Crypto World

Trading Techniques of the Inside Bar Pattern

Candlestick patterns are an important part of a comprehensive trading strategy. However, it may be difficult to choose the pattern you can rely on. In this case, traders focus on the most popular setups that have proven to work across various markets and timeframes. One of such patterns is the inside bar pattern.

In price action trading, the inside bar is often analysed as a pause in market structure, reflecting short-term volatility compression that may lead to either trend continuation or trend reversal.

In this article, we will break down the basics of the inside bar pattern, examine examples of this formation on real-market price charts, and discuss how to interpret its signals for trading purposes.

What Is an Inside Bar Candle Pattern?

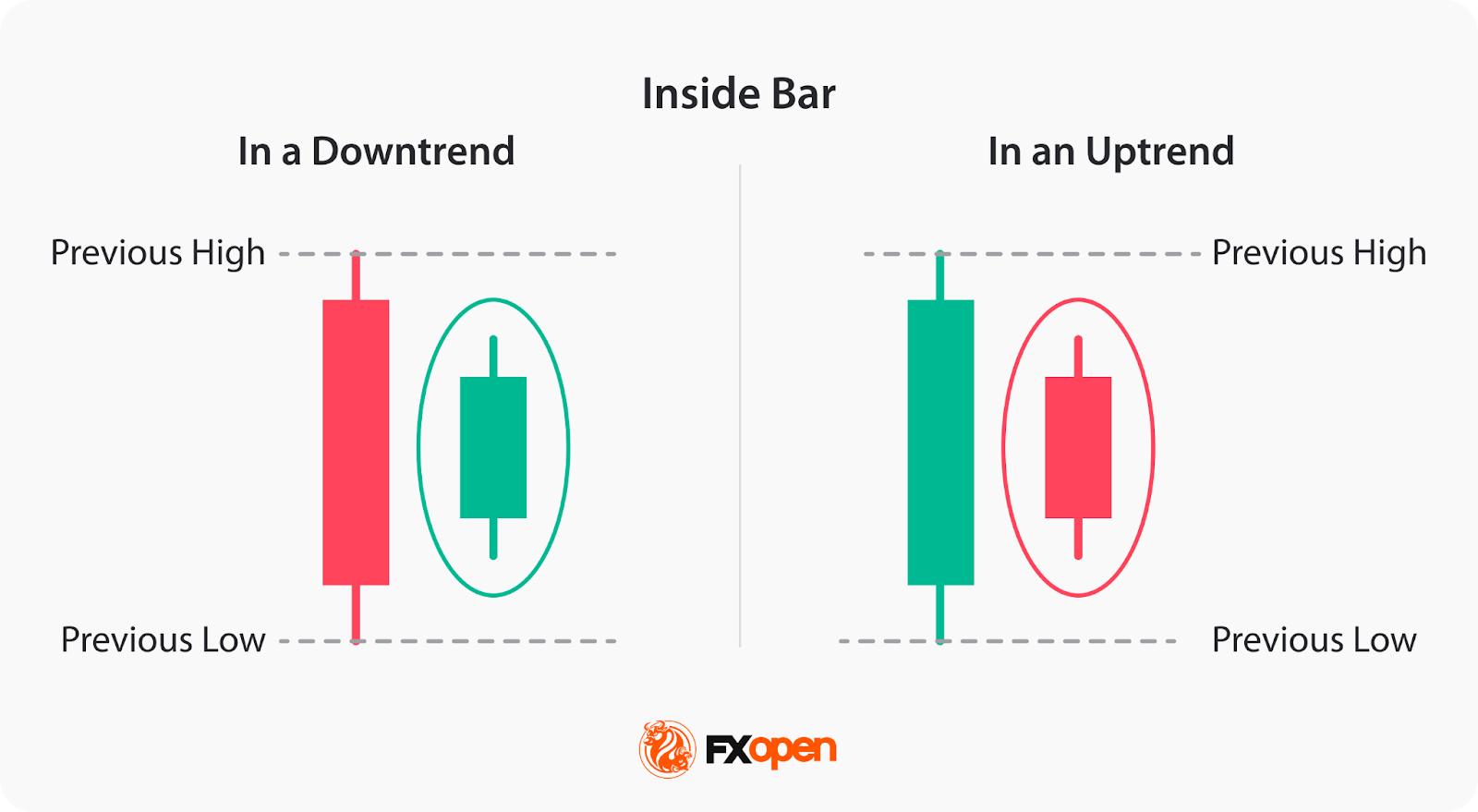

An inside bar is a two-candlestick formation that appears on a price chart when a candlestick’s high and low range is contained within the high and low range of the preceding candle. In other words, the entire price action of one candle is confined within the previous candlestick’s price range.

The preceding candle is commonly referred to as the mother bar, while the following candle is the inside bar itself. This formation highlights range contraction and a brief consolidation phase, where buying and selling pressure temporarily reach equilibrium.

Still, the pattern doesn’t signal a trend reversal or a trend continuation. The price may continue moving in the prevailing trend or turn around. Also, the pattern may appear in both an uptrend and a downtrend.

The inside bar can be observed across different financial instruments such as stocks, cryptocurrencies*, ETFs, indices, and forex currency pairs and can be traded using contracts for difference (CFDs) provided by FXOpen. In the forex market, traders most often apply the inside bar pattern to liquid currency pairs, where higher trading volume may support trade execution.

Identifying the Inside Bar on Trading Charts

To identify this formation on trading charts, traders follow these steps:

- Look for two candlesticks: Traders start by identifying two candlesticks that look like the inside bar.

- Compare the high and low range: After that, they check if the high and low range of the subsequent candle, inside bar, is entirely contained within the high and low range of the preceding candlestick, mother bar.

- Confirm the pattern: Once they identify that the subsequent candle meets the criteria, traders confirm it as an inside bar.

The reliability of the pattern’s signals may vary by timeframe, with many traders favouring the H1, H4, or daily charts, as higher timeframes tend to filter out market noise and reduce the risk of false breakouts.

In the forex market, inside bars tend to form more frequently during lower-liquidity periods, such as the Asian session, while breakouts are more commonly observed during high-liquidity phases like the London and New York session overlap.

Many traders incorporate multi-timeframe analysis when evaluating inside bar setups. A formation that appears on a lower timeframe but aligns with a higher-timeframe trend or key level may carry more significance than a pattern that develops in isolation. For example, an inside bar forming on an hourly chart within a daily uptrend may be interpreted as a continuation signal rather than a reversal attempt, particularly when supported by broader market structure.

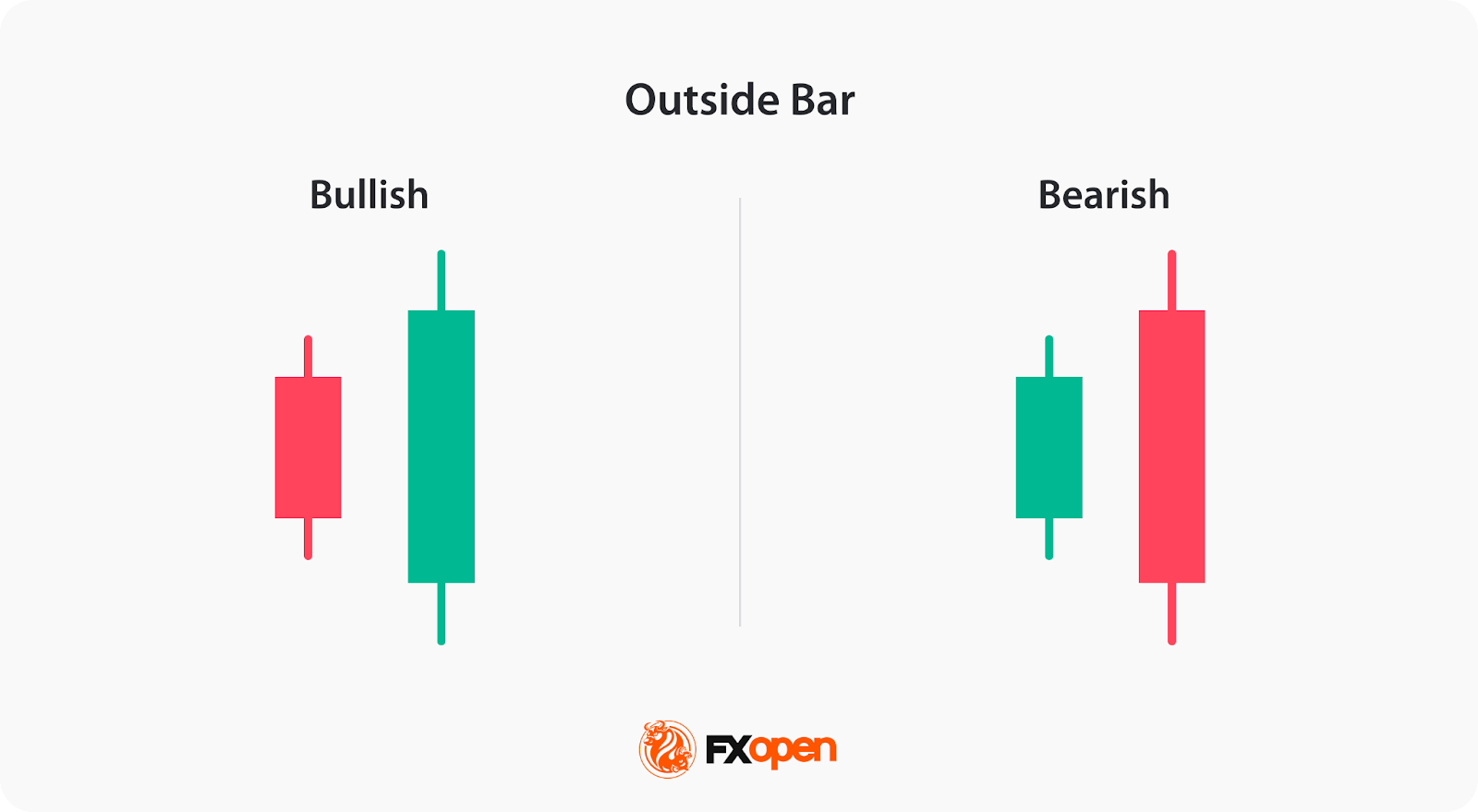

Inside Bar vs Outside Bar

The inside candle pattern occurs when the high and low of a candle are contained within the range of the preceding candlestick, indicating consolidation or indecision in the market. It suggests a potential reversal or continuation of the current trend.

On the other hand, an outside bar—often considered a form of engulfing pattern—appears when a candlestick completely exceeds the previous candle’s high–low range. As Al Brooks defines it in his Trading Price Action Trends, an outside bar occurs when “the high of the current bar is above the high of the previous bar and the low is below the low of the previous bar,” reflecting increased participation from both buyers and sellers. A bearish outside setup typically forms near the top of an uptrend and may signal a downward reversal, while a bullish outside setup forms near the bottom of a downtrend and may suggest an upward reversal.

While the inside bar reflects volatility compression and consolidation, the outside bar typically signals volatility expansion and a stronger momentum shift in price action. Both are widely used by traders for technical analysis and identifying potential trades.

Traders can analyse outside and inside bars on forex, stocks, and other markets using the FXOpen TickTrader platform.

Trading the Inside Bar Pattern

Trading with the inside bar candlestick pattern involves using it as a signal for potential breakouts or continuation of the prevailing trend. Here are the steps traders usually follow when trading with the pattern:

Determine the Direction of the Preceding Trend

Traders may use trendlines or moving averages (EMA or SMA) to define overall market bias and confirm trend direction.

When the formation develops within a strong, established trend and aligns with that trend’s direction, it is typically interpreted as a continuation setup. However, when the same structure appears after an extended directional move and forms at significant technical levels such as higher-timeframe support, resistance, or supply and demand zones, it may instead reflect trend exhaustion and potential reversal conditions. For this reason, traders evaluate both trend context and location before assigning directional bias to the pattern.

In some cases, several inside bars may form consecutively, creating a coiling pattern that reflects extended price compression and can precede a stronger volatility expansion.

Wait for a Breakout

The formation indicates consolidation and potential price compression. Traders often wait for a breakout from the setup’s range to initiate a trade. A breakout above the high of the formation suggests a bullish signal, while a breakout below the low indicates a bearish signal.

However, failed or false breakouts—sometimes referred to as fakey setups—can occur when price briefly breaks the mother bar range before reversing, often due to low liquidity or weak momentum.

Breakouts that occur near key support and resistance levels confirmed by additional tools are often considered stronger. John Murphy’s Technical Analysis of the Financial Markets highlights the value of indicators such as RSI and MACD in confirming breakout strength. Low-volume moves carry a higher risk of false breakouts.

Some traders monitor these false breaks as potential reversal signals, particularly when they occur against an extended trend.

Consider Additional Confirmation

Many traders wait for 2-3 candlesticks to form in a breakout direction. Also, to avoid false breakouts, traders may look for additional confirmation indicators to support their trading decisions. An increasing volume at the breakout or a signal from a trend indicator may provide additional confluence. Common confirmation tools include Average True Range (ATR) and volume indicators, which may help assess volume and volatility conditions.

Set Their Entry Points

Traders typically apply several entry models when trading an inside bar setup. The most common approach is a breakout entry using stop orders placed beyond the high or low of the mother bar.

In trend-continuation conditions, traders may also use a break-and-retest model, entering after price closes beyond the formation and then retests the breakout level as support or resistance.

Set Stop-Loss and Take-Profit Orders

Although there are no strict rules, traders typically set stop-loss orders above the bearish and below the bullish pattern, considering the timeframe and the entry point, so they aren’t too wide. Some traders trail stops below swing highs or lows during strong trends. Monitoring volatility through tools such as ATR may also help traders determine whether to widen or tighten stops as the market transitions from consolidation to expansion.

For take-profit targets, traders might consider significant swing points or key support/resistance levels. As part of risk management, traders often apply predefined risk-to-reward ratios (such as 1:2 or 1:3) and adjust position sizing.

Live Market Example

Below, we provide an example of an inside bar breakout strategy with a bullish inside bar stock pattern on a Tesla chart. This setup represents a typical bullish continuation pattern, where the breakout is confirmed by candles closing above the mother bar’s high and holding above a nearby resistance level.

Following the inside bar breakout trading strategy, the trader waits for the breakout above the high of the mother bar marked by a horizontal line. The stop loss is set below the candle’s low, and the take profit is at the next resistance level.

Final Thoughts

While the inside bar pattern can be a useful tool for identifying trend reversals and continuations, it’s important not to rely solely on this pattern for your trading decisions. In practice, traders often combine the inside bar with technical indicators, broader market context, and structured risk management tools to form a complete trading strategy.

If you want to develop your own trading strategy, you can use FXOpen’s TickTrader trading platform. If you have a strategy and you would like to trade it across over 700 instruments with tight spreads and low commissions (additional fees may apply), you can consider opening an FXOpen account.

FAQ

Is an Inside Bar Bullish or Bearish?

The inside bar setup does not inherently indicate a bullish or bearish bias. It simply represents a period of consolidation or market indecision. Thus, a formation in an uptrend can be bullish and signal a continuation of the trend, or bearish and signal a trend reversal. The same concept applies to a downtrend, where the indicator may be bearish and the trend will continue, or bullish and the trend will reverse.

What Does a Bullish Inside Bar Mean?

The meaning of an inside bar candle pattern that is bullish refers to the pattern, after which the price moves upwards. When this pattern forms during an uptrend, it suggests a temporary pause or consolidation before the uptrend potentially resumes. When it is formed in a downtrend, it signals a trend reversal.

What Is the Inside Bar Strategy?

In the inside bar strategy, traders wait for the pattern to form and look for a breakout above the high of the formation to enter a long position or below the low to enter a short trade. A stop-loss order might be placed below the low of the pattern in a long trade and above the high of the pattern in a short trade. Profit targets can be determined based on the trader’s trading plan, technical indicators, or key support and resistance levels.

How May You Confirm an Inside Bar Signal?

As the inside bar provides both continuation and reversal signals, it is critical to confirm them. First, traders wait for the pattern to form and the following candles to close above or below it. Second, traders use volume or momentum indicators to identify the strength of the price movements. Another option is to use chart patterns that also provide continuation or reversal signals. Confirmation may also come from alignment with support and resistance or volatility conditions measured by ATR.

Are Inside Bars More Popular in Downtrends?

No, the inside bar pattern can be used in both uptrends and downtrends. No statistics can confirm that the pattern is more preferable in a downtrend. Traders can use it in their trading strategies regardless of the trend they trade in.

Which Timeframe Is Most Popular for Inside Bar Trading?

The inside bar pattern can form on any timeframe, but many traders consider it more reliable on higher timeframes, such as the H1, H4, and daily charts. Higher timeframes tend to reduce market noise and filter out minor price fluctuations, which may lower the risk of false breakouts. Lower timeframes, such as 5-minute or 15-minute charts, can also be used, but they often require stricter confirmation and more active risk management.

Is the Inside Bar a Breakout or Continuation Pattern?

The inside bar is described as a neutral consolidation pattern rather than a strictly breakout or continuation setup. It reflects a pause in price action caused by range contraction and reduced volatility. Depending on market context, an inside bar may lead to a breakout, signal a trend continuation, or occasionally precede a trend reversal. Traders usually rely on the prevailing trend, support and resistance levels, and confirmation tools, such as momentum readings from RSI or MACD, increased volume, or volatility conditions measured by ATR, to determine how to trade the setup. However, in the Encyclopedia of Chart Patterns, Bulkowski presents that the pattern provides continuation signals in 62% of cases.

How Reliable Is the Inside Bar in Forex Trading?

The reliability of the inside bar in forex trading depends largely on market conditions and confirmation. The common required conditions for any trade are liquid currency pairs and active trading sessions, such as the London or New York sessions. When combined with tools like support and resistance, momentum indicators, and clear risk management rules, the inside bar can be a useful component of a broader trading strategy. On its own, however, it should not be treated as a guaranteed signal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Cango Offloads 4,451 BTC for $305M to Repay Loan and Fund AI

TLDR

- Cango sold 4,451 BTC, reducing Bitcoin reserves by 60% to repay a Bitcoin-collateralized loan.

- The company raised $305M, improving its financial leverage and balance sheet.

- Cango aims to pivot towards AI compute infrastructure, targeting small and medium enterprises.

- Jack Jin, former Zoom Communications leader, appointed CTO of Cango’s AI business line.

- Bitcoin’s price dropped 1.06%, while Cango saw a 3.26% after-hours rebound to $0.9500.

Cango, a Bitcoin mining company, has sold 4,451 BTC for approximately $305 million, reducing its Bitcoin reserves by 60%. The sale aims to repay a Bitcoin-collateralized loan amid recent market volatility.

Bitcoin Sale Reduces Cango’s Reserves and Strengthens Balance Sheet

The sale of 4,451 BTC represents a substantial reduction in Cango’s digital asset holdings. This move is part of a broader strategy to strengthen the company’s balance sheet and reduce financial leverage.

The $305 million raised from the sale was directly applied to partially repay a Bitcoin-backed loan, improving Cango’s financial position. The divestment comes at a time when Bitcoin prices have rebounded from a recent low.

By selling a portion of its reserves, Cango aims to maintain flexibility while funding strategic growth initiatives, including expansion into AI compute infrastructure.

Cango Shifts Focus to AI Compute Infrastructure

In addition to the sale, Cango is pivoting toward AI computing by leveraging its existing infrastructure. The company plans to offer distributed compute capacity for the AI industry, targeting small and medium-sized enterprises.

Cango’s modular approach promises faster deployment timelines compared to traditional data center models. Cango also appointed Jack Jin as CTO of its AI business line.

Jin, a former leader at Zoom Communications, brings expertise in AI/ML infrastructure and large-scale GPU systems. His experience aligns with Cango’s strategy to develop a global distributed inference platform using modular, containerized GPU compute nodes.

Bitcoin Dips 1.06% While Cango Inc. Sees After-Hours Rebound

At the time of press, CoinMarketCap data indicates that Bitcoin’s price is currently $69,983.52, down 1.06% in the last 24 hours. The price fluctuated between $69,730 and $71,000 during the day.

On the other side, Cango Inc. (CANG) closed at $0.9200, down 5.52% on the day. The stock fluctuated between $0.8840 and $0.9887. After hours, the price rose by 3.26%, reaching $0.9500.

The stock had a previous close of $0.9738. Trading volume reached 1,229,780 shares, with an average volume of 985,054. The 52-week range for Cango is between $0.8840 and $2.8750, with a market cap of $318.642 million.

Crypto World

3 Altcoins Facing Liquidation Risks in the 2nd Week of February

After three consecutive weeks of sharp declines, buying pressure has returned to the market. However, it remains insufficient to dispel investor skepticism fully. Several altcoins now show unique catalysts that could drive outsized recoveries this week, increasing liquidation risks.

Ethereum (ETH), Dogecoin (DOGE), and Zcash (ZEC) could collectively trigger more than $3.1 billion in liquidations if traders fail to assess the following risks properly.

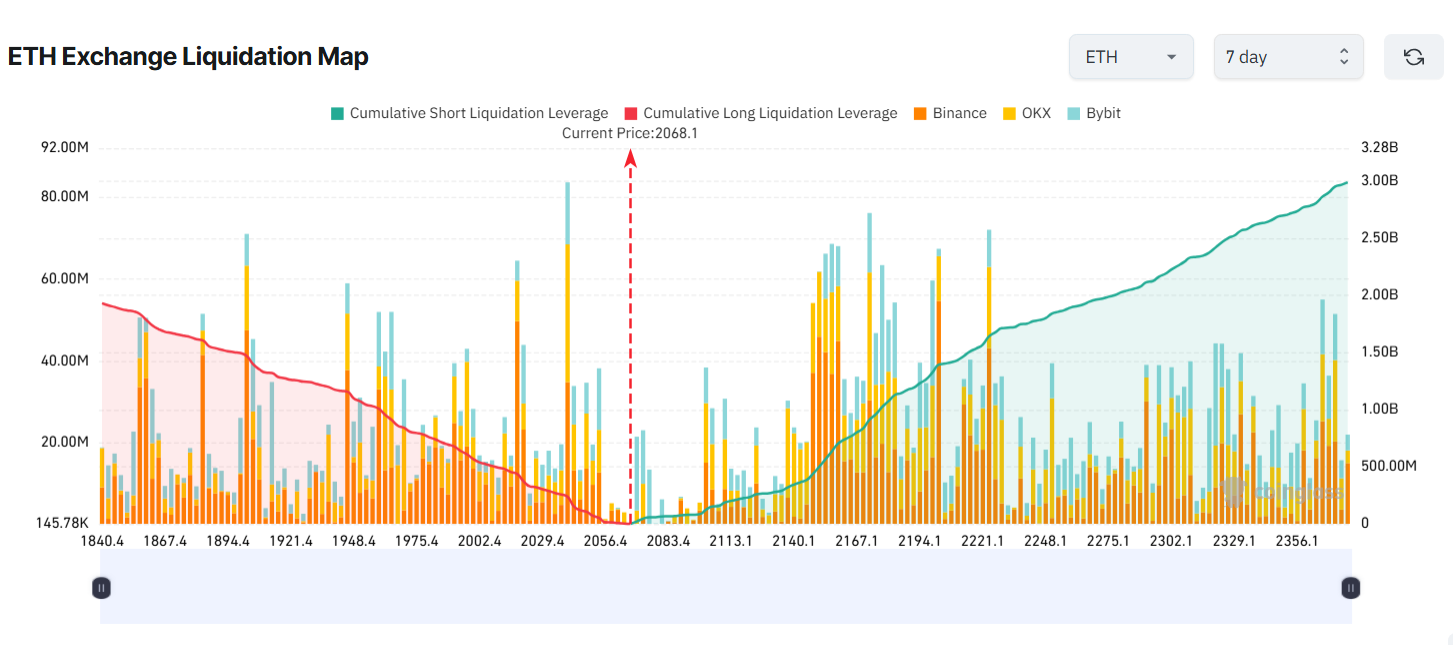

1. Ethereum (ETH)

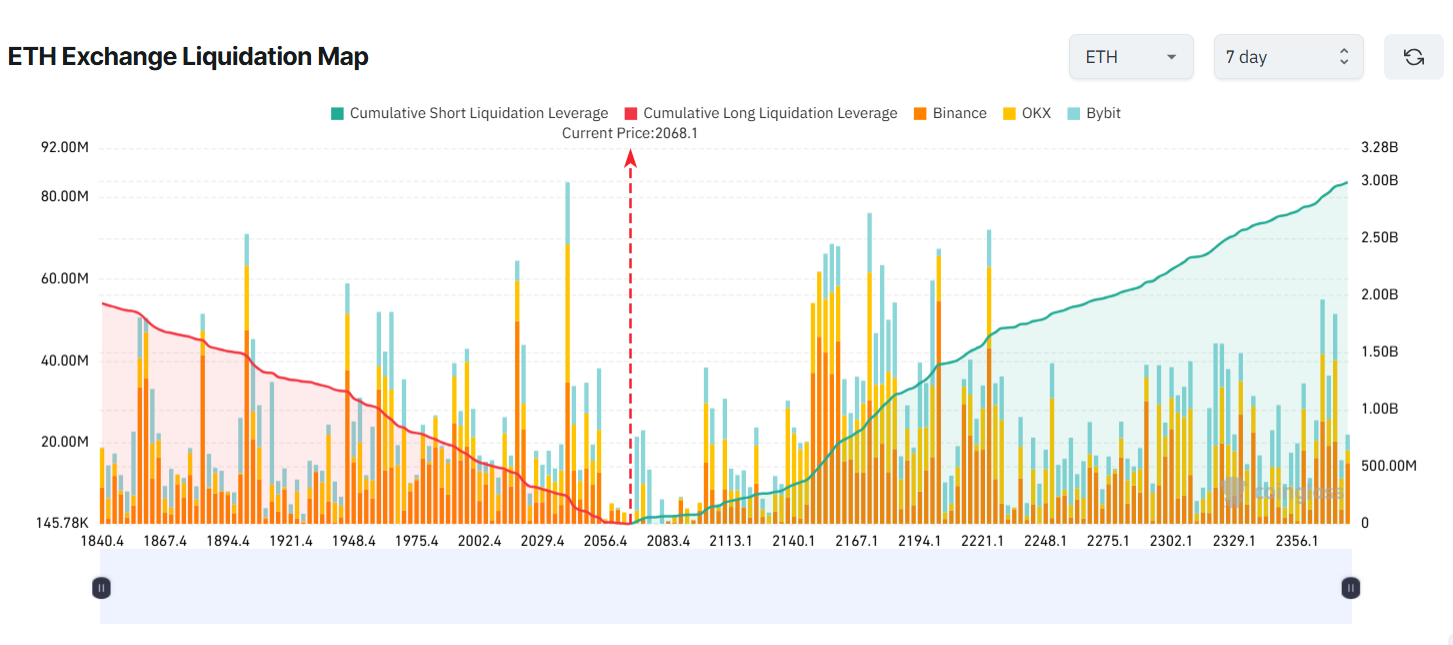

ETH’s 7-day liquidation map shows that potential liquidations from short positions outweigh those from long positions.

Sponsored

Sponsored

Many traders appear to expect further downside. ETH has already fallen about 40% since mid-January.

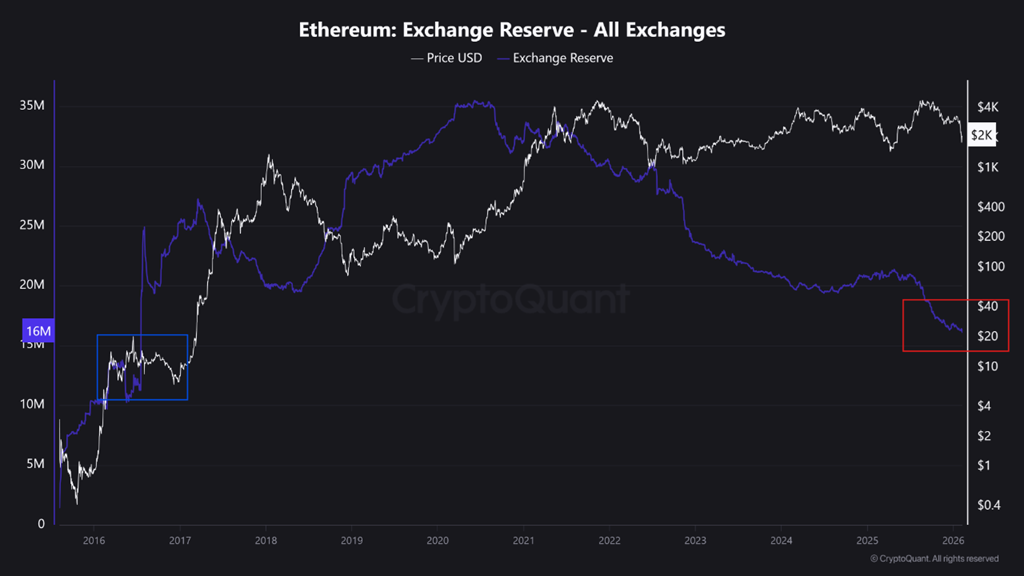

This bearish expectation faces growing risk. On-chain data shows that only around 16 million ETH remain on exchanges. This level marks the lowest since 2024.

Recent sell-offs have accelerated outflows from exchanges. Lower exchange balances reduce available supply. This dynamic can amplify price recoveries through supply–demand imbalances.

Additionally, more than 4 million ETH also sit in the staking queue. This further constrains the market’s liquid supply.

If ETH’s recovery strengthens due to these factors, short sellers could face significant risk. If ETH rises to $2,370 this week, potential liquidations from short positions could reach $3 billion.

Sponsored

Sponsored

2. Dogecoin (DOGE)

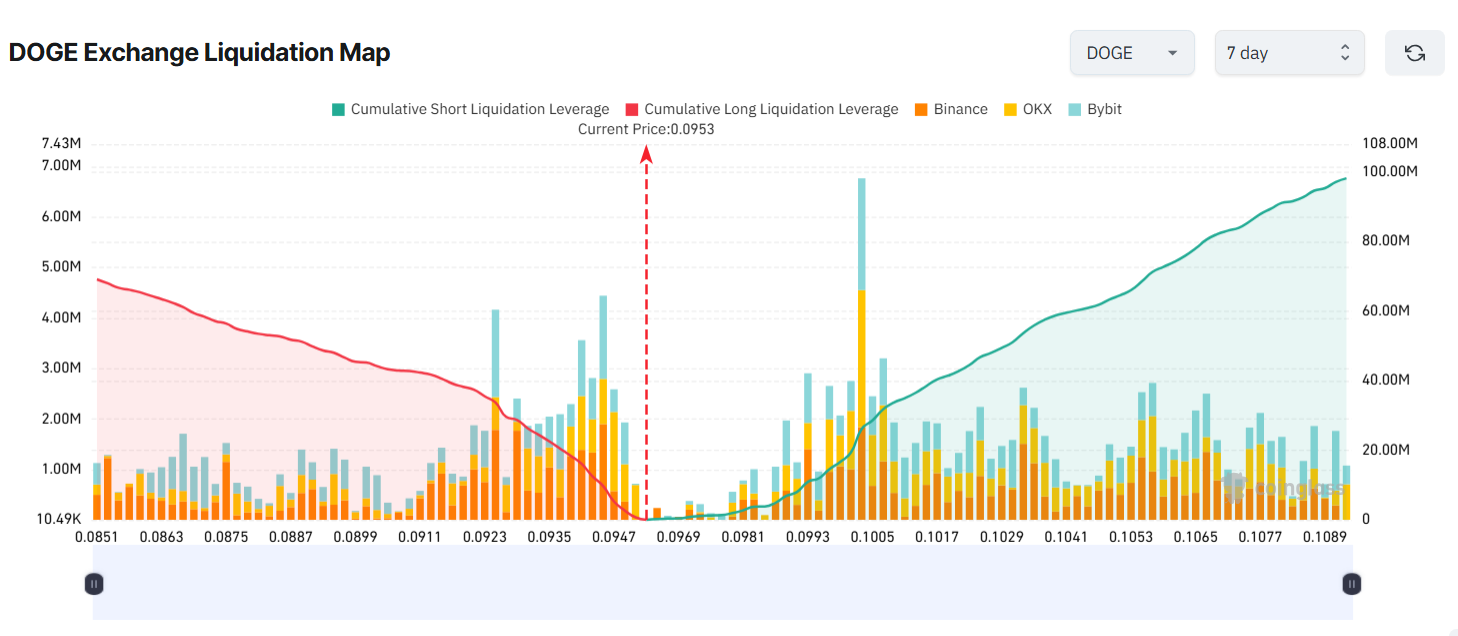

Dogecoin (DOGE) has fallen below $0.10. This level matches its 2024 price low. The 7-day liquidation map shows potential short liquidations of up to $98 million if DOGE rebounds to $0.109 this week.

Analysts argue that such a scenario remains plausible given both short- and long-term structures.

In the short term, trader Trader Tardigrade points to a Bull Flag pattern. This setup suggests DOGE could move toward $0.12 this week.

From a longer-term perspective, analyst Javon Marks highlights the formation of Higher Lows (HL) following Higher Highs (HH). This structure signals strength.

Sponsored

Sponsored

“As Higher Lows hold, we could see Dogecoin climb over 640% to and above the current ATH levels at ~$0.73905,” Javon Marks projected.

Discussion around Dogecoin may also regain momentum. In early February, billionaire Elon Musk responded to a question from the Tesla Owners Silicon Valley account regarding Dogecoin.

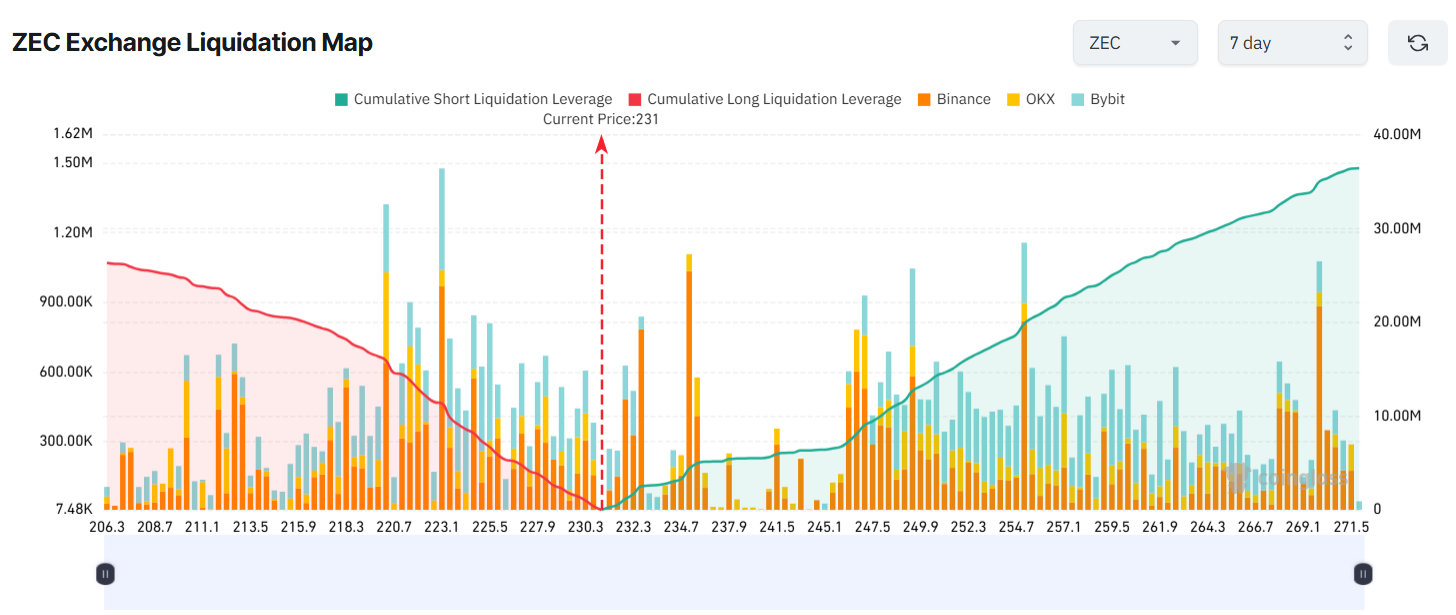

3. Zcash (ZEC)

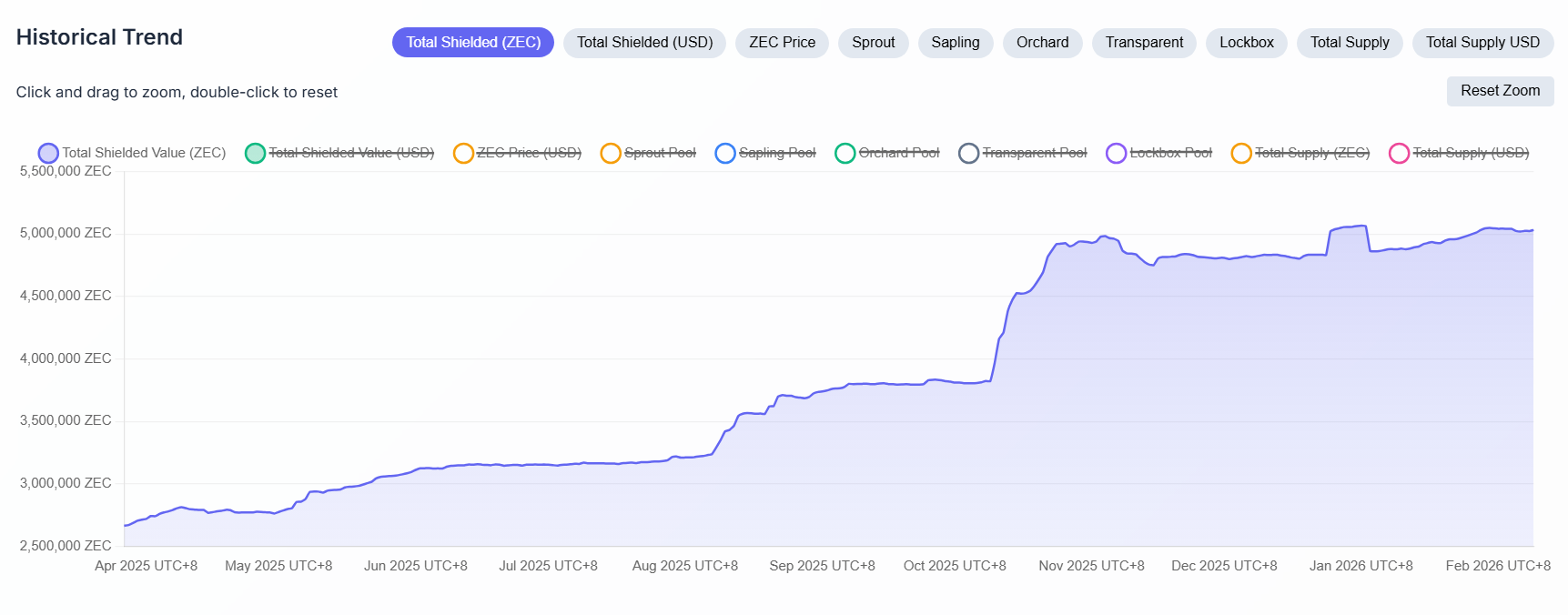

Zcash (ZEC) has dropped about 50% since January 8. The decline followed the announcement that the entire Electric Coin Company (ECC) team, the core developer behind Zcash, would depart. Broader negative market sentiment has further prolonged the downturn.

ZEC’s liquidation map shows that potential liquidations from short positions dominate. This indicates that many traders still expect the downtrend to continue.

Sponsored

Sponsored

Several positive signals have emerged recently. Vitalik Buterin, the founder of Ethereum, publicly donated to Shielded Labs, a development group working on Zcash.

Buterin emphasized that privacy is not optional. He described it as core blockchain infrastructure. This action could help revive positive sentiment toward ZEC.

Data from zkp.baby shows that more than 5 million ZEC remain locked in the Shielded pool, despite the sharp price decline. Negative news and broader selling pressure appear not to have undermined investor confidence in Zcash’s technology.

Overall, the altcoin market has begun to rebound after a period of panic selling. Recent analyses suggest total market capitalization could recover above $2.8 trillion.

This broader recovery, combined with asset-specific catalysts, could push prices well beyond short sellers’ expectations, increasing the likelihood of liquidations.

Crypto World

WLFI price outlook as bulls target key resistance at $0.14

- World Liberty Financial’s price traded to highs of $0.1145 in the early hours on Monday.

- The WLFI token could break to $0.14 or higher if bulls hold.

- Broader market conditions may derail the momentum.

WLFI, the native token of the World Liberty Financial project, posted double-digit gains early on Monday, rebounding from losses that saw prices slide to lows near $0.09 on Friday.

Data from CoinMarketCap showed WLFI climbing more than 12% to intraday highs of $0.1145, placing it among the day’s top performers alongside Axie Infinity.

The rally was supported by a sharp rise in trading activity, with 24-hour volume surging 98% to more than $228 million.

The move also coincided with Bitcoin and Ethereum hovering near $70,000 and $2,000, respectively.

The rebound suggests the token is attempting to recover quickly from the lows recorded during last week’s broader market sell-off.

WLFI price jumps to near $0.12

WLFI’s upward momentum propelled the token close to $0.12, with likely bullish drivers being a confluence of whale accumulation and an upcoming high-profile event.

Blockchain analytics firm Lookonchain reported that a new wallet had deployed $10 million in USDC to acquire 47.6 million WLFI tokens.

The large purchase was at an average price of $0.109, and data showed the whale still held more than $4.8 million of dry powder ready for fresh buying.

Adding to the bullish sentiment is the anticipation surrounding the World Liberty Forum.

The event is slated for February 18 at Mar-a-Lago, and could feature investment heavyweights from Goldman Sachs, Franklin Templeton, and FIFA.

These developments come despite the latest spotlight on World Liberty Financial from Democrats, largely around the $500 million investment into the project by the UAE.

Investors defying the negative sentiment from this development look to have added to the buying pressure that pushed WLFI toward the $0.12 supply wall.

World Liberty Financial price prediction

Technical indicators on WLFI’s four-hour chart point to a strengthening near-term outlook, with prices trading above the midline of a descending channel.

Further upside could see the token test the upper boundary of the channel.

From a technical perspective, this setup suggests the potential for a breakout, with a key supply zone located around $0.14.

Momentum indicators are also supportive. The Moving Average Convergence Divergence (MACD) has registered a bullish crossover, while the Relative Strength Index (RSI) is hovering near 47, indicating neutral-to-bullish conditions as the market recovers from earlier overbought levels.

Traders are now focused on $0.14 as the main resistance level.

A sustained move above this zone could open the way toward $0.16, where the upper Bollinger Band and previous support levels converge.

On the downside, a failure to hold support near $0.13 could trigger a pullback toward the lower end of the channel, around $0.10, underscoring the importance of strong volume confirmation for any further upside move.

Crypto World

Will Bitcoin Pump or Crash From $70K? 3 Charts Can Answer

Bitcoin is holding firm around the $70,000 level after one of its sharpest sell-offs this cycle, leaving investors split on what comes next.

On-chain data, ETF flows, and market structure signals now point in two opposing directions, raising a key question: is Bitcoin preparing for another leg up, or setting up for renewed downside?

Sponsored

Sponsored

Selling Pressure Remains Elevated

One of the clearest warning signals comes from Bitcoin’s growth rate difference between market cap and realized cap. The indicator remains in negative territory, historically associated with heavier selling pressure.

When realized cap grows faster than market cap, it suggests coins are being redistributed at lower prices rather than pushed higher by fresh demand.

In past cycles, this environment made sustained price “pumps” difficult, as rallies were often met with distribution rather than follow-through.

Overall, current conditions suggest a structural selling pressure overwhelming demand.

Whales are Buying Bitcoin Aggressively

At the same time, on-chain accumulation data tells a very different story. Inflows to long-term accumulation addresses surged sharply during the recent dip, marking the largest single-day inflow of this cycle.

Sponsored

Sponsored

Historically, such spikes tend to appear near local bottoms rather than tops.

While accumulation does not guarantee an immediate rally, it signals that large holders are absorbing supply instead of distributing it.

This creates a floor effect, limiting downside even when broader sentiment remains fragile.

Sponsored

Sponsored

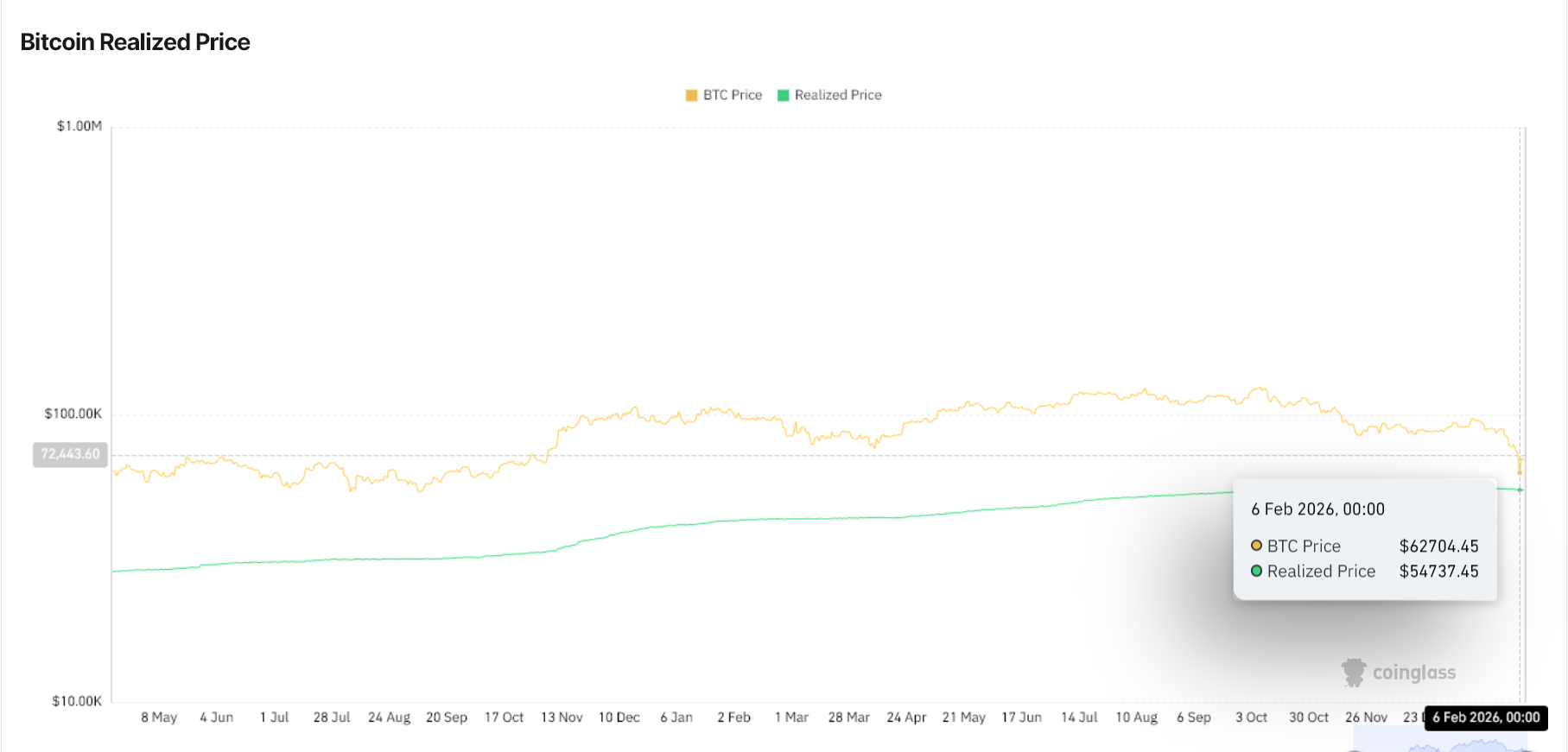

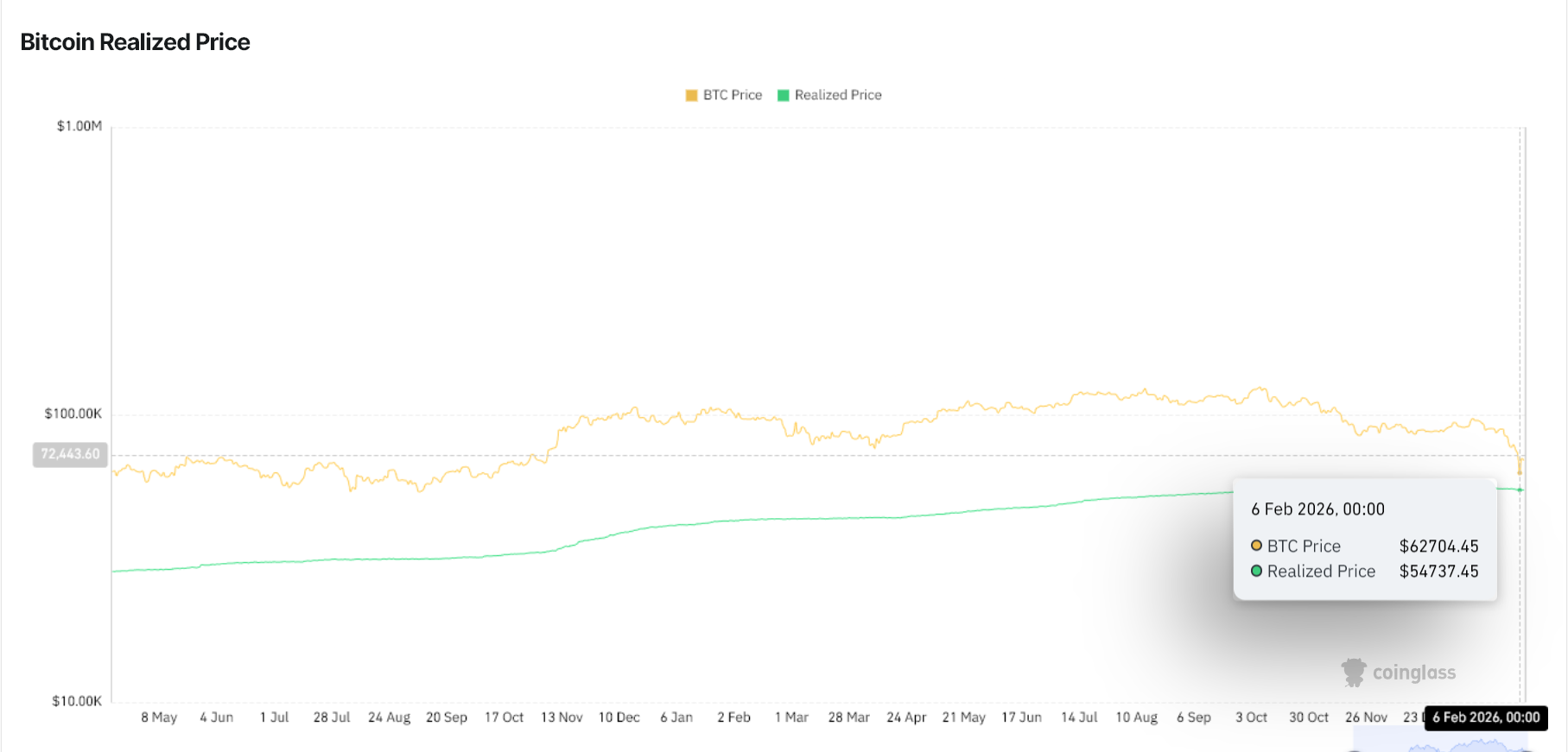

Price Holds Above Realized Value

Bitcoin is also trading well above its realized price, which currently sits near the mid-$50,000 range. That keeps the broader network in profit and reduces the risk of widespread capitulation.

Previous cycles show that deep, sustained bear markets typically occur only when price falls below realized levels for extended periods.

For now, Bitcoin remains in a neutral-to-positive regime.

Sponsored

Sponsored

ETF Flows Stabilize After Shock Outflows

US spot Bitcoin ETFs recorded heavy outflows during the crash, validating Arthur Hayes’ view that institutional hedging and dealer mechanics amplified the move. However, flows flipped back to strong inflows once prices stabilized near $60,000–$65,000.

That reversal suggests the worst forced selling has passed, though ETF demand has not yet returned to levels that would drive a breakout.

Range-Bound, Not Explosive

Taken together, the data points to a market caught between accumulation and distribution. Whale buying and ETF stabilization support the downside, while persistent sell pressure limits upside momentum.

In the near term, Bitcoin is more likely to remain range-bound around $70,000 than enter a decisive pump or dump.

Crypto World

HTX Launches USDe Minting and Redemption Service

TLDR

- HTX launches USDe minting and redemption service, offering an efficient platform for global users with enhanced features.

- The new minting and redemption service eliminates the need for OTC liquidity, simplifying the process for users.

- HTX introduces a daily rewards program for USDe holders, paid weekly, increasing capital efficiency and incentivizing participation.

- Users can now access USDe with unlimited minting and redemption capabilities and uniform transaction costs.

- HTX’s new campaigns, including APY boosts and trading competitions, encourage increased engagement with the USDe ecosystem.

HTX has launched its new USDe minting and redemption service, enhancing its platform with a daily rewards program for USDe holders. This service follows the recent listing of USDe and promises to provide a more efficient experience for HTX’s global user base.

USDe Minting and Redemption Now Available on HTX

According to the press release, the HTX minting and redemption process for USDe utilizes Ethena Labs’ smart contracts. The service eliminates the need for spot order books or OTC liquidity, simplifying the minting and redemption process.

This new feature provides benefits, including unlimited scale for minting and redemption and uniform transaction costs. With this integration, HTX users can smoothly enter or exit USDe positions, avoiding liquidity issues often seen in secondary markets.

The addition of USDe to HTX’s platform strengthens its position in both the DeFi and CeFi ecosystems. As HTX strives for innovation, these features enable users to manage their exposure to USDe with improved efficiency and transparency.

Daily Rewards and Additional Campaigns for USDe Holders

Alongside minting and redemption, HTX introduces a daily rewards program for users holding USDe in their spot accounts. Rewards will be paid weekly, allowing users to earn passive returns while maintaining dollar-denominated exposure.

The initiative enhances capital efficiency, offering an attractive incentive to hold USDe on the platform. HTX users can also participate in several campaigns, such as the upcoming APY boost for USDe in HTX Earn. This will provide subscribers with an annual percentage yield of up to 15%.

In addition, users can compete in a trading competition to share a 10,000 USDe prize pool. These initiatives aim to increase engagement with the USDe ecosystem and incentivize users to participate in HTX’s offerings.

Crypto World

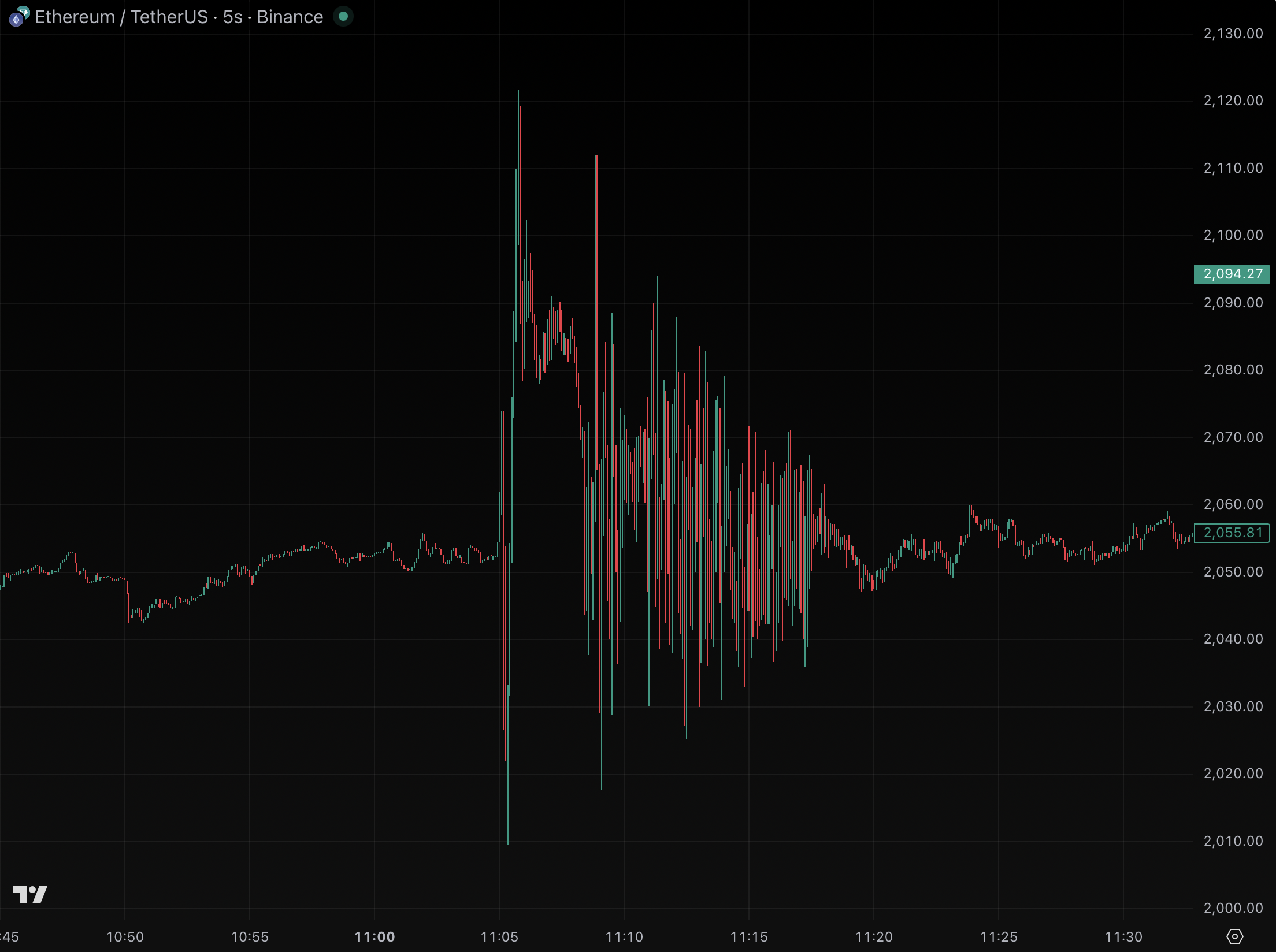

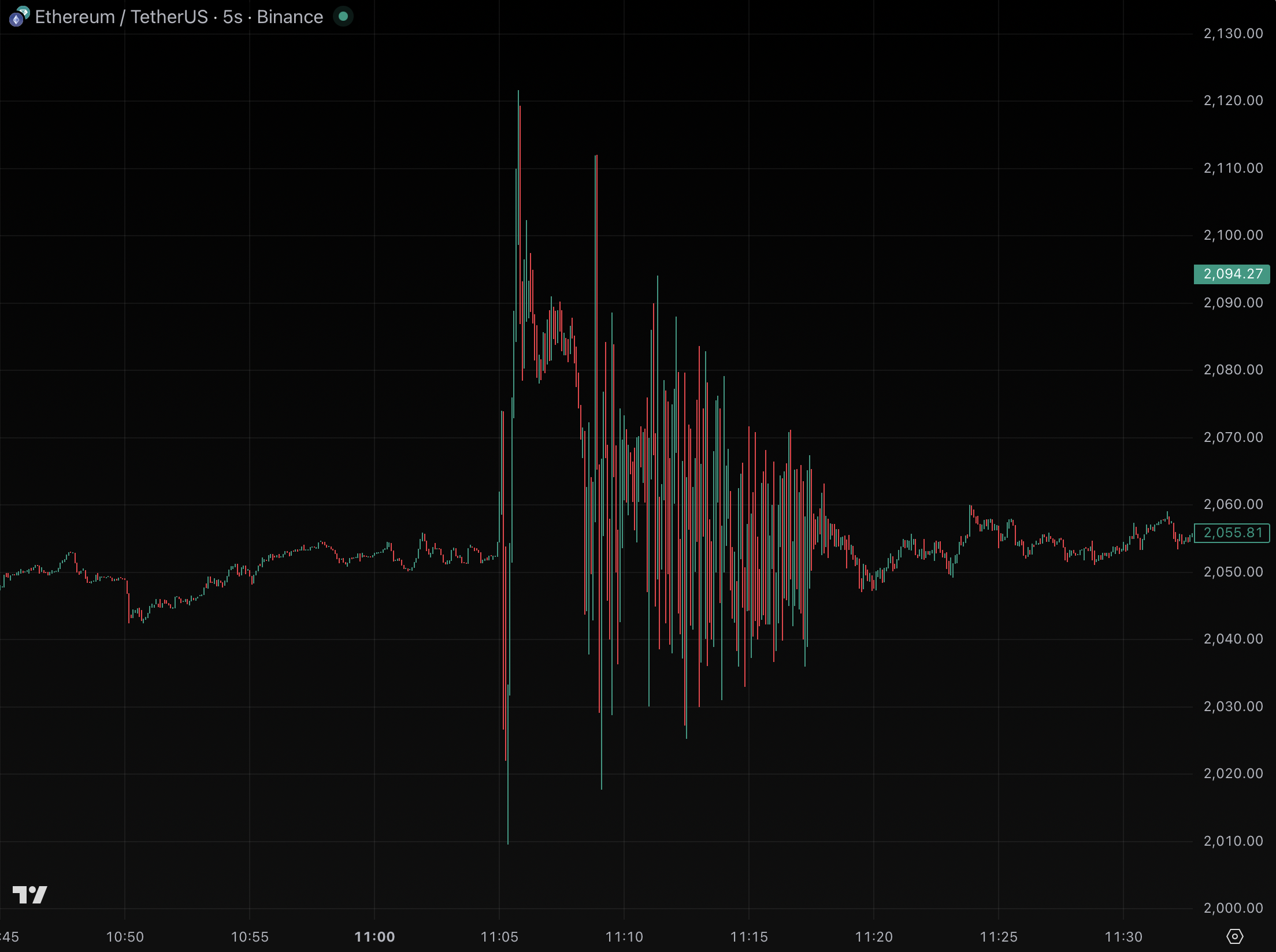

Binance critics revive trading allegations against CZ after ETH whipsaw

Amid ongoing backlash over its role in October 10’s liquidations and a bizarre chart of transactions from Saturday, critics of Binance are questioning founder Changpeng Zhao (CZ) over his repeated claims that he’s not an active crypto trader.

Sharing reminders about CZ’s ownership of market-makers Merit Peak Limited and Sigma Chain (which have both traded on Binance) critics decried a tether (USDT)-denominated ether (ETH) chart from Binance’s exchange on Saturday, alleging that CZ somehow was involved.

However, one of the most repeated assurances from CZ is that he is not an active crypto trader.

Indeed, in countless interviews, he tells a story of his brief attempt at active trading about a decade ago, concluding that he was entirely unskilled at that endeavor.

’I don’t trade at all’

For years, CZ has claimed, he’s not been an active crypto trader. Although he makes infrequent, long-term purchases, he reiterates that he’s “not a trader. I buy and hold.”

CZ worked at Bloomberg and built high-frequency trading platforms for stockbrokers, so he had plenty of experience with active traders before his career at crypto businesses Blockchain.info, OKCoin, and Binance.

According to CZ’s version of his biography, he wanted to become a trader during the early years of his crypto career, didn’t succeed, and instead decided to focus on building Binance.

Rather than trade along the way, he’s focused on long-term investments: bitcoin (BTC), the Binance Coin (BNB) he founded, and most of all, equity in Binance itself.

“I don’t trade at all, I just hold bitcoins,” CZ said in a representative interview. “I hold BNB, and I don’t do daytrading.”

Read more: Lawsuits are piling up against Binance over Oct. 10

CZ doesn’t need to trade to make billions from Binance

Bloomberg analysts agree that CZ’s long-held equity in Binance, for what it’s worth, accounts for the vast majority of his estimated $50 billion net worth.

Even without any digital asset holdings, CZ could easily be worth tens of billions of dollars simply as the founding shareholder of his profitable company.

However, critics on social media have recently become skeptical of CZ, alleging or insinuating that he’s concerned with manipulating Binance trading pairs.

A highly suspicious whipsaw in ETH renewed their anger.

Just because trades occur on Binance, however, doesn’t mean that CZ or Binance are participating in those markets beyond its customary commissions for matching third-party orders.

Wintermute CEO Evgeny Gaevoy called Saturday’s trading action “a market-maker bot blowing up to the tune of tens of millions,” defending his own market-making company from an accusation about scamming on Binance, for example.

For his part, CZ barely acknowledged the social media controversy. He summarized it as another example of FUD and posted recaps of his snowboarding trip, instead.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Remittix tops crypto altcoin charts worldwide as exchanges get set to list mega token Remittix

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix is climbing global altcoin charts as rising demand for payment-focused crypto and a wave of upcoming exchange listings put the token firmly in the spotlight.

Summary

- Remittix has sold over 703.7 million tokens, raised more than $28.9 million, and continues to gain traction through strong sales, user engagement, and a 300% bonus incentive.

- Confirmed listings on BitMart and LBANK, with more exchanges preparing to onboard the token, are expanding Remittix’s global reach and liquidity.

- A live wallet, upcoming PayFi platform launch on February 9, 2026, and CertiK verification are reinforcing Remittix’s position as one of the most closely watched altcoins of 2026.

The crypto market is paying attention as Remittix climbs altcoin rankings across trading platforms and chart trackers. The interest in payment tokens has been on the increase with the growing demand for real utility in the blockchain world. Although other tokens fluctuate and experience volatility, Remittix has been successful in terms of sales and user engagement.

The project’s momentum has intensified as multiple exchanges prepare to list Remittix, giving the token broader access globally. Remittix isn’t just moving in the charts; it is becoming one of the most talked-about tokens in the crypto market.

How Remittix is rising in market attention

Remittix’s recent performance shows an increase in investor interest and adoption of the token. Remittix has sold more than 703.7 million out of the 750 million tokens available for sale at $0.123 and has raised more than $28.9 million, with the aim of reaching the milestone of raising approximately $30 million.

The project’s 300% bonus, available via email activation, has also driven new buyers, increasing liquidity and attention.

Beyond sales figures, Remittix has seen real product engagement. Its crypto wallet is live on the Apple App Store, with the Google Play release in progress. This wallet allows users to securely store, send, and manage assets ahead of the official platform launch on 9 February 2026, when the full PayFi services will go live.

Some crypto analytics platforms have reported a climb in social mentions and ranking metrics tied to altcoin performance. This uptick in attention signals that Remittix is gaining traction among traders and investors looking at projects with both utility and growing demand.

Listing momentum is boosting Remittix exposure

Exchange listings are playing a key role in Remittix’s rising profile. BitMart and LBANK have already confirmed listings for Remittix, giving traders on those platforms direct access to trade and hold the token. These listings help expand liquidity and provide a broader market reach for users seeking exposure to Remittix as one of the fastest growing crypto in 2026.

Preparations are underway for additional top-tier exchange listings that will open Remittix to even larger trading communities once the next funding milestone is hit. Market watchers note that broad exchange access often correlates with higher volume visibility and ranking improvements on altcoin charts.

Security and credibility support this expansion. Remittix is fully audited and verified by CertiK, holding a #1 ranking on CertiK Skynet with an 80.09 Grade A score from over 24,000 community ratings, which strengthens confidence among traders and long-term holders.

Also, a 15% USDT referral program rewards engagement and helps broaden the user base. All of this activity, strong sales, listing momentum, live wallet adoption, and incentives, contribute to why Remittix attracts attention from both traders and long-term supporters.

Key drivers behind Remittix demand:

- Tackling the $19 trillion global payments market with real-world solutions

- Seamless crypto-to-bank transfers across 30+ countries

- Utility-focused token supported by genuine transaction activity

- Deflationary tokenomics designed for long-term growth

- Broad market appeal extending beyond traditional crypto users

Why Remittix continues to attract interest

Remittix’s growth in visibility is rooted in both its incentives and product rollout. Positioned at the intersection of crypto, payments, and global remittance, a $19 trillion market, Remittix aims to be the go-to crypto-to-fiat payment hub for merchants, users, and businesses worldwide.

With the 9 February 2026 platform launch approaching, Remittix is moving from early momentum to real utility deployment. As more exchanges prepare to list the token and user engagement grows, Remittix stands as a clear example of how practical adoption and visibility can combine to lift a token’s presence across global charts.

To learn more about Remittix, visit the website and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

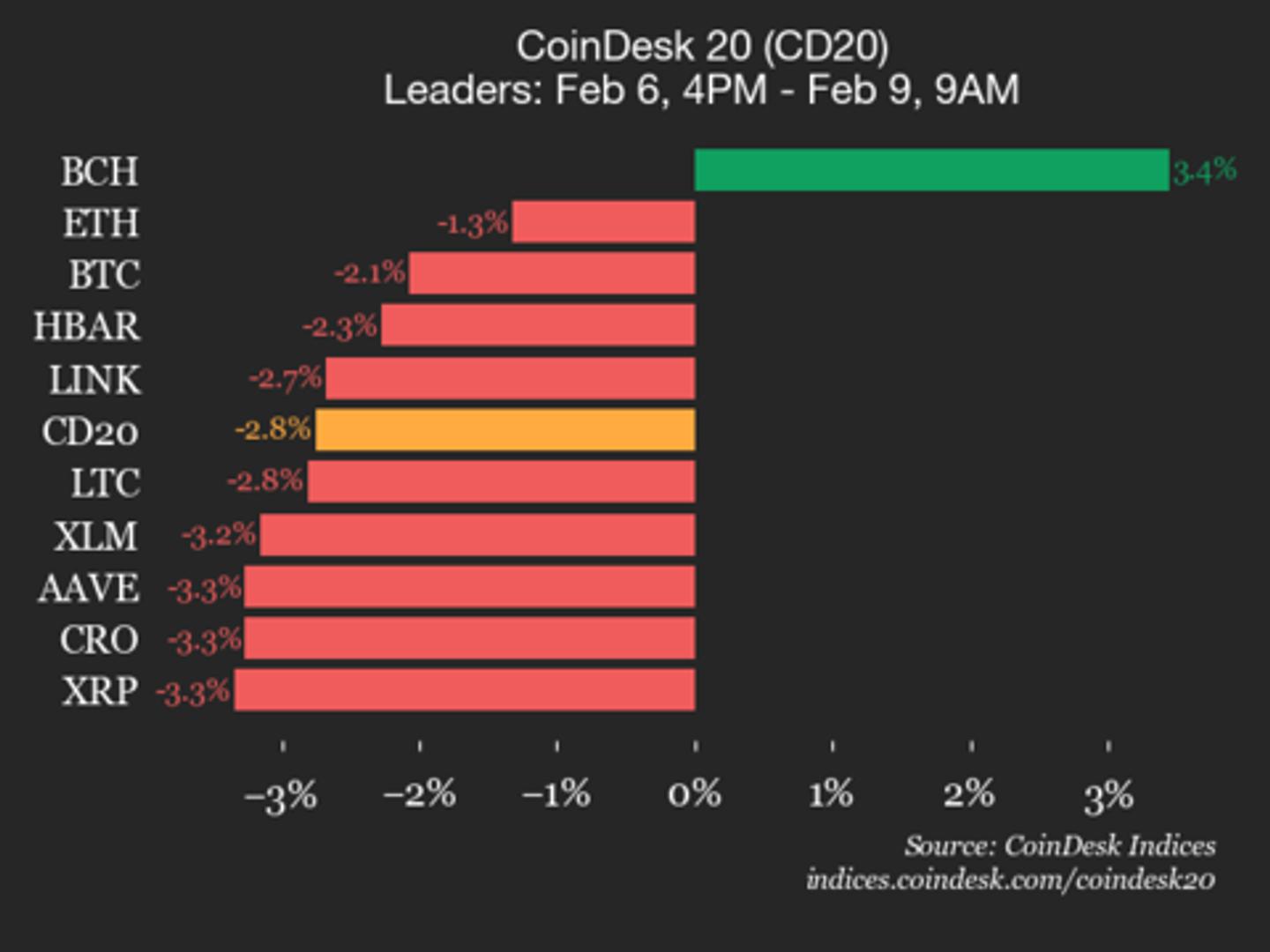

CoinDesk 20 performance update: Bitcoin Cash (BCH) is only gainer, up 3.4%

Aptos (APT) declined 9.4% and NEAR Protocol (NEAR) fell 8%, leading index lower.

Crypto World

Solana price near key $75 support as RSI oversold signals potential bounce

- Solana (SOL) currently trades near $83 after a nearly 39% monthly drop.

- Weekly and daily RSI signal the token is oversold, hinting at a possible short bounce.

- The key support around $75 is critical to prevent further decline.

Solana (SOL) has been under intense pressure in recent weeks.

The altcoin currently trades around $83, down nearly 39% over the past month.

This decline comes amid broader weakness in the crypto market and low retail engagement.

Technical analysis shows that SOL’s weekly Relative Strength Index (RSI) is deeply oversold.

Some are suggesting that the token may have reached a “final dip,” referencing a long-term structural support around the $75 level, and eyes are now on whether this support can hold.

Solana price technical analysis

From a technical standpoint, Solana’s trading volume remains high, with over $3.9 billion exchanging in the past 24 hours.

But despite this high activity, the token is trading well below key moving averages.

The 50-day and 200-day averages now act as the immediate resistance levels and remain out of reach for now.

Short-term momentum indicators, including the MACD histogram, have flattened, reflecting waning bearish momentum.

In addition, on the daily and weekly charts, RSI remains near historic lows, indicating extreme oversold conditions.

This combination suggests potential for a short-term relief bounce, though trend reversal is not guaranteed.

Market sentiment shows a muted retail engagement

Retail interest in Solana remains muted, with recent reports showing low futures open interest, signalling that traders are reducing exposure.

Derivatives funding rates are also negative, suggesting bias toward short positions.

Solana ETFs have also recorded outflows, reinforcing weak institutional participation.

Analysts note that these factors add to the bearish pressure on the token.

Still, technical indicators hint at a potential stabilisation near critical support zones, with the $75 level having been repeatedly cited as key support in recent forecasts.

Breaking below this threshold could open the door to further downside, possibly toward $67 or even $51 in extreme scenarios.

On the upside, recovery faces resistance around $111 and $138, which would need to be breached to shift the market sentiment positively.

Long-term Solana market analysis

Long-term forecasts for Solana remain mixed.

Some analysts foresee recovery toward the mid-$100s if support holds and broader market conditions improve.

Bullish projections even extend toward $250, though these are contingent on sustained buying pressure and macro-level stability.

For now, the focus remains on short-term price stability.

Investors and traders should keep a close eye on the $75 support, viewing it as a potential floor for consolidation.

SOL’s trajectory will likely depend on a combination of market sentiment, institutional flows, and technical momentum.

As it stands, Solana is navigating a critical juncture where its next move could define the tone for the coming months.

Crypto World

Phemex introduces 24/7 TradFi futures trading with 0-Fee Carnival, creating an all-in-one trading hub

- Phemex, a user-first crypto exchange, announced the launch of Phemex TradFi, a new futures trading offering.

- Futures linked to commodities, foreign exchange, and global indices will be introduced in subsequent phases.

- Phemex TradFi is designed for traders seeking simplicity and continuity across markets.

Apia, Samoa, February 9, 2025 — Phemex, a user-first crypto exchange, announced the launch of Phemex TradFi, a new futures trading offering that allows users to access traditional financial assets, including stocks and precious metals, on a 24/7 basis.

Futures linked to commodities, foreign exchange, and global indices will be introduced in subsequent phases.

The launch marks Phemex’s entry into multi-market derivatives, enabling traders to manage exposure to both crypto and traditional assets within a single, USDT-settled futures framework.

To support early adoption, Phemex is introducing a 0-Fee TradFi Futures Carnival, offering three months of zero trading fees, starting from February 6, on stock futures alongside a $100,000 incentive pool aimed at structured and risk-aware participation, and a first-trade protection mechanism that reimburses eligible users with trading bonus if their initial TradFi futures trade results in a loss.

Unlike spot markets that are constrained by exchange hours, TradFi futures continue price discovery outside standard trading sessions.

By bringing this derivative structure into a crypto-native environment, Phemex allows users to respond to global macro events as they unfold, whether during nights, weekends, or market closures—without switching platforms or settlement systems.

Phemex TradFi is designed for traders seeking simplicity and continuity across markets.

Users can trade crypto and traditional futures side by side, benefit from transparent maker-taker pricing rather than spread-based execution, and apply strategy-driven tools to manage risk more systematically.

Copy trading support for TradFi futures is also planned, extending Phemex’s strategy trading ecosystem into traditional markets.

“As markets become more connected and operate beyond fixed sessions, platforms need to evolve with them” commented Federico Variola, CEO of Phemex.

“Our goal with Phemex TradFi is not to replicate traditional markets, but to rethink how they are accessed — bringing continuous availability, unified settlement, and risk-aware tools into a single trading environment that reflects how traders actually operate today.”

The introduction of TradFi futures signals Phemex’s evolution from a crypto-native exchange into a broader derivatives platform built for always-on global markets.

As additional asset classes roll out, Phemex aims to offer traders a more integrated, resilient, and forward-looking way to navigate both digital and traditional finance.

About Phemex

Founded in 2019, Phemex is a user-first crypto exchange trusted by over 10 million traders worldwide. The platform offers spot and derivatives trading, copy trading, and wealth management products designed to prioritize user experience, transparency, and innovation.

With a forward-thinking approach and a commitment to user empowerment, Phemex delivers reliable tools, inclusive access, and evolving opportunities for traders at every level to grow and succeed.

For media inquiries, please contact: [email protected]

For more information, please visit: https://phemex.com/

Media contact Oyku Yavuz PR Lead [email protected]

This article is authored by a third party, and CoinJournal does not endorse or take responsibility for its content, accuracy, quality, advertisements, products, or materials. Readers should independently research and exercise due diligence before making decisions related to the mentioned company.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat22 hours ago

NewsBeat22 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports18 hours ago

Sports18 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 hours ago

NewsBeat2 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat13 hours ago

NewsBeat13 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports49 minutes ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout