Crypto World

Strategy Posts $12.4B Loss as Bitcoin Falls Below Cost Basis

Michael Saylor’s Strategy reported a $12.4 billion net loss for the fourth quarter, driven largely by mark-to-market declines in its massive Bitcoin holdings. The loss coincided with Bitcoin briefly slipping below $60,000, pushing the firm’s stash beneath its cumulative cost basis for the first time since 2023 and wiping out gains made after last year’s U.S. election rally.

For years, Strategy transformed itself from an enterprise software company into a leveraged Bitcoin proxy, exploiting a persistent premium in its stock price to raise capital and buy more BTC. That strategy is now faltering. The treasury company announced no new equity issuance or debt financing alongside earnings, signalling tightening access to capital as investor appetite cools.

While Saylor has insisted there are no margin calls and said the firm holds $2.25 billion in cash, enough to cover interest obligations for more than two years, pressure is mounting as Bitcoin continues to trade well below Strategy’s reported average acquisition price of $76,052. The company also reiterated that it does not expect to generate profits in the foreseeable future.

Strategy Holds 713,502 BTC Worth $46 Billion

Strategy currently holds more than 713,000 Bitcoin, valued at roughly $46 billion, per Bloomberg data. Although the firm added $75.3 million worth of BTC in late January, analysts say the broader model is under strain. Benchmark analyst Mark Palmer told Bloomberg that investors are now focused on whether Strategy can still raise capital to fund additional Bitcoin purchases under worsening market conditions.

Critics have grown louder. As reported earlier Michael Burry recently warned that continued declines in Bitcoin could trigger cascading losses for corporate holders, reviving concerns long raised by short sellers about Strategy’s reliance on leverage and non-yielding assets. Strategy’s shares are now down nearly 80% from their November 2024 peak, underscoring how quickly sentiment has turned.

BitMine Faces $8.2B Unrealized ETH Loss as Ether Slides Below $2,000

BitMine Immersion Technologies is also sitting on roughly $8.2 billion in unrealized losses after Ethereum’s price fell to around $1,930, well below the firm’s average purchase price of $3,826 per token. The company holds about 4.29 million ETH, acquired for roughly $16.4 billion, and has seen the value of those holdings shrink following a nearly 30% decline since early January.

Despite the drawdown, BitMine has staked more than 2.9 million ETH, generating about $188 million in annual yield, holds $538 million in cash with no debt, and says it views the sell-off as a buying opportunity, even as its shares have plunged 88% from their July peak, echoing losses seen at Michael Saylor’s Strategy.

The post Strategy Posts $12.4B Loss as Bitcoin Falls Below Cost Basis appeared first on Cryptonews.

Crypto World

U.S. lost 92,000 jobs in February, unemployment rate rose to 4.2%

The U.S. job market weakened appreciably in February, possibly putting back in play the chance of Federal Reserve rate cuts in the first half of 2026.

The country loss 92,000 jobs last month, according to Friday’s report from the Bureau of Labor Statistics. Economists had forecast an addition of 59,000 new jobs, compared with January’s gain of 126,000.

The unemployment rate rose to 4.4% versus economist expectations of 4.3%, and January’s reading of 4.3%.

Under pressure overnight ahead of the report and trading down to $70,000 as oil soared higher and equity markets dipped, bitcoin remained right around that mark in the minutes following the data.

U.S. stock index futures continue lower, with the Nasdaq down 1% and S&P 500 off 0.8%. The 10-year Treasury yield has fallen four basis points to 4.11%. Precious metals reversed an early decline, with gold now higher by 1% and silver by 2%. WTI crude oil is up 6.2% to $86 per barrel.

Ahead of this morning’s report, markets were pricing in a 95% probability that the Federal Reserve would hold rates steady at the March 18 meeting and an 85% chance of no rate cut in April.

Meanwhile, rising oil prices linked to tensions in the Middle East could add upward pressure to inflation expectations. If sustained, higher energy prices may feed into broader inflation, particularly through energy and food costs. Combined with signs that the U.S. economy may be re-accelerating, this could prompt markets to reassess the path of monetary policy.

Crypto World

BofA Upgrades Ford (F), Tesla (TSLA), and GM (GM) Stock: What Investors Need to Know

Quick Summary

- BofA reinstated coverage with “buy” ratings for Ford, GM, and Tesla on March 4, 2026

- Price targets set at $17 for Ford (34% potential gain), $105 for GM (14% upside), and $460 for Tesla (14% upside)

- Both Ford and GM expected to capitalize on pivot away from EVs toward profitable trucks and SUVs

- Tesla’s buy rating driven primarily by robotaxi business, which BofA values at approximately 52% of total company worth

- Electric vehicle sales projected to decline over 20% in 2026 amid reduced incentives and slower manufacturer deployment

On March 4, 2026, Bank of America resumed its analysis of North American automobile manufacturers, designating Ford, General Motors, and Tesla as premier investment opportunities for the coming year.

According to analyst Alexander Perry, the automotive sector stands poised to exceed market projections in 2026. Perry cited evolving regulatory frameworks and renewed emphasis on traditional combustion engines as primary catalysts.

Ford earned a “buy” designation alongside a $17 price objective. This represents a potential 34% appreciation from the stock’s opening value on March 4.

According to Bank of America’s assessment, Ford stands in an advantageous position to capitalize on emerging U.S. regulatory shifts. The financial institution anticipates Ford will intensify its concentration on truck and SUV production, segments that deliver superior profitability compared to electric vehicle offerings.

Ford commands more than 30% of the pickup truck segment, with its F-Series maintaining its position as America’s best-selling vehicle nameplate. The automaker expanded its domestic market penetration by 50 basis points throughout 2025.

General Motors similarly earned a “buy” recommendation, accompanied by a $105 price objective — representing 14% appreciation potential from March 4 levels. GM maintains the leading position among U.S. automakers with 17.1% market share.

Electric Vehicle Momentum Slows

Bank of America indicates that both Ford and GM stand to gain as the automotive industry retreats from ambitious electrification goals. Substantial EV investments and stringent emissions regulations had compressed profitability margins over recent years.

The investment firm calculates variable profit margins for trucks and SUVs at $17,500 per unit, substantially exceeding the corporate average range of $10,000 to $12,000.

BofA projects electric vehicle sales will contract by more than 20% throughout 2026 as government subsidies diminish and manufacturers decelerate their EV deployment strategies.

Perry observed that multiple manufacturers are postponing or abandoning lower-margin electric vehicle initiatives while prolonging their internal combustion engine production timelines.

Bank of America additionally highlighted that the elimination of CAFE penalty structures and greenhouse gas emission relief measures are empowering automakers to optimize their product portfolios toward higher-margin vehicle categories.

Tesla’s Autonomous Vehicle Strategy

Tesla secured a “buy” rating with a $460 price objective, likewise representing 14% upside potential from March 4 values. BofA’s investment thesis for Tesla centers predominantly on its self-driving vehicle operations.

The firm anticipates rapid expansion of Tesla’s robotaxi network. Tesla’s autonomous taxi services currently function in San Francisco and Austin, with deployments planned for seven additional metropolitan areas during the first half of 2026.

BofA calculates that the robotaxi division comprises approximately 52% of Tesla’s overall enterprise value. While competing platforms employ comprehensive sensor arrays combining cameras, radar, and lidar technology, Tesla utilizes an exclusively camera-based system that the firm characterizes as more cost-effective and readily scalable.

Perry also identified favorable macroeconomic conditions supporting the broader automotive industry. The average age of vehicles on American roads has reached 12.8 years, while vehicle miles traveled have achieved record levels — dynamics that BofA suggests may initiate a significant vehicle replacement wave.

Crypto World

Palantir Technologies (PLTR) Shares Show Strong Growth at the Beginning of March

Shares of Palantir Technologies (PLTR), a company specialising in big data analytics software, have become one of the stock market’s standout performers at the start of this spring.

While the closing price on the last trading day of February was around $137, during yesterday’s session the stock climbed to $155.

Why Is PLTR Rising?

The stock’s strong performance is driven by a combination of fundamental factors, including:

→ Competitors’ problems at the Pentagon: News about temporary restrictions placed on the AI start-up Anthropic in its work with US government agencies has strengthened Palantir’s position as a reliable partner.

→ Use in the Middle East conflict: Analysts at Baird highlighted this week the ability of Palantir’s systems to operate in real time and deliver predictive analytics on the battlefield.

→ Higher price targets: Several agencies (including Zacks and Trefis) have raised their forecasts for PLTR shares amid expectations that revenue growth could reach around 78% by the end of the year.

In addition, technical factors are also playing a role.

Technical Analysis of the Palantir Technologies (PLTR) Share Price

In November 2025, we noted that the chart had taken on a bearish tone and that the $190–200 zone could act as resistance. Indeed, in December PLTR shares made a bearish reversal from that area and fell to around $130 in less than two months, breaking support near $166 (which later turned into resistance).

New data now makes it possible to outline a broader ascending channel. In this context, the price formed a bullish inverted head-and-shoulders pattern (H&S) near the lower boundary in February.

The bullish gap around the $139 level appears to represent a breakout above the neckline of the pattern, while the surge in trading volume highlights the strength of demand.

Considering that the stock has risen by more than 10% over the past week, it may now be regarded as technically overbought, making a short-term pullback a reasonable expectation.

From a broader perspective, however, the bulls’ attempt to resume the long-term upward trend in PLTR shares may ultimately prove successful.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

BTC, ETH at a Crossroads After Reclaiming Key Levels, ADA Whales on the Move: Bits Recap March 6th

Here’s everything most interesting surrounding BTC, ETH, and ADA.

The past few days have been quite positive for Bitcoin (BTC) and Ethereum (ETH), whose prices soared to a one-month peak.

Cardano’s ADA also headed north, but the bears intercepted the move, and the asset is now deep in red territory on a weekly scale. The correction aligns with recent whale behavior, suggesting they may be scaling back their exposure to the token.

BTC’s Performance

Nearly a week ago, the US and Israeli forces attacked Iran, thus marking the start of a new major military conflict that stunned the world and sent shockwaves through the financial and crypto markets. BTC reacted with an immediate plunge below $64,000, but just hours later, it rebounded above $67,000 following reports that the supreme leader of the Asian country, Ali Khamenei, had been killed.

The primary cryptocurrency continued its uptrend, reaching a monthly high of nearly $74,000 on March 4. Some of the potential catalysts behind the rally could be the initial indications that Iran is willing to discuss terms for ending the war, as well as the growing interest in the asset from large investors.

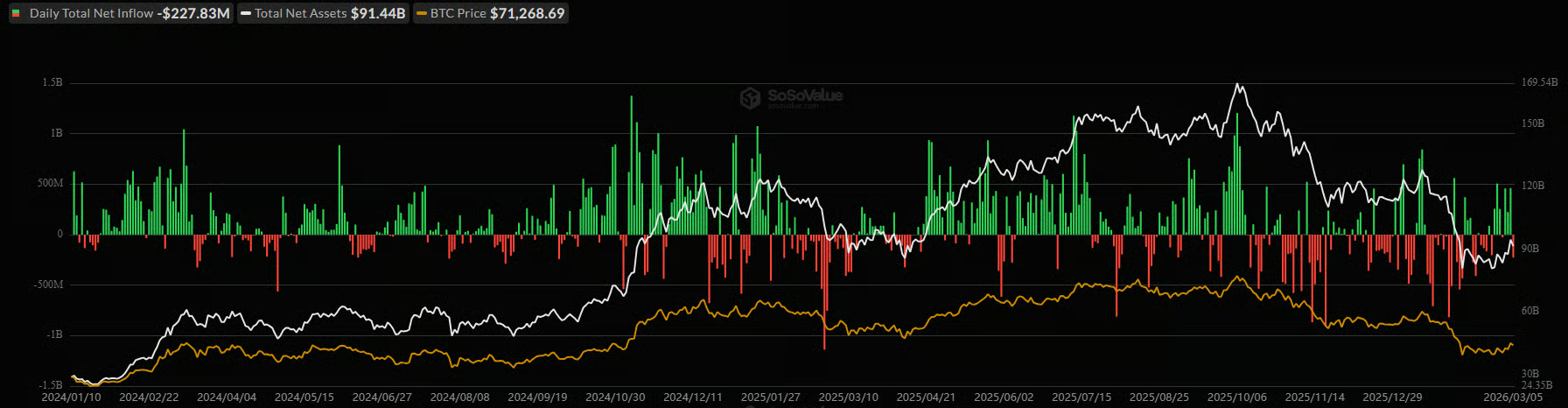

Data from SoSoValue show that inflows into spot BTC ETFs have been substantial over the past several days. The trend indicates that big investors, such as hedge funds and pension funds, have been increasing their exposure to the asset through these funds, whose issuers must buy real Bitcoin to back these purchases.

Some analysts, such as Ali Martinez, believe BTC could post much more significant gains in the short term. Earlier this week, he underlined the importance of reclaiming the $70,685 resistance level, adding that the $72,000-$81,000 zone has very little supply and describing it as “open air in that range.”

“The next major supply clusters appear around $83,307 and $84,569, which could act as the significant resistance zones,” he claimed.

Others were not so bullish. X user Ted reminded that shortly after Russia’s invasion of Ukraine in 2022, BTC showed a similar upside move before undergoing a severe correction, suggesting history could repeat itself.

You may also like:

How’s ETH Doing?

The second-largest cryptocurrency followed BTC’s footsteps, posting a painful decline below $1,900 but later rising to almost $2,200. As of this moment, it trades at around $2,060, representing a 4% increase on a seven-day scale.

Earlier this week, Ali Martinez assumed that a sustained close above $2,147 could set the stage for a further ascent to $2,335 or even $2,542. On-chain indicators such as the plummeting supply of ETH stored on exchanges support the bullish case.

Recently, the balance plunged to 15.93 million tokens, the lowest point since the summer of 2016. This means that investors continue to abandon centralized trading venues and move their holdings to self-custody, thereby reducing immediate selling pressure.

On the other hand, analysts like X user Emirhan suggested that a break below the key $2,109 level could open the door to a drop to under $1,900. The price did indeed slip beneath that mark, and we have yet to see whether an additional decline will come next.

The ADA Whales

Cardano’s native token tried to reclaim $0.30 but failed, and it is now worth around $0.26 (per CoinGecko’s data), representing a 7% decrease over the last week.

According to Martinez, the big investors have “redistributed” 230 million tokens in the span of just seven days. His graph displays a reduction in their total holdings, which can be interpreted as a major sell-off that could impact the price for several reasons.

This development increases the amount of ADA circulating on the open market, and without a corresponding rise in demand, the additional supply could suppress the valuation. Additionally, whale distribution signals fading confidence that may unsettle smaller players and prompt them to cash out as well.

It is important to note that the big investors had a much different strategy in recent months, accumulating roughly 820 million ADA between August 2025 and February this year.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Kazakhstan central bank to invest up to $350 million in crypto and digital asset markets

Kazakhstan’s central bank revealed plans to allocate up to $350 million from its gold and foreign exchange reserves to investments linked to cryptocurrencies and digital assets.

The bank’s governor, Timur Suleimanov, said the institution is developing a list of acceptable investments, which will extend beyond direct cryptocurrency holdings, according to a Reuters report on Friday.

The country became a major bitcoin mining hub after China’s 2021 mining ban pushed operators abroad. In 2025, Astana-based Fonte Capital introduced central Asia’s first spot bitcoin ETF (BETF), offering regulated, physically backed exposure to bitcoin.

The investment strategy is expected to include shares of high-tech companies connected to digital assets, cryptocurrency infrastructure firms and index funds whose performance tracks crypto markets.

Deputy central bank chair Aliya Moldabekova said the investments would be made in April and May, emphasizing that authorities are taking a measured approach.

“We are not talking about any large investment in cryptocurrencies,” Moldabekova said, according to Reuters. “We are currently selecting companies that deal with digital assets, for example those involved in cryptocurrency infrastructure.”

The allocation represents only a small share of the country’s overall reserves. As of Feb. 1, the central bank held $69.4 billion in gold and foreign exchange reserves, while the country’s national fund, which accumulates oil revenues, held $65.23 billion in assets, according to the central bank data.

Crypto World

Bitcoin Price and Stocks Stabilize as Bond Market Signals Ongoing Macro Risk

Bitcoin (BTC) and global equity markets have stabilized above key psychological price levels, shaking off an early-week sell-off triggered by geopolitical tensions in the Middle East.

While Bitcoin is trading firmly above $70,000 and the S&P 500 has recovered lost ground, the bond market is signaling that the coast is far from clear.

Yields on U.S. Treasuries have surged for four consecutive days, warning traders that the combination of energy shocks and sticky inflation could keep the Federal Reserve hawkish for longer.

Discover: The best new crypto around!

Bitcoin and Stocks: Reading the Risk-On Signal in the Price Charts

The price of Bitcoin is around $70,500 as of Friday, marking a resilient 6% rebound for the week. The leading cryptocurrency briefly touched $73,470 on Wednesday, recovering sharply from a slide to near $63,000 over the weekend. That initial drop was driven by a spike in oil prices following reports of blocked transit in the Strait of Hormuz, a move that rattled risk assets globally.

The recovery has been mirrored in the equity markets. S&P 500 futures bounced from a multi-week low of 6,718 to reclaim the 6,840 level, stabilizing after the U.S. pledged naval escorts to secure energy transport routes.

This synchronized price action highlights a rising correlation between crypto and traditional equities. Bitcoin briefly reclaimed $73k despite war chaos, yet its tight coupling with the S&P 500 suggests it remains vulnerable to broad macro sentiment rather than acting as a detached safe haven.

If Bitcoin can maintain support above $72,000, it builds a base to challenge the $74,000 local high. However, if the correlation with equities holds and stocks roll over, the $65,000 level becomes the critical invalidation point for this relief rally.

Bond Yields Flash Warning: Why Traders Can’t Ignore the Macro Noise

While equity traders are buying the dip, bond traders are pricing in risk. The yield on the 10-year U.S. Treasury note has climbed from 3.93% to 4.15% in just four days. Bond prices move inversely to yields, and this sharp move suggests capital is demanding a higher premium for inflation risk.

The two-year yield, which is highly sensitive to Fed policy expectations, has jumped to nearly 3.60%. This repricing directly impacts risk appetite; higher yields typically drain liquidity from speculative assets like crypto by offering a more attractive risk-free return.

Fed rate cut hints had previously sent BTC flying past $72k, but the bond market is now effectively taking those chips off the table.

Data from CME Fed funds futures confirms the shift in sentiment. Investors now see less than a 50% chance of two rate cuts this year, a steep drop from the nearly 80% probability priced in before the conflict began.

If the 10-year yield breaks above 4.20%, it could exert heavy downward pressure on Bitcoin’s price. If yields stabilize or retreat below 4.00%, it would likely greenlight the next leg up for risk assets.

While some point to recent surges in altcoin ETFs as evidence of persistent institutional appetite, cautious analysts note that oil shock impacts are often delayed. If energy prices bleed into broader inflation data, the Federal Reserve may have to hold rates high, capping the upside for Bitcoin and stocks alike.

The Levels That Change Everything: What Traders Are Watching

Traders are focusing on three critical levels to determine the market’s next direction:

First, watch Bitcoin at $74,000. This is the immediate resistance cap; a daily close above this level would signal that the market has fully absorbed the geopolitical shock.

Second, monitor the 10-Year Treasury Yield at 4.2%. This is the danger zone for risk assets. If yields push through this level, expect algorithmic selling to hit both the S&P 500 and Bitcoin.

Finally, the invalidation level sits around $63,000. If the current stabilization fails, a break below this support would suggest the downtrend is resuming.

Discover: The best pre-launch crypto sales!

The post Bitcoin Price and Stocks Stabilize as Bond Market Signals Ongoing Macro Risk appeared first on Cryptonews.

Crypto World

Costco (COST) Stock Falls Pre-Market Despite Strong Q2 Earnings Performance

Quick Summary

- Quarterly earnings per share reached $4.58, surpassing analyst expectations of $4.55; total revenue of $69.6 billion exceeded the $69.3 billion forecast

- Comparable sales across stores increased 7.4%, while digitally-driven comparable sales jumped 22.6%

- Net income increased nearly 14% compared to the prior year, reaching $2.035 billion

- Revenue from membership fees expanded 13.6% to $1.355 billion; paid membership base grew to 82.1 million

- COST shares gained 14% year-to-date but declined 0.2% during premarket hours following the earnings release

Costco reported strong fiscal second-quarter 2026 results that exceeded Wall Street’s projections on most important performance indicators. The warehouse retailer’s net income advanced nearly 14% from the same period last year to $2.035 billion, translating to $4.58 per diluted share and beating the consensus forecast of $4.55.

Total revenue reached $69.6 billion, modestly surpassing the anticipated $69.3 billion. Comparable sales across the company’s warehouse locations increased 7.4% overall, or 6.7% when adjusted for gasoline price fluctuations and currency exchange impacts.

This marks an acceleration from the prior quarter ending in December, when adjusted comparable sales grew 6.4%. Sequential monthly trends also demonstrated strengthening momentum — comparable sales climbed 7% in December, 7.1% in January, and accelerated to 7.9% in February.

Costco Wholesale Corporation, COST

The company’s digital operations delivered particularly impressive results. Comparable sales through digital channels surged 22.6%, supported by a 32% increase in website visitors and a 45% jump in mobile app traffic throughout the quarter. Personalized product recommendation features alone generated more than $470 million in online revenue.

COST stock traded 0.2% lower in premarket activity on Friday following the earnings announcement, although shares remain 14% higher year-to-date — positioned to fully recover the losses experienced during the previous year.

Membership Revenue and Profitability Remain Strong

Income from membership fees increased 13.6% year-over-year to $1.355 billion. Approximately one-third of this growth stemmed from the membership fee adjustment implemented in September 2024 across U.S. and Canadian locations. When excluding the fee increase and foreign exchange impacts, membership income still expanded 7.5%.

The total paid membership count reached 82.1 million, representing a 4.8% increase from the prior year. Executive-level memberships climbed to 40.4 million, up 9.5%. The global renewal rate remained stable at 89.7%, unchanged from the previous quarter.

Renewal rates in the U.S. and Canada decreased 10 basis points sequentially to 92.1%, which management attributed to online membership enrollments — which historically renew at marginally lower rates compared to in-warehouse signups.

Gross profit margin expanded to 11.02% from 10.85% in the year-ago period. Core-on-core margins improved by 22 basis points, with improvements spanning food, non-food, and fresh merchandise categories. Selling, general, and administrative expenses rose modestly to 9.19% of sales from 9.06% last year, partially driven by increased general liability reserves.

Tariff Environment, Store Growth, and Forward Outlook

CEO Ron Vachris described the tariff landscape as “extremely fluid.” Recently eliminated IEEPA tariffs have been substituted with new global tariffs scheduled to remain in place for at least 150 days. Costco filed legal action in the Court of International Trade to preserve its ability to claim refunds if those tariffs were invalidated — which occurred in February.

Vachris noted the retailer did not transfer complete tariff costs to members in numerous instances. Should refunds materialize, the company intends to pass that value back through reduced prices and enhanced promotional offers. The company has already reduced prices on eggs, cheese, coffee, select paper goods, and certain tariff-impacted merchandise including textiles and cookware.

The retailer operated 924 warehouses globally at quarter-end. Management projects 28 net new location openings in fiscal 2026 and aims to sustain 30-plus new openings annually moving forward. Capital expenditures for the full year are estimated at approximately $6.5 billion.

February net sales totaled $21.69 billion, increasing 9.5% year-over-year. Total comparable sales rose 7.9% for the month (7.0% adjusted). Digital-enabled sales climbed 21.8%.

No special dividend was declared. The board indicated it would continue evaluating the possibility, but stated there were no announcements to make at this time.

Crypto World

$74K Bitcoin Local Peak? Traders Divided on Bear Market Continuation

Bitcoin (BTC) traded 4.5% below the $74,000 high reached on Thursday, with traders conflicted over whether this level may have marked the local top for BTC price.

Key takeaways:

-

Bitcoin charts still show similarities to the 2022 bear cycle, suggesting another leg down below $60,000 is possible.

-

Others say the bottom is in and expect a breakout rally to $75,000–$80,000 to be next.

Is the 2022 BTC price cycle repeating?

BTC’s current technical structure, following the latest recovery from $60,000, shows similarities with the middle of past bear cycles.

Bitcoin’s latest rise to $74,000 came 149 days after its bull market peak of $126,000 in October 2025.

Related: Bitcoin ‘anomalous’ outflow sees 32K BTC leave exchanges in a single day

“$BTC made a local high around 140–150 days after its all-time high in the previous two cycles before pushing lower,” said analyst Bitcoin Hyper in an X post on Thursday.

Echoing this view, pseudonymous trader Bitcoin Isaiah called the rally to $74,000 a “perfect local top indicator,” pointing to premature celebrations by the bulls as a signal for further dumping.

The analyst referred to the 2022 cycle, when similar euphoria preceded a 68% crash from $48,200 to $15,500, suggesting that history could repeat with a revisit to sub-$60,000 levels.

Master of Crypto said that the brief pump above $70,000 was a liquidity trap, wiping out both shorts and longs before targeting lower zones between $62,000-$65,000 where more ask-orders are located, adding:

“The price usually goes where the bigger money sits.”

As Cointelegraph reported, signs of a pullback emerged this week after the rally to $74,000, namely a classic bearish chart pattern and major overhead resistance.

Is Bitcoin’s relief rally over?

The bulls, however, argue that $60,000 was the likely market bottom, marking a structural shift.

For example, crypto analyst Bitcoin Munger said the 2022 Bitcoin bear fractal was not a “reason to be bearish” because this cycle is different.

An accompanying chart showed that while the 2022 drawdown saw the price “cut through” the 200-week exponential moving average (EMA), the current only retested the trend line and bounced.

Meanwhile, analyst Mister Crypto says the BTC/USD pair is breaking out of an ascending triangle with the expectation of a “strong move to the upside,” if the upper trend line at $70,000 holds as support.

Other differences from the 2022 cycle include strong institutional ETF inflows and tightening supply, which may help Bitcoin avoid another crash and set it up for a rally to $75,000-$80,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

USD/CHF Exchange Rate Rebounds from Multi-Year Low

The resilience of the Swiss economy and inflation remaining below 1% have made the Swiss franc an attractive safe-haven asset amid an extremely tense geopolitical backdrop and elevated gold prices. As the USD/CHF chart shows, the US dollar fell against the Swiss franc below 0.7650 in February — the lowest level since summer 2011.

However, the pair has since begun forming higher lows, suggesting that strong support is emerging in this area. The outbreak of intensified military activity in the Middle East this week has led to a rise in the USD, with the dollar also strengthening against the franc. Market participants may be starting to view the Swiss currency as an overvalued safe-haven asset.

Notably:

→ This week could mark the second-largest weekly gain since the beginning of 2025.

→ The Swiss National Bank (SNB) has already hinted at the possibility of currency interventions due to the “excessive strength of the franc”.

Technical Analysis of the USD/CHF Chart

From a bearish perspective:

→ The 0.7870 level, which acted as support throughout 2025 (before being broken), has predictably served as resistance this week.

→ The rebound from the February low may be interpreted as a bearish flag pattern within the broader long-term downtrend, suggesting the potential continuation of that trend.

From a bullish perspective:

→ Buying pressure has clearly broken through local resistance (the red trend line), meaning the 0.7760 level may now act as support.

→ Price movements are forming the outlines of an ascending channel.

Given that USD/CHF is trading near multi-year lows, it is reasonable to assume that the projected blue trajectory may not represent merely a temporary rebound within a multi-month bearish trend, but could instead be part of a significant bullish reversal. In this scenario, the lower blue trend line takes on strategic importance.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Strike wins New York BitLicense, clearing path for bitcoin financial services rollout

Strike received a BitLicense and money transmitter license from the New York State Department of Financial Services, clearing the way for the bitcoin financial services firm to operate in the state.

“Receiving our BitLicense is a defining milestone for Strike,” said Jack Mallers, founder and CEO of Strike. “With our BitLicense, we can now bring that mission to New York, the global center of finance.”

Strike’s entry into New York is part of its expansion plans outlined in November 2025, when Mallers said his platform would add bitcoin-backed lending to allow users to borrow fiat currency while continuing to hold their bitcoin. The move would place Strike in a sector that saw several high-profile failures in 2022, when lenders including BlockFi, Celsius and Genesis filed for bankruptcy during the crypto market downturn.

The approval, announced Thursday, allows Strike to offer its products to individuals and businesses across New York, one of the most tightly regulated digital asset markets in the U.S. The company can now provide services that include buying and selling bitcoin, salary deposits converted into bitcoin and bill payments made from a bitcoin balance.

Strike can also offer tools such as recurring purchases and price-triggered orders that execute trades when bitcoin reaches a set level. Users can also convert up to 100% of direct-deposited wages into bitcoin, with conversion fees waived on deposits up to $20,000 each month.

Strike said customer bitcoin and cash balances remain held one-to-one and are not lent or used for company operations.

The license places the company under the New York State Department of Financial Services’ supervision, which includes audits, capital reserve rules and cybersecurity examinations.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports19 hours ago

Sports19 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!