Crypto World

The AI content flood is here, and tools like ZeroGPT are fighting to bring back academic integrity

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As AI-generated content overtakes human-written material online, tools like ZeroGPT are becoming essential for education, journalism, and enterprise to safeguard authenticity.

Summary

- Studies show AI-generated content now accounts for over 50% of online material, raising concerns about misinformation, disinformation, and academic misconduct.

- Educational institutions face rising cases of AI-assisted cheating, with discipline rates climbing globally, driving demand for reliable AI-detection tools.

- Platforms like ZeroGPT offer high-accuracy AI detection, multilingual support, and accessible integrations via WhatsApp, Telegram, and APIs to help organizations protect integrity while reducing operational costs.

The internet continues to be inundated with massive machine-generated content ever since the launch of ChatGPT in 2022. AI-generated content has spread like wildfire, and a new category of detection tools like ZeroGPT are racing to keep up.

The numbers are striking. In November 2024, the number of AI-generated content published on the web had surpassed the volume written by humans. This milestone, uncovered by growth agency Graphite in an analysis of 65,000 English web pages, found that 50.8% of articles published that month were AI-generated.

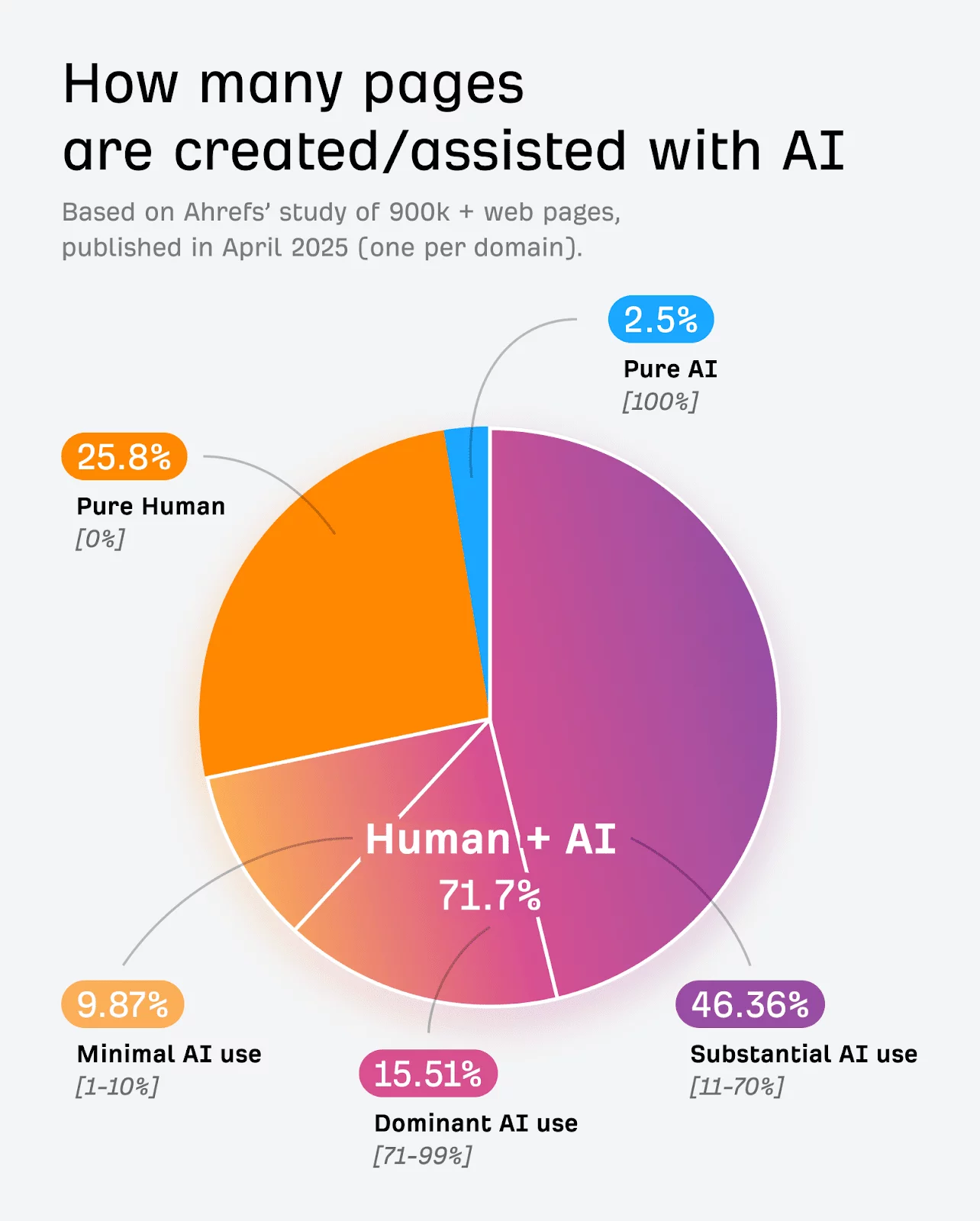

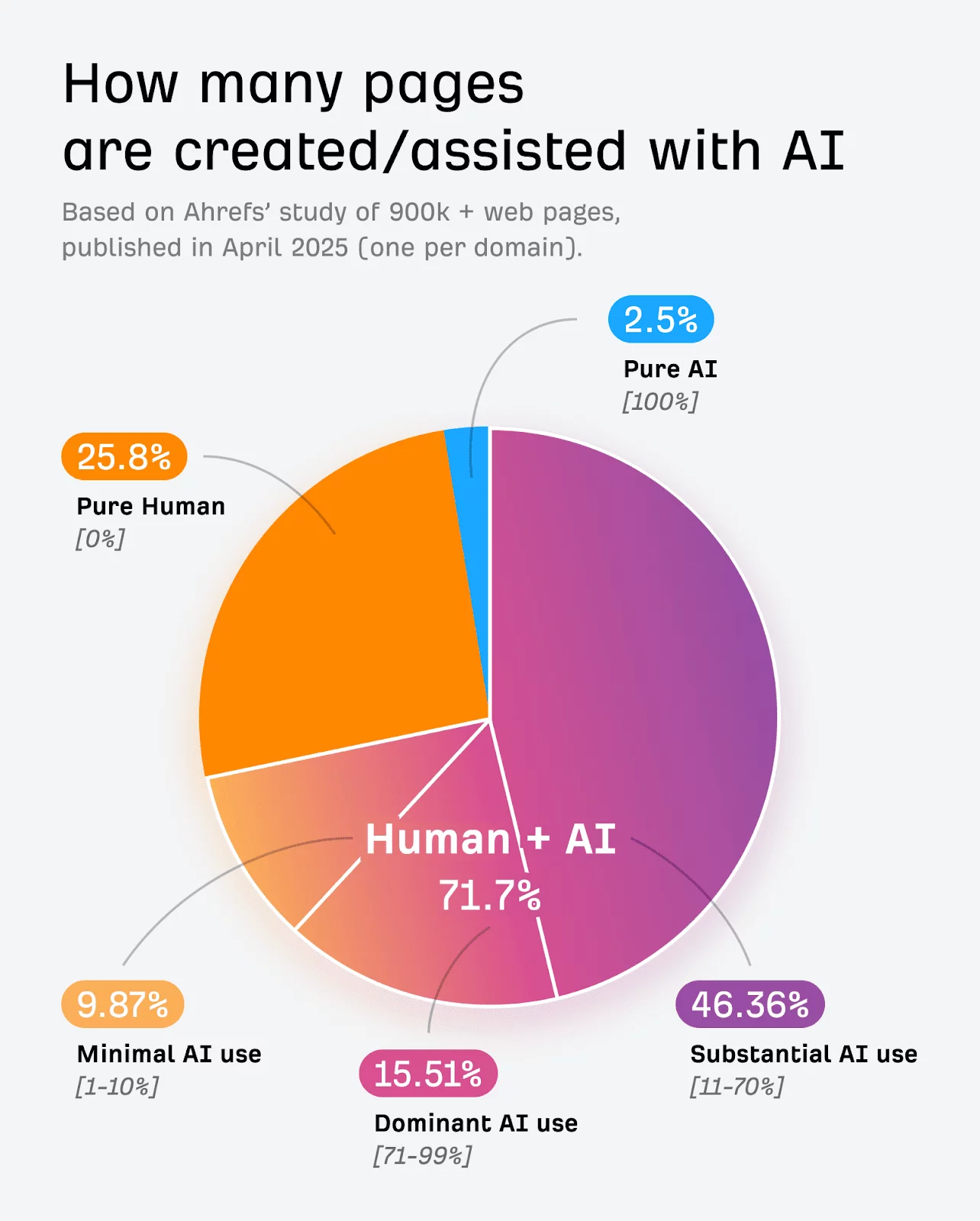

Graphite’s discovery was no anomaly. In April 2025, SEO and marketing intelligence platform Ahrefs reported that 74.2% of content spanning 900,000 English-language URLs had some element of AI.

But volume is only part of the problem. What’s more concerning is that this sheer volume is fueling misinformation and disinformation campaigns and eroding academic integrity. The harder question that everyone is grappling with right now is: how can someone know what’s real?

The academic integrity crisis

The AI content surge has landed harder in education — a sector where the authenticity of written work is key. According to an investigation by Gurdian, 7,000 university students in the UK were caught cheating using AI tools in the 2023-24 academic year. This translates to 5.1 out of 1,000 students, up from 1.6 in the previous academic year. In the 2024-25 academic calendar, the number had gone up to 7.5 cases per 1,000 students.

Globally, student discipline rate for AI-related academic misconduct climbed from 48% in 2022–23 to 64% in 2024–25. Approximately 90% of students have confessed to knowing about ChatGPT, and 89% have used it for homework. The weight of the matter has pushed many institutions to impose strict regulations on AI use and adopt robust detection tools.

But having the will to detect AI content and having reliable tools to do it are two different things.

Enter the AI-content detectors

The detection market has grown in tandem with the problem it’s trying to solve. Tools like Turnitin, GPTZero, and Originality have moved from niche utilities to essential institutional infrastructure. Each takes a different approach to the same fundamental challenge of identifying the statistical and linguistic patterns that AI language models leave behind.

AI detector ZeroGPT, one of the most widely used tools on the market, has built its product on accessibility and accuracy. The platform was trained on massive text data collected from the internet, educational data, and its in-house AI datasets, and can detect content generated by ChatGPT, Google Gemini, Claude, DeepSeek, and many other major large language models with up 98% accuracy.

The platform also offers a plagiarism checker, a built-in paraphraser, grammar checker, summarizer, humanize AI, and translator, making it a multi-purpose writing toolkit rather than a single-use scanner.

What sets ZeroGPT apart from other detectors is its availability on WhatsApp and Telegram. Anyone can access ChatGPT’s features, such as AI detection, paraphrasing, and grammar error checking via a chatbot right inside WhatsApp and Telegram, without having to visit the official website.

Perhaps most striking is that ZeroGPT requires no sign-up for basic use. In a market where many competitors gate core features behind registration walls or paywalls, that accessibility has helped it reach millions of users across education, marketing, journalism, and enterprise compliance.

For organizations that need to embed detection into their existing workflows, ZeroGPT offers an API built around RESTful architecture with fast response times. The API can be integrated with learning management systems, editorial platforms, HR tools for reviewing application materials, and compliance monitoring systems.

The platform also supports multilingual detection across different languages. This feature matters the most in global academic settings where non-English AI content is equally prevalent.

The cost to keep academic integrity

The cost to keep academic integrity is placing a substantial financial burden on institutions. It is estimated that the administrative effort, legal review, and academic committee proceedings associated with one misconduct case cost an average of $3,200 to $8,500.

And that cost is just the tip of the iceberg because institutions are spending at least $50,000 per year to train their staff on how to identify AI-generated content. Institutions also suffer from enrolment declines when cases of academic scandals break out to the public.

The need for AI-content detectors in academia is no longer a luxury; it is a necessity. Tools like ZeroGPT are helping institutions safeguard academic honesty, while at the same time significantly cutting the expenses linked to academic misconduct investigations.

On a larger scale, AI detectors are helping to prevent what the researcher Aviv Ovadya calls infocalypse: an internet where synthetic media reduces public trust, as no one knows who created what they are looking at or the intent.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

US Supreme Court Tariff Ruling Steals The Show As Bitcoin Sticks To $67,000

Bitcoin (BTC) saw choppy price action after Friday’s Wall Street open as markets reacted to the US Supreme Court decision on President Donald Trump’s trade tariffs.

Key points:

-

The US Supreme Court rules that certain US tariffs are illegal, sparking a modest risk-asset response.

-

US inflation data further cuts market hopes of a March interest-rate cut.

-

Bitcoin price action stays rooted in a firm range, with consensus seeing bears “in control.”

Supreme Court ruling attacks Trump tariffs

Data from TradingView showed $67,000 forming a focus for BTC price action, while US stocks gained.

The overall risk-asset response was muted however, as the Supreme Court ruled that some tariffs remained legal. In the firing line were those implemented under the International Emergency Economic Powers Act (IEEPA).

“IEEPA does not authorize the President to impose tariffs,” the Court wrote in its 170-page ruling.

Despite this, talk quickly surfaced over tariff refunds, with trading resource The Kobeissi Letter putting the potential total at $150 billion.

“Today’s Supreme Court ruling will be referenced for decades to come,” it added in a thread on X.

The event overshadowed earlier US macro data, which missed expectations. The Personal Consumption Expenditures (PCE) Index, known as the Federal Reserve’s “preferred” inflation gauge, hit its highest levels since late 2023 at 3%.

GDP data for Q4 2025, meanwhile, came in much lower than anticipated at 1.4% growth instead of 3%.

The numbers further reduced the odds of the Fed cutting interest rates at its March meeting, with data from CME Group’s FedWatch Tool now seeing a mere 4% chance of a 0.25% reduction.

On Thursday, trading resource Mosaic Asset Company expressed hope that stocks could still perform well despite the gloomy rates outlook.

“Even if the Fed goes an extended period on hold with interest rates, it’s worth remembering that financial conditions are still running much looser than average,” it summarized in an update.

“That should remain a tailwind for the bull market for now, even if the S&P 500 doesn’t reflect it. The combination of loose conditions and strong market breadth means a positive backdrop for position trading (for now).”

Bitcoin failing to escape “downwards trajectory”

Bitcoin traders continued to have few illusions about the precarious state of the market.

Related: Bitcoin ‘roadmap to bottom’ says $58.7K Binance cost basis now crucial

In his latest analysis, trader Jelle said that bears were still “in control.”

Bears remain in control – driving price lower and lower.

Don’t fight the trend, embrace it as the opportunity it presents: another chance to load up on cheaper coins.$BTC pic.twitter.com/wnhrKanAUb

— Jelle (@CryptoJelleNL) February 20, 2026

Trader and analyst Rekt Capital emphasized the importance of the 200-week exponential moving average (EMA), along with Bitcoin risking flipping it to resistance.

“History suggests Weekly Closes below the 200-week EMA followed by bearish retests of the EMA into new resistance can spur on the next phase of Bearish Acceleration to the downside,” he wrote on Thursday.

Earlier in the week, trader and commentator Skew suggested that the local BTC price range was indicative of “developing ‘value.’”

“Clear respected market supply around $70K & Clear tested market demand around $65K. This essentially points out the obvious which is a sustained move above $70K or below $65K will lead to trending price action,” he told X followers.

“Since the trend is in a downwards trajectory currently, this makes $72K quite significant as many shorts will place stops above & also it acts as a near term invalidation if cracked.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin Mining difficulty Jumps 15% after US Storm Disruption

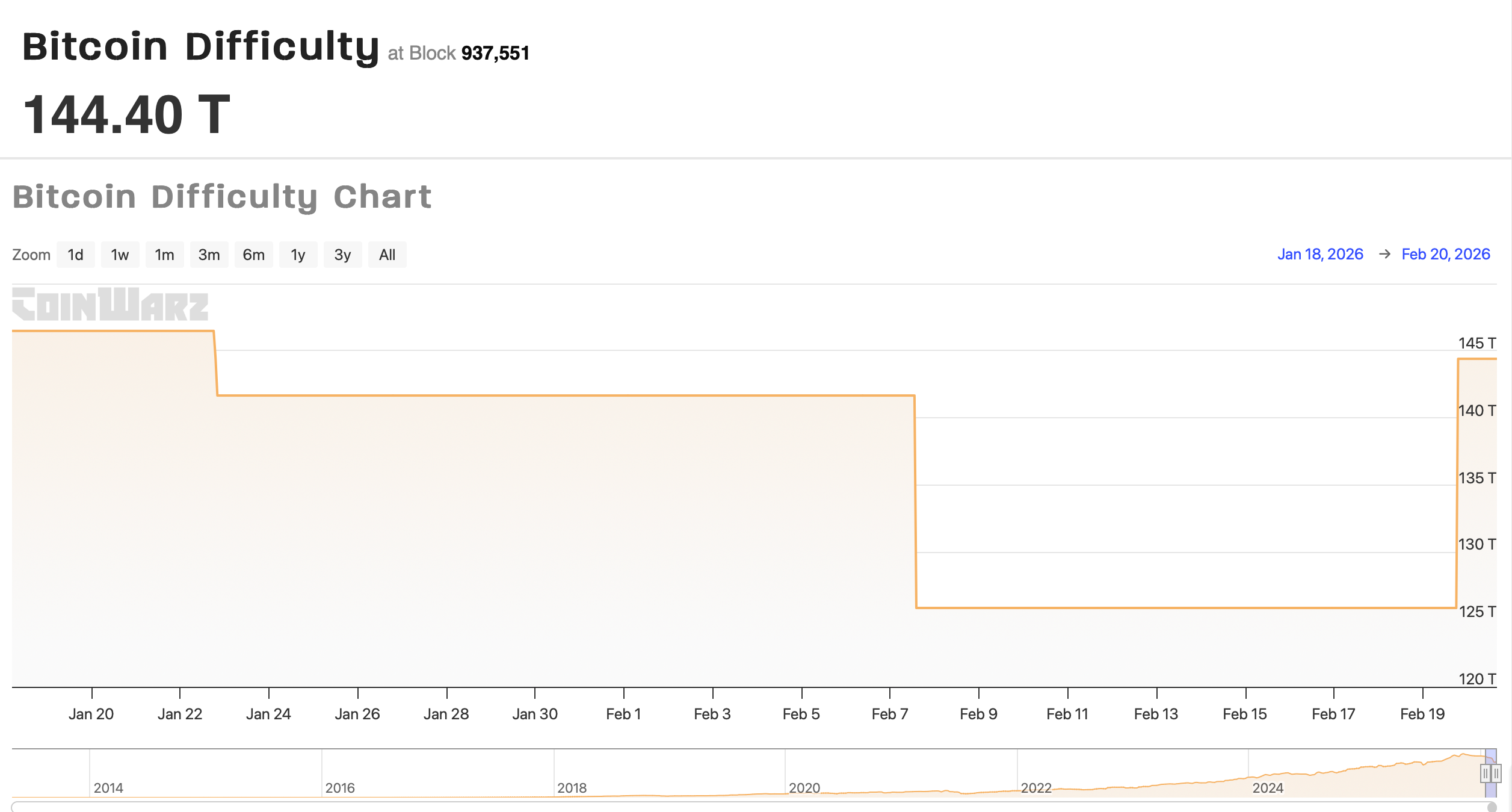

Bitcoin’s mining difficulty jumped about 15% to 144.4 trillion on Feb. 20, according to CoinWarz data, reversing an 11% drop earlier this month that marked the sharpest decline since China’s 2021 mining ban.

The earlier decline followed a sharp drop in hash rate after severe winter storms swept across much of the United States, disrupting power grids and forcing miners offline. In late January, Foundry USA, the largest mining pool by hash rate, briefly saw its computing power fall to about 198 exahashes per second from nearly 400 EH/s, before recovering.

Hash rate measures the total computing power securing the network, while mining difficulty adjusts every 2,016 blocks, about every two weeks, to keep block production near its 10-minute target.

As US miners restored operations after the storm, hash rate rebounded, prompting the latest upward difficulty adjustment.

While higher difficulty strengthens Bitcoin’s (BTC) network security, it also raises the computational effort required to earn block rewards, tightening margins for miners already facing cost pressures.

Related: Thirteen years after the first halving, Bitcoin mining looks very different in 2025

US miners monetize grid curtailments during winter storm

Although January’s winter storm forced some US Bitcoin miners offline, it didn’t necessarily erase revenue. Many participate in demand response programs or hold flexible power contracts, allowing them to pause mining and sell electricity back to the grid when prices spike.

“In January, our power infrastructure highlighted the flexibility of our operating model,” said Bruce Rodgers, chairman and CEO of Bitcoin miner LM Funding America.

According to a February report, the company curtailed operations during Winter Storm Fern and redirected contracted power to the grid, generating more than a quarter of its typical quarterly energy and curtailment revenue over a single weekend.

Canaan Inc., a Singapore-based mining hardware manufacturer with US operations, also said in its January production update that its US mining activities participated in power curtailments in storm-affected regions through coordination with site partners to help balance grid demand.

Since China’s 2021 mining crackdown, the United States has become the world’s largest Bitcoin-mining hub, hosting major operations in crypto-friendly states such as Texas and Georgia.

According to data from Cambridge Centre for Alternative Finance, the US accounts for over one-third of global Bitcoin hash rate.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Crypto market prediction as $2B Bitcoin options expire today

More than $2.4 billion in crypto options are set to expire at 08:00 UTC today on Deribit, a positioning event that could inject fresh volatility into the market.

Summary

- Around $2.0B in Bitcoin and $404M in Ethereum contracts are set to roll off on Deribit, raising the potential for short-term volatility.

- Bitcoin’s put/call ratio of 0.59 and Ethereum’s 0.75 reflect constructive sentiment, with max pain at $70,000 for BTC and $2,050 for ETH.

- BTC faces resistance near $69,500–$70,000 and support at $65,000, while ETH must clear $2,000–$2,050 to confirm upside momentum.

According to Deribit data, $2 billion in Bitcoin (BTC) options and $404 million in Ethereum (ETH) options will roll off.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, over $2.4B in crypto options are set to expire on Deribit.$BTC: ~$2.0B notional | Put/Call: 0.59 | Max Pain: $70K$ETH: ~$404M notional | Put/Call: 0.75 | Max Pain: $2,050 Positioning skews call heavy across both assets, with… pic.twitter.com/pgl2z4ZGJ6

— Deribit (@DeribitOfficial) February 19, 2026

For Bitcoin, the put/call ratio stands at 0.59, signaling call-heavy positioning and a stronger upside skew. The max pain level is $70,000, slightly above current spot levels, suggesting price could gravitate toward that area into expiry.

Ethereum’s put/call ratio sits at 0.75, reflecting more balanced but still constructive positioning, with max pain at $2,050.

Large options expiries can trigger short-term volatility, especially with positioning skewed toward calls. With $2 billion in Bitcoin and over $400 million in Ethereum contracts expiring, dealer hedging around key strikes, notably $70,000 for BTC and $2,050 for ETH, could pin prices near those levels.

However, a decisive move beyond them may amplify momentum through gamma-driven flows, increasing the odds of a sharp breakout.

Crypto market prediction: Bitcoin (BTC)

Bitcoin trades around $67,850 on the daily chart, attempting to stabilize after a sharp early-February sell-off that dragged price from the mid-$90,000s to a local low near $60,000. Since that flush, BTC has been consolidating between roughly $65,000 and $70,000.

Technically, price remains below the 50-day DEMA near $69,500, which now acts as immediate resistance. A sustained break above $69,500–$70,000 would open the door toward $72,000 and potentially the mid-$70,000 region.

On the downside, support sits around $65,000, followed by the psychological $60,000 level — the zone that previously attracted strong dip buying.

Momentum indicators show bearish pressure easing but not fully reversed. The Balance of Power histogram remains negative, though red bars are shrinking, signaling waning selling intensity. A decisive push toward the $70,000 max pain level could accelerate short-term flows tied to options hedging.

Ethereum (ETH) price prediction

Ethereum, meanwhile, trades near $1,958 after sliding from above $3,000 in January to a recent low around $1,900. The daily chart shows ETH attempting to form a base just below the $2,000 psychological level.

The RSI sits near 34, recovering from oversold territory but still below the neutral 50 mark, indicating momentum remains fragile.

Immediate resistance is clustered between $2,000 and $2,050, notably close to the max pain level. A break above that zone could trigger a squeeze toward $2,200. Support lies near $1,900, with a deeper floor around $1,800.

With positioning skewed toward calls, particularly in Bitcoin, traders will be watching whether price gravitates toward max pain levels or breaks decisively as contracts expire, potentially setting the tone for the next directional move.

Crypto World

SEC Commissioners Outline ‘Incremental’ Path for Tokenized Securities Frameworks

Securities and Exchange Commission (SEC) leadership unveiled a concrete plan for an “innovation exemption” at ETHDenver Wednesday, signaling a pragmatic but cautious pathway for trading tokenized securities in U.S. markets.

SEC Chair Paul Atkins and Commissioner Hester Peirce detailed an incremental framework that allows crypto companies to facilitate limited trading of blockchain-based traditional assets, effectively creating a regulatory sandbox for Real World Assets (RWAs).

Quick Takeaways

The Exemption Deal: The proposal allows issuers to collaborate with specialist transfer agents to whitelist token holders for onchain trading.

Volume Limits: The “innovation exemption” will likely include strict volume caps and temporary duration periods to test stability.

Market Demand: Tokenized stock interest is exploding.

Why The SEC Is Acting Now

The agency is playing catch-up with market reality. Over the last year, TradFi giants have aggressively moved toward blockchain settlement.

Nasdaq Nasdaq wants to update its rules so some stocks and exchange-traded products can exist in either a normal digital form or as blockchain-based tokens.

Trading would work the same way it does today.

The only difference is that blockchain technology would help handle record-keeping and settlement behind the scenes. is already seeking approval to trade tokenized equities alongside traditional stocks.

This follows the SEC’s January 2026 clarification, which established that the economic reality of an asset determines its status, not the technology used.

This regulatory clarity is crucial for product issuers, paving the way for even more major ETF launches and staking products from firms like Grayscale and Canary Capital.

Details on the ‘Incremental’ Approach

Don’t expect an overnight revolution. Commissioner Peirce described the exemption as a “modest” step, comparing the current state of tokenized securities to buying an “abandoned storage unit.”

“Tokenized securities are still securities,” Peirce reiterated. The new framework focuses on integrating technology without dismantling investor protections.

Under the plan, issuers can test novel platforms, likely DeFi Automated Market Makers (AMMs) on permissionless chains, provided they maintain strict compliance with disclosure and custody rules.

This measured approach contrasts sharply with other global jurisdictions.

While the U.S. attempts to integrate crypto rails, authorities elsewhere are clamping down, with Russia moving to block foreign crypto exchanges entirely.

What This Means For Traders

This is the green light for institutional-grade RWAs. If approved, this exemption bridges the gap between “crypto native” assets and traditional finance.

For traders, this signals that liquidity for tokenized treasuries and equities will likely move on-chain in a regulated manner.

This is particularly bullish for ledgers optimized for RWA operations, a sector where XRP is currently aggressive in establishing infrastructure.

However, risks remain. Regulatory experts warn that “synthetic” tokenized securities, those not directly sponsored by the issuer, could be classified as security-based swaps, carrying higher counterparty risks.

It is a stark reminder of the risks noted by Christine Lagarde regarding digital assets operating without clear frameworks.

Expect formal rulemaking for these crypto capital-raising pathways by mid-2026.

Discover: The best pre-launch crypto sales

The post SEC Commissioners Outline ‘Incremental’ Path for Tokenized Securities Frameworks appeared first on Cryptonews.

Crypto World

Crypto slides, but Tokenized RWAs and VC Push Ahead

Crypto markets have erased nearly $1 trillion in value over the past month, yet parts of the industry tied to infrastructure and tokenized real-world assets (RWAs) are telling a different story. Tokenized Treasurys are expanding, venture firms are still raising capital and Bitcoin-focused companies are consolidating their footprints.

This week’s Crypto Biz looks at the widening gap between spot markets and capital formation — from Nakamoto’s $107 million acquisition spree to Dragonfly’s new $650 million fund, the continued rise of tokenized RWAs and why Paradigm says Bitcoin miners may have a growing role in stabilizing the power grid.

Nakamato to acquire two Bitcoin companies for $107 million

Bitcoin holding company Nakamoto has agreed to acquire BTC Inc and UTXO Management in a combined $107 million deal, expanding its footprint across Bitcoin media, events and financial services.

Under the terms of the agreement, investors in BTC Inc and UTXO will receive 363,589,819 shares of Nakamoto common stock. The shares are priced at $1.12 under a call option structure, which is well above Nakamoto’s current trading price of about $0.30.

The transaction brings Bitcoin Magazine and the annual Bitcoin Conference under Nakamoto’s umbrella, while adding UTXO’s asset management and advisory business to the company’s portfolio.

Dragonfly closes $650 million fund

Despite a broader shake-up in crypto venture capital, Dragonfly Capital has closed its fourth fund at $650 million, signaling continued institutional appetite for blockchain infrastructure plays.

The firm indicated it is increasingly focused on financial products built on blockchain rails, including payment systems, stablecoin networks, lending markets and tokenized real-world assets. The strategy reflects a wider pivot among investors toward revenue-generating infrastructure rather than speculative token launches.

“This is the biggest meta shift I can feel in my entire time in the industry,” said Dragonfly general partner Tom Schmidt, describing the transition toward onchain finance and tokenized capital markets.

Tokenized RWA market expands despite crypto downturn

While broader crypto markets remain under pressure, tokenized real-world assets continue to gain traction, highlighting steady demand for onchain yield products.

The total value of tokenized RWAs has climbed about 13.5% over the past 30 days, according to RWA.xyz data. Over the same period, the broader crypto market has lost about $1 trillion in value. Much of the RWA growth has been driven by tokenized US Treasurys and private credit, though tokenized stocks are also gaining traction.

The divergence underscores how tokenized fixed-income products continue to attract capital even during periods of market stress, positioning RWAs as one of the more resilient segments of the digital asset economy.

Paradigm reiterates Bitcoin mining’s role in energy stabilization

Venture firm Paradigm is making the case that Bitcoin mining can serve as a flexible power load on the grid, potentially helping balance electricity demand at a time when local energy sources are being constrained by rapid AI data center development.

In a recent report, Paradigm argued that Bitcoin miners are well-positioned to absorb excess generation during low-demand periods and scale back when the grid is strained. That flexibility, Paradigm suggests, could make mining a useful partner for utilities facing peak-load challenges.

The idea isn’t entirely new, but it’s getting renewed attention as pressure grows on power systems from both decarbonization goals and rising overall electricity use tied to AI. Whether miners can actually deliver that flexibility at scale will depend on contracts with grid operators and the economics of energy markets, two areas with many moving parts.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Crypto World

XRP price risks $1.30 breakdown amid thinning liquidity

XRP price is hovering near $1.42 as thinning liquidity and repeated tests of the $1.30 support level raise the risk of a breakdown.

Summary

- XRP is down 25% in 30 days and remains below major resistance.

- On-chain data shows declining USD and XRP liquidity, increasing fragility.

- $1.30 is the critical support level to watch.

XRP traded at $1.42 at press time, down 0.7% in the last 24 hours. Over the past week, price has ranged between $1.35 and $1.64, with sellers capping rebounds near the upper end of that band.

The recent correction has been sharp. After a 25% decline over the last 30 days, XRP (XRP) is now 61% below its July 2025 peak of $3.65. As lower highs continue to form on the daily chart, the overall structure remains weak.

In derivatives markets, positioning is relatively stable. CoinGlass data shows futures volume up 0.96% to $3.75 billion, while open interest slipped 0.43% to $2.36 billion. That mix suggests traders are active but not aggressively increasing leverage.

Liquidity compression adds fragility

A Feb. 20 analysis by CryptoQuant contributor The Alchemist 9 reviewed three indicators: Binance exchange inflows, USD liquidity (MAG-XRP), and XRP liquidity (MAG-XRP).

During a previous rally phase, exchange inflows spiked sharply. Large inflows usually mean tokens are moving onto exchanges, which can signal potential sell pressure. In that instance, the spike occurred before a period of strong volatility and a major price expansion.

USD liquidity measures the capital depth supporting XRP markets. When XRP rallied, USD liquidity expanded and helped sustain the move. Recently, liquidity has been declining. With less capital depth in the order book, the price becomes more sensitive to sudden selling.

XRP liquidity tracks token-side availability. Before the earlier breakout, XRP liquidity compressed significantly. That reduction in active supply aligned with the start of the upward move. Now, XRP liquidity is trending lower again, resembling those earlier pre-expansion conditions.

At present, exchange inflows are moderate, but both USD and XRP liquidity are contracting. This creates a thinner market structure. In thin conditions, breaks of support or resistance often trigger sharper moves.

These metrics do not predict direction on their own, but they highlight rising volatility risk.

XRP price technical analysis

The $1.30 level is the key short-term support. It marks the lower boundary of recent consolidation. Price has repeatedly tested this range.

While rebounds followed, repeated touches often weaken demand. A daily close below $1.30 may lead to accelerated selling in a thin market.

Lower highs are still visible in the daily structure. The 50-day moving average serves as trend resistance, and XRP is trading below it. Bollinger Bands are tightening, showing price compression. This often precedes a strong move once support or resistance breaks.

The relative strength index is hovering between 35 and 45, reflecting limited bullish momentum. With attempts to push above 50 having failed, there is no clear bullish divergence at this stage.

If $1.30 holds and price reclaims $1.40 to $1.45, momentum could improve, opening room toward $1.50 to $1.60. If $1.30 breaks on a daily close, the next downside targets sit near $1.20 to $1.25, followed by $1.10 to $1.15 if selling pressure intensifies.

Crypto World

Polymarket acquires prediction market API startup Dome

Polymarket has acquired Dome, a Y Combinator-backed startup that is building a unified API solution for developers to access and build across multiple prediction market platforms.

Summary

- Polymarket has acquired Y Combinator-backed startup Dome.

- Dome offers a unified API for cross-platform prediction market access.

- It has raised $500,000 from Y Combinator and $4.7 million in seed funding.

The acquisition was confirmed by both companies in a Feb. 19 post on X, though neither side shared details about Dome’s future roadmap within Polymarket or how the team will be integrated. The financial terms of the deal were not disclosed.

According to details from Y Combinator, Dome was part of its Fall 2025 cohort and is developing a unified API for prediction markets through a single integration layer, where “developers can access live and historical data.”

“Dome makes it simple to trade, embed market data into products, and deploy strategies across multiple platforms through one interface,” it said.

Dome raised $500,000 from Y Combinator and secured a further $4.7 million in seed funding, according to details shared on the X profile of co-founder Kunal Roy, who, alongside Kurush Dubash, previously served as founding engineers at Alchemy.

“We’re obsessed with prediction markets and want to have the biggest impact in the space. There’s no better place to do that than Polymarket.” Dubash wrote on X.

Besides QCEX, a derivatives exchange and clearinghouse licensed by the U.S. Commodity Futures Trading Commission, which Polymarket acquired in a bid to re-enter the country, Dome marks the company’s first official acquisition focused on developer infrastructure.

Since it was greenlighted by the commission to operate an intermediated trading platform, Polymarket has secured multiple major partnerships with media brands like Yahoo Finance and Google Finance, alongside sports organizations such as Major League Soccer and the National Hockey League.

Last month, the company partnered with Parcl to launch a prediction market tied to real estate trends. It has also expanded onto the Solana blockchain through an integration with Jupiter and was recently added to the MetaMask mobile app, widening its retail distribution.

Crypto World

Bitcoin May See Upside After AI Stocks Become ‘Silly Big’

Bitcoin’s next major leg up could hinge on artificial intelligence stocks becoming excessively overvalued in the eyes of investors, according to macroeconomist Lyn Alden.

“It could be that the AI stocks eventually just peak, they get so silly big that they can’t get realistically much higher,” Alden told Natalie Brunell on the Coin Stories podcast published to YouTube on Thursday.

When an asset’s price rises to a level where further gains are harder to justify, capital often moves into other opportunities with more potential upside.

With Bitcoin (BTC) down almost 46% from its October all-time high of $126,100, Alden suggests it could be a beneficiary of that rotation.

Nvidia may be the “most important stock” in US, says exec

Some financial analysts are questioning whether the largest AI stocks will keep up their momentum in 2026. Albion Financial Group chief investment officer Jason Ware recently told Fox Business that he expects GPU chipmaker Nvidia (NVDA), the largest company on the Nasdaq stock exchange by market capitalization, to have “another great quarter,” but asked whether it will “be good enough.”

“We all know they are the most concentrated, obvious winner in the AI build out. Can that growth continue in a way that supports the stock moving higher?”

Nvidia’s (NVDA) stock price is up 35.48% over the past 12 months, according to Google Finance, and Ware said that it is “probably the most important company and most important stock in America in the market.”

The rise of investor interest in AI means that Bitcoin is now “competing for capital” in a way it never has before, Bitcoin developer Mark Carallo said on Thursday.

Bitcoin only needs a “marginal amount” of new demand

However, Alden said Bitcoin wouldn’t need a significant wave of capital to move higher. “It only takes a marginal amount of new demand to come in,” Alden said, adding that long-term holders essentially “put the floor in” as short-term traders rotate out.

“The coins rotate from fast money hands to strongly held hands; they are really not going to want to part with it unless it goes up like 5X or more, that kind of buyer,” she said.

Bitcoin is trading at $67,849 at the time of publication, down 24.49% over the past 30 days, according to CoinMarketCap.

Related: Bitcoin mining difficulty rebounds 15% as US miners recover from winter outages

Alden said she does not expect a quick, near-term surge in Bitcoin’s price.

“Bitcoin rarely makes V-shape bottoms outside COVID stimulus-type events,” she said, adding that it “normally it hits a low level then goes sideways for quite a while.”

“I think we’re in more of a grind,” Alden said, adding that it may move $10,000 lower or $20,000 lower, and it is still in that “grinding part.”

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Bitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets

As Bitcoin struggles to hold $67,000, options markets are flashing warning signs as traders aggressively bid up downside protection to hedge against a potential capitulation event.

By early morning, UTC, BTC had climbed 1% over 24 hours to trade near $67,000, recovering from an uneasy dip below the $66,000 handle.

The setup remains precarious. Even as price action steadies, the average U.S. ETF investor is nursing a stinging 20% paper loss, with a cost basis near $84,000. This fragility comes after a brutal 47% drawdown from the October 2025 highs.

- BTC steadies near $67K, but options skew remains bearish.

- Average ETF investor sits on a 20% unrealized loss.

- Private credit stress (Blue Owl) adds macro headwinds.

While recent reports indicate Abu Dhabi government funds bought $1 billion in BTC, while BlackRock doubled down on mining infrastructure, signaling continued institutional appetite, the broader retail market remains skittish. Investors are haunted by the prospect of a complete washout.

Discover: The best crypto to diversify portfolios with

Are We Facing Capitulation?

Jake Ostrovskis of trading firm Wintermute notes that traders are now “paying for insurance,” buying puts to cap downside risk while limiting their upside participation. This defensiveness aligns with harsh statistical realities.

The leverage washout has been severe, with Bitcoin recently hitting -2.88 standard deviations below its 200-day moving average—an anomaly unseen in a decade according to VanEck analysis.

Contagion fears are actively resurfacing. Crypto lender Blockfills froze withdrawals after a $75 million lending loss, echoing the collapses of 2022.

Simultaneously, traditional markets are flashing red: private credit giant Blue Owl fell 6% after curbing redemptions. With Fed minutes recently warning of macro headwinds, risk-off behavior is dominating the narrative.

Despite the gloom, huge divergence exists in equities. Bitcoin miners CleanSpark and MARA rallied 6%, outperforming the tech-heavy Nasdaq 100 which slid 0.6%.

Discover: The best crypto presales on the market

What Happens Next for BTC Price?

From a technical standpoint, Bitcoin is fiercely defending the $66,000-$68,000 zone. If this level fails, the bearish triangle pattern suggests a slide toward $60,000 or even $55k, according to CryptoQuant.

However, alternate scenarios exist. Arthur Hayes points to treasury liquidity as a potential savior for risk assets.

Furthermore, long-term confidence hasn’t evaporated; Trump insiders recently confirmed a $1 million target, suggesting whales may view this dip as a generational accumulation zone.

For now, bulls will be hoping for a swift run back to $84k to give the ETF customers confidence.

The post Bitcoin Holds Near $67K as Traders Pay Up for Crash Protection in Options Markets appeared first on Cryptonews.

Crypto World

Bitcoin Bears Face $600M Liquidation Risk, Sparks $70K Rally

Bitcoin (CRYPTO: BTC) has traded in a narrow corridor, effectively flinging up a question mark over the next directional thrust for the market. The past week has seen the benchmark crypto oscillate between roughly $65,900 and $70,500, a range that has left traders parsing for catalysts amid a broader risk-off climate. While momentum has oscillated, the risk of a sudden liquidation cascade remains a live concern: a modest rally could force a wave of short-covering in futures, squeezing risk assets higher and drawing new buyers back into the market. Against this backdrop, the network’s fundamentals have shown resilience, even as macro data continues to shape sentiment.

Key takeaways

- A 4.3% rise to about $69,600 could trigger more than $600 million in forced liquidations on short BTC futures, according to liquidation heatmaps. This dynamic underscores how quickly sentiment can flip on a price move.

- Hashrate has rebounded toward multi-week highs, with the seven-day average hovering near 1,100 exahashes per second, challenging earlier fears that miners were diverting capacity away from BTC toward other sectors.

- The BIP-360 proposal aims to bolster long-term security by enabling post-quantum protection through a backwards-compatible soft fork, addressing concerns about quantum threats while preserving on-chain privacy until spending.

- Macro data in the United States showed slower growth than expected, with Q4 2025 GDP at an annualized 1.4%, while inflation remained persistent, complicating expectations for near-term rate cuts and potentially nudging traders toward on-chain hedges.

- Futures funding dynamics show continuing pressure from bears, with periods of negative funding and persistent undercurrents that keep the market sensitive to any upside surprise that could trigger a short squeeze.

Tickers mentioned: $BTC, $NVDA

Sentiment: Bearish

Price impact: Positive. A rally toward the $69,600 area could force substantial short liquidations and tilt momentum back toward bulls.

Trading idea (Not Financial Advice): Hold.

Market context: The market sits at a crossroads where macro weakness and on-chain resilience collide: macro data suggests a slower economy and sticky inflation, while the Bitcoin network shows signs of structural strength through rising hashrate and post-quantum security planning, a combination that could set up a short squeeze if price action turns decisively higher.

Why it matters

The immediate price action for Bitcoin is heavily tethered to traders’ expectations about liquidity and leverage in the futures market. When the price nudges, as it did toward the $69,600 region, liquidations—especially on short positions—become a dominant driver of momentum. In recent cycles, a sharp move higher from a tight range has repeatedly triggered a cascade of liquidations, squeezing out speculative bets and luring fresh capital back into the market. This mechanism is particularly potent when the market trades below psychologically important levels and a sudden uptick can trigger a cascade that shifts market psychology from pessimism to renewed risk appetite.

On the fundamental side, the resurgence of network hashrate to around 1,100 exahashes per second signals that participants remain confident enough to invest in BTC mining hardware despite external price pressures. This resilience is notable because it counters early fears that mining capacity might drain away toward other sectors, including AI. The reacceleration in hashrate contributes to a sense of on-chain security and network durability, factors that historically underpin longer-term valuations rather than short-term price skews.

Another dimension of the story is the technical roadmap embodied by BIP-360, a proposal designed to address post-quantum security risks without disrupting current operations. By safeguarding the spend-path and concealing public keys on-chain until spend time, this plan reduces the potential exposure to quantum computing threats while preserving privacy in ordinary conditions. If such a soft fork progresses smoothly, it could restore some bullish confidence by clarifying the long-term security narrative for Bitcoin, helping to offset near-term macro headwinds.

Meanwhile, macro data remains a headwind for many traditional assets. The United States posted GDP growth in the fourth quarter of 2025 at an annualized rate of 1.4%, below expectations, a development that tends to sap risk appetite in equities and dampen immediate expectations for aggressive monetary easing. Coupled with inflation data that showed the PCE price index excluding food and energy rising 0.4% month over month, investors have had to recalibrate their outlooks for rate trajectories. In this environment, on-chain markets can appear attractive to macro traders seeking uncorrelated or counter-cyclical exposure, even as the total market risk remains elevated.

Another layer to consider is the broader risk-off mood evident in traditional markets, including the S&P 500 and gold. As equities waver, gold has emerged as a potential hedge, but the relative stock-bond dynamic remains unsettled. The trading landscape—characterized by muted upside momentum yet persistent volatility—suggests that Bitcoin could act as a catalyst for a broader reallocation if fundamental improvements align with a technical breakout above key levels like $70,000.

In terms of funding dynamics, BTC perpetual futures have shown a mix of negative and neutral readings in recent sessions. This indicates that bears have remained committed to their positions even as price tests important supports. The combination of tighter funding and a risk-off tilt has kept upside momentum in check, even as the network-side improvements create a foundation for possible reversals should liquidity and sentiment align in favor of bulls.

For investors watching the space, the question remains whether this confluence of macro weakness, on-chain resilience, and a clearer security roadmap can coalesce into a sustainable rally or whether the market will continue to drift in a wide range until a new catalyst emerges. In the near term, the path of least resistance may hinge on the balance between fear of macro risks and the lure of a short squeeze driven by liquidations and forced unwindings on the downside bets.

In sum, Bitcoin remains at a pivotal juncture. The combination of a rebuilt hashrate, a tangible post-quantum roadmap, and an expected price re-pricing driven by liquidations could tilt sentiment in favor of bulls, but only if macro catalysts align and the market can sustain buying interest above critical thresholds. As traders monitor the interplay between on-chain fundamentals and macro headlines, the next move could redefine the near-term trajectory for BTC and potentially ripple through the broader crypto complex.

What to watch next

- Watch for a move back above $70,000 and the subsequent response in long vs. short positioning in BTC futures.

- Track the seven-day hashrate trend toward or above 1,100 EH/s and any updates on the deployment or consensus around BIP-360.

- Monitor U.S. macro releases, including GDP and PCE data, for potential shifts in risk appetite and liquidity conditions.

- Observe funding rates on BTC perpetual futures for signs of shifting trader sentiment or emerging short squeezes.

- Follow ETF flows and commentary around the Bitcoin investment vehicle landscape for potential liquidity influx or withdrawal pressures.

Sources & verification

- CoinGlass liquidation heatmap estimates for a move toward $69,600, illustrating potential short BTC futures liquidations exceeding $600 million.

- U.S. GDP growth for Q4 2025 at 1.4% annualized, as reported by Yahoo Finance.

- U.S. personal consumption expenditures price index ex food and energy rising 0.4% month over month, contributing to the inflation backdrop.

- HashrateIndex seven-day hashrate data showing a recovery to around 1,100 EH/s.

- BIP-360 post-quantum security framework and its intended soft-fork approach for hiding public keys on-chain until spending time.

- BTC perpetual futures funding rate observations from market data providers, including notes on recent negative funding periods.

Bitcoin price dynamics and network resilience

Bitcoin (CRYPTO: BTC) is navigating a delicate phase where on-chain security fundamentals converge with macro headwinds to shape the near-term path of least resistance. The range-bound price action has left the market vulnerable to abrupt shifts driven by leveraged positions, but it is precisely this dynamic that can catalyze swift reversals when liquidity returns and short positions are forced to unwind. CoinGlass estimates suggest that a move to around $69,600 could unleash substantial short liquidations, potentially flipping sentiment from fear to momentum if buyers reenter with conviction. This interplay between price, leverage, and liquidity remains a defining feature of the current market backdrop.

Beyond price, the on-chain story has gained clarity. The seven-day average hashrate has climbed back toward the high end of recent ranges, signaling ongoing mining activity and network resilience even in the face of price pressure. While early concerns that miners would pivot away from BTC toward other sectors have cooled, the resilience of hashrate underscores a broader risk-reward calculus: the network’s security and stability continue to be a central factor for long-term investors evaluating BTC’s role in diversified portfolios. The BIP-360 proposal further reinforces this narrative by addressing post-quantum threats through a backwards-compatible mechanism, significantly reducing the risk posed by quantum computing to on-chain security while preserving user privacy until spend moment.

Market participants are also weighing macro data that remains less than supportive of a rapid risk-on rebound. The GDP print and inflation metrics paint a picture of a still-fragile macro environment, where the quest for yield remains tempered and risk assets require a clear catalyst. In such an environment, Bitcoin’s potential for a short squeeze depends on a combination of technical breakouts, improved on-chain fundamentals, and a shift in risk sentiment—a trifecta that could redraw the balance of power between bears and bulls in the months ahead. Traders will be watching for sustained buying pressure above key levels, and the emergence of a decisive narrative that can both reassure existing holders and entice new entrants into the market.

As the market continues to digest these inputs, the path forward will likely hinge on how quickly macro volatility evolves and how effectively the Bitcoin ecosystem communicates its security and scalability roadmap to a broader audience. The balance between fear and opportunity remains delicate, but the confluence of improved network metrics, post-quantum safeguards, and the potential for liquidity-driven reversals means the coming weeks could redefine Bitcoin’s standing in the risk spectrum. For now, observers should remain cautious but attentive to any shift that could unleash a new cycle of momentum in this evolving market.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion9 hours ago

Fashion9 hours agoWeekend Open Thread: Boden – Corporette.com

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show

(@EthereumDenver)

(@EthereumDenver)  Eric Trump says Bitcoin will reach $1 million.

Eric Trump says Bitcoin will reach $1 million.