Crypto World

Solana president Lily Liu’s bold vision for Solana

In a fireside chat at Consensus Hong Kong 2026, Solana Foundation President Lily Liu unpacked her “Internet Capital Markets” vision with moderator Michael Lau, Chairman of Consensus.

Liu asserted that blockchains’ true strength lies in finance and markets, not utopian general-purpose tech. Liu envisioned tokenizing all world assets on-chain, enabling seamless access from everyday payments to high-frequency trading and creating a unified, global marketplace for capital formation.

Liu traced crypto’s capital-raising evolution from early ICOs to rapid modern raises, arguing this extensible primitive should empower non-crypto projects and companies worldwide. Liu stressed democratising talent and capital formation, which is rare in most markets, as crypto’s core societal impact.

Highlighting Asia’s pivotal role, Liu called it crypto’s “core market,” not frontier, given its Bitcoin origins and vast user/talent base. Liu championed revenue-focused metrics over governance tokens, insisting real network and app usage must drive sustainable value accrual to holders for long-term sovereignty and opportunity.

Crypto World

Crypto Super PAC to Pour $5M Into Barry Moore’s Senate Bid: Report

Defend American Jobs, an affiliate of the crypto-focused Fairshake PAC, is planning a $5 million push to back Alabama Senate candidate Barry Moore, according to Bloomberg. The five-week campaign, set to roll out on broadcast television and the Fox News Channel, includes a Trump endorsement as part of its messaging. The reporting cites a Fairshake statement, underscoring how crypto-aligned political committees are leaning into federal races to shape policy considerations around digital assets. The move arrives amid a broader pattern of crypto-adjacent fundraising that has become a defining feature of contemporary U.S. politics, with parties and PACs leveraging media buys to influence voters on regulatory and market issues.

Key takeaways

- Crypto-linked PACs are deploying large ad buys (millions) across major TV outlets to influence voters in Senate races where crypto policy is a live issue.

- Fairshake is backed by notable crypto industry players, signaling the depth of corporate interest behind crypto-friendly political campaigns.

- Barry Moore has a documented history of crypto-friendly positions, including past committee work and public statements endorsing a pro-crypto stance.

- Past fundraising cycles show substantial crypto-related spending, with tens of millions directed toward pro-crypto candidates and policies.

Tickers mentioned: $BTC, $COIN

Sentiment: Neutral

Price impact: Neutral. The article centers on political fundraising rather than immediate market responses.

Trading idea (Not Financial Advice): Hold. Monitor policy developments and campaign activity for potential long-term crypto-market implications.

Market context: The episode illustrates how regulatory debates and macro-fund flows intersect with political campaigns, as crypto-friendly narratives gain traction in a climate of heightened attention to digital assets and related policy clarity.

Why it matters

The funding activity highlights a strategic approach by crypto interests to influence policy at a national level. Fairshake’s $5 million expenditure, backed by high-profile crypto affiliates, shows how political spending can be concentrated around candidates perceived as sympathetic to favorable regulatory treatment. The push also underscores how partisan environments can amplify crypto policy debates, potentially shaping how lawmakers address innovation, market structure, and consumer protections in the years ahead.

Barry Moore’s profile in this narrative is notable. Elected to the U.S. House in 2020, Moore served on the Agriculture Committee and has been associated with discussions around responsible crypto regulation, including the Digital Asset Market Clarity Act. His public statements have aligned with a view of digital assets as integral to the state’s and the nation’s economic future. A December post on X appeared to reflect support for Trump’s crypto position and executive actions, reinforcing the broader pattern of crypto-leaning rhetoric among certain Republican lawmakers.

Observers point to independent assessments that rate Moore as strongly supportive of crypto, based on a track record of statements and policy positions. This kind of labeling—when aggregated by advocacy groups—helps investors and voters gauge which candidates might push for clearer rules, more predictable tax treatment, and policies that foster blockchain innovation. However, the policy landscape remains unsettled, with regulators and lawmakers weighing a range of approaches to digital assets and market infrastructure. The Alabama polling data cited in local coverage suggests a demographic segment receptive to pro-crypto messaging, even as battles over specifics persist.

What to watch next

- Watch the five-week ad schedule for Moore’s campaign, including potential follow-ups on Fox News and other broadcast outlets.

- Monitor any new statements from Fairshake or its affiliates about policy positions, as the fundraising narrative evolves ahead of the primary and general election.

- Track regulatory developments in Washington related to digital assets that could influence campaign messaging and voter concerns.

- Observe polling updates in Alabama and other states where crypto-leaning politicians are contesting elections, as shifts could alter fundraising dynamics.

Sources & verification

- Bloomberg Government reporting on Fairshake’s $5 million Alabama Senate primary ad buy and Trump endorsement.

- The Fairshake statement cited by Bloomberg outlining support for Barry Moore and the five-week media push.

- References to Fairshake’s backing by Coinbase and Ripple Labs and the broader crypto-aligned PAC ecosystem.

- Historical spending by crypto-related PACs, including a figure around $130 million in the 2024 elections.

- Alabama Daily News poll data showing initial voter preferences for Moore and Marshall in a February snapshot.

Crypto influence in Alabama politics and the midterms

Defend American Jobs’ $5 million commitment to back Barry Moore illustrates how crypto-aligned fundraising seeks to shape policy conversations ahead of the midterms. The campaign’s five-week plan, anchored in television and cable advertising, reflects a broader strategy: deploy high-impact media in key markets to foreground a crypto-friendly economic narrative. The Bloomberg report underscores that Fairshake’s approach includes support from a constellation of industry players, and it notes that the PAC’s actions are part of a wider effort to elevate crypto policy in electoral debates. The involvement of a presidential figure in the messaging—Donald Trump—also signals the high-level salience of digital-asset policy among partisans and donors as they map out policy priorities for the coming years.

Beyond the Alabama race, the story speaks to the persistence of crypto-asset policy as a political issue. Fairshake’s public positioning, supported by industry backers, demonstrates how corporate resources are deployed to influence voters’ perceptions of digital assets, market structure, and regulatory clarity. The fact that Fairshake is described as one of the most prominent crypto-related PACs—backed by major players—highlights the scale of financial flows that can accompany policy debates. As crypto advocates argue for clearer rules and more predictable frameworks, lawmakers who express supportive positions could become central figures in shaping the regulatory environment that will govern innovation, exchanges, and the broader ecosystem.

Barry Moore’s record and public statements contribute to a broader pattern in which certain members of Congress articulate a forward-looking view of crypto as economic infrastructure rather than a niche technology. From his early congressional tenure to his more recent statements, Moore has tied his messaging to the idea that crypto is part of Alabama’s—and America’s—future. The X post from December, implying alignment with Trump’s stance on crypto, reinforces this posture in a political climate where party alignment and donor influence can translate into policy signals with real-world implications for the industry’s growth and regulatory trajectory. In parallel, local polling indicates a receptivity to pro-crypto messaging among Republican voters, suggesting that fundraising narratives could gain traction as campaigns scale their outreach ahead of primary and general elections.

What to watch next

- Track the continuation of Moore’s ad campaigns as the five-week window unfolds, including potential interviews and discussions on crypto policy among campaign surrogates.

- Watch for further disclosures from Fairshake and its industry partners regarding policy positions and voting records that align with crypto-friendly approaches.

- Follow regulatory developments at the federal level that could influence campaign messaging, such as discussions around tax treatment, market structure, and consumer protections for digital assets.

https://platform.twitter.com/widgets.js

Crypto World

Franklin Templeton and Binance Launch Tokenized Collateral Program

Eligible clients can now use tokenized money market funds as off-exchange trading collateral.

Asset manager Franklin Templeton, which oversees about $1.6 trillion in assets, and Binance, the world’s largest crypto exchange by daily trading volume, have launched a new program that allows institutions to use tokenized money market funds (MMFs) as collateral when trading on Binance.

Under the collaboration, eligible clients can use tokenized fund shares issued through Franklin Templeton’s Benji Technology Platform as collateral, according to a press release viewed by The Defiant. Benji is Franklin Templeton’s proprietary blockchain-based technology stack.

The release said the assets stay off the exchange in regulated custody, while their value is “mirrored” inside Binance’s trading system. Custody and settlement are handled through Ceffu, Binance’s institutional custody partner.

The setup is meant to reduce risk for institutions while allowing them to keep earning yield on their assets. The move highlights a larger trend of firms offering yield as a way to stay competitive – especially as more financial activity moves on-chain.

“Since partnering in 2025, our work with Binance has focused on making digital finance actually work for institutions,” said Roger Bayston, Head of Digital Assets at Franklin Templeton. “Our off-exchange collateral program is just that: letting clients easily put their assets to work in regulated custody while safely earning yield in new ways. That’s the future Benji was designed for, and working with partners like Binance allows us to deliver it at scale.”

The launch follows Franklin Templeton’s broader push to bring MMFs into blockchain-based finance while remaining fully regulated. Earlier this year, the firm updated two institutional funds to support stablecoin reserves and enable distribution via blockchain systems.

It also builds on the expansion of the Benji platform across public blockchains. In September 2025, Franklin Templeton rolled out Benji on BNB Chain, joining existing deployments on Ethereum, Arbitrum, Solana, and Stellar.

Binance’s native token BNB is down about 2.5% on the day, changing hands at $622, according to CoinGecko.

Crypto World

Binance teams up with Franklin Templeton to use tokenized money market funds as off-exchange collateral

Binance, the world’s largest cryptocurrency exchange, is working with crypto-friendly tradfi firm Franklin Templeton to offer an institutional off-exchange collateral program, making digital markets more secure and capital-efficient.

The new service allows eligible clients to use tokenized money market fund shares issued through Franklin Templeton’s Benji Technology Platform as off-exchange collateral to trade on Binance using Ceffu’s, the exchange’s partner custody layer.

The program alleviates a long-standing pain point for institutional traders by allowing them to use traditional, regulated, yield-bearing money market fund assets in digital markets without having to park them on an exchange, according to a press release.

The value of Benji-issued fund shares is reflected in Binance’s trading environment, while the tokenized assets themselves are securely held off-exchange in regulated custody. This reduces counterparty risk, letting institutional participants earn yield and support their trading activity without hedging on custody, liquidity, or regulatory protections, the firms said.

“Partnering with Franklin Templeton to offer tokenized real-world assets for off-exchange collateral settlement is a natural next step in our mission to bring digital assets and traditional finance closer together,” said Catherine Chen, Head of VIP & Institutional at Binance.

Crypto World

What to Expect From January US Nonfarm Payrolls Data

The United States (US) Bureau of Labor Statistics (BLS) will release the delayed Nonfarm Payrolls (NFP) data for January on Wednesday at 13:30 GMT.

Volatility around the US Dollar (USD) will likely ramp up on the employment report, with investors looking for fresh insights on the US Federal Reserve’s (Fed) path forward on interest rates.

Sponsored

Sponsored

What to Expect From the Next Nonfarm Payrolls Report?

The BLS reported early last week that it had postponed the release of the official employment report, originally scheduled on Friday, due to the partial government shutdown. After the US House passed a package on Tuesday to end the shutdown, the agency announced that it will release the labor market data on Wednesday, February 11.

Investors expect NFP to rise by 70K following the 50K increase recorded in December. In this period, the Unemployment Rate is expected to remain unchanged at 4.4%, while the annual wage inflation, as measured by the change in the Average Hourly Earnings, is projected to soften to 3.6% from 3.8%.

Previewing the employment report, TD Securities analysts note that they expect job gains to have remained subdued in January, increasing by 45K.

“We look for private to add 40K and government to add 5K. We expect private sector strength to be concentrated in healthcare and construction. We look for the Unemployment Rate to show continued signs of stabilization, remaining at 4.4%. The low-fire, low-hire labor market remains. Average Hourly Earnings likely increased 0.3% m/m and 3.7% y/y,” they add.

How Will the US September Nonfarm Payrolls Affect Eur/USD?

The USD started the month on a firm footing as markets reacted to the nomination of Kevin Warsh, who served as a Fed Governor from 2006 to 2011, as the new chair of the Fed. Meanwhile, the USD also benefited from the heightened volatility surrounding precious metals, especially Silver and Gold, and Stock markets.

In turn, the USD Index, which gauges the USD’s valuation against a basket of six major currencies, rose 0.5% in the first week of February. Fed Governor Lisa Cook said earlier in the month that she believes the labor market will continue to be supported by last year’s interest rate cuts.

Sponsored

Sponsored

Cook further noted that the labor market has stabilized and is approximately in balance, adding that policymakers remain highly attentive to the potential for a rapid shift.

Similarly, Governor Philip Jefferson argued that the job market is likely in balance with a low-hire, low-fire environment. The CME Group FedWatch Tool shows that markets are currently pricing in about a 15% probability of a 25 basis-point (bps) rate cut in March.

In case the NFP reading disappoints, with a print below 30K, and the Unemployment Rate rises unexpectedly, the USD could come under pressure with the immediate reaction, opening the door to a leg higher in EUR/USD. On the other hand, an NFP figure at or above the market expectation could reaffirm another policy hold next month.

The market positioning suggests that the USD has some room on the upside in this scenario. Investors will also pay close attention to the wage inflation component of the report.

If Average Hourly Earnings rise less than expected, the USD could find it difficult to gather strength, even if the headline NFP print arrives near the market forecast.

Danske Bank analysts argue that softer wage growth could negatively impact consumer activity and pave the way for a dovish Fed action.

“The Challenger report showed more job cuts than expected in January and the JOLTs Job Openings came in at 6.5m in December (consensus 7.2m). Hence, the US ratio of job openings to unemployed fell to just 0.87 in December. Such cooling is usually a good predictor for weakening wage growth and may be a concern for the private consumption outlook and, all else equal, supports the case for earlier cuts from the Fed,” they explain.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical outlook for EUR/USD:

“The Relative Strength Index (RSI) indicator on the daily chart holds above 50, and EUR/USD fluctuates above the 20-day Simple Moving Average (SMA) after having tested this dynamic support last week, reflecting buyers’ willingness to retain control.” “On the upside, 1.2000 (round level, psychological level) aligns as the next resistance before 1.2080 (January 27 high) and 1.2160 (static level). Looking south, the first key support level could be spotted at 1.1680, where the 100-day SMA is located, before 1.1620-1.1600 (200-day SMA, Fibonacci 23.6% retracement of the January 2025-January 2026 uptrend). A decisive drop below this support region could attract technical sellers and open the door for an extended slide.”

Crypto World

Tokenization Will Revolutionize Financial Markets, Says Paul Atkins

TLDR

- Tokenization can enhance financial market transparency and create more predictable systems, according to Paul Atkins.

- Tokenization represents digital ownership of assets, moving traditional securities onto blockchain for efficient management.

- Real-time on-chain clearance and settlement could eliminate traditional delays, reducing the gap between transactions and settlements.

- The SEC, under Atkins’ leadership, aims to provide clarity and regulatory support for tokenization and blockchain technologies.

- Tokenization could reshape financial services by enabling safer and faster transactions.

In a Fox News interview, Paul Atkins, former SEC commissioner, outlined how tokenization could reshape financial markets. He emphasized that tokenization would improve transparency and create more predictable systems in the financial world. According to Atkins, the SEC is actively working to provide clarity for market participants and embrace technological innovation. Tokenization, he explained, is a promising tool for enhancing efficiency in financial services.

The Potential of Tokenization for Financial Markets

Paul Atkins highlighted that tokenization, at its core, represents a digital version of an underlying asset. “A token is essentially a smart contract, a digital representation of ownership,” he stated during the interview.

In the case of securities, which are already traded electronically, tokenization brings a new way to manage these assets on a blockchain. He pointed out that whether a security is in paper form or stored digitally, tokenization could simplify the entire process by moving it onto the blockchain.

This shift could allow transactions to be cleared and settled on-chain in real time, reducing the traditional delay. Atkins also noted that moving towards a T-zero (immediate) settlement model would de-risk the financial services sector.

“The time between transaction and settlement has already reduced from five days to one, and we aim to bring it down even further,” he explained. This faster and more secure process could have a significant impact on global financial transactions.

The SEC’s Approach to Innovation and Clarity

Under Atkins’ leadership, the SEC has focused on providing a clear regulatory framework for tokenization and blockchain technologies. He stressed that innovation in financial markets must go hand in hand with regulatory clarity.

Atkins also pointed out that market participants would decide the most efficient methods for conducting transactions, such as using stablecoins, tokenized mutual funds, or bank deposits. “We are at the cusp of a transformative change,” he concluded, underlining the importance of embracing new technologies while ensuring transparency and security for investors.

Atkins believes that the growth of tokenization will reshape the financial landscape, allowing for safer, faster transactions across multiple sectors. As the SEC continues to support these technological advancements, the future of financial transactions appears poised for significant changes.

Crypto World

Tether Backs LayerZero Labs as USDt0 Surpasses $70 Billion in Cross-Chain Transfers

TLDR:

- Tether invests in LayerZero Labs to support proven cross-chain interoperability infrastructure

- USDt0 has processed over $70 billion in cross-chain value transfers in less than twelve months

- LayerZero technology enables seamless asset movement across blockchains without fragmentation

- Partnership combines Tether’s WDK with LayerZero infrastructure for agentic finance capabilities

Tether Investments announced a strategic investment in LayerZero Labs on February 10, 2026. The move supports the development of cross-chain interoperability infrastructure.

USDt0, an omnichain fungible token built on LayerZero’s technology, has processed over $70 billion in cross-chain value transfers since its launch.

The investment reflects Tether’s commitment to reducing blockchain fragmentation and improving liquidity efficiency across digital asset markets.

USDt0 Demonstrates Global-Scale Interoperability Performance

LayerZero Labs created one of the most widely adopted bridging frameworks in the digital asset industry. The company’s technology enables secure and efficient asset movement across multiple blockchain networks.

Everdawn Labs leveraged LayerZero’s infrastructure to develop and launch USDt0 and XAUt0 to the market. These implementations proved that stablecoins and tokenized assets can transfer seamlessly without fragmenting liquidity.

USDt0 achieved remarkable transaction volume in less than twelve months of operation. The omnichain fungible token facilitated more than $70 billion in cross-chain value transfers.

This performance validated LayerZero’s technology as critical infrastructure for major digital assets. The platform demonstrated its capability to handle global-scale operations under live market conditions.

The Omnichain Fungible Token standard provides the technical foundation for these cross-chain transfers. Assets move across different blockchain environments without losing their properties or liquidity.

This approach addresses a fundamental challenge in the digital asset ecosystem. Multiple blockchain networks can now operate more cohesively through this interoperability layer.

Tether’s Wallet Development Kit combines with LayerZero’s infrastructure to create advanced foundational rails. The system supports digital asset payments, settlements, and custody for real-world applications.

This combination also enables agentic finance capabilities. AI agents can operate autonomous wallets and transact with stablecoins at scale.

Technology Alignment Supports Future Market Development

Tether’s CEO Paolo Ardoino commented on the investment rationale and the company’s infrastructure focus. “Tether invests in infrastructure that is already delivering real-world utility,” Ardoino stated.

He noted that LayerZero’s technology allows real-time asset transfers across any transport layer. The infrastructure supports the emerging agentic AI economy requiring micro-payment orchestration at unprecedented scale.

LayerZero’s CEO Bryan Pellegrino responded to the investment announcement with recognition of Tether’s market position. “Tether is a company the world envies,” Pellegrino said.

He described USDt0’s success as an important stepping stone for the partnership. The investment represents validation of LayerZero’s engineering approach and execution capabilities according to Pellegrino.

The investment aligns with Tether’s broader infrastructure strategy. The company supports systems that reduce fragmentation across blockchain networks.

Enhanced liquidity efficiency enables stablecoins to function as global settlement instruments. This approach addresses practical challenges in cross-chain asset movement.

LayerZero’s proven track record influenced Tether’s investment decision. The technology has demonstrated its ability to support major assets under production conditions.

Both companies aim to build infrastructure for global permissionless markets. The partnership strengthens the foundation for future cross-chain financial applications.

Crypto World

Robinhood Chain Testnet Launches on Arbitrum for Tokenized Real-World Assets

TLDR:

- Robinhood Chain testnet enables developers to build financial-grade apps on Arbitrum technology

- Infrastructure partners Alchemy, Chainlink, LayerZero, and TRM already integrating with platform

- Testnet will feature Stock Tokens for integration testing ahead of mainnet launch later in 2025

- Platform supports tokenized assets, lending protocols, and perpetual futures exchanges on Layer 2

Robinhood Chain has officially launched its public testnet, marking a major step in the company’s blockchain ambitions.

The Layer 2 network, built on Arbitrum technology, targets financial services and tokenized real-world assets. Developers can now access the testnet to build and validate applications on the Ethereum-compatible platform.

Infrastructure partners including Alchemy, Allium, Chainlink, LayerZero, and TRM have already begun integration work.

Infrastructure and Technical Foundation

Robinhood announced the testnet launch through its official social media channels, inviting developers to explore the platform’s capabilities.

The company tweeted that developers can now build on a financial-grade Ethereum Layer 2 designed to support tokenized assets.

The network provides compatibility with standard Ethereum development tools while leveraging Arbitrum’s proven Layer 2 technology.

This approach enables developers to work within a familiar environment while accessing enhanced scalability features.

The company has published comprehensive developer documentation at https://docs.robinhood.com/chain to support early builders.

Network entry points are now accessible, allowing participants to connect and begin testing their applications. The testnet phase serves multiple purposes, from identifying technical issues to establishing network stability before mainnet deployment.

Johann Kerbrat, SVP and GM of Crypto and International at Robinhood, outlined the platform’s vision in a statement. “The testnet for Robinhood Chain lays the groundwork for an ecosystem that will define the future of tokenized real-world assets,” he said.

The executive added that the platform will “enable builders to tap into DeFi liquidity within the Ethereum ecosystem.” Kerbrat expressed enthusiasm about collaborating with infrastructure partners to bring financial services onchain.

Early infrastructure partners play a crucial role in the testnet phase. Their involvement ensures that essential services and tools are available from the start.

This collaborative approach aims to create a robust foundation for future applications and services on the network.

Developer Features and Future Roadmap

The testnet environment supports seamless bridging and self-custody functionality for digital assets. Developers can build financial-grade decentralized products, including tokenized asset platforms and lending protocols.

The architecture also accommodates perpetual futures exchanges and similar complex financial applications.

Robinhood plans to introduce testnet-only assets in coming months to facilitate integration testing. Stock Tokens will be available exclusively for development purposes, allowing builders to test trading mechanisms and settlement processes. Direct testing with Robinhood Wallet will provide additional integration opportunities for developers.

The platform emphasizes reliability, security, and compliance as core design principles. These priorities reflect Robinhood’s experience in regulated financial services and its infrastructure capabilities. The mainnet launch is scheduled for later this year, though specific timing remains to be announced.

Steven Goldfeder, Co-Founder and CEO of Offchain Labs, emphasized the partnership’s potential in his remarks. “With Arbitrum’s developer-friendly technology, Robinhood Chain is well-positioned to help the industry deliver the next chapter of tokenization,” he stated.

Goldfeder noted the collaboration aims to advance permissionless financial services across the ecosystem. “Working alongside the Robinhood team, we are excited to help build the next stage of finance,” he added.

Crypto World

Ethereum price prediction as 220K ETH leaves exchanges

Ethereum price is testing a key demand zone as more than 220,000 ETH leaves exchanges, tightening liquid supply during a sharp market pullback.

Summary

- Ethereum price prediction hinges heavily on ETH holding the $1,850 demand zone.

- Exchange reserves have dropped by 220,000 ETH, while accumulating addresses now hold 27 million ETH, about 23% of supply.

- Holding $1,850 could open a rebound toward $2,000–$2,100, while a breakdown risks a move toward $1,750.

Ethereum was trading at $1,975 at press time, down 4% in the past 24 hours. The broader trend remains under pressure. ETH has fallen 12% over the last seven days, 37% in the past month, and is now down 61% from its August 2025 high of $4,946.

Spot trading volume came in at $22 billion, down 11.30% over the past day. On the derivatives side, Coinglass data shows futures volume declining 14% to $47 billion, while open interest dropped 5% to $23 billion.

That combination suggests traders are closing positions rather than aggressively adding new leverage.

220K ETH leaves exchanges as long-term wallets grow

While price has struggled, on-chain behavior tells a different story.

According to a Feb. 10 analysis by CryptoQuant contributor Arab Chain, more than 220,000 Ethereum (ETH) has been withdrawn from exchanges in recent days, the largest net outflow since October. On Feb. 5, Binance alone recorded approximately 158,000 ETH in daily net outflows, the highest since last August.

Large exchange withdrawals typically reduce immediate sell-side pressure. When ETH moves into private wallets or long-term storage, it becomes less accessible for quick liquidation.

This doesn’t guarantee upside, but it changes the supply dynamic. If demand stabilizes, a tighter float can amplify price reactions.

Additional data from analyst _OnChain shows that “accumulating addresses” — defined as wallets that have never recorded an outflow, hold at least 100 ETH, and are not linked to exchanges or miners — now control 27 million ETH, or roughly 23% of the circulating supply.

Historically, Ethereum has traded below the realized price of these accumulating addresses only twice in nine years: during the 2025 all-time low and again since January 2026. That context suggests long-term holders are less likely to sell near current levels.

Ethereum price prediction: Can $1,850 hold?

With lower highs and lower lows, Ethereum is still clearly in a downward trend. Selling pressure increased after the recent drop below the $3,200–$3,300 range, and the price moved closer to the $1,850 support zone.

During the sell-off, the 20-period Bollinger Bands widened considerably, suggesting increased volatility.

The price briefly touched the lower band around $1,690, as is often the case with large declines. The middle band, which is now at $2,490, is acting as resistance, while the upper band is situated near $3,290.

The relative strength index fell below 30, entering oversold territory, and currently hovers around 30–32. Momentum is weak, though the pace of the decline has slowed, and there’s no clear bullish divergence yet.

If the $1,850 support holds, Ethereum could stabilize and attempt a rebound toward $2,000–$2,100. A more sustained recovery would require a move above $2,490 to reclaim the middle band and signal a potential trend shift. For that to happen, RSI would need to climb above 40–45, and volume would need to expand on green candles.

If $1,850 fails, downside risk increases quickly. A break below that level could expose $1,750, followed by the lower Bollinger Band around $1,690. Continued declines in open interest and weak spot volume would reinforce a bearish continuation scenario.

Crypto World

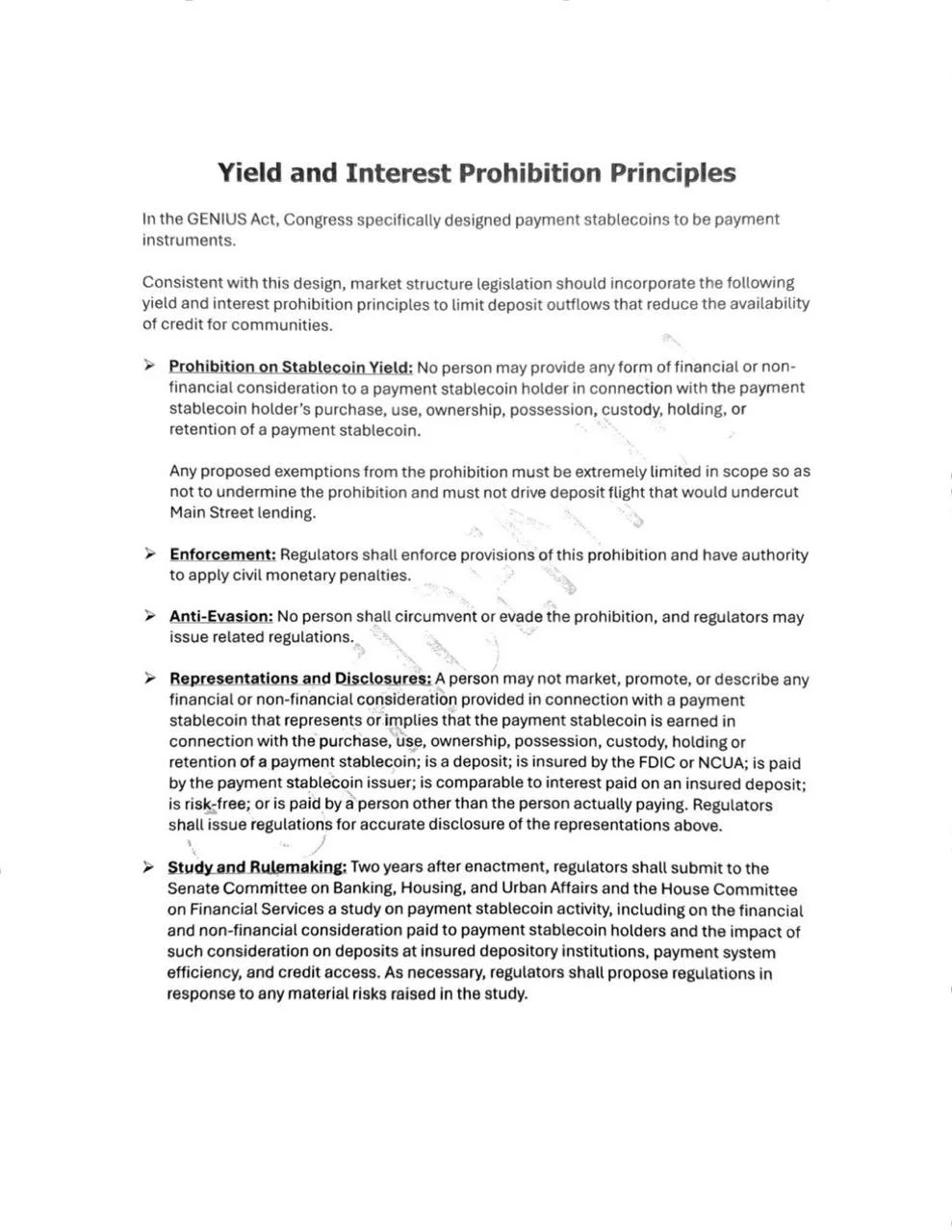

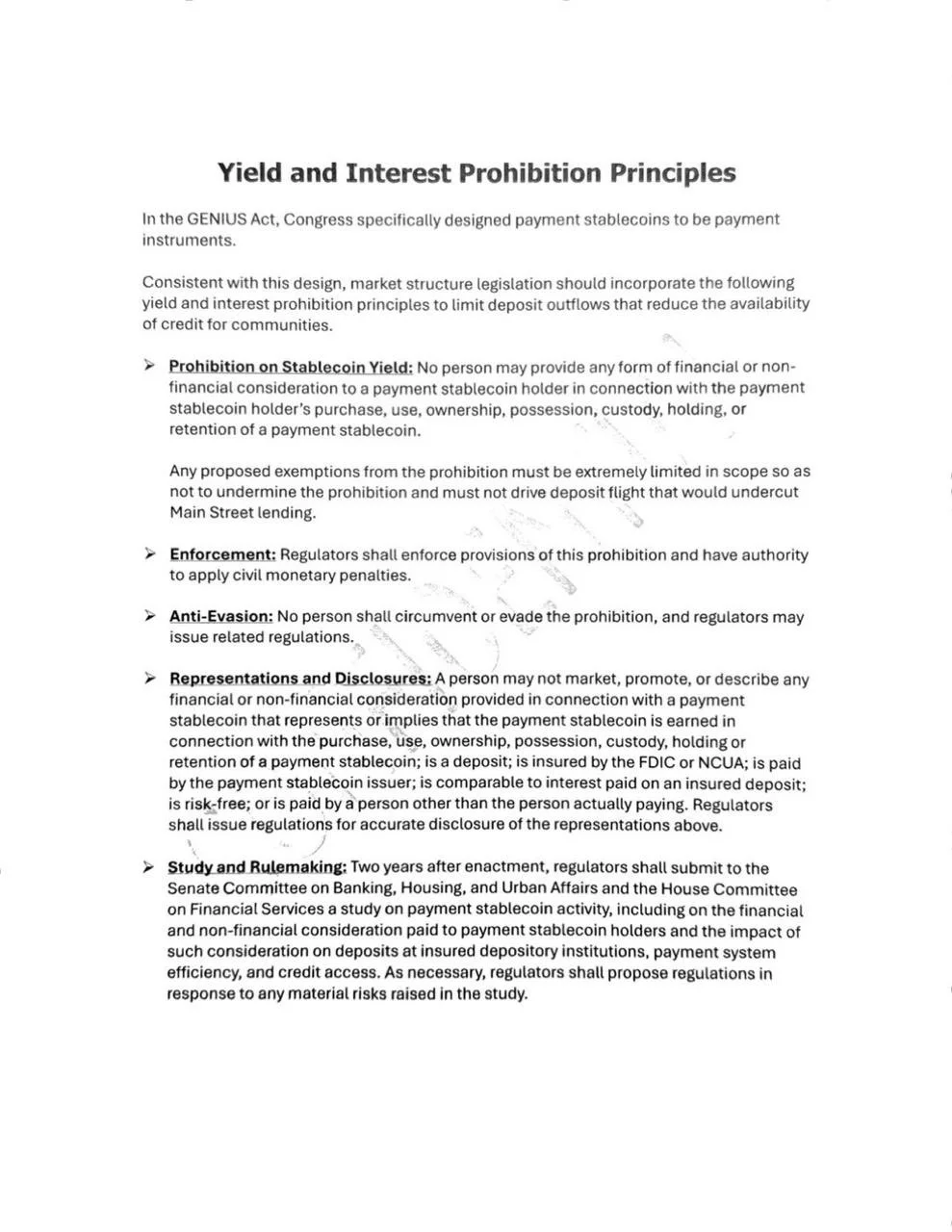

Banks, Crypto fail to reach agreement in White House stablecoin meeting

A White House meeting on stablecoin yield and rewards ended without a deal, but participants described the discussions as more productive than previous talks, according to details shared by journalist Eleanor Terrett.

Summary

- White House stablecoin yield talks ended without a deal, but both banks and crypto firms described the meeting as more productive than earlier discussions.

- Banks introduced written “prohibition principles” and signaled limited flexibility by acknowledging potential exemptions for transaction-based stablecoin rewards.

- The White House urged both sides to reach an agreement on stablecoin rewards regulation by March 1, with further talks expected soon.

The gathering brought together senior banking executives, crypto industry leaders, and policy staff to debate whether and how stablecoin issuers should be allowed to offer yield or rewards.

While no compromise was reached, negotiations moved into more detailed territory.

White House stablecoin talks show progress but no final deal

Banking representatives arrived with a written set of “prohibition principles” outlining firm red lines around stablecoin rewards. These principles detailed what banks are willing to accept and where they refuse to budge.

One notable shift emerged. Banks included language allowing for “any proposed exemption” related to transaction-based rewards.

Sources described this as a meaningful concession, as banks had previously declined to discuss exemptions altogether.

Much of the debate centered on “permissible activities.” This refers to what types of account behavior would allow crypto firms to offer rewards. Crypto companies pushed for broad definitions. Banks argued for narrower limits to reduce risk and regulatory exposure.

Ripple’s Chief Legal Officer Stuart Alderoty said that “compromise is in the air,” signaling cautious optimism despite unresolved issues.

March 1 deadline looms as talks continue

The meeting was smaller than the first White House session on stablecoins. It was led by Patrick Witt, Executive Director of the President’s Crypto Council. Staff from the Senate Banking Committee were also present.

Crypto attendees included representatives from Coinbase, a16z, Ripple, Paxos, and the Blockchain Association. Major banks in attendance included Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC, and U.S. Bank, alongside leading banking trade groups.

The White House has urged both sides to reach an agreement by March 1. Further discussions are expected in the coming days. However, it remains unclear whether another full-scale meeting will be held before the deadline.

Crypto World

xMoney Expands Domino’s Partnership to Greece, Powering Faster Checkout Experiences

[PRESS RELEASE – Vaduz, Liechtenstein, February 9th, 2026]

xMoney ($XMN) is expanding its partnership with Domino’s, bringing its payment infrastructure to Domino’s Greece following a successful rollout in Cyprus.

The collaboration focuses on acquiring services, enabling Domino’s Greece to accept card payments and digital wallets, including Apple Pay and Google Pay, across both web and mobile ordering platforms.

At the core of the integration is xMoney’s embeddable checkout solution, designed to deliver a seamless payment experience without redirection. Customers complete their orders faster, while all sensitive payment data is securely handled by xMoney’s compliant infrastructure.

The expansion was announced in person at a community event hosted at SuiHub Athens – a community space established to support builders and Sui ecosystem partners – bringing together the xMoney and Sui teams, Domino’s representatives, and building on xMoney’s previously announced work with Sui to expand real-world payment access across Europe.

“Domino’s operates in a high-volume, real-time environment where speed and reliability are critical,” said Manos Tsouloufris, CTO of Daufood. “xMoney’s checkout solution supports multiple payment methods in a single, seamless flow, helping us serve customers faster at scale.”

While the current implementation focuses on fiat payments, the two teams are also exploring future possibilities around digital asset payments, where network speed, user experience, and confirmation times make sense for real-world commerce.

The launch in Greece represents the next step in a broader European expansion, reinforcing xMoney’s role as a trusted payments partner for brands that operate at scale and its presence within the Sui ecosystem reflects a growing focus on practical, consumer-facing payment experiences built for everyday use.

“When people order food, they don’t think about payments, and that’s exactly the point,” said Gregorious Siourounis, Co-Founder and CEO of xMoney. “Our role is to make checkout fast, reliable, and invisible, so brands like Domino’s can focus on their customers. Bringing this experience to Greece is a natural next step.”

As xMoney expands across markets and merchant use cases, XMN supports the broader ecosystem by aligning long-term participation and infrastructure growth across the network. Designed to sit alongside xMoney’s licensed payment rails, XMN helps structure how value, incentives, and future on-chain capabilities evolve, without impacting the simplicity of everyday checkout experiences.

Faster checkout. Less friction.

Payments that deliver.

About Domino’s

Founded in 1960, Domino’s Pizza is the largest pizza company in the world, with a significant business in both delivery and carryout pizza. It operates a network of company-owned and independent franchise stores in the United States and more than 90 international markets.

About xMoney

xMoney is revolutionizing the payments landscape with strategic European licenses, delivering a seamless, secure, and forward-thinking ecosystem powered by innovative product design, cutting-edge technology, and unwavering compliance. XMN, xMoney’s newly launched token, is natively integrated into the licensed and regulated payment infrastructure – empowering merchants and consumers with lightning-fast, trustworthy transactions underpinned by full regulatory transparency. Now trading on Kraken, KuCoin, MEXC, Bitvavo, Bluefin and other exchanges, XMN is primed for broader adoption with a robust pipeline of integrations ahead.

Contact details:

Website: www.xmoney.com

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech4 hours ago

Tech4 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World16 hours ago

Crypto World16 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?