Crypto World

Tokenized Commodities Market Crosses $6B as Gold Hits Historic Rally

The tokenized commodities market has posted a striking resurgence, climbing 53% in under six weeks to exceed $6.1 billion in total value. The surge positions this segment as the fastest-growing corner of real-world asset tokenization, driven by expanding on-chain access to gold and other physical assets. Investors are increasingly seeking regulated, blockchain-enabled exposure to tangible assets, and the data indicate a material shift in demand toward tokenized commodities as a mainstream route to diversification.

Key takeaways

- The tokenized commodities market rose 53% in less than six weeks to top $6.1 billion, marking rapid expansion within real-world asset tokenization.

- Gold-backed tokens dominate the segment, led by Tether’s XAUt and Paxos-listed PAX Gold, with market capitalizations of about $3.6 billion and $2.3 billion respectively in the recent period.

- Year-over-year growth for tokenized commodities reached about 360%, outpacing tokenized stocks and tokenized funds by wide margins.

- Tether expanded its tokenized-commodities footprint by acquiring a $150 million stake in Gold.com, signaling deeper integration of XAUt into mainstream gold platforms and potential USDt purchase options for physical gold.

- Gold’s price momentum complemented the on-chain story, with gold hitting all-time levels in late January before consolidating in the $5,000s—while Bitcoin faced a separate price trajectory, remaining volatile after a broader market downturn.

Tickers mentioned: $BTC, $PAXG

Sentiment: Neutral

Price impact: Neutral. The article detailing asset issuance and price movements centers on on-chain tokenized assets rather than immediate price shifts in major cryptos.

Market context: The expansion of tokenized commodities underscores a broader push to transform physical assets into liquid, tradable on-chain instruments, even as traditional cryptocurrencies navigate their own volatility and macro-driven flows.

Why it matters

The growth of tokenized commodities—especially gold-backed tokens—reflects a notable pivot in how stakeholders access and leverage real-world assets. By converting physical metals into blockchain-tradable instruments, issuers aim to deliver improved liquidity, auditable on-chain provenance, and potentially broader reach to investors who prefer digital-native channels. The leading force in this sector is gold, which remains a cornerstone of the tokenized market and is increasingly integrated with mainstream platforms via strategic partnerships and cross-chain tooling.

Tether’s strategic expansion into tokenized gold signals both confidence in the asset class and a practical bridge between stablecoins and precious metals. The company’s $150 million stake in Gold.com represents not just capital but a potential pathway for the on-ramping of USDt into physical gold purchases. By aligning XAUt with Gold.com’s user base, the ecosystem could see more users transact in gold-backed tokens and, in turn, push higher liquidity across tokenized gold markets. The move also aligns with broader efforts to broaden access to real assets through on-chain rails, potentially lowering barriers for investors who want exposure without the logistical complexities of holding physical metal.

On the price side, gold has rallied meaningfully, reflecting a period of elevated demand for tangible assets amid macro uncertainty. In late January, gold touched striking levels around a then-new high, underscoring why tokenized gold remains attractive to market participants seeking a combination of liquidity and hedging characteristics. While the on-chain narrative emphasizes growth and access, the traditional price dynamics of gold provide important context for the overall momentum in tokenized commodities. Bitcoin, by contrast, has faced its own pressures, trading below record highs for extended stretches and prompting debates about whether it should be viewed as a digital safe-haven or a high-growth asset with its own risk profile.

Bitcoin (CRYPTO: BTC) has moved through a volatile period since October, when a broader crypto market downturn triggered substantial liquidations. After a roughly 52% drop from an early-October peak to around $60,000, the asset has bounced back toward the high $60,000s to near $69,000 in recent readings, according to market data. Investors continue to debate whether Bitcoin remains a store of value or behaves more like a software-growth asset in the current macro regime. The discussion is not purely academic; it shapes how capital allocators perceive risk, correlation with traditional markets, and the appetite for real-world assets that promise on-chain transparency and settlement efficiency.

Beyond price action, commentary from major industry players has emphasized a shift in narrative. Grayscale and others have argued that Bitcoin’s long-standing moniker as “digital gold” faces renewed scrutiny as the asset’s price dynamics resemble those of risk-on growth equities at times. Yet the tokenized-commodities space continues to distinguish itself with a separate value proposition: the ability to tokenize and trade assets with a real-world physical counterpart, governed by on-chain protocols and regulated custodians. The convergence of on-chain finance with traditional asset classes—exemplified by gold—highlights a broader trend toward real-world asset tokenization that could redefine liquidity, settlement speed, and investor access in coming quarters.

What to watch next

- Follow the pace of growth in the tokenized commodities market, including quarterly or monthly updates on total market capitalization and the share of gold-backed tokens.

- Monitor Tether’s integration of XAUt on Gold.com and any announced USDt-enabled pathways for acquiring physical gold, including potential new merchant partners or custodial arrangements.

- Track gold price dynamics in relation to on-chain demand for tokenized gold products, noting any correlations with currency moves or macro risk sentiment.

- Look for regulatory developments or disclosures that could affect on-chain commodity tokens, custody standards, or reporting requirements for tokenized assets.

Sources & verification

- Token Terminal data on the growth and composition of the tokenized commodities market, including the six-week rise to $6.1B and relative YoY growth.

- Tether’s stake in Gold.com and statements about integrating XAUt and exploring USDt-based purchases of physical gold.

- Gold price commentary and all-time high levels around January, with the subsequent pullback and rebound figures.

- Bitcoin price dynamics and market context, including the October crash and latest price movements tracked by primary market data aggregators.

- On-chain tokenized gold tokens such as XAUt and PAXG, including market caps and year-over-year growth figures cited in official data releases and market dashboards.

Momentum in tokenized commodities reshapes on-chain gold access

The tokenized commodities space is gaining traction as a fast-moving segment within real-world asset tokenization. Data indicate a 53% surge in value over a period of fewer than six weeks, taking the total to north of $6.1 billion. This lift positions tokenized commodities as a leading growth vocation in the on-chain economy, with gold-backed tokens at the epicenter of the expansion. Token Terminal’s data illustrate the broader arc: starting the year just above $4 billion, the market has added roughly $2 billion in value since January, signaling not only robust demand but a structural shift toward digitized collateral and settlement layers for tangible assets.

Within the space, gold is the dominant force. Tether’s gold-backed token, XAUt, has been the primary driver of the ascent, contributing to a market capitalization of about $3.6 billion in the period under review. In second place sits Paxos-listed PAX Gold (CRYPTO: PAXG), which rose to approximately $2.3 billion. The prominence of gold tokens underscores the perceived safety and liquidity that on-chain representations of physical metal can provide in a market where traditional assets have faced friction and opacity. The top five largest tokenized commodities, according to Token Terminal’s dashboard, collectively show how gold’s on-chain footprint is outpacing other real-world assets in tokenized formats, reinforcing the sector’s potential to unlock new liquidity pools for long-only and hedged investors alike.

Year-over-year, the momentum is even more pronounced: the tokenized commodities market has surged roughly 360% compared with the previous year, a pace that outstrips the growth of tokenized stocks (about 42% over the same period) and tokenized funds (roughly 3.6%). The sector’s relative scale—now just over one-third of the $17.2 billion tokenized funds market and clearly larger than tokenized stocks at $538 million—emphasizes a broad reallocation toward tangible assets via blockchain rails. The ongoing evolution is not only about tokenizing gold but about building a broader ecosystem where gold, silver, and other real assets can be accessed with improved liquidity, transparency, and settlement efficiency.

Tether’s strategic foray into Gold.com illustrates how the ecosystem is layering on additional infrastructure to serve the growing demand for tokenized gold. By integrating XAUt into Gold.com’s platform, Tether is positioning USDt as a potential on-ramp to physical gold ownership, with discussions publicly framed around enabling customers to purchase physical gold using the stablecoin. The strategic fit is clear: a more seamless bridge from on-chain assets to physical metals could expand the user base for tokenized gold while also offering a practical use case for stablecoins beyond payments and liquidity provisioning. This development aligns with a broader trend of on-chain-native assets increasingly intersecting with traditional commodities markets, a synthesis that could reshape how institutions and individuals access and leverage gold as a hedge or strategic asset.

At the same time, gold itself has captured attention with a renewed leg higher. The spot price of gold climbed aggressively in the preceding year, surpassing earlier records and reaching fresh highs before a brief retreat. The price action reinforces gold’s bid as a traditional safe-haven asset, supplying a favorable backdrop for tokenized gold tokens to demonstrate both exposure and resilience in volatile market environments. Bitcoin, meanwhile, navigates its own course. After a pronounced fall from October’s peak, the benchmark cryptocurrency has rebounded in fits and starts, trading near the upper $60,000s to around $69,000 in recent readings. Market participants continue to wrestle with whether BTC represents a digital store of value or a high-growth instrument that may correlate with broader risk sentiment at times. This ongoing dialogue—between the on-chain commoditized world and the broader crypto universe—highlights the breadth of investor interest in assets that offer both liquidity and recognizable risk profiles.

As the sector matures, the central question becomes how tokenized commodities can sustain growth, attract institutional capital, and integrate with traditional financial ecosystems. The data show that the market’s expansion is not a peripheral trend but a substantive development in the crypto economy’s asset mix. If the pace persists, tokenized gold and other commodities could become a meaningful corridor for hedging, diversification, and strategic exposure within both crypto-native portfolios and more conventional investment strategies. The interplay between on-chain access to gold, stablecoin ecosystems, and physical-asset settlement could define a new phase of crypto-enabled real-world asset investing.

Crypto World

Oaktree’s Howard Marks says there’s no systemic problem with private credit

Howard Marks, co-chairman, Oaktree Capital.

Courtesy David A. Grogan | CNBC

Veteran investor Howard Marks said he doesn’t see a widespread problem brewing in private credit, but warned that the sector’s rapid expansion over the past 15 years could expose weaker lenders when markets eventually turn.

“There’s not a systemic problem with private credit,” Marks, co-chairman and co-founder of Oaktree Capital, said Thursday on CNBC’s “Money Movers.”

The noted investor said that the risk stems from the pace of expansion in direct lending, which has ballooned to a market now exceeding $1 trillion from its early development around 2011.

His comments come as sentiment toward direct lenders has soured following the collapse of auto-related borrowers Tricolor and First Brands. Much of the concern has centered on loans made to software companies as investors worry that artificial intelligence could disrupt those businesses.

“There’s a saying in the banking business that the worst of loans are made in the best of times. We’ve seen 17 years of good times. When the stuff hits the fan, or as Warren Buffett would say, when the tide goes out, we will find out whose credit analysis was discerning, who made fewer software loans to the better company,” Marks said.

The pressure has already begun to show up in fund flows. Investors pulled nearly 8% from Blackstone Inc.’s flagship private credit fund in the most recent quarter, highlighting growing caution among allocators.

Marks said it’s impossible to predict when exactly the cycle will turn.

“The things that affect the investment world so profoundly are the things that were not foreseen,” Marks said. “If they could be foreseen … anticipated and adjusted to and factored into prices, they wouldn’t have that cataclysmic effect.”

Crypto World

Ethereum Taps $2.2K as Traders Brace for a Potential Trend Change

Market analysts said Ether’s (ETH) uptrend was confirmed after the latest 25% recovery to $2,200 from its multi-year lows below $1,800.

Key takeaways:

-

Ether rose to $2,200 on Wednesday, as onchain data shows signs of returning demand.

-

ETH price support around $2,100 remains key for the bulls to hold.

Ether sellers are “losing control”

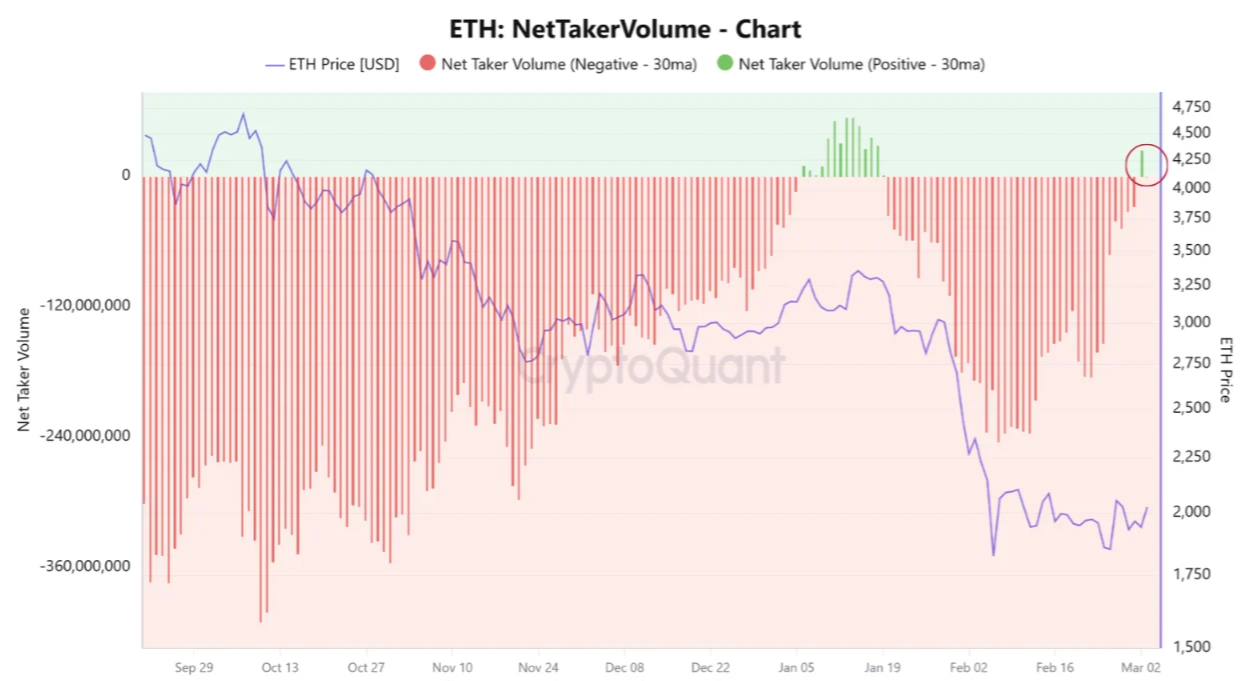

Ether’s net taker volume suggests that “sellers may be losing control” as demand for ETH derivatives returned, data from CryptoQuant shows.

Net taker volume, a metric that measures the imbalance between buyers and sellers in derivatives markets, has flipped positive after being in negative territory for nearly two months.

This negative regime coincided with the bear market drawdown, indicating sustained aggressive selling across derivatives markets.

“The latest prints show flows starting to turn positive, suggesting that seller dominance may be fading,” CryptoQuant analyst MorenoDV_ said in a recent Quicktake post, adding:

“Historically, shifts from prolonged negative taker pressure toward positive territory often precede short covering rallies and liquidity-driven rebounds, particularly after periods of forced selling.”

The return in ETH demand is also reflected by Ether’s Coinbase Premium Index, which has risen to levels last seen in December 2025.

After being negative for several months, the index has flipped positive, pointing to a return in demand from US investors, which could propel the ETH price higher.

“This indicates that US buying pressure remains positive,” CryptoQuant analyst CW8900 said, adding:

“If the Coinbase premium rises further, the rally will accelerate.”

Meanwhile, demand for spot Ether ETFs continues to recover, with these investment products recording $169.4 million in inflows on Wednesday. This shows the return of demand from institutional investors.

ETH traders anticipate a price rebound

Ether’s latest breakout must, however, not pull back below the $1,750 mark, according to analysts.

Trader and analyst Crypto Patel said that the $1,750 support must hold for “bulls to stay in control,” with the upside target set at “$2,500-$2,600.

“Lose $1,750 and bears take over again.”

Commenting on Ether’s Thursday push above $2,000, analyst Bren said a “larger bounce above $2,200 is likely.”

Meanwhile, Man of Bitcoin said that a successful retest of $2,100 support after the current retracement could open the path to $3,400 or higher.

As Cointelegraph reported, a daily candlestick close above $2,100 will revive the hopes of a recovery toward the 50-day simple moving average (SMA) at $2,381. A break above this level will mean that the corrective phase may be over.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Core Scientific Lands $500M Morgan Stanley Credit Line, Expandable to $1B

Bitcoin mining and data center company Core Scientific has closed a $500 million loan facility with Morgan Stanley, with the option to expand the financing to as much as $1 billion.

According to a company announcement on Thursday, the financing may be used for general corporate purposes tied to building and expanding data center assets, including equipment purchases, real estate acquisition and securing additional power agreements.

The company operates large-scale data centers in several US states, including Texas, Georgia and North Carolina, hosting both Bitcoin (BTC) mining equipment and other high-density computing workloads.

The 364-day facility carries interest at the Secured Overnight Financing Rate (SOFR) plus 2.5% and includes an accordion feature that allows total commitments to increase by another $500 million.

Core Scientific currently derives most of its revenue from Bitcoin mining but is converting “most” of its data center footprint to support AI-related and other high-density computing workloads.

The announcement comes days after the company’s shares fell following a fourth-quarter earnings miss, as crypto mining income dropped to $42.2 million, nearly 50% lower than the same quarter a year earlier.

Related: Ex-OpenAI researcher’s hedge fund reveals big Bitcoin miner bets in new SEC filing

Core Scientific’s road to AI and HPC

Core Scientific filed for Chapter 11 bankruptcy protection in December 2022 after falling Bitcoin prices, rising energy costs and losses tied to crypto lender Celsius strained its finances. In January 2024, it emerged from bankruptcy and relisted its shares on Nasdaq after completing a court-approved restructuring.

Following the restructuring, Core Scientific began repurposing parts of its data center infrastructure to support artificial intelligence and high-performance computing (HPC) workloads alongside its Bitcoin mining operations.

That shift accelerated in June 2024, when the company signed a 12-year agreement with AI cloud provider CoreWeave to supply data center capacity for HPC.

A year later, CoreWeave sought to deepen the relationship through a proposed acquisition, agreeing in July 2025 to buy Core Scientific in an all-stock transaction valued at about $9 billion. However, the merger failed to gain sufficient shareholder approval during a vote in October and did not move forward.

Several other Bitcoin mining companies have also begun repurposing their infrastructure to support AI and HPC workloads in recent months.

In July, Hive Digital Technologies said it was expanding into HPC, building an AI infrastructure business that it expects could reach $100 million in annual revenue.

About a month later, TeraWulf signed 10-year colocation agreements with AI infrastructure company Fluidstack valued at $3.7 billion, with Google backing about $1.8 billion of the lease obligations.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Liquidity Time Preference Markets (Shadow TVL)

Reimagining DeFi Liquidity Through Time. Decentralized Finance has largely measured its strength using one metric: Total Value Locked (TVL). Billions of dollars sit inside smart contracts, signaling capital commitment, protocol confidence, and market depth. But TVL has a hidden flaw: it ignores time.

A dollar locked for 5 minutes and a dollar locked for 5 years are treated the same.

This blind spot opens the door to a new primitive in DeFi design: Liquidity Time Preference Markets, also known as Shadow TVL.

The Problem With Traditional TVL

TVL answers one question:

“How much capital is inside a protocol right now?”

But DeFi users behave very differently depending on how long they intend to stay.

Consider three liquidity providers:

| Provider | Capital | Lock Duration |

|---|---|---|

| Trader A | $1M | 30 minutes |

| Yield Farmer B | $1M | 7 days |

| DAO Treasury C | $1M | 2 years |

Traditional TVL says:

TVL = $3M

But economically, these deposits are not equal. The DAO treasury provides structural stability, while Trader A provides temporary liquidity that could vanish instantly.

This creates the concept of Shadow TVL — a deeper metric that accounts for time-weighted liquidity commitment.

What is Shadow TVL?

Shadow TVL = Liquidity adjusted by time commitment.

Instead of measuring only how much capital is present, Shadow TVL measures:

-

How long is liquidity expected to remain

-

How stable is the capital base, actually?

-

The protocol’s real economic security

Example:

| Deposit | Amount | Lock Duration | Shadow Value |

|---|---|---|---|

| $1M | 1 hour | 0.0001 weight | |

| $1M | 30 days | 0.3 weight | |

| $1M | 2 years | 1.0 weight |

Even though TVL is $3M, Shadow TVL may only equal ~$1.3M in stable liquidity.

This reveals the true durability of a protocol’s liquidity base.

Introducing Liquidity Time Preference Markets

Rather than just measuring time preference, DeFi could trade it directly.

A Liquidity Time Preference Market allows participants to buy and sell liquidity commitment durations.

Participants could trade:

-

Short-term liquidity rights

-

Long-term liquidity guarantees

-

Liquidity futures contracts

Think of it like interest rate markets, but for capital patience.

How It Could Work

Step 1 — Liquidity Commitment Tokens

When depositing liquidity, users mint a token representing their lock duration.

Example tokens:

-

LQ-1D → Liquidity locked for 1 day

-

LQ-30D → Liquidity locked for 30 days

-

LQ-365D → Liquidity locked for 1 year

These tokens represent time-bound liquidity guarantees.

Step 2 — Secondary Markets

These liquidity commitments become tradable assets.

Traders could speculate on:

-

Liquidity shortages

-

Market volatility

-

Protocol stability

Example:

If traders expect high volatility next month, 30-day liquidity tokens become more valuable, because protocols will need deeper liquidity.

Step 3 — Shadow TVL Pricing

Protocols could use market prices of these tokens to compute Shadow TVL in real time.

Instead of:

TVL = $500M

Protocols would show:

Shadow TVL = $500M capital with 87-day average commitment

This creates a liquidity durability index.

Why This Changes DeFi Economics

1. Eliminates “Mercenary Liquidity.”

Yield farmers often chase incentives and exit instantly.

Liquidity Time Markets reward long-term capital commitment, reducing unstable liquidity.

2. New Derivatives Market

Liquidity duration becomes a financial asset.

Examples:

DeFi could develop a yield curve for liquidity similar to government bond markets.

3. Predictable Protocol Stability

Protocols could price risk based on how long liquidity is expected to remain.

A DEX with:

is far more stable than one with $200M TVL but a 2-day commitment.

4. Capital Efficiency

DAOs and funds could optimize treasury deployment by selecting liquidity durations matching their risk profile.

Example:

| Strategy | Liquidity Duration |

|---|---|

| Arbitrage Funds | 1–3 days |

| Market Makers | 30–90 days |

| DAO Treasuries | 1–3 years |

Liquidity becomes programmable over time.

The Emergence of a Liquidity Yield Curve

Just like traditional finance has a bond yield curve, DeFi could develop a Liquidity Commitment Curve.

Example market rates:

| Duration | Expected Yield |

|---|---|

| 1 day | 2% APR |

| 30 days | 7% APR |

| 1 year | 18% APR |

This curve reflects market demand for liquidity stability.

During volatile markets, long-duration liquidity becomes extremely valuable.

Potential Use Cases

Stablecoin Defense

Stablecoin protocols could require a minimum liquidity duration for collateral pools.

This prevents bank-run style liquidity collapses.

MEV Protection

Validators and builders could secure blockspace liquidity guarantees, ensuring deep order books even during congestion.

DeFi Credit Markets

Lenders could issue loans backed by liquidity commitment tokens, turning liquidity guarantees into collateral.

Risks and Challenges

Despite its promise, Liquidity Time Preference Markets introduce new complexities:

Smart Contract Risk

Liquidity locks and tokenization increase protocol complexity.

Liquidity Fragmentation

Too many duration tokens could fragment capital across markets.

Speculation Loops

Traders might speculate heavily on liquidity scarcity.

However, these risks are similar to those seen in early interest rate derivatives markets in traditional finance.

Why This Idea Matters

DeFi’s biggest weakness is unstable liquidity.

TVL numbers can look impressive, but capital can disappear instantly.

Shadow TVL introduces a missing dimension: time.

Instead of measuring how much liquidity exists, DeFi could measure:

How committed is that liquidity actually?

Liquidity Time Preference Markets turn patience into a tradable financial primitive.

And once time becomes a market…

DeFi doesn’t just have liquidity.

It has predictable liquidity stability.

REQUEST AN ARTICLE

Crypto World

BTCC TradFi Hits $200M Volume and Celebrates with Zero-Fee Campaign on Gold and Silver

[PRESS RELEASE – LODZ, Poland, March 5th, 2026]

BTCC, the world’s longest-serving cryptocurrency exchange, today announced that its recently launched TradFi product has surpassed $200 million in cumulative trading volume since going live on February 10, 2026. To celebrate this milestone, BTCC is introducing a zero-fee trading campaign for the XAU and XAG pairs, where participants can earn up to 10 grams of gold through a tiered volume bonus program.

The $200 million milestone demonstrates strong demand for traditional market access among crypto traders. BTCC TradFi, launched in February 2026, enables users to trade traditional financial instruments, including forex, commodities, indices, and equities, directly on the BTCC platform using USDT as margin and settlement currency. TradFi aims to remove barriers for crypto traders to gain exposure to the global traditional financial markets.

Running from March 5 to March 19, 2026, the zero-fee campaign waives all trading fees on XAU and XAG pairs. Alongside the 0-fee promotion, users can also participate in a tiered bonus program based on the total TradFi trading volume during the campaign. Participants can earn up to 10g of gold by reaching the milestone of 5,000,000 USDT in cumulative trading volume across all TradFi pairs.

Precious metals have been among the most actively traded asset classes on BTCC’s platform. In 2025, tokenized gold on BTCC recorded $5.72 billion in trading volume, with Q4 volume surging 809% over Q1, underscoring sustained user interest in precious metals. This momentum sets the stage for the zero-fee campaign on XAU and XAG, giving both new and existing users a cost-free entry point into one of the platform’s most in-demand markets.

For traders seeking traditional market exposure without leaving the crypto ecosystem, BTCC TradFi offers a seamless platform that bridges cryptocurrency and traditional assets. The zero-fee campaign is an opportunity to explore gold and silver trading at zero trading cost on the BTCC platform. For campaign details and eligibility requirements, users may visit BTCC’s 0-fee campaign page.

About BTCC

Founded in 2011, BTCC is a leading global cryptocurrency exchange serving over 11 million users across 100+ countries. Partnered with 2023 Defensive Player of the Year and 2x NBA All-Star Jaren Jackson Jr. as global brand ambassador, BTCC delivers secure, accessible crypto trading services with an unmatched user experience.

Official website: https://www.btcc.com/en-US

X: https://x.com/BTCCexchange

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

xStocks Unveils xChange, Bringing Real-World Equity Liquidity Onchain Across Ethereum and Solana

TLDR:

- xChange is the first unified execution layer trading over 70 tokenized stocks across Ethereum and Solana onchain.

- Every xStock is backed 1:1 by underlying shares in custody, ensuring real equity exposure on the blockchain.

- Atomic settlement guarantees trades execute fully at the quoted price or not at all, eliminating partial fills.

- xStocks has surpassed $3.5 billion in onchain volume and 80,000 unique holders since launching in June 2025.

xChange, the new unified execution layer from xStocks, is now live on Ethereum and Solana. The platform enables trading of more than 70 tokenized stocks directly onchain.

Pricing is anchored to real-world public market data, while atomic settlement ensures each trade completes fully or not at all.

Since its June 2025 launch, xStocks has recorded over $3.5 billion in onchain transaction volume, marking rapid adoption of tokenized equities.

How xChange Bridges Traditional Markets and DeFi

xChange connects traditional market depth with decentralized finance infrastructure in one unified system. The platform does not rely on third-party intermediaries to process trades.

Instead, it executes transactions directly onchain across both Ethereum and Solana. This setup preserves the transparency and composability that DeFi participants expect.

Each xStock is fully collateralized and backed 1:1 by underlying shares held in custody. This structure means every onchain transaction reflects genuine equity exposure.

Atomic settlement removes the risk of partial fills entirely from the process. Trades either execute in full at the quoted price or do not go through.

Kraken announced the launch through its official X account, describing it as “the first unified execution layer for tokenized equities.” The exchange added that xChange delivers “TradFi liquidity. DeFi infrastructure. Always on.”

The platform operates 24/5, extending equity trading well beyond standard exchange hours. As a result, tokenized stocks function as always-on, programmable financial assets.

Val Gui, General Manager of xStocks, described the platform’s purpose directly. “xChange is about redefining how equities trade in a digital-first world,” Gui stated.

He added that it “brings real-world market liquidity onchain and turns tokenized stocks into fully programmable, always-on assets.” Gui noted these assets are built to “power the next generation of global financial applications.”

xStocks Records Strong Growth Metrics Since June 2025

Since launching in June 2025, xStocks has surpassed $3.5 billion in total onchain transaction volume. The platform has also crossed $25 billion in total trading volume across exchanges.

These figures reflect growing demand for tokenized equities among DeFi users and traditional finance participants. The pace of growth points to measurable market adoption across both audiences.

Over $225 million in tokenized assets are currently held onchain. More than 80,000 unique onchain holders have participated in the broader ecosystem.

Tokenized equities are gaining traction as a distinct and recognized asset class. Adoption has continued expanding across multiple chains, platforms, and applications.

xChange builds on this momentum by introducing a unified execution layer across networks. The platform connects liquidity across Ethereum and Solana while tying pricing to traditional equity markets.

This connection supports tighter spreads and improved execution quality throughout the system. Onchain settlement and transferability remain fully intact at every step.

Rather than replacing existing DeFi liquidity models, xChange functions as an added layer. It improves price alignment and execution reliability across the broader ecosystem.

The outcome is a hybrid model that combines real-world equity market depth with blockchain-based trading infrastructure. xChange positions tokenized stocks as a functional bridge connecting two distinct financial worlds.

Crypto World

Bitcoin Spot Demand Surges as War Tensions Shake Global Markets

Unleveraged buyers and ETF inflows pushed Bitcoin higher even as geopolitical uncertainty rattled global markets.

Bitcoin’s spot market demand strengthened over the weekend as rising war tensions unsettled global financial markets. The increase in spot buying helped stabilize prices after recent declines and kept BTC relatively firm during the broader market pullback.

Market data shows that this support is coming mainly from unleveraged buyers rather than derivatives activity. Analysts say the shift reduces downside risk in the near term, even as geopolitical and macroeconomic pressures persist.

Spot Buyers Step In as Bitcoin Climbs the Wall of Worry

A recent report from Bitfinex noted that spot buyers have actively supported Bitcoin since March 1. These buyers accumulated about $3.5 billion through steady purchases, mainly during late Asian and U.S. trading hours.

This wave of demand pushed BTC back above $65,000 and marked what analysts describe as a “wall of worry” phase. In it, prices climb even as uncertainty and external risks dominate market sentiment.

Meanwhile, derivatives data shows open interest moving in line with spot volumes at a balanced 1:1 ratio. The pattern suggests the rally is driven by genuine accumulation rather than leveraged trades or short-term speculation.

Further support came from the Coinbase Premium Index, which turned positive after a prolonged negative streak. The index has maintained a modest premium, signaling continued demand from U.S. market participants.

Additionally, the defense of the $60,000 support level has reinforced Bitcoin’s transition into an expansion phase. Market participation has increased, and perpetual funding rates remain moderate and well below overheated levels, indicating a balanced and sustainable environment.

You may also like:

ETF Inflows Reinforce Bitcoin’s Market Recovery

Notably, U.S. spot Bitcoin exchange-traded funds contributed significantly to the shift by reversing earlier outflows.

According to Bitfinex, strong inflows last week helped absorb selling pressure from miners and long-term holders. For context, March 4 saw $461.9 million in net flows, and week-to-date figures through March 5 have already exceeded $1.14 billion.

These inflows have reinforced key technical levels. Bitfinex highlights $77,400 as a major resistance area and $54,100 as core support based on historical cycles. They also note Bitcoin’s correlation with Nasdaq and geopolitical risks tied to the Strait of Hormuz, which could influence near-term volatility.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SOL Strategies Stock Climbs 21% on 691K SOL Milestone

TLDR

- SOL Strategies stock rose 20.97% to $1.50 after the company released its February business update.

- The STKESOL liquid staking platform surpassed 691,000 SOL staked within weeks of launch.

- The platform attracted 1,034 holders shortly after its rollout.

- The validator network expanded to 33,568 unique wallets in February.

- Total assets under delegation reached 3.87 million SOL, including treasury and third-party stakes.

SOL Strategies stock climbed 20.97% to $1.50 on Nasdaq after a strong February update. The company reported rapid growth in staking operations and liquid staking adoption. The update showed rising validator activity and expanding assets under delegation.

SOL Strategies Stock Jumps as Liquid Staking Gains Traction

The company said its STKESOL liquid staking platform surpassed 691,000 SOL staked within weeks of launch. It also confirmed that 1,034 holders joined the platform during the initial rollout. The figures came from its February business update, which highlighted expanding validator activity and rising delegated assets.

SOL Strategies stated that its validator network reached 33,568 unique wallets in February. That figure increased from about 31,000 wallets at the start of the month. The company said STKESOL growth supported higher validator participation and stronger network engagement.

The firm reported total assets under delegation of 3.87 million SOL in February. This total included treasury holdings and tokens delegated by third parties. Proprietary validators generated about 1,276 SOL in rewards during the month.

The company confirmed that users, delegated assets, and staking rewards all increased during February. These metrics reflect performance across validator and staking services. The company linked this expansion directly to the rollout of liquid staking services.

SOL Strategies said liquid staking allows users to earn rewards while keeping tokens liquid. It issues tokenized staking positions that users can trade or deploy elsewhere. The company described this product as an added revenue channel beyond validator services.

Revenue Growth Expands Across Staking Operations

Interim CEO Michael Hubbard said the company continues scaling infrastructure despite crypto market volatility. He stated, “The staking platform now has four revenue streams running simultaneously.” These include treasury staking, third-party delegated staking, liquid staking, and institutional staking services.

Hubbard confirmed partnerships form part of the institutional staking strategy. He cited a partnership with global asset manager VanEck as an example. The company reported that quarterly results rose 69% year on year.

Staking and validator rewards totaled 9,787 SOL during the quarter. This figure marked a 120% increase from the same quarter last year. The company linked this rise to expanded Solana-focused infrastructure operations.

SOL Strategies also reported growth in its Solana portfolio holdings. The portfolio increased to about 529,000 SOL from 139,726 previously recorded. The company attributed the rise to balance sheet growth and higher Solana exposure.

The February update included governance changes before the annual shareholder meeting on March 31. The company confirmed that Michael Hubbard will transition from interim to permanent CEO. SOL Strategies previously operated as Cypherpunk Holdings before rebranding in September 2024.

The company acquired SOL during the second quarter of 2024. It later rebranded to reflect its focus on Solana validators and staking services. SOL Strategies stock has declined 75.81% over the past six months despite the recent 21% rise.

Crypto World

iPhone Crypto Wallets Under Attack from State-Grade Malware

The era of assumed iPhone invincibility is over for mobile crypto traders. A sophisticated new threat, the ‘Coruna exploit kit’, is actively leveraging 23 disparate iOS vulnerabilities to bypass Apple’s top-notch security and drain crypto wallets.

According to a new Google TAG report, the kit does not just crash apps or serve ads. It silently scans for BIP39 seed phrase theft, extracts QR codes, and siphons private keys from unpatched devices. The funds are gone before the user realizes the browser has been compromised.

That matters. For years, advanced exploit chains were the exclusive domain of nation-state intelligence agencies. Coruna marks a terrifying regime change: state-grade surveillance tools have been repackaged for mass-market retail theft.

This iPhone crypto wallet warning comes as Chainalysis reported in 2025 that the crypto theft market is valued at over $75Bn, with wallet drainers accounting for a large amount of that figure.

How Coruna Exploits 23 iOS Vulnerabilities to Drain Crypto Wallets

The Coruna exploit kit is a highly efficient “1-click” attack that activates when a user visits a compromised site, often posing as a gambling or news platform.

It targets vulnerabilities in WebKit to breach the device, then uses local privilege escalation exploits to escape the browser’s sandbox.

Analyzing iOS versions 13.0 to 17.2.1, Coruna employs multiple entry points to deliver a crypto wallets drainer designed to steal blockchain assets.

It scans the file system for cryptocurrency-related strings, checks the photo library for QR codes, and extracts mnemonic phrases from the Notes app.

This automated exploitation can result in immediate and irreversible theft of assets, and any iPhone user who uses their device for crypto trading and asset storing needs to stay vigilant.

DISCOVER: Next Crypto to Explode in 2026

State-Grade Malware Goes Mass Market

Previously, exploit chains of this complexity were hoarded by entities like NSO Group for targeted surveillance of high-value targets—dissidents, journalists, or diplomats.

Coruna flips the script. It takes vulnerabilities weaponized in campaigns like Operation Triangulation, a suspected state-sponsored attack, and hands them to financially motivated criminal groups.

The barrier to entry for executing a sophisticated MetaMask hack or draining a Trust Wallet has collapsed, and even the most inexperienced tech heads can now carry it out.

This follows a disturbing pattern whereby tools developed for espionage inevitably leak into the broader cybercriminal ecosystem. The attackers behind Coruna are not looking for state secrets. They are looking for liquidity.

This is industrial-scale theft. The iVerify security firm documented the exploit affecting at least 42,000 devices, with total losses not yet announced.

Who Is Being Targeted and Why Mobile Crypto Traders Are Especially Exposed

If you trade on mobile and hold self-custody wallets, you are the target profile. The attack vectors are often embedded in sites that crypto users frequent: unregulated gambling interfaces, dubious token claim pages, and third-party app stores.

The malware explicitly targets data directories associated with major non-custodial wallets. It looks for the encrypted vaults of MetaMask, BitKeep (now Bitget Wallet), and Trust Wallet. If the encryption is weak, or if the user has stored the password in a compromised keychain or note, the wallet is drained.

The risk is compounded by user behavior. Mobile traders frequently interact with DApps and sign transactions on the go, often prioritizing speed over security hygiene.

Coruna exploits this complacency. It doesn’t need to trick you into signing a bad transaction; it simply steals the keys to the castle while you browse.

For now, proceed with caution and consider moving your crypto funds to cold wallet storage, such as a Ledger or Trezor.

EXPLORE: Best Crypto Presales to Buy in 2026

The post iPhone Crypto Wallets Under Attack from State-Grade Malware appeared first on Cryptonews.

Crypto World

OKB price skyrockets after NYSE parent company ICE invests in OKX

- OKX token OKB jumped more than 50% to highs of $124 after a major announcement.

- NYSE parent company has invested in OKX at a $25 billion valuation.

- ICE’s move signals a strategic pivot toward tokenized securities and derivatives trading.

OKB, the native token of OKX, surged past the $100 mark following news of a major investment from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE).

The token jumped from around $77.65 to a high of about $124 before giving back part of the gains.

The move came as the broader cryptocurrency market moved higher after a difficult start to the month.

ICE invests in OKX at $25 billion valuation

An announcement on March 5, 2026, said Intercontinental Exchange (ICE), the parent of the New York Stock Exchange, has taken a minority stake in OKX, valuing the crypto exchange at $25 billion.

The investment marks a notable endorsement of OKX by one of the world’s largest financial infrastructure providers. As part of the deal, ICE will take a seat on the company’s board and plans to support closer integration between traditional financial markets and digital assets.

The partnership will also see OKX provide ICE with live cryptocurrency price feeds. In addition, the exchange plans to list tokenized versions of NYSE-listed stocks and derivatives, making them available to its more than 120 million users.

The investment in OKX adds to ICE’s growing portfolio of digital asset initiatives as the company expands its strategy around blockchain and tokenized markets.

Earlier, ICE made a $2 billion investment in Polymarket at a $9 billion valuation and has also developed its own blockchain-based trading infrastructure.

Star Xu, founder and CEO of OKX, said in a statement:

“ICE has built and operated some of the most important financial infrastructure in the world, including the New York Stock Exchange and global derivatives and clearing platforms. Their decision to invest in OKX, and join our board, reflects a shared belief that digital asset technology will play an enduring role in the future of financial markets.”

OKB price outlook

OKB’s explosive rally reflects market enthusiasm for OKX’s enhanced legitimacy and growth potential.

The token’s daily trading volume surged by more than 1,600% to over $421 million as prices rose past $100.

The token’s price movement after the announcement helped bulls hit intraday highs last seen in December 2025.

As OKX’s utility token, OKB benefits from platform fees, staking rewards, and now tokenized TradFi products.

These avenues, likely to see further adoption impetus among institutional investors, could help bulls.

However, as the chart above shows, profit-taking has already pushed OKB to the key $100 level.

If the pullback from the intraday peak continues, immediate support lies at the $91 and the $80 levels.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech11 hours ago

Tech11 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

Confirmed & Analyzed

Confirmed & Analyzed

BREAKING: New "Coruna" iOS Exploit Targets Crypto Wallets!

BREAKING: New "Coruna" iOS Exploit Targets Crypto Wallets!