Crypto World

U.S. Federal Reserve urges new rules for crypto derivatives

Federal Reserve researchers have proposed treating cryptocurrencies as a separate asset class for derivatives margin rules, citing their unique risks and high volatility.

Summary

- Fed researchers suggest creating a dedicated crypto risk category in derivatives markets.

- The proposal separates stablecoins and floating cryptocurrencies for better risk modeling.

- The move aims to improve margin accuracy and reduce under-collateralization in OTC trades.

U.S. central bank researchers are calling for cryptocurrencies to be treated as a separate asset class in derivatives markets, arguing that digital assets carry risks that do not fit neatly into existing financial categories.

In a paper updated on Feb. 12, analysts examined how crypto-related risks are handled in over-the-counter derivatives. The study, titled “Initial Margin for Crypto Currencies Risks in Uncleared Markets,” focuses on how margin requirements are calculated under the framework used by the International Swaps and Derivatives Association.

Why crypto needs its own category

The researchers argue that the behavior of cryptocurrencies differs greatly from that of traditional assets like stocks, commodities, and foreign exchange. Market stress tends to show up more abruptly, prices move more quickly, and swings are bigger. These features make it harder to measure risk using existing models.

Because of this, the paper suggests creating a separate crypto risk class within the current margin system. The proposal suggests sorting digital assets into two broad categories.

The first would include pegged cryptocurrencies, such as stablecoins designed to mirror the value of traditional currencies. The second would cover floating cryptocurrencies, whose prices are determined entirely by market supply and demand.

This distinction is intended to acknowledge the different levels of risk involved. Stablecoins tend to fluctuate less, while unpegged tokens can swing sharply and without warning. According to the authors, applying the same margin framework to both groups can result in misjudged risk and poorly calibrated requirements.

The study also advises relying on long-term market data, including periods of severe financial stress, when assigning risk weights. While this mirrors established industry methods, it tailors them more closely to the specific behavior of crypto markets.

What this could mean for markets

If market participants adopt the proposal, margin requirements for crypto derivatives could become both stricter and more accurately aligned with underlying risk. In practical terms, traders and institutions might have to commit additional collateral, particularly for contracts linked to highly volatile assets.

Backers argue that this approach would lower the chances of under-collateralization, a situation in which trading losses exceed the margin posted. In stressed markets, that problem can spread quickly and threaten financial stability. A clearer framework could help limit those risks.

At the same time, the paper stresses that it is not a formal regulation. It represents research and analysis by Fed staff, not an official rule or policy decision. Any real changes would need to come through industry adoption or future regulatory action.

Still, the timing is notable. As crypto markets grow and become more connected to traditional finance, regulators and institutions are paying closer attention to risk management. More banks, funds, and trading firms are now involved in digital assets, making standardized rules more important.

By recognizing crypto as its own category, the researchers signal that digital assets have reached a level of maturity that demands tailored oversight. While the proposal does not change the rules today, it adds momentum to ongoing efforts to bring a clearer structure to crypto derivatives markets.

Crypto World

Kraken xStocks launches xChange for on-chain stock trading

Kraken-backed xStocks has launched a new on-chain trading engine designed to connect traditional equity liquidity with decentralized finance infrastructure.

Summary

- xStocks introduced xChange, an on-chain trading engine for tokenized stocks.

- Users can trade 70+ tokenized equities across Ethereum and Solana.

- The platform has already recorded $3.5B on-chain volume, $25B total trading volume, and 80,000 holders.

In a March 5 announcement, Kraken said its tokenized equity platform xStocks has introduced xChange, an execution layer that allows users to trade tokenized stocks directly on-chain across Ethereum (ETH) and Solana (SOL).

xChange allows trading of more than 70 tokenized equities on-chain while keeping prices aligned with real-world public market data.

On-chain trading engine connects liquidity across Ethereum and Solana

Each tokenized stock on xChange is fully collateralized and backed 1:1 by underlying shares held in custody, ensuring transactions represent actual equity exposure rather than synthetic derivatives.

The system introduces atomic settlement, meaning every trade either executes completely at the quoted price or does not execute at all. Partial fills are avoided, giving traders predictable execution similar to traditional market infrastructure.

The trading engine also connects on-chain markets with traditional equity liquidity. Real-time pricing mechanisms link tokenized equities to public market depth, which can tighten spreads and improve execution quality while keeping settlement on the blockchain.

Tokenized equities adoption grows across DeFi platforms

xChange builds on the growth of tokenized equities since the launch of xStocks in June 2025. According to the company, the platform has recorded over $3.5 billion in on-chain transaction volume, alongside $25 billion in total trading volume across exchanges.

Tokenized assets on-chain now exceed $225 million, with more than 80,000 unique on-chain holders interacting with the ecosystem.

The new execution layer operates 24 hours a day, five days a week, allowing tokenized stock trading beyond traditional exchange hours. This extended availability gives DeFi applications and global users access to equities even when traditional stock markets are closed.

Val Gui, general manager of xStocks, said the system brings traditional market liquidity onto blockchain infrastructure while turning tokenized equities into programmable digital assets that can be integrated into DeFi applications.

The approach combines public market pricing with blockchain settlement, allowing tokenized stocks to move across decentralized applications while maintaining exposure to underlying equities.

Crypto World

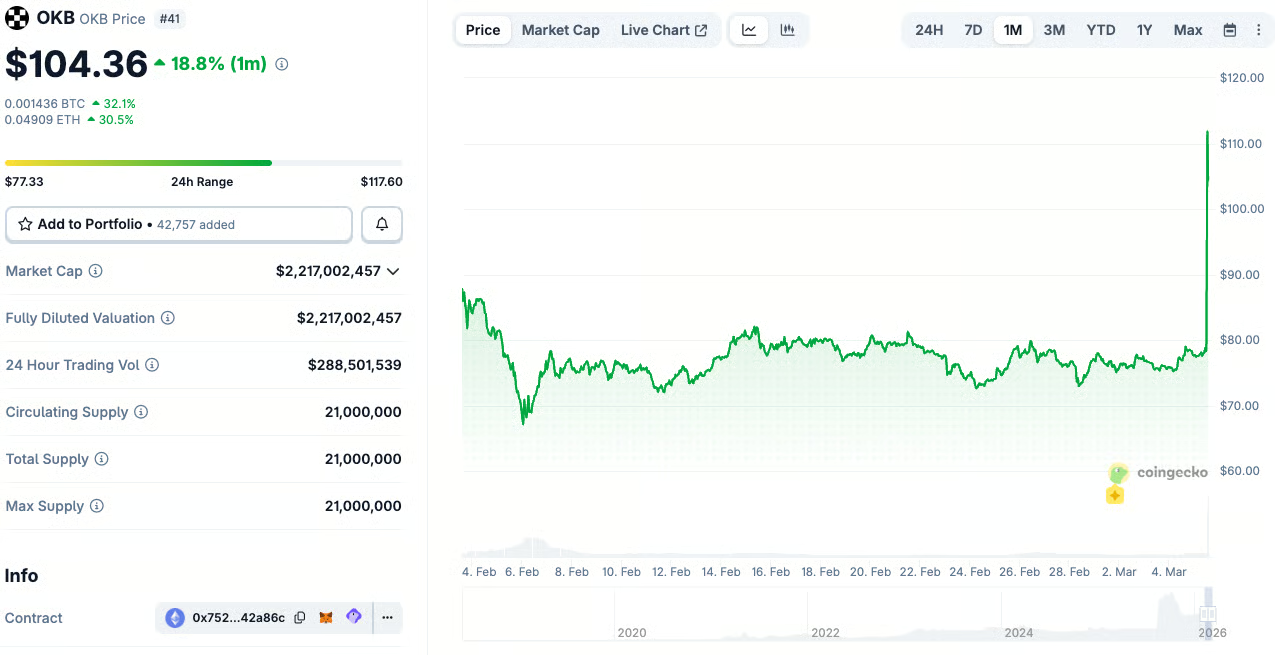

NYSE Parent Company Invests in OKX at $25 Billion Valuation

OKX is now valued at $25 billion following an investment from NYSE’s parent company.

One of the world’s most popular cryptocurrency exchanges, OKX, was valued at a whopping $25 billion following its latest round of investments.

According to reports, the Intercontinental Exchange, which is the parent company of the New York Stock Exchange, acquired a minority stake in the crypto trading firm.

It also places OKX well above recent market entrants such as Bullish and Gemini, currently sitting at $5.39 billion and $1 billion, respectively.

As soon as the news broke out, the price of OKB (the native cryptocurrency of the OKX ecosystem) went vertical. It skyrocketed by a whopping 37% in a matter of minutes.

The move is the last in a series of deepening institutional involvements in the cryptocurrency industry. As CryptoPotato reported earlier, Morgan Stanley also filed for its own Bitcoin Trust ETF, while Kraken – a US-based crypto exchange, became the first to receive a Fed Master Account.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

US SEC Proposes Guidelines on How Securities Laws Can be Applied to Crypto

Like the SEC, the derivatives trading regulator, the CFTC, is also working to regulate prediction markets.

The United States Securities and Exchange Commission (SEC) has inched closer to creating guardrails to ascertain how cryptocurrencies are regulated.

In a recent commission-level guidance submitted to the White House’s Office of Information and Regulatory Affairs (OIRA), the SEC outlined how securities laws can be applied to crypto. If followed, the new guidelines could affect how crypto-focused companies register and operate their businesses in the country.

New Guidelines for Crypto Market

According to the OIRA’s website, the guidance was labeled as the “Application of the Federal Securities Laws to Certain Types of Crypto Assets and Certain Transactions Involving Crypto Assets.”

The website shared sparse details about the SEC’s proposal. Still, an SEC spokesperson informed Bloomberg that the financial agency “will consider interpretive guidance around a token taxonomy for crypto assets.” This means that factors such as a crypto’s inherent properties, behavior, and use cases would be considered to determine whether securities laws apply or not.

With these guidelines in place, crypto firms would know how to proceed with registration, operations, and investor engagement. It is worth noting that commission-level guidance has more power than staff-level guidance. Still, it falls short of the requirements to become a rule, which include processes such as public notice and comment.

The latest move aligns with Paul Atkins’ goal of bringing crypto-friendliness to the country since he became the SEC chairman. A few weeks ago, he hinted at the agency’s commitment to establishing structural crypto regulations despite falling cryptocurrency prices.

CFTC Calls for Regulation of Prediction Markets

The SEC is not the only Wall Street regulator advocating for a crypto-friendly regulatory framework. On March 2nd, the Commodity Futures Trading Commission (CFTC) submitted a measure to the White House’s OIRA on prediction markets.

You may also like:

Michael Selig, the CFTC chairman, shed some light on the prediction markets’ measure, saying:

“We’re going to be setting very clear standards as to what can be self-certified in our markets and what cannot and how to evaluate the different products that are offered in the space.”

The CFTC’s latest move comes amid heightened attention investors give to prediction markets, popularized by leading platforms Polymarket and Kalshi.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

OpenAI’s new Wall Street AI stack is coming for crypto next

OpenAI’s latest financial-services tools plug ChatGPT into FactSet, Third Bridge, Excel, and Google Sheets, laying the groundwork for AI agents that can treat crypto as just another institutional asset class.

Summary

- Tools let finance professionals pull data, run models, and draft memos directly in ChatGPT.

- The same setup can be wired into crypto market and on-chain data, lowering the barrier to automated strategies.

- OpenAI’s broader push into financial workflows positions AI as core infrastructure for both tradfi and digital assets.

OpenAI’s move to wire ChatGPT directly into FactSet, Third Bridge, and spreadsheet environments is being sold as a play for banks, asset managers, and research shops, but the architecture is asset-agnostic.

Once you have an AI layer that can ingest institutional data, build models, and draft investment memos, swapping equities for Bitcoin (BTC), Ethereum (ETH), or alt liquidity pools is just a matter of pointing the same stack at different feeds: exchange APIs, on-chain analytics, and derivatives venues.

OpenAI’s broader agent framework is already being used alongside crypto APIs to automate portfolio rebalancing, yield monitoring, and strategy execution, turning what used to be bespoke quant and dev work into something closer to configuration. That lowers the barrier to running systematic strategies in DeFi and centralized venues, and it pushes crypto trading desks to look more like lean, AI-augmented quant pods than discretionary shops.

At a higher level, the company is positioning itself as middleware for financial workflows, not just a chatbot, embedding AI into risk, reporting, and decision-making across fintech and banking. If that stack becomes standard, crypto will be pulled into the same pipelines, priced and risk-managed by the same agents that handle equities and credit, with human analysts increasingly supervising rather than building models from scratch. For digital assets, the signal is clear: the real AI trade is not another token launch, but the quiet normalization of crypto inside an AI-native financial operating system.

Crypto World

ZeroHash applies for national trust bank charter to expand regulated stablecoin services

ZeroHash, which develops behind-the-scenes crypto infrastructure for businesses, said it applied for a National Trust Bank Charter from the U.S. Office of the Comptroller of the Currency (OCC), looking to operate under federal regulatory oversight.

If approved, the charter would give ZeroHash permission to issue stablecoins, custody digital assets and manage reserves under direct federal oversight. It would not be allowed to take customer deposits or engage in commercial lending.

That status could allow the Chicago-based company, which already holds licenses in 51 U.S. jurisdictions and operates internationally, to expand its stablecoin and digital asset services under a single federal framework, rather than navigating a patchwork of state-by-state rules.

ZeroHash is following a path forged by a number of other crypto companies. In the past month, several firms have received initial approval for national bank trust charters. These include Stripe’s stablecoin firm Bridge and cryptocurrency exchange Crypto.com. In December, Circle Internet (CRCL), Ripple, Paxos, Fidelity Digital Assets and BitGo all received similar approvals.

Founded in 2017, ZeroHash’s platform enables companies to embed stablecoins and digital asset functionality into services like payments, trading and payroll.

Clients include financial heavyweights like Morgan Stanley, Interactive Brokers, Stripe and Franklin Templeton.

In practical terms, a federal trust charter would let ZeroHash offer services that align with recent legislative developments, including provisions in the Genius Act, which clarifies the legal treatment of stablecoins in the U.S.

The OCC is now reviewing the application. No timeline for approval has been given.

Crypto World

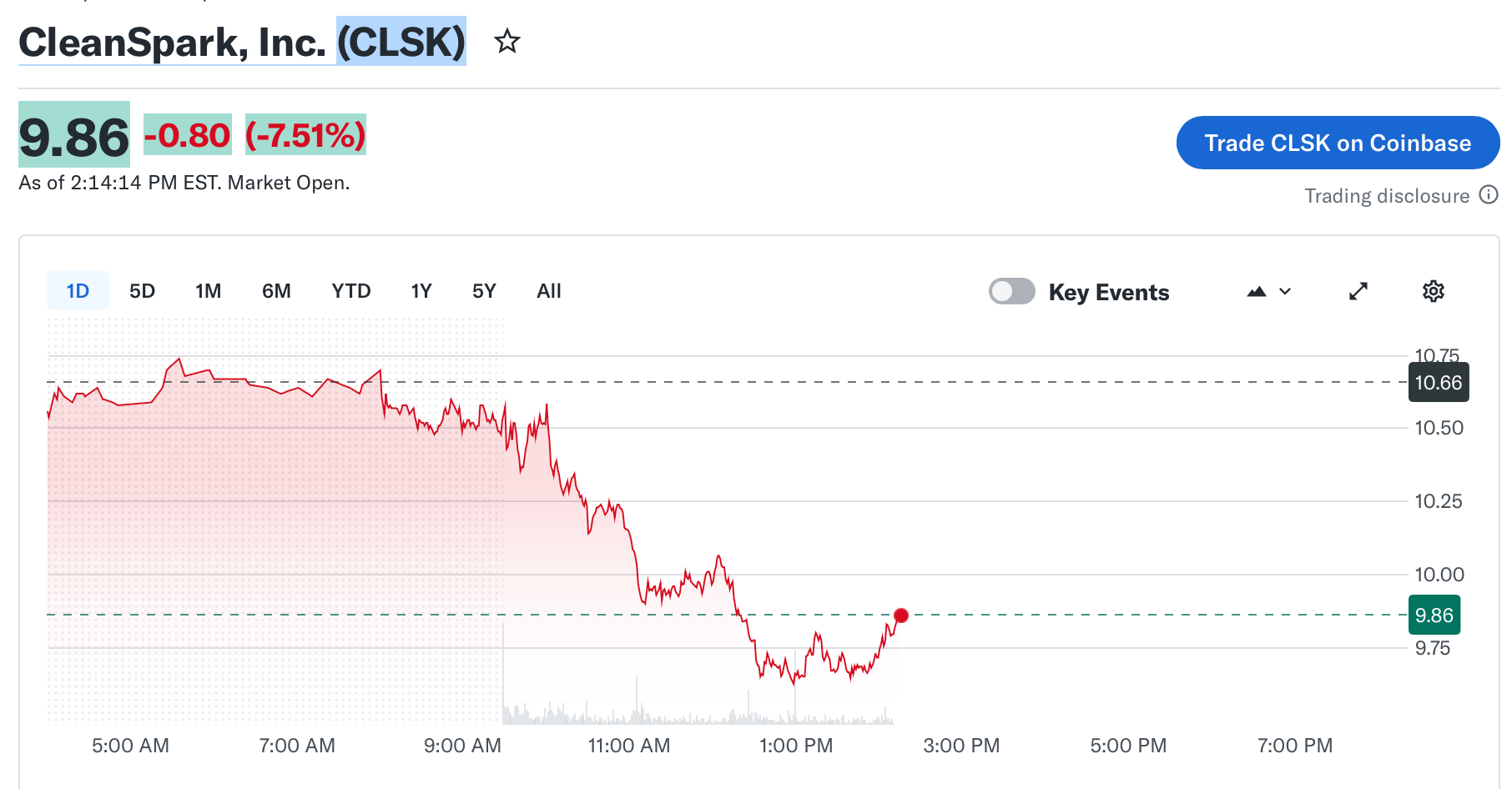

CleanSpark Sells Most February BTC Output, Generating $36.6M in Proceeds

US Bitcoin miner CleanSpark last month sold 553 Bitcoin from its February production for about $36.6 million, while producing 568 BTC during the month, according to the company’s latest operational update.

The company ended February with 13,363 BTC (BTC) in its treasury and continued expanding its infrastructure by completing the closing on a second Texas campus that adds 300 megawatts of ERCOT-approved power capacity.

The Electric Reliability Council of Texas, or ERCOT, operates the state’s electrical grid.

CleanSpark said its deployed fleet totaled 235,588 mining machines at the end of February, operating with 50 EH/s peak hashrate, a measure of mining computing power, and 43.2 EH/s average hashrate.

Across its power portfolio, the company has 1.8 gigawatts of capacity under contract, with 808 megawatts currently in use.

CleanSpark said it has produced 1,141 BTC year-to-date, as of Feb. 28. The company also said 1,086 BTC of its holdings are posted as collateral or receivable in connection with derivatives transactions.

The company is also positioning parts of its infrastructure to support artificial intelligence and high-performance computing workloads, reflecting a broader shift among Bitcoin miners seeking to monetize power-dense data center capacity beyond crypto mining.

At the time of writing, the company’s stock was down about 7.5% on the day, according to Yahoo Finance data. Sector-tracking exchange-traded fund CoinShares Bitcoin Mining ETF was down 6.4%, at the same time.

Related: Ex-OpenAI researcher’s hedge fund reveals big Bitcoin miner bets in new SEC filing

Miners sell off Bitcoin in 2026

CleanSpark is not alone in selling Bitcoin, as several publicly traded miners have recently liquidated portions of their holdings to fund infrastructure expansion and artificial intelligence data center projects.

Bitcoin miner Riot Platforms said it sold 1,818 BTC in December for about $161.6 million, as part of a strategy shift toward monetizing its power and data center infrastructure, including support for AI workloads. The company reported in January it held 18,005 BTC as of Dec. 31, down from 19,368 BTC a month earlier, after producing 460 BTC during December.

In February, Bitdeer said it had liquidated its entire corporate Bitcoin treasury. The Bitcoin miner reported producing 189.8 BTC during the period, selling the full amount along with an additional 943.1 BTC from its existing reserves.

Core Scientific said during its fourth-quarter earnings call on March 2 that it sold about 1,900 Bitcoin for roughly $175 million in January, reducing its holdings to fewer than 1,000 BTC.

On Thursday, the company said it secured a $500 million credit facility from Morgan Stanley, which it will use to fund infrastructure supporting high-density computing workloads such as AI and high-performance computing (HPC).

Rumors have also circulated about MARA Holdings, the second-largest corporate Bitcoin treasury holder with 53,822 BTC on its balance sheet, suggesting the miner may begin selling its reserves.

However, MARA vice president of investor relations Robert Samuels dismissed the speculation in a post on X on Tuesday, saying the company has not changed its core treasury strategy.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

Crypto World

CLSK sold one of its highest proportions of mined BTC during February.

CleanSpark (CLSK), a U.S.-based bitcoin mining company that operates large-scale data centers, sold almost all the bitcoin it produced last month to generate cash for an expansion into artificial intelligence (AI) and high-performance computing (HPC).

The Nasdaq-listed miner produced 568 BTC in February and sold 553 BTC, roughly 97%, according to its latest operational update. The sales generated about $36.65 million in proceeds at an average price of $66,279 per bitcoin, one of the highest production-to-sales ratios the company has reported.

The sale reflects a broader trend among bitcoin miners pivoting toward AI and HPC, with companies increasingly selling either new production or reducing their balance-sheet holdings to help fund new data center and infrastructure development.

CleanSpark still maintains a sizable treasury. As of Feb. 28, it held 13,363 BTC, with 1,086 BTC pledged as collateral or recorded as receivables related to derivative transactions.

Operationally, the company continues to scale its mining platform. CleanSpark reported 50 EH/s of operational hashrate, roughly 7 percent of the global network’s computing power.

The company also closed on a second Texas campus, adding 300 megawatts of ERCOT approved capacity and bringing its total contracted power portfolio to 1.8 gigawatts.

Crypto World

ETH Rally Toward $2.5K Held Back By Macro, War, DApp Use

Key takeaways:

-

ETH derivatives signal a shift to safety as professional desks hedge against downside risks and global instability.

-

Institutional preference for decentralization keeps Ethereum dominant despite its recent drop in network activity.

Ether (ETH) price dropped by 6% following a brief rally to $2,200 on Wednesday, tracking a downturn in US equities as the war in Iran entered its sixth day. Disruptions to global oil production and Middle East natural gas shipping pushed WTI crude prices to levels not seen since July 2024.

Investors lowered their economic growth outlook as the conflict escalated and moved to a risk-off posture.

Traders’ sentiment was further pressured as the Trump administration faced a legal setback on its import tariffs. A Federal court on Monday rejected a Justice Department request to pause the case for 90 days, effectively striking down the administration’s use of emergency powers for trade levies.

Ether remains caught in this macroeconomic crossfire, which has stifled momentum despite a 22% recovery from the $1,800 retest on Feb. 24. Onchain data and derivatives markets currently reflect significant apathy from bulls.

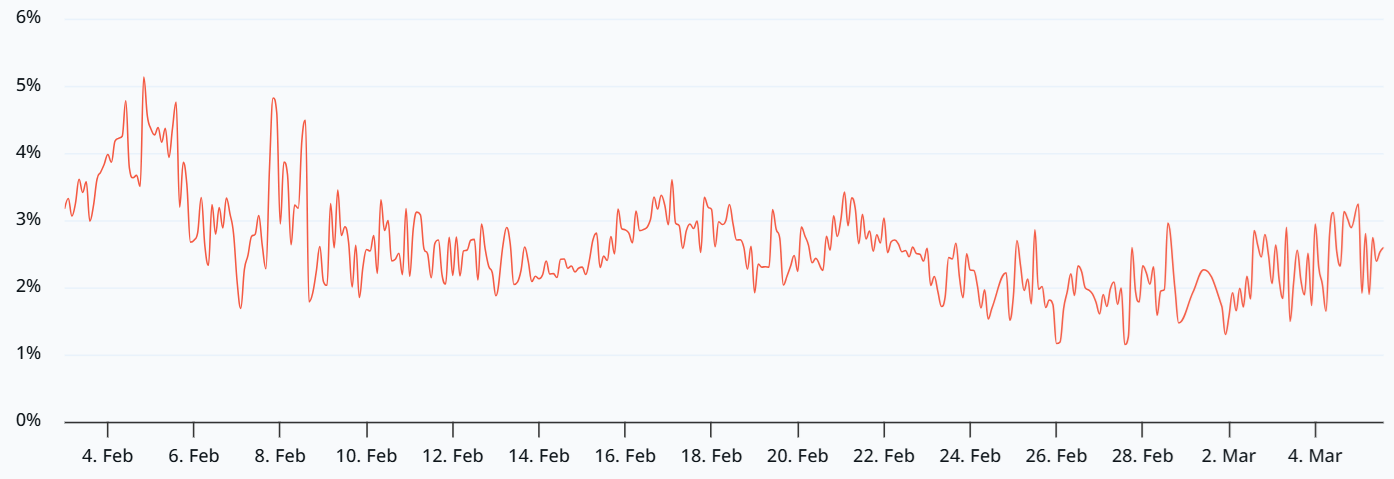

The ETH 30-day futures annualized premium sits well below the 5% neutral threshold, signaling a lack of demand for bullish leverage. However, this metric is weighed down by the fact that ETH trades 58% below its August 2025 all-time high of $4,956. To gauge whether professional desks anticipate further downside, one must analyze the options market.

When whales and market makers seek protection against price drops, the ETH options skew (put-call) typically rises above the 6% neutral mark. Extreme market stress can push this indicator past 15%.

The ETH options skew reached 7% on Thursday after briefly touching neutral levels a day prior. This persistent skepticism among professional traders provides bears with the necessary leverage to fuel further uncertainty. Beyond external macro pressures, including US private credit losses and rising corporate layoffs, Ether continues to face its own idiosyncratic headwinds.

Ethereum is positioned to capture the pickup in DApps demand

Ethereum network activity has stagnated following a modest rally in early February. Consistent demand for blockchain utility remains essential for sustainable ETH price action and reducing inflationary pressure. The built-in burn mechanism of Ethereum depends on competition to enter the validation queue, a process typically fueled by decentralized exchange (DEX) activity.

Weekly DEX volumes on the Ethereum network recently hit $12.6 billion, falling from $20.2 billion one month prior. Decentralized application (DApp) revenues dropped to $14.1 million over seven days, marking a 47% decline from the previous month. Competing blockchains have seen a similar trend, as DEX volumes on Solana also decreased by 50% over the same 30-day window.

Related: Bitcoin trader sees ‘lower soon’ as BTC price starts to erase $74K breakout

Despite the weak onchain metrics, ETH is well-positioned to capture an eventual pickup in DApp activity due to its dominance in total value locked (TVL). When including layer-2 scaling solutions, the Ethereum ecosystem accounts for nearly 65% of the total blockchain market TVL.

Related: 38% of altcoins near all-time lows, worse than FTX crash–Analyst

The Ethereum base layer holds $55.4 billion in TVL, while its leading competitor Solana, accounts for $6.8 billion. This gap serves as evidence of a preference among institutional investors for decentralization over the lower fees and faster user experiences offered by networks like Solana and BNB Chain.

The current weakness in Ether derivatives and onchain metrics does not necessarily signal an imminent price crash. Market sentiment can shift quickly toward a sustained bullish momentum if ETH reclaims the $2,400 level. For the moment, the Ether price remains closely tied to the broader risk-off sentiment, which reduces the odds of a sustainable bullish momentum.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Kraken’s surprise Fed win may harken onslaught of crypto firms with narrow Fed access

The crypto industry keeps knocking down the barriers into the core U.S. financial system, and digital assets exchange Kraken’s approval for a limited Federal Reserve account marked another such milestone that analysts think could be the first of a trend.

The crypto arrival inside the Fed payment system — provisional and limited though it is — has aggravated the traditional banks and injected some confusion in the Fed’s ongoing effort to write policies for how crypto firms are supposed to go about getting limited “skinny” master accounts. But Kraken’s Co-CEO Arjun Sethi said that this development represents “what it looks like when crypto infrastructure matures into core financial infrastructure.”

Kraken’s Wyoming-chartered banking arm, Payward Financial, is granted a year of access to a “limited purpose” account as a “Tier 3” entrant, according to the Federal Reserve Bank of Kansas City, one of a dozen regional banks in the Federal Reserve system.

“We see this as the first of many Federal Reserve approvals for crypto entities to obtain master accounts, which gives them direct access to the central bank payment rails including Fed Wire,” said Jaret Sieburg, a Washington policy analyst at TD Cowen, in a client note on Thursday. “Crypto entity access to master accounts was inevitable under President [Donald] Trump, given his support for the crypto sector. We expect additional announcements in the coming months.”

Ian Katz, an analyst who tracks federal financial policies at Capital Alpha in Washington, echoed that sentiment.

“The Fed’s decision could open the doors for other crypto operations including Circle, Anchorage and Custodia, a Wyoming-based firm that has unsuccessfully sued the Fed over the right to have a master account,” he noted.

What does direct access to the Fed payments systems mean for Kraken?Potentially, according to Sethi: instant “settlement between fiat and crypto, institutional-grade cash management integrated with digital asset custody and programmable financial products built within a fully regulated framework.”

Those who operate traditional banks in the U.S. were displeased with the Kraken development — the latest threat they’ve flagged from the crypto space.

“There are significant risks to expanding direct Fed account access to institutions that operate outside the traditional banking regulatory framework,” the Independent Community Bankers of America said in a statement. “The Fed should continue limiting master account access to institutions that meet the financial services sector’s highest standards.”

But former Kraken CEO and current chairman, Jesse Powell, celebrated the development.

“We’re the bankers now,” the Kraken co-founder posted on social media site X. “Saddle up.”

Other crypto-tied institutions have also sought entry onto the Fed rails, including Anchorage Digital (which has sought a full master account, which would include earning interest on reserves placed with the Fed) and the recent arrival among federally approved trust banks, Erebor Bank. The industry also continues to lobby the Fed on its effort to establish a new policy to replace the 2022 guidance that Kansas City’s Kraken decision was based on.

At the national level, the Federal Reserve board started writing new policies for establishing what are commonly referred to as “skinny” master accounts for firms that don’t need the entire array of traditional master account services. But that process is in the early stages, and if regional Fed banks start approving similar accounts in the meantime, it could create uncertainties about what happens when the new policy is set.

“This action ignores public comment that the Federal Reserve sought on this framework, and it was issued with no transparency into the process for approval or the risk mitigants that have been imposed to address the very significant risks it raises,” the Bank Policy Institute’s co-head of regulatory affairs, Paige Pidano Paridon, said in a statement.

The Fed board in Washington, where the central bank is headquartered, deferred requests for comment this week to Kansas City.

The regional Fed banks, of which there are a dozen throughout the U.S., each operates under its own priorities and management, which can make their decisions uneven on such matters. So it’s uncertain whether the location of the Fed hub — Minneapolis for Anchorage Digital, for instance, and Cleveland for Erebor — will affect their outcomes.

The Kansas City Fed will keep working with firms there “to help ensure that access to the payment system supports a level competitive field and reinforces the stability and resilience that has underpinned the Federal Reserve’s payment system offerings throughout its history,” said President Jeff Schmid.

Crypto World

SEC, Justin Sun reach settlement over Tron lawsuit

The U.S. Securities and Exchange Commission reached a settlement with Tron and founder Justin Sun on Thursday, the SEC said in a court filing.

Under the terms of the settlement, Rainberry Inc., one of the companies associated with the Tron network, will pay a $10 million fine and be barred from future violations of securities regulations. The SEC sued Sun and Tron in 2023, alleging violation of federal securities laws through the sale and airdropping of TRX.

“The remaining claims against Rainberry would be dismissed with prejudice,” the filing said. “The Final Judgment would also dismiss all claims against Justin Sun, Tron Foundation, and BitTorrent Foundation.”

With prejudice means the SEC would not be able to bring a similar case again in future for the same conduct.

“The Commission has reviewed and approved the terms of the settlement, as reflected in the Consent and proposed Final Judgment. Rainberry, Justin Sun, Tron Foundation, and BitTorrent Foundation have consented to entry of the Final Judgment,” the filing said.

The proposed settlement is still subject to a federal judge’s approval.

At the time the SEC, under the leadership of former Chair Gary Gensler, brought a number of lawsuits against crypto firms.

The SEC dropped most of these cases after President Donald Trump retook office last January, mostly under Commissioner Mark Uyeda, the acting chair. The commission is now run by Chairman Paul Atkins.

Sun bought about $80 million worth of World Liberty Financial tokens (WLFI) — the token tied to the company partially owned by Trump and his family — after Trump was reelected in 2024. The SEC’s case against Sun was paused last year, alongside numerous other cases the agency brought against crypto firms.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech16 hours ago

Tech16 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports5 hours ago

Sports5 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial