Crypto World

The Insiders Know Something: 200 Consecutive Sales as Markets Crumble

TLDR:

- All 200 top insider transactions were sales, marking unusual broad risk reduction among insiders.

- Bitcoin ETFs saw significant outflows as the price dipped below key technical support levels.

- ETF flows have fluctuated widely, signaling shifting institutional sentiment toward crypto exposure.

- Concurrent declines in BTC, ETH, and ETFs indicate heightened market correlation and risk aversion.

The Insider Selling Storm 2026 narrative emerges amid real market stress and mixed institutional flows. Bitcoin recently traded near $63,000–$74,000 after a multi‑month selloff that erased much of 2025’s gains.

Major Bitcoin ETFs like iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC saw outflows and deep losses as prices fell below support levels.

Despite near‑term weakness, Bitcoin ETF flows have swung between record inflows and heavy redemptions in recent months. This points to a volatile institutional interest as macro risks rise.

Insider Activity Signals Market Caution

High-volume insider trades last week show that all 200 meaningful transactions were sales. No significant purchases occurred, highlighting informed caution across sectors.

Public messaging remains optimistic, but insider behavior diverges sharply. Confidence is high in narratives, yet top-level actors systematically reduce exposure.

Market participants respond to risk rather than headline sentiment. Structured risk management drives uniform selling patterns.

Insiders offload overvalued and liquid assets while preserving scarce, durable holdings. Their actions align with simultaneous declines across multiple markets globally.

Trading volume provides further clarity. While prices stabilized temporarily, reduced liquidity suggests relief rallies are absorption events.

Participants are used strategically as exit points rather than accumulation opportunities. This behavior demonstrates that the market is in a late-cycle phase.

Distribution occurs quietly as informed sellers convert exposure into liquidity, leaving fewer active buyers for high-risk assets.

Synchronized Declines and Defensive Positioning

Bitcoin fell to $60,000 while silver dipped to $64, and major tech stocks weakened sharply during the same period. Housing shows early signs of reduced activity.

Short-term price recovery is evident but weak. Lower trading volumes indicate the bounce is temporary and driven by selective buyers.

Stablecoins, including USDT and USDC, exhibit steady inflows, signaling defensive capital allocation. Long-duration assets such as Bitcoin, metals, and select real estate remain largely held.

These assets retain value when financial markets rely on confidence rather than scarcity, emphasizing durability and risk protection.

Relief rallies are distribution phases. Informed participants sell methodically while weaker buyers absorb inventory.

Market breadth remains thin, and recovery depends on volume expansion, not temporary price movements.

Capital allocation is increasingly selective. Participants seek optionality through liquid assets and avoid overvalued securities.

Market structure shows calm superficially, but underlying depth reflects cautious positioning and preparation for volatility.

Crypto World

Arkham data shows Bitmine sending 9,600 ETH to Coinbase Prime

Blockchain data shows that crypto treasury firm BitMine Immersion Technologies recently transferred around 9,600 ETH to wallets linked to Coinbase’s institutional platform Coinbase Prime.

Summary

- BitMine transferred 9,600 ETH to Coinbase Prime in two transactions worth roughly $19–20 million.

- Despite the move, the firm still controls over 1 million ETH across tracked wallets, with around 3.04 million ETH staked.

- Bitmine has accumulated more than 4.5 million ETH worth over $9 billion, positioning itself as one of the largest corporate holders of Ethereum.

Bitmine transfers 9,600 ETH to Coinbase Prime

According to on-chain intelligence platform Arkham, the transactions moved roughly 9,600 Ethereum (ETH), worth about $19–20 million at current prices, from Bitmine-controlled wallets to Coinbase Prime addresses.

Such transfers are commonly associated with institutional custody management, liquidity provisioning, or over-the-counter trading activity. The first transfer sent 5,300 ETH worth $10.75 million followed by a second batch of 4,308 ETH worth $8.74 million.

Despite the movement, Arkham data indicates that Bitmine continues to control more than 1 million ETH across tracked wallets, while a large portion of its holdings, around 3.04 million ETH, are staked.

Large transfers to Coinbase Prime are often linked to institutional custody management, over-the-counter (OTC) trading, or liquidity provisioning, rather than immediate spot market selling.

The company has emerged as one of the most aggressive corporate accumulators of Ethereum. Its strategy mirrors the corporate Bitcoin treasury model popularized by companies like MicroStrategy, but with a focus on Ethereum as the primary reserve asset.

Bitmine has dramatically expanded its ETH holdings in recent months as part of a large-scale buying spree. The company now holds over 4.5 million ETH tokens worth more than $9 billion, making it one of the largest institutional holders of the asset.

The firm has repeatedly added tens of thousands of ETH during market pullbacks, including purchases of more than 50,000 ETH in a single week, signaling strong long-term conviction in the network’s growth and institutional adoption.

This aggressive accumulation has drawn investor attention, particularly as Bitmine positions itself as a publicly traded vehicle for exposure to Ethereum. The company’s stock, traded under the ticker BMNR, has also shown signs of recovery alongside renewed buying activity and broader crypto market stabilization.

While the latest transfer represents only a small portion of its total reserves, it highlights the scale of Bitmine’s treasury operations and the growing role of large corporate entities in Ethereum markets.

Crypto World

Pi Network (PI) Eyes $0.50 Target as Four Key Drivers Align This Week

Key Highlights

- PI experienced a ~7% price increase on March 10, while trading volume exploded over 65% to reach $39.7 million

- Crypto analyst Dr. Altcoin forecasts PI reaching $0.50 within the week, citing Pi Day on March 14 as a major catalyst

- Scheduled network enhancements are set for completion by March 12, bringing anticipated DeFi capabilities

- Should Kraken announce a listing, the analyst suggests PI could surge to $0.75

- The token has gained approximately 70% from its record low and successfully breached critical resistance zones

The PI token from Pi Network recorded approximately 3% gains on March 9, bouncing back from a 5% decline the previous day. Throughout the last week, the cryptocurrency advanced from $0.166 to approximately $0.221, delivering stronger performance than both Bitcoin and Ethereum during this timeframe.

Trading activity has experienced a dramatic uptick. A month ago, daily volume barely reached $10 million. Current data from CoinGecko and CoinMarketCap shows it has rocketed past $400 million.

Cryptocurrency analyst Dr. Altcoin shared on X that PI may achieve the $0.50 milestone within the coming days. This represents approximately 130% appreciation from present values and would mark the token’s peak price point since July 2025.

His analysis identifies four key catalysts: the March 14 Pi Day celebration, escalating trading volumes, sustained price momentum, and speculation around a Kraken exchange integration.

Pi Day Celebration and Technical Enhancements

March 14 represents Pi Day, a significant annual milestone within the Pi Network ecosystem. Historically, the development team has leveraged this date to reveal substantial announcements and strategic roadmap developments.

Planned network improvements are targeted for completion by March 12. Fresh DeFi infrastructure, potentially featuring a PiDEX or automated market maker system, is anticipated to go live during this window.

The Pi Network development team utilized the first mainnet anniversary celebration in February to communicate strategic objectives encompassing artificial intelligence integration, accelerated KYC verification processes, and plans for a KYC-as-a-Service offering.

Chart Analysis and Price Targets

From a technical perspective, PI has climbed above its 100-day Exponential Moving Average. The Supertrend technical indicator has switched from bearish red to bullish green for the first time in several months.

The cryptocurrency successfully penetrated the $0.2146 barrier, which represented its January peak. The Percentage Price Oscillator has moved into positive territory and displays upward momentum.

Critical support exists within the $0.20 to $0.204 range. Maintaining prices above this area preserves the bullish technical structure. Falling beneath $0.20 could trigger a pullback toward $0.186.

Immediate resistance zones appear at $0.237, followed by $0.29. Clearing these barriers would bring the $0.50 projection into realistic territory.

Dr. Altcoin further noted that an official Kraken listing confirmation coinciding with Pi Day celebrations might propel PI toward the $0.75 level.

PI secured a position among the most-tracked cryptocurrencies on CoinMarketCap on March 10, indicating heightened retail investor attention building ahead of the upcoming event.

The countdown stands at five days until March 14 arrives.

Crypto World

Bitcoin ETFs Gain $167M While Altcoin Funds See Outflows

US spot Bitcoin exchange-traded funds posted net inflows on Monday, snapping a two-session stretch of outflows as Bitcoin rose toward $70,000 and investor demand returned to the largest cryptocurrency.

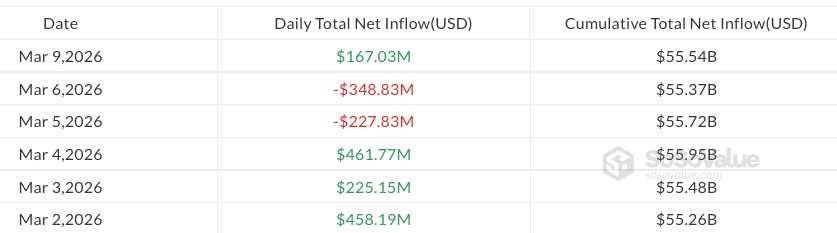

Spot Bitcoin (BTC) ETFs recorded $167 million of inflows on Monday, following around $577 million in outflows on Thursday and Friday, according to SoSoValue data.

Demand was weaker across other crypto-linked ETFs. Altcoin funds experienced significant selling pressure, with outflows persisting across Ether (ETH), XRP (XRP) and Solana (SOL) ETFs even as the underlying tokens rose 3-5% over the past 24 hours, according to CoinGecko data.

The gains followed US President Donald Trump telling reporters on Monday that the war with Iran could be coming to an end, easing geopolitical fears and pushing oil prices lower.

Ether, XRP and Solana now on a three-day outflow streak

Ether, XRP and Solana ETFs saw outflows totaling $51 million, $18 million and $2.5 million, respectively, on Monday, according to SoSoValue. This marked a three-day outflow streak, with Ether seeing the largest cumulative losses at $225 million.

While ETH and SOL selling have been subsiding over the past three trading sessions, XRP outflows increased, totaling around $41 million since Thursday. Solana’s outflows amounted to roughly $16 million over the same period.

Related: Crypto funds gain $619M as markets hold up despite oil and war fears

The sideways trading in crypto ETFs came as analysts warned that it’s still early to declare a structural bottom in Bitcoin, which traded at $70,015 at the time of writing, according to CoinGecko.

CryptoQuant’s analyst IT cited the Bitcoin long-term holder to short-term holder spent output profit ratio, which hit 0.89, showing short-term holders selling at a loss.

The data suggests market stress is building, but has not yet reached capitulation levels, meaning a clearer bottom may still be ahead.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

CoinPoker Debuts New App with Rake Free Poker, Signs Abby Merk and Papo MC

[PRESS RELEASE – Panama City, Republic of Panama, March 10th, 2026]

Online poker site CoinPoker launched a new software client and mobile app in March 2026 alongside rake-free poker games and the signing of new sponsored players.

Joining the site’s ambassador team – already including some of the top names in poker, such as three-time Triton Series champion Mario Mosböck and WSOP Online main event champion Benjamin ‘Bencb’ Rolle – are Abby Merk and Alejandro ‘Papo MC’ Lococo.

https://x.com/CoinPoker_OFF/status/2030009912424849452

United States pro Abigail ‘Abby Poker’ Merk is an award-winning poker content creator from Chicago, ranked among the top female players in Illinois. With a background in volunteering, tutoring, and mentorship, Abby has also trained women in leadership skills and strategic thinking through the game of poker.

Freestyle rapper Papo MC has over $15 million in live tournament earnings – the #2 ranked player in Argentina behind Nacho Barbero – and a World Series of Poker bracelet.

Other household names of poker, such as Jean-Robert Bellande, Faraz Jaka, Mariano, YoH ViraL, Nik Airball, and Brantzen Wong, have also recently announced partnerships with CoinPoker.

https://x.com/mariomosboeck/status/2030247270378020932

Rake-Free Poker Games

Throughout March, CoinPoker is hosting rake-free poker games – players receive all cash game rake and tournament fees back daily, in the form of various promotions. In the first half of the month, players can potentially earn 100% flat rakeback credited to their accounts at 08:00 UTC each day.

In the second half of March, CoinPoker is returning all rake to players in the form of Splash Pot cash drops, CoinRaces leaderboards, and a Level Up Series of tournaments with boosted prizepools and refunded buy-ins – making for free poker tournaments until March 31.

Level Up Series

The Level Up tournament series debuts the site’s new multi-day tournaments and features such as bubble protection, blind rollback, final table deals and more. These events run alongside the site’s regular freerolls and MTTs, with added value in the prizepool and a full rebate on the rake.

That free poker event made headlines on PokerStrategy, and the 100% rakeback promotion was featured on Esports Insider.

Following its new software rollout, CoinPoker has also been rated among the best poker apps by the likes of Card Player Magazine and Gambling Insider and seen record traffic, rivalling the likes of GGPoker with over 7,000 players online for launch day.

The new poker app and desktop client include in-built player stats powered by PokerIntel, new games like PLO6, All-in or Fold, and Bomb Pot formats, and new features like EV cashouts, Interactive Emojis, and Throwables at the tables. No Limit Hold’em, Pot Limit Omaha, and PLO5 are also available, now with an improved lobby and table interface.

Throughout March, all of its poker games are essentially free to play to debut the new software, and its welcome bonus offer of 150% up to $2000 also returns in April onwards.

About CoinPoker

CoinPoker is an online poker site available for download on Windows, Mac, iOS, or Android, alongside an in-browser web client for free poker on mobile.

The platform’s tournaments and cash games are played in stablecoin Tether (USDT). Other major cryptocurrencies are also accepted, such as Bitcoin, Ethereum, and USDC, and 25+ countries can also deposit by bank transfer.

Alongside free poker action against real opponents around the world, the site also has an attached crypto casino and sportsbook.

Website: https://coinpoker.com/

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SharpLink Gaming Stock Reports $734M Loss Tied to ETH Holdings

SharpLink, Inc. (formerly SharpLink Gaming Stock) has reported a staggering -$734M comprehensive loss for the fiscal year, driven almost entirely by market volatility in its corporate Ethereum treasury.

While the headline number implies a catastrophic operational failure, the underlying mechanics tell a more nuanced story of asset accumulation and passive earnings.

This is due to ETH USD and its yield-bearing nature, meaning that SharpLink is earning on its staked holdings. Since June 2025, the firm has accrued over 14,500 ETH in rewards, totaling over $29M at current prices.

Shareholders are now navigating a high-beta trade in which traditional earnings metrics have been replaced by staking yields and fluctuations in net asset value (NAV).

What the -$734M Loss Reveals About Corporate Crypto Risk

The reported loss is primarily a function of accounting mechanics meeting crypto volatility. As of March 9, 2026, SharpLink held 867,798 ETH, valued at approximately $1.72Bn, making it the second-largest public holder of the asset, behind BitMine.

The company has aggressively staked these assets, with nearly 100% of its treasury currently deployed to generate yield, underscoring SharpLink’s long-term belief in Ethereum.

Unlike a standard corporate risk scenario involving failed investments, SharpLink’s balance sheet hit reflects the mark-to-market reality of holding volatile assets during price drawdowns. However, the strategy has proven productive despite the valuation dip.

Former BlackRock executive and current SharpLink Gaming Stock Co-CEO Joseph Chalom has positioned the firm to capture yield regardless of spot price action.

According to company filings, the treasury includes 587,232 native ETH and nearly 280,000 ETH in liquid staking derivatives (LsETH and WeETH), signaling a sophisticated approach to capital efficiency that retail traders rarely see on public balance sheets.

EXPLORE: Best Crypto Presales to Buy in 2026

Could This SharpLink Gaming Stock Loss Trigger a Wave of Corporate Crypto Rethinks?

SharpLink’s performance is a litmus test for institutional appetite for crypto-proxy equities. Despite the paper losses, institutional ownership in the company soared to a record 46% by the end of 2025.

This suggests that Wall Street is increasingly treating the stock as a leveraged ETH ETF with a yield kicker, rather than a traditional tech company.

The market is currently reacting to broader macro pressures impacting crypto asset prices, which are amplifying volatility on SharpLink’s books. Wall Street analysts note that while the $734M loss looks ugly in the headlines, the stock price is up +54.47% over the past year.

If Ethereum undergoes a prolonged period of downside price action, the correlation between the company’s solvency and ETH prices tightens significantly.

This mirrors the early days of MicroStrategy’s Bitcoin pivot, but with the added complexity of staking rewards and regulatory considerations around yield-bearing assets.

The Levels That Change Everything for SharpLink Shareholders

The key metrics to watch are the ETH-per-share ratio and the dilution rate, not the net loss. Recently, shareholders approved increasing the authorized common stock from 100M to 500M shares and raising up to $6Bn. If the company dilutes shareholders faster than it accumulates ETH, the value proposition could collapse.

Traders should keep an eye on institutional inflows versus the company’s aggressive ATM offerings. SharpLink’s stock is expected to decouple from traditional earnings reports and align more with its Ethereum treasury value.

If the company can accumulate ETH while managing shares, the $734M loss may be seen as volatility rather than destruction. However, if ETH prices don’t recover from recent $2Bn acquisitions, pressure on the $6Bn funding facility will increase.

Looking ahead, the market will closely analyze Q1 2026 earnings for signs of Chalom’s forecast of a 10x increase in Ethereum TVL. For now, SharpLink represents a high-risk bet on Ethereum’s future, with significant losses viewed as a normal cost of doing business.

DISCOVER: Next Crypto to Explode in 2026

The post SharpLink Gaming Stock Reports $734M Loss Tied to ETH Holdings appeared first on Cryptonews.

Crypto World

Why Is XRP’s Price Up Today Despite Another Massive ETF Withdrawal?

The ETFs recorded their worst outflow day since late January.

Ripple’s cross-border token has joined the overall market resurgence over the past day, jumping by 4% and touching $1.40.

What’s particularly interesting about this pump today is that it comes despite the substantial outflow from the spot XRP ETFs yesterday.

Why Is XRP Up Today?

XRP was rejected at nearly $1.50 last week when the entire crypto market rebounded after the US and Israel launched attacks against Iran. Alongside most altcoins and the market leader, XRP dumped to $1.35 in the following days and even slipped to $1.32 on Sunday when BTC dropped to $65,500.

It reacted well to the latest correction and went on the offensive, especially in the past 12 hours or so. As of now, the token trades at just over $1.45 for the first time since last Friday. Perhaps a large portion of this jump today could be attributed to the aforementioned market-wide revival propelled by Trump’s remarks yesterday evening that the war with Iran is “very complete, pretty much.”

Separately, today’s gains come just shortly after Ripple’s official channel on X outlined some of the major advancements in the Ripple Payments infrastructure, including over $100 billion in transactions, reaching more than 60 markets, and having 51 real-time rails.

$100B+ processed.

60+ markets.

51 real-time rails.

RLUSD at $1B market cap in under a year.Ripple Payments brings it all together: fiat, stablecoins, 75+ licenses, so businesses can move money globally without the patchwork: https://t.co/f5yXTWOPQk pic.twitter.com/1IpEci84d4

— Ripple (@Ripple) March 9, 2026

What’s Next?

Analyst CW weighed in on XRP’s price performance, noting that long positions continue to “increase gradually,” adding that investors are “quietly preparing for a rise.”

You may also like:

Fellow analyst CryptoWZRD explained that the asset had closed the previous daily candle indecisively, and added that Ripple’s coin needs “more positive sentiment from XRPBTC, which will help the move.”

They said that positive territory would be visible once XRP reclaims the $1.4230 level; otherwise, it could face another price drop.

XRP Daily Technical Outlook:$XRP closed indecisively. We need more positive sentiment from XRPBTC, which will help the move. Above $1.4230 is positive territory. Below that level, the market will decline further 🧙♂️ pic.twitter.com/0plZtDiFrD

— CRYPTOWZRD (@cryptoWZRD_) March 10, 2026

XRP ETFs Bleed Again

In contrast to the notable 4% gains charted today, the spot XRP ETFs have continued to see substantial withdrawals. Data from SoSoValue shows that investors pulled out a total of $18.11 million from the funds yesterday, the highest single-day net outflow since January 29.

Last week also ended in the red, although it began on a strong note and the ETFs had recorded a 7-day green streak, which was broken on March 5. As of now, the cumulative net inflows have dropped to $1.22 billion from a recent peak of $1.26 billion.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Vitalik Buterin Introduces DVT-Lite to Streamline Ethereum (ETH) Staking Process

Key Highlights

- Ethereum’s Vitalik Buterin proposes DVT-lite to enable “one-click” staking accessibility for institutional participants

- In February, the Ethereum Foundation deployed 72,000 ETH through a streamlined “DVT-lite” configuration

- The DVT-lite framework deploys identical validator keys across multiple machines, ensuring automatic failover if one system fails

- The Foundation’s 72,000 ETH deposit sits in the validator activation queue with expected activation on March 19

- Network-wide staking has reached 37.5 million ETH, valued at roughly $76.5 billion, accounting for 31% of circulating supply

Vitalik Buterin, co-creator of Ethereum, is championing a new approach to make staking more accessible to institutional players through a streamlined distributed validator technology variant dubbed DVT-lite. Buterin contends that overly complicated technical requirements are undermining network decentralization and believes ETH holders should participate in staking without requiring specialized expertise.

Through a social media post on X, Buterin outlined his vision to transform distributed staking into a “maximally easy and one-click” experience for institutions. He detailed an architecture where validators operate within simplified containerized systems, such as Docker containers, with automatic peer-to-peer cluster connectivity.

The architecture employs a single validator key distributed across multiple machines. When one machine experiences downtime, backup systems seamlessly assume validation duties, minimizing exposure to penalties — referred to as “slashing” — that result from validator inactivity.

This approach diverges from traditional DVT implementations, which fragment private keys across numerous machines and demand continuous inter-node coordination. While traditional DVT offers enhanced security, it introduces significant configuration complexity. DVT-lite targets delivering comparable advantages with substantially reduced operational overhead.

According to Buterin, the notion that blockchain infrastructure management requires specialized professionals is “awful and anti-decentralization.” He emphasized the urgent need to confront and dismantle this perception.

Foundation Pilots DVT-Lite With Major Deployment

The Ethereum Foundation has already implemented DVT-lite in real-world conditions, deploying 72,000 ETH through this system in February. These funds currently await activation in the validator entry queue, with full staking scheduled for March 19.

Buterin revealed his intention to personally adopt this configuration and encouraged other major ETH stakeholders to do likewise. His objective is distributing validator control across a broader participant base rather than consolidating power among a limited group of specialized operators.

Earlier in January, he had proposed “native DVT” integration directly into the protocol layer, enabling staking participation without dependency on individual nodes. DVT-lite represents the immediate, implementable iteration of that broader concept.

Staking Activity Continues Surging Despite Market Conditions

Even as Ether trades near $2,068 and has lagged behind other assets recently, staking participation continues showing robust growth.

The validator entry queue currently contains 3.2 million ETH, creating a 55-day waiting period for new validators. Meanwhile, the exit queue holds merely 29,000 ETH with only a 12-hour processing time.

Across the entire network, 37.5 million ETH is actively staked. This figure represents 31% of Ethereum’s total supply and carries an approximate market value of $76.5 billion based on prevailing prices.

The Ethereum Foundation’s 72,000 ETH commitment will transition to active validation status on March 19, following completion of the entry queue process.

Crypto World

Anthropic sues U.S. government over AI blacklist tied to military use dispute

Artificial intelligence developer Anthropic has filed a lawsuit against multiple U.S. government agencies, accusing the federal government of unlawfully blacklisting its technology after the company refused to allow certain military uses of its AI systems.

Summary

- Anthropic sued multiple U.S. agencies, alleging retaliation after refusing certain military uses of its AI.

- The dispute centers on restrictions against autonomous weapons and mass surveillance using the company’s Claude AI models.

- The lawsuit challenges a federal directive that halted government use of Anthropic technology and labeled the firm a national security supply-chain risk.

The complaint, filed in the U.S. District Court for the Northern District of California, seeks declaratory and injunctive relief against a broad group of federal entities and officials, including the Departments of War, Treasury, State, and Homeland Security, as well as the Federal Reserve and Securities and Exchange Commission.

Anthropic alleges the government retaliated against the company after it refused to permit its AI model family, known as Claude, to be used for lethal autonomous warfare or mass surveillance of Americans.

According to the complaint, tensions escalated after government officials demanded that Anthropic remove those restrictions and allow the Department of War to make “all lawful use” of the technology. The company said it agreed to expand cooperation but maintained its two key safety limitations.

The dispute culminated in a directive from Donald Trump, ordering federal agencies to immediately cease using Anthropic’s technology, followed by a decision from the Department of War to label the firm a “Supply-Chain Risk to National Security.”

The designation barred military contractors and partners from doing business with Anthropic, effectively cutting the company out of the defense supply chain. Several agencies subsequently halted contracts or instructed employees to stop using the company’s AI systems.

Anthropic argues these actions violate the First Amendment, the Administrative Procedure Act, and constitutional due-process protections. The company claims the measures were taken in retaliation for expressing concerns about the safety and reliability of AI systems used in autonomous weapons and mass surveillance.

The complaint states the government’s actions have already led to canceled contracts and could jeopardize hundreds of millions of dollars in near-term business, while also damaging the company’s reputation and commercial relationships.

Anthropic is asking the court to declare the government’s actions unlawful and block enforcement of the directives while the dispute is litigated.

Crypto World

Tron Joins Agentic AI Foundation; Founder Foresees Future of AI

Tron (CRYPTO: TRX) DAO has joined the Agentic AI Foundation, signaling a strategic tilt toward AI agents and scalable, open on-chain infrastructure. In a Monday announcement, the Tron DAO stated that the network would become a member of AAIF and would hold a seat on its governance board. The move aligns with a broader industry push to develop interoperable standards for AI-enabled transactions, aiming to avoid fragmented ecosystems as agents operate across services.

The DAO argued that interoperable frameworks will play a critical role in enabling AI agents to operate across platforms without creating fragmented ecosystems. In recent weeks, industry commentary has emphasized the need for scalable blockchain infrastructure to support AI-powered automation, with Stripe executives noting a structural gap in capacity that must be addressed as AI agents gain traction (more from Cointelegraph). The integration of AAIF underscores Tron’s view that open standards and collaboration are essential to realizing this vision.

The AAIF is steered by the Linux Foundation and is designed to foster open-source development for agentic AI, while establishing governance, safety, and interoperability standards for the space. Tron joins a growing cohort of members that includes Circle and JPMorgan, a signal that traditional finance and crypto players are converging on shared, cross-chain AI infrastructure.

Tron’s founder, Justin Sun, has framed AI as a defining priority for 2026, arguing that the network’s speed, scalability, and low transaction costs make it well suited to host AI-driven agent transactions. The project also points to concrete steps already in motion, such as the Bank of AI—a financial layer built for AI agents by AINFT—which launched on Tron and BNB Chain in mid-February (see announcement).

According to DeFiLlama, Tron has been a standout in network revenue across recent windows, a signal that AI-related activity could be contributing to usage. The latest figures show Tron revenue around $1.01 million over the past 24 hours, $6.54 million over the past seven days, and $25.58 million over the past 30 days, underscoring robust real-world activity even before broader AI deployments fully unfold.

Sun has been vocal about the link between AI-driven demand and network usage, noting that “AI is scaling fast. When agents transact, demand shows up in the network metrics. TRON keeps leading on real usage.” The remarks reflect a broader industry expectation that AI agents will push throughput and liquidity considerations to the forefront of blockchain planning.

Industry observers have pointed to infrastructure shortcomings as AI agents scale, with Stripe’s leadership highlighting the need for more robust blockchain ecosystems. A Cointelegraph piece cited by Stripe leadership framed AI agent activity as a driver of demand that will require blockchains capable of handling billions of transactions per second, a benchmark many networks are racing toward as real-time AI-enabled automation expands.

Looking ahead, proponents say AAIF-backed standards could unlock more scalable, cross-chain workflows for AI agents, while Tron’s ongoing collaboration with other backbone platforms aims to reduce interoperability friction. The Bank of AI initiative, along with continued development of cross-chain tools and governance mechanisms, could help set the pace for how AI agents operate in mainstream crypto ecosystems.

Key takeaways

- Tron formally joins the Agentic AI Foundation and secures a seat on its governance board, signaling a strategic emphasis on AI-driven on-chain activity.

- The AAIF, run by the Linux Foundation, pursues open-source development and governance standards for agentic AI, emphasizing interoperability and safety.

- Circle and JPMorgan are among the notable peers already participating, highlighting a growing convergence of traditional finance and crypto on shared AI infrastructure.

- Tron’s leadership frames 2026 as a pivotal year for AI, citing speed, scalability, and low fees as competitive advantages for hosting AI agent transactions.

- The Bank of AI, launched on Tron and BNB Chain, demonstrates concrete actions toward enabling AI agents to operate within financial rails.

- Industry analysis points to a broader need for scalable infrastructure as AI agents push blockchain usage higher, aligning with evolving governance and interoperability standards.

Market context: The development of open, interoperable AI infrastructure is now a major theme across crypto and fintech, with industry voices calling for scalable, cross-chain frameworks to support AI agents’ growing transaction load. The Stripe reference and AAIF’s governance framework underscore a shift toward standardized tooling and safety regimes as AI-enabled automation becomes more prevalent in on-chain ecosystems.

Why it matters

The move places Tron at the center of a broader industry shift toward AI-native blockchain infrastructure. By aligning with AAIF, Tron signals a commitment to open standards that could reduce fragmentation as AI agents operate across ecosystems. For developers, this could translate into more interoperable tooling and safer, more accessible AI-enabled transaction flows. For investors and users, the coordination around governance and safety standards may improve confidence in deploying AI agents on public blockchains, potentially driving increased usage and liquidity.

From a builder’s perspective, the collaboration with AAIF and the Bank of AI demonstrates a path to scalable, real-world AI on-chain experiences. The emphasis on interoperability could lower integration costs and accelerate cross-chain AI workflows, while the Linux Foundation-backed governance framework seeks to balance experimentation with oversight. This balance matters for risk management, regulatory alignment, and long-term adoption of agentic AI across decentralized networks.

Finally, the involvement of established financial players such as Circle and JPMorgan suggests that traditional finance is increasingly eyeing AI-enabled on-chain operations. As AI agents become more capable, the market will closely watch how governance, safety, and interoperability standards evolve, and which ecosystems emerge as the most reliable environments for scalable AI-driven transactions.

What to watch next

- AAIF governance milestones and interoperability standard updates in the coming quarters.

- TRON’s cross-chain activity metrics and throughput as AI agent usage grows on the network.

- Adoption metrics for the Bank of AI across Tron and BNB Chain and any subsequent integrations with other networks.

- Additional AAIF members announced and their collaboration plans with existing participants.

- Regulatory signals and policy developments affecting open-infrastructure projects for AI on-chain ecosystems.

Sources & verification

- Tron DAO announcement of AAIF membership and governance seat: https://x.com/justinsuntron/status/2031241691064316309

- AINFT Bank of AI launch on Tron and BNB Chain: https://x.com/OfficialAINFT/status/2023026587088851265

- DeFiLlama revenue data for Tron: https://defillama.com/revenue/chains

- Stripe’s infrastructure gap discussion linked to AI agents (Cointelegraph): https://cointelegraph.com/news/stripe-ai-agents-will-require-blockchains-hit-1b-transactions-per-second

Tron anchors AI-driven interoperability on-chain

Tron (CRYPTO: TRX) DAO’s latest collaboration with the Agentic AI Foundation marks a deliberate shift toward building a cooperative AI-enabled ecosystem. The decision to join AAIF and secure a seat on its governance board underscores a belief that future AI agents will demand robust, cross-platform interoperability rather than bespoke, siloed systems. The Linux Foundation-backed foundation positions itself as a hub for open-source development, safety standards, and governance protocols—an environment where major players in both crypto and traditional finance co-create the scaffolding for AI agents to transact reliably and at scale.

In practical terms, the partnership signals an emphasis on standardization and shared infrastructure that could reduce friction for developers building AI agents across networks. Tron’s leadership argues that their platform’s speed and cost advantages render it particularly suitable for processing high-velocity AI transactions, while the ongoing Bank of AI initiative demonstrates concrete steps toward bridging AI-coded workflows with real-world financial rails. As the AI landscape evolves, observers will be watching for how AAIF’s governance and cross-industry collaboration translate into tangible benefits for users and builders alike.

Crypto World

Markets Rally as Trump Announces Iran Conflict Nearing Conclusion

TLDR

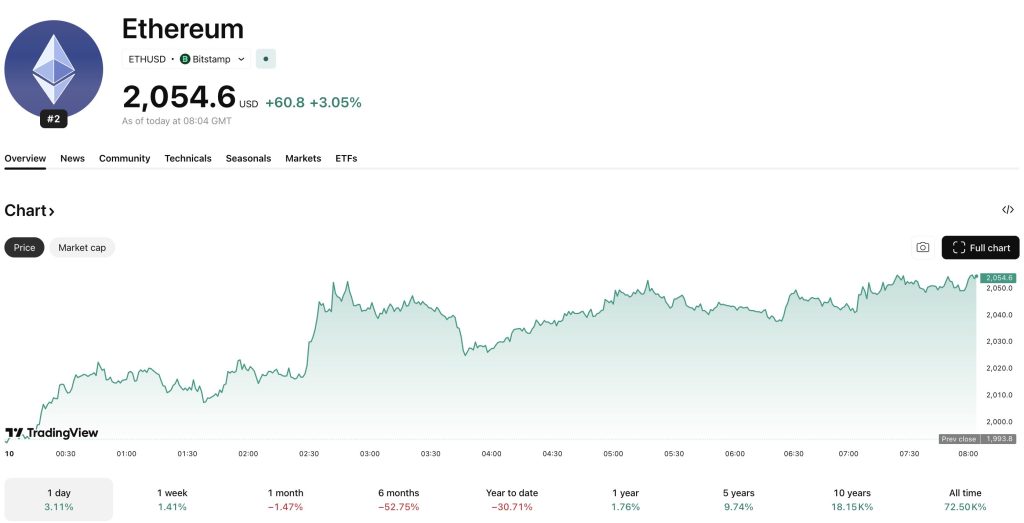

- Ethereum surged past the $2,000 threshold while Solana posted the strongest gains among major cryptocurrencies following Trump’s announcement that U.S. military goals in Iran were “pretty well complete”

- American equity futures posted gains Tuesday following a turbulent trading day; crude oil prices plummeted from peaks above $119 down to approximately $88 per barrel

- Digital asset investment vehicles attracted $619 million in capital over the week despite significant market volatility, with bitcoin-focused products capturing the majority

- Bitcoin’s three-month correlation coefficient with the S&P 500 reached 0.78, indicating alternative cryptocurrencies are amplifying broader market movements

- The upcoming Federal Reserve policy meeting scheduled for March 17–18 represents the next critical event, with any hawkish stance potentially pressuring higher-risk digital assets

Digital currency markets alongside U.S. equity futures experienced significant upward movement Tuesday following President Donald Trump’s declaration that hostilities with Iran were approaching conclusion, calming anxieties that had destabilized worldwide markets merely twenty-four hours prior.

Trump addressed journalists Monday evening, stating U.S. military goals were “pretty well complete” while expressing his belief that the conflict was progressing “very far” beyond its initially projected four-to-five week duration. He echoed these sentiments in statements to CBS News, indicating adversarial forces had essentially been stripped of their naval and aerial combat capabilities.

Oil markets responded immediately. West Texas Intermediate crude, which had momentarily surged beyond $119 per barrel during Sunday’s overnight session, declined to approximately $88. Brent crude retreated to roughly $92 per barrel.

Asian stock indices jumped 2% Tuesday after experiencing a 3.7% decline Monday. Technology equities within the MSCI Asia Pacific index soared 3.5%. Dow Jones futures increased 0.28%, while S&P 500 and Nasdaq 100 contracts similarly advanced.

Within cryptocurrency markets, ether appreciated 2.6% to reach $2,029, recapturing the $2,000 threshold it has struggled to maintain since February’s conclusion. Solana demonstrated the strongest performance with 2.9% gains, hitting $85.67. BNB increased 2.6% to $639. XRP climbed 1.7% to $1.37. Dogecoin managed just 1% growth and continues trading 1.4% lower for the week.

Market intelligence firm Nansen’s analysts observed that cryptocurrency markets had “already absorbed the negatives and priced them in,” indicating reactions were driven by news cycles rather than fundamental economic deterioration.

Institutional Capital Continues Flowing Into Digital Assets

Notwithstanding recent market turbulence, professional investors maintained their acquisition pace. CoinShares documented $619 million in cryptocurrency fund contributions for the week concluding Friday. Bitcoin investment vehicles captured $521 million of those inflows, elevating total assets under management to $108.3 billion.

These capital inflows occurred during a week witnessing the S&P 500 erasing $1 trillion in market capitalization during a single trading session while the U.S. economy eliminated 92,000 employment positions.

Ryan Kirkley, co-founder and CEO of Global Settlement, observed that spot bitcoin ETFs are “attracting capital even as price weakens,” highlighting how institutional participants view price declines as strategic accumulation opportunities.

Ethereum’s subsequent critical resistance sits at $2,500, where FxPro market strategists suggest a sustainable upward trajectory could be validated. Solana continues trading approximately 55% beneath its cycle peak and has lagged ether during every rally attempt since October.

XRP has maintained consolidation between $1.30 and $1.45 throughout most of March. Regulatory clarity stemming from Ripple’s previous legal resolution has proven insufficient to independently catalyze upward price action.

Federal Reserve Decision Emerges as Next Critical Catalyst

Kirkley highlighted that bitcoin’s 90-day correlation coefficient with the S&P 500 has climbed to 0.78, representing one of the strongest relationships since mid-2022. When bitcoin demonstrates tight coupling with traditional equities, alternative cryptocurrencies amplify directional movements in both upward and downward scenarios.

The Federal Reserve convenes March 17–18. Any hawkish communication or indication of potential interest rate increases would disproportionately impact higher-risk digital asset categories.

Regarding corporate developments, Oracle is scheduled to release quarterly results Tuesday, with Adobe reporting Thursday. February’s Consumer Price Index statistics arrive Wednesday, followed by January’s Personal Consumption Expenditures data Friday.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos22 hours ago

News Videos22 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World18 hours ago

Crypto World18 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat9 hours ago

NewsBeat9 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech19 hours ago

Tech19 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business14 hours ago

Business14 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat5 days ago

NewsBeat5 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show