Crypto World

Trump Unveils 10% Global Tariff After SCOTUS Ruling

The United States Supreme Court ruled on Friday that President Donald Trump could not use national emergency powers to levy tariffs during peacetime, a decision that curbs a longstanding tool for unilateral trade action. The ruling clarifies that the International Emergency Economic Powers Act (IEEPA) cannot be wielded to impose broad tariffs in the absence of a declared emergency, a nuance that could steer future policy moves and trigger recalibrations across markets sensitive to policy signals. Moments after the decision, the White House signaled a shift: Trump announced a 10% global tariff to be imposed under other legal authorities, signaling a different approach to trade protectionism while the court’s opinion tightened the executive branch’s strategic levers. “Effective immediately. All national security tariffs under Section 232 and Section 301 tariffs remain fully in place. And in full force and effect. Today, I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged.”

The ruling, published after hours of deliberation, underscored the framers’ intent to reserve broad taxing powers for Congress. The court’s language was blunt: “In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope.” The decision also cited Article I, Section 8 of the Constitution, which vests in Congress the power to lay and collect taxes, duties, imposts, and excises, highlighting the structural balance designed into fiscal authority. The jurisprudence around IEEPA has always been contentious, but the Court’s interpretation here narrows the scope of executive emergency powers in a peacetime context. The ruling arrives at a moment when tariff rhetoric has already unsettled markets, reinforcing investors’ emphasis on policy clarity and legislative oversight.

For crypto markets, the episode represents another data point in a long-running conversation about policy risk and asset prices. The debate over tariffs has historically correlated with risk-off moves across high-volatility assets, including digital tokens, as traders reassess exposure to policy shocks and the potential knock-on effects on global liquidity. A related analysis in the wake of tariff threats noted that Bitcoin decoupled somewhat from stock behavior in the face of policy headlines, illustrating that crypto assets can react differently to macro signals than traditional equities. Bitcoin decouples stocks-lose-3-5-t-amid-trump-tariff-war-and-fed-warning-of-higher-inflation. The broader takeaway is that even with partial decoupling, crypto markets remain sensitive to policy trajectories and the pace at which governments alter trade rules and economic assumptions.

The core of the Friday decision centers on the delicate balance between emergency authorities and constitutional checks. The Supreme Court’s perspective emphasizes that the executive branch cannot rely on a wartime-like authority to reshape peacetime trade dynamics without legislative backing. This is not merely a curtailment of a single tool; it signals a preference for congressional oversight when it comes to tariff structures and the revenue-raising powers that accompany them. The court’s phrasing draws a clear line: while emergency powers exist, their application must align with constitutional design and explicit statutory authorization. In practical terms, the ruling narrows the menu of options available to an administration seeking rapid, unilateral responses to perceived threats to national security or economic vitality.

From a governance standpoint, the decision does not eliminate tariff policy. Rather, it redirects the path—pushing the administration toward other legal authorities, such as the Trade Expansion Act of 1962 and the Trade Act of 1974. The President’s stated plan to invoke a 10% global tariff under different statutory authority does not erase the underlying policy aim; it alters the mechanism and potentially the scope of the measures. This shift will likely invite renewed scrutiny from Congress, as lawmakers weigh the costs and benefits of tariffs in a globalized economy where supply chains and inflation expectations are already under pressure. The White House’s assertion that the 10% tariff would operate “over and above our normal tariffs” underscores the potential for layered duties that could ripple through customs, manufacturing, and consumer prices if implemented in practice.

Why it matters

For investors and traders who monitor cross-asset dynamics, the ruling adds another layer to an ever-evolving policy backdrop. The legal floor established by the Court reinforces the idea that fiscal measures of this scale require explicit congressional authorization, potentially delaying or complicating tariff actions that might otherwise be deployed swiftly as a response to perceived national security threats. In crypto markets, where liquidity is often a barometer of risk sentiment, policy signals—whether from courts or lawmakers—can precipitate tighter or looser financial conditions. The episode also illustrates the ongoing tension between executive agility and legislative accountability in the realm of trade policy, a tension that can influence how crypto and other risk assets price in the near term.

Beyond immediate price moves, the case highlights a broader policy cadence: as the administration tests the boundaries of executive authority, investors are increasingly watching for transparency in the legislative process and for concrete, long-horizon plans that reduce ambiguity. The market’s appetite for clarity is particularly acute in the crypto space, where policy and regulation directly influence custody, cross-border flows, and the expansion of on-ramps and regulated venues. The discussion around IEEPA, additional tariff authorities, and potential regulatory responses across jurisdictions is likely to persist, shaping how individuals and institutions allocate capital across digital assets and traditional markets.

Moreover, the decision’s emphasis on constitutional borders may inform future debates around how the United States uses economic tools to shape trade policy. It underscores the importance of aligning executive actions with legislative authorization to ensure that policy changes withstand judicial scrutiny and political pushback. For builders and participants in the crypto economy, the takeaway is straightforward: while policy levers will continue to evolve, credible, well-justified regulatory frameworks will be central to the industry’s long-term viability and its ability to attract mainstream adoption and institutional investment.

The interplay between law, policy, and markets remains dynamic. In the near term, traders will be watching for the specific text and implementation details of the proposed 10% global tariff and for any accompanying regulatory guidance. The interplay between tariff policy and financial markets—crypto included—will continue to test the resilience of risk assets amid policy-induced volatility. As the day’s developments unfold, market participants will assess not only the immediate price action but also the longer arc of how the United States negotiates its economic interests in a deeply interconnected global economy.

What to watch next

- Official text and scope of the new 10% global tariff under Section 122, including which goods and sectors are affected.

- Any additional legal challenges or legislative actions related to tariffs and emergency powers.

- Immediate market reactions across crypto and equities, including liquidity shifts and volatility spikes.

- Policy updates from lawmakers on tariff authority and potential alternative measures.

Sources & verification

- Supreme Court ruling PDF: https://www.supremecourt.gov/opinions/25pdf/24-1287_4gcj.pdf

- White House X broadcast link: https://x.com/i/broadcasts/1oJMvRRqDBjxQ

- Bitcoin decouples stocks-lose-3-5-t-amid-trump-tariff-war-and-fed-warning-of-higher-inflation: https://cointelegraph.com/news/bitcoin-decouples-stocks-lose-3-5-t-amid-trump-tariff-war-and-fed-warning-of-higher-inflation

- President Trump signs reciprocal tariff executive order: https://cointelegraph.com/news/president-trump-signs-reciprocal-tariff-executive-order

Crypto World

Crypto Capital Shifts From Tokens to Stocks as Launches Struggle: DWF

Investor capital increasingly flows from tokens into publicly listed crypto companies as new token launches struggle, according to research and commentary from market maker DWF Labs.

Drawing on Memento Research data covering hundreds of token launches across major centralized and decentralized exchanges, the firm said more than 80% of projects have fallen below their token generation event (TGE) price. Typical drawdowns range between 50% and 70% within roughly 90 days of listing, suggesting public buyers often face immediate losses after launch.

DWF Labs managing partner Andrei Grachev told Cointelegraph that the figures reflect a consistent post-listing pattern rather than short-term market volatility. He said most tokens reach a price peak within the first month and then trend downward as selling pressure builds.

“TGE price is the exchange-listed price set before launch,” Grachev said. “This is the price the token is set to open at on the exchange, so we can see how much the price actually changes due to volatility in the first few days,” he added.

The analysis focused on structured launches tied to projects with products or protocols, rather than memecoins. Airdrops and early investor unlocks were identified as major sources of selling pressure.

Related: Kraken-backed SPAC raises $345M in upsized Nasdaq IPO

Crypto IPOs, M&A surge as capital shifts from tokens

In contrast, capital formation has strengthened in traditional markets tied to the sector. Fundraising for crypto-related initial public offerings (IPOs) reached about $14.6 billion in 2025, up sharply from the prior year, while merger and acquisition (M&A) activity surpassed $42.5 billion, the highest level in five years.

Grachev said the shift should be understood as a rotation rather than a withdrawal of capital. If capital were simply leaving crypto, you wouldn’t see IPO raises jump 48x year-over-year to $14.6 billion, M&A hit a 5-year high of over $42.5 billion, and crypto equity performance outpacing token performance,” he said.

In its report, DWF compared listed companies such as Circle, Gemini, eToro, Bullish and Figure with tokenized projects using trailing 12-month price-to-sales ratios. Public equities traded at multiples between roughly 7 and 40 times sales, compared with 2 to 16 times for comparable tokens.

The firm argued that the valuation gap is driven by accessibility. Many institutional investors, including pension funds and endowments, are restricted to regulated securities markets. Public shares can also be included in indexes and exchange-traded funds, creating automatic buying from passive investment products.

Maksym Sakharov, co-founder and group CEO of WeFi, also confirmed to Cointelegraph that there has been a capital rotation from token launches. “When risk appetite tightens, investors don’t stop craving exposure, so they start demanding cleaner ownership, clearer disclosure, and a path to enforceable rights,” he said.

Sakharov added that the money is going toward businesses that look like infrastructure because of custody, payments, settlement, brokerage, compliance and plumbing. He noted that the “equity wrapper” is attractive because it aligns with real-world adoption, enabling licensing, audits, partnerships and distribution channels.

Related: CertiK keeps IPO on the table as valuation hits $2B, CEO says

Why investors favor crypto equities over tokens?

The market is increasingly treating tokens and businesses as separate things, Sakharov said, noting that a token alone cannot replace distribution or a working product. If a project fails to generate steady users, fees, transaction volume and retention, the token ends up priced on expectations rather than real activity, which is why many launches look successful at first but later disappoint.

Listed crypto equities are not necessarily safer, but they are clearer and easier for investors to evaluate, according to Sakharov. Public companies offer reporting standards, governance and legal claims, and they fit within institutional portfolio rules, whereas holding tokens often requires custody approvals and policy changes.

Grachev described this shift as structural rather than cyclical. While tokens will remain part of crypto networks for incentives and governance, he said institutional capital increasingly prefers equity rails.

“Tokens won’t disappear, but we’re seeing a permanent bifurcation: serious protocols with real revenue will thrive, while the long tail of speculative launches faces a much harder environment,” he concluded.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

SportFi could shift from fan engagement to on-chain markets tied to live sports outcomes

SportFi has spent most of its life in a familiar lane: tokens that reward fandom with voting rights, perks and a thin layer of speculative trading. The next version being mapped out by some of the sector’s biggest builders suggests a more ambitious destination — one where sports become a live data feed for smart contracts, and tokens behave less like collectibles and more like programmable markets.

The logic is simple: sports already produce constant, globally understood outcomes. Win, lose, qualify, get relegated — the “settlement layer” is the scoreboard. If token supply and incentives can be tied to those outcomes, SportFi starts to resemble a gamified asset class rather than a bolt-on engagement product.

One roadmap outlined by sports-focused blockchain firm Chiliz frames this shift as “gamified tokenomics”: match-day results would trigger mint-and-burn mechanics, for example, burning supply on wins or expanding it on losses, executed transparently through smart contracts.

“Our journey is about trying to become like a sentiment marketplace above these tokens and making them available everywhere so developers can create tools where we can indeed play with these tokens as a sentiment game,” Chiliz CEO Alexandre Dreyfus told CoinDesk in an interview.

Dreyfus pitched it less as gambling and more as a sentiment marketplace that mirrors sport’s competitive rhythm: seasonal, event-driven and reactive to real-world performance.

That matters because it changes who the product is for. Fan tokens have typically leaned on a sense of “ownership” in a team, such as voting on the colour of the club’s warm-up kit and what song plays in the stadium as the players walk out. Trading activity, however, has often been driven by headline moments — signings, managerial changes, tournament runs.

A rules-based, outcome-linked supply model is designed to formalize that behaviour into the token itself, making price formation and scarcity part of the match-day experience rather than an accidental byproduct.

Intersection with prediction markets

If that layer works, it opens the door to the next one: DeFi around sports-native assets. In practice, that means building the plumbing for tokens to be used as collateral, traded in deeper liquidity pools, or packaged into structured products, a step toward sports assets behaving like other crypto primitives.

It’s also where SportFi begins to intersect with prediction markets, without trying to become one. “We are investing in making our fan tokens more gamified. So, maybe I’m betting on Polymarket that Barcelona is going to beat Paris Saint-Germain, but then maybe I’m going to hedge that by buying the fan token of Barca,” Dreyfus said.

The idea is that fan tokens could become another instrument for match outcomes: a liquid, tradable expression of sentiment that can sit alongside event contracts rather than replace them.

The longer-term arc is even more conventional and potentially more transformative. Sports organizations are famously asset-rich and cash-poor, sitting on valuable media rights, brand IP and stadium economics while managing volatile costs. Tokenization could turn those future cash flows into on-chain instruments, giving clubs alternative liquidity routes beyond banks and specialized funds. Decentral, a Chilliz-based protocol, is tokenizing future receivables such as broadcasting rights, allowing teams to receive stablecoin liquidity.

None of this is guaranteed. Regulation will define how far SportFi can go, especially when tokens resemble gambling, as prediction markets have found out.

Nevertheless, SportFi’s journey shows signs of evolving from simply putting a badge on a blockchain into using smart contracts to translate sports’ real-world outcomes and, eventually, their real-world cash flows into programmable financial markets.

Crypto World

Harvard University Pulls Back From Bitcoin ETFs While Mutuum Finance Presale Sees Explosive $20.6M Inflows

Harvard University’s endowment exposure to Bitcoin exchange-traded funds (ETFs) has been reduced, according to recent crypto news. The move signals a more cautious stance amid continued market volatility. Meanwhile, in the DeFi crypto sector, Mutuum Finance (MUTM) has captured significant investor attention, raising over $20.60 million in its ongoing presale. The project leverages a framework that combines a dual-lending mechanism.

Harvard Reduces Bitcoin Exposure and Adds Ethereum

Harvard University has adjusted its cryptocurrency portfolio, cutting back on its Bitcoin ETF holdings while entering the Ethereum market for the first time. According to its latest 13F filing, Harvard Management Company, the subsidiary managing the university’s endowment, held 5.35 million shares of the iShares Bitcoin Trust ETF (IBIT) as of Dec. 31, a 21% decrease from the previous quarter, valued at roughly $265.8 million. Despite the reduction, IBIT remains the largest single position in Harvard’s portfolio, representing 12.78% of total assets.

At the same time, Harvard initiated a stake in the iShares Ethereum Trust ETF (ETHA), acquiring 3,870,900 shares worth approximately $86.8 million. This comes as Bitcoin retraces 26% over the last 30 days, falling from $97,000 to below $70,000. Recent crypto news shows the leading asset saw $223M in liquidations as it fell below $68,000, its 200-week EMA. As Bitcoin retraces, Mutuum Finance (MUTM) is exploding in momentum during presale. The project recently launched its V1 Protocol on Sepolia testnet, a significant move that has attracted investor attention.

Presale Participation and Platform Features

The MUTM presale has attracted broad interest, with over 19,020 participants contributing more than $20.60 million to date. Investors can join the DeFi crypto’s presale at just $0.04 today before its upcoming phases, where its prices are set to go higher, including $0.045 in phase 8 and $0.06 at launch.

In a recent update, Mutuum Finance now allows investors to participate in its presale using both cryptocurrency and traditional card payments, making it accessible to a wider audience. By supporting debit and credit card purchases alongside crypto options, the project removes the barrier of needing to first acquire digital assets, enabling newcomers to enter the ecosystem quickly and seamlessly.

The project further incentivizes participation through an ongoing $100,000 giveaway, where 10 lucky participants will each receive $10,000 worth of MUTM. To qualify, users need to join the presale with a minimum $50 purchase and complete a few simple tasks, such as following the project’s social media channels. In addition, the top buyer each day, based on the highest MUTM purchase, receives a $500 MUTM reward.

Strengthening Lending Security

Mutuum Finance employs a multi-layered oracle framework to enhance the safety of its lending ecosystem. The protocol uses Chainlink Price Feeds as the primary reference, supported by fallback oracles and an internal Time-Weighted Average Price (TWAP) mechanism. This approach ensures accurate asset valuations even during periods of high market volatility or disruptions in price feeds, helping reduce the risk of manipulation.

The system is also designed to protect borrowers from sudden market shocks. If a token’s price on a major exchange diverges sharply from the verified feed due to sudden crypto news or any other event, the platform temporarily suspends activity for that market to prevent unintended liquidations. For instance, a sudden anomalous Bitcoin price e.g; $10,000 on a single exchange, would be disregarded, with loan values calculated based on the verified average price, around $68,000 today. This safeguards users from both accidental errors and potential market manipulation.

Hands-On Learning via Testnet Access

The V1 Protocol is currently live on the Sepolia testnet, allowing users to experience the Mutuum Finance ecosystem firsthand. Participants can deposit test assets to receive mtTokens, while borrowers receive debt tokens that track obligations on-chain.

An automated liquidator bot monitors positions to maintain protocol stability and reduce default risk. The testnet currently supports USDT, ETH, LINK, and WBTC, with plans to integrate additional assets after full launch. This environment enables users to explore borrowing and lending mechanics, understand the protocol’s operational features, and familiarize themselves with the platform without risking real assets.

As Harvard trims its Bitcoin ETF holdings in the latest crypto news, institutional sentiment toward traditional crypto products remains mixed amid ongoing volatility. In contrast, Mutuum Finance (MUTM) is seeing explosive presale inflows, surpassing $20.60 million from over 19,020 participants at its Phase 7 price of $0.04. The DeFi crypto platform features a multi-layered oracle security, a live testnet, and a transparent lending framework, attracting strong interest. Phase 7 presale is progressing fast and will sell out soon. Join now before it’s too late.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Ripple ETF Demand Is Gone as XRP Price Tumbles 11% Weekly

It has been over three months since the first XRP ETF launched, but the demand seems to have evaporated.

It has been another week of underwhelming XRP ETF performance, with the funds attracting little to no actual net inflows.

At the same time, the underlying asset has struggled to maintain the price resurgance from last week, and now trades over 10% lower.

Where Did the Ripple ETF Demand Go?

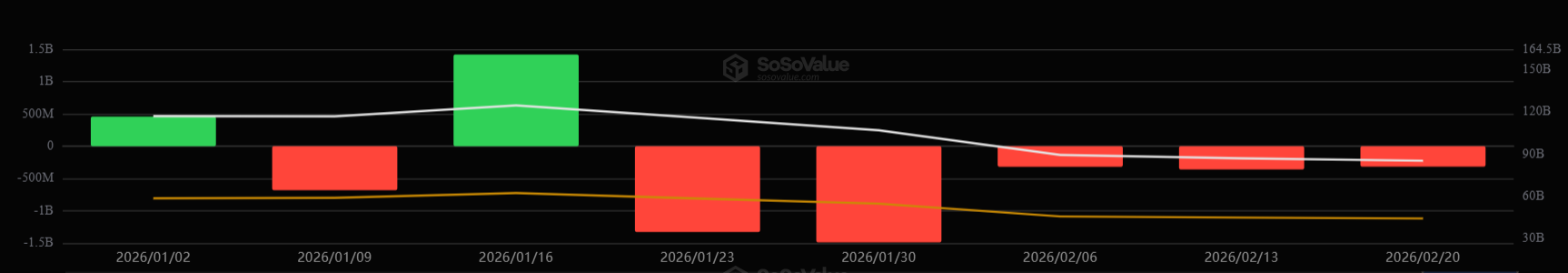

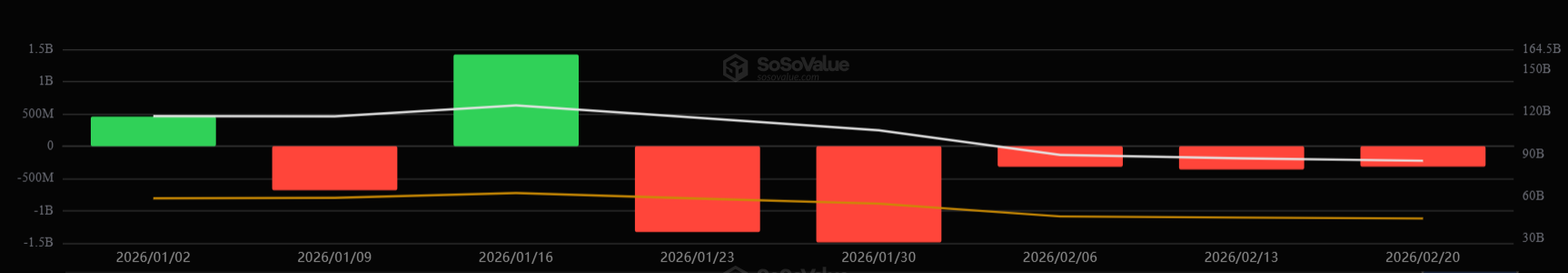

Canary Capital’s XRPC was met by investors with open arms, breaking the 2025 debut-day trading volume record on November 13. Four more products tracking the altcoin followed suit, and the total inflows quickly skyrocketed to over $1 billion. However, it has been mostly plateauing since then, and even some weeks deep in the red.

For example, investors pulled out $40.64 million during the week that ended on January 23, and another $52.26 million the following week. The next one was more positive, with $39.04 million in net inflows. The trend changed then: the interest and demand are nowhere to be found.

Two weeks ago – on February 11 – the ETFs had no reportable daily flows, with SoSoValue showing a clear “$0.00” for the first time since the products’ inception. This behavior worsened last week when there were two such days – February 17 and February 20. Even the other two showed little interest: $2.21 million in net outflows on February 18 and $4.05 million in net inflows on February 19.

Since Monday was a national holiday in the US and the markets were closed, this meant that half of the business days had no actual trading volume to report. As such, it’s no surprise that the cumulative net inflows have remained flat at $1.23 billion.

XRP Price Falls

Somewhat unexpectedly, Ripple’s native cross-border token jumped hard by double digits last weekend, going to a multi-week peak of over $1.65 despite the lack of ETF action. However, this sporadic price pump was short-lived, and the asset quickly lost traction. It returned to $1.40 mid-week and even dipped below that level on a couple of occasions.

You may also like:

It has managed to defend that support as of press time, but it’s still more than 10% down weekly. Aside from ETF investors who had displayed a serious lack of interest in the asset, data shared by popular analyst CW shows that short traders continue to dominate the XRP landscape.

Nevertheless, a recent report by Santiment suggested that XRP could be slightly undervalued at the moment, according to the 30-day MVRV ratio. Moreover, the skyrocketing amount of realized losses could lead to a significant price rebound for Ripple’s token, as it has happened in the past. In fact, it led to a 114% surge back in 2022 when such losses were last observed.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Polymarket Bitcoin Price Prediction Says $75K, But Charts Don’t

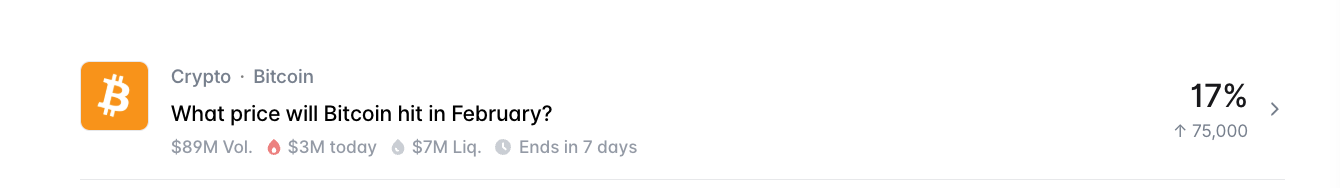

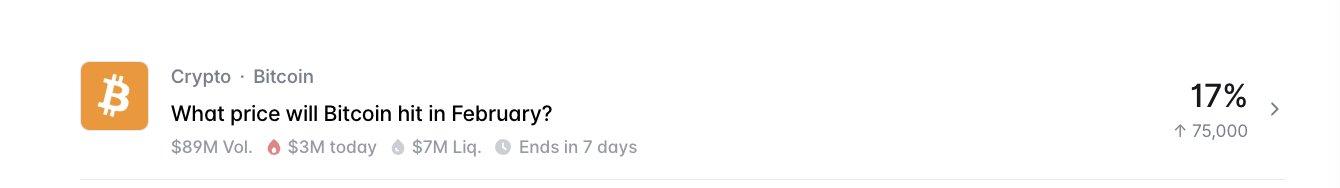

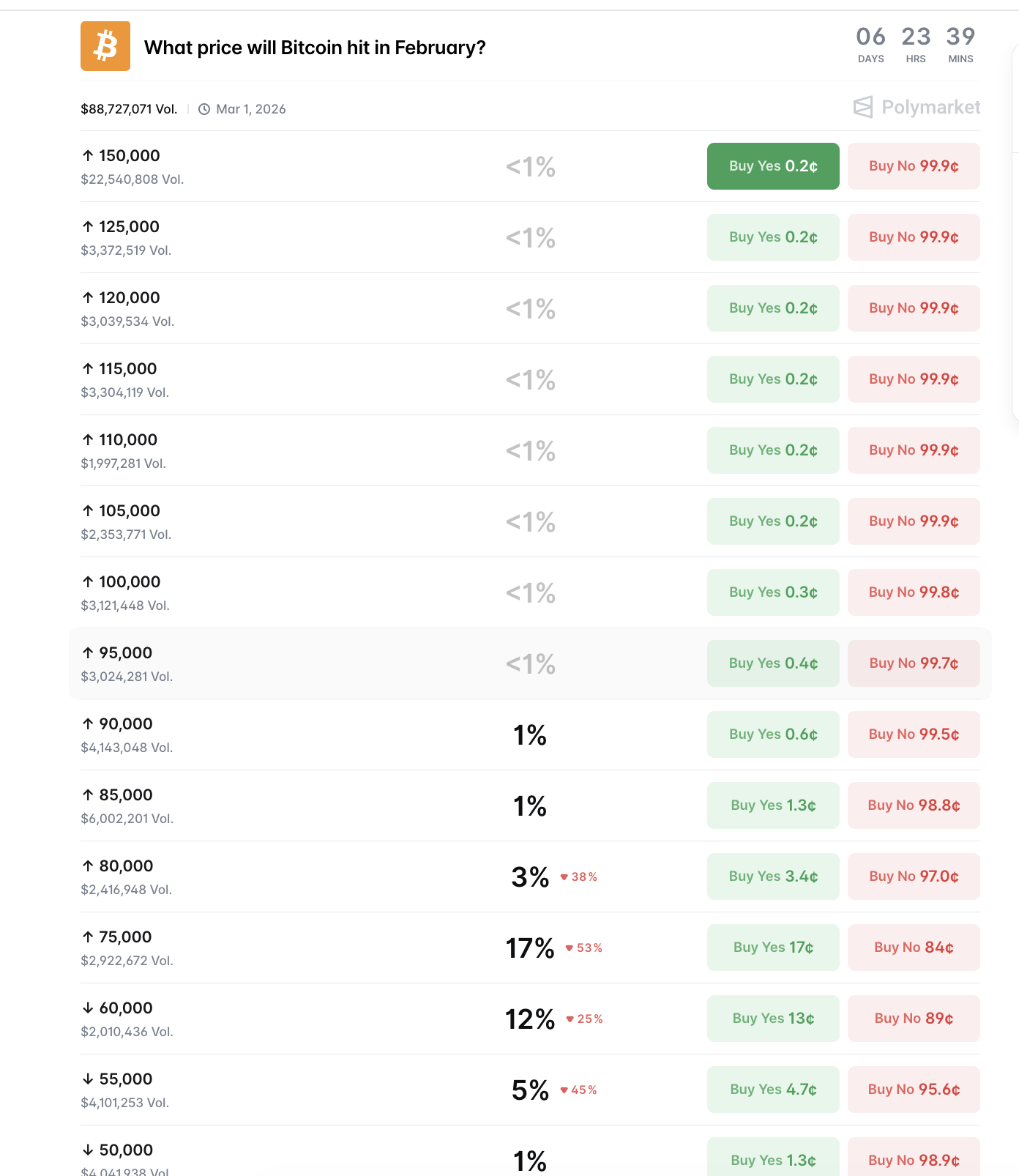

Bitcoin price has traded mostly flat over the past 24 hours near $68,000, reflecting continued indecision. The broader seven-day trend still shows a mild decline, highlighting the lack of strong bullish momentum. Yet one prediction market’s positioning is telling a far more optimistic story.

On Polymarket, the single largest February outcome, at 17%, expects Bitcoin to cross $75,000. This makes it the most popular directional bet as the month approaches its final week. However, market structure, on-chain activity, and whale positioning suggest reality may not align with this bullish expectation.

Prediction Markets Favor $75,000 — But Hidden Bearish Divergence Signals Trouble

Prediction market data shows ‘above $75,000’ remains the most favored February target despite weakening sentiment. Polymarket volumes, for this bet, exceed $88 million, with millions in active liquidity.

However, the probability of the $75,000 outcome has already declined by more than 50%, reflecting fading confidence.

At the same time, the next most likely outcome sits at ‘under $60,000’ with a 12% probability. This positioning reveals a growing split in expectations. While many traders still hope for upside, a large portion of the market is increasingly preparing for a deeper correction instead.

This growing caution aligns closely with Bitcoin’s technical structure.

On the daily chart, Bitcoin formed a lower high between November 15 and February 16. This means price failed to fully recover during its latest rally attempt.

Meanwhile, the Relative Strength Index (RSI), which measures momentum strength, formed a higher high during the same period.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Because Bitcoin was already in a downtrend, this creates a hidden bearish divergence. This pattern usually signals continuation of the existing downtrend rather than a bullish reversal. It shows that even though momentum improved briefly, the broader selling pressure remains intact.

Since this divergence appeared, Bitcoin has already corrected nearly 6%. As long as this signal remains active, the probability of reaching the prediction market’s $75,000 target remains limited.

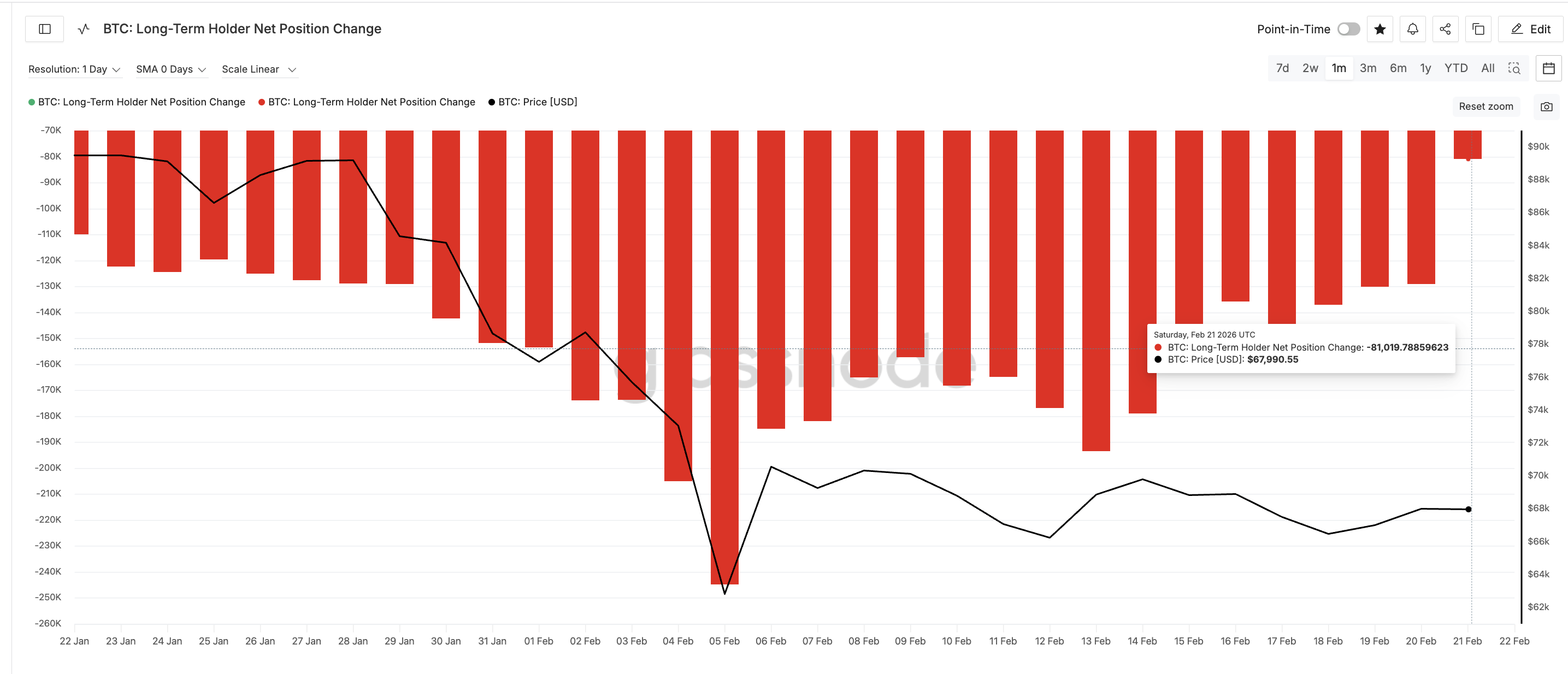

Long-Term Holders Have Slowed Selling, But Have Not Started Buying

Long-term holder activity helps explain why prediction markets still retain some optimism, even as risks increase. These investors may have held Bitcoin for more than 1 year. Their buying and selling patterns often determine whether Bitcoin enters a sustained rally or correction.

On February 5, long-term holders reduced their holdings by 244,919 BTC (30-day rolling change), a sign of extremely heavy selling. By February 21, this number improved to 81,019 BTC. This marks a roughly 67% reduction in selling pressure.

This sharp slowdown in selling helps stabilize Bitcoin’s price and explains why some traders still expect upside.

However, long-term holders are still net sellers overall. They have not yet transitioned into accumulation. Their activity has improved, but they are not yet providing the strong buying support needed to push Bitcoin toward new highs.

This creates a neutral balance. Bitcoin may avoid immediate collapse, but it also lacks the strength needed for a major breakout to push it close to $75,000.

Whale Behavior Is Split

Whale positioning further reflects uncertainty.

The largest Bitcoin whales, holding between 100,000 and 1 million BTC, increased their holdings from 676,540 BTC to 690,000 BTC. This represents an accumulation of about 13,460 BTC, signaling cautious buying.

However, smaller whales holding between 10,000 and 100,000 BTC reduced their holdings from 2.27 million BTC to 2.26 million BTC. This means roughly 10,000 BTC were sold during the same period.

This opposing behavior shows a lack of unified conviction, even though the net balance slightly tilts towards accumulation. Some whales are preparing for a rebound, while others remain defensive.

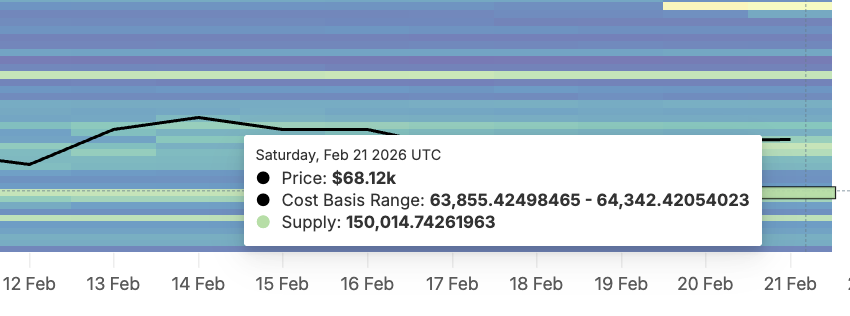

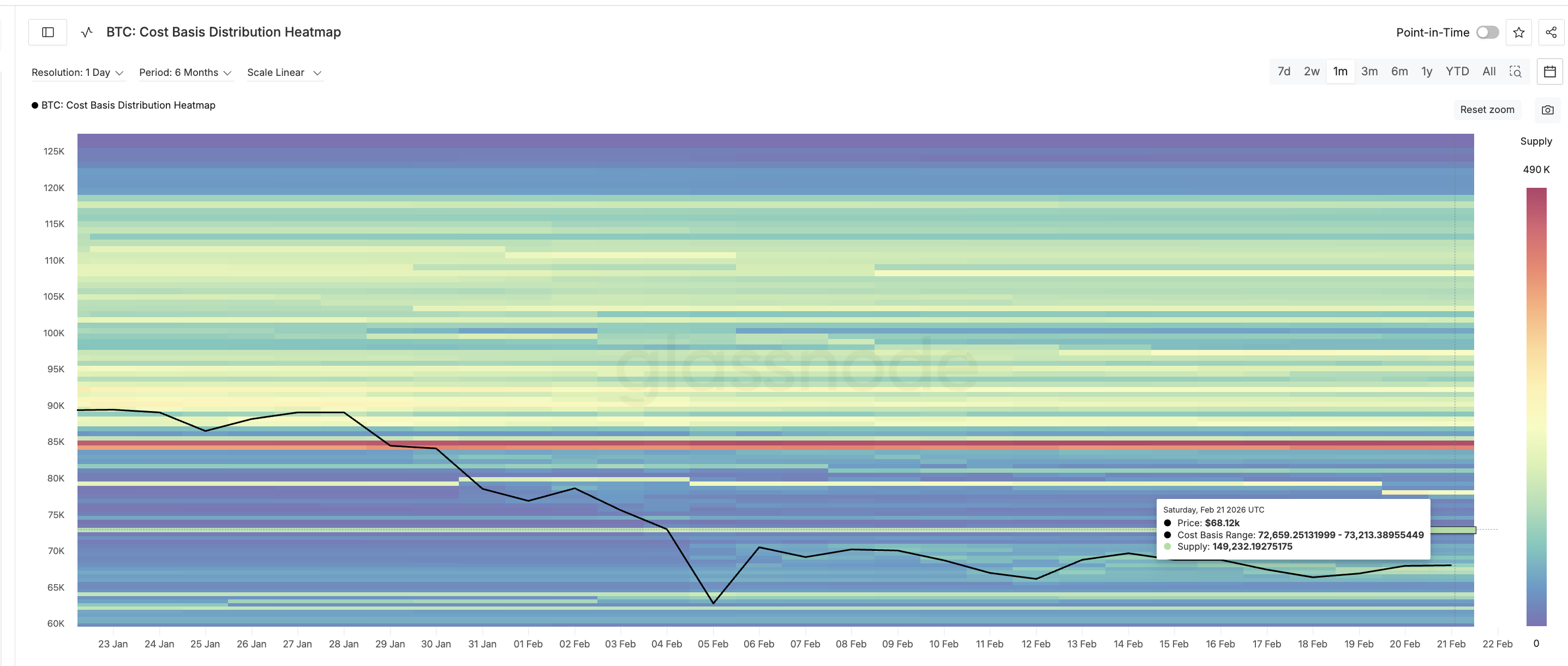

At the same time, cost basis distribution data reveals a major resistance cluster between $72,600 and $73,200. Around 149,000 BTC were accumulated in this range. These levels also appear clearly on the price chart as a major resistance zone just below $75,000.

When Bitcoin approaches this area, many holders may sell to exit at breakeven. And the whale accumulation strength, as seen, isn’t strong enough to absorb the supply yet. This selling pressure creates a strong barrier that prediction markets may be underestimating.

Bitcoin Price Structure Shows BTC May Remain Trapped Between Key Levels

Bitcoin’s price structure closely aligns with these on-chain cost basis clusters.

To reach the $75,000 prediction target, Bitcoin must first break above $72,200. This level represents both technical resistance and is close to one of the largest cost basis clusters on the chart. Breaking this zone would require a rally of more than 6% from current levels.

However, failure to break this resistance increases the likelihood of continued range-bound movement. On the downside, strong support exists between $64,300 and $63,800, where approximately 150,000 BTC were accumulated.

On the Bitcoin price chart, the key support level resembling the zone is $63,300, breaking which would also mean the supply cluster break. Breaking under $63,300 can make the $60,000 zone, the 12% probability bet on Polymarket, come to fruition.

As a result, Bitcoin is currently trapped between two major cost basis zones. Resistance near $72,200 limits upside, while support near $63,300 prevents immediate collapse.

This range-bound structure suggests that prediction markets may be overestimating the probability of a breakout toward $75,000 while underestimating the growing risk of continued consolidation or a correction.

Crypto World

OpenClaw confirms Discord ban on Bitcoin and crypto discussions

Open-source AI agent framework OpenClaw has drawn attention not only for its code but for governance choices. The project, created by Peter Steinberger, recently enforced a hard rule: no discussions of cryptocurrency on its primary community channels. The ban surfaced after a user on X reported being blocked from OpenClaw’s Discord for referencing a block height as a timing mechanism in a benchmark for autonomous agents. Steinberger publicly backed the moderation, saying the community operates under strict server rules, including a crypto-free policy. In a later clarification, he offered to restore the user after receiving a username via email, signaling a cautious but reversible approach to enforcement.

Key takeaways

- OpenClaw enforces a strict no-crypto policy on its Discord server, publicly backing the ban after a user referenced a blockchain timing mechanism in a multi-agent benchmark.

- The founder confirmed the action and later offered to reinstate the user upon receiving the account details, illustrating a degree of administrative flexibility within the rules.

- A separate rebrand episode involved a fake token tied to the project, which briefly soared to a multi-million dollar market cap before collapsing sharply amid questions of authenticity and attribution.

- OpenClaw’s rapid growth, including surpassing 200,000 GitHub stars, has drawn significant attention from developers and crypto practitioners alike.

- Industry players are increasingly discussing crypto rails for AI workflows, with major moves from Circle and Coinbase signaling a broader push toward stablecoins and on-chain automation for AI agents.

- Security researchers have flagged widespread exposure of OpenClaw instances and a wave of malicious plug-ins targeting crypto traders, underscoring ongoing risk in open-source AI ecosystems.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The case sits at the crossroads of AI agent development and crypto infrastructure, illustrating how research tooling and digital assets increasingly intersect while questions about safety and governance remain unresolved.

Why it matters

The OpenClaw episode highlights a broader tension within the crypto-AI frontier: as autonomous agents gain traction, the communities building and using these tools must decide how crypto interacts with software governance. A no-crypto rule, such as the one OpenClaw instituted, can reflect an intent to keep research environments clean of financial incentives or external manipulation, but it may also constrain collaborations that rely on token-based incentives or payments within AI experiments.

From a user perspective, the incident underscores two practical concerns. First, moderation policies on open-source AI projects can directly affect access and collaboration, potentially slowing innovation if critical contributors are blocked for what could be perceived as benign references. Second, the CLAWD episode—where a token tied to the project briefly surged to a multi-million-dollar market cap and then cratered—serves as a cautionary tale about token fraud risk around high-profile projects. Even when a founder denies affiliation, the rapid market realization of a token can draw unintended attention and speculation, attracting bad actors before the project can respond effectively.

For the broader crypto ecosystem, the narrative sits alongside a wave of enterprise-grade AI developments that are increasingly being paired with native crypto rails. Circle’s commentary about billions of AI agents relying on stablecoins in the near future and Coinbase’s Agentic Wallets initiative point to a future where on-chain payments, wallet management, and autonomous trading become routine for software agents. This trend could drive demand for reliable on-chain infrastructure, but it will also elevate the importance of governance, security, and clear delineation between project development and speculative token activity.

What to watch next

- OpenClaw’s official stance on moderation and any updates to its crypto-free policy, including whether moderation rules will be clarified or revised.

- Any new information about the CLAWD token incident, including whether other developers or communities confirm or debunk ties to OpenClaw.

- Ongoing security research into OpenClaw deployments and the emergence of malicious plug-ins tied to crypto-trading activities.

- Progress on crypto-enabled AI workflows, such as new implementations of AgentKit-like tooling or on-chain automation features from major platforms.

Sources & verification

- OpenClaw Discord moderation actions and related X posts documenting the ban and subsequent reinstatement offer.

- The GitHub repository for OpenClaw, illustrating the project’s rapid growth and community engagement.

- Security research on the CLAWD token incident, including SlowMist’s threat intelligence analysis and linked investigations.

- Coinbase’s coverage of AI agents and on-chain wallet capabilities through Agentic Wallets, and related developer tooling.

OpenClaw’s crypto ban underscores tensions at the AI-crypto frontier

OpenClaw’s moderation decision, explicitly banning crypto mentions on its Discord, marks a notable stance within an ecosystem that increasingly blurs the line between research code and financial instruments. The initial online clash began when a user referenced a Bitcoin block height as a timing mechanism for a multi-agent benchmark, triggering a response from Steinberger that the server’s rules do not permit crypto references. The conversation quickly escalated to a formal acknowledgment: the policy existed, discussions about it were ongoing, and access could be suspended for non-compliance. The question now is how this policy will affect collaboration with external researchers who leverage on-chain data or token-based incentives to drive experiments in autonomous agents.

The claim that the ban would be lifted for a user once a username was provided by email signals a measured approach to governance. It suggests that OpenClaw is balancing its enforcement with a path to reinstatement, rather than pursuing permanent exclusion. This approach could reflect a broader trend: as AI research communities grow, moderators may increasingly grapple with how to handle financial instruments that—while tangential to the project’s technical objectives—are integral to the broader crypto economy. The tension lies in preserving a focused, safe development environment while not stifling legitimate cross-pollination between AI experimentation and crypto-enabled incentives or payments.

The bitcoin reference also triggers a deeper look at how crypto assets influence perception of open-source AI projects. When a project emphasizes transparency and collaboration but draws a line at crypto mentions, it raises questions about the boundaries between research collaboration and financial speculation. The event did not occur in isolation. In a separate, high-profile moment in the same period, a rebranding effort associated with OpenClaw preceded the appearance of a fake token, branded to resemble the project. The token, branded as $CLAWD, quickly attracted attention and reached a reported market capitalization of around $16 million within hours before a dramatic decline—more than 90%—after Steinberger publicly distanced the project from the token’s creation. Early buyers alleged that the token was a marketing ploy or a misattribution, highlighting the persistent risk of fraud in fast-moving crypto ecosystems tied to AI tooling.

Steinberger’s public statements at the time contained a clear warning: he would never launch a cryptocurrency, and any token claiming association with him or the project was fraudulent. Security researchers later documented widespread exposure of OpenClaw instances and a variety of malicious plug-ins aimed at crypto traders, underscoring the vulnerability of rapidly scaled, open-source AI platforms to exploitation. The experience is a reminder that, as AI agents become more capable and more deeply integrated with blockchain-enabled economics, the infrastructure around those agents must be rigorously secured, and governance policies must be transparent and enforceable.

Despite these controversies, OpenClaw has continued to grow, attracting a broad developer audience. By late January, the project had already surpassed significant milestones in community engagement, including more than 200,000 GitHub stars—a metric that signals intense interest in autonomous-agent architectures and their potential applications across finance, data processing, and decentralized marketplaces. The momentum around the project coincides with a broader industry push to integrate crypto rails with AI workflows. Circle’s public forecasts and Coinbase’s Agentic Wallets initiative illustrate that major players believe crypto-enabled automation will become a staple of the AI ecosystem, from simple payments to complex, automated trading strategies and compute settlements.

In this context, the OpenClaw episode raises important questions for builders, investors, and users. Governance rules that restrict crypto discussions may help maintain focus and reduce immediate risk, but they also necessitate careful communication to avoid misinterpretation or unintended exclusivity. As AI agents begin to touch more sectors of the real economy, the industry will likely see new forms of collaboration that respect safety standards while enabling legitimate experimentation with on-chain incentives and settlements. For developers, the key takeaway is to design governance that is as robust as the code itself—clear, auditable, and adaptable—as communities navigate the evolving terrain where autonomous agents and crypto intersect.

Bitcoin (CRYPTO: BTC) remains a touchpoint in discussions about crypto-enabled automation, and the broader trajectory of stablecoins and crypto wallets in AI workflows suggests that these technologies will coexist with varying degrees of integration and caution. The OpenClaw episode, with its bans, token episodes, and security concerns, provides a concrete case study in how quickly the AI-crypto nexus can surface governance questions, reputational risk, and the need for strong verification and safety measures as new software agents begin to operate in decentralized ecosystems.

https://cdn.example.com/analytics.js

Crypto World

How Whales and Retail Investors Are Reacting

Here’s who has been buying and who has been selling throughout BTC’s most recent retracement.

Bitcoin’s price movements since early October can safely be categorized as bearish, given the fact that the asset shed over 50% of its value from its all-time high to its multi-year low of $60,000 marked on February 6.

Although it has recovered some ground since then, the cryptocurrency is deep in the red even on a year-to-date scale. Santiment investigated which investor group sold off during the months-long correction, and which increased their positions.

Who’s Selling and Buying?

The post from the analytics company reveals an interesting pattern. It reads that wallets holding between 10 and 10,000 bitcoins have reduced their positions by 0.8% since the October peak. In contrast, micro investors, those with 0.1 BTC or less, have increased their holdings by 2.5% within the same timeframe.

The analysis reads that this behavior from both groups does not suggest an upcoming price reversal.

“Optimally, we begin to see these two Bitcoin groups begin to reverse course. Without key stakeholder support, any spark of a rally will tend to be slightly limited due to the lack of large capital,” Santiment said, before indicating that retail investors have remained undeterred, currently holding the highest amount in nearly two years.

ETF Investors Flock

Unlike the small discrepancy between the two investor groups examined by Santiment, those who gain exposure to the largest cryptocurrency through ETFs have shown a clear and painful trend. In the two weeks leading to the asset’s all-time high of over $126,000, they poured in over $6 billion into the funds.

Since then, red has dominated almost every week, with multiple $1 billion or more net outflow examples. In three consecutive weeks in early November, they withdrew more than $3.5 billion. This behavior continued into the new year, and the spot Bitcoin ETFs are currently on a massive red streak of five weeks in a row in the red.

Data from SoSoValue shows that these investors pulled out $1.33 billion during the week that ended on January 23. Another $1.49 billion followed, but the silver lining is that the net inflows have decreased to under $360 million in the past three weeks. Nevertheless, the total net inflows into the spot BTC ETFs have declined from $62.77 billion in early October to $54 billion last Friday.

You may also like:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Elliptic Flags Network of Russian Crypto Platforms Bypassing Sanctions

A group of cryptocurrency exchanges linked to Russia is helping users move funds outside the reach of Western financial restrictions, according to a report released Saturday by blockchain analytics firm Elliptic.

Key Takeaways:

- Elliptic identified five Russia-linked crypto exchanges providing pathways to bypass Western sanctions.

- Only one platform is formally sanctioned, yet several processed large transactions with restricted entities.

- Activity has shifted across multiple services, suggesting enforcement actions redirect rather than halt flows.

The study identifies five trading platforms, most of them not formally sanctioned, that continue to provide channels for high-volume crypto transactions beyond the oversight of the traditional banking system.

The findings arrive as European officials consider tighter measures, including a potential blanket ban on crypto transactions involving Russia, amid concerns that new platforms are emerging to replace previously targeted operators.

Elliptic: Nearly 10% of Bitpapa Transactions Tied to Sanctioned Targets

Among the exchanges examined, only the peer-to-peer marketplace Bitpapa is under US sanctions.

The US Treasury’s Office of Foreign Assets Control (OFAC) designated the platform in March 2024 for alleged sanctions evasion.

Elliptic found that about 9.7% of Bitpapa’s outgoing transactions were linked to sanctioned entities and that the exchange frequently rotated wallet addresses to make monitoring more difficult.

The report also highlights ABCeX, an unsanctioned exchange operating from Moscow’s Federation Tower, the same building previously used by Garantex before US authorities seized its domains in March 2025.

Elliptic estimates ABCeX has processed at least $11 billion in crypto, with significant transfers flowing to Garantex and another exchange, Aifory Pro.

Another case involves Exmo, which said it exited the Russian market after the 2022 invasion of Ukraine by selling its regional operations to a separate entity, Exmo.me.

Elliptic’s analysis suggests operational ties remain: both services appear to share custodial infrastructure and pooled hot wallets.

The firm recorded more than $19.5 million in transactions between Exmo and sanctioned exchanges, including Garantex, Grinex and Chatex.

Rapira, registered in Georgia but maintaining a Moscow office, was also flagged after sending over $72 million directly to sanctioned exchange Grinex.

Authorities in Russia reportedly raided Rapira’s offices in late 2025 over suspected capital transfers to Dubai.

The fifth platform, Aifory Pro, operates cash-to-crypto services in Moscow, Dubai and Turkey.

The company reportedly offers virtual payment cards funded with USDT that allow Russian users to access services restricted by Western providers. Elliptic also traced nearly $2 million from Aifory Pro to the Iranian exchange Abantether.

Sanctions Shift Activity, Illicit Crypto Volume Hits Record High

Researchers say the network illustrates how enforcement actions can shift activity rather than eliminate it.

After the shutdown of Garantex, transaction volumes rose on other exchanges, according to data from multiple analytics firms.

Chainalysis reported that illicit crypto addresses received a record $154 billion in 2025, while TRM Labs produced a similar estimate of $158 billion.

As reported, Russia’s industrial crypto mining sector continued to expand in 2024, with the country’s two largest operators, BitRiver and Intelion, generating a combined $200 million in revenue and accounting for more than half of the legal market.

The post Elliptic Flags Network of Russian Crypto Platforms Bypassing Sanctions appeared first on Cryptonews.

Crypto World

OpenClaw Bans Bitcoin and Crypto Mentions on Discord After Fake Token Scare

The developer behind the fast-growing open-source AI agent framework OpenClaw has confirmed that any mention of Bitcoin or other cryptocurrencies on its Discord server can lead to removal.

In a Saturday post on X, a user revealed that they were blocked from OpenClaw’s Discord simply for referencing Bitcoin block height as a timing mechanism in a multi-agent benchmark.

In response, OpenClaw creator Peter Steinberger confirmed the action, writing that members had accepted “strict server rules” upon joining and that the community maintains a “no crypto mention whatsoever” policy.

Steinberger later agreed to re-add the user, asking them to email their username so he could restore their access to the server.

Related: Ethereum’s Trustless Agents standard is the missing link for AI payments

OpenClaw’s crypto problem began with a fake token

Trouble began during a rebrand after Steinberger received a trademark notice related to the project’s original name. In the short window between releasing old social accounts and claiming new ones, scammers seized the abandoned handles and promoted a Solana-based token called $CLAWD.

The token surged to roughly $16 million in market capitalization within hours before collapsing more than 90% after Steinberger publicly denied involvement. Early buyers accused the developer.

Steinberger responded at the time by warning users he would never launch a cryptocurrency and that any token claiming association with him was fraudulent. Security researchers later identified hundreds of exposed OpenClaw instances online and dozens of malicious plug-ins, many designed to target crypto traders.

OpenClaw has expanded rapidly since launching in late January, surpassing 200,000 GitHub stars within weeks and attracting a wide developer audience interested in autonomous agents.

Related: Deel taps MoonPay to roll out stablecoin salary payouts in UK, EU

Crypto firms bullish on AI agents

Industry leaders increasingly see crypto as the default payment rail for AI. Circle CEO Jeremy Allaire predicted that billions of agents will use stablecoins for routine payments within a few years

Earlier this month, Coinbase launched “Agentic Wallets” infrastructure that lets AI agents hold wallets and autonomously spend, earn and trade crypto onchain. Built on its AgentKit developer framework and powered by the x402 payments protocol, the system enables software agents to actively manage DeFi positions, rebalance portfolios, pay for compute and data services, and participate in digital marketplaces.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Bitcoin ETFs Lose Billions Amid Wall Street’s Rotation to Gold

US spot Bitcoin exchange-traded funds (ETFs) are facing their most sustained period of institutional friction this year.

This year, the funds have logged six weeks of outflows amid macroeconomic uncertainty that is driving capital toward traditional safe havens.

BlackRock, Fidelity Lead Bitcoin ETF Exodus Amid Macro Jitters

Since the start of 2026, the funds have bled nearly $4.5 billion, offset by just $1.8 billion of inflows during the first and third weeks of the year, according to data from SosoValue.

The bulk of the damage occurred during the past five-week stretch beginning in late January. That run alone erased roughly $4 billion from the ETF complex, triggered by Bitcoin’s recent price struggles.

The bleeding has been most pronounced among the category’s heavyweights. BlackRock’s iShares Bitcoin Trust (IBIT) has shed over $2.1 billion in the past five weeks, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw more than $954 million walk out the door.

CryptoQuant analyst J.A. Maartun said Bitcoin ETF outflows are at $8.3 billion, down from their October all-time high, marking the weakest year since the funds launched.

Meanwhile, the current steady stream of withdrawals highlights a clear shift in institutional appetite from the aggressive momentum that defined the asset class in its first two years.

Over the past year, the US’s macro policies have prompted a broader de-risking among Wall Street allocators.

This has sparked a rotation out of digital assets and into precious metals like gold and silver. For context, gold and gold-themed ETFs have seen $16 billion in inflows during the past three months.

Still, market observers have pointed out that Bitcoin ETFs’ structural footprint remains largely intact.

Bloomberg senior ETF analyst Eric Balchunas noted that the larger picture remains historically bullish for the nascent asset class.

He noted that, despite recent outflows, the funds have significantly outperformed early market expectations, which had projected first-year inflows of just $5 billion to $15 billion.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video2 days ago

Video2 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics7 hours ago

Politics7 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat7 days ago

NewsBeat7 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat7 days ago

NewsBeat7 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Business47 minutes ago

Business47 minutes agoMattel’s American Girl brand turns 40, dolls enter a new era

European Union proposes banning all crypto transactions with Russia to prevent sanctions evasion.

European Union proposes banning all crypto transactions with Russia to prevent sanctions evasion.