Crypto World

Stripe taps Base for AI agent x402 payment protocol

Stripe has launched a new payment system designed for artificial intelligence agents, allowing them to pay for digital services automatically using cryptocurrency.

Summary

- Stripe launched x402 payments to enable AI agents to make automated USDC transactions on Base.

- The system supports fast, low-cost micropayments for APIs, data, and compute services.

- The move shows the growing convergence between AI, fintech, and blockchain infrastructure.

Stripe product manager Jeff Weinstein revealed the feature on Feb. 11 and it is currently in preview. The update adds support for Base, an Ethereum-based blockchain network, for the x402 payment protocol.

Through this system, AI agents can quickly and easily make small payments using USD Coin (USDC) stablecoins. Developers can charge agents for services like data access, processing power, and API calls using Stripe’s built-in tools, eliminating the need for manual billing or traditional subscriptions.

Built for machine-to-machine payments

Weinstein said current payment systems are designed mainly for humans and are not well-suited for automated software. AI agents, he noted, need fast, low-cost, and always-available payment rails that can work without human supervision.

Under the new system, businesses create a standard Stripe Payment Intent. Stripe assigns a one-of-a-kind wallet address to every transaction. When the AI agent sends funds to that address, the payment can be monitored in real time through the Stripe dashboard, via webhooks, or by using the API.

Once the transaction is confirmed, the funds are deposited into the merchant’s Stripe balance, just like any standard payment. Stripe’s current infrastructure also manages tax reporting, refunds, and compliance tools.

The system relies on x402, an open protocol that revives the old HTTP “402 Payment Required” status code. When an agent tries to access a paid service, it receives a payment request. After sending USDC on Base, access is automatically granted.

Because Base offers fast settlement and low fees, payments can be completed in a matter of seconds. This makes the setup suitable for frequent, low-value transactions, such as paying per request or per minute of usage.

Stripe has also released an open-source command-line tool called “purl,” along with sample code in Python and Node.js, to help developers test machine payments.

Expanding the agent economy

The launch reflects Stripe’s growing focus on what it calls the “agent economy,” where software programs operate independently and manage their own finances. These agents are expected to buy data, computing resources, and digital services without human approval.

The company said more protocols, currencies, and blockchain networks will be added in the future. For now, support is focused on USDC on Base, which provides stability and predictable pricing.

Industry observers see the move as another sign that AI, fintech, and crypto are becoming more closely connected. Instead of relying on monthly plans or prepaid credits, services can now be priced per action, per second, or per request.

Crypto World

Curve Accuses PancakeSwap of Using Stableswap Code Without Authorization

PancakeSwap, the leading decentralized exchange on BNB Smart Chain, rolled out the StableSwap feature on March 1.

PancakeSwap, the leading decentralized exchange (DEX) on BNB Smart Chain, is facing allegations of unauthorized code use.

Earlier today, Ethereum-based DEX Curve Finance accused the platform of copying its StableSwap code without permission, constituting a violation of the code’s license. PancakeSwap rolled out the StableSwap feature on March 1.

“Looks like you copied our code without asking. It is violation of its license. Not only it is illegal: historically it showed to be unwise for those who did it this way in other regards,” Curve wrote on X.

Curve also offered to discuss licensing and potential collaboration to enable PancakeSwap to use the code legally.

“We’re reaching out to your team directly to discuss this,” responded PancakeSwap.

Curve’s StableSwap algorithm is designed to enhance stablecoin exchanges by reducing slippage and fees, making it a valuable asset in decentralized finance (DeFi).

PancakeSwap’s CAKE token is down nearly 4% in the past 24 hours, but remains up 4% over the past week.

PancakeSwap currently holds a total value locked (TVL) of approximately $2 billion, according to DeFiLlama, making it the second-largest DEX after Uniswap.

This article was generated with the assistance of AI workflows.

Crypto World

Iran war exposes big market concentration risk. It isn’t in US stocks

Investors have poured money into emerging markets in recent years as the search for big stock gains has migrated overseas and as they look for diversification beyond the concentrated S&P 500. But the U.S.-Iran military conflict has reframed the concentration question, highlighting the level of risk in emerging markets when it comes to gains being dependent on a select number of stocks, many tied to the AI boom.

The iShares MSCI Emerging Markets ETF (EEM) has had strong performance over the past few years and into 2026, up 29% in 2025 and still holding onto a small gain this year. However, its holdings remain largely tilted toward Asia, with large exposure to China, South Korea, India, and Taiwan, together representing over three-quarters of the index weight, and many of the top stocks tied to tech, including Taiwan Semiconductor and Samsung.

“If you look at the index within emerging markets, it’s still roughly 80% Asia,” Malcolm Dorson, senior emerging markets portfolio manager and senior v.p. head of the active investment team at ETF company Global X said on CNBC’s “ETF Edge” earlier this week. “That gives you a lot of concentration risk,” he said.

Overall, the EM index has a 30%-plus tech sector weighting.

South Korean stocks have experienced extreme volatility this week. The market posted its worst single-day move ever on Wednesday as the escalating war in the Middle East resulted in concerns about energy supplies to Asia, where top stocks in the memory sector fueling the AI boom rely on energy-intensive processes. After its worst day ever, the South Korean index rebounded on Thursday for its best day since 2008. The iShares MSCI South Korea ETF (EWY) is still down close to 13% this week.

Some of the enormous volatility in South Korean stocks is tied to how well they have performed recently, and how many retail investors have seen big gains from holding them. SK Hynix, a top holding in the broad emerging market indexes, gained 274% last year, while Samsung gained 125%.

Performance of the iShares MSCI South Korea ETF over the past one-year period.

A huge spike in oil prices since the outbreak of the military conflict has rattled global markets. On Friday, Brent crude futures topped $90 and U.S. West Texas Intermediate crude futures were closing in on that range, up more than 30% this week, while Brent has advanced nearly 26%.

The energy squeeze in Asian nations can be seen in China’s reported decision this week to tell domestic oil refining companies to stop any exports of fuel, and more Asian nations may follow with similar moves to retain energy stockpiles, energy market experts have said.

It isn’t time to abandon emerging markets, according to ETF investing strategists, and some macroeconomic factors may sustain outperformance in these markets over the longer-term. But Dorson said a “barbell approach” to investment strategy may be wise, balancing exposure between different types of emerging markets rather than relying on one region. He says thinking this way should lead investors who want to maintain international exposure to look at Latin America as a balance against Asian markets.

“I think you need to have both,” Dorson said.

Countries like Argentina, Brazil, and Colombia are heavily linked to energy and commodities market, and he said rising oil prices can provide an additional tailwind for those economies. “I’d say 25 to 33% of the story should be that attractiveness of getting exposure to commodities,” he said. He added that there are also political reform efforts in Latin American nations that could serve as additional tailwinds for economies. “All eyes are on political change that could drive fiscal reform,” he said, and he added that may benefit financial services sector stocks across the region.

Equities in several Latin America markets also trade at significant discounts to U.S. stocks, with many price-to-earnings ratios roughly half those in the S&P 500. For example, Vanguard’s S&P 500 ETF, VOO, currently trades at a P/E ratio of 28, while its emerging markets ETF, VWO, trades at a P/E ratio of 18.

Sign up for our weekly newsletter that goes beyond the livestream, offering a closer look at the trends and figures shaping the ETF market.

Crypto World

Counter-Drone Defense Stocks Surge as Iran Conflict Escalates: Ondas (ONDS), BlackSky, and Iridium

Key Takeaways

- Since hostilities erupted, Iran has launched more than 500 ballistic missiles and 2,000 drones, with inexpensive Shahed drones penetrating air defenses

- Attacks resulted in six U.S. military deaths and strikes on regional assets including the U.S. Embassy in Saudi Arabia

- Ondas shares have climbed more than 1,200% over the past year, with the company announcing $6 million in fresh counter-drone contracts from Middle Eastern clients

- Oppenheimer maintains Outperform ratings on Ondas, BlackSky, and Iridium as beneficiaries of the escalating drone threat

- Airobotics, an Ondas subsidiary, maintains a $20 million contract for autonomous perimeter defense technology

The intensifying aerial confrontation involving the U.S., Israel, and Iran is creating unprecedented demand for anti-drone solutions — and several publicly traded companies are capitalizing on the shift.

According to Gen. Dan Caine, chairman of the Joint Chiefs of Staff, Iran has deployed over 500 ballistic missiles and more than 2,000 drones since fighting erupted last Saturday. Although most were neutralized, successful strikes inflicted significant casualties and infrastructure damage.

Six U.S. military personnel lost their lives at a Kuwaiti installation. The U.S. Embassy in Saudi Arabia sustained damage. Qatar’s primary liquified-natural-gas facility was hit. Iran’s preferred weapon is the economical Shahed drone, designed for swarm attacks that can saturate conventional defense networks.

Oppenheimer analyst Timothy Horan stated that U.S. and Israeli forces had “significantly underestimated Iran’s drone capabilities.” He emphasized that the attacks are depleting interceptor inventories and exposing vulnerabilities in legacy counter-drone platforms.

Ondas has emerged as a primary beneficiary. The company manufactures the Iron Drone interceptor system, capable of neutralizing various small unmanned aerial vehicles. Oppenheimer maintains an Outperform rating with a $16 price target. Shares climbed 4.9% to $10.51 on Wednesday.

On March 6, Ondas disclosed approximately $6 million in new contracts for counter-drone platforms from defense and homeland security agencies across the Middle East and additional territories. The purchase orders encompass dozens of Sentrycs Cyber-RF counter-UAS units.

How Sentrycs Technology Works

The Sentrycs platform identifies, monitors, and hijacks unauthorized drones through protocol manipulation techniques. It can autonomously redirect hostile drones from sensitive zones or force landings in safe areas. The manufacturer emphasizes rapid deployment compatibility with existing detection infrastructure.

Ondas CEO Eric Brock highlighted “strong demand and a growing urgency among governments to find scalable solutions for defending critical infrastructure.”

The firm also posted 208% revenue expansion over the trailing twelve months and maintains a net cash position. Its current market capitalization reaches $4.72 billion.

BlackSky and Iridium Emerge as Satellite-Based Plays

BlackSky and Iridium represent complementary investment opportunities tied to the drone conflict. Both deliver satellite and communications infrastructure, increasingly critical as aerial warfare unfolds in what analysts describe as a “highly contested” communications landscape throughout the Gulf.

BlackSky shares advanced 7% to $24.30 on Wednesday. Iridium appreciated 2.1% to $24.51. Oppenheimer assigns Outperform ratings to both companies, with price targets of $31 and $34 respectively.

Additional defense contractors with counter-drone capabilities include CACI, AeroVironment, Kratos Defense, Lockheed Martin, RTX, and Northrop Grumman — offering solutions ranging from electronic jamming to directed-energy weapons to kinetic interceptors.

Ondas subsidiary Airobotics maintains a distinct $20 million purchase agreement for an autonomous perimeter security platform under a multi-year government procurement.

Crypto World

Crypto Exchanges Emerge as TradFi Venues amid Tokenized Commodities Boom

Demand for tokenized commodities is increasing as investors look for safe-haven exposure through crypto-native markets that trade around the clock, rather than only during traditional market hours.

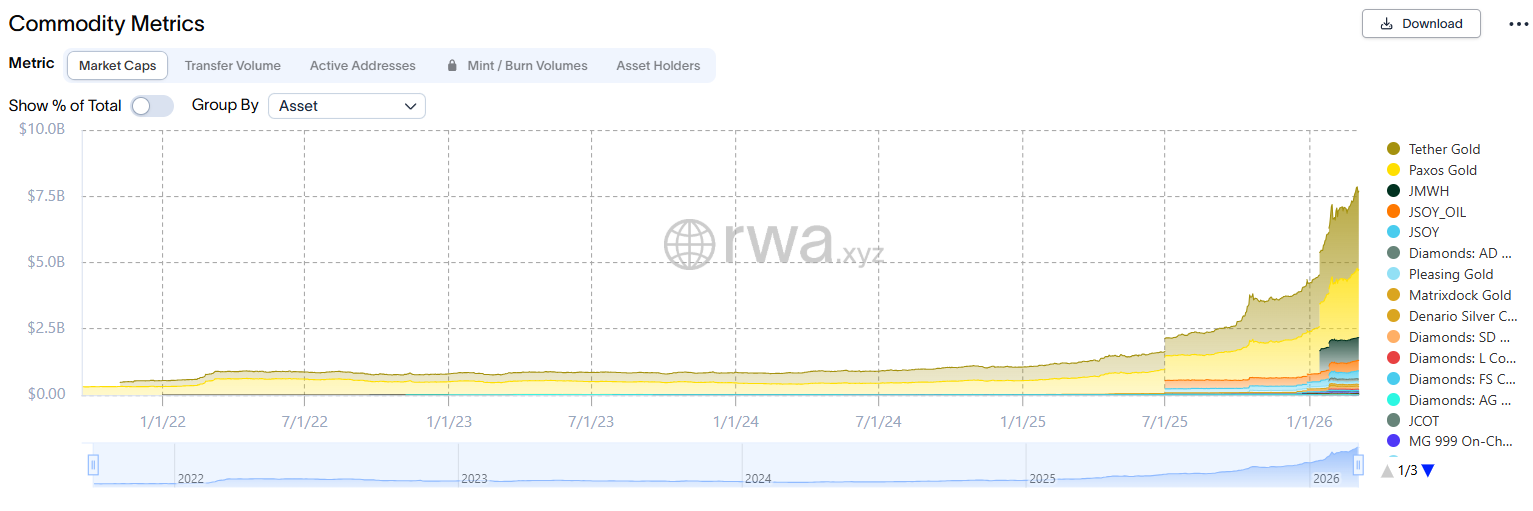

The tokenized commodities sector grew 10% over the past month to $7.69 billion in cumulative market capitalization, while holders increased by 5.8% to 189,390, according to data aggregator RWA.xyz.

Tether Gold (XAUT) makes up the lion’s share with $2.96 billion of onchain commodities, while Paxos Gold (PAXG) is second with $2.56 billion.

The growth underscores how real-world assets are becoming a larger part of crypto market activity. Tokenized commodities allow investors to gain 24/7 blockchain-based exposure to assets including gold and silver, while offering the ability to transfer and trade them through digital asset infrastructure.

Related: Crypto’s yield gap with TradFi narrows as staking, RWAs surge

Crypto exchanges emerge as new TradFi venues

At the same time, crypto exchanges are drawing more interest from traders seeking exposure to traditional assets through derivatives.

This trend is particularly visible during strong price trend periods such as the recent gold and silver rallies, according to blockchain data platform CryptoQuant.

“Activity has spiked during periods of strong precious-metal price momentum,” wrote CryptoQuant’s head of research, Julio Moreno, in a research report published on Tuesday.

He added that daily volume was overwhelmingly concentrated in gold and silver contracts, which reached $3.77 billion and $3.75 billion, respectively, on Tuesday.

Related: US financial markets ‘poised to move on-chain’ amid DTCC tokenization greenlight

Binance perpetual trading activity on the rise

Trading in those products has expanded quickly. CryptoQuant said Binance’s TradFi perpetual futures have generated more than $130 billion in cumulative trading volume and about 90 million trades since launching in January.

CryptoQuant attributed the rising demand for tokenized commodities and the precious metal rally to tariff-related uncertainty, higher interest rates and stronger safe-haven demand.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?

Crypto World

US Jobs Miss Fails to Stop Bitcoin Erasing Its $74,000 Breakout Attempt

Bitcoin (BTC) slipped under $70,000 around Friday’s Wall Street open as weak US employment data failed to boost risk assets.

Key points:

-

Bitcoin and stocks slump in reaction to a surprise downturn in US nonfarm payrolls.

-

Fed interest-rate odds stay hawkish, with markets seeing just one cut this year.

-

BTC price action “round trips” its latest breakout attempt, continuing a 2026 trend.

Bitcoin ignores “clearly weakening” labor market

Data from TradingView showed daily BTC price downside passing 3% to hit $68,176 on Bitstamp.

US nonfarm payrolls data disappointed across the board, showing that the labor market was more under pressure than expected.

The economy lost 92,000 jobs in February, per data from the Bureau of Labor Statistics (BLS), in contrast to the predicted 58,000 increase. The unemployment rate also came in higher at 4.4%.

The print contrasted with that from January, which delivered surprisingly strong employment results.

“This marks just the 2nd monthly job loss since the 2020 pandemic,” trading resource The Kobeissi Letter wrote in a response on X.

“The US labor market is clearly weakening.”

Labor-market strain traditionally signals a tailwind for crypto and risk assets as it implies a greater chance of interest-rate cuts.

The latest data from CME Group’s FedWatch Tool nonetheless showed little chance of the Federal Reserve doing so at its next meeting on March 18. Markets also saw just one rate cut in store for 2026.

The employment result thus failed to boost risk assets, with crypto following US stocks lower. At the time of writing, the S&P 500 and Nasdaq Composite Index were down 1.5% and 1.3%, respectively.

Only gold gained, with the precious metal up 1.5% to $5,155 per ounce.

BTC price comes full circle from monthly highs

Among Bitcoin traders, frustration was apparent as BTC/USD failed to cement a breakout from its narrow local trading range.

Related: Bitcoin ‘anomalous’ outflow sees 32K BTC leave exchanges in a single day

“Deviations above the Range High keep getting sold,” J. A. Maartunn, a contributor to onchain analytics platform CryptoQuant, commented.

Maartunn flagged three such failed breakouts in recent months, with each ending up as a deviation before a retreat lower.

“The latest deviation just occurred around $71K. If history repeats, this level may again act as a trap for late longs,” he warned.

Price returned to interact with key long-term levels, notably the 200-week exponential moving average (EMA) and the old all-time high from 2021.

“Looks like $BTC is round tripping the range…again,” Keith Alan, cofounder of trading resource Material Indicators, added.

Earlier, Cointelegraph reported on existing expectations of new lows coming for Bitcoin next, despite its run to monthly highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

How private credit cracks at BlackRock, Blue Owl could hit crypto and DeFi markets

Cracks in the global private credit market are rattling investors, raising concerns the stress could spill into crypto markets.

Bloomberg reported Friday that BlackRock’s $26 billion private credit fund has begun limiting withdrawals amid rising redemption requests. The move follows similar stress at Blue Owl, which sold $1.4 billion in loans last month to meet withdrawals and reportedly has exposure to a collapsed U.K. property lender.

Shares of major asset managers including BlackRock (BLK), Apollo Global Management (APO), Ares Management (ARES) and KKR slid 4%-6% Friday, extending their 2026 rout.

Read more: Blue Owl liquidity crisis has investors bracing for 2008-style fallout

If redemption pressure forces private credit funds to unwind positions, it could trigger broader deleveraging across asset classes that could ripple through digital assets including bitcoin , Andreja Cobeljic, head of derivatives trading at Swiss crypto bank AMINA Bank warned in an emailed note.

Credit stress meets energy shock

U.S. banks extended nearly $300 billion in loans to private credit providers as of mid-2025 and another $285 billion to private equity funds, Cobeljic wrote, carrying risks that credit woes could extend to the banking sector

“In isolation this would be manageable,” he said. “But emerging in the middle of a broader global deleveraging event, alongside an energy shock and collapsing rate-cut expectations, it is a different conversation.”

“For risk assets, including crypto, a disorderly unwind here would represent a significant second-order shock that current pricing does not reflect,” he said.

Contagion to tokenized asset markets

A second channel of credit risk could surface directly on blockchain rails.

Tokenized private credit products — loans and funds packaged and issued on public blockchains as tokens — have grown quickly as part of the broader real-world asset (RWA) trend. According to data from rwa.xyz, the on-chain private credit market now stands at just under $5 billion. That remains tiny compared with the roughly $3.5 trillion global private credit market in 2025, estimated by the Alternative Credit Council.

But the growing presence of these assets inside decentralized finance (DeFi) means stress in the underlying loans could ripple directly to crypto markets.

“Institutions are entering crypto, but often with products that even degens and DeFi natives don’t fully grasp,” said Teddy Pornprinya, co-founder of real-world asset protocol Plume.

Real-world credit products can carry complex risks that are not always obvious to crypto investors, he said, including volatile net asset value swings and headline yields that don’t fully reflect fees or credit risk.

A recent episode shows how off-chain credit stress can spill into DeFi.

According to a report by risk advisory firm Chaos Labs, the 2025 bankruptcy of auto-parts supplier First Brands Group affected a private credit strategy run by Fasanara Capital. A tokenized version of the strategy, mF-ONE, had been issued on the Midas RWA platform and used as collateral for borrowing on the Morpho protocol.

When the underlying fund marked down exposure tied to the bankruptcy, the token’s net asset value slipped about 2%, pushing highly leveraged borrowers close to liquidation and tightening liquidity on the platform. Lenders ultimately avoided losses, but the episode highlighted how tokenized private credit used as DeFi collateral can transmit traditional credit stress into on-chain markets.

Crypto World

Russia Considers Separate Stablecoin Law Amid Crypto Regulation Reforms

Key Insights

- Russia separate stablecoin law may create clear legal status for fiat-pegged tokens within the national financial system.

- Lawmakers may restrict trading on unlicensed crypto platforms under a broader exchange regulation bill.

- A ruble-pegged stablecoin approved for trade highlights Russia’s focus on cross-border blockchain payments.

Russia Plans Dedicated Stablecoin Regulation

The Russia separate stablecoin law proposal forms part of the country’s broader cryptocurrency regulatory reforms. The Ministry of Finance is considering legislation that will address fiat-pegged digital assets separately from exchange regulations.

BREAKING: 🇷🇺 Russia says it’s working on a stablecoin bill. pic.twitter.com/oEeF01Z3kg

— Crypto India (@CryptooIndia) March 5, 2026

Officials believe stablecoins serve a different function than decentralized cryptocurrencies. As a result, regulators prefer a legal framework designed specifically for these assets. The proposed Russia separate stablecoin law would define how stablecoins operate within the national financial system.

Alexey Yakovlev, director of the ministry’s Department of Financial Policy, highlighted the potential of these assets. He noted that stablecoins could play a significant role in financial infrastructure and global transactions.

At present, Russian law does not clearly define stablecoins. The planned legislation aims to clarify their legal status and regulatory classification.

Crypto Exchange Regulation Moves Forward

The Russia separate stablecoin law debate comes after advancements on wider cryptocurrency regulation. Legislators are still working on a bill that will govern crypto trading platforms nationwide.

The proposed exchange law may prohibit Russian citizens from trading digital assets on platforms that lack official permits. Regulators desire to enhance regulation and minimize risk in the crypto market.

With the proposed structure, the transactions might be conducted in the regulated institutions like banks, brokers, and stock exchanges. With the help of this structure, compliance and transparency will be enhanced.

Reports indicate lawmakers may present the exchange legislation to the State Duma during the spring session. If approved, the rules could take effect as early as July.

Stablecoins and Cross-Border Payments

Interest in the Russia separate stablecoin law reflects the country’s focus on international settlements. Policymakers view stablecoins as potential tools for cross-border financial transactions.

The Bank of Russia introduced a regulatory category called foreign digital rights. This type can involve cryptocurrencies and stablecoins that can be used in particular international applications.

An overseas trade stablecoin named A7A5 was authorized as a ruble-pegged stablecoin. Authorities approved the asset for cross-border settlements that meet regulatory requirements.

Negotiations among the central bank, the finance ministry and industry players are underway. The regulators want to come up with balanced rules to ensure financial stability and innovation.

The proposal of the Russia separate stablecoin law is indicative of the much bigger plan to modernize financial infrastructure. Well-defined policies may boost the trust in payment systems based on blockchains.

Crypto World

Binance Slams US Senate Probe over Iran as Based on Defamatory Reports

Cryptocurrency exchange Binance has officially responded to a February inquiry launched by a group of 11 US senators, largely denying facilitating transactions to Iranian entities and the narrative around employees’ terminations.

In a Friday letter to US Senators Richard Blumenthal and Ron Johnson of the Permanent Subcommittee on Investigations, Binance said that an inquiry launched in February into the exchange’s activities was based on reports that were “demonstrably false, unsupported by credible evidence, and defamatory in several material respects.”

The exchange referred to reporting from the Wall Street Journal, New York Times and Fortune, which said that Binance fired employees that reported the company had facilitated more than $1 billion in crypto transactions to entities connected to Iran, called Hexa Whale and Blessed Trust. According to Binance, the company launched an investigation in response to law enforcement inquiries, resulting in the removal of the entities from the platform.

“[T]o our knowledge, no Binance account transacted directly with an Iran-based entity,” said that exchange.

In response to the reports’ claims about the dismissal of employees who brought the investigation to the attention of executives, Binance said that some of them resigned, while another was terminated for disclosing internal user information:

“Binance takes seriously the privacy of its users and has no tolerance for employees violating that trust by sharing internal information externally. Binance also closely follows its labor and employment policies. This employment action was no different.”

The letter from the 11 senators to Treasury Secretary Scott Bessent and Attorney General Pamela Bondi asked for a response by March 13 as to whether the government officials intended to investigate Binance. As of Friday, neither Bessent nor Bondi had publicly commented on the matter.

Related: SEC ends case against Justin Sun with $10M settlement

In 2023, Binance reached a settlement with US authorities, agreeing to pay $4.3 billion to resolve violations of sanctions and Anti-Money-Laundering laws. Then-CEO Changpeng “CZ” Zhao stepped down as part of the deal and pleaded guilty to one felony charge, which later resulted in a four-month prison term.

Trump-Binance ties under scrutiny after presidential pardon

Zhao pleaded guilty and served prison time, under an agreement that he not be permitted to assume another leadership role at Binance. However, in October, US President Donald Trump issued a pardon for CZ, which legally opened the door to his return to the exchange. Zhao has publicly ruled out going back as CEO.

Before Trump announced the pardon, the administration’s ties to Binance were already under scrutiny from many lawmakers after a UAE-based company, MGX, used the USD1 stablecoin issued by World Liberty Financial to settle a $2 billion investment in the exchange. Many lawmakers have labeled the deal as corruption given that World Liberty Financial is backed by the president and his sons.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Kraken Fed Access, MARA Bitcoin Strategy, NYSE Tokenization Push

The digital asset sector took another step toward integration with traditional finance this week when Kraken secured direct access to the US Federal Reserve’s payment rails — a milestone that could reshape how crypto companies move dollars. Direct access to the Fed’s payment infrastructure could give the crypto exchange greater control over dollar flows while reducing reliance on banking partners, a longstanding challenge for the industry.

It also signals that crypto infrastructure is continuing to mature and integrate with the traditional banking system despite broader industry headwinds and a months-long market correction — one of the key themes in this week’s Crypto Biz newsletter.

Meanwhile, Bitcoin (BTC) miner MARA Holdings pushed back on speculation that it plans to dump its BTC reserves, clarifying that recent regulatory filings simply expand its treasury flexibility. Bitcoin rewards company Fold strengthened its balance sheet by eliminating $66 million in convertible debt, while analysts say a proposed New York Stock Exchange tokenization framework could open the door to greater institutional participation.

Kraken wins Fed payment access in crypto industry first

Kraken’s banking arm has secured a limited-purpose master account with the Kansas City Federal Reserve Bank, granting it direct access to the US central bank’s payment infrastructure, a first for a crypto-native company.

In a Wednesday announcement, Kraken Financial confirmed it can now use the Fed’s Fedwire system, a real-time gross settlement network that allows financial institutions to send and receive payments with the Fed. The access allows Kraken to process US dollar payments directly with the central bank instead of relying on intermediary banks.

The approval is initially granted for one year, with restrictions tailored to Kraken’s business model and risk profile.

“With a Federal Reserve master account, we can operate not as a peripheral participant in the US banking system, but as a directly connected financial institution,” said Arjun Sethi, Kraken’s co-CEO.

MARA clarifies Bitcoin treasury strategy after sell-off concerns

Bitcoin mining company MARA Holdings said recent disclosures about selling Bitcoin from its balance sheet were intended to signal flexibility — not an imminent liquidation of its holdings.

Vice president Robert Samuels said the company’s latest Form 10-K filing with the US Securities and Exchange Commission clarifies that MARA expanded its treasury strategy to allow potential Bitcoin sales if market conditions warrant. The policy also allows the company to purchase additional BTC periodically.

Some members of the crypto community interpreted the filing as authorization to sell MARA’s more than 53,000 BTC treasury, an interpretation Samuels called “factually incorrect.”

Bitcoin-focused Fold eliminates $66M in convertible debt

Bitcoin financial services company Fold said it eliminated $66.3 million in convertible debt, removing a potential source of balance-sheet pressure and shareholder dilution ahead of launching a new Bitcoin-rewards credit card.

In a recent disclosure, Fold said it retired two outstanding convertible notes — debt instruments that can be converted into equity — thereby reducing the risk of issuing additional shares in the future. The move also freed 521 Bitcoin that had previously been pledged as collateral for the debt.

The stronger balance sheet could support the rollout of Fold’s planned Bitcoin rewards credit card, which will allow users to earn BTC on everyday purchases through the Visa network.

Fold went public on the Nasdaq in February 2025 through a SPAC merger with FTAC Emerald Acquisition, becoming one of the first publicly traded Bitcoin-focused financial services companies.

TD Securities says NYSE tokenization push could attract institutions

Tokenization efforts tied to the New York Stock Exchange could accelerate institutional adoption of blockchain-based markets, according to TD Securities strategist Reid Noch.

The NYSE recently proposed tokenizing equities through an alternative trading system that would enable 24-hour trading and near-instant settlement for tokenized stocks and exchange-traded funds while operating under existing market rules.

Noch said the model resembles a “2.0” evolution of market infrastructure: Custody and settlement will remain with the Depository Trust & Clearing Corporation (DTCC), while trading will continue to follow National Best Bid and Offer (NBBO) requirements.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Crypto World

Tether’s $7.5M bet on Bitcoin payments using USDT

As majors sell off, Tether quietly doubles down on turning Bitcoin into a $-settlement backbone via Lightning-native USDT rails.

Summary

- Tether co-leads a $7.5M round in Utexo to enable native USDT settlement on Bitcoin and Lightning.

- Utexo promises fixed, pre-confirmable fees, atomic settlement and stronger privacy anchored to Bitcoin’s security.

- Move comes as BTC trades near $68,600 and majors slide 3–5%, underscoring demand for resilient $ liquidity.

Tether has taken a calculated step to bind USDT more tightly to Bitcoin’s base layer, co-leading a $7.5M financing round for Utexo, a startup building infrastructure for native USDT settlement directly on the Bitcoin network and via the Lightning Network. While stablecoins already flow across multiple chains, this effort explicitly targets Bitcoin as a primary $-clearing rail at a time when the broader market is wobbling and liquidity quality matters more than headline valuations.

Utexo’s pitch is straightforward: use Bitcoin’s security and Lightning’s throughput to deliver pre-confirmable, fixed-fee USDT payments that settle atomically and preserve user privacy. In practice, that means traders, payment processors and exchanges could lock in fees ahead of time, reduce counterparty risk and avoid the fee volatility and congestion typical of many smart contract chains during risk-off episodes. With majors like BTC, ETH, SOL and others trading lower on the day—Bitcoin around $68,619, Ethereum near $1,976, and most large caps down roughly 3–5%—the value of predictable, high-quality $ rails becomes less abstract and more like core market plumbing.

Paolo Ardoino frames the investment as part of a broader strategy: turning Bitcoin into a global $-settlement network, not just a volatility proxy or digital gold narrative vehicle. With USDT’s circulating supply hovering around $184B, already the largest $ stablecoin float in the market, even a modest migration of settlement volume onto Bitcoin and Lightning could shift order-flow dynamics on competing L1s and sidechains. For derivatives venues, OTC desks and market makers, native USDT on Bitcoin could reduce bridging risk, compress spreads around BTC pairs and hardwire $ liquidity into the asset that anchors the entire crypto complex.

In macro terms, Tether’s Utexo play reads as a market-structure hedge: while spot prices bleed and volatility picks up, the firm is investing in the rails that will clear the next wave of leverage and settlement cycles. If Utexo delivers on atomic, private USDT settlement at scale, Bitcoin ceases to be just the risk barometer on price dashboards and becomes the neutral, censorship-resistant $ backbone underneath crypto’s fragmented liquidity stack.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business4 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker