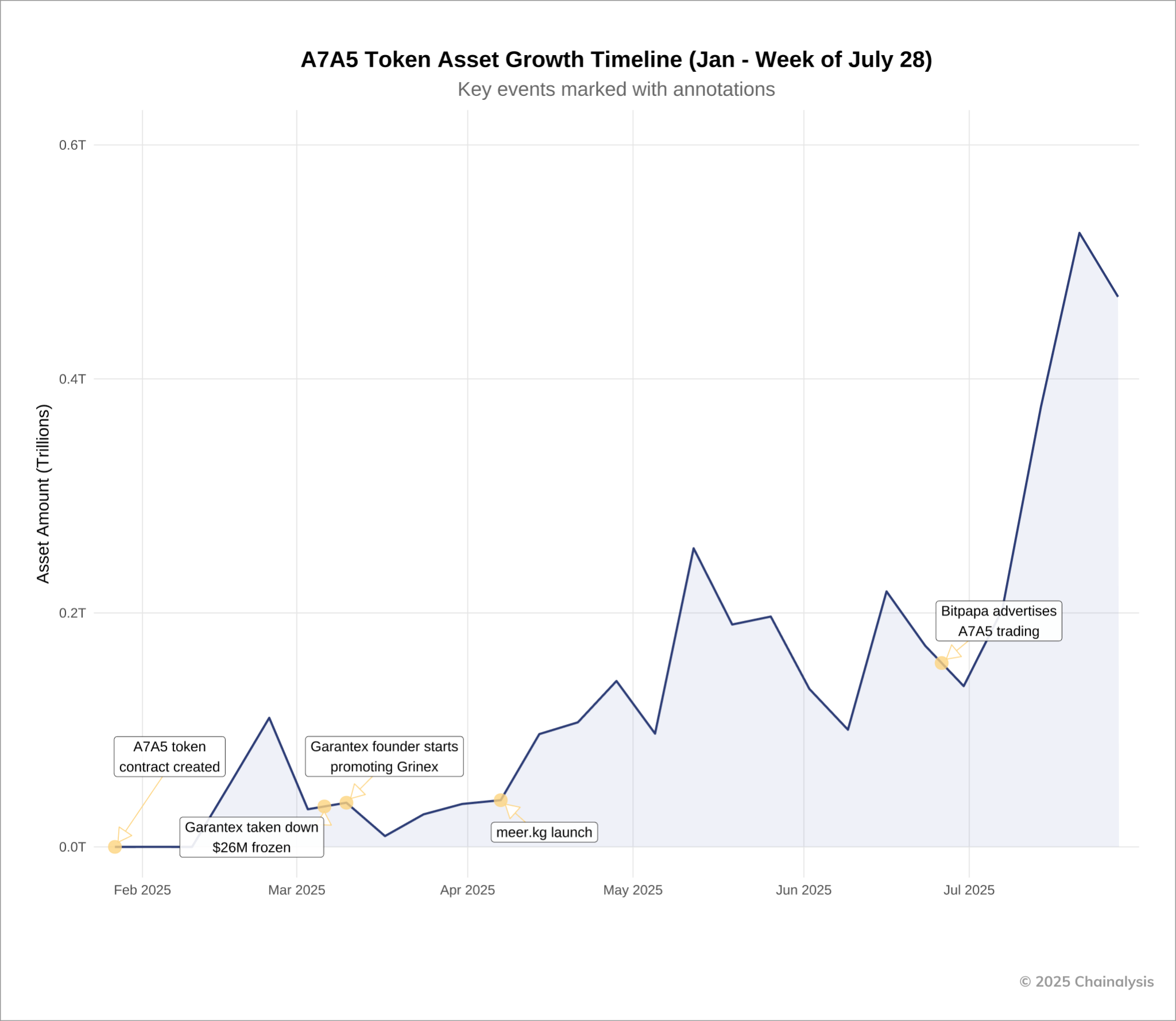

Stablecoin A7A5 Grows Parallel System for Sanctioned Companies

As cryptocurrency is becoming increasingly intertwined with the traditional financial world, it’s also forming the foundation of a parallel, shadow financial system.

A January report from TRM Labs found a surge in illicit or illegal crypto use to an all-time high of $158 billion. This included a massive increase in crypto flows related to sanctions evasion.

This was led primarily by A7A5, a Russian ruble-based stablecoin launched by Russia-based company A7. Some $39 billion in sanctions-related crypto flows were attributed to the A7 wallet cluster.

Far from a small, underground system for illicit activity, A7A5 has facilitated billions of dollars’ worth of commercial activity, creating a “shadow” economy built on crypto.

Sanctions and the rise of A7A5

After Russia invaded Ukraine in February 2022, it faced a raft of sanctions excluding the country and companies based there from participating in the global financial system.

Mastercard and Visa suspended international operations for cards issued in Russia, while cards issued abroad stopped functioning in the country. Russian banks were also closed off from SWIFT, severely limiting the ability of companies based in the country to conduct commerce abroad.

While these major Western payment networks were shut off, alternatives grew. Mir, the Russian payment network founded in 2017, expanded its market share after Visa and Mastercard’s exit.

Russia also turned to crypto for international commerce. In December 2024, Russian Finance Minister Anton Siluanov noted that his government had passed legislation authorizing foreign trade in “digital financial assets” and Bitcoin (BTC) that was mined in Russia. While Siluanov did not recommend crypto as a form of investment, he claimed that it was “the future” in the context of global payments settlement.

Enter A7A5. The coin was first introduced in February 2025 by the eponymous A7 financial platform. According to legal and professional services firm Astraea Group, A7 is co-owned by Moldovan oligarch Ilan Shor, himself sanctioned and residing in Russia, and the state-owned Promsvyazbank (PSB), which has strong ties to Russia’s defense industry.

Shor and PSB developed a group of companies in strategically important sectors like oil, gas, metals, chemicals and defense technologies. These include A7-Agent, A7 Goldinvest and A71.

A7A5’s blockchain contract launched in February 2025 and soon began trading on Moscow-based exchange Garantex, which was subsequently sanctioned and shut down.

Trading has continued on Grinex. According to Chainalysis, this Kyrgyzstan-based exchange is the confirmed successor of its Russian counterpart and was accepting transfers from Garantex immediately after its sanction-induced closure.

The token was also launched on Kyrgyzstan-based platform Meer, as well as Bitpapa. Despite sanctions from the Office of Foreign Assets Control (OFAC) on all these platforms, token asset growth exploded in 2025.

Creating an alternative, sanctions-proof system

Analysts have noted that the illicit crypto economy has evolved beyond the darknet and ransomware but has become a separate, robust financial system for sanctioned actors.

Ari Redbord, global head of policy at TRM Labs, said, “State-aligned actors, professional criminals and sanctions evaders are no longer experimenting with crypto; they’re operating durable financial infrastructure onchain.”

He continued that, in 2025, Russia’s illicit crypto ecosystem “evolved into something far more deliberate … Wallets tied to the A7 network alone accounted for at least $39 billion, reflecting coordinated, state-aligned financial infrastructure built for sanctions evasion, not broad market use.”

State coordination with A7A5 and tie-ins with the broader Russian financial market are further evidenced by daily asset flows, according to Chainalysis. The vast majority of trades occur Monday through Friday, with the largest number of trades at the beginning of the week.

“These trading patterns suggest that A7A5 is primarily being used by businesses operating Monday through Friday, which would align with Russia’s legislative goals of facilitating cross-border transfers for Russian businesses via cryptocurrency,” wrote Chainalysis.

Andrew Firman, head of national security at Chainalysis, told Radio Free Europe in December 2025, “The A7A5 token development seems like Russia’s next logical step in Russia’s efforts to develop alternative payment systems to circumvent sanctions.”

In its report, TRM Labs stated that A7A5 volumes don’t represent sanctions evasion but sanctioned activity “more broadly, including state-aligned economic flows.”

“These dynamics illustrate how Russia-linked actors are increasingly leveraging crypto — particularly stablecoins and higher-risk services — as part of a long-term, nation-state-backed strategy.”

Oleg Ogienko, A7A5’s director for regulatory and overseas affairs, has told crypto news media that his company is not violating the laws of Kyrgyzstan, where doing business with Russian companies is not prohibited. He added that the company conducts Know Your Customer and Anti-Money Laundering procedures, as well as audits, and doesn’t violate Financial Action Task Force principles.

A company spokesperson previously told Cointelegraph that accusations of sanctions evasion “are politicized and lack factual evidence.”

“Companies and individuals globally use the A7A5 ruble stablecoin for export-import contracts, cross-border payments and blockchain projects. Its growth reflects a nondiscriminatory approach to value transfer on the blockchain,” they said.

Ambitions for further growth in the sector are apparent. In July, A7A5 announced that PSB cardholders will be able to purchase tokens with their cards. It plans to extend this service to other banks in the future.

In the space of a year, A7A5 has grown into an effective alternative payment rail for sanctioned parties. Time will tell how much appetite there is to grow this further.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Bear Market Fears Grow as BTC Struggles Below $70K, CLARITY Act Resolution Nears: Weekly Crypto Recap

Some of the most prominent names in the crypto industry believe the bill will be approved soon. Meanwhile, BTC’s price struggles continue.

After several consecutive weeks of intense volatility and new multi-year lows, bitcoin has finally found some support but also significant resistance that continues to suppress its breakout attempts.

Last Friday, the cryptocurrency tested the $65,000 support after it was stopped at $70,000 and $72,000 days earlier. The bulls intervened at this point and didn’t allow another breakdown. Just the opposite; bitcoin started to recover some ground and exceeded $70,000 in a rare weekend rally.

Nevertheless, that was another short-term fakeout as the asset’s attempt failed in its tracks. By Monday, it had already lost that coveted psychological level and began a gradual descent. After a few days of trading sideways between $68,000 and $70,000, it broke down to under $66,000 yesterday amid multiple calls about further declines, and new lows of down to $10,000 in some doomsday scenarios.

It reacted rather well to this drop and jumped to just over $68,000 earlier today. However, another rejection awaited, and BTC now sits below $67,000 once again. This means that its weekly performance is somewhat negative, given the fact that it traded slightly above this level at this time last Friday when we published our previous update.

Even the more volatile altcoin sector has not posted any significant moves in either direction. XRP, BNB, and ADA are slightly in the green, while ETH, LINK, and XLM are with some losses.

More impressive gains come from the likes of WLFI, PEPE, and ZEC, while HYPE has dropped the most from the larger-cap alts.

Market Data

Market Cap: $2.36T | 24H Vol: $95B | BTC Dominance: 56.4%

You may also like:

BTC: $66,750 (-1%) | ETH: $1,930 (-2%) | XRP: $1.38 (+0.3%)

This Week’s Crypto Headlines You Can’t Miss

Ethereum Foundation Flags Post-Quantum Security as Core Priority in 2026 Protocol Roadmap. The Ethereum Foundation published a 2026 roadmap post, saying it would prioritize post-quantum security and further increases to the gas limit. It also wants to restructure its development efforts into three core tracks covering scaling, user experience, and Layer 1 security.

2,486 BTC: Strategy Doubles Down as Portfolio Hits Unrealized Loss. Although its enormous stash continues to be deep in the red (in terms of unrealized losses), Saylor’s Strategy announced another BTC acquisition this week, purchasing 2,486 BTC for just under $170 million. It now holds more than 717,000 BTC.

Ripple CEO Garlinghouse Predicts CLARITY Bill Has 90% Chance of Approval Soon. Although banks, the crypto industry, and lawmakers continue to struggle to find a resolution to the highly anticipated CLARITY Act, Ripple’s CEO Brad Garlinghouse said after the most recent meeting that bipartisan interest in the legislation is high, which is why he expects approval soon.

Ethereum Staking Address Now Holds Over Half ETH Supply For First Time Ever: Santiment. Data from the analytics company indicated that over half of ETH’s supply is now held by Ethereum’s proof-of-stake contract address for the first time in the asset’s eleven-year history.

CryptoQuant Founder Proposes Freezing Old Bitcoin Addresses to Prevent Quantum Attacks. It might be years away from deployment, but quantum computing is a main concern within the cryptocurrency community. CryptoQuant’s CEO proposed that old Bitcoin addresses might need to be frozen to prevent quantum attacks in the future.

Bitcoin Entering Phase 2 Bear Market, Analyst Warns. As mentioned earlier, analysts are rushing to offer their views on the bear market topic, suggesting that the asset might be months away from a more profound recovery. Veteran chartist Willy Woo said BTC has strengthened its bear market trend and has approached the second phase of a multi-stage downturn.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid – click here for the complete price analysis.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Here’s why the Ethereum-based privacy token AZTEC price is rising

- AZTEC has surged nearly 80% after listing on major Korean exchanges.

- AZTEC has gained traction as a privacy-focused Ethereum Layer 2 solution.

- Key levels to watch are the support at $0.0188 and the resistance at $0.0371.

The Ethereum-based privacy token AZTEC has seen a dramatic surge in its price over the last 24 hours.

The current price of AZTEC is around $0.035, representing an impressive increase of nearly 80% in a single day.

Trading volumes have also spiked, reflecting heightened market activity and strong investor interest.

Exchange listings fuel the rally

One of the main drivers behind AZTEC’s surge is its listing on major South Korean exchanges.

Upbit and Bithumb have added AZTEC trading pairs, including KRW-denominated options.

These listings make it easier for South Korean retail traders to access the token directly, without needing USDT or BTC as intermediaries.

The immediate effect has been a sharp increase in buying pressure, pushing the token to new all-time highs.

Such regional exchange activity often creates a premium, as local traders bid aggressively in the initial hours after a listing.

This surge is further supported by the token’s presence on global exchanges like Coinbase, Kraken, Bybit, KuCoin, and MEXC, which listed the token on February 12, immediately after the protocol went live.

What is AZTEC?

AZTEC is not just another altcoin.

It is the native token of Aztec, a privacy-focused Layer 2 protocol built on the Ethereum Network.

The protocol uses zero-knowledge proofs to enable private transactions while maintaining Ethereum’s security standards.

This combination of privacy and scalability makes Aztec particularly appealing to users and developers looking for confidential and efficient transaction solutions.

Recent protocol upgrades and network developments have also helped strengthen confidence in the token.

Investors see both short-term trading opportunities and long-term potential as adoption grows.

The market’s response reflects the perception that privacy solutions on Ethereum are gaining traction in a competitive landscape.

AZTEC price forecast

For traders and investors alike, the coming days will be crucial in determining if AZTEC can sustain its momentum and reach higher price levels.

The immediate support lies near $0.0188, which was the lower bound of the recent 24-hour range.

On the upside, the immediate resistance is at the current all-time high of around $0.0371.

If the token can break above $0.0371, the next area of interest may approach $0.04, a psychological barrier for many traders.

However, given the rapid pace of this rally, some short-term pullbacks are possible.

Volume trends and activity on both Korean and global exchanges will likely influence the next moves.

In the short term, traders should watch for consolidation around the $0.03–$0.035 range, as this may determine whether the rally continues or enters a retracement phase.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video13 hours ago

Video13 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World18 hours ago

Crypto World18 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Crypto World7 days ago

Crypto World7 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery