Crypto World

Two Victims Lose $62 Million To Address Poisoning Since December

Just one victim lost $12.2 million in January by copying the wrong address from their transaction history in an “address poisoning attack,” adding to a similar $50 million attack in December, according to Scam Sniffer.

Address poisoning is when attackers send small transactions or “dust” from addresses that look similar to ones in the target’s transaction history, hoping the victim will copy the wrong address.

Scam Sniffer added that signature phishing also surged recently, with $6.27 million stolen from 4,741 victims in January, a 207% increase compared to December.

Two wallets accounted for 65% of all signature phishing losses.

Signature phishing is slightly different as it tricks users into signing malicious blockchain transactions, such as unlimited token approvals.

Address poisoning trend not slowing down

“Address poisoning is one of the most consistent ways large amounts of crypto get lost,” reported security firm Web3 Antivirus on Thursday.

Some of the biggest address poisoning losses it tracked over time ranged from $4 million to $126 million. “Recent incidents show this trend isn’t slowing down,” they stated.

Related: Stablecoin ‘dust’ txs on Ethereum triple post-Fusaka: Coin Metrics

The researchers explained that address poisoners “generate full addresses that match the same first/last few characters you see, but the middle is different, so it looks ‘identical.’”

Dust attacks on Ethereum have surged

Analysts speculate that the Ethereum Fusaka upgrade in December has contributed to the increase in attacks because it made the network cheaper to use in terms of transaction costs.

Stablecoin-related dust activity is now estimated to make up 11% of all Ethereum transactions and 26% of active addresses on an average day, reported Coin Metrics earlier in February.

The firm analyzed over 227 million balance updates for stablecoin wallets on Ethereum from November 2025 through January 2026, finding that 38% were under a single penny — “consistent with millions of wallets receiving tiny poisoning deposits,” it stated.

Blockchain intelligence firm Whitestream reported on Sunday that the decentralized DAI stablecoin “has gained a reputation as a preferred stablecoin for illicit actors, serving as a ‘parking place’ for illegally sourced funds.”

“This is due to the protocol’s governance, which does not cooperate with authorities in freezing DAI wallets,” it stated, referencing recent address poisoning attacks.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Market Analysis: AUD/USD And NZD/USD Build Momentum As Bulls Target Fresh Gains

AUD/USD started a fresh increase above 0.6980 and 0.7000. NZD/USD is also rising and might aim for more gains above 0.6060.

Important Takeaways for AUD USD and NZD USD Analysis Today

· The Aussie Dollar started a decent increase above 0.6950 against the US Dollar.

· There was a break above a key bearish trend line with resistance at 0.7000 on the hourly chart of AUD/USD at FXOpen.

· NZD/USD is consolidating gains above the 0.5995 pivot zone.

· There is a major bearish trend line forming with resistance at 0.6030 on the hourly chart of NZD/USD at FXOpen.

AUD/USD Technical Analysis

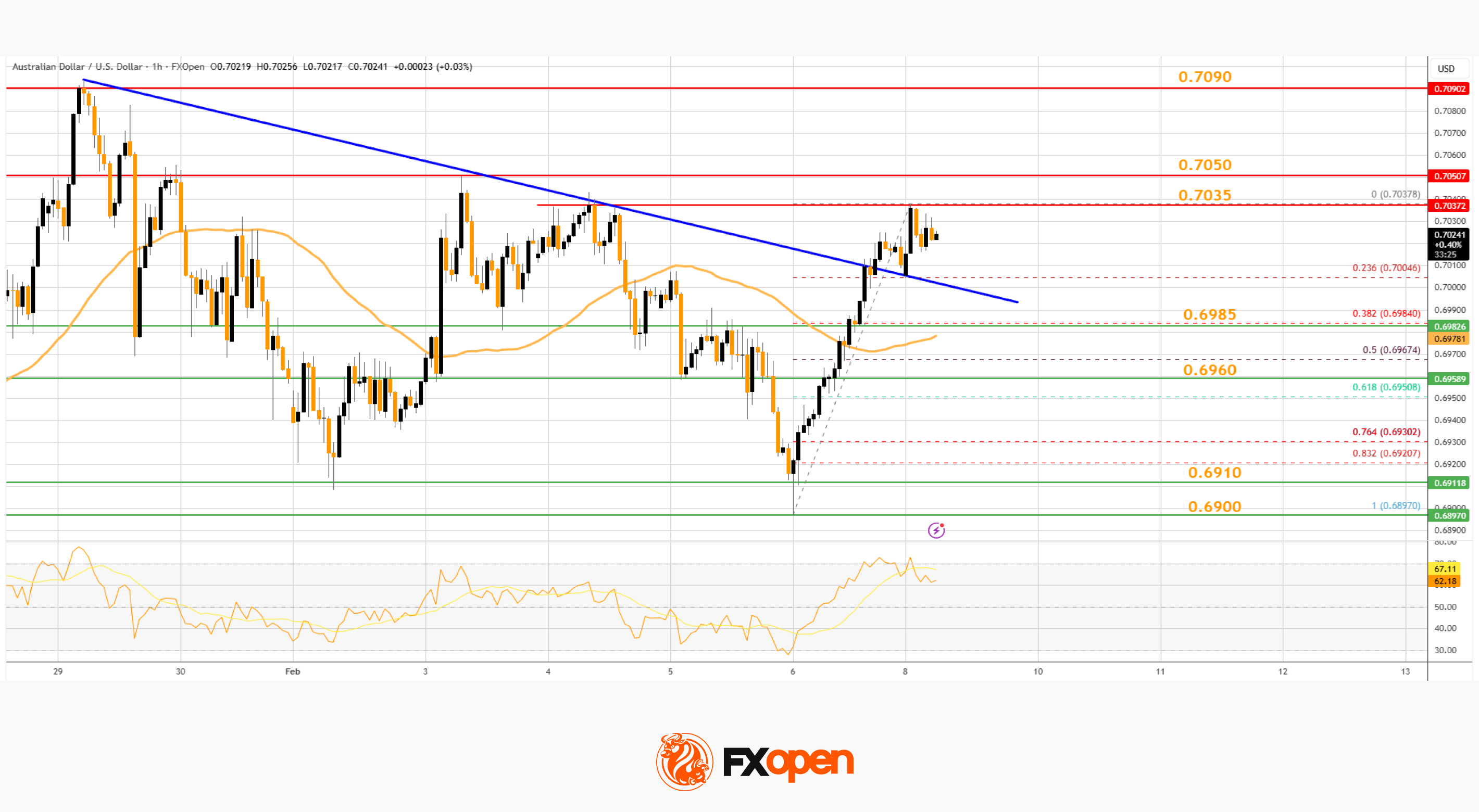

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from 0.6900. The Aussie Dollar was able to clear 0.6950 to move into a positive zone against the US Dollar.

There was a close above 0.6980 and the 50-hour simple moving average. Besides, there was a break above a key bearish trend line with resistance at 0.7000. Finally, the pair tested 0.7035. A high was formed near 0.7037 and the pair recently started a consolidation phase.

There was a minor decline below 0.7030. On the downside, initial support is near the 23.6% Fib retracement level of the upward move from the 0.6897 swing low to the 0.7037 high.

The next area of interest could be near 0.6985, the 50% Fib retracement, and the 50-hour simple moving average. If there is a downside break below 0.6985, the pair could extend its decline toward 0.6960. Any more losses might signal a move toward 0.6910.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.7035. The first major hurdle for the bulls might be 0.7050. An upside break above 0.7050 might send the pair further higher. The next stop is near 0.7090. Any more gains could clear the path for a move toward 0.7120.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair started a fresh increase from 0.5930. The New Zealand Dollar broke the 0.5950 barrier to start the recent rally against the US Dollar.

The pair settled above 0.6000 and the 50-hour simple moving average. The bulls were able to push the pair above the 61.8% Fib retracement level of the downward move from the 0.6060 swing high to the 0.5928 low.

However, the bears are now protecting the 76.4% Fib retracement at 0.6030. There is also a major bearish trend line forming with resistance at 0.6030. The NZD/USD chart suggests that the RSI is still above 50.

On the downside, immediate support is near the 0.5995 level and the 50-hour simple moving average. The first key zone for the bulls sits at 0.5930.

The next key level is 0.5900. If there is a downside break below 0.5900, the pair might slide toward 0.5865. Any more losses could lead NZD/USD into a bearish zone to 0.5820.

On the upside, the pair might struggle near 0.6030. The next major resistance is near the 0.6060 zone. A clear move above 0.6060 might even push the pair toward 0.6090. Any more gains might clear the path for a move toward the 0.6120 zone in the coming days.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Story co-founder defends token unlock delay, says project needs ‘more time’

Story Protocol co-founder SY Lee defended the project’s decision to push its first major IP token unlock to August 2026, in a recent interview with CoinDesk, saying the blockchain needs “more time” to build usage and that near-zero on-chain revenue is “the wrong metric” for an intellectual-property and AI data network.

The six-month delay keeps team and investor tokens locked as Story pivots from a general IP registry toward licensing human-generated datasets for artificial-intelligence training.

He pointed to Worldcoin’s 2024 decision to extend investor and team lockups from three to five years, a move that reduced near-term circulating supply and was framed as extending the development runway, with the token posting double-digit gains in the hours after the announcement. Story, Lee said, is following the same logic.

“If we were all mercenary, we would have wanted a shorter lockup,” he said, describing the extension as a signal of long-term commitment rather than distress.

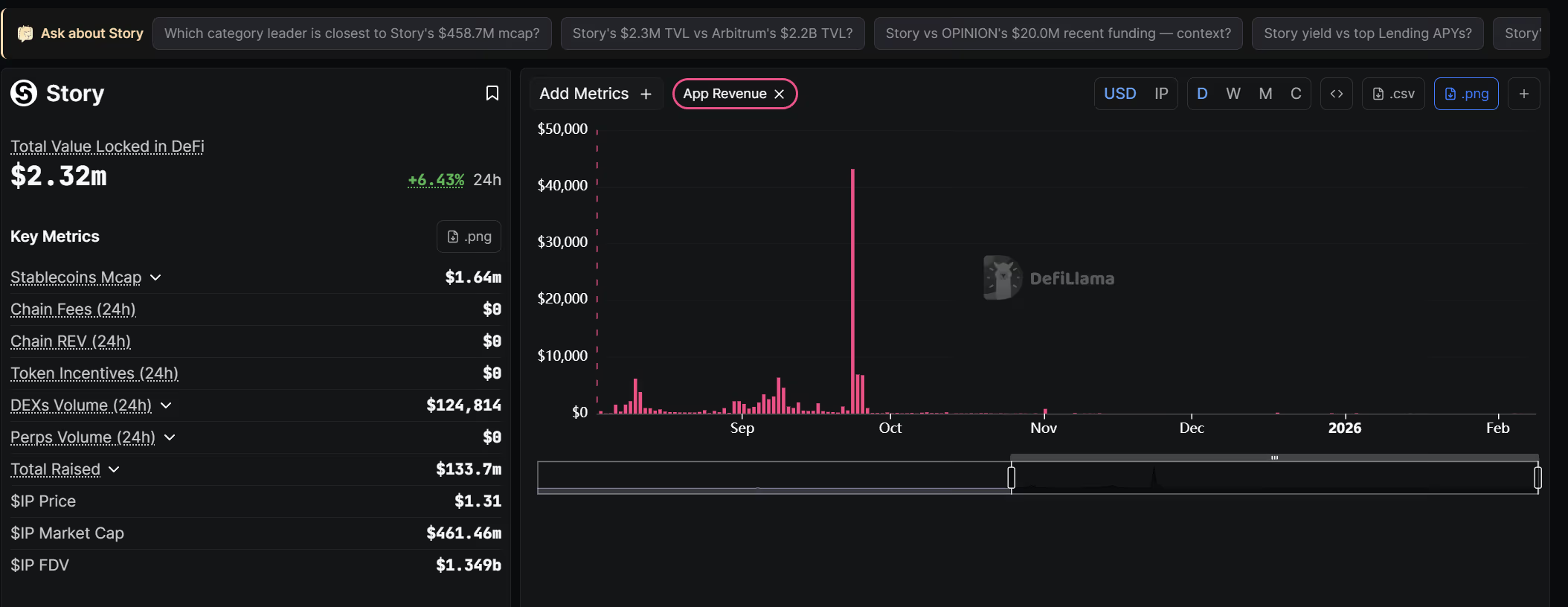

Story’s daily revenue, which peaked at $43,000 in September 2025 and is currently $0 per DeFiLlama, has also been a concern for many investors.

Lee contends that those numbers understate Story’s activity because much of the intended monetization occurs off-chain through licensing agreements rather than in transaction tolls.

In his view, gas revenue is a lagging indicator for a network designed to record rights, provenance, and usage terms before it begins extracting meaningful value from them.

“We intentionally put our chain gas fee pretty low. We’re more of an IP chain,” he said. “You may not see the type of revenue stream that you’re looking for like a DeFi chain.”

Instead, he said Story’s near-term focus is on recording ownership terms and usage rights for datasets and models used to train artificial-intelligence systems — something the project announced last year — with payments and royalty splits embedded in smart contracts.

That shift moves the project away from tokenizing media content or collectibles and toward what Lee described as “unscrapable” human-contributed data, such as multilingual voice samples and first-person video, assets he argues are harder for AI developers to obtain legally at scale through traditional web scraping.

The transition, however, delays the visibility of on-chain income because much of the expected value is tied to enterprise licensing deals rather than retail transaction fees. Lee compared the timeline to his previous Web2-based startup experience — which landed him a $440 million exit in 2021 — noting that it took years for meaningful revenue to materialize.

For token holders, the practical implication is that supply expansion is being slowed while the team attempts to demonstrate traction in AI data partnerships and rights-cleared dataset collection.

Whether that strategy ultimately converts into a sustainable business model is an open question, but Lee maintained that extending vesting schedules is healthier than rushing liquidity into a weak market.

“The best founders, the best teams, the best companies usually do it for a decade plus, we’re in it for the long term and longer innings,” Lee said.

Crypto World

South Korea’s FSS to probe whale manipulation and spoofing in crypto markets

South Korea’s Financial Supervisory Service plans to conduct an investigation into high-risk areas of the virtual asset market, such as whale-driven manipulation and API-based spoofing, according to local media.

Summary

- South Korea’s FSS will investigate whale-driven manipulation, spoofing via APIs, and token price inflation tactics.

- AI tools will be deployed to detect abnormal trading patterns and voice phishing.

- The FSS will also introduce fines for IT-related incidents and tighten on-site inspections.

The FSS is ramping up enforcement efforts as part of its 2026 plan and will utilize advanced tools like artificial intelligence to identify suspicious trading patterns, alongside legislative frameworks like the Digital Asset Basic Act to curb market abuse and enhance oversight in the crypto industry, Yonhap said on Feb. 9.

According to the reports, the FSS will conduct an investigation into practices like whale price manipulation, alongside schemes like the “net cage” method, where withdrawals and deposits have been suspended on specific tokens, and acts like the “horse racing” tactic involving large-scale buying to quickly increase the price of a token at a specific point in time.

Among other areas, the FSS will also scrutinize the use of API orders for market manipulation and investigate cases where social media is used to spread false information and influence token prices.

The FSS plans to use artificial intelligence to detect price manipulation at the second- and minute-level, automatically flag suspicious trading intervals and groups, and conduct text analysis to uncover coordinated manipulation efforts. AI will also be used to prevent voice phishing scams by facilitating real-time information sharing between telecommunications and financial companies and laying the groundwork for a future compensation system for affected victims.

At the same time, it will introduce a dedicated preparatory team to support and ensure the smooth implementation of the second phase of the Digital Asset Basic Act. The team will establish a disclosure system for token issuance and trading support, and develop guidelines for the proper reviewing and licensing of crypto exchanges and stablecoin issuers.

A special judicial police consultative body will be established to strengthen on-site enforcement for financial crimes against consumers, in line with President Lee Jae-myung’s plan to prioritize crackdowns on abusive financial practices.

A separate team will focus on IT risks across the financial sector, and new fines for IT-related incidents will be introduced as a punitive measure. Companies that fail to properly manage IT assets or identify and address security vulnerabilities in their systems would be subject to on-site inspections and audits.

The latest notification comes just days after Bithumb, South Korea’s second-largest crypto exchange, became the center of controversy after an internal error led to the accidental distribution of 2,000 Bitcoin to users. As a result, the price of Bitcoin on the platform briefly fell more than 10% below prices on other major exchanges.

Crypto World

3 Major Things That Could Move Crypto Markets This Week

A busy week lies ahead on the United States economic calendar, with labor market and inflation reports due while macroeconomic uncertainty remains elevated.

Crypto markets flatlined over the weekend, as investors licked their wounds following the massive $700 billion rout last week. The following several days could see more volatility with more government shutdown data on the way and a key inflation report.

US President Trump reiterated his 100,000 target for the Dow Jones as US stock futures rose on Monday morning. Meanwhile, precious metal markets are recovering, with gold reclaiming $5,000 per ounce and silver rising back to $80 per ounce.

Economic Events Feb. 9 to 13

The latest partial US government shutdown has already affected key data releases. The delayed December Retail Sales data is due on Monday, shedding light on the state of consumer spending.

This is followed by labor market data in the form of the January Jobs Report on Wednesday and Initial Jobless Claims data on Thursday.

“The most important thing, believe it or not, is the Labor Department’s nonfarm payroll report on Wednesday,” said CNBC’s Jim Cramer. “If that comes in soft, it means the Fed can keep cutting rates, and that’s great news for the stock market itself.”

Another big hitter, January’s CPI Inflation report, is due on Friday. The Consumer Price Index measures the average change over time in the prices paid by consumers for a basket of goods and services.

Key Events This Week:

1. December Retail Sales data – Monday

2. January Jobs Report – Wednesday

3. Initial Jobless Claims data – Thursday

4. January Existing Home Sales data – Thursday

5. January CPI Inflation data – Friday

6. 5 Fed speaker events this week

More government…

— The Kobeissi Letter (@KobeissiLetter) February 8, 2026

These labor market and inflation reports are critical in helping investors and Washington understand what is happening in the US economy, and are a key influence on the Federal Reserve’s monetary policy.

You may also like:

“Rate expectations have been remarkably stable over the last couple of weeks,” said Angelo Kourkafas, senior global investment strategist at Edward Jones, as reported by Reuters.

“We’ll see if any either weakness in the labor market data or any surprising cool-down in inflation accelerates a bit the timeline for when the market thinks the next rate cut may be delivered.”

Crypto Market Outlook

Crypto markets barely moved over the weekend, with total capitalization hovering around $2.45 trillion, its lowest level since November 2024. Bitcoin recovered to reclaim $71,000 following its crash to around $60,000 on Friday, but it remains 44% down from its all-time high and in a bear market.

Ether prices reclaimed $2,100 but couldn’t advance any further. The asset remains deep in bear market territory, down 58% from its August all-time high. The alcoins saw a minor bounce, but most of them are still on the floor after being obliterated in last week’s market crash.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Privacy-by-Design Makes Blockchain Work: The Japan APPI Case

Japan’s blockchain endeavours have taken on a more practical tone over the past couple of years, with major institutions now assessing where the technology genuinely fits into day‑to‑day financial and industrial workflows.

Some of the clearest signals are coming from the banking sector. In late 2025, the Japanese government confirmed its support for a project led by the country’s three largest banks to issue stablecoins for payments and settlement, under the oversight of the Financial Services Agency.

It’s a revealing direction. The work is centred on moving money and settling trades, not chasing volatility. That caution comes from experience.

Large Japanese institutions rarely move until they’ve weighed the operational and reputational implications, and blockchain still raises uncomfortable questions on both sides. It offers traceability and clean audit trails, but it also surfaces information in ways many organisations have never had to manage before.

This lands very differently inside a large organisation. On a public chain, transaction details are visible by default, and impossible to contain once they’re recorded. For teams used to controlling how information moves, and who sees what, that challenges long-standing expectations around confidentiality, trust and responsible data handling.

There’s a reason that kind of exposure makes people uneasy. It changes how risk is assessed and whether projects move forward at all.

The Cost of Transparency

Privacy sits at the centre of Japan’s digital strategy, and it draws a clear line around how far institutions are willing to go with blockchain. That sensitivity becomes hard to ignore once projects move beyond pilots and start brushing up against real operations.

On public blockchains, very little stays isolated. A payment here, a settlement there; before long, patterns begin to emerge. Volumes, timing and counterparties can quickly reveal more than the original transaction was meant to convey.

That way of working feels unfamiliar to many Japanese institutions. Banks are used to drawing clear lines between internal data, counterparty information and regulatory disclosure. Manufacturers and logistics firms draw similar lines around supply chains, pricing and sourcing. Public ledgers have a habit of ignoring those lines.

You see it when teams start digging into the data. Traceability and clean audit trails sound great, until someone realises how much of it is visible and how easily it can be analysed. Information that would normally stay inside a business is suddenly far more exposed. And that discomfort is not just cultural; there are strict compliance reasons behind it.

Why Privacy Carries Real Weight in Japan

Anyone building or operating digital systems quickly runs into the Act on the Protection of Personal Information (APPI), Japan’s data protection regime overseen by the Personal Information Protection Commission. It isn’t treated as a box-ticking exercise. It’s the framework organisations use to decide what data can move, where it can go and who remains accountable once it does.

Act amendments approved in 2020 and fully implemented from 2022, tightened expectations around breach reporting, individual rights and cross-border data handling. Once personal data leaves an internal system, organisations are expected to account for who can see it, how long it remains available and under what conditions it can be shared again.

Those changes pulled Japan much closer to GDPR-style expectations around accountability and data control. That alignment matters for blockchain. Rules designed around deletion rights, correction and purpose limitation sit comfortably with traditional databases, but they sit far less easily alongside immutable records and shared ledgers.

Once data is written on-chain, it is permanently recorded and replicated across multiple participants. That makes limiting access, correcting mistakes or reversing disclosure difficult later on. For teams used to accounting for every hand-off, that takes some getting used to.

The challenge also extends beyond domestic projects. Many blockchain applications operate across Asia-Pacific, where data protection rules vary. For compliance teams, that reality forces architectural decisions much earlier. What goes on-chain, and what stays off it, can determine whether a project ever clears internal review.

Where Builders Get Stuck

If you talk to teams building blockchain systems for institutions, the same issue comes up again and again. Most networks push them toward extremes. Either everything is visible by default, or almost everything is sealed off. There isn’t much middle ground.

That might be workable in early tests but it becomes far harder once regulators, auditors and risk teams get involved. Fully transparent systems expose more than most organisations are comfortable sharing. Fully private systems can make audits and reporting harder to support.

Teams respond by pushing sensitive logic off-chain or into permissioned environments that feel safer. Extra controls get bolted on. Disclosures are handled as one-offs. Compliance is demonstrated manually when someone asks for it. Over time, logic ends up split between public chains, off-chain databases and closed networks, which slows deployment and makes oversight harder.

You can see the effect in adoption. Consumer use moves ahead. Institutional deployments move more cautiously, even where the interest is clearly there. The promise is obvious, but the foundations still feel underprepared for sustained scrutiny.

Designing for Proof, Not Exposure

This is where the conversation needs to change. Institutions are not trying to publish private or sensitive data. They are trying to demonstrate that certain conditions were met: that a rule was followed, that consent was captured, that access made sense at the time. Looked at this way, the challenge becomes operational rather than philosophical.

You don’t need to put the underlying data out in the open to do that. What matters is having a reliable way to prove those conditions hold.

That’s why selective disclosure and zero-knowledge techniques are appearing in architectures aimed at real-world deployment. They make it possible to demonstrate compliance, eligibility or adherence to policy without dragging entire transaction histories or user records into the open. What gets shared is the conclusion, not every step that led to it. New blockchains like Midnight present such solutions to the industry and various sectors exploring blockchain integration.

For teams used to managing risk, that feels like common sense. Disclosure becomes deliberate. Audits stop feeling like a guessing game. The risk of oversharing drops away. Data protection stops being something to fix later and starts shaping decisions much earlier.

If blockchain is going to move beyond pilots and proofs of concept, that change matters. Systems designed this way don’t ask institutions to rethink how accountability works. They fit into existing expectations instead of fighting them.

Why This Matters Beyond Web3

That approach carries particular weight in markets like Japan, where data handling is taken seriously, and regulatory enforcement leaves little room for ambiguity when expectations are missed. Architectures that make disclosure explicit and limited sit far more comfortably alongside APPI’s emphasis on accountability and purpose limitation. They also travel better across borders, where privacy rules may differ but scrutiny rarely eases.

The implications extend well beyond blockchain. AI systems, data-driven platforms and cross-border digital services face the same pressure as they scale. As the volume of data grows, maintaining trust without losing control becomes harder. Ways of proving compliance without oversharing will matter across the digital economy, not just in Web3.

Japan isn’t trying to slow blockchain down. It’s pushing it to grow up.

Privacy-by-design forces harder choices earlier, but it also clears a path through regulation, risk and trust that institutions can actually walk. For institutions, that’s what adoption looks like in practice. And if blockchain is going to move from promise to something organisations rely on in highly regulated markets, this is the direction it needs to travel.

Crypto World

Solana price stalls near $85 after mid-band rejection

Solana price is hovering near $85 as falling volume, shrinking open interest, and a weak chart structure keep downside risk in focus.

Summary

- Solana has lost 35% over the past month and nearly 70% from its all-time high as price struggles below key levels.

- Derivatives activity continues to fade with recent sessions seeing significant long positions flushed out.

- Technical signals are bearish and momentum is showing oversold conditions without a clear reversal.

Solana was trading around $86.02 at press time, down 0.1% over the past 24 hours. The token has struggled to find a footing after a sharp pullback, falling about 13% over the past week and roughly 35% over the last 30 days. From its January 2025 all-time high near $293, SOL is now down close to 70%.

Price action has stayed heavy. While Solana (SOL) briefly pushed higher earlier this month, those gains faded quickly, pushing the token back toward the lower end of its recent seven-day range between $75.76 and $104.98. Buyers have stepped in to provide near support, but follow-through has been limited.

Market activity has continued to slow. Spot trading volume over the past 24 hours fell nearly 36% to $3.72 billion, pointing to fading participation. Futures data shows a similar picture.

According to CoinGlass data, derivatives volume dropped 22.44% to $9.46 billion, while open interest slipped 2.34% to $5.29 billion, suggesting traders are reducing exposure rather than adding new positions.

Risk-off sentiment and leverage unwinds add pressure

Solana’s weakness comes as risk appetite across global markets remains fragile.

Rising geopolitical tensions and a more hawkish approach by U.S. policymakers have put pressure on high-volatility assets. Known for being a high beta, SOL has been hit more severely than many of its peers.

Within crypto markets, leverage has been steadily flushed out. Recent sessions have seen liquidity sweeps wipe out billions in long positions, accelerating declines. While Solana’s open interest has occasionally increased alongside negative funding rates, this has more often been due to aggressive short positioning rather than new bullish bets.

Sentiment has also been impacted by structural issues with the network. The number of validators has fallen by about 70% from its peak to less than 800, which raises concerns about the long-term viability of operations for smaller operators.

Discussions about inflation, value capture, and stake concentration have raised caution, especially as the sector’s memecoin-driven momentum waned.

Solana price technical analysis

On the chart, Solana continues to trade within a clearly defined bearish structure. Price was rejected near the Bollinger mid-band around $108, and the sequence of lower highs remains intact.

SOL is trading below both the 50-day and 100-day moving averages, which continue to slope downward. The $95–$100area has flipped into overhead supply after repeated failures, limiting recovery attempts.

Instead of a steady base, daily candles have remained near the lower Bollinger Band, indicating ongoing selling pressure.

Momentum indicators are still weak. The daily relative strength index is oversold but lacks a bullish divergence, sitting near 30. Prior dips to comparable RSI levels have produced brief recoveries, but buyers have struggled to sustain follow-through.

The $85 region is serving as short-term support and is in line with a previous demand pocket. A daily close below this level would expose the $80–$75 area next.

To ease downside pressure, Solana would need to reclaim the mid-band and hold above $100, supported by stronger volume, something the market has yet to deliver.

Crypto World

Here’s why the quantum threat for bitcoin may be smaller than people fear

A new report from digital asset manager CoinShares is pushing back on the growing narrative that bitcoin faces an imminent quantum computing crisis, arguing that only a small sliver of supply is realistically at risk in a way that could move markets.

CoinShares is fourth-largest manager of digital asset exchange-traded products globally behind BlackRock, Grayscale, and Fidelity and has a self-reported 34% market share of EMEA. It had over $10 billion in assets under management as of September 2025.

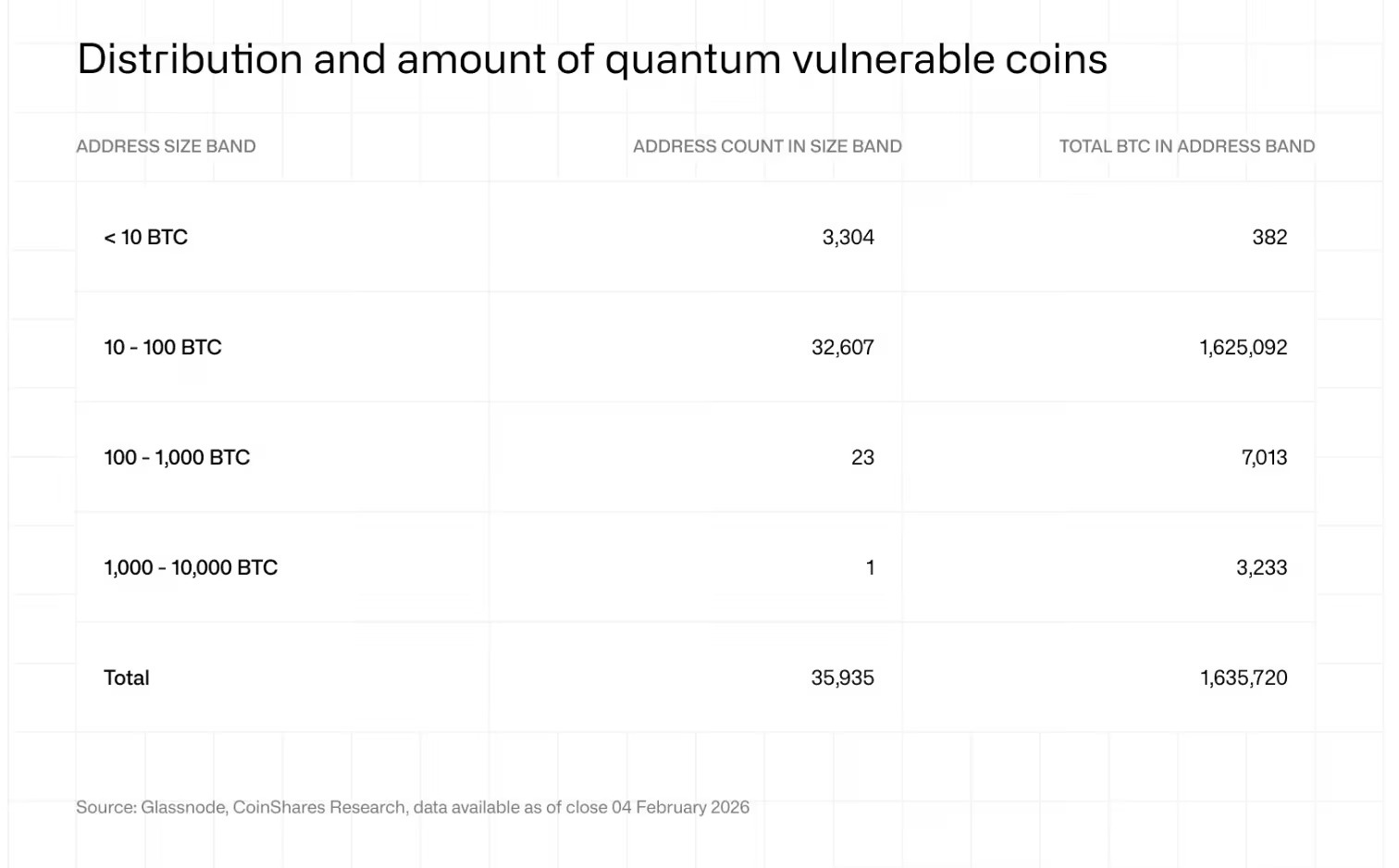

The Saturday report challenged widely cited estimates suggesting that as much as 20% to 50% of all bitcoin could eventually be vulnerable to quantum-enabled key extraction. Those figures, CoinShares said, blur the line between theoretical exposure and coins that could actually be compromised at scale.

CoinShares narrowed its focus to legacy Pay-to-Public-Key (P2PK) addresses, where public keys are permanently visible on-chain and therefore easier targets if quantum computers become capable of reversing them.

The firm estimates about 1.6 million BTC — or roughly 8% of total supply — sits in these older address types.

But CoinShares argued the number of coins large enough to create “appreciable market disruption” if stolen is far smaller: about 10,200 BTC. The remainder, it said, is distributed across more than 32,000 UTXOs averaging around 50 BTC each, making them far less attractive and far more time-consuming to crack even under optimistic assumptions.

The key point is that most of the potentially exposed bitcoin isn’t sitting in a handful of giant, juicy targets. It’s scattered across more than 32,000 separate chunks of coins, and each chunk averages about 50 BTC.

A quantum attacker would have to crack those chunks one by one to steal them, instead of breaking into a single address and walking away with a market-moving haul. That makes the job slower, noisier and less profitable, even if one assumes the attacker has unusually strong quantum hardware.

CoinShares said breaking bitcoin’s cryptography would require fault-tolerant quantum systems roughly 100,000 times more powerful than the largest machines today, placing the threat at least a decade away. Ledger CTO Charles Guillemet, quoted in the report, noted that Google’s Willow is a 105-qubit machine, while key-breaking would require millions of qubits.

Instead, the firm endorsed a gradual transition to post-quantum signatures, framing quantum risk not as an emergency, but as a foreseeable engineering problem bitcoin can absorb over time.

Quantum fears aren’t new for bitcoin, but they’ve been creeping back into market conversations as prices wobble and investors look for structural risks to blame.

In December, CoinDesk reported that most bitcoin developers view quantum computing as a distant, non-issue, arguing machines capable of cracking bitcoin’s cryptography are unlikely to exist for decades.

Critics counter that the real problem is not the timeline, but the lack of visible preparation, especially as governments and major tech firms begin rolling out quantum-resistant systems.

Proposals such as BIP-360 aim to introduce new wallet formats that could allow users to migrate gradually, but the debate has highlighted a growing gap between developers and increasingly institutional capital that wants a clearer long-term plan.

Crypto World

Coinbase Returns to the Super Bowl with a Quirky Lo-Fi Karaoke Ad

Coinbase has returned to the Super Bowl with a bold, nostalgia-forward spot that eschews hard sells in favor of a shared cultural moment. Four years after its viral QR-code stunt, the exchange leaned into a Backstreet Boys karaoke-inspired concept, letting the lyrics of “Everybody (Backstreet’s Back)” flash across the screen in a one-minute montage. Marketing chief Catherine Ferdon described the creative as a deliberate attempt to spark a communal experience and to illustrate how the crypto community has evolved beyond a niche interest. The move comes as Coinbase seeks to sustain mainstream visibility at a time when crypto brands are navigating a dense regulatory backdrop and mixed public sentiment, rather than relying solely on direct product demonstrations.

The execution centers on text animation and a simple premise: a catchy, universally recognizable tune that listeners can sing along to, with the goal of memory and sharing rather than a traditional call to action. In that sense, the ad mirrors a broader approach in crypto marketing that prioritizes cultural resonance and broad memorability to drive top-of-munnel awareness, rather than relying on flashy product showcases alone. The spot’s design choices—minimal on-screen branding, a familiar chorus, and a single point of reference—signal Coinbase’s intent to let the moment carry the conversation rather than to funnel viewers immediately into signing up or downloading an app.

Coinbase’s 2026 appearance follows a notable high-water mark in 2022, when the company staged a color-shifting QR-code commercial that bounced across the screen and directed viewers to a sign-up link. The campaign, which offered BTC to new users, reportedly crashed Coinbase’s site and drew millions of visits in a matter of minutes, underscoring the game-changing reach of the Super Bowl for crypto marketing. The 2022 effort featured a simple hook and a sense of immediacy—an approach that Coinbase appears to be reinterpreting this year, albeit through a different cultural lens that hinges on shared experience rather than a direct promotional offer.

Key takeaways

- Coinbase returns to the Super Bowl with a one-minute, lyric-driven ad that emphasizes communal experience over a direct product pitch.

- The creative choice leans on nostalgia and a universally known song to foster memorability and discussion among a broad audience.

- The company’s earlier QR-code stunt in 2022, which steered viewers to a Bitcoin (CRYPTO: BTC) signup link, demonstrated the explosive potential of Super Bowl exposure for crypto brands, even as it overwhelmed the site.

- Public reactions online were mixed—some praised the simplicity and recall value, while others criticized the tone or timing amid market volatility and regulatory scrutiny.

- Coinbase executives defended the campaign as a breakthrough moment designed to “break through” in a crowded media landscape and to celebrate the crypto community’s growth.

Tickers mentioned: $BTC, $ETH

Sentiment: Neutral

Market context: The ad lands in a period of heightened attention to crypto brands in mainstream media, where reach and resonance compete with heightened regulatory scrutiny and evolving consumer attitudes toward digital assets. It underscores a trend of brands using high-visibility events to shape narrative and familiarity around crypto, even as market conditions and policy debates continue to influence user acquisition and brand trust.

Why it matters

The Super Bowl spotlight is a rare opportunity for a crypto brand to move beyond technical jargon and reach a broad audience in a single, high-impact moment. By leaning into a communal, sing-along moment, Coinbase aims to embed itself in cultural memory, potentially boosting long-term recognition even among viewers who may not immediately engage in on-chain activity. The choice to foreground lyrics over a product feature suggests a shift toward brand-building as a gateway to eventual product adoption, especially as consumer perception of crypto oscillates between curiosity and caution.

From an investor and builder perspective, the campaign signals that Coinbase is prioritizing media presence and narrative control as part of a diversified strategy to attract new participants to the ecosystem. The reference to past performance—most notably the 2022 QR-code stunt that prompted a flood of sign-ups and traffic—highlights the outsized impact that large-scale media events can have on user interest and platform exposure. In a market where liquidity and risk sentiment swing with macro headlines, such brand visibility can provide a unique form of non-price-driven traction, potentially widening the funnel beyond the usual crypto-native audience.

The ad also intersects with the evolving conversation around crypto advertising itself. As regulators scrutinize marketing claims and risk disclosures, the ability to generate positive topical chatter without triggering regulatory pushback becomes a delicate balancing act. Coinbase’s approach—opening a conversation through a shared cultural moment rather than a direct sign-up prompt—may influence how other players craft campaigns that are memorable yet compliant, especially when targeting mass audiences in the United States and abroad.

Within the content, the emphasis on community and accessibility is reinforced by public commentary from industry figures. An engineer from the Ethereum Foundation noted that many attendees enjoyed singing along and found the moment approachable, illustrating how a crypto-brand moment can resonate with developers and enthusiasts alike. At the same time, critics argued that such campaigns can feel performative or disconnected from the underlying realities of asset risk and regulatory risk, reminding readers that mass-media stunts do not obviate the need for transparent disclosure and responsible messaging.

Coinbase’s leadership echoed that dual message. CEO Brian Armstrong defended the ad on social media, arguing that most people engage with ads in fleeting, buzzed settings and that a distinctive moment is often required to break through. The company’s marketing chief emphasized that the objective was to create a memorable, shareable experience that mirrors the crypto community’s growth. Taken together, these statements reflect a strategic bet: that a well-timed pop-cultural moment can bolster brand familiarity and open doors for deeper engagement as crypto markets and products mature.

Looking ahead, the broader context for Coinbase and similar brands remains nuanced. Mainstream media moments can catalyze new user interest, but they also invite scrutiny about risk disclosure and the real-world implications of crypto ownership. In parallel, the industry will likely watch for how such campaigns influence long-run adoption, whether subsequent campaigns lean into similar cultural cues, and how regulators respond to creative advertising that touches on financial products without overtly directing purchases.

What to watch next

- Monitor Coinbase’s post-campaign metrics: social engagement, traffic spikes, and any uptick in new sign-ups or app activity following the ad.

- Watch for further brand campaigns from Coinbase or rival exchanges that blend pop culture with crypto messaging, testing the balance between reach and regulatory compliance.

- Assess regulatory and policy developments that could influence future advertising strategies for crypto services, including disclosures and consumer protections.

- Track sentiment shifts across social platforms as viewers reflect on the impact of the ad and potential influence on purchasing behavior or sign-up decisions.

- Follow public comments from Coinbase leadership for signals about how the company plans to sustain broad awareness while navigating market cycles and evolving consumer expectations.

Sources & verification

- Official statements from Coinbase marketing chief Catherine Ferdon describing the ad’s intent and experience-driven approach.

- Post by Coinbase CEO Brian Armstrong on X defending the campaign’s approach to break through with audiences.

- Historical reference to Coinbase’s 2022 QR-code Super Bowl spot and its reported traffic impact, including the sign-up link associated with Bitcoin (CRYPTO: BTC).

- Public comments from Ethereum Foundation engineer Chase Wright on reactions to the ad in social conversations.

- Media coverage and analysis of online reception, including diverse opinions on the ad’s simplicity, memorability, and timing amid market conditions.

Key figures and next steps

Coinbase’s campaign demonstrates a continued appetite for mass-media engagement as a path to broader crypto familiarity. While the short-term impact on sign-ups or asset prices remains debatable, the larger takeaway is clear: brands are experimenting with entertainment-led formats to connect with diverse audiences, and the crypto sector is not shying away from mainstream stages.

For readers and market participants, the episode underscores the importance of separating hype from fundamentals. A single advertising moment can raise awareness, but sustained growth hinges on clear disclosures, measured risk communication, and a product-and-ecosystem narrative that withstands scrutiny and evolves with user needs.

Crypto World

Bitcoin Price Faces 40% Risk Despite Improving US Demand

The Bitcoin price has rebounded nearly 20% after slipping close to $60,000 on February 6. The move has revived “buy-the-dip” hopes and fueled talk of a local bottom. At the same time, US demand indicators have started to recover from recent lows.

But beneath the surface, volume signals, on-chain data, and price structure suggest the rally may be fragile. Several warning patterns now resemble setups that preceded major declines in this cycle.

Bear Flag Shows Big Money Is Not Fully Committed

One of the clearest warning signals comes from the Klinger Oscillator, a volume-based indicator that tracks big money flow.

Sponsored

Sponsored

Unlike indicators such as the CMF, which focus mainly on short-term big-money pressure, the Klinger Oscillator measures large-wallet volume intensity across trends. It is designed to highlight how large players position themselves over time, not just day-to-day activity.

In simple terms, it shows whether big money is quietly accumulating or preparing to sell into rallies.

Between October 6 and January 14, Bitcoin fell from around $126,000 to $97,800, a decline of roughly 22%. During that period, the Klinger Oscillator moved higher while the price weakened. This created a bearish divergence.

That divergence warned that volume strength by large wallets (possibly whales and institutions) was not supporting price recovery. Within weeks, Bitcoin extended its decline toward $60,000 as the Klinger reading dropped sharply (possible big money outflows).

A similar pattern is forming again.

Between February 2 and February 9, the price drifted lower while the Klinger Oscillator trended upward. This suggests large players may be positioning (recent buys) to sell into rebounds rather than build long-term exposure.

At the same time, Bitcoin’s drop from mid-January to early February formed a sharp downside “pole.” The current price bounce movement resembles a bear flag, a pattern that often signals a continuation of the lower trend, with a near 40% crash possibility if the lower trendline support gives way. That could trap the bulls buying into the bounce.

Sponsored

Sponsored

When rising Klinger readings align with a bear flag, it usually means rallies lack deep institutional support. Big players are active, but not in accumulation mode, and might distribute at any given chance. Days of BTC ETF outflows in the near term would validate the Klinger-led hypothesis.

Improving US Demand Has Failed to Mark Bottoms Before

This technical weakness does not exist in isolation. It comes even as US demand has started to improve.

The Coinbase Premium Index tracks whether Bitcoin trades at a premium or discount on US-based Coinbase compared with global exchanges. It primarily reflects American institutional demand.

On February 4, the index fell to around -0.22, showing weak US participation. This level closely matched December 31, 2024, when the index dropped to -0.23. At that time, Bitcoin traded near $93,300.

Sponsored

Sponsored

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Many traders believed a bottom had formed. Instead, the price later fell to about $76,200, a decline of nearly 18%.

Since early February, the index has recovered to near -0.07, signaling improving US interest and aligning with the Klinger oscillator’s rising reading. However, history shows that demand recovery often comes before price bottoms, not after. In 2024, US demand improved first. The deeper correction came later.

On-chain data adds another layer of risk.

The 1-day to 1-week holder group, made up of short-term traders, increased its share of supply from about 2.05% to over 3.3% since February 5 (during the 20% rebound). That is a rise of more than 60% in just days, as highlighted by HODL Waves, a metric segregating wallets by time.

This cohort tends to sell quickly when prices weaken. Their growing presence makes the market more unstable. A similar surge in short-term holders in late January was followed by a rapid 3% pullback. So far, improving US demand is being matched by rising speculation, not strong conviction.

Sponsored

Sponsored

Key Bitcoin Price Levels Show Where the Bounce Could Fail

All signals now converge around a few critical Bitcoin price zones.

The first major support sits near $67,350. A daily close below this level could restart selling pressure.

If that breaks, the next downside targets are:

- $60,130, the recent low

- $57,900 (a key Fibonacci support and a mear 18% correction zone from the current levels)

- $53,450 a major retracement zone

- $43,470, the bear flag projection

A move from current levels to $43,400 would represent a further decline of roughly 35%. On the upside, Bitcoin must reclaim $72,330 to stabilize and get out of the possible bull trap. This level capped recent rallies.

Above that, $79,240 remains decisive. Recovering this zone would retrace about half of the prior fall and likely invalidate the bearish structure. Only then would the path toward $97,870 reopen. Until that happens, all Bitcoin price rallies remain vulnerable.

Crypto World

$44B BTC blunder puts South Korea regulators on alert

South Korea’s top financial watchdog is stepping up oversight of crypto markets days after a local exchange mistakenly distributed billions of dollars worth of bitcoin to users.

The Financial Supervisory Service said Sunday it will launch planned investigations into “high-risk” practices that undermine market order, including large-scale price manipulation by so-called whales, trading schemes tied to suspended deposits and withdrawals, and coordinated pump tactics fueled by social media misinformation.

The watchdog also said it plans to build tools that automatically extract suspicious trading patterns by the second and minute, alongside text-analysis systems using artificial intelligence to flag potential market abuse.

The announcement follows a widely reported exchange error last week in which some users of Bithumb, among the country’s biggest exchanges, were mistakenly credited with at least 2,000 bitcoin each instead of small promotional rewards, a blunder estimated at roughly $44 billion at the time.

BTC prices dropped 30% compared to the global average at the time, as some recipients tried to sell the assets. The exchange had restricted trading and withdrawals for the 695 affected customers within 35 minutes of the erroneous distribution on Friday.

Regulators said the incident exposed the “vulnerabilities and risks” of virtual assets and signaled they could conduct on-site inspections of exchanges if irregularities are found in internal control systems.

Beyond market manipulation, the FSS said it will introduce punitive fines for IT incidents across the financial sector and raise the security accountability of chief executives and chief information security officers, a shift that could have direct implications for crypto trading platforms.

The agency also confirmed it has set up a preparatory team for the Basic Digital Asset Act, which would expand Korea’s regulatory framework beyond the first phase of crypto rules.

The crackdown plan reflects a broader push by President Lee Jae-myung to stamp out what he has called “cruel financial practices,” with the FSS also outlining measures to strengthen enforcement against fraud and expand tools to combat voice phishing.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics14 hours ago

Politics14 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat8 hours ago

NewsBeat8 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business14 hours ago

Business14 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports4 hours ago

Sports4 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics16 hours ago

Politics16 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business21 hours ago

Business21 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout