Crypto World

Vietnam Draft Rules Set Sights on 0.1% Tax on Crypto Transfers

Vietnam is moving to formalize how crypto transactions are taxed and regulated, signaling a push toward a tightly controlled but economically significant digital asset market. A draft circular circulated by the Ministry of Finance would impose a 0.1% personal income tax on the value of each crypto transfer executed through licensed service providers, aligning digital asset activity with the country’s securities trading framework. While transfers and trading would be VAT-exempt, the plan taxes turnover, applying the levy to investors regardless of residency. For institutions, crypto-related income would be taxed at 20% corporate rate, calculated after deducting purchase costs and related expenses. The measures also set a high bar for exchanges, including a 10 trillion dong charter capital threshold and a 49% foreign-ownership cap, reflecting a cautious approach to market infrastructure.

The draft circular, released for public consultation, also formalizes a definition of crypto assets as digital assets issued, stored or transferred using cryptographic or similar technologies. It arrives as Vietnam accelerates a broader, five-year pilot program for a regulated crypto-asset market that began in September 2025. By October 2025, officials indicated no companies had applied to participate in the pilot, underscoring barriers related to capital requirements and eligibility criteria. Separately, authorities have begun opening licensing windows for digital asset trading platforms, signaling that the regulatory framework could start to take shape in early 2026.

As the policy discussion unfolds, Vietnam’s approach appears to be balancing tax revenue opportunities with stringent oversight of who can operate and how financial flows are monitored. The Ministry of Finance’s draft circulates alongside ongoing regulatory experiments and a push to bring crypto activity into formal channels, while the broader ecosystem weighs the implications for retail investors, institutions, and technology providers. The Hanoi Times highlighted the 0.1% PIT as the centerpiece of the tax framework, noting that the tax would be levied on transfers through licensed providers and would mirror the existing stock-trading levy in form and function. The article also points to a clear distinction between value-added tax treatment and turnover taxes, a nuance that could influence how exchanges structure their operations and how tax authorities monitor cross-border activity.

Vietnam formally defines crypto assets

In what appears to be a step toward regulatory clarity, authorities described crypto assets as digital instruments that rely on cryptographic or analogous technologies to issue, store and verify transfers. This definitional move is a precursor to stricter licensing criteria and more predictable tax treatment, which in turn could attract legitimate players while screening out speculative, non-compliant activity. The proposed regime sets a higher capital bar for exchanges than many industries require for traditional banks, signaling an intent to ensure resilience and risk controls in markets that are closely linked to global capital flows.

Under the proposed rules, operators seeking to run a digital asset exchange would need substantial capital, with charter requirements set at 10 trillion dong (about $408 million at current exchange rates). Foreign ownership would be allowed but capped at 49% of an exchange’s equity, limiting influence from outside the country while still enabling international participation. Such thresholds underscore the government’s preference for domestic guardianship of critical financial infrastructure, even as it permits foreign-backed ventures to participate under strict caps and regulatory oversight.

The broader regulatory arc has been visible since Vietnam launched a five-year crypto market pilot in September 2025, a landmark shift intended to test how a regulated ecosystem could coexist with a growing domestic economy. By early October, authorities acknowledged that no companies had yet submitted applications to join the pilot, a reflection of the substantial entry hurdles and careful qualification criteria in play. This admission came alongside reports that the pilot’s scope would eventually be complemented by formal licensing for trading platforms, a move that would bring crypto activity under formal government supervision and pave the way for standardized reporting and consumer protections.

Vietnam opens licensing for crypto exchanges

In the lag time between policy signals and practical rollout, Vietnam began accepting applications for exchange licenses, marking a tangible step toward operationalizing a regulated crypto market. The State Securities Commission of Vietnam (SSC) stated that applications would be accepted starting January 20, 2026, framing the licensing process as a deliberate, multi-year effort to bring crypto activities into a formal regulatory framework. The liquidity and risk-management requirements implied by the licensing window are designed to channel legitimate market participants into a controlled environment, potentially reducing fraud and improving transparency for investors and policymakers alike.

Key takeaways

- The Ministry of Finance’s draft circular would impose a 0.1% personal income tax on the value of each crypto transfer conducted through licensed providers, aligning crypto transfers with the country’s stock-trading levy.

- Crypto transfers and trading would be exempt from value-added tax, while turnover-based taxation would apply to investors regardless of residency status.

- Institutional investors earning income from crypto transfers would face a 20% corporate income tax on profits after deducting costs and expenses.

- Exchanges would face a high capital requirement of 10 trillion dong (roughly $408 million) and foreign ownership would be limited to 49% of equity.

- A formal definition of crypto assets would anchor regulatory rules, helping separate compliant activity from informal or illicit use cases.

- The country has launched a five-year pilot for a regulated crypto market (Sept 2025) with licensing for exchanges anticipated to begin in 2026, although initial participation had not materialized by Oct 2025.

Market context: The policy comes as many jurisdictions reassess how to regulate crypto markets, balancing tax revenue with consumer protection and financial stability. Vietnam’s approach leans toward rigorous control, reflecting a global trend toward centralized oversight while still signaling potential for regulated participation by international players under strict conditions.

Why it matters

The package signals a deliberate attempt to integrate crypto activity into the formal economy, with taxes and licensing acting as primary levers to enhance oversight. For retail investors, the PIT on transfers through licensed providers creates a clear tax path that will influence trading behavior and cost considerations. Institutions face a defined tax regime and a high bar for market entry, potentially filtering participants to those willing to navigate substantial capital prerequisites and regulatory compliance obligations.

From a market infrastructure perspective, the 10 trillion dong charter capital threshold and 49% foreign-ownership cap set a high ceiling for domestic exchanges, aiming to safeguard the financial system while still inviting foreign expertise. The definitional clarity around crypto assets helps align Vietnamese rules with broader financial standards, reducing ambiguity for developers, exchanges, and custodians seeking to establish local operations. Observers will watch how this framework interacts with ongoing pilot programs and whether the regulatory appetite broadens to accommodate more players over time.

For policymakers, the balance between revenue collection, investor protection, and market growth is delicate. Vietnam’s approach suggests a patient, data-driven trajectory: tax structures that incentivize compliance, capital requirements that deter low-capital risk, and licensing that creates an auditable, auditable market foundation. If successful, the model could influence neighboring economies contemplating similar regulated pathways for digital assets, especially in a region where adoption is uneven and regulatory certainty remains a key obstacle for institutional participation.

What to watch next

- January 20, 2026: Applications open for digital asset exchange licenses, establishing a formal entry point for market participants.

- Public responses to the draft circular: Feedback from domestic and international stakeholders could shape final text and practical implementation.

- Details on how PIT and corporate tax will be administered across different crypto products and services, including calculation methodologies and reporting requirements.

- Progress of the five-year pilot: uptake, participant eligibility, and any regulatory adjustments arising from early pilot findings.

- Any updates to foreign ownership rules or capital thresholds as exchanges begin building their local presence under clarified regulatory conditions.

Sources & verification

- Draft circular on crypto taxation and licensing circulated by Vietnam’s Ministry of Finance for public consultation.

- The Hanoi Times report outlining the 0.1% personal income tax on crypto transfers through licensed providers.

- Five-year crypto market pilot launched in September 2025, with a status update stating no applicants as of October 6, 2025.

- State Securities Commission of Vietnam (SSC) statement on the licensing window for digital asset exchanges and the January 20, 2026 start date.

- Coverage of Vietnam opening licensing for crypto exchanges and related regulatory developments referenced in contemporaneous reporting.

Crypto World

As ‘Sell America’ market volatility rages on, look to your bonds

Amid recent debate over the so-called “Sell America” trade and capital rotating out of U.S. markets, foreign stocks have received most of the attention. But international bonds, especially emerging market bonds, have also been riding high.

“The best performing area in fixed income year to date, and also last year, was emerging markets,” said Joanna Gallegos, co-founder of fixed-income ETF company BondBloxx on this week’s CNBC “ETF Edge.”

As an example, the iShares JPMorgan USD Emerging Markets Bond ETF (EMB) generated over a 13% return in 2025. BondBloxx’s JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD) had a similar 2025.

Weakness in the U.S. dollar, concerns about the fiscal health of the U.S. at a time of high spending and deficits, and the investing impact of President Trump’s foreign policy, plus the recent performance trends, are all contributing to more interest from investors to diversify internationally.

But for Gallegos, it start with the currency and performance chasing rather than a view that the U.S. is losing favor as a market. “The dollar pressure is putting more of a view on non-U.S. assets,” Gallegos said. “I think people are just seeing the returns from last year and looking for a way to take advantage of those opportunities more so than anything else,” she said. “The U.S. trade is not going away,” she added.

The performance of the iShares JPMorgan USD Emerging Markets Bond ETF versus the iShares Core US Aggregate Bond ETF over the past five years.

Morningstar data for the month of January backs up the view that U.S. investors are not abandoning the domestic market, whether it is stocks or bonds being debated and even as more assets move overseas.

U.S. market ETFs brought in an estimated $156 billion of net inflows in January, which was the best January ever, according to Morningstar. But investors also added $51 billion in net positive flows to international equity ETFs, which was a monthly record for that category. And taxable bond ETFs popped, with $46 billion from investors in net inflows for the month, led by Vanguard Total Bond Market ETF (BND) and the Vanguard Intermediate-Term Corporate Bond ETF (VCIT).

Despite fears about a private credit bubble, the U.S. continues to offer “the strongest fixed income market,” according to Gallegos, and “the biggest opportunity set for the world to continue to invest in it.”

Investors are expanding their portfolios and adding new sources of return while keeping U.S. assets at the core. “I think we still see resilient economy,” Gallegos said, pointing to steady earnings and a strong corporate balance sheet. In the bond market, specifically, she said, “the yield curve looks like it’s steepening, behaving appropriately, with rates on the long end being higher than the rates on the shorter end.”

Todd Sohn, technical strategist at Strategas Securities, said on “ETF Edge” that the scale of potential change on the fixed-income side of the portfolio is even larger than what is happening with equity assets, but it is not necessarily an international-first story. Money market funds have dominated flows for the past few years, with “trillion in assets” sitting on the sidelines as cash accounts have generated decent returns with no risk. But as central bank interest rates begin to drift lower, Sohn says more capital will move into the credit markets and bonds. “That money is going to get deployed to fixed-income products,” he said.

Gallegos says investors no longer need to stretch as far for yield. She highlighted investment-grade credit, and in particular, investors seizing the opportunity to move “out on the rate spectrum to BBB,” where yields are higher but default risk remains historically low. And she emphasized that bonds are no longer solely a defensive tool. “Bonds are not just necessarily the safety part of your portfolio, but also the opportunity and the income set as well,” Gallegos said.

Top bond ETFs by assets

Crypto World

What Caused Bitcoin Crash? 3 Theories Behind BTC’s 40% Dip in a Month

Bitcoin (CRYPTO: BTC) has endured one of its steepest drawdowns in weeks, sinking more than 40% over the past month to a year-to-date low near $59,930 on Friday. The retreat leaves the asset roughly 50% off its October 2025 all-time high around $126,200. Market participants point to a mix of leverage, ETF-linked products, and shifting risk appetite as the accelerants behind the move. The episode has intensified scrutiny of the nexus between funding channels, hedging activity, and mining economics as liquidity tightens and option markets unwind.

Key takeaways

- Analysts highlight Asia-linked flow dynamics—including leveraged bets tied to Bitcoin ETFs and yen funding—as potential catalysts for the sell-off.

- Short-term risk to miners remains elevated, with BTC hovering near the $60k mark and the possibility of renewed pressure if the level fails to hold.

- A widely discussed theory posits that banks could have been forced to unwind exposure to structured notes tied to spot BTC ETFs, amplifying selling pressure during the slide.

- The mining sector is reportedly pivoting toward AI data-center workloads, contributing to hash-rate shifts and changing the economics of mining operations.

- Hash-rate indicators and production-cost data suggest mounting stress for some operators if prices stay depressed, particularly for producers with higher energy costs.

Tickers mentioned: $BTC, $IBIT, $SOL, $RIOT

Sentiment: Bearish

Price impact: Negative. The price collapse has heightened risk across mining cash flows and lenders’ hedging obligations, reinforcing a downside tilt.

Market context: The move unfolds amid thinning liquidity, ongoing ETF flow considerations, and macro risk sentiment that shape crypto pricing and funding conditions.

Why it matters

At its core, the current bout of volatility underscores how crypto price action remains tethered to leverage cycles and funding dynamics. If large holders and miners face balance-sheet stress as prices retreat, the resilience of BTC could hinge on liquidity restoration and the capacity of major players to manage hedges and collateral calls. The episode also highlights the growing integration between traditional finance instruments and crypto exposure—for example, ETF-linked notes and over-the-counter hedges—where the mechanics of delta-hedging can intensify price moves in fast-moving markets.

From a mining perspective, the evolving energy and capacity landscape matters for network security and long-term dynamics. Reports about miners reallocating capital toward AI data-center projects signal a shift in how hardware is deployed and priced into production costs. The tension between a falling price floor and rising or variable energy expenses can widen the gap between theoretical profitability and actual cash flow for operators. This has implications for hash-rate stability, miner incentives, and the broader health of BTC mining outside of bull-market phases.

On the regulatory and institutional front, the unfolding narrative intersects with how large banks and asset managers interact with crypto products. If organized hedging around spot BTC ETFs remains sizable, any further price shocks could trigger feedback loops that amplify volatility until markets reach a clearer equilibrium between funding costs, risk appetite, and crypto demand. The conversation around Morgan Stanley and other banks’ hedging behavior—whether tied to structured notes or other instruments—adds a layer of complexity to understanding who bears the cost of volatility and how liquidity is distributed during stress episodes.

What to watch next

- Bitcoin’s price behavior around the $60,000 level: does it defend the level, or does renewed downside pressure test nearby support?

- Hash-rate and mining economics: will energy costs and capital reallocation toward AI data centers reshape the mining landscape in the coming weeks?

- ETF flows and bank hedging: how do institutional exposures to BTC-linked products evolve, and what does that imply for liquidity during stress periods?

- Corporate pivots in mining: how are operators like Riot Platforms (RIOT) and others adjusting capital plans in response to price volatility?

- Macro and regulatory cues: what new developments could alter risk sentiment or the availability of liquidity to crypto markets?

Sources & verification

- BTC price level and price-action narrative tied to the week’s moves and the year-to-date low near $59,930, with reference to the BTC/USD daily chart from TradingView.

- Activity around BlackRock’s IBIT and related volume/option data cited as a trigger for stress and unwind in ETF-linked bets.

- Discussion of structured-note hedging and potential bank involvements, anchored to the Morgan Stanley product documentation and related regulatory filings.

- Hash-rate and mining-cost indicators, including the Hash Ribbons signal and underlying cost data for mining operations (electricity costs and net production expenditure).

- Company-level mining shifts and past activity, such as Riot Platforms’ December actions and IREN’s pivot to AI data-center deployments, as cited in related articles.

Bitcoin price reaction and miner vulnerabilities

Bitcoin (CRYPTO: BTC) has endured a rapid re-pricing as liquidity conditions tightened and carry trades unwound. After a run that had carried the asset close to $126,200 in October 2025, BTC retraced to around $59,930 by Friday, exposing a more than 40% drop from recent highs and placing the year-to-date performance in the red. The pullback comes amid a confluence of factors: patience in risk markets, sudden squeezes in leveraged bets, and the energy of ETF-linked products that amplify price movements when flows reverse. The narrative has centered on Asia-based players who had pursued aggressive bets on BTC appreciation using options tied to Bitcoin ETFs and financing through yen borrowings. As one participant described, this funding dynamic allowed bets to scale quickly, only to reverse with the worsening price trajectory.

The tension around ETF-linked products is exemplified by BlackRock’s IBIT discussions, where a surge in volume and options activity was observed on one of the largest days for the instrument. Parker White, COO and CIO of Nasdaq-listed DeFi Development Corp. (DFDV), noted that participants used yen-based funding to support bets on BTC and related assets, recycling capital across currencies in search of outsized gains. In the period in question, IBIT recorded about $10.7 billion in trading volume, roughly doubling typical activity, while approximately $900 million in options premium changed hands—an unusually energetic display given the broader price weakness. The price action across BTC and SOL in that session underscored how sensitive the market remains to funding-driven dynamics.

This was the highest volume day on $IBIT, ever, by a factor of nearly 2x, trading $10.7B today. Additionally, roughly $900M in options premiums were traded today, also the highest ever for IBIT. Given these facts and the way $BTC and $SOL traded down in lockstep today (normally…

— Parker (@TheOtherParker_) February 6, 2026

As BTC momentum faltered and yen-funding costs rose, those leveraged bets began to sour quickly. Lenders demanded more cash, and asset liquidations accelerated, reinforcing the downturn. The episode has fed into a broader conversation about how banks and market makers hedge exposures tied to crypto products. In particular, the idea that banks—potentially including Morgan Stanley—might have needed to liquidate Bitcoin or related positions to manage structured-note exposure tied to spot BTC ETFs has gained traction among observers who see delta-hedging as a potential catalyst for negative gamma risk. When prices fall sharply, dealers must hedge by selling underlying BTC or futures, which can accelerate price declines in a feedback loop.

Beyond the banking-hedge narrative, some market observers have pointed to the mining sector’s evolving strategy as a factor shaping price dynamics. A school of thought argues that an ongoing mining exodus toward AI data-center capacity could reduce BTC hashing power at a pace that complicates mining economics during a prolonged bear phase. Judge Gibson emphasized this point in a recent post on X, noting that AI demand is already drawing equipment away from pure BTC mining toward data-center deployments. Riot Platforms (NASDAQ: RIOT) confirmed a broader pivot toward AI data-center infrastructure in December 2025, while IREN and other miners have reported similar strategic shifts. Hash-rate data, including the Hash Ribbons indicator, show a 30-day moving average slipping below the 60-day line, a setup historically associated with stress on miner margins and potential capitulation risk.

Current production-cost estimates place the breakeven edge for miners in the vicinity of BTC’s price level. The latest figures show the average electricity cost to mine a single BTC around $58,160, with net production expenditure near $72,700. If BTC’s price remains anchored below the $60,000 mark, some mining operations could face true financial strain, forcing balance-sheet adjustments or, in extreme cases, asset sales to cover operating costs. Meanwhile, the long-term holder cohort appears to be pruning exposure, with wallets containing 10 to 10,000 BTC representing a smaller share of circulating supply than in nine months past, a sign that large holders may be reducing positions amid heightened volatility.

The market remains in a fragile balance, where price levels and mining economics are inextricably linked to funding costs, energy prices, and macro risk appetite. As BTC navigates this terrain, the outcome will likely hinge on a combination of liquidity restoration, continued mining-capacity realignments, and the ability of institutional actors to manage risk without adding to volatility. If the price holds above critical thresholds, miners may regain some breathing room; if not, the financial stress could intensify across the ecosystem, with knock-on effects for crypto lending, derivatives, and the broader risk-on appetite that has defined the asset class in recent years.

//platform.twitter.com/widgets.js

Crypto World

What Crashed Bitcoin? 3 Theories Behind BTC’s 40% Price Dip in a Month

Bitcoin (BTC) experienced on of the biggest sell-offs over the past month, sliding more than 40% to reach a year-to-date low of $59,930 on Friday. It is now down over 50% from its October 2025 all-time high near $126,200.

Key takeaways:

-

Analysts are pointing to Hong Kong hedge funds and ETF-linked U.S. bank products as possible drivers of BTC’s crash.

-

Bitcoin could slip back below $60,000, putting the price closer to miners’ break-even levels.

Hong Kong hedge funds behind BTC dump?

One popular theory suggests that Bitcoin’s crash this past week may have originated in Asia, where some Hong Kong hedge funds were placing substantial, leveraged bets that BTC would continue to rise.

These funds used options linked to Bitcoin ETFs like BlackRock’s IBIT and paid for those bets by borrowing cheap Japanese yen, according to Parker White, COO and CIO of Nasdaq-listed DeFi Development Corp. (DFDV).

They swapped that yen into other currencies and invested in risky assets like crypto, hoping prices would rise.

This was the highest volume day on $IBIT, ever, by a factor of nearly 2x, trading $10.7B today. Additionally, roughly $900M in options premiums were traded today, also the highest ever for IBIT. Given these facts and the way $BTC and $SOL traded down in lockstep today (normally…

— Parker (@TheOtherParker_) February 6, 2026

When Bitcoin stopped going up, and yen borrowing costs increased, those leveraged bets quickly went bad. Lenders then demanded more cash, forcing the funds to sell Bitcoin and other assets quickly, which exacerbated the price drop.

Morgan Stanley caused Bitcoin selloff: Arthur Hayes

Another theory gaining traction comes from former BitMEX CEO Arthur Hayes.

He suggested that banks, including Morgan Stanley, may have been forced to sell Bitcoin (or related assets) to hedge their exposure in structured notes tied to spot Bitcoin ETFs, such as BlackRock’s IBIT.

These are complex financial products where banks offer clients bets on Bitcoin’s price performance (often with principal protection or barriers).

When Bitcoin falls sharply, breaching key levels like around $78,700 in one noted Morgan Stanley product, dealers must delta-hedge by selling underlying BTC or futures.

This creates “negative gamma,” meaning that as prices drop further, hedging sales accelerate, turning banks from liquidity providers into forced sellers and exacerbating the downturn.

Miners shifting from Bitcoin to AI

Less prominent but circulating is the theory that a so-called “mining exodus” may have also fueled the Bitcoin downtrend.

In a Saturday post on X, analyst Judge Gibson said that the growing AI data center demand is already forcing Bitcoin miners to pivot, which has led to a 10-40% drop in hash rate.

For instance, in December 2025, Bitcoin miner Riot Platforms announced its shift toward a broader data center strategy, while selling $161 million worth of BTC. Last week, another miner, IREN, announced its pivot to AI data centers.

Related: Crypto’s stress test hits balance sheets as Bitcoin, Ether collapse

Meanwhile, the Hash Ribbons indicator also flashed a warning: the 30-day hash-rate average has slipped below the 60-day, a negative inversion that historically signals acute miner income stress and raises the risk of capitulation.

As of Saturday, the estimated average electricity cost to mine a single Bitcoin was around $58,160, while the net production expenditure was approximately $72,700.

If Bitcoin drops back below $60,000, miners could start to experience real financial stress.

Long-term holders are also looking more cautious.

Data shows wallets holding 10 to 10,000 BTC now control their smallest share of supply in nine months, suggesting this group has been trimming exposure rather than accumulating.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Is Solana Price Doomed After Falling Below $100?

Solana has staged a sharp intraday recovery after recent losses pressured the price earlier this week. SOL bounced strongly as the broader crypto market added nearly $200 billion in value.

Aggressive dip buying prevented deeper losses, helping Solana stabilize and post a 12% daily gain despite lingering market uncertainty.

Solana LTHs Are Not So Bullish Yet

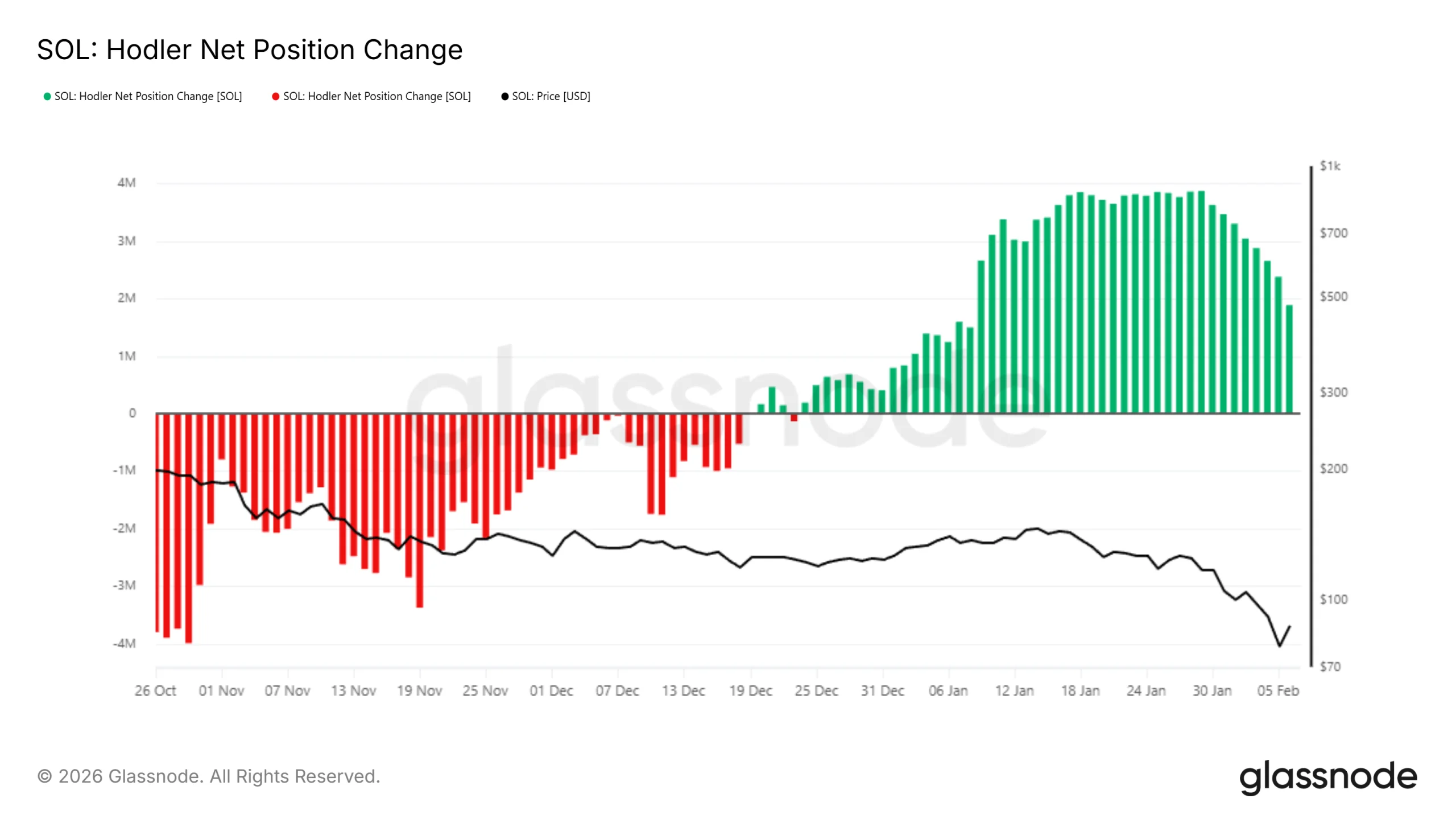

On-chain data shows long-term holder buying momentum is slowing. The HODLer Net Position Change has declined, indicating reduced accumulation from investors who typically support prices during downturns. This shift followed SOL’s sharp pullback over the past week, which appears to have dampened long-term conviction.

Sponsored

Sponsored

A sustained recovery depends on whether long-term holders resume accumulation. If buying momentum remains weak, Solana may struggle to build durable upside. Reduced support from this cohort limits demand absorption, increasing the risk that short-term rallies fade without broader participation from long-term investors.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Momentum indicators suggest selling pressure may be nearing exhaustion. The Money Flow Index is approaching the oversold threshold below 20.0. A move into this zone typically signals selling saturation, often preceding periods of stabilization or short-term rebounds in price.

Historically, Solana has entered oversold territory only three times in the past two and a half years. Each instance coincided with notable price stabilization or reversal. If the indicator slips further, it may help SOL pause its decline and attract renewed dip-buying interest from traders.

SOL Price Recovery Still Likely

Solana price is trading near $88 at the time of writing after climbing 12% in the past 24 hours. Earlier in the session, SOL dropped roughly 13% to an intraday low. Strong dip buying prevented a close near $67, highlighting active demand at lower levels.

Support from the broader market could allow SOL to push above $90 in the near term. A recovery rally would require reclaiming $100 as support. Securing that level would confirm improving momentum and open the path toward a move near $110 as confidence returns.

Downside risk persists if long-term holder selling continues. Failure to reclaim $100 could cap upside and leave SOL range-bound near $90. Under weaker conditions, the price may retreat toward $78. Such a move would invalidate the bullish thesis and extend Solana’s corrective phase.

Crypto World

CryptoQuant Breaks Down Current Bear Market Signals

Bitcoin has fallen below its 365-day MA, spot and institutional demand have remained weak, and liquidity has tightened; all signs of a bear market.

The crypto market is currently in a bearish season, as confirmed by on-chain indicators. Demand has waned, liquidity is tightening, and technical structure shows downside risk.

The market research firm CryptoQuant has released a detailed assessment of the bear cycle, explaining just how much the bears have dominated.

BTC Falls Below 365-Day MA

According to the report, the CryptoQuant Bull Score Index, which hovered around 80 (the bullish territory) as bitcoin (BTC) peaked at $126,000 in early October, is now sitting at zero. The index entered bearish territory after the October 10 liquidation event, which resulted in $19 billion in losses. BTC was still trading around $110,000 at the time; as the asset’s price hit $75,000, the index fell to zero.

At the time of writing, data from CoinMarketCap showed BTC changing hands below $68,000, with a 24-hour decline of at least 7%. Bitcoin’s price has declined 23% since it fell below its 365-day moving average (MA) on November 12, 2025. The last time BTC fell below this metric was in March 2022. Analysts say the asset’s current performance is worse than the early 2022 bear phase.

With technical structure confirming downside risk, BTC has fallen below the lower band of the Traders’ On-chain Realized Price. The level acted as the ultimate support during the bull market. The next support zone now lies between $70,000 and $60,000.

Demand Weakens, Liquidity Tightens

Amid the downturn in prices, spot and institutional demand have remained weak. The Coinbase Bitcoin Price Premium has been negative since mid-October, indicating weaker demand in the U.S. than in the rest of the world.

Furthermore, the U.S. spot exchange-traded fund (ETF) market is witnessing a reversal in demand. This time last year, the products had loaded up more than 46,000 BTC; however, they are now net sellers, having offloaded about 15,000 BTC so far. Their sales have created a demand gap of more than 50,000 BTC, contributing to selling pressure.

You may also like:

In the last four months, Bitcoin’s spot demand annual growth has fallen 93% from 1.1 million to 77,000 BTC. This shows that most of this cycle’s demand growth has passed.

On the liquidity front, the 60-day growth of Tether’s (USDT) market cap has turned negative (-$133 million) for the first time since October 2023. The stablecoin’s expansion peaked at $15.9 billion in late October 2025. The reversal is typical of bear market cycles.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

EY warns firms they must own the wallet to keep their customers

In the evolving landscape of digital finance, Big Four consultancy firm EY has zeroed in on what it believes is the next defining frontier: wallets.

Wallets are fast becoming the critical interface for the next era of financial services, not just tools for holding cryptocurrency, according to Mark Nichols, principal at EY.

“The wallet is the strategy,” Nichols who co-leads the firm’s digital assets consulting business, told CoinDesk in an interview. “Who owns the wallet, who provisions the wallet, will win the client relationship.”

Nichols and his West Coast counterpart, Rebecca Carvatt, view wallets as more than infrastructure. They’re the gateway to storing, moving and managing tokenized value in a world where financial instruments, from payments to private credit, are increasingly moving onchain, he said.

Not just custody: Wallets as the hub of tokenized finance

The vision is expansive. Far from being a niche utility for crypto enthusiasts, wallets are becoming the connective tissue of a broader tokenized financial system. Wallets will soon be indispensable for retail investors, asset managers, treasurers and even commercial banks, according to Carvatt, co-leader of EY’s digital assets consulting business.

“They’re going to be the access point for everything — payments, tokenized assets and stablecoins,” she said.

EY’s perspective positions wallets as the new bank accounts of the future, with services tailored not just to individuals, but to corporates and institutional investors who require sophisticated integration with risk systems, compliance tools and real-time capital flows.

The implication is clear: whoever controls the wallet controls the relationship. For financial institutions already losing ground to crypto-native platforms, the shift is existential.

Beyond liquidity: The real promise of tokenization

The broader shift to tokenization is often framed as a play for liquidity, but EY believes that narrative undersells the true impact. “It’s not just about liquidity,” Nichols says. “Liquidity isn’t the be-all and end-all, it’s about the utility that onchain finance enables.”

What EY sees instead is the emergence of blockchain as a real-time infrastructure for financial markets, one that allows for programmable transaction chains, and fundamentally reshapes how capital is managed. Tokenization enables atomic settlement, sure, but its real power lies in margin optimization and operational efficiency.

Nichols points to scenarios where firms can use stablecoins or tokenized assets to meet margin calls more frequently and precisely. That, in turn, reduces initial margin requirements, freeing up capital for investment. “It’s about better risk alignment and real-time capital management,” he says. “And the wallet becomes the gateway to making that possible.”

A decade in the space: EY’s deep crypto bench

While some firms are racing to catch up, EY has been building in the digital asset space for more than 12 years. Its early investments in crypto-native audit and compliance practices now span thousands of professionals, supporting everything from hedge fund tax returns to tokenized M&A advisory.

“We’ve worked with every client profile – large banks, asset managers, exchanges, digital natives, infrastructure providers,” Nichols says. “and have been working in the digital asset ecosystem for over a decade.”

EY’s hedge fund audit business was one of the earliest to support crypto, and its advisory team has helped firms prepare for public listings and complex regulatory environments. The firm has developed bespoke services for wallet monitoring, onchain compliance, and token-native tax reporting. It also continues to advise traditional financial institutions on how to design safe, compliant digital asset strategies, particularly as they begin to develop or integrate wallet infrastructure.

Wallets for everyone: A segment-by-segment view

EY is clear that wallet needs are not monolithic. Consumers want seamless UX and secure access to payments and crypto. Corporates need integration with treasury functions and regulatory compliance across jurisdictions. Institutional clients demand secure custody, connectivity to decentralized finance (DeFi) and staking products, and embedded risk tooling.

Self-custody, EY argues, won’t be mainstream. The average user or institution doesn’t want to manage their own private keys. Instead, trusted wallet providers will emerge, banks, fintechs, or specialized custodians; each tailoring their offering based on the segment they serve.

Provisioning wallets, then, becomes a strategic imperative. Whether firms choose to build their own, acquire providers, or form partnerships, the wallet is the new front door to financial services. Firms that act now will reduce future customer acquisition costs and own a more defensible position in the digital asset ecosystem.

Regulation: A catalyst, not a roadblock

One of the most persistent beliefs about tokenization is that regulation is a blocker. But EY’s leaders disagree. “We already have the regulatory framework in core markets, and alongside the broader industry, the passage of market structure legislation will allow for remaining issues to be ironed out,” Nichols says. “A security is a security, a commodity is a commodity. Blockchain is technology.”

In the U.S., the GENIUS Act and existing Securities and Exchange Commission (SEC) exemptions provide pathways for compliant tokenized products. Globally, jurisdictions are racing to attract digital asset innovation with evolving licensing regimes. While harmonization is still in progress, the momentum is unmistakable.

EY sees this moment as a call to maturity, an inflection point where infrastructure is catching up to vision. “We’re past the experimentation phase,” Carvatt says. “Now it’s about safe, scalable implementation.”

Rethinking asset management from the ground up

Perhaps nowhere is the impact of tokenization and wallet infrastructure more profound than in asset management. A typical fund currently requires a distribution network, an investment team, a custodian, a fund administrator, and regulatory reporting channels. With tokenization and smart contracts, much of that stack becomes programmable, and potentially obsolete.

“Asset managers just want to build great portfolios,” Nichols says. “Blockchain lets them do that without all the legacy friction.”

By tokenizing fund underliers and embedding logic into smart contracts, asset managers can automate functions like distribution, compliance, and reporting. This opens the door to lower fees, broader investor access, and new types of products, particularly in private credit and alternatives, where cost has historically been a barrier.

“From the unbanked to the unbrokered, we’re seeing more people gain exposure to assets that were previously out of reach,” Carvatt says. “That’s powerful.”

The future of finance is onchain

Whether for crypto, payments, or tokenized assets, wallets will be the gateway to a new financial reality. Firms that ignore this will risk irrelevance. Those that embrace it will own the infrastructure, and the customer relationship, at the heart of digital finance.

“The future of finance is on-chain,” Nichols says. “And the wallet is at its center.”

Read more: R3 bets on Solana to bring institutional yield onchain

Crypto World

Why Large Wallets Are Buying Mutuum Finance (MUTM) Instead of High-Cap Altcoins

As market conditions remain uncertain, large investors are becoming increasingly selective and are turning their attention to early-stage projects with clear utility and long-term upside rather than established, slower-moving assets. This shift has been especially noticeable in Mutuum Finance (MUTM), where growing large-wallet activity suggests that whales are positioning early in a presale project that already shows real development progress.

With a working product, a clear adoption path, and a still-undervalued entry point, Mutuum Finance is quickly emerging as one of the new crypto coins drawing attention from investors searching for the best crypto to buy now ahead of the next market cycle.

Presale Momentum and Whale Inflows

Mutuum Finance is currently in its presale phase, and recent on-chain activity has highlighted growing whale interest. One notable transaction saw a single wallet contribute over $118,000 in a single presale purchase, signaling strong conviction from large investors. This inflow came during a period when many high-cap altcoins were trending sideways or declining, reinforcing the idea that smart money is rotating into early-stage opportunities.

Overall, the presale has now raised over $20.43 million, with participation from more than 18,950 holders. For many analysts tracking crypto investment trends, this combination of whale inflows and steady retail participation suggests growing confidence in Mutuum Finance as a long-term DeFi play.

Presale Progression and Why the Current Phase Matters

Mutuum Finance is in Phase 7 of its presale, with the MUTM token priced at $0.04. The presale has followed a structured pricing model, starting at $0.01 in Phase 1 and increasing gradually as development milestones were achieved. At the current price, MUTM is already up 300% from its initial presale level, yet it remains below the confirmed $0.06 launch price, representing a built-in discount for early participants.

Nearly half of the 1.82 billion tokens allocated for the presale have already been sold, with over 840 million tokens now out of circulation. As supply continues to tighten, analysts view the current phase as one of the final opportunities to secure MUTM at a lower valuation. For investors asking what crypto to buy now, the combination of a discounted price and shrinking supply is a key reason whales are stepping in early.

What Is Mutuum Finance?

Mutuum Finance is a decentralized lending and borrowing protocol designed to let users put idle capital to work or access liquidity without selling their assets. The platform operates across two main models: peer-to-contract (P2C) and peer-to-peer (P2P).

In the P2C model, users can supply assets like USDT into liquidity pools and earn yield based on borrowing demand. For example, an investor supplying $10,000 in USDT could earn competitive APY, with returns potentially reaching up to $1,000 per year in passive income, depending on utilization rates. On top of interest, lenders can also earn dividends in MUTM tokens, distributed through the protocol’s buy-and-distribute mechanism. These dividends are received by staking mtTokens, which represent deposit positions and automatically accrue value over time.

The P2P model expands flexibility by allowing users to lend or borrow directly against higher-risk assets, including popular memecoins such as SHIB, DOGE, or PEPE. This setup gives borrowers access to liquidity using speculative assets, while lenders can negotiate higher yields to match the added risk. This dual-model approach is one reason analysts consider Mutuum Finance a standout DeFi crypto.

V1 Protocol Is Already Live

Another major factor driving whale confidence is that Mutuum Finance has already launched its V1 protocol on the Sepolia testnet. Investors can currently test the core features in a live but risk-free environment, which is rare for presale projects. Users can supply assets, mint mtTokens, borrow against collateral through debt tokens, and observe how interest accrues in real time. The protocol also includes automated liquidation mechanisms and health factor monitoring to manage risk and protect lenders.

Having a working protocol before launch significantly reduces execution risk. For many large wallets, this level of progress is a key signal when deciding which crypto to invest in, as it separates projects with real foundations from those still operating on promises alone.

Leaderboard Rewards and Giveaway Incentives

To make participation easier, Mutuum Finance currently allows investors to buy MUTM tokens directly using debit or credit cards, lowering the barrier to entry for newcomers. The project also runs a 24-hour leaderboard, where the top contributor who holds first place for a full 24-hour period receives $500 worth of MUTM tokens as a reward.

In addition, Mutuum Finance is hosting a $100,000 giveaway, where participants can enter by investing at least $50 in the presale and completing additional tasks listed on the project’s website. These incentives are designed to encourage community engagement while rewarding early supporters during the presale phase.

As whales continue to rotate away from saturated high-cap altcoins, Mutuum Finance is increasingly standing out as a crypto to buy now for investors focused on early-stage growth. With large-wallet inflows, a live protocol, steady presale progression, and a discounted entry price of $0.04 compared to the $0.06 launch price, the project is attracting attention from both short-term and long-term investors.

For now, MUTM remains available at its lowest price before launch. With whales already accumulating and presale supply steadily shrinking, the current phase may represent one of the final opportunities to enter early before market pricing takes over.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Crypto is no longer a ‘crude’ word for companies in the UAE

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Once, the word “crypto” might have made UAE executives nervous. Today, it sparks little, if any, fear.

Summary

- Crypto went from taboo to toolkit: In the UAE, digital assets are no longer speculative or suspect — they’re discussed in boardrooms alongside oil, commodities, and macro strategy.

- Regulatory clarity beats ideological debate: Clear rules, fast execution, and top-down commitment have turned the UAE into a global magnet for founders, capital, and high-net-worth migrants.

- The real edge is confidence: While other markets oscillate with politics and enforcement cycles, the UAE offers long-term certainty — letting companies build, experiment, and scale without fear of sudden reversals.

Many wonder why the UAE would bother with crypto when it already sits on vast oil reserves…you know, the crude oil that initially funded the infrastructure, and put the UAE on the global map. The answer is simple: the UAE wants to win. A mindset other jurisdictions should take note of.

The UAE knows it is part of a global race. Boardrooms and industries across the nation are fiercely competitive. Companies want to be the best, and they are determined not to miss out on an opportunity of a lifetime.

UAE’s stance has changed dramatically

Just a few years ago, crypto was a taboo topic in the UAE, and now the country is fully committed to cementing its position as the world’s leading crypto hub. The perception has undergone a complete turnaround.

UAE government officials are taking this message worldwide, speaking at crypto conferences and staking their claim. Companies and entrepreneurs are paying attention. The UAE has become the world’s top destination for relocating high-net-worth individuals, with an estimated 9,800 millionaires forecasted to move there in 2025 alone.

So what sets the UAE apart from other jurisdictions? Speed and clarity. While entrepreneurs elsewhere plead for regulatory guidance, the UAE has made clear rules a top priority, recognizing that innovation thrives when companies can act quickly and confidently.

This approach is particularly striking compared with past experiences in other markets. In previous U.S. administrations, for example, companies often hesitated to innovate, fearing regulatory or legal repercussions.

Trump’s administration won’t last forever

Attend a crypto industry event, and you’ll hear how far behind the U.S. has fallen in regulatory innovation. Even though the Trump administration is favorable for the industry, and the GENIUS Act was a big win, and the CLARITY Act could do the same, an element of uncertainty looms. Will future leadership revert to old habits, potentially creating a less supportive environment for crypto?

The UAE doesn’t face that risk. Its government has proactively set clear regulations, backed innovation at the highest levels, and signaled long-term commitment, giving companies the confidence to operate and grow without fear of sudden policy reversals. The UAE has sent a clear message that companies can explore, experiment, and grow without unnecessary barriers, making it a magnet for forward-thinking business and digital finance ventures.

Crypto has a reputation elsewhere as volatile, chaotic, or even dubious. In the UAE, it is pragmatic. It is strategic. And it is increasingly viewed as part of a forward-looking financial toolkit rather than a speculative gamble. The cultural shift is equally striking. Energy companies discuss Bitcoin (BTC) allocations alongside oil futures. Entrepreneurs pitch blockchain-based platforms for commodity trading and find investors willing to listen.

Young entrepreneurs can take more risks in the UAE

Young startups that might once have struggled to gain traction are now welcomed into a sector with a progressive approach to innovation in digital asset regulation, setting a new benchmark for the sector.

It is not just financial, it is cultural. A signal that risk, when measured, is encouraged.

The convergence of oil and crypto mirrors the UAE’s broader story. The country transformed deserts into cities, sand into skyscrapers, and oil into prosperity. Now, digital assets are part of that narrative, tools to secure the future while respecting the past.

Of course, the journey is not without risks. Crypto markets remain volatile, regulations continue to evolve, and not every experiment will succeed. Yet in the UAE, companies have the space to navigate uncertainty with confidence.

There is room to innovate, adapt, and learn, which is an unusual combination of flexibility and stability that attracts both local innovators and international investors.

At its core, this shows something deeper about the UAE. The country has always pursued boundless possibilities. From turning deserts into metropolises to transforming oil wealth into global influence, it has consistently reimagined what is possible.

Other jurisdictions that delay regulatory clarity risk falling behind. The UAE demonstrates that speed, vision, and decisiveness win. Its strategic embrace of crypto shows that the country is prepared to shape the future of global finance.

Crypto World

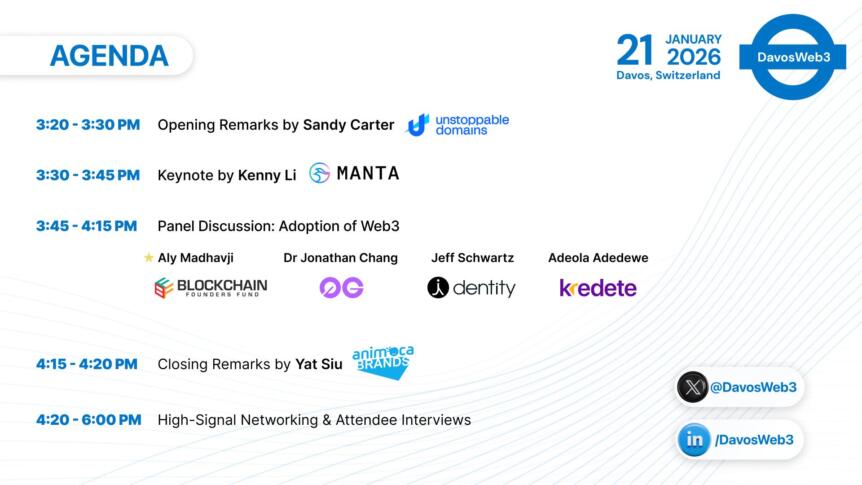

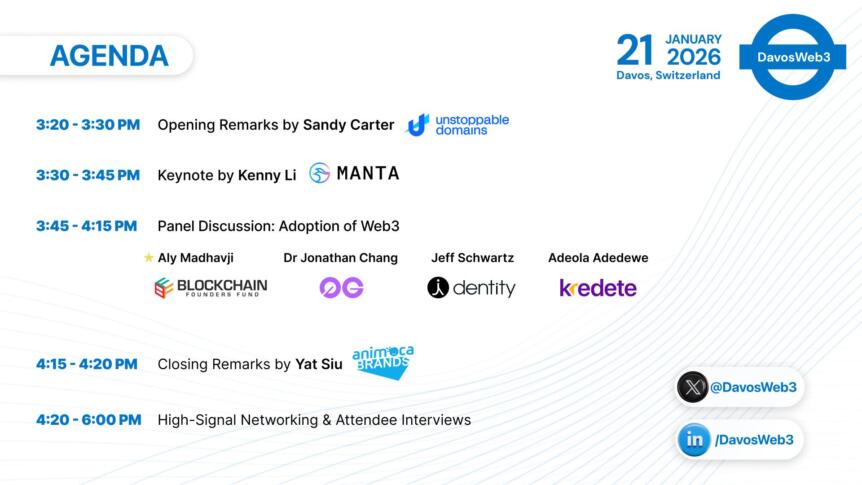

DavosWeb3 2026 Unveils Declaration on Responsible Web3 and AI Development

Editor’s note: On the sidelines of the World Economic Forum in Davos, the second DavosWeb3 roundtable convened a small group of founders, investors, and ecosystem leaders for a focused discussion on how decentralized technologies are evolving beyond experimentation. Held at the Financial Times House, the gathering emphasized practical deployment, governance, and accountability, particularly where Web3 intersects with artificial intelligence, financial infrastructure, and digital identity. The launch of the Davos Declaration formalized this direction, outlining shared principles intended to guide the next phase of decentralized innovation.

Key points

- The Davos Declaration outlines seven principles aimed at responsible Web3 and AI development.

- Speakers focused on real-world use cases such as remittances, digital identity, and institutional-grade finance.

- AI infrastructure, capital allocation, and decentralization were discussed through a long-term, execution-driven lens.

- The roundtable format prioritized substance over visibility, contrasting with typical Davos programming.

Why this matters

As Web3 matures, conversations are shifting from speculative growth to infrastructure, governance, and measurable impact. Events like DavosWeb3 signal how builders and investors are aligning decentralized technology with existing financial systems, regulatory expectations, and AI development. For the global market and the MENA-adjacent innovation ecosystem, this reflects a broader move toward accountability and integration, positioning Web3 as foundational digital infrastructure rather than a standalone experiment.

What to watch next

- How the Davos Declaration principles are adopted or referenced by Web3 projects and investors.

- Follow-on collaborations or initiatives emerging from the DavosWeb3 network.

- Practical deployments of decentralized identity, AI infrastructure, and fintech solutions discussed at the roundtable.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Davos, Switzerland – February 4, 2026 – The second DavosWeb3 roundtable unfolded on January 21 at the Financial Times House, quietly carving out space for meaningful dialogue amid the World Economic Forum buzz. No flashy keynotes, just a focused group of builders, investors, and leaders exchanging grounded ideas on how decentralized tech can scale thoughtfully, especially as it intersects with AI.

The day culminated in the launch of the Davos Declaration, a clear-eyed pledge to seven core principles: Collaboration, Equitability, Transparency, Accountability, Inclusion, Decentralization, and Sustainability. Co-organizer Ajeet Khurana recited it, setting the tone for conversations that prioritized substance over speculation.

Speakers brought sharp, practical perspectives that reflected the event’s ethos:

- Adeola Adedewe (Kredete) spoke about transforming remittances into credit-building tools for underserved markets, closing massive gaps in emerging economies.

- Aly Madhavji (Blockchain Founders Fund) stressed the power of patient, transparent capital to create durable impact across a portfolio of over 200 companies.

- Dr. Jonathan Chang (0G Foundation) pushed for modular AI infrastructure treated as a transparent public good, with real accountability baked in.

- Kenny Li (Manta Network) shared reflections on evolving beyond oversaturated infrastructure toward targeted, institutional-grade financial tooling after five years of building.

- Jeffrey Schwartz (Dentity) highlighted how decentralized identity is already verifying the majority of U.S. notaries for mortgage processes privacy-preserving tech meeting real-world security needs.

- Sandy Carter (Unstoppable Domains) opened by noting crypto’s mainstream arrival in Davos and introduced the .web3 domain as a foundation for true digital ownership.

- Yat Siu (Animoca Brands) closed with a vision of gamified finance as the quickest path to universal financial literacy, backed by a massive portfolio and upcoming public-market steps.

“Great technology requires a greater conscience,” one of the organizers summed up capturing the day’s blend of ambition and principle.

The gathering reinforced that Web3 is maturing into essential infrastructure: less hype, more execution, more accountability. DavosWeb3 remains a rare spot for these kinds of high-signal exchanges.

Through partners like DroomDroom, we are bringing in-depth roundtable insights directly to the broader Web3 community.

About DavosWeb3

DavosWeb3 is the annual roundtable in Davos dedicated to thoughtful conversations on the future of decentralized technologies. More at davosweb3.com or @DavosWeb3 on X. Media inquiries: press@davosweb3.com

Crypto World

China’s Crypto Ban Just Got Worse For Stablecoins and RWAs

China’s top financial regulators have significantly extended the existing crypto ban. This expansion specifically targets stablecoin issuances and the tokenization of real-world assets.

The joint notice was released Feb. 6 by eight agencies, including the People’s Bank of China and the China Securities Regulatory Commission. It represents the most aggressive tightening of capital controls since the landmark 2021 prohibition on Bitcoin mining and trading.

Sponsored

Sponsored

Beijing Shuts Offshore Loopholes in New Stablecoin Rules

The regulatory agencies cited a recent surge in virtual asset activities as a direct threat to the country’s financial stability and monetary sovereignty.

Under the new rules, foreign entities are strictly prohibited from offering stablecoin or tokenization services to Chinese residents.

Perhaps more significantly, the crackdown targets the “offshore loophole” by banning domestic firms and their overseas branches from issuing digital currencies without explicit government approval.

The PBOC emphasized that stablecoins, particularly those pegged to fiat currencies, carry attributes of sovereign money.

In light of this, the authorities argued that these private digital assets undermine the state’s ability to control the money supply. They further claimed these assets circumvent strict anti-money-laundering and customer-identification protocols.

Specifically, the notice prohibits any entity from issuing Renminbi-pegged stablecoins abroad, a move analysts see as a defense of the e-CNY, China’s official central bank digital currency.

Sponsored

Sponsored

RWA Tokenization Targeted

The directive also targets the burgeoning $24 billion Real-World Asset (RWA) tokenization sector.

The regulators reclassified unauthorized tokenization—such as fractionalized ownership of real estate or securities—as “illegal public security offerings” and “unauthorized futures business.”

“Real-world asset tokenization activities within China, as well as providing related intermediary and information technology services, which are suspected of involving illegal token issuance, unauthorized public offerings of securities, illegal operation of securities and futures businesses, illegal fundraising, and other illegal financial activities, should be prohibited,” the notice stated.

The notice leaves a narrow path for activities conducted on government-approved financial infrastructure.

However, it requires any firm pursuing tokenization abroad to meet heightened compliance standards and obtain domestic clearance.

To enforce these measures, the central government plans to launch a collaborative framework that integrates local and national oversight.

The coordinated approach aims to eliminate the regulatory arbitrage previously used by Chinese tech and finance firms. These companies often utilized neighboring jurisdictions to experiment with blockchain-based assets outside of Beijing’s direct oversight.

By tightening the tether on both stablecoins and RWAs, Beijing has signaled that the next generation of digital finance must remain entirely within state-sanctioned, permissioned systems.

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech19 hours ago

Tech19 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports11 hours ago

Sports11 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Sports2 hours ago

Former Viking Enters Hall of Fame

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat1 day ago

NewsBeat1 day agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat13 hours ago

NewsBeat13 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”