Crypto World

The Real Cost of Idle Capital in Crypto Markets

In this market, idle funds are the biggest risk. Most crypto users worry about volatility. More experienced participants tend to focus on a different factor: opportunity cost. When markets slow down, extended sideways movement is rarely neutral from a capital perspective.That’s why a growing number of traders are reallocating funds toward more capital-efficient DeFi models.

Each day capital remains unused can result in missed returns compared to more efficient allocation strategies.

A Structural Issue: Many Platforms Incentivize Passive Capital

Many platforms are structured in ways that benefit from users leaving funds idle, trading less frequently, operating under limited transparency, and responding slowly to changing market conditions.

Speed, yield, and flexibility are frequently highlighted, but are not always fully realized in practice.

By contrast, newer DeFi models are increasingly based on the idea that active capital allocation tends to outperform passive positioning.

In crypto, real conviction shows up on-chain.

Users aren’t just registering on these platforms — they’re allocating capital almost immediately. That behavior usually only happens when three conditions are met:

1. Control Is Absolute

Funds remain non-custodial. No permission risk. No “maintenance pauses” when volatility spikes.

2. Capital Efficiency Is Obvious

These platforms illustrate how idle assets can underperform and how quickly capital can be redeployed when infrastructure allows.

When performance becomes measurable rather than hypothetical, user hesitation tends to decline.

3. Exit Is Always Available

Third, liquidity and exit flexibility remain available. Prolonged lockups often undermine trust, which is why many modern DeFi protocols aim to minimize them.

Knowing that capital can be reallocated quickly, both in and out, often increases user confidence and willingness to deploy funds.

Market Dynamics Are Shifting, Often Without Broad Attention

Here’s what’s happening quietly:

- Smart money is reducing exposure to platforms with opaque incentives

- Traders are prioritizing flexibility + yield, not branding

- Capital is flowing toward systems that reward action, not patience

Several emerging DeFi platforms sit at the intersection of these trends.

This isn’t a future narrative. It’s a present reallocation.

Waiting for “Confirmation” Is a Losing Strategy

Many users say they’ll wait:

- for more coverage

- for bigger headlines

- for social proof

By the time that happens, the best conditions are already gone.

In crypto markets, earlier participation is often linked to asymmetric return profiles rather than elevated risk alone.

Early-stage phases of new platforms tend to favor participants who allocate capital sooner, before incentive structures evolve or compress.

From Registration to Deployment: Minutes, Not Friction

IODeFi removes the usual excuses:

- Registration is fast

- Wallet connection is seamless

- Deposits are straightforward

- Capital becomes productive immediately

This reduces unnecessary complexity and lowers the learning curve associated with capital deployment.

Final Thought: Precision Often Outperforms Excessive Caution

Caution feels safe. But in crypto, it often means underperforming by default.

Such platforms are not universally suitable, but they reflect a broader shift toward treating capital as an actively managed resource.

While some participants remain on the sidelines, others have already begun reallocating capital.

Crypto World

Fed Says Tokenized Securities Under Same Capital Rules

US regulators have clarified that tokenized securities will receive the same capital treatment as their traditional counterparts, saying the rules are “technology neutral.”

The Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency said on Thursday that they would treat traditional and tokenized securities the same under bank capital requirements.

“The technologies used to issue and transact in a security do not generally impact its capital treatment,” the agencies said.

“An eligible tokenized security should be treated in the same manner as the non-tokenized form of the security would be treated under the capital rule,” the new guidance added.

Under the guidance, financial institutions won’t need to over-collateralize when holding tokenized securities on their balance sheets, as is required when holding unproven and volatile assets.

Many traditional finance companies have shown increasing interest in tokenization, which regulators said prompted them to issue the new guidance.

The agencies said that derivatives referencing an “eligible tokenized security” should also be treated, for capital purposes, as derivatives referencing the non-tokenized form of the security.

The regulators added that tokenized securities are also not affected in their ability to be legally deemed financial collateral, so long as they are liquid and legally owned or controlled by an institution that can sell them if the borrower fails to pay, as part of the terms of a collateral agreement.

“An eligible tokenized security that satisfies the definition of ‘financial collateral’ would qualify as financial collateral for purposes of the capital rule and may be recognized by the banking organization as a credit risk mitigant if all the other relevant requirements in the capital rule are met,” the regulators said.

Related: IRS proposes mandating electronic delivery of tax forms for crypto

Asset tokenization has been a keen point of interest for traditional finance firms, with a long list of heavyweights such as JPMorgan, BlackRock and Franklin Templeton, tipping into the market via investments or infrastructure plays.

One of the major selling points of the space is the ability to trade 24/7 via blockchain, rather than the standard day-trading windows of traditional markets.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

Crypto World

Solana ETFs Hold Strong Despite 70% Token Price Decline

Exchange-traded funds tied to Solana have held on to their early inflows, despite the token having more than halved in price since the funds were launched, which analysts say indicates institutional resilience.

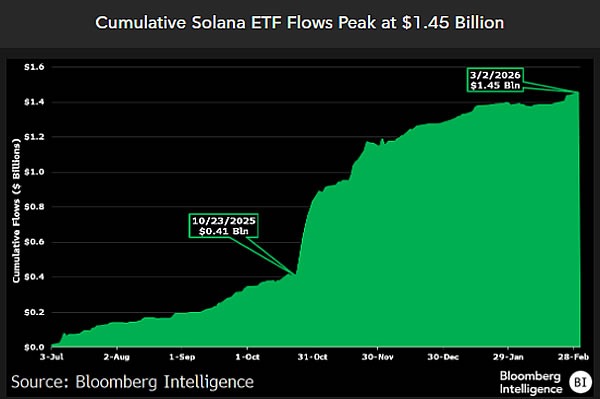

Solana (SOL) is down 57% since Solana ETFs launched in the US in July, but the funds have managed to accumulate $1.5 billion in flows and “not really give any of it up,” Bloomberg ETF analyst Eric Balchunas said on Thursday.

He added that 50% of the inflows to the ETFs are from institutional investors, which Balchunas called a “serious investor base” and a good sign for the future.

Solana ETFs beat Bitcoin on market size basis

Balchunas said that by adjusting Solana’s $50 billion market capitalization to Bitcoin’s (BTC), $1.4 trillion, Solana ETFs have seen the equivalent of $54 billion in net new flows, “which is about DOUBLE where Bitcoin was at the same point.”

Bitcoin had also gained in the months after Bitcoin ETFs were launched, compared to Solana’s price fall, which Balchunas said was “pretty impressive numbers given [the] size and condition of the underlying market.”

Balchunas said that ETFs launching into that kind of market downturn usually make it “near impossible to get inflows.”

“Most wouldn’t even make it to age one or two if they went down 57% in the first six months,” he said. “Solana [is] defying physics here.”

Related: 3 Solana platforms to shutter following devastating $40M hack

Solana ETFs saw their first net outflow day in over a month on Thursday with $6 million exiting the six products, according to CoinGlass. It followed a big net inflow day on Wednesday when $19 million entered the products.

Solana down 70% from all-time high

Solana hit an all-time high in January 2025 amid a memecoin minting frenzy that pushed the token to $293.

Today, it is 70% down from that peak, trading at around $88, having fallen 2.7% on the day and 11% over the past month, according to CoinGecko.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

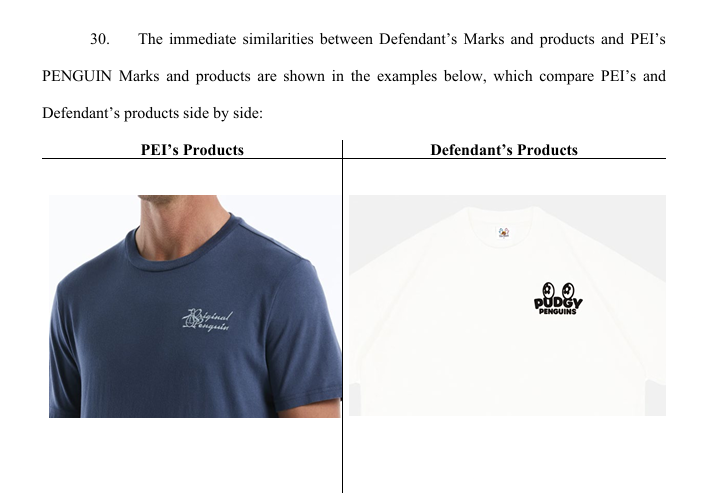

Pudgy Penguins Accused of Infringing Original Penguin Trademark

PEI Licensing, the firm behind Original Penguin, has filed a lawsuit in a Florida federal court accusing Pudgy Penguins of trademark infringement, dilution and unfair competition. The complaint argues that Pudgy Penguins’ apparel and branding employ a penguin motif and a family of marks that are confusingly similar to PEI’s federally registered PENGUIN marks. PEI points to a long history with the word mark and penguin imagery—claims the company has used since 1967 (word mark) and 1956 (penguin design on apparel)—and notes a cease-and-desist sent in October 2023 demanding Pudgy Penguins abandon USPTO registrations that resemble PEI’s marks. The dispute sits at the crossroads of traditional IP enforcement and the growing world of NFT-inspired merchandise, underscoring how digital brands are increasingly intersecting with physical goods.

Key takeaways

- PEI Licensing contends that Pudgy Penguins’ use of penguin imagery and the PENGUIN word mark in apparel constitutes infringement, dilution and unfair competition, arguing the marks are confusingly similar to PEI’s established branding.

- The lawsuit was filed in a Florida federal court and seeks sweeping relief, including actions with the USPTO to reject Pudgy Penguins’ trademark applications and to stop further infringement.

- PEI asserts decades of use for its marks, claiming the PENGUIN word mark dates to 1967 and a penguin design on clothing since 1956, bolstering its position on fame and protection against dilution.

- Pudgy Penguins has publicly contested the claims, stating that its marks are visually distinct, target a different audience, and have already received USPTO approvals for multiple applications.

- The case illustrates mounting tensions as NFT-driven communities move into physical goods, raising questions about branding, consumer perception and how the USPTO evaluates cross-domain marks.

Market context: The action sits within a broader trend of traditional IP owners vigilantly defending long-established marks against permutations created by NFT and Web3 brands. As projects push into apparel and lifestyle products, complex questions arise about how to balance protection with the creative expressions that draw communities together in the digital space.

Why it matters

For IP owners, the suit signals a willingness to apply established trademark law to a novel class of products tied to blockchain communities. If PEI succeeds in blocking Pudgy Penguins’ registrations or securing injunctive relief, it could reinforce a framework where decades-old marks are shielded not only from direct counterfeit goods but also from NFT-driven brands that attempt to translate digital identities into tangible merchandise. Such a decision would tilt the risk calculus for NFT projects considering cross-brand collaborations and licensed apparel, potentially encouraging more robust IP screening before launching physical lines.

On the other side, Pudgy Penguins argues that its branding is sufficiently distinct and that it has secured multiple USPTO approvals, which could complicate the path for PEI to demonstrate confusion. The company contends that its audience and market are different from Original Penguin’s, a distinction it believes undercuts PEI’s dilution and infringement theories. The dispute also raises practical questions about how the USPTO evaluates marks that straddle the traditional fashion sector and the evolving Web3 ecosystem, where brand narratives can be built around memes and community-driven imagery rather than conventional fashion houses.

Beyond the courtroom, the case highlights how NFT-native brands increasingly confront IP frameworks that were designed for physical goods and established consumer markets. If the court weighs in on the merits of likelihood of confusion, it could influence future decisions about how aggressively NFT projects pursue trademark protection for marks that sit at the intersection of crypto culture and lifestyle branding. For investors, the outcome may affect how brand licensing strategies are valued in NFT ecosystems—potentially shaping both the attractiveness of licensed collaborations and the perceived risk of dilution for iconic marks used in or alongside digital collectibles.

The dispute also underscores a broader strategic question for creators: when does the protection of a familiar mark justify intervention against a new brand approach that leverages similar visuals? The plaintiff-cum-brand-owner dynamic in this case could serve as a reference point for other NFT projects weighing whether to pursue formal trademark protection for family branding on apparel, or to explore alternative protection strategies that emphasize distinct, non-confusable branding elements while still capitalizing on the appeal of familiar tropes like penguin imagery.

In short, the PEI-Pudgy Penguins case is more than a single litigation. It tests the boundaries of trademark protection in an era where communities can spin up apparel lines quickly around digital assets, and it may influence how quickly regulators and courts adapt traditional IP doctrines to a rapidly evolving branding landscape within the NFT economy.

What to watch next

- Progress of the Florida court case, including any scheduling orders for pleadings or potential motions for preliminary relief.

- USPTO decisions on Pudgy Penguins’ trademark applications, including possible refusals or refusals that could shape the trajectory of the case.

- Any private settlements or public statements that signal a path toward resolution outside the courtroom.

- Subsequent branding initiatives from Pudgy Penguins or other NFT projects seeking apparel licenses might influence how the market interprets IP risk and brand strategy.

- Broader implications for how NFT-based brands structure IP portfolios, especially when expanding into physical goods and lifestyle products.

Sources & verification

- The CourtListener docket for PEI Licensing LLC v. Pudgy Penguins Inc., which outlines the complaint and related filings.

- Public statements from Pudgy Penguins leadership regarding branding and ongoing USPTO filings.

- The October 2023 cease-and-desist letter from PEI to Pudgy Penguins addressing alleged infringement.

- USPTO trademark application records for Pudgy Penguins’ marks cited in the filings.

Trademark clash reshapes NFT IP landscape

In a move that mirrors the growing convergence of fashion branding and blockchain culture, PEI Licensing has brought a formal action in a Florida federal court accusing Pudgy Penguins Inc. of infringing and diluting its long-standing PENGUIN marks. The complaint hinges on two facets: a word mark—PENGUIN—and a penguin design used on apparel. PEI contends that Pudgy Penguins’ branding, which leverages penguin imagery and similar phrasing, risks creating consumer confusion in the market for clothing and related goods. The company emphasizes that its PENGUIN word mark has a long formative history, with first use dating back to 1967 and the penguin design appearing on apparel as early as 1956, asserting that these elements have achieved a level of fame that warrants robust protection against similar use by others.

PEI’s action cites a cease-and-desist issued in October 2023, a document the company says demanded that Pudgy Penguins halt attempts to register PENGUIN marks with the USPTO. The core allegation is that Pudgy Penguins has “misappropriated valuable property rights” by pursuing registrations that could confuse consumers into associating Pudgy Penguins’ products with PEI’s established brand. PEI seeks a broad remedy: court intervention to block Pudgy Penguins’ registrations, to halt ongoing infringement, to destroy products that are likely to cause confusion, and to recover any profits tied to such items. The complaint frames the dispute within classic IP theory—trademark infringement, dilution and unfair competition—applied to a modern context where a digital-native brand seeks to translate a meme-driven identity into tangible merchandise.

Responding to the suit, Pudgy Penguins’ chief legal officer, Jennifer McGlone, told reporters that the company remained surprised by the action, noting that discussions toward a private resolution had been ongoing. She argues that Pudgy Penguins’ marks are visually distinct, target a different audience, and have already secured USPTO approvals for multiple applications, suggesting that PEI’s claims lack merit. The company further pointed to a social-media post as evidence of a clear separation from Original Penguin’s branding, attempting to frame the dispute as a misalignment of audiences rather than a direct encroachment.

The unfolding case spotlights a broader debate about how traditional IP frameworks adapt to the NFT era. As projects move from purely digital assets into physical goods—think apparel and accessories—mark owners must decide how aggressively to defend their portfolios. A ruling in PEI’s favor could reinforce protections against cross-brand apparel lines that resemble established labels, potentially slowing similar collaborations, while a decision for Pudgy Penguins might signal a degree of latitude for NFT–driven brands to leverage iconic imagery without encroaching on long-standing fashion trademarks. The CourtListener docket associated with the complaint offers a window into the procedural posture, including requests to direct the USPTO to reject registrations and to halt further use of marks likely to be confused with PEI’s branding.

Ultimately, this dispute is about more than a single brand’s legal rights. It reflects the evolving expectations of brand protection in a landscape where online communities can rapidly translate digital fame into real-world products. Outcomes could influence how NFT projects plan licensing strategies, assess IP risk, and structure their branding to preserve the trust and loyalty of their communities while navigating traditional trademark scrutiny. As the case progresses, observers will watch not only for a potential settlement but for how the court interprets the balance between protecting a venerable, historic mark and recognizing the creative expressions that drive the NFT ecosystem forward.

Crypto World

How to Optimize Company Operational Costs: A Manual on Modern Payment Ecosystems

Recent business landscape shifts have forced companies to rethink financial management. Remote work, global teams, scattered suppliers — all demand fast, cheap, transparent settlements. Traditional banking works, sure, but often feels like shipping packages by postal carriage in the drone era. That’s why businesses increasingly seek alternatives enabling settlements without intermediaries and currency conversions within minutes.

This piece isn’t about financial miracles or tech wonders. Rather, it’s about building smart payment infrastructure, cutting fees, speeding operations while staying legally compliant. We’ll examine real tools (from classic methods to cutting-edge solutions) and identify where hidden costs lurk.

Anatomy of Corporate Payment Expenses

When Airbnb was gaining momentum, the company faced a challenge: paying hosts across 190+ countries. Bank transfers took 3–7% commission plus several days. The solution became a proprietary payment system — a path later echoed by modern crypto solutions for business, though not every company can afford or justify such investment.

Typical cost structure looks like this: payment system fees (1.5-3.5%), currency conversion (another 2-4% on unfavorable rates), interbank charges ($15 to $50 per SWIFT), internal processing costs (accounting salaries, software). Annually, an average company with €10M turnover might spend up to €350K just on transactional expenses.

Stripe published a 2023 study showing businesses underestimate real payment costs by 40-60%. Hidden expenses include chargebacks, fraud, human error during manual entry, cash flow delays. One mistaken $100K payment can paralyze a department for a week.

Classic Banking: Where Money Gets Lost

Picture a Polish IT company paying contractors in the US, India, and Portugal. Through SWIFT, transfers take 3-5 days, passing through 2-3 correspondent banks, each taking $25-40. Exchange rates set by banks with their own markup. Result: from $5,000 sent, the recipient gets $4,820. The rest vanishes in fees.

An alternative — systems like Wise (formerly TransferWise) — use local accounts to simulate international transfers. Instead of physically moving money across borders, the company sends zloty to Wise’s Polish account, while the recipient gets dollars from their US account. Fees drop to 0.4-1%, timing to one day.

Revolut Business went further, offering multi-currency accounts holding 28 currencies simultaneously. For companies with constant multi-currency settlements, this means buying euros or dollars during favorable rates, not when payment’s due.

Yet classic systems have limits. Payments to certain countries (Argentina, Nigeria, partially Turkey) remain complicated due to currency controls. Weekends and holidays paralyze SWIFT. Most importantly, even modern neobanks still operate within fiat system limitations.

Cryptocurrency Rails: When Speed Matters

When Tesla announced accepting Bitcoin, that was more PR than business strategy. But there are spheres where cryptocurrencies solved real pain points. GameStop launched an NFT marketplace in 2022 not for hype, but to monetize digital assets without intermediaries.

Practical applications run deeper than they appear. Companies use stablecoins (USDT, USDC) for rapid international settlements. Transferring $100K in USDC between Berlin and Toronto takes 15 minutes and costs $2-5, regardless of amount. Particularly relevant for e-commerce: stores can accept payments globally without configuring local payment gateways in each country.

Ripple (XRP) was specifically created for banks — JPMorgan, Santander and others test it for interbank settlements. Settlement speed: 3-5 seconds versus 3-5 days with SWIFT, fees: fractions of a cent. Mass adoption hasn’t happened yet due to regulatory uncertainty.

Businesses need to understand: cryptocurrencies aren’t fiat money replacements, but additional tools. Bitcoin or Ethereum volatility makes them unsuitable for daily settlements without instant conversion. Yet for payments to freelancers in countries with limited banking (Venezuela, Zimbabwe), sometimes it’s the only option.

Multi-Chain Solutions and Their Role

Previously, transferring between different blockchains was a quest: exchange Bitcoin for Ethereum through an exchange, withdraw to wallet, wait for confirmations. Modern cross-chain crypto swaps like those offered by LetsExchange have automated this process, allowing direct asset exchanges between different networks without centralized intermediaries.

Thorchain, Cosmos, and Polkadot built infrastructure for blockchain interaction. Practical business benefit: accept payments in one cryptocurrency, make payouts in another, optimizing fees. For instance, receive USDT on Tron network (fee $1), swap to USDC on Polygon (fee $0.01), and withdraw through Ethereum when gas is cheaper.

Uniswap V3 allows companies to independently provide liquidity and earn from exchange commissions. Some fintechs use this as an additional revenue source: account balances work instead of just sitting idle.

Important nuance — regulatory. The European MiCA (Markets in Crypto-Assets) will take full effect from late 2024, establishing clear rules for crypto business. Companies should consult lawyers before implementing crypto products.

Automation and API Integrations

Shopify processes billions annually, and the key to efficiency is complete automation. Each payment automatically reconciles with invoices, splits between seller and platform, reserves for possible returns. Human intervention only occurs when problems arise.

Modern payment gateways provide APIs for integration with ERP systems (SAP, Oracle), CRM (Salesforce), and accounting (QuickBooks, Xero). This eliminates manual data entry — the main error source. When a client pays an invoice, the record automatically enters accounting, updates inventory, triggers shipping processes.

Plaid built an entire business on connecting financial systems. Through their API, apps can check balances, initiate payments, reconcile transactions without logging into each bank separately. For companies with dozens of accounts across different banks, this proves critical.

Artificial intelligence began analyzing payment patterns. Algorithms detect anomalies (unexpected large payments, new recipients), warn about possible fraud, forecast cash flow. Visa and Mastercard use ML models to block fraudulent transactions before completion.

Geographic Peculiarities and Local Methods

What works in the US can fail in Asia. WeChat Pay and Alipay control 94% of China’s online payment market. Western companies entering the Chinese market must integrate these systems, though they fundamentally differ from familiar card payments.

Latin America lives on Pix (Brazil) and Mercado Pago (Argentina, Mexico). Pix — a state instant transfer system launched by Brazil’s Central Bank in 2020. Within three years, 140+ million users registered. Transactions are free, instant, work 24/7. For business, this means zero fees on receiving payments.

Africa built a unique mobile money ecosystem. M-Pesa (Kenya, Tanzania) processes more transactions than Western Union worldwide. People pay utilities, receive salaries, take microloans — all through SMS, without bank accounts. International companies adapt systems to such realities.

Even within Europe, differences are significant. Germans dislike credit cards, preferring SEPA transfers and cash. Netherlands lives on iDEAL (direct bank payments). Scandinavia nearly abandoned cash. Global strategy must account for local specifics.

Security and Compliance: Invisible Costs

Equifax lost data on 147 million clients in 2017 through an unpatched vulnerability. Compensation cost $1.4 billion. Security investments seem like expenses until you become a hack victim.

PCI DSS (Payment Card Industry Data Security Standard) — minimum requirements for companies processing card data. Certification costs $5K to $500K depending on volumes. But the alternative is worse: data breach fines reach $100K plus card acceptance bans.

KYC (Know Your Customer) and AML (Anti-Money Laundering) — not just bureaucracy. For violations, the European Banking Authority fines millions of euros. HSBC paid $1.9 billion in 2012 for AML requirement breaches. Compliance automation through services like Onfido or Jumio saves money long-term.

Two-factor authentication, biometrics, card data tokenization — standards that became cheaper in recent years. Google Authenticator is free but reduces hack risk by 96%. Tokenization replaces real card numbers with one-time codes — if intercepted, they’re worthless.

Practical Steps Toward Optimization

Auditing current systems is the first task. How much does each transaction type cost? What’s average speed? How much time does accounting spend on reconciliation? Buffer reduced payment processing time from 40 hours monthly to 2 hours simply by switching from manual transfers to automated systems.

Provider diversification reduces risks. If the main payment gateway crashes (Visa and Mastercard had outages in 2018 and 2022), backup picks up the load. Plus you can switch between providers depending on fees for specific regions.

Fee negotiations work. Payment systems are willing to lower commissions for stable clients with predictable volume. One European marketplace reduced acquiring from 2.8% to 1.9% simply by showing annual statistics and inviting competing offers.

Team training investments pay off. Finance professionals need to understand the difference between SEPA Instant and SEPA Credit, know when to use cryptocurrencies versus traditional rails. Shopify Academy teaches payment basics for free — such resources are available to everyone.

Future of Payment Systems

Central banks are launching their own digital currencies (CBDC). Bahamian Sand Dollar has operated since 2020, Chinese digital yuan tests in millions of transactions, ECB plans digital euro by 2028. For business, this could mean instant settlements without intermediaries at all — payment goes directly from company account to recipient’s Central Bank account.

Open Banking forces banks to share data through APIs. In the EU, this is already reality thanks to PSD2. Result — apps like Revolut or N26 can show balances from all banks, initiate payments, build analytics. Traditional bank monopoly crumbles.

Quantum computers threaten modern encryption. IBM and Google work on post-quantum cryptography. Companies should monitor developments — in 5-10 years, entire security infrastructure will need updating.

Embedded finance makes financial services part of non-financial products. Uber doesn’t just call taxis but also credits drivers. Shopify issues business loans to sellers based on sales. Tesla allows buying electric cars on credit without banks. The blurring of lines between fintech and regular business will only intensify.

Cutting Costs Without Disruption

Operational payment costs aren’t fixed. Every company can reduce them by 20-40% without radical changes. An audit, choosing the right tools, and constant optimization suffice. The financial world changes rapidly, but basic principles remain: transparency, speed, security, and reasonable cost. The rest is finding balance between innovation and stability.

Crypto World

Culper Research shorts Ether, warns of Ethereum ‘death spiral’

Short-selling firm Culper Research says it has taken a bearish position against Ethereum’s native token and companies closely tied to it, arguing that the blockchain’s economic model is deteriorating following recent network changes.

Summary

- Culper Research disclosed a short position against ether and ETH-linked stocks, including BitMine.

- The firm argues Ethereum’s fee revenue has collapsed, weakening the network’s economic incentives.

- Culper claims some network activity metrics may be inflated by spam transactions such as address-poisoning and dusting.

Short seller Culper targets Ethereum and BitMine in bearish report

In a report published March 5, Culper disclosed it is shorting Ethereum (ETH) as well as equity linked to the asset, including BitMine Immersion Technologies, a firm that has built a large treasury position in the cryptocurrency.

The report argues that Ethereum’s recent upgrades, designed to increase block capacity and reduce transaction costs, have had an unintended consequence: sharply reducing fee revenue that supports the network’s validator incentives.

Culper said Ethereum’s fee generation has collapsed in recent months, undermining the narrative that the network’s tokenomics are strengthening over time.

Ethereum’s fee revenue has collapsed, and with it the economic engine that once justified ETH’s valuation, the report stated.

According to the firm, the drop in fees is eroding staking yields for validators, potentially weakening long-term incentives to secure the network. Culper described the dynamic as a possible “death spiral,” in which falling economic rewards discourage participation while further undermining network security and investor confidence.

The report also singles out BitMine, which has accumulated millions of dollars worth of ether as part of a corporate treasury strategy. Culper argues the company’s valuation is heavily tied to the price of ETH and could face significant downside if the cryptocurrency continues to struggle.

Culper’s report also highlights recent on-chain transactions from wallets associated with Buterin, arguing that the Ethereum co-founder has sold tens of thousands of ETH this year, which the firm says undermines bullish narratives around the asset.

“Vitalik is selling, while bulls like Tom Lee are clueless as to ETH’s new reality,” the report said. “We’re with Vitalik.”

Culper also pushed back on bullish interpretations of rising Ethereum transaction counts and address activity, arguing that some of the increase may stem from spam-like on-chain activity such as address-poisoning or dusting transactions rather than organic user growth.

The short thesis arrives amid a period of volatility for crypto markets, with Ether and other major digital assets facing renewed scrutiny over their long-term economic models as scaling upgrades and layer-2 adoption reshape the blockchain ecosystem.

Crypto World

How Will Markets React to $2.6B Crypto Options Expiring Today?

The end of another week has arrived, which means more crypto options contracts are expiring as spot markets eye recovery.

Around 31,700 Bitcoin options contracts will expire on Friday, Mar. 6, with a notional value of roughly $2.2 billion. This event is much smaller than last week’s, so there is unlikely to be any impact on spot markets.

Crypto markets have seen a little daylight this week, with around $150 billion added to total market capitalization since Monday, but things were starting to cool off again by Friday.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 1.7, meaning that there are more expiring shorts (puts) than longs (calls). Max pain is around $69,000, according to Coinglass, which is a little below current spot prices, so many could be out of the money on expiry.

Open interest (OI), or the value or number of Bitcoin options contracts yet to expire, remains highest at the $60,000 strike price on Deribit as bearish bets remain dominant. Total BTC options OI across all exchanges has been climbing this month and has reached $41.7 billion.

Crypto derivatives provider Greeks Live observed the market rebound, noting that Bitcoin was firmly holding above the $70,000 psychological threshold and is “now poised to challenge $75,000.”

“However, options market data indicate that selling call options has dominated trading over the past two days. Despite ongoing price gains, momentum has slowed.”

March 6 Options Expiration Data

32,000 BTC options expired with a Put-Call Ratio of 1.69, maximum pain point at $69,000, and notional value of $2.3 billion.

184,000 ETH options expired with a Put-Call Ratio of 0.85, maximum pain point at $1,950, and notional value of $380… pic.twitter.com/wIZP4KDhg2— Greeks.live (@GreeksLive) March 5, 2026

In addition to today’s batch of Bitcoin options, around 184,000 Ethereum contracts are also expiring, with a notional value of $380 million, max pain at $1,950, and a put/call ratio of 0.85. Total ETH options OI across all exchanges is around $7.5 billion.

You may also like:

This brings the total notional value of crypto options expiries to around $2.6 billion.

Spot Market Outlook

Total market cap is down 1.2% on the day to $2.49 trillion; however, it remains at the upper bounds of its month-long sideways channel.

Bitcoin hit a four-week high of $74,000 on Thursday but was halted there and has pulled back to $70,300 at the time of writing. The asset has seen a strong recovery since the war in Iran started last weekend.

Ether prices stalled at $2,200 and had declined 2% on the day back to $2,065 during the Friday morning Asian trading session. The altcoins were mostly flat on the day and have failed to move in tandem with the top two this week.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin Relief Rally Fades as Bear Market Signals Hold

Bitcoin staged a brief relief rally above $74,000 on Thursday, but it has already petered out as analysts predict a persistent bear market will keep momentum subdued.

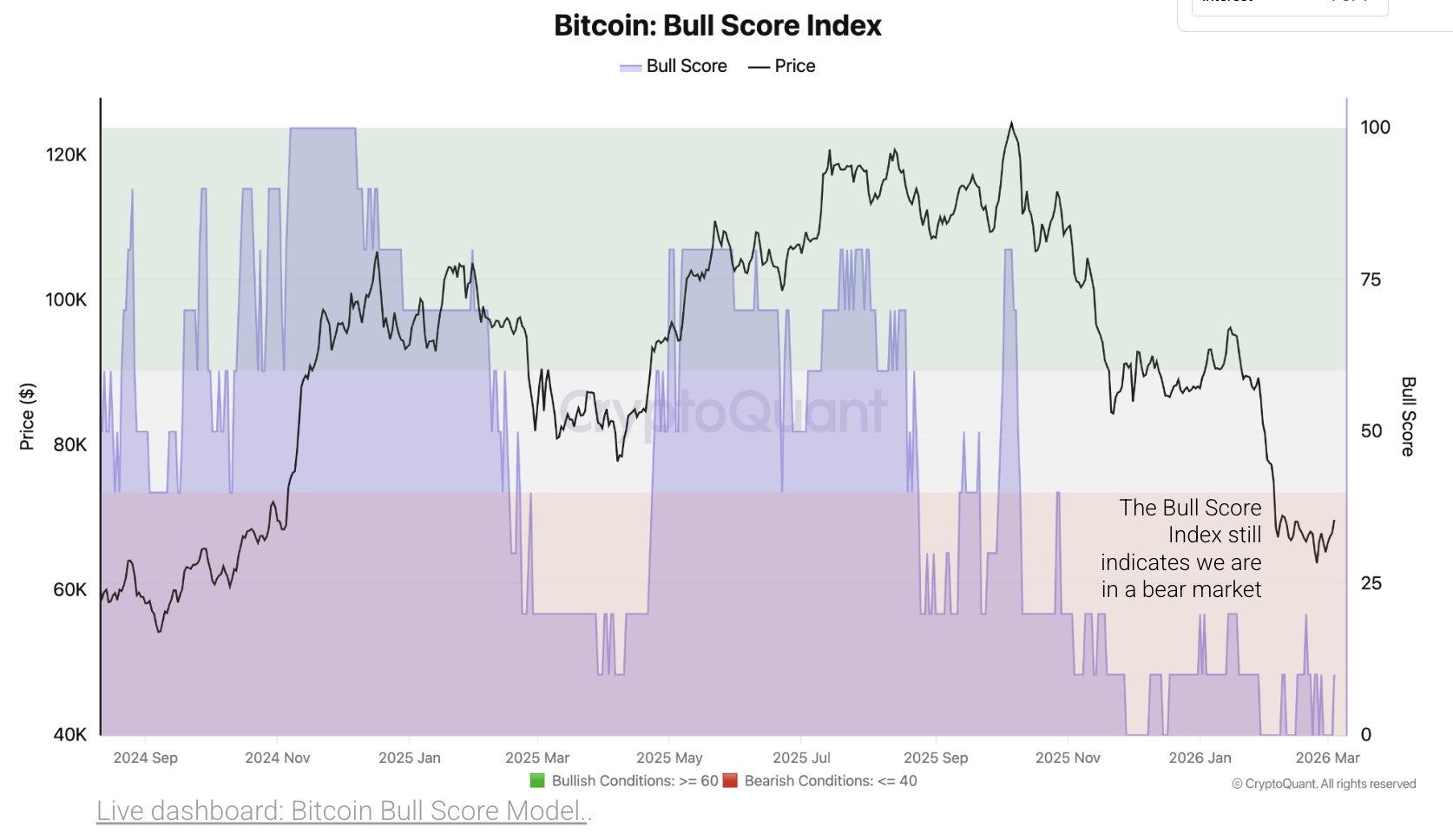

“Bitcoin is still in a bear market despite the recent rally,” on-chain analytics company CryptoQuant said on Thursday.

The platform’s Bull Score Index, a composite indicator that measures the overall health of Bitcoin (BTC) using a combination of fundamental and technical metrics, remains at 10 out of 100, “deep in bearish territory,” it said.

“Even after the recent price rally, fundamental and technical indicators still point to a bear market environment,” it stated.

“The current move is likely just a relief rally, not the start of a new bull phase.”

Bitcoin briefly tapped a one-month high of $74,000 on Coinbase on Thursday, touching the 50-day exponential moving average, according to TradingView. However, it has already lost more than $3,000, falling back below $71,000 during Friday morning trading.

Bitcoin still vulnerable to renewed downside pressure

Nick Ruck, the director of LVRG Research, told Cointelegraph that the crypto market’s recent relief rally came on “renewed risk appetite and ETF inflows,” but cautioned that the advance has “quickly faced headwinds with prices pulling back toward $71,000 amid persistent macro uncertainties and fading momentum.”

While the brief push provided a welcome relief rally amid supportive liquidity conditions, “ongoing bear market dynamics reinforce caution as softer macro signals, like the anticipated slowdown in February nonfarm payrolls, keep cryptocurrencies vulnerable to renewed downside pressure,” he said.

Bitcoin could see renewed buying interest

CryptoQuant said that a positive Coinbase Premium has signaled renewed US buying interest, driving the recent rally.

Related: Bitcoin slide slowing, but bear market still in play: Analysts

Bitcoin spot demand from US-based investors also switched from contraction to growth, as seen by the Coinbase Bitcoin Premium “switching from deeply negative territory in early February to the most positive since October,” they said.

Selling pressure from traders and long-term holders has also eased after unrealized losses reached levels not seen since July 2022.

Meanwhile, analysts at SwissBlock observed on Friday that “momentum is flashing a critical shift,” adding “We’re exiting peak negative momentum, the kind of transition that often precedes a regime change.”

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Pudgy Penguins Hit WIth Trademark Suit Over Merch

PEI Licensing, the firm behind the clothing brand Original Penguin, has filed a lawsuit against the nonfungible token project Pudgy Penguins, alleging trademark infringement, dilution and unfair competition.

The lawsuit, filed in a Florida federal court on Wednesday, focused on claims around Pudgy Penguins’ apparel, accusing the company of using a “family of penguin trademarks that are confusingly similar” to its own.

“This action results from Defendant’s unauthorized use and attempted registration of various PENGUIN word and design trademarks in connection with apparel and related goods and services that are confusingly similar to PEI’s federally registered and famous PENGUIN and penguin design trademarks,” PEI said in its complaint.

PEI claimed in its lawsuit that it has used the “PENGUIN word mark at least as early as 1967” and first used a “penguin design” on apparel as early as 1956.

PEI Licensing said that it sent a cease and desist to Pudgy Penguins in October 2023, claiming its “products infringe and dilute PEI’s famous PENGUIN Marks.”

The letter also demanded that Pudgy Penguins abandon applications with the US Patent and Trademark Office “to register various PENGUIN marks,” according to the lawsuit.

PEI claimed that Pudgy Penguins had “misappropriated valuable property rights of PEI,” which was “likely to cause confusion or mistake, or to deceive members of the consuming public.”

PEI asked the court to order the USPTO to reject Pudgy Penguins’ applications and stop the company from allegedly infringing on its trademark.

Related: SEC ends case against Justin Sun with $10M settlement

It also requested that Pudgy Penguins be ordered to destroy any products found “likely to be confused” with PEI’s trademarks and be awarded all profits from the sales of such products.

Pudgy Penguins’ legal chief, Jennifer McGlone, told Cointelegraph the company “was surprised by the action, particularly as both parties had been engaged in productive discussions to resolve this matter privately.”

McGlone said the company had advanced applications with the USPTO and was “confident that PEI’s claims lack merit. The trademarks in question are visually distinct and serve entirely different audiences and markets.”

“We have the utmost confidence that we will prevail as Pudgy Penguins has already secured multiple trademark application approvals from the USPTO covering the Pudgy Penguins brand and related marks,” she said.

Meanwhile, the Pudgy Penguins X account posted a meme implying that its brand bears no similarities with Original Penguin.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Vancouver’s Bitcoin ambitions face setback as staff urge council to drop plan

City officials in Vancouver are recommending that councillors abandon a proposal to integrate Bitcoin into municipal financial strategy, dealing a potential blow to a high-profile initiative championed by Mayor Ken Sim.

Summary

- Vancouver city staff recommend council drop Mayor Ken Sim’s proposal to explore making the city “Bitcoin-friendly.”

- The motion previously sought to examine accepting Bitcoin payments and potentially adding the asset to municipal reserves.

- Officials cited regulatory limits, financial risks, and operational challenges as reasons to halt further work on the proposal.

Vancouver staff throw cold water on the mayor’s Bitcoin city proposal

According to a staff report prepared for the Vancouver City Council meeting on March 10, officials advised councillors not to proceed with the mayor’s earlier motion to explore making Vancouver a “Bitcoin-friendly city.”

The proposal originally directed city staff to examine whether the municipality could incorporate Bitcoin into financial operations, including accepting cryptocurrency payments for municipal services or potentially allocating a portion of city reserves to digital assets.

The report outlines concerns related to regulatory authority, financial risk, and operational feasibility, ultimately recommending that council take no further action on the motion.

Sim first introduced the proposal in December 2024, arguing that Bitcoin could help protect the purchasing power of municipal funds amid inflation and economic uncertainty. The motion also framed the initiative as a way to position Vancouver as a global hub for blockchain innovation.

However, city staff said the proposal raises significant legal and policy issues under current municipal frameworks. Existing legislation governing local governments in British Columbia does not currently allow municipalities to hold or transact in cryptocurrencies as part of their financial management strategies, according to the report.

The recommendation comes after months of debate over the risks and potential benefits of integrating digital assets into public sector finance. Critics have argued that the volatility of cryptocurrencies could expose taxpayer funds to unnecessary risk, while supporters have promoted Bitcoin as a potential hedge against inflation.

The report will now be considered by Vancouver’s city council, which must decide whether to formally drop the proposal or pursue further analysis despite staff concerns.

If adopted, the recommendation would effectively halt the mayor’s push to explore Bitcoin’s role in the city’s financial reserves and payment systems.

Crypto World

Ethereum Founder Vitalik Buterin Calls for Bold Rethink of Crypto Applications

TLDR:

- Vitalik Buterin calls for radical Ethereum application redesign while protecting core network security guarantees.

- Ethereum founder says AI may replace traditional crypto wallets and reshape how users interact with blockchain apps.

- Privacy now ranks alongside censorship resistance and security as a foundational Ethereum network principle.

- Buterin urges developers to rethink DeFi, oracles, and layer-2 roles using a first-principles approach.

Ethereum co-founder Vitalik Buterin has urged developers to rethink how applications operate across the network.

He said Ethereum must remain firm on its core principles while exploring new approaches at the application layer. His comments point to changes in privacy, artificial intelligence integration, and decentralized finance design.

The remarks arrive as developers debate Ethereum’s long-term architecture and its relationship with emerging technologies.

Vitalik Buterin Pushes Ethereum Developers to Rethink Crypto Applications

Buterin said Ethereum must keep its fundamental properties intact despite rapid technological shifts. He listed censorship resistance, open source development, privacy, and security as non-negotiable network principles.

He warned against uncertainty around the base layer’s guarantees. According to his post on X, developers must maintain trustless verification tools such as light clients.

At the same time, he urged the community to adopt a more experimental approach to applications. Ethereum’s ecosystem, he said, should reconsider existing assumptions about user interfaces and platform design.

Artificial intelligence formed a central theme in his comments. Buterin suggested AI systems could replace traditional crypto wallet interfaces within a year.

He noted that AI tools may reshape how users interact with blockchain software. Instead of discrete applications, AI agents may guide users through a continuous interaction layer.

According to Buterin, such changes could transform how developers build services on Ethereum. Applications may become modular systems that users assemble dynamically.

Ethereum Privacy and Layer-2 Strategy Take Center Stage

Buterin also emphasized the importance of privacy across Ethereum’s application stack. He said the ecosystem increasingly treats privacy as a core security property.

That shift could lead developers to rebuild large parts of the Ethereum software stack. Current infrastructure rarely prioritizes privacy at every layer.

He also pointed to growing work around private networking technologies. Several Ethereum Foundation initiatives focus on improving privacy across network communications.

Decentralized finance design also appeared in his discussion. Buterin suggested some DeFi systems could evolve into universal futures markets built on reliable decentralized oracles.

He proposed that oracles could combine cryptographic proofs with artificial intelligence models. These systems may verify data from trusted news sources using privacy-preserving technologies.

The Ethereum founder also encouraged the community to reconsider the role of layer-2 networks. He said developers should reassess which L2 designs best complement Ethereum’s base layer.

Buterin framed the discussion as a broader cultural shift within the ecosystem. Developers, he said, should challenge existing assumptions and rebuild applications from first principles.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports14 hours ago

Sports14 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker