Crypto World

Veteran Analyst Says Bitcoin is Dead, But Long Live Crypto

Bitcoin’s long-held narrative as a safe haven and digital gold is under scrutiny, as veteran analyst Ran Neuner, among others, questions the pioneer crypto’s future.

Experts outline why Bitcoin may no longer serve the role it once claimed, and why the broader crypto ecosystem could be on the brink of a new era.

Sponsored

Bitcoin’s Store-of-Value Thesis Faces Crisis as Crypto Evolves

Despite a weakening US Dollar and mounting global uncertainty, Bitcoin underperformed expectations as a hedge against fiat debasement.

The US Dollar Index (DXY) fell roughly 9% in 2025, and another 2% year-to-date in 2026, yet Bitcoin declined 20–22% YTD, trading for $68,255 as of this writing. Gold, by contrast, surged, proving resilient in risk-off scenarios.

“When tariffs, currency tension, and fiscal instability hit, this was the moment Bitcoin was supposed to behave like a store of value. Instead, capital ran to gold,” wrote analyst Ran Neuner.

Analysts, including Willy Woo and Henrik Zeberg, reinforce this view, highlighting that Bitcoin behaves as a high-beta, risk-on asset rather than a safe haven.

Bitcoin’s ideological allure appears to be fading. Retail participation has reached multi-year lows, and early evangelists have largely exited the market.

Sponsored

“We fought for ETF approval. We fought for institutional access. We wanted it inside the system. Now it is. There is nothing to fight for anymore…If it’s not used as cash, and it didn’t meaningfully absorb the stress bid, then what exactly is the narrative?” Neuner said, describing the post-ETF era as a turning point.

Institutional Access Achieved, But at a Cost

With 11 spot Bitcoin ETFs approved, corporate treasuries holding large allocations, and pro-crypto regulatory frameworks in place, Bitcoin has fully integrated into TradFi systems.

Michael Burry warned that this shift exposes companies holding BTC to significant value erosion if markets continue to correct:

Sponsored

“BTC has failed as a safe haven like gold and behaves more like a volatile stock tied to the S&P 500,” SwanDesk reported, citing Burry.

Crypto’s Next Phase: AI and Machine-Native Finance Amid Narrative Shift

Neuner sees the future not in Bitcoin’s store-of-value thesis, but in the emerging economy powered by AI agents.

Trillions of autonomous microtransactions will require instant, programmable settlement rails, a need that blockchain networks are uniquely positioned to serve.

“AI agents won’t use banks. They won’t use credit cards. They’ll need instant, programmable settlement rails. That’s crypto,” he said.

Sponsored

While Bitcoin struggles to retain its original purpose, broader crypto infrastructure could become the foundation for the next digital economy.

Analysts suggest that even if Bitcoin bled to death, decentralized networks, altcoins, and blockchain-based solutions may capture real utility and revenue models in the AI-driven era.

Neuner’s assessment highlights a critical turning point for crypto. Bitcoin may no longer be the ideological engine it once was, but the industry’s potential extends far beyond a single token.

Crypto World

XRP ETFs Record $1.4 Billion Inflows Despite Market Volatility

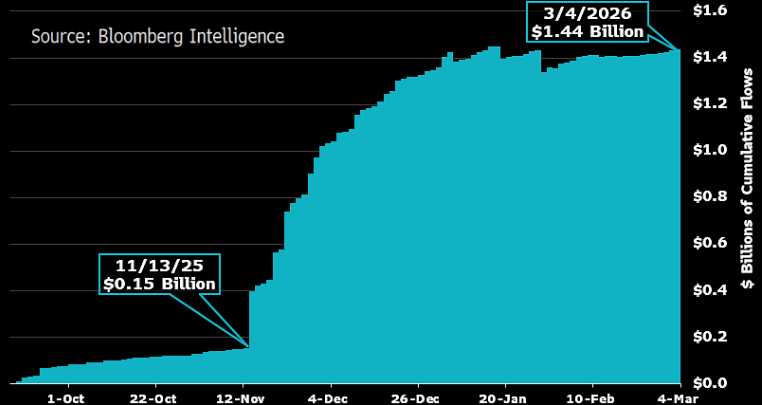

Exchange-traded funds (ETFs) tracking the cryptocurrency XRP have attracted approximately $1.4 billion in cumulative inflows since their launch, according to recent data from analysts at Bloomberg Intelligence. The figures suggest sustained investor interest in XRP-based investment products despite ongoing volatility across the broader digital asset market.

XRP ETFs Attract Investors Despite Market Volatility

According to data provided by analyst James Seyffart, capital has been slowly draining into XRP-oriented ETFs since their launch. This is due to the fact that the inflows have continued despite the variation in price on the altcoin, indicating a steady institutional demand.

According to market observers, the ETFs provide an institutional investor with a regulated way of gaining exposure to digital assets without having to hold the cryptocurrencies themselves. Consequently, asset managers and other large institutions have become more and more familiar with ETFs as a vehicle to gain exposure to crypto.

This milestone of $1.4 billion was reached at a time when the XRP had been experiencing price adjustments in the general cryptocurrency market. Generally, decline in the asset prices may lower the inflows of investors, but the XRP based ETFs have registered positive fund flows.

Analysts observe that the ETF structure is mostly appealing to long-term investors who can see price declines as possible buying points. Such strategies are widely used among asset managers and institutional investors who tend to consider short-term fluctuations as a longer investment period.

ETFs Expand Regulated Access to Cryptocurrency Investments

ETFs have emerged as one of the most visible financial products that enable investors to be exposed to cryptocurrencies in regulated financial markets. Through traditional investment brokerage accounts, investors are able to buy or sell crypto-linked investments without buying and holding digital tokens.

In the case of XRP, an increase in the number of ETF products may greatly increase market inclusion, especially among those investors who are more comfortable with traditional financial instruments, as opposed to managing actual crypto trading.

The long-term inflows into XRP-bound funds might indicate the increased trust of institutional investors in the cryptocurrency industry. Analysts often view ETF inflows as a long-term demand in new asset classes.

Should the trend persist, analysts believe that ETF demand will become one of the most important metrics to look at as far as future performance and institutional adoption of XRP are concerned.

Crypto World

Bitcoin Nears Gold: An Opportunity Within Risk

Bitcoin’s long-run price relationship with gold is flashing a bullish signal after a retracement that mirrors levels seen in 2017, 2022, and 2023. The BTC–gold ratio has begun to show strength in tandem with a bullish divergence on the daily RSI, a setup that traders watch as a potential pivot from risk-off to risk-on sentiment. Analysts describe the moment as an “opportunity within risk,” where macro volatility intersects with a nascent shift in capital allocation. As liquidity shifts and institutional attention debates the next leg for bitcoin, the ratio’s behavior is drawing renewed interest from traders watching the macro backdrop and cross-asset dynamics.

Key takeaways

- The Bitcoin-to-gold ratio is signaling a bullish divergence on the daily RSI, suggesting fading selling pressure even as prices form lower lows.

- In February, the BTC/Gold ratio retraced toward a key support zone around 12–13, a level that has acted as resistance in 2017 and as support in 2022–2023, potentially marking a long-term bottom for the pair.

- Gold ETF flows showed a major outflow, with SPDR Gold Shares (GLD) shedding about $3 billion on March 6, highlighting risk-off repositioning in precious metals amid broader market volatility.

- Bitcoin ETF flows turned positive in March, with 30-day net inflows of $906 million by March 11, indicating a resurgence of institutional participation after prior outflows.

- Macro conditions are described by policymakers and researchers as creating a window of “opportunity within risk” for BTC, as bitcoin’s correlations with macro assets like oil and U.S. equities shift amid geopolitical tensions.

- Despite these signals, ETFs still account for a relatively small share of total BTC spot trading, implying substantial room for future institutional expansion.

Tickers mentioned: $BTC, $GLD

Sentiment: Bullish

Price impact: Positive. A confluence of improving ETF inflows for BTC and a rebound in the BTC/Gold ratio suggests upside potential, though macro risk remains a consideration for near-term moves.

Market context: A backdrop of macro volatility is shaping crypto liquidity and cross-asset flows, with rising institutional activity in BTC spot trading contrasted against ongoing gold ETF dynamics and geopolitical drivers that influence risk appetite.

Why it matters

The BTC–gold ratio has long served as a proxy for risk sentiment and cross-asset competition between non-sovereign stores of value. A bullish divergence on the RSI — when price forms lower lows while momentum indicators crest higher lows — points to waning selling pressure and the potential for a trend reversal. If the ratio can sustain a bottom near the 12–13 range seen in prior cycles, Bitcoin could embark on a multi-year re-pricing against gold, implying shifts in diversification strategies among investors who balance crypto exposure with traditional inflation hedges.

The flow dynamics underscore a broader transition in investor posture. The SPDR Gold Shares (GLD) outflow near $3 billion on March 6 suggests a tactical rotation away from gold, at least in the short term, while Bitcoin’s ETF balances and net flows have started to revert from net outflows to net inflows in early March. For background context, a notable observation from the Kobeissi Letter highlighted the scale of GLD’s outflow and compared it to activity seen over the last two years, underscoring how large-cap moves in the precious metals space can influence risk-on/risk-off cycles across assets.

On the BTC side, the institutional signal has begun to resume. The 30-day change in Bitcoin ETF balances turned positive, moving to 12,909 BTC after a prior period of heavy withdrawals, even as gold ETF holdings declined. This juxtaposition illustrates a shifting appetite for bitcoin among large market participants who historically favored traditional hedges during times of geopolitical stress. Binance Research has framed these dynamics within a wider macro context, noting that volatility can occasionally create an “opportunity within risk” for Bitcoin when macro assets move in a correlated fashion with energy and equities markets.

Against this backdrop, market participants are also watching the role of exchange-traded products in driving liquidity. Bitcoin’s share of US spot ETF trading volume has edged higher in recent weeks, signaling growing institutional participation, though it remains a minority share of total activity. If this trend continues, it could bolster BTC’s capacity to absorb shocks and sustain upside momentum when risk sentiment improves. The broader narrative—geopolitical tensions, inflation dynamics, and policy expectations—continues to influence price behavior in ways that can either exacerbate volatility or unlock durable moves when catalysts align.

As noted in prior coverage, historical patterns around midterm elections and macro shocks show BTC delivering varying returns, but the longer-run perspective remains constructive for BTC vs. gold when risk-on sentiment returns. It is at these points that the BTC–gold ratio might transition from a defensive stance to a more cyclical, growth-oriented trajectory, supported by increasing institutional flows and a measured reallocation of capital between crypto and traditional hedges.

What to watch next

- Monitor the BTC/Gold ratio’s ability to hold the 12–13 support area and whether momentum confirms a new uptrend on the weekly chart.

- Track SPDR Gold Shares (GLD) flows for signals of renewed risk-off rotations or renewed interest in gold as a hedge.

- Watch 30-day BTC ETF balance changes and overall ETF flow data for a sustained shift from selling to buying pressure.

- Observe the share of US spot trading volume attributed to BTC-related ETFs as institutional participation strengthens.

- Keep an eye on macro developments and geopolitical events that could reaccelerate cross-asset correlations, affecting both BTC and gold dynamics.

Sources & verification

- World Gold Council data on gold ETF flows and holdings to corroborate the GLD outflow narrative.

- Kobeissi Letter commentary on GLD flows and the scale of the recent outflow.

- Bold.report data showing the 30-day BTC ETF net inflows improving to approximately $906 million as of March 11.

- Binance Research weekly market commentary (March 11, 2026) discussing macro volatility and Bitcoin’s opportunity within risk.

- Cointelegraph coverage on Bitcoin versus gold ETF flows and related market dynamics, including references to BTC/Gold ratio behavior and RSI signals.

Bitcoin’s long-run tilt against gold signals a potential trend shift

Bitcoin (CRYPTO: BTC) is tracing a long-horizon pattern versus gold that could hint at a broader regime shift in capital allocation. The BTC–gold ratio has recharged after a dip that aligned with major macro events, and a bullish RSI divergence on the daily chart indicates a possible easing of downward price pressure. The retrace to a support zone around 12–13 on the BTCXAU scale echoes a critical juncture seen in 2017 before a multi-year acceleration, as well as the stabilization seen in 2022 and 2023. While the exact path remains uncertain, traders are watching whether this level holds as a foundation for a durable breakout from a bear-market phase in the ratio.

One pivotal factor is the flow dynamic between gold and bitcoin-related instruments. The SPDR Gold Shares (GLD) ETF experienced a sizable outflow around March 6, a signal that risk-off capital was rotating away from bullion at that moment. The Kobeissi Letter captured the magnitude of the move, noting that the outflow exceeded typical daily shifts by a wide margin. In contrast, Bitcoin-focused ETF activity began to show renewed interest, with 30-day BTC ETF balances flipping from negative territory to a positive drift. By March 11, net inflows reached roughly $906 million, suggesting a re-emergence of institutional participation in BTC markets after prior corrections.

The macro backdrop adds an additional layer of nuance. Binance Research described current volatility as creating a meaningful “opportunity within risk” for Bitcoin, pointing to how BTC’s price action has begun to mirror other macro assets amid regional tensions and shifting risk sentiment. In practical terms, this means that while geopolitical developments can drive immediate volatility, they can also create dispersion that benefits an asset with growing institutional interest and a robust macro narrative. The market’s liquidity dynamics—particularly the share of BTC trading volume emanating from spot ETFs—signal that institutions are cautiously increasing exposure, even as overall ETF penetration remains below highs observed in broader equity markets.

Looking ahead, the critical question is whether BTC can sustain a higher-low trajectory against gold and crack the resistance that defines the current phase. If the ratio remains supported and momentum continues to strengthen, Bitcoin could extend its outperformance relative to gold in the coming quarters. The market’s response to macro news, regulatory developments, and ETF flows will likely shape whether this divergence translates into a sustained trend or a temporary re-pricing within a broader range.

Crypto World

Bitcoin LTH Supply Near Record Highs Despite Pullback From Peak

Bitcoin’s overheating indicators remain moderate compared with previous market cycle peaks.

Bitcoin’s LTH Realized Supply stood at 8.05 million BTC as of March 11, 2026, representing a decline of roughly 5.5% from the cycle peak of 8,529,671 BTC recorded on March 8, 2026, when the asset traded at $65,974, and the metric’s Z-score reached 3.20.

At the time of the latest reading, the Z-score had eased to 2.66.

Compressed Cycle

According to crypto analyst Axel Adler Jr., despite the recent pullback, the amount of Bitcoin held by long-term holders at this point in the cycle remains historically high. When compared with previous cycles at the same post-halving stage, day 691 after the halving, the current cycle shows significantly larger holdings.

In fact, the total volume of coins held by long-term holders was found to be about 1.52 times higher than during the 2020 cycle and roughly 3.4 times higher than in the 2016 cycle at equivalent points. Adler explained that the current Z-score of 2.66 is very similar to the 2016 cycle reading of 2.94 at the same stage. In the 2016 halving cycle, this period witnessed the early phase of the final redistribution period, which continued for approximately another 200 days before the metric reached its all-time high in December 2018.

On the other hand, the 2020 cycle displayed a very different structure at the same point in time. At day 691 following the halving in that cycle, the Z-score was only 1.08, reflecting the end of the bear market following the Terra/LUNA collapse, and the LTH Realized Supply had already been declining for eight months from its peak.

Adler also examined the MA365 ratio, which currently stands at 1.595 in the ongoing cycle. This level is lower than the equivalent ratio in the 2016 cycle, which was 2.523, and slightly higher than the 2020 cycle value of 1.502. According to the analyst, this means that the degree of overheating relative to the one-year moving average remains moderate.

In previous cycles, the final peaks of LTH Realized Supply occurred between days 880 and 912 after the halving, almost 190 to 220 days later than the current point in the cycle. In those cycles, the Z-score ultimately climbed to between 4.24 and 4.94 before the peak was reached. If the present cycle follows a similar timeline, Adler said the current peak could represent only an intermediate high rather than the final one.

You may also like:

Accumulation Loses Momentum

However, he also pointed out that the current cycle differs structurally from earlier ones because institutional inflows into Bitcoin ETFs have locked up large volumes of coins, thereby reducing the share of supply available for active circulation and potentially accelerating the accumulation process among long-term holders.

There has also been a slowdown in accumulation momentum, as the 30-day rate of change is currently at +7.6%, far below the levels seen in comparable phases of previous cycles, when the metric rose by as much as 87% in 2016 and 51.6% in 2020. According to the analyst, the declining growth rate suggests the market may be entering a stabilization phase following the strong accumulation seen in January and February 2026.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SEC and CFTC End Regulatory Turf War With Joint Crypto Coordination Deal

The SEC and CFTC have signed a formal memorandum of understanding to coordinate digital asset oversight, ending years of jurisdictional conflict that forced crypto firms to navigate competing regulatory demands simultaneously.

The agreement establishes six priority areas: shared crypto-asset taxonomy, coordinated enforcement decisions, joint regulatory examinations, policymaking alignment, a new harmonization website for simultaneous agency input on firm applications, and confidential supervisory data sharing between the two bodies.

Both agencies also launched a Joint Harmonization Initiative to work through product classification, regulatory reporting, clearing and margin systems, and cross-market surveillance.

The practical upshot: firms regulated by both agencies no longer ping-pong between conflicting requirements.

Discover: The best new crypto!

What the SEC-CFTC MoU Actually Establishes

The memorandum sets binding procedures across policymaking, supervisory activities, enforcement, and regulatory examinations.

Critically, it commits both agencies to aligning certain regulatory definitions, targeting the classification gap that has left token issuers and exchanges uncertain whether they’re dealing with a security, a commodity, or both.

The Joint Harmonization Initiative covers joint examinations on product applications from dual-regulated firms, coordinated planning to reduce duplicative compliance burdens, and a dedicated harmonization website where firms can submit applications and receive simultaneous input from both agencies.

SEC Chairman Paul Atkins stated earlier this year: “For too long, market participants have been forced to navigate regulatory boundaries that are unclear… This event will build on our broader harmonization efforts to ensure that innovation takes root on American soil.”

What the SEC-CFTC Deal Means for Crypto Exchanges, Tokens, and Custody

For exchanges, the immediate benefit is jurisdictional clarity on token listings: the shared crypto-asset taxonomy means classification decisions carry weight at both agencies simultaneously.

Custody providers and dual-regulated firms gain a single supervisory pathway rather than sequential examinations that surfaced conflicting findings. Token issuers targeting U.S. markets now have a defined framework to engage rather than a guessing game between agencies.

The agreement also has direct implications for stablecoin issuers, whose products can fall under SEC or CFTC jurisdiction depending on classification, precisely the ambiguity the harmonization initiative targets.

The agreement advances independently of the CLARITY Act, the House bill that passed in July 2025 that would hand CFTC primary spot market authority, but remains stalled in the Senate over disputes between the banks and the industry around stablecoin yields and tokenized assets.

If the CLARITY Act clears the Senate, it codifies the MoU’s framework into law. If it stalls further, the MoU still delivers operational coordination, just without statutory backing.

Discover: The top crypto to diversify your portfolio with

Is US Regulation Here? The Next Steps…

The harmonization website launch is the first concrete milestone, it determines how quickly dual-regulated firms can access the new joint application pathway.

Watch also for the first coordinated enforcement action under the MoU, which will signal whether the agencies are genuinely aligning on classification or still operating in parallel.

Democrats have already signaled continued pressure on crypto-adjacent markets, and the MoU’s prediction market and perpetual futures frameworks will face scrutiny in that context.

If the CLARITY Act advances through the Senate in 2026, the MoU becomes the operational layer beneath a full statutory framework, and the U.S. emerges with the most structured crypto regulatory environment globally.

The post SEC and CFTC End Regulatory Turf War With Joint Crypto Coordination Deal appeared first on Cryptonews.

Crypto World

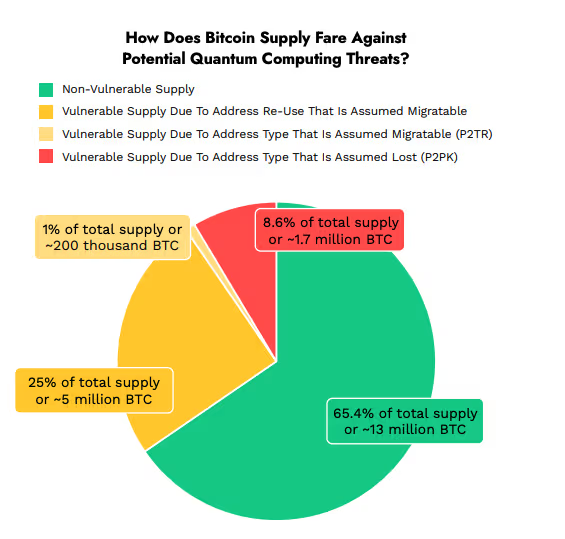

One-Third of Bitcoin at Risk From Quantum Threat

Bitcoin (CRYPTO: BTC) faces a long-running security debate as researchers map the timeline over which quantum computing could undermine current cryptography. A white paper from Ark Invest, prepared with Unchained Capital’s insights, argues that a substantial portion of the BTC supply is not immediately exposed to such a threat, while a meaningful minority could require attention in the years ahead. The study estimates that roughly 65.4% of the circulating BTC is not vulnerable to a quantum-based breakthrough today, leaving about 34.6% at risk under certain assumptions about address behavior and key exposure. In concrete terms, the assessment breaks down the vulnerable pool into roughly 5 million BTC that could migrate due to address reuse, about 1.7 million BTC (around 8.6% of supply) possibly lost in legacy P2PK (Pay To Public Key) addresses, and roughly 200,000 BTC (about 1%) that could migrate because of newer P2TR (Pay To Taproot) formats. The authors contend that breaking Bitcoin’s elliptic-curve cryptography would require a quantum computer with thousands of qubits and a vast number of quantum gates, meaning a direct attack remains distant, even as prep work accelerates. Even so, their practical feasibility would require quantum systems to reach performance levels that our research suggests will take much time to achieve.

“Even so, their practical feasibility would require quantum systems to reach performance levels that our research suggests will take much time to achieve.”

The Ark Invest analysis sits alongside broader discussions about the pace of quantum development. It contrasts with a February CoinShares assessment, which estimated that only about 10,200 BTC—roughly 0.05% of the supply—present true market-relevant quantum risk, even though older P2PK addresses still carry theoretical exposure. Separately, progress in quantum hardware continues apace: a landmark facility capable of housing one million physical qubits, a scale that dwarfs typical data-crunching rigs, is slated for completion in 2027. Chicago-based PsiQuantum leads the project, backed in part by BlackRock-linked funds, underscoring institutional interest in quantum infrastructure as much as cryptographic risk.

Quantum breakthrough remains “long-term risk” for Bitcoin

The white paper frames quantum risk as a gradual, multi-stage development rather than an instantaneous vulnerability. It outlines five stages of quantum computing progress, with the most consequential impact—breaking ECC at a pace faster than Bitcoin’s block interval—occurring only in the final stage. In practical terms, Bitcoin’s exposure from migrating or reusing addresses would remain limited until stage 3, when a quantum computer could break the 256-bit ECC key. The authors point to a mid-2030s window for the first public-key break, a benchmark derived from assessments by major tech firms such as Google, IBM and Microsoft. The conclusion is not alarmist, but it signals that the network has time to study protections and plan upgrades without rushing a hard fork or governance overreach.

“Those who hold and transact Bitcoin should regard quantum risk as a long-run risk rather than an imminent threat,” the paper notes, framing it as a call to prepare rather than panic. The authors emphasize that awareness and foresight will be essential as the risk migrates through the network over time, potentially shaping how wallets, exchanges and custodians think about security architecture in the coming decade. The discussion also touches on governance frictions: unlike a single-fork upgrade, implementing post-quantum safeguards across Bitcoin’s decentralized consensus model will require broad alignment across nodes, miners and developers.

The Ark Invest report includes a figure on the multi-stage trajectory of quantum advancement but also flags a practical nuance: even at higher stages, the speed of a security breach would depend on the specific cryptographic primitives in use and how quickly the ecosystem migrates to post-quantum alternatives. In the meantime, researchers and builders are exploring how to harden the network with post-quantum cryptography (PQC) while preserving compatibility and performance. The authors also discuss candidate post-quantum schemes, such as ML-DSA (lattice-based) and SLH-DSA (hash-based), which are among the approaches considered for future resilience.

On the governance frontier, the paper notes that a wholesale, rapid shift to PQC would be challenging under Bitcoin’s consensus rules. A proposed path discussed in the literature is BIP-360, which contemplates a Pay-to-Merkle-Root type output designed to mitigate long-exposure quantum risk without immediately reworking the entire signature ecosystem. Yet, the authors caution that BIP-360 is not a cure-all; it does not itself embed post-quantum signatures, which the team regards as essential for durable protection against quantum attacks. Experts such as Chris Tam of BTQ Technologies have underscored this gap, arguing that effective post-quantum defense requires signatures, not just new address formats.

The broader takeaway is that quantum risk, while real, is a long-term concern that invites proactive planning rather than haste. The Ark Invest paper emphasizes that the transition to quantum-safe mechanisms will likely unfold in stages, with ongoing research, testing and governance conversations shaping the path forward. As the spotlight intensifies on quantum hardware, Bitcoin’s security posture will increasingly hinge on how the community negotiates practical upgrades within a decentralized framework that favors gradual, consensus-driven change.

In closing, Ark Invest’s analysis corroborates a cautious but constructive view: the threat remains distant enough to permit careful preparation, yet imminent enough in its trajectory to justify continued investment in quantum-ready cryptography and related upgrades. The dialogue around post-quantum protections—beyond mere address formats—reflects a mature understanding that long-horizon risk requires long-horizon solutions, coordinated across ecosystems from core developers to wallet providers and exchanges.

Why it matters

For individual holders, the report underscores that the security of today’s holdings relies on a combination of on-chain design and user behavior. A sizable portion of BTC may still be at risk only if quantum attackers gain the means to break elliptic-curve cryptography in a time window long enough for the network to implement upgrades. This matters not as a near-term crisis, but as a strategic reason to stay informed about post-quantum advances and to monitor consensus-driven proposals that could alter how keys and addresses are managed in the future.

For builders and wallet providers, the analysis highlights the importance of future-proofing infrastructure. The emergence of PQC standards and the potential need for quantum-safe address formats could influence wallet compatibility, key management, and transaction verification. The discussion around BIP-360 — and the broader push toward signatures resilient to quantum attacks — points to a practical roadmap where security upgrades are evaluated in stages rather than through abrupt protocol changes.

For the market at large, the study underscores that quantum readiness is increasingly a governance and investment narrative as much as a technical one. The prospect of a major quantum milestone, like a million-qubit facility, signals a broader shift toward quantum readiness across technology and finance, which could impact risk appetite, capital allocation and the pace at which institutions engage with crypto security initiatives.

What to watch next

- Progress on BIP-360 and any proposals to introduce post-quantum signatures or other PQC-based protections.

- Updates to Ark Invest’s research or new white papers that refine the share of vulnerable BTC as quantum hardware advances.

- Milestones in quantum hardware deployments, including PsiQuantum’s 1-million-qubit roadmap and related funding developments.

- Adoption timelines for post-quantum cryptography standards and their integration into Bitcoin’s consensus framework.

Sources & verification

- Ark Invest and Unchained’s white paper on Bitcoin and quantum computing, including address migration and exposure breakdown. https://www.ark-invest.com/Thank-You/bitcoin-and-quantum-computing?submissionGuid=0568c5c5-6004-4bb3-9c71-ad9f904c3cf6

- CoinShares analysis referenced in February detailing market-relevant quantum risk estimates. https://cointelegraph.com/news/only-10k-bitcoin-quantum-risk-coinshares

- Announcement of PsiQuantum’s one-million-qubit facility with BlackRock-linked funding. https://cointelegraph.com/news/construction-quantum-facility-1m-qubits-begins

- BIP-360 post-quantum discussion and related commentary, including the critique that it lacks post-quantum signatures. https://cointelegraph.com/news/bitcoin-quantum-resistant-bip-360-post-quantum-signatures-taproot

- Perspective on the potential timeline for post-quantum upgrades, including expert commentary from BTQ Technologies. https://cointelegraph.com/news/whale-9b-bitcoin-sale-not-quantum-concerns-galaxy-digital

Crypto World

Concrete integrates with Binance Wallet to enable USDT yield

Editor’s note: Concrete’s integration with Binance Wallet signals a shift in DeFi yield access. By embedding risk-adjusted USDT strategies directly into a widely used wallet, the collaboration aims to simplify entry for institutions and retail investors alike, while reducing interface fragmentation that has long hindered on-chain yield infrastructure. This milestone highlights a broader push toward robust, audited yield capabilities that prioritize risk management and transparency, rather than chasing short-term gains.

Key points

- Concrete vaults are accessible inside Binance Wallet for USDT yield strategies.

- Modular architecture separates custody, strategy execution, and accounting to lower friction.

- Promotional rewards up to $200,000 for eligible participants staking 100 USDT via Binance Wallet.

- Focus on risk-adjusted, institutional-grade strategies over short-term yield chasing.

Why this matters

Bringing Concrete into a major wallet ecosystem reduces fragmentation and broadens access to disciplined DeFi yield infrastructure, with emphasis on risk management and transparent evaluation of strategy parameters.

What to watch next

- Real-time APY will adjust dynamically based on participation and market conditions.

- Uptake of the rewards program and staking in the Concrete USDT Vault via Binance Wallet.

- Expansion of access as Concrete vaults become native inside Binance Wallet ecosystem.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Concrete Integrates with Binance Wallet to Enable Access to Institutional-Grade USDT Yield

As demand for stablecoin yield grows, Concrete’s vault technology brings institutional strategy execution directly into one of the world’s largest wallet ecosystems.

NEW YORK, March 12, 2026 – Blueprint Finance, a multi-chain DeFi infrastructure company, today announced that its Ethereum-based institutional-grade vault infrastructure, Concrete, has integrated with the Binance Wallet ecosystem. This milestone enables Binance Wallet users to access sophisticated, risk-adjusted USDT yield strategies directly through their native wallet interface.

Concrete is purpose-built to address fundamental challenges in DeFi by providing infrastructure that prioritizes risk-adjusted yield strategies over short-term yield maximization.

“Integrating Concrete directly into Binance Wallet is a major step toward making sophisticated on-chain yield infrastructure accessible at a global scale,” said Nic Roberts-Huntley, CEO and co-founder of Blueprint Finance. “For too long, sophisticated on-chain yield strategies have been siloed behind fragmented interfaces and operational complexity. By embedding Concrete Vaults natively within one of the world’s most widely used wallet ecosystems, we’re bringing disciplined, risk-adjusted USDT yield strategies[1] to a global audience. This integration reflects the signal that DeFi is headed away from unsustainable yield chasing and toward infrastructure that institutions and retail users alike can rely on.”

Institutional-grade vault strategies are available natively inside one of the most widely used wallet ecosystems in the world. With tens of millions of users globally, Binance has become the gateway through which retail participants, power users, and institutions alike access decentralized finance. This integration also removes the fragmentation that has historically kept advanced on-chain strategies out of mainstream reach.

Concrete’s vault engine utilizes modular smart contract architecture and quantitative modeling frameworks originally developed for institutional environments. It separates custody, strategy execution, and accounting into enforceable layers, while automation reduces operational friction. Concrete Vaults seek to provide risk-adjusted, institutional-grade strategies, where each strategy is evaluated using quantitative models that account for volatility, downside probability, liquidity depth, and execution costs.[2]

To celebrate the integration, Concrete is launching a promotional rewards campaign of up to $200,000 in total rewards for eligible participants. Eligible users who stake at least 100 USDT in the Concrete USDT Vault via Binance Wallet may participate in the rewards program, alongside the vault’s ongoing yield generation. Reward structure and form are subject to change. Real-time APY will adjust dynamically based on participation and market conditions.

Visit concrete.xyz for more information.

About Concrete

Concrete is an Ethereum-based protocol that provides institutional-grade tooling for on-chain yield generation. With a proven track record of executing billions in structured flow volume, Concrete offers sophisticated vault architecture and strategy layering to enable secure and transparent yield generation in the DeFi ecosystem. Concrete is part of the Blueprint ecosystem.

About Blueprint Finance

Blueprint Finance is a multi-chain DeFi infrastructure company and the core developer of both the Ethereum-based Concrete and Solana-based Glow Finance. Concrete powers tokenized DeFi native vault infrastructure and the creation of new derivatives for any asset, while Glow powers yield, trading, and lending on Solana. The company’s quantitative framework transforms complex DeFi mechanisms into products that work reliably for both institutions and individuals alike. By eliminating traditional DeFi pain points, such as liquidation risk and capital fragmentation, Blueprint is building the technical foundation for broader institutional adoption of decentralized finance.

This press release is for informational purposes only and does not constitute an offer of securities, investment advice, or a solicitation of any kind. Yield is variable and not guaranteed. Past performance is not indicative of future results. Participation involves smart contract risk, market risk, and potential loss of principal. Users should review all applicable terms and conduct their own research before participating. Concrete vaults are not insured by any government agency.

[1] Risk-adjusted” refers to Concrete’s use of quantitative models to evaluate strategy parameters such as volatility, downside probability, liquidity depth, and execution costs. It does not imply elimination of risk or guarantee of returns. All strategies involve risk, including potential loss of principal.

[2] Strategy evaluation frameworks are subject to change and may not capture all relevant risk factors. Quantitative modeling does not guarantee performance or prevent losses.

Crypto World

Hyperliquid price prediction: can HYPE hit a new ATH after $38 break?

- Hyperliquid price rose to its highest level in over a month as it touched $38.08.

- The HYPE is up amid increased trading activity as open interest jumps to over $1.56 billion.

- Technical indicators on the daily chart suggest a bullish continuation.

What’s driving the HYPE price up?

Bitcoin’s rally above $70,000 following Wednesday’s CPI data helped lift sentiment across the broader crypto market, even as geopolitical tensions continued to escalate.

Gains among major altcoins also provided momentum for smaller tokens such as Hyperliquid.

However, HYPE appears particularly well positioned for a potential breakout as trading activity in the energy sector intensifies amid the escalating U.S.–Israel conflict with Iran.

Data from Coinglass shows that Hyperliquid’s open interest rose from $1.18 billion to more than $1.56 billion, marking a 32% increase between March 6 and March 12, 2026.

Much of this activity has been driven by traders entering futures positions as oil prices surged. Crude briefly climbed toward $120 before pulling back.

Even after the retreat, prices remain above $100, as the Strait of Hormuz blockade continues to disrupt a key global shipping route, with Iranian leaders insisting the waterway should remain closed.

As Bloomberg recently reported, trading activity on Hyperliquid has surged under these conditions, with futures volume reaching about $2.2 billion in the past 24 hours.

At the same time, the platform’s stablecoin market capitalization increased nearly 3% to $4.76 billion.

Hyperliquid price: Is a new ATH next?

HYPE is currently trading at its highest level since February 3, 2026.

A similar price zone was last tested in November 2025, when bullish momentum weakened and the token failed to maintain support.

The latest retest raises the question of whether Hyperliquid could be setting up for a fresh push toward a new all-time high. If the current momentum continues, bulls may increasingly target that milestone in the near term.

Meanwhile, crypto investor Arthur Hayes has projected a much more aggressive outlook, suggesting that HYPE could climb to $150 by August 2026, driven by strong platform growth and token buyback dynamics.

HYPE price short-term technical outlook

From a technical standpoint, the first resistance lies in the $38–$42 range, followed by a stronger barrier around $48–$50.

A decisive close above $38 could open the door for a move toward these levels, with the all-time high above $59 emerging as a potential target if bullish momentum strengthens.

On the downside, if broader market weakness triggers a pullback, initial support is likely near $33.

A deeper correction could bring the 50-day SMA around $30 and the 100-day SMA near $28 into focus as key demand zones.

Crypto World

Ark Invest says quantum computing is a long-term risk for bitcoin, not an imminent threat

Asset manager Ark Invest says quantum computing is a long-term consideration for Bitcoin security but not an imminent threat.

In a Wednesday report co-authored with Unchained, the investment manager said today’s quantum computers are far below the capabilities needed to break Bitcoin’s cryptography, which relies on elliptic curve encryption to secure wallets.

“Today’s quantum systems lack the capabilities required to compromise Bitcoin,” wrote authors Dhruv Bansal, co-founder and CSO at Unchained; Tom Honzik, director of custody research at Unchained; and David Puell, research trading analyst and associate portfolio manager for digital assets at Ark Invest.

Even if quantum systems eventually reach that level, the risks will likely emerge gradually and at high cost to attackers, the report said.

One of the main reasons Bitcoin won’t face an immediate threat is because a major breakthrough in quantum computing would likely disrupt broader internet security first, prompting coordinated responses from governments, technology firms and financial institutions before reaching Bitcoin.

The report comes as long-term investors grapple with the possibility that advances in quantum computing could one day break the cryptography underpinning bitcoin, fueling speculation about a potential security crisis.

Earlier this year, a prominent portfolio strategist at Jefferies, Christopher Wood, said investors should drop 10% bitcoin allocation and add gold instead, due to a quantum threat. The move rattled investors and spooked the digital assets market.

35% of the supply in risk

While researchers broadly agree that such capabilities remain far off, the prospect that powerful quantum machines could eventually crack private keys or older wallet formats has raised concerns among investors about long-term risks to bitcoin and the broader digital asset ecosystem.

Ark’s report estimated that about 35% of bitcoin’s supply sits in address types theoretically exposed to future quantum attacks, including roughly 1.7 million BTC believed to be lost and about 5.2 million BTC that could be migrated to more secure wallets.

One of those wallets, roughly 1 million BTC, belongs to Satoshi Nakamoto, the creator of the Bitcoin network.

However, rather than a sudden “Q-day,” Ark Invest sees these progressions unfolding in several different stages over many years. Some investors fear the first attack could occur before 2030, while others suggest it could be “decades away,” the report noted.

The report argues that in either scenarios, it will likely give the Bitcoin community time to upgrade the network with quantum-resistant cryptography and encourage users to move coins to safer address formats.

“The good news is that we already know how to protect against quantum attacks,” the report said.

“The majority of Bitcoin’s supply is held in quantum-resistant addresses, and the remainder is held in quantum-vulnerable addresses that should not be at risk until Stage 3 of our timeline, when a CRQC exists that can break a 256-bit ECC key.”

The world’s largest cryptocurrency was trading around $70,000 at the time of publication.

Read more: Grayscale sees regulation, not quantum fears, shaping crypto markets in 2026

Crypto World

JPMorgan sued over alleged $328M crypto Ponzi scheme tied to Goliath Ventures

JPMorgan Chase has been sued by investors in Goliath Ventures, with a proposed class action lawsuit alleging the bank ignored “red flags” that the allegedly fraudulent crypto pool raised and helped enable what the complaint describes as a $328 million crypto Ponzi scheme that affected over 2,000 people.

Filed in federal court in the Northern District of California Wednesday, the complaint claims Chase “provided the essential banking infrastructure through which the Ponzi scheme operated,” processing investor deposits, facilitating transfers and enabling payments that allegedly “created the false appearance of legitimate profits.”

Florida resident Christopher Alexander Delgado was arrested last month by federal authorities on wire fraud and money laundering charges tied to his operation of Goliath. That criminal case is in its early stages.

“Numerous red flags made the fraudulent nature of the scheme obvious and known to Chase,” Wednesday’s proposed class action claims. “Despite those red flags, Chase turned a blind eye and continued servicing the accounts used to perpetrate the fraud, earning substantial fees from the hundreds of millions of dollars it washed through Goliath and Delgado’s banking activities at Chase.”

A JPMorgan spokesperson toldCoinDesk that the bank would “decline to comment.”

The complaint, filed by Robby Alan Steele through his lawyers at Shaw Lewenz and co-counsel, states that JPMorgan was the sole banking institution for Goliath. It further states that approximately $253 million was deposited into a Chase account linked to Goliath between January 2023 and June 2025. Roughly $123 million was transferred from that account to crypto exchange Coinbase, while about $50 million was sent to investors as purported returns.

The lawsuit, which does not state a specific damages figure, repeatedly argued the bank should have spotted the alleged fraud from the flow of funds alone.

“From a bank’s perspective, the fraudulent scheme was obvious,” the complaint said. “A fraudulent scheme of this magnitude cannot be run surreptitiously through one bank.”

The suit also mentions JPMorgan CEO Jamie Dimon’s public criticism of cryptocurrencies, adding it contradicts the bank’s alleged conduct.

“Despite Dimon’s long history of criticizing cryptocurrency,” the complaint said, Chase “knowingly permitted a bank customer—Goliath—to commingle investors’ money at Chase” and use funds from later investors to pay earlier ones “in a classic Ponzi scheme fashion.”

Crypto World

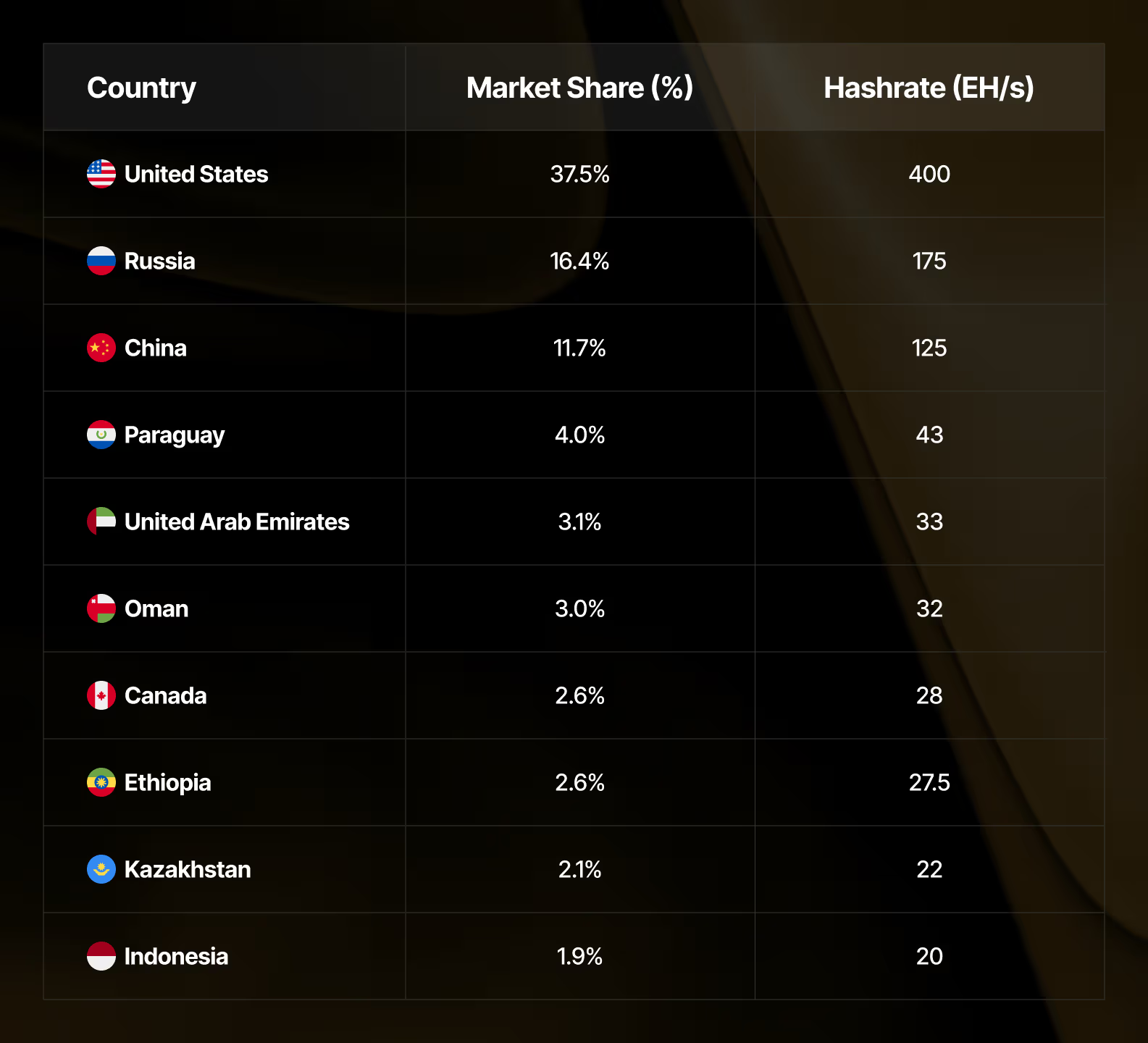

BTC mining faces price risk, not power cost shock, as oil tops $100

As oil surges past $100 amid escalating Middle East tensions, the question for the Bitcoin network and miners is not whether their power bills will rise, but whether Bitcoin’s price will fall.

According to research from bitcoin mining software and services company Luxor’s Hashrate Index, the direct effect of oil price shocks on mining costs is likely to be limited, but the broader macroeconomic consequences could weigh more heavily on the industry.

However, the impact of oil prices surging isn’t zero on the Bitcoin network.

Luxor estimates that about 8 to 10 percent of global bitcoin hashrate operates in electricity markets where power prices are closely linked to crude oil. These operations are primarily concentrated in Gulf states such as the United Arab Emirates and Oman, with smaller contributions from Iran, Kuwait, Qatar and Libya.

“The genuinely oil-exposed countries” are the Gulf states, Luxor wrote in its research note, adding that the UAE and Oman together account for roughly about 6% of the network’s computing power or hashrate.

“These grids run primarily on natural gas derived from oil production, with electricity pricing that does track crude more directly than in the US or Russia,” the report said.

Meanwhile, Iran is estimated to hold another 0.8%, and other smaller contributors like Kuwait, Qatar, and Libya bring the total crude-sensitive hashrate exposure to roughly 8–10% of the network.

The remaining roughly 90% of the network runs in regions where electricity prices are driven by natural gas, coal, hydro or nuclear energy, meaning crude oil price swings have little direct influence on mining costs.

Impact on mining

What does this mean for bitcoin miners, who run power-hungry machines to secure the network and validate the transactions?

Luxor argues that even if oil prices remain above $100 per barrel, the effect on mining economics from higher electricity costs would likely be limited to a small portion of the network. Electricity is the single largest input cost for mining bitcoin.

Instead, the bigger risk for miners lies in how geopolitical shocks affect bitcoin’s price. According to Luxor, periods of macro stress often trigger risk-off behavior in financial markets, which can pressure volatile assets such as Bitcoin.

Recent data cited by the firm shows hashprice, a measure of profitability for the miners, fell to an all-time low of $27.89 per petahash per second per day in February, driven largely by a 23.8% drop in bitcoin’s price during the same period.

For miners, Luxor concludes, profitability is far more sensitive to changes in bitcoin’s price than to shifts in electricity costs.

Read more: Bitcoin hashrate drops 12% in worst drawdown since China mining ban: CryptoQuant

-

Business6 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos3 days ago

News Videos3 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Ann Taylor

-

Crypto World3 days ago

Crypto World3 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech1 day ago

Tech1 day agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports7 days ago

Sports7 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

Politics6 days agoTop Mamdani aide takes progressive project to the UK

-

Tech2 days ago

Tech2 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Business2 days ago

Business2 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Sports5 days ago

Sports5 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports4 days ago

Sports4 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat23 hours ago

NewsBeat23 hours agoResidents reaction as Shildon murder probe enters second day

-

Entertainment6 days ago

Entertainment6 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business4 days ago

Business4 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business1 day ago

Business1 day agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech3 days ago

Tech3 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business3 days ago

Business3 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat1 day ago

NewsBeat1 day agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.

-

Business6 days ago

Business6 days agoIran war enters second week as Trump demands ’unconditional surrender’

TODAY: Alongside the

TODAY: Alongside the