Crypto World

Uniswap Grabs Early Win as US Judge Dismisses Bancor Patent Lawsuit

A New York federal court has dismissed a patent infringement suit brought by Bancor-affiliated entities against Uniswap, finding that the asserted claims describe abstract ideas that are not eligible for patent protection under US law. Judge John G. Koeltl of the Southern District of New York granted the defendants’ motion to dismiss the complaint filed by Bprotocol Foundation and LocalCoin Ltd. The ruling, issued on February 10, leaves room for the plaintiffs to amend within 21 days; absent a timely amendment, the dismissal would become with prejudice. While the decision represents a procedural win for Uniswap, it does not resolve the merits of the underlying dispute, which centers on whether the decentralized exchange’s technology infringes patented methods for pricing and liquidity.

Key takeaways

- The court applied the Supreme Court’s two-step framework for patent eligibility and determined the challenged claims relate to an abstract concept—the calculation of currency exchange rates for transactions—rather than a patentable invention.

- Even though the patents touch on blockchain-based automation, the judge found no inventive concept sufficient to transform the abstract idea into a patent-eligible application.

- The complaint was dismissed without prejudice, giving Bprotocol Foundation and LocalCoin Ltd. a 21-day window to file an amended complaint addressing the court’s concerns.

- Direct infringement, induced infringement, and willful infringement claims were all dismissed, with the court indicating the plaintiffs failed to plausibly plead that Uniswap’s code contains the patented reserve-ratio features.

- Despite the procedural success for Uniswap, the door remains open for reassertion if the plaintiffs can reframe the allegations to meet the patent-eligibility standard or otherwise articulate a viable infringement theory.

Market context: The ruling sits within ongoing debates over software and business-method patents in crypto, where courts have repeatedly scrutinized whether blockchain-enabled pricing and liquidity mechanisms constitute protectable inventions or abstract financial practices.

Sentiment: Neutral

Market context: The decision comes amid a broader climate in which courts assess blockchain-related claims under established tests for patent-eligibility, potentially influencing how crypto developers approach IP risk and claims enforcement.

Sources & verification: The memorandum opinion and order from Judge Koeltl (Feb. 10); the CourtListener docket for Bprotocol Foundation v. Universal Navigation Inc.; Hayden Adams’ X post reacting to the decision; the original Bancor-Uniswap patent dispute coverage and filings cited in the referenced materials.

Why it matters

The court’s analysis reinforces the notion that merely applying a conventional pricing algorithm within a blockchain framework may not suffice to render a claim patentable. By characterizing the disputed concepts as abstract ideas tied to currency exchange calculations, the ruling underscores the enduring legal distinction between mathematical formulas and patent-eligible tech implementations, even when those implementations run on decentralized networks. For Uniswap (CRYPTO: UNI), the decision protects the platform from an immediate patent-ownership challenge rooted in fundamental pricing logic that was already broadly implemented across digital asset exchanges.

From Bancor’s perspective, the dismissal—without prejudice—creates a strategic opening. The plaintiffs can attempt to adjust the pleading to address the court’s concerns, potentially reframing the claims to emphasize an “inventive concept” or to articulate a more concrete, non-abstract application tied to a particular technology environment. The outcome may influence later filings against other DeFi protocols if claim language can be refined to meet the legal standard, especially in cases where developers claim that specific programmable constraints or reserve mechanisms are patentable because they are uniquely tied to a given protocol.

Beyond the parties involved, the decision signals how the U.S. patent system balances the protection of crypto innovations against broad, abstract financial techniques. While it does not close the door on all IP actions in DeFi, it does remind developers and litigants that the mere use of blockchain infrastructure or smart contracts does not automatically render a broad abstract idea patent-eligible. The landscape remains nuanced, with the potential for future rulings to alter how similar claims are framed and prosecuted.

https://platform.twitter.com/widgets.js

The immediate post-decision commentary from Uniswap founder Hayden Adams, who publicly celebrated the outcome, reflects the high-stakes nature of these disputes for open-source, community-driven projects. Adams’ brief social post—“A lawyer just told me we won”—highlights how patent battles intersect with developer culture and the public perception of DeFi innovation.

What to watch next

- Whether Bprotocol Foundation and LocalCoin Ltd. file an amended complaint within 21 days, and how the revised claims address the court’s abstract-idea reasoning.

- Any subsequent court rulings that interpret or apply the “inventive concept” standard to parallel DeFi patent cases, potentially shaping future strategy for both plaintiffs and defendants.

- Whether additional documents—such as claim charts or technical specifications—emerge to support allegations of infringement tied to Uniswap’s protocol code.

- Possible settlements or alternative dispute-resolution steps if parties seek to narrow the dispute without protracted litigation.

Sources & verification

- Memorandum opinion and order by Judge Koeltl, February 10, Southern District of New York.

- CourtListener docket: Bprotocol Foundation v. Universal Navigation Inc. (docket page cited in filing history).

- Hayden Adams’ X post reacting to the ruling.

- Bancor’s patent infringement allegations against Uniswap as documented in prior coverage.

What the ruling changes for DeFi and IP strategy

Uniswap’s procedural win reinforces the importance of framing crypto innovations in terms of concrete technical improvements rather than broad economic practices. For developers, it underscores the need to articulate how a protocol’s specific architecture—beyond generic pricing formulas—contributes a novel, non-obvious technical solution. For plaintiffs, the decision emphasizes the necessity of tying claims to verifiable technical embodiments, such as particular code features or protocol configurations, that clearly differ from ordinary market operations.

What to watch next

Going forward, observers will closely track whether a revised complaint could survive the patent-eligibility hurdle and, if so, how the court will evaluate whether a claimed feature meaningfully transforms an abstract idea into patent-eligible subject matter. The interplay between public blockchain code and patented concepts is likely to remain a focal point as more DeFi projects navigate IP risk in a rapidly evolving regulatory and judicial environment.

Rewritten Article Body

Judicial decision reframes patent-eligibility in a DeFi dispute between Bancor-affiliated plaintiffs and Uniswap

In a decision that foregrounds the ongoing jurisprudence around crypto patents, a New York federal court ruled that Bancor-affiliated plaintiffs’ claims against the Uniswap ecosystem are directed to abstract ideas rather than concrete, patentable inventions. The Southern District of New York, applying the Supreme Court’s two-step framework for patent eligibility, concluded that the core concept—calculating currency exchange rates to facilitate transactions—lacks the inventive concept required to qualify for patent protection. The ruling focuses on US patent law’s limits, not on the operational legitimacy of Uniswap’s decentralized exchange (Uniswap), which remains a foundational player in the DeFi space.

The plaintiffs—Bprotocol Foundation and LocalCoin Ltd.—had alleged that Uniswap’s protocol infringed patents tied to a “constant product automated market maker” mechanism that underpins many liquidity pools on decentralized exchanges. The court’s analysis rejected the argument that merely implementing a pricing formula on blockchain infrastructure could overcome the abstract-idea hurdle. In its view, the use of existing blockchain and smart contract technologies to address an economic problem does not constitute a patentable invention. The court emphasized that limiting an abstract idea to a particular technological environment does not convert it into patent-eligible subject matter, and it found no further inventive concept that would transform the abstract idea into patentable territory.

Crucially, the memorandum explained that the asserted claims cover the abstract idea of determining exchange rates for transactions rather than a specific, novel technical improvement. The court highlighted that “currency exchange is a fundamental economic practice,” and that the claimed method amounted to nothing more than a mathematical transformation performed in a blockchain-enabled setting. The decision expressly notes that merely asserting a mathematical formula within a decentralized framework does not, by itself, generate eligibility. The ruling also rejected arguments that a particular linkage to reserve ratios in Uniswap’s code or ecosystem would rescue the claims from the abstract-idea category.

Beyond the abstract-idea assessment, the court dismissed the infringement theories levelled by the plaintiffs. It found that the amended complaint failed to plausibly plead direct infringement—specifically, that Uniswap’s publicly available code embodies the claimed reserve ratio constants. Claims of induced and willful infringement were likewise dismissed, with the court stating that the plaintiffs did not credibly show that Uniswap’s team had knowledge of the patents before the lawsuit was filed. The dismissal was without prejudice, preserving the option for the plaintiffs to file an amended pleading that could address these shortcomings.

The decision came with a notable public response: Hayden Adams, the founder of Uniswap, took to X to acknowledge the outcome, signaling a morale boost for developers and teams operating in the open-source DeFi space. The public posting underscored the practical impact of court rulings on the culture and momentum of decentralized finance development.

The procedural posture of the case remains in flux. While Uniswap’s legal team secured a favorable procedural ruling, the case is not over. The plaintiffs have 21 days to amend their complaint; failure to do so would convert the dismissal into one with prejudice, effectively ending the action barring any new claims. If Bancor and LocalCoin elect to proceed with an amended filing, the court will scrutinize whether the revised claims meet the patent-eligibility standard and sufficiently articulate any alleged infringement in a way that satisfies the pleading requirements set forth by the court.

In the broader context, the decision contributes to a growing body of decisions that caution against overbroad or abstract patent claims in the crypto and DeFi space. It reinforces the premise that software-driven financial concepts—however novel in a blockchain setting—must advance a concrete technical improvement to clear the patent bar. The outcome also signals that, for now, DeFi projects focusing on open, interoperable codebases may enjoy a degree of protection from aggressive patent assertions based on abstract pricing ideas, at least until a more precise standard for crypto-specific technology claims emerges in the courts.

Crypto World

New Berkshire Hathaway CEO still talks with Warren Buffett nearly every day

Berkshire Hathaway CEO Greg Abel said he still speaks with Warren Buffett nearly every day, underscoring the continued presence of the legendary investor at the sprawling conglomerate, even after handing over the top job at the start of the year.

Buffett, who stepped down as CEO after more than six decades at the helm, remains chairman of the Omaha-based company and continues to come into the office regularly, Abel said.

“He’s in the office every day, so we’re talking every day if I’m in Omaha, we’re always connecting,” Abel said on CNBC’s “Squawk Box” Thursday. “If I’m traveling, like I was yesterday, I often check in just to catch up on what he’s seeing, what he’s hearing, what am I feeling. So if it’s not every day, it’s every couple days.”

Abel also acknowledged the challenge of stepping into Buffett’s role as Berkshire’s chief communicator to shareholders, particularly when writing his first annual letter to investors.

“The shoes to fill are tough on all fronts, but Warren is an exceptional communicator,” Abel said. “It was not easy. I’ve told Warren, ‘listen, the responsibilities transferred are great, but as far as the work and the task I had to do, that was the toughest.’”

Abel used the letter to shareholders to outline a clear framework of foundational values centered on financial strength and disciplined investing, vowing to preserve the blueprint Buffett carefully orchestrated since the 1960s.

Buffett offered little comfort, Abel added with a laugh. “When we were discussing it, he said, ‘the second letter doesn’t get any easier.’”

On investing, Abel said Berkshire is unlikely to move into cryptocurrencies, echoing Buffett’s longstanding skepticism of the asset class.

“I don’t think you’ll see crypto … I just don’t see it,” Abel said.

He left the door open to investments tied to technology, however.

“What I do see is that when it comes to technology, even from an operational perspective, where we’re seeing how we use it, the impact it’s having, it does allow us to develop strong views and a better knowledge base around certain companies that are technology companies, or how we’re using the technology. So technology will always be on the table,” Abel said.

Crypto World

ETH, XRP, ADA, BNB, and HYPE

This Thursday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

Ethereum (ETH)

With $2,000 support secured, Ethereum has a good shot at testing the $2,400 resistance in the near future. This also allowed the price to close the week with a 2% gain.

The current PA shows a clear reversal pattern, with a bullish engulfing candle indicating buyers are back in control. To secure their dominance, they will need to break above $2,400 as well.

Looking ahead, the most important resistance on the chart is found at $2,800. Thus, bulls may be able to keep Ethereum in a rally until then. Once there, sellers could return in force.

Ripple (XRP)

XRP turned bullish this week and reclaimed the $1.4 support level. While the price fell by a modest 2% compared to last week, the recent buying spree sends a strong bullish signal to market participants.

The most important resistance point is at $1.6, which will need to become support if buyers want to keep XRP in a sustained uptrend. Any weakness there will quickly be exploited by sellers.

Looking ahead, after a prolonged downtrend, this cryptocurrency is finally giving signs that the selloff may be behind us and a recovery is likely.

Cardano (ADA)

Cardano had a difficult start this week, falling by 7%. Buyers tried multiple times to reclaim the support at 28 cents, but each time they were rejected, including this week. This is a sign of weakness.

As long as ADA keeps failing to move above 28 cents, it is unlikely for any bullish momentum to form. Should selling intensify, the price may fall to 24 cents again, as it did earlier this year.

Looking ahead, this cryptocurrency is in a tough spot. While most altcoins are giving signs of a reversal, Cardano still lags behind its peers. Hopefully, this will change soon and push the price back into an uptrend.

Binance Coin (BNB)

Binance Coin moved higher by 4% this week after buyers defended the $580 support well. Their current target is the resistance at $690, which may be challenging to break through, given the previous price action.

Even if sellers attempt to defend the current resistance, bullish momentum is intensifying and may be enough to drive a quick relief rally towards $900.

Looking ahead, BNB has a clear shot at a rally in the weeks to come, considering that since late 2025, the price has been in a downtrend. A sustained rally appears likely and may be quite significant.

Hype (HYPE)

HYPE closed the week 12% higher and reclaimed a price above the key $30 support. As long as the price holds above this level, the bulls have the upper hand, and they may aim to break the resistance at $36 next.

While the momentum is bullish, there is a bit of lag since the price moved above $30. This should not last long since it would encourage sellers to return and put pressure on that support again.

Looking ahead, HYPE needs to break the $36 resistance to maintain a bullish bias in the coming weeks. Hopefully, buying volume will increase to sustain the current move into higher highs.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Cardano Gets Real-World Checkout Rails in 137 Swiss Spar Stores

Supermarket giant Spar has enabled ADA payment rails for customers in 137 Swiss stores, as the country moves closer to its global crypto hub ambitions.

Switzerland’s push as a crypto-friendly hub is getting a new retail test case, with Cardano’s ADA token now usable for grocery purchases at Spar stores across the country.

Cardano (ADA) users can start paying for their groceries in 137 Spar supermarkets across Switzerland after the latest Open Crypto Pay integration from Swiss fintech firm DFX.swiss, the Cardano Foundation said Thursday.

The system is designed to process transactions in real time and allow payments directly from ADA wallets without routing through a centralized exchange. For merchants, Open Crypto pay reduces transaction costs by about two-thirds compared to traditional cards, according to the announcement.

Frederik Gregaard, the CEO of the Swiss-based Cardano Foundation, called the development the “beginning of a fundamental shift in how value moves through society,” which marks the blockchain industry’s transition from an experimental phase to “genuine financial transformation.”

Spar first rolled out nationwide crypto and stablecoin payments in Switzerland in August 2025 for 100 stores via Binance Pay and DFX.swiss, with plans at the time to extend to 300 stores.

Related: Switzerland delays crypto tax info sharing until 2027

Tether, Lugano commit $6.4 million to global crypto hub ambitions

Separately, on Tuesday, Tether and the city of Lugano committed 5 million Swiss francs ($6.4 million) to a second phase of the city’s Plan B forum between 2026 and 2030, which aims to make Lugano a “global hub for digital asset infrastructure.”

Lugano has already allowed residents to pay certain municipal fees in Bitcoin (BTC) and USDt (USDT) as part of an effort to embed digital assets into the local economy.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Stellar (XLM) drops 3.5% as nearly all assets decline

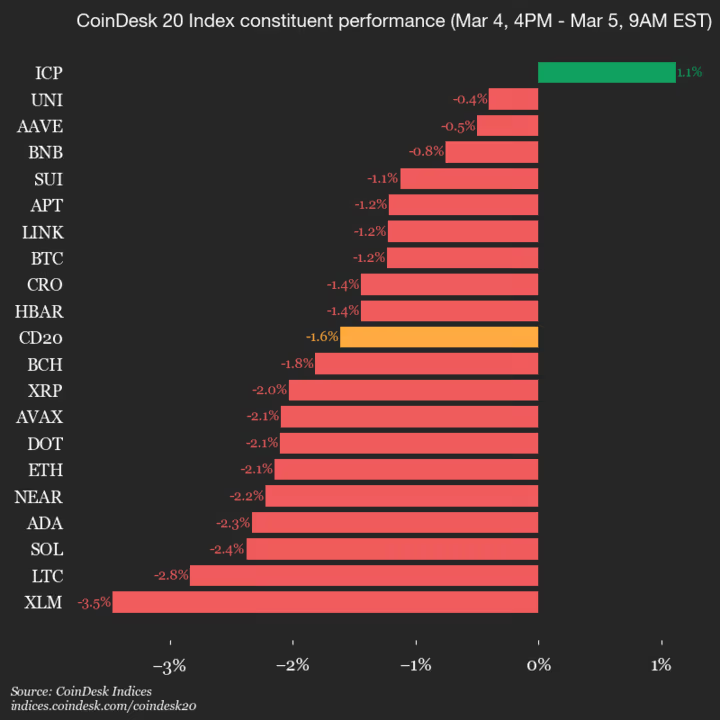

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2064.51, down 1.6% (-33.92) since 4 p.m. ET on Wednesday.

One of 20 assets is trading higher.

Leaders: ICP (+1.1%) and UNI (-0.4%).

Laggards: XLM (-3.5%) and LTC (-2.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

4 Bitcoin Charts Show BTC Price Forming a Bottom

Bitcoin has cooled from its all-time high and is tracing a defined range, yet several technical signals point to a potential bottom and a renewed ascent. The asset remains roughly 42% below its peak of around $126,000, with price action compressing in the $60,000 to $72,000 zone. After a dip to $60,000 on Feb. 6, Bitcoin rallied to a 30-day high near $74,000 and has since pulled back to about $72,500. Analysts describe the formation as an Adam-and-Eve bottom on shorter timeframes, while the BTC-to-gold ratio tests cycle-support levels, suggesting that risk-off pressures could be easing as buyers accumulate near critical supports. For context and data, traders often reference market pages like the Bitcoin price hub.

Key takeaways

- Bitcoin is potentially forming an Adam-and-Eve bottom on shorter timeframes, signaling a trend reversal.

- The BTC-to-gold ratio is revisiting cycle-low territory, a pattern historically associated with bottoming conditions.

- BTC has retested a multi-year trend line that has marked bear-market bottoms in prior cycles, bolstering the case for support validity.

- Price action has produced a breakout above the $70,000 neckline, but sustained strength above that level is required to confirm a new uptrend.

- Analysts emphasize that a meaningful recovery would depend on a slowdown in profit-taking and a clear break above nearby resistance zones.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: In a market shaped by liquidity cycles and shifting risk appetite, BTC’s path remains tethered to whether key support holds and whether demand resumes near pivotal levels. Observers watch macro cues, on-chain signals, and the pace of price action around the breakout threshold at $70,000 to gauge the durability of any potential reversal.

Why it matters

The emergence of a potential bottom could recalibrate sentiment among both retail and institutional participants. If the pattern holds, traders may eye renewed liquidity and interest as Bitcoin challenges the upper end of the current range, potentially paving the way for a sustained rally rather than another extended consolidation phase.

Patterns like Adam-and-Eve bottoms historically precede meaningful upside, especially when a neckline break is supported by a convincing close above resistance. The confluence of a rising pattern on shorter timeframes and a test of a longer-term trend line suggests that bulls could gain traction if buying pressure persists through the next few sessions.

However, the market remains wary. Even with a break above the neckline, a lack of momentum or renewed selling could reassert the bear narrative, keeping BTC tethered to a broad range. In such a scenario, on-chain activity, volatility regimes, and macro developments would play a decisive role in testing whether a bottom is truly in or merely forming a temporary floor.

What to watch next

- Monitor BTC price action around the $70,000 level and observe whether price closes above that benchmark on consecutive daily candles.

- Watch the BTC-to-gold ratio for signs of a sustained move away from cycle lows, which could corroborate a broader risk-on shift.

- Assess momentum indicators, including RSI and MACD, for confirmation of a trend reversal and a shift in buying pressure.

Sources & verification

- BTC price action: bottom near $60,000 on Feb. 6, followed by a rally to around $74,000 and a retracement to roughly $72,500, with a breakout above $70,000 on the neckline observed in the wake of the pattern.

- Adam-and-Eve bottom concept and related analysis, including commentary on the evolving pattern on shorter timeframes.

- Bitcoin-to-gold ratio studies showing a 13-month downtrend and cycle-low considerations, with historical context from bear-market bottoms in prior cycles.

- TradingView data illustrating BTC’s approach to a multi-year trend line that has marked previous bottoms in 2018 and 2022.

Market reaction and key details

Bitcoin (CRYPTO: BTC) has moved through a landscape defined by volatility, where a wraparound of support and resistance levels often decides whether a mid-range rebound matures into a sustained rally. The asset’s rebound from a $60,000 floor—achieved on Feb. 6—to a 30-day peak near $74,000 demonstrates a resilient bid that could underpin further gains if buyers maintain price discipline around the $70,000 mark. A break above that neckline, followed by a stable daily close, would be the clearest evidence that the bottom formation is taking hold. Analysts who track the 12-hour charts have highlighted the ongoing Adam-and-Eve bottom as a bullish reversal flag, albeit with the caveat that the pattern’s success hinges on demand persistence rather than mere technical breadth.

On-chain dynamics and cross-asset signals add further texture. The BTC-to-gold ratio has been trending lower for about 13 months, a drift that has historically coincided with macro risk-off shifts and liquidity constraints. Yet, when BTC eventually resumes price discovery, the pattern often aligns with renewed appetite for risk assets, as observed in prior bear-market troughs. The pattern’s proponents argue that BTC’s relative weakness against gold in recent months could be indicative of a mispricing correction that unfolds once the downtrend exhausts itself. In the same vein, the macro setup—characterized by bouts of volatility and cautious positioning—has kept traders vigilant for a decisive breakout above key thresholds. A noteworthy observation from market participants is the alignment between the neckline break at $70,000 and the subsequent penetration of the trend line that has historically signaled deeper bottoms in Bitcoin’s history.

Further confirmation comes from market observers monitoring the broader technical matrix. TradingView data show Bitcoin retesting a multi-year support trend line on a monthly basis, a move that has preceded recoveries in past cycles. Several traders have spoken to the idea that a retest, if followed by a confirmed bounce, could catalyze a renewed upside phase. In a recent post, a market analyst noted that if history repeats, the price could stage a meaningful upside after a successful test of the line, a thesis that has driven cautious optimism among some market participants. Others have highlighted that even with a robust breakout, sustained upside requires more than a single bullish candle; it demands sustained conviction across price action, volume, and on-chain metrics.

As with any market-sensitive analysis, caution remains warranted. A breakout above $70,000 is a necessary step, but not a promise of a new long-term bull run. The narrative hinges on many moving parts: the tempo of profit-taking, the depth of liquidity, the strength of macro cues, and unseen catalysts such as regulatory developments and institutional participation. The tension between optimism around a bottom and the risk of renewed volatility is likely to define the near-term trajectory. For now, traders will be watching whether the price can hold above the critical zone and whether the longer-term trend line can serve as a reliable anchor for continued upside in the weeks ahead.

Related analyses and ongoing coverage continue to emphasize that the interplay between chart patterns, cross-asset signals, and macro conditions will determine whether Bitcoin transitions from a corrective phase into a more durable upcycle. As always, readers are encouraged to verify the situation across multiple data sources and to monitor official statements and market-moving events that influence sentiment and liquidity in the space.

Crypto World

CORZ secures up to $1 billion loan facility from Morgan Stanley

Core Scientific (CORZ), the Texas-based digital infrastructure provider, has secured up to $1 billion in strategic financing from Morgan Stanley to support the development of its data center infrastructure.

The company announced the initial closing of a $500 million 364-day loan facility, with an accordion option that could expand total commitments by another $500 million, subject to standard conditions. Borrowings under the facility will carry interest at the Secured Overnight Financing Rate (SOFR), plus 2.50%.

According to CEO Adam Sullivan, the additional capital will allow the company to move faster on projects approaching service readiness, helping it better meet growing customer demand.

Core Scientific plans to use the funds for general corporate purposes tied to data center development. This includes equipment purchases, early-stage project costs, land acquisitions, and securing additional energy supply agreements needed to power future facilities.

This comes just days after Core Scientific’s Q4 earnings, during which the company disclosed that it sold $175 million worth of bitcoin as it pivots toward AI infrastructure.

Shares of Core Scientific were down around 1% in pre-market trading on Thursday.

Crypto World

Solana Price to Break Soon? $95 Is the Level to Watch

Solana (SOL) is approaching another important level that could point to an explosive price prediction. SOL is trading near $91.70 at the time of writing, up around 3% in the past 24 hours. The token is up roughly 6% over the last week.

The broader picture remains stressful. Solana is still about 11% lower over the past month and nearly 70% below its January 2025 all-time high of $293.31.

Meanwhile, derivatives activity is picking up. CoinGlass data shows trading volume dropping 3% to $16.4 billion, while open interest climbed 2% to $5.37 billion.

Additionally, on March 4, Solana ETF inflows hit $19.06 million, according to SoSoValue. This suggests institutions are accumulating right now, opening new positions as price approaches a key decision zone.

Discover: The best new cryptocurrencies

Solana Price Prediction: Why $95 Is the Level Everyone Is Watching

The $95 price is now the key level. Looking at the move from the $120 swing high to the $80 low, the 38.2% to 50% Fibonacci retracement sits exactly near $95. That area often acts as the first major resistance during recovery rallies, and the market appears to be respecting it.

It also has structural weight. The $100 range represented a key support level during the March 2025 crash. It now appears to have flipped to resistance, but successfully recapturing during a market-wide rally could flip it back to support.

RSI has long recovered from oversold and is now slightly above 50, reflecting growing momentum. If it stalls there, sellers could regain control. A 24-hour trading volume of just over $6 billion on the rebound has also been moderate, suggesting this move may still be a corrective bounce rather than a full reversal.

If SOL breaks and holds above $95, the next upside zone opens around $105 to $110. This would align with a more bullish Solana price projection targeting local range highs.

However, if price rejects again here, focus quickly shifts back toward $85. A loss of that support level would expose the recent lows near $80, invalidating the current recovery attempt.

In the mid-to-long-term, there’s sticky resistance ahead, located around the $200 and $275 levels. Clearing this would line Solana up to challenge its ATH, opening the possibility to a summer spent in price discovery mode.

Ultimately, in spite of all the negative market noise, things are looking bullish for Solana in many respects. The network has an early lead on the likely soon-to-be-massive sectors of stablecoins and real world asset (RWA) tokenization.

In the latter department, asset managers Franklin Templeton and BlackRock have started leveraging the network for its tokenization capabilities.

Discover: The next crypto to explode

The post Solana Price to Break Soon? $95 Is the Level to Watch appeared first on Cryptonews.

Crypto World

What’s the Most Likely Scenario for BTC After Reclaiming $70K

Bitcoin has bounced hard after the liquidation washout in February and is trying to rebuild a short-term uptrend. The asset is now pushing into a heavy resistance band where the last breakdown started, so this move looks more like a recovery leg inside a broader corrective structure than a clean trend reversal.

The key question is whether buyers can turn this squeeze into sustained demand or if it stalls where trapped holders are waiting to sell.

Bitcoin Price Analysis: The Daily Chart

On the daily timeframe, BTC has rallied from the major demand area around $60,000 toward the $72,000 to $75,000 resistance zone. It lines up with the lower part of the previous distribution range and sits just below the declining 100-day moving average, which still caps the medium term trend to the downside.

The price has also climbed back to the upper band of the falling channel that has guided the downtrend since late last year, so this area is where analysts usually ask if the move is just a relief rally or the start of a larger base. A daily close above this resistance cluster and a clean breakout of the channel would be the first real signal that sellers are losing control, and that a new bullish market is in the making.

BTC/USDT 4-Hour Chart

On the 4-hour chart, the drop from early February has turned into a broad consolidation inside a symmetrical triangle that was broken upward in the past few days. The price squeezed out of the contracting range and ran straight into the upper green zone, where it is now moving sideways under roughly $73,000 to $75,000.

The 4-hour RSI is in the strong region and has reached the overbought zone after a sharp vertical leg, which often leads to either a pause or a short-term pullback before any further push higher.

Yet, as long as Bitcoin holds above the broken triangle and the bullish imbalances formed around $70,000, the path of least resistance stays toward a retest of the upper resistance, but a failure back inside the old range would warn that the breakout was mainly a squeeze, and that more downside is probable.

Sentiment Analysis

Bitcoin funding rates across futures exchanges flipped deeply negative during the recent consolidation after the crash, and have stayed mostly below or around zero even while the price bounced. This indicates that many traders are paying to hold short positions into the lows and are now being forced to cover as the market moves against them, which fits the idea of a squeeze-driven rebound rather than a pure fresh spot demand.

The fact that funding is only slowly creeping back toward neutral shows that there is still caution and even residual bearish positioning in the derivatives market.

If this rally continues while funding remains modest, it suggests the move is being supported by real buying and unwinding of crowded shorts, but if funding spikes positive quickly near resistance levels, it would signal that late longs are chasing and that the risk of another shakeout is rising.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Is XRP’s Bottom In? The Answers Were Promising

The conclusion was quite bullish, indicating that XRP could be on its way to a massive price reversal soon.

The broader scale shows that Ripple’s cross-border token has been quite volatile ever since the current cycle began after the US presidential elections in late 2024. At the time, it traded at around $0.60, but exploded to match its 2018 all-time high by January 2025 and eventually broke it in July, setting a new one at $3.65.

The bears took control in the following months, and XRP plunged below $3.00 and $2.00 by the end of the year. After a brief surge to $2.40 on January 6, the asset resumed its downtrend and plunged to a 15-month low on February 5 at $1.11 (on most exchanges).

It reacted well to this decline and even challenged the $1.65 resistance a few weeks later, but to no avail. Although it was stopped there, it still trades at around $1.45 as of press time, which is 30% higher than its local low seen a month ago. Given the resurgence of the crypto market over the past several days, the question now is whether XRP has already bottomed out and, if so, what its next targets are.

ChatGPT Says…

To gain some perspective, we consulted three of the most utilized AI chatbots, starting with OpenAI’s solution. It noted that XRP found solid support at the “panic low” of $1.10-$1.15, and its ability to rebound decisively should encourage the bulls. It now trades above another significant structural support located at $1.30-$1.35, which should be a proper line of defense if there’s another leg down.

It placed the odds for a “bottom is in” scenario at 50%, saying that if $1.30 holds and crypto sentiment continues to improve, the cross-border token could be on its way to reclaim the first obstacle on its path to redemption at $1.65. If broken, the next target would be the psychological $2.00 line, followed by the January $2.40 peak.

“XRP could reach $2.50-$3.00 within 6-12 months if the crypto market enters a new expansion phase,” ChatGPT predicted.

In addition, it gave a 30% chance that XRP is currently in a long accumulation phase, which would mean trading within a tight range between $1.20 and $1.90 for the next up to 9 months. The bearish scenario (20%) is the least likely for now, ChatGPT added, and another drop to and below $1.10 is not overly expected unless there’s a major black swan event.

Gemini and Grok – Do You Agree?

Gemini’s short answer supported ChatGPT’s belief, saying, “It is highly likely that the $1.11 local bottom is in.” It indicated that higher lows are holding now after that flash crash, even though the asset was stopped at $1.65.

You may also like:

Grok also weighed in on the matter, and it had a similar opinion. However, it outlined some of the recent key developments within the Ripple ecosystem that could further boost the underlying token. One of the latest was a major adoption move as the US Depository Trust and Clearing Corporation (DTCC) added Hidden Road Partners CIV US LLC to its NSCC Market Participant Identifiers directory.

This meant that the NSCC update allowed Ripple Prime to route institutional post-trade volumes directly onto the XRP Ledger. Grok added that if these moves continue and impact XRP, the asset could target $2.00-$2.15 in the near term and $2.80-$3.30 by the end of the year.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Global X says double down on emerging markets

It may be time to dive deeper into the emerging markets trade.

Despite risks tied to the war with Iran, Global X ETFs’ Malcolm Dorson points to weaker dollar trends and uncertainty at home as a tailwind for the group.

“It might be time to double down,” the firm’s senior portfolio manager told CNBC’s “ETF Edge.”

He expects a burst of U.S. war spending will soften the greenback, which jumped this week, and create a favorable backdrop for emerging markets.

When asked about whether the dollar’s near-term strength could stick, Dorson responded, “for sure.”

However, it’s not his base case.

“A lot of people are trying to say this is going to be over in a week or two. We’re not sure,” he said. “However, I do think there are a lot of reasons to take advantage, to buy the dip here [in emerging markets.]”

As of Wednesday’s market close, the iShares MSCI Emerging Markets ETF (EEM) is off more than 5% week to date. It’s still up almost 37% over the past year.

VettaFi’s Cinthia Murphy also sees advantages by putting money to work abroad and finds investors have grown accustomed to geopolitical noise.

“There is no question that international has been the flavor of the year,” the firm’s director of research said.

Murphy indicates energy is the area to watch if the Iran conflict becomes prolonged.

“European markets are super dependent on energy and oil coming out of the Middle East,” she said. “So, I think it could really shake things up a lot.”

Murphy listed the United States Oil Fund (USO) as a potential way to play energy. It’s up 12% so far this week and up 32% this year, as of Wednesday’s close.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech8 hours ago

Tech8 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes