Crypto World

STON.fi Brings Bitcoin and Ethereum to TON DeFi

STON.fi, one of the leading AMM protocols on The Open Network (TON), announced that TON-native representations of Bitcoin (BTC) and Ethereum (ETH) are now available within the ecosystem in a fully non-custodial DeFi format.

The integration gives TON users direct access to the two largest crypto assets, including the ability to swap them and provide liquidity, while maintaining full control over their funds.

BTC and ETH are represented on TON as wrapped assets issued in TON-native format, each fully backed 1:1 by the underlying tokens and managed through smart contracts. Ethereum is available as wrapped ETH (WETH), while Bitcoin is accessible via cbBTC, a Bitcoin-backed token issued by Coinbase and fully collateralized with BTC on a one-to-one basis. This structure allows both assets to be used across decentralized applications within TON ecosystem without interacting directly with their native blockchains.

Through STON.fi, users can deploy WETH and cbBTC across TON DeFi, including swapping and providing liquidity via WETH/USDt and cbBTC/USDt pools. At the same time, Omniston, STON.fi’s liquidity aggregation protocol, enables swaps to WETH and cbBTC from any TON-native token, routing liquidity across the ecosystem. Applications integrated with Omniston instantly gain access to WETH and cbBTC liquidity, enabling swaps across hundreds of TON-based dApps without additional integrations and expanding the range of available DeFi strategies within the ecosystem.

“Bringing BTC and ETH into TON DeFi is about expanding real utility, not just asset coverage,” said Slavik Baranov, CEO of STON.fi Dev. “This launch enables users to actively use Bitcoin and Ethereum inside TON ecosystem rather than holding them passively. By making these assets usable in TON-native DeFi, we’re strengthening the overall depth of the ecosystem.”

As TON continues to develop as a blockchain closely integrated with Telegram — a messenger used daily by hundreds of millions of people — access to major crypto assets directly within Telegram-native and TON-based applications has become a natural part of the ecosystem’s evolution. Bitcoin and Ethereum sit at the core of the global crypto economy, and their availability on TON allows users to access these assets directly within the apps they already use, without leaving the ecosystem, through decentralized and permissionless infrastructure.

To learn more about how WETH and cbBTC integration works on STON.fi, users can visit: https://ston.fi/eth-ton and https://ston.fi/btc-ton.

About STON.fi

STON.fi is one of the leading non-custodial swap dApps and a suite of swap-enabling protocols within The Open Network (TON) ecosystem, known for its deep liquidity, wide token coverage, and dominance in total value locked (TVL) and trading volume. With over $6.8 billion in total trading volume and more than 31 million operations, STON.fi dominates TON DeFi ecosystem in token coverage, liquidity depth, and active user participation. Backed by top investors such as CoinFund, Delphi Ventures, The Open Platform, Karatage, TON Ventures, and others, STON.fi continues to advance decentralized finance through open development and innovations such as Omniston — a decentralized liquidity aggregation protocol.

Crypto World

Vara tells crypto exchange KuCoin to halt operations in Dubai

Dubai’s digital assets regulator said cryptocurrency exchange KuCoin has been operating without the necessary regulatory approvals and licensing, and must cease and desist from serving clients in the region.

“Kucoin does not hold any licence to provide virtual asset services in/from Dubai. Any activities related to Virtual Assets advertised or conducted by this company are therefore in breach of the VARA Regulations,” the Virtual Assets Regulatory Authority (VARA) said in a statement.

“Any promotion, advertising, or solicitation related to Kucoin has not been approved by VARA, and the company is therefore not allowed to offer, promote, or market any Virtual Asset products or services in Dubai or to its residents,” the regulator added, advising consumers and investors in Dubai to avoid engaging with Kucoin.

The alert comes just weeks after Austria’s financial regulator prohibited the European arm of KuCoin from conducting new business and onboarding customers due to a lack of appropriate compliance staff.

A few months earlier, Austria’s finance regulator, FMA, granted KuCoin a Markets in Crypto Assets (MiCA) permit to operate across the European Union.

KuCoin, a Seychelles-based cryptocurrency exchange founded in China in 2017, is now one of the largest offshore crypto platforms, ranked in the top 10 by trading volume.

Crypto World

Justin Sun ‘Very Pleased’ With $10 Million SEC Settlement

The US regulator has dismissed all claims against Sun, the Tron Foundation, and BitTorrent Foundation.

Justin Sun, the founder of the Tron Foundation, took it to X to announce that the claims against him made by the US Securities and Exchange Commission have been officially dismissed after reaching a $10 million settlement.

The lawsuit began during the height of the previous SEC administration’s war on crypto, when he and a few other parties were sued for several trading schemes.

Lawsuit Dismissed

Sun outlined on X that he was “very pleased” with the decision made by the US regulator to dismiss all claims against him, the Tron Foundation, and the BitTorrent Foundation. He believes this move “brings closure,” but promised that he will continue building.

Sun added that the United States, which needs to become a global crypto hub as claimed numerous times by President Trump and his administration, will be a main focus in his future plans.

I am very pleased to confirm that the SEC has moved to dismiss all claims against me, Tron Foundation, and BitTorrent Foundation.

Today’s resolution brings closure, but I never stopped building. I will continue to focus on accelerating innovation in the United States and around…

— H.E. Justin Sun 👨🚀 🌞 (@justinsuntron) March 5, 2026

The decision to resolve the civil fraud case comes with a $10 million settlement, but Sun and his companies did not admit or deny any wrongdoing, said US District Judge Edgardo Ramos in Manhattan.

The Lawsuit Itself

It began in 2023 when Sun was accused of organizing the unregistered sale of crypto securities tied to the TRX and BTT tokens and of manipulating trading volumes. According to the SEC, Sun attempted to artificially inflate the trading volume of TRX through wash trading schemes between April 2018 and February 2019, making employees of the Tron Foundation participate in more than 600,000 illegal trades using accounts controlled by them and the BitTorrent Foundation.

You may also like:

The agency also claimed that Sun sold a large portion of the TRX tokens on the secondary market and generated proceeds of “$31 million from illegal, unregistered offers and sales of the token (TRX).”

Two years after the lawsuit began, the US watchdog asked the federal court overseeing the case to issue a stay, which paused the proceeding. However, once the US administration changed, Sun became a major financial supporter of Trump-linked crypto ventures, purchasing billions of WLFI tokens, which made him the largest backer of World Liberty Financial.

Although TRX and BTT crashed immediately after the lawsuit began three years ago, the impact on the performance over the past 12 hours after Sun’s announcement has been minimal. TRX is 0.5% up on the day, while BTT is actually 1% down.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Crypto News Today: $2.6 Billion Options Expiry With Volatility Expected

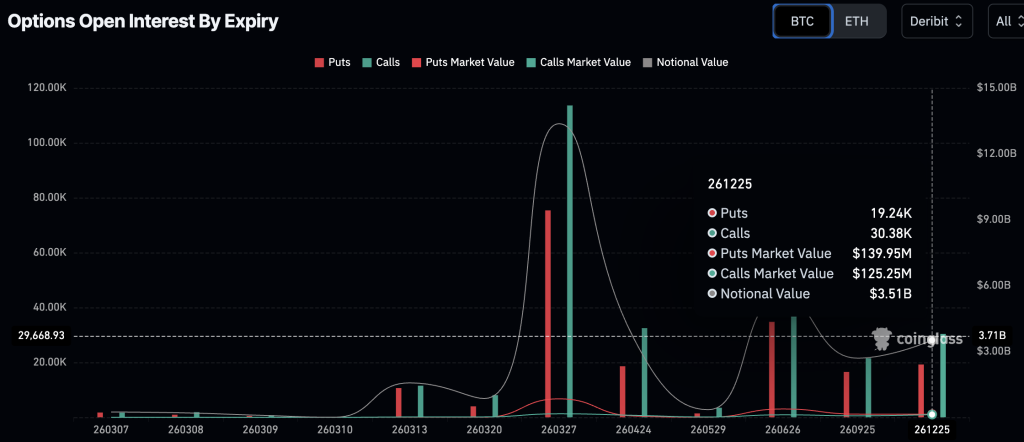

In crypto news today, the markets are bracing for a spike in Bitcoin volatility as approximately $2.6Bn in options contracts are set to expire across major exchanges. Bitcoin USD is currently holding firmly above the $70,000 threshold, but derivatives data indicate a potential gravitational pull downward toward the ‘max pain’ price of $69,000.

With 31,700 Bitcoin contracts and 184,000 Ethereum contracts rolling off the board, traders are watching closely to see if the 08:00 UTC settlement triggers a relief rally or a short-term correction.

The expiry comes as spot markets attempt to consolidate after adding +$150Bn to the total market cap earlier this week, as it reached $2.5 trillion once more.

Prices have been cooling off since Friday morning, and the divergence between the current spot price and the max pain levels suggests the next few hours could be choppy.

Bitcoin Options: $69,000 Max Pain Level — What It Means for BTC Price

The lion’s share of today’s expiry lies in Bitcoin, with a notional value of roughly $2.2Bn. Data from CoinGlass highlights a max pain point of $69,000, slightly below the current trading range. If prices gravitate toward this level before settlement, Bitcoin could see a sharp flush to punish over-leveraged longs.

The put/call ratio for this batch of contracts sits at 1.7, indicating a heavy dominance of bearish bets. A ratio significantly above 1.0 typically signals that traders are hedging against downside risk, with more expiring shorts (puts) than longs (calls) in the mix.

Open interest (OI) on Deribit remains highest at the $60,000 strike price, suggesting that while the immediate max pain is near $69,000, the broader market structure still has significant defensive positioning lower down.

If Bitcoin holds above $70,000 through the settlement window, the failure of these bearish puts to profit could force a rapid unwinding, potentially fueling a move toward $75,000.

Discover: The best crypto to diversify your portfolio with

Ethereum Options: $1,950 Max Pain: Volatility Risk for ETH USD

Ethereum faces its own settlement pressure today, with approximately 184,000 contracts expiring carrying a notional value of around $380M. Unlike Bitcoin’s bearish skew, Ethereum’s put/call ratio stands at 0.85, signaling a more balanced but slightly bullish sentiment among traders.

However, the max pain price for ETH is significantly lower at $1,950. With Ethereum trading well above this level, the risk of a “pinning” event, in which price is pulled down to maximize option writer profits, is less severe but not impossible.

Recent discussions around Ethereum’s roadmap have added fundamental noise to the price action, but today’s moves will likely be driven by these derivatives flows.

If ETH can maintain its distance from the $1,950 max pain point, it confirms strong spot demand, potentially setting the stage for a run at $2,200.

Analyst Views: Is a Relief Rally Coming, or is a Deeper Correction Next?

Market watchers are divided on whether this option’s expiry will mark a local top or a refueling station for the next leg up. Data from GreeksLive shows that selling call options has dominated trading over the last 48 hours.

“Despite ongoing price gains, momentum has slowed,” the firm noted, pointing out that Bitcoin is poised to challenge $75,000 only if it can shake off the expiry-induced drag.

A contrarian view suggests that the high put/call ratio on Bitcoin acts as a signal for a squeeze. When the crowd is heavy on puts, the market often moves the opposite way to punish the majority.

Market sentiment has suddenly flipped in recent days, and if spot buyers absorb the selling pressure at $69,000, the path of least resistance remains up.

Discover: The hottest meme coins in crypto

The post Crypto News Today: $2.6 Billion Options Expiry With Volatility Expected appeared first on Cryptonews.

Crypto World

Bitcoin Goes Mainstream: Morgan Stanley, TD Bank, and Citi Announce Major BTC Plans

TLDR:

- Morgan Stanley plans to offer Bitcoin trading, lending, yield, and custody services to clients in the near future.

- TD Bank shifts focus to Bitcoin products, stablecoins, and tokenized deposits following a major regulatory stance change.

- Citi aims to make Bitcoin bankable by adding BTC custody to its $30 trillion traditional asset management structure.

- Bitcoin for Corporations event revealed that legacy banks are actively building BTC products driven by regulatory clarity.

Bitcoin is entering the core product lines of three major global financial institutions. Morgan Stanley, TD Bank, and Citi each announced plans to offer Bitcoin-related services.

These statements were made at the Bitcoin for Corporations event held last week. The event brought together Bitcoin-native builders and executives from traditional banking.

Regulatory clarity and rising client demand appear to be driving this shift forward. Together, these three banks mark a turning point for Bitcoin in mainstream finance.

Morgan Stanley and TD Bank Outline Their Bitcoin Service Plans

Amy Oldenburg, Head of Digital Asset Strategy at Morgan Stanley, spoke directly at the event. She stated that “2025 was incredible for the bank’s digital assets journey.”

Morgan Stanley has confirmed future plans to offer Bitcoin trading, lending, yield, and custody. These services represent a clear expansion of the bank’s digital asset capabilities going forward. Oldenburg’s confirmation indicates the bank is building a full-spectrum Bitcoin product suite for clients.

Jeff Solomon, Special Advisor and Vice Chair at TD Bank, also addressed the gathering directly. He noted that “the regulatory stance on digital Assets has flipped from avoidance to adoption.”

This shift has opened new space for banks to build Bitcoin-based products confidently. TD Bank is now focused on delivering stablecoins, tokenized deposits, and Bitcoin products to customers. Solomon’s remarks reflect a growing confidence among legacy banks in digital asset integration.

Both banks reflect a clear trend taking shape across traditional financial institutions. Banks are no longer treating Bitcoin as a compliance risk to keep at arm’s length. Instead, they are building direct products that connect regulated clients to Bitcoin markets.

The changing regulatory environment has played a central role in accelerating these decisions. Client interest has further pushed institutions to move from observation into active product development.

Citi Plans to Bring Bitcoin Into Its $30 Trillion Asset Management Structure

Nisha Surendran, Head of Digital Asset Custody at Citi Investor Services, shared a focused message. Her central idea was direct and clear: “make Bitcoin bankable.”

Later this year, Citi plans to bring Bitcoin into its $30 trillion asset management structure. The bank will start with institutional custody and key management as its first practical steps. These services allow clients to hold Bitcoin securely within a fully regulated financial environment.

Citi’s scale sets this move apart from other institutional Bitcoin efforts in the market. The bank currently manages $30 trillion in traditional assets across its global client base. Bringing Bitcoin into that structure could expose it to a broad range of institutional investors.

Custody and key management lay the groundwork for deeper Bitcoin integration over time. They also build confidence for clients who want Bitcoin alongside their existing portfolio holdings.

The combined plans from Morgan Stanley, TD Bank, and Citi show Bitcoin’s growing place in traditional finance. Each bank is approaching digital assets from its own strategic angle.

Yet all three are moving toward offering Bitcoin-based products to institutional clients. This momentum shows that Bitcoin is no longer a fringe consideration for legacy banks. The coming months will reveal how quickly these commitments translate into actual client offerings.

Crypto World

John Daghita arrested in Saint Martin for alleged $46M crypto theft

A U.S. government contractor accused of stealing more than $46 million in crypto from the U.S. Marshals Service has been arrested in Saint Martin following a joint international law enforcement operation, according to the FBI.

Summary

- John Daghita was arrested in Saint Martin for allegedly stealing more than $46 million in cryptocurrency from the United States Marshals Service.

- The arrest followed a joint operation between the Federal Bureau of Investigation and France’s French Gendarmerie Nationale, including the elite Groupe d’intervention de la Gendarmerie nationale.

- Kash Patel said the case highlights continued international cooperation to track down suspects accused of defrauding U.S. government agencies.

John Daghita captured in a joint FBI operation

In a statement shared on social media, FBI Director Kash Patel confirmed that suspect John Daghita was apprehended overnight by the Federal Bureau of Investigation working alongside France’s elite law enforcement units.

The arrest took place on the Caribbean island of Saint Martin.

According to Patel, the operation was carried out by the French Gendarmerie Nationale, including its elite tactical force, the Groupe d’intervention de la Gendarmerie nationale, in coordination with the FBI.

Authorities allege that Daghita stole more than $46 million in cryptocurrency from the United States Marshals Service, a federal agency responsible for managing and securing seized assets, including digital currencies confiscated in criminal investigations. The agency has historically overseen large crypto holdings obtained through high-profile cases, with funds typically stored in government-controlled wallets until they are auctioned or otherwise disposed of.

Patel praised the international coordination involved in the arrest, highlighting assistance from the French Gendarmerie’s International Cooperation Team Serious Crime Unit in Saint Martin as well as tactical support from the Gendarmerie unit based in Guadeloupe.

“FBI will continue working 24/7 with our international partners to track down, apprehend, and bring to justice those who attempt to defraud American taxpayers—no matter where they try to hide,” Patel said.

Details about how the alleged theft occurred or when the funds were taken have not yet been publicly disclosed. Authorities have also not indicated whether the stolen crypto has been recovered.

Daghita is expected to face further legal proceedings as authorities coordinate next steps following his detention in Saint Martin.

Crypto World

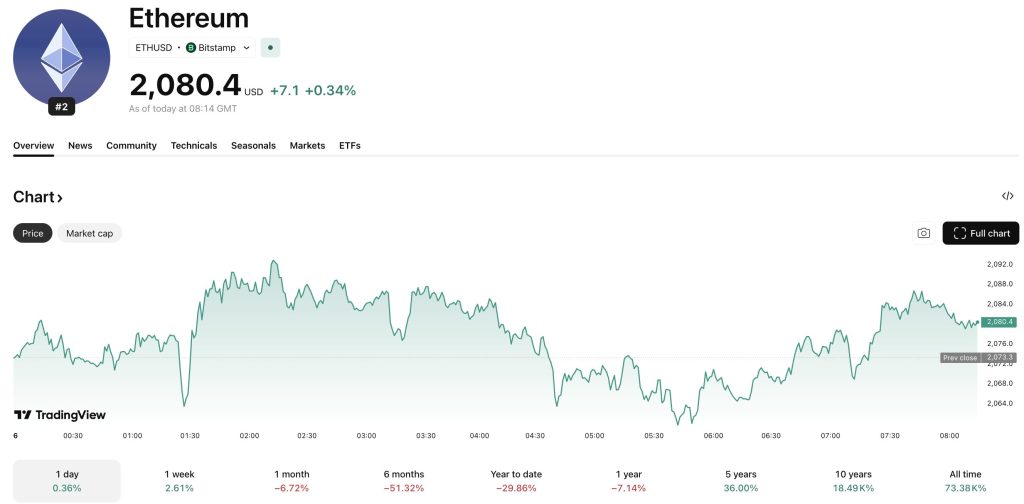

ETH USD: Is the Ethereum Breakout a Bull Trap?

The Ethereum price slammed into the critical $2,160 resistance level yesterday, and after attempting to reverse a historic six-month losing streak, ETH USD looks to have rejected and is now trading back under $2,100.

Price action is currently extremely volatile, with ETH falling -1.6% over the last 24 hours to trade near $2,080, leaving traders paralyzed between a potential breakout and a classic bull trap.

While bullish momentum is building on lower timeframes, many European trading desks are warning of a classic bull trap setup, a fakeout that lures buyers in before flushing the price to new lows.

With the asset sitting at a make-or-break pivot, this coming weekend could define the Ethereum trend for the remainder of Q1 2026.

Ethereum Price Analysis: What’s Next After $2,160 Rejection?

While the 12-hour timeframe is teasing a massive reversal pattern that has bulls salivating, Ethereum needs to hold above $2,000. A daily close above this level would confirm the inverse Head and Shoulders pattern, with the neckline sitting firmly at that crucial $2,160 level.

Adding to the bullish case is a clear divergence in the Relative Strength Index (RSI), which has been making higher lows while the price consolidated. This momentum shift suggests that sellers are finally becoming exhausted.

If buyers can defend the $2,000 zone and clear the $2,160 resistance level, the immediate path of least resistance flips to the upside, targeting the 200-day moving average.

However, the risk of a fakeout remains high. If ETH USD fails to clear this breakout and slips back below $2,000, the bullish structure would be invalidated.

In that scenario, the price would likely retest the $1,900 support zone. Traders watching the crypto price prediction today are acutely aware that volume must sustain this move, as a breakout on low volume is a prime candidate for a reversal.

Discover: The best crypto to diversify your portfolio with

On-Chain Data Shows Massive Accumulation for ETH USD: Is It Enough?

On-chain metrics reveal aggressive accumulation despite chart resistance. Data from Glassnode shows that long-term holders added 252,142 Ethereum to their holdings in February 2026.

This “averaging down” behavior indicates that investors see current prices as a buying opportunity, regardless of short-term volatility.

This accumulation trend coincides with updates on Ethereum’s long-term roadmap from Vitalik, boosting confidence among institutional investors.

The disparity between increasing holder balances and stagnant prices often signals a potential supply shock, assuming macro conditions don’t lead to liquidation.

Currently, support levels are holding, with the realized price for short-term holders aligning with market prices, suggesting that the capitulation phase may soon end.

Analysts Warn: Is This a Bull Trap?

Despite some market optimism, analysts are highlighting significant structural risks on the weekly timeframe.

Benjamin Cowen points out that Ethereum is trading below its weekly “bull market support band,” and the 50-week and 200-week moving averages are near a death cross.

This has raised concerns among seasoned traders that the current rally might be a “bull trap.” If resistance at $2,160 holds, analysts predict a potential drop to $1,320-$1,345, a level not seen since the last cycle’s early accumulation phases.

Additionally, a new Chinese AI, Kimi, forecasts volatile market conditions leading into 2026 before any sustained all-time highs can occur.

To counter this bearish outlook, bulls need a weekly close above $2,300 on ETH USD to regain structural support; without it, the macro trend remains bearish.

Discover: The hottest meme coins in crypto

The post ETH USD: Is the Ethereum Breakout a Bull Trap? appeared first on Cryptonews.

Crypto World

Dubai regulator issues alert over KuCoin-linked entities advertising crypto services

Dubai’s virtual assets regulator has issued a public warning about several companies linked to the crypto exchange KuCoin, alleging they may have been promoting or providing services to residents without the required authorization.

Summary

- Dubai’s VARA issued an alert naming Phoenixfin Pte Ltd, MEK Global Limited, Peken Global Limited, and KuCoin Exchange EU GmbH for allegedly advertising crypto services under the KuCoin brand without proper authorization.

- VARA said the entities must stop all unlicensed virtual asset activities in or from Dubai, noting they do not hold a license to offer regulated crypto services in the jurisdiction.

- The regulator cautioned that engaging with unlicensed platforms could expose users to financial and legal risks, urging investors to verify whether firms are listed on VARA’s official registry before using their services.

Dubai watchdog flags KuCoin-linked companies for unlicensed crypto activity

In a regulatory notice dated March 5, the Virtual Assets Regulatory Authority (VARA) named Phoenixfin Pte Ltd, MEK Global Limited, Peken Global Limited, and KuCoin Exchange EU GmbH, which it said are commercially advertising services under the KuCoin brand.

According to the regulator, the entities may have been offering virtual asset services to users in Dubai “without the necessary regulatory approvals” and may have misrepresented their licensing status in the jurisdiction.

As a result, VARA has instructed the companies to “cease and desist all unlicensed VA activities” in or from Dubai.

The authority emphasized that the exchange does not hold a license to provide virtual asset services in or from Dubai, meaning any such activities would be in breach of local regulations governing crypto service providers.

Under Dubai Law No. (4) of 2022 and Cabinet Resolution No. 111/2022, all virtual asset service providers must obtain regulatory approval from VARA before offering services in the emirate.

VARA also warned that interacting with unlicensed platforms could expose investors to “significant financial risks and potential legal consequences”, urging residents to verify whether companies are listed on the regulator’s public register before engaging with them.

The regulator further noted that any promotion, advertising, or solicitation related to KuCoin has not been approved, meaning the platform is not permitted to market or promote virtual asset products or services in Dubai.

Founded in 2017, KuCoin is a Seychelles-based cryptocurrency exchange that offers spot, derivatives and margin trading to users worldwide.

The alert is part of VARA’s broader effort to enforce its crypto regulatory framework and prevent unlicensed operators from targeting investors in the emirate.

Crypto World

Vancouver Mayor Ken Sim’s BTC reserves proposal blocked by city, provincial law

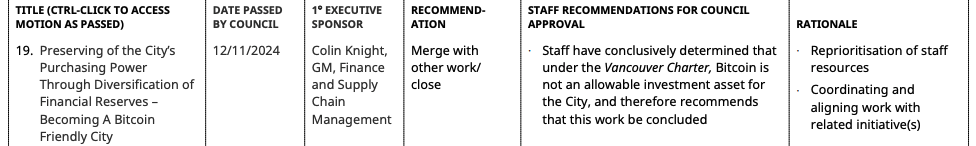

Vancouver Mayor Ken Sim’s plan to invest city reserves in bitcoin is not permitted under the Vancouver Charter and British Columbia’s Municipal Finance Authority Act, a staff report says.

The briefing released ahead of a March council meeting recommends closing a 2024 motion to make Vancouver a “bitcoin-friendly city,” after staff determined the plan violates municipal investment rules embedded in the city’s charger. Staff wrote they “conclusively determined that under the Vancouver Charter, bitcoin is not an allowable investment asset for the City.”

The conclusion reflects the highly restrictive framework governing how Canadian municipalities can invest public funds. Section 201 of the Vancouver Charter allows the city to invest idle funds only in a narrow set of instruments, such as federal or provincial government securities, government-guaranteed bonds, municipal debt, bank-guaranteed investments, credit union deposits and certain pooled investment vehicles.

British Columbia’s Municipal Finance Authority Act reinforces the restriction.

Municipal investment pools are limited to conservative assets such as government bonds, municipal securities, bank deposits and highly rated commercial paper.

The law defines eligible securities as bonds, debentures, deposit certificates and promissory notes, reflecting a framework built around fixed income and cash equivalents. Stocks, commodities and cryptocurrencies are not included.

A narrower question remains unresolved: whether Vancouver could still pursue the softer branding goal embedded in the motion by accepting bitcoin for taxes or fees, provided the cryptocurrency is immediately converted into Canadian dollars.

While the charter regulates how city funds are invested, it does not necessarily govern how payments are processed.

Crypto World

Major whales scoop up 4.18B XRP since the 10/10 market crash

Large XRP holders have significantly increased their positions in recent months, accumulating billions of tokens following the sharp market downturn that began around October 10.

Summary

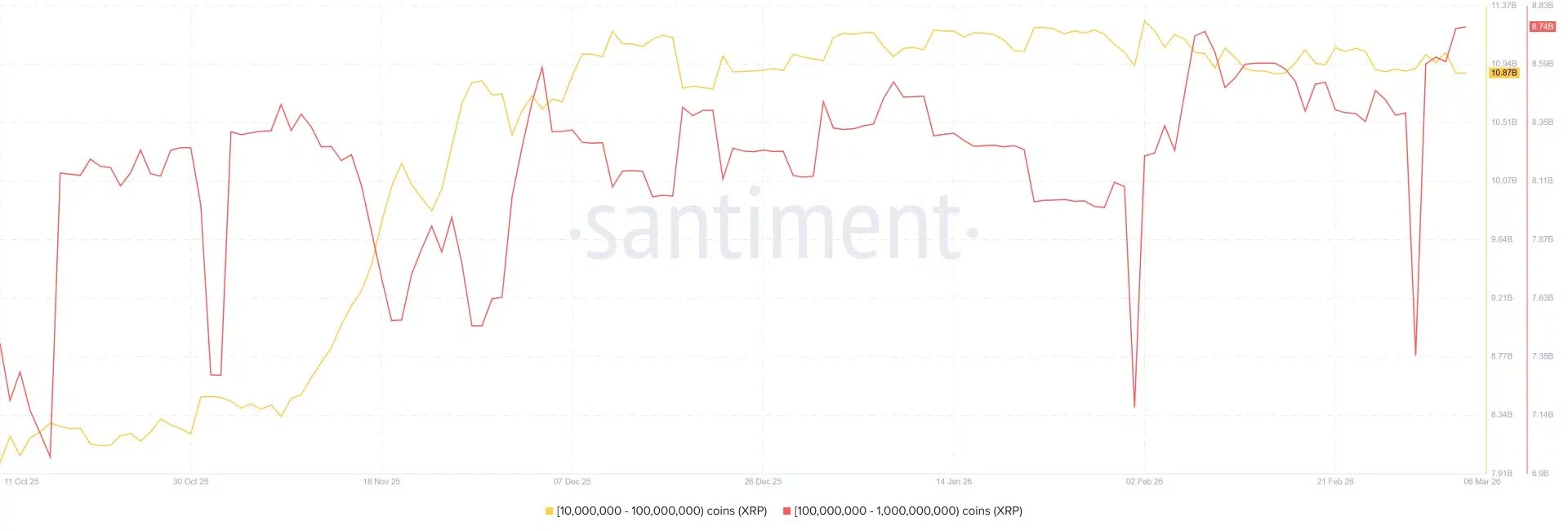

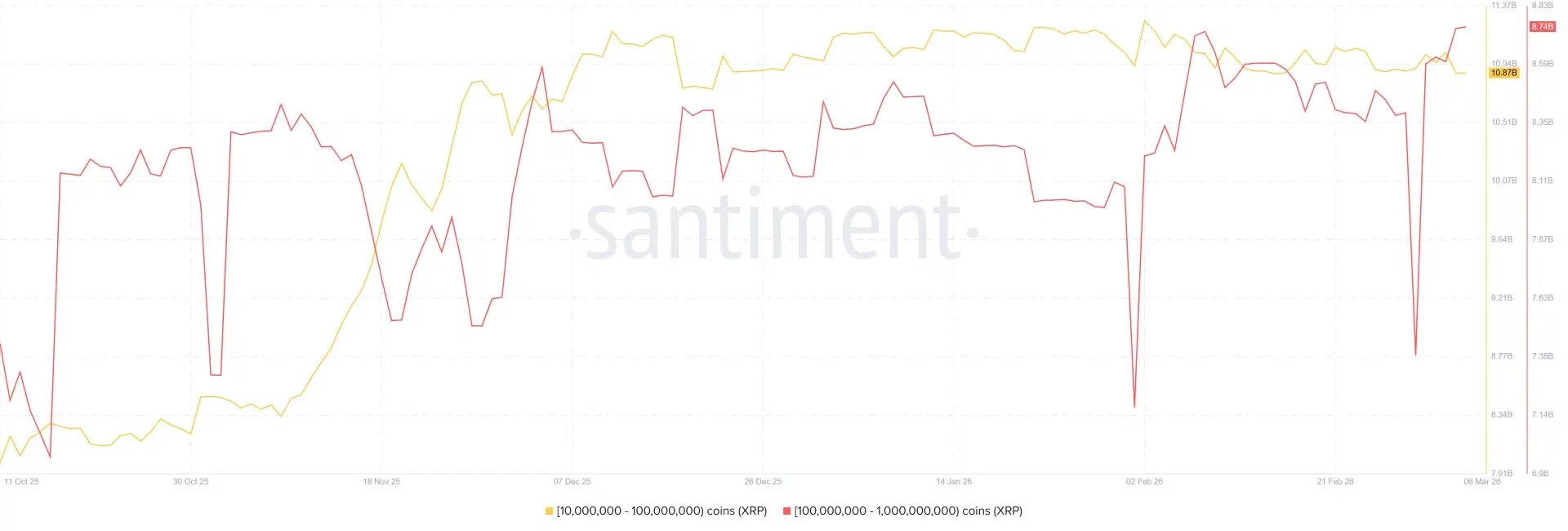

- Large XRP holders accumulated 4.18 billion tokens following the Oct. 10 market crash, according to Santiment data.

- Wallets holding 10M–100M XRP now control roughly 10.87B tokens, signaling sustained whale accumulation.

- XRP is currently consolidating near $1.40, with key support at $1.35 and resistance around $1.50–$1.60.

The broader crypto market experienced a notable correction during that period, with several major assets retracing after a strong rally earlier in the year. The Ripple token (XRP) was among the tokens affected, sliding from above the $2.30 region and entering a prolonged downtrend that lasted through early 2026.

However, the sell-off appears to have created an accumulation opportunity for large investors.

Data from Santiment shows that wallets holding between 10 million and 100 million XRP have steadily increased their balances since the October crash. These addresses collectively added roughly 4.18 billion XRP over the period, pushing their combined holdings to about 10.87 billion XRP.

Meanwhile, the largest whale cohort, wallets holding 100 million to 1 billion XRP, have also maintained elevated holdings, with balances recently climbing toward 8.74 billion XRP.

The sustained rise in these wallet balances suggests that major investors have been quietly accumulating during the market pullback rather than exiting positions, a pattern that historically precedes stronger market moves once broader sentiment improves.

XRP price analysis

At press time, XRP is trading near $1.40, stabilizing after weeks of sideways price action following the earlier decline from the $2.20 region.

The daily chart shows XRP forming a consolidation range between roughly $1.35 and $1.50, indicating a potential base-building phase as volatility continues to compress.

Momentum indicators remain neutral. The Relative Strength Index (RSI) is hovering around 45, suggesting that the asset is neither oversold nor overbought. This typically reflects a market waiting for a stronger directional catalyst.

Meanwhile, the Chaikin Money Flow (CMF) indicator is slightly negative near -0.11, indicating mild capital outflows despite the ongoing whale accumulation.

Key technical levels to watch include support around $1.35, which has held multiple times in recent weeks. A breakdown below this level could open the door toward $1.20.

On the upside, resistance sits near $1.50, with a stronger barrier around $1.60. A decisive breakout above this zone could signal renewed bullish momentum if whale accumulation continues.

Crypto World

Vancouver Staff Say Bitcoin Cannot Be Held in City Reserves

Vancouver city staff said Bitcoin cannot be held in municipal reserves and recommended that the city council drop a proposal to create a Bitcoin reserve.

City staff, led by Colin Knight, general manager of the Finance and Supply Chain Management department, “conclusively determined” that Bitcoin (BTC) is not an “allowable investment” for the city under the Vancouver Charter, according to a motions update report dated March 2.

Staff recommended merging the motion with other related initiatives to reprioritize resources, with a final decision pending a council vote at a meeting on March 10.

The proposal to create a Vancouver Bitcoin reserve was originally introduced in late 2024 by Mayor Ken Sim as part of a motion titled “Preserving the City’s Purchasing Power Through Diversification of Financial Reserves — Becoming a Bitcoin-Friendly City.”

The council passed the motion with six votes in favor and two opposed. However, the latest developments could stall the proposal entirely.

Bitcoin’s inflation hedge argument fades amid bear market

Introducing the proposal in 2024, Mayor Sim said the motion was partly aimed at helping the city hedge against inflation using Bitcoin, which has often been described as “digital gold” because of its fixed supply capped at 21 million coins.

“As an open, decentralized, and secure digital asset, Bitcoin has been recognized by many financial experts and analysts as a potential hedge against inflation and currency debasement,” the motion reads.

Related: Bitcoin is forming a bottom as the 4-year cycle ends: VanEck CEO

The argument that Bitcoin acts as an inflation hedge has weakened recently as the cryptocurrency’s price declined sharply. Bitcoin has fallen about 50% from its October 2025 peak of above $126,000, returning to late-2024 levels and briefly touching lows near $60,000.

Despite skepticism from some analysts who argue Bitcoin does not behave like digital gold, macroeconomists such as Lyn Alden remain bullish on the digital asset relative to gold in the near term.

“If I had to bet Bitcoin versus gold over the next two to three years, I would bet Bitcoin,” Alden said on the New Era Finance podcast on Wednesday.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports15 hours ago

Sports15 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

Keep an eye on price action

Keep an eye on price action

(@TradeX636)

(@TradeX636)