Crypto World

Solana price risks a drop below $80 as bearish engulfing candles indicate weakness

Solana’s price is showing renewed downside risk after bearish engulfing candles rejected key resistance, with weakening market structure increasing the likelihood of testing sub-$80 support levels.

Summary

- Bearish engulfing candles confirm rejection at the key $90 resistance

- Loss of the point of control signals weakness, favoring further downside

- $78–$80 support is the critical zone, with Fibonacci and liquidity confluence

Solana (SOL) price action has shifted back into a vulnerable technical position after a failed attempt to reclaim higher resistance. What initially looked like a potential stabilization has now turned into renewed weakness, as sellers regain control after a rejection at a key resistance zone. The broader structure remains corrective, and recent candlestick behavior suggests that downside continuation is becoming increasingly likely.

As price trades back below important value levels, attention is now turning to high-timeframe support zones that could come into play in the near term. Whether these levels hold or fail will determine if Solana can stage a meaningful bounce or if the correction deepens further.

Solana price key technical points

- Bearish engulfing candles rejected $90 resistance, reinforcing seller control

- Loss of the point of control signals weakness, favoring rotation lower

- $78–$80 support zone aligns with Fibonacci confluence, acting as a key downside target

Solana recently attempted to push above the $90 resistance level, but the move failed to gain traction. Price quickly closed back below resistance, forming bearish engulfing candles that invalidated the breakout attempt. These engulfing structures are significant because they often reflect aggressive selling pressure entering the market when buyers lose control.

The rejection from resistance is further reinforced by Solana’s inability to hold above the point of control (POC). Multiple counter-trend closes below this level indicate that the market has shifted away from balance and back into bearish momentum. When price loses the POC after a failed breakout, it often signals the start of a deeper corrective rotation.

Loss of value opens path toward $78 support

With price now trading below the point of control, the next logical downside magnet is the value area low. This level defines the lower boundary of fair value within the current range and frequently acts as a target during corrective phases.

Below the value area low sits high-timeframe support around $78, which also marks the lower edge of the broader trading structure. A move into this region would place Solana below the $80 psychological level, increasing volatility as traders reassess risk.

From a technical perspective, the $78 area carries additional significance due to its alignment with the 0.618 Fibonacci retracement. Fibonacci confluence often attracts price during corrective moves, particularly when paired with visible resting liquidity.

Liquidity sweep or deeper breakdown?

The swing low near $78 indicates an area with likely resting liquidity. Markets often dip into such zones to trigger stop-loss orders before deciding on the next directional move. If Solana quickly trades into this region and then reclaims it with strong buying interest, the move could resemble a liquidity sweep, setting the stage for a reactive bounce.

However, timing and structure will be critical. A slow grind lower, or prolonged acceptance below $78, would weaken the bounce thesis and suggest that a deeper corrective phase is unfolding. In that scenario, the market would be signaling that buyers are not yet ready to defend key support.

Broader market structure remains corrective

From a market structure standpoint, Solana has not yet invalidated its bearish bias. Lower highs remain intact, and recent attempts to reclaim resistance have failed. Without a decisive reclaim of value and strong bullish volume, rallies should continue to be treated as corrective rather than trend-changing.

The presence of bearish engulfing candles at resistance adds further weight to this view, as such patterns often precede continuation lower rather than immediate reversal.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Solana is likely to continue rotating lower in the short term. As long as the price remains below the resistance and the point of control, the probability favors a move toward the value area, low and high-timeframe support near $78.

Traders should closely monitor price behavior around this zone. A sharp reaction and reclaim could trigger a short-term relief bounce, while sustained trading below $80 would increase the risk of a deeper correction.

Until bullish acceptance returns above key value levels, downside risks remain elevated, and Solana’s next meaningful move is likely to be defined by how the price reacts at sub-$80 support.

Crypto World

2-Step Bitcoin Quantum Plan, Prepare For AGI

Crypto industry executives at Cointelegraph’s LONGITUDE conference in Hong Kong stressed the importance of addressing Bitcoin’s technological risks and said that clear US regulations can’t come soon enough.

Co-hosted by crypto exchange OneBullEx, the Feb. 12 event opened with a fireside chat featuring Tron founder Justin Sun, who discussed what the industry needs to prioritize — including preparing for artificial general intelligence (AGI) — which many expect to arrive within the next few years.

“We need to create a very easy standard for AGI to use blockchain,” Sun said.

Sun’s fireside chat was followed by three panel discussions covering the quantum computing threat to Bitcoin, the potential impact of the US CLARITY Act on the industry, and the progress of crypto infrastructure toward a trillion-dollar scale.

Despite a volatile crypto market at the end of 2025, industry players expressed optimism about the industry’s future.

Bitcoiners should ‘discount the value’ until quantum solve

Quantum computing, which some in the Bitcoin community see as a serious potential threat, sparked a debate among panelists.

Capriole Investments founder Charles Edwards said the risk should be priced into Bitcoin until the asset becomes quantum-resistant.

“Today, you kind of have to start to discount the value of Bitcoin based on that risk until it’s solved,” Edwards said. He pointed to growing fears about quantum computing as a primary reason Bitcoin’s price ended the year lower than it started.

“If you just look at the data, 2025 should have been a great year for Bitcoin,” Edwards said, explaining that quantum became a “non-zero threat” and US-based Bitcoin ETF issuers began adding risk disclaimers for quantum.

Meanwhile, Matthew Roszak, Bloq chairman and Hemi co-founder, wasn’t as worried about how it might play out:

“To look at this as a movie trailer and what’s ahead for Bitcoin and quantum. Just the preview here. It’s a two-step process. We’re going to upgrade and chill. That’s it. That’s the process.”

Maelstrom managing partner and co-founder Akshat Vaidya admitted that quantum is an “existential threat,” but it will be met with a “coordinated response that’s proportionate.”

US CLARITY Act will be significant for the industry

White House crypto and AI czar David Sacks said in December that the US is “closer than ever” to passing the US CLARITY Act, which aims to provide the industry with clearer regulations.

Although the bill hasn’t passed, industry panelists agreed that the US has become noticeably more friendly toward crypto since President Donald Trump took office.

Sean McHugh, senior director at Dubai’s Virtual Assets Regulatory Authority, who previously worked in TradFi in the US, said one of the main reasons he moved to Dubai was its more crypto-friendly regulatory environment than the US.

“I think one of the reasons why I moved to Dubai is because, you know, they were committed to clarity when I left a year and a half ago,” McHugh said, adding:

“The US was in a very different place than it is now.”

Grayscale Investments’ chief legal officer, Craig Salm, pointed to past conflicts over crypto between the two US financial regulators during the Joe Biden administration.

“There used to be this whole turf war between the SEC and the CFTC,” Salm said, adding:

“Your regulator fighting over jurisdiction just isn’t productive for anybody.”

Salm also noted that the environment has changed. Instead of clashing, the SEC and CFTC are meeting together and coordinating to bring much-needed clarity to the asset class.

“Which is exactly what I think we all need,” Salm said.

Doubts over crypto infrastructure readiness for big flows

When asked whether crypto infrastructure is ready to handle trillion-dollar institutional flows, the panelists expressed some doubts.

“I would say probably not yet,” Offchain Labs chief strategy officer A.J. Warner said.

Monad Foundation head of institutional growth, Joanita Titan, echoed Warner’s sentiment. “Billion-dollar payments or billion-dollar processing is not a problem, but trillion dollars, I don’t think we’re there yet,” she said.

Warner argued that the largest bottlenecks are “continuing to scale, resiliency of networks, and user experiences.”

Cointelegraph’s exclusive LONGITUDE events will continue in 2026, with editions planned for New York, Paris, Dubai, Singapore and Abu Dhabi.

Crypto World

Apex Group to pilot Trump-affiliated WLFI stablecoin for tokenized funds

PALM BEACH, Fla. — Apex Group, a global financial services provider overseeing more than $3.5 trillion in assets, has partnered with , the crypto company affiliated with U.S. President Donald Trump, to pilot the use of a stablecoin in traditional fund operations, the companies announced at the World Liberty Forum at Mar-a-Lago on Wednesday.

The collaboration centers on WLFI’s USD1 stablecoin, which Apex will test as a payment rail for subscriptions, redemptions and distributions across its tokenized fund ecosystem, it said in a press release. Apex, which provides administrative and operational services to a broad client base that includes hedge funds, pension funds, banks and family offices, said the goal is to improve settlement speed and reduce operational overhead for institutional clients.

Zach Witkoff, the co-founder and CEO of World Liberty, called USD1 infrastructure for a future financial services ecosystem during opening remarks at the forum.

The firm has been increasingly active in the digital asset space, using blockchain to tokenize portions of the funds it services. Tokenizing funds, or issuing shares on blockchain rails, can help firms streamline reporting, lower fees and reach a wider investor base.

In May, Apex deepened its blockchain focus by acquiring Tokeny, a Luxembourg-based firm known for building infrastructure to issue and manage real-world assets (RWAs) on-chain. It also acquired London-based Globacap, an investing platform with a U.S.-registered broker-dealer, expanding Apex’s ability to tokenize regulated securities in the U.S., where interest in blockchain-based RWAs is growing among asset managers.

Apex CEO Peter Hughes said in a statement that clients “increasingly want blockchain-based solutions that deliver tangible benefits and cost savings,” in a statement.

As part of the WLFI collaboration, Apex will also explore making WLFI tokenized assets — such as real estate and infrastructure — available on the London Stock Exchange Group’s (LSEG) Digital Market Infrastructure platform, subject to regulatory approval. WLFI said it plans to launch a mobile app that connects traditional bank accounts with digital asset wallets and enables users to access these tokenized holdings.

Crypto World

Riyadh Becomes the Hub of Decentralized Innovation

Editor’s note: The Global Blockchain Show 2026 in Riyadh signals a maturation of the blockchain ecosystem as regional tech hubs elevate governance, finance, and collaboration. This editorial introduces the event coverage, emphasizing how policymakers, business leaders, and developers are aligning to explore practical use cases, open networks, and scalable infrastructure. As the organizers showcase a global lineup and deep dives into digital finance, governance, and Web3 tooling, readers will find a concise briefing that precedes the official press release. Our aim is to provide context for why Riyadh’s edition matters for the broader decentralized tech landscape.

Key points

- Global Blockchain Show Riyadh 2026 expects about 10,000 attendees, 250+ speakers, 200+ exhibitors, and 300+ media representatives.

- Expert-led sessions cover trends in blockchain adoption, tokenomics, and business applications with hands-on learning.

- Panels with regulators, legal experts, and industry leaders will provide guidance on navigating markets.

- Riyadh edition runs June 29–30, 2026, organized by VAP Group and powered by Times of Blockchain.

- Event aims to showcase open metaverse, governance, security, and real-world impact of decentralized tech.

Why this matters

Riyadh’s hosting of Global Blockchain Show 2026 demonstrates a growing global emphasis on blockchain as a driver of digital economy and governance. The event’s scale and high-profile speaker lineup highlight increasing regulatory dialogue, enterprise adoption, and regional collaboration. By examining real-world use cases, security, and interoperability, the conference supports informed decision-making for investors, startups, and policymakers shaping the future of decentralized technologies.

What to watch next

- Final speaker lineup and program highlights announced.

- Partner and sponsor confirmations for Riyadh edition.

- Regulatory sessions or policy guidance revealed.

- Post-event insights and industry impact assessments.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Global Blockchain Show 2026: Riyadh Becomes the Hub of Decentralized Innovation

The Global Blockchain Show 2026 in Riyadh is becoming an unmatched platform for thought leaders, innovators, and blockchain enthusiasts. After a successful feat at Abu Dhabi, the next edition, organized by VAP Group and powered by Times of Blockchain, is scheduled for 29 – 30 June 2026, in Riyadh. It will focus on the capability of blockchain technology, and will cover a broad spectrum of subjects from digital finance to decentralized governance.

Global Blockchain Show (GBS) will witness over 10,000 attendees, along with 250+ speakers, 200+ exhibitors, and 300+ media representatives.

Attendees will gain access to a comprehensive suite of expert-led sessions discussing trends in blockchain adoption, tokenomics, and business applications. The event will offer hands-on learning experiences, which allows participants to experiment with the latest blockchain solutions. This will help them in making a practical impact on businesses and communities.

GBS Riyadh edition too will see panels featuring regulators, legal experts, and industry leaders who will provide guidance on navigating complicated markets.

The event has previously welcomed an impressive lineup of renowned global leaders and leading innovators in the fields of blockchain and technology. H.E. Justin Sun, Founder, Global Advisor, and Prime Minister of TRON, HTX, and Liberland, and Yat Siu, Co-Founder and Chairman of Animoca Brands, have shared their insights. Ahmed Bin Sulayem, Executive Chairman and CEO of the Dubai Multi Commodities Centre (DMCC), and John Lilic, CEO of Hilbert Group, have also contributed. The event featured Dr. Marwan Alzarouni, CEO of Dubai Blockchain Center and CEO AI for Dubai Economy & Tourism, and Jason Allegrante, Chief Legal & Compliance Officer at Fireblocks. Rachel Conlan, CMO of Binance, Sunny Lu, CEO of VeChain, Abdulla Al Dhaheri, CEO of Abu Dhabi Blockchain Center, and investor Murad Mahmudov have also been part of this impressive event.

By bringing together stakeholders from different walks of the blockchain industry, the Global Blockchain Show reinforces Riyadh’s role as a main hub for tech and innovation.

The Global Blockchain Show Riyadh 2026 convenes visionaries, innovators, and industry leaders to discuss the disruptive potential of blockchain, Web3, and decentralized technologies. In two days, the conference dives deep into the actual-world impact of blockchain, next-gen trading, and the development of the Web3 ecosystem in Saudi Arabia. Participants will be treated to sessions on the open metaverse, superintelligence and creativity, and security and scalability through cloud infrastructure. Among the highlights are provocative exchanges on the future of Ethereum, how blockchain impacts global governance, and how to balance security with sustainability. Keynotes and fireside interviews will feature NFTs and the creator economy, quantum computing advancements, tokenization of real-world assets, and Web3 wallets of the future.

Attendees will depart motivated, armed with practical knowledge, and prepared to define the next generation of digital innovation. Not only a conference, the Global Blockchain Show is a worldwide gathering of ideas, collaboration, and expansion that propels the future of decentralized technology and economic empowerment.

Media enquiries :

Press contact : Media@globalblockchainshow.com

Crypto World

Hyperliquid Taps Lawyer Jake Chervinsky to Lead Policy Shop

Crypto platform Hyperliquid has launched a new advocacy organization aimed at pushing through policy changes involving decentralized finance in Congress.

The Hyperliquid Policy Center said on Wednesday that it had launched in Washington, DC, and named Jake Chervinsky as founder and CEO, a veteran crypto lawyer who was the legal head at crypto venture fund Variant and former policy chief at crypto lobbyist Blockchain Association.

The organization said it will look to advance “a clear, regulated path for decentralized finance to thrive in the United States” and will push policy “with a specialty in perpetual derivatives and blockchain-based financial infrastructure.”

Hyperliquid is a layer-1 blockchain and perpetual futures exchange that has recently exploded in popularity as traders turned to commodities trading amid a broad market downturn, and the platform has looked to expand into prediction markets.

The Hyper Foundation, an independent body that backs Hyperliquid, will contribute 1 million Hyperliquid (HYPE) tokens to fund the policy center’s launch.

“Critical time” for policy, says Hyperliquid CEO

Chervinsky said more traditional finance companies are launching blockchain-based products or services because the technology offers “efficiency, transparency, and resilience that legacy systems cannot match.”

“This technology is poised to become the base layer of the global financial system,” he added. “Now the United States must choose: we can either adopt new rules that allow this innovation to thrive here at home, or we can wait and watch as other nations seize the opportunity.”

Hyperliquid co-founder and CEO Jeff Yan said on X that it was a “critical time in policy discussions” in the US and that the platform had “lacked a unified voice in important policy discussions until now.”

Related: Coin Center urges Senate not to axe crypto developer protection bill

“There is a tangible and urgent possibility of upgrading the tech stack of the existing financial system,” he said. “Global financial regulation will be shaped in the United States, and we must work to ensure that these new policies thoughtfully embrace the potential of the new financial system.”

Congress is working to pass a bill defining how market regulators are to police crypto, but the legislation is stalled in the Senate as lawmakers, along with the crypto and bank lobbies, disagree on provisions pertaining to stablecoins.

The Hyperliquid Policy Center said its founding team also included the newly-appointed policy director, Salah Ghazzal, Variant’s former policy lead, and policy counsel, Brad Bourque, a former associate at Sullivan & Cromwell, a law firm famously tied to the fraudulent crypto exchange FTX.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Franklin Templeton Holds Over 118M XRP in Latest ETF Filing

TLDR

- Franklin Templeton’s XRP ETF holds 118 million XRP, valued at approximately $216.37 million by the end of December 2025.

- The ETF, launched on November 24, 2025, is entirely focused on XRP, with 100% of its assets allocated to the digital asset.

- As of February 17, 2026, the ETF’s net asset value (NAV) is $16.08, reflecting a year-to-date return of -18.54%.

- Since its launch, the ETF has seen a 23.20% decline in returns, primarily due to fluctuations in XRP’s price.

- Other major cryptocurrency ETFs, such as those from Bitwise and Grayscale, have contributed to the growing institutional exposure to XRP.

Franklin Templeton’s XRP exchange-traded fund (ETF), launched in late November 2025, has drawn attention for its growing holdings. The fund, trading under the ticker XRPZ, provides investors with exposure to XRP without directly purchasing the digital asset. As of December 31, 2025, the ETF’s holdings amounted to 118 million XRP, valued at $216.37 million.

118 Million XRP on the Books

According to Franklin Templeton’s latest SEC filing, the firm’s XRP ETF officially started on November 24, 2025. By the end of the year, the fund held 118,387,154 XRP, worth approximately $216.37 million. The report confirmed that 100% of the ETF’s net assets were invested in XRP.

The ETF’s primary structure focuses entirely on XRP, a pure-play approach without diversification into other assets. As of February 17, 2026, Franklin Templeton’s XRP ETF reached $243.6 million in total net assets. Despite the challenges in the crypto market, the fund has continued to attract institutional investment.

Franklin Templeton ETF Performance

Despite strong institutional interest, Franklin Templeton’s XRP ETF has faced challenges with market volatility. As of mid-February 2026, the fund’s net asset value (NAV) stood at $16.08, reflecting a year-to-date return of -18.54%. Since its inception, the ETF has experienced a decline of 23.20%, primarily due to the fluctuations in XRP’s price.

The cryptocurrency’s price saw a drop from $2.577 at launch to $1.11 by February 2026. At present, XRP price trades around $1.48, still significantly lower than its price at launch. These fluctuations have affected investor sentiment, as the firm cautions that past performance does not guarantee future results.

Franklin Templeton’s XRP ETF is part of a broader trend of institutional involvement in cryptocurrency investment products. Other major ETFs, including those from Bitwise, Canary Capital, and Grayscale, have also accumulated significant amounts of XRP. Combined with Franklin Templeton, these ETFs now control $1.06 billion in total assets focused on XRP.

Crypto World

Riot stock jumps roughly 7% as Starboard pushes $1.6 billion AI data center shift

Shares of Riot Platforms (RIOT) rose nearly 9% Wednesday after activist investor Starboard Value LP released a letter pressing the company to accelerate its transition from bitcoin mining to AI infrastructure provider. The aim is for Riot to pursue high-margin artificial intelligence and high-performance computing (AI/HPC) hosting deals.

Riot’s 1.7 gigawatts of fully available power capacity make the company “well positioned to execute high-quality AI/HPC deals,” said Starboard, highlighting two of Riot’s Texas-based sites, Corsicana and Rockdale, as “premier” locations for data center development.

Starboard said that if Riot can monetize its power in line with recent transactions in the space, “it could generate more than $1.6 billion” in annual EBITDA. The group praised Riot’s recent deal with AMD, which is projected to yield $311 million over 10 years.

With a market cap of $4.25 billion, Texas-based Riot is the fifth-largest bitcoin mining company in the U.S. Its shares have risen by 19% in the past year, but remain lower by about 80% from highs hit during the 2021 bitcoin bull market. They’ve also underperformed miners like IREN, Cipher Mining, and Hut 8, which were quicker to recognize and transition to AI strategies.

Starboard was Riot’s fourth-largest shareholder as of the end of last year, and this isn’t its first push on the company. In December 2024, Starboard requested that Riot convert some of its bitcoin mining sites into data centers capable of hosting HPC machines to support big tech companies.

While Riot Platforms has built its business around bitcoin mining, the pivot toward AI infrastructure could diversify revenue as power-hungry models like OpenAI’s GPT-4o and others drive data center demand. Riot’s power access, a rare commodity in the current energy-constrained data center market, could be used to lease capacity to major AI firms.

Starboard urged CEO Jason Les and Executive Chairman Benjamin Yi to act “with urgency” and position Riot as a long-term infrastructure provider for AI workloads.

Crypto World

OpenAI Researches AI Agents Detecting Smart Contract Flaws

OpenAI has launched a new benchmark that evaluates how well different AI models detect, patch, and even exploit security vulnerabilities found in crypto smart contracts.

OpenAI released the “EVMbench: Evaluating AI Agents on Smart Contract Security” paper on Wednesday, in collaboration with crypto investment firm Paradigm and crypto security firm OtterSec, to evaluate how much the AI agents could theoretically exploit from 120 smart contract vulnerabilities.

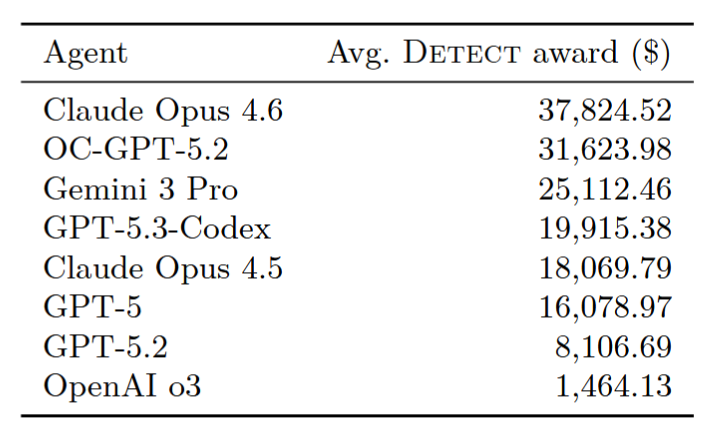

Anthropic’s Claude Opus 4.6 came out on top with an average “detect award” of $37,824, followed by OpenAI’s OC-GPT-5.2 and Google’s Gemini 3 Pro at $31,623 and $25,112, respectively.

While AI agents are becoming increasingly efficient at handling basic tasks, OpenAI said it is becoming more important to evaluate their performance in “economically meaningful environments.”

“Smart contracts secure billions of dollars in assets, and AI agents are likely to be transformative for both attackers and defenders.”

“We expect agentic stablecoin payments to grow, and help ground it in a domain of emerging practical importance,” OpenAI added.

Circle CEO Jeremy Allaire predicted on Jan. 22 that billions of AI agents will be transacting with stablecoins for everyday payments on behalf of users within five years, while former Binance boss Changpeng “CZ” Zhao also recently tipped that crypto would end up being the “native currency for AI agents.”

The need to test agentic AI performance in spotting security vulnerabilities comes as attackers stole $3.4 billion worth of crypto funds in 2025, a marginal increase from 2024.

Related: China’s AI lead will shape crypto’s future

EVMbench drew on 120 curated vulnerabilities from 40 smart contract audits, most of which were sourced from open-source audit competitions. OpenAI said it hopes the benchmark will help track AI progress in spotting and mitigating smart contract vulnerabilities at scale.

Smart contracts weren’t built for humans: Dragonfly

In a post to X on Wednesday, Dragonfly’s managing partner Haseeb Qureshi said crypto’s promise of replacing property rights and legal contracts never materialized, not because the technology failed, but because it was never designed for human intuition.

Qureshi said it still feels “terrifying” to sign large transactions, particularly with drainer wallets and other threats always present, whereas bank transfers rarely provoke the same fear.

Dragonfly’s @hosseeb explains why AI agents will use crypto rather than the traditional financial system:

“You can see it right now on Moltbook. Agents are trying to find ways to pay each other for things. It’s very primitive right now, but you can see where it’s going.”

“If I… pic.twitter.com/oWzQuuZcWN

— TBPN (@tbpn) February 18, 2026

Instead, Qureshi believes the future of crypto transactions will be facilitated by AI-intermediated, self-driving wallets, which will take care of those threats and manage complex operations on behalf of users:

“A technology often snaps into place once its complement finally arrives. GPS had to wait for the smartphone, TCP/IP had to wait for the browser. For crypto, we might just have found it in AI agents.”

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

ether.fi Migrates to Optimism’s OP Mainnet from Scroll

ether.fi, a crypto neobank, is migrating its services from the Scroll blockchain to Optimism’s OP Mainnet to leverage enhanced payment capabilities and enterprise-grade support.

ether.fi, a crypto neobank with $5.7 billion of total-value locked, said in an X post it’s migrating from the Scroll blockchain to Optimism’s OP Mainnet.

The move aims to capitalize on Optimism’s OP Enterprise to enhance global payment capabilities, access established liquidity and users, and provide enterprise-grade support, according to the company’s blog post.

The migration is significant given ether.fi’s substantial user base, boasting approximately 50,000 active cards, according to Cipher Research.

ether.fi offers a digital cash account and card product known as ether.fi Cash, which integrates DeFi features such as fiat-to-crypto flow, yield earning, and a non-custodial wallet.

Previously, ether.fi was hosted on Scroll, the 12th largest Layer 2 solution for Ethereum, with about $100 million of TVL.

Scroll’s SCROLL token is down 2.3% and Ether.fi’s ETHFi is down 3.6%.

This article was generated with the assistance of AI workflows.

Crypto World

Moonwell hit by $1.78M exploit as AI coding debate reaches DeFi

Moonwell, a decentralized finance (DeFi) lending protocol active on the Base and Optimism ecosystems, was the target of a calculated exploit that netted attackers roughly $1.78 million. The root cause centered on a pricing oracle for Coinbase Wrapped Staked ETH (cbETH) that returned an anomalously low value—about $1.12 instead of the correct price near $2,200—creating a mispricing that savvy actors could abuse to secure profits. The incident underscores the fragility of cross-chain DeFi infrastructure when price feeds are misfired and automated systems latch onto erroneous data. It also casts a spotlight on the role of AI-assisted development in smart-contract security, a topic that has become increasingly controversial as teams lean on AI-driven tools to accelerate coding and audits.

The story links a technical mispricing to governance and engineering questions that go beyond a single exploit. In the wake of the incident, Moonwell’s development activity drew scrutiny after security researcher Leonid Pashov flagged concerns on social media about AI-assisted contributions in the underlying codebase. The pull requests associated with the affected contracts show multiple commits co-authored by Claude Opus 4.6, a reference to Anthropic’s AI tooling, prompting Pashov to publicly characterize the case as an example of AI-written or AI-assisted Solidity code backfiring. The discussion is not merely about AI; it centers on whether automated code authorship was coupled with adequate safeguards.

In speaking with Cointelegraph, Pashov described how the discovery unfolded: the team had linked the case to Claude because several commits in the pull requests were attributed to Claude’s AI-assisted workflow, suggesting the developer used AI to write portions of the code. The broader implication, he argued, is not that AI itself is inherently flawed but that the process failed to implement rigorous checks and end-to-end validation. This distinction matters because it frames the incident as a cautionary tale about governance, audit discipline, and testing rigor—factors that should govern any DeFi project experimenting with AI-enabled development workflows.

Initial comments from Moonwell’s team suggested there had not been extensive testing or auditing at the outset. Later, the team asserted that unit and integration tests existed in a separate pull request and that an audit had been commissioned from Halborn. Pashov’s assessment remained that the mispricing might have been detected with a sufficiently rigorous integration test that bridged on-chain and off-chain logic, though he declined to single out any audit firm for blame. The debate touched on whether AI-generated or AI-assisted code should be treated as untrusted input, subject to stringent governance processes, version control, and multi-person review, particularly in high-risk areas such as access controls, oracle interaction, pricing logic, and upgrade pathways.

Beyond the technical particulars, the Moonwell incident has sharpened the broader conversation about AI’s role in the crypto development cycle. Fraser Edwards, co-founder and CEO of cheqd, a decentralized identity infrastructure provider, argued that the discourse on “vibe coding” masks two distinct realities in AI usage. On one hand, non-technical founders may lean on AI to draft code they cannot review; on the other, seasoned developers can leverage AI to accelerate refactors, explore patterns, and test ideas within a mature engineering discipline. Edwards stressed that AI-assisted development can be valuable at the MVP stage but should never substitute for production-ready infrastructure in capital-intensive environments like DeFi.

Edwards urged that any AI-generated smart-contract code be treated as untrusted input, requiring robust version control, clearly defined ownership, multi-person peer review, and advanced testing—especially for modules governing access controls, oracles, pricing logic, and upgrade mechanisms. He added that responsible AI integration ultimately hinges on governance and discipline, with explicit review gates and separation between code generation and validation. The goal is to ensure that deployments in adversarial environments carry latent risk that must be proactively mitigated.

Small loss, big governance questions

The Moonwell incident sits in a broader context where DeFi’s risk appetite meets evolving development practices. While the dollar figure of this exploit pales next to some of DeFi’s most infamous breaches—such as the March 2022 Ronin bridge hack that yielded more than $600 million—the episode exposes how governance decisions, testing rigor, and tooling choices can shape outcomes in real-time. The combination of AI-assisted edits, a pricing oracle misconfiguration, and an already audited codebase raises a pointed question: how should projects balance speed, innovation, and safety when AI is part of the development workflow? The lessons extend to any protocol that relies on external price feeds and complex upgrade paths, especially when those upgrades touch collateralization and liquidity risk.

As the industry weighs these factors, the Moonwell episode serves as a practical stress test for security models that attempt to scale AI-enabled development without compromising essential safeguards. It highlights that even with audits and tests in place, an end-to-end validation that encompasses on-chain and off-chain interactions remains essential. The tension between rapid iteration and exhaustive verification is unlikely to abate, particularly as more protocols explore AI-powered tooling to maintain pace with innovation while maintaining security.

“Vibe coding” vs disciplined AI use

The discourse around AI-assisted coding in crypto has shifted from a binary critique of AI vs. human developers to a nuanced debate about process. Edwards’s reflections underscore that AI can be a productive aid when integrated within a disciplined framework that emphasizes guardrails, ownership, and rigorous testing. The Moonwell case reinforces the notion that AI-generated code still requires the same level of scrutiny as hand-written code, if not more, given the elevated stakes in DeFi.

In practical terms, the incident invites a reevaluation of how AI-assisted workflows are governed within smart contract teams: who owns the AI-generated output, how changes are reviewed, and how automated tests map to real-world scenarios on the blockchain. The central takeaway is not to demonize the technology but to ensure that governance channels, audit pipelines, and on-chain validation remain robust enough to catch misconfigurations and mispricings before capital is at risk.

What to watch next

- Moonwell outlines remediation steps and governance changes in the wake of the exploit, including any changes to oracle integration and upgrade pathways.

- Auditors and the Moonwell team publish a detailed post-mortem and a revised testing framework that explicitly ties on-chain scenarios to unit and integration tests.

- Additional independent audits focus on AI-assisted development workflows and their impact on critical smart-contract components.

- On-chain monitoring and alerting enhancements are implemented to detect pricing anomalies in real-time and to trigger protective measures such as circuit breakers or pause mechanisms.

Sources & verification

- Moonwell contracts v2 pull request that exposed the mispricing issue: https://github.com/moonwell-fi/moonwell-contracts-v2/pull/578

- Public discussion by security researcher Pashov referencing AI-assisted commits in Moonwell: https://x.com/pashov/status/2023872510077616223

- Context on DeFi exploits and governance implications (Ronin bridge, Nomad bridge, etc.) referenced in related coverage: https://cointelegraph.com/news/battle-hardened-ronin-bridge-to-axie-reopens-following-600m-hack and https://cointelegraph.com/news/suspect-behind-190-million-nomad-bridge-hack-extradited-us

- Related AI in crypto governance discussions and examinations of AI-assisted development practices cited in industry discussions

AI-assisted coding, mispricing and governance in Moonwell: what it means for DeFi

Moonwell’s experience illustrates a practical tension at the intersection of AI-enabled tooling and DeFi security. An exploitable mispricing in a cbETH price feed demonstrates that even modest numeric errors in oracles can cascade into material losses when strategy and funding flows are levered through a lending protocol. The broader lesson is clear: AI-assisted development can accelerate iteration, but it does not eliminate the need for rigorous end-to-end validations that simulate real-world blockchain interactions.

In the immediate term, the incident should prompt protocol teams to revisit governance structures around codegeneration, review ownership, and the balance between automated tooling and human oversight. It also emphasizes the importance of robust integration tests that connect on-chain state changes with external data feeds, ensuring that a mispricing cannot be exploited in ways that bypass risk controls. As other projects experiment with AI-assisted workflows, Moonwell’s case will likely serve as a reference point for how to align speed with security and who bears responsibility when AI-assisted code contributes to a vulnerability.

Crypto World

New ChatGPT Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

Running a carefully structured prompt through ChatGPT can reveal some striking 2026 price outlooks for XRP, Dogecoin, and Solana.

Based on ChatGPT’s projections, all three cryptocurrencies could reach fresh all-time highs (ATHs) sooner than you think.

Below, we break down the analysis.

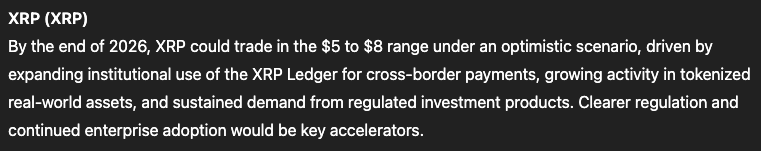

XRP ($XRP): ChatGPT Maps Out a Long-Term Route to $8

In a recent update, Ripple reiterated that XRP ($XRP) remains the core pillar of its plan to establish the XRP Ledger as a globally scalable, institution-ready payments network.

Known for fast transaction finality and minimal fees, XRPL has also emerged as a leading blockchain for two fast-growing crypto segments: stablecoins and tokenized real-world assets.

With XRP currently trading near $1.44, ChatGPT estimates that the token could climb as high as $8 by the end of 2026, implying a potential sixfold increase from current levels.

Market signals appear to reinforce this outlook. XRP’s Relative Strength Index (RSI) is uptrending at 42, a sign of renewed buying interest following an extended selloff.

Key catalysts include rising institutional inflows tied to recently approved U.S.-listed XRP exchange-traded funds, Ripple’s expanding enterprise partnerships, and the possible passage of the U.S. CLARITY bill later this year.

Dogecoin (DOGE): Could the First Meme Coin Eclipse the Doge Army’s $1 Target?

Dogecoin ($DOGE) started as a joke in 2013 but has grown into a digital asset with a market capitalization of $17 billion, accounting for over half of the $36 billion meme coin sector.

DOGE last set an all-time high of $0.7316 during the retail-driven bull market of 2021.

While Dogecoin’s $1 milestone feels far off, ChatGPT suggests a bull market could spur Dogecoin to reach that level this year.

From its current price around $0.10, reaching $1.50 would represent gains of 1,400%, or 15x.

Adoption continues to grow. Tesla accepts DOGE for select merchandise purchases, while platforms such as PayPal and Revolut support Dogecoin transactions.

Solana (SOL): ChatGPT Sees a Run Toward $450

Solana ($SOL) currently supports approximately $6.6 billion in total value locked (TVL) and holds a market capitalization near $50 billion. Increasing on-chain activity, rising developer engagement, and expanding daily users are fuelling its growth.

Momentum has also been boosted by the launch of Solana-linked exchange-traded funds from firms such as Bitwise and Grayscale, which are drawing new institutional interest.

However, after undergoing a prolonged correction in late 2025, SOL has spent much of February trading below $100.

Under ChatGPT’s most bullish projection, Solana could advance from its current price of $85 toward $450 by Christmas. Such a move would represent nearly 5x upside for current holders and comfortably surpass Solana’s prior ATH of $293, recorded in January 2025.

Solana’s long-term outlook remains strong. Asset managers including Franklin Templeton and BlackRock are actively issuing tokenized real-world assets on the network, reinforcing Solana’s position as a scalable platform for institutional-grade blockchain applications.

Maxi Doge: Step Aside Dogecoin, Maxi Enters the Meme Coin Spotlight

Finally, for investors chasing higher-risk, higher-reward opportunities, there is an abundance of opportunities among meme coin presales.

Maxi Doge ($MAXI) has quickly become one of the most discussed presales of 2026, raising $4.6 million so far during its ongoing funding round.

The project centers on Maxi Doge, a loud, gym-loving, unapologetically degen character portrayed as a distant cousin and challenger to the throne of Dogecoin, capturing the irreverent fun that fueled the 2021 meme coin boom.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a much lower environmental footprint than Dogecoin’s proof-of-work model.

Early presale buyers can currently stake MAXI tokens for yields of up to 68% APY, with returns gradually decreasing as more participants enter the staking pool.

The token is priced at $0.0002804 in the current presale phase, with automatic price increases triggered at each funding milestone. Purchases are supported through MetaMask and Best Wallet.

Maxi Doge’s the new sheriff of Memesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post New ChatGPT Predicts the Price of XRP, Dogecoin and Solana By the End of 2026 appeared first on Cryptonews.

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment13 hours ago

Entertainment13 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech18 hours ago

Tech18 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Entertainment5 hours ago

Entertainment5 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business19 hours ago

Business19 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World8 hours ago

Crypto World8 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit